Boynton Lakes Plaza | Boyton Beach, FL South Beach Regional | Jacksonville Beach, FL El Cerrito Plaza | El Cerrito, CA Glenwood Green | Old Bridge, NJ Circle Marina Shops & Marketplace | Long Beach, CA THIRD QUARTER 2025 Fixed Income Supplemental Regency Centers.

Boynton Lakes Plaza | Boyton Beach, FL South Beach Regional | Jacksonville Beach, FL El Cerrito Plaza | El Cerrito, CA Glenwood Green | Old Bridge, NJ Circle Marina Shops & Marketplace | Long Beach, CA THIRD QUARTER 2025 Fixed Income Supplemental Regency Centers.

Highlights Third Quarter 2025 Reported Nareit FFO of $1.15 per diluted share and Core Operating Earnings of $1.09 per diluted share Increased Same Property Net Operating Income ("NOI") year-over-year, excluding termination fees, by 4.8% Raised 2025 Nareit FFO guidance to a range of $4.62 to $4.64 per diluted share and 2025 Core Operating Earnings guidance to a range of $4.39 to $4.41 per diluted share The midpoint of increased 2025 Nareit FFO per share guidance represents more than 7% year-over-year growth Raised 2025 guidance for Same Property NOI year-over-year growth, excluding termination fees, to a range of +5.25% to +5.5% Same Property percent leased ended the quarter at 96.4%, an increase of 40 basis points year-over-year, and Same Property percent commenced ended the quarter at 94.4%, up 190 basis points year-over-year Executed 1.8 million square feet of comparable new and renewal leases during the quarter at blended rent spreads of +12.8% on a cash basis and +22.9% on a straight-lined basis Started more than $170 million of new development and redevelopment projects in the quarter, bringing year-to-date total project starts to approximately $220 million As of September 30, 2025, Regency's in-process development and redevelopment projects had estimated net project costs of $668 million at a blended estimated yield of 9% Acquired a portfolio of five shopping centers located within the Rancho Mission Viejo master planned community in Orange County, CA, for $357 million Pro-rata net debt and preferred stock to TTM operating EBITDAre at September 30, 2025 was 5.3x Subsequent to quarter end, on October 27, 2025, Regency's Board of Directors (the "Board") declared a quarterly cash dividend on the Company's common stock of $0.755 per share, an increase of more than 7% FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Highlights Third Quarter 2025 Reported Nareit FFO of $1.15 per diluted share and Core Operating Earnings of $1.09 per diluted share Increased Same Property Net Operating Income ("NOI") year-over-year, excluding termination fees, by 4.8% Raised 2025 Nareit FFO guidance to a range of $4.62 to $4.64 per diluted share and 2025 Core Operating Earnings guidance to a range of $4.39 to $4.41 per diluted share The midpoint of increased 2025 Nareit FFO per share guidance represents more than 7% year-over-year growth Raised 2025 guidance for Same Property NOI year-over-year growth, excluding termination fees, to a range of +5.25% to +5.5% Same Property percent leased ended the quarter at 96.4%, an increase of 40 basis points year-over-year, and Same Property percent commenced ended the quarter at 94.4%, up 190 basis points year-over-year Executed 1.8 million square feet of comparable new and renewal leases during the quarter at blended rent spreads of +12.8% on a cash basis and +22.9% on a straight-lined basis Started more than $170 million of new development and redevelopment projects in the quarter, bringing year-to-date total project starts to approximately $220 million As of September 30, 2025, Regency's in-process development and redevelopment projects had estimated net project costs of $668 million at a blended estimated yield of 9% Acquired a portfolio of five shopping centers located within the Rancho Mission Viejo master planned community in Orange County, CA, for $357 million Pro-rata net debt and preferred stock to TTM operating EBITDAre at September 30, 2025 was 5.3x Subsequent to quarter end, on October 27, 2025, Regency's Board of Directors (the "Board") declared a quarterly cash dividend on the Company's common stock of $0.755 per share, an increase of more than 7% FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

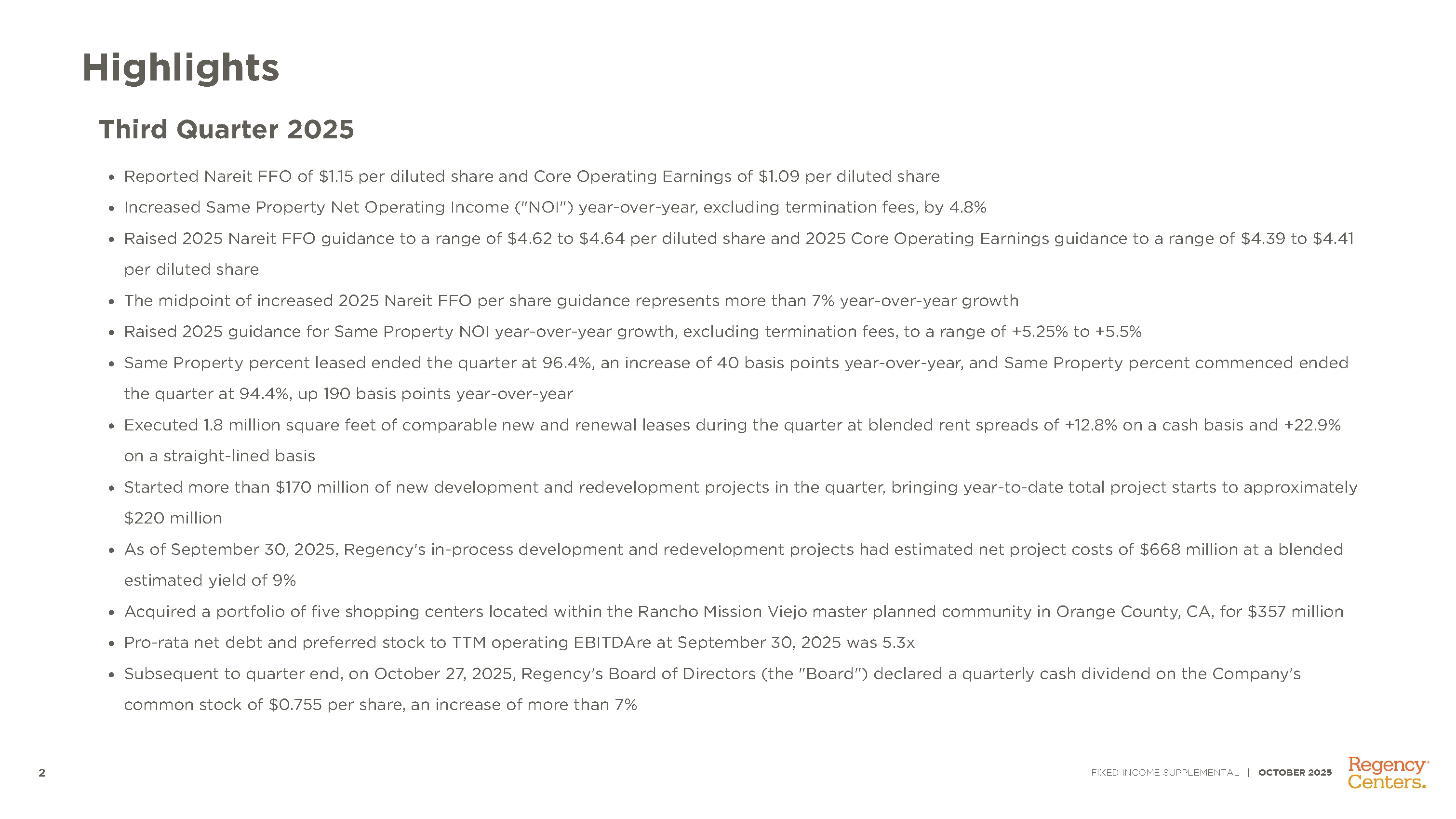

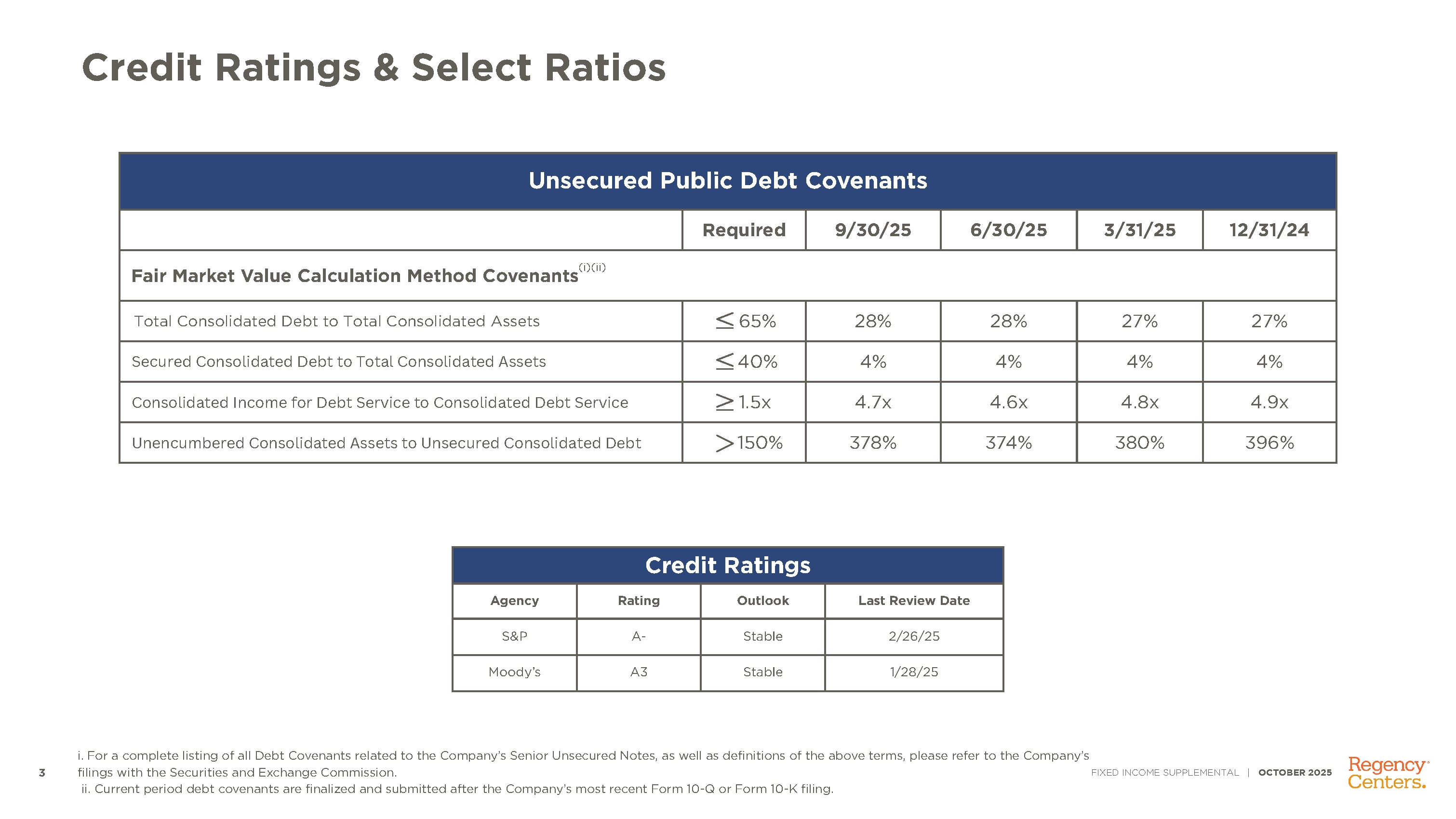

Credit Ratings & Select Ratios Unsecured Public Debt Covenants Required 9/30/25 6/30/25 3/31/25 12/31/24 Fair Market Value Calculation Method Covenants Total Consolidated Debt to Total Consolidated Assets 65% 28% 28% 27% 27% Secured Consolidated Debt to Total Consolidated Assets 40% 4% 4% 4% 4% Consolidated Income for Debt Service to Consolidated Debt Service 1.5x 4.7x 4.6x 4.8x 4.9x Unencumbered Consolidated Assets to Unsecured Consolidated Debt 150% 378% 374% 380% 396% Credit Ratings Agency Rating Outlook Last Review Date S&P A- Stable 2/26/25 Moody’s A3 Stable 1/28/25 3 i. For a complete listing of all Debt Covenants related to the Company’s Senior Unsecured Notes, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission. ii. Current period debt covenants are finalized and submitted after the Company’s most recent Form 10-Q or Form 10-K filing. FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Credit Ratings & Select Ratios Unsecured Public Debt Covenants Required 9/30/25 6/30/25 3/31/25 12/31/24 Fair Market Value Calculation Method Covenants Total Consolidated Debt to Total Consolidated Assets 65% 28% 28% 27% 27% Secured Consolidated Debt to Total Consolidated Assets 40% 4% 4% 4% 4% Consolidated Income for Debt Service to Consolidated Debt Service 1.5x 4.7x 4.6x 4.8x 4.9x Unencumbered Consolidated Assets to Unsecured Consolidated Debt 150% 378% 374% 380% 396% Credit Ratings Agency Rating Outlook Last Review Date S&P A- Stable 2/26/25 Moody’s A3 Stable 1/28/25 3 i. For a complete listing of all Debt Covenants related to the Company’s Senior Unsecured Notes, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission. ii. Current period debt covenants are finalized and submitted after the Company’s most recent Form 10-Q or Form 10-K filing. FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

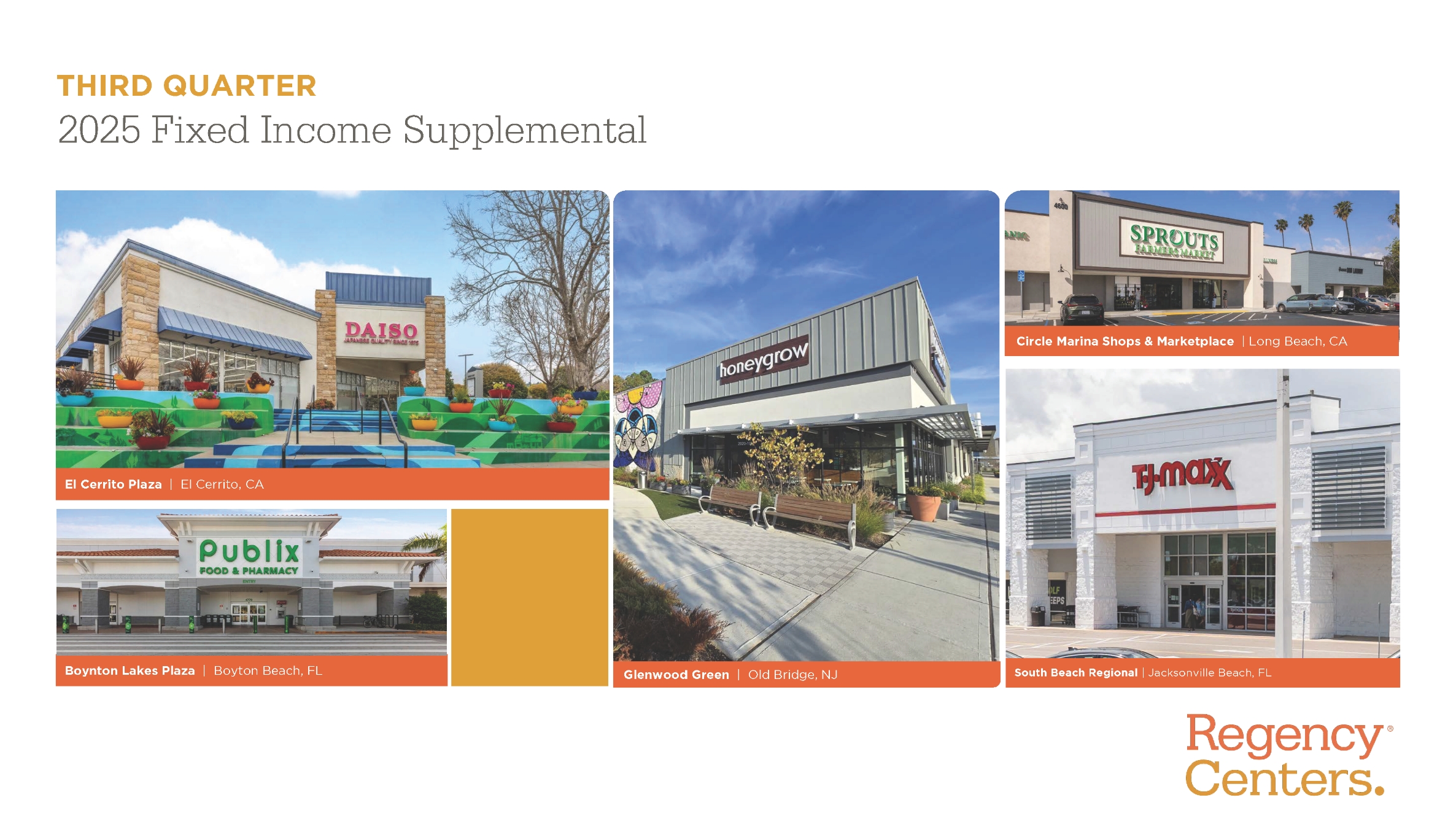

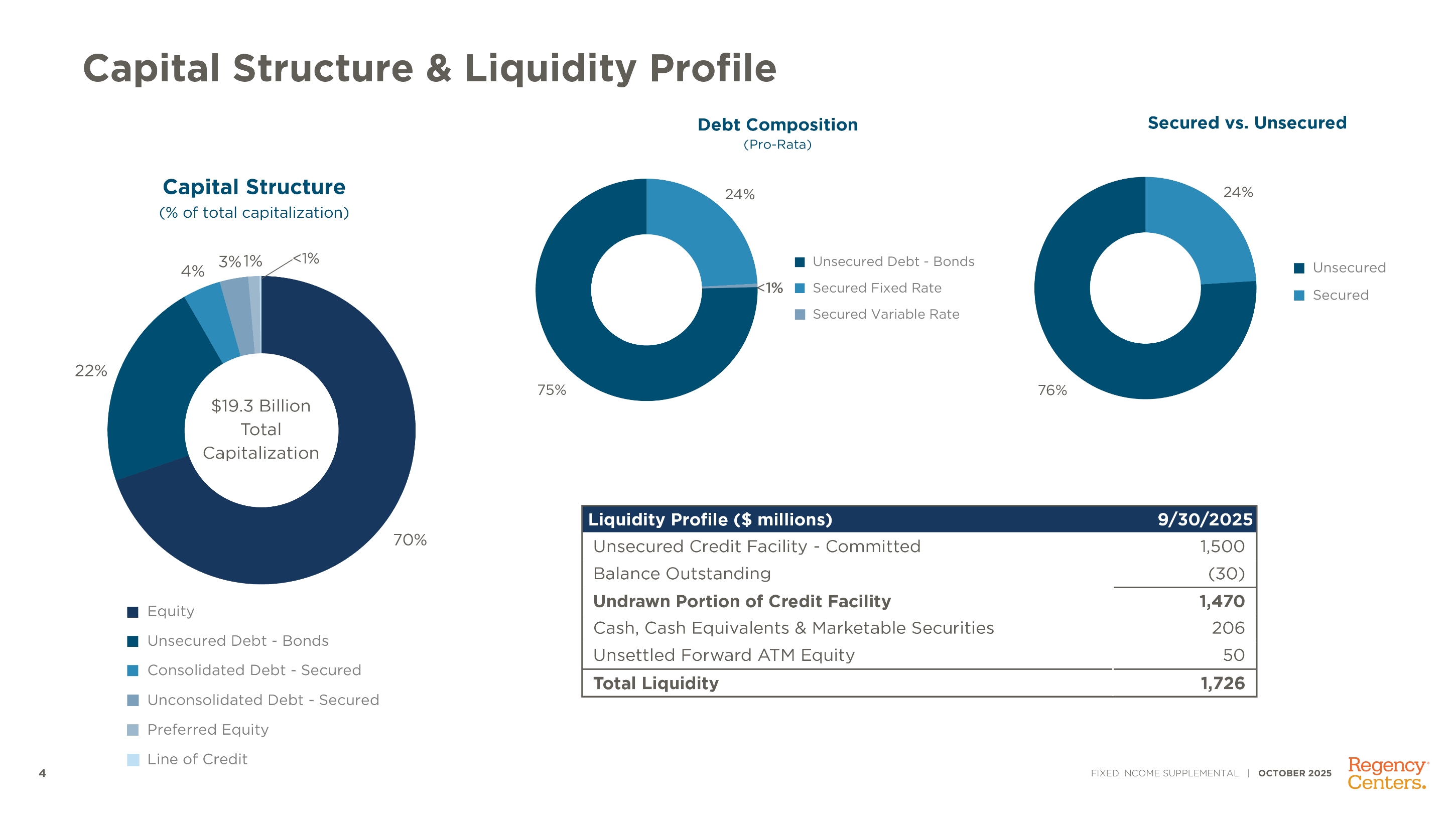

Capital Structure & Liquidity Profile 70% 22% 4% 3% 1% Equity Unsecured Debt - Bonds Consolidated Debt - Secured Unconsolidated Debt - Secured Preferred Equity Line of Credit Capital Structure (% of total capitalization) $19.3 Billion Total Capitalization <1% 75% 24% 1% 76% 24% Liquidity Profile ($ millions) 9/30/2025 Unsecured Credit Facility - Committed 1,500 Balance Outstanding (30) Undrawn Portion of Credit Facility 1,470 Cash, Cash Equivalents & Marketable Securities 50 Unsettled Forward ATM Equity 206 Total Liquidity 1726 4 Unsecured Debt - Bonds Secured Fixed Rate Secured Variable Rate Debt Composition (Pro-Rata) <1% Secured vs. Unsecured FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Capital Structure & Liquidity Profile 70% 22% 4% 3% 1% Equity Unsecured Debt - Bonds Consolidated Debt - Secured Unconsolidated Debt - Secured Preferred Equity Line of Credit Capital Structure (% of total capitalization) $19.3 Billion Total Capitalization <1% 75% 24% 1% 76% 24% Liquidity Profile ($ millions) 9/30/2025 Unsecured Credit Facility - Committed 1,500 Balance Outstanding (30) Undrawn Portion of Credit Facility 1,470 Cash, Cash Equivalents & Marketable Securities 50 Unsettled Forward ATM Equity 206 Total Liquidity 1726 4 Unsecured Debt - Bonds Secured Fixed Rate Secured Variable Rate Debt Composition (Pro-Rata) <1% Secured vs. Unsecured FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

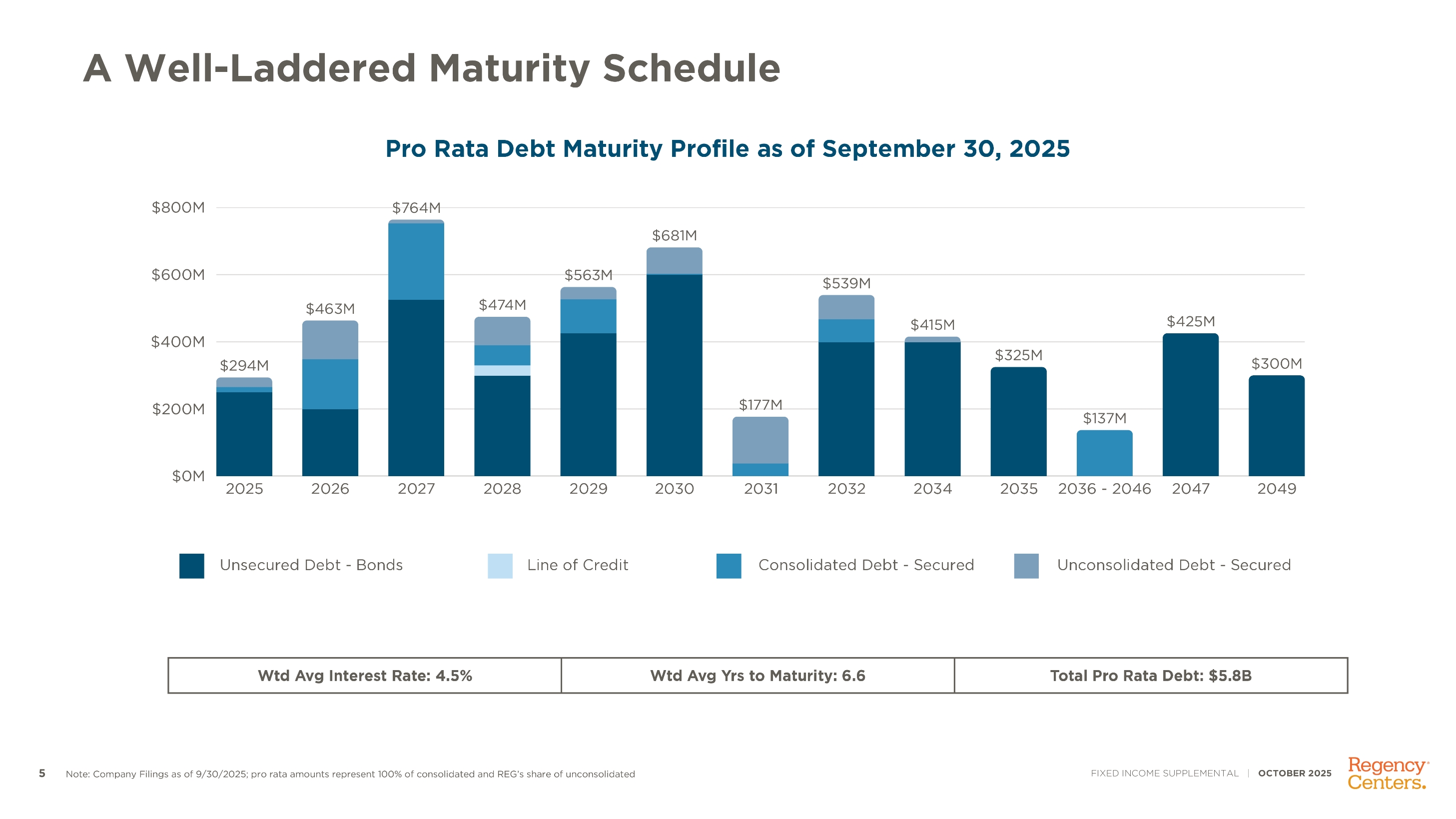

Schedule Pro Rata Debt Maturity Profile as of September 30, 2025 2025 2026 2027 2028 2029 2030 2031 2032 2034 2035 2036 - 2046 2047 2049 $0M $200M $400M $600M $800M $294M $463M $764M $474M $563M $681M $177M $539M $415M $325M $137M $425M $300M Unsecured Debt - Bonds Line of Credit Consolidated Debt - Secured Unconsolidated Debt - Secured Note: Company Filings as of 9/30/2025; pro rata amounts represent 100% of consolidated and REG’s share of unconsolidated Wtd Avg Interest Rate: 4.5% Wtd Avg Yrs to Maturity: 6.6 Total Pro Rata Debt: $5.8B FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Forward-Looking Statements Certain statements in this document regarding anticipated financial, business, legal or other outcomes including business and market conditions, outlook and other similar statements relating to Regency’s future events, developments, or financial or operational performance or results such as our 2025 Guidance, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “could,” “should,” “would,” “expect,” “estimate,” “believe,” “intend,” “forecast,” “project,” “plan,” “anticipate,” “guidance,” and other similar language. However, the absence of these or similar words or expressions does not mean a statement is not forward-looking. While we believe these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance these expectations will be attained, and it is possible actual results may differ materially from those indicated by these forwardlooking statements due to a variety of risks and uncertainties. Our operations are subject to a number of risks and uncertainties including, but not limited to, those risk factors described in our Securities and Exchange Commission (“SEC”) filings, our Annual Report on Form 10-K for the year ended December 31, 2024 (“2024 Form 10- K”) under Item 1A, as supplemented by the discussion in Item 1A of Part II of our subsequent Quarterly Reports on Form 10-Q. When considering an investment in our securities, you should carefully read and consider these risks, together with all other information in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and our other filings and submissions to the SEC. If any of the events described in the risk factors actually occur, our business, financial condition or operating results, as well as the market price of our securities, could be materially adversely affected. Forward-looking statements are only as of the date they are made, and Regency undertakes no duty to update its forward-looking statements, whether as a result of new information, future events or developments or otherwise, except as to the extent required by law. These risks and events include, without limitation: Risk Factors Related to the Current Economic and Geopolitical Environments Interest rates in the current economic environment may adversely impact our cost to borrow, real estate valuation, and stock price. Economic challenges and policy changes may adversely impact our tenants and our business. Unfavorable developments that may affect the banking and financial services industry could adversely affect our business, liquidity and financial condition, and overall results of operations. Current geopolitical challenges could impact the U.S. economy and consumer spending and our results of operations and financial condition. Evolving political and economic events and uncertainties, including tariffs, retaliatory tariffs, international trade disputes, and immigration policies could adversely impact the businesses of our tenants and our business. Risk Factors Related to Pandemics or other Public Health Crises Pandemics or other public health crises may adversely affect our tenants financial condition, the profitability of our properties, and our access to the capital markets and could have a material adverse effect on our business, results of operations, cash flows and financial condition. Risk Factors Related to Operating Retail-Based Shopping Centers Economic and market conditions may adversely affect the retail industry and consequently reduce our revenues and cash flow, and increase our operating expenses. Shifts in retail trends, sales, and delivery methods between brick-and-mortar stores, e-commerce, home delivery, and curbside pick-up may adversely impact our revenues, results of operations, and cash flows. Changing economic and retail market conditions in geographic areas where our properties are concentrated may reduce our revenues and cash flow. Our success depends on the continued presence and success of our “anchor” tenants. A percentage of our revenues are derived from “local” tenants and our net income may be adversely impacted if these tenants are not successful, or if the demand for the types or mix of tenants significantly change. We may be unable to collect balances due from tenants in bankruptcy. Many of our costs and expenses associated with operating our properties may remain constant or increase, even if our lease income decreases. Compliance with the Americans with Disabilities Act and other building, fire, and safety regulations may have a material negative effect on us. Risk Factors Related to Real Estate Investments Our real estate assets may decline in value and be subject to impairment losses which may reduce our net income. We face risks associated with development, redevelopment, and expansion of properties. We face risks associated with the development of mixed-use commercial properties. We face risks associated with the acquisition of properties. We may be unable to sell properties when desired because of market conditions. Changes in tax laws could impact our acquisition or disposition of real estate. Risk Factors Related to the Environment Affecting Our Properties Climate change may adversely impact our properties, some of which may be more vulnerable due to their geographic location, and may lead to additional compliance obligations and costs. Costs of environmental remediation may adversely impact our financial performance and reduce our cash flow. Risk Factors Related to Corporate Matters An increased focus on metrics and reporting related to environmental, social, and governance (“ESG”) factors by investors and other stakeholders may impose additional costs and expose us to new risks. An uninsured loss or a loss that exceeds the insurance coverage on our properties may subject us to loss of capital and revenue on those properties. Failure to attract and retain key personnel may adversely affect our business and operations. Risk Factors Related to Our Partnerships and Joint Ventures We do not have voting control over all of the properties owned in our real estate partnerships and joint ventures, so we are unable to ensure that our objectives will be pursued. The termination of our partnerships may adversely affect our cash flow, operating results, and our ability to make distributions to stock and unit holders. Risk Factors Related to Funding Strategies and Capital Structure Our ability to sell properties and fund acquisitions and developments may be adversely impacted by higher market capitalization rates and lower NOI at our properties which may adversely affect results of operations and financial condition. We depend on external sources of capital, which may not be available in the future on favorable terms or at all. Our debt financing may adversely affect our business and financial condition. Covenants in our debt agreements may restrict our operating activities and adversely affect our financial condition. Increases in interest rates would cause our borrowing costs to rise and negatively impact our results of operations. Hedging activity may expose us to risks, including the risks that a counterparty will not perform and that the hedge will not yield the economic benefits we anticipate, which may adversely affect us. Risk Factors Related to Information Management and Technology The unauthorized access, use, theft or destruction of tenant or employee personal, financial or other data, or of Regency's proprietary or confidential information stored in our information systems or by third parties on our behalf, could impact operations, and expose us to potential liabilities and material adverse financial impact. Any actual or perceived failure to comply with new or existing laws, regulations and other requirements relating to the privacy, security and processing of personal information could adversely affect our business, results of operations, or financial condition. The use of technology based on artificial intelligence presents risks relating to confidentiality, creation of inaccurate and flawed outputs and emerging regulatory risk, any or all of which may adversely affect our business and results of operations. Risk Factors Related to Taxes and the Parent Company’s Qualification as a REIT If the Parent Company fails to qualify as a REIT for federal income tax purposes, it would be subject to federal income tax at regular corporate rates. Dividends paid by REITs generally do not qualify for reduced tax rates. Certain non-U.S. stockholders may be subject to U.S. federal income tax on gain recognized on a disposition of our common stock if the Parent Company does not qualify as a “domestically controlled” REIT. Legislative or other actions affecting REITs may have a negative effect on us or our investors. Complying with REIT requirements may limit our ability to hedge effectively and may cause us to incur tax liabilities. Partnership tax audit rules could have a material adverse effect. Risk Factors Related to the Company’s Common Stock Restrictions on the ownership of the Parent Company’s capital stock to preserve its REIT status may delay or prevent a change in control. The issuance of the Parent Company's capital stock may delay or prevent a change in control. Ownership in the Parent Company may be diluted in the future. The Parent Company’s amended and restated bylaws provides that the courts located in the State of Florida will be the sole and exclusive forum for substantially all disputes between us and our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees. There is no assurance that we will continue to pay dividends at current or historical rates. Non-GAAP Disclosure We believe these non-GAAP measures provide useful information to our Board of Directors, management and investors regarding certain trends relating to our financial condition and results of operations. Our management uses these non-GAAP measures to compare our performance to that of prior periods for trend analyses, purposes of determining management incentive compensation and budgeting, forecasting and planning purposes. We do not consider non-GAAP measures an alternative to financial measures determined in accordance with GAAP, rather they supplement GAAP measures by providing additional information we believe to be useful to our shareholders. The principal limitation of these non-GAAP financial measures is they may exclude significant expense and income items that are required by GAAP to be recognized in our consolidated financial statements. In addition, they reflect the exercise of management’s judgment about which expense and income items are excluded or included in determining these non- GAAP financial measures. In order to compensate for these limitations, reconciliations of the non-GAAP financial measures we use to their most directly comparable GAAP measures are provided. Non-GAAP financial measures should not be relied upon in evaluating the financial condition, results of operations or future prospects of the Company. Nareit FFO is a commonly used measure of REIT performance, which the National Association of Real Estate Investment Trusts (“Nareit”) defines as net income, computed in accordance with GAAP, excluding gains on sale and impairments of real estate, net of tax, plus depreciation and amortization related to real estate, and after adjustments for unconsolidated real estate partnerships. Regency computes Nareit FFO for all periods presented in accordance with Nareit's definition. Since Nareit FFO excludes depreciation and amortization and gains on sales and impairments of real estate, it provides a performance measure that, when compared year over year, reflects the impact on operations from trends in percent leased, rental rates, operating costs, acquisition and development activities, and financing costs. This provides a perspective of the Company’s financial performance not immediately apparent from net income determined in accordance with GAAP. Thus, Nareit FFO is a supplemental non-GAAP financial measure of the Company's operating performance, which does not represent cash generated from operating activities in accordance with GAAP; and, therefore, should not be considered a substitute measure of cash flows from operations. The Company provides a reconciliation of Net Income Attributable to Common Shareholders to Nareit FFO. Core Operating Earnings is an additional performance measure that excludes from Nareit FFO: (i) transaction related income or expenses; (ii) gains or losses from the early extinguishment of debt; (iii) certain non-cash components of earnings derived from above and below market rent amortization, straight-line rents, and amortization of mark-to-market of debt and derivative adjustments; and (iv) other amounts as they occur. The Company provides a reconciliation of Net Income Attributable to Common Shareholders to Nareit FFO to Core Operating Earnings. Adjusted Funds From Operations is an additional performance measure used by Regency that reflects cash available to fund the Company’s business needs and distribution to shareholders. AFFO is calculated by adjusting Core Operating Earnings ("COE") for (i) capital expenditures necessary to maintain and lease the Company’s portfolio of properties, (ii) debt cost and derivative adjustments and (iii) stock-based compensation. The Company provides a reconciliation of Net Income Attributable to Common Shareholders to Nareit FFO, to Core Operating Earnings, and to Adjusted Funds from Operations.. 6 Follow Us Third Quarter 2025 Earnings Conference Call Wednesday, October 29th, 2025, Time: 11:00 AM ET Dial#: 877-407-0789 or 201-689-8562 Webcast: investors.regencycenters.com Contact Information: Christy McElroy Senior Vice President, Capital Markets 904-598-7616 ChristyMcElroy@RegencyCenters.com FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Boynton Lakes Plaza | Boyton Beach, FL South Beach Regional | Jacksonville Beach, FL El Cerrito Plaza | El Cerrito, CA Glenwood Green | Old Bridge, NJ Circle Marina Shops & Marketplace | Long Beach, CA THIRD QUARTER 2025 Fixed Income Supplemental Regency Centers.

Boynton Lakes Plaza | Boyton Beach, FL South Beach Regional | Jacksonville Beach, FL El Cerrito Plaza | El Cerrito, CA Glenwood Green | Old Bridge, NJ Circle Marina Shops & Marketplace | Long Beach, CA THIRD QUARTER 2025 Fixed Income Supplemental Regency Centers.  Highlights Third Quarter 2025 Reported Nareit FFO of $1.15 per diluted share and Core Operating Earnings of $1.09 per diluted share Increased Same Property Net Operating Income ("NOI") year-over-year, excluding termination fees, by 4.8% Raised 2025 Nareit FFO guidance to a range of $4.62 to $4.64 per diluted share and 2025 Core Operating Earnings guidance to a range of $4.39 to $4.41 per diluted share The midpoint of increased 2025 Nareit FFO per share guidance represents more than 7% year-over-year growth Raised 2025 guidance for Same Property NOI year-over-year growth, excluding termination fees, to a range of +5.25% to +5.5% Same Property percent leased ended the quarter at 96.4%, an increase of 40 basis points year-over-year, and Same Property percent commenced ended the quarter at 94.4%, up 190 basis points year-over-year Executed 1.8 million square feet of comparable new and renewal leases during the quarter at blended rent spreads of +12.8% on a cash basis and +22.9% on a straight-lined basis Started more than $170 million of new development and redevelopment projects in the quarter, bringing year-to-date total project starts to approximately $220 million As of September 30, 2025, Regency's in-process development and redevelopment projects had estimated net project costs of $668 million at a blended estimated yield of 9% Acquired a portfolio of five shopping centers located within the Rancho Mission Viejo master planned community in Orange County, CA, for $357 million Pro-rata net debt and preferred stock to TTM operating EBITDAre at September 30, 2025 was 5.3x Subsequent to quarter end, on October 27, 2025, Regency's Board of Directors (the "Board") declared a quarterly cash dividend on the Company's common stock of $0.755 per share, an increase of more than 7% FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Highlights Third Quarter 2025 Reported Nareit FFO of $1.15 per diluted share and Core Operating Earnings of $1.09 per diluted share Increased Same Property Net Operating Income ("NOI") year-over-year, excluding termination fees, by 4.8% Raised 2025 Nareit FFO guidance to a range of $4.62 to $4.64 per diluted share and 2025 Core Operating Earnings guidance to a range of $4.39 to $4.41 per diluted share The midpoint of increased 2025 Nareit FFO per share guidance represents more than 7% year-over-year growth Raised 2025 guidance for Same Property NOI year-over-year growth, excluding termination fees, to a range of +5.25% to +5.5% Same Property percent leased ended the quarter at 96.4%, an increase of 40 basis points year-over-year, and Same Property percent commenced ended the quarter at 94.4%, up 190 basis points year-over-year Executed 1.8 million square feet of comparable new and renewal leases during the quarter at blended rent spreads of +12.8% on a cash basis and +22.9% on a straight-lined basis Started more than $170 million of new development and redevelopment projects in the quarter, bringing year-to-date total project starts to approximately $220 million As of September 30, 2025, Regency's in-process development and redevelopment projects had estimated net project costs of $668 million at a blended estimated yield of 9% Acquired a portfolio of five shopping centers located within the Rancho Mission Viejo master planned community in Orange County, CA, for $357 million Pro-rata net debt and preferred stock to TTM operating EBITDAre at September 30, 2025 was 5.3x Subsequent to quarter end, on October 27, 2025, Regency's Board of Directors (the "Board") declared a quarterly cash dividend on the Company's common stock of $0.755 per share, an increase of more than 7% FIXED INCOME SUPPLEMENTAL | OCTOBER 2025 Credit Ratings & Select Ratios Unsecured Public Debt Covenants Required 9/30/25 6/30/25 3/31/25 12/31/24 Fair Market Value Calculation Method Covenants Total Consolidated Debt to Total Consolidated Assets 65% 28% 28% 27% 27% Secured Consolidated Debt to Total Consolidated Assets 40% 4% 4% 4% 4% Consolidated Income for Debt Service to Consolidated Debt Service 1.5x 4.7x 4.6x 4.8x 4.9x Unencumbered Consolidated Assets to Unsecured Consolidated Debt 150% 378% 374% 380% 396% Credit Ratings Agency Rating Outlook Last Review Date S&P A- Stable 2/26/25 Moody’s A3 Stable 1/28/25 3 i. For a complete listing of all Debt Covenants related to the Company’s Senior Unsecured Notes, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission. ii. Current period debt covenants are finalized and submitted after the Company’s most recent Form 10-Q or Form 10-K filing. FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Credit Ratings & Select Ratios Unsecured Public Debt Covenants Required 9/30/25 6/30/25 3/31/25 12/31/24 Fair Market Value Calculation Method Covenants Total Consolidated Debt to Total Consolidated Assets 65% 28% 28% 27% 27% Secured Consolidated Debt to Total Consolidated Assets 40% 4% 4% 4% 4% Consolidated Income for Debt Service to Consolidated Debt Service 1.5x 4.7x 4.6x 4.8x 4.9x Unencumbered Consolidated Assets to Unsecured Consolidated Debt 150% 378% 374% 380% 396% Credit Ratings Agency Rating Outlook Last Review Date S&P A- Stable 2/26/25 Moody’s A3 Stable 1/28/25 3 i. For a complete listing of all Debt Covenants related to the Company’s Senior Unsecured Notes, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission. ii. Current period debt covenants are finalized and submitted after the Company’s most recent Form 10-Q or Form 10-K filing. FIXED INCOME SUPPLEMENTAL | OCTOBER 2025 Capital Structure & Liquidity Profile 70% 22% 4% 3% 1% Equity Unsecured Debt - Bonds Consolidated Debt - Secured Unconsolidated Debt - Secured Preferred Equity Line of Credit Capital Structure (% of total capitalization) $19.3 Billion Total Capitalization <1% 75% 24% 1% 76% 24% Liquidity Profile ($ millions) 9/30/2025 Unsecured Credit Facility - Committed 1,500 Balance Outstanding (30) Undrawn Portion of Credit Facility 1,470 Cash, Cash Equivalents & Marketable Securities 50 Unsettled Forward ATM Equity 206 Total Liquidity 1726 4 Unsecured Debt - Bonds Secured Fixed Rate Secured Variable Rate Debt Composition (Pro-Rata) <1% Secured vs. Unsecured FIXED INCOME SUPPLEMENTAL | OCTOBER 2025

Capital Structure & Liquidity Profile 70% 22% 4% 3% 1% Equity Unsecured Debt - Bonds Consolidated Debt - Secured Unconsolidated Debt - Secured Preferred Equity Line of Credit Capital Structure (% of total capitalization) $19.3 Billion Total Capitalization <1% 75% 24% 1% 76% 24% Liquidity Profile ($ millions) 9/30/2025 Unsecured Credit Facility - Committed 1,500 Balance Outstanding (30) Undrawn Portion of Credit Facility 1,470 Cash, Cash Equivalents & Marketable Securities 50 Unsettled Forward ATM Equity 206 Total Liquidity 1726 4 Unsecured Debt - Bonds Secured Fixed Rate Secured Variable Rate Debt Composition (Pro-Rata) <1% Secured vs. Unsecured FIXED INCOME SUPPLEMENTAL | OCTOBER 2025 A Well-Laddered Maturity

A Well-Laddered Maturity