©2025 Laureate Education, Inc. Third Quarter 2025 Earnings Presentation October 30, 2025 .2

2©2025 Laureate Education, Inc. Forward Looking Statements This presentation includes statements that express Laureate’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, ‘‘forward-looking statements’’ within the meaning of the federal securities laws, which involve risks and uncertainties. Laureate’s actual results may vary significantly from the results anticipated in these forward-looking statements. You can identify forward-looking statements because they contain words such as ‘‘believes,’’ ‘‘expects,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘seeks,’’ ‘‘approximately,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘estimates’’ or ‘‘anticipates’’ or similar expressions that concern our strategy, plans or intentions. All statements we make relating to guidance (including, but not limited to, total enrollments, revenues, and Adjusted EBITDA), and all statements we make relating to our current growth strategy and other future plans, strategies or transactions that may be identified, explored or implemented and any litigation or dispute resulting from any completed transaction are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, including with respect to our current growth strategy and the impact of any completed divestiture or separation transaction on our remaining businesses. Accordingly, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations are disclosed in our Annual Report on Form 10-K filed with the SEC on February 20, 2025, our subsequent Quarterly Reports on Form 10-Q filed, and to be filed, with the SEC and other filings made with the SEC. These forward-looking statements speak only as of the time of this release and we do not undertake to publicly update or revise them, whether as a result of new information, future events or otherwise, except as required by law. In addition, this presentation contains various operating data, including market share and market position, that are based on internal company data and management estimates. While management believes that our internal company research is reliable and the definitions of our markets which are used herein are appropriate, neither such research nor these definitions have been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources, including those discussed under “Industry and Market Data” in Laureate’s filings with the SEC.

3©2025 Laureate Education, Inc. Presentation of Non-GAAP Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (GAAP) throughout this presentation, Laureate provides the non-GAAP measures of Adjusted EBITDA and its related margin, Adjusted net income, Adjusted Earnings Per Share (Adjusted EPS), Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total cash and cash equivalents, net of debt (or net cash), and Free Cash Flow. We have included the non-GAAP measures of Adjusted EBITDA and net cash because they are key measures used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. We have included the non-GAAP measures of Adjusted net income and Adjusted EPS because management believes that these measures provide investors with better visibility into the Company’s underlying earnings as they exclude items that may not be indicative of our core operating results. Adjusted EBITDA consists of net income (loss), adjusted for the items included in the accompanying reconciliation. The exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to- period comparisons of our core business. Additionally, Adjusted EBITDA and Adjusted EBITDA margin, which is calculated by dividing Adjusted EBITDA by revenue, are key inputs into the formula used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. We define Adjusted net income as net income (loss), before (income) loss from discontinued operations, plus discrete tax items, loss on debt extinguishment, loss (gain) on disposal of subsidiaries, net, foreign currency exchange (gain) loss, net, and loss on impairment of assets. We define Adjusted EPS as Adjusted net income divided by GAAP diluted weighted average shares outstanding. Adjusted net income and Adjusted EPS provide a useful indicator about Laureate’s earnings from core operations. Adjusted EBITDA to Unlevered Free Cash Flow Conversion consists of Unlevered Free Cash Flow (which is defined as cash flows from operating activities, less capital expenditures (net of sales of PP&E), plus net cash interest expense) divided by Adjusted EBITDA. Adjusted EBITDA to Unlevered Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flows. Total cash and cash equivalents, net of debt (or net cash) consists of total cash and cash equivalents, less total gross debt. Net cash provides a useful indicator about Laureate’s leverage and liquidity. Free Cash Flow consists of operating cash flow minus capital expenditures (net of sales of PP&E). Free Cash Flow provides a useful indicator about Laureate’s ability to fund its operations and repay its debt. Laureate’s calculations of Adjusted EBITDA and its related margin, Adjusted net income, Adjusted EPS, Adjusted EBITDA to Unlevered Free Cash Flow Conversion, total cash and cash equivalents, net of debt (or net cash), and Free Cash Flow are not necessarily comparable to calculations performed by other companies and reported as similarly titled measures. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Adjusted EBITDA, Adjusted net income, Adjusted EPS and Free Cash Flow are reconciled from their most directly comparable GAAP measures in the attached tables under “Non-GAAP Reconciliations”. We evaluate our results of operations on both an as reported and an organic constant currency basis. The organic constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates, acquisitions and divestitures. We believe that providing organic constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate organic constant currency amounts using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period, and then exclude the impact of acquisitions and divestitures.

4©2025 Laureate Education, Inc. Summary Overview Note: Throughout this presentation amounts may not sum to totals due to rounding

5©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Executive Summary Third quarter Revenue and Adjusted EBITDA ahead of guidance Completion of Q3 primary intake for Mexico and secondary intake in Peru Mexico primary intake: New Enrollments +4% excluding campus closures; solid results against the backdrop of a softer macroeconomic environment – reinforcing the resiliency of our business model Peru secondary intake: New Enrollments +21% driven by scaling of fully online programs, albeit from a smaller base Net Income of $34M in third quarter Increasing full-year 2025 guidance at the mid-point by $61M for Revenue and $17M for Adjusted EBITDA Favorable secondary intake in Peru and better price/mix Improved foreign currency rates Announcing $150M increase in stock buyback authorization Solid Execution and Continued Favorable Currency Trends Increasing Full Year Guidance and Upsizing Stock Buyback Authorization by $150M

6©2025 Laureate Education, Inc. Compelling Investment Characteristics

7©2025 Laureate Education, Inc. Mexico Peru Combined Population 130 million 32 million 162 million Higher Education Students (000s) 5,518 2,042 7,560 Higher Education Gross Participation Rate (Total)1 36% 57% 40% Traditional 4+ yr degrees 35% 42% 36% Technical / Vocational 1% 15% 4% Market Share for Private Institutions2 46% 76% 57% Sources: UNESCO, World Bank, Secretaría de Educación Pública (Mexico), Superintendencia Nacional de Educación Superior Universitaria (Peru), Ministry of Education of Peru. Data as of year-end 2023. (1) Defined as total enrollments as compared to 18-24 year old population. (2) Private institution market share in higher education; for Mexico and Combined includes all states in which UVM or UNITEC have operations (total private market share for all of Mexico is 39%); for Peru based on total country. Attractive Markets with Significant Growth Opportunities Participation rates growing and still well below developed markets Attractive Market Opportunities in Mexico and Peru

©2025 Laureate Education, Inc. 8 Leading University Portfolio in Mexico & Peru Sources: QS Stars , Guía Universitaria (UVM), MERCO Institutional Reputation Ranking (UPC) 1960 Brand Founded Market Segment Ratings/RankingsQS StarsTM Overall Universidad del Valle de México (UVM) Premium/ Traditional Enrollment @ 9/30/25 133,400 1966Universidad Tecnológica de México (UNITEC) Value/ Teaching143,600 1994 Premium/ Traditional79,600 1994 Value/ Teaching132,200 1983 Technical/ Vocational22,600 Universidad Peruana de Ciencias Aplicadas (UPC) Universidad Privada del Norte (UPN) CIBERTEC M ex ic o Pe ru • Ranked Top 5 university in Mexico • 5-Stars rated by QS Stars in categories of Employability, Inclusiveness, Online Learning & Social Impact • Largest private university in Mexico • 5-Stars rated by QS Stars in categories of Employability, Inclusiveness, Online Learning & Social Impact • Ranked #1 in educational sector in Peru • 5-Stars rated by QS Stars in categories of Employability, Inclusiveness, Online Learning & Social Impact • 3rd largest private university in Peru • 5-Stars rated by QS Stars in categories of Employability, Inclusiveness, Online Learning & Social Impact • One of the largest private technical / vocational institutes in Peru

9©2025 Laureate Education, Inc. Q3 & YTD 2025 Performance Results

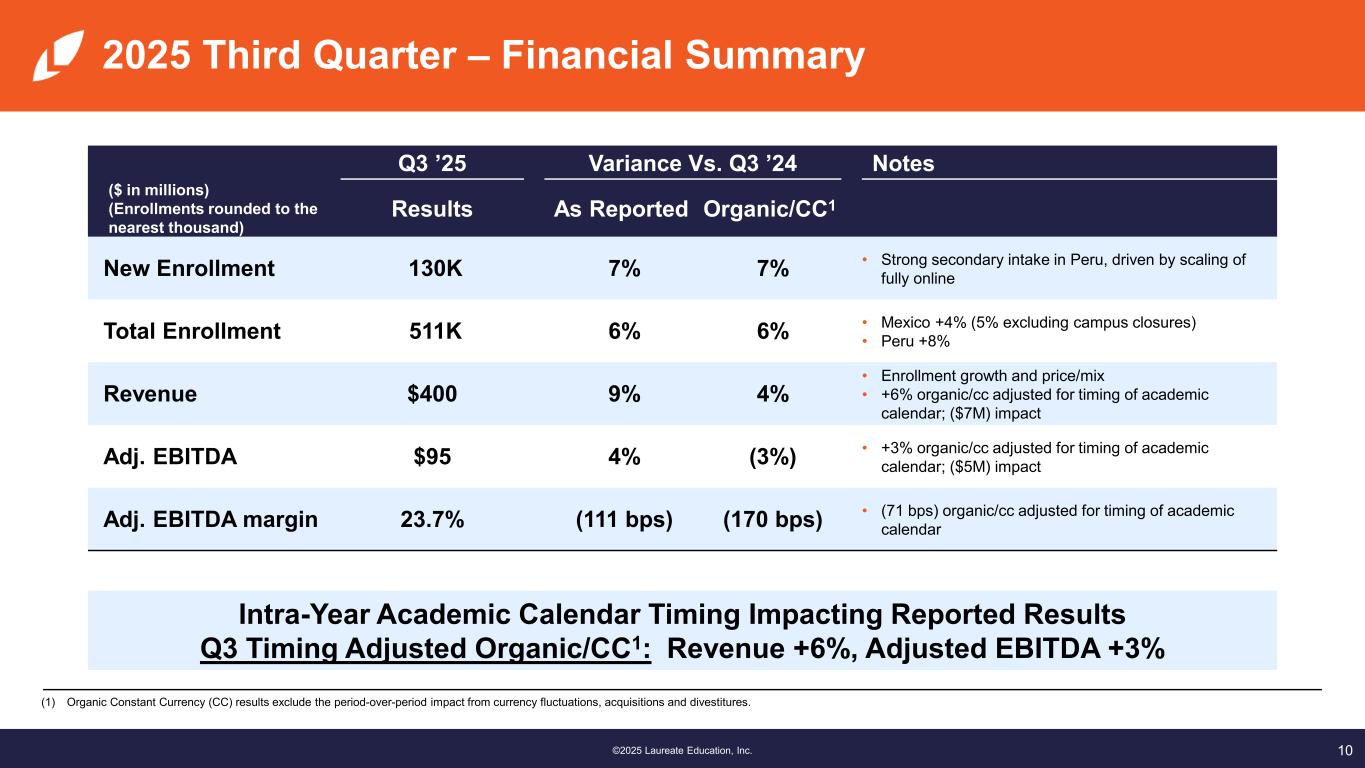

10©2025 Laureate Education, Inc. 2025 Third Quarter – Financial Summary Q3 ’25 Variance Vs. Q3 ’24 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 130K 7% 7% • Strong secondary intake in Peru, driven by scaling of fully online Total Enrollment 511K 6% 6% • Mexico +4% (5% excluding campus closures) • Peru +8% Revenue $400 9% 4% • Enrollment growth and price/mix • +6% organic/cc adjusted for timing of academic calendar; ($7M) impact Adj. EBITDA $95 4% (3%) • +3% organic/cc adjusted for timing of academic calendar; ($5M) impact Adj. EBITDA margin 23.7% (111 bps) (170 bps) • (71 bps) organic/cc adjusted for timing of academic calendar (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Intra-Year Academic Calendar Timing Impacting Reported Results Q3 Timing Adjusted Organic/CC1: Revenue +6%, Adjusted EBITDA +3%

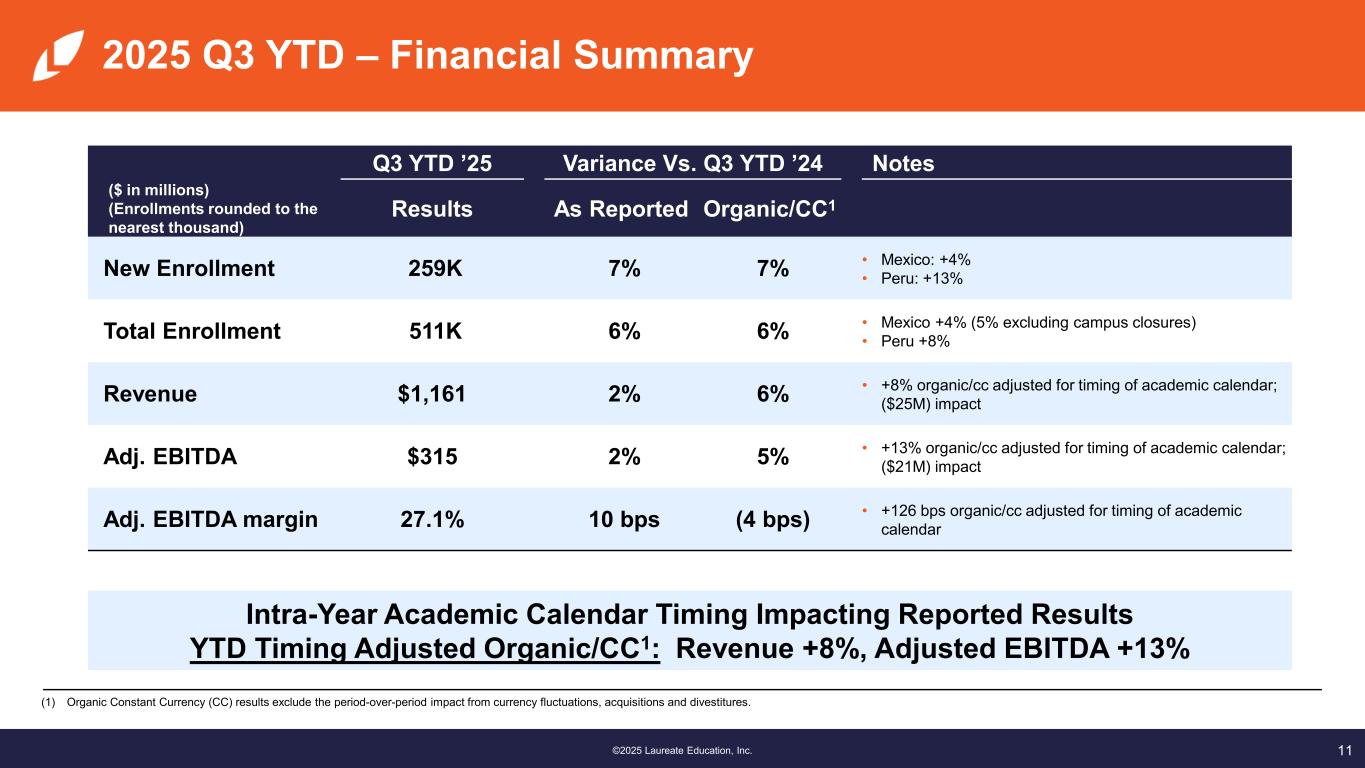

11©2025 Laureate Education, Inc. 2025 Q3 YTD – Financial Summary Q3 YTD ’25 Variance Vs. Q3 YTD ’24 Notes ($ in millions) (Enrollments rounded to the nearest thousand) Results As Reported Organic/CC1 New Enrollment 259K 7% 7% • Mexico: +4% • Peru: +13% Total Enrollment 511K 6% 6% • Mexico +4% (5% excluding campus closures) • Peru +8% Revenue $1,161 2% 6% • +8% organic/cc adjusted for timing of academic calendar; ($25M) impact Adj. EBITDA $315 2% 5% • +13% organic/cc adjusted for timing of academic calendar; ($21M) impact Adj. EBITDA margin 27.1% 10 bps (4 bps) • +126 bps organic/cc adjusted for timing of academic calendar (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Intra-Year Academic Calendar Timing Impacting Reported Results YTD Timing Adjusted Organic/CC1: Revenue +8%, Adjusted EBITDA +13%

12©2025 Laureate Education, Inc. Segment Results

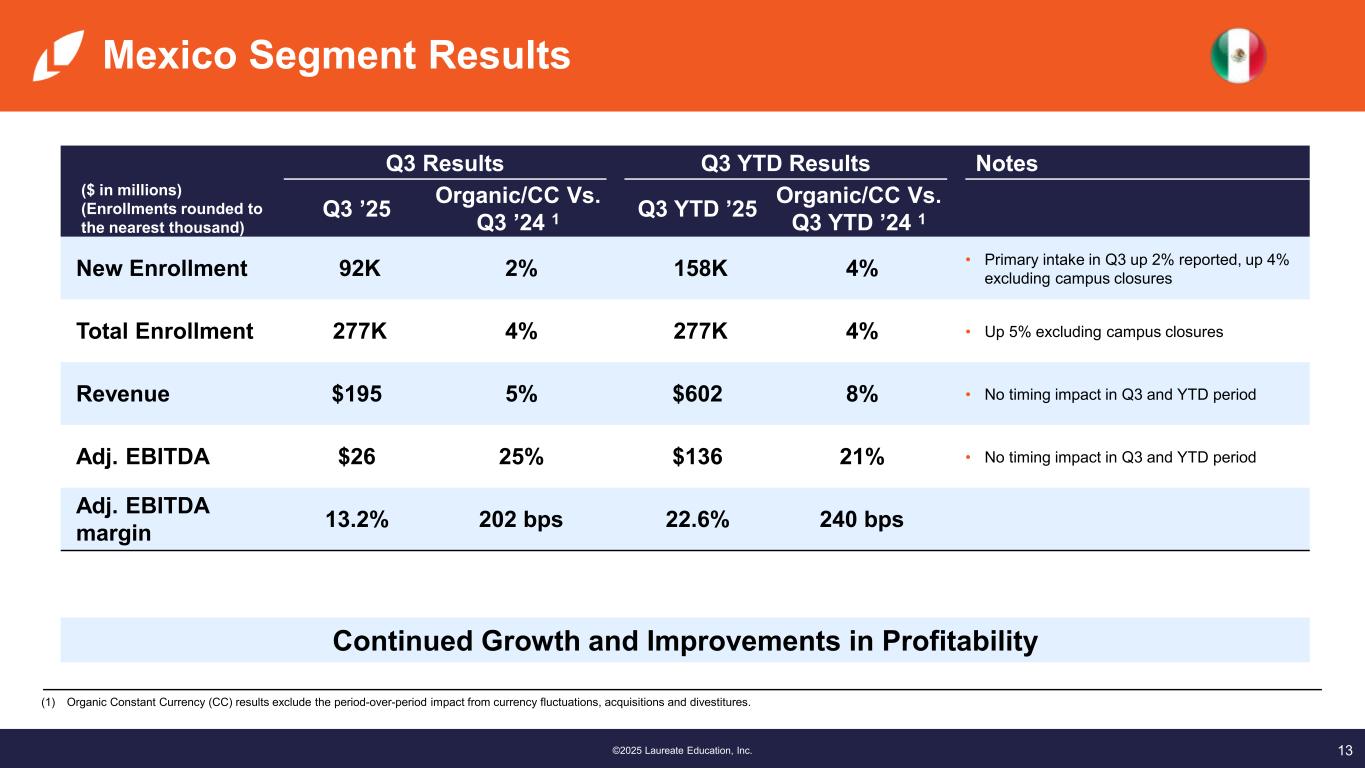

13©2025 Laureate Education, Inc. Mexico Segment Results Q3 Results Q3 YTD Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q3 ’25 Organic/CC Vs. Q3 ’24 1 Q3 YTD ’25 Organic/CC Vs. Q3 YTD ’24 1 New Enrollment 92K 2% 158K 4% • Primary intake in Q3 up 2% reported, up 4% excluding campus closures Total Enrollment 277K 4% 277K 4% • Up 5% excluding campus closures Revenue $195 5% $602 8% • No timing impact in Q3 and YTD period Adj. EBITDA $26 25% $136 21% • No timing impact in Q3 and YTD period Adj. EBITDA margin 13.2% 202 bps 22.6% 240 bps Continued Growth and Improvements in Profitability (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures.

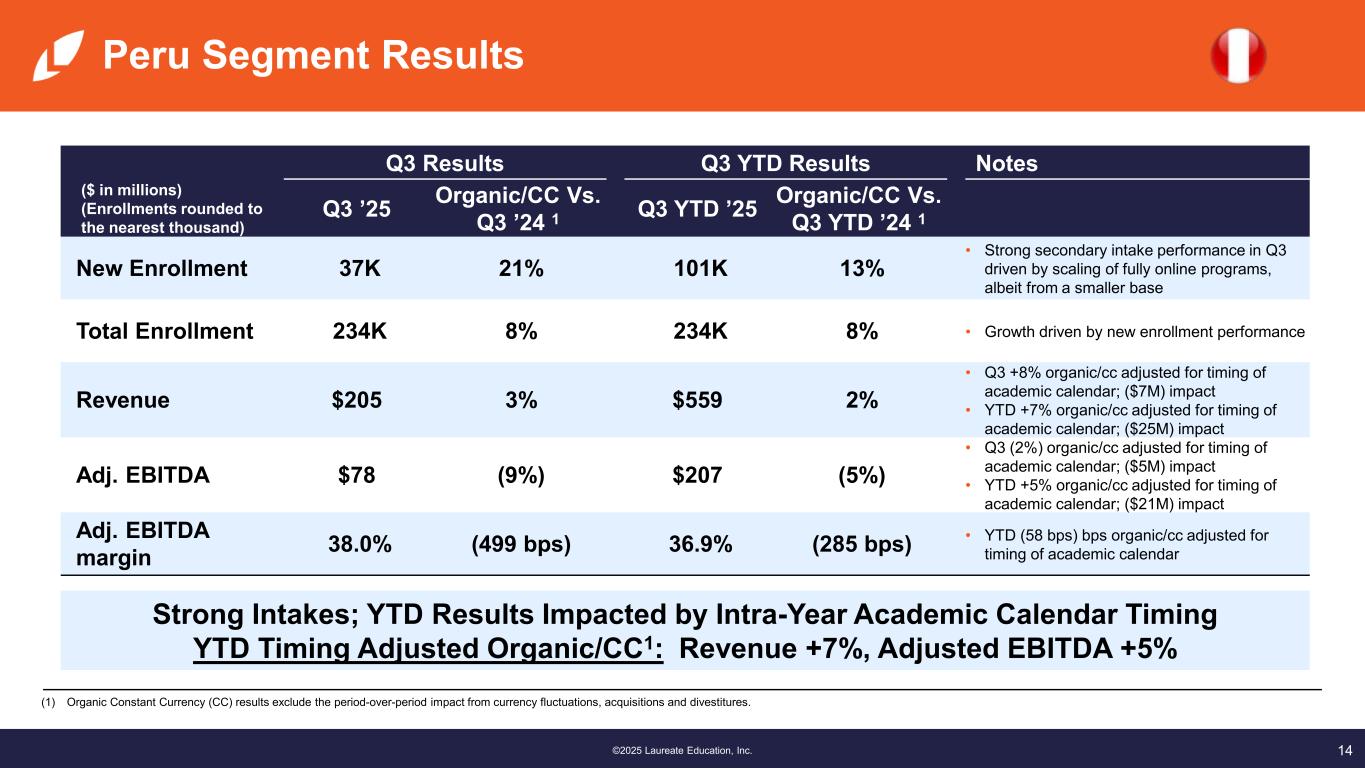

14©2025 Laureate Education, Inc. Peru Segment Results (1) Organic Constant Currency (CC) results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Q3 Results Q3 YTD Results Notes ($ in millions) (Enrollments rounded to the nearest thousand) Q3 ’25 Organic/CC Vs. Q3 ’24 1 Q3 YTD ’25 Organic/CC Vs. Q3 YTD ’24 1 New Enrollment 37K 21% 101K 13% • Strong secondary intake performance in Q3 driven by scaling of fully online programs, albeit from a smaller base Total Enrollment 234K 8% 234K 8% • Growth driven by new enrollment performance Revenue $205 3% $559 2% • Q3 +8% organic/cc adjusted for timing of academic calendar; ($7M) impact • YTD +7% organic/cc adjusted for timing of academic calendar; ($25M) impact Adj. EBITDA $78 (9%) $207 (5%) • Q3 (2%) organic/cc adjusted for timing of academic calendar; ($5M) impact • YTD +5% organic/cc adjusted for timing of academic calendar; ($21M) impact Adj. EBITDA margin 38.0% (499 bps) 36.9% (285 bps) • YTD (58 bps) bps organic/cc adjusted for timing of academic calendar Strong Intakes; YTD Results Impacted by Intra-Year Academic Calendar Timing YTD Timing Adjusted Organic/CC1: Revenue +7%, Adjusted EBITDA +5%

15©2025 Laureate Education, Inc. Capitalization and Share Count

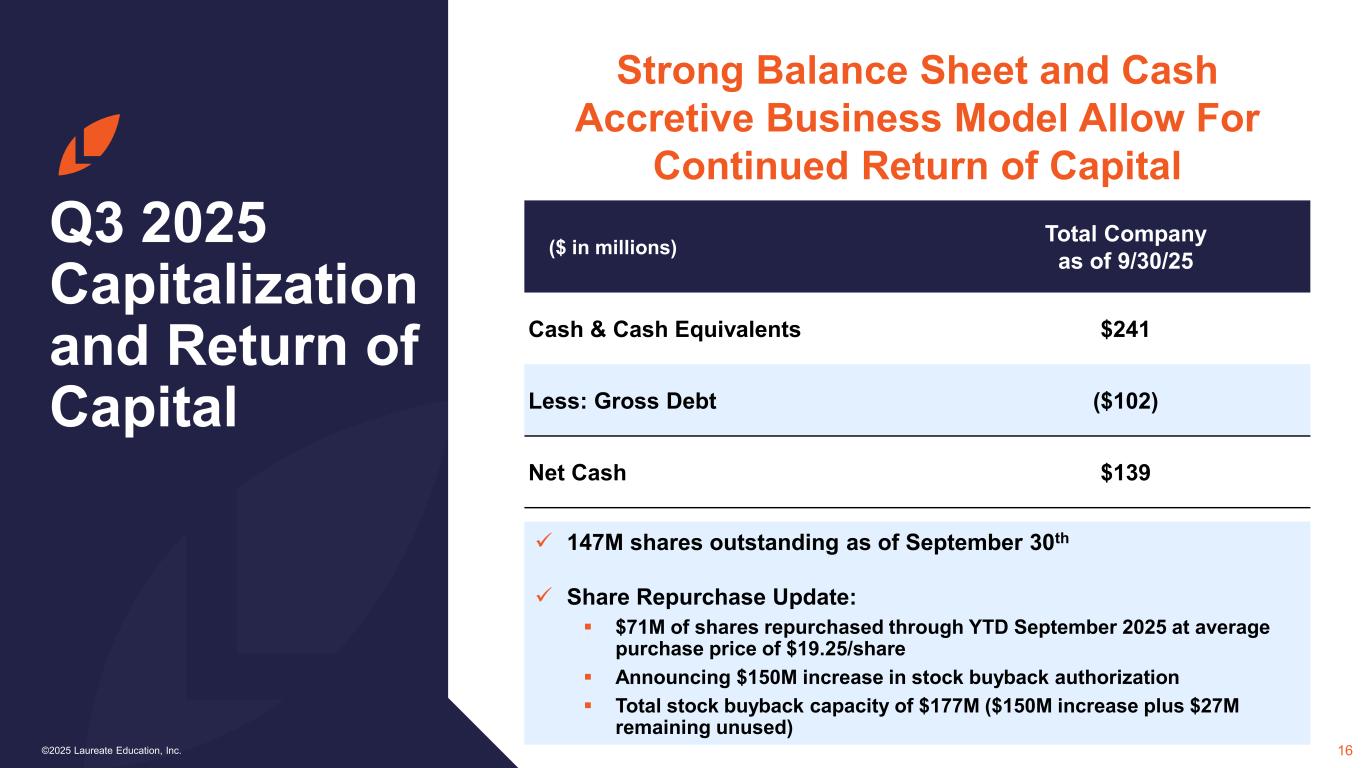

16©2025 Laureate Education, Inc. Q3 2025 Capitalization and Return of Capital Strong Balance Sheet and Cash Accretive Business Model Allow For Continued Return of Capital ($ in millions) Total Company as of 9/30/25 Cash & Cash Equivalents $241 Less: Gross Debt ($102) Net Cash $139 147M shares outstanding as of September 30th Share Repurchase Update: $71M of shares repurchased through YTD September 2025 at average purchase price of $19.25/share Announcing $150M increase in stock buyback authorization Total stock buyback capacity of $177M ($150M increase plus $27M remaining unused)

17©2025 Laureate Education, Inc. Outlook

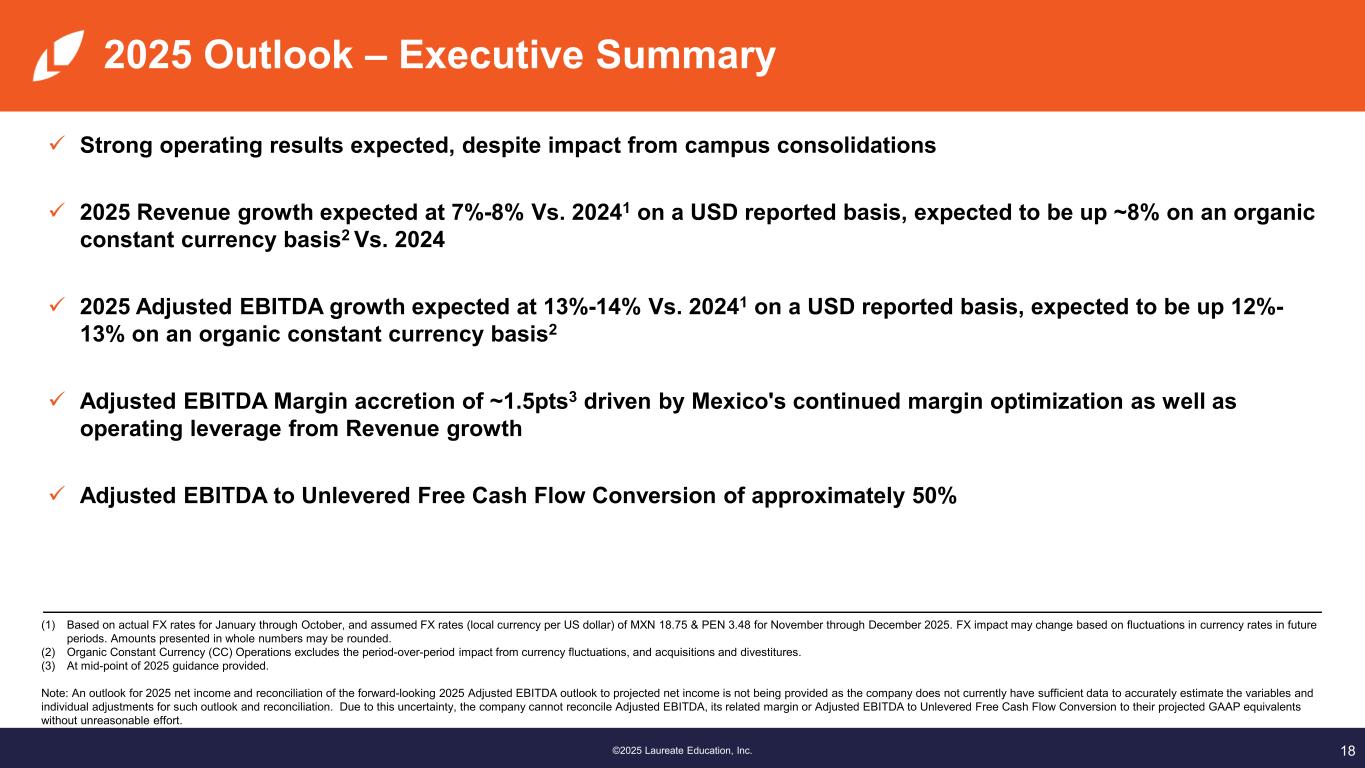

18©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. 2025 Outlook – Executive Summary Strong operating results expected, despite impact from campus consolidations 2025 Revenue growth expected at 7%-8% Vs. 20241 on a USD reported basis, expected to be up ~8% on an organic constant currency basis2 Vs. 2024 2025 Adjusted EBITDA growth expected at 13%-14% Vs. 20241 on a USD reported basis, expected to be up 12%- 13% on an organic constant currency basis2 Adjusted EBITDA Margin accretion of ~1.5pts3 driven by Mexico's continued margin optimization as well as operating leverage from Revenue growth Adjusted EBITDA to Unlevered Free Cash Flow Conversion of approximately 50% (1) Based on actual FX rates for January through October, and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. (2) Organic Constant Currency (CC) Operations excludes the period-over-period impact from currency fluctuations, and acquisitions and divestitures. (3) At mid-point of 2025 guidance provided. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA, its related margin or Adjusted EBITDA to Unlevered Free Cash Flow Conversion to their projected GAAP equivalents without unreasonable effort.

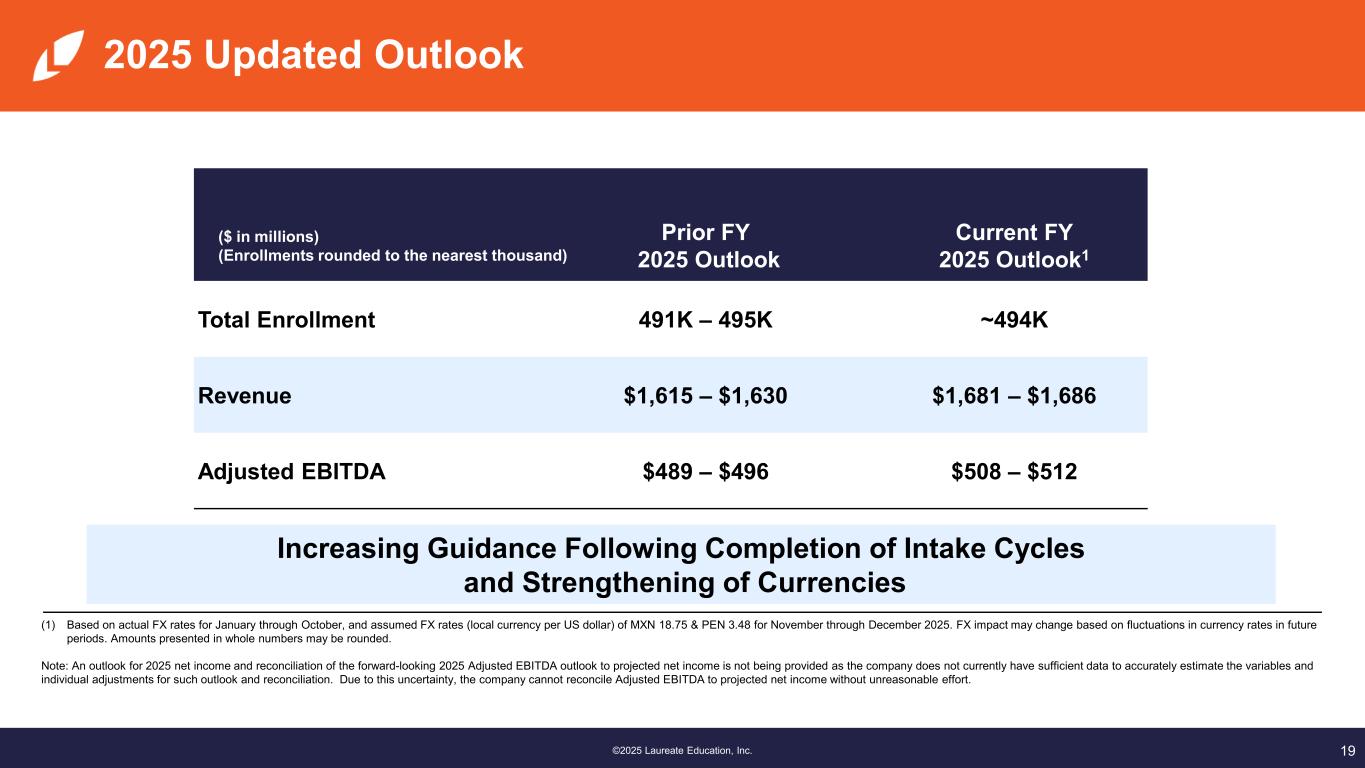

19©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. 2025 Updated Outlook (1) Based on actual FX rates for January through October, and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Increasing Guidance Following Completion of Intake Cycles and Strengthening of Currencies ($ in millions) (Enrollments rounded to the nearest thousand) Prior FY 2025 Outlook Current FY 2025 Outlook1 Total Enrollment 491K – 495K ~494K Revenue $1,615 – $1,630 $1,681 – $1,686 Adjusted EBITDA $489 – $496 $508 – $512

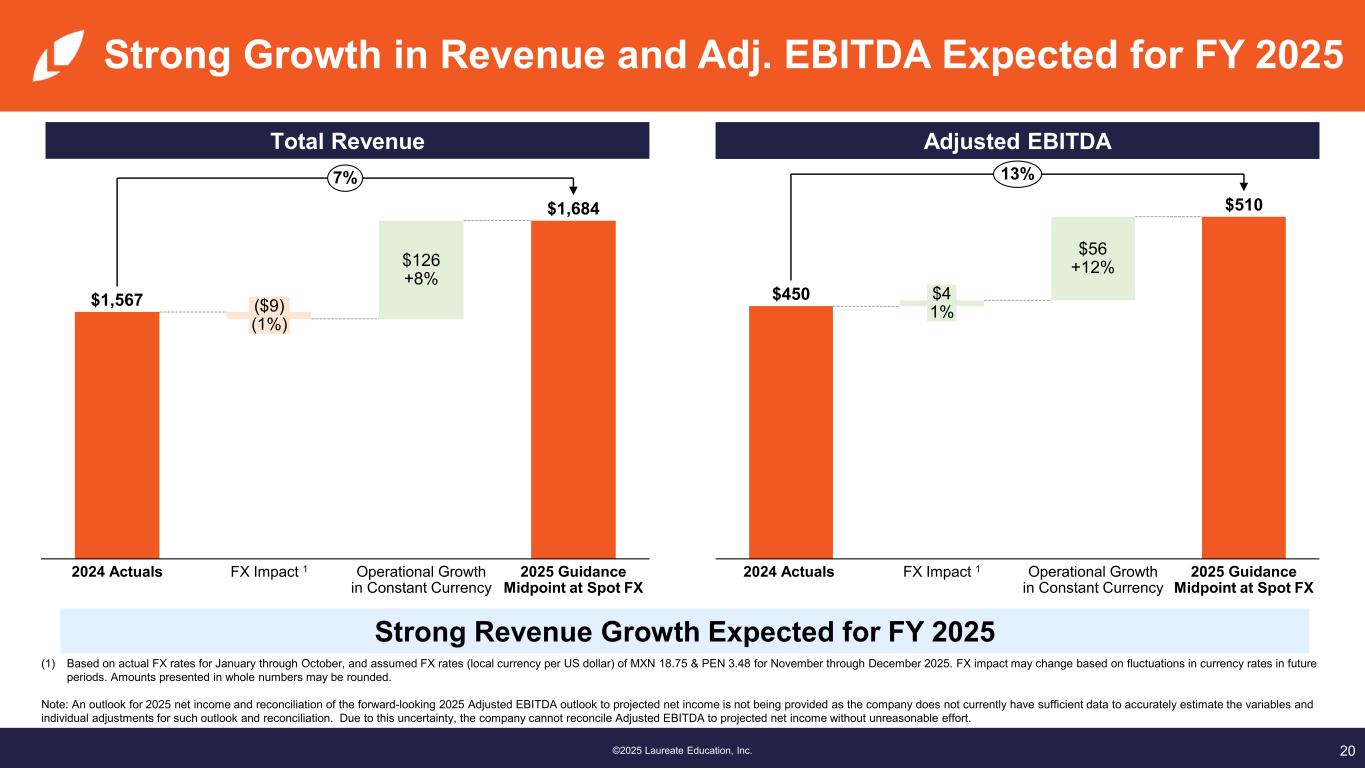

20©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Strong Growth in Revenue and Adj. EBITDA Expected for FY 2025 Total Revenue ($M) Adjusted EBITDA ($M) Strong Revenue Growth Expected for FY 2025 (1) Based on actual FX rates for January through October, and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Total R venue Adjusted EBITDA $1,567 $1,684 2024 Actuals ($9) (1%) FX Impact 1 $126 +8% Operational Growth in Constant Currency 2025 Guidance Midpoint at Spot FX 7% $450 $510 2024 Actuals $4 1% FX Impact 1 $56 +12% Operational Growth in Constant Currency 2025 Guidance Midpoint at Spot FX 13%

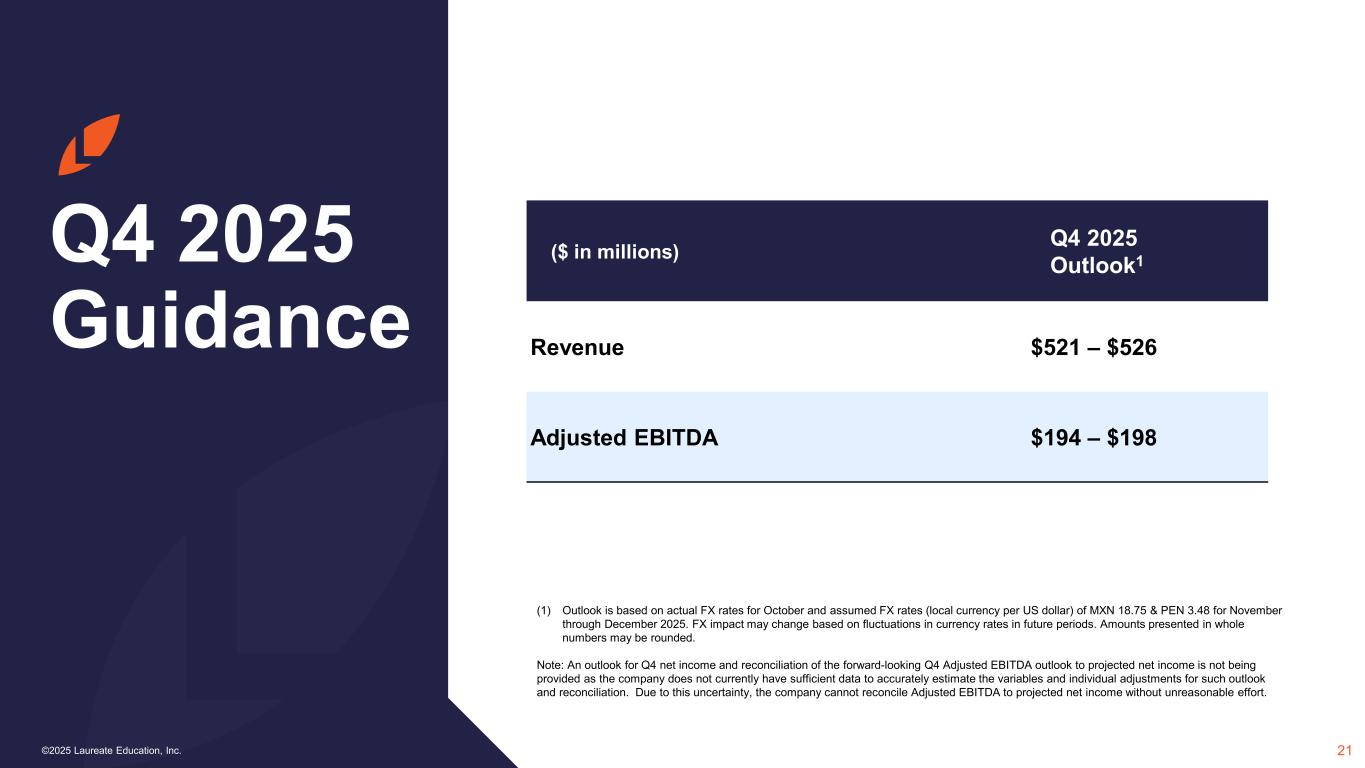

21©2025 Laureate Education, Inc. Q4 2025 Guidance ($ in millions) Q4 2025 Outlook1 Revenue $521 – $526 Adjusted EBITDA $194 – $198 (1) Outlook is based on actual FX rates for October and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for Q4 net income and reconciliation of the forward-looking Q4 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort.

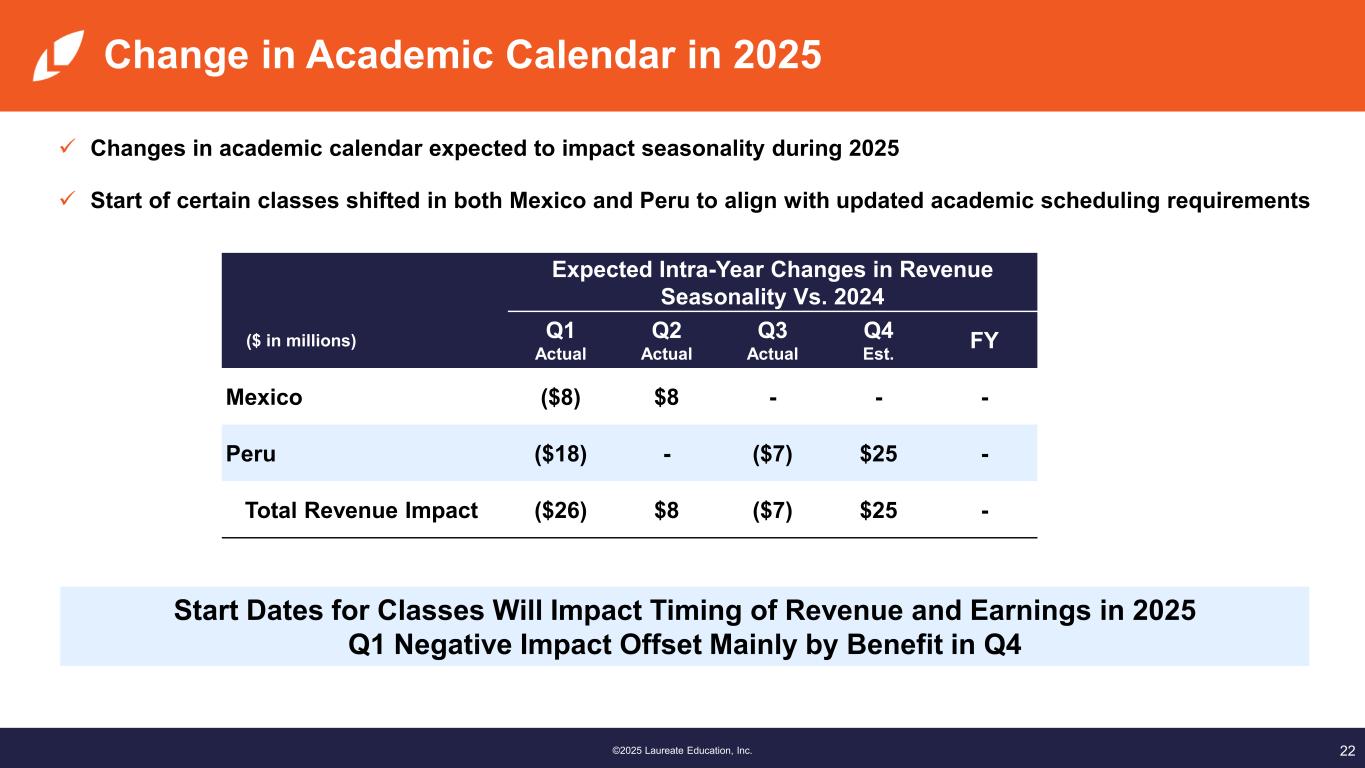

22©2024 Laureate Education, Inc.® | Confidential & Proprietary©2025 Laureate Education, I c. Change in Academic Calendar in 2025 Expected Intra-Year Changes in Revenue Seasonality Vs. 2024 ($ in millions) Q1 Actual Q2 Actual Q3 Actual Q4 Est. FY Mexico ($8) $8 - - - Peru ($18) - ($7) $25 - Total Revenue Impact ($26) $8 ($7) $25 - Changes in academic calendar expected to impact seasonality during 2025 Start of certain classes shifted in both Mexico and Peru to align with updated academic scheduling requirements Start Dates for Classes Will Impact Timing of Revenue and Earnings in 2025 Q1 Negative Impact Offset Mainly by Benefit in Q4

23©2025 Laureate Education, Inc. Appendix

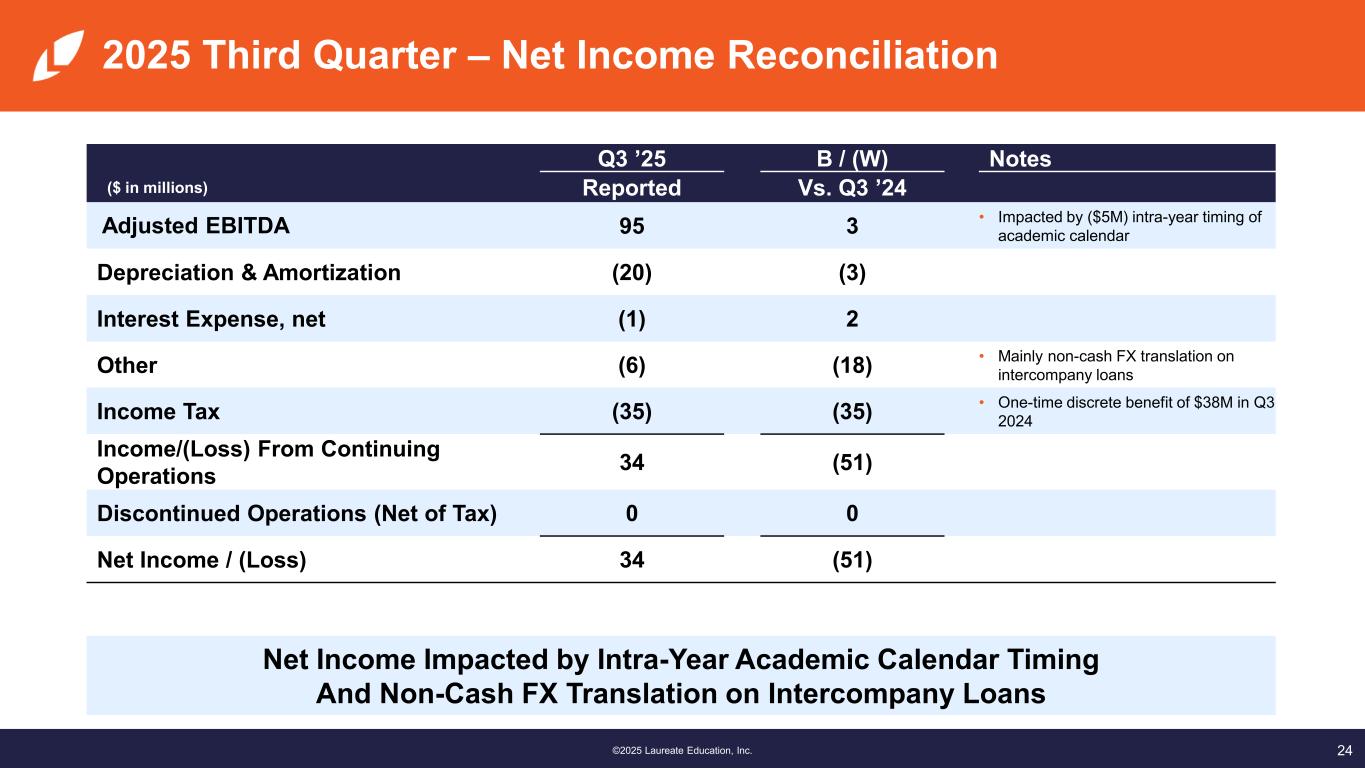

24©2025 Laureate Education, Inc. 2025 Third Quarter – Net Income Reconciliation Q3 ’25 B / (W) Notes ($ in millions) Reported Vs. Q3 ’24 Adjusted EBITDA 95 3 • Impacted by ($5M) intra-year timing of academic calendar Depreciation & Amortization (20) (3) Interest Expense, net (1) 2 Other (6) (18) • Mainly non-cash FX translation on intercompany loans Income Tax (35) (35) • One-time discrete benefit of $38M in Q3 2024 Income/(Loss) From Continuing Operations 34 (51) Discontinued Operations (Net of Tax) 0 0 Net Income / (Loss) 34 (51) Net Income Impacted by Intra-Year Academic Calendar Timing And Non-Cash FX Translation on Intercompany Loans

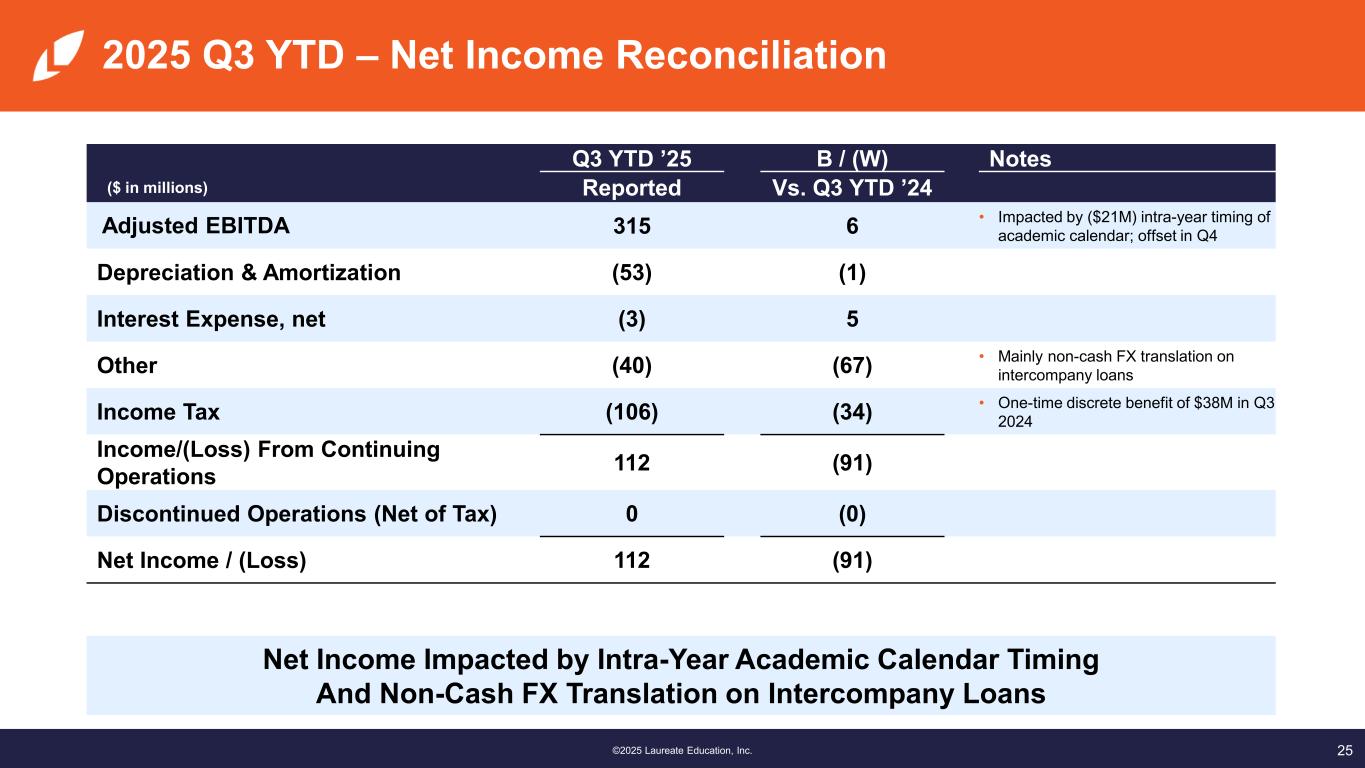

25©2025 Laureate Education, Inc. 2025 Q3 YTD – Net Income Reconciliation Q3 YTD ’25 B / (W) Notes ($ in millions) Reported Vs. Q3 YTD ’24 Adjusted EBITDA 315 6 • Impacted by ($21M) intra-year timing of academic calendar; offset in Q4 Depreciation & Amortization (53) (1) Interest Expense, net (3) 5 Other (40) (67) • Mainly non-cash FX translation on intercompany loans Income Tax (106) (34) • One-time discrete benefit of $38M in Q3 2024 Income/(Loss) From Continuing Operations 112 (91) Discontinued Operations (Net of Tax) 0 (0) Net Income / (Loss) 112 (91) Net Income Impacted by Intra-Year Academic Calendar Timing And Non-Cash FX Translation on Intercompany Loans

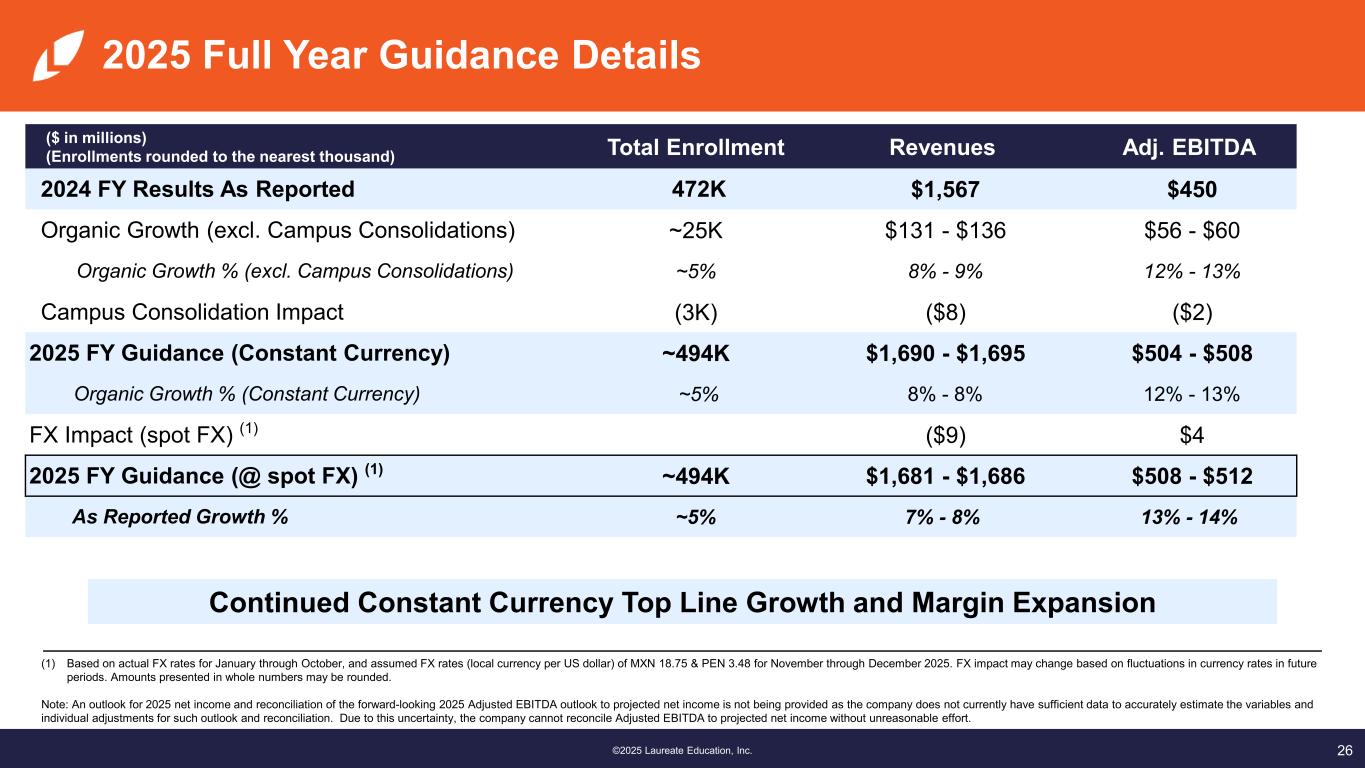

26©2025 Laureate Education, Inc. 2025 Full Year Guidance Details ($ in millions) (Enrollments rounded to the nearest thousand) Total Enrollment Revenues Adj. EBITDA 2024 FY Results As Reported 472K $1,567 $450 Organic Growth (excl. Campus Consolidations) ~25K $131 - $136 $56 - $60 Organic Growth % (excl. Campus Consolidations) ~5% 8% - 9% 12% - 13% Campus Consolidation Impact (3K) ($8) ($2) 2025 FY Guidance (Constant Currency) ~494K $1,690 - $1,695 $504 - $508 Organic Growth % (Constant Currency) ~5% 8% - 8% 12% - 13% FX Impact (spot FX) (1) ($9) $4 2025 FY Guidance (@ spot FX) (1) ~494K $1,681 - $1,686 $508 - $512 As Reported Growth % ~5% 7% - 8% 13% - 14% (1) Based on actual FX rates for January through October, and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for 2025 net income and reconciliation of the forward-looking 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Continued Constant Currency Top Line Growth and Margin Expansion

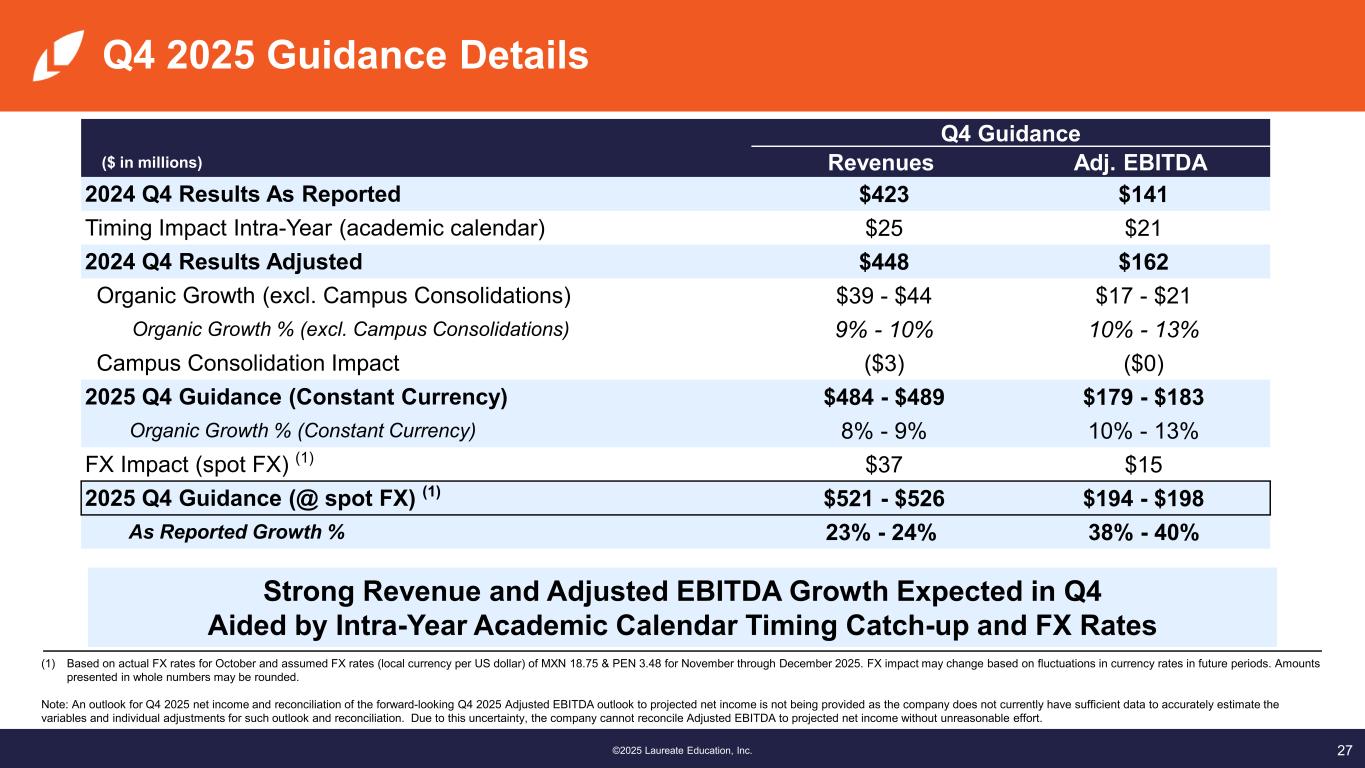

27©2025 Laureate Education, Inc. Q4 2025 Guidance Details (1) Based on actual FX rates for October and assumed FX rates (local currency per US dollar) of MXN 18.75 & PEN 3.48 for November through December 2025. FX impact may change based on fluctuations in currency rates in future periods. Amounts presented in whole numbers may be rounded. Note: An outlook for Q4 2025 net income and reconciliation of the forward-looking Q4 2025 Adjusted EBITDA outlook to projected net income is not being provided as the company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such outlook and reconciliation. Due to this uncertainty, the company cannot reconcile Adjusted EBITDA to projected net income without unreasonable effort. Strong Revenue and Adjusted EBITDA Growth Expected in Q4 Aided by Intra-Year Academic Calendar Timing Catch-up and FX Rates Q4 Guidance ($ in millions) Revenues Adj. EBITDA 2024 Q4 Results As Reported $423 $141 Timing Impact Intra-Year (academic calendar) $25 $21 2024 Q4 Results Adjusted $448 $162 Organic Growth (excl. Campus Consolidations) $39 - $44 $17 - $21 Organic Growth % (excl. Campus Consolidations) 9% - 10% 10% - 13% Campus Consolidation Impact ($3) ($0) 2025 Q4 Guidance (Constant Currency) $484 - $489 $179 - $183 Organic Growth % (Constant Currency) 8% - 9% 10% - 13% FX Impact (spot FX) (1) $37 $15 2025 Q4 Guidance (@ spot FX) (1) $521 - $526 $194 - $198 As Reported Growth % 23% - 24% 38% - 40%

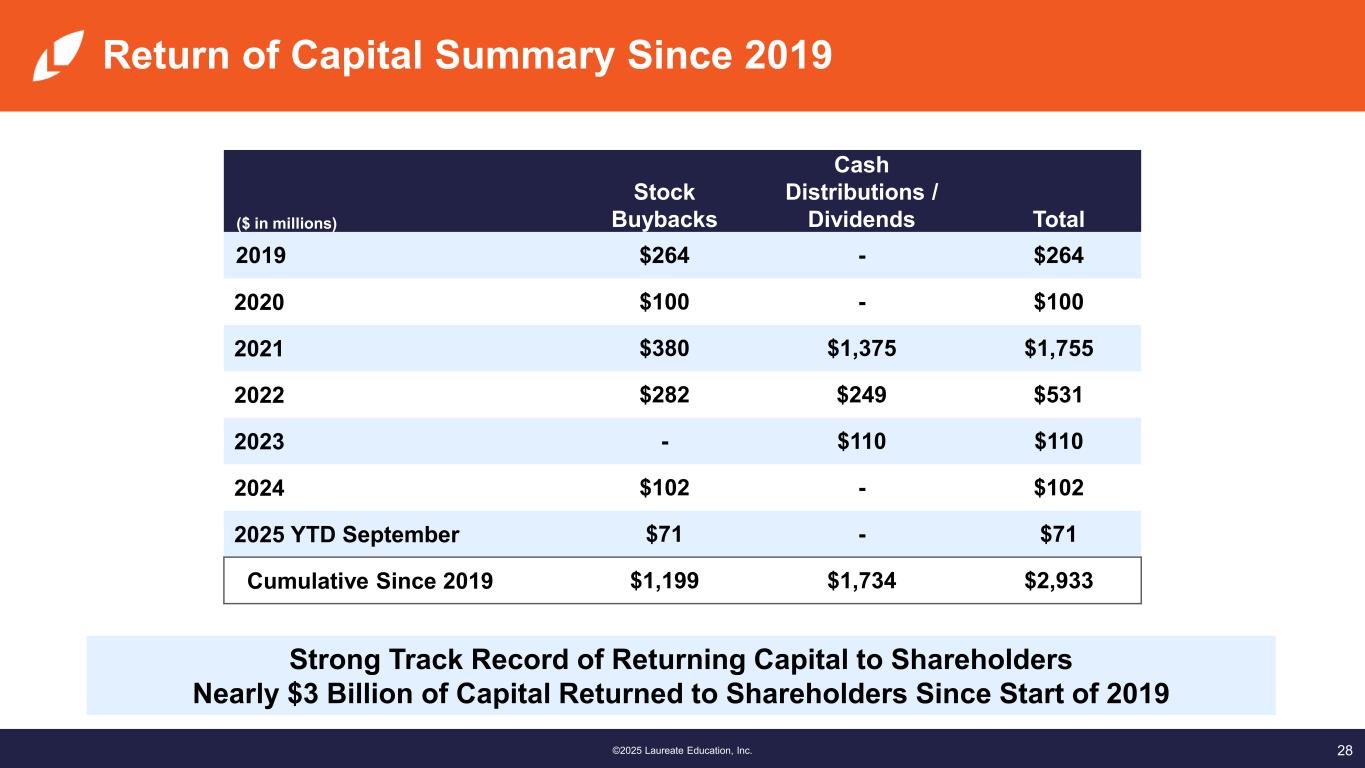

28©2025 Laureate Education, Inc. Return of Capital Summary Since 2019 ($ in millions) Stock Buybacks Cash Distributions / Dividends Total 2019 $264 - $264 2020 $100 - $100 2021 $380 $1,375 $1,755 2022 $282 $249 $531 2023 - $110 $110 2024 $102 - $102 2025 YTD September $71 - $71 Cumulative Since 2019 $1,199 $1,734 $2,933 Strong Track Record of Returning Capital to Shareholders Nearly $3 Billion of Capital Returned to Shareholders Since Start of 2019

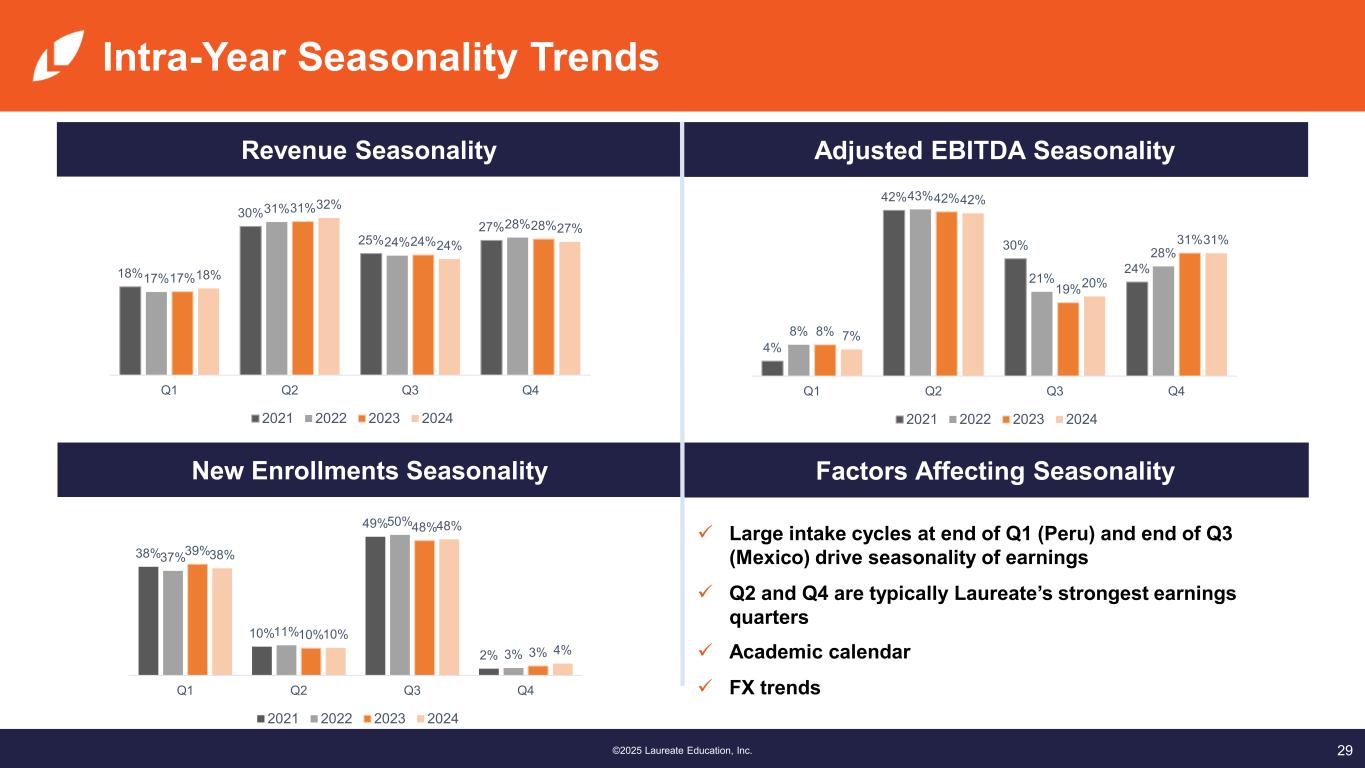

29©2025 Laureate Education, Inc. New Enrollments Seasonality Intra-Year Seasonality Trends Revenue Seasonality Adjusted EBITDA Seasonality Factors Affecting Seasonality Large intake cycles at end of Q1 (Peru) and end of Q3 (Mexico) drive seasonality of earnings Q2 and Q4 are typically Laureate’s strongest earnings quarters Academic calendar FX trends 18% 30% 25% 27% 17% 31% 24% 28% 17% 31% 24% 28% 18% 32% 24% 27% Q1 Q2 Q3 Q4 2021 2022 2023 2024 4% 42% 30% 24% 8% 43% 21% 28% 8% 42% 19% 31% 7% 42% 20% 31% Q1 Q2 Q3 Q4 2021 2022 2023 2024 38% 10% 49% 2% 37% 11% 50% 3% 39% 10% 48% 3% 38% 10% 48% 4% Q1 Q2 Q3 Q4 2021 2022 2023 2024

30©2025 Laureate Education, Inc. Financial Results & Tables

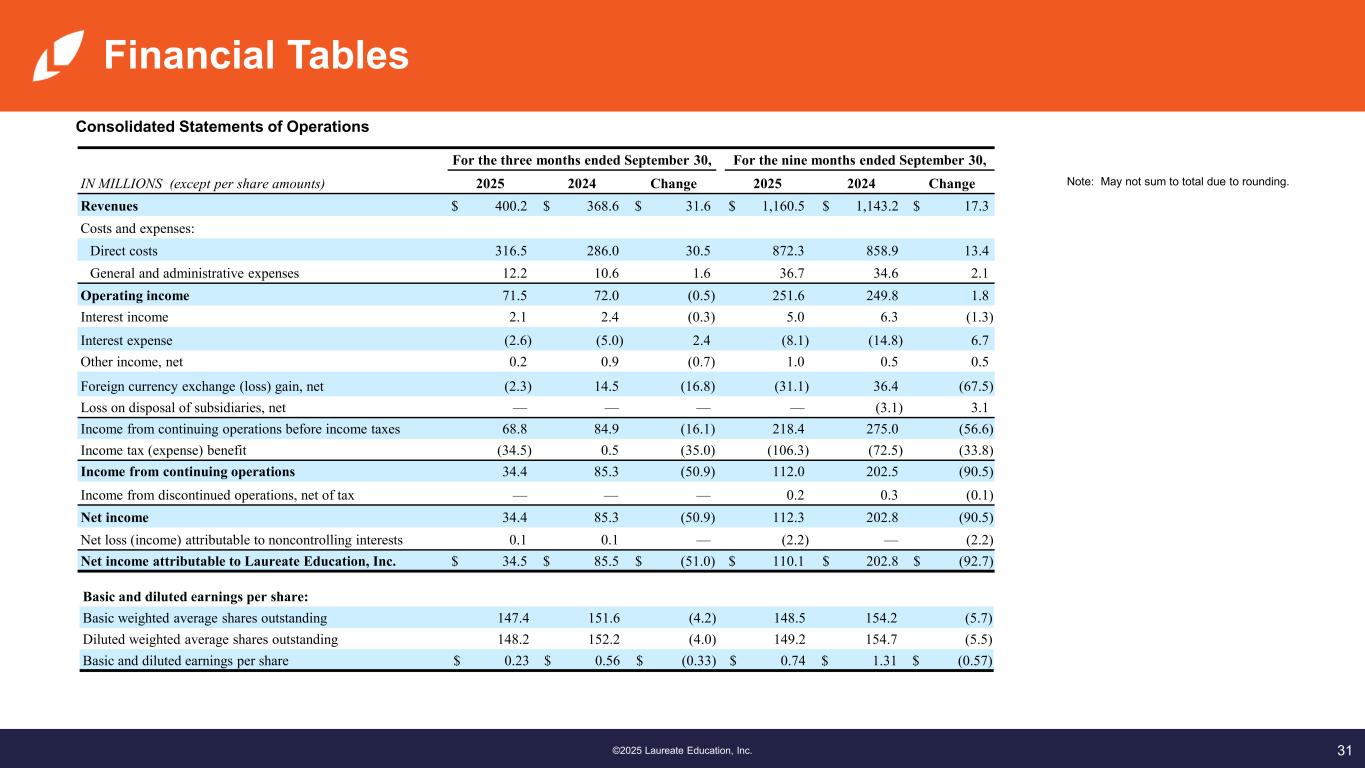

31©2025 Laureate Education, Inc. Financial Tables Consolidated Statements of Operations Note: May not sum to total due to rounding. For the three months ended September 30, For the nine months ended September 30, IN MILLIONS (except per share amounts) 2025 2024 Change 2025 2024 Change Revenues $ 400.2 $ 368.6 $ 31.6 $ 1,160.5 $ 1,143.2 $ 17.3 Costs and expenses: Direct costs 316.5 286.0 30.5 872.3 858.9 13.4 General and administrative expenses 12.2 10.6 1.6 36.7 34.6 2.1 Operating income 71.5 72.0 (0.5) 251.6 249.8 1.8 Interest income 2.1 2.4 (0.3) 5.0 6.3 (1.3) Interest expense (2.6) (5.0) 2.4 (8.1) (14.8) 6.7 Other income, net 0.2 0.9 (0.7) 1.0 0.5 0.5 Foreign currency exchange (loss) gain, net (2.3) 14.5 (16.8) (31.1) 36.4 (67.5) Loss on disposal of subsidiaries, net — — — — (3.1) 3.1 Income from continuing operations before income taxes 68.8 84.9 (16.1) 218.4 275.0 (56.6) Income tax (expense) benefit (34.5) 0.5 (35.0) (106.3) (72.5) (33.8) Income from continuing operations 34.4 85.3 (50.9) 112.0 202.5 (90.5) Income from discontinued operations, net of tax — — — 0.2 0.3 (0.1) Net income 34.4 85.3 (50.9) 112.3 202.8 (90.5) Net loss (income) attributable to noncontrolling interests 0.1 0.1 — (2.2) — (2.2) Net income attributable to Laureate Education, Inc. $ 34.5 $ 85.5 $ (51.0) $ 110.1 $ 202.8 $ (92.7) Basic and diluted earnings per share: Basic weighted average shares outstanding 147.4 151.6 (4.2) 148.5 154.2 (5.7) Diluted weighted average shares outstanding 148.2 152.2 (4.0) 149.2 154.7 (5.5) Basic and diluted earnings per share $ 0.23 $ 0.56 $ (0.33) $ 0.74 $ 1.31 $ (0.57)

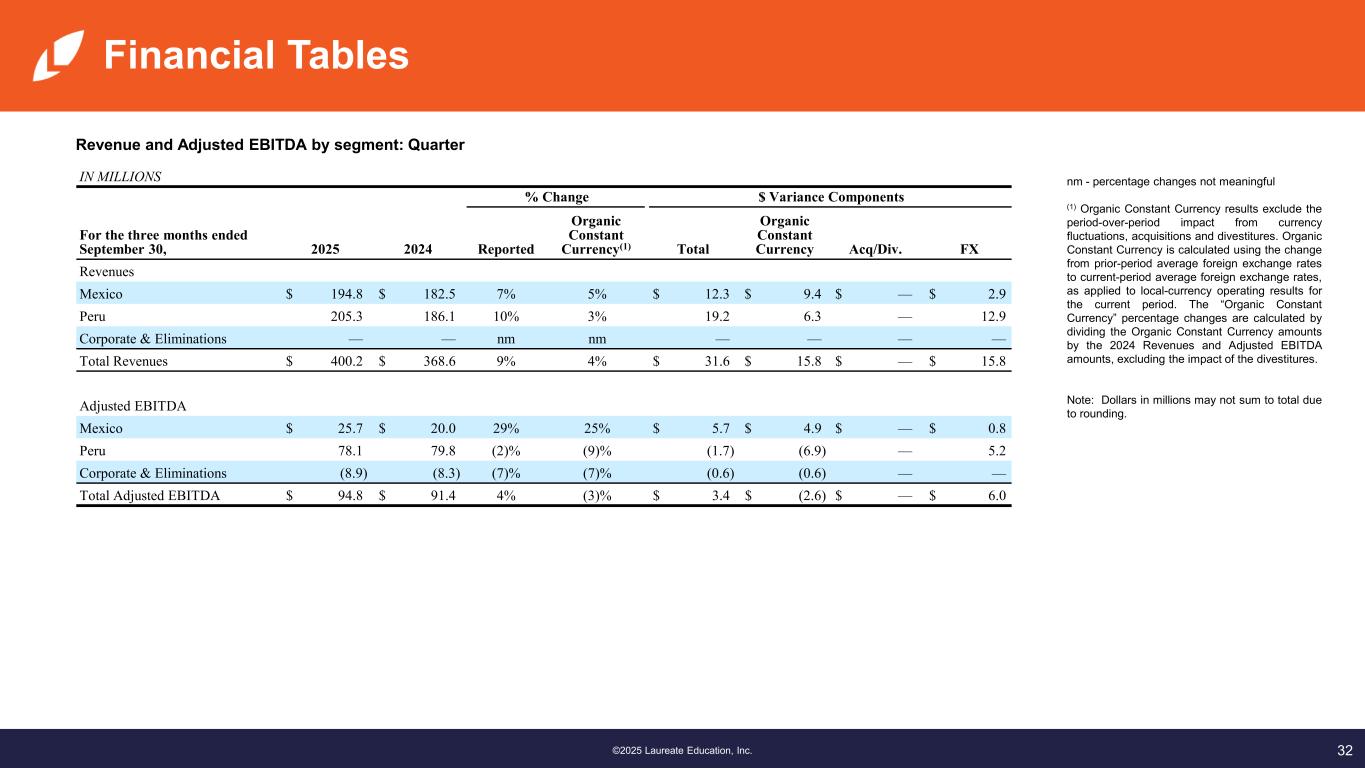

32©2025 Laureate Education, Inc. Financial Tables Revenue and Adjusted EBITDA by segment: Quarter nm - percentage changes not meaningful (1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2024 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures. Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS % Change $ Variance Components For the three months ended September 30, 2025 2024 Reported Organic Constant Currency(1) Total Organic Constant Currency Acq/Div. FX Revenues Mexico $ 194.8 $ 182.5 7% 5% $ 12.3 $ 9.4 $ — $ 2.9 Peru 205.3 186.1 10% 3% 19.2 6.3 — 12.9 Corporate & Eliminations — — nm nm — — — — Total Revenues $ 400.2 $ 368.6 9% 4% $ 31.6 $ 15.8 $ — $ 15.8 Adjusted EBITDA Mexico $ 25.7 $ 20.0 29% 25% $ 5.7 $ 4.9 $ — $ 0.8 Peru 78.1 79.8 (2)% (9)% (1.7) (6.9) — 5.2 Corporate & Eliminations (8.9) (8.3) (7)% (7)% (0.6) (0.6) — — Total Adjusted EBITDA $ 94.8 $ 91.4 4% (3)% $ 3.4 $ (2.6) $ — $ 6.0

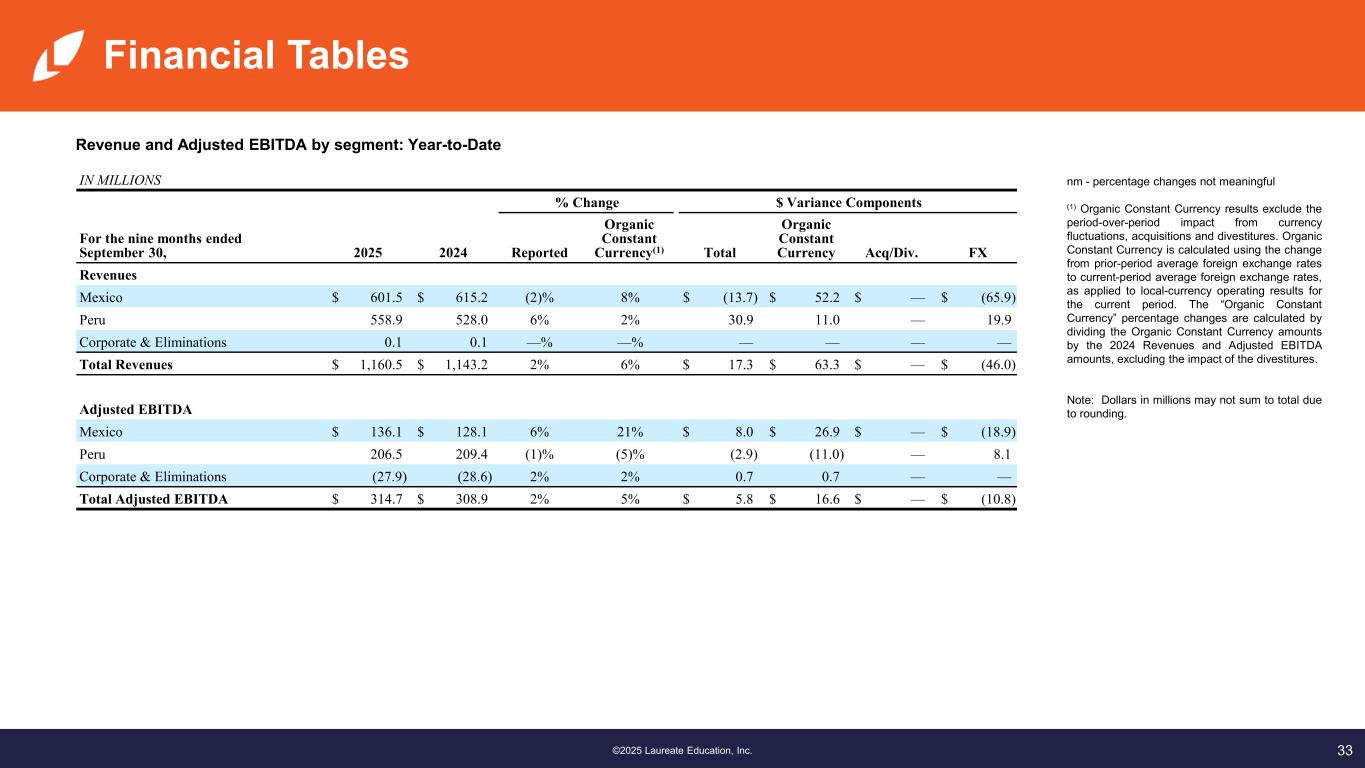

33©2025 Laureate Education, Inc. Financial Tables Revenue and Adjusted EBITDA by segment: Year-to-Date nm - percentage changes not meaningful (1) Organic Constant Currency results exclude the period-over-period impact from currency fluctuations, acquisitions and divestitures. Organic Constant Currency is calculated using the change from prior-period average foreign exchange rates to current-period average foreign exchange rates, as applied to local-currency operating results for the current period. The “Organic Constant Currency” percentage changes are calculated by dividing the Organic Constant Currency amounts by the 2024 Revenues and Adjusted EBITDA amounts, excluding the impact of the divestitures. Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS % Change $ Variance Components For the nine months ended September 30, 2025 2024 Reported Organic Constant Currency(1) Total Organic Constant Currency Acq/Div. FX Revenues Mexico $ 601.5 $ 615.2 (2)% 8% $ (13.7) $ 52.2 $ — $ (65.9) Peru 558.9 528.0 6% 2% 30.9 11.0 — 19.9 Corporate & Eliminations 0.1 0.1 —% —% — — — — Total Revenues $ 1,160.5 $ 1,143.2 2% 6% $ 17.3 $ 63.3 $ — $ (46.0) Adjusted EBITDA Mexico $ 136.1 $ 128.1 6% 21% $ 8.0 $ 26.9 $ — $ (18.9) Peru 206.5 209.4 (1)% (5)% (2.9) (11.0) — 8.1 Corporate & Eliminations (27.9) (28.6) 2% 2% 0.7 0.7 — — Total Adjusted EBITDA $ 314.7 $ 308.9 2% 5% $ 5.8 $ 16.6 $ — $ (10.8)

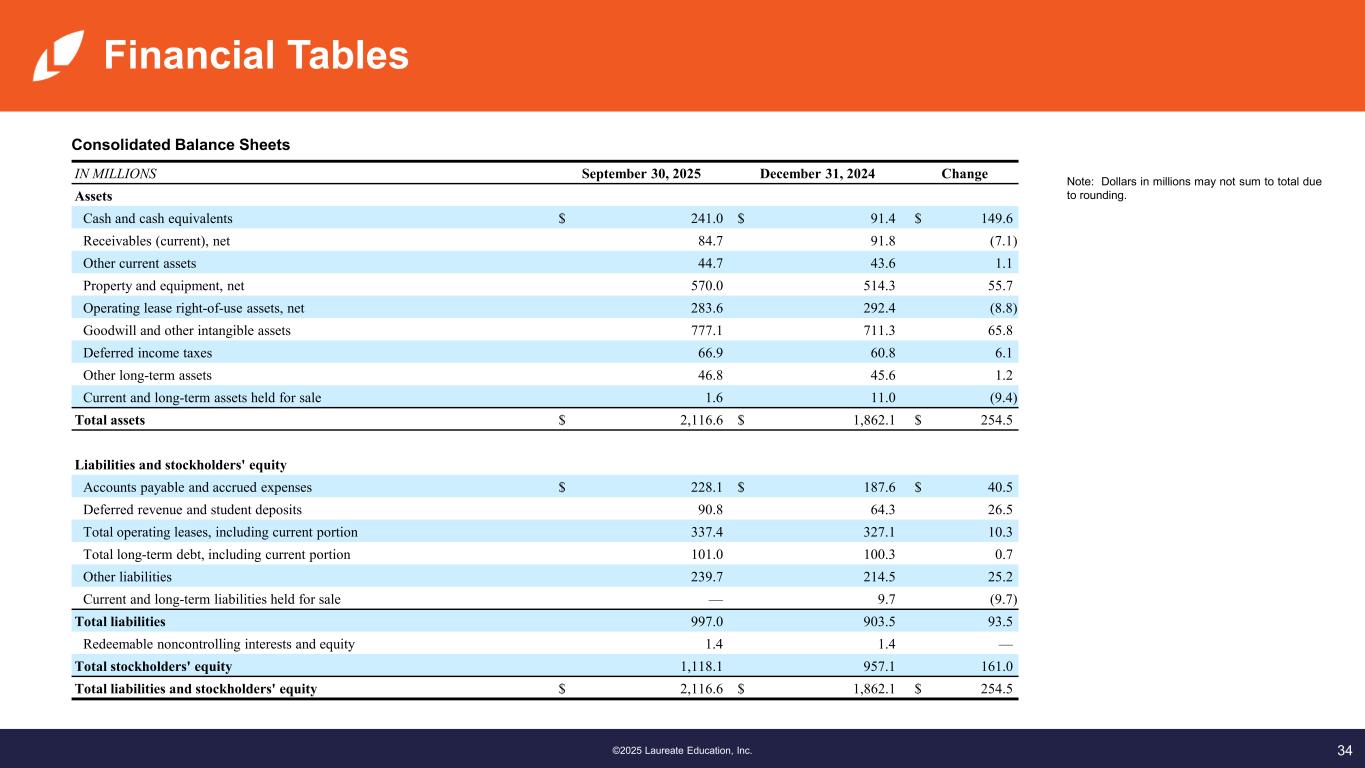

34©2025 Laureate Education, Inc. Financial Tables Consolidated Balance Sheets Note: Dollars in millions may not sum to total due to rounding. IN MILLIONS September 30, 2025 December 31, 2024 Change Assets Cash and cash equivalents $ 241.0 $ 91.4 $ 149.6 Receivables (current), net 84.7 91.8 (7.1) Other current assets 44.7 43.6 1.1 Property and equipment, net 570.0 514.3 55.7 Operating lease right-of-use assets, net 283.6 292.4 (8.8) Goodwill and other intangible assets 777.1 711.3 65.8 Deferred income taxes 66.9 60.8 6.1 Other long-term assets 46.8 45.6 1.2 Current and long-term assets held for sale 1.6 11.0 (9.4) Total assets $ 2,116.6 $ 1,862.1 $ 254.5 Liabilities and stockholders' equity Accounts payable and accrued expenses $ 228.1 $ 187.6 $ 40.5 Deferred revenue and student deposits 90.8 64.3 26.5 Total operating leases, including current portion 337.4 327.1 10.3 Total long-term debt, including current portion 101.0 100.3 0.7 Other liabilities 239.7 214.5 25.2 Current and long-term liabilities held for sale — 9.7 (9.7) Total liabilities 997.0 903.5 93.5 Redeemable noncontrolling interests and equity 1.4 1.4 — Total stockholders' equity 1,118.1 957.1 161.0 Total liabilities and stockholders' equity $ 2,116.6 $ 1,862.1 $ 254.5

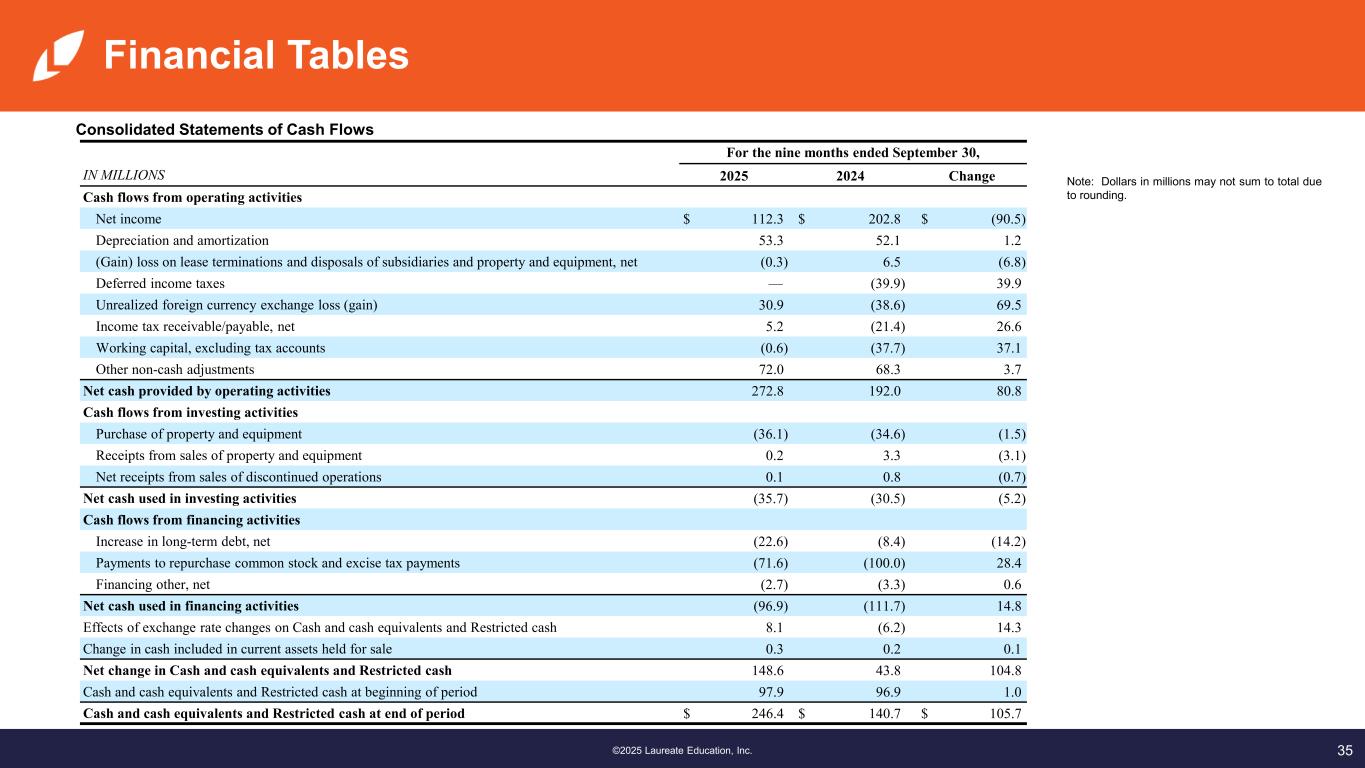

35©2025 Laureate Education, Inc. Financial Tables Consolidated Statements of Cash Flows Note: Dollars in millions may not sum to total due to rounding. For the nine months ended September 30, IN MILLIONS 2025 2024 Change Cash flows from operating activities Net income $ 112.3 $ 202.8 $ (90.5) Depreciation and amortization 53.3 52.1 1.2 (Gain) loss on lease terminations and disposals of subsidiaries and property and equipment, net (0.3) 6.5 (6.8) Deferred income taxes — (39.9) 39.9 Unrealized foreign currency exchange loss (gain) 30.9 (38.6) 69.5 Income tax receivable/payable, net 5.2 (21.4) 26.6 Working capital, excluding tax accounts (0.6) (37.7) 37.1 Other non-cash adjustments 72.0 68.3 3.7 Net cash provided by operating activities 272.8 192.0 80.8 Cash flows from investing activities Purchase of property and equipment (36.1) (34.6) (1.5) Receipts from sales of property and equipment 0.2 3.3 (3.1) Net receipts from sales of discontinued operations 0.1 0.8 (0.7) Net cash used in investing activities (35.7) (30.5) (5.2) Cash flows from financing activities Increase in long-term debt, net (22.6) (8.4) (14.2) Payments to repurchase common stock and excise tax payments (71.6) (100.0) 28.4 Financing other, net (2.7) (3.3) 0.6 Net cash used in financing activities (96.9) (111.7) 14.8 Effects of exchange rate changes on Cash and cash equivalents and Restricted cash 8.1 (6.2) 14.3 Change in cash included in current assets held for sale 0.3 0.2 0.1 Net change in Cash and cash equivalents and Restricted cash 148.6 43.8 104.8 Cash and cash equivalents and Restricted cash at beginning of period 97.9 96.9 1.0 Cash and cash equivalents and Restricted cash at end of period $ 246.4 $ 140.7 $ 105.7

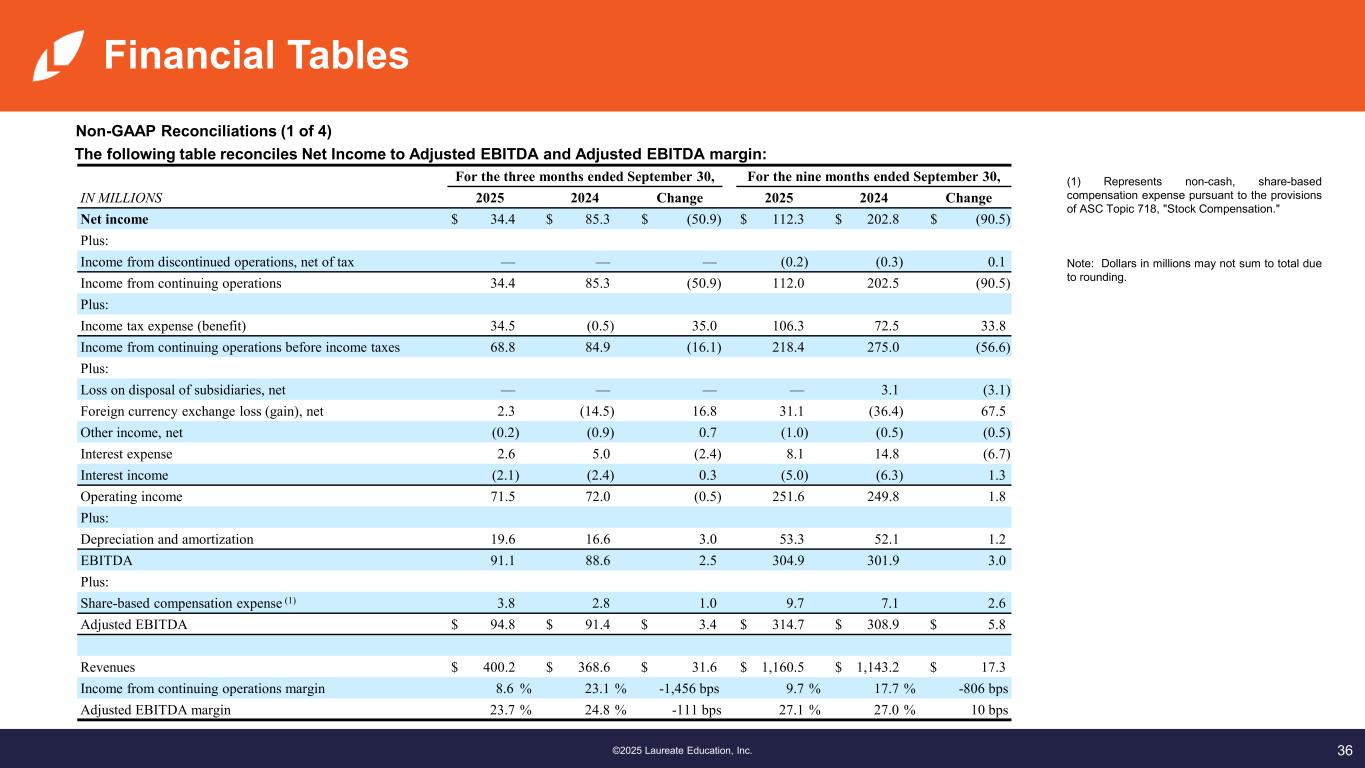

36©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (1 of 4) The following table reconciles Net Income to Adjusted EBITDA and Adjusted EBITDA margin: (1) Represents non-cash, share-based compensation expense pursuant to the provisions of ASC Topic 718, "Stock Compensation." Note: Dollars in millions may not sum to total due to rounding. For the three months ended September 30, For the nine months ended September 30, IN MILLIONS 2025 2024 Change 2025 2024 Change Net income $ 34.4 $ 85.3 $ (50.9) $ 112.3 $ 202.8 $ (90.5) Plus: Income from discontinued operations, net of tax — — — (0.2) (0.3) 0.1 Income from continuing operations 34.4 85.3 (50.9) 112.0 202.5 (90.5) Plus: Income tax expense (benefit) 34.5 (0.5) 35.0 106.3 72.5 33.8 Income from continuing operations before income taxes 68.8 84.9 (16.1) 218.4 275.0 (56.6) Plus: Loss on disposal of subsidiaries, net — — — — 3.1 (3.1) Foreign currency exchange loss (gain), net 2.3 (14.5) 16.8 31.1 (36.4) 67.5 Other income, net (0.2) (0.9) 0.7 (1.0) (0.5) (0.5) Interest expense 2.6 5.0 (2.4) 8.1 14.8 (6.7) Interest income (2.1) (2.4) 0.3 (5.0) (6.3) 1.3 Operating income 71.5 72.0 (0.5) 251.6 249.8 1.8 Plus: Depreciation and amortization 19.6 16.6 3.0 53.3 52.1 1.2 EBITDA 91.1 88.6 2.5 304.9 301.9 3.0 Plus: Share-based compensation expense (1) 3.8 2.8 1.0 9.7 7.1 2.6 Adjusted EBITDA $ 94.8 $ 91.4 $ 3.4 $ 314.7 $ 308.9 $ 5.8 Revenues $ 400.2 $ 368.6 $ 31.6 $ 1,160.5 $ 1,143.2 $ 17.3 Income from continuing operations margin 8.6 % 23.1 % -1,456 bps 9.7 % 17.7 % -806 bps Adjusted EBITDA margin 23.7 % 24.8 % -111 bps 27.1 % 27.0 % 10 bps

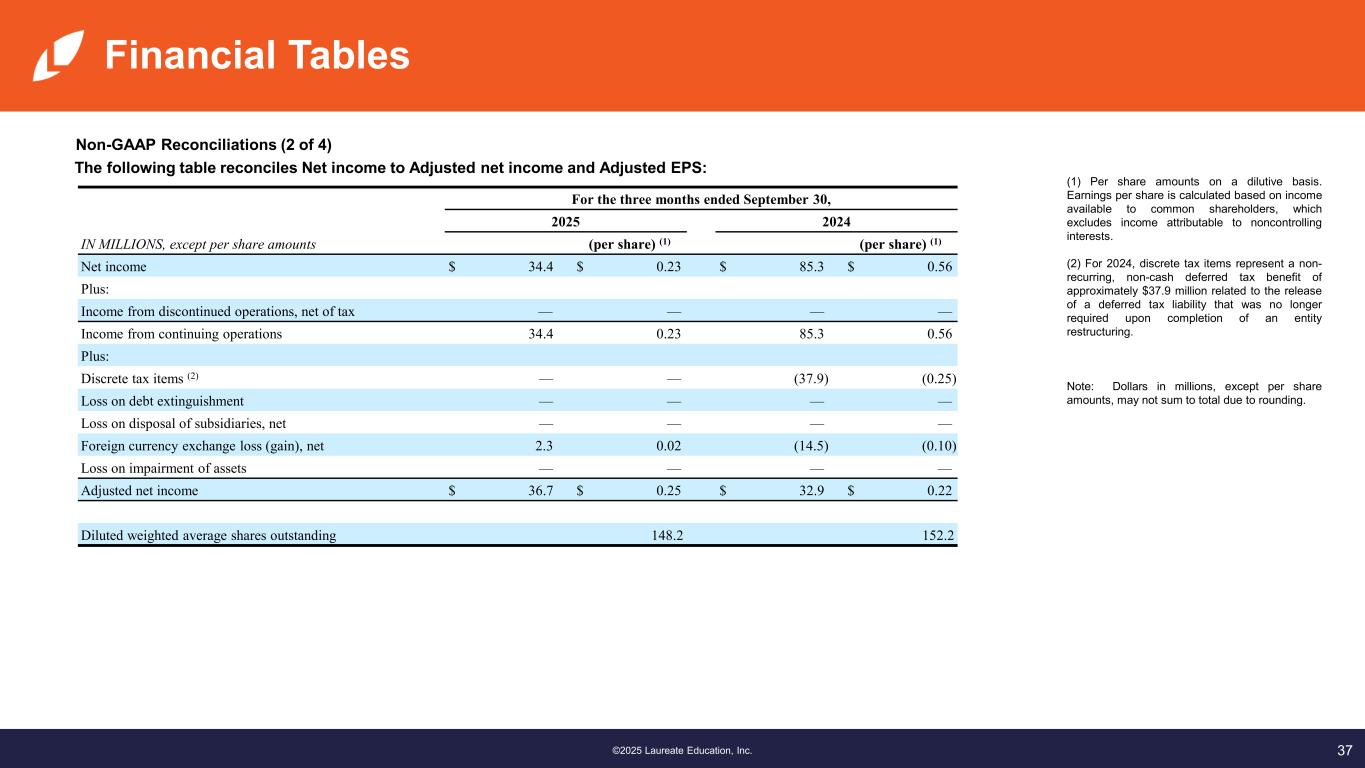

37©2025 Laureate Education, Inc. (1) Per share amounts on a dilutive basis. Earnings per share is calculated based on income available to common shareholders, which excludes income attributable to noncontrolling interests. (2) For 2024, discrete tax items represent a non- recurring, non-cash deferred tax benefit of approximately $37.9 million related to the release of a deferred tax liability that was no longer required upon completion of an entity restructuring. Note: Dollars in millions, except per share amounts, may not sum to total due to rounding. Financial Tables Non-GAAP Reconciliations (2 of 4) The following table reconciles Net income to Adjusted net income and Adjusted EPS: For the three months ended September 30, 2025 2024 IN MILLIONS, except per share amounts (per share) (1) (per share) (1) Net income $ 34.4 $ 0.23 $ 85.3 $ 0.56 Plus: Income from discontinued operations, net of tax — — — — Income from continuing operations 34.4 0.23 85.3 0.56 Plus: Discrete tax items (2) — — (37.9) (0.25) Loss on debt extinguishment — — — — Loss on disposal of subsidiaries, net — — — — Foreign currency exchange loss (gain), net 2.3 0.02 (14.5) (0.10) Loss on impairment of assets — — — — Adjusted net income $ 36.7 $ 0.25 $ 32.9 $ 0.22 Diluted weighted average shares outstanding 148.2 152.2

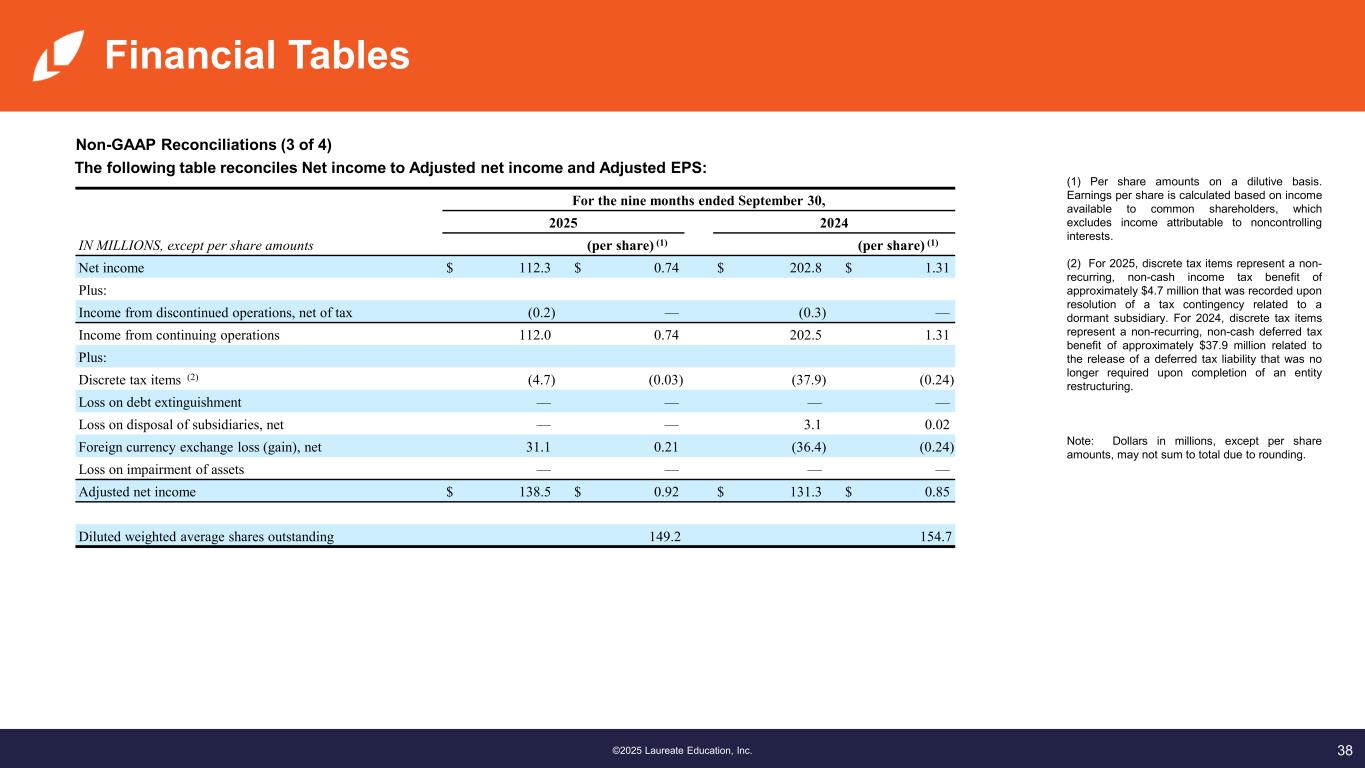

38©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (3 of 4) The following table reconciles Net income to Adjusted net income and Adjusted EPS: (1) Per share amounts on a dilutive basis. Earnings per share is calculated based on income available to common shareholders, which excludes income attributable to noncontrolling interests. (2) For 2025, discrete tax items represent a non- recurring, non-cash income tax benefit of approximately $4.7 million that was recorded upon resolution of a tax contingency related to a dormant subsidiary. For 2024, discrete tax items represent a non-recurring, non-cash deferred tax benefit of approximately $37.9 million related to the release of a deferred tax liability that was no longer required upon completion of an entity restructuring. Note: Dollars in millions, except per share amounts, may not sum to total due to rounding. For the nine months ended September 30, 2025 2024 IN MILLIONS, except per share amounts (per share) (1) (per share) (1) Net income $ 112.3 $ 0.74 $ 202.8 $ 1.31 Plus: Income from discontinued operations, net of tax (0.2) — (0.3) — Income from continuing operations 112.0 0.74 202.5 1.31 Plus: Discrete tax items (2) (4.7) (0.03) (37.9) (0.24) Loss on debt extinguishment — — — — Loss on disposal of subsidiaries, net — — 3.1 0.02 Foreign currency exchange loss (gain), net 31.1 0.21 (36.4) (0.24) Loss on impairment of assets — — — — Adjusted net income $ 138.5 $ 0.92 $ 131.3 $ 0.85 Diluted weighted average shares outstanding 149.2 154.7

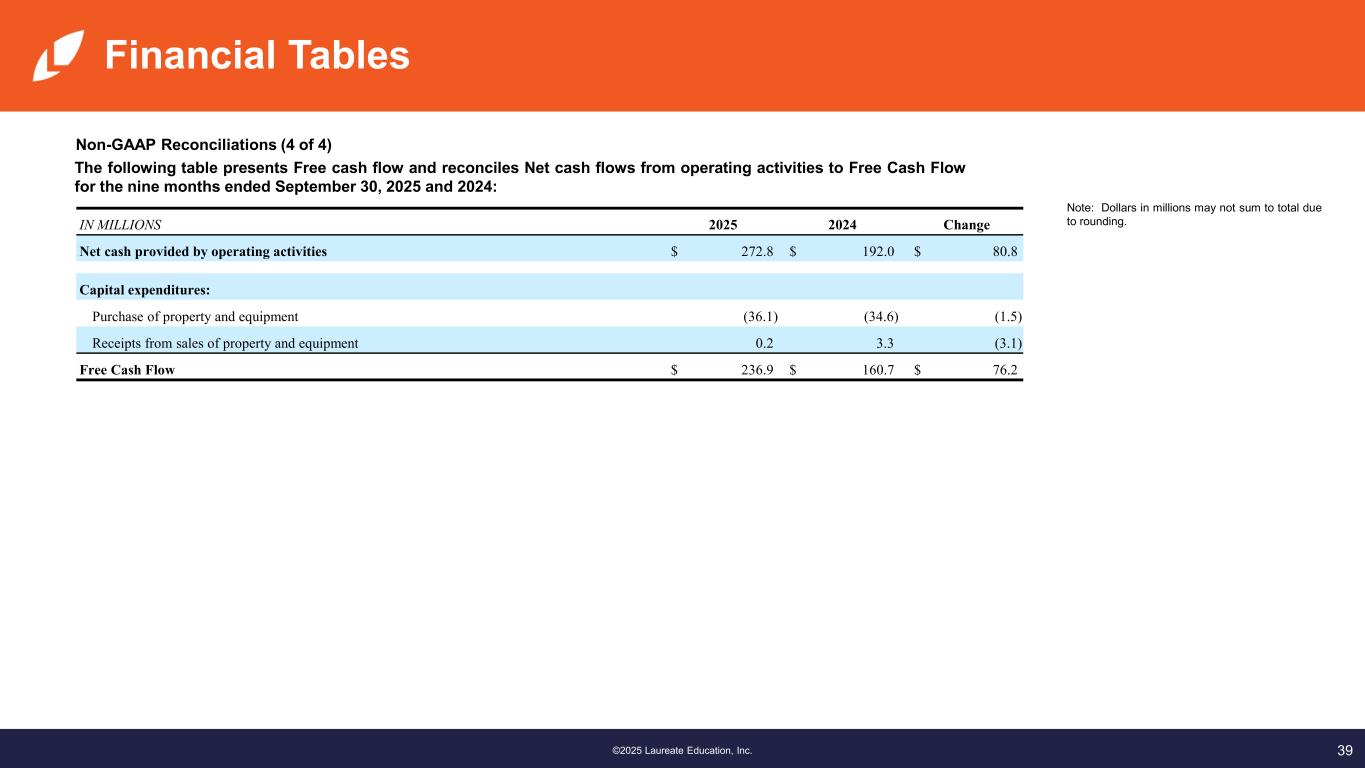

39©2025 Laureate Education, Inc. Financial Tables Non-GAAP Reconciliations (4 of 4) The following table presents Free cash flow and reconciles Net cash flows from operating activities to Free Cash Flow for the nine months ended September 30, 2025 and 2024: Note: Dollars in millions may not sum to total due to rounding.IN MILLIONS 2025 2024 Change Net cash provided by operating activities $ 272.8 $ 192.0 $ 80.8 Capital expenditures: Purchase of property and equipment (36.1) (34.6) (1.5) Receipts from sales of property and equipment 0.2 3.3 (3.1) Free Cash Flow $ 236.9 $ 160.7 $ 76.2

©2025 Laureate Education, Inc.