Exhibit (c)(4)

Exhibit (c)(5) Confidential FOR DISCUSSION PURPOSES ONLY Discussion Materials August 12, 2025

Exhibit (c)(4)

Exhibit (c)(5) Confidential FOR DISCUSSION PURPOSES ONLY Discussion Materials August 12, 2025

Disclaimer Matthews South, LLC (or, where applicable, its affiliates, in each case MS) is not acting as a valuation expert. MS is providing the estimates set forth in this document (or any attachment or enclosure to it) solely for your own internal informational use only (and should not be the source of marks in any financial statements). These materials and MS’ presentation relating to these materials may not be disclosed to any third party or circulated or referred to publicly or used for or relied upon for any other purpose without the prior written consent of MS. These estimates were not prepared with a view to public disclosure or to conform to any disclosure standards under any state, federal or international securities laws or other laws, rules or regulations, and MS does not take any responsibility for the use of the estimates by persons other than those set forth above. Notwithstanding anything in this document to the contrary, you may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without MS imposing any limitation of any kind. MS’s estimates are typically derived all or in part from model prices, external sources, market data (which may be generated internally), and may be based on certain assumptions, all of which are subject to change without notice. No guarantee or warranty is made as to the reasonableness of the assumptions or the accuracy and completeness of the valuation methodologies, models, market data, or pricing sources (internal and/or external), and the estimates should not be relied upon as such. Any responsibility or liability for any such information is expressly disclaimed. Confidential FOR DISCUSSION PURPOSES ONLY

Disclaimer (cont’d) The analyses contained in this document do not purport to be appraisals, opinions, or recommendations, nor do they necessarily reflect the prices at which securities or instruments actually may be sold or purchased. The views expressed in this report reflect our personal views. This document is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. The price and value of the instruments referred to in this document and the income from them may go down as well as up, and clients may realize losses on any investments. Past performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. Each recipient has the capability to independently evaluate investment risk and will exercise independent judgment in evaluating investment decisions in that its investment decisions will be based on its own independent assessment of the opportunities and risks presented by a potential investment, market factors and other investment considerations. We do not provide tax, accounting, or legal advice to our clients, and all persons are advised to consult with their tax, accounting, or legal advisers as they deem appropriate. Confidential FOR DISCUSSION PURPOSES ONLY

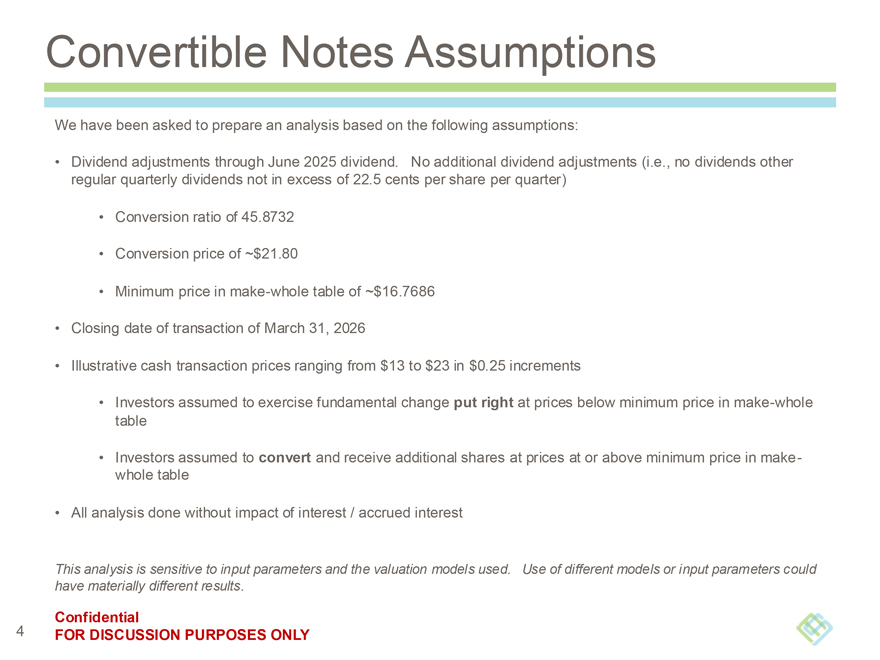

Convertible Notes Assumptions We have been asked to prepare an analysis based on the following assumptions: Dividend adjustments through June 2025 dividend. No additional dividend adjustments (i.e., no dividends other regular quarterly dividends not in excess of 22.5 cents per share per quarter) Conversion ratio of 45.8732 Conversion price of ~$21.80 Minimum price in make-whole table of ~$16.7686 Closing date of transaction of March 31, 2026 Illustrative cash transaction prices ranging from $13 to $23 in $0.25 increments Investors assumed to exercise fundamental change put right at prices below minimum price in make-whole table Investors assumed to convert and receive additional shares at prices at or above minimum price in make-whole table All analysis done without impact of interest / accrued interest This analysis is sensitive to input parameters and the valuation models used. Use of different models or input parameters could have materially different results. Confidential FOR DISCUSSION PURPOSES ONLY

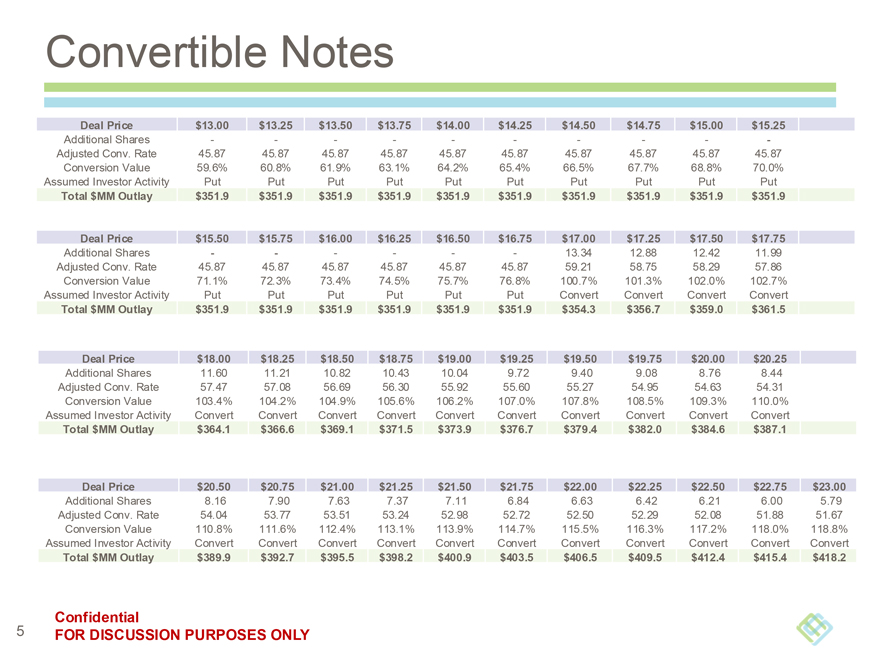

Convertible Notes Deal Price $13.00 $13.25 $13.50 $13.75 $14.00 $14.25 $14.50 $14.75 $15.00 $15.25 Additional Shares Adjusted Conv. Rate 45.87 45.87 45.87 45.87 45.87 45.87 45.87 45.87 45.87 45.87 Conversion Value 59.6% 60.8% 61.9% 63.1% 64.2% 65.4% 66.5% 67.7% 68.8% 70.0% Assumed Investor Activity Put Put Put Put Put Put Put Put Put Put Total $MM Outlay $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 Deal Price $15.50 $15.75 $16.00 $16.25 $16.50 $16.75 $17.00 $17.25 $17.50 $17.75 Additional Shares 13.34 12.88 12.42 11.99 Adjusted Conv. Rate 45.87 45.87 45.87 45.87 45.87 45.87 59.21 58.75 58.29 57.86 Conversion Value 71.1% 72.3% 73.4% 74.5% 75.7% 76.8% 100.7% 101.3% 102.0% 102.7% Assumed Investor Activity Put Put Put Put Put Put Convert Convert Convert Convert Total $MM Outlay $351.9 $351.9 $351.9 $351.9 $351.9 $351.9 $354.3 $356.7 $359.0 $361.5 Deal Price $18.00 $18.25 $18.50 $18.75 $19.00 $19.25 $19.50 $19.75 $20.00 $20.25 Additional Shares 11.60 11.21 10.82 10.43 10.04 9.72 9.40 9.08 8.76 8.44 Adjusted Conv. Rate 57.47 57.08 56.69 56.30 55.92 55.60 55.27 54.95 54.63 54.31 Conversion Value 103.4% 104.2% 104.9% 105.6% 106.2% 107.0% 107.8% 108.5% 109.3% 110.0% Assumed Investor Activity Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Total $MM Outlay $364.1 $366.6 $369.1 $371.5 $373.9 $376.7 $379.4 $382.0 $384.6 $387.1 Deal Price $20.50 $20.75 $21.00 $21.25 $21.50 $21.75 $22.00 $22.25 $22.50 $22.75 $23.00 Additional Shares 8.16 7.90 7.63 7.37 7.11 6.84 6.63 6.42 6.21 6.00 5.79 Adjusted Conv. Rate 54.04 53.77 53.51 53.24 52.98 52.72 52.50 52.29 52.08 51.88 51.67 Conversion Value 110.8% 111.6% 112.4% 113.1% 113.9% 114.7% 115.5% 116.3% 117.2% 118.0% 118.8% Assumed Investor Activity Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Total $MM Outlay $389.9 $392.7 $395.5 $398.2 $400.9 $403.5 $406.5 $409.5 $412.4 $415.4 $418.2 Confidential FOR DISCUSSION PURPOSES ONLY

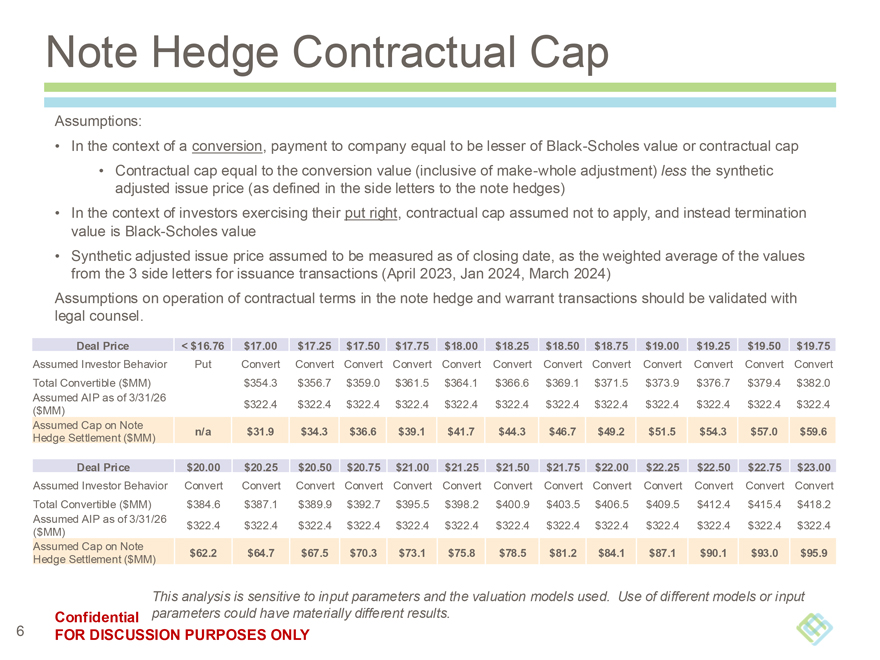

Note Hedge Contractual Cap Assumptions: In the context of a conversion, payment to company equal to be lesser of Black-Scholes value or contractual cap Contractual cap equal to the conversion value (inclusive of make-whole adjustment) less the synthetic adjusted issue price (as defined in the side letters to the note hedges) In the context of investors exercising their put right, contractual cap assumed not to apply, and instead termination value is Black-Scholes value Synthetic adjusted issue price assumed to be measured as of closing date, as the weighted average of the values from the 3 side letters for issuance transactions (April 2023, Jan 2024, March 2024) Assumptions on operation of contractual terms in the note hedge and warrant transactions should be validated with legal counsel. Deal Price < $16.76 $17.00 $17.25 $17.50 $17.75 $18.00 $18.25 $18.50 $18.75 $19.00 $19.25 $19.50 $19.75 Assumed Investor Behavior Put Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Total Convertible ($MM) $354.3 $356.7 $359.0 $361.5 $364.1 $366.6 $369.1 $371.5 $373.9 $376.7 $379.4 $382.0 Assumed AIP as of 3/31/26 ($MM) $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 Assumed Cap on Note Hedge Settlement ($MM) n/a $31.9 $34.3 $36.6 $39.1 $41.7 $44.3 $46.7 $49.2 $51.5 $54.3 $57.0 $59.6 Deal Price $20.00 $20.25 $20.50 $20.75 $21.00 $21.25 $21.50 $21.75 $22.00 $22.25 $22.50 $22.75 $23.00 Assumed Investor Behavior Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Convert Total Convertible ($MM) $384.6 $387.1 $389.9 $392.7 $395.5 $398.2 $400.9 $403.5 $406.5 $409.5 $412.4 $415.4 $418.2 Assumed AIP as of 3/31/26 ($MM) $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 $322.4 Assumed Cap on Note Hedge Settlement ($MM) $62.2 $64.7 $67.5 $70.3 $73.1 $75.8 $78.5 $81.2 $84.1 $87.1 $90.1 $93.0 $95.9 This analysis is sensitive to input parameters and the valuation models used. Use of different models or input parameters could have materially different results. Confidential FOR DISCUSSION PURPOSES ONLY

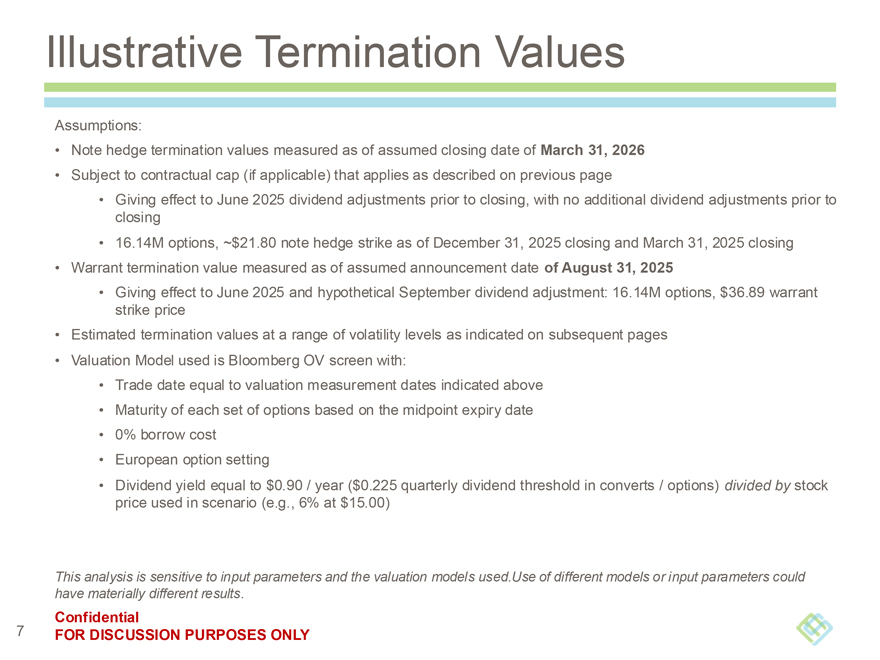

Illustrative Termination Values Assumptions: Note hedge termination values measured as of assumed closing date of March 31, 2026 Subject to contractual cap (if applicable) that applies as described on previous page Giving effect to June 2025 dividend adjustments prior to closing, with no additional dividend adjustments prior to closing 16.14M options, ~$21.80 note hedge strike as of December 31, 2025 closing and March 31, 2025 closing Warrant termination value measured as of assumed announcement date of August 31, 2025 Giving effect to June 2025 and hypothetical September dividend adjustment: 16.14M options, $36.89 warrant strike price Estimated termination values at a range of volatility levels as indicated on subsequent pages Valuation Model used is Bloomberg OV screen with: Trade date equal to valuation measurement dates indicated above Maturity of each set of options based on the midpoint expiry date 0% borrow cost European option setting Dividend yield equal to $0.90 / year ($0.225 quarterly dividend threshold in converts / options) divided by stock price used in scenario (e.g., 6% at $15.00) This analysis is sensitive to input parameters and the valuation models used.Use of different models or input parameters could have materially different results. Confidential FOR DISCUSSION PURPOSES ONLY

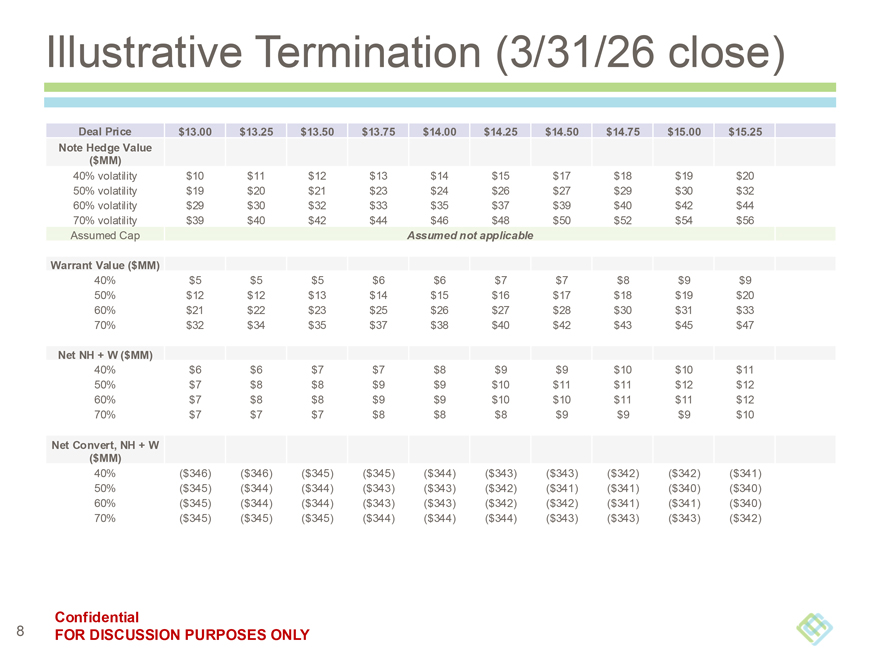

Illustrative Termination (3/31/26 close) Deal Price $13.00 $13.25 $13.50 $13.75 $14.00 $14.25 $14.50 $14.75 $15.00 $15.25 Note Hedge Value ($MM) 40% volatility $10 $11 $12 $13 $14 $15 $17 $18 $19 $20 50% volatility $19 $20 $21 $23 $24 $26 $27 $29 $30 $32 60% volatility $29 $30 $32 $33 $35 $37 $39 $40 $42 $44 70% volatility $39 $40 $42 $44 $46 $48 $50 $52 $54 $56 Assumed Cap Assumed not applicable Warrant Value ($MM) 40% $5 $5 $5 $6 $6 $7 $7 $8 $9 $9 50% $12 $12 $13 $14 $15 $16 $17 $18 $19 $20 60% $21 $22 $23 $25 $26 $27 $28 $30 $31 $33 70% $32 $34 $35 $37 $38 $40 $42 $43 $45 $47 Net NH + W ($MM) 40% $6 $6 $7 $7 $8 $9 $9 $10 $10 $11 50% $7 $8 $8 $9 $9 $10 $11 $11 $12 $12 60% $7 $8 $8 $9 $9 $10 $10 $11 $11 $12 70% $7 $7 $7 $8 $8 $8 $9 $9 $9 $10 Net Convert, NH + W ($MM) 40% ($346) ($346) ($345) ($345) ($344) ($343) ($343) ($342) ($342) ($341) 50% ($345) ($344) ($344) ($343) ($343) ($342) ($341) ($341) ($340) ($340) 60% ($345) ($344) ($344) ($343) ($343) ($342) ($342) ($341) ($341) ($340) 70% ($345) ($345) ($345) ($344) ($344) ($344) ($343) ($343) ($343) ($342) Confidential FOR DISCUSSION PURPOSES ONLY

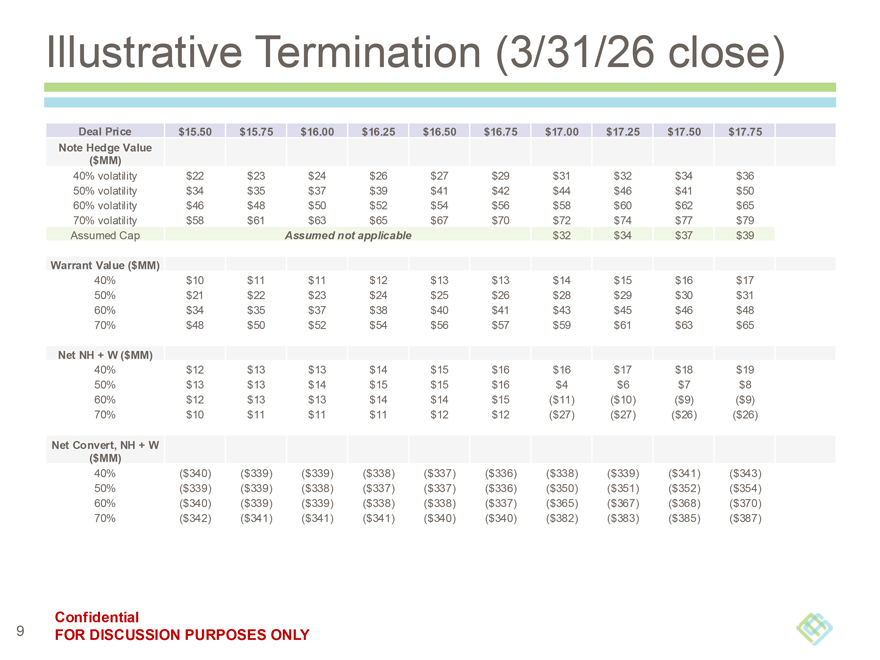

Illustrative Termination (3/31/26 close) Deal Price $15.50 $15.75 $16.00 $16.25 $16.50 $16.75 $17.00 $17.25 $17.50 $17.75 Note Hedge Value ($MM) 40% volatility $22 $23 $24 $26 $27 $29 $31 $32 $34 $36 50% volatility $34 $35 $37 $39 $41 $42 $44 $46 $41 $50 60% volatility $46 $48 $50 $52 $54 $56 $58 $60 $62 $65 70% volatility $58 $61 $63 $65 $67 $70 $72 $74 $77 $79 Assumed Cap Assumed not applicable $32 $34 $37 $39 Warrant Value ($MM) 40% $10 $11 $11 $12 $13 $13 $14 $15 $16 $17 50% $21 $22 $23 $24 $25 $26 $28 $29 $30 $31 60% $34 $35 $37 $38 $40 $41 $43 $45 $46 $48 70% $48 $50 $52 $54 $56 $57 $59 $61 $63 $65 Net NH + W ($MM) 40% $12 $13 $13 $14 $15 $16 $16 $17 $18 $19 50% $13 $13 $14 $15 $15 $16 $4 $6 $7 $8 60% $12 $13 $13 $14 $14 $15 ($11) ($10) ($9) ($9) 70% $10 $11 $11 $11 $12 $12 ($27) ($27) ($26) ($26) Net Convert, NH + W ($MM) 40% ($340) ($339) ($339) ($338) ($337) ($336) ($338) ($339) ($341) ($343) 50% ($339) ($339) ($338) ($337) ($337) ($336) ($350) ($351) ($352) ($354) 60% ($340) ($339) ($339) ($338) ($338) ($337) ($365) ($367) ($368) ($370) 70% ($342) ($341) ($341) ($341) ($340) ($340) ($382) ($383) ($385) ($387) Confidential FOR DISCUSSION PURPOSES ONLY

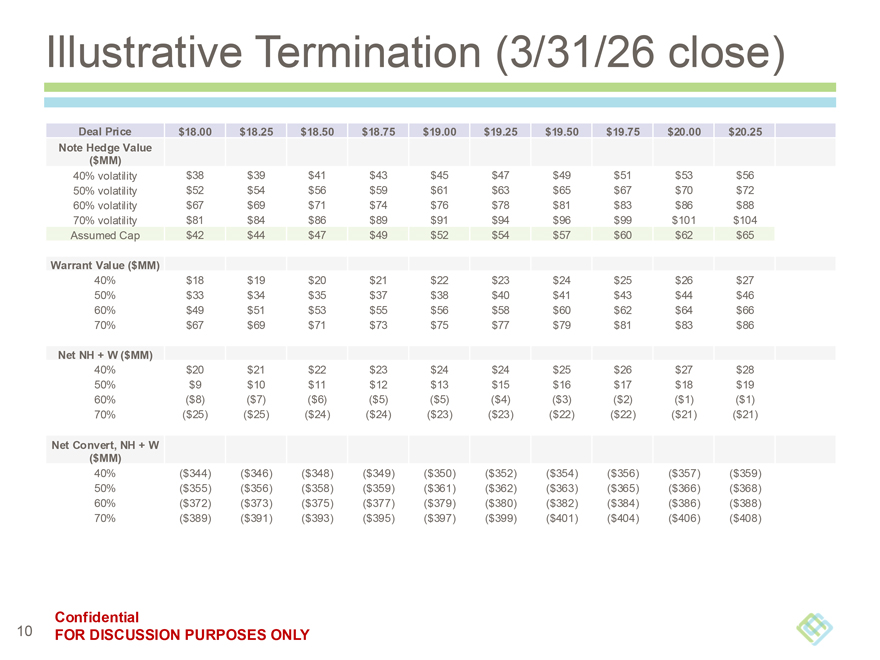

Illustrative Termination (3/31/26 close) Deal Price $18.00 $18.25 $18.50 $18.75 $19.00 $19.25 $19.50 $19.75 $20.00 $20.25 Note Hedge Value ($MM) 40% volatility $38 $39 $41 $43 $45 $47 $49 $51 $53 $56 50% volatility $52 $54 $56 $59 $61 $63 $65 $67 $70 $72 60% volatility $67 $69 $71 $74 $76 $78 $81 $83 $86 $88 70% volatility $81 $84 $86 $89 $91 $94 $96 $99 $101 $104 Assumed Cap $42 $44 $47 $49 $52 $54 $57 $60 $62 $65 Warrant Value ($MM) 40% $18 $19 $20 $21 $22 $23 $24 $25 $26 $27 50% $33 $34 $35 $37 $38 $40 $41 $43 $44 $46 60% $49 $51 $53 $55 $56 $58 $60 $62 $64 $66 70% $67 $69 $71 $73 $75 $77 $79 $81 $83 $86 Net NH + W ($MM) 40% $20 $21 $22 $23 $24 $24 $25 $26 $27 $28 50% $9 $10 $11 $12 $13 $15 $16 $17 $18 $19 60% ($8) ($7) ($6) ($5) ($5) ($4) ($3) ($2) ($1) ($1) 70% ($25) ($25) ($24) ($24) ($23) ($23) ($22) ($22) ($21) ($21) Net Convert, NH + W ($MM) 40% ($344) ($346) ($348) ($349) ($350) ($352) ($354) ($356) ($357) ($359) 50% ($355) ($356) ($358) ($359) ($361) ($362) ($363) ($365) ($366) ($368) 60% ($372) ($373) ($375) ($377) ($379) ($380) ($382) ($384) ($386) ($388) 70% ($389) ($391) ($393) ($395) ($397) ($399) ($401) ($404) ($406) ($408) Confidential FOR DISCUSSION PURPOSES ONLY

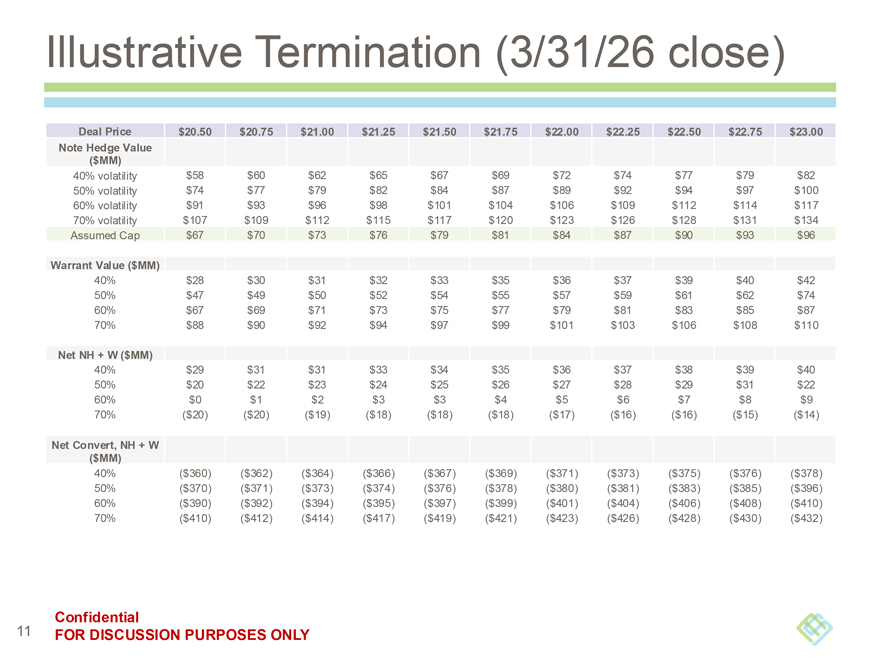

Illustrative Termination (3/31/26 close) Deal Price $20.50 $20.75 $21.00 $21.25 $21.50 $21.75 $22.00 $22.25 $22.50 $22.75 $23.00 Note Hedge Value ($MM) 40% volatility $58 $60 $62 $65 $67 $69 $72 $74 $77 $79 $82 50% volatility $74 $77 $79 $82 $84 $87 $89 $92 $94 $97 $100 60% volatility $91 $93 $96 $98 $101 $104 $106 $109 $112 $114 $117 70% volatility $107 $109 $112 $115 $117 $120 $123 $126 $128 $131 $134 Assumed Cap $67 $70 $73 $76 $79 $81 $84 $87 $90 $93 $96 Warrant Value ($MM) 40% $28 $30 $31 $32 $33 $35 $36 $37 $39 $40 $42 50% $47 $49 $50 $52 $54 $55 $57 $59 $61 $62 $74 60% $67 $69 $71 $73 $75 $77 $79 $81 $83 $85 $87 70% $88 $90 $92 $94 $97 $99 $101 $103 $106 $108 $110 Net NH + W ($MM) 40% $29 $31 $31 $33 $34 $35 $36 $37 $38 $39 $40 50% $20 $22 $23 $24 $25 $26 $27 $28 $29 $31 $22 60% $0 $1 $2 $3 $3 $4 $5 $6 $7 $8 $9 70% ($20) ($20) ($19) ($18) ($18) ($18) ($17) ($16) ($16) ($15) ($14) Net Convert, NH + W ($MM) 40% ($360) ($362) ($364) ($366) ($367) ($369) ($371) ($373) ($375) ($376) ($378) 50% ($370) ($371) ($373) ($374) ($376) ($378) ($380) ($381) ($383) ($385) ($396) 60% ($390) ($392) ($394) ($395) ($397) ($399) ($401) ($404) ($406) ($408) ($410) 70% ($410) ($412) ($414) ($417) ($419) ($421) ($423) ($426) ($428) ($430) ($432) Confidential FOR DISCUSSION PURPOSES ONLY

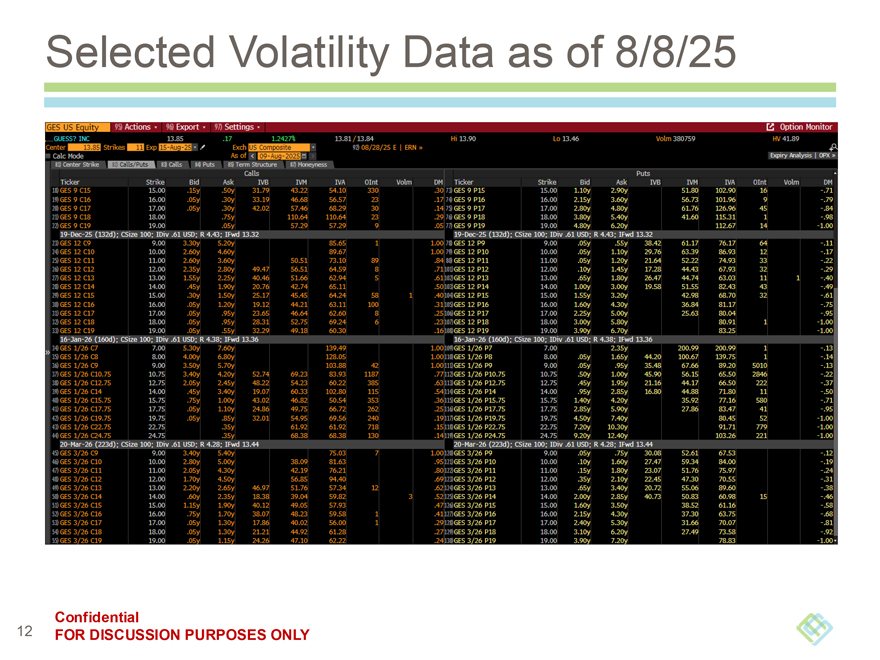

Selected Volatility Data as of 8/8/25 Confidential FOR DISCUSSION PURPOSES ONLY

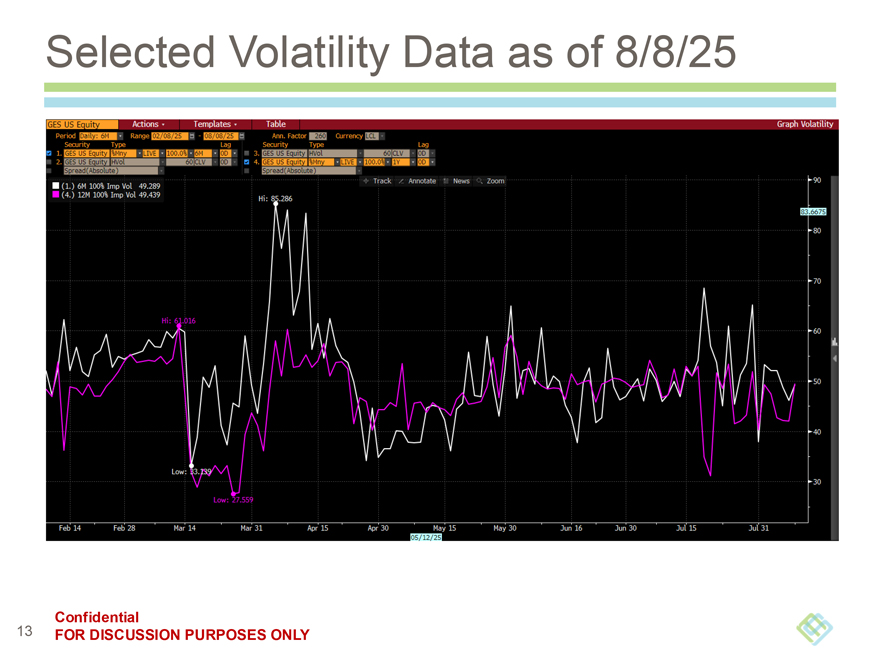

Selected Volatility Data as of 8/8/25 Confidential FOR DISCUSSION PURPOSES ONLY