Exhibit (c)(2)

PROJECT GLOW EXECUTIVE SUMMARY AUGUST 19, 2025

Exhibit (c)(2)

PROJECT GLOW EXECUTIVE SUMMARY AUGUST 19, 2025

PROCESS SUMMARY

SITUATION OVERVIEW On March 13, 2025, Glow received a non-binding proposal from WHP Global (“WHP”) to purchase all outstanding shares not already held by Paul Marciano, Maurice Marciano and Carlos Alberini (the “Potential Rollover Shareholders”) for $13.00 per share in cash On March 17, 2025, Glow publicly announced that its Board of Directors had received a non-binding proposal from WHP and formed a Special Committee of independent and disinterested directors of the Board to evaluate the proposal (the “Special Committee”), with the assistance of outside financial and legal advisors, and to determine the course of action that is in the best interest of Glow and its shareholders – On that day, Paul Marciano and Maurice Marciano individually filed Schedule 13Ds disclosing the proposal from WHP On April 1, 2025, Glow received a draft merger agreement from WHP, despite WHP not completing any due diligence or signing a non-disclosure agreement (“NDA”) On April 2, 2025, Glow received a non-binding proposal from Authentic Brands Group LLC (“ABG”) to purchase all outstanding shares not already held by the Potential Rollover Shareholders for $15.00 per share in cash On April 3, 2025, Glow publicly announced that the Special Committee retained Solomon Partners as its financial advisor and Willkie Farr & Gallagher LLP (“Willkie”) as its legal advisor On April 24, 2025, Solomon Partners initiated outreach to additional brand management, strategic and financial acquirors approved by the Special Committee, soliciting offers for a full range of alternatives including pairing the Potential Rollover Shareholders with a buyer in a go-private transaction or an outright sale of Glow On May 5, 2025, Solomon Partners sent the Special Committee and Company approved Confidential Information Memorandum (“CIM”) and process letter to interested parties under NDA and provided access to a preliminary virtual data room (“VDR”)

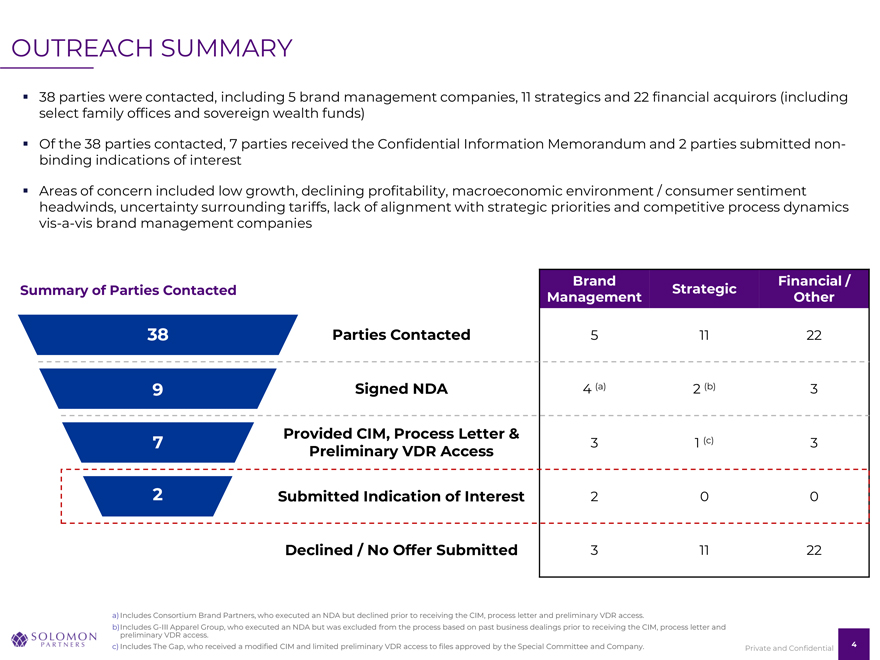

OUTREACH SUMMARY 38 parties were contacted, including 5 brand management companies, 11 strategics and 22 financial acquirors (including select family offices and sovereign wealth funds) Of the 38 parties contacted, 7 parties received the Confidential Information Memorandum and 2 parties submitted non-binding indications of interest Areas of concern included low growth, declining profitability, macroeconomic environment / consumer sentiment headwinds, uncertainty surrounding tariffs, lack of alignment with strategic priorities and competitive process dynamics vis-a-vis brand management companies Brand Financial / Summary of Parties Contacted Strategic Management Other 38 Parties Contacted 5 11 22 9 Signed NDA 4 (a) 2 (b) 3 Provided CIM, Process Letter & 7 3 1 (c) 3 Preliminary VDR Access 2 Submitted Indication of Interest 2 0 0 Declined / No Offer Submitted 3 11 22 a)Includes Consortium Brand Partners, who executed an NDA but declined prior to receiving the CIM, process letter and preliminary VDR access. b)Includes G-III Apparel Group, who executed an NDA but was excluded from the process based on past business dealings prior to receiving the CIM, process letter and preliminary VDR access. c) Includes The Gap, who received a modified CIM and limited preliminary VDR access to files approved by the Special Committee and Company. 4 Private and Confidential

SITUATION OVERVIEW (CONT.) On May 19, 2025, Glow received a non-binding indication of interest from ABG to purchase all outstanding shares of Glow other than the shares of the Potential Rollover Shareholders for $15.00 per share in cash, and on May 20, 2025, Glow received a non-binding indication of interest from Bluestar Alliance LLC (“Bluestar”) to purchase all outstanding shares of Glow for a total purchase price of $1.35 billion, with a rollover opportunity for the Potential Rollover Shareholders – Despite repeated discussions with Solomon Partners, Willkie, Paul Marciano and Carlos Alberini, WHP refused to sign an NDA with a standstill and did not participate in the process – After receiving Bluestar’s non-binding indication of interest, and numerous discussions over the following weeks, Bluestar failed to hire advisors and engage in due diligence On July 12, 2025, Glow received a mark-up of the merger agreement from ABG in which ABG eliminated the provision allowing Glow to continue paying its regular quarterly dividend of $0.30 per share On July 14, 2025, Glow received an updated offer from ABG to purchase all outstanding shares of Glow other than the shares of the Potential Rollover Shareholders for $15.00 per share in cash On July 28, 2025, Glow received an updated offer from ABG to purchase all outstanding shares of Glow other than the shares of the Potential Rollover Shareholders for $15.50 per share in cash – On that day, Glow also received a mark-up of the merger agreement from ABG in which ABG accepted the “majority of the minority” provision On August 5, 2025, Glow received an updated offer from ABG to purchase all outstanding shares of Glow other than the shares of the Potential Rollover Shareholders for $16.25 per share in cash and agreed to Glow paying up to $0.60 per share of total dividends during the period before the closing of the proposed transaction, consisting of Glow’s regular $0.30 per share September and December dividends On August 11, 2025, Glow received an updated offer from ABG to purchase all outstanding shares of Glow other than the shares of the Potential Rollover Shareholders for $16.75 per share in cash and agreed to Glow paying a regular quarterly dividend of up to $0.225 per share during the period before the closing of the proposed transaction – $16.75 per share offer price represents a 73% premium over Glow’s unaffected share price of $9.70 (a), a 6.6x LTM EBITDA multiple (b) and a 9.0x CY+1 PE multiple (c) a) Glow’s closing share price on March 14, 2025, the trading day prior to March 17, 2025, the date that Glow publicly announced receipt of a non-binding proposal from WHP Global, per a Schedule 13D filed on March 17, 2025. b)EBITDA based on the twelve-month period ended fiscal month-end June 2025. Source: “FY24, FY25 & FY26 Jun YTD P&Ls.xlsx”, provided to Solomon by Management and approved for its use by the Special Committee on August 14, 2025. Enterprise value calculation based on $293.2M of current and long-term debt and finance lease obligations, $172.1M of cash and cash equivalents and $55.1M of redeemable and nonredeemable noncontrolling interests as of fiscal month-end June 2025. Source: “FY26 Balance Sheet_June”, provided to Solomon by Management and approved for its use by the Special Committee on August 14, 2025. Includes the face value of the convertible senior notes of $351.9M and a net benefit of $16.0M from the negotiated termination of the convertible note hedge and warrant transactions, provided to Solomon by Management and approved for its use by the Special Committee on August 14, 2025. Fully diluted shares outstanding based on 52.1M shares outstanding as of August 8, 2025, 3.0M nonvested stock awards / units that are assumed to fully vest upon the occurrence of a change in control of the Company and option equivalent shares calculated using the treasury stock method at $16.75 per share. Source: “Calculation of Fully Diluted Share Count (August 8, 2025)”, approved for its use by Management on August 8, 2025, and approved for its use by the Special Committee on August 14, 2025. c) Source: “5-Year Projections—Extract—Broken Links.xlsx”, provided to Solomon by Management and approved for its use by the Special Committee on August 14, 2025. 5 Private and Confidential

SIMPLIFIED PROPOSED TRANSACTION STRUCTURE SUMMARY

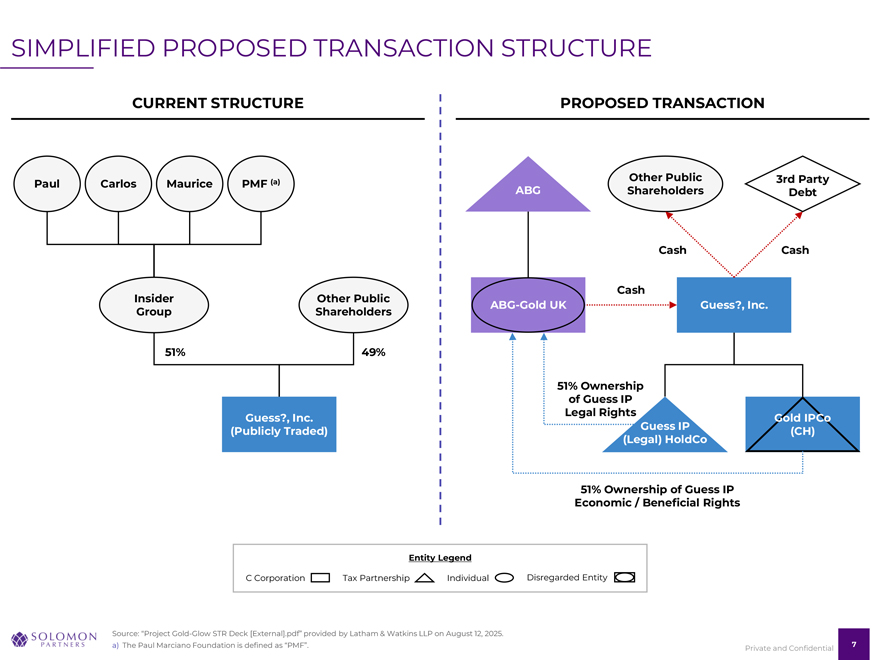

SIMPLIFIED PROPOSED TRANSACTION STRUCTURE CURRENT STRUCTURE PROPOSED TRANSACTION (a) Other Public 3rd Party Paul Carlos Maurice PMF ABG Shareholders Debt Cash Cash Cash Insider Other Public ABG Guess?, -Gold LLC UK Guess?, Inc. Group Shareholders 51% 49% 51% Ownership of Guess IP Legal Rights Guess?, Inc. Gold IPCo (Publicly Traded) Guess IP (CH) (Legal) HoldCo 51% Ownership of Guess IP Economic / Beneficial Rights Entity Legend C Corporation Tax Partnership Individual Disregarded Entity Source: “Project Gold-Glow STR Deck [External].pdf” provided by Latham & Watkins LLP on August 12, 2025. a) The Paul Marciano Foundation is defined as “PMF”. 7 Private and Confidential

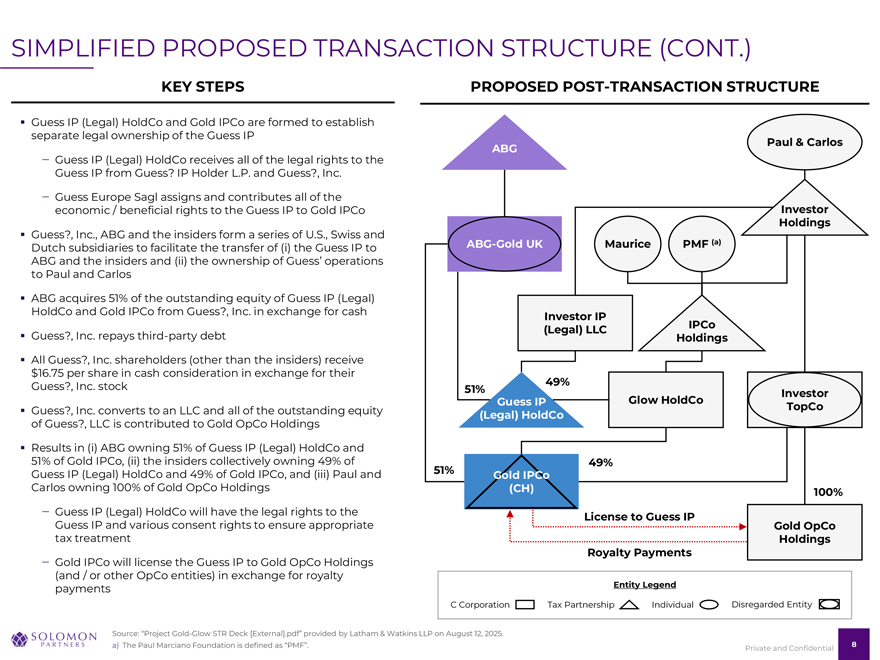

SIMPLIFIED PROPOSED TRANSACTION STRUCTURE (CONT.) KEY STEPS PROPOSED POST-TRANSACTION STRUCTURE Guess IP (Legal) HoldCo and Gold IPCo are formed to establish separate legal ownership of the Guess IP Paul & Carlos – Guess IP (Legal) HoldCo receives all of the legal rights to the ABG Guess IP from Guess? IP Holder L.P. and Guess?, Inc. – Guess Europe Sagl assigns and contributes all of the economic / beneficial rights to the Guess IP to Gold IPCo Investor Holdings Guess?, Inc., ABG and the insiders form a series of U.S., Swiss and Dutch subsidiaries to facilitate the transfer of (i) the Guess IP to ABG Guess?, -Gold LLC UK Maurice PMF (a) ABG and the insiders and (ii) the ownership of Guess’ operations to Paul and Carlos ABG acquires 51% of the outstanding equity of Guess IP (Legal) HoldCo and Gold IPCo from Guess?, Inc. in exchange for cash Investor IP (Legal) LLC IPCo Guess?, Inc. repays third-party debt Holdings All Guess?, Inc. shareholders (other than the insiders) receive $16.75 per share in cash consideration in exchange for their Guess?, Inc. stock 49% 51% Glow HoldCo Guess?, Investor LLC Guess IP TopCo Guess?, Inc. converts to an LLC and all of the outstanding equity (Legal) HoldCo of Guess?, LLC is contributed to Gold OpCo Holdings Results in (i) ABG owning 51% of Guess IP (Legal) HoldCo and 51% of Gold IPCo, (ii) the insiders collectively owning 49% of 49% Guess IP (Legal) HoldCo and 49% of Gold IPCo, and (iii) Paul and 51% Gold IPCo Carlos owning 100% of Gold OpCo Holdings (CH) 100% – Guess IP (Legal) HoldCo will have the legal rights to the License to Guess IP Guess IP and various consent rights to ensure appropriate Gold OpCo tax treatment Holdings Royalty Payments – Gold IPCo will license the Guess IP to Gold OpCo Holdings (and / or other OpCo entities) in exchange for royalty Entity Legend payments C Corporation Tax Partnership Individual Disregarded Entity Source: “Project Gold-Glow STR Deck [External].pdf” provided by Latham & Watkins LLP on August 12, 2025. a) The Paul Marciano Foundation is defined as “PMF”. 8 Private and Confidential

DISCLAIMER The following pages contain material provided to the Special Committee of the Board of Directors (the “Special Committee”) and the Board of Directors (the “Board”) of Guess ?, Inc. (the “Company” or “Glow”) by Solomon Partners Securities, LLC (“Solomon”) in connection with Project Glow. These materials were prepared on a confidential basis in connection with an oral presentation to the Special Committee and the Board and not with a view toward complying with the disclosure standards under state or federal securities laws or otherwise. These materials are solely for use of the Special Committee and the Board in its evaluation of the proposed transaction and may not be used for any other purpose or disclosed to any party without Solomon’s prior written consent. The information contained in this presentation was based solely on publicly available information or information furnished to Solomon by the Company. Solomon has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. This presentation includes certain statements, estimates and projections provided by the Company with respect to the historical and anticipated future performance of the Company. Such statements, estimates and projections contain or are based on significant assumptions and subjective judgments made by the Company’s management. None of Solomon, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information, projections or any conclusion contained herein. Solomon, its affiliates and its and their respective employees, directors, officers, contractors, advisors, members, successors and agents shall have no liability with respect to any information, projections or matter contained herein, or any oral information provided herewith or data any of them generates. The information contained herein should not be assumed to have been updated at any time subsequent to date shown on the first page of the presentation and the delivery of the presentation does not constitute a representation by Solomon that such information will be updated at any time after the date of the presentation. Neither Solomon nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. The Company, the Special Committee and the Board acknowledge that Solomon is an affiliate of Natixis, a global full service commercial and investment bank. These materials are not and should not be construed as a fairness opinion. 9 Private and Confidential