President & CEO

November 16, 2017

Thad Hill

Calpine Corporation

Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and other forward-looking

information that reflect Calpine’s current views with respect to future events and financial performance. These

estimates, projections and other forward-looking information are based on assumptions that Calpine believes, as of the

date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual results, and those

differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof. Calpine undertakes no

duty to update or revise the information contained herein other than as required by law.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this

presentation as they are based on current expectations and general assumptions and are subject to various risks,

uncertainties and other factors, including those set forth in Calpine’s Quarterly Reports on Form 10-Q for the three

months ended March 31, June 30 and September 30, 2017, its Annual Report on Form 10-K for the year ended December

31, 2016 and in other documents that Calpine files with the SEC. Many of these risks, uncertainties and other factors are

beyond Calpine’s control and may cause actual results to differ materially from the views, beliefs and estimates

expressed herein. Calpine’s reports and other information filed with the SEC, including the risk factors identified in its

Annual Report on Form 10-K for the year ended December 31, 2016, and its Quarterly Report on Form 10-Q for the three

months ended September 30, 2017, can be found on the SEC’s website at www.sec.gov and on Calpine’s website at

www.calpine.com.

Reconciliation to U.S. GAAP Financial Information

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the

Securities Exchange Act of 1934, as amended. Schedules are included herein that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures calculated and

presented in accordance with U.S. GAAP.

Calpine Corporation 1

Safe Harbor Statement

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the proposed acquisition of Calpine by Energy

Capital Partners III, LLC (“ECP”). This communication does not constitute a solicitation of any vote or approval. In

connection with the proposed transaction, Calpine has filed with the SEC preliminary and definitive proxy statements and

other relevant documents. The definitive proxy statement has been mailed or otherwise provided to Calpine’s

stockholders. INVESTORS AND SECURITYHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND ANY OTHER

DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders may obtain a free copy of the proxy statement (when available) and other

documents filed by Calpine with the SEC from the SEC’s website at www.sec.gov. In addition, investors and security

holders may obtain free copies of the documents filed with the SEC at Calpine’s website at www.calpine.com/investor-

relations.

Participants in the Solicitation

Calpine and its directors and executive officers may be deemed to be participants in the solicitation of proxies from

Calpine’s stockholders in connection with the proposed transaction. Investors and security holders may obtain more

detailed information regarding the names, affiliations and interests of Calpine’s directors and executive officers by

reading Calpine’s Annual Report on Form 10-K, which was filed with the SEC on February 10, 2017, and proxy statement

for its 2017 annual meeting of stockholders, which was filed with the SEC on March 29, 2017. Additional information

regarding potential participants in such proxy solicitation and a description of their direct and indirect interests, by

security holdings or otherwise, are included in the proxy statement and other relevant documents filed by Calpine with

the SEC in connection with the proposed transaction.

Additional Information

Calpine Corporation 2

0

5

10

15

20

25

30

35

40

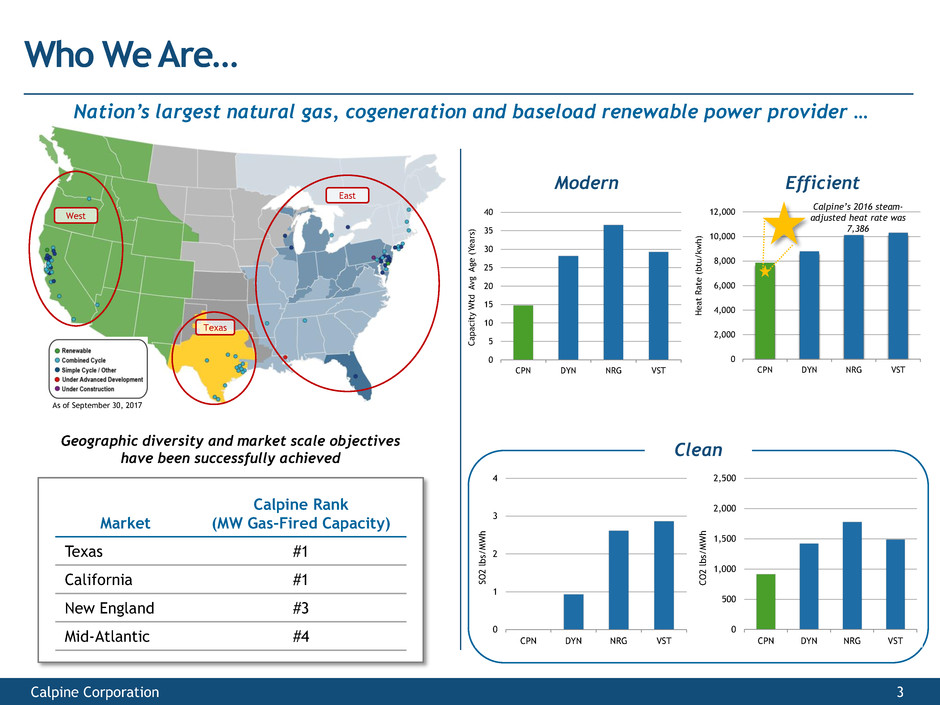

CPN DYN NRG VST

Ca

pa

ci

ty

Wt

d

A

vg

Age

(Y

ea

rs

)

0

2,000

4,000

6,000

8,000

10,000

12,000

CPN DYN NRG VST

He

at

R

at

e

(b

tu/

kw

h)

As of September 30, 2017

West

Texas

East

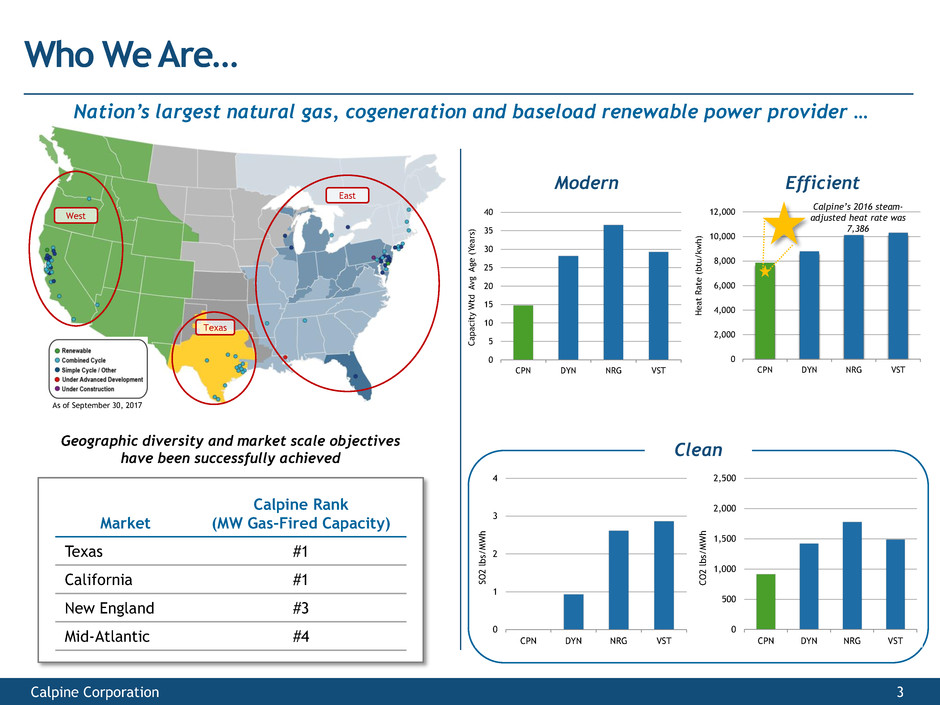

Who We Are…

3

Market

Calpine Rank

(MW Gas-Fired Capacity)

Texas #1

California #1

New England #3

Mid-Atlantic #4

Geographic diversity and market scale objectives

have been successfully achieved

Nation’s largest natural gas, cogeneration and baseload renewable power provider …

Modern Efficient

Clean

Calpine’s 2016 steam-

adjusted heat rate was

7,386

Calpine Corporation

0

1

2

3

4

CPN DYN NRG VST

SO

2

lb

s/

MW

h

0

500

1,000

1,500

2,000

2,500

CPN DYN NRG VST

CO

2

lbs

/MW

h

4

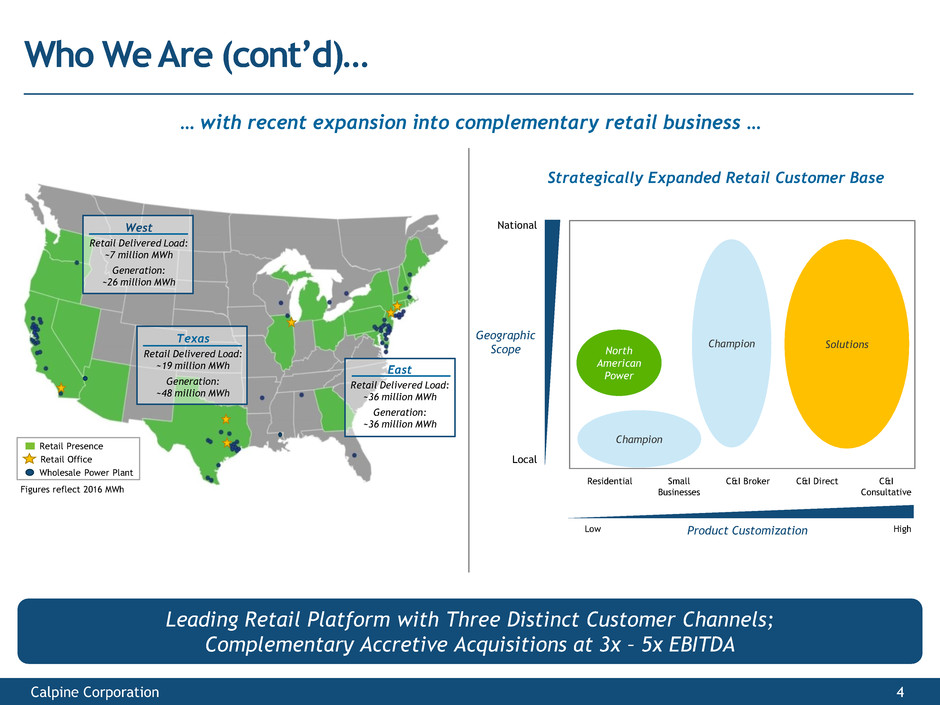

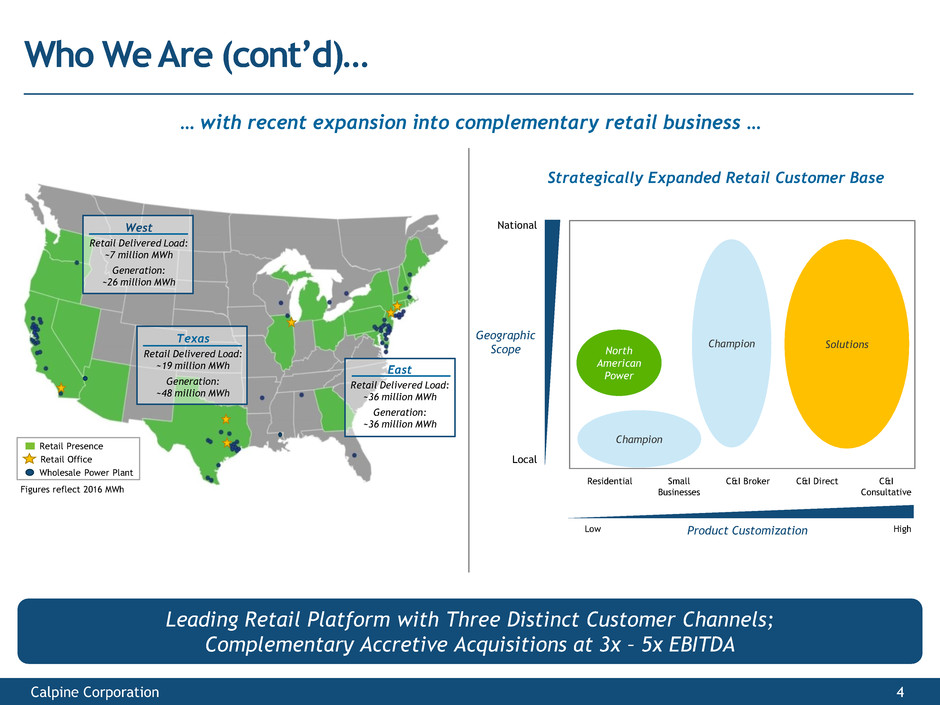

… with recent expansion into complementary retail business …

Strategically Expanded Retail Customer Base

Leading Retail Platform with Three Distinct Customer Channels;

Complementary Accretive Acquisitions at 3x – 5x EBITDA

Who We Are (cont’d)…

Retail Presence

Retail Office

Wholesale Power Plant

West

Retail Delivered Load:

~7 million MWh

Generation:

~26 million MWh

Texas

Retail Delivered Load:

~19 million MWh

Generation:

~48 million MWh

East

Retail Delivered Load:

~36 million MWh

Generation:

~36 million MWh

Figures reflect 2016 MWh

Residential Small

Businesses

C&I Broker C&I Direct C&I

Consultative

Low Product Customization High

National

Geographic

Scope

Local

SolutionsChampion

Champion

North

American

Power

Calpine Corporation

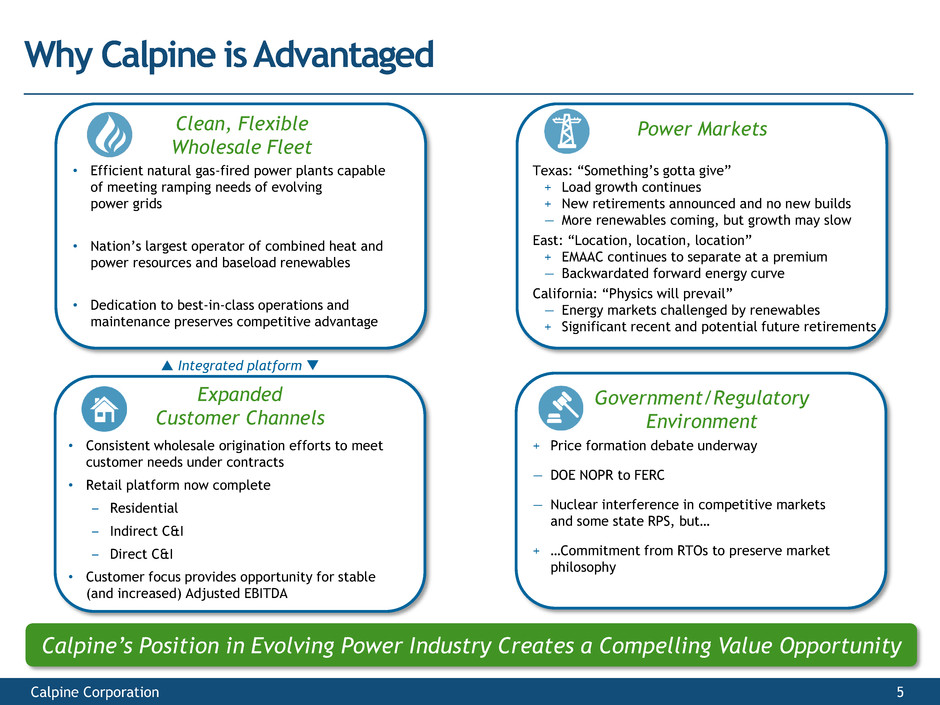

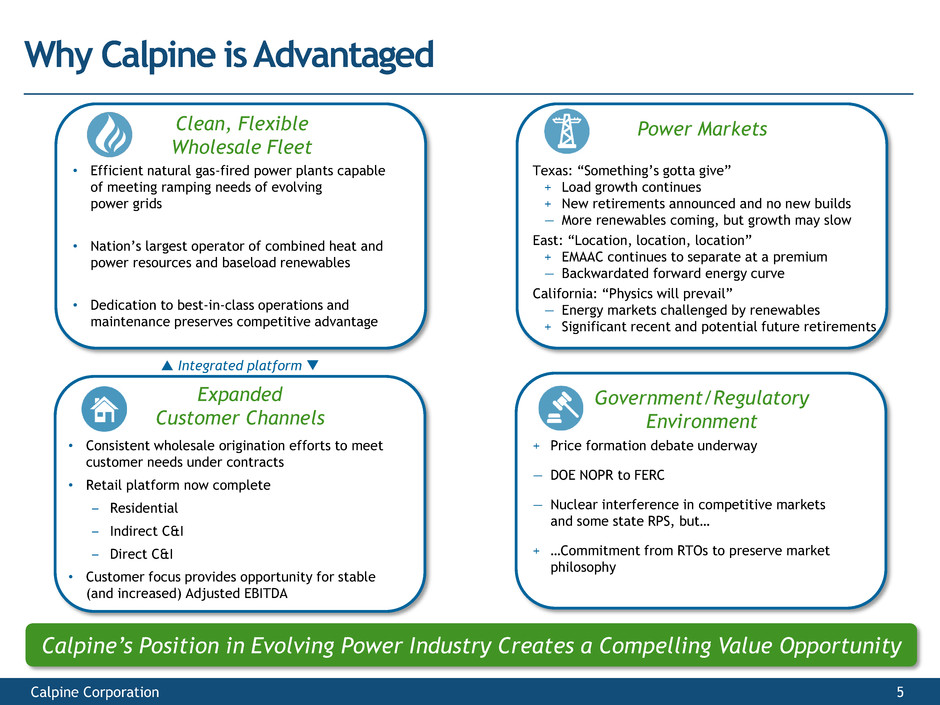

Why Calpine is Advantaged

Calpine Corporation 5

Power Markets

Texas: “Something’s gotta give”

+ Load growth continues

+ New retirements announced and no new builds

— More renewables coming, but growth may slow

East: “Location, location, location”

+ EMAAC continues to separate at a premium

— Backwardated forward energy curve

California: “Physics will prevail”

— Energy markets challenged by renewables

+ Significant recent and potential future retirements

+ Price formation debate underway

— DOE NOPR to FERC

— Nuclear interference in competitive markets

and some state RPS, but…

+ …Commitment from RTOs to preserve market

philosophy

Clean, Flexible

Wholesale Fleet

• Efficient natural gas-fired power plants capable

of meeting ramping needs of evolving

power grids

• Nation’s largest operator of combined heat and

power resources and baseload renewables

• Dedication to best-in-class operations and

maintenance preserves competitive advantage

Expanded

Customer Channels

• Consistent wholesale origination efforts to meet

customer needs under contracts

• Retail platform now complete

‒ Residential

‒ Indirect C&I

‒ Direct C&I

• Customer focus provides opportunity for stable

(and increased) Adjusted EBITDA

Government/Regulatory

Environment

Calpine’s Position in Evolving Power Industry Creates a Compelling Value Opportunity

Integrated platform

$52

$44

$42

Peer

(current)

2013-2015

3 Year Avg

2016

Who

le

sal

e

Ga

s Fl

ee

t C

os

ts

($

/kW

)

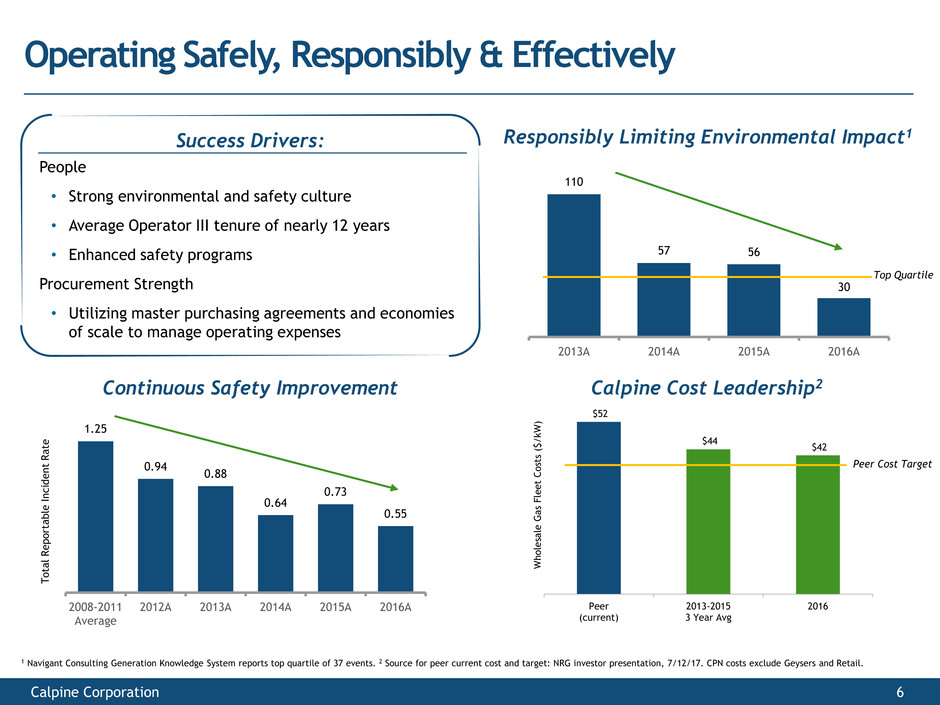

110

57 56

30

2013A 2014A 2015A 2016A

1.25

0.94

0.88

0.64

0.73

0.55

2008-2011

Average

2012A 2013A 2014A 2015A 2016A

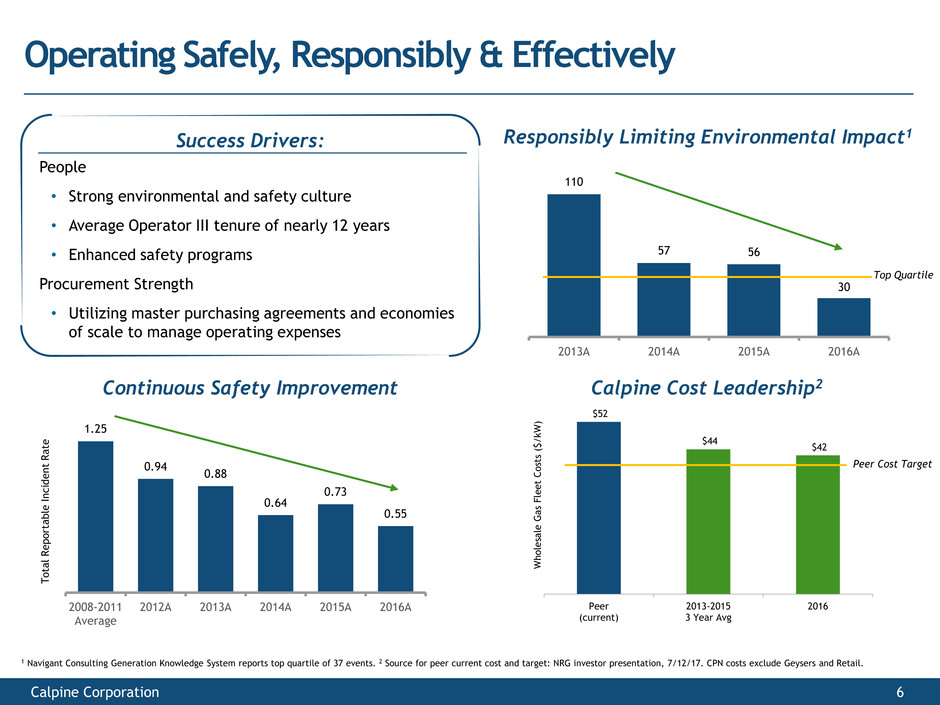

Operating Safely, Responsibly & Effectively

Calpine Corporation 6

Continuous Safety Improvement

Responsibly Limiting Environmental Impact1 Success Drivers:

People

• Strong environmental and safety culture

• Average Operator III tenure of nearly 12 years

• Enhanced safety programs

Procurement Strength

• Utilizing master purchasing agreements and economies

of scale to manage operating expenses

Calpine Cost Leadership2

To

tal

R

e

p

or

ta

b

le

I

n

c

id

e

n

t

Ra

te

Top Quartile

1 Navigant Consulting Generation Knowledge System reports top quartile of 37 events. 2 Source for peer current cost and target: NRG investor presentation, 7/12/17. CPN costs exclude Geysers and Retail.

Peer Cost Target

$12

$13

$14

$15

$16

$17

$18

$19

2018 2019 2020

Ho

us

to

n Spar

k Spr

ead

($/

M

W

h)

04/13/17 07/14/17 10/13/17

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

10 12 14 16 18 20 22 24N

or

Ca

l N

on

-Re

newa

ble

S

up

ply

/ L

oa

d

(MW

)

Hour Ending

Load Available Resources Outages

$-

$50

$100

$150

$200

$250

2018/19 2019/20 2020/21

Au

cti

on

Cleeari

ng

Price

($

/M

W

-d

)

RTO CPN MW-weighted price EMAAC

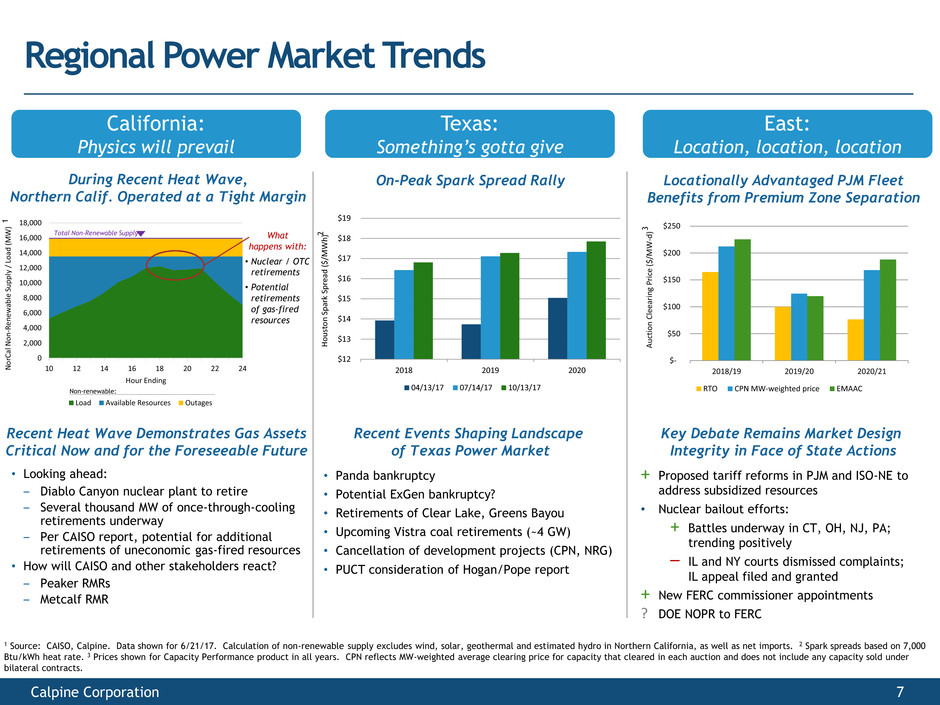

East:

Location, location, location

Texas:

Something’s gotta give

California:

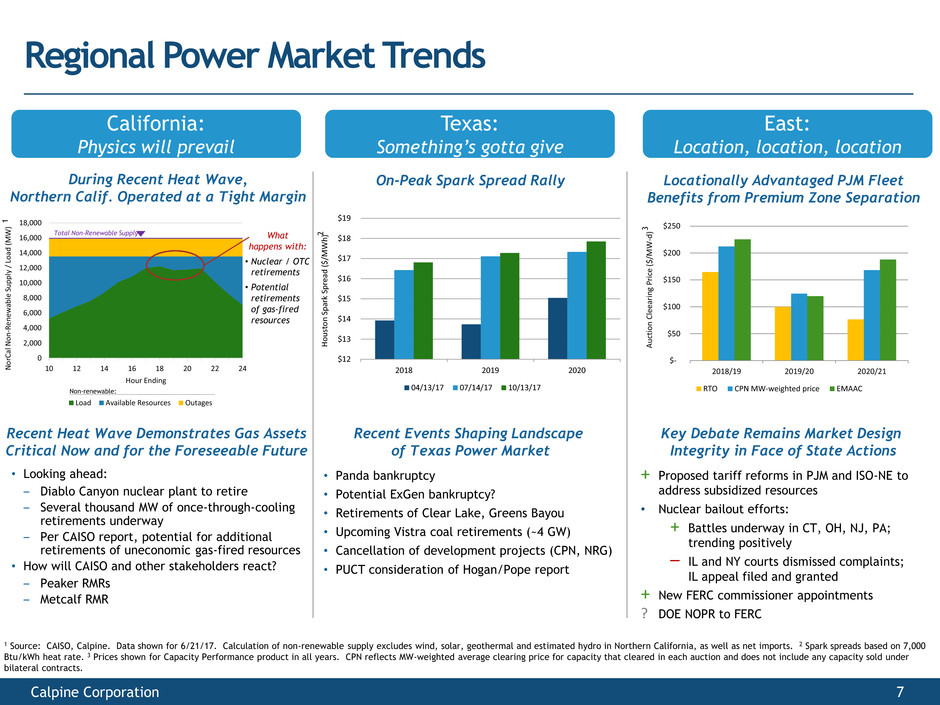

Physics will prevail

7 Calpine Corporation

3

1 Source: CAISO, Calpine. Data shown for 6/21/17. Calculation of non-renewable supply excludes wind, solar, geothermal and estimated hydro in Northern California, as well as net imports. 2 Spark spreads based on 7,000

Btu/kWh heat rate. 3 Prices shown for Capacity Performance product in all years. CPN reflects MW-weighted average clearing price for capacity that cleared in each auction and does not include any capacity sold under

bilateral contracts.

2

During Recent Heat Wave,

Northern Calif. Operated at a Tight Margin

On-Peak Spark Spread Rally

Recent Events Shaping Landscape

of Texas Power Market

Locationally Advantaged PJM Fleet

Benefits from Premium Zone Separation

Key Debate Remains Market Design

Integrity in Face of State Actions

• Looking ahead:

‒ Diablo Canyon nuclear plant to retire

‒ Several thousand MW of once-through-cooling

retirements underway

‒ Per CAISO report, potential for additional

retirements of uneconomic gas-fired resources

• How will CAISO and other stakeholders react?

‒ Peaker RMRs

‒ Metcalf RMR

• Panda bankruptcy

• Potential ExGen bankruptcy?

• Retirements of Clear Lake, Greens Bayou

• Upcoming Vistra coal retirements (~4 GW)

• Cancellation of development projects (CPN, NRG)

• PUCT consideration of Hogan/Pope report

+ Proposed tariff reforms in PJM and ISO-NE to

address subsidized resources

• Nuclear bailout efforts:

+ Battles underway in CT, OH, NJ, PA;

trending positively

– IL and NY courts dismissed complaints;

IL appeal filed and granted

+ New FERC commissioner appointments

? DOE NOPR to FERC

What

happens with:

• Nuclear / OTC

retirements

• Potential

retirements

of gas-fired

resources

1

Total Non-Renewable Supply

Regional Power Market Trends

Non-renewable:

Recent Heat Wave Demonstrates Gas Assets

Critical Now and for the Foreseeable Future

<5%

~25%

~75%

2015A 2016A 2017E

$200 $200 $200

$53

$46

$550

$400

$280

$750

~$850

$600

$1,230

2017E 2018E 2019E

Amortization 2023 Notes Pasadena

Solutions Bridge 2019 Term Loan OMEC

2022 Notes

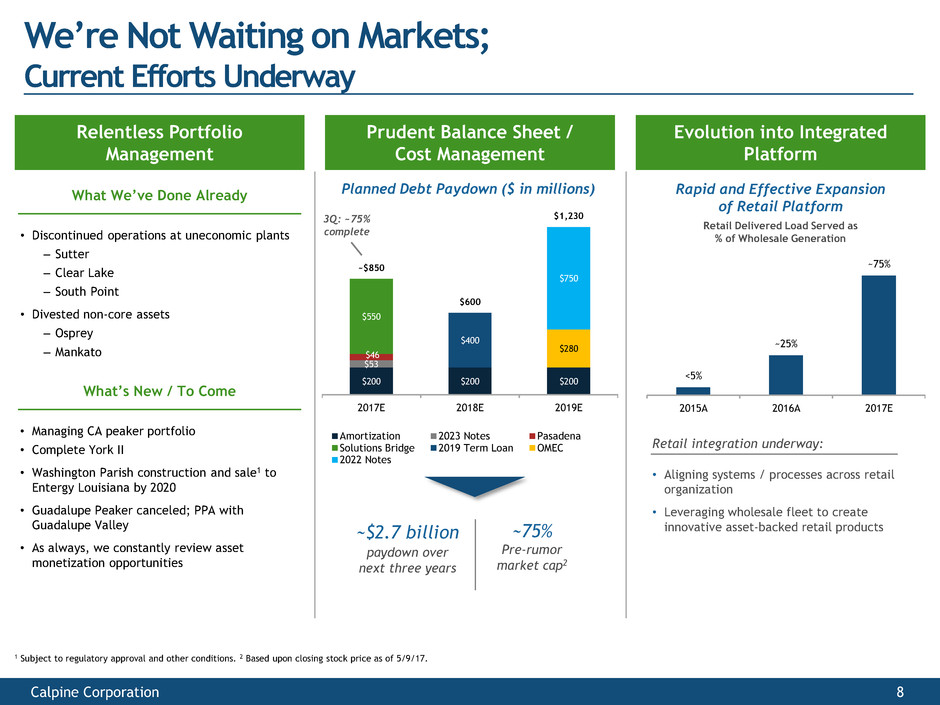

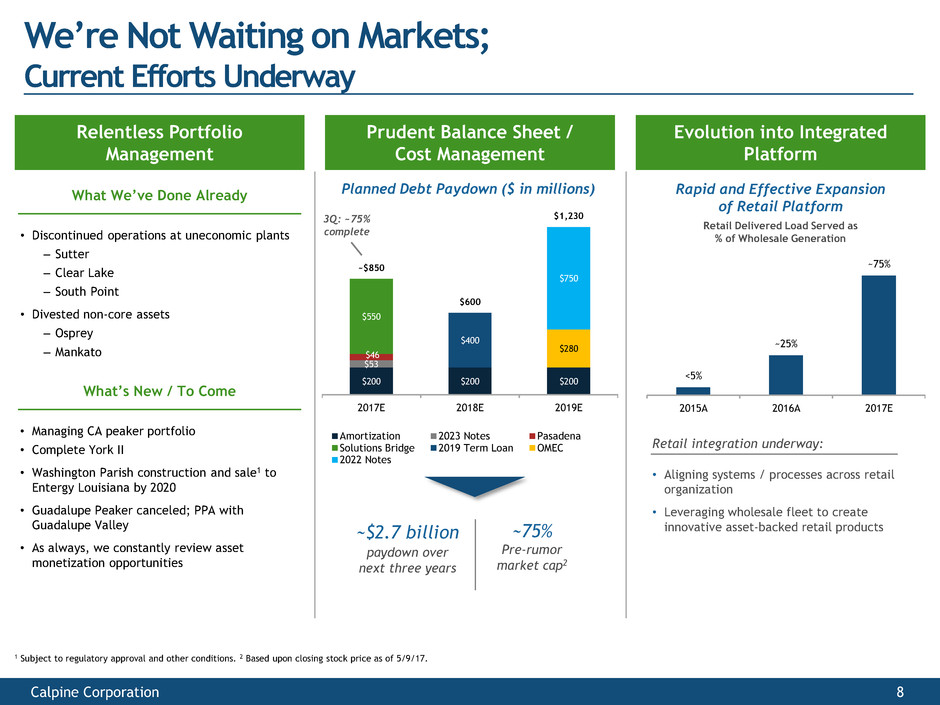

We’re Not Waiting on Markets;

Current Efforts Underway

Calpine Corporation 8

Relentless Portfolio

Management

Prudent Balance Sheet /

Cost Management

Evolution into Integrated

Platform

Retail integration underway:

• Aligning systems / processes across retail

organization

• Leveraging wholesale fleet to create

innovative asset-backed retail products

Rapid and Effective Expansion

of Retail Platform

Retail Delivered Load Served as

% of Wholesale Generation

3Q: ~75%

complete

~$2.7 billion

paydown over

next three years

Planned Debt Paydown ($ in millions)

1 Subject to regulatory approval and other conditions. 2 Based upon closing stock price as of 5/9/17.

~75%

Pre-rumor

market cap2

What We’ve Done Already

• Discontinued operations at uneconomic plants

‒ Sutter

‒ Clear Lake

‒ South Point

• Divested non-core assets

‒ Osprey

‒ Mankato

What’s New / To Come

• Managing CA peaker portfolio

• Complete York II

• Washington Parish construction and sale1 to

Entergy Louisiana by 2020

• Guadalupe Peaker canceled; PPA with

Guadalupe Valley

• As always, we constantly review asset

monetization opportunities

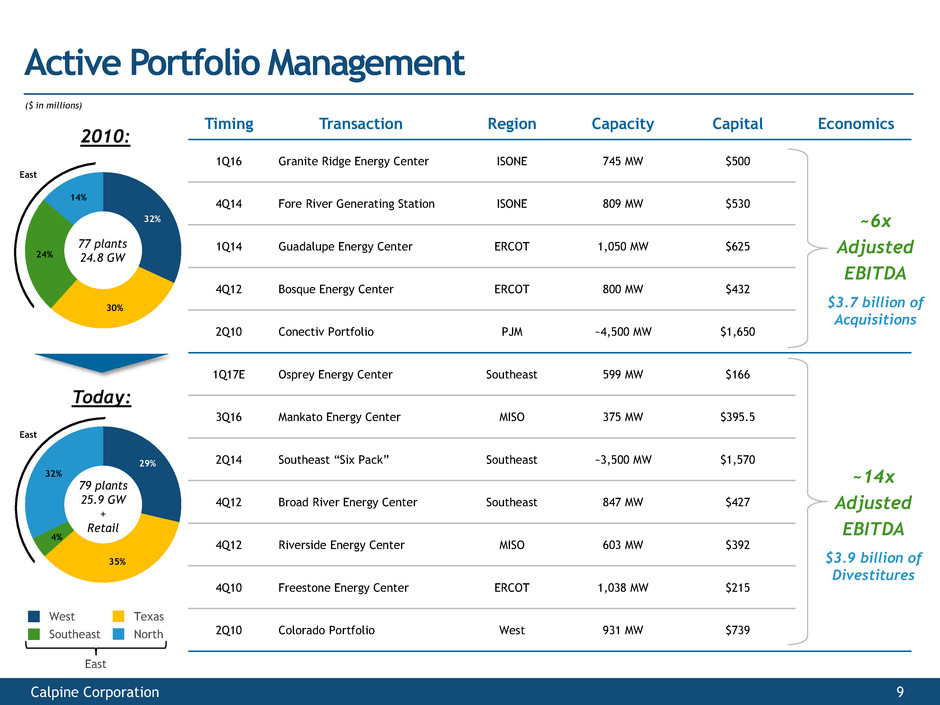

Calpine Corporation 9

Active Portfolio Management

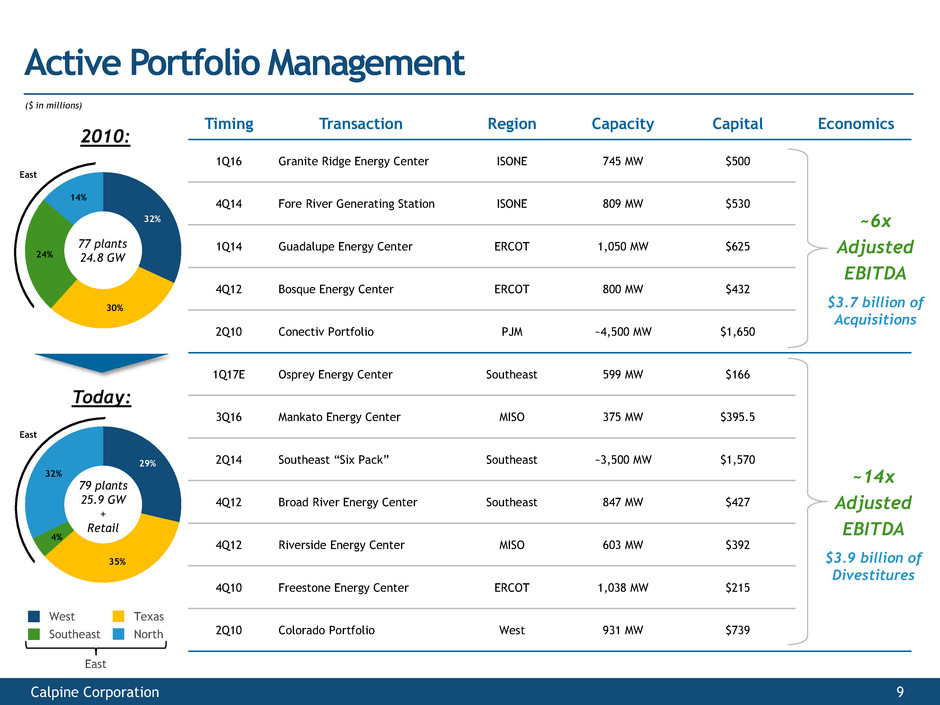

Timing Transaction Region Capacity Capital Economics

1Q16 Granite Ridge Energy Center ISONE 745 MW $500

4Q14 Fore River Generating Station ISONE 809 MW $530

1Q14 Guadalupe Energy Center ERCOT 1,050 MW $625

4Q12 Bosque Energy Center ERCOT 800 MW $432

2Q10 Conectiv Portfolio PJM ~4,500 MW $1,650

1Q17E Osprey Energy Center Southeast 599 MW $166

3Q16 Mankato Energy Center MISO 375 MW $395.5

2Q14 Southeast “Six Pack” Southeast ~3,500 MW $1,570

4Q12 Broad River Energy Center Southeast 847 MW $427

4Q12 Riverside Energy Center MISO 603 MW $392

4Q10 Freestone Energy Center ERCOT 1,038 MW $215

2Q10 Colorado Portfolio West 931 MW $739

$3.7 billion of

Acquisitions

$3.9 billion of

Divestitures

~6x

Adjusted

EBITDA

~14x

Adjusted

EBITDA

29%

35%

4%

32%

32%

30%

24%

14%

2010:

Today:

77 plants

24.8 GW

Southeast

West

79 plants

25.9 GW

+

Retail

East

East

North

Texas

East

($ in millions)

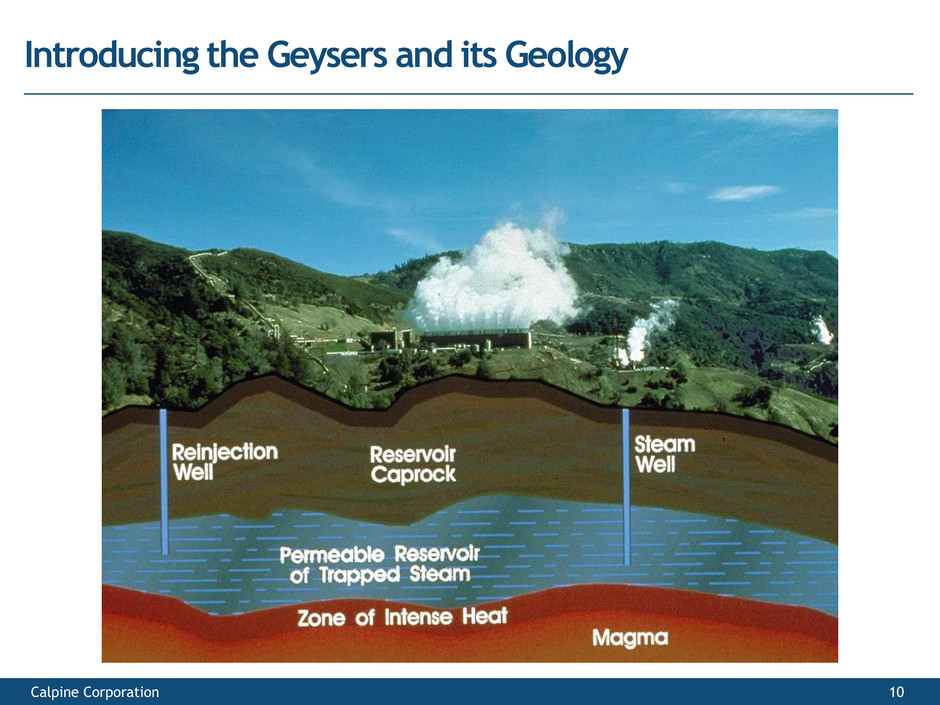

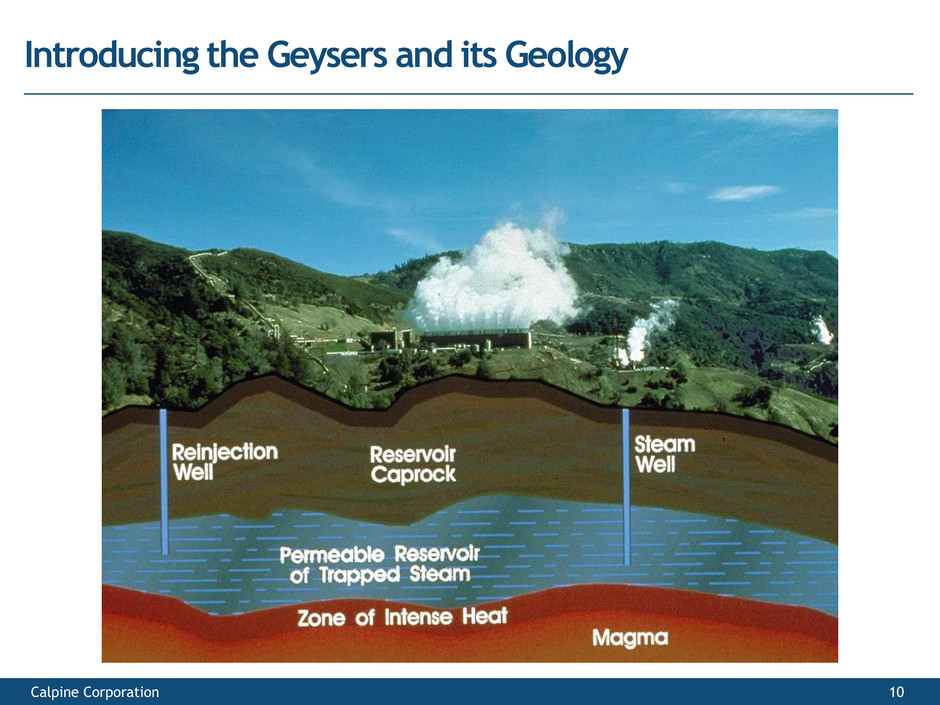

Introducing the Geysers and its Geology

Calpine Corporation 10