Se pt em be r 2 02 5 WAVERLY SHORES VILLAGE – HOLLAND, MI Sun Communities, Inc. (NYSE: SUI) Investor Presentation

Cautionary Statement Regarding Forward-Looking Statements 2 This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc., referred to herein as “we,” “our,” “Sun,” and “the Company,” and from third-party sources indicated herein. Such third-party information has not been independently verified. Sun makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended (the "Securities Act"), and the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Company intends that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this document that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments, and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as "forecasts," "intend," "goal," "estimate," "expect," "project," "projections," "plans," "predicts," "potential," "seeks," "anticipates," "should," "could,“ "may," "will," "designed to," "foreseeable future," "believe," "scheduled," "guidance," "target," and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. These forward-looking statements reflect the Company's current views with respect to future events and financial performance, but involve known and unknown risks, uncertainties and other factors, both general and specific to the matters discussed in this document, some of which are beyond the Company's control. These risks, uncertainties and other factors may cause the Company's actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks described under "Risk Factors” contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2024, and in the Company's other filings with the Securities and Exchange Commission, from time to time, such risks, uncertainties and other factors include, but are not limited to: The Company's liquidity and refinancing demands; The Company's ability to obtain or refinance maturing debt; The Company's ability to maintain compliance with covenants contained in its debt facilities and its unsecured notes; Availability of capital; General volatility of the capital markets and the market price of shares of the Company's capital stock; Increases in interest rates and operating costs, including insurance premiums and real estate taxes; Difficulties in the Company's ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; The ability of the Company to complete the sale of the remaining Safe Harbor properties that are subject to receipt of third-party consents on a timely basis or at all; The ability of the Company to realize the anticipated benefits of the sale of Safe Harbor, including with respect to tax strategies, or at all; The Company's succession plan for its CEO, which could impact the execution of the Company's strategic plan; Competitive market forces; The ability of purchasers of manufactured homes to obtain financing; The level of repossessions of manufactured homes; The Company's ability to maintain effective internal control over financial reporting and disclosure controls and procedures; The Company's remediation plan and its ability to remediate the material weakness in its internal control over financial reporting; Expectations regarding the amount or frequency of impairment losses; Changes in general economic conditions, including inflation, deflation, energy costs, the real estate industry, the effects of tariffs or threats of tariffs, trade wars, immigration issues, supply chain disruptions, and the markets within which the Company operates; Changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar, Australian dollar, and pound sterling; The Company's ability to maintain its status as a REIT; Changes in real estate and zoning laws and regulations; The Company's ability to maintain rental rates and occupancy levels; Legislative or regulatory changes, including changes to laws governing the taxation of REITs; Outbreaks of disease and related restrictions on business operations; Risks related to natural disasters such as hurricanes, earthquakes, floods, droughts, and wildfires; and Litigation, judgments or settlements, including costs associated with prosecuting or defending claims and any adverse outcomes. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in the Company’s expectations or otherwise, except as required by law. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to the Company or persons acting on the Company’s behalf are qualified in their entirety by these cautionary statements. CAUTIONARY STATEMENT REGARDING GUIDANCE This presentation includes certain estimates and assumptions included in the Company’s financial, earnings and operational guidance, as presented in its earnings press release and supplemental operating and financial data dated July 30, 2025. These estimates and assumptions represent a range of possible outcomes and may differ materially from actual results. These estimates include contributions from all acquisitions, dispositions and capital markets activity completed through July 30, 2025, and the effect of the completion of the Company’s sale of subsidiaries owning 9 marina properties representing approximately $118 million of value (the “Delayed Consent Subsidiaries”), which were not part of the initial closing of the sale of Safe Harbor Marinas. These estimates exclude all other prospective acquisitions, dispositions and capital markets activity. These estimates and assumptions are forward-looking based on the Company’s assessment of economic and market conditions and the Company’s assumptions as of the date guidance was issued and are subject to the other risks outlined above under the caption Cautionary Statement Regarding Forward-Looking Statements.

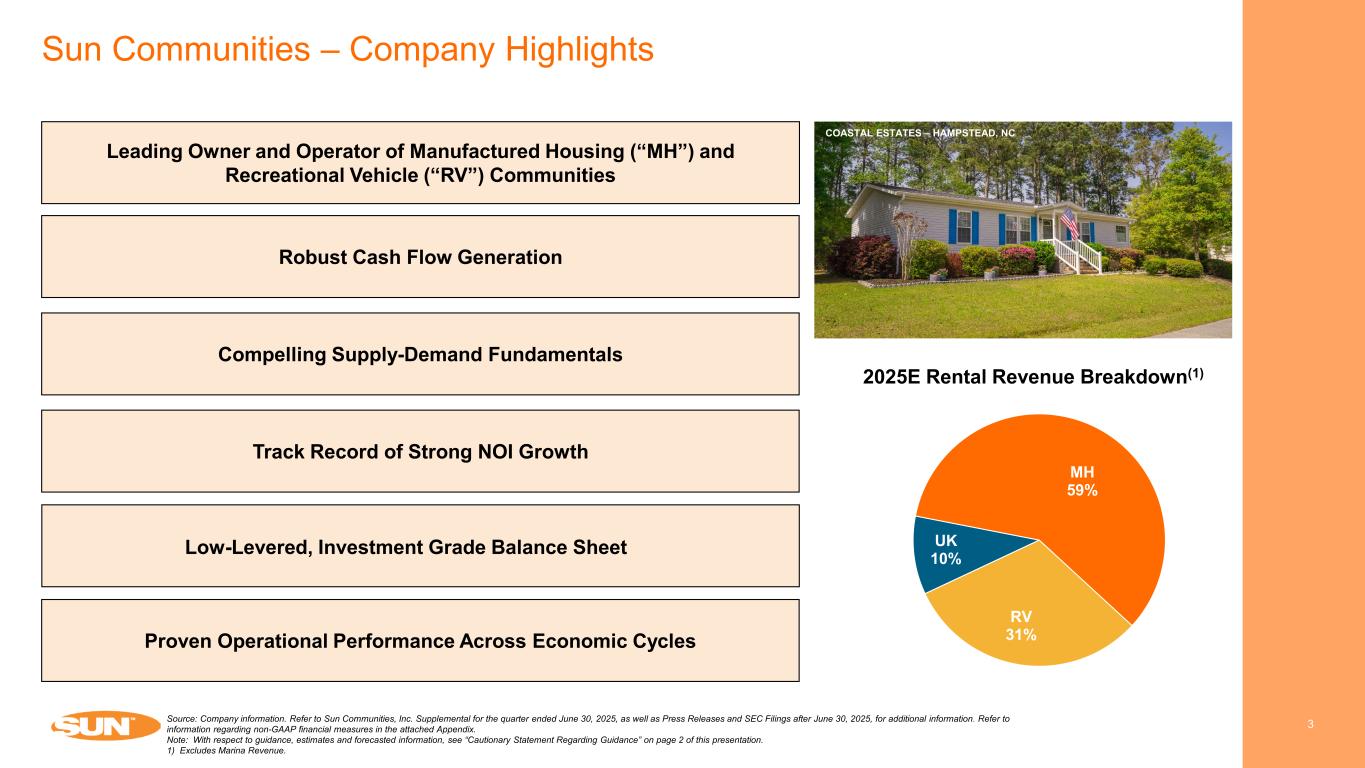

Sun Communities – Company Highlights 3Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. 1) Excludes Marina Revenue. Robust Cash Flow Generation Leading Owner and Operator of Manufactured Housing (“MH”) and Recreational Vehicle (“RV”) Communities Compelling Supply-Demand Fundamentals Track Record of Strong NOI Growth Low-Levered, Investment Grade Balance Sheet Proven Operational Performance Across Economic Cycles COASTAL ESTATES – HAMPSTEAD, NC 2025E Rental Revenue Breakdown(1) MH 59% RV 31% UK 10%

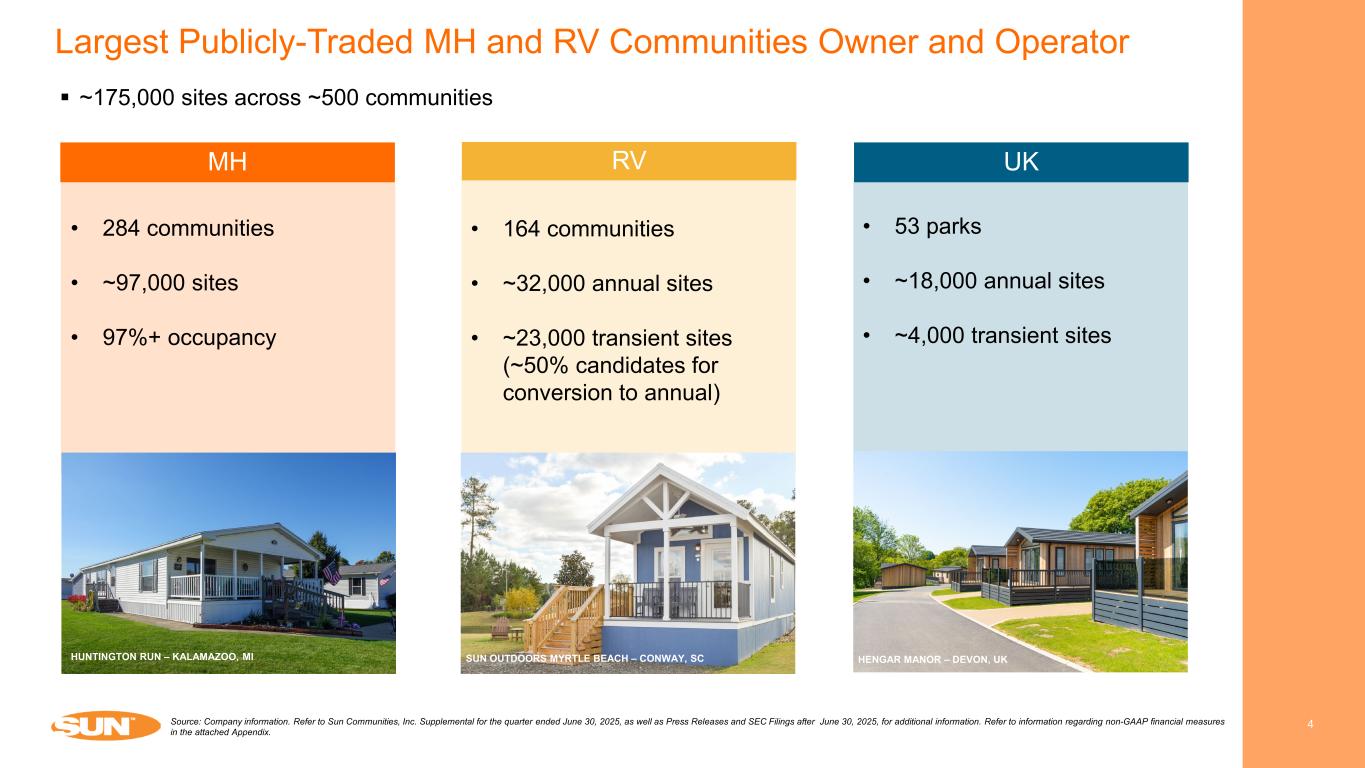

4 ~175,000 sites across ~500 communities Largest Publicly-Traded MH and RV Communities Owner and Operator Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. MH • 284 communities • ~97,000 sites • 97%+ occupancy • 53 parks • ~18,000 annual sites • ~4,000 transient sites RV • 164 communities • ~32,000 annual sites • ~23,000 transient sites (~50% candidates for conversion to annual) HUNTINGTON RUN – KALAMAZOO, MI UK HENGAR MANOR – DEVON, UKSUN OUTDOORS MYRTLE BEACH – CONWAY, SC

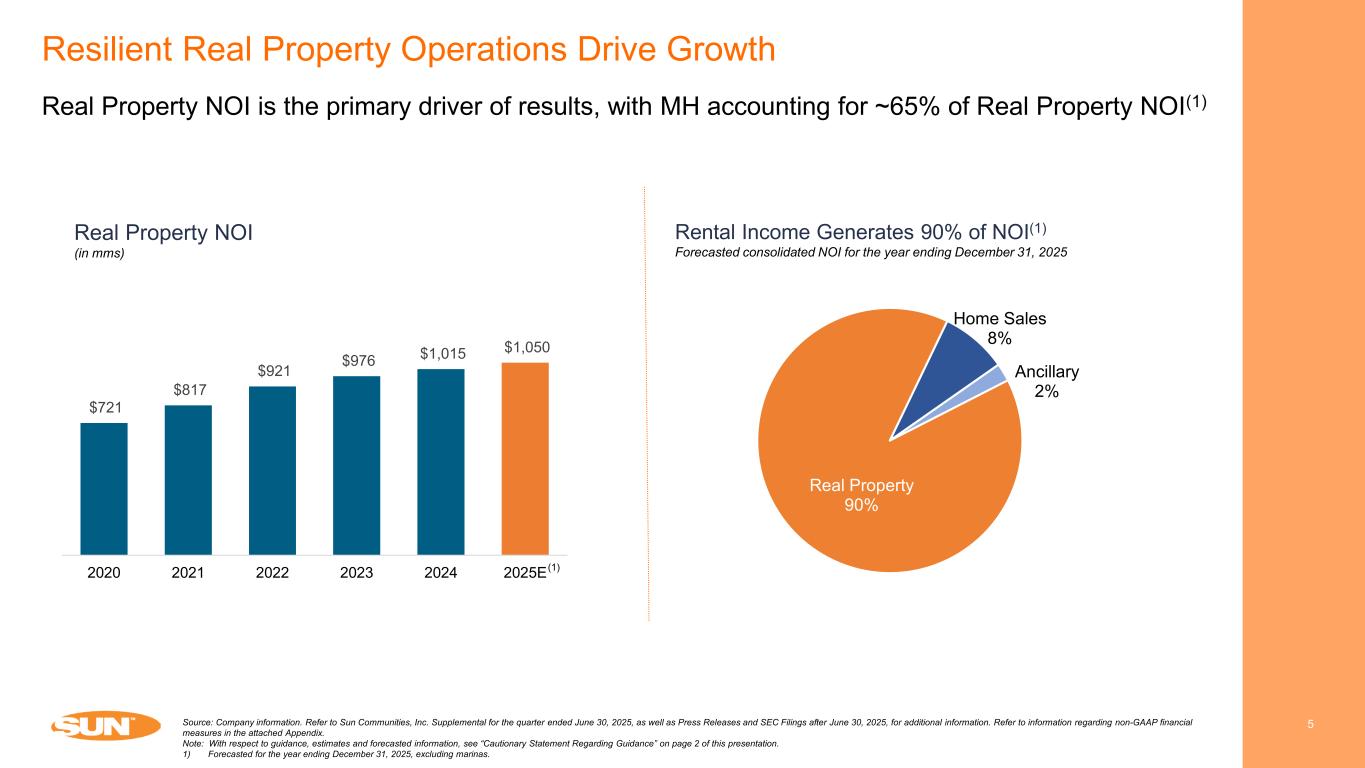

$721 $817 $921 $976 $1,015 $1,050 2020 2021 2022 2023 2024 2025E Resilient Real Property Operations Drive Growth 5 Real Property NOI is the primary driver of results, with MH accounting for ~65% of Real Property NOI(1) Real Property NOI (in mms) Rental Income Generates 90% of NOI(1) Forecasted consolidated NOI for the year ending December 31, 2025 Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. 1) Forecasted for the year ending December 31, 2025, excluding marinas. (1) Real Property 90% Home Sales 8% Ancillary 2%

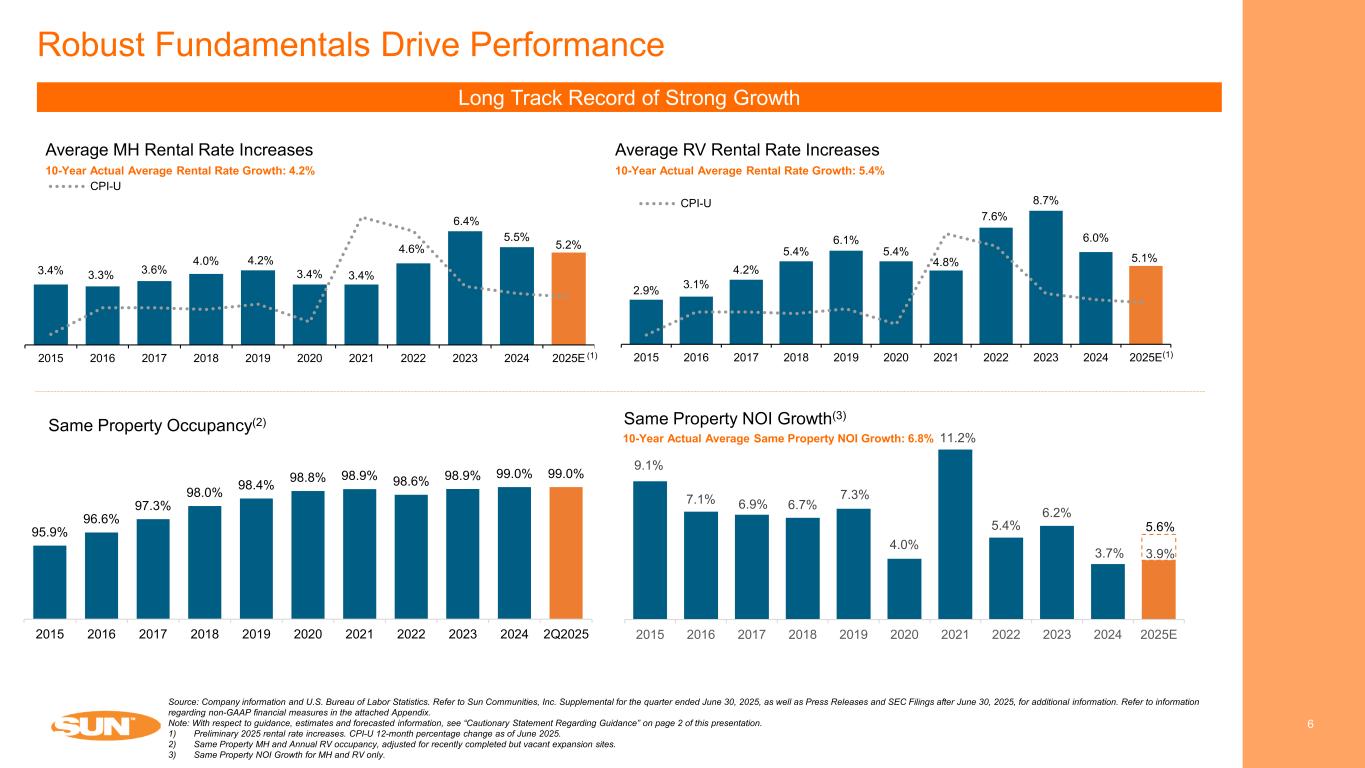

9.1% 7.1% 6.9% 6.7% 7.3% 4.0% 11.2% 5.4% 6.2% 3.7% 3.9% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E 2.9% 3.1% 4.2% 5.4% 6.1% 5.4% 4.8% 7.6% 8.7% 6.0% 5.1% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E CPI-U Robust Fundamentals Drive Performance 6 Long Track Record of Strong Growth Average MH Rental Rate Increases Average RV Rental Rate Increases Same Property Occupancy(2) Same Property NOI Growth(3) 10-Year Actual Average Same Property NOI Growth: 6.8% 10-Year Actual Average Rental Rate Growth: 4.2% 10-Year Actual Average Rental Rate Growth: 5.4% Source: Company information and U.S. Bureau of Labor Statistics. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. 1) Preliminary 2025 rental rate increases. CPI-U 12-month percentage change as of June 2025. 2) Same Property MH and Annual RV occupancy, adjusted for recently completed but vacant expansion sites. 3) Same Property NOI Growth for MH and RV only. 5.6% (1) (1) 95.9% 96.6% 97.3% 98.0% 98.4% 98.8% 98.9% 98.6% 98.9% 99.0% 99.0% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2Q2025 3.4% 3.3% 3.6% 4.0% 4.2% 3.4% 3.4% 4.6% 6.4% 5.5% 5.2% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025E CPI-U

2Q Performance and Business Update 7Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. DEEP RUN – CREAM RIDGE, NJ • Safe Harbor Marinas Sale: Closed on all final delayed consent properties on August 29 • Strong 2Q25 Results: Core FFO per share of $1.76; Same Property NOI +4.9% in North America • Updated Guidance: 2025 Same Property NOI growth of 3.9% - 5.6% in North America; FY25 Core FFO guidance of $6.51 to $6.67 per share • New CEO Announced: Charles Young appointed CEO and Board member effective October 1, 2025; Gary Shiffman to transition to Non-Executive Chairman • Credit Rating Upgrades: S&P upgraded rating to BBB+ and Moody’s upgraded rating to Baa2 • Continued Non-Strategic Asset Dispositions: Closed on sale of California land parcel for $18mm on September 2 • Thoughtful, Strategic Use of Proceeds from Safe Harbor Sale: • Repaid ~$3.3 billion of debt, inclusive of prepayment costs • Executing on capital return strategy via over $930 million of stock repurchases and distributions since May 1: o Repurchased ~$400mm of stock through August 31 o Paid one-time special cash distribution of ~$520mm ($4.00/share) o Increased quarterly dividend by ~10%+, representing ~$50mm of additional annual shareholder capital returns • Opportunistically acquired freehold interests in 22 UK ground leased properties for ~$199mm • Targeting reinvestment in strategic growth opportunities o Utilizing 1031 exchange escrow accounts to fund potential future acquisitions on a tax efficient basis. • Balance Sheet: Substantial de-leveraging and fully eliminated floating rate debt exposure.

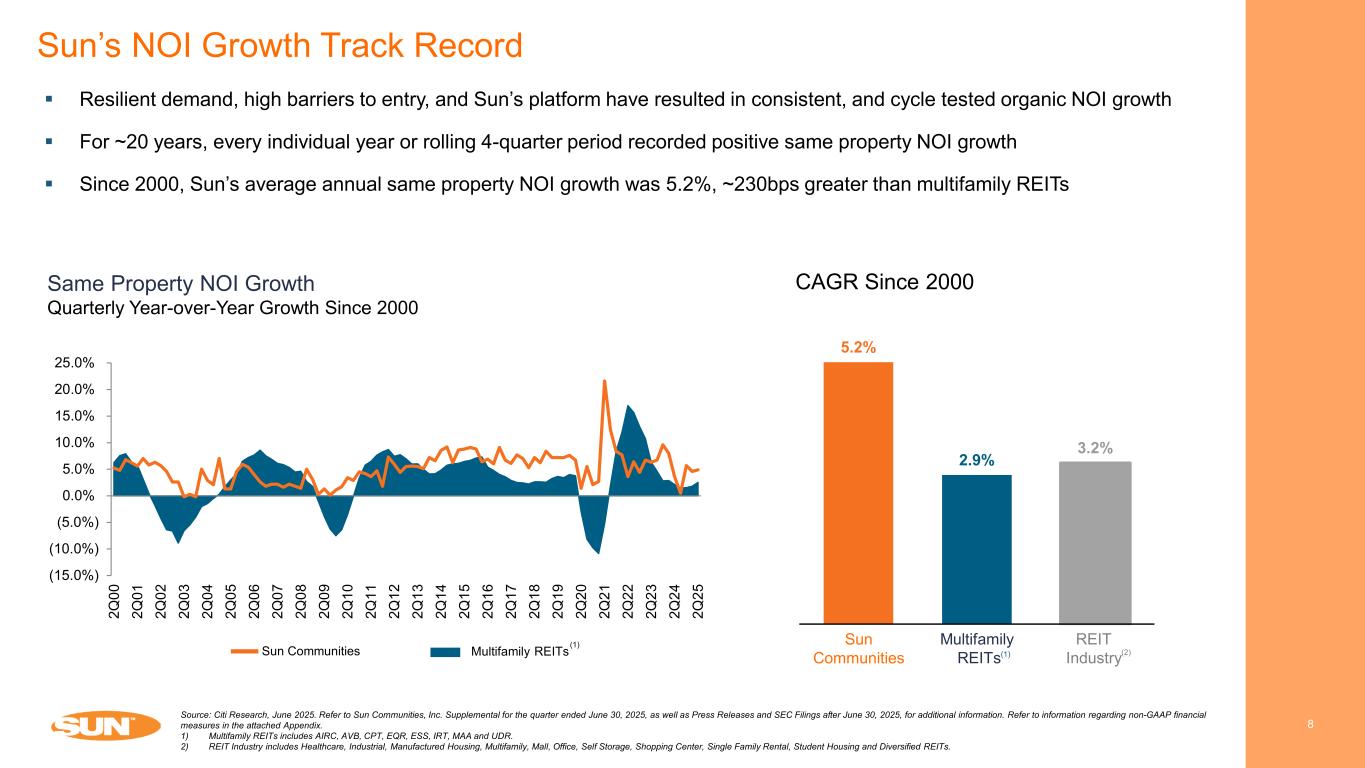

Sun’s NOI Growth Track Record 8 Multifamily REITsSun Communities Resilient demand, high barriers to entry, and Sun’s platform have resulted in consistent, and cycle tested organic NOI growth For ~20 years, every individual year or rolling 4-quarter period recorded positive same property NOI growth Since 2000, Sun’s average annual same property NOI growth was 5.2%, ~230bps greater than multifamily REITs Same Property NOI Growth Quarterly Year-over-Year Growth Since 2000 Source: Citi Research, June 2025. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1) Multifamily REITs includes AIRC, AVB, CPT, EQR, ESS, IRT, MAA and UDR. 2) REIT Industry includes Healthcare, Industrial, Manufactured Housing, Multifamily, Mall, Office, Self Storage, Shopping Center, Single Family Rental, Student Housing and Diversified REITs. (1) CAGR Since 2000 Sun Communities Multifamily REITs REIT Industry(1) (2) 5.2% 2.9% 3.2% (15.0%) (10.0%) (5.0%) 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2Q 00 2Q 01 2Q 02 2Q 03 2Q 04 2Q 05 2Q 06 2Q 07 2Q 08 2Q 09 2Q 10 2Q 11 2Q 12 2Q 13 2Q 14 2Q 15 2Q 16 2Q 17 2Q 18 2Q 19 2Q 20 2Q 21 2Q 22 2Q 23 2Q 24 2Q 25

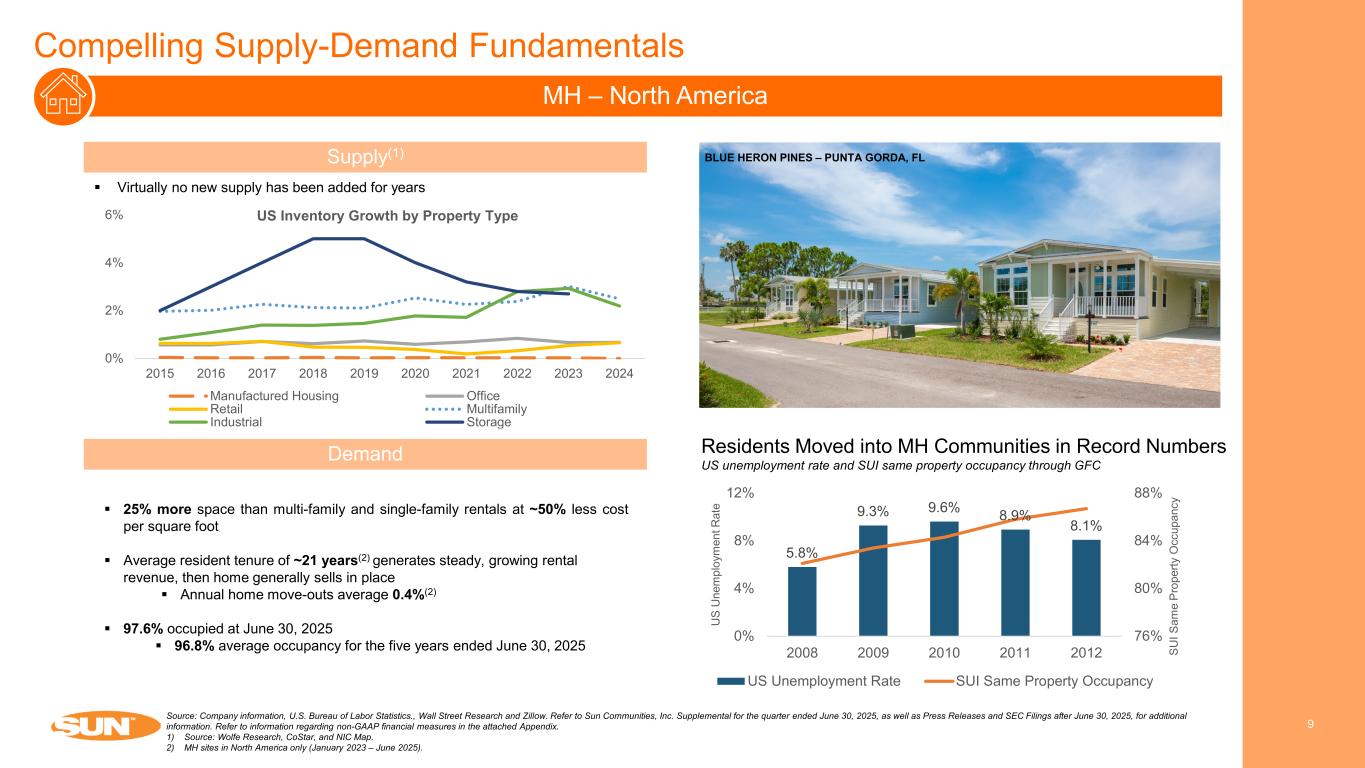

Compelling Supply-Demand Fundamentals 9 MH – North America Source: Company information, U.S. Bureau of Labor Statistics., Wall Street Research and Zillow. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1) Source: Wolfe Research, CoStar, and NIC Map. 2) MH sites in North America only (January 2023 – June 2025). Virtually no new supply has been added for years 25% more space than multi-family and single-family rentals at ~50% less cost per square foot Average resident tenure of ~21 years(2) generates steady, growing rental revenue, then home generally sells in place Annual home move-outs average 0.4%(2) 97.6% occupied at June 30, 2025 96.8% average occupancy for the five years ended June 30, 2025 Demand Supply(1) Residents Moved into MH Communities in Record Numbers US unemployment rate and SUI same property occupancy through GFC BLUE HERON PINES – PUNTA GORDA, FL 5.8% 9.3% 9.6% 8.9% 8.1% 76% 80% 84% 88% 0% 4% 8% 12% 2008 2009 2010 2011 2012 SU I S am e Pr op er ty O cc up an cy U S U ne m pl oy m en t R at e US Unemployment Rate SUI Same Property Occupancy 0% 2% 4% 6% 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 US Inventory Growth by Property Type Manufactured Housing Office Retail Multifamily Industrial Storage

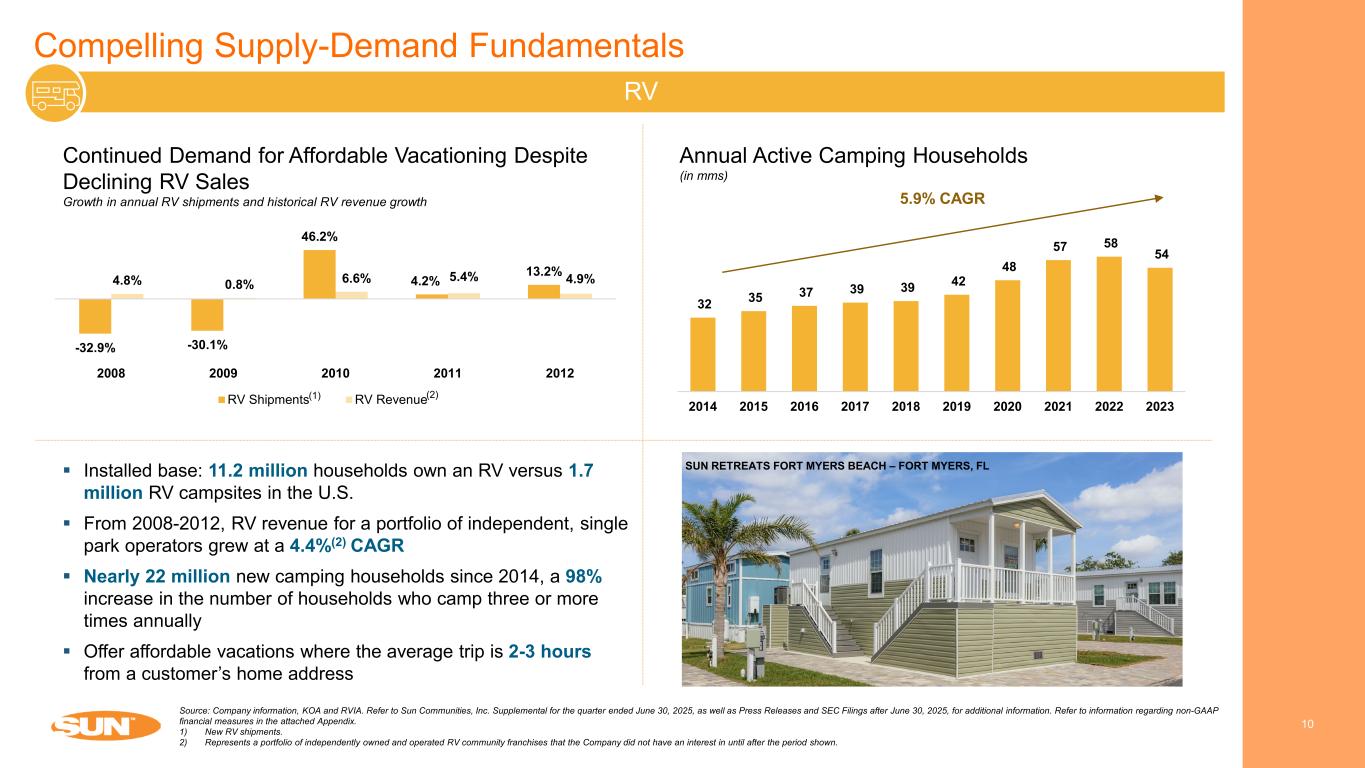

Compelling Supply-Demand Fundamentals 10 RV Continued Demand for Affordable Vacationing Despite Declining RV Sales Growth in annual RV shipments and historical RV revenue growth Installed base: 11.2 million households own an RV versus 1.7 million RV campsites in the U.S. From 2008-2012, RV revenue for a portfolio of independent, single park operators grew at a 4.4%(2) CAGR Nearly 22 million new camping households since 2014, a 98% increase in the number of households who camp three or more times annually Offer affordable vacations where the average trip is 2-3 hours from a customer’s home address Source: Company information, KOA and RVIA. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1) New RV shipments. 2) Represents a portfolio of independently owned and operated RV community franchises that the Company did not have an interest in until after the period shown. -32.9% -30.1% 46.2% 4.2% 13.2%4.8% 0.8% 6.6% 5.4% 4.9% 2008 2009 2010 2011 2012 RV Shipments RV Revenue(2) Annual Active Camping Households (in mms) 5.9% CAGR (1) 32 35 37 39 39 42 48 57 58 54 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 SUN RETREATS FORT MYERS BEACH – FORT MYERS, FL

Compelling Supply-Demand Fundamentals 11 UK Source: Company information, Wall Street Research and Zillow. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. Strategic goal of increasing real property NOI contribution Strong historical and expected income growth 10-year average rental rate increase of 5.2% Expecting 3.7% rental rate increase in 2025 Home Sales NOI: Resident turnover in communities is largest driver of home sales volume (~60%) Upgrade existing residents (~20%) Select communities expansions (~10%) Transient-to-annual conversions (~10%) Irreplaceable coastal ‘destination’ locations close to London and other major cities Numerous barriers to entry including strict regulations and scarcity of land Brexit and other macroeconomic structural factors create demand for domestic vacationing throughout the UK Majority of parks are owner-occupied on 20+ year licenses subject to annual rent increases Average resident tenure 7 - 8 years Supply & DemandBusiness Model (1) STOWFORD FARM MEADOWS – DEVON, UK

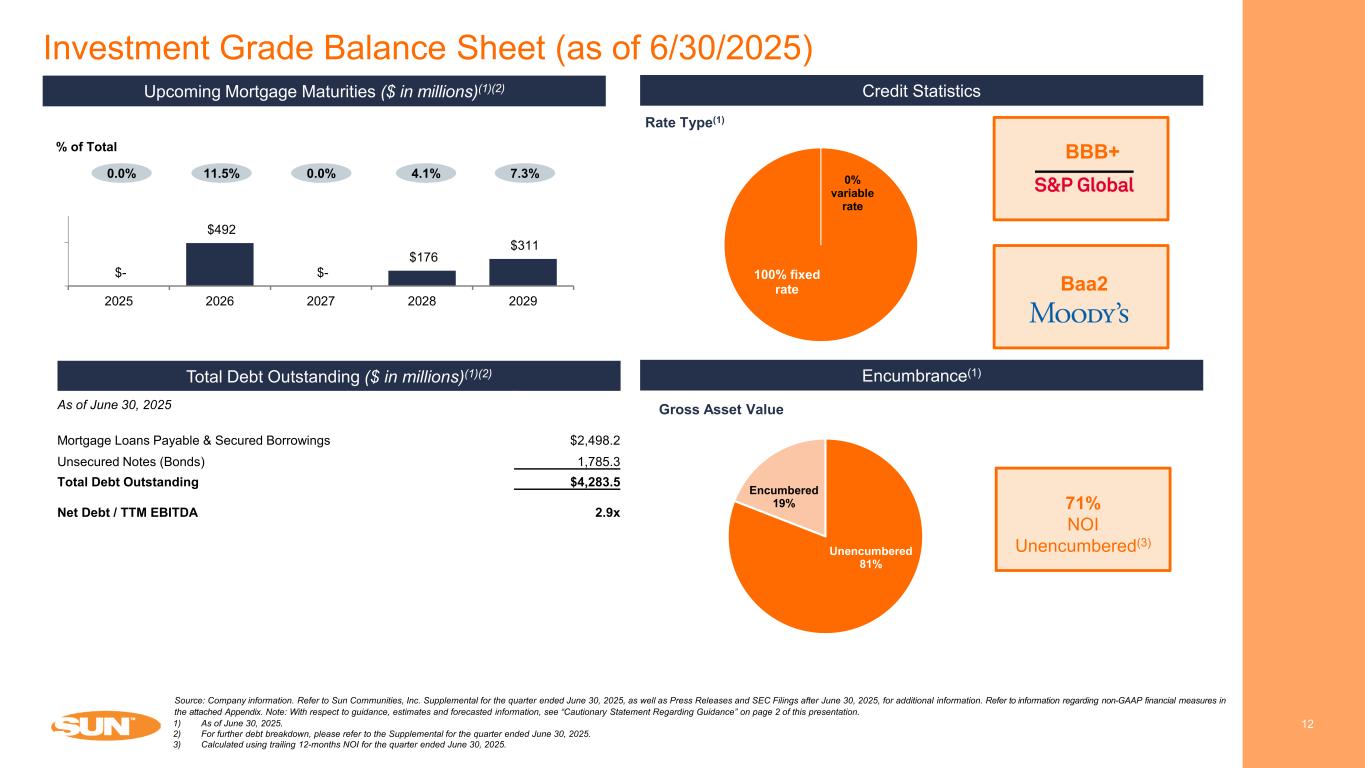

Unencumbered 81% Encumbered 19% Investment Grade Balance Sheet (as of 6/30/2025) 12 100% fixed rate 0% variable rate Credit Statistics Rate Type(1) Upcoming Mortgage Maturities ($ in millions)(1)(2) 0.0% 11.5% 0.0% 4.1% % of Total Encumbrance(1) Gross Asset Value 71% NOI Unencumbered(3) Total Debt Outstanding ($ in millions)(1)(2) $- $492 $- $176 $311 2025 2026 2027 2028 2029 As of June 30, 2025 Mortgage Loans Payable & Secured Borrowings $2,498.2 Unsecured Notes (Bonds) 1,785.3 Total Debt Outstanding $4,283.5 Net Debt / TTM EBITDA 2.9x BBB+ Baa2 7.3% Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. Note: With respect to guidance, estimates and forecasted information, see “Cautionary Statement Regarding Guidance” on page 2 of this presentation. 1) As of June 30, 2025. 2) For further debt breakdown, please refer to the Supplemental for the quarter ended June 30, 2025. 3) Calculated using trailing 12-months NOI for the quarter ended June 30, 2025.

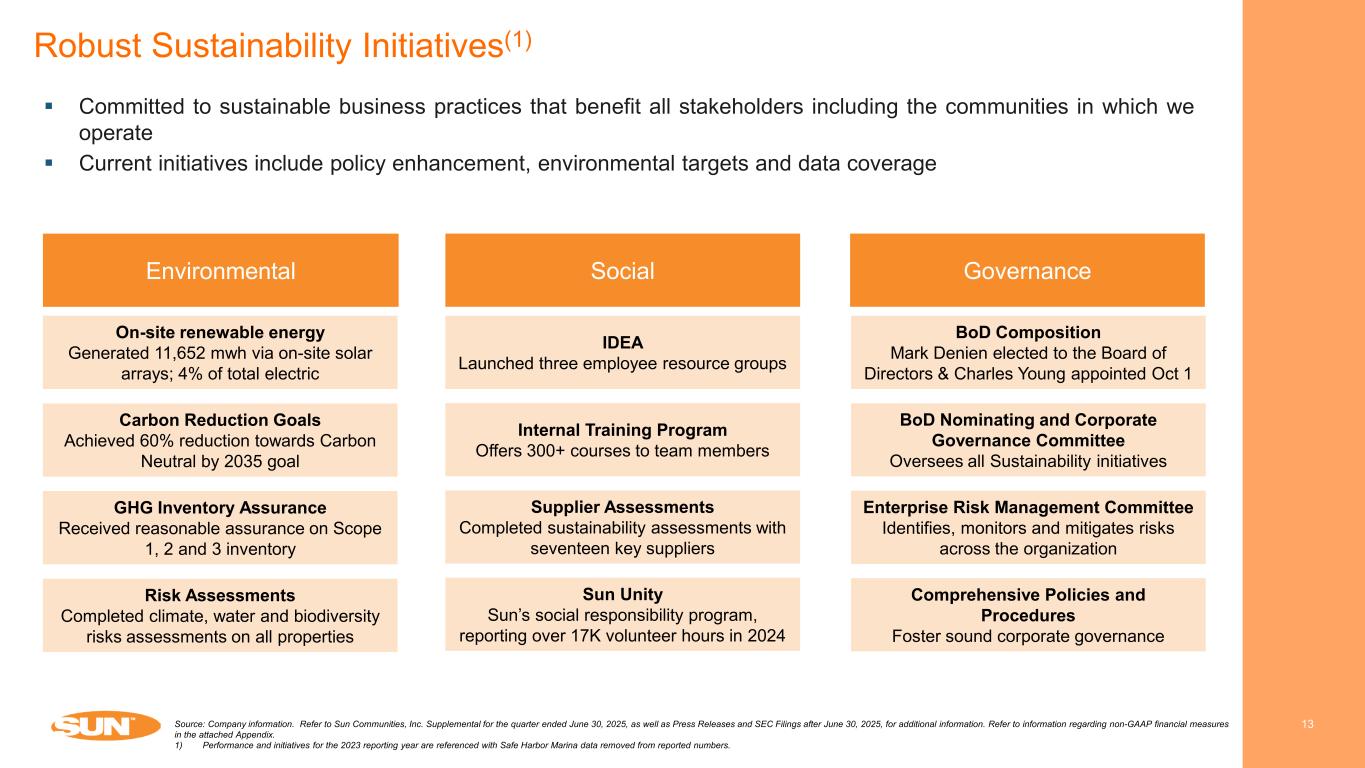

Robust Sustainability Initiatives(1) 13 Environmental Committed to sustainable business practices that benefit all stakeholders including the communities in which we operate Current initiatives include policy enhancement, environmental targets and data coverage Social Internal Training Program Offers 300+ courses to team members IDEA Launched three employee resource groups Governance BoD Composition Mark Denien elected to the Board of Directors & Charles Young appointed Oct 1 Enterprise Risk Management Committee Identifies, monitors and mitigates risks across the organization Supplier Assessments Completed sustainability assessments with seventeen key suppliers BoD Nominating and Corporate Governance Committee Oversees all Sustainability initiatives Sun Unity Sun’s social responsibility program, reporting over 17K volunteer hours in 2024 Comprehensive Policies and Procedures Foster sound corporate governance Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1) Performance and initiatives for the 2023 reporting year are referenced with Safe Harbor Marina data removed from reported numbers. On-site renewable energy Generated 11,652 mwh via on-site solar arrays; 4% of total electric Carbon Reduction Goals Achieved 60% reduction towards Carbon Neutral by 2035 goal GHG Inventory Assurance Received reasonable assurance on Scope 1, 2 and 3 inventory Risk Assessments Completed climate, water and biodiversity risks assessments on all properties

Appendix 14MALVERN VIEW – HEREFORDSHIRE, UK

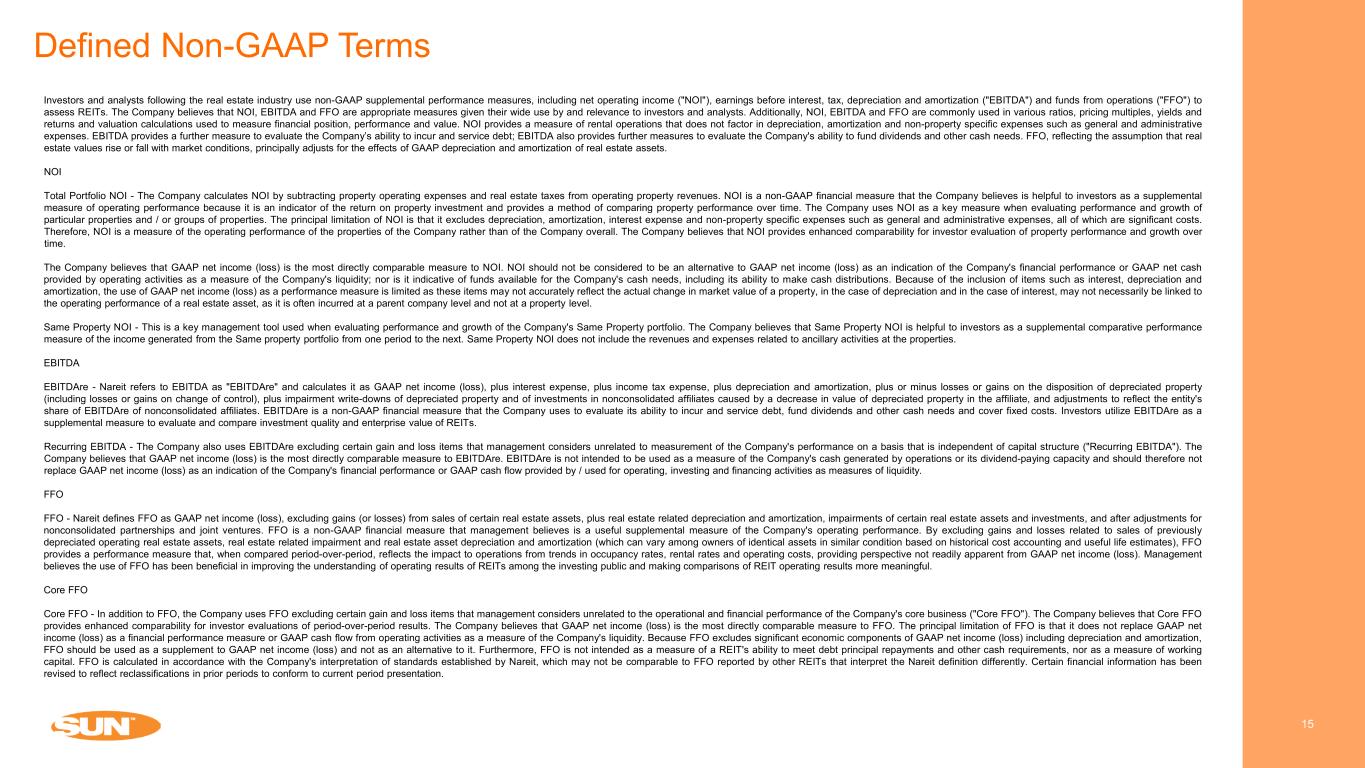

Defined Non-GAAP Terms 15 Investors and analysts following the real estate industry use non-GAAP supplemental performance measures, including net operating income ("NOI"), earnings before interest, tax, depreciation and amortization ("EBITDA") and funds from operations ("FFO") to assess REITs. The Company believes that NOI, EBITDA and FFO are appropriate measures given their wide use by and relevance to investors and analysts. Additionally, NOI, EBITDA and FFO are commonly used in various ratios, pricing multiples, yields and returns and valuation calculations used to measure financial position, performance and value. NOI provides a measure of rental operations that does not factor in depreciation, amortization and non-property specific expenses such as general and administrative expenses. EBITDA provides a further measure to evaluate the Company’s ability to incur and service debt; EBITDA also provides further measures to evaluate the Company's ability to fund dividends and other cash needs. FFO, reflecting the assumption that real estate values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation and amortization of real estate assets. NOI Total Portfolio NOI - The Company calculates NOI by subtracting property operating expenses and real estate taxes from operating property revenues. NOI is a non-GAAP financial measure that the Company believes is helpful to investors as a supplemental measure of operating performance because it is an indicator of the return on property investment and provides a method of comparing property performance over time. The Company uses NOI as a key measure when evaluating performance and growth of particular properties and / or groups of properties. The principal limitation of NOI is that it excludes depreciation, amortization, interest expense and non-property specific expenses such as general and administrative expenses, all of which are significant costs. Therefore, NOI is a measure of the operating performance of the properties of the Company rather than of the Company overall. The Company believes that NOI provides enhanced comparability for investor evaluation of property performance and growth over time. The Company believes that GAAP net income (loss) is the most directly comparable measure to NOI. NOI should not be considered to be an alternative to GAAP net income (loss) as an indication of the Company's financial performance or GAAP net cash provided by operating activities as a measure of the Company's liquidity; nor is it indicative of funds available for the Company's cash needs, including its ability to make cash distributions. Because of the inclusion of items such as interest, depreciation and amortization, the use of GAAP net income (loss) as a performance measure is limited as these items may not accurately reflect the actual change in market value of a property, in the case of depreciation and in the case of interest, may not necessarily be linked to the operating performance of a real estate asset, as it is often incurred at a parent company level and not at a property level. Same Property NOI - This is a key management tool used when evaluating performance and growth of the Company's Same Property portfolio. The Company believes that Same Property NOI is helpful to investors as a supplemental comparative performance measure of the income generated from the Same property portfolio from one period to the next. Same Property NOI does not include the revenues and expenses related to ancillary activities at the properties. EBITDA EBITDAre - Nareit refers to EBITDA as "EBITDAre" and calculates it as GAAP net income (loss), plus interest expense, plus income tax expense, plus depreciation and amortization, plus or minus losses or gains on the disposition of depreciated property (including losses or gains on change of control), plus impairment write-downs of depreciated property and of investments in nonconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, and adjustments to reflect the entity's share of EBITDAre of nonconsolidated affiliates. EBITDAre is a non-GAAP financial measure that the Company uses to evaluate its ability to incur and service debt, fund dividends and other cash needs and cover fixed costs. Investors utilize EBITDAre as a supplemental measure to evaluate and compare investment quality and enterprise value of REITs. Recurring EBITDA - The Company also uses EBITDAre excluding certain gain and loss items that management considers unrelated to measurement of the Company's performance on a basis that is independent of capital structure ("Recurring EBITDA"). The Company believes that GAAP net income (loss) is the most directly comparable measure to EBITDAre. EBITDAre is not intended to be used as a measure of the Company's cash generated by operations or its dividend-paying capacity and should therefore not replace GAAP net income (loss) as an indication of the Company's financial performance or GAAP cash flow provided by / used for operating, investing and financing activities as measures of liquidity. FFO FFO - Nareit defines FFO as GAAP net income (loss), excluding gains (or losses) from sales of certain real estate assets, plus real estate related depreciation and amortization, impairments of certain real estate assets and investments, and after adjustments for nonconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure that management believes is a useful supplemental measure of the Company's operating performance. By excluding gains and losses related to sales of previously depreciated operating real estate assets, real estate related impairment and real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates), FFO provides a performance measure that, when compared period-over-period, reflects the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not readily apparent from GAAP net income (loss). Management believes the use of FFO has been beneficial in improving the understanding of operating results of REITs among the investing public and making comparisons of REIT operating results more meaningful. Core FFO Core FFO - In addition to FFO, the Company uses FFO excluding certain gain and loss items that management considers unrelated to the operational and financial performance of the Company's core business ("Core FFO"). The Company believes that Core FFO provides enhanced comparability for investor evaluations of period-over-period results. The Company believes that GAAP net income (loss) is the most directly comparable measure to FFO. The principal limitation of FFO is that it does not replace GAAP net income (loss) as a financial performance measure or GAAP cash flow from operating activities as a measure of the Company's liquidity. Because FFO excludes significant economic components of GAAP net income (loss) including depreciation and amortization, FFO should be used as a supplement to GAAP net income (loss) and not as an alternative to it. Furthermore, FFO is not intended as a measure of a REIT's ability to meet debt principal repayments and other cash requirements, nor as a measure of working capital. FFO is calculated in accordance with the Company's interpretation of standards established by Nareit, which may not be comparable to FFO reported by other REITs that interpret the Nareit definition differently. Certain financial information has been revised to reflect reclassifications in prior periods to conform to current period presentation.

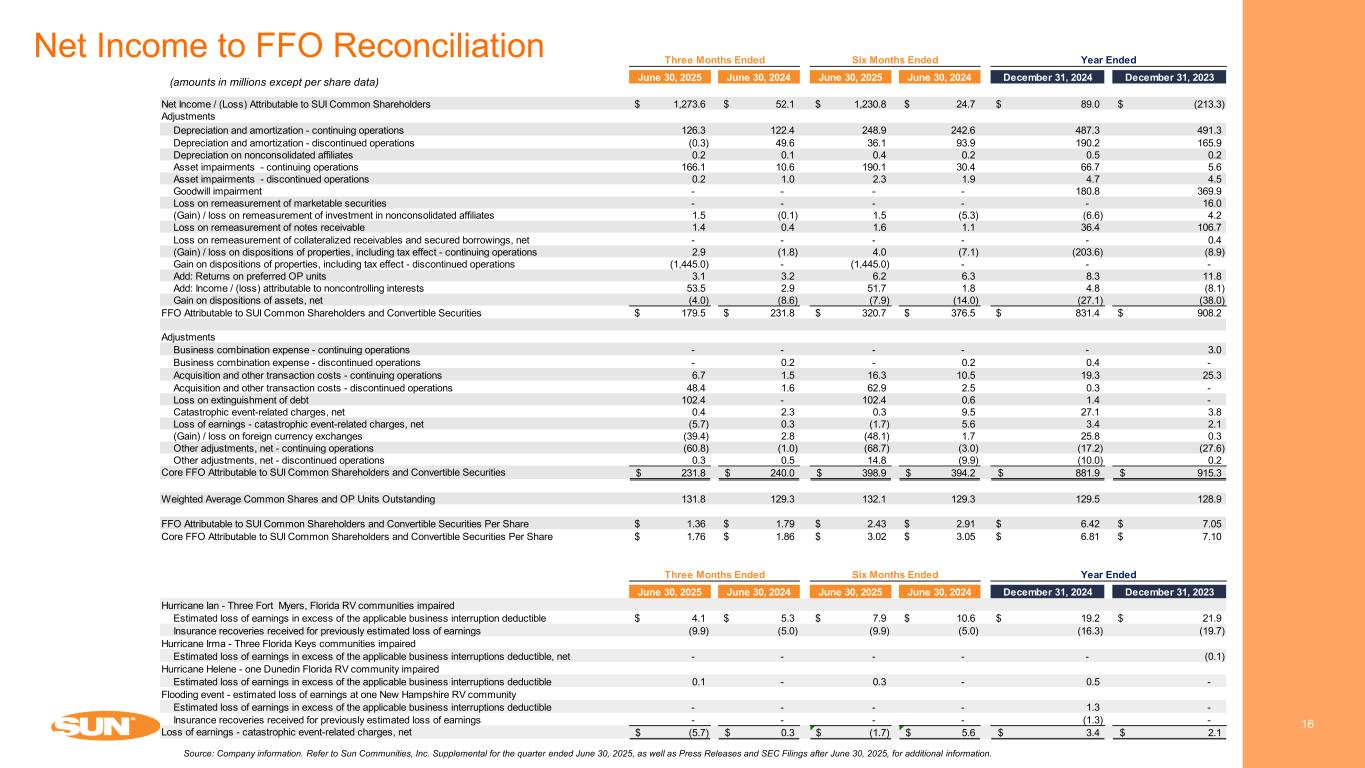

June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 December 31, 2024 December 31, 2023 Net Income / (Loss) Attributable to SUI Common Shareholders 1,273.6$ 52.1$ 1,230.8$ 24.7$ 89.0$ (213.3)$ Adjustments Depreciation and amortization - continuing operations 126.3 122.4 248.9 242.6 487.3 491.3 Depreciation and amortization - discontinued operations (0.3) 49.6 36.1 93.9 190.2 165.9 Depreciation on nonconsolidated affiliates 0.2 0.1 0.4 0.2 0.5 0.2 Asset impairments - continuing operations 166.1 10.6 190.1 30.4 66.7 5.6 Asset impairments - discontinued operations 0.2 1.0 2.3 1.9 4.7 4.5 Goodwill impairment - - - - 180.8 369.9 Loss on remeasurement of marketable securities - - - - - 16.0 (Gain) / loss on remeasurement of investment in nonconsolidated affiliates 1.5 (0.1) 1.5 (5.3) (6.6) 4.2 Loss on remeasurement of notes receivable 1.4 0.4 1.6 1.1 36.4 106.7 Loss on remeasurement of collateralized receivables and secured borrowings, net - - - - - 0.4 (Gain) / loss on dispositions of properties, including tax effect - continuing operations 2.9 (1.8) 4.0 (7.1) (203.6) (8.9) Gain on dispositions of properties, including tax effect - discontinued operations (1,445.0) - (1,445.0) - - - Add: Returns on preferred OP units 3.1 3.2 6.2 6.3 8.3 11.8 Add: Income / (loss) attributable to noncontrolling interests 53.5 2.9 51.7 1.8 4.8 (8.1) Gain on dispositions of assets, net (4.0) (8.6) (7.9) (14.0) (27.1) (38.0) FFO Attributable to SUI Common Shareholders and Convertible Securities 179.5$ 231.8$ 320.7$ 376.5$ 831.4$ 908.2$ Adjustments Business combination expense - continuing operations - - - - - 3.0 Business combination expense - discontinued operations - 0.2 - 0.2 0.4 - Acquisition and other transaction costs - continuing operations 6.7 1.5 16.3 10.5 19.3 25.3 Acquisition and other transaction costs - discontinued operations 48.4 1.6 62.9 2.5 0.3 - Loss on extinguishment of debt 102.4 - 102.4 0.6 1.4 - Catastrophic event-related charges, net 0.4 2.3 0.3 9.5 27.1 3.8 Loss of earnings - catastrophic event-related charges, net (5.7) 0.3 (1.7) 5.6 3.4 2.1 (Gain) / loss on foreign currency exchanges (39.4) 2.8 (48.1) 1.7 25.8 0.3 Other adjustments, net - continuing operations (60.8) (1.0) (68.7) (3.0) (17.2) (27.6) Other adjustments, net - discontinued operations 0.3 0.5 14.8 (9.9) (10.0) 0.2 Core FFO Attributable to SUI Common Shareholders and Convertible Securities 231.8$ 240.0$ 398.9$ 394.2$ 881.9$ 915.3$ Weighted Average Common Shares and OP Units Outstanding 131.8 129.3 132.1 129.3 129.5 128.9 FFO Attributable to SUI Common Shareholders and Convertible Securities Per Share 1.36$ 1.79$ 2.43$ 2.91$ 6.42$ 7.05$ Core FFO Attributable to SUI Common Shareholders and Convertible Securities Per Share 1.76$ 1.86$ 3.02$ 3.05$ 6.81$ 7.10$ June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 December 31, 2024 December 31, 2023 Hurricane Ian - Three Fort Myers, Florida RV communities impaired Estimated loss of earnings in excess of the applicable business interruption deductible 4.1$ 5.3$ 7.9$ 10.6$ 19.2$ 21.9$ Insurance recoveries received for previously estimated loss of earnings (9.9) (5.0) (9.9) (5.0) (16.3) (19.7) Hurricane Irma - Three Florida Keys communities impaired Estimated loss of earnings in excess of the applicable business interruptions deductible, net - - - - - (0.1) Hurricane Helene - one Dunedin Florida RV community impaired Estimated loss of earnings in excess of the applicable business interruptions deductible 0.1 - 0.3 - 0.5 - Flooding event - estimated loss of earnings at one New Hampshire RV community Estimated loss of earnings in excess of the applicable business interruptions deductible - - - - 1.3 - Insurance recoveries received for previously estimated loss of earnings - - - - (1.3) - Loss of earnings - catastrophic event-related charges, net (5.7)$ 0.3$ (1.7)$ 5.6$ 3.4$ 2.1$ Year EndedSix Months EndedThree Months Ended Three Months Ended Six Months Ended Year Ended 16 Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. Net Income to FFO Reconciliation (amounts in millions except per share data)

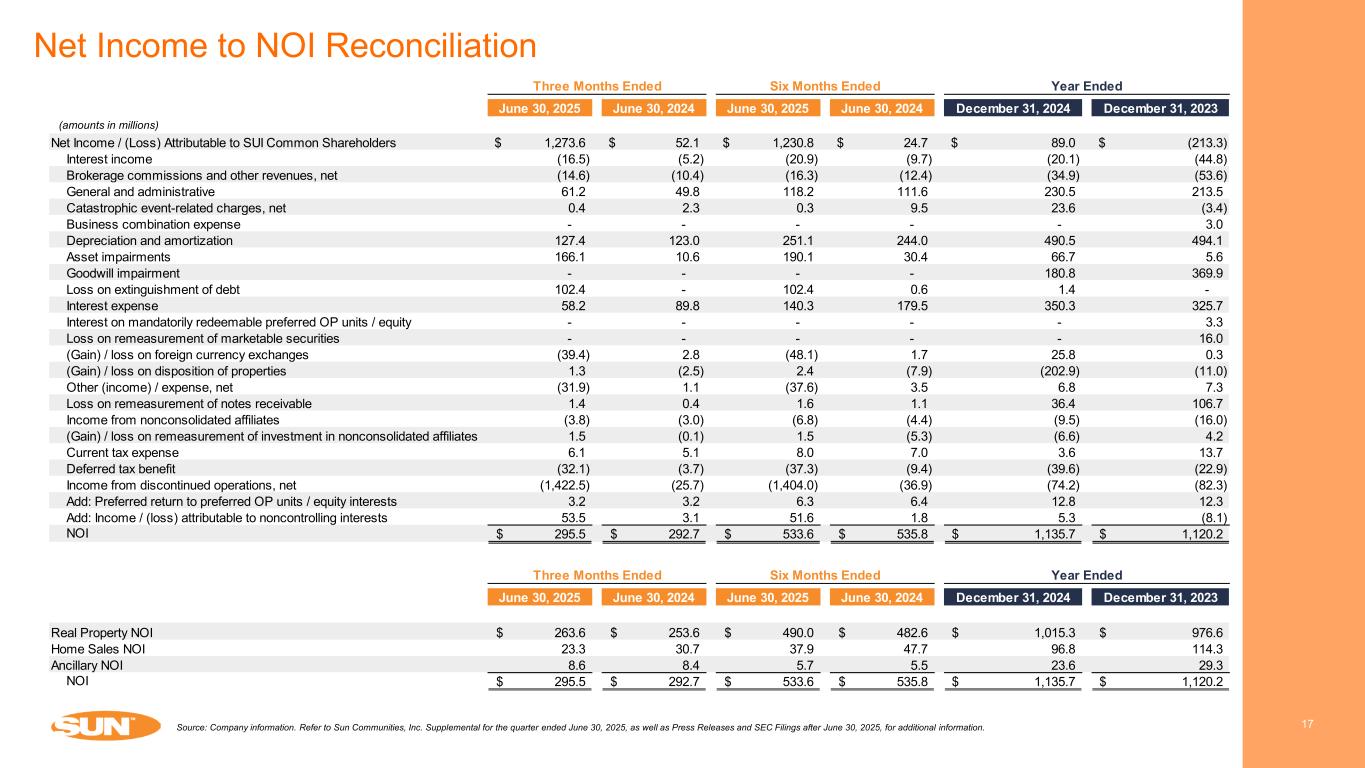

June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 December 31, 2024 December 31, 2023 Net Income / (Loss) Attributable to SUI Common Shareholders 1,273.6$ 52.1$ 1,230.8$ 24.7$ 89.0$ (213.3)$ Interest income (16.5) (5.2) (20.9) (9.7) (20.1) (44.8) Brokerage commissions and other revenues, net (14.6) (10.4) (16.3) (12.4) (34.9) (53.6) General and administrative 61.2 49.8 118.2 111.6 230.5 213.5 Catastrophic event-related charges, net 0.4 2.3 0.3 9.5 23.6 (3.4) Business combination expense - - - - - 3.0 Depreciation and amortization 127.4 123.0 251.1 244.0 490.5 494.1 Asset impairments 166.1 10.6 190.1 30.4 66.7 5.6 Goodwill impairment - - - - 180.8 369.9 Loss on extinguishment of debt 102.4 - 102.4 0.6 1.4 - Interest expense 58.2 89.8 140.3 179.5 350.3 325.7 Interest on mandatorily redeemable preferred OP units / equity - - - - - 3.3 Loss on remeasurement of marketable securities - - - - - 16.0 (Gain) / loss on foreign currency exchanges (39.4) 2.8 (48.1) 1.7 25.8 0.3 (Gain) / loss on disposition of properties 1.3 (2.5) 2.4 (7.9) (202.9) (11.0) Other (income) / expense, net (31.9) 1.1 (37.6) 3.5 6.8 7.3 Loss on remeasurement of notes receivable 1.4 0.4 1.6 1.1 36.4 106.7 Income from nonconsolidated affiliates (3.8) (3.0) (6.8) (4.4) (9.5) (16.0) (Gain) / loss on remeasurement of investment in nonconsolidated affiliates 1.5 (0.1) 1.5 (5.3) (6.6) 4.2 Current tax expense 6.1 5.1 8.0 7.0 3.6 13.7 Deferred tax benefit (32.1) (3.7) (37.3) (9.4) (39.6) (22.9) Income from discontinued operations, net (1,422.5) (25.7) (1,404.0) (36.9) (74.2) (82.3) Add: Preferred return to preferred OP units / equity interests 3.2 3.2 6.3 6.4 12.8 12.3 Add: Income / (loss) attributable to noncontrolling interests 53.5 3.1 51.6 1.8 5.3 (8.1) NOI 295.5$ 292.7$ 533.6$ 535.8$ 1,135.7$ 1,120.2$ June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 December 31, 2024 December 31, 2023 Real Property NOI 263.6$ 253.6$ 490.0$ 482.6$ 1,015.3$ 976.6$ Home Sales NOI 23.3 30.7 37.9 47.7 96.8 114.3 Ancillary NOI 8.6 8.4 5.7 5.5 23.6 29.3 NOI 295.5$ 292.7$ 533.6$ 535.8$ 1,135.7$ 1,120.2$ Year Ended Year Ended Three Months Ended Three Months Ended Six Months Ended Six Months Ended Net Income to NOI Reconciliation 17Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. (amounts in millions)

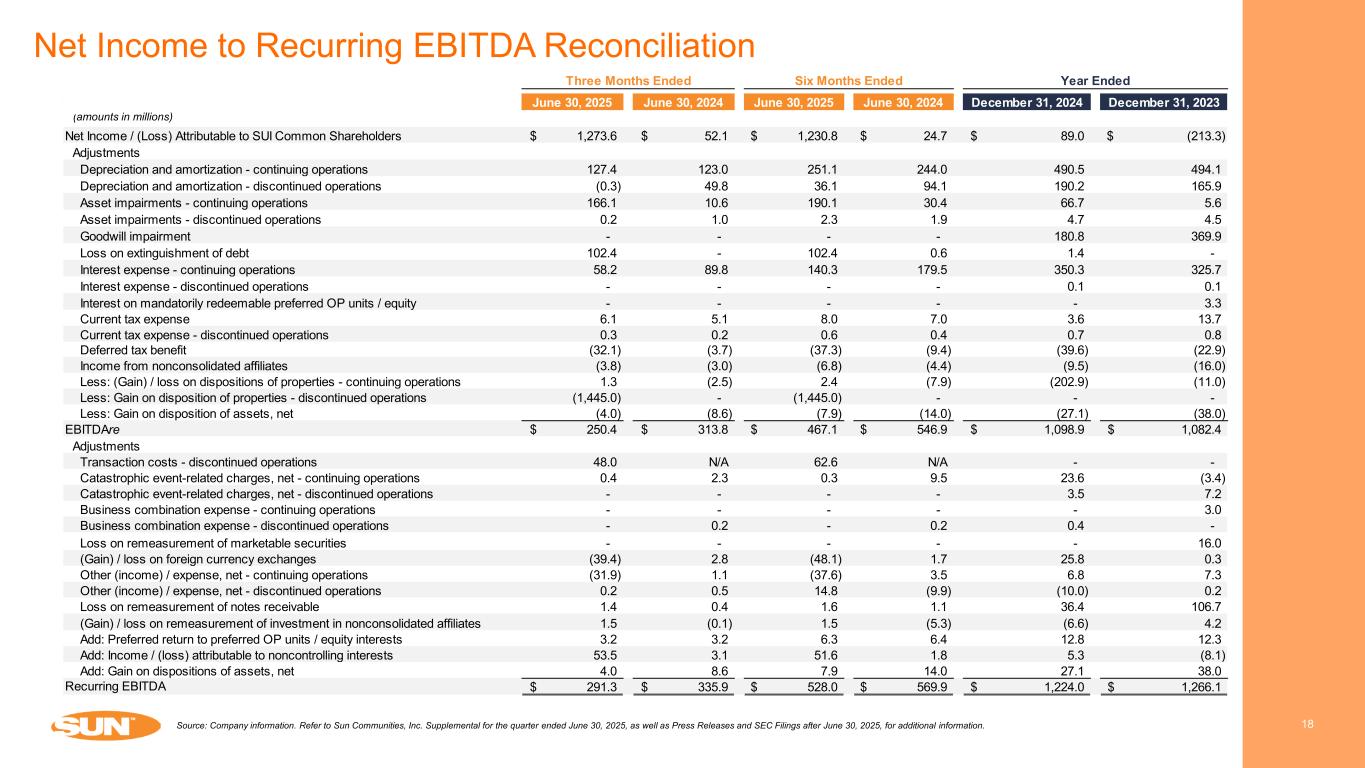

June 30, 2025 June 30, 2024 June 30, 2025 June 30, 2024 December 31, 2024 December 31, 2023 Net Income / (Loss) Attributable to SUI Common Shareholders 1,273.6$ 52.1$ 1,230.8$ 24.7$ 89.0$ (213.3)$ Adjustments Depreciation and amortization - continuing operations 127.4 123.0 251.1 244.0 490.5 494.1 Depreciation and amortization - discontinued operations (0.3) 49.8 36.1 94.1 190.2 165.9 Asset impairments - continuing operations 166.1 10.6 190.1 30.4 66.7 5.6 Asset impairments - discontinued operations 0.2 1.0 2.3 1.9 4.7 4.5 Goodwill impairment - - - - 180.8 369.9 Loss on extinguishment of debt 102.4 - 102.4 0.6 1.4 - Interest expense - continuing operations 58.2 89.8 140.3 179.5 350.3 325.7 Interest expense - discontinued operations - - - - 0.1 0.1 Interest on mandatorily redeemable preferred OP units / equity - - - - - 3.3 Current tax expense 6.1 5.1 8.0 7.0 3.6 13.7 Current tax expense - discontinued operations 0.3 0.2 0.6 0.4 0.7 0.8 Deferred tax benefit (32.1) (3.7) (37.3) (9.4) (39.6) (22.9) Income from nonconsolidated affiliates (3.8) (3.0) (6.8) (4.4) (9.5) (16.0) Less: (Gain) / loss on dispositions of properties - continuing operations 1.3 (2.5) 2.4 (7.9) (202.9) (11.0) Less: Gain on disposition of properties - discontinued operations (1,445.0) - (1,445.0) - - - Less: Gain on disposition of assets, net (4.0) (8.6) (7.9) (14.0) (27.1) (38.0) EBITDAre 250.4$ 313.8$ 467.1$ 546.9$ 1,098.9$ 1,082.4$ Adjustments Transaction costs - discontinued operations 48.0 N/A 62.6 N/A - - Catastrophic event-related charges, net - continuing operations 0.4 2.3 0.3 9.5 23.6 (3.4) Catastrophic event-related charges, net - discontinued operations - - - - 3.5 7.2 Business combination expense - continuing operations - - - - - 3.0 Business combination expense - discontinued operations - 0.2 - 0.2 0.4 - Loss on remeasurement of marketable securities - - - - - 16.0 (Gain) / loss on foreign currency exchanges (39.4) 2.8 (48.1) 1.7 25.8 0.3 Other (income) / expense, net - continuing operations (31.9) 1.1 (37.6) 3.5 6.8 7.3 Other (income) / expense, net - discontinued operations 0.2 0.5 14.8 (9.9) (10.0) 0.2 Loss on remeasurement of notes receivable 1.4 0.4 1.6 1.1 36.4 106.7 (Gain) / loss on remeasurement of investment in nonconsolidated affiliates 1.5 (0.1) 1.5 (5.3) (6.6) 4.2 Add: Preferred return to preferred OP units / equity interests 3.2 3.2 6.3 6.4 12.8 12.3 Add: Income / (loss) attributable to noncontrolling interests 53.5 3.1 51.6 1.8 5.3 (8.1) Add: Gain on dispositions of assets, net 4.0 8.6 7.9 14.0 27.1 38.0 Recurring EBITDA 291.3$ 335.9$ 528.0$ 569.9$ 1,224.0$ 1,266.1$ Year EndedThree Months Ended Six Months Ended Net Income to Recurring EBITDA Reconciliation 18Source: Company information. Refer to Sun Communities, Inc. Supplemental for the quarter ended June 30, 2025, as well as Press Releases and SEC Filings after June 30, 2025, for additional information. (amounts in millions)