4th Quarter FY 2025 Supplemental Information 1 .2

$84.4B Net Sales +8.0% Growth +5.7% Comparable Sales +6.4% Adjusted Comparable Sales1 +3.7% Comparable Traffic +13.6% E-Comm Comparable Sales +13.5% Adjusted E-Comm Comparable Sales2 Q4 Highlights - Sales 1 - Excluding impacts from changes in gasoline prices and foreign exchange 2 - E-commerce Comparable Sales excluding impacts from FX 2 +1.9% Comparable Ticket +2.6% Adjusted Comparable Ticket1

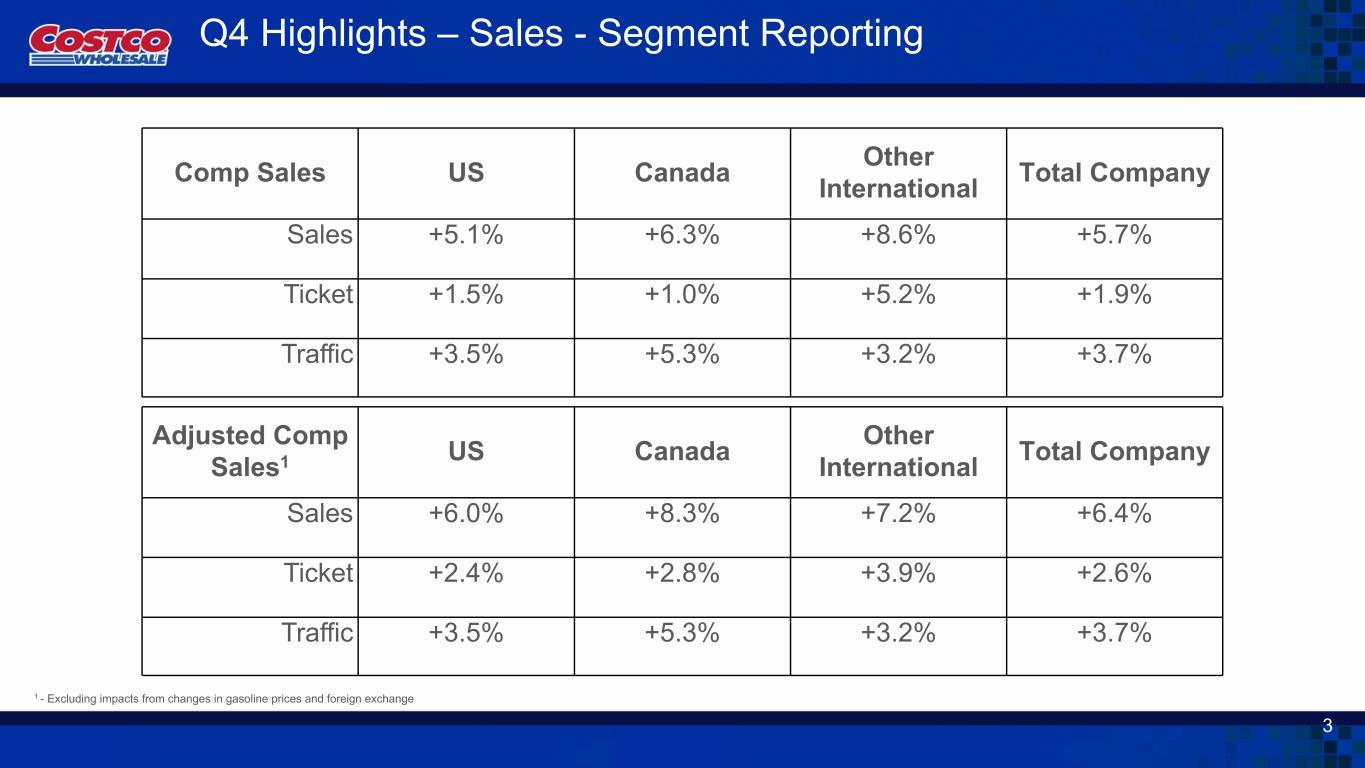

Q4 Highlights – Sales - Segment Reporting 1 - Excluding impacts from changes in gasoline prices and foreign exchange Comp Sales US Canada Other International Total Company Sales +5.1% +6.3% +8.6% +5.7% Ticket +1.5% +1.0% +5.2% +1.9% Traffic +3.5% +5.3% +3.2% +3.7% 3 Adjusted Comp Sales1 US Canada Other International Total Company Sales +6.0% +8.3% +7.2% +6.4% Ticket +2.4% +2.8% +3.9% +2.6% Traffic +3.5% +5.3% +3.2% +3.7%

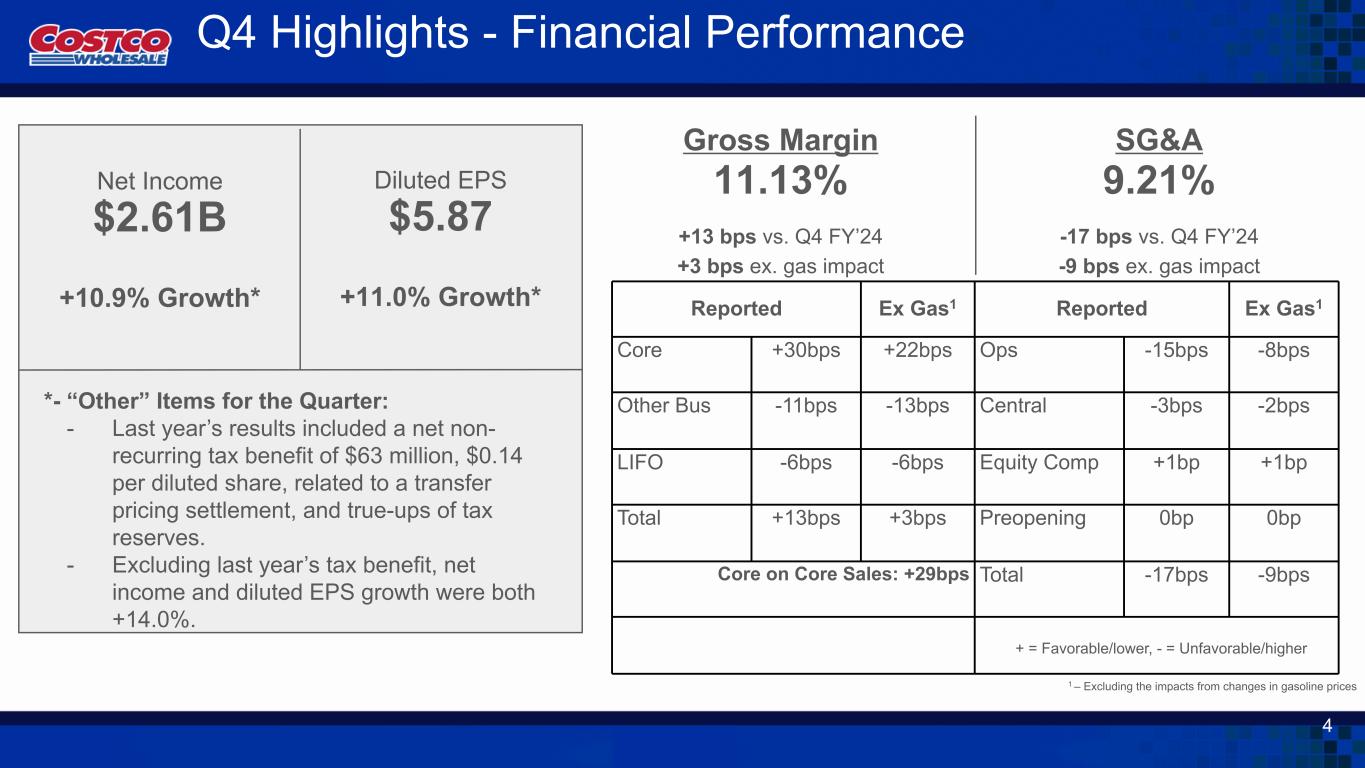

Q4 Highlights - Financial Performance Gross Margin 11.13% +13 bps vs. Q4 FY’24 +3 bps ex. gas impact SG&A 9.21% -17 bps vs. Q4 FY’24 -9 bps ex. gas impact 4 1 – Excluding the impacts from changes in gasoline prices Reported Ex Gas1 Reported Ex Gas1 Core +30bps +22bps Ops -15bps -8bps Other Bus -11bps -13bps Central -3bps -2bps LIFO -6bps -6bps Equity Comp +1bp +1bp Total +13bps +3bps Preopening 0bp 0bp Core on Core Sales: +29bps Total -17bps -9bps + = Favorable/lower, - = Unfavorable/higher Diluted EPS $5.87 +11.0% Growth* Net Income $2.61B +10.9% Growth* *- “Other” Items for the Quarter: - Last year’s results included a net non- recurring tax benefit of $63 million, $0.14 per diluted share, related to a transfer pricing settlement, and true-ups of tax reserves. - Excluding last year’s tax benefit, net income and diluted EPS growth were both +14.0%.

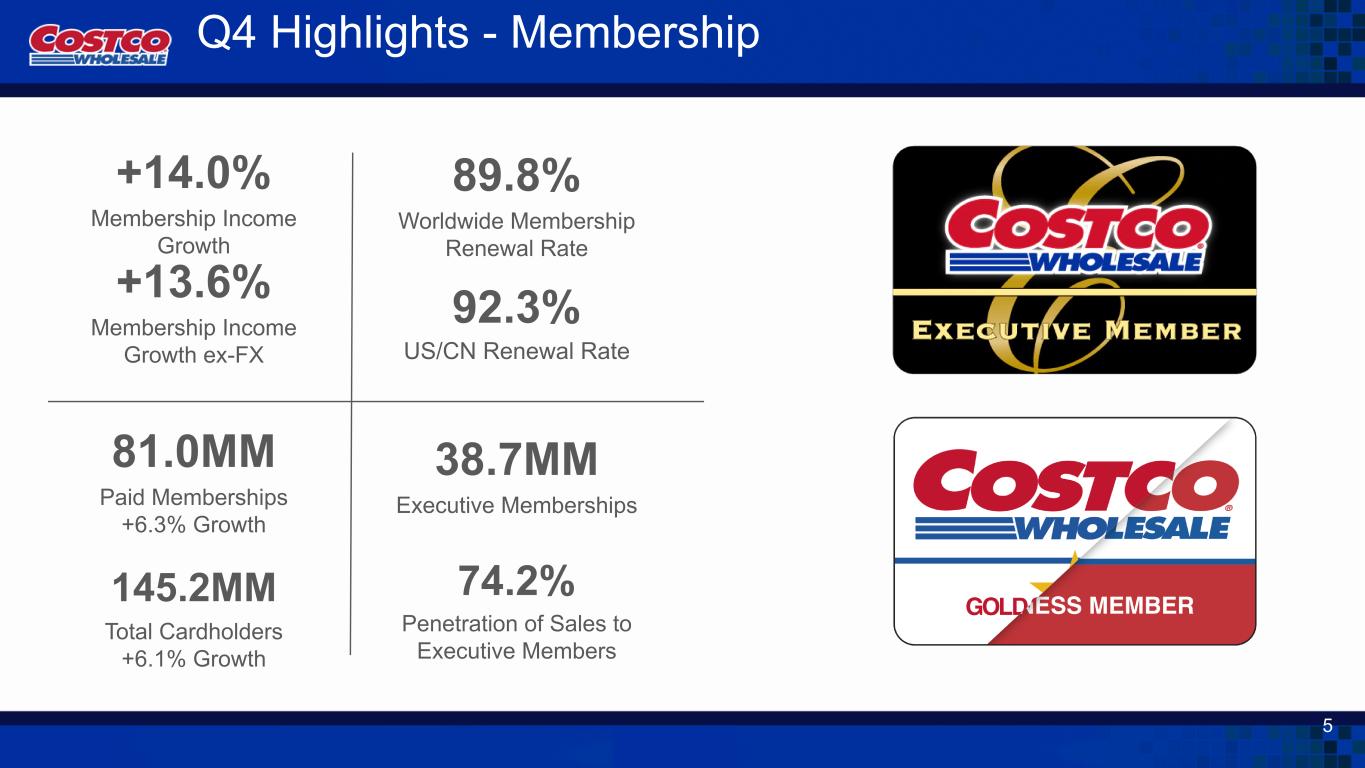

+14.0% Membership Income Growth +13.6% Membership Income Growth ex-FX 89.8% Worldwide Membership Renewal Rate 92.3% US/CN Renewal Rate 81.0MM Paid Memberships +6.3% Growth 145.2MM Total Cardholders +6.1% Growth 38.7MM Executive Memberships 74.2% Penetration of Sales to Executive Members Q4 Highlights - Membership 5

+13.6% E-Comm Comparable Sales 1 - E-commerce Comparable Sales excluding impacts from FX +13.5% Adjusted E-Comm Comparable Sales1 Top Sales Categories: - Gold/Jewelry - Housewares - Tires - Apparel - Sporting Goods - Majors - Small Electrics - Garden/Patio Digital Metrics: - Ecommerce Site Traffic: +27% - Costco Logistics Items Delivered +13% Digital Enhancements: - Data augmentation to enhance search experience - Online waiting room for hot items - Relevant member messaging on home page - Passwordless access for iOS/Android mobile app Q4 Highlights - Digital 6

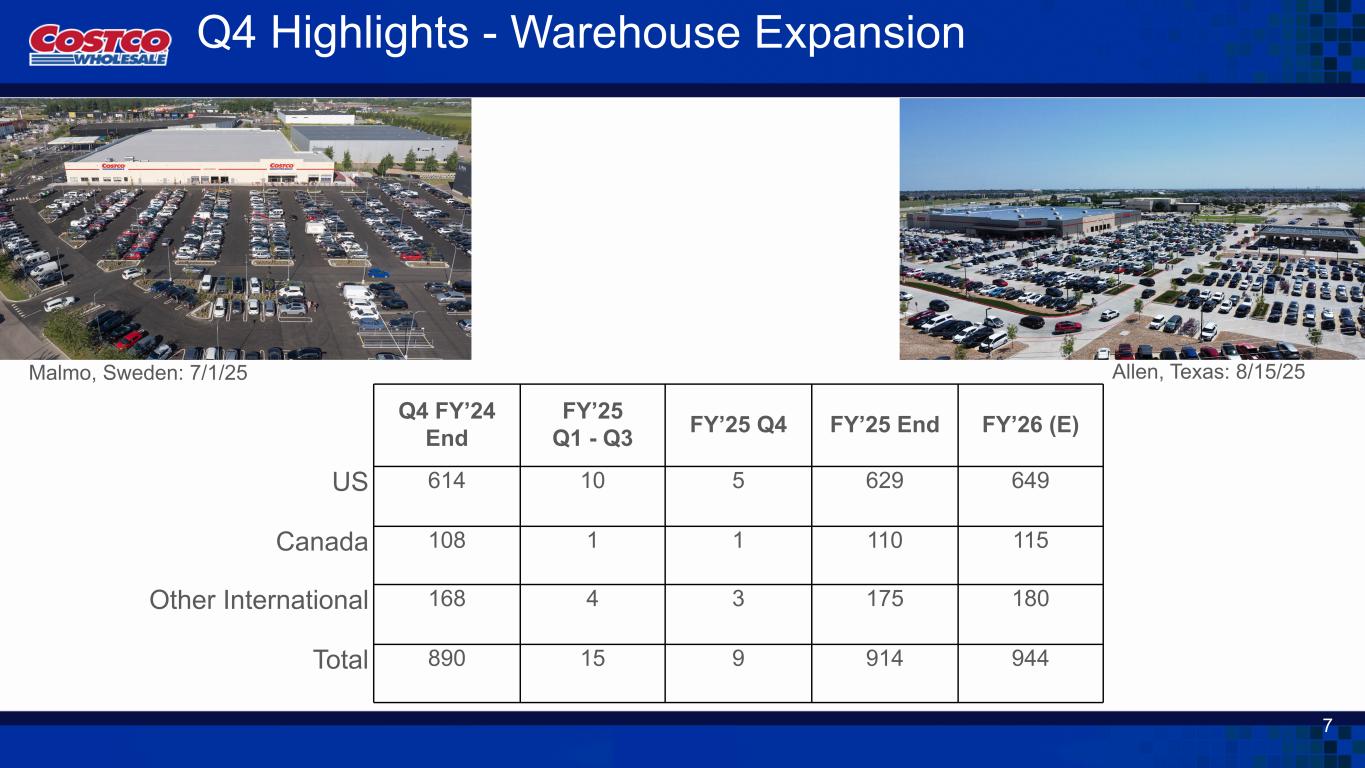

Q4 Highlights - Warehouse Expansion Malmo, Sweden: 7/1/25 7 Allen, Texas: 8/15/25 Q4 FY’24 End FY’25 Q1 - Q3 FY’25 Q4 FY’25 End FY’26 (E) US 614 10 5 629 649 Canada 108 1 1 110 115 Other International 168 4 3 175 180 Total 890 15 9 914 944

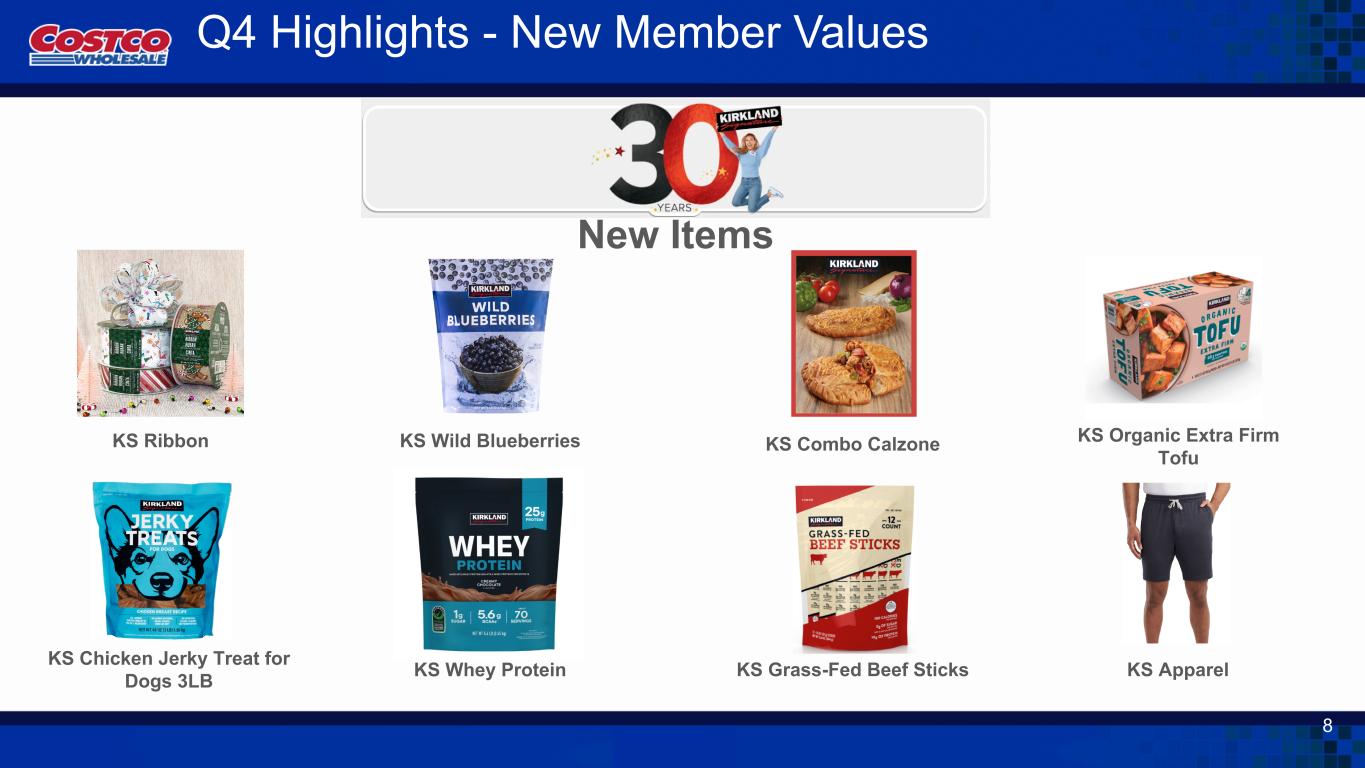

Q4 Highlights - New Member Values KS Apparel KS Organic Extra Firm Tofu 8 New Items KS Ribbon KS Wild Blueberries KS Grass-Fed Beef Sticks KS Combo Calzone KS Chicken Jerky Treat for Dogs 3LB KS Whey Protein

Safe Harbor Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs and wages), workforce interruptions, energy and certain commodities, geopolitical conditions (including tariffs), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to environmental and social matters, public- health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with U.S. GAAP. 9