Fourth Quarter 2025 Results January 30, 2026

24th Quarter 2025 Cautionary Statement Forward-Looking Information This earnings presentation and the associated conference call may include forward‐looking statements by us and our authorized officers pertaining to such matters as our goals, beliefs, intentions, and expectations regarding, among other things: (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the future costs and benefits of the actions we may take; (c) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (d) our assessments of interest rate and other market risks; (e) our ability to achieve profitability goals within projected timeframes and to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (f) our ability to attract, incentivize, and retain key personnel and the roles of key personnel; (g) our ability to achieve our financial and other strategic goals, including those related to our recent holding company reorganization, which was completed in October 2025, our merger with Flagstar Bancorp, Inc., which was completed in December 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, which was completed in March 2023, and our ability to comply with the heightened regulatory standards with respect to governance and risk management which we are subject to as a national bank with assets of $50 billion or more; (h) the impact of the $1.05 billion capital raise we completed in March 2024; (i) our previously disclosed material weaknesses in internal control over financial reporting; (j) the conversion or exchange of shares of our preferred stock; (k) the payment of dividends on shares of our capital stock, including adjustments to the amount of dividends payable on shares of our preferred stock; (l) the availability of equity and dilution of existing equity holders associated with future equity awards and stock issuances; (m) the effects of the reverse stock split we effected in July 2024; and (n) the impact of the recent sale of our mortgage servicing operations, third party mortgage loan origination business, and mortgage warehouse business. Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” "confident," and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; we do not assume any duty, and do not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward‐looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses, including changes required under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; our ability to achieve the anticipated benefits of our recently completed holding company reorganization transaction; changes in our Board of Directors or executive management team; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; our ability to successfully remediate our previously disclosed material weaknesses in internal control over financial reporting; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the impacts of tariffs, sanctions and other trade policies of the United States and its global trading counterparts; the outcome of federal, state, and local elections and the resulting economic and other impact on the areas in which we conduct business; the impact of changing political conditions; the imposition of restrictions on our operations by bank regulators; the outcome of pending or threatened litigation, or of investigations or any other matters before regulatory agencies, whether currently existing or commencing in the future; our ability to comply with heightened regulatory standards with respect to governance and risk management which we are subject to as a national bank with assets $50 billion or more; the restructuring of our mortgage business; our ability to recognize anticipated cost savings and enhanced efficiencies with respect to our balance sheet and expense reduction strategies; the impact of failures or disruptions in or breaches of our operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, civil unrest, international military conflict, terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed in December 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, which was completed in March 2023: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; the possibility that we may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K for the year ended December 31, 2024, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

34th Quarter 2025 Management Focus Areas Transformation Strategy Produced Clear Results Restoring Profitability Grew C&I $343 million, or 2% QoQ; reflects execution on growth initiatives; second consecutive quarter of net C&I growth Grew C&I primary bank relationships and regional markets/focus industry presence Continue to hire additional talent Deploy expanded product offerings and capabilities into middle market, corporate, and specialized industry verticals Execute on C&I and Private Bank Growth Initiatives Lower provision for credit losses Net charge-offs down $27 million driving the net charge-off ratio down 16 basis points to 30 basis points NALs down 8% Criticized and classified loans decreased $2.9 billion, or 19% compared to December 31, 2024, and decreased $330 million, or 3% compared to the prior quarter Proactive Management of CRE Portfolio Continue reduction in CRE exposure CRE concentration ratio declined to 381% from 405% in prior quarter Multi-family and CRE par payoffs of $1.8 billion with 50% being substandard Multi-family loans held- for-investment down $1.5 billion, or 5% QoQ CRE down $0.8 billion, or 8% QoQ Credit Improvement Returned to profitability Delivered quarterly adjusted operating leverage of close to 900 basis points Grew adjusted PPNR to $65 million, a $45 million increase compared to prior quarter Continued NIM expansion; further reduced funding costs Disciplined cost controls driving stable expenses(1) Improve Earnings Profile 1 2 3 4 See cautionary statements on page 2 | See notes on page 29

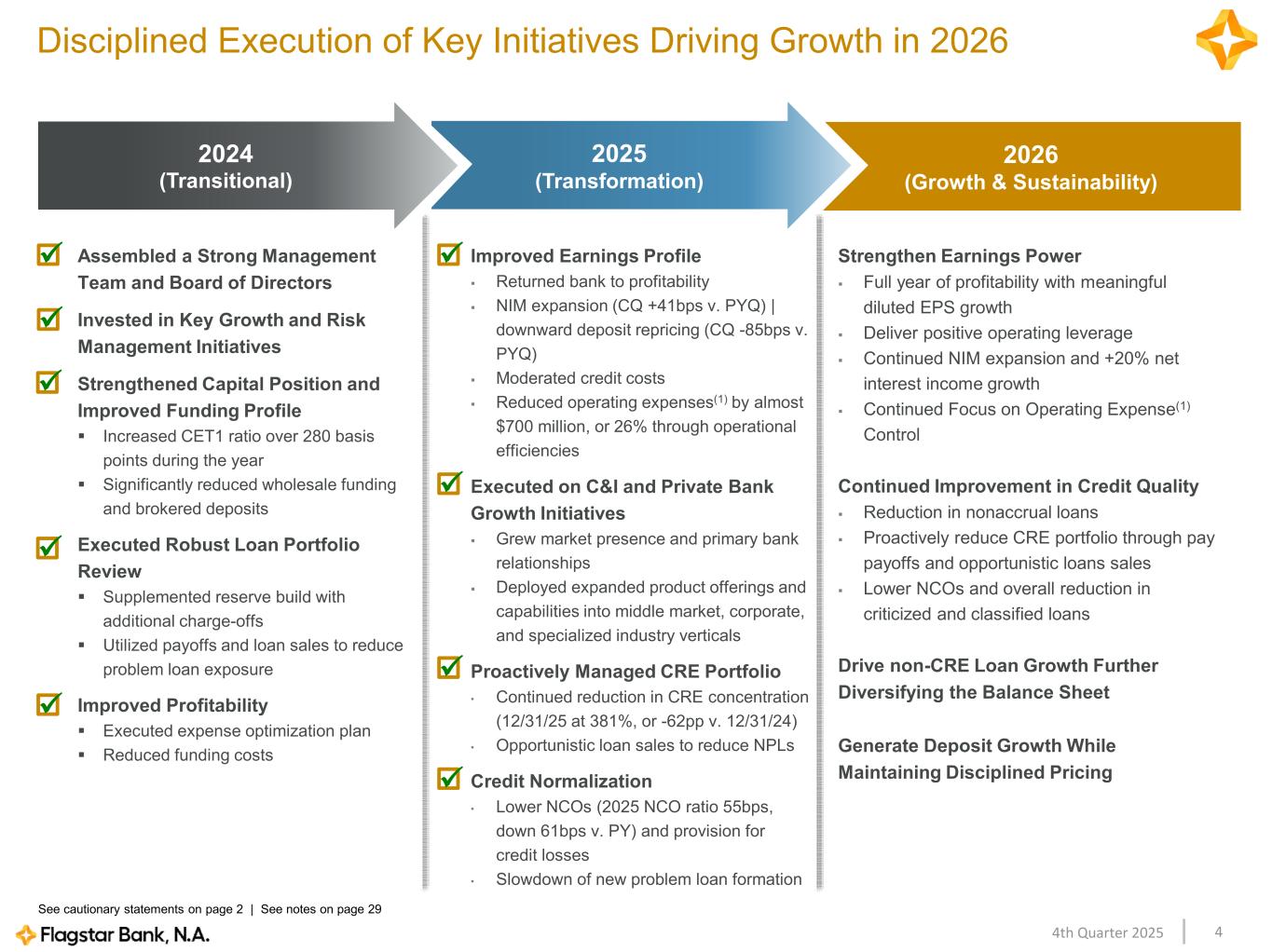

44th Quarter 2025 Improved Earnings Profile Returned bank to profitability NIM expansion (CQ +41bps v. PYQ) | downward deposit repricing (CQ -85bps v. PYQ) Moderated credit costs Reduced operating expenses(1) by almost $700 million, or 26% through operational efficiencies Executed on C&I and Private Bank Growth Initiatives Grew market presence and primary bank relationships Deployed expanded product offerings and capabilities into middle market, corporate, and specialized industry verticals Proactively Managed CRE Portfolio • Continued reduction in CRE concentration (12/31/25 at 381%, or -62pp v. 12/31/24) • Opportunistic loan sales to reduce NPLs Credit Normalization • Lower NCOs (2025 NCO ratio 55bps, down 61bps v. PY) and provision for credit losses • Slowdown of new problem loan formation Assembled a Strong Management Team and Board of Directors Invested in Key Growth and Risk Management Initiatives Strengthened Capital Position and Improved Funding Profile Increased CET1 ratio over 280 basis points during the year Significantly reduced wholesale funding and brokered deposits Executed Robust Loan Portfolio Review Supplemented reserve build with additional charge-offs Utilized payoffs and loan sales to reduce problem loan exposure Improved Profitability Executed expense optimization plan Reduced funding costs Disciplined Execution of Key Initiatives Driving Growth in 2026 See cautionary statements on page 2 | See notes on page 29 2026 (Growth & Sustainability) 2025 (Transformation) 2024 (Transitional) Strengthen Earnings Power Full year of profitability with meaningful diluted EPS growth Deliver positive operating leverage Continued NIM expansion and +20% net interest income growth Continued Focus on Operating Expense(1) Control Continued Improvement in Credit Quality Reduction in nonaccrual loans Proactively reduce CRE portfolio through pay payoffs and opportunistic loans sales Lower NCOs and overall reduction in criticized and classified loans Drive non-CRE Loan Growth Further Diversifying the Balance Sheet Generate Deposit Growth While Maintaining Disciplined Pricing

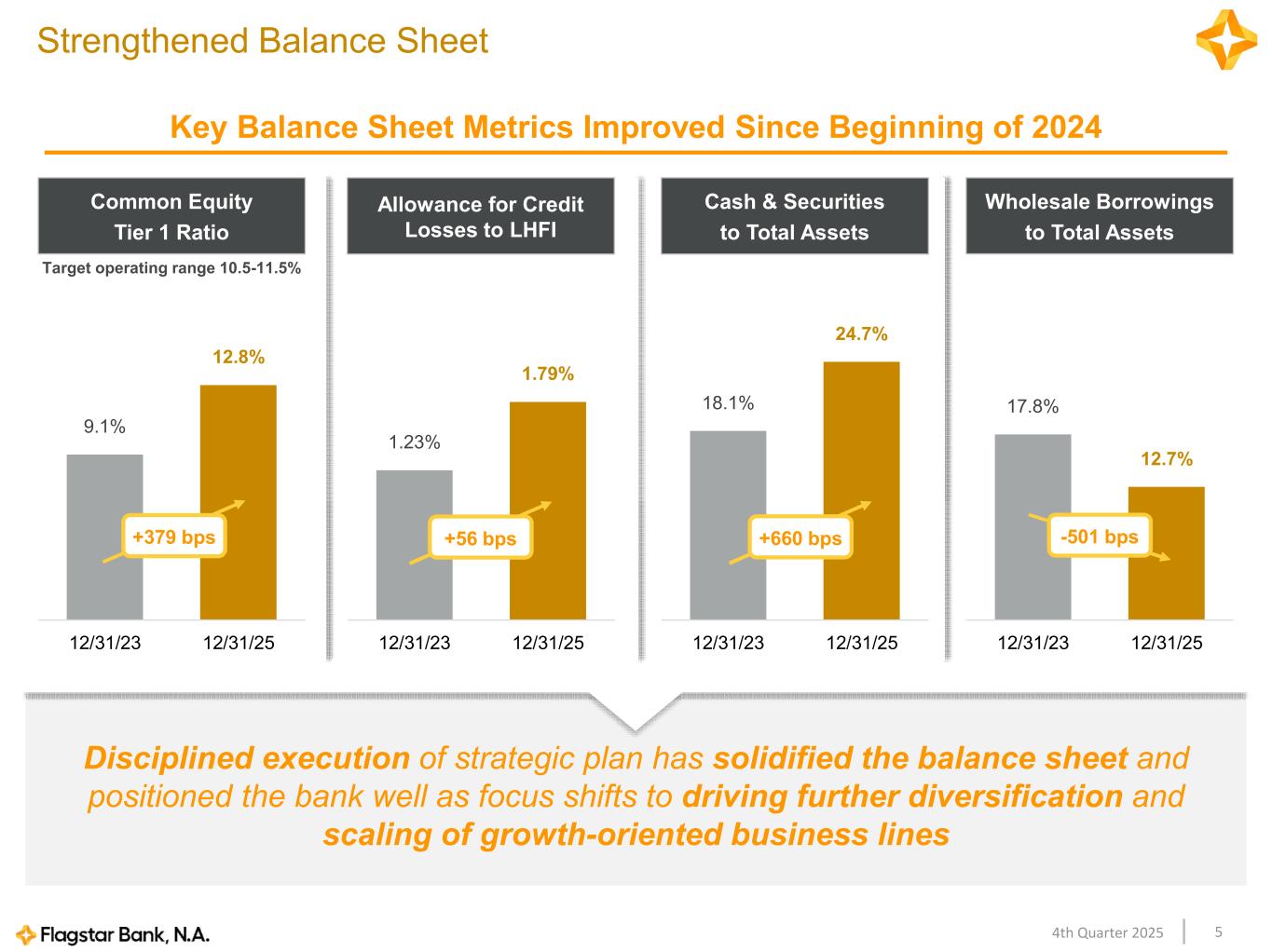

54th Quarter 2025 Disciplined execution of strategic plan has solidified the balance sheet and positioned the bank well as focus shifts to driving further diversification and scaling of growth-oriented business lines 9.1% 12.8% 12/31/23 12/31/25 Strengthened Balance Sheet Wholesale Borrowings to Total Assets Target operating range 10.5-11.5% 17.8% 12.7% 12/31/23 12/31/25 -501 bps Cash & Securities to Total Assets 18.1% 24.7% 12/31/23 12/31/25 +660 bps Allowance for Credit Losses to LHFI 1.23% 1.79% 12/31/23 12/31/25 +56 bps Common Equity Tier 1 Ratio +379 bps Key Balance Sheet Metrics Improved Since Beginning of 2024

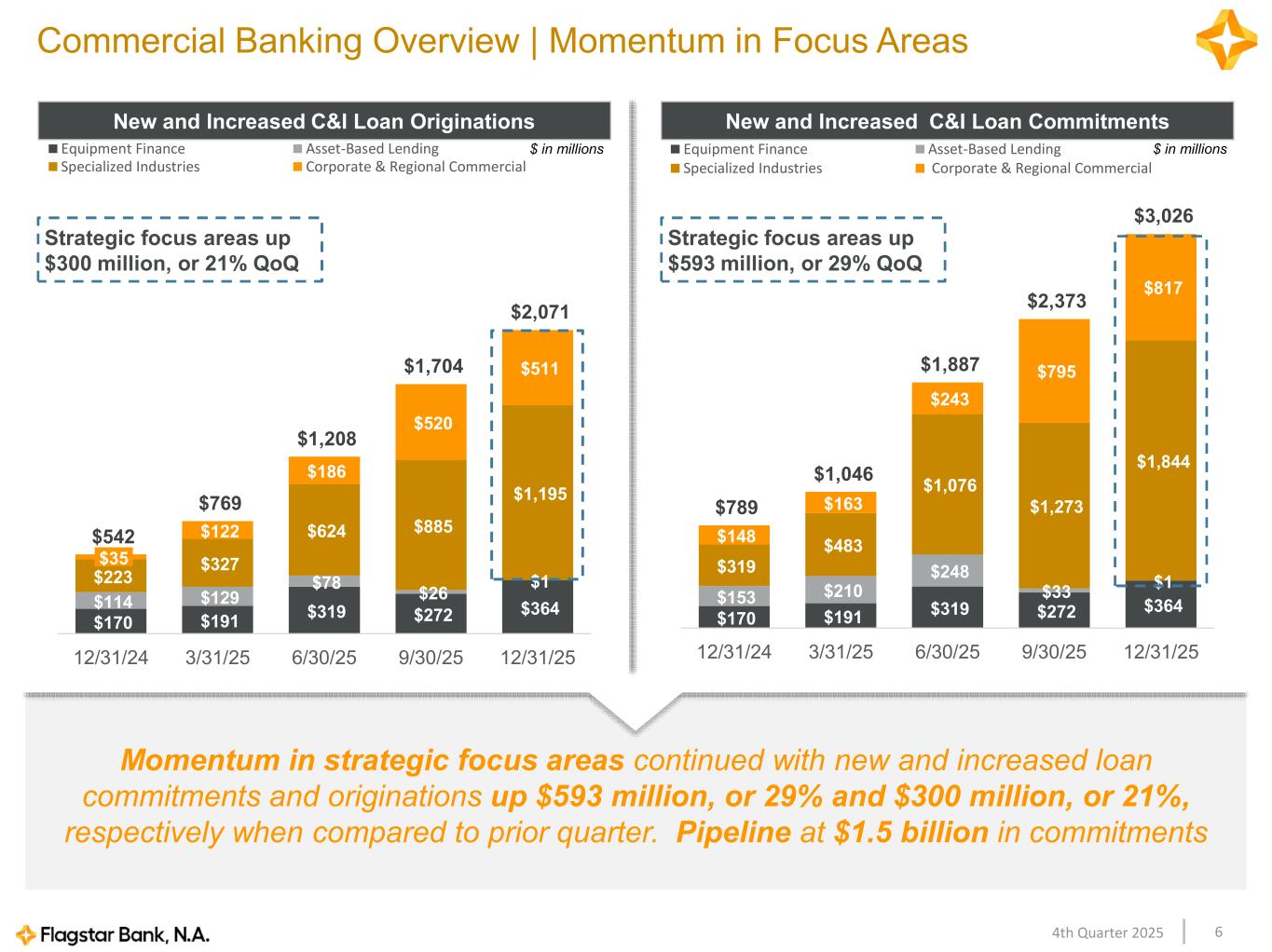

64th Quarter 2025 $170 $191 $319 $272 $364 $114 $129 $78 $26 $1 $223 $327 $624 $885 $1,195 $122 $186 $520 $511 $542 $769 $1,208 $1,704 $2,071 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Equipment Finance Asset-Based Lending Specialized Industries Corporate & Regional Commercial Commercial Banking Overview | Momentum in Focus Areas New and Increased C&I Loan Commitments $ in millions New and Increased C&I Loan Originations $ in millions $170 $191 $319 $272 $364 $153 $210 $248 $33 $1 $319 $483 $1,076 $1,273 $1,844 $148 $163 $243 $795 $817 $789 $1,046 $1,887 $2,373 $3,026 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Equipment Finance Asset-Based Lending Specialized Industries Corporate & Regional Commercial Strategic focus areas up $300 million, or 21% QoQ Strategic focus areas up $593 million, or 29% QoQ Momentum in strategic focus areas continued with new and increased loan commitments and originations up $593 million, or 29% and $300 million, or 21%, respectively when compared to prior quarter. Pipeline at $1.5 billion in commitments $35

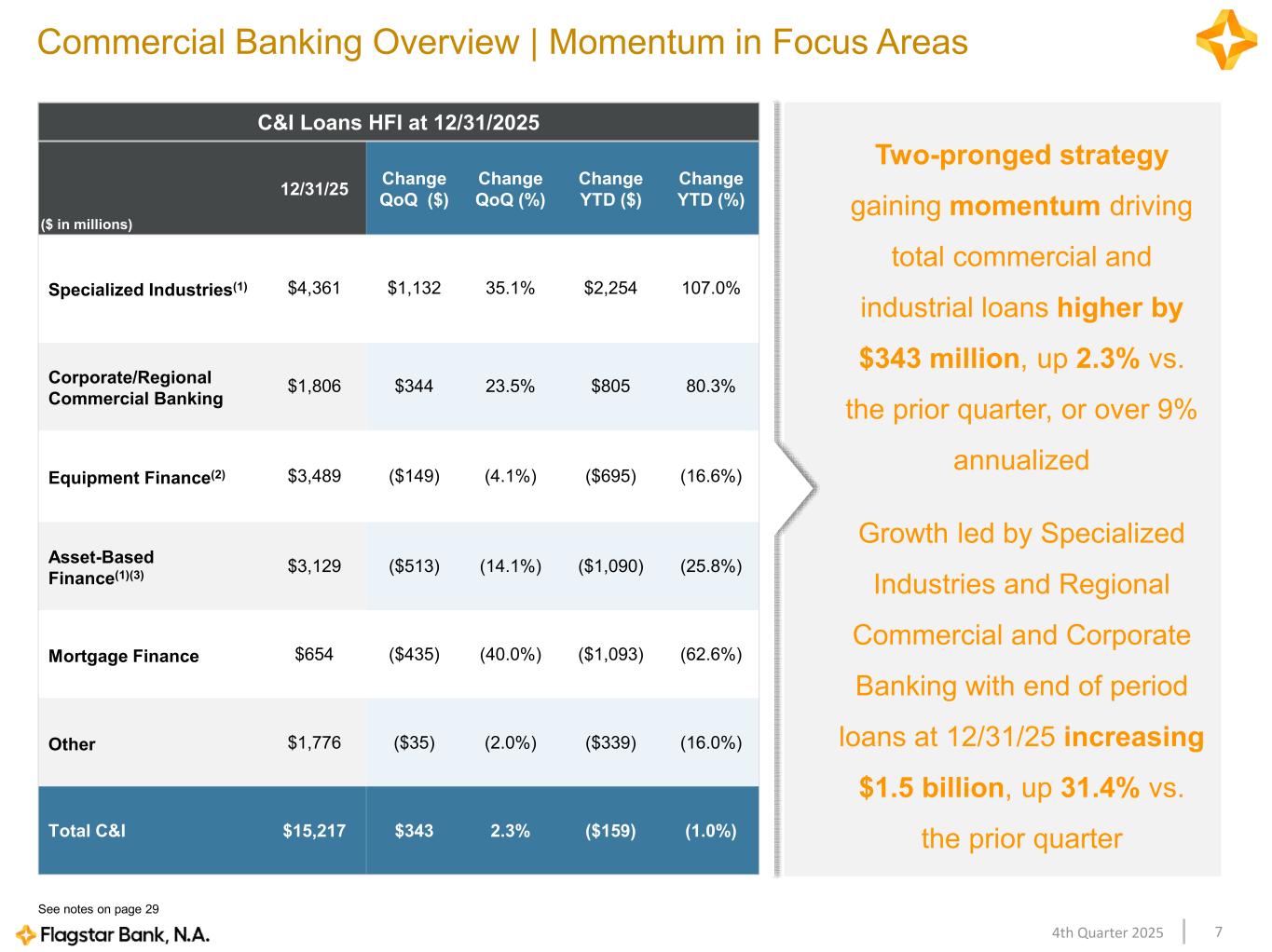

74th Quarter 2025 Commercial Banking Overview | Momentum in Focus Areas Two-pronged strategy gaining momentum driving total commercial and industrial loans higher by $343 million, up 2.3% vs. the prior quarter, or over 9% annualized Growth led by Specialized Industries and Regional Commercial and Corporate Banking with end of period loans at 12/31/25 increasing $1.5 billion, up 31.4% vs. the prior quarter C&I Loans HFI at 12/31/2025 ($ in millions) 12/31/25 Change QoQ ($) Change QoQ (%) Change YTD ($) Change YTD (%) Specialized Industries(1) $4,361 $1,132 35.1% $2,254 107.0% Corporate/Regional Commercial Banking $1,806 $344 23.5% $805 80.3% Equipment Finance(2) $3,489 ($149) (4.1%) ($695) (16.6%) Asset-Based Finance(1)(3) $3,129 ($513) (14.1%) ($1,090) (25.8%) Mortgage Finance $654 ($435) (40.0%) ($1,093) (62.6%) Other $1,776 ($35) (2.0%) ($339) (16.0%) Total C&I $15,217 $343 2.3% ($159) (1.0%) See notes on page 29

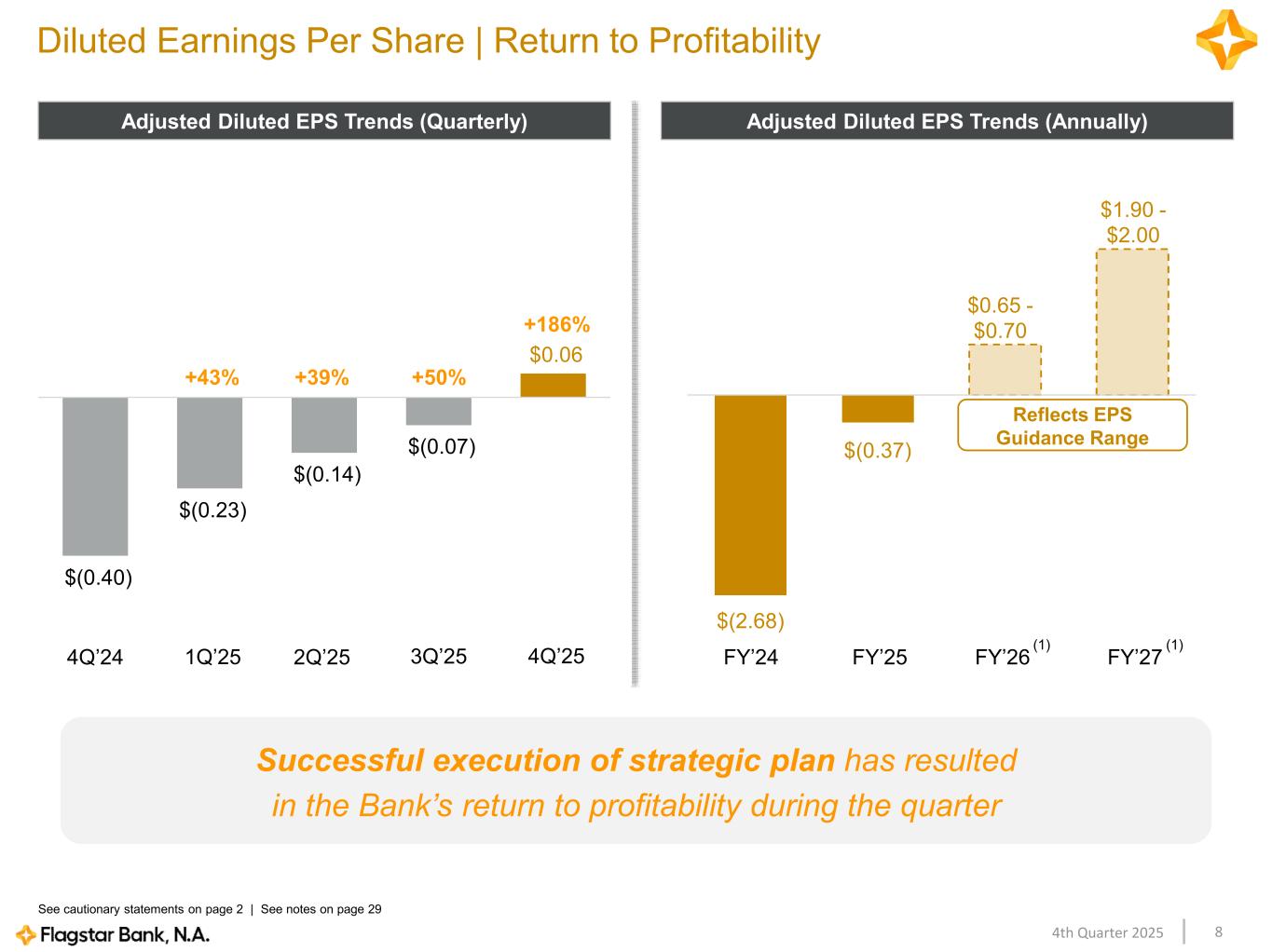

84th Quarter 2025 $(0.40) $(0.23) $(0.14) $(0.07) $0.06 Diluted Earnings Per Share | Return to Profitability Adjusted Diluted EPS Trends (Quarterly) Reflects EPS Guidance Range $0.65 - $0.70 $1.90 - $2.00 +43% +39% +50% 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 FY’26 FY’27 +186% FY’25 $(0.37) See cautionary statements on page 2 | See notes on page 29 Adjusted Diluted EPS Trends (Annually) FY’24 $(2.68) Successful execution of strategic plan has resulted in the Bank’s return to profitability during the quarter (1) (1)

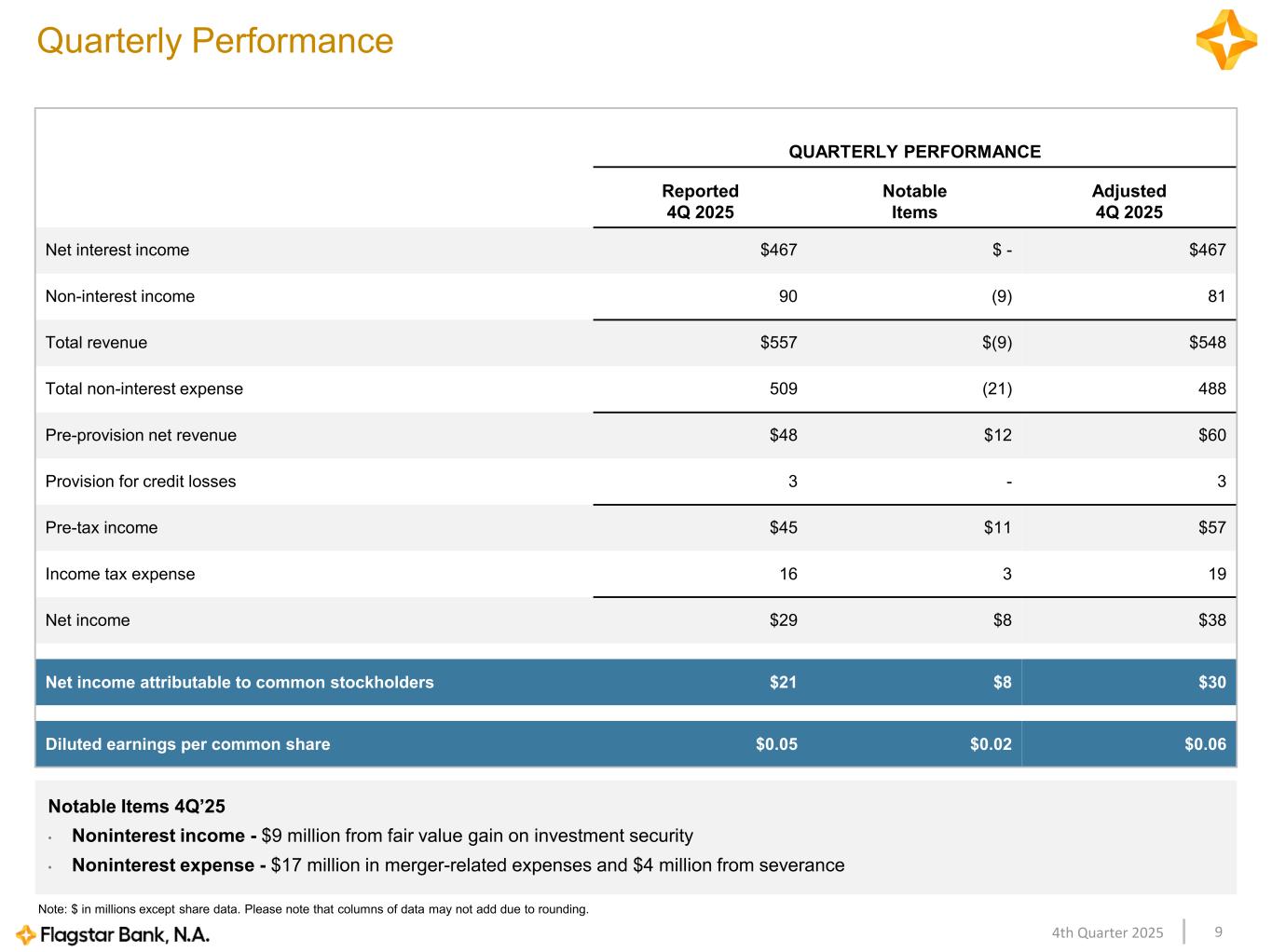

94th Quarter 2025 Note: $ in millions except share data. Please note that columns of data may not add due to rounding. Quarterly Performance QUARTERLY PERFORMANCE Reported 4Q 2025 Notable Items Adjusted 4Q 2025 Net interest income $467 $ - $467 Non-interest income 90 (9) 81 Total revenue $557 $(9) $548 Total non-interest expense 509 (21) 488 Pre-provision net revenue $48 $12 $60 Provision for credit losses 3 - 3 Pre-tax income $45 $11 $57 Income tax expense 16 3 19 Net income $29 $8 $38 Net income attributable to common stockholders $21 $8 $30 Diluted earnings per common share $0.05 $0.02 $0.06 Notable Items 4Q’25 • Noninterest income - $9 million from fair value gain on investment security • Noninterest expense - $17 million in merger-related expenses and $4 million from severance

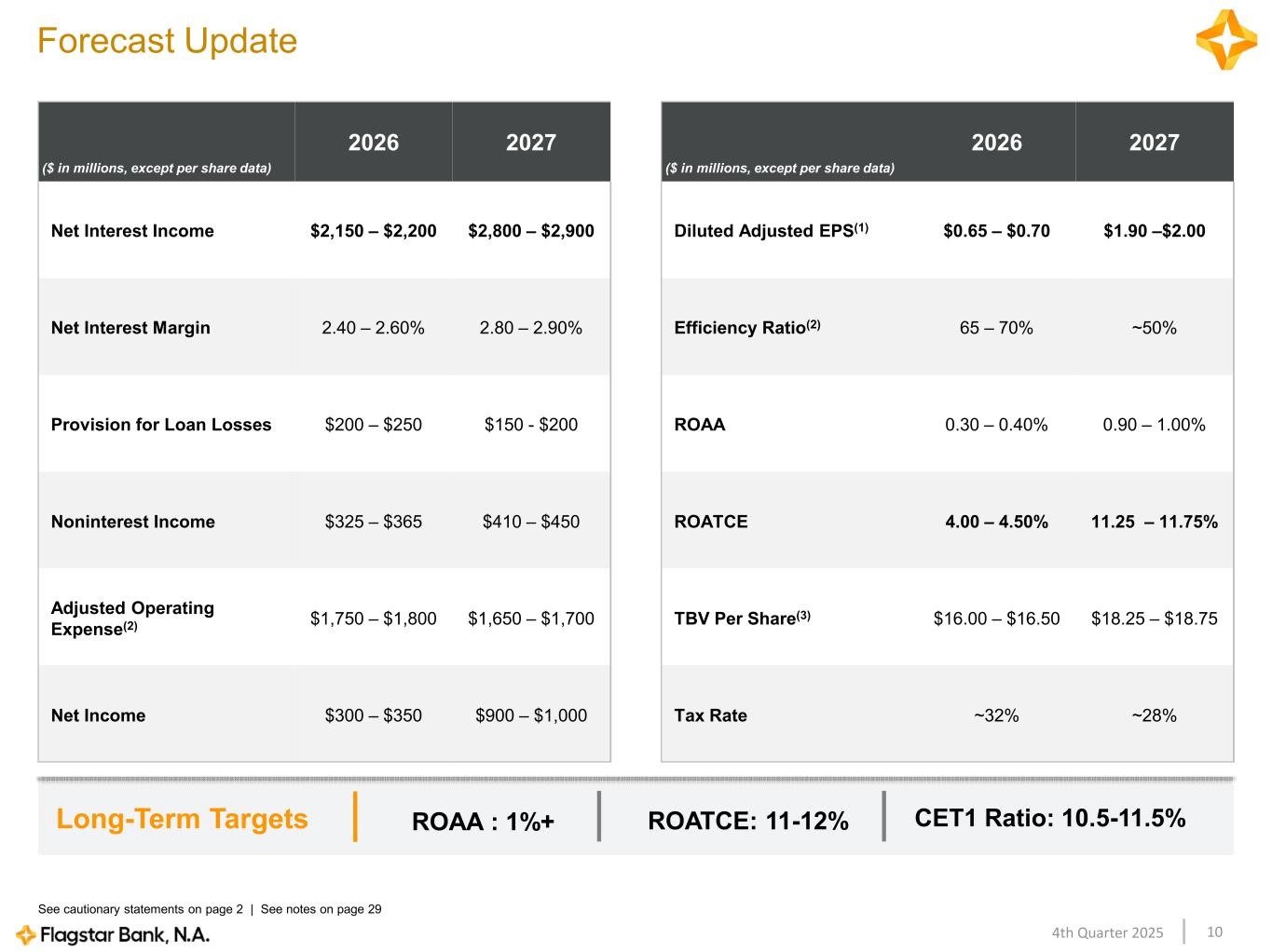

104th Quarter 2025 Forecast Update ($ in millions, except per share data) 2026 2027 Net Interest Income $2,150 – $2,200 $2,800 – $2,900 Net Interest Margin 2.40 – 2.60% 2.80 – 2.90% Provision for Loan Losses $200 – $250 $150 - $200 Noninterest Income $325 – $365 $410 – $450 Adjusted Operating Expense(2) $1,750 – $1,800 $1,650 – $1,700 Net Income $300 – $350 $900 – $1,000 Long-Term Targets ROAA : 1%+ ROATCE: 11-12% CET1 Ratio: 10.5-11.5% See cautionary statements on page 2 | See notes on page 29 ($ in millions, except per share data) 2026 2027 Diluted Adjusted EPS(1) $0.65 – $0.70 $1.90 –$2.00 Efficiency Ratio(2) 65 – 70% ~50% ROAA 0.30 – 0.40% 0.90 – 1.00% ROATCE 4.00 – 4.50% 11.25 – 11.75% TBV Per Share(3) $16.00 – $16.50 $18.25 – $18.75 Tax Rate ~32% ~28%

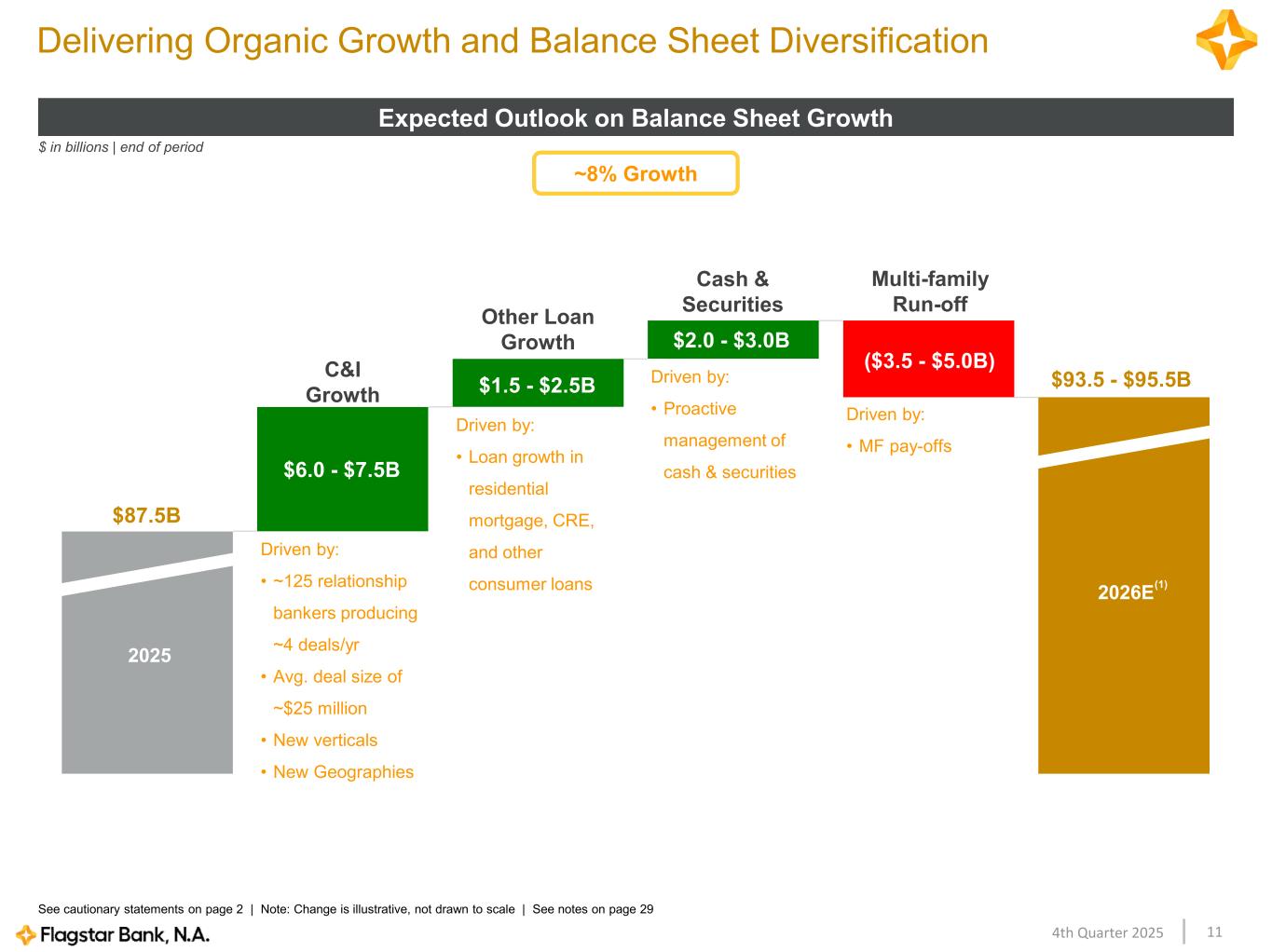

114th Quarter 2025 Delivering Organic Growth and Balance Sheet Diversification Expected Outlook on Balance Sheet Growth See cautionary statements on page 2 | Note: Change is illustrative, not drawn to scale | See notes on page 29 $87.5B ~8% Growth (1) $93.5 - $95.5B 2026E 2025 Driven by: • ~125 relationship bankers producing ~4 deals/yr • Avg. deal size of ~$25 million • New verticals • New Geographies $ in billions | end of period $6.0 - $7.5B ($3.5 - $5.0B) $2.0 - $3.0B $1.5 - $2.5B Driven by: • Loan growth in residential mortgage, CRE, and other consumer loans Driven by: • Proactive management of cash & securities Driven by: • MF pay-offs C&I Growth Other Loan Growth Cash & Securities Multi-family Run-off

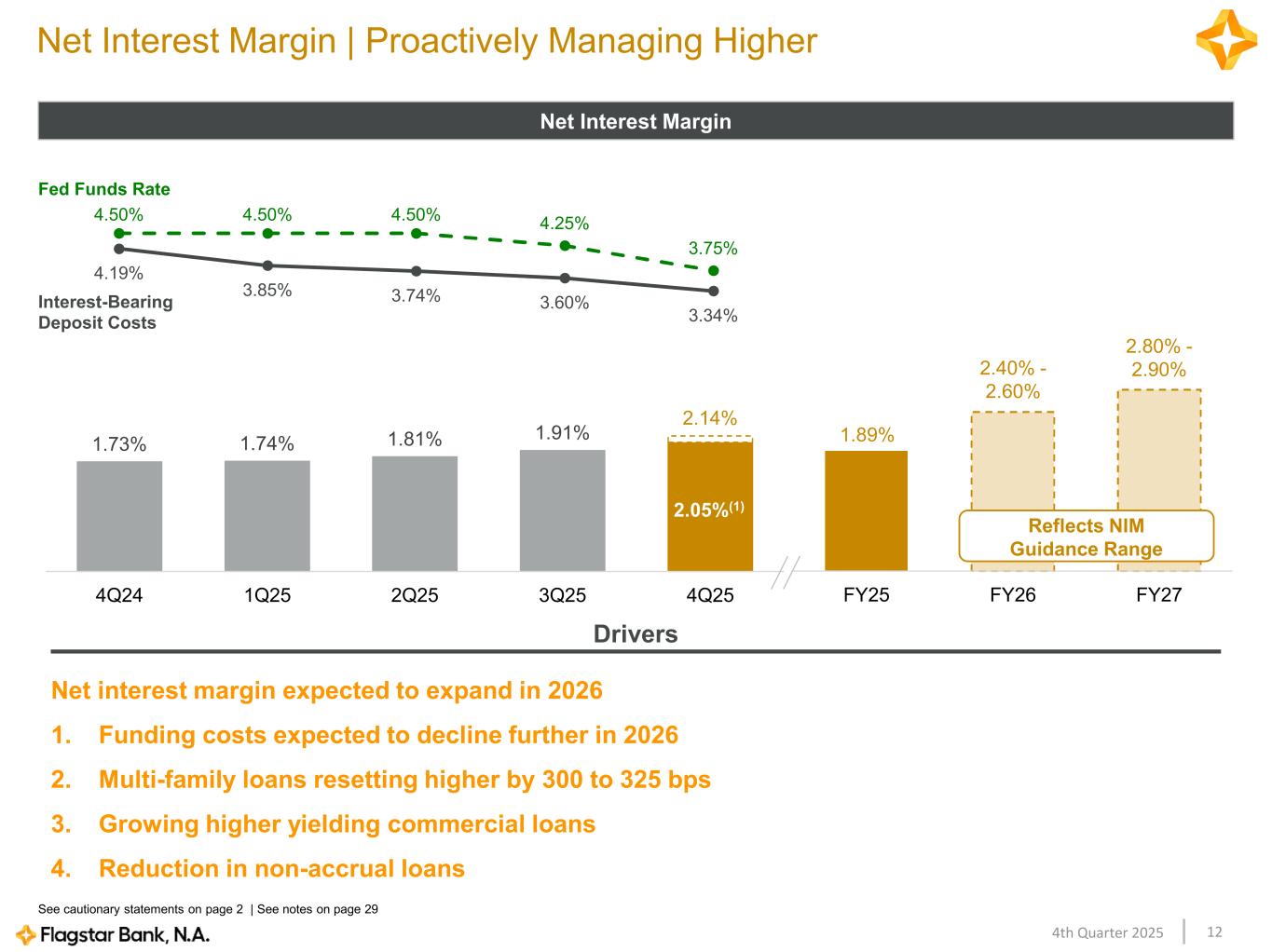

124th Quarter 2025 1.73% 1.74% 1.81% 1.91% 2.14% 4Q24 1Q25 2Q25 3Q25 4Q25 FY25 FY26 FY27 4.19% 3.85% 3.74% 3.60% 3.34% 4.50% 4.50% 4.50% 4.25% 3.75% Net Interest Margin | Proactively Managing Higher Net Interest Margin Net interest margin expected to expand in 2026 1. Funding costs expected to decline further in 2026 2. Multi-family loans resetting higher by 300 to 325 bps 3. Growing higher yielding commercial loans 4. Reduction in non-accrual loans Drivers See cautionary statements on page 2 | See notes on page 29 Interest-Bearing Deposit Costs Fed Funds Rate Reflects NIM Guidance Range 1.89% 2.40% - 2.60% 2.80% - 2.90% 2.05%(1)

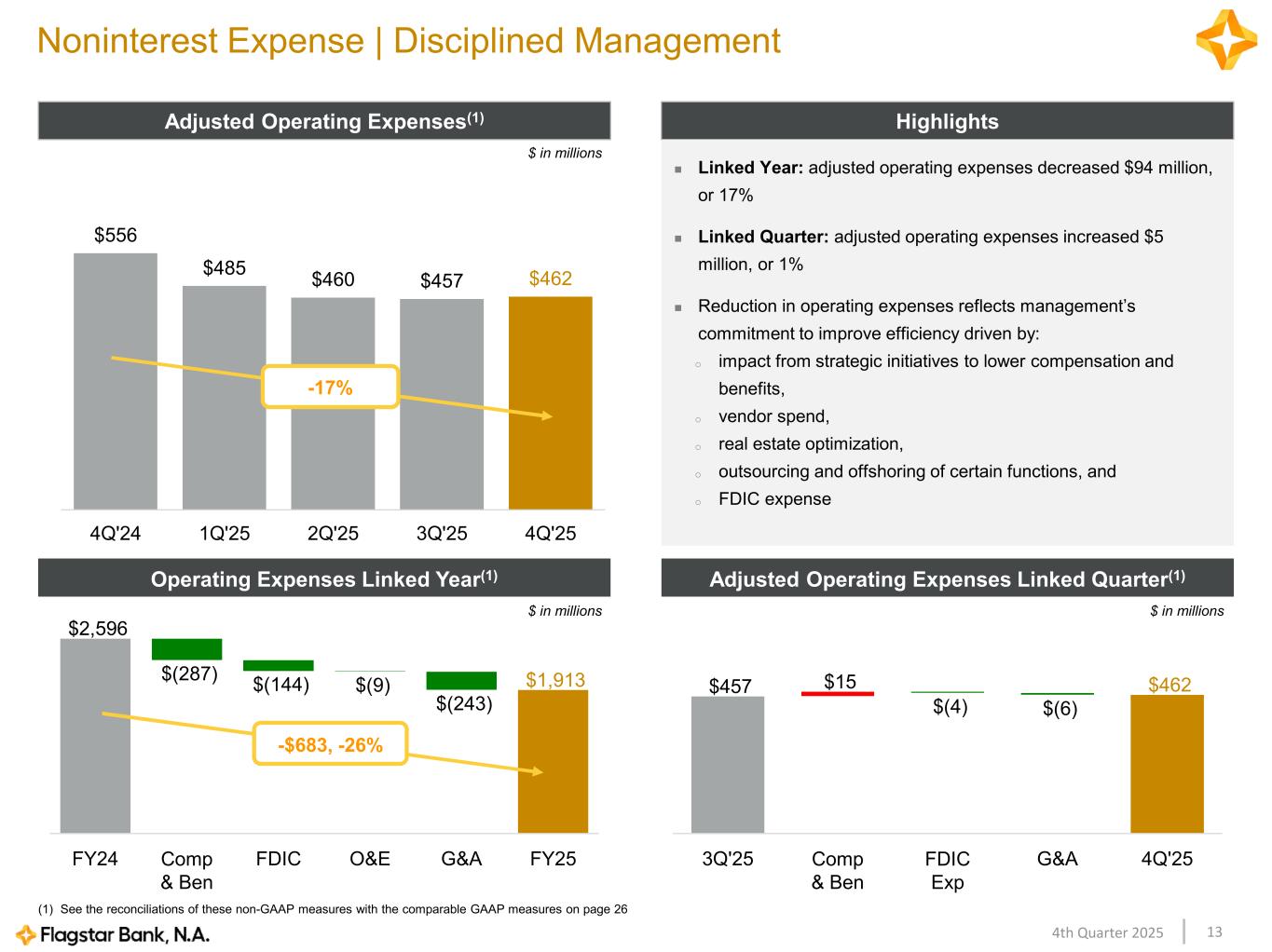

134th Quarter 2025 $556 $485 $460 $457 $462 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 Noninterest Expense | Disciplined Management Highlights Linked Year: adjusted operating expenses decreased $94 million, or 17% Linked Quarter: adjusted operating expenses increased $5 million, or 1% Reduction in operating expenses reflects management’s commitment to improve efficiency driven by: o impact from strategic initiatives to lower compensation and benefits, o vendor spend, o real estate optimization, o outsourcing and offshoring of certain functions, and o FDIC expense Adjusted Operating Expenses(1) -17% $457 $15 $(4) $(6) $462 3Q'25 Comp & Ben FDIC Exp G&A 4Q'25 Adjusted Operating Expenses Linked Quarter(1) (1) See the reconciliations of these non-GAAP measures with the comparable GAAP measures on page 26 Operating Expenses Linked Year(1) $2,596 $(287) $(144) $(9) $(243) $1,913 FY24 Comp & Ben FDIC O&E G&A FY25 $ in millions $ in millions $ in millions -$683, -26%

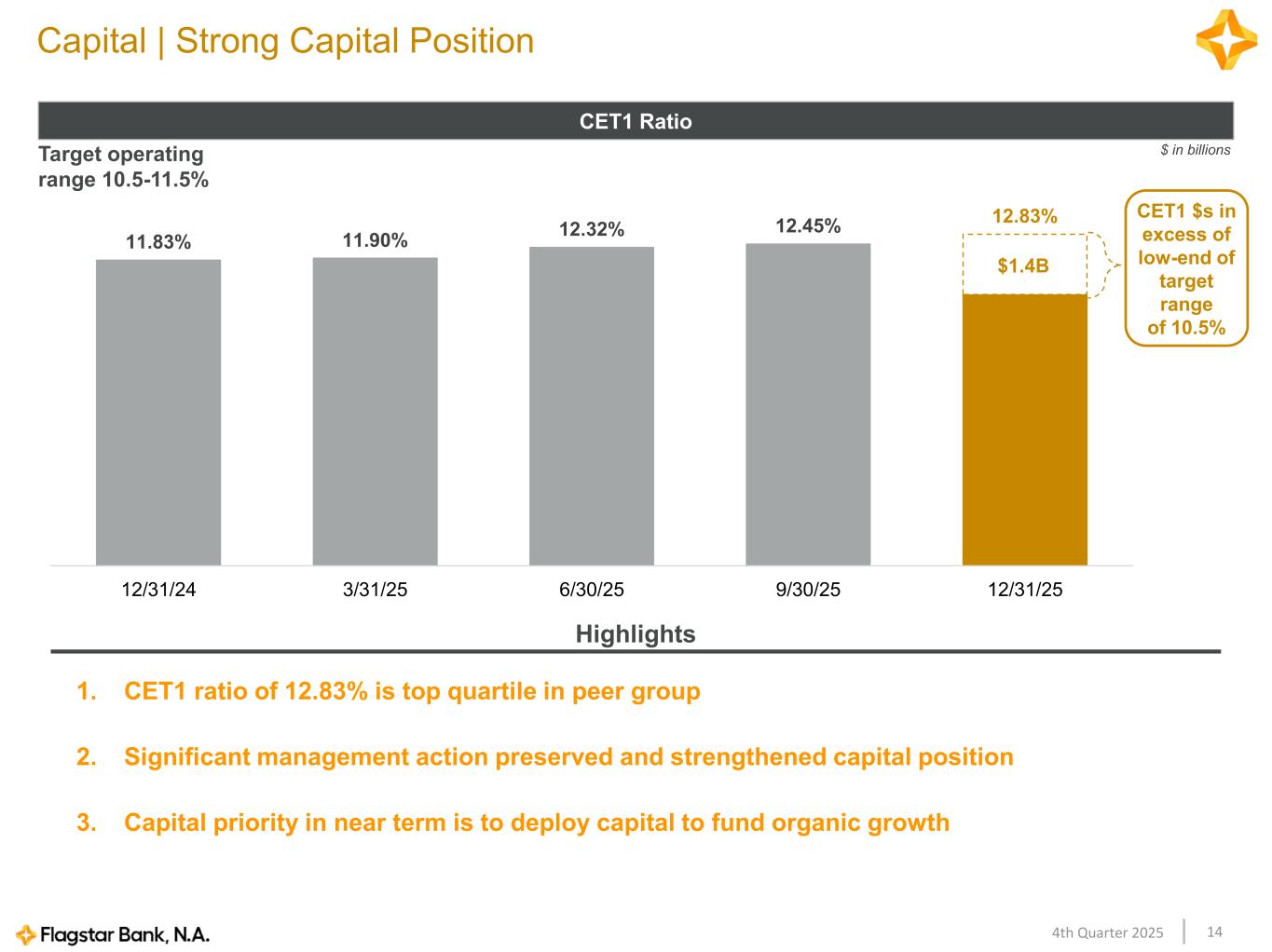

144th Quarter 2025 11.83% 11.90% 12.32% 12.45% 12.83% 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Capital | Strong Capital Position CET1 Ratio Target operating range 10.5-11.5% 1. CET1 ratio of 12.83% is top quartile in peer group 2. Significant management action preserved and strengthened capital position 3. Capital priority in near term is to deploy capital to fund organic growth Highlights $1.4B $ in billions CET1 $s in excess of low-end of target range of 10.5%

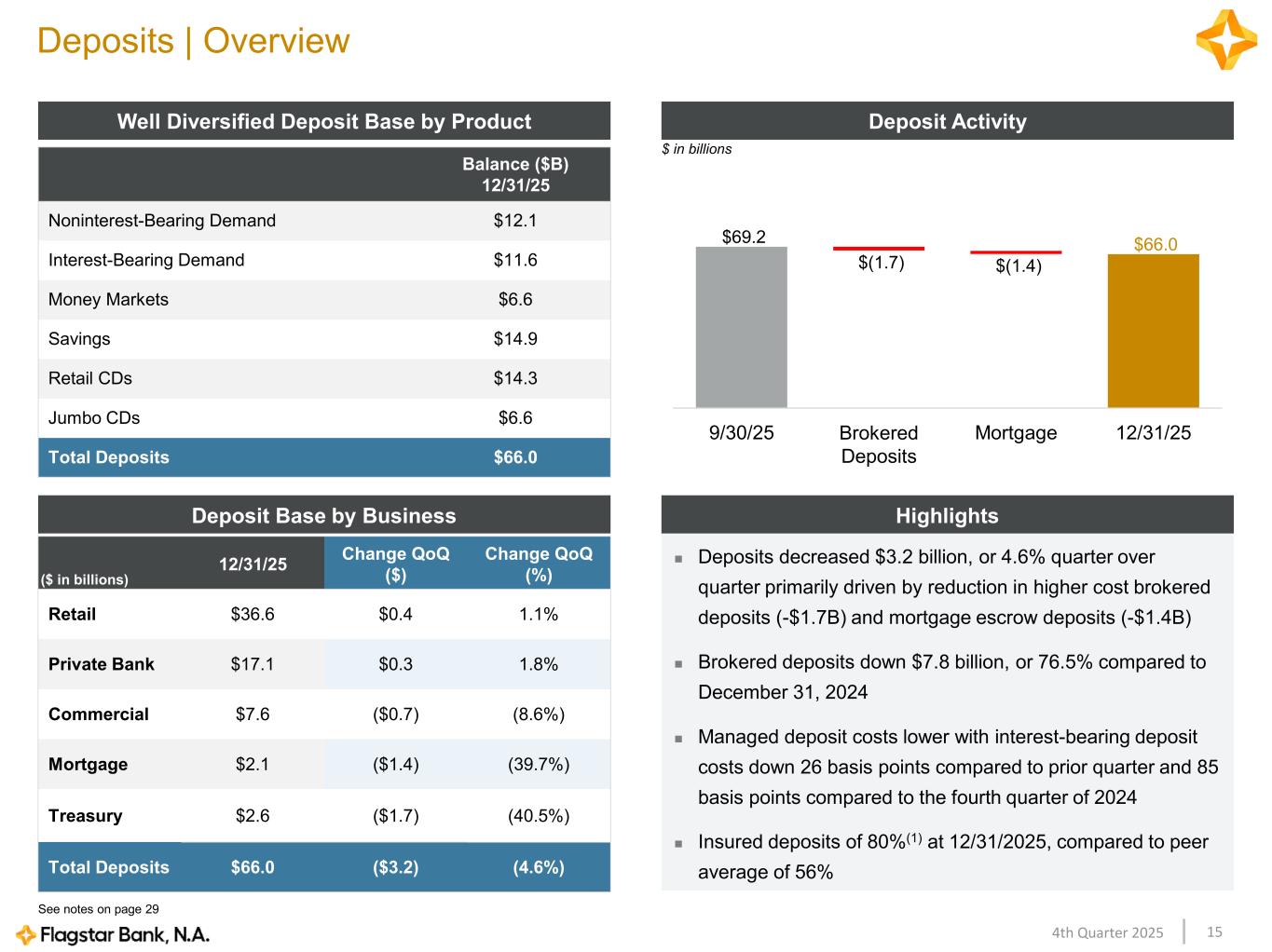

154th Quarter 2025 Balance ($B) 12/31/25 Noninterest-Bearing Demand $12.1 Interest-Bearing Demand $11.6 Money Markets $6.6 Savings $14.9 Retail CDs $14.3 Jumbo CDs $6.6 Total Deposits $66.0 Deposits | Overview Deposit ActivityWell Diversified Deposit Base by Product Deposits decreased $3.2 billion, or 4.6% quarter over quarter primarily driven by reduction in higher cost brokered deposits (-$1.7B) and mortgage escrow deposits (-$1.4B) Brokered deposits down $7.8 billion, or 76.5% compared to December 31, 2024 Managed deposit costs lower with interest-bearing deposit costs down 26 basis points compared to prior quarter and 85 basis points compared to the fourth quarter of 2024 Insured deposits of 80%(1) at 12/31/2025, compared to peer average of 56% HighlightsDeposit Base by Business ($ in billions) 12/31/25 Change QoQ ($) Change QoQ (%) Retail $36.6 $0.4 1.1% Private Bank $17.1 $0.3 1.8% Commercial $7.6 ($0.7) (8.6%) Mortgage $2.1 ($1.4) (39.7%) Treasury $2.6 ($1.7) (40.5%) Total Deposits $66.0 ($3.2) (4.6%) $ in billions $69.2 $(1.7) $(1.4) $66.0 9/30/25 Brokered Deposits Mortgage 12/31/25 See notes on page 29

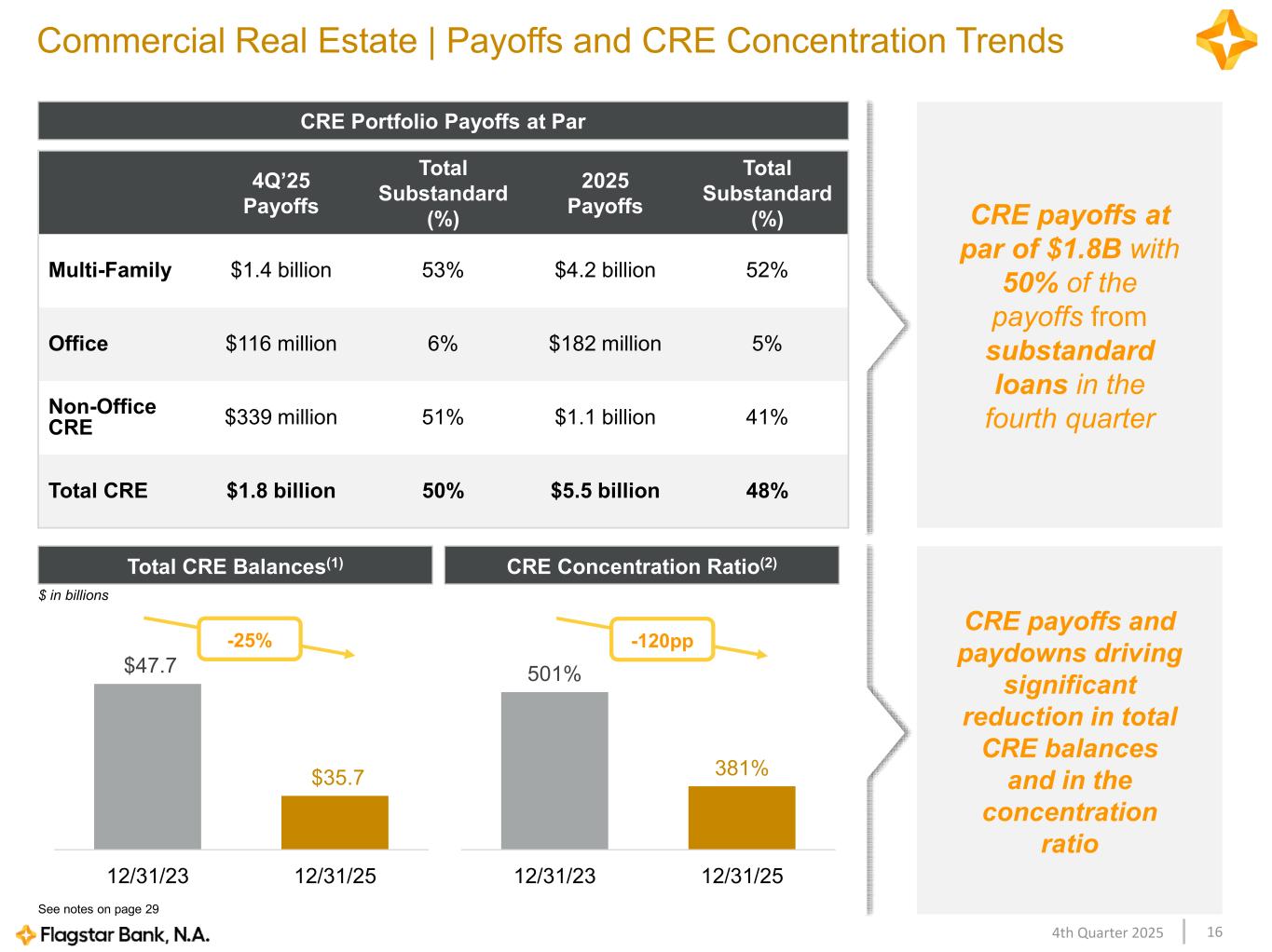

164th Quarter 2025 Commercial Real Estate | Payoffs and CRE Concentration Trends 4Q’25 Payoffs Total Substandard (%) 2025 Payoffs Total Substandard (%) Multi-Family $1.4 billion 53% $4.2 billion 52% Office $116 million 6% $182 million 5% Non-Office CRE $339 million 51% $1.1 billion 41% Total CRE $1.8 billion 50% $5.5 billion 48% CRE payoffs at par of $1.8B with 50% of the payoffs from substandard loans in the fourth quarter CRE Portfolio Payoffs at Par 501% 381% 12/31/23 12/31/25 Total CRE Balances(1) CRE payoffs and paydowns driving significant reduction in total CRE balances and in the concentration ratio -120pp $47.7 $35.7 12/31/23 12/31/25 CRE Concentration Ratio(2) $ in billions -25% See notes on page 29

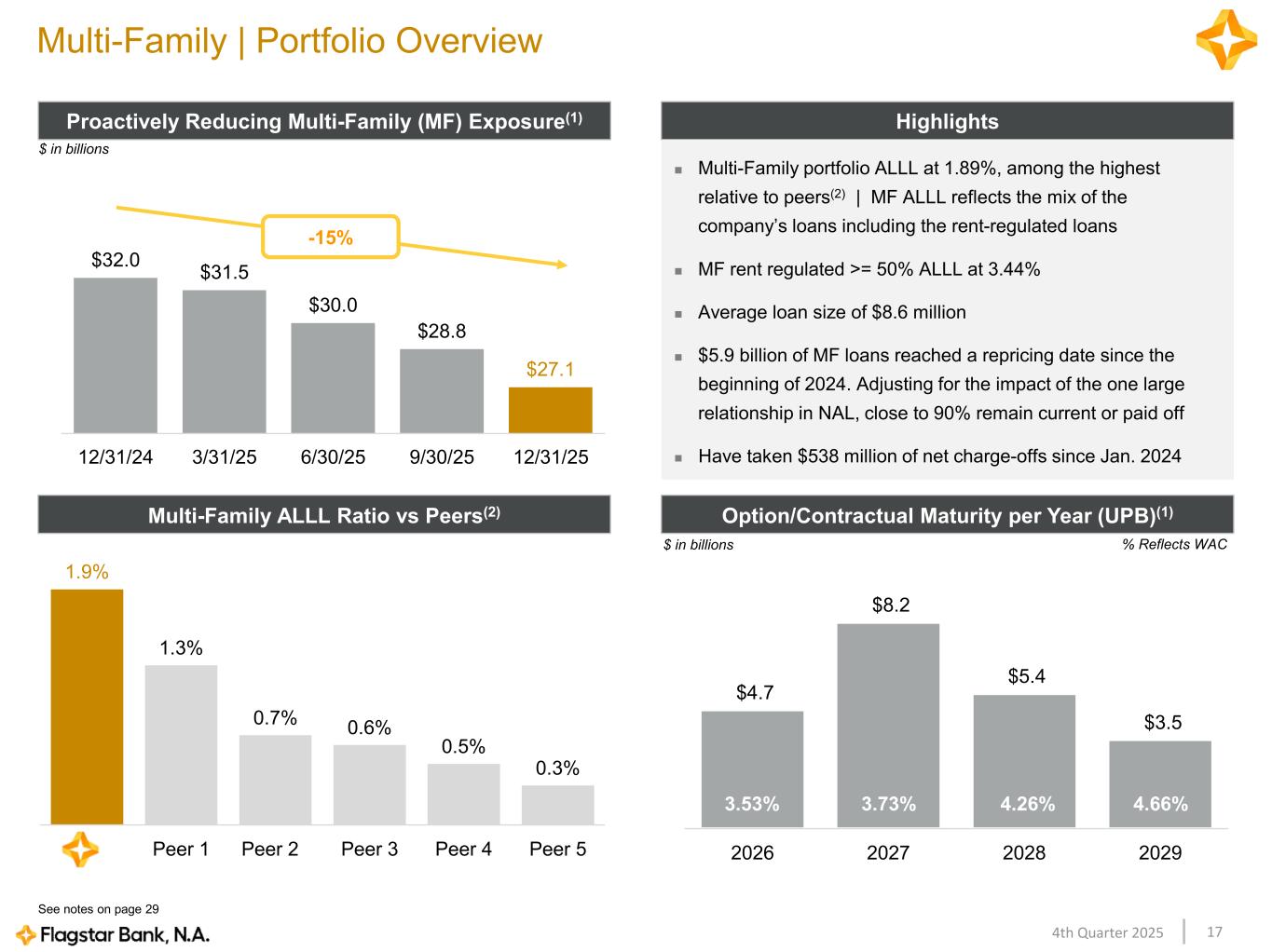

174th Quarter 2025 Multi-Family | Portfolio Overview Highlights Multi-Family portfolio ALLL at 1.89%, among the highest relative to peers(2) | MF ALLL reflects the mix of the company’s loans including the rent-regulated loans MF rent regulated >= 50% ALLL at 3.44% Average loan size of $8.6 million $5.9 billion of MF loans reached a repricing date since the beginning of 2024. Adjusting for the impact of the one large relationship in NAL, close to 90% remain current or paid off Have taken $538 million of net charge-offs since Jan. 2024 $32.0 $31.5 $30.0 $28.8 $27.1 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Proactively Reducing Multi-Family (MF) Exposure(1) -15% $ in billions 1.9% 1.3% 0.7% 0.6% 0.5% 0.3% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Multi-Family ALLL Ratio vs Peers(2) $4.7 $8.2 $5.4 $3.5 2026 2027 2028 2029 Option/Contractual Maturity per Year (UPB)(1) $ in billions % Reflects WAC See notes on page 29 3.53% 3.73% 4.66%4.26%

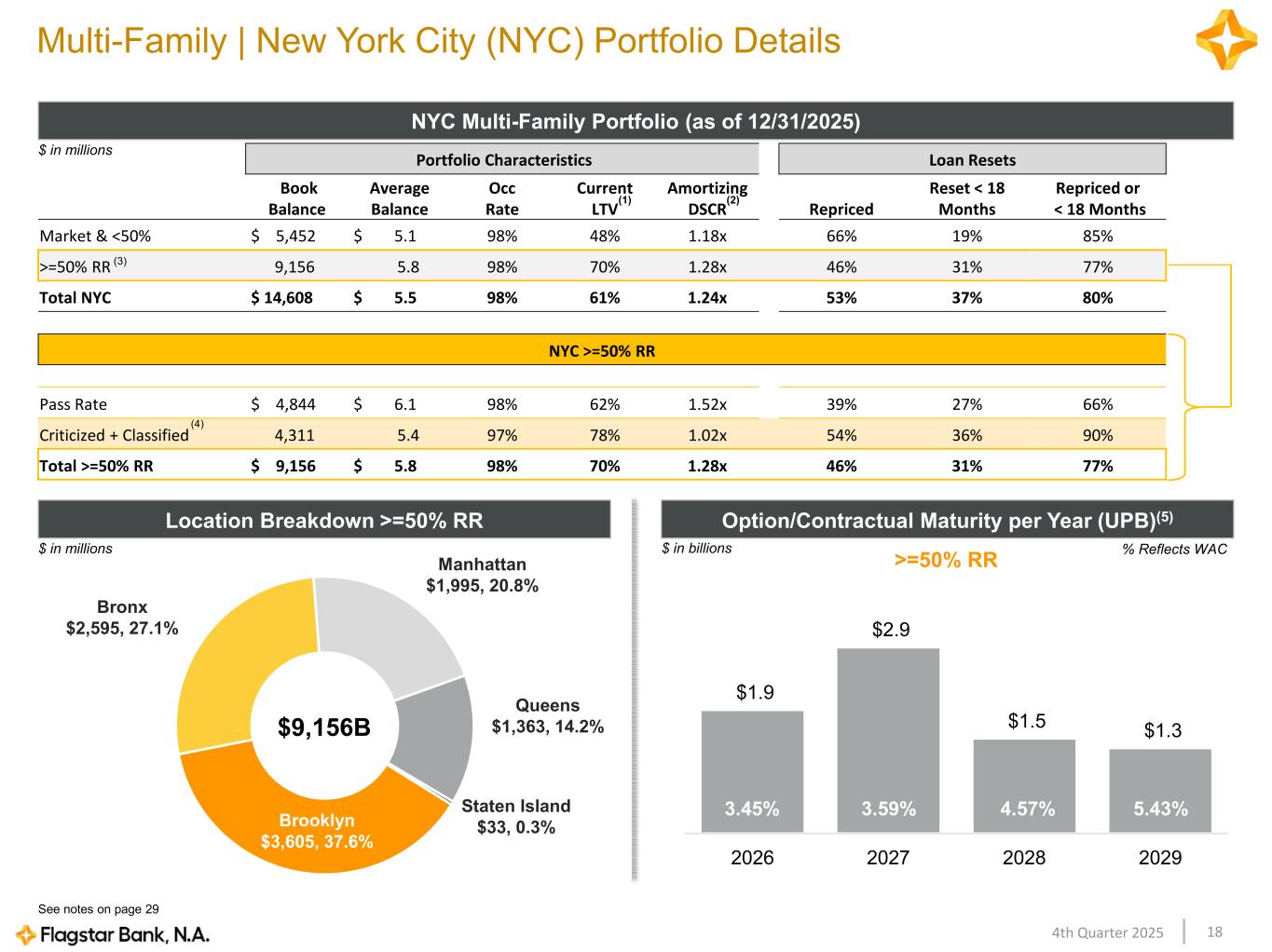

184th Quarter 2025 Portfolio Characteristics Loan Resets Book Balance Average Balance Occ Rate Current LTV Amortizing DSCR Repriced Reset < 18 Months Repriced or < 18 Months Market & <50% $ 5,452 $ 5.1 98% 48% 1.18x 66% 19% 85% >=50% RR 9,156 5.8 98% 70% 1.28x 46% 31% 77% Total NYC $ 14,608 $ 5.5 98% 61% 1.24x 53% 37% 80% NYC >=50% RR Pass Rate $ 4,844 $ 6.1 98% 62% 1.52x 39% 27% 66% Criticized + Classified 4,311 5.4 97% 78% 1.02x 54% 36% 90% Total >=50% RR $ 9,156 $ 5.8 98% 70% 1.28x 46% 31% 77% Multi-Family | New York City (NYC) Portfolio Details NYC Multi-Family Portfolio (as of 12/31/2025) $ in millions (3) (1) (2) Location Breakdown >=50% RR $ in millions (4) $9,156B Manhattan $1,995, 20.8% Queens $1,363, 14.2% Staten Island $33, 0.3% Brooklyn $3,605, 37.6% Bronx $2,595, 27.1% $1.9 $2.9 $1.5 $1.3 2026 2027 2028 2029 Option/Contractual Maturity per Year (UPB)(5) $ in billions % Reflects WAC >=50% RR See notes on page 29 3.45% 3.59% 5.43%4.57%

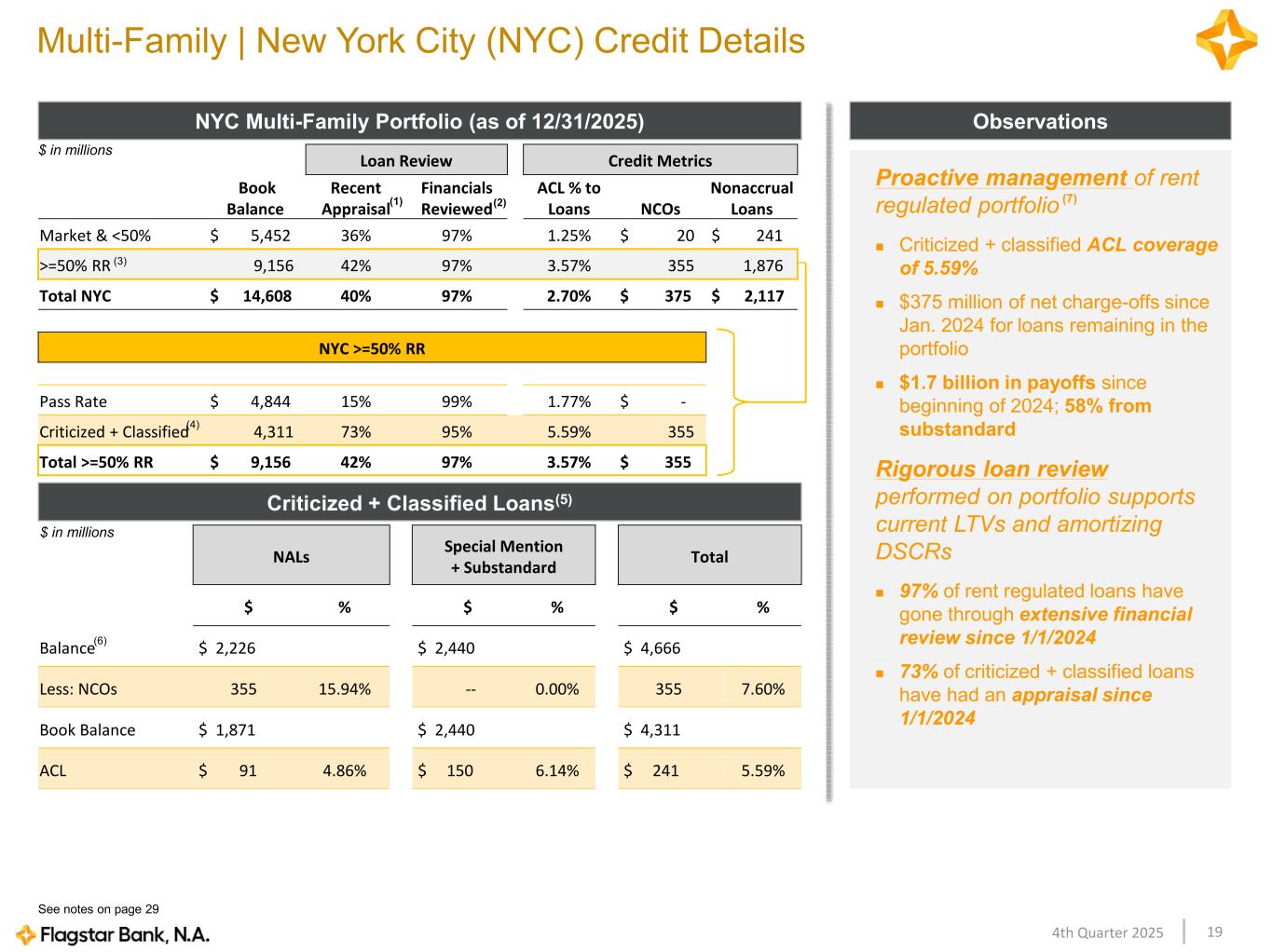

194th Quarter 2025 Loan Review Credit Metrics Book Balance Recent Appraisal Financials Reviewed ACL % to Loans NCOs Nonaccrual Loans Market & <50% $ 5,452 36% 97% 1.25% $ 20 $ 241 >=50% RR 9,156 42% 97% 3.57% 355 1,876 Total NYC $ 14,608 40% 97% 2.70% $ 375 $ 2,117 NYC >=50% RR Pass Rate $ 4,844 15% 99% 1.77% $ - Criticized + Classified 4,311 73% 95% 5.59% 355 Total >=50% RR $ 9,156 42% 97% 3.57% $ 355 Multi-Family | New York City (NYC) Credit Details NYC Multi-Family Portfolio (as of 12/31/2025) $ in millions (3) (1) (2) Proactive management of rent regulated portfolio Criticized + classified ACL coverage of 5.59% $375 million of net charge-offs since Jan. 2024 for loans remaining in the portfolio $1.7 billion in payoffs since beginning of 2024; 58% from substandard Rigorous loan review performed on portfolio supports current LTVs and amortizing DSCRs 97% of rent regulated loans have gone through extensive financial review since 1/1/2024 73% of criticized + classified loans have had an appraisal since 1/1/2024 Criticized + Classified Loans(5) $ in millions (4) (7) NALs Special Mention + Substandard Total $ % $ % $ % Balance $ 2,226 $ 2,440 $ 4,666 Less: NCOs 355 15.94% -- 0.00% 355 7.60% Book Balance $ 1,871 $ 2,440 $ 4,311 ACL $ 91 4.86% $ 150 6.14% $ 241 5.59% (6) Observations See notes on page 29

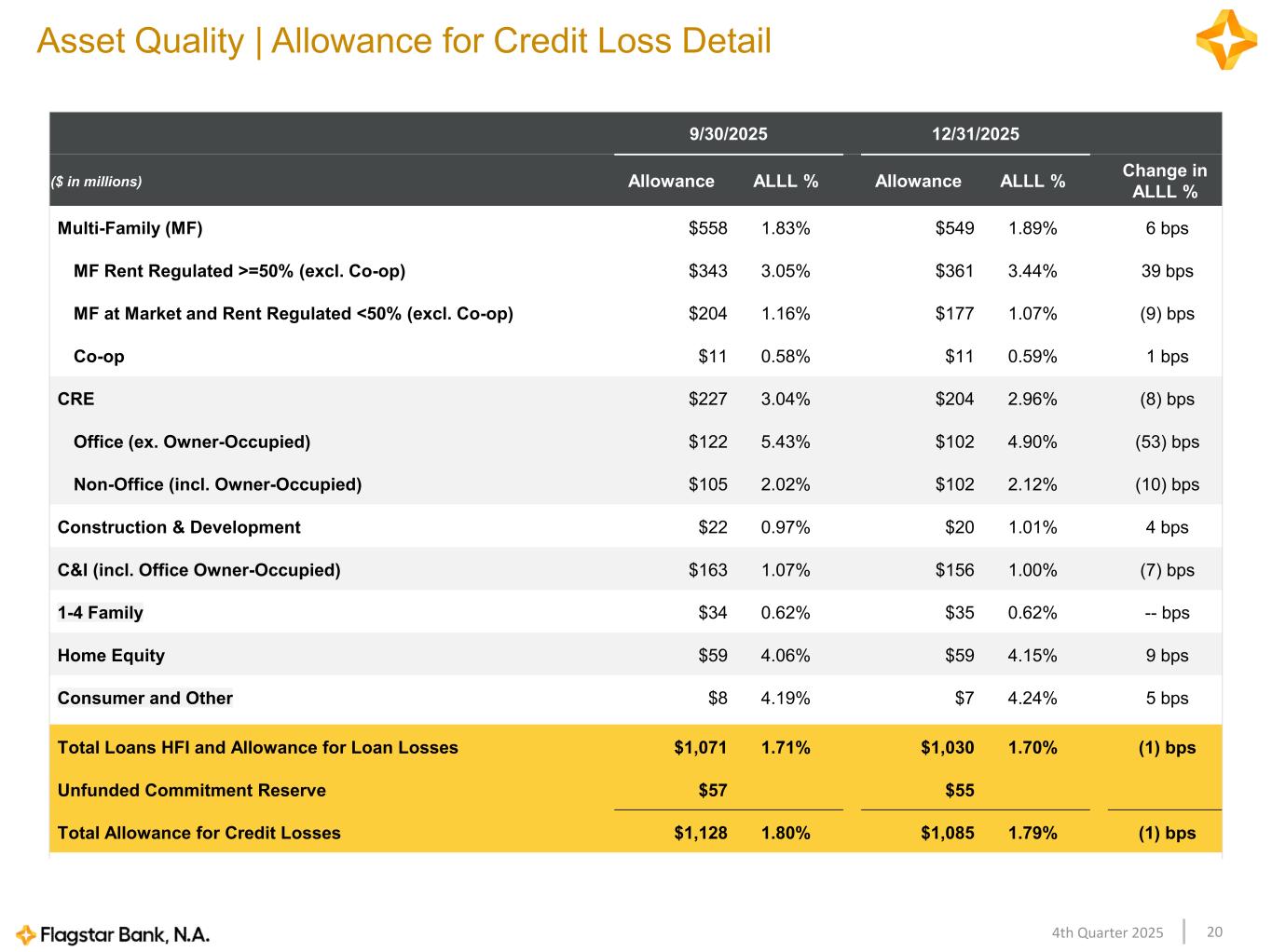

204th Quarter 2025 9/30/2025 12/31/2025 ($ in millions) Allowance ALLL % Allowance ALLL % Change in ALLL % Multi-Family (MF) $558 1.83% $549 1.89% 6 bps MF Rent Regulated >=50% (excl. Co-op) $343 3.05% $361 3.44% 39 bps MF at Market and Rent Regulated <50% (excl. Co-op) $204 1.16% $177 1.07% (9) bps Co-op $11 0.58% $11 0.59% 1 bps CRE $227 3.04% $204 2.96% (8) bps Office (ex. Owner-Occupied) $122 5.43% $102 4.90% (53) bps Non-Office (incl. Owner-Occupied) $105 2.02% $102 2.12% (10) bps Construction & Development $22 0.97% $20 1.01% 4 bps C&I (incl. Office Owner-Occupied) $163 1.07% $156 1.00% (7) bps 1-4 Family $34 0.62% $35 0.62% -- bps Home Equity $59 4.06% $59 4.15% 9 bps Consumer and Other $8 4.19% $7 4.24% 5 bps Total Loans HFI and Allowance for Loan Losses $1,071 1.71% $1,030 1.70% (1) bps Unfunded Commitment Reserve $57 $55 Total Allowance for Credit Losses $1,128 1.80% $1,085 1.79% (1) bps Asset Quality | Allowance for Credit Loss Detail

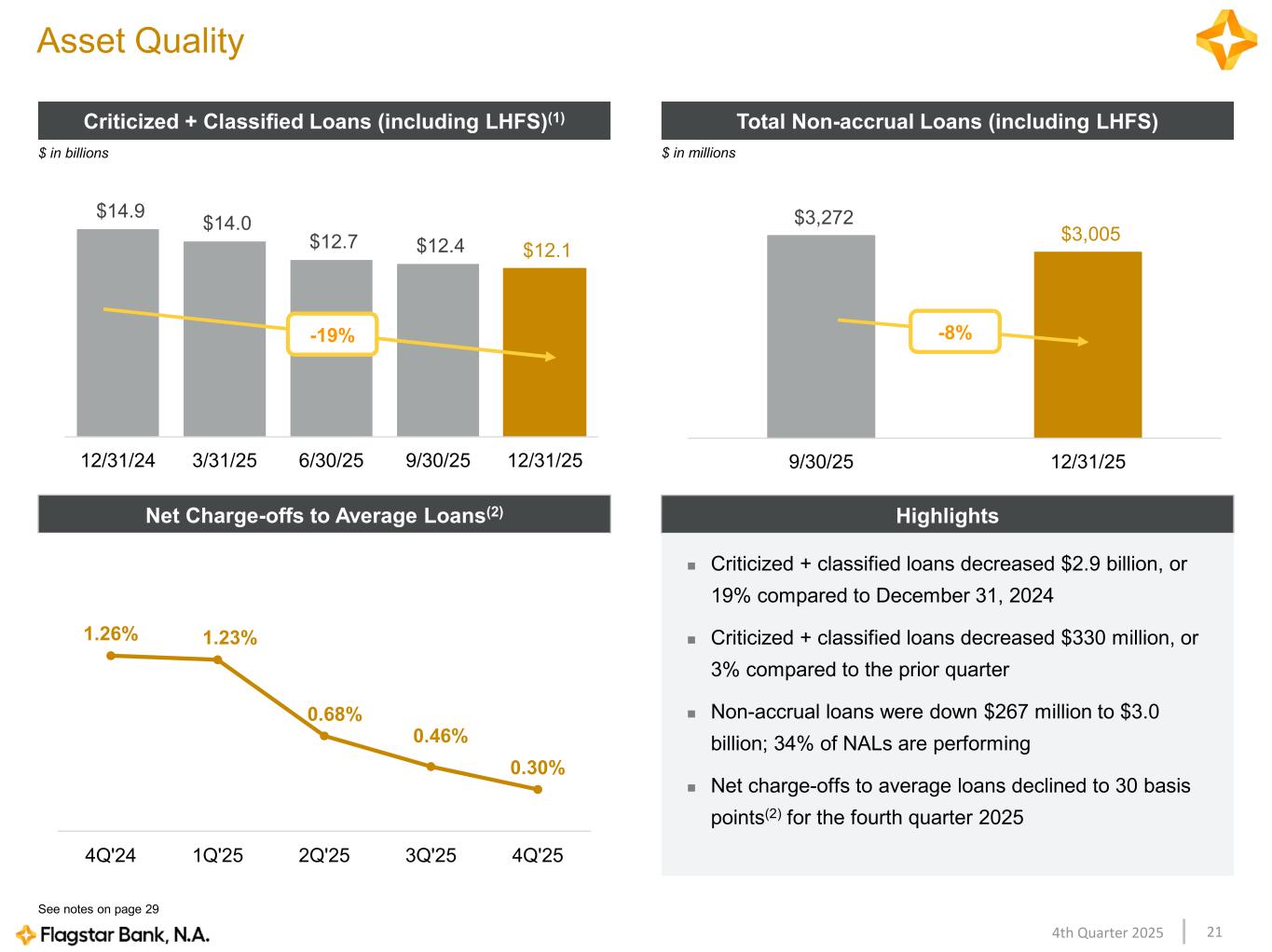

214th Quarter 2025 $14.9 $14.0 $12.7 $12.4 $12.1 12/31/24 3/31/25 6/30/25 9/30/25 12/31/25 Asset Quality Criticized + Classified Loans (including LHFS)(1) Total Non-accrual Loans (including LHFS) Highlights Criticized + classified loans decreased $2.9 billion, or 19% compared to December 31, 2024 Criticized + classified loans decreased $330 million, or 3% compared to the prior quarter Non-accrual loans were down $267 million to $3.0 billion; 34% of NALs are performing Net charge-offs to average loans declined to 30 basis points(2) for the fourth quarter 2025 Net Charge-offs to Average Loans(2) 1.26% 1.23% 0.68% 0.46% 0.30% 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 $3,272 $3,005 9/30/25 12/31/25 $ in millions$ in billions -8%-19% See notes on page 29

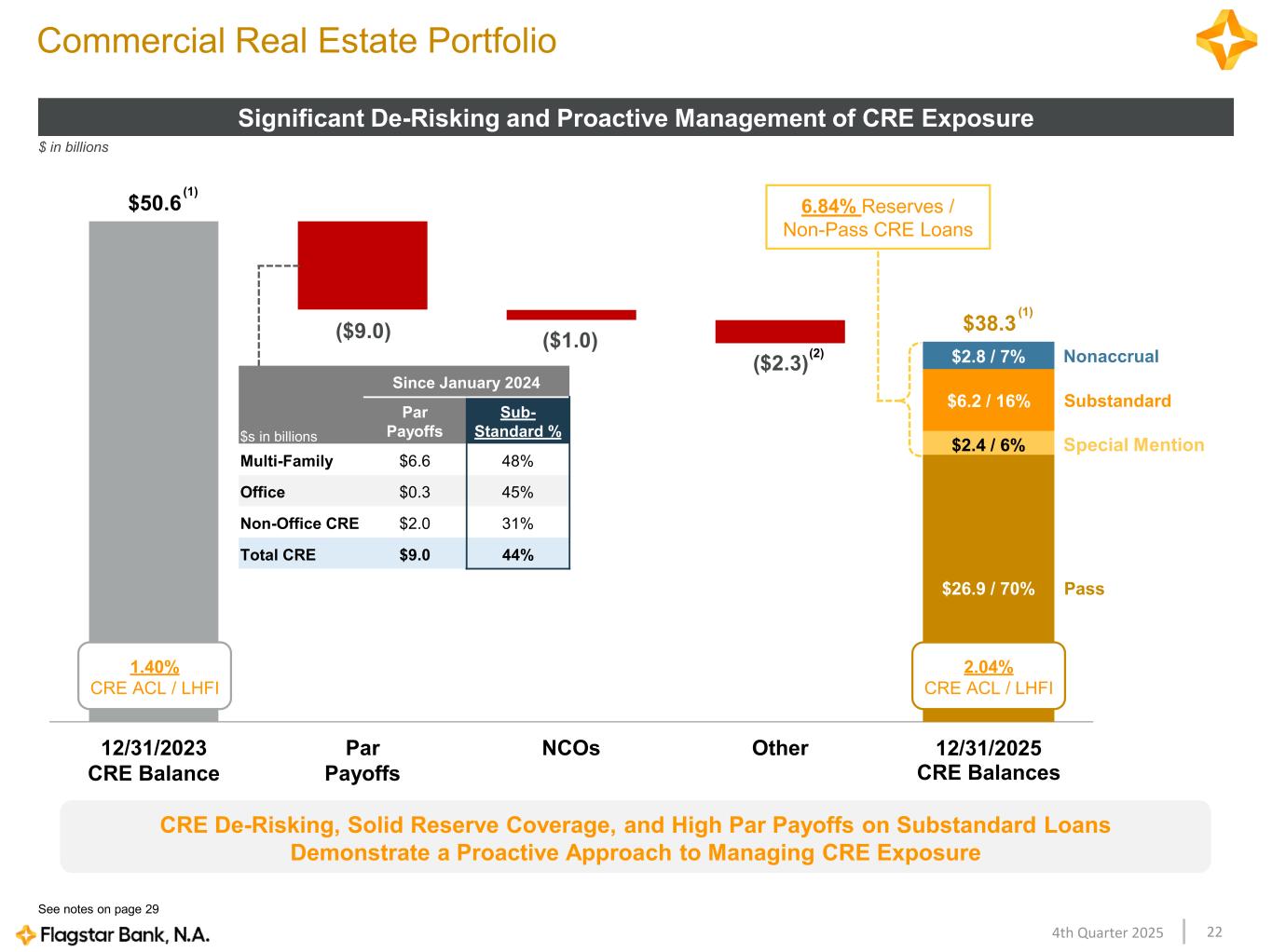

224th Quarter 2025 12/31/2023 CRE Balance Par Payoffs NCOs Other Commercial Real Estate Portfolio Significant De-Risking and Proactive Management of CRE Exposure See notes on page 29 CRE De-Risking, Solid Reserve Coverage, and High Par Payoffs on Substandard Loans Demonstrate a Proactive Approach to Managing CRE Exposure $50.6 ($9.0) $ in billions $38.3 ($1.0) ($2.3) Since January 2024 $s in billions Par Payoffs Sub- Standard % Multi-Family $6.6 48% Office $0.3 45% Non-Office CRE $2.0 31% Total CRE $9.0 44% 12/31/2025 CRE Balances $2.8 / 7% $26.9 / 70% $2.4 / 6% $6.2 / 16% (2) (1) (1) Pass Special Mention Substandard Nonaccrual 6.84% Reserves / Non-Pass CRE Loans 2.04% CRE ACL / LHFI 1.40% CRE ACL / LHFI

Appendix

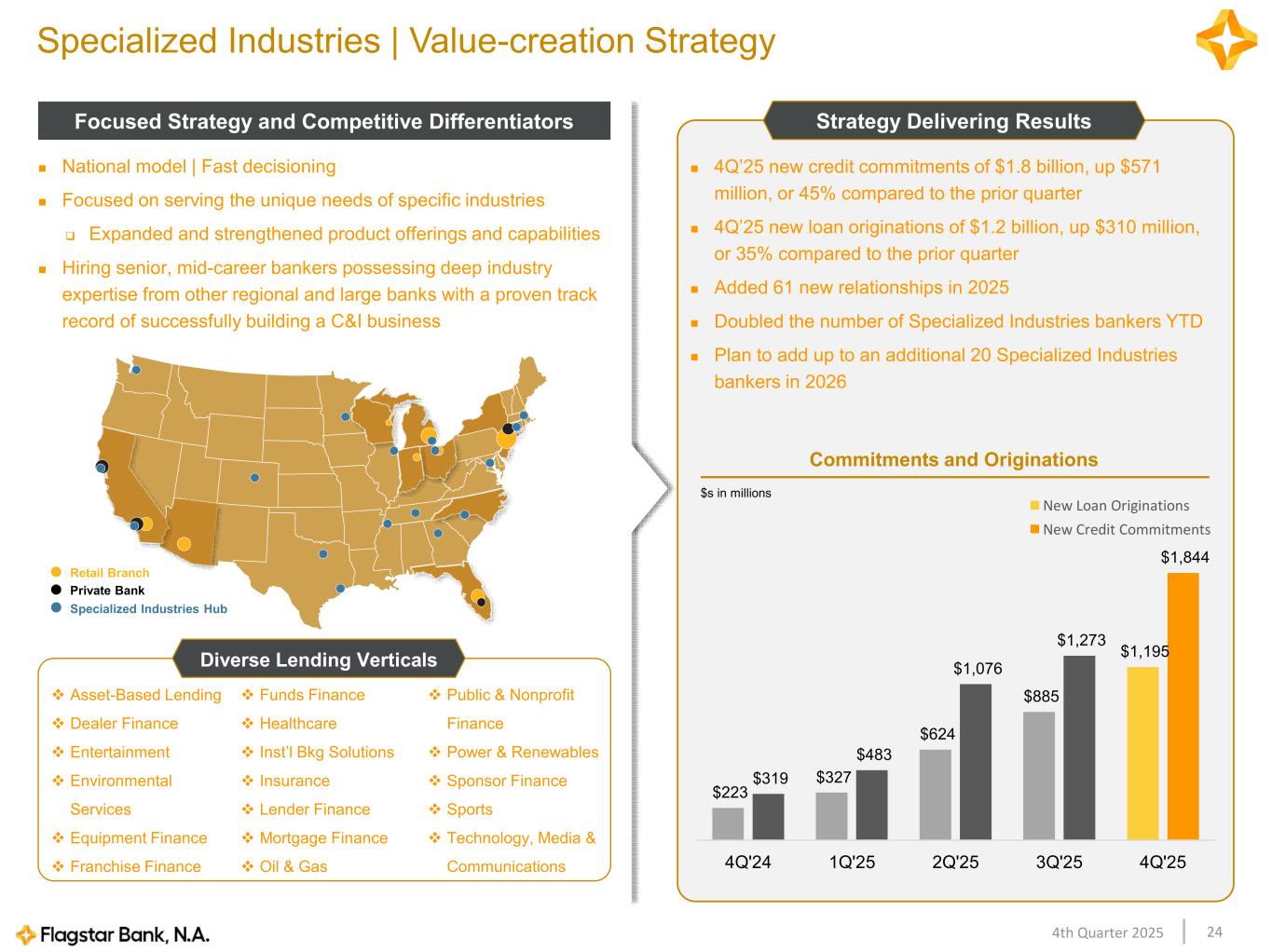

244th Quarter 2025 Specialized Industries | Value-creation Strategy Focused Strategy and Competitive Differentiators Strategy Delivering Results Public & Nonprofit Finance Power & Renewables Sponsor Finance Sports Technology, Media & Communications Asset-Based Lending Dealer Finance Entertainment Environmental Services Equipment Finance Franchise Finance Funds Finance Healthcare Inst’l Bkg Solutions Insurance Lender Finance Mortgage Finance Oil & Gas Diverse Lending Verticals National model | Fast decisioning Focused on serving the unique needs of specific industries Expanded and strengthened product offerings and capabilities Hiring senior, mid-career bankers possessing deep industry expertise from other regional and large banks with a proven track record of successfully building a C&I business $223 $327 $624 $885 $1,195 $319 $483 $1,076 $1,273 $1,844 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 New Loan Originations New Credit Commitments Commitments and Originations Retail Branch Private Bank 4Q’25 new credit commitments of $1.8 billion, up $571 million, or 45% compared to the prior quarter 4Q’25 new loan originations of $1.2 billion, up $310 million, or 35% compared to the prior quarter Added 61 new relationships in 2025 Doubled the number of Specialized Industries bankers YTD Plan to add up to an additional 20 Specialized Industries bankers in 2026 Specialized Industries Hub $s in millions

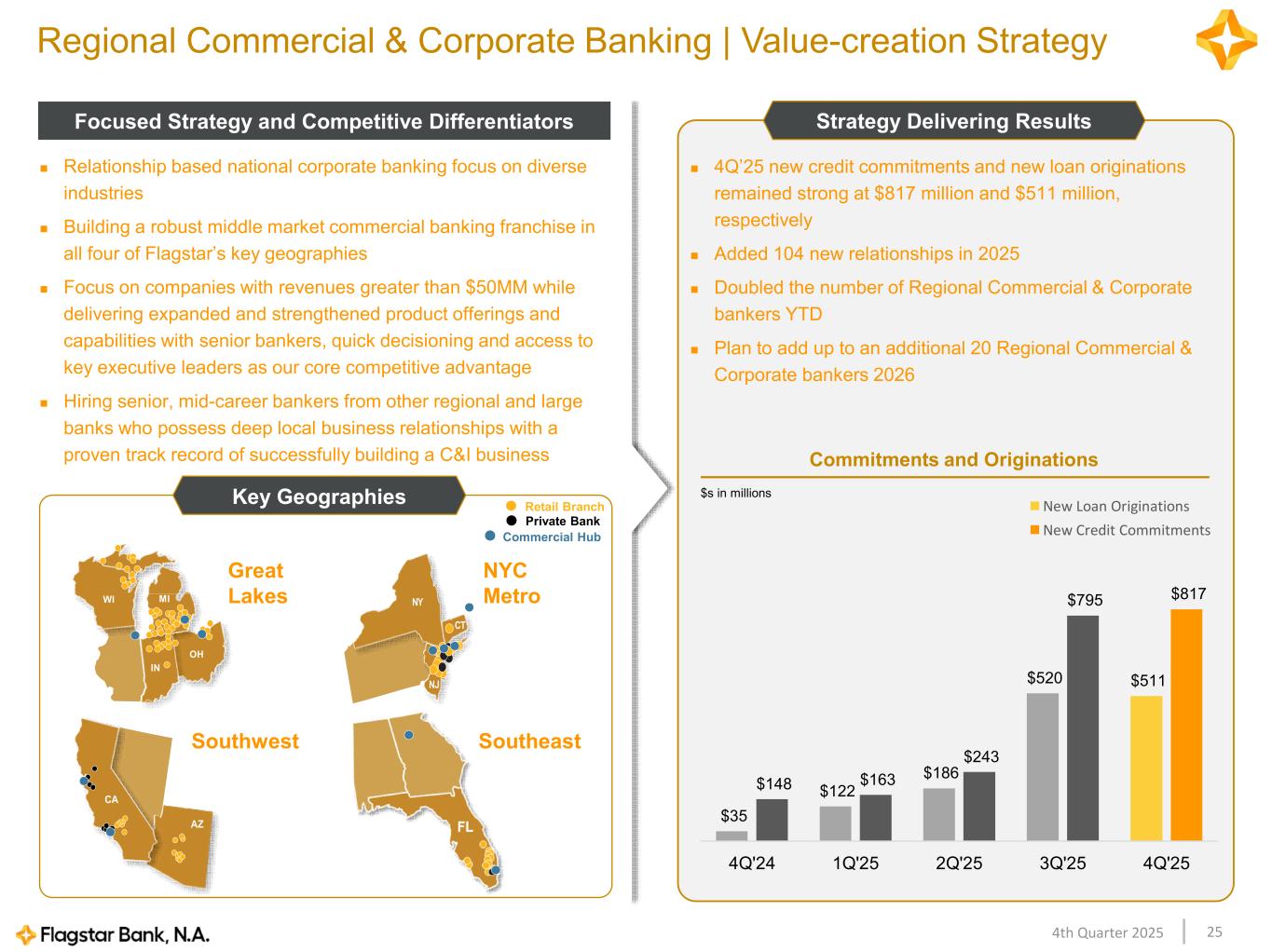

254th Quarter 2025 Regional Commercial & Corporate Banking | Value-creation Strategy Focused Strategy and Competitive Differentiators Strategy Delivering Results NY CT NJ WI MI IN OH Relationship based national corporate banking focus on diverse industries Building a robust middle market commercial banking franchise in all four of Flagstar’s key geographies Focus on companies with revenues greater than $50MM while delivering expanded and strengthened product offerings and capabilities with senior bankers, quick decisioning and access to key executive leaders as our core competitive advantage Hiring senior, mid-career bankers from other regional and large banks who possess deep local business relationships with a proven track record of successfully building a C&I business 4Q’25 new credit commitments and new loan originations remained strong at $817 million and $511 million, respectively Added 104 new relationships in 2025 Doubled the number of Regional Commercial & Corporate bankers YTD Plan to add up to an additional 20 Regional Commercial & Corporate bankers 2026 $35 $122 $186 $520 $511 $148 $163 $243 $795 $817 4Q'24 1Q'25 2Q'25 3Q'25 4Q'25 New Loan Originations New Credit Commitments Great Lakes NYC Metro Southwest Southeast Key Geographies Retail Branch Private Bank Commitments and Originations CA AZ Commercial Hub $s in millions

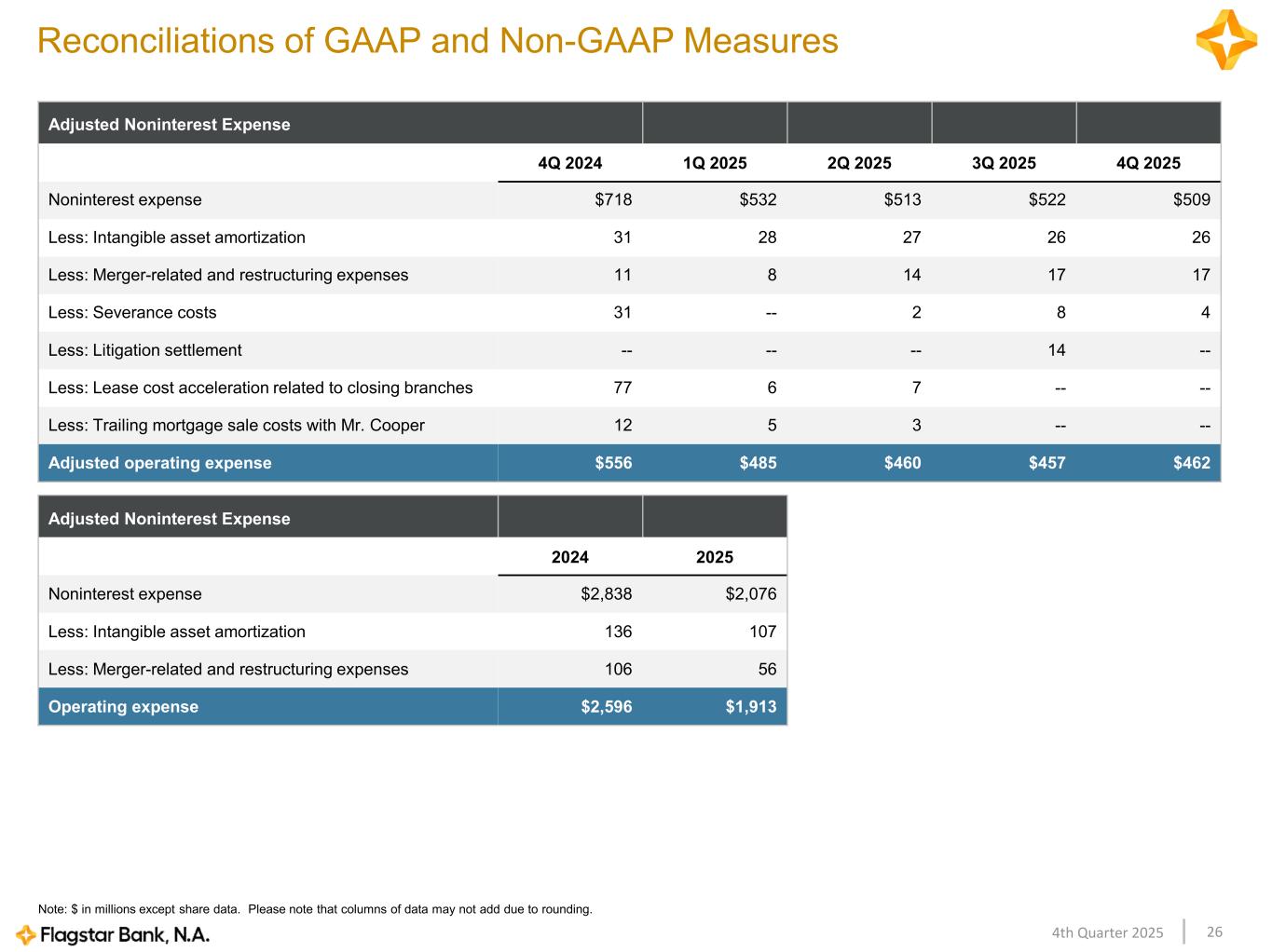

264th Quarter 2025 Note: $ in millions except share data. Please note that columns of data may not add due to rounding. Reconciliations of GAAP and Non-GAAP Measures Adjusted Noninterest Expense 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 Noninterest expense $718 $532 $513 $522 $509 Less: Intangible asset amortization 31 28 27 26 26 Less: Merger-related and restructuring expenses 11 8 14 17 17 Less: Severance costs 31 -- 2 8 4 Less: Litigation settlement -- -- -- 14 -- Less: Lease cost acceleration related to closing branches 77 6 7 -- -- Less: Trailing mortgage sale costs with Mr. Cooper 12 5 3 -- -- Adjusted operating expense $556 $485 $460 $457 $462 Adjusted Noninterest Expense 2024 2025 Noninterest expense $2,838 $2,076 Less: Intangible asset amortization 136 107 Less: Merger-related and restructuring expenses 106 56 Operating expense $2,596 $1,913

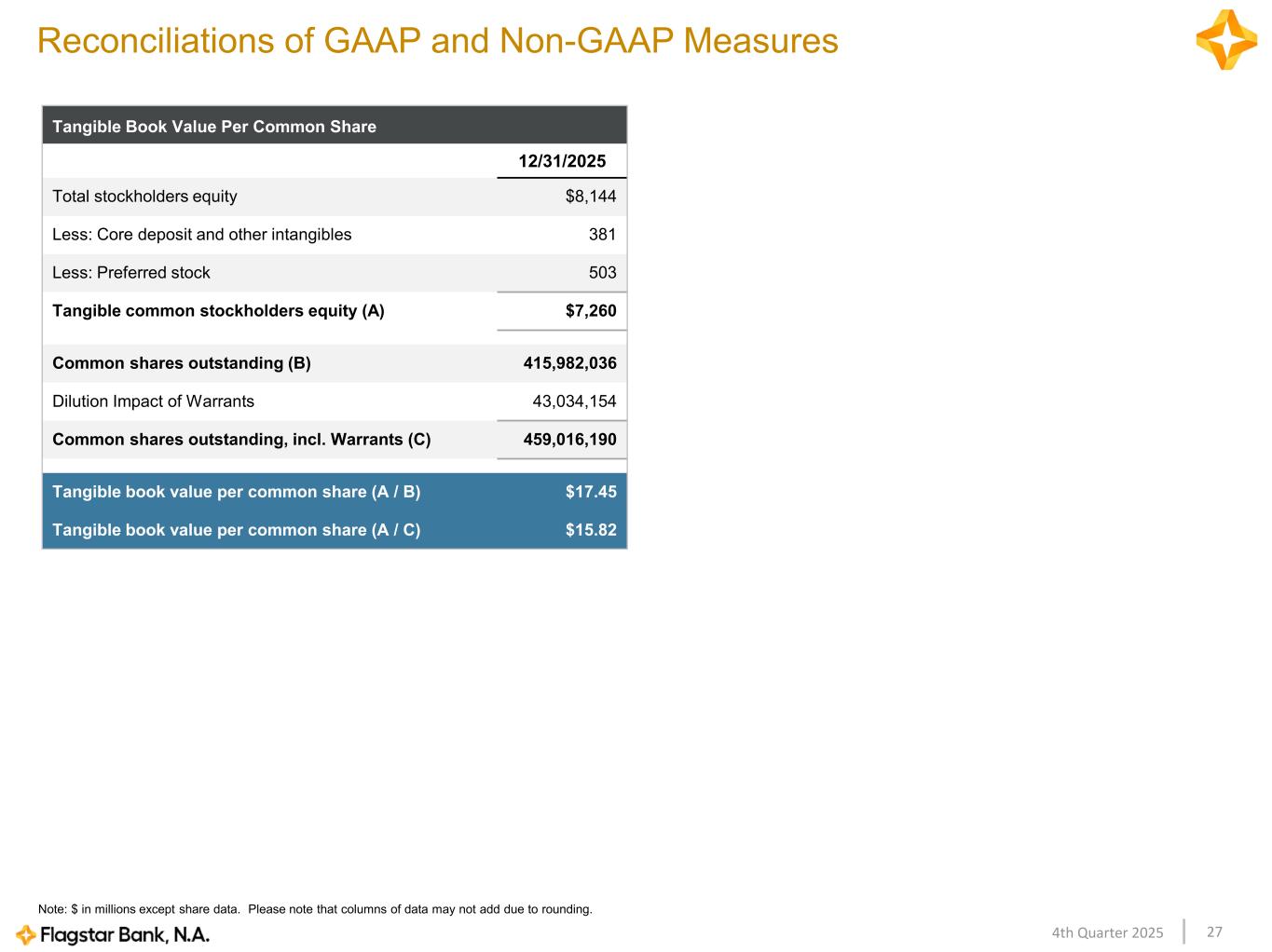

274th Quarter 2025 Note: $ in millions except share data. Please note that columns of data may not add due to rounding. Reconciliations of GAAP and Non-GAAP Measures Tangible Book Value Per Common Share 12/31/2025 Total stockholders equity $8,144 Less: Core deposit and other intangibles 381 Less: Preferred stock 503 Tangible common stockholders equity (A) $7,260 Common shares outstanding (B) 415,982,036 Dilution Impact of Warrants 43,034,154 Common shares outstanding, incl. Warrants (C) 459,016,190 Tangible book value per common share (A / B) $17.45 Tangible book value per common share (A / C) $15.82

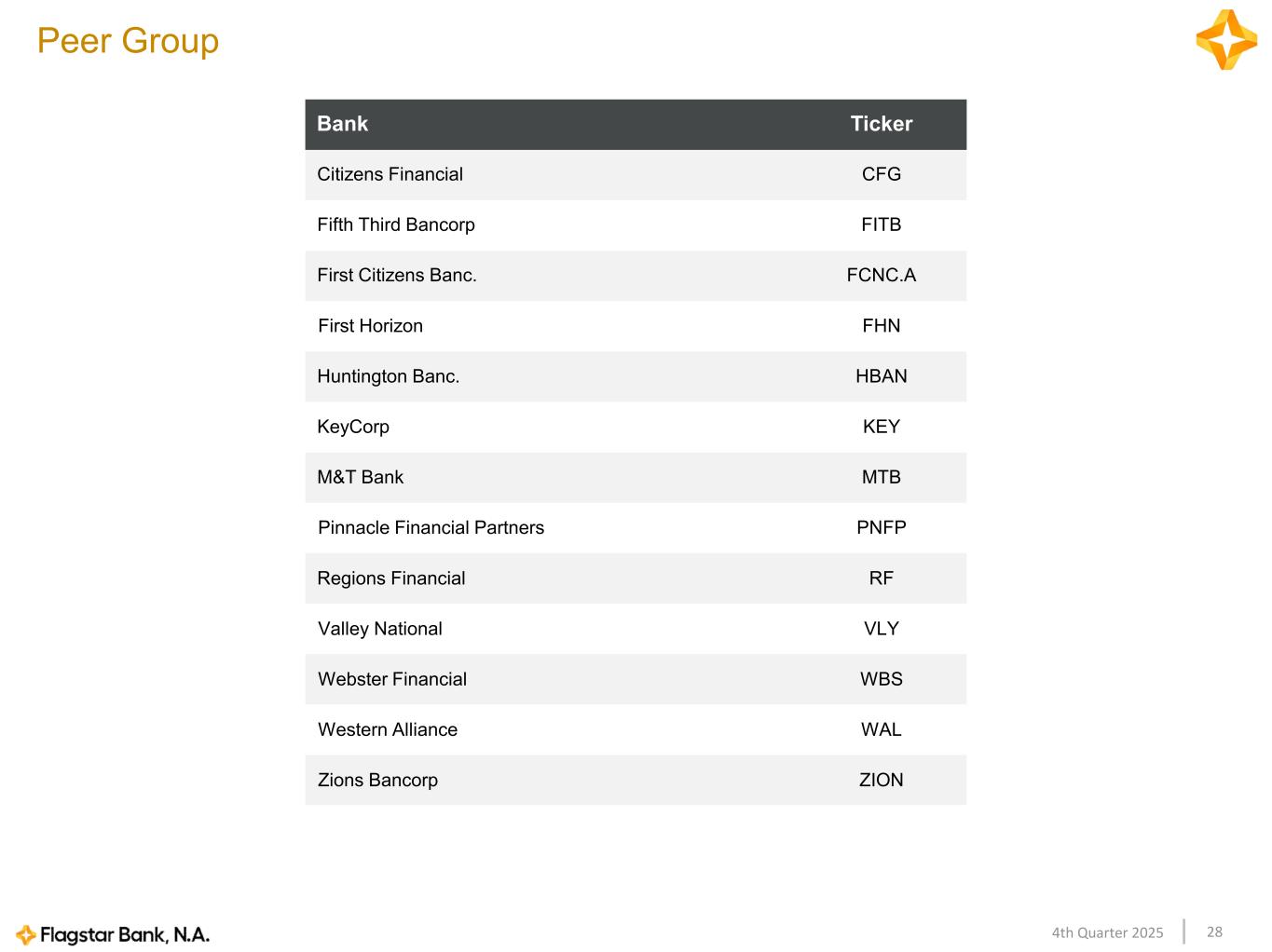

284th Quarter 2025 Bank Ticker Citizens Financial CFG Fifth Third Bancorp FITB First Citizens Banc. FCNC.A First Horizon FHN Huntington Banc. HBAN KeyCorp KEY M&T Bank MTB Pinnacle Financial Partners PNFP Regions Financial RF Valley National VLY Webster Financial WBS Western Alliance WAL Zions Bancorp ZION Peer Group

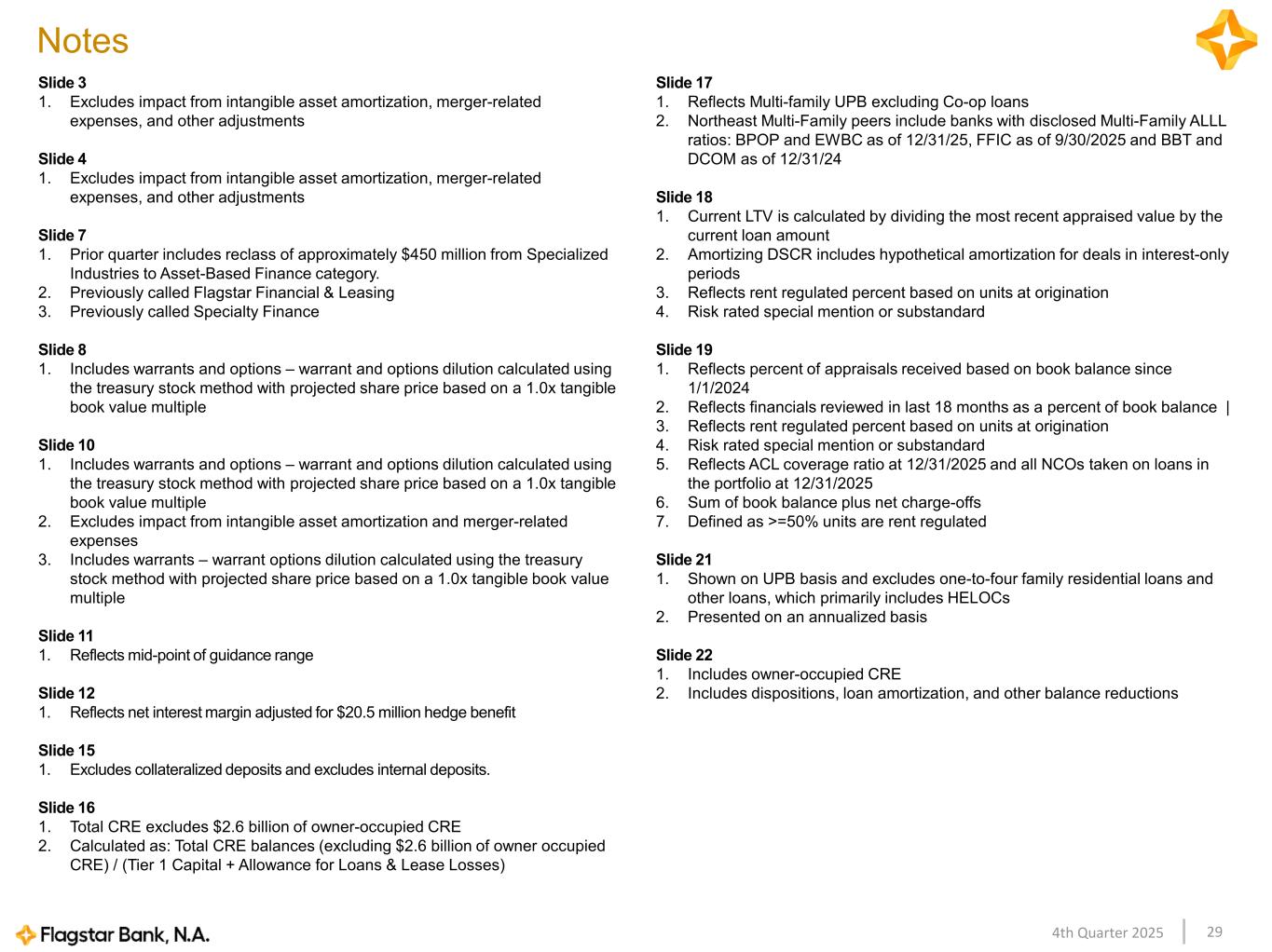

294th Quarter 2025 Notes Slide 3 1. Excludes impact from intangible asset amortization, merger-related expenses, and other adjustments Slide 4 1. Excludes impact from intangible asset amortization, merger-related expenses, and other adjustments Slide 7 1. Prior quarter includes reclass of approximately $450 million from Specialized Industries to Asset-Based Finance category. 2. Previously called Flagstar Financial & Leasing 3. Previously called Specialty Finance Slide 8 1. Includes warrants and options – warrant and options dilution calculated using the treasury stock method with projected share price based on a 1.0x tangible book value multiple Slide 10 1. Includes warrants and options – warrant and options dilution calculated using the treasury stock method with projected share price based on a 1.0x tangible book value multiple 2. Excludes impact from intangible asset amortization and merger-related expenses 3. Includes warrants – warrant options dilution calculated using the treasury stock method with projected share price based on a 1.0x tangible book value multiple Slide 11 1. Reflects mid-point of guidance range Slide 12 1. Reflects net interest margin adjusted for $20.5 million hedge benefit Slide 15 1. Excludes collateralized deposits and excludes internal deposits. Slide 16 1. Total CRE excludes $2.6 billion of owner-occupied CRE 2. Calculated as: Total CRE balances (excluding $2.6 billion of owner occupied CRE) / (Tier 1 Capital + Allowance for Loans & Lease Losses) Slide 17 1. Reflects Multi-family UPB excluding Co-op loans 2. Northeast Multi-Family peers include banks with disclosed Multi-Family ALLL ratios: BPOP and EWBC as of 12/31/25, FFIC as of 9/30/2025 and BBT and DCOM as of 12/31/24 Slide 18 1. Current LTV is calculated by dividing the most recent appraised value by the current loan amount 2. Amortizing DSCR includes hypothetical amortization for deals in interest-only periods 3. Reflects rent regulated percent based on units at origination 4. Risk rated special mention or substandard Slide 19 1. Reflects percent of appraisals received based on book balance since 1/1/2024 2. Reflects financials reviewed in last 18 months as a percent of book balance | 3. Reflects rent regulated percent based on units at origination 4. Risk rated special mention or substandard 5. Reflects ACL coverage ratio at 12/31/2025 and all NCOs taken on loans in the portfolio at 12/31/2025 6. Sum of book balance plus net charge-offs 7. Defined as >=50% units are rent regulated Slide 21 1. Shown on UPB basis and excludes one-to-four family residential loans and other loans, which primarily includes HELOCs 2. Presented on an annualized basis Slide 22 1. Includes owner-occupied CRE 2. Includes dispositions, loan amortization, and other balance reductions