Please wait

BEAZER HOMES USA, INC.0000915840DEF 14AFALSEiso4217:USD00009158402024-10-012025-09-3000009158402023-10-012024-09-3000009158402022-10-012023-09-3000009158402021-10-012022-09-3000009158402020-10-012021-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-10-012025-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2024-10-012025-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-10-012024-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-10-012024-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-10-012023-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-10-012023-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-10-012022-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-10-012022-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-10-012021-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-10-012021-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-10-012025-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-10-012025-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-10-012025-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-10-012025-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-10-012025-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-10-012025-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-10-012024-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-10-012024-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-10-012024-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-10-012024-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-10-012024-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-10-012024-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-10-012023-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-10-012023-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-10-012023-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-10-012023-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-10-012023-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-10-012023-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-10-012022-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-10-012022-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-10-012022-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-10-012022-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-10-012022-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-10-012022-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-10-012021-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-10-012021-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-10-012021-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-10-012021-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-10-012021-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-10-012021-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-10-012025-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-10-012024-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-10-012023-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-10-012022-09-300000915840ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-10-012021-09-300000915840ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-10-012021-09-30000091584012024-10-012025-09-30000091584022024-10-012025-09-30000091584032024-10-012025-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | |

| Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

| | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| | |

BEAZER HOMES USA, INC. (Name of registrant as specified in its charter) |

| | |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ABOUT US | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| STRATEGY We are executing a balanced growth strategy that emphasizes profitability, balance sheet efficiency, and returns above our cost of capital. Our capital allocation approach focuses on high-return investments, maintaining prudent financial leverage, and returning capital to stockholders when aligned with our long-term strategic and financial priorities. During 2025, we continued to focus on our strategic multiyear goals and celebrate the achievement of our Zero Energy Ready goal. | | | Our purpose is to create durable and growing value for our customers, employees, partners and stockholders and strengthen the communities that we serve. |

| | | | | | | | |

| MULTI-YEAR GOALS | |

| |

| | | | | | | | |

| | | | | | | | |

| | Reaching more than 200 active communities by the end of fiscal 2027 | | | |

| | | | | | | |

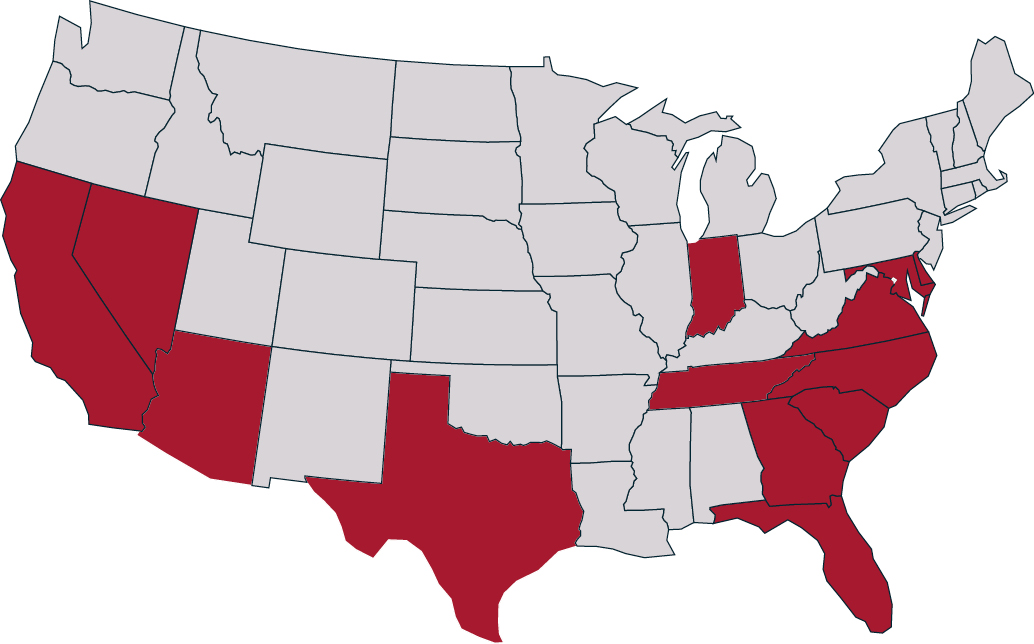

| | | | | 25,660 Controlled Lots | 4,427 Homes Closed | 164 Average Active Community Count |

| | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Reducing our net debt to net capitalization ratio to low 30% range by the end of fiscal 2027 | | | |

| | | | | | |

| | | | | 1,018 Employees | $2.30B Homebuilding Revenue | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | |

| | Double Digit Growth in Book Value Per Share compounded annually from fiscal 2024 to fiscal 2027 | | | | As one of the country's largest homebuilders, we build homes and communities meant to inspire sustainable and healthier living. Every Beazer home is designed and built to provide Advanced Home Performance, giving our homeowners a sanctuary of peace and comfort. With Beazer’s Curated Choices, homeowners can personalize their primary living areas from our flexible layouts that adapt to different lifestyles, at no additional cost. And unlike most national homebuilders, we empower our homeowners to shop and compare loan options. Our Mortgage Choice program gives our homeowners the resources to easily compare multiple loan offers and choose the best lender and loan offer for them, potentially saving them thousands of dollars over the life of their loan. Each customer receives Elevated Experiences with the help of a trusted team of experts during their home-buying journey and beyond through our customer care and warranty programs. Community Impact is part of our business model. In addition to energy efficient home construction and company-wide volunteerism, 100% of the net profits for our Charity Title Agency and Charity Home Insurance Agency subsidiaries are used for charitable action. Visit www.beazer.com to learn more. |

| | | | |

| | | | |

| | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Fulfilled our commitment that by the end of calendar year 2025, every home we start will be Zero Energy Ready | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | |

| | | | | | | | |

From Our Chairman | |

|

|

| DEAR FELLOW STOCKHOLDERS: |

Fiscal 2025 was a year of strategic progress for Beazer. We expanded our community count while strengthening our balance sheet and positioning the Company to maintain stability in the current home sales environment as well as capitalize on the upside when market conditions improve. Successfully Navigating Macro Challenges Throughout the year, macro headwinds across our industry persisted, with elevated mortgage rates, weak consumer sentiment and excess builder inventory. In response to these challenges, we sought a deliberate, disciplined approach to our operations and capital allocation. These efforts included, but were not limited to: ■slowing land spend to match current market conditions; ■renegotiating land acquisition terms to reduce costs and enhance flexibility; ■pursuing capital-efficient growth opportunities through expanded usage of lot option agreements and completing a sale-leaseback of about 80 of our model homes to free up cash for higher return uses; and ■rebidding our material and labor costs, which we expect to result in savings of about $10,000 per home. As a result of these efforts, we were able to make continued progress on our multi-year goals. Specifically, we finished fiscal 2025 with: 1.An average active community count of 164, up 14% from last year, advancing toward our goal of having more than 200 active communities by the end of fiscal 2027; 2.A net debt to net capitalization ratio below 40%, advancing toward our goal of achieving a ratio in the low-30% range by the end of fiscal 2027; and, 3.A book value per share of nearly $43 from a combination of profitability and the impact of share repurchases, advancing toward our goal of a double-digit compound annual growth rate in book value per share by the end of fiscal 2027. Additionally, we were also excited to have recently launched our "Enjoy the Great Indoors" brand refresh, which is designed to highlight how our advanced home performance and curated choices improve affordability and contribute to a healthier and more comfortable lifestyle for our homeowners. As we enter fiscal 2026, we’re encouraged by modestly improving market dynamics - with declining new home inventory and improving affordability poised to support demand. If these trends persist, they should contribute to better selling conditions over the next year, enabling us to leverage the operational and strategic improvements we've made to enhance returns and further differentiate our market position. Protecting the Company's Deferred Tax Assets Under Proposals 4 and 5, we are once again asking for stockholder approval of certain protective measures that will help us preserve our ability to fully maximize our deferred tax assets to offset the taxable income we generate now and in the future. The majority of these tax assets are tax credits that were earned through the Company's substantial investment in and commitment to energy-efficient building practices. These protections have been strongly supported by our stockholders to date, and because our deferred tax assets have substantial value to us and our stockholders, we hope you will support the renewal of these protections. |

| | |

Continued Board Refreshment Before closing, we would like to express our gratitude to Danny Shepherd for his dedicated service and invaluable contributions to our Board of Directors since 2016. In accordance with our corporate governance principles, Danny has reached the prescribed retirement age and will not be standing for re-election. I am grateful for Danny's thoughtful leadership, strategic insight, and unwavering commitment to the Company and our stockholders. I am also pleased to welcome Howard Heckes as a new independent director. Howard was appointed to our Board of Directors on December 8, 2025 and is standing for election at the 2026 Annual Meeting. Howard brings a wealth of experience across the construction materials and services sectors with strong ties to the homebuilding industry and a long track record of successful leadership throughout his career. Howard's extensive experience in building materials, home improvement, and finding unique points of differentiation to successfully grow businesses are a valuable addition to our Board and stockholders. Howard's appointment to our Board of Directors continues our long-term director refreshment efforts, marking the fourth new director appointed during the last two fiscal years. Looking Forward As we look ahead, we believe we are well-positioned to make further progress on our multi-year goals with a leaner, more efficient balance sheet, and numerous catalysts for margin improvement. Let me finish by thanking our team for their ongoing efforts to create value for our customers and you, our valued shareholders, for your continued support. |

|

ALLAN P. MERRILL Chairman, President and Chief Executive Officer Beazer Homes USA, Inc. December 22, 2025 |

| | |

Notice of Annual Meeting of Stockholders |

|

ITEMS OF BUSINESS

The items to be voted on are as follows:

| | | | | | | | | | | |

| PROPOSALS |

| | | |

| 1 | | Election of directors; FOR each nominee | |

| | | |

| | | |

| 2 | | An advisory vote regarding the compensation paid to the Company’s named executive officers; FOR | |

| | | |

| | | |

| 3 | | Ratification of appointment of Deloitte & Touche LLP as the Company’s independent auditors; FOR | |

| | | |

| | | |

| 4 | | Adoption of the Charter Amendment for the Protection of NOLs and Energy-Efficiency Tax Credits; and FOR | |

| | | |

| | | |

| 5 | | Ratification of the Rights Agreement for the Protection of NOLs and Energy-Efficiency Tax Credits. FOR | |

| | | |

| | | |

| 6 | | Transaction of any other business that properly comes before the meeting or any adjournments or postponements thereof. As of the date of this proxy statement, the Company is not aware of any other business to come before the meeting. |

| | | |

Stockholders of record as of the close of business on December 12, 2025 are entitled to notice of, and to vote at, the annual meeting.

We are pleased to announce that we are delivering your proxy materials for the 2026 annual meeting of stockholders via the Internet. Because we are delivering proxy materials via the Internet, the Securities and Exchange Commission requires us to mail a letter to our stockholders notifying them that these materials are available on the Internet and how these materials may be accessed. This letter, which we refer to as our “Notice and Access Letter,” will be mailed to our stockholders on or about December 22, 2025.

Our Notice and Access Letter will instruct you on how to access and review our proxy statement for the 2026 annual meeting of stockholders and our annual report for the fiscal year ended September 30, 2025. It will instruct you on how you may vote your proxy via the Internet, or how you can request a full set of printed proxy materials, including a proxy card to return by mail. If you would like to receive printed proxy materials, you should follow the instructions contained in our Notice and Access Letter. Unless requested, you will not receive printed proxy materials by mail.

ANNUAL MEETING

INFORMATION

| | | | | |

| WHEN: Thursday, February 5, 2026 8:30 a.m. (Eastern time) |

| |

| WHERE: Hyatt Regency Atlanta Perimeter at Villa Christina 4000 Summit Boulevard Atlanta, Georgia 30319 |

VOTING METHODS

| | | | | |

| VOTE VIA INTERNET Visit www.proxyvote.com or follow the instructions provided in the Notice of Internet Availability of Proxy Materials |

| |

| CALL TOLL-FREE Call 1-800-690-6903 |

| |

| VOTE BY MAIL Mark, sign, date and return the enclosed proxy card in the postage-paid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717 |

| |

| VOTE AT MEETING Join our Annual Meeting at location listed above |

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to vote as soon as possible.

| | | | | | | | |

| | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on February 5, 2026: This proxy statement, along with the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2025, are available free of charge on the Company’s website at http://www.beazer.com. | |

| | |

PERFORMANCE HIGHLIGHTS

Here are several highlights of our financial and operational achievements in fiscal 2025 in comparison to fiscal 2024:

| | | | | | | | | | | | | | | | | |

| | |

| | FINANCIAL |

| | | | | |

| $2.30B Homebuilding Revenue Achieved a year-over-year increase in homebuilding revenue of 0.4% | $45.6M Net Income Generated net income from continuing operations of $45.6 million, compared to $140.2 million in fiscal 2024 | $157.7M Adjusted EBITDA1 Achieved $157.7 million in Adjusted EBITDA, compared to $243.4 million in fiscal 2024 | $33.1M Share Repurchases Repurchased $33.1 million of outstanding common stock compared to $12.9 million in 2024 |

| | | | | |

| | | | | | | | | | | | | | |

| | |

| | OPERATIONAL |

| | | | |

| 2.0 Sales Pace Achieved average monthly home sales pace per community of 2.0, a decrease of 19.3% | $684.0M Land Acquisition and Land Development Spending Spent $684.0 million on land acquisition and land development, a decrease of 11.9% | $516.5M Dollar Value of Backlog Ended the year with dollar value of homes in backlog of $516.5 million, representing 945 homes, compared to $797.2 million, representing 1,482 homes at the end of fiscal 2024 |

| | | | |

| | | | |

| $520,100 Average Selling Price Average selling price for our homes was $520,100, reflecting an increase of 0.9% | 164 Average Active Community Count Average active community count was 164, an increase of 14.2% | 25,660 Number of Controlled Lots Ended the year with 25,660 lots controlled either through ownership or options to purchase, a decrease of 10.1% |

| | | | |

(1)Please see Annex I for a reconciliation of non-GAAP measures to GAAP measures. Statements regarding goals, aspirations, strategies or future initiatives and their expected results, including those contained in the Letter from our Chairman, are forward-looking statements, which involve known and unknown risks, uncertainties and other factors described in our Annual Report on Form 10-K for the fiscal year ended September 30, 2025.

SUSTAINABILITY HIGHLIGHTS

We are focused on facilitating access to energy-efficient, lower cost of ownership homes and reducing our environmental impact, enhancing and giving back to the communities in which we live and operate, and upholding stringent ethical and governance standards.

During fiscal 2025, we published our 2024 Sustainability Update, which can be found on our website, www.beazer.com. The Sustainability Update describes key sustainability topics relevant to the Company, our initiatives related to those topics and our progress with respect to those initiatives. The following overview of our Sustainability Program highlights our key initiatives, as well as some of our most recent sustainability-related accomplishments.

| | | | | |

| |

| ENERGY EFFICIENCY | ADVANCED HOME PERFORMANCE |

| |

| |

We Lead in Energy Efficiency. In 2020, we set an ambitious goal of building every home to the U.S. Department of Energy's (DOE) Zero Energy Ready Home (n/k/a the DOE Efficient New Homes Program) standard. We are proud to have achieved this goal during fiscal 2025. The DOE recognizes that homes built to this standard are 40-50% more energy efficient than a typical new home. With durable construction, lower operating costs and a reduced carbon footprint, every Beazer home can have a lasting positive impact for our customers, community and environment.

| We Build for the Future. Building for the future is about more than innovative construction techniques. At Beazer, we build homes that include the following advanced home features:

■Solar-Ready/Solar Included: our homebuyers are able to save on utility bills using solar panels on their first day of ownership or at a later time. ■Cleaner Air: each Beazer home is equipped with a whole house fresh air system, creating a cleaner breathing environment. ■Quieter Homes: Our homes provide additional insulation and alternate building practices that reduce noise and distractions inside the home. |

| |

| |

| OUR PEOPLE, OUR COMMUNITIES | GOVERNANCE |

| |

| |

We Focus on our People. Our employees are the cornerstone of our Company's foundation. We cultivate an environment where our employees can be proud to come to work every day, so that they can build rewarding careers that reflect their individual talents and aspirations. We are also proud to dedicate 100% of the net profits from Charity Title Agency and Charity Home Insurance Agency to the Beazer Charity Foundation to support causes that matter to our employees and the communities that we serve. | We Operate Responsibly. Our Board of Directors allocates appropriate oversight responsibility to its committees for selected sustainability matters that align with their respective responsibilities. This allows the Board to focus on sustainability risks and opportunities in the context of Beazer’s long-term business strategy while responding to the evolving needs of the Company. |

| |

ENERGY EFFICIENCY

The Home Energy Rating System (HERS®) is the industry-leading homebuilding scoring system developed by the Residential Energy Services Network (RESNET) for inspecting and calculating a home’s energy performance after construction is complete. The HERS methodology measures the energy efficiency of a home on an easy-to-understand scale: the lower the HERS Index Score, the more energy efficient the home operates.

The average HERS Index Score for a Beazer home delivered in fiscal 2025 was 32, compared to 36 in fiscal 2024 and 42 in 2023 (historical periods adjusted to reflect benefits of renewable energy technologies, as described below). We are proud of the continuous improvement in the performance of our homes and the value we provide to customers.

Beazer Homes has the lowest HERS score of any national homebuilder based on publicly reported average HERS scores in 2025 for each of the top 30 homebuilders in the U.S. (based on 2024 sales according to Builder Magazine). Historically, we have reported our average HERS Index Score as a “gross” score that excludes the benefit of renewable energy technologies (i.e. solar-photovoltaic system). We have transitioned to reporting scores reflecting the benefits of renewable energy technologies to more closely align with how our industry peers report HERS scores.

ADVANCED HOME PERFORMANCE

We continue to expand on our industry-leading reputation for our commitment to energy efficiency, water efficiency, and indoor air quality. We work with industry-leading partners who value innovation and quality while embracing environmentally friendly processes and objectives. Our advanced construction practices and materials are designed to provide customers with lower carbon producing, energy-efficient homes that have demonstrated high-performance and lower costs of ownership. We achieve these results for our homeowners in part through our commitments to the U.S. Department of Energy's Energy Efficient Homes Program (formerly known as the Zero Energy Ready Home ProgramTM), our approach to land acquisition, planning and development, and the EPA's ENERGY STAR® and Indoor AirPlus® programs.

In December 2020, we became the first national homebuilder to publicly commit to ensuring that, by the end of calendar year 2025, every home we start would meet the requirements of the DOE's Zero Energy Ready Home Program (n/k/a the DOE Efficient New Homes Program). We fulfilled this commitment by the end of fiscal 2025. In October 2025, the Energy & Environmental Building Alliance (EEBA) recognized our commitment by awarding us their Most ZERH SFH Homes Built award.

The DOE’s Efficient New Homes program builds upon current HERS standards and the EPA’s ENERGY STAR program while incorporating other building science innovations and practices to achieve greater energy efficiency than a typical new home. Building homes to this standard represents an elevated level of quality, comfort and innovation for our customers.

OUR PEOPLE, OUR COMMUNITIES

Across our Company, Beazer team members are committed to supporting causes that make a difference. From local service activities to Company-wide initiatives, giving back is a central element of our culture, championed by passionate employees and embraced by customers and partners who share our commitment to have a positive impact on the communities we serve.

| | | | | |

| Our wholly owned subsidiaries, Charity Title Agency and Charity Home Insurance Agency, donate 100% of their net profits to the Beazer Charity Foundation, which provides grants to national and local nonprofits. Since its inception, Charity Title Agency has provided approximately $8.6 million to the Beazer Charity Foundation. | |

|

Because of that support, in fiscal 2025, the Beazer Charity Foundation provided grants totaling $2.2 million to over 50 local and national charities, including our national charitable partner, the Fisher House Foundation ("Fisher House"). Each organization we support provides benefits to those in need in the communities in which our customers and employees live and work.

For example, Fisher House provides comfort homes where military and veteran families can stay free of charge while a loved one is being treated in a hospital. In fiscal 2025, in addition to the over $1.8 million donated by the Beazer Charity Foundation, our employees, directors and trade partners collectively raised additional funds in excess of $1.2 million for the benefit of Fisher House and its affiliated entities.

| | | | | |

| As part of our commitment to service, we hosted our first annual Day of Service in March 2025, mobilizing employees nationwide to support their local communities through hands-on volunteerism. Over 1,000 employees, their friends, families, and our trade partners participated in impactful initiatives such as beautifying Fort Belvoir Fisher House, creating therapeutic art for hospitals with the Foundation for Hospital Art, distributing shoes to children via Operation Warm, and assisting Jonathan’s Place in providing safe shelter for vulnerable youth. These efforts reflect our dedication to social responsibility and reinforce our belief that building thriving communities extends beyond the homes we construct. The day following our Day of Service, over 300 employees, their guests and our trade partners proudly took part in our Rock. Run. Raise! event that included participating in the St. Jude Rock 'n' Roll 5K and half marathon that capped a weekend of wellness, volunteerism, and fundraising in support of the Fisher House Foundation. Rock. Run. Raise! exemplifies our values of community, wellness, and collective action. |

GOVERNANCE

Our Board of Directors plays a crucial role in the governance and oversight of the Company. Collectively and as individuals, each director is responsible for acting in the best interests of shareholders by exercising fiduciary responsibilities, approving and setting the company’s strategic direction, ensuring accountability through oversight of management performance, and upholding strong corporate governance standards. Our Board guides our long-term success while maintaining transparency, ethical conduct, and compliance with laws and regulations.

Our directors bring a wealth of expertise, experience and insights. Below is an overview of the varied skills and experience on our Board.

| | | | | | | | | | | |

|

| Homebuilding/ Construction Industry Experience | | Corporate Governance/Ethics Experience |

| CEO/COO Experience | | Risk Management Expertise |

| CFO/Accounting/ Finance Experience | | Marketing/Sales Expertise |

| Public Company Board Experience | | Sustainability Expertise |

| Mergers & Acquisitions | | |

Learn more about our governance practices and each director nominee under "Board and Governance Matters" beginning on page 18.

This summary provides an overview of the information contained within this proxy statement. We encourage you to read the entire proxy statement prior to voting.

ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | | | | |

| DATE & TIME February 5, 2026 8:30 a.m. (Eastern time) | | LOCATION Hyatt Regency Atlanta Perimeter at Villa Christina 4000 Summit Boulevard Atlanta, Georgia 30319 | | RECORD DATE Stockholders of record as of the close of business on December 12, 2025 are entitled to notice of, and to vote at, the annual meeting. |

VOTING MATTERS

Stockholders will be asked to vote on the following matters at the Annual Meeting:

| | | | | | | | |

| | |

| PROPOSAL | BOARD RECOMMENDATION |

| | |

ITEM 1. Election of Directors | | Vote ‘FOR’ each director nominee |

| | |

| | |

ITEM 2. An Advisory Vote Regarding the Compensation Paid to the Company’s Named Executive Officers | | Vote ‘FOR’ |

| | |

| | |

ITEM 3. Ratification of Appointment of Deloitte & Touche LLP as the Company’s Independent Auditors | | Vote ‘FOR’ |

| | |

| | |

ITEM 4. Adoption of the Charter Amendment for the Protection of NOLs and Energy-Efficiency Tax Credits | | Vote ‘FOR’ |

| | |

| | |

ITEM 5. Ratification of the Rights Agreement for the Protection of NOLs and Energy-Efficiency Tax Credits | | Vote ‘FOR’ |

| | |

| | | | | | | | | | | | | | |

| PROPOSAL 1 | | |

| | | |

| | | | |

| | | | |

| Election of Directors | | |

| | | | |

| | | | |

| The Board of Directors recommends a vote FOR the election of each of the nominees. | | |

| | | | |

BOARD SNAPSHOT

BOARD NOMINEES (PGS. 21 - 29)

Below are the nominees for election to the Board of Directors at the Annual Meeting of Stockholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| NAME & PRINCIPAL OCCUPATION | | SERVING

SINCE | | COMMITTEES |

| AGE | INDEPENDENT | A | HC | G | FD | T |

| | | | | | | | | |

| Howard C. Heckes Former President and Chief Executive Officer Masonite International Corporation | 60 | 2025 | Yes | Mr. Heckes, was appointed to the Board on December 8, 2025 and will be appointed to committees following the 2026 Annual Meeting. |

| | | | | | | | | |

| | | | | | | | | |

| Lloyd E. Johnson Former Global Managing Director, Finance and Internal Audit Accenture Corporation | 71 | 2021 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| John J. Kelley III Former Chief Legal Officer and Executive Vice President Equifax Inc | 65 | 2024 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Allan P. Merrill Chairman, President and Chief Executive Officer Beazer Homes USA, Inc. | 59 | 2011 | No | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Peter M. Orser Former President and Chief Executive Officer Weyerhaeuser Real Estate Company | 69 | 2016 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Norma A. Provencio Lead Director President and Owner Provencio Advisory Services Inc | 68 | 2009 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| June Sauvaget Vice President, EMEA Marketing Netflix, Inc. | 47 | 2024 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Alyssa P. Steele Chief Executive Officer CREO Group | 45 | 2024 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| C. Christian Winkle Former Chief Executive Officer Sunrise Senior Living | 62 | 2019 | Yes | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| A | Audit | | G | Governance | | T | Technology | | Chair |

| HC | Human Capital | | FD | Finance and Development | | | | | Member |

KEY QUALIFICATIONS

The following are several of the key qualifications, skills and experience of our Board nominees that we believe are uniquely important to our business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| DIRECTOR | HOMEBUILDING/

CONSTRUCTION

INDUSTRY

EXPERIENCE | CEO/COO

EXPERIENCE | CFO/

ACCOUNTING/

FINANCE

EXPERIENCE | PUBLIC

COMPANY

BOARD

EXPERIENCE | CORPORATE

GOVERNANCE/

ETHICS

EXPERIENCE | RISK

MANAGEMENT

EXPERTISE | MARKETING/

SALES

EXPERTISE | SUSTAINABILITY

EXPERTISE | MERGERS &

ACQUISITIONS

EXPERIENCE |

| Heckes | | | | | | | | | |

| Johnson | | | | | | | | | |

| Kelley | | | | | | | | | |

| Merrill | | | | | | | | | |

| Orser | | | | | | | | | |

| Provencio | | | | | | | | | |

| Sauvaget | | | | | | | | | |

| Steele | | | | | | | | | |

| Winkle | | | | | | | | | |

| Total | 4 | 5 | 4 | 9 | 6 | 6 | 5 | 5 | 6 |

The lack of a designation for a nominee under a category in the above chart does not mean that he or she does not possess that particular qualification, skill or experience. The marks above simply indicate that the characteristic is one for which the nominee is especially well known among our Board.

We believe our Board nominees reflect the broad expertise and perspective needed to govern our business and constructively engage with senior management.

NOMINEES & BOARD REFRESHMENT

| | | | | |

Our Board considers diversity of professional qualifications, experiences, and areas of expertise in evaluating director candidates. Each individual is evaluated in the context of our Board as a whole, with the objective of recommending a group of nominees that can best promote the success of our business and represent stockholder interests through the exercise of sound judgment based on diversity of experience and background. When identifying potential director candidates — whether to replace a director who is retiring or has resigned, or to expand the Board to gain additional capabilities — the Governance | |

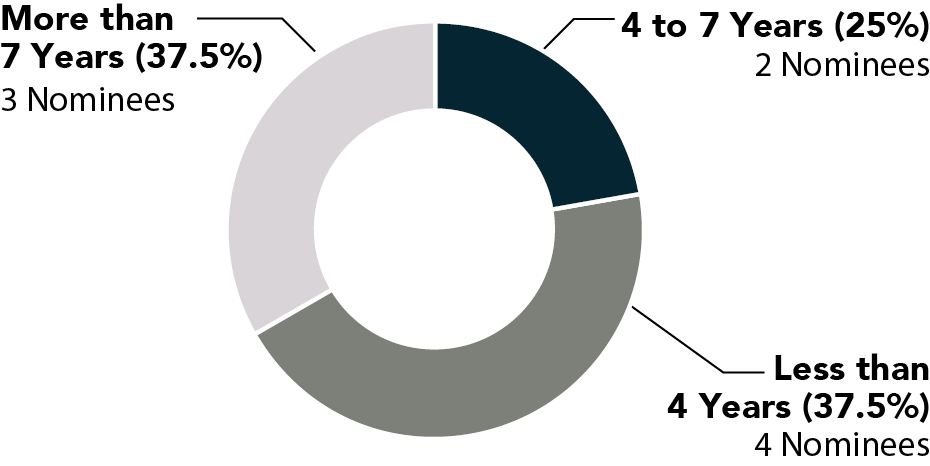

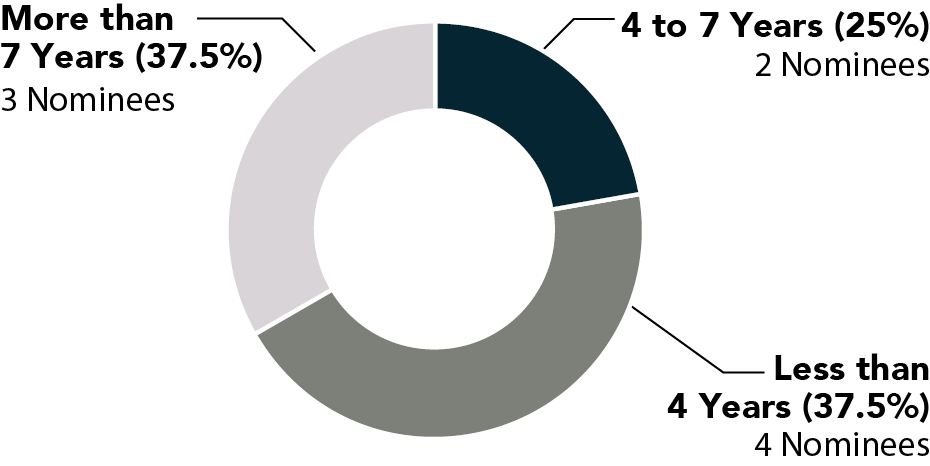

BALANCED TENURES OF BOARD NOMINEES |

|

|

Committee, in consultation with the full Board, determines the skills, experiences and other characteristics that a potential candidate should possess in light of the composition and needs of the Board and its committees. The Governance Committee also considers whether or not the candidate would be considered independent under the applicable NYSE and SEC governance standards. |

CORPORATE GOVERNANCE HIGHLIGHTS (PGS. 31 – 40)

| | | | | | | | |

| | |

COMPENSATION BEST PRACTICES ■Clawbacks of incentive awards upon certain events, including restatements, in accordance with SEC rules and NYSE listing requirements ■Double triggers for both cash severance and accelerated vesting of equity upon a change of control ■Meaningful named executive officer and director stock ownership and holding requirements ■Policies against hedging, pledging and stock option repricing ■No tax gross-ups in connection with severance or change of control

| BOARD INDEPENDENCE AND OVERSIGHT ■Significant director refreshment over the last two years with the retirement of three directors and the appointment of four new directors ■Robust and thorough Board, committee and director evaluation practices to enhance effectiveness ■Board and committee engagement and oversight on all sustainability matters | STOCKHOLDER RIGHTS AND ENGAGEMENT ■Annual election of all directors ■Majority vote standard for the election of directors, with a director resignation policy ■Long-standing stockholder engagement practices |

| | |

STOCKHOLDER ENGAGEMENT

We are committed to a robust stockholder engagement program. Our Board values our stockholders’ perspectives. Feedback from stockholders on our business, executive compensation program and sustainability matters represent important considerations for Board discussions throughout the year. Over the course of the year, management engaged with investors on more than 260 occasions.

Our Board maintains a process for stockholders and interested parties to communicate with the Board. Stockholders and interested parties may write or call our Board as provided under “Reporting of Concerns to Independent Directors” on page 39. | | | | | | | | |

260+ Fiscal 2025 Investor engagements

| | TOPICS DISCUSSED ■Strategy and value proposition ■Healthy community count growth ■Gross margin improvement ■Capital allocation, including land spend and share repurchases ■Long-term returns and earnings ■Sustainability ■Macroeconomic pressures ■Affordability concerns ■Sustained demand for housing |

| | |

| | | | | | | | | | | | | | |

| PROPOSAL 2 | | |

| | | |

| | | | |

| | | | |

| An Advisory Vote Regarding the Compensation Paid to the Company’s Named Executive Officers | | |

| | | | |

| | | | |

| The Board of Directors recommends a vote FOR the approval of the compensation of our named executive officers. | | |

| | | | |

EXECUTIVE COMPENSATION

Our executive compensation is designed to:

■Attract, retain and reward top talent;

■Align pay with performance without encouraging inappropriate risk-taking; and

■Utilize long-term equity-based compensation to reinforce sustained value creation through the achievement of financial, operational, and strategic objectives.

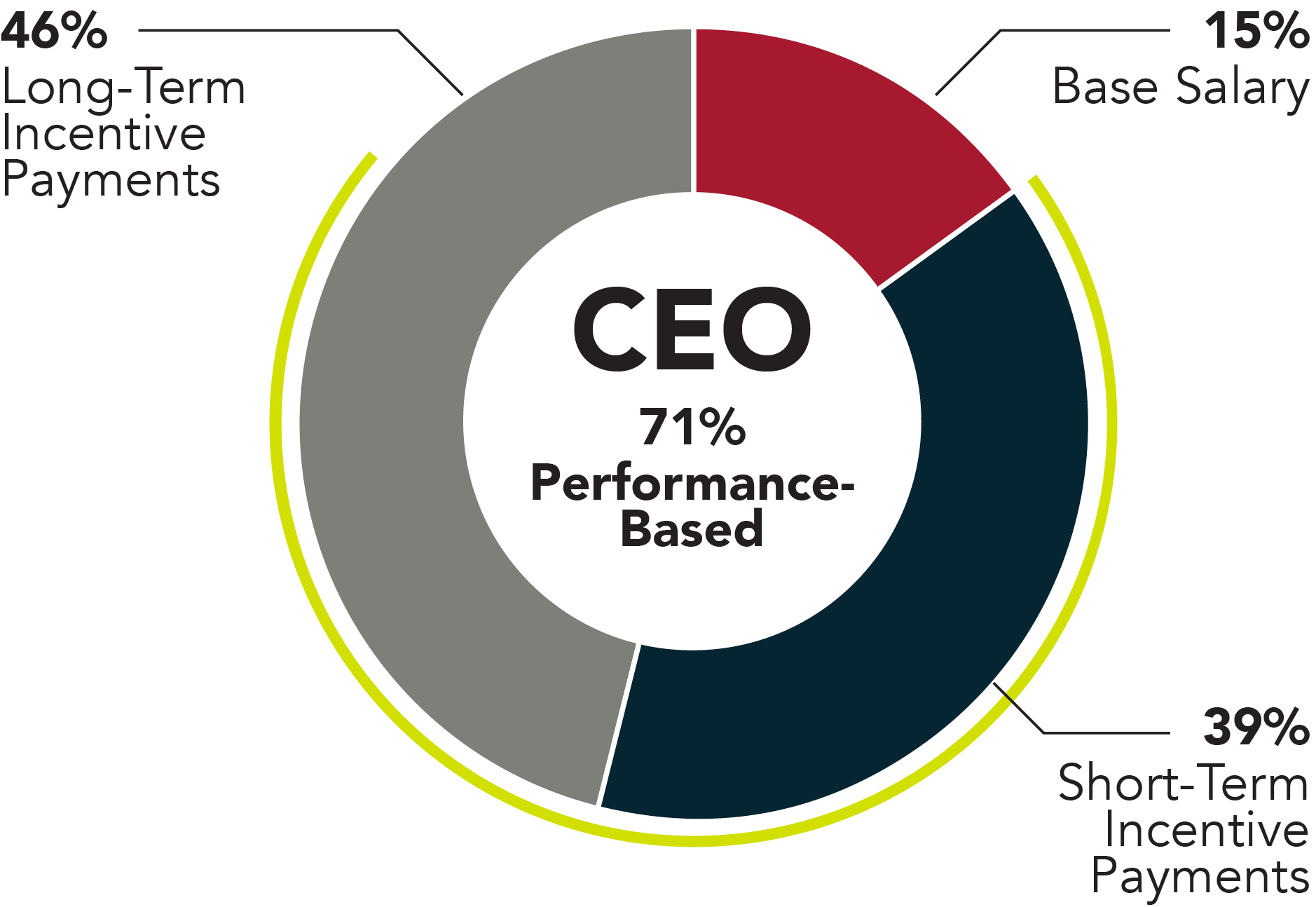

We utilize a combination of base salary, short-term cash incentives and long-term incentives. The majority of target long-term incentive award opportunities for our NEOs are tied to multi-year performance goals that align with key strategic objectives, with a portion of the awards provided in time-based restricted stock.

The Human Capital Committee (the "Committee") reviews our core compensation philosophy annually in conjunction with the review of our compensation programs. While our core compensation philosophy and objectives have remained consistent in recent years, the Committee has made adjustments to various aspects of our compensation programs to reinforce strategic priorities.

Based on data for the 2025 Peer Group, the Committee's independent consultant, Pearl Meyer, advised the Committee that target total compensation for our NEOs was positioned within a competitive range (plus or minus 15%) of the 2025 Peer Group 50th percentile, individually and in the aggregate, with the exception of Mr. Dunn, whose target total compensation is subject to a multi-year upward adjustment process associated with his appointment on August 1, 2024 as the Company's Senior Vice President, General Counsel and Corporate Secretary.

TARGET PAY MIX (PG. 48)

| | | | | |

| CEO | OTHER NEOs (WEIGHTED AVERAGE) |

| |

| |

The table below outlines fiscal 2025 base salaries for our NEOs.

| | | | | |

| FY 2025

BASE SALARY

($) |

| Allan P. Merrill | 1,066,050 |

| David I. Goldberg | 646,875 |

| Michael A. Dunn | 350,000 |

SHORT-TERM INCENTIVE OPPORTUNITIES (PGS. 52-53)

The table below outlines fiscal 2025 target short-term incentive award opportunities for our NEOs as a percentage of base salary.

| | | | | |

| FY 2025 TARGET SHORT-TERM INCENTIVE

AWARD OPPORTUNITY

AS A % OF BASE SALARY |

| Allan P. Merrill | 250 | % |

| David I. Goldberg | 135 | % |

| Michael A. Dunn | 75 | % |

LONG-TERM INCENTIVE OPPORTUNITIES (PGS. 54-58)

The table below outlines fiscal 2025 target long-term incentive award opportunities for our NEOs as a percentage of base salary.

| | | | | |

| FISCAL 2025-2027 TARGET LONG-TERM INCENTIVE

AWARD OPPORTUNITY

AS A % OF BASE SALARY |

| Allan P. Merrill | 400 | % |

| David I. Goldberg | 200 | % |

| Michael A. Dunn | 75 | % |

COMPENSATION OUTCOMES (PGS. 50 – 58)

SHORT-TERM INCENTIVE AWARDS

As further discussed in the Compensation Discussion & Analysis on pg. 50, our NEOs did not earn a payout under the fiscal 2025 short-term incentive plan due to the Bonus Plan EBITDA threshold hurdle not being achieved. However, after extensive consideration of the challenges posed by the operating environment and the operational and strategic achievements made by management in the face of this environment, the Committee and the Board exercised discretion in support of NEO retention and alignment of interests with stockholders, and granted time-based restricted stock awards on a two-year cliff vesting schedule for each NEO. The grants, as a percentage of their fiscal 2025 short-term incentive target opportunities, were 30% for Mr. Merrill; 50% for Mr. Goldberg; and 50% for Mr. Dunn.

| | | | | | | | | | | | | | |

| NAME | 2025 TARGET BONUS

(% OF ACTUAL

BASE SALARY) | 2025 TARGET

STI AWARD

OPPORTUNITY

($) | 2025 ACTUAL

INCENTIVE

AWARD

($) | 2025 INCENTIVE

AWARD AS A

PERCENTAGE

OF TARGET

(%) |

| Allan P. Merrill | 250 | % | 2,665,125 | | 799,538 | | 30 | % |

| David I. Goldberg | 135 | % | 873,281 | | 436,641 | | 50 | % |

| Michael A. Dunn | 75 | % | 262,500 | | 131,250 | | 50 | % |

LONG-TERM INCENTIVE AWARDS

2023-2025 Performance Period Results

■Community Count – Actual results for this metric were between Threshold and Target. After applying straight line interpolation between these levels, the achievement level for this metric was 40.0%. The specific performance targets for this metric are not disclosed here because we believe that the disclosure would result in competitive harm to us by potentially disrupting our vendor and supplier relationships and providing competitors with insight into our business strategies beyond what is disclosed publicly.

■Return on Assets (ROA) – The performance necessary to earn Threshold, Target and Superior payout required an average ROA over the performance period of 13.0%, 14.0% and 15.0% respectively. Average actual return on assets for the performance period was 8.90%.

■Environmental – Actual results for this metric exceeded the Superior level. The specific performance targets for this metric are not disclosed here because we believe that the disclosure would result in competitive harm to us by potentially disrupting our vendor and supplier relationships and providing competitors with insight into our business strategies beyond what is disclosed publicly.

The Committee viewed the achievement levels for all three metrics for this performance period as very challenging and requiring significant improvement over the three-year period. Ultimately, an award was not earned for the Return on Assets metric, but awards were earned at 40.0% for the Community Count metric and at 100% for the Environmental metric for total earned awards of 140.0% of Target before adjustment based on our relative TSR.

The Company's three-year TSR percentile rank was below the 25th percentile vs. the members of the TSR Peer Group, resulting in a negative 30% adjustment to award funding. After application of the TSR modifier, the recipients’ percentage of awards earned attributable to the fiscal 2023-2025 performance period was decreased from 140.0% to 98.0% of Target.

2025-2027 Performance Period Measures

For performance shares and performance cash awards related to the 2025-2027 performance period, the Committee decided to maintain the community count metric (similar to the 2023-2025 and 2024-2026 cycles) while replacing former ROA and environmental metrics with return on equity and net debt to adjusted EBITDA. These metrics were selected to reinforce the Company’s balanced growth strategy in support of long-term value creation. Community count goals for the 2025-2027 performance period were set at levels of increased difficulty compared to the previous performance period. The specific performance targets for community count growth are not disclosed here because we believe that the disclosure would result in competitive harm to us by potentially disrupting our vendor and supplier relationships and providing competitors with insight into our business strategies beyond what is disclosed publicly. The Committee believes the performance hurdles for community count growth will be challenging to achieve.

Performance metrics for 2025-2027 performance period also include the following objectives:

■Return on equity — The performance necessary to earn a Threshold payout requires an average return on equity for the performance period of at least 12.5%, the performance necessary to earn a Target payout requires an average return on equity for the performance period of at least 15%, and the performance necessary to earn a Superior payout requires an average return on equity for the performance period of at least 17.5%.

■Net debt/Adjusted EBITDA — The performance necessary to earn a Threshold payout requires a net debt/adjusted EBITDA ratio for the performance period of 2.00x, the performance necessary to earn a Target payout requires a net debt/adjusted EBITDA ratio for the performance period of 1.75x, and the performance necessary to earn a Superior payout requires a net debt/adjusted EBITDA ratio for the performance period of 1.50x.

Overall award funding based on actual vs. planned results for these three metrics will continue to be subject to adjustment by up to +/- 30% based on the Company’s three-year TSR relative to members of the TSR Peer Group. Consistent with prior years, the large majority (70%) of total target long-term incentive award opportunities for NEOs is tied to multi-year performance goals, with the remaining 30% provided in the form of restricted stock vesting over three years based on continued service.

| | | | | | | | | | | | | | |

| PROPOSAL 3 | | |

| | | |

| | | | |

| | | | |

| Ratification of Appointment of Deloitte & Touche LLP as the Company’s Independent Auditors | | |

| | | | |

| | | | |

| The Board recommends a vote FOR the ratification of Deloitte & Touche LLP as the Company’s independent auditors. | | |

| | | | |

Although stockholder ratification is not required, the appointment of Deloitte & Touche LLP as the Company’s independent auditors for fiscal 2026 is being submitted for ratification at the annual meeting because the Board believes doing so is a good corporate governance practice.

| | | | | | | | | | | | | | |

| PROPOSAL 4 | | |

| | | |

| | | | |

| | | | |

| Adoption of the Charter Amendment for the Protection of NOLs and Energy-Efficiency Tax Credits | | |

| | | | |

| | | | |

| The Board recommends a vote FOR the adoption of the Amendment for the Protection of NOLs and Energy-Efficiency Tax Credits. | | |

| | | | |

| | | | | | | | | | | | | | |

| PROPOSAL 5 | | |

| | | |

| | | | |

| | | | |

| Ratification of the Rights Agreement for the Protection of NOLs and Energy-Efficiency Tax Credits | | |

| | | | |

| | | | |

| The Board recommends a vote FOR the ratification of the New Rights Agreement for the Protection of NOLs and Energy-Efficiency Tax Credits. | | |

| | | | |

Proposals 4 and 5 are being submitted to stockholders to extend protective provisions designed to preserve the value of the Company’s deferred tax assets by acting as a deterrent to any person desiring to acquire 4.95% or more of our common stock. The majority of the Company's deferred tax assets are energy-efficiency tax credits that we earned through substantial investment and commitment to energy-efficient building practices.

| | |

Board and Governance Matters |

|

| | | | | | | | | | | |

| PROPOSAL 1 | | |

| | |

| | | |

| | | |

| Election of Directors | |

| | | |

| | | |

| In connection with Mr. Shepherd’s retirement, which will become effective as of the end of his term at the 2026 annual meeting of stockholders, we appointed Howard C. Heckes to serve on the Board of Directors effective as of December 8, 2025. Mr. Heckes' extensive experience in building materials, home improvement, and finding unique points of differentiation to successfully grow businesses are a valuable addition to our Board and stockholders. Mr. Heckes’ appointment is in addition to the appointment of John J. Kelley III, June Sauvaget and Alyssa Steele to the Board of Directors in 2024. With Mr. Heckes’ appointment, the average tenure of our director nominees is now 6 years, and the average age of our director nominees is 61. Each of the nominees listed below has been nominated as a director to serve a term of one year and until his or her respective successor has been qualified and elected.

In the event any nominee is not available as a candidate for director, votes will be cast pursuant to authority granted by the proxy for such other candidate or candidates as may be recommended by the Governance Committee and subsequently nominated by our Board of Directors. Our Board has no reason to believe that any of the following nominees will be unable or unwilling to serve as a director, if elected. | |

| | | |

| | | |

| The Board of Directors recommends a vote FOR the election of each of the nominees. | |

| | | |

DIRECTOR NOMINATION PROCESS

Pursuant to our Corporate Governance Guidelines, the Governance Committee is directed to work with our Board on an annual basis to determine the appropriate qualifications, skills and experiences for each director and for our Board as a whole. In evaluating these characteristics, the Governance Committee and our Board take into account many factors, including the individual director’s general understanding of our business on an operational level, as well as his or her professional background and willingness to devote sufficient time to Board duties.

BOARD AND GOVERNANCE MATTERS

TENURES & BOARD REFRESHMENT

| | | | | |

Each director candidate is evaluated in the context of our Board as a whole, with the objective of recommending a group of nominees that can best promote the success of our business and represent stockholder interests through the exercise of sound judgment based on diversity of experience and background. When identifying potential director candidates — whether to replace a director who is retiring or has resigned, or to expand the Board to gain additional capabilities — the Governance Committee, in consultation with the full Board, determines the skills, experience and other characteristics that a potential candidate should possess in light of the composition and needs of the Board and its committees. | |

BALANCED TENURES OF BOARD NOMINEES |

|

|

|

|

| |

The Governance Committee also considers whether or not the candidate would be considered independent under the applicable NYSE and SEC governance standards. While our Board does not believe that it should limit the number of terms served by directors, the Board periodically evaluates the appropriate size for our Board and will set the number of directors in accordance with our Bylaws and based on recommendations of the Governance Committee. Additionally, while the Board may grant exceptions, as a general policy, directors will not be nominated for re-election at or after the age of 74. |

| | | | | | | | | | | | | | |

| | | | |

| BOARD REFRESHMENT IN THE PAST 5 YEARS | SKILLS OF NEWLY ADDED DIRECTORS |

| | | | |

| | | | |

5 new independent directors have been added to the Board since 2021 4 directors have retired from the Board since 2021 | | Risk Management Expertise | | Public Company Board Experience |

| Marketing/Sales Expertise | | Corporate Governance/Ethics Experience |

| CEO/COO Experience | | Mergers & Acquisitions |

| Sustainability Expertise | | Homebuilding/ Construction Industry Experience |

PROCEDURES REGARDING DIRECTOR CANDIDATES RECOMMENDED BY STOCKHOLDERS

The Governance Committee will consider Board candidates recommended by our stockholders. If the Governance Committee determines to nominate a stockholder-recommended candidate, then that nominee’s name will be included in the proxy statement for our next annual meeting. Stockholder recommendations must be addressed to: Beazer Homes USA, Inc., Attention: Corporate Secretary, 2002 Summit Boulevard NE, 15th Floor, Atlanta, Georgia 30319.

Our stockholders also have the right under our Bylaws to directly nominate director candidates at an annual meeting by following the procedures outlined in our Bylaws. Our Governance Committee evaluates candidates recommended by stockholders in the same manner it evaluates director candidates identified by the Committee.

BOARD AND GOVERNANCE MATTERS

BOARD SKILLS AND QUALIFICATIONS The following are several of the key qualifications, skills and experience of our Board nominees that we believe are uniquely important to our business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| DIRECTOR | HOMEBUILDING/

CONSTRUCTION

INDUSTRY

EXPERIENCE | CEO/COO

EXPERIENCE | CFO/

ACCOUNTING/

FINANCE

EXPERIENCE | PUBLIC

COMPANY

BOARD

EXPERIENCE | CORPORATE

GOVERNANCE/

ETHICS

EXPERIENCE | RISK

MANAGEMENT

EXPERTISE | MARKETING/

SALES

EXPERTISE | SUSTAINABILITY

EXPERTISE | MERGERS &

ACQUISITIONS

EXPERIENCE |

| Heckes | | | | | | | | | |

| Johnson | | | | | | | | | |

| Kelley | | | | | | | | | |

| Merrill | | | | | | | | | |

| Orser | | | | | | | | | |

| Provencio | | | | | | | | | |

| Sauvaget | | | | | | | | | |

| Steele | | | | | | | | | |

| Winkle | | | | | | | | | |

| Total | 4 | 5 | 4 | 9 | 6 | 6 | 5 | 5 | 6 |

The lack of a designation for a Board nominee under a category in the above chart does not mean that he or she does not possess that particular qualification, skill or experience. The marks above simply indicate that the characteristic is one for which the Board nominee is especially well known among the other Board nominees.

We believe our Board nominees reflect the broad expertise and perspective needed to govern our business and constructively engage with senior management.

BOARD AND GOVERNANCE MATTERS

DIRECTOR BIOGRAPHIES

The biographical information appearing below with respect to each nominee has been furnished to us by the nominee:

| | | | | | | | | | | | | | | | | | | | |

| | Howard C. Heckes, 60 Independent Director Mr. Heckes served as Chief Executive Officer of Masonite International Corporation, a global designer, manufacturer, marketer and distributor of interior and exterior doors and door solutions from 2019 to 2024. In his role at Masonite, Mr. Heckes was responsible for leading the company’s strategic growth initiatives, operational performance, and global expansion across residential and commercial markets. Prior to Masonite, Mr. Heckes served as Chief Executive Officer of Energy Management Collaborative, an LED lighting and controls solutions provider, where he developed and scaled business processes and market positioning for a rapidly growing business. Earlier in his career, Mr. Heckes held senior leadership roles at The Valspar Corporation and Newell Brands, where he managed large-scale operations and drove innovation in consumer and industrial products. Mr. Heckes holds a B.S. in Industrial Engineering from Iowa State University and an M.S. in Industrial Engineering from the University of Iowa. QUALIFICATIONS We believe Mr. Heckes' extensive experience in building materials, home improvement, and energy solutions make him a valuable addition to the Board. |

| | |

TENURE Director since December 2025 OTHER PUBLIC COMPANY DIRECTORSHIPS ■James Hardie Industries plc

| | |

| | | | | |

| | EXPERIENCE | | |

| | | Homebuilding/ Construction Industry Experience | | Corporate Governance/Ethics Experience |

| | | Public Company Board Experience | | Mergers & Acquisitions |

| | | Risk Management Expertise | | CEO/COO Experience |

| | | | Marketing/Sales Expertise | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | Lloyd E. Johnson, 71 Independent Director Mr. Johnson served as Global Managing Director, Finance and Internal Audit, for Accenture Corporation from 2004 to 2015. At Accenture, he was responsible for leading the global consulting company’s corporate audit organization and providing guidance and counsel in finance and strategic planning. Prior to joining Accenture, Mr. Johnson was an Executive Director of M&A and General Auditor at Delphi Automotive and was Corporate Vice President, Finance and Chief Audit Executive at Emerson Electric Corporation. Mr. Johnson began his career at Coopers & Lybrand, which is now part of PwC. Mr. Johnson received a Bachelor of Science in Business Administration degree in accounting and a Master of Accountancy degree with a major in accounting from the University of South Carolina and his Master of Business Administration from Duke University. QUALIFICATIONS Mr. Johnson has over 40 years of significant financial management expertise as well as experience as a finance executive for two public companies and experience in the public accounting field. We believe Mr. Johnson’s finance and accounting expertise is valuable to the Company in many respects, including with respect to assessment of our capital structure and financial strategy, as well as accounting expertise. |

| | |

TENURE Director since 2021 OTHER PUBLIC COMPANY DIRECTORSHIPS ■Apogee Enterprises, Inc. ■Haemonetics Corp. ■VSE Corporation COMMITTEES ■Audit (Chair) ■Human Capital | | |

| | | | | |

| | EXPERIENCE | | |

| | | Homebuilding/ Construction Industry Experience | | Corporate Governance/Ethics Experience |

| | | CFO/Accounting/ Finance Experience | | Risk Management Expertise |

| | | Public Company Board Experience | | Sustainability Expertise |

| | | | Mergers & Acquisitions | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | John J. Kelley III, 65 Independent Director Mr. Kelley served as the Chief Legal Officer of Equifax Inc., from 2013 until his retirement in 2025. In his role at Equifax, Inc., Mr. Kelley had responsibility for global legal services, compliance, government and legislative relations, and corporate governance. In addition, he was responsible for advising the Equifax board of directors and senior management team during the 2017 cybersecurity incident, leading the resolution of related regulatory and litigation matters. Before joining Equifax, Mr. Kelley was a senior partner at King & Spalding in its corporate practice group, where he practiced in a broad range of corporate finance transactions and securities matters, and advised public clients regarding SEC reporting and disclosure requirements, among other corporate governance and compliance matters. While a partner at King & Spalding, Mr. Kelley was instrumental in helping create the Lead Director Network, which is a network of lead directors, presiding directors and non-executive chairmen from many of America's leading companies who meet to discuss how to improve the performance of their corporations and earn the trust of their stockholders through more effective board leadership. Mr. Kelley graduated summa cum laude from Hamilton College, where he was a member of Phi Beta Kappa. He received his Juris Doctor degree from the University of Virginia School of Law. QUALIFICATIONS We believe Mr. Kelley's experience in matters of corporate governance, regulatory compliance and strategic execution, as well as information technology and security, make him a valuable addition to the Company. |

| | |

TENURE Director since 2024 COMMITTEES ■Technology (Chair) ■Finance and Development ■Human Capital | | |

| | | | | |

| | EXPERIENCE | | |

| | | Public Company Board Experience | | Risk Management Expertise |

| | | Corporate Governance/Ethics Experience | | Sustainability Expertise |

| | | | Mergers & Acquisitions | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | Allan P. Merrill, 59 President and Chief Executive Officer Mr. Merrill joined the Company in May 2007 as Executive Vice President and Chief Financial Officer. He was named President and Chief Executive Officer in June 2011 and elected Chairman in November 2019. Prior to joining the Company, Mr. Merrill worked in both investment banking and online real estate marketing. While working for UBS and its predecessor firm Dillon, Read & Co. (from 1987 to 2000), Mr. Merrill ultimately served as co-head of the Global Resources Group, overseeing relationships with construction and building materials companies around the world, including advising Beazer Homes on its 1994 initial public offering and several major acquisitions. Immediately prior to joining Beazer, Mr. Merrill was with Move, Inc. where he served as Executive Vice President of Corporate Development and Strategy after joining the firm as its first President of Homebuilder.com. Mr. Merrill is also involved in several housing industry organizations. He served on the Board of Directors of Freddie Mac (Federal Home Loan Mortgage Corporation) from September 2020 to April 2025. He is a past Chairman of Leading Builders of America, a trade organization of the country’s largest public and private homebuilders. He also serves on the Policy Advisory Board of the Joint Center for Housing Studies at Harvard University and he previously served on the board of privately held Builder Homesite Inc. On October 29, 2025, he was appointed to the Board of Directors of Ally Financial, Inc. Mr. Merrill is a graduate of the University of Pennsylvania’s Wharton School with a Bachelor of Science degree in Economics. QUALIFICATIONS We believe Mr. Merrill’s experience in and knowledge of the homebuilding sector, gained primarily through finance, capital markets and strategic development roles over more than 25 years, is particularly valuable to the Company as it seeks to achieve its financial and operational goals. |

| | |

TENURE Director since 2011 OTHER PUBLIC COMPANY DIRECTORSHIPS ■Ally Financial Inc. | | |

| | | | | |

| | EXPERIENCE | | |

| | | Homebuilding/ Construction Industry Experience | | Corporate Governance/Ethics Experience |

| | | CEO/COO Experience | | Risk Management Expertise |

| | | CFO/Accounting/ Finance Experience | | Marketing/Sales Expertise |

| | | | Public Company Board Experience | | Sustainability Expertise |

| | | | Mergers & Acquisitions | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | Peter M. Orser, 69 Independent Director Mr. Orser served as President and Chief Executive Officer of the Weyerhaeuser Real Estate Company, a subsidiary of Weyerhaeuser Company, where he oversaw five different homebuilding operations across the United States, from 2010 to 2014. In July 2014, under his leadership, Weyerhaeuser completed the successful sale of the company. Prior to that, Mr. Orser spent almost 25 years in various positions at Quadrant Homes, a leading homebuilder in the state of Washington and a subsidiary of Weyerhaeuser, including serving as President from 2003 to 2010. Mr. Orser is active in a number of civic organizations, including organizations focused on advancing housing in his community. Mr. Orser holds a Bachelor of Science degree from the University of Puget Sound and a Master of Urban Planning from the University of Washington. QUALIFICATIONS Mr. Orser’s experience in the homebuilding industry provides significant operational and safety expertise to the Company. We believe his understanding of our industry, as well as his management experience gained over the course of his career, is valuable to the Company. |

| | |

TENURE Director since 2016 COMMITTEES ■Human Capital (Chair) ■Governance ■Technology | | |

| | | | | |

| | EXPERIENCE | | |

| | | Homebuilding/ Construction Industry Experience | | Public Company Board Experience |

| | | CEO/COO Experience | | Marketing/Sales Expertise |

| | | | Mergers & Acquisitions | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | Norma A. Provencio, 68 Lead Independent Director Ms. Provencio was named Lead Director in November 2019. Ms. Provencio is President and owner of Provencio Advisory Services Inc., a healthcare financial and operational consulting firm. Prior to forming Provencio Advisory Services in October 2003, she was the Partner-in-Charge of KPMG’s Pacific Southwest Healthcare Practice since May 2002. From 1979 to 2002, she was with Arthur Andersen, serving as that firm’s Partner-in-Charge of the Pharmaceutical, Biomedical and Healthcare Practice for the Pacific Southwest. Ms. Provencio received her Bachelor of Science in Accounting from Loyola Marymount University. She is a certified public accountant and also completed her service as a member of the Board of Trustees of Loyola Marymount University in May 2023. In June 2024, Ms. Provencio began service as a member of the Board of Trustees of Mount Saint Mary's University. QUALIFICATIONS Ms. Provencio has over 40 years of experience in the public accounting field. We believe her in-depth understanding of accounting rules and financial reporting regulations to be valuable to the Company’s commitment and efforts to comply with regulatory requirements. |

| | |

TENURE Director since 2009 COMMITTEES ■Governance ■Human Capital | | |

| | | | | |

| | EXPERIENCE | | |

| | | CFO/Accounting/ Finance Experience | | Risk Management Expertise |

| | | Public Company Board Experience | | Mergers & Acquisitions |

| | | Corporate Governance/Ethics Experience | | |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | June Sauvaget, 47 Independent Director Ms. Sauvaget was appointed to the Board effective January 1, 2024. Ms. Sauvaget is Vice President, EMEA Marketing of Netflix, Inc. Prior to her current role, she served as Executive Vice President, Sales and Chief Marketing Officer of SunPower Corporation, a leading residential solar, storage and energy services provider in North America, from December 2021 to June 2023. Before her tenure at SunPower, she served as Chief Marketing Officer of Brex Inc., a financial service and technology company that offers business credit cards and cash management accounts to technology companies. She also previously served in multiple advertising and marketing leadership roles at Spotify and GAP Inc. Ms. Sauvaget received a Bachelor of Science in Business Administration from San Francisco State University. QUALIFICATIONS Ms. Sauvaget has over 20 years of extensive advertising, marketing and leadership experience that we believe will be valuable to the Company's growth and marketing initiatives. |

| | |

TENURE Director since 2024 COMMITTEES ■Finance and Development ■Human Capital ■Technology | | |

| | | | | |

| | EXPERIENCE | | |

| | | Public Company Board Experience | | Marketing/Sales Expertise |

| | | Corporate Governance/Ethics Experience | | Sustainability Expertise |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | Alyssa P. Steele, 45 Independent Director Ms. Steele was appointed to the Board effective January 1, 2024. Ms. Steele serves as the Chief Executive Officer of CREO Group. Prior to her current role, she served as the Chief Executive Officer of Rugs USA, an e-commerce industry leader in rugs and home décor products, from December 2022 to July 2025. She previously served in multiple leadership positions at HD Supply, a wholly owned subsidiary of The Home Depot and one of the largest industrial distributors in North America within the maintenance, repair and operations sectors, including as Chief Merchandising Officer and Chief Commercial Officer from November 2018 through November 2022. Prior to that, Ms. Steele served in multiple e-commerce and retail leadership roles with EBAY from August 2015 to November 2018 and The Home Depot from 2007 to 2015. Ms. Steele earned her Bachelor of Arts in French from Presbyterian College, a Master of International Management from IAE, Paris and a Master of Business Administration from Georgia State University. QUALIFICATIONS Ms. Steele has over 15 years of leadership experience in retail and e-commerce, as well as more than a decade in the building supply industry. We believe that this combination of experience, leadership and skills will provide value to the Company. |

| | |

TENURE Director since 2024 COMMITTEES ■Audit ■Finance and Development ■Technology | | |

| | | | | |

| | EXPERIENCE | | |

| | | CEO/COO Experience | | Marketing/Sales Expertise |

| | | Public Company Board Experience | | Mergers & Acquisitions |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | | | | | | | | | | | | | |

| | C. Christian Winkle, 62 Independent Director Mr. Winkle served as the chief executive officer and a member of the board of directors of Sunrise Senior Living, which operates senior living communities in the United States, Canada and the United Kingdom, including Gracewell Healthcare communities, from September 2014 to January 2021. He was chief executive officer of MedQuest, Inc., a leading operator of independent, fixed-site, outpatient diagnostic imaging centers in the United States from November 2005 to August 2013. He served as president and chief executive officer of Mariner Health Care, Inc., which operated skilled nursing facilities, assisted living and long-term acute care hospitals from January 1999 to July 2004. Mr. Winkle was the chief operating officer of Integrated Health Services, where he helped pioneer the sub-acute care sector and was responsible for all facility and ancillary service operations. He is a member of Argentum and American Seniors Housing Association (ASHA) boards. On August 14, 2025, he was appointed to the Board of Directors of Regional Health Properties Inc, a healthcare property holding and leasing company. Mr. Winkle received his Bachelor of Science degree from Case Western Reserve University. QUALIFICATIONS Mr. Winkle's broad management experience and his specific expertise in serving the important aging adults demographic provides value to the Company. We believe that this combination of experience, leadership and skills will provide value to the Company and our product offerings. |

| | |

TENURE Director since 2019 OTHER PUBLIC COMPANY DIRECTORSHIPS ■Regional Health Properties, Inc. COMMITTEES ■Finance and Development (Chair) ■Audit | | |

| | | | | |

| | EXPERIENCE | | |

| | | CEO/COO Experience | | Public Company Board Experience |

| | | CFO/Accounting/ Finance Experience | | Risk Management Expertise |

| | | | | | |

BOARD AND GOVERNANCE MATTERS

DIRECTOR INDEPENDENCE

Our Board of Directors has evaluated all business and charitable relationships between the Company and the Company’s directors during fiscal 2025 as required by the Company’s Corporate Governance Guidelines. As a result of this evaluation, the Board has determined that each non-employee director (each director other than Mr. Merrill) is an “independent director” as defined by the standards for director independence established by applicable laws, rules and listing standards including the standards for independent directors established by The New York Stock Exchange (NYSE) and the Securities and Exchange Commission (SEC). The Company’s Corporate Governance Guidelines are available on the Company’s website at beazer.com.

MAJORITY VOTE STANDARD AND DIRECTOR RESIGNATION POLICY

MAJORITY VOTE STANDARD

Our Bylaws and Corporate Governance Guidelines provide a majority voting standard for the election of directors in uncontested elections. Director nominees will be elected if the votes cast for such nominee exceed the number of votes cast against such nominee. In the event that (i) a stockholder proposes a nominee to compete with nominees selected by our Board, and the stockholder does not withdraw the nomination prior to our mailing the notice of the stockholders meeting, or (ii) one or more directors are nominated by a stockholder pursuant to a solicitation of written consents, then directors will be elected by a plurality vote.

DIRECTOR RESIGNATION POLICY