S-K 1300 Technical Report Summary Greenbushes Mine, Western Australia Albemarle Corporation 4250 Congress St, Suite 900, Charlotte, NC, 28209, USA Prepared by: SLR USA Advisory Inc. 1658 Cole Blvd, Suite 100, Lakewood, Colorado, 80401 SLR Project No.: ADV-DE-00702 Effective Date: June 30, 2025 Signature Date: February 11, 2026 Revision: 0 Exhibit 96.1 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 i Table of Contents Table of Contents ....................................................................................................................... i 1.0 Executive Summary ...................................................................................................1-1 1.1 Report Scope ...............................................................................................................1-1 1.2 Property Description and Location ................................................................................1-2 1.3 Geology and Mineralization ..........................................................................................1-2 1.4 Exploration Status ........................................................................................................1-2 1.5 Development and Operations .......................................................................................1-3 1.6 Mineral Resources and Mineral Reserves ....................................................................1-5 1.7 Market Studies .............................................................................................................1-7 1.8 Environmental, Permitting, and Social Considerations ..................................................1-9 1.9 Economic Evaluation ....................................................................................................1-9 1.10 Conclusions ................................................................................................................ 1-11 1.11 Recommendations...................................................................................................... 1-12 1.12 Key Risks ................................................................................................................... 1-13 2.0 Introduction ................................................................................................................2-1 2.1 Report Scope ...............................................................................................................2-1 2.2 Site Visits .....................................................................................................................2-1 2.3 Sources of Information .................................................................................................2-2 2.4 Forward-Looking Statements ........................................................................................2-2 2.5 List of Abbreviations .....................................................................................................2-3 2.6 Independence ...............................................................................................................2-8 2.7 Inherent Mining Risks ...................................................................................................2-9 3.0 Property Description ..................................................................................................3-1 3.1 Location ........................................................................................................................3-1 3.2 Land Tenure .................................................................................................................3-3 3.3 Surface Rights and Easement ......................................................................................3-8 3.4 Material Government Consents ....................................................................................3-8 3.5 Significant Limiting Factors ...........................................................................................3-8 4.0 Accessibility, Climate, Local Resources, Infrastructure and Physiography ..........4-1 4.1 Accessibility ..................................................................................................................4-1 4.2 Climate .........................................................................................................................4-1 4.3 Local Resources ...........................................................................................................4-1 4.4 Infrastructure ................................................................................................................4-2 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 ii 4.5 Physiography ................................................................................................................4-2 5.0 History .........................................................................................................................5-1 5.1 Past Production ............................................................................................................5-1 5.2 Exploration and Development of Previous Owners or Operators ..................................5-2 6.0 Geological Setting, Mineralization, and Deposit ......................................................6-1 6.1 Regional Geology .........................................................................................................6-1 6.2 Local Geology ..............................................................................................................6-1 6.3 Mineralization ...............................................................................................................6-8 6.4 Deposit Types ..............................................................................................................6-8 7.0 Exploration..................................................................................................................7-1 7.1 Exploration ...................................................................................................................7-1 7.2 Drilling ..........................................................................................................................7-1 7.3 Hydrogeology ...............................................................................................................7-5 7.4 Geotechnical Data, Testing, and Analysis ....................................................................7-6 8.0 Sample Preparation, Analyses, and Security ...........................................................8-1 8.1 Analytical and Test Laboratories...................................................................................8-1 8.2 Sample Preparation and Analysis .................................................................................8-1 8.3 Sample Security ...........................................................................................................8-2 8.4 Density Determination ..................................................................................................8-2 8.5 Quality Assurance and Quality Control .........................................................................8-2 9.0 Data Verification .........................................................................................................9-1 10.0 Mineral Processing and Metallurgical Testing ....................................................... 10-1 10.1 Mineralogy .................................................................................................................. 10-1 10.2 Metallurgical ............................................................................................................... 10-1 10.3 LOM Plan ................................................................................................................... 10-2 11.0 Mineral Resource Estimates .................................................................................... 11-1 11.1 Resource Areas .......................................................................................................... 11-1 11.2 Statement Of Mineral Resources ................................................................................ 11-2 11.3 Initial Assessment ...................................................................................................... 11-3 11.4 Resource Database .................................................................................................... 11-6 11.5 Geological Modelling .................................................................................................. 11-6 11.6 Basic Statistics ......................................................................................................... 11-13 11.7 Treatment of High Grade .......................................................................................... 11-15 11.8 Geospatial Analysis .................................................................................................. 11-15 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 iii 11.9 Kriging Neighborhood Analysis ................................................................................. 11-17 11.10 Block Model .............................................................................................................. 11-17 11.11 Bulk Density ............................................................................................................. 11-18 11.12 Block Model Validation ............................................................................................. 11-19 11.13 Resource Classification ............................................................................................ 11-22 11.14 Mining Depletion ....................................................................................................... 11-23 11.15 Reconciliation ........................................................................................................... 11-23 11.16 Comparison to Previous Mineral Resource Estimate ................................................ 11-23 12.0 Mineral Reserve Estimates ...................................................................................... 12-1 12.1 Summary .................................................................................................................... 12-1 12.2 Statement of Mineral Reserves................................................................................... 12-1 12.3 Approach .................................................................................................................... 12-3 12.4 Planning Status .......................................................................................................... 12-4 12.5 Comparison to Previous Mineral Reserve Estimate .................................................. 12-13 13.0 Mining Methods ........................................................................................................ 13-1 13.1 Mining Method ............................................................................................................ 13-1 13.2 Geotechnical Considerations ...................................................................................... 13-1 13.3 Hydrogeological Considerations ................................................................................. 13-5 13.4 Mining Strategy .......................................................................................................... 13-5 13.5 Life of Mine Plan Results and Outcomes .................................................................... 13-8 13.6 Mining Equipment ..................................................................................................... 13-16 14.0 Processing and Recovery Methods ........................................................................ 14-1 14.1 Process Overview ...................................................................................................... 14-1 14.2 Technical Grade Plant (TGP) ..................................................................................... 14-4 14.3 Chemical Grade Plant 1 (CGP1) Processing Circuit ................................................... 14-8 14.4 Chemical Grade Plant 2 (CGP2) Processing Circuit ................................................. 14-12 14.5 Chemical Grade Plant 3 (CGP3) Processing Circuit ................................................. 14-16 14.6 Tailings Reprocessing Plant (TRP) ........................................................................... 14-18 14.7 Final Product ............................................................................................................ 14-22 14.8 Plant Yield ................................................................................................................ 14-22 15.0 Infrastructure ............................................................................................................ 15-1 15.1 Site Access ................................................................................................................ 15-3 15.2 Power Supply ............................................................................................................. 15-4 15.3 Water Supply .............................................................................................................. 15-5

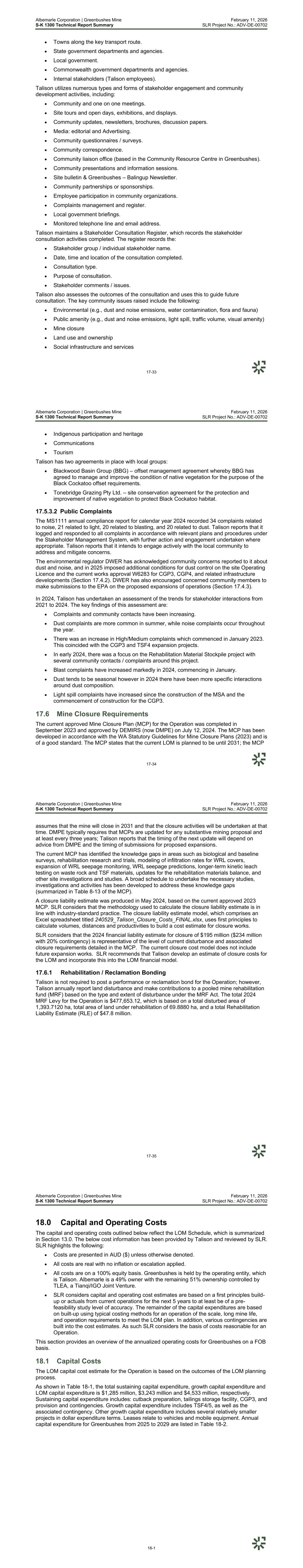

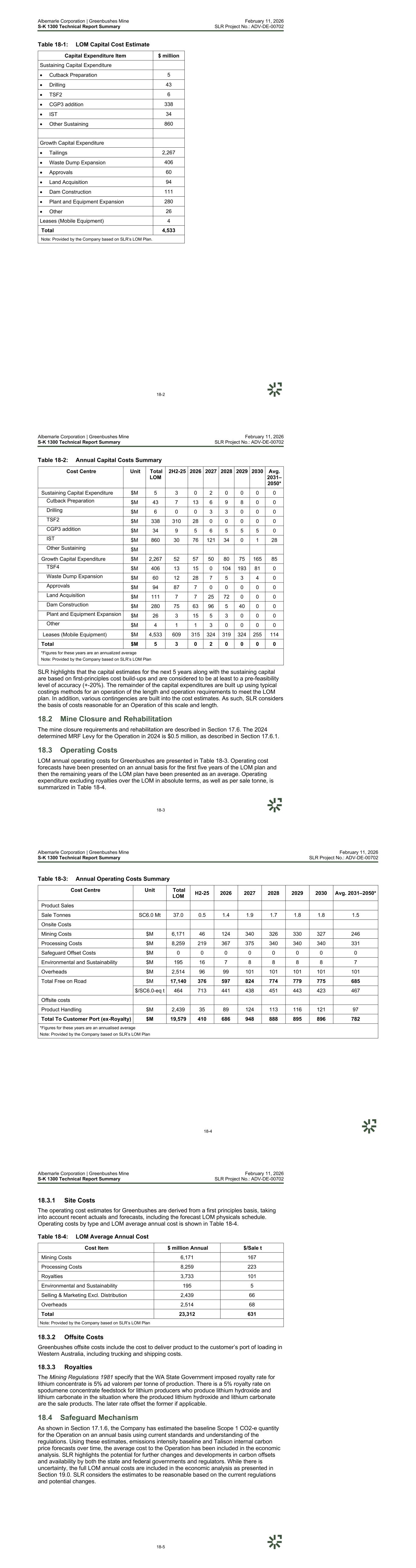

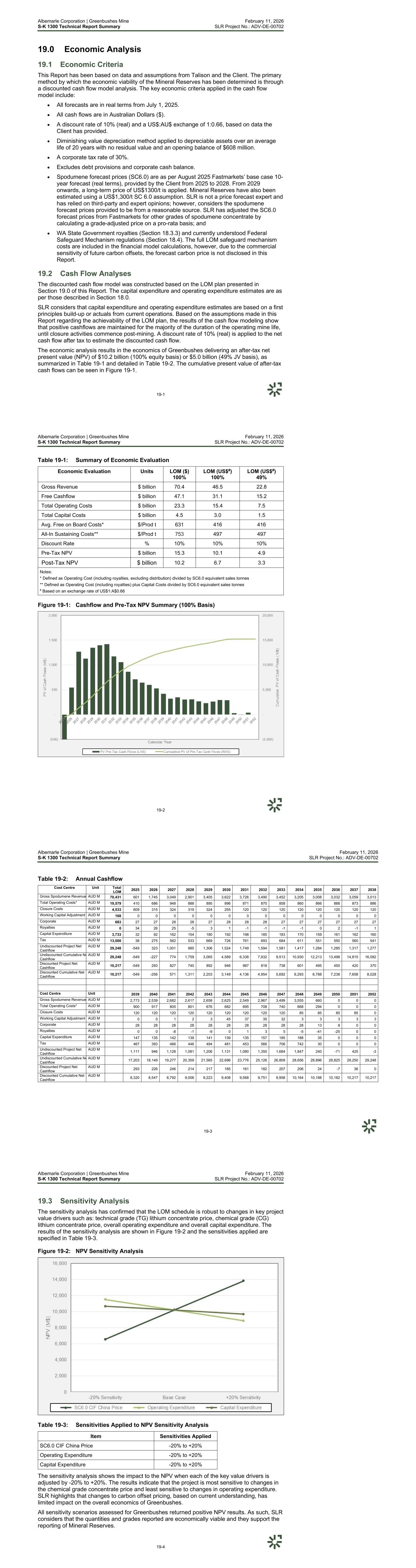

Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 iv 15.4 Flood Risk ................................................................................................................ 15-11 15.5 Mine Service Area (MSA) ......................................................................................... 15-11 15.6 Propane .................................................................................................................... 15-12 15.7 Diesel Storage and Dispensing ................................................................................ 15-12 15.8 Site-Camp Accommodation Facilities ....................................................................... 15-13 15.9 Communications and SCADA Systems .................................................................... 15-13 15.10 Tailings Storage ....................................................................................................... 15-13 16.0 Market Studies .......................................................................................................... 16-1 16.1 Introduction ................................................................................................................ 16-1 16.2 Lithium Demand ......................................................................................................... 16-1 16.3 Lithium Supply ............................................................................................................ 16-5 16.4 Lithium Supply-Demand Balance ................................................................................ 16-7 16.5 Lithium Prices ............................................................................................................. 16-8 17.0 Environmental Studies, Permitting, and Plans, Negotiations, or Agreements with Local Individuals or Groups ............................................................................ 17-1 17.1 Environmental Studies ................................................................................................ 17-1 17.2 Environmental Management ..................................................................................... 17-12 17.3 Mine Waste and Water Management ....................................................................... 17-12 17.4 Operation Permitting and Compliance ...................................................................... 17-14 17.5 Social or Community Requirements ......................................................................... 17-31 17.6 Mine Closure Requirements ..................................................................................... 17-34 18.0 Capital and Operating Costs ................................................................................... 18-1 18.1 Capital Costs .............................................................................................................. 18-1 18.2 Mine Closure and Rehabilitation ................................................................................. 18-3 18.3 Operating Costs ......................................................................................................... 18-3 18.4 Safeguard Mechanism ................................................................................................ 18-5 19.0 Economic Analysis ................................................................................................... 19-1 19.1 Economic Criteria ....................................................................................................... 19-1 19.2 Cash Flow Analyses ................................................................................................... 19-1 19.3 Sensitivity Analysis ..................................................................................................... 19-4 20.0 Adjacent Properties .................................................................................................. 20-1 21.0 Other Relevant Data and Information ...................................................................... 21-1 21.1 Standalone Ore Sorting Plant ..................................................................................... 21-1 21.2 Underground Mine ...................................................................................................... 21-1 22.0 Interpretation and Conclusions ............................................................................... 22-1 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 v 22.1 Geology ...................................................................................................................... 22-1 22.2 Mining......................................................................................................................... 22-1 22.3 Processing ................................................................................................................. 22-1 22.4 Environmental, Social, and Governance ..................................................................... 22-2 22.5 Water.......................................................................................................................... 22-2 23.0 Recommendations ................................................................................................... 23-1 23.1 Geology and Mineral Resources................................................................................. 23-1 23.2 Mining......................................................................................................................... 23-1 23.3 Processing ................................................................................................................. 23-1 23.4 Infrastructure .............................................................................................................. 23-2 23.5 ESG ........................................................................................................................... 23-2 23.6 Tailings Storage ......................................................................................................... 23-2 23.7 Water.......................................................................................................................... 23-3 24.0 References ................................................................................................................ 24-1 25.0 Reliance on Information Provided by the Registrant ............................................. 25-1 25.1 Macroeconomic Trends .............................................................................................. 25-1 25.2 Marketing ................................................................................................................... 25-1 25.3 Legal Matters .............................................................................................................. 25-1 25.4 Environmental Matters ................................................................................................ 25-1 25.5 Stakeholder Accommodations .................................................................................... 25-2 25.6 Governmental Factors ................................................................................................ 25-2 26.0 Date and Signature Page ......................................................................................... 26-1 Tables Table 1-1: Nameplate and LOM Plant Capacities ............................................................. 1-3 Table 1-2: LOM Physicals ................................................................................................. 1-5 Table 1-3: Statement of Mineral Resources as at June 30, 2025 ...................................... 1-6 Table 1-4: Statement of Mineral Reserves as at June 30, 2025 ........................................ 1-7 Table 1-5: Summary of Capital Costs ............................................................................. 1-10 Table 1-6: Summary of Economic Evaluation ................................................................. 1-11 Table 2-1: Site Visit Summary ........................................................................................... 2-2 Table 2-2: List of Abbreviations and Acronyms ................................................................. 2-3 Table 3-1: Greenbushes Mine Land Tenure ...................................................................... 3-5 Table 7-1: Lode Resource Drilling Summary ..................................................................... 7-3 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 vi Table 8-1: Central Lode Density Statistics ........................................................................ 8-2 Table 8-2: Summary of CRM Submissions for Li2O ........................................................... 8-3 Table 10-1: Greenbushes Mineralogical Report Summary ................................................ 10-1 Table 10-2: Greenbushes Metallurgical Test Work Summary ........................................... 10-2 Table 11-1: Statement of Mineral Resources as at June 30, 2025 .................................... 11-3 Table 11-2: Cost Inputs Used for Underground Stope Optimisation .................................. 11-5 Table 11-3 Open pit Mineral Resources Marginal Cut-off Grade Assumptions ................. 11-6 Table 11-4: Estimation Domain Details ........................................................................... 11-10 Table 11-5: Block Model Size and Extents ...................................................................... 11-18 Table 11-6: Bulk Density Assigned ................................................................................. 11-19 Table 11-7: Comparison with Previous Mineral Resources Estimates ............................. 11-24 Table 12-1: Statement of Mineral Reserves as at June 30, 2025 ...................................... 12-2 Table 12-2: Pit Optimization Geotechnical Parameters ..................................................... 12-5 Table 12-3: Pit Optimization Mining Parameters ............................................................... 12-5 Table 12-4: Pit Design Parameters - Maximum Inter-Ramp Angle .................................. 12-10 Table 12-5: Ramp and Pit Standoff Parameters .............................................................. 12-11 Table 12-6: Mineral Reserves Mass Yield (SC6.0 Concentrate) ..................................... 12-12 Table 12-7: LOM Plant Feed Yield .................................................................................. 12-12 Table 12-8: Reserves Marginal Cut-off Grade Assumptions ........................................... 12-13 Table 12-9: Comparison with Previous Mineral Reserve Estimates ................................ 12-13 Table 13-1: LOM Physicals ............................................................................................... 13-8 Table 13-2: Waste Dump Capacity and Percentage Filled .............................................. 13-12 Table 13-3 LOM Schedule as at June 30, 2025 ............................................................. 13-14 Table 13-4: Major Production Mine Fleet ........................................................................ 13-16 Table 13-5: Major Mining Fleet Summary ....................................................................... 13-17 Table 14-1: Nameplate and LOM Plant Capacities ........................................................... 14-1 Table 17-1: Current Key Operation E&S Approvals and Licences/Permits ...................... 17-16 Table 17-2: Future Key E&S Approvals and Licences/Permits ........................................ 17-23 Table 17-3: Status with Material E&S Non-Compliance .................................................. 17-28 Table 18-1: LOM Capital Cost Estimate ............................................................................ 18-2 Table 18-2: Annual Capital Costs Summary ..................................................................... 18-3 Table 18-3: Annual Operating Costs Summary ................................................................. 18-4 Table 18-4: LOM Average Annual Cost ............................................................................ 18-5 Table 19-1: Summary of Economic Evaluation ................................................................. 19-2 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 vii Table 19-2: Annual Cashflow ............................................................................................ 19-3 Table 19-3: Sensitivities Applied to NPV Sensitivity Analysis ............................................ 19-4 Figures Figure 1-1: Lithium Supply-Demand Balance ('000 tonnes Lithium Carbonate Equivalent) 1-8 Figure 3-1: Greenbushes General Location Plan ............................................................... 3-2 Figure 3-2: Greenbushes Regional Location Map .............................................................. 3-4 Figure 3-3: Greenbushes Mine Operation Layout............................................................... 3-7 Figure 6-1: Regional Geology ............................................................................................ 6-3 Figure 6-2: Generalized Geology Map with inset Cross Section ......................................... 6-4 Figure 6-3: E-W Cross-Section across the Central and Kapanga Zones ............................ 6-5 Figure 6-4: Simplified Stratigraphic Column ....................................................................... 6-6 Figure 6-5: Generalized Cross Section (looking north) Showing Greenbushes Pegmatite Mineral Zoning ................................................................................................. 6-8 Figure 7-1: Plan View of Drilling b Type ............................................................................. 7-2 Figure 8-1: Scatter Plot showing CRM SORE 6 performance for Li2O (warning = 2xSD, error = 3xSD)............................................................................................................ 8-4 Figure 8-2: CRM Scatter plot showing SORE 3 performance for Li2O. (warning = 2xSD, error = 3xSD)............................................................................................................ 8-4 Figure 8-3: Scatter Plot of RC Field Duplicates .................................................................. 8-5 Figure 8-4: Scatter Plot of DD Field Duplicates .................................................................. 8-6 Figure 8-5: QQ plots of adjusted values. Bottom - correction adjustment applied in Leapfrog to Li2O assay data from RC samples. .............................................................. 8-7 Figure 11-1: Exclusion Zone (Red Line) for Mineral Resources ......................................... 11-4 Figure 11-2: Underground Resource Blocks Below Open Pit ............................................. 11-5 Figure 11-3: Plan View of the Interpreted Pegmatite Units (Central Lode – yellow, White Well – Yellow, Kapanga – Magenta) ..................................................................... 11-8 Figure 11-4: Cut Off Grades Selected for Indicator RBF Interpolants Within Each Pegmatite Unit .............................................................................................................. 11-11 Figure 11-5: Declustered Statistics for Peg_1 (Central Lode) ........................................... 11-12 Figure 11-6: Histogram of Sample Lengths ...................................................................... 11-12 Figure 11-7: Li2O Histograms and Basic Statistics of Composites .................................... 11-13 Figure 11-8: Variography for Central Lode High-Grade Domain ....................................... 11-16 Figure 11-9: Variography for Kapanga High-Grade Domain ............................................. 11-16 Figure 11-10: QKNA Analysis for Min/Max Number of Composites for Pegmatite High Grade Domain 1 ..................................................................................................... 11-17

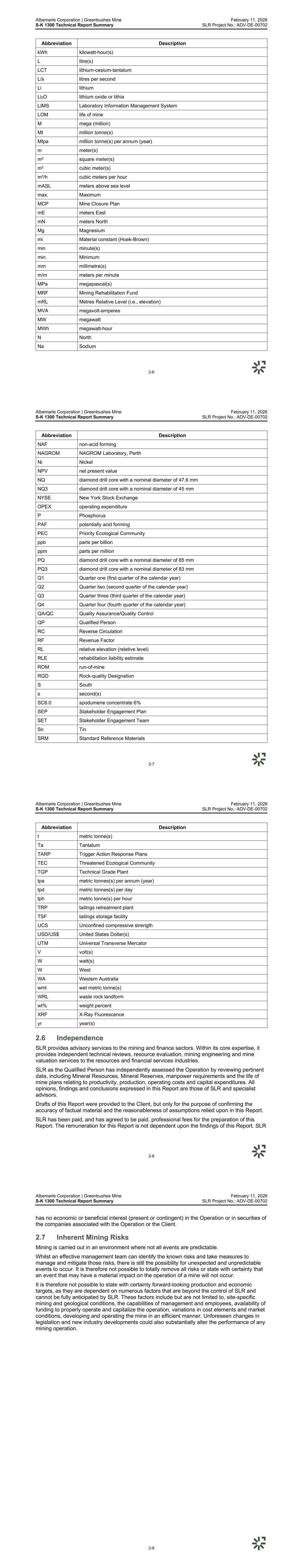

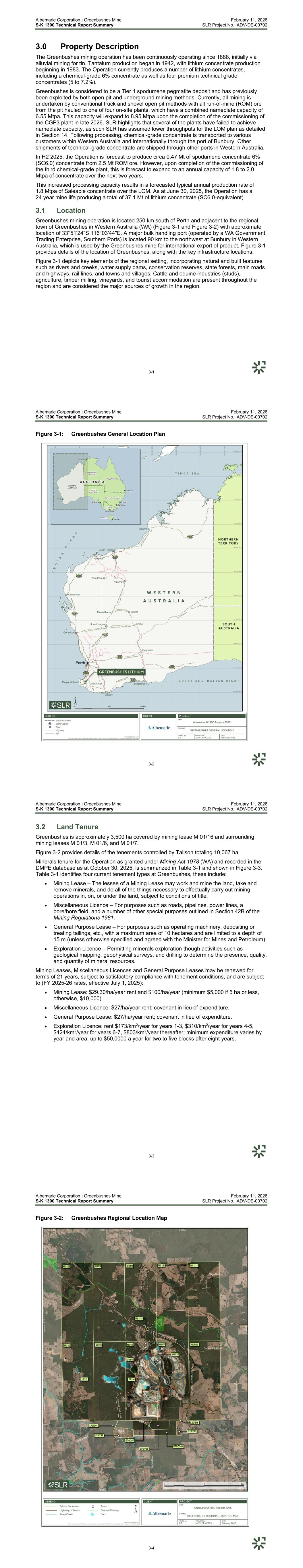

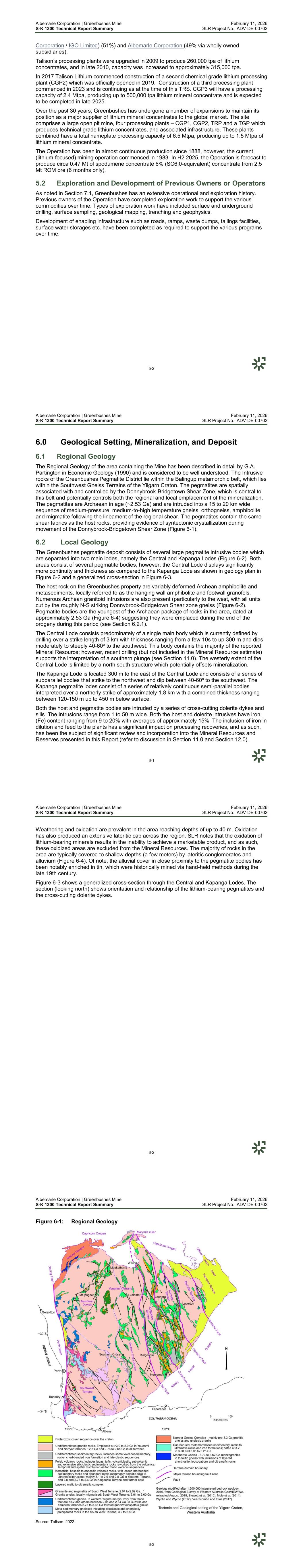

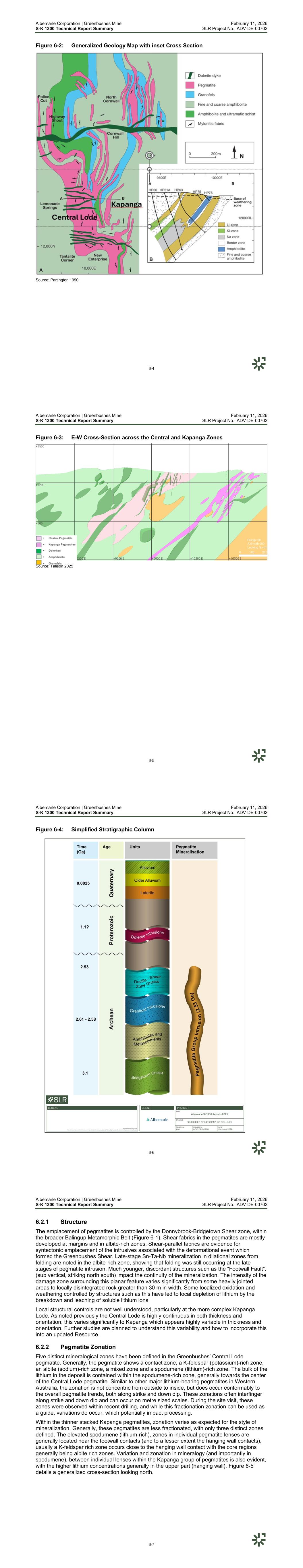

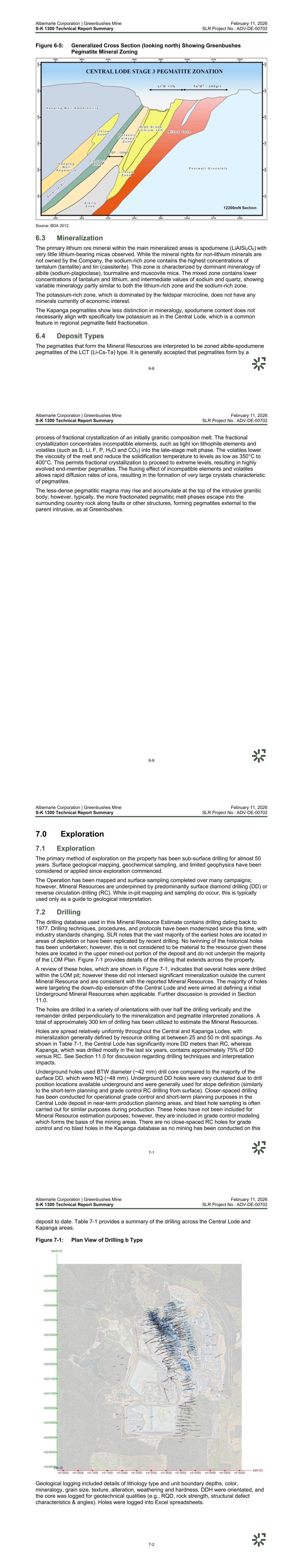

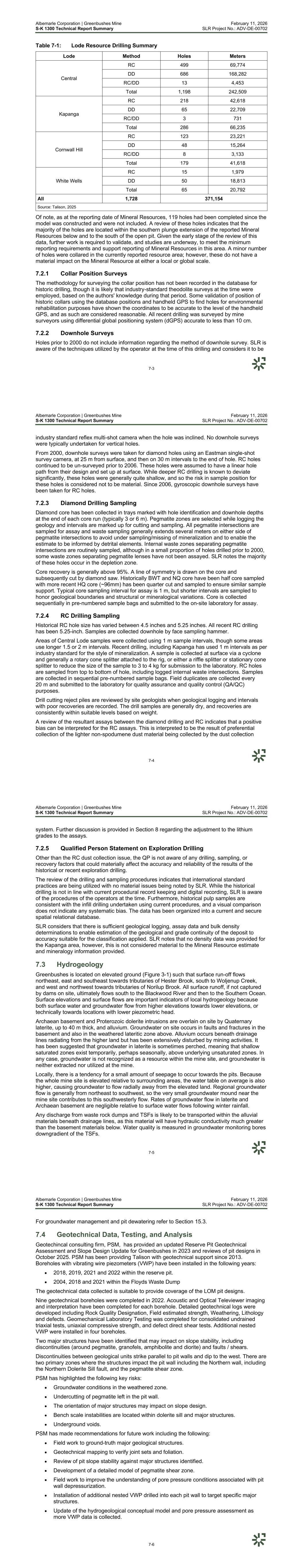

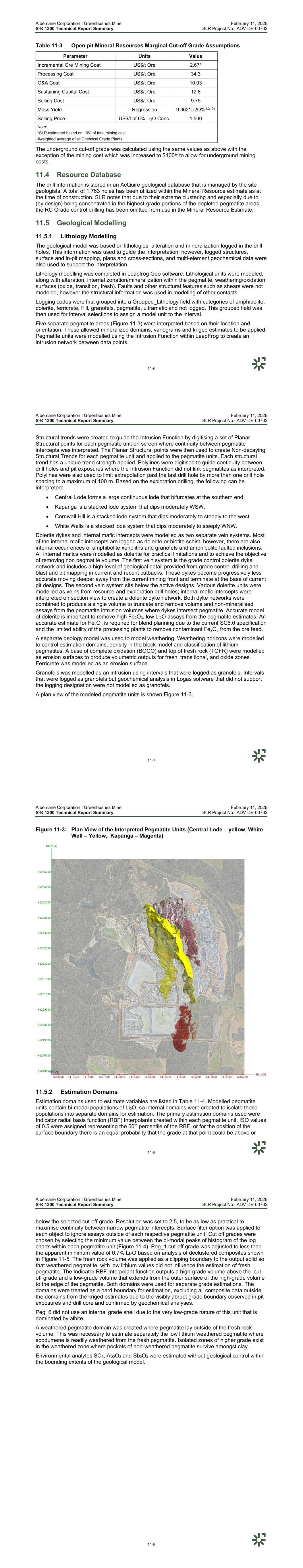

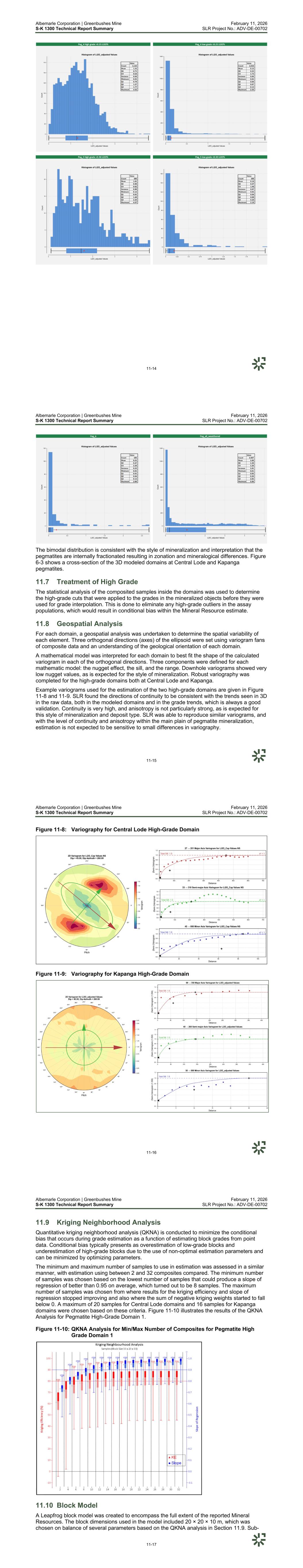

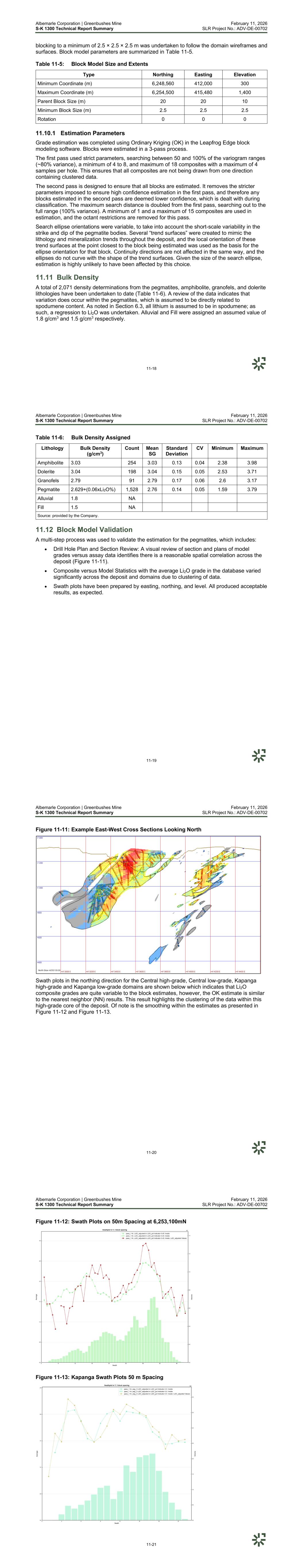

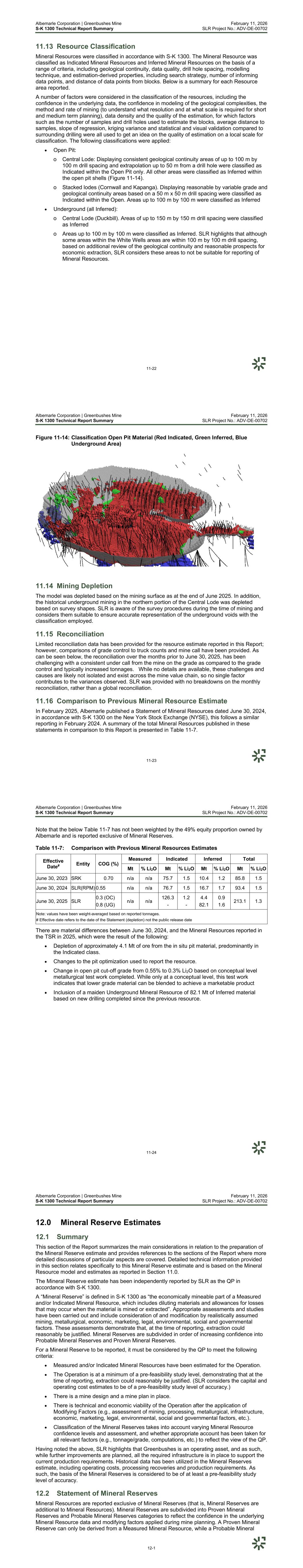

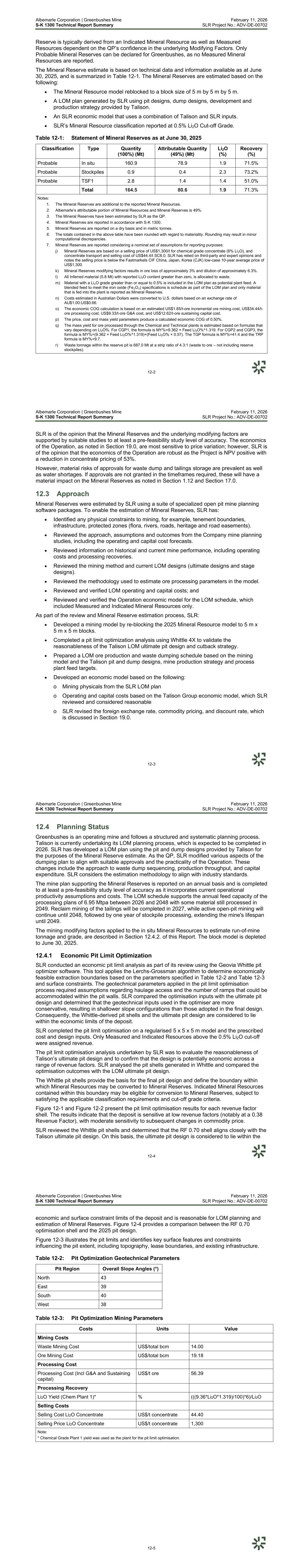

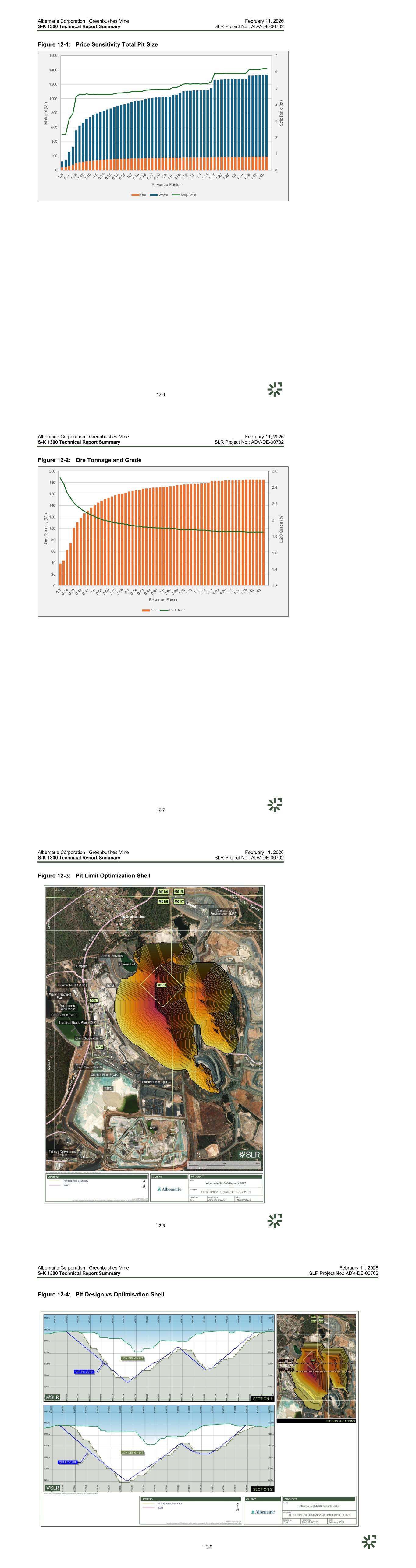

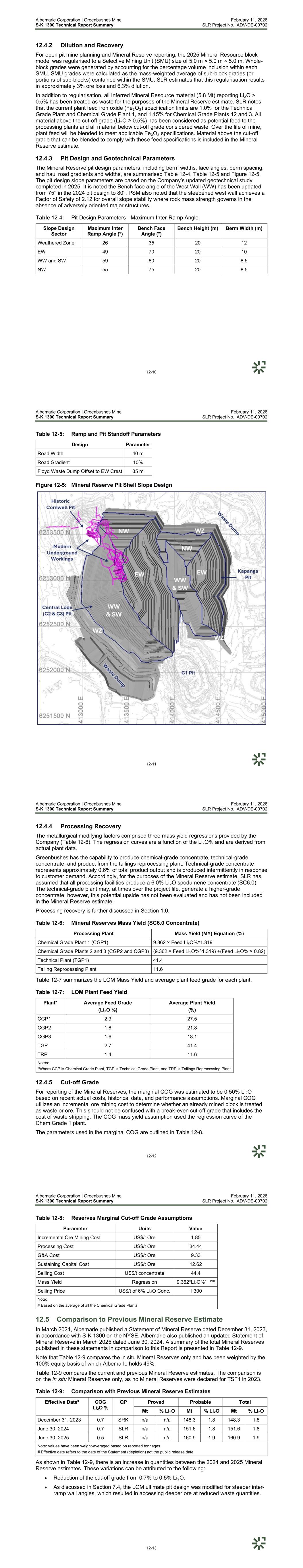

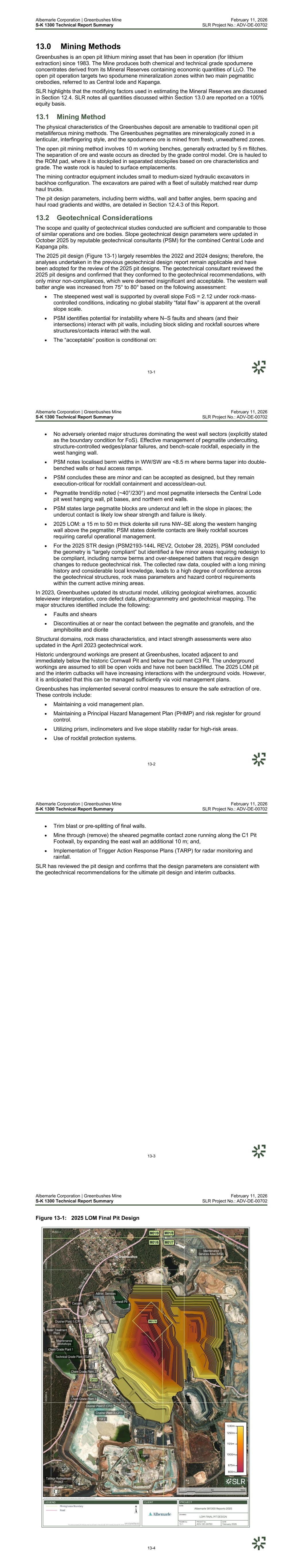

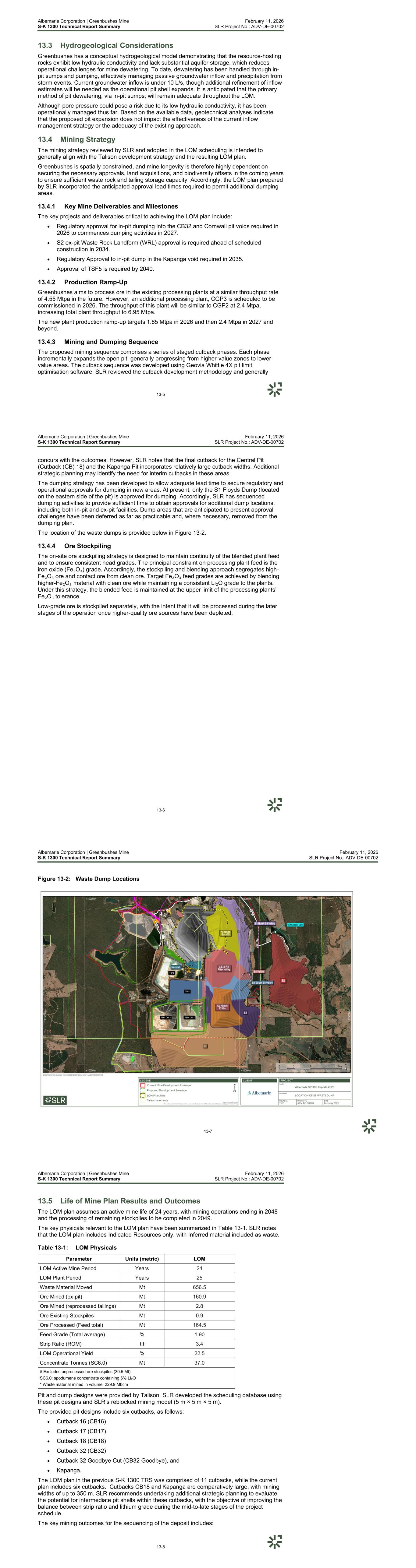

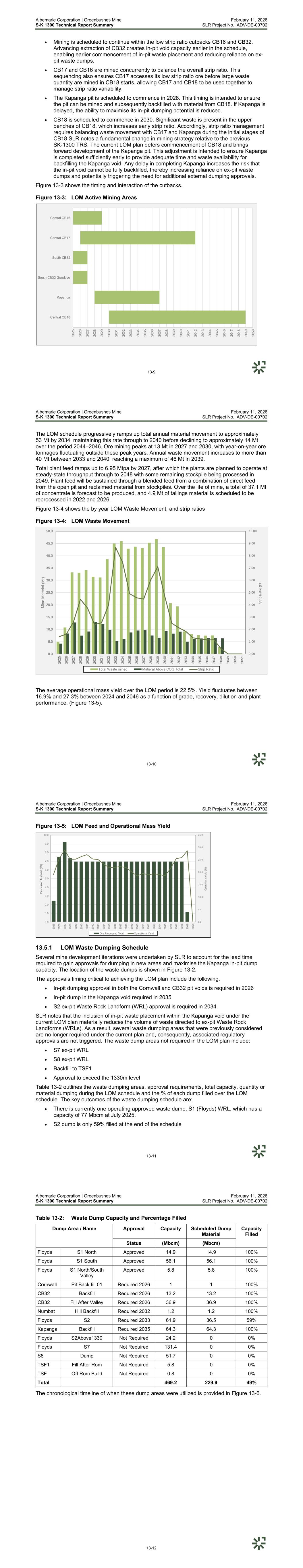

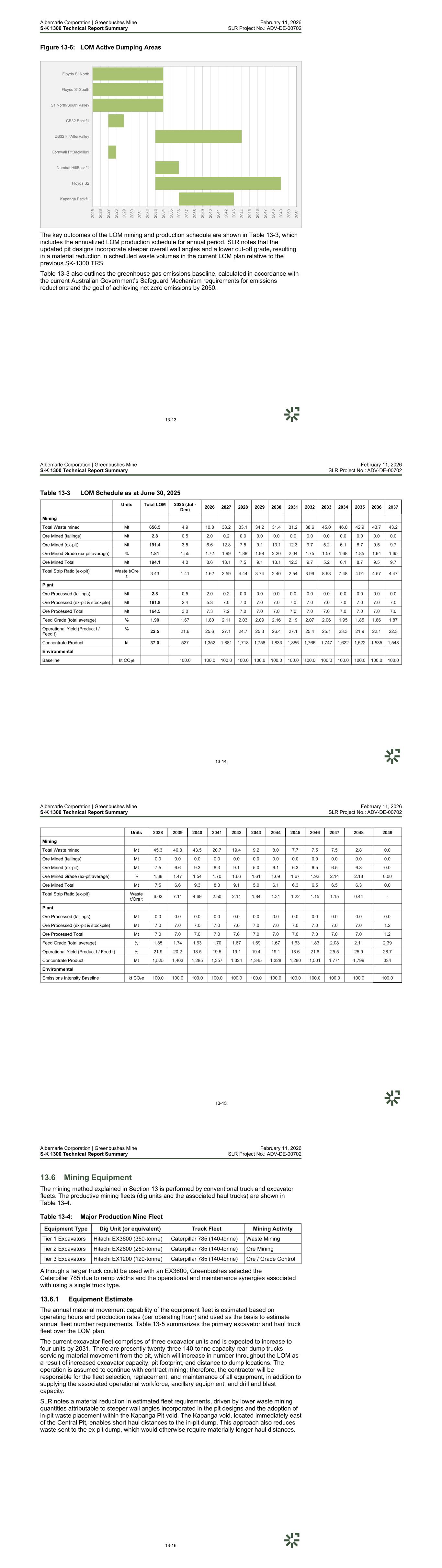

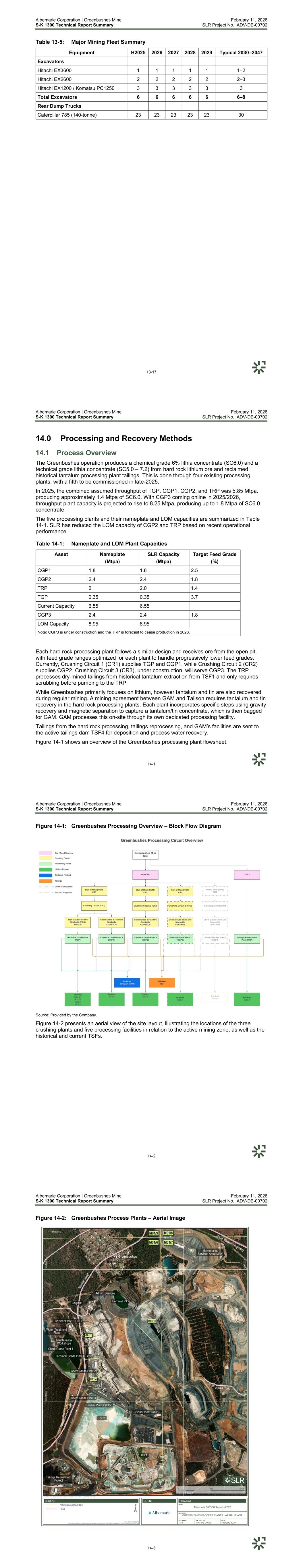

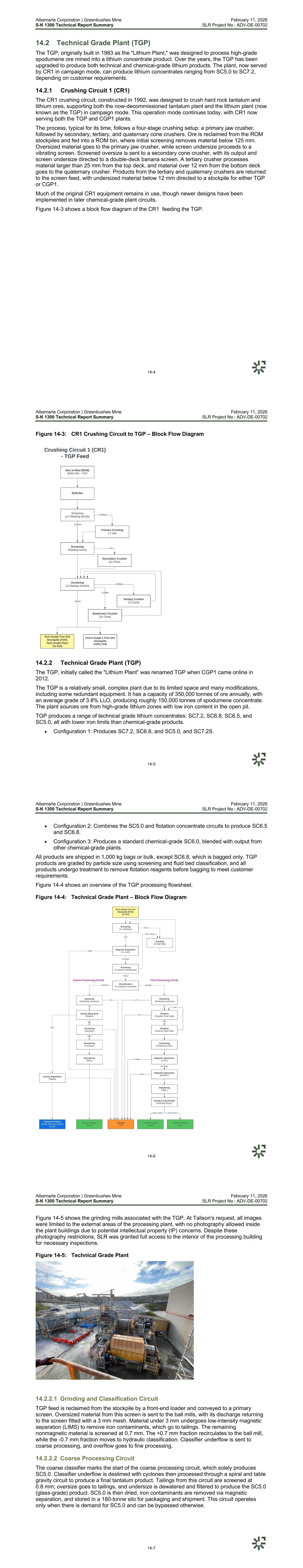

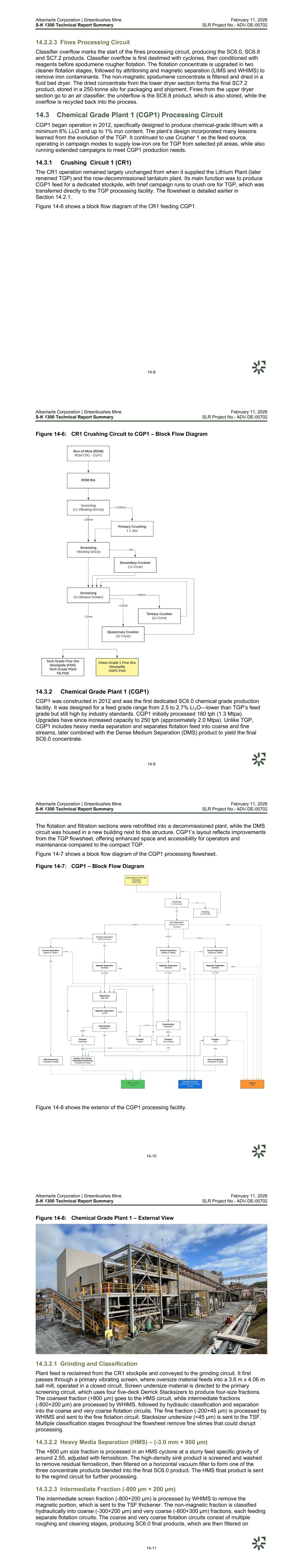

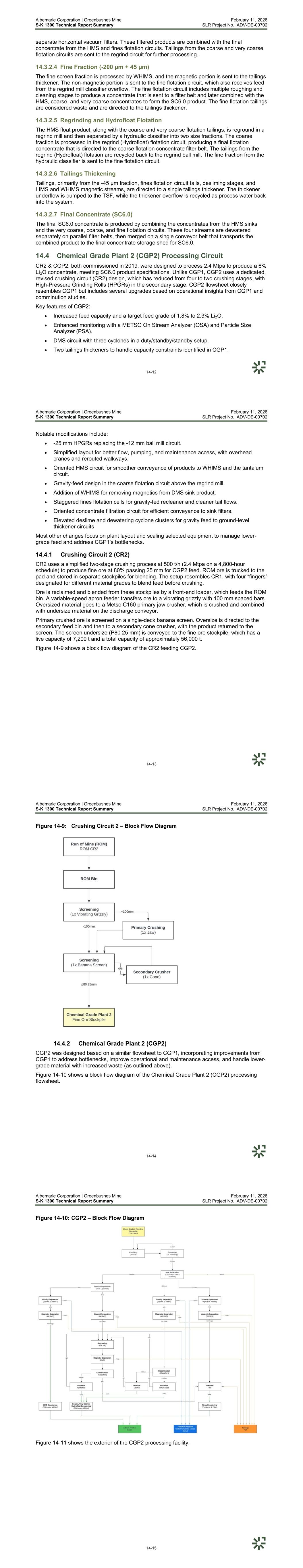

Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 viii Figure 11-11: Example East-West Cross Sections Looking North ...................................... 11-20 Figure 11-12: Swath Plots on 50m Spacing at 6,253,100mN ............................................. 11-21 Figure 11-13: Kapanga Swath Plots 50 m Spacing ............................................................ 11-21 Figure 11-14: Classification Open Pit Material (Red Indicated, Green Inferred, Blue Underground Area) ...................................................................................... 11-23 Figure 12-1: Price Sensitivity Total Pit Size ........................................................................ 12-6 Figure 12-2: Ore Tonnage and Grade ................................................................................ 12-7 Figure 12-3: Pit Limit Optimization Shell ............................................................................ 12-8 Figure 12-4: Pit Design vs Optimisation Shell .................................................................... 12-9 Figure 12-5: Mineral Reserve Pit Shell Slope Design ....................................................... 12-11 Figure 13-1: 2025 LOM Final Pit Design ............................................................................ 13-4 Figure 13-2: Waste Dump Locations .................................................................................. 13-7 Figure 13-3: LOM Active Mining Areas ............................................................................... 13-9 Figure 13-4: LOM Waste Movement ................................................................................ 13-10 Figure 13-5: LOM Feed and Operational Mass Yield ....................................................... 13-11 Figure 13-6: LOM Active Dumping Areas ......................................................................... 13-13 Figure 14-1: Greenbushes Processing Overview – Block Flow Diagram ............................ 14-2 Figure 14-2: Greenbushes Process Plants – Aerial Image ................................................. 14-3 Figure 14-3: CR1 Crushing Circuit to TGP – Block Flow Diagram ...................................... 14-5 Figure 14-4: Technical Grade Plant – Block Flow Diagram ................................................ 14-6 Figure 14-5: Technical Grade Plant ................................................................................... 14-7 Figure 14-6: CR1 Crushing Circuit to CGP1 – Block Flow Diagram ................................... 14-9 Figure 14-7: CGP1 – Block Flow Diagram ....................................................................... 14-10 Figure 14-8: Chemical Grade Plant 1 – External View ..................................................... 14-11 Figure 14-9: Crushing Circuit 2 – Block Flow Diagram ..................................................... 14-14 Figure 14-10: CGP2 – Block Flow Diagram ....................................................................... 14-15 Figure 14-11: Chemical Grade Plant 2 – Exterior View ...................................................... 14-16 Figure 14-12: Crushing Circuit 3 – Block Flow Diagram ..................................................... 14-17 Figure 14-13: CGP3 – Block Flow Diagram ....................................................................... 14-18 Figure 14-14: TRP – Block Flow Diagram .......................................................................... 14-19 Figure 14-15: TRP Concentrate Storage Sheds ................................................................. 14-21 Figure 15-1: Overall Layout ................................................................................................ 15-2 Figure 15-2: Port of Bunbury - Berth 8 ............................................................................... 15-4 Figure 15-3: Water Storages .............................................................................................. 15-7 Figure 15-4: Simplified Water Flow Sheet .......................................................................... 15-8 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 ix Figure 15-5: Water Pipe Route Saltwater Gully to Clearwater Dam ................................. 15-10 Figure 15-6: Mine Services Area (MSA) ........................................................................... 15-12 Figure 15-7: TSF2 ............................................................................................................ 15-14 Figure 15-8: Greenbushes TSFs ...................................................................................... 15-16 Figure 16-1: EV Sales and Penetration Rates (000 vehicles, %) ........................................ 16-2 Figure 16-2: Lithium Demand in Key Sectors (000 LCE tonnes) ........................................ 16-3 Figure 16-3: Forecast Mine Supply (000 tonnes LCE) ........................................................ 16-6 Figure 16-4: Lithium Supply-Demand Balance (000 tonnes LCE) ...................................... 16-8 Figure 16-5: Spodumene Prices (6% lithia, spot, CIF China, US$/tonne) ........................... 16-9 Figure 16-6: Spodumene Long-Term Price Forecast Scenarios (6% Li2O spot, CIF China, US$/tonne, real (2025))................................................................................ 16-11 Figure 19-1: Cashflow and Pre-Tax NPV Summary (100% Basis) ..................................... 19-2 Figure 19-2: NPV Sensitivity Analysis ................................................................................ 19-4 Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-1 1.0 Executive Summary SLR USA Advisory Inc. (SLR), formerly RPMGlobal USA, Inc. (RPM), was retained by Albemarle Corporation (Albemarle or the Client) to prepare an independent Technical Report Summary (TRS) on the Greenbushes Lithium Mine (Greenbushes or the Operation or the Mine) located in Western Australia (Figure 3-1). The purpose of this Report is to provide a Technical Report Summary (TRS or the Report), including an updated Mineral Resource and Mineral Reserves estimate in accordance with the United States Securities and Exchange Commission (SEC) S-K Regulations. Greenbushes is held within the operating entity, Talison Lithium Australia Pty Ltd (Talison or the Company) of which Albemarle is a 49% owner, with the remaining 51% ownership controlled by the Tianqi Lithium Energy Australia (TLEA or JV) between Tianqi Lithium (Tianqi) and IGO Ltd (IGO) with ownership of 26.01% and 24.99%, respectively. Talison is the incorporated operator of the Greenbushes mine. Each Shareholder is entitled to 50% of the spodumene concentrate and other lithium products produced from the mining operation. Marketing and sales are managed by Shareholders individually. SLR’s technical team (the Team) consisted of Senior, Principal, and executive-level Consultants in geology, mining, processing, infrastructure, environment, health, safety, and social (EHSS) relevant experience in the project's styles of mineralization, mining methods, and regional setting. SLR, as the QP, was responsible for compiling or supervising the compilation of this Report and the Statements of Mineral Resources and Mineral Reserves stated within. It should be noted that all costs are presented in Australian dollars ($) unless otherwise stated, the economics have been detailed and evaluated on a 100% equity basis, and no adjustment has been made for inflation (real terms basis). 1.1 Report Scope The purpose of this Report is to update the Mineral Resources and Mineral Reserves estimates and provide a Technical Report Summary (TRS or Report) for Greenbushes, as at June 30, 2025, reported to reflect the ownership in the relevant holding companies that own the Project. This TRS conforms to the United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Title 17 Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary. The TRS was prepared by SLR as a third-party firm in accordance with S-K 1300. References to the QP are references to SLR and not to any individual employed or engaged by SLR. In addition to work undertaken to generate independent Mineral Resources and Mineral Reserves estimates, the TRS relies largely on information provided by Talison or the Client, either directly from the site and other offices or from reports by other organizations whose work is the property of the Talison or the Client or its subsidiaries. The data relied upon for the Mineral Resources and Mineral Reserves estimates independently completed by SLR have been compiled primarily by the Client and Talison and subsequently reviewed and verified as well as reasonably possible by SLR. The TRS is based on information made available to SLR as at June 30, 2025. Neither the Client, nor Talison has advised SLR of any material change, or event likely to cause material change, to the underlying data, designs, or forecasts since the date of asset inspections. It is noted that references to quarterly, half-yearly, or annual time periods are based on a calendar year commencing January 1 each year, unless otherwise noted. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-2 1.2 Property Description and Location Greenbushes is a large-scale open pit mining operation located 250 km south of Perth in Western Australia directly adjacent to the South Western Highway. The highway allows access to a third-party-owned and operated major bulk handling port capability located 90 km to the northwest at Bunbury. Greenbushes is one of the largest known high-grade spodumene pegmatite resources in the world and extracts lithium and tantalum products. SLR notes that the tantalum rights are owned by a third party. The Operation’s property area is approximately 3,500 hectares (ha), which is a smaller subset of a larger 10,067 ha land package controlled 100% by Talison. The Operation is accessible year-round via sealed bitumen roads, and there is sufficient road and port infrastructure in place with sufficient capacity to support the planned mining operations. The climate is characterized as temperate, and SLR considers there to be no limitations on mining or exploration at the site due to the climate, however the Operation is entirely dependent on rainfall as the source of water. 1.3 Geology and Mineralization The intrusive rocks of the Greenbushes Pegmatite District lie within the Balingup metamorphic belt, which lies within the Southwest Gneiss Terrains of the Yilgarn Craton. The pegmatites are spatially associated with and controlled by the Donnybrook-Bridgetown Shear Zone, which is central to this belt and potentially controls both the regional and local emplacement of the mineralization. The Greenbushes pegmatite deposit consists of several large pegmatite intrusive bodies, which are separated into two main lodes, namely the Central and Kapanga Lodes. Both areas consist of several pegmatite bodies; however, the Central Lode displays significantly more continuity and thickness as compared to the Kapanga Lode. Recent drilling has defined advanced stage exploration areas at White Wells and down-dip extension of Central and Kapanga Lodes, which present significant upside to the reported Mineral Resources. Furthermore, recent review work by Talison has highlighted numerous exploration targets along the Greenbushes trend, which SLR considers warrant further exploration. Five distinct mineralogical zones have been defined in the Greenbushes Central Lode pegmatite. Generally, the pegmatite shows a contact zone, a K-feldspar (potassium)-rich zone, an albite (sodium)-rich zone, a mixed zone, and a spodumene (lithium)-rich zone. The bulk of the lithium in the deposit is contained within the spodumene-rich zone, generally towards the center of the Central Lode pegmatite. 1.4 Exploration Status The Greenbushes deposit is well explored and understood, with exploration drilling programs completing 1,763 holes since drilling commenced in the early 1970s. Exploration has been continuous throughout the life of the Operation, with recent exploration focused on the mining areas within the Life of Mine (LOM) pit limits. These exploration programs have gathered geological and geochemical data, with the bulk of this data collected from surface drilling activities. However, some drilling has been undertaken via underground methods historically. Greenbushes’ forward-looking exploration strategy focuses on increasing the geological confidence within the footprint of the tenement holdings to expand the current resource base, particularly focused on the underground area with a initial

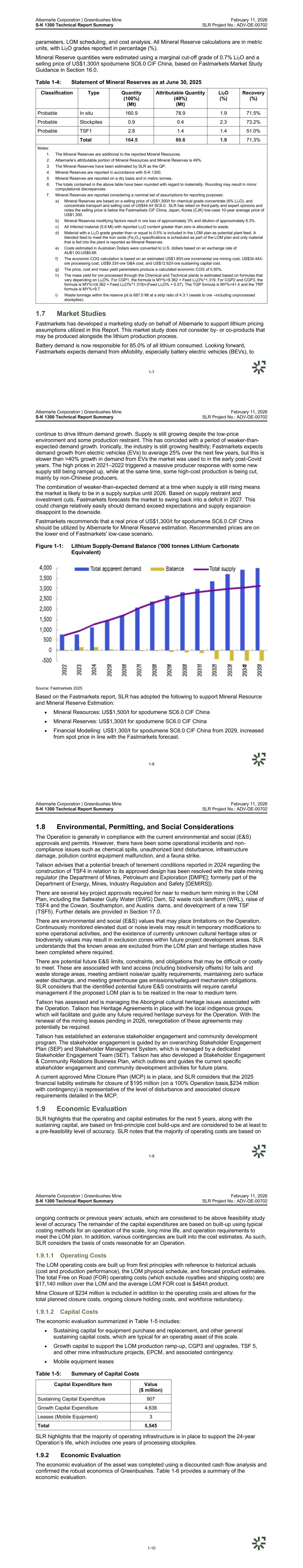

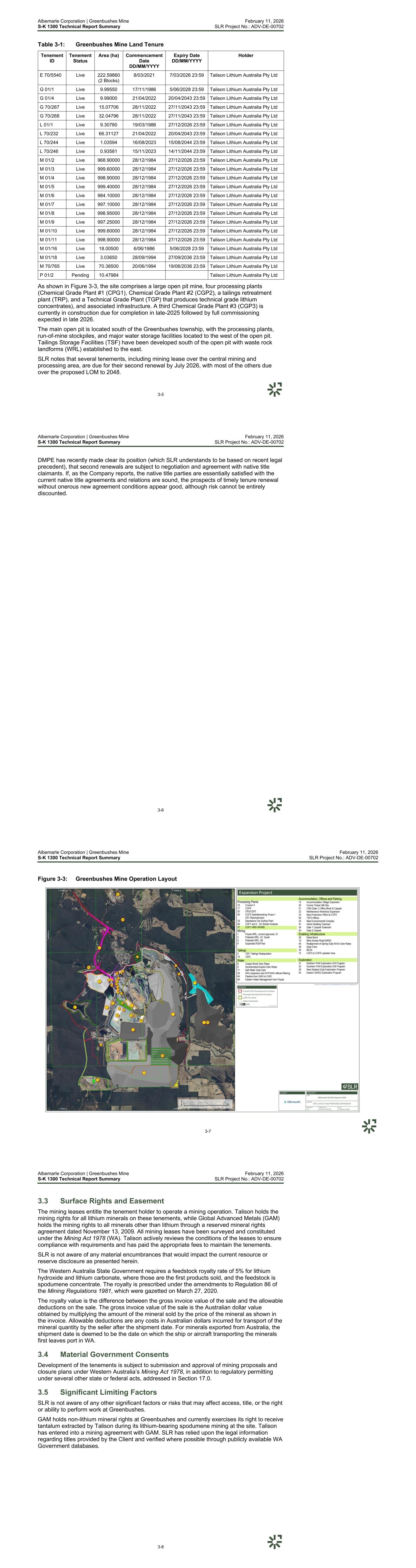

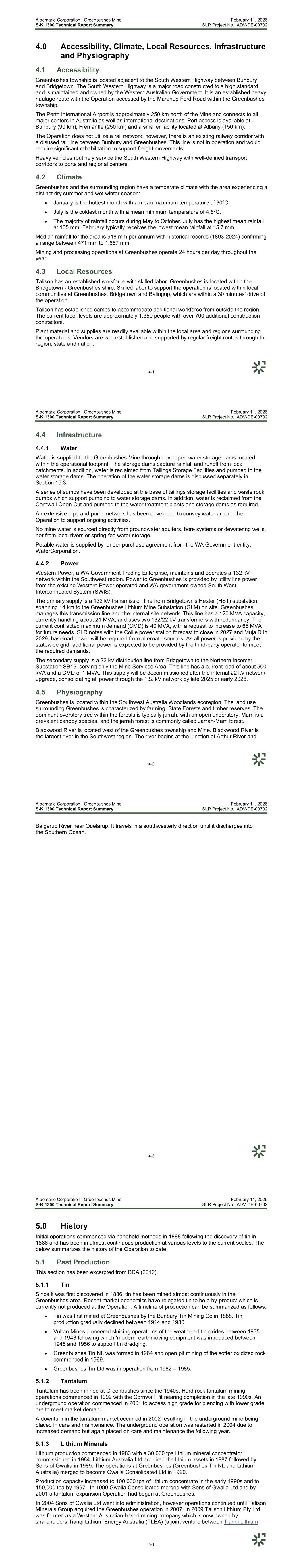

Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-3 underground Mineral Resource being stated in this Report. As noted, SLR considers the White Wells and down-dip extension of Central Lode to be high-priority targets. 1.5 Development and Operations The Operation utilizes conventional open-cut mining techniques optimized for the deposit's geological characteristics, with targeted extraction from the Central Lode and Kapanga pegmatite zones. Mining is forecast to be within a single open pit with the final pit design incorporating staged cutbacks to balance cost efficiency, recovery, and safety. The mining fleet is expected to remain fully contractor-operated, consisting of a mixed fleet of hydraulic excavators and 140-tonne haul trucks. Contractors manage equipment supply, maintenance, replacement, and workforce logistics, subsequently, all mining costs are based on unit rates. 1.5.1 Key Site Infrastructure The Operation currently has four operating processing plants and associated infrastructure– Chemical Grade Plant #1 (CGP1), Chemical Grade Plant #2 (CGP2), a Tailings Retreatment Plant (TRP), and a Technical Grade Plant (TGP). Combined, these plants produce various technical grade lithium concentrates and a 6% lithium oxide (Li2O, or lithia) chemical grade concentrate (SC6.0). As outlined in Table 1-1, the plants combined have a total nameplate processing capacity of 6.55 Mtpa producing up to 1.5 Mtpa of lithium mineral concentrate. A third Chemical Grade Plant #3 (CGP3) is currently being constructed and is forecast to commence commissioning in late-2025 with full production forecast in late 2026. With the inclusion of CGP3, nameplate processing capacity will increase to 8.95 Mtpa; however, SLR has assumed a throughput of 8.65 Mtpa based on recent actuals. Table 1-1: Nameplate and LOM Plant Capacities Asset Nameplate (Mtpa) SLR Capacity (Mtpa) CGP1 1.8 1.8 CGP2 2.4 2.4 TRP 2.0 2.0 TGP 0.35 0.35 Current Capacity 6.55 6.55 CGP3 2.4 2.4 LOM Capacity 8.95 8.95 The Operation’s electricity is primarily supplied via a 132 kV transmission line from the Hester substation to the on-site Greenbushes Lithium Mine Substation, with a capacity of 120 MVA and a current load of 21 MVA. The contracted maximum demand is 40 MVA, with a request to increase to 65 MVA to support future growth. 5 The water supply system relies entirely on rainfall and surface water runoff to a network of relatively small dams, with the majority of rainfall occurring during winter. Nine water storage dams are operating on site, with a planned dam capacity expansion, the S8 Saltwater Gully (SWG) Expansion Project, pending approval for construction. The SWG Expansion Project is a Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-4 key component of the five-year LOM plan as it includes water storage areas to supplement current storage capacities. Typical storage within the current dams is approximately 5 to 6 GL which is considered very low compared to annual process water demand of 25 GL or more (before taking into account decant return). Water supply is a key risk to the achievability of the LOM plan and is detailed further in Section 1.12. Four tailings storage facilities (TSFs), namely TSF1, TSF2, TSF3 and TSF4 have been developed at Greenbushes as part of the mining operations. TSF2’s remaining capacity was consumed in H1 2024 with all material after this time placed in TSF4. At the start of July 2025, the remaining capacity of TSF4 based on the current LOM, is sufficient until 2034. After this time, a raise will be completed to TSF4, with the tailings planned to be stored in a new TSF5 facility, proposed for an off-site location with a design capacity yet to be confirmed. Further details are provided in Section 1.8, 1.12, and Section 17.0 regarding approvals and risks associated with TSFs. There is currently one operating waste dump, S1 (Floyds), with a capacity of 77 million banked cubic meters (Mbcm) and due to reach capacity by 2034. Following this, several waste dumps are planned to be constructed to support the LOM waste storage requirements. As detailed in Section 1.8, 1.12, and Section 17.0, a number of approvals are required for each of these. 1.5.2 Life of Mine Physicals The key physicals relevant to the LOM plan have been summarized in Table 1-2. The LOM plan assumes an active mine life of 24 years, with mining operations ending in 2048 and the processing of remaining stockpiles to be completed in 2049. The LOM schedule progressively ramps up total annual material movement to approximately 53 Mt by 2034, maintaining this rate through to 2040 before declining to approximately 14 Mt over the period 2044–2046. Annual waste movement increases to more than 40 Mt between 2033 and 2040, reaching a maximum of 46 Mt in 2039. Total chemical and technical (excludes TRP) plant feed ramps up to 6.95 Mtpa by 2027, after which the plant is planned to operate at steady-state throughput through to 2048 with some remaining stockpile material being processed in 2049. Plant feed will be sustained through a blended feed from a combination of direct feed from the open pit and reclaimed material from stockpiles. Over the life of mine, a total of 37.0 Mt of concentrate is forecast to be produced, and 2.8 Mt of historical tailings material is scheduled to be reprocessed between 2026 and 2028. Each of the five plants that form the basis for the LOM plants has a different yield forecast, which is detailed in Section1.0. The mining operation is land-constrained, and it is essential to secure the necessary regulatory approvals, biodiversity offsets, and land acquisitions for additional waste rock dump capacity. While it is common for mining operations with a 20+ year LOM to require future approvals, SLR highlights an elevated risk due to land constraints, regulatory requirements, and the need for capital investment. SLR considers these areas to be key risks to achieve the LOM plan as noted in Section 1.12, and Section 17.0. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-5 Table 1-2: LOM Physicals Parameter Units (metric) LOM LOM Active Mine Period Years 24 LOM Plant Period Years 25 Waste Material Moved# Mt 656.5 Ore Mined (ex-pit) Mt 160.9 Ore Mined (reprocessed tailings) Mt 2.8 Ore Existing Stockpiles Mt 0.9 Ore Processed (Feed total) Mt 164.5 Feed Grade (Total average) % 1.90 Strip Ratio (ROM) t:t 3.4 LOM Operational Yield % 22.5 Concentrate Tonnes (SC6.0) Mt 37.0 Note: # Excludes unprocessed ore stockpiles (30.5 Mt). SC6.0: spodumene concentrate containing 6% Li2O * Waste material mined in volume: 229.9 Mbcm 1.6 Mineral Resources and Mineral Reserves Unless otherwise stated in this Report, the Mineral Resources and Mineral Reserves reported reflect the Company’s 49% interest in the asset, and Mineral Resources are reported exclusive of Mineral Reserves (i.e., Reported Mineral Resources are in addition to reported Mineral Reserves). The Mineral Resources as at June 30, 2025, summarized in Table 1-3, have been estimated and classified in accordance with S-K 1300 and have reasonable prospects for economic extraction in line with an Initial Assessment. The Mineral Resources have been estimated with reference to a cut-off grade (COG) of 0.3% Li2O, employing an open pit mining method and 0.8% Li2O in the underground area. The COG was determined with regard to estimated mining and processing costs, yield and product qualities, and long-term benchmark pricing of US1,500 per tonne SC6. It is highlighted that the long-term benchmark price provided by third-party experts Fastmarkets (as discussed in Section 11.5) is over a timeline of 7 to 10 years, which was selected based on the Mineral Resource's reasonable long-term prospect. Both the Mineral Resources and Mineral Reserves have been reported using the 30 June surface provided SLR, as the QP considers the geological model to be based on adequate structural and geochemical data that has been reviewed and verified by geologists over a long period of time, as well as by SLR. Deposit modeling has been carried out using industry-standard geological modeling software and procedures. The estimation and classification of the Mineral Resource reflect the QP’s opinion of a substantial quantum of in situ material with reasonable prospects for economic extraction remaining available. SLR notes that the Mineral Resources are reported exclusive of Mineral Reserves. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-6 Table 1-3: Statement of Mineral Resources as at June 30, 2025 Type Classification Quantity (100%) (Mt) Attributable Quantity (49%) (Mt) Li2O Grade (%) Open Pit Indicated 126.3 61.9 1.2 Inferred 4.4 2.2 0.9 Underground Indicated - - - Inferred 82.1 40.2 1.6 Stockpiles Indicated 2.5 1.2 1.7 Inferred 1.4 0.7 1.5 TSF Indicated Inferred Total Indicated 128.8 63.1 1.2 Inferred 87.9 43.1 1.6 Notes: 1. The Mineral Resources are reported exclusive of the Mineral Reserves. 2. The Mineral Resources have been compiled under the supervision of SLR as the QP. 3. All Mineral Resources figures reported in the table above represent estimates at June 30, 2025. Mineral Resource estimates are not precise calculations, being dependent on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate and reflect the view of the QP. Rounding may cause some computational discrepancies. 4. Mineral Resources are reported in accordance with S-K 1300. 5. The Mineral Resources reflect the 49% ownership in the relevant holding companies. 6. The Open Pit Mineral Resources are reported at a cut-off grade of 0.3 % Li2O while the Underground Mineral Resources are reported at a cut-off grade of 0.8% Li2O. Refer to Section 0 for determinations of the cut-off grades applied. 7. Mineral Resources are estimated using a long-term selling price of US$1,500/t CIF CKJ1 of SC6 grade concentrate (benchmark 6% Li2O), and a US$/A$ exchange rate of A$1.00:US$0.66. SLR is of the opinion that, with consideration of the recommendations summarized in Sections 1.0 and 23.0 of this TRS, any issues relating to all relevant technical and economic factors likely to influence the prospect of economic extraction can be resolved with further work. The Mineral Reserves have been estimated as at June 30, 2025, as summarized in Table 1-4. Mineral Reserves are subdivided into Proven Mineral Reserves and Probable Mineral Reserves categories to reflect the confidence in the underlying Mineral Resource data and modifying factors applied during mine planning. A Proven Mineral Reserve can only be derived from a Measured Mineral Resource, while a Probable Mineral Reserve is typically derived from an Indicated Mineral Resource as well as Measured Resources dependent on the QP’s confidence in the underlying Modifying Factors. No Measured Mineral Resources have been reported for the Operation, as such no Proven Mineral Reserves are reported. The conversion of Mineral Resources to Mineral Reserves incorporated systematic mine planning and analysis, including pit optimization, detailed pit design, the application of modifying 1 Cost, Insurance and Freight paid to Chikugo Port (China).

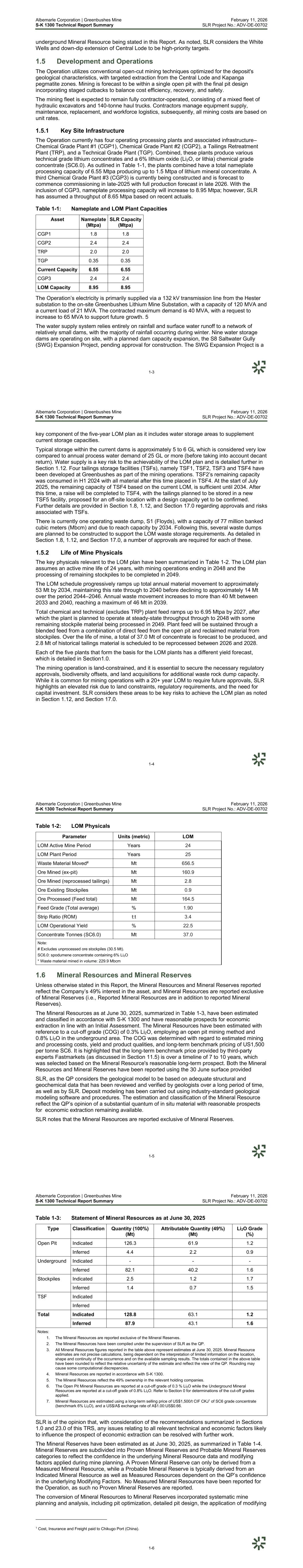

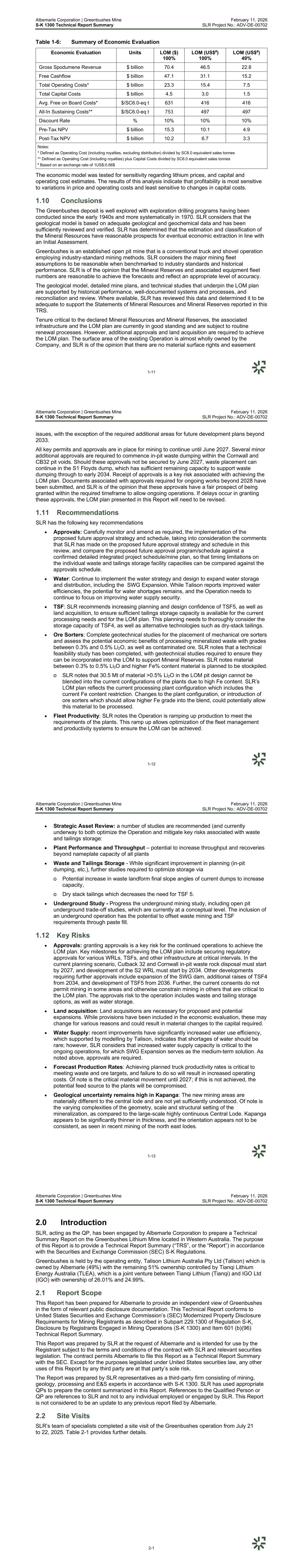

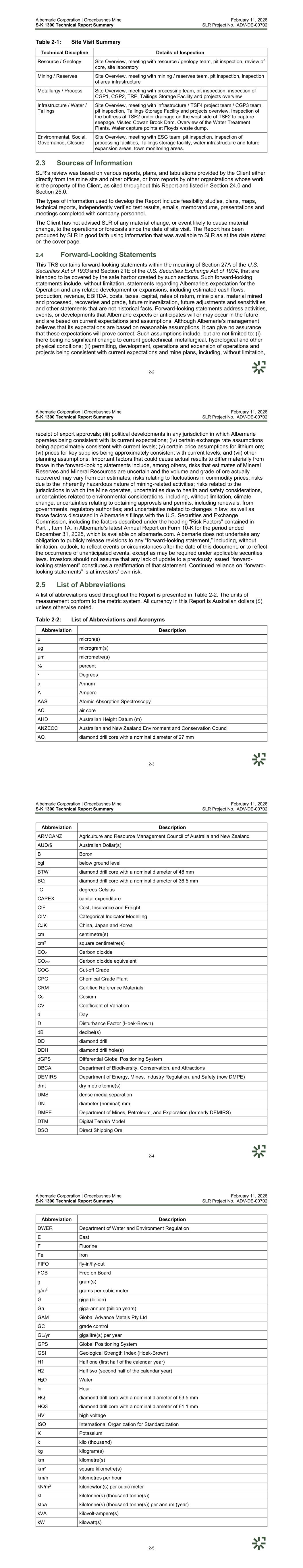

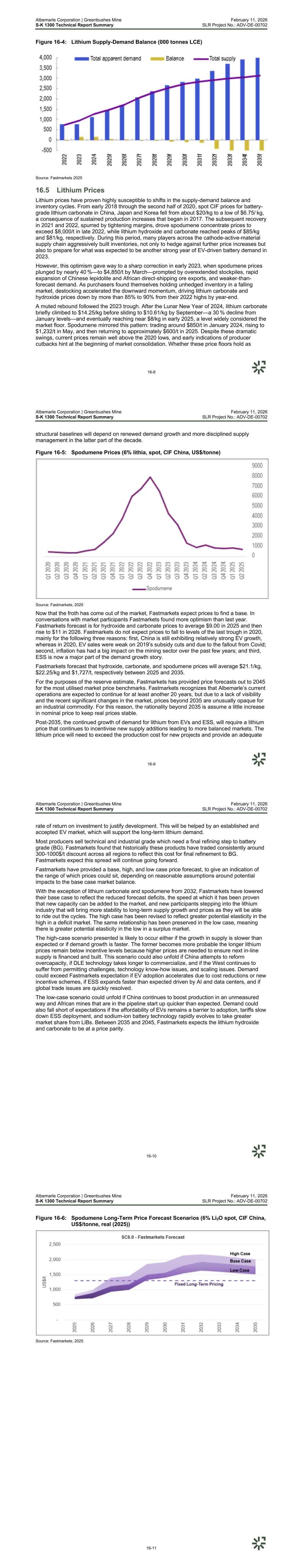

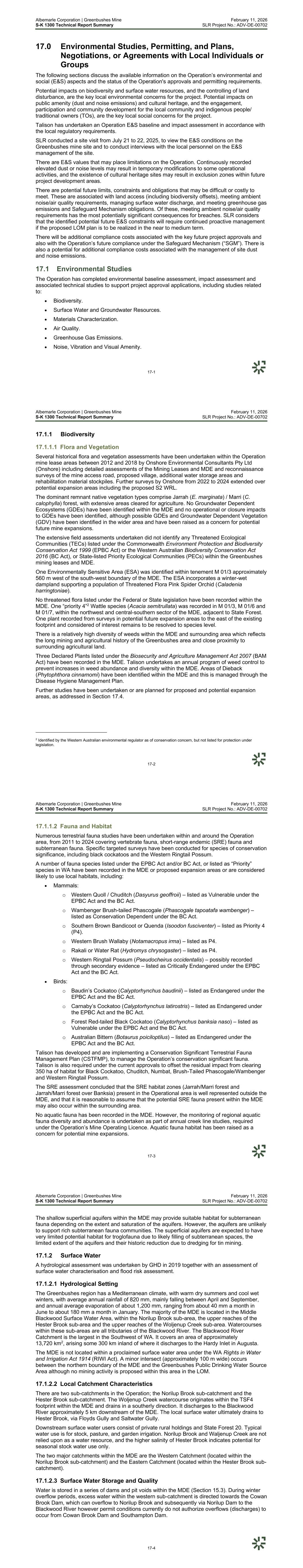

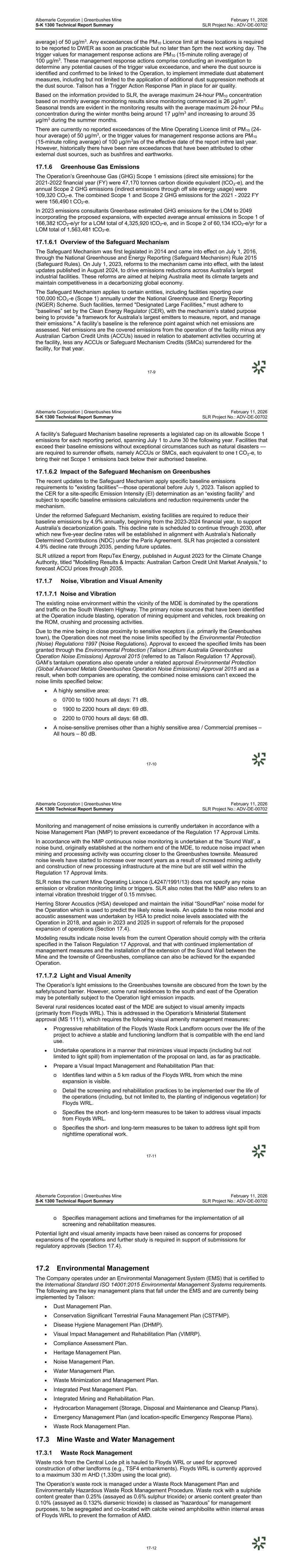

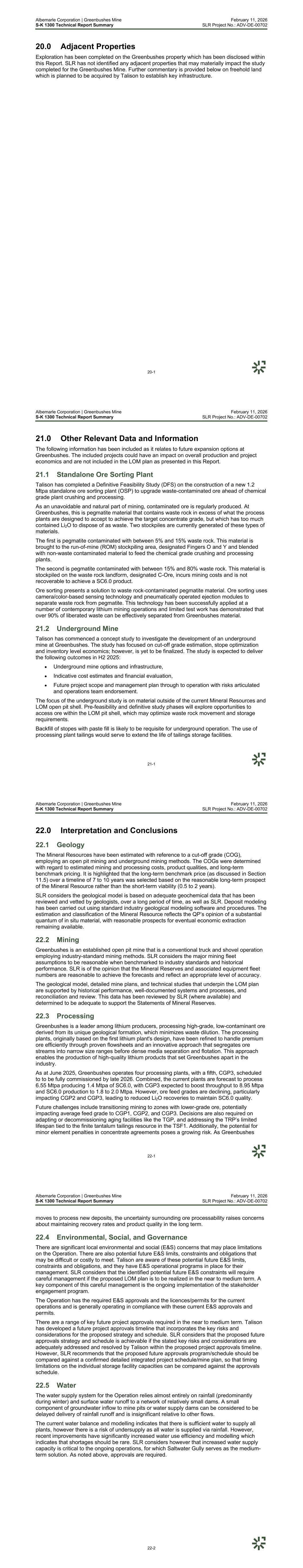

Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-7 parameters, LOM scheduling, and cost analysis. All Mineral Reserve calculations are in metric units, with Li2O grades reported in percentage (%). Mineral Reserve quantities were estimated using a marginal cut-off grade of 0.7% Li2O and a selling price of US$1,300/t spodumene SC6.0 CIF China, based on Fastmarkets Market Study Guidance in Section 16.0. Table 1-4: Statement of Mineral Reserves as at June 30, 2025 Classification Type Quantity (100%) (Mt) Attributable Quantity (49%) (Mt) Li2O (%) Recovery (%) Probable In situ 160.9 78.9 1.9 71.5% Probable Stockpiles 0.9 0.4 2.3 73.2% Probable TSF1 2.8 1.4 1.4 51.0% Total 164.5 80.6 1.9 71.3% Notes: 1. The Mineral Reserves are additional to the reported Mineral Resources. 2. Albemarle’s attributable portion of Mineral Resources and Mineral Reserves is 49%. 3. The Mineral Reserves have been estimated by SLR as the QP. 4. Mineral Reserves are reported in accordance with S-K 1300. 5. Mineral Reserves are reported on a dry basis and in metric tonnes. 6. The totals contained in the above table have been rounded with regard to materiality. Rounding may result in minor computational discrepancies. 7. Mineral Reserves are reported considering a nominal set of assumptions for reporting purposes: a) Mineral Reserves are based on a selling price of US$1,300/t for chemical grade concentrate (6% Li2O), and concentrate transport and selling cost of US$44.4/t SC6.0. SLR has relied on third-party and expert opinions and notes the selling price is below the Fastmarkets CIF China, Japan, Korea (CJK) low-case 10-year average price of US$1,300. b) Mineral Reserves modifying factors result in ore loss of approximately 3% and dilution of approximately 6.3%. c) All Inferred material (5.8 Mt) with reported Li2O content greater than zero is allocated to waste. d) Material with a Li₂O grade greater than or equal to 0.5% is included in the LOM plan as potential plant feed. A blended feed to meet the iron oxide (Fe₂O₃) specifications is scheduled as part of the LOM plan and only material that is fed into the plant is reported as Mineral Reserves. e) Costs estimated in Australian Dollars were converted to U.S. dollars based on an exchange rate of AU$1.00:US$0.66. f) The economic COG calculation is based on an estimated US$1.85/t-ore incremental ore mining cost, US$34.44/t- ore processing cost, US$9.33/t-ore G&A cost, and US$12.62/t-ore sustaining capital cost. g) The price, cost and mass yield parameters produce a calculated economic COG of 0.50%. h) The mass yield for ore processed through the Chemical and Technical plants is estimated based on formulas that vary depending on Li2O%. For CGP1, the formula is MY%=9.362 × Feed Li2O%^1.319. For CGP2 and CGP3, the formula is MY%=(9.362 × Feed Li2O%^1.319)+(Feed Li2O% × 0.57). The TGP formula is MY%=41.4 and the TRP formula is MY%=9.7. i) Waste tonnage within the reserve pit is 687.0 Mt at a strip ratio of 4.3:1 (waste to ore –including unprocessed stockpiles). 1.7 Market Studies Fastmarkets has developed a marketing study on behalf of Albemarle to support lithium pricing assumptions utilized in this Report. This market study does not consider by- or co-products that may be produced alongside the lithium production process. Battery demand is now responsible for 85.0% of all lithium consumed. Looking forward, Fastmarkets expects demand from eMobility, especially battery electric vehicles (BEVs), to Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-8 continue to drive lithium demand growth. Supply is still growing despite the low-price environment and some production restraint. This has coincided with a period of weaker-than- expected demand growth. Ironically, the industry is still growing healthily; Fastmarkets expects demand growth from electric vehicles (EVs) to average 25% over the next few years, but this is slower than >40% growth in demand from EVs the market was used to in the early post-Covid years. The high prices in 2021–2022 triggered a massive producer response with some new supply still being ramped up, while at the same time, some high-cost production is being cut, mainly by non-Chinese producers. The combination of weaker-than-expected demand at a time when supply is still rising means the market is likely to be in a supply surplus until 2026. Based on supply restraint and investment cuts, Fastmarkets forecasts the market to swing back into a deficit in 2027. This could change relatively easily should demand exceed expectations and supply expansion disappoint to the downside. Fastmarkets recommends that a real price of US$1,300/t for spodumene SC6.0 CIF China should be utilized by Albemarle for Mineral Reserve estimation. Recommended prices are on the lower end of Fastmarkets' low-case scenario. Figure 1-1: Lithium Supply-Demand Balance ('000 tonnes Lithium Carbonate Equivalent) Source: Fastmarkets 2025 Based on the Fastmarkets report, SLR has adopted the following to support Mineral Resource and Mineral Reserve Estimation: • Mineral Resources: US$1,500/t for spodumene SC6.0 CIF China • Mineral Reserves: US$1,300/t for spodumene SC6.0 CIF China • Financial Modelling: US$1,300/t for spodumene SC6.0 CIF China from 2029, increased from spot price in line with the Fastmarkets forecast. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-9 1.8 Environmental, Permitting, and Social Considerations The Operation is generally in compliance with the current environmental and social (E&S) approvals and permits. However, there have been some operational incidents and non- compliance issues such as chemical spills, unauthorized land disturbance, infrastructure damage, pollution control equipment malfunction, and a fauna strike. Talison advises that a potential breach of tenement conditions reported in 2024 regarding the construction of TSF4 in relation to its approved design has been resolved with the state mining regulator (the Department of Mines, Petroleum and Exploration [DMPE]; formerly part of the Department of Energy, Mines, Industry Regulation and Safety [DEMIRS]). There are several key project approvals required for near to medium term mining in the LOM Plan, including the Saltwater Gully Water (SWG) Dam, S2 waste rock landform (WRL), raise of TSF4 and the Cowan, Southampton, and Austins dams, and development of a new TSF (TSF5). Further details are provided in Section 17.0. There are environmental and social (E&S) values that may place limitations on the Operation. Continuously monitored elevated dust or noise levels may result in temporary modifications to some operational activities, and the existence of currently unknown cultural heritage sites or biodiversity values may result in exclusion zones within future project development areas. SLR understands that the known areas are excluded from the LOM plan and heritage studies have been completed where required. There are potential future E&S limits, constraints, and obligations that may be difficult or costly to meet. These are associated with land access (including biodiversity offsets) for tails and waste storage areas, meeting ambient noise/air quality requirements, maintaining zero surface water discharge, and meeting greenhouse gas emissions/safeguard mechanism obligations. SLR considers that the identified potential future E&S constraints will require careful management if the proposed LOM plan is to be realized in the near to medium term. Talison has assessed and is managing the Aboriginal cultural heritage issues associated with the Operation. Talison has Heritage Agreements in place with the local indigenous groups, which will facilitate and guide any future required heritage surveys for the Operation. With the renewal of the mining leases pending in 2026, renegotiation of these agreements may potentially be required. Talison has established an extensive stakeholder engagement and community development program. The stakeholder engagement is guided by an overarching Stakeholder Engagement Plan (SEP) and Stakeholder Management System, which is managed by a dedicated Stakeholder Engagement Team (SET). Talison has also developed a Stakeholder Engagement & Community Relations Business Plan, which outlines and guides the current specific stakeholder engagement and community development activities for future plans. A current approved Mine Closure Plan (MCP) is in place, and SLR considers that the 2025 financial liability estimate for closure of $195 million (on a 100% Operation basis,$234 million with contingency) is representative of the level of disturbance and associated closure requirements detailed in the MCP. 1.9 Economic Evaluation SLR highlights that the operating and capital estimates for the next 5 years, along with the sustaining capital, are based on first-principle cost build-ups and are considered to be at least to a pre-feasibility level of accuracy. SLR notes that the majority of operating costs are based on Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-10 ongoing contracts or previous years’ actuals, which are considered to be above feasibility study level of accuracy The remainder of the capital expenditures are based on built-up using typical costing methods for an operation of the scale, long mine life, and operation requirements to meet the LOM plan. In addition, various contingencies are built into the cost estimates. As such, SLR considers the basis of costs reasonable for an Operation. 1.9.1.1 Operating Costs The LOM operating costs are built up from first principles with reference to historical actuals (cost and production performance), the LOM physical schedule, and forecast product estimates. The total Free on Road (FOR) operating costs (which exclude royalties and shipping costs) are $17,140 million over the LOM and the average LOM FOR cost is $464/t product. Mine Closure of $234 million is included in addition to the operating costs and allows for the total planned closure costs, ongoing closure holding costs, and workforce redundancy. 1.9.1.2 Capital Costs The economic evaluation summarized in Table 1-5 includes: • Sustaining capital for equipment purchase and replacement, and other general sustaining capital costs, which are typical for an operating asset of this scale. • Growth capital to support the LOM production ramp-up, CGP3 and upgrades, TSF 5, and other mine infrastructure projects, EPCM, and associated contingency. • Mobile equipment leases Table 1-5: Summary of Capital Costs Capital Expenditure Item Value ($ million) Sustaining Capital Expenditure 907 Growth Capital Expenditure 4,636 Leases (Mobile Equipment) 3 Total 5,545 SLR highlights that the majority of operating infrastructure is in place to support the 24-year Operation’s life, which includes one years of processing stockpiles. 1.9.2 Economic Evaluation The economic evaluation of the asset was completed using a discounted cash flow analysis and confirmed the robust economics of Greenbushes. Table 1-6 provides a summary of the economic evaluation.

Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-11 Table 1-6: Summary of Economic Evaluation Economic Evaluation Units LOM ($) 100% LOM (US$#) 100% LOM (US$#) 49% Gross Spodumene Revenue $ billion 70.4 46.5 22.8 Free Cashflow $ billion 47.1 31.1 15.2 Total Operating Costs* $ billion 23.3 15.4 7.5 Total Capital Costs $ billion 4.5 3.0 1.5 Avg. Free on Board Costs* $/SC6.0-eq t 631 416 416 All-In Sustaining Costs** $/SC6.0-eq t 753 497 497 Discount Rate % 10% 10% 10% Pre-Tax NPV $ billion 15.3 10.1 4.9 Post-Tax NPV $ billion 10.2 6.7 3.3 Notes: * Defined as Operating Cost (including royalties, excluding distribution) divided by SC6.0 equivalent sales tonnes ** Defined as Operating Cost (including royalties) plus Capital Costs divided by SC6.0 equivalent sales tonnes # Based on an exchange rate of 1US$:0.66$ The economic model was tested for sensitivity regarding lithium prices, and capital and operating cost estimates. The results of this analysis indicate that profitability is most sensitive to variations in price and operating costs and least sensitive to changes in capital costs. 1.10 Conclusions The Greenbushes deposit is well explored with exploration drilling programs having been conducted since the early 1940s and more systematically in 1970. SLR considers that the geological model is based on adequate geological and geochemical data and has been sufficiently reviewed and verified. SLR has determined that the estimation and classification of the Mineral Resources have reasonable prospects for eventual economic extraction in line with an Initial Assessment. Greenbushes is an established open pit mine that is a conventional truck and shovel operation employing industry-standard mining methods. SLR considers the major mining fleet assumptions to be reasonable when benchmarked to industry standards and historical performance. SLR is of the opinion that the Mineral Reserves and associated equipment fleet numbers are reasonable to achieve the forecasts and reflect an appropriate level of accuracy. The geological model, detailed mine plans, and technical studies that underpin the LOM plan are supported by historical performance, well-documented systems and processes, and reconciliation and review. Where available, SLR has reviewed this data and determined it to be adequate to support the Statements of Mineral Resources and Mineral Reserves reported in this TRS. Tenure critical to the declared Mineral Resources and Mineral Reserves, the associated infrastructure and the LOM plan are currently in good standing and are subject to routine renewal processes. However, additional approvals and land acquisition are required to achieve the LOM plan. The surface area of the existing Operation is almost wholly owned by the Company, and SLR is of the opinion that there are no material surface rights and easement Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-12 issues, with the exception of the required additional areas for future development plans beyond 2033. All key permits and approvals are in place for mining to continue until June 2027. Several minor additional approvals are required to commence in-pit waste dumping within the Cornwall and CB32 pit voids. Should these approvals not be secured by June 2027, waste placement can continue in the S1 Floyds dump, which has sufficient remaining capacity to support waste dumping through to early 2034. Receipt of approvals is a key risk associated with achieving the LOM plan. Documents associated with approvals required for ongoing works beyond 2028 have been submitted, and SLR is of the opinion that these approvals have a fair prospect of being granted within the required timeframe to allow ongoing operations. If delays occur in granting these approvals, the LOM plan presented in this Report will need to be revised. 1.11 Recommendations SLR has the following key recommendations • Approvals: Carefully monitor and amend as required, the implementation of the proposed future approval strategy and schedule, taking into consideration the comments that SLR has made on the proposed future approval strategy and schedule in this review, and compare the proposed future approval program/schedule against a confirmed detailed integrated project schedule/mine plan, so that timing limitations on the individual waste and tailings storage facility capacities can be compared against the approvals schedule. • Water: Continue to implement the water strategy and design to expand water storage and distribution, including the SWG Expansion. While Talison reports improved water efficiencies, the potential for water shortages remains, and the Operation needs to continue to focus on improving water supply security. • TSF: SLR recommends increasing planning and design confidence of TSF5, as well as land acquisition, to ensure sufficient tailings storage capacity is available for the current processing needs and for the LOM plan. This planning needs to thoroughly consider the storage capacity of TSF4, as well as alternative technologies such as dry-stack tailings. • Ore Sorters: Complete geotechnical studies for the placement of mechanical ore sorters and assess the potential economic benefits of processing mineralized waste with grades between 0.3% and 0.5% Li2O, as well as contaminated ore. SLR notes that a technical feasibility study has been completed, with geotechnical studies required to ensure they can be incorporated into the LOM to support Mineral Reserves. SLR notes material between 0.3% to 0.5% Li2O and higher Fe% content material is planned to be stockpiled. o SLR notes that 30.5 Mt of material >0.5% Li2O in the LOM pit design cannot be blended into the current configurations of the plants due to high Fe content. SLR’s LOM plan reflects the current processing plant configuration which includes the current Fe content restriction. Changes to the plant configuration, or introduction of ore sorters which should allow higher Fe grade into the blend, could potentially allow this material to be processed. • Fleet Productivity: SLR notes the Operation is ramping up production to meet the requirements of the plants. This ramp up allows optimization of the fleet management and productivity systems to ensure the LOM can be achieved. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 1-13 • Strategic Asset Review: a number of studies are recommended (and currently underway to both optimize the Operation and mitigate key risks associated with waste and tailings storage: • Plant Performance and Throughput – potential to increase throughput and recoveries beyond nameplate capacity of all plants • Waste and Tailings Storage - While significant improvement in planning (in-pit dumping, etc.), further studies required to optimize storage via o Potential increase in waste landform final slope angles of current dumps to increase capacity, o Dry stack tailings which decreases the need for TSF 5. • Underground Study - Progress the underground mining study, including open pit underground trade-off studies, which are currently at a conceptual level. The inclusion of an underground operation has the potential to offset waste mining and TSF requirements through paste fill. 1.12 Key Risks • Approvals: granting approvals is a key risk for the continued operations to achieve the LOM plan. Key milestones for achieving the LOM plan include securing regulatory approvals for various WRLs, TSFs, and other infrastructure at critical intervals. In the current planning scenario, Cutback 32 and Cornwall in-pit waste rock disposal must start by 2027, and development of the S2 WRL must start by 2034. Other developments requiring further approvals include expansion of the SWG dam, additional raises of TSF4 from 2034, and development of TSF5 from 2036. Further, the current consents do not permit mining in some areas and otherwise constrain mining in others that are critical to the LOM plan. The approvals risk to the operation includes waste and tailing storage options, as well as water storage. • Land acquisition: Land acquisitions are necessary for proposed and potential expansions. While provisions have been included in the economic evaluation, these may change for various reasons and could result in material changes to the capital required. • Water Supply: recent improvements have significantly increased water use efficiency, which supported by modelling by Talison, indicates that shortages of water should be rare; however, SLR considers that increased water supply capacity is critical to the ongoing operations, for which SWG Expansion serves as the medium-term solution. As noted above, approvals are required. • Forecast Production Rates: Achieving planned truck productivity rates is critical to meeting waste and ore targets, and failure to do so will result in increased operating costs. Of note is the critical material movement until 2027; if this is not achieved, the potential feed source to the plants will be compromised. • Geological uncertainty remains high in Kapanga: The new mining areas are materially different to the central lode and are not yet sufficiently understood. Of note is the varying complexities of the geometry, scale and structural setting of the mineralization, as compared to the large-scale highly continuous Central Lode. Kapanga appears to be significantly thinner in thickness, and the orientation appears not to be consistent, as seen in recent mining of the north east lodes. Albemarle Corporation | Greenbushes Mine S-K 1300 Technical Report Summary February 11, 2026 SLR Project No.: ADV-DE-00702 2-1 2.0 Introduction SLR, acting as the QP, has been engaged by Albemarle Corporation to prepare a Technical Summary Report on the Greenbushes Lithium Mine located in Western Australia. The purpose of this Report is to provide a Technical Report Summary (“TRS”, or the “Report”) in accordance with the Securities and Exchange Commission (SEC) S-K Regulations. Greenbushes is held by the operating entity, Talison Lithium Australia Pty Ltd (Talison) which is owned by Albemarle (49%) with the remaining 51% ownership controlled by Tianqi Lithium Energy Australia (TLEA), which is a joint venture between Tianqi Lithium (Tianqi) and IGO Ltd (IGO) with ownership of 26.01% and 24.99%. 2.1 Report Scope This Report has been prepared for Albemarle to provide an independent view of Greenbushes in the form of relevant public disclosure documentation. This Technical Report conforms to United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary. This Report was prepared by SLR at the request of Albemarle and is intended for use by the Registrant subject to the terms and conditions of the contract with SLR and relevant securities legislation. The contract permits Albemarle to file this Report as a Technical Report Summary with the SEC. Except for the purposes legislated under United States securities law, any other uses of this Report by any third party are at that party’s sole risk. The Report was prepared by SLR representatives as a third-party firm consisting of mining, geology, processing and E&S experts in accordance with S-K 1300. SLR has used appropriate QPs to prepare the content summarized in this Report. References to the Qualified Person or QP are references to SLR and not to any individual employed or engaged by SLR. This Report is not considered to be an update to any previous report filed by Albemarle. 2.2 Site Visits SLR’s team of specialists completed a site visit of the Greenbushes operation from July 21 to 22, 2025. Table 2-1 provides further details.