1st Quarter FY 2026 Supplemental Information 1 .2

$66.0B Net Sales +8.2% Growth +6.4% Comparable Sales +6.4% Adjusted Comparable Sales1 +3.1% Comparable Traffic +20.5% Digitally-Enabled Comparable Sales +20.5% Adjusted Digitally-Enabled Comparable Sales2 Q1 Highlights - Sales 1 - Excluding impacts from changes in gasoline prices and foreign exchange 2 – Digitally-Enabled Comparable Sales excluding impacts from FX 2 +3.2% Comparable Ticket +3.2% Adjusted Comparable Ticket1

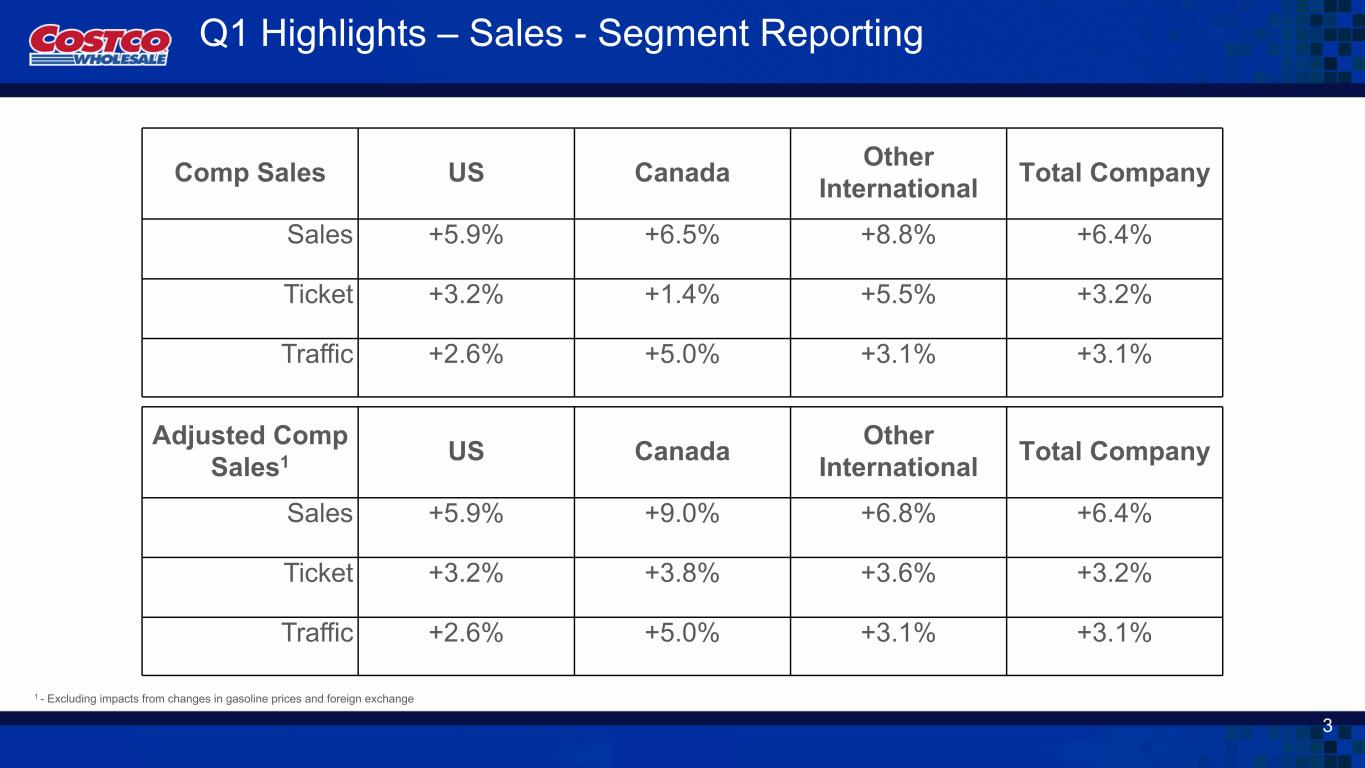

Q1 Highlights – Sales - Segment Reporting 1 - Excluding impacts from changes in gasoline prices and foreign exchange Comp Sales US Canada Other International Total Company Sales +5.9% +6.5% +8.8% +6.4% Ticket +3.2% +1.4% +5.5% +3.2% Traffic +2.6% +5.0% +3.1% +3.1% 3 Adjusted Comp Sales1 US Canada Other International Total Company Sales +5.9% +9.0% +6.8% +6.4% Ticket +3.2% +3.8% +3.6% +3.2% Traffic +2.6% +5.0% +3.1% +3.1%

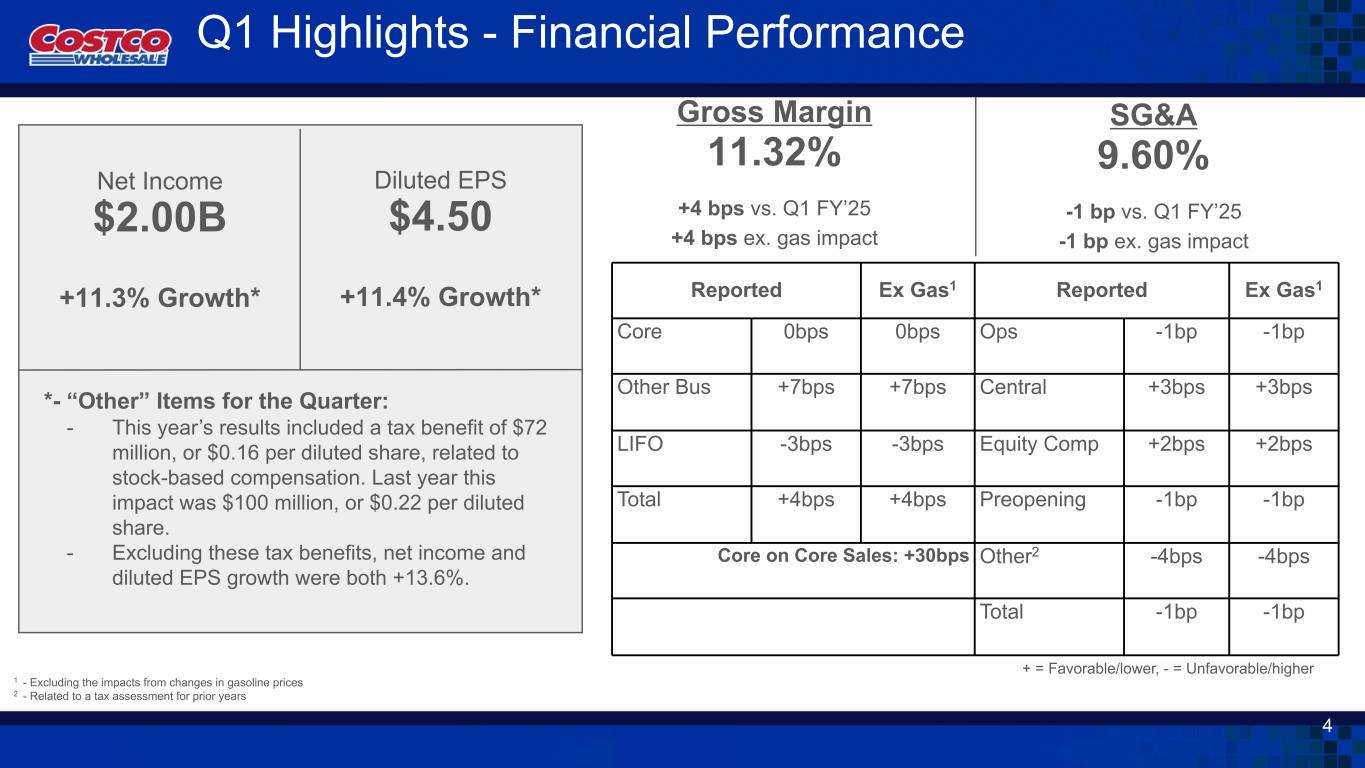

Q1 Highlights - Financial Performance Gross Margin 11.32% +4 bps vs. Q1 FY’25 +4 bps ex. gas impact SG&A 9.60% -1 bp vs. Q1 FY’25 -1 bp ex. gas impact 4 1 - Excluding the impacts from changes in gasoline prices 2 - Related to a tax assessment for prior years Reported Ex Gas1 Reported Ex Gas1 Core 0bps 0bps Ops -1bp -1bp Other Bus +7bps +7bps Central +3bps +3bps LIFO -3bps -3bps Equity Comp +2bps +2bps Total +4bps +4bps Preopening -1bp -1bp Core on Core Sales: +30bps Other2 -4bps -4bps Total -1bp -1bp + = Favorable/lower, - = Unfavorable/higher Diluted EPS $4.50 +11.4% Growth* Net Income $2.00B +11.3% Growth* *- “Other” Items for the Quarter: - This year’s results included a tax benefit of $72 million, or $0.16 per diluted share, related to stock-based compensation. Last year this impact was $100 million, or $0.22 per diluted share. - Excluding these tax benefits, net income and diluted EPS growth were both +13.6%.

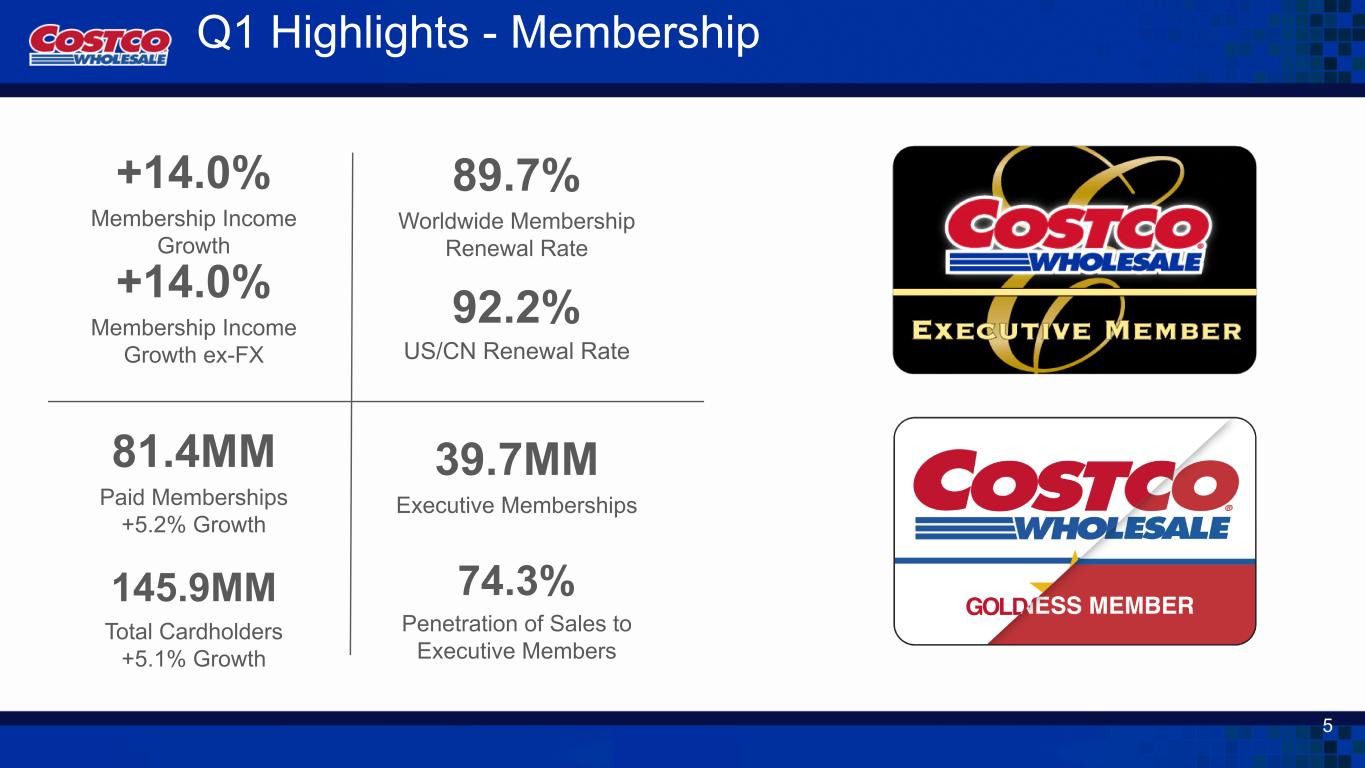

+14.0% Membership Income Growth +14.0% Membership Income Growth ex-FX 89.7% Worldwide Membership Renewal Rate 92.2% US/CN Renewal Rate 81.4MM Paid Memberships +5.2% Growth 145.9MM Total Cardholders +5.1% Growth 39.7MM Executive Memberships 74.3% Penetration of Sales to Executive Members Q1 Highlights - Membership 5

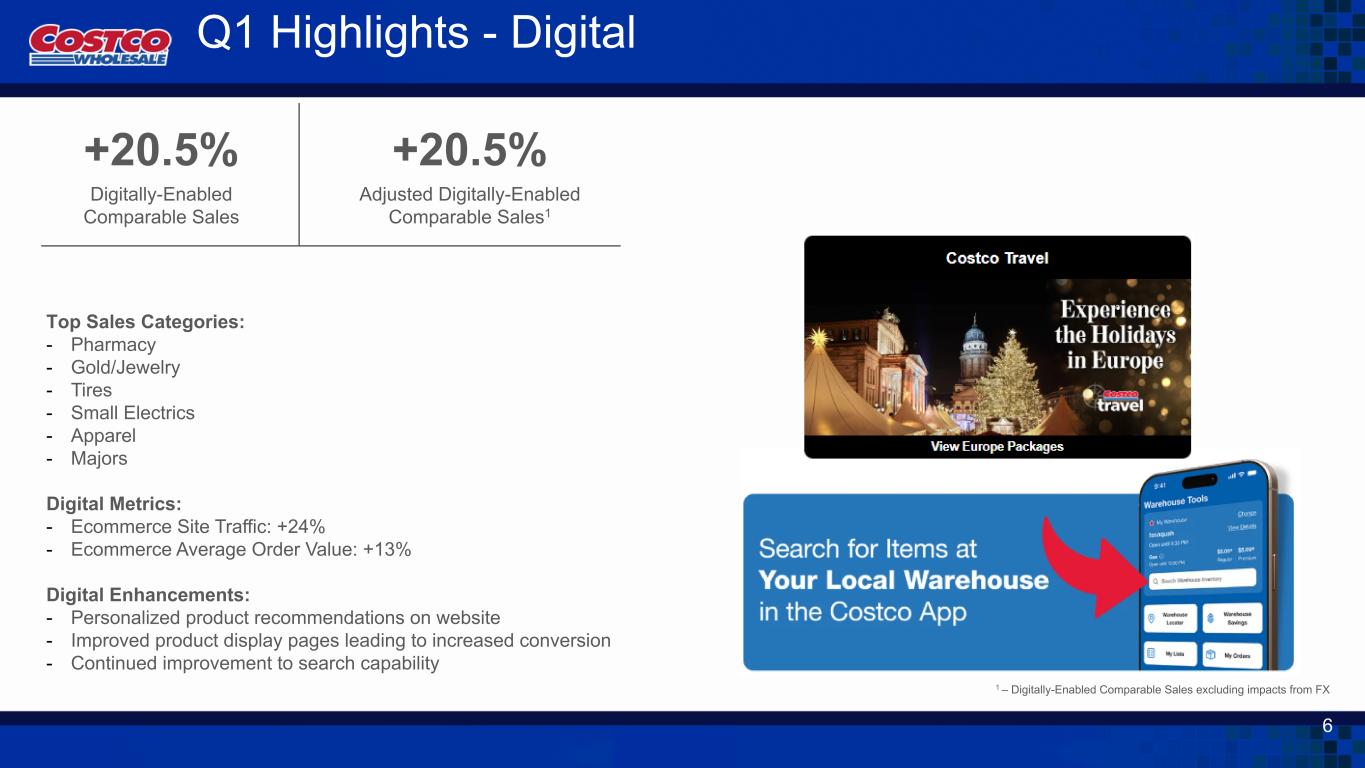

+20.5% Digitally-Enabled Comparable Sales 1 – Digitally-Enabled Comparable Sales excluding impacts from FX +20.5% Adjusted Digitally-Enabled Comparable Sales1 Top Sales Categories: - Pharmacy - Gold/Jewelry - Tires - Small Electrics - Apparel - Majors Digital Metrics: - Ecommerce Site Traffic: +24% - Ecommerce Average Order Value: +13% Digital Enhancements: - Personalized product recommendations on website - Improved product display pages leading to increased conversion - Continued improvement to search capability Q1 Highlights - Digital 6

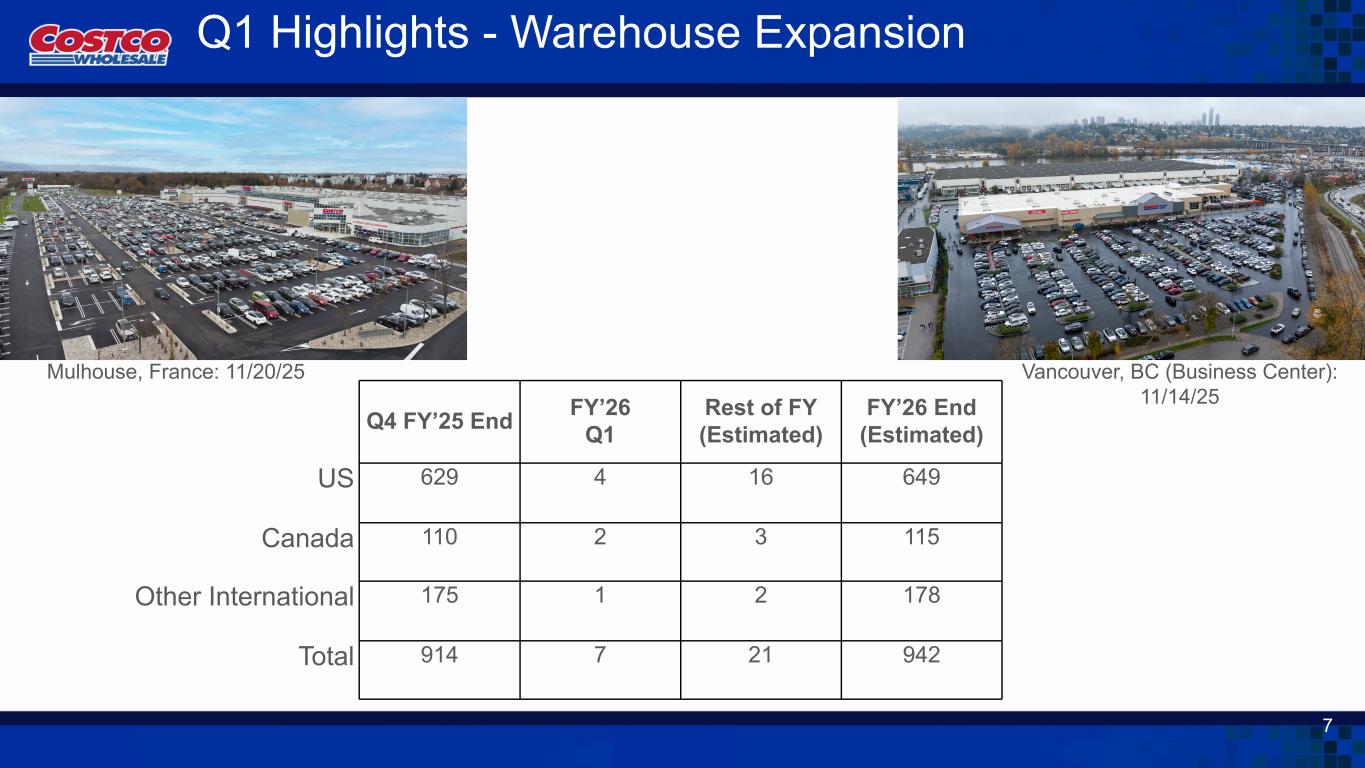

Q1 Highlights - Warehouse Expansion Mulhouse, France: 11/20/25 7 Vancouver, BC (Business Center): 11/14/25 Q4 FY’25 End FY’26 Q1 Rest of FY (Estimated) FY’26 End (Estimated) US 629 4 16 649 Canada 110 2 3 115 Other International 175 1 2 178 Total 914 7 21 942

Q1 Highlights - New Member Values KS Tomato Basil Soup KS Crème Brulee Bar Cake 8 KS Chicken Pot Pie From $4.29 to $3.99/lb KS Bacon From $18.99 to $16.99 KS Caramelized Blueberry Croissant KS Dry Facial Daily Clean Towels KS Whip Cream From $10.49 to $8.99 KS Walnuts 3 lbs From $14.49 to $12.99 New Items Lowering Everyday Low Prices

Safe Harbor Certain statements contained in this document constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward-looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health-care costs and wages), workforce interruptions, energy and certain commodities, geopolitical conditions (including tariffs), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to environmental and social matters, public- health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with U.S. GAAP. 9