United States

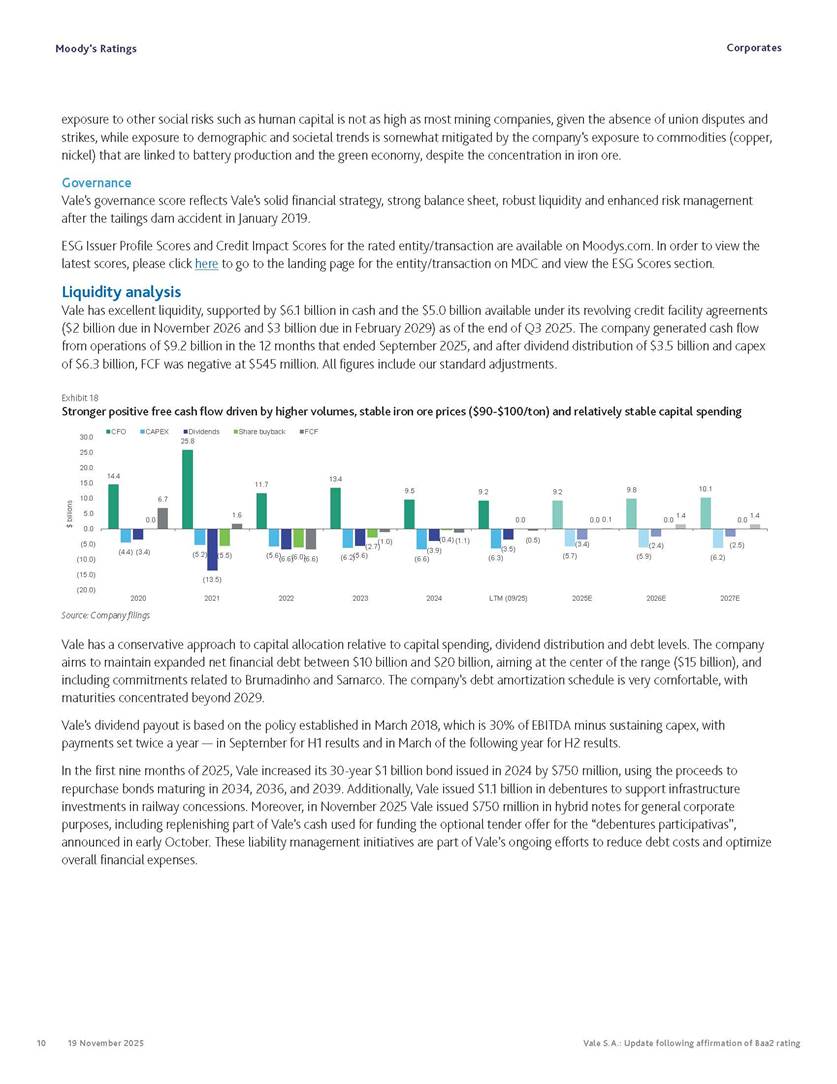

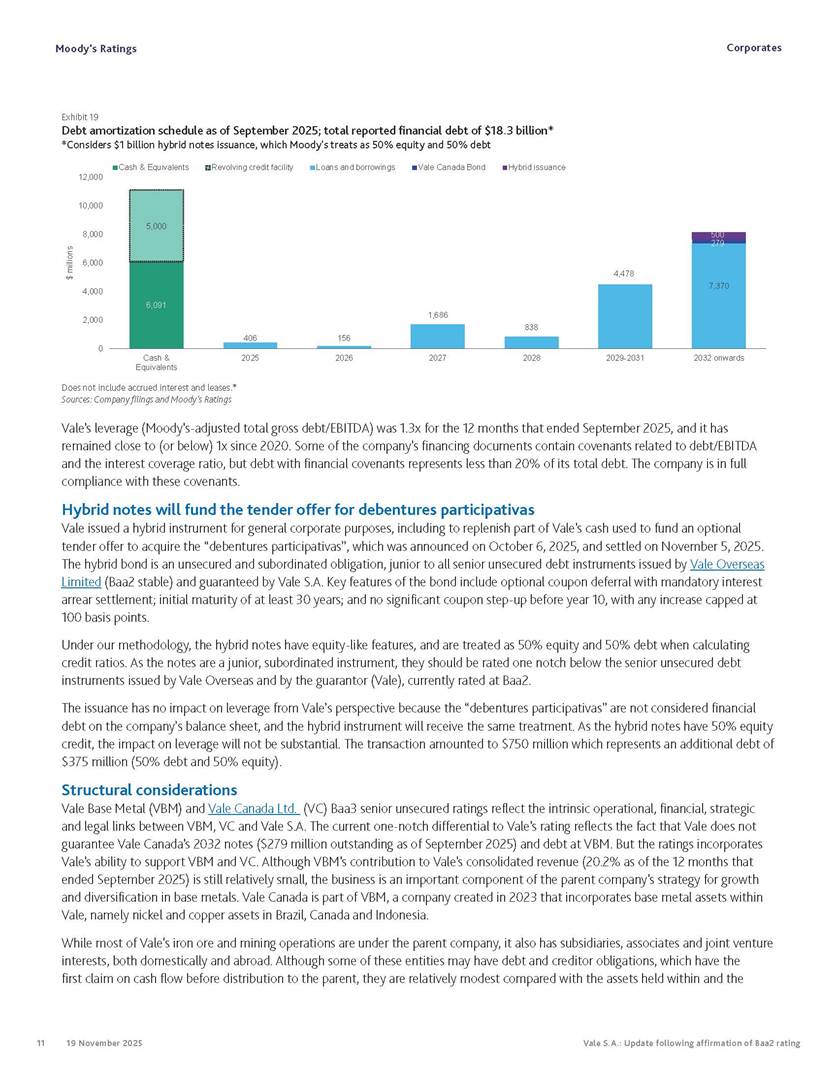

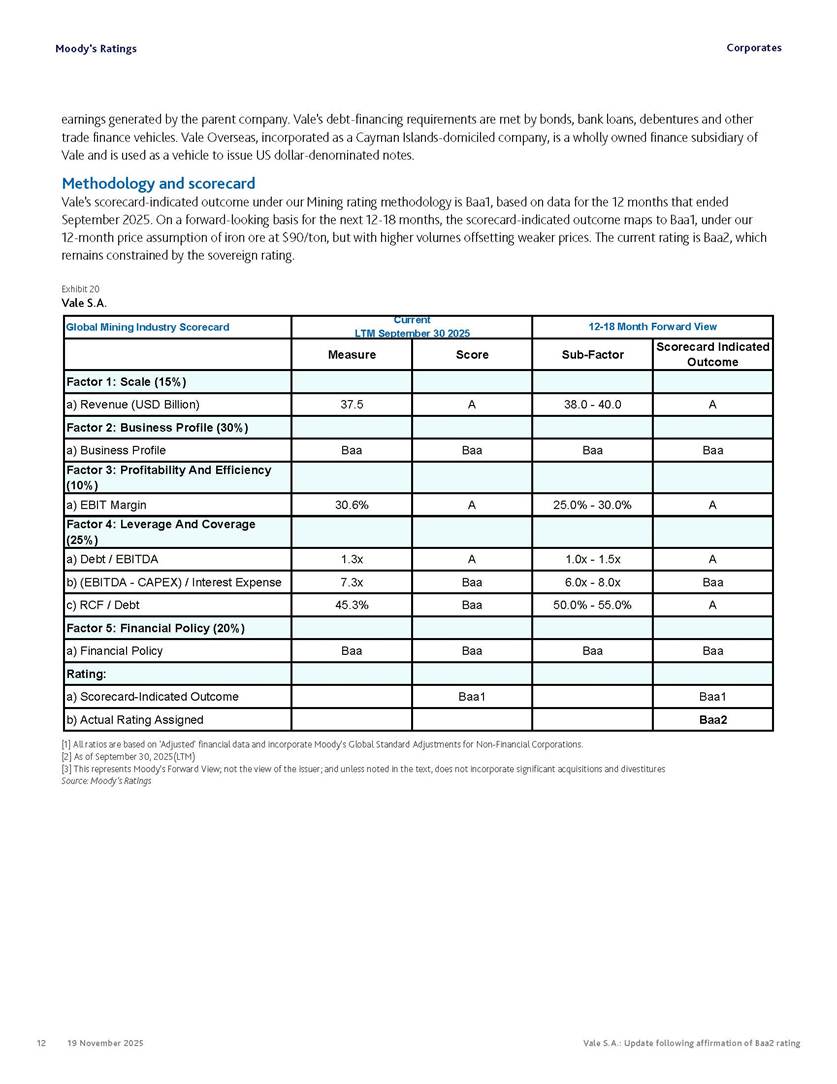

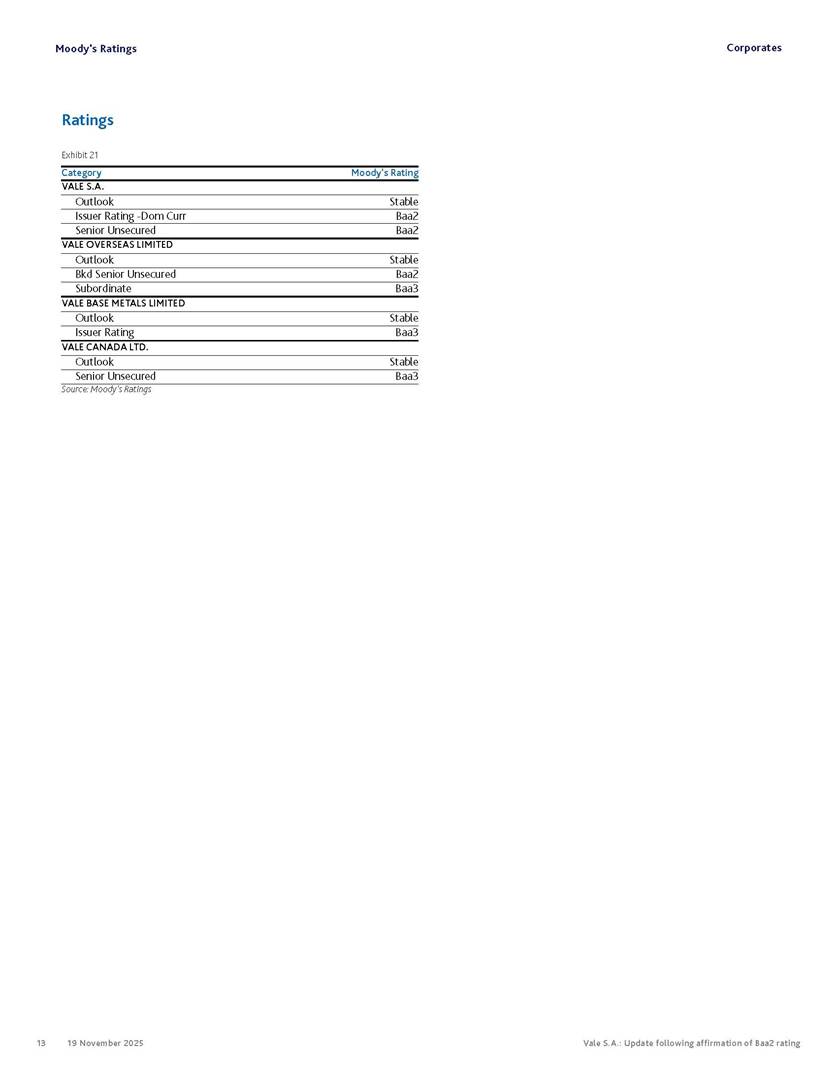

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

November 2025

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x Form 40-F ¨

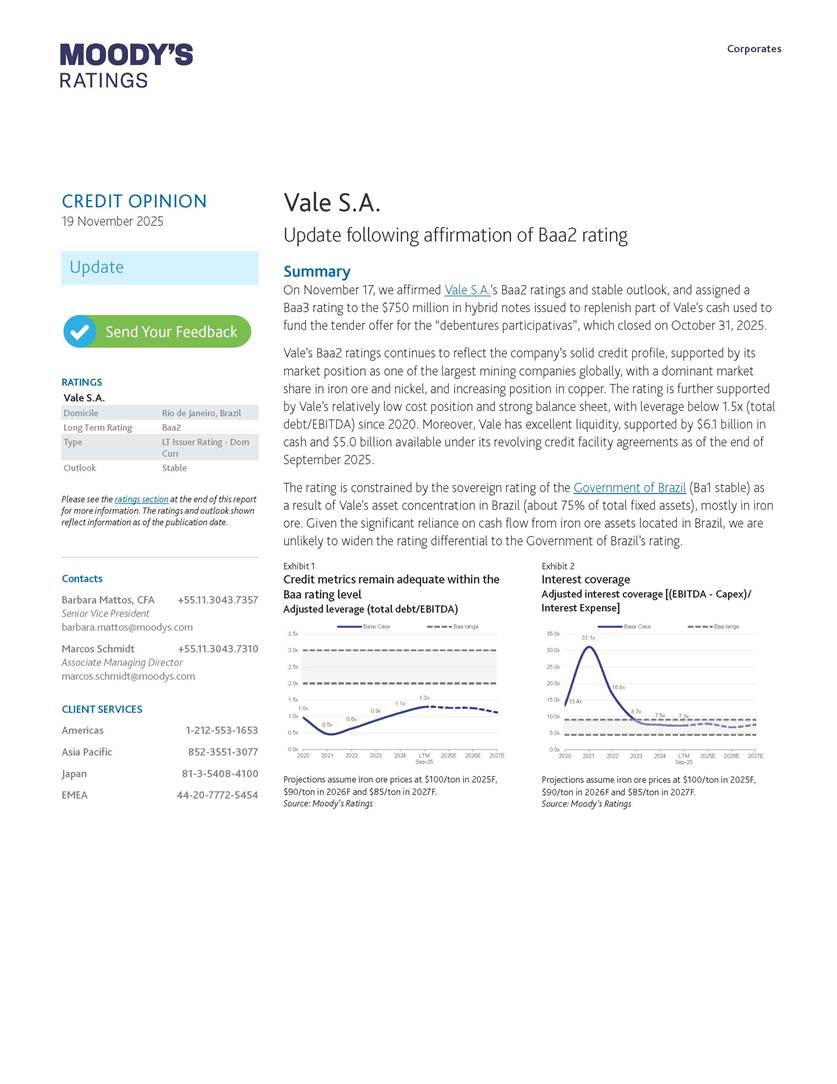

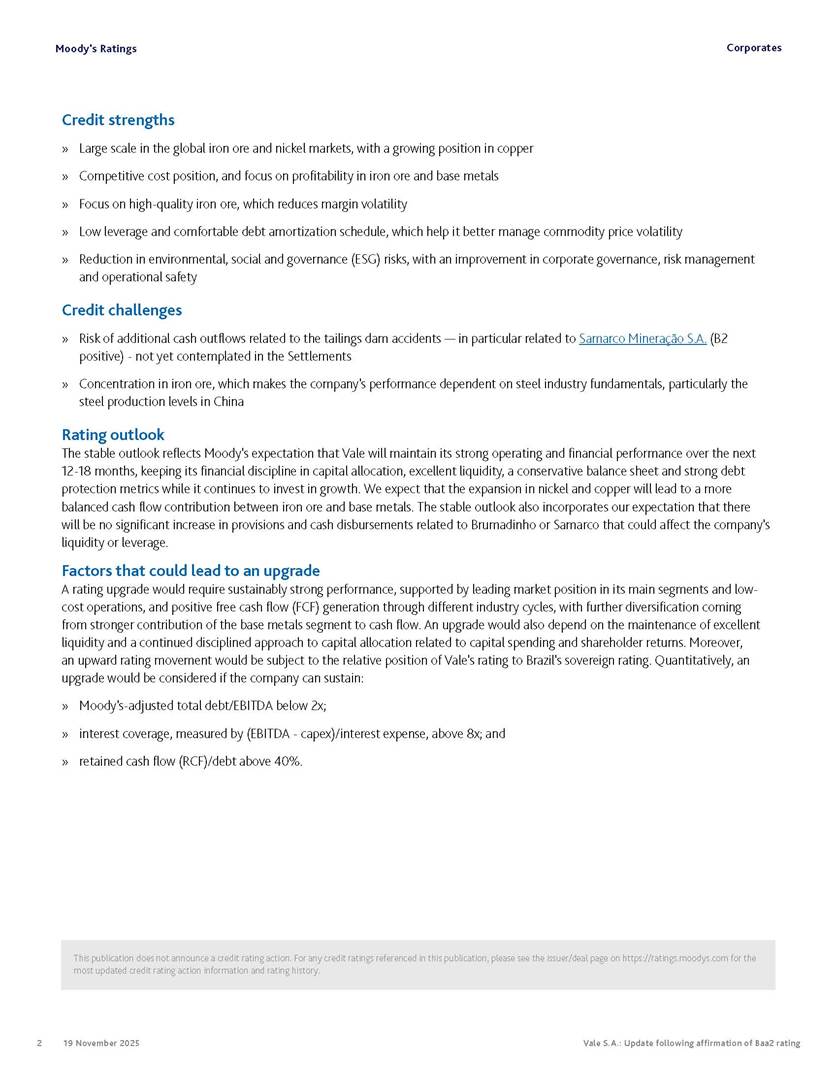

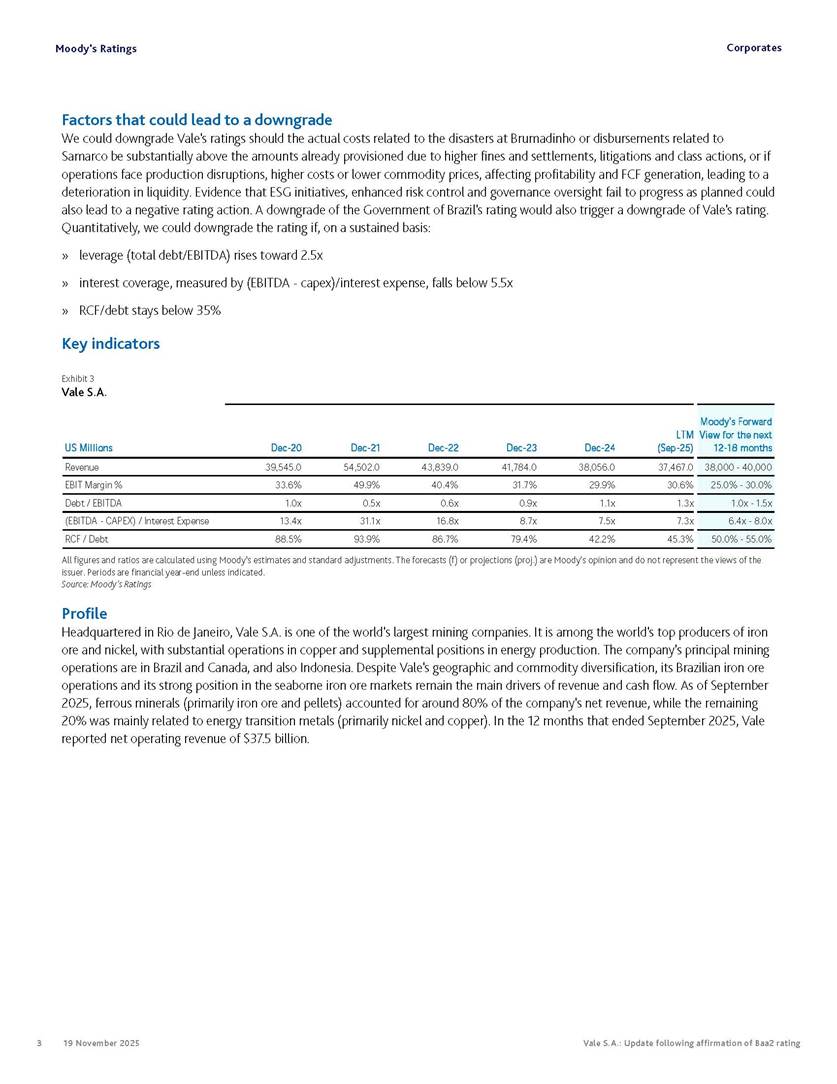

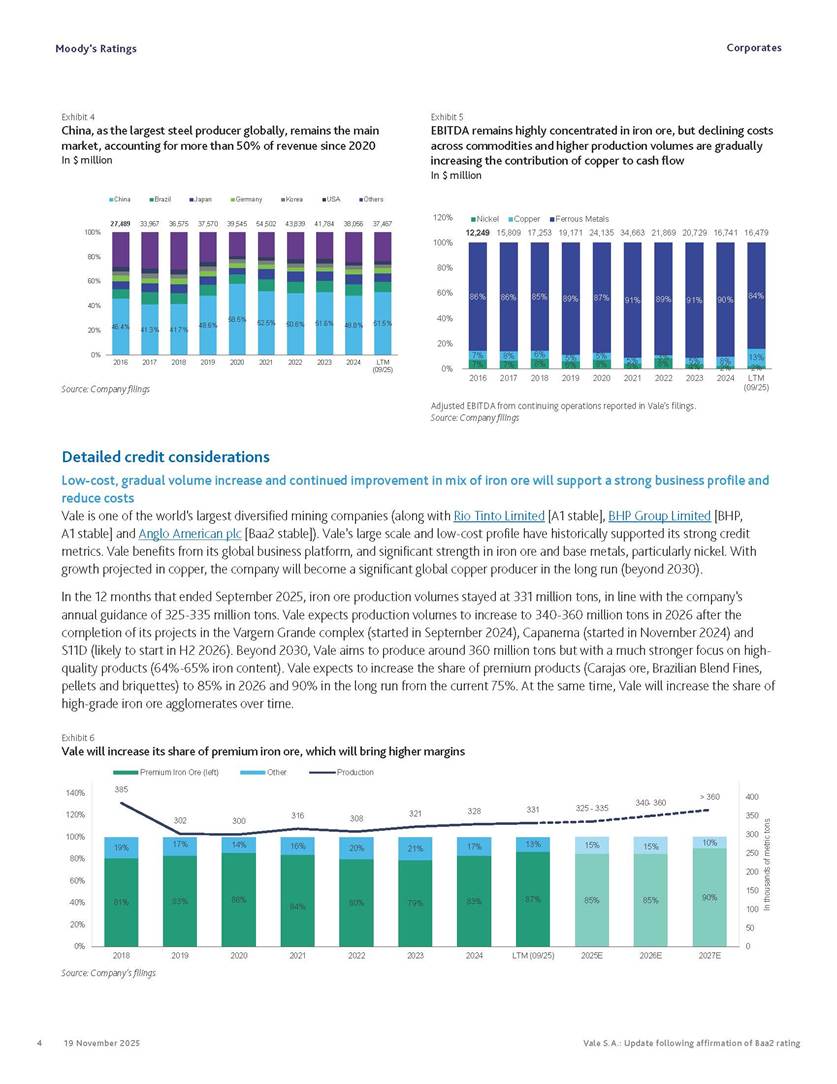

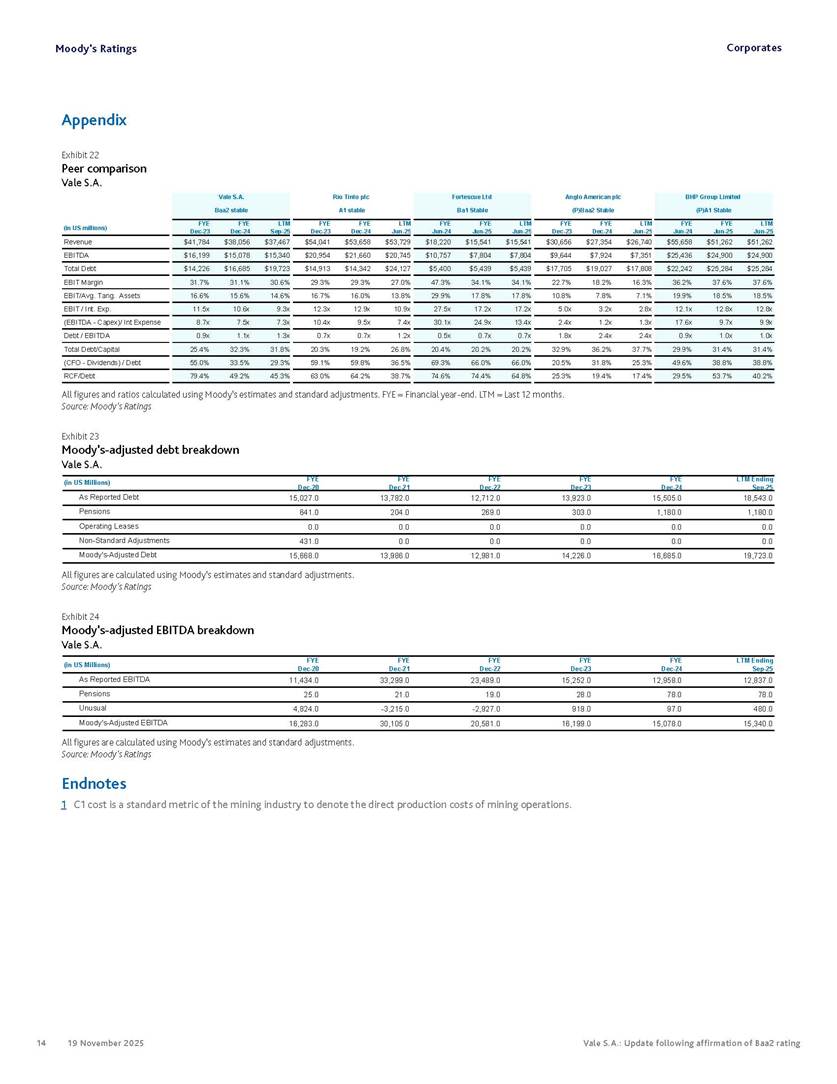

Moody’s affirms Vale’s Baa2 rating Rio de Janeiro, November 19, 2025 – Vale S.A. (“Vale” or the “Company”) informs that, in a report released today, Moody’s Investor Service (“Moody’s”), as part of its periodic review of the Company’s rating, has reaffirmed Vale’s rating at Baa2 with a stable outlook. The report is available in English on Moody’s website and attached to this communication. A free translation into Portuguese will be disclosed to the market shortly. Marcelo Feriozzi Bacci Executive Vice President, Finance and Investor Relations For further information, please contact: Vale.RI@vale.com Thiago Lofiego: thiago.lofiego@vale.com Mariana Rocha: mariana.rocha@vale.com Luciana Oliveti: luciana.oliveti@vale.com Pedro Terra: pedro.terra@vale.com Patricia Tinoco: patricia.tinoco@vale.com This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F. Corporates CREDIT OPINION 19 November 2025 Update RATINGS Vale S.A. Domicile Rio de Janeiro, Brazil Long Term Rating Baa2 Type LT Issuer Rating - Dom Curr Outlook Stable Please see the ratings section at the end of this report for more information. The ratings and outlook shown reflect information as of the publication date. Contacts Barbara Mattos, CFA +55.11.3043.7357 Senior Vice President barbara.mattos@moodys.com Marcos Schmidt +55.11.3043.7310 Associate Managing Director marcos.schmidt@moodys.com CLIENT SERVICES Americas 1-212-553-1653 Asia Pacific 852-3551-3077 Japan 81-3-5408-4100 EMEA 44-20-7772-5454 Vale S.A. Update following affirmation of Baa2 rating Summary On November 17, we affirmed Vale S.A.'s Baa2 ratings and stable outlook, and assigned a Baa3 rating to the $750 million in hybrid notes issued to replenish part of Vale's cash used to fund the tender offer for the “debentures participativas”, which closed on October 31, 2025. Vale's Baa2 ratings continues to reflect the company’s solid credit profile, supported by its market position as one of the largest mining companies globally, with a dominant market share in iron ore and nickel, and increasing position in copper. The rating is further supported by Vale's relatively low cost position and strong balance sheet, with leverage below 1.5x (total debt/EBITDA) since 2020. Moreover, Vale has excellent liquidity, supported by $6.1 billion in cash and $5.0 billion available under its revolving credit facility agreements as of the end of September 2025. The rating is constrained by the sovereign rating of the Government of Brazil (Ba1 stable) as a result of Vale's asset concentration in Brazil (about 75% of total fixed assets), mostly in iron ore. Given the significant reliance on cash flow from iron ore assets located in Brazil, we are unlikely to widen the rating differential to the Government of Brazil's rating. Exhibit 1 Credit metrics remain adequate within the Baa rating level Adjusted leverage (total debt/EBITDA) Exhibit 2 Interest coverage Adjusted interest coverage [(EBITDA - Capex)/ Interest Expense] 1.0x 0.5x 0.6x 0.9x 1.1x 1.3x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 2020 2021 2022 2023 2024 LTM Sep-25 2025E 2026E 2027E Base Case Baa range Projections assume iron ore prices at $100/ton in 2025F, $90/ton in 2026F and $85/ton in 2027F. Source: Moody's Ratings 13.4x 31.1x 16.8x 8.7x 7.5x 7.3x 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x 35.0x 2020 2021 2022 2023 2024 LTM Sep-25 2025E 2026E 2027E Base Case Baa range Projections assume iron ore prices at $100/ton in 2025F, $90/ton in 2026F and $85/ton in 2027F. Source: Moody's Ratings Moody's Ratings Corporates Credit strengths » Large scale in the global iron ore and nickel markets, with a growing position in copper » Competitive cost position, and focus on profitability in iron ore and base metals » Focus on high-quality iron ore, which reduces margin volatility » Low leverage and comfortable debt amortization schedule, which help it better manage commodity price volatility » Reduction in environmental, social and governance (ESG) risks, with an improvement in corporate governance, risk management and operational safety Credit challenges » Risk of additional cash outflows related to the tailings dam accidents — in particular related to Samarco Mineração S.A. (B2 positive) - not yet contemplated in the Settlements » Concentration in iron ore, which makes the company's performance dependent on steel industry fundamentals, particularly the steel production levels in China Rating outlook The stable outlook reflects Moody's expectation that Vale will maintain its strong operating and financial performance over the next 12-18 months, keeping its financial discipline in capital allocation, excellent liquidity, a conservative balance sheet and strong debt protection metrics while it continues to invest in growth. We expect that the expansion in nickel and copper will lead to a more balanced cash flow contribution between iron ore and base metals. The stable outlook also incorporates our expectation that there will be no significant increase in provisions and cash disbursements related to Brumadinho or Samarco that could affect the company's liquidity or leverage. Factors that could lead to an upgrade A rating upgrade would require sustainably strong performance, supported by leading market position in its main segments and low- cost operations, and positive free cash flow (FCF) generation through different industry cycles, with further diversification coming from stronger contribution of the base metals segment to cash flow. An upgrade would also depend on the maintenance of excellent liquidity and a continued disciplined approach to capital allocation related to capital spending and shareholder returns. Moreover, an upward rating movement would be subject to the relative position of Vale's rating to Brazil's sovereign rating. Quantitatively, an upgrade would be considered if the company can sustain: » Moody's-adjusted total debt/EBITDA below 2x; » interest coverage, measured by (EBITDA - capex)/interest expense, above 8x; and » retained cash flow (RCF)/debt above 40%. This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the issuer/deal page on https://ratings.moodys.com for the most updated credit rating action information and rating history. 2 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Factors that could lead to a downgrade We could downgrade Vale's ratings should the actual costs related to the disasters at Brumadinho or disbursements related to Samarco be substantially above the amounts already provisioned due to higher fines and settlements, litigations and class actions, or if operations face production disruptions, higher costs or lower commodity prices, affecting profitability and FCF generation, leading to a deterioration in liquidity. Evidence that ESG initiatives, enhanced risk control and governance oversight fail to progress as planned could also lead to a negative rating action. A downgrade of the Government of Brazil's rating would also trigger a downgrade of Vale's rating. Quantitatively, we could downgrade the rating if, on a sustained basis: » leverage (total debt/EBITDA) rises toward 2.5x » interest coverage, measured by (EBITDA - capex)/interest expense, falls below 5.5x » RCF/debt stays below 35% Key indicators Exhibit 3 Vale S.A. US Millions Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 LTM (Sep-25) Moody's Forward View for the next 12-18 months Revenue 39,545.0 54,502.0 43,839.0 41,784.0 38,056.0 37,467.0 38,000 - 40,000 EBIT Margin % 33.6% 49.9% 40.4% 31.7% 29.9% 30.6% 25.0% - 30.0% Debt / EBITDA 1.0x 0.5x 0.6x 0.9x 1.1x 1.3x 1.0x - 1.5x (EBITDA - CAPEX) / Interest Expense 13.4x 31.1x 16.8x 8.7x 7.5x 7.3x 6.4x - 8.0x RCF / Debt 88.5% 93.9% 86.7% 79.4% 42.2% 45.3% 50.0% - 55.0% All figures and ratios are calculated using Moody’s estimates and standard adjustments. The forecasts (f) or projections (proj.) are Moody's opinion and do not represent the views of the issuer. Periods are financial year-end unless indicated. Source: Moody's Ratings Profile Headquartered in Rio de Janeiro, Vale S.A. is one of the world's largest mining companies. It is among the world's top producers of iron ore and nickel, with substantial operations in copper and supplemental positions in energy production. The company's principal mining operations are in Brazil and Canada, and also Indonesia. Despite Vale's geographic and commodity diversification, its Brazilian iron ore operations and its strong position in the seaborne iron ore markets remain the main drivers of revenue and cash flow. As of September 2025, ferrous minerals (primarily iron ore and pellets) accounted for around 80% of the company's net revenue, while the remaining 20% was mainly related to energy transition metals (primarily nickel and copper). In the 12 months that ended September 2025, Vale reported net operating revenue of $37.5 billion. 3 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Exhibit 4 China, as the largest steel producer globally, remains the main market, accounting for more than 50% of revenue since 2020 In $ million Exhibit 5 EBITDA remains highly concentrated in iron ore, but declining costs across commodities and higher production volumes are gradually increasing the contribution of copper to cash flow In $ million 46.4% 41.3% 41.7% 48.6% 58.5% 52.5% 50.6% 51.6% 48.8% 51.5% 27,489 33,967 36,575 37,570 39,545 54,502 43,839 41,784 38,056 37,467 0% 20% 40% 60% 80% 100% 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (09/25) China Brazil Japan Germany Korea USA Others Source: Company filings 7% 7% 8% 6% 8% 5% 8% 4% 2% 2% 7% 8% 6% 5% 5% 5% 3% 5% 8% 13% 86% 86% 85% 89% 87% 91% 89% 91% 90% 84% 12,249 15,809 17,253 19,171 24,135 34,663 21,869 20,729 16,741 16,479 0% 20% 40% 60% 80% 100% 120% 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (09/25) Nickel Copper Ferrous Metals Adjusted EBITDA from continuing operations reported in Vale's filings. Source: Company filings Detailed credit considerations Low-cost, gradual volume increase and continued improvement in mix of iron ore will support a strong business profile and reduce costs Vale is one of the world's largest diversified mining companies (along with Rio Tinto Limited [A1 stable], BHP Group Limited [BHP, A1 stable] and Anglo American plc [Baa2 stable]). Vale’s large scale and low-cost profile have historically supported its strong credit metrics. Vale benefits from its global business platform, and significant strength in iron ore and base metals, particularly nickel. With growth projected in copper, the company will become a significant global copper producer in the long run (beyond 2030). In the 12 months that ended September 2025, iron ore production volumes stayed at 331 million tons, in line with the company's annual guidance of 325-335 million tons. Vale expects production volumes to increase to 340-360 million tons in 2026 after the completion of its projects in the Vargem Grande complex (started in September 2024), Capanema (started in November 2024) and S11D (likely to start in H2 2026). Beyond 2030, Vale aims to produce around 360 million tons but with a much stronger focus on highquality products (64%-65% iron content). Vale expects to increase the share of premium products (Carajas ore, Brazilian Blend Fines, pellets and briquettes) to 85% in 2026 and 90% in the long run from the current 75%. At the same time, Vale will increase the share of high-grade iron ore agglomerates over time. Exhibit 6 Vale will increase its share of premium iron ore, which will bring higher margins 81% 83% 86% 84% 80% 79% 83% 87% 85% 85% 90% 19% 17% 14% 16% 20% 21% 17% 13% 15% 15% 10% 385 302 300 316 308 321 328 331 325 - 335 340- 360 > 360 0 50 100 150 200 250 300 350 400 0% 20% 40% 60% 80% 100% 120% 140% 2018 2019 2020 2021 2022 2023 2024 LTM (09/25) 2025E 2026E 2027E In thousands of metric tons Premium Iron Ore (left) Other Production Source: Company's filings 4 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Despite Vale's large scale, the company's costs increased in 2023-24, following an industrywide cost increase. C11 cash costs totaled $21.8 per ton (excluding third-party purchases) in 2024, up from $19.6 per ton in 2022, but lower than the $22.3 per ton in 2023. This increase is explained by the effect of overall inflationary pressures on the mining industry, such as on diesel and raw materials, including freight costs. In the first nine months of 2025, C1 cash costs declined toward $20.0 per ton, in line with the company's guidance that C1 costs will be in the $20.5-$22.0 per ton range in 2025. Vale expects C1 cash costs to decline below $20 per ton in 2026 and beyond, in line with those of large iron ore producers globally. Exhibit 7 Iron ore C1 cash costs (excluding third-party purchases) and break-even costs increased because of industrywide cost pressures, but are declining $/dry metric ton (dmt) 141.4 113.3 92.6 95.6 108.6 98.5 105.1 118.3 100.7 98.2 90.6 93 90.8 85.1 94.4 18.7 20.9 19.4 19.5 23.6 23.5 21.9 20.8 23.5 24.9 20.6 18.8 21 22.2 20.7 49.00 58.4 57.3 52.3 61.7 55.4 58.7 56 62.4 64.3 58.7 53.1 57.5 57.5 54.4 0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0 160.0 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 In USD/dmt Iron ore fines Vale CFR/FOB realized price Vale’s C1 cash cost ex-third-party purchase cost (C/F) Iron ore fines EBITDA break-even (US$/dmt) Source: Company filings Expansion in base metals enhances diversification and brings higher earnings stability Vale has a significant pipeline of projects to expand the production of copper and nickel, and increase the contribution of base metals in its consolidated results. The increase in base metal production volumes will reduce Vale's cash flow reliance on iron ore, enhance its geographic diversification and position it as a key participant in commodities that are likely to see increased demand due to energy transition. Vale is already among the top producers of nickel, but the expansion in copper will place the company among the largest copper producers globally. In nickel, Vale Base Metals Limited (VBM, Baa3 stable) plans to reach annual production of 160,000-175,000 tons in 2025, supported by projects currently underway in Canada (Sudbury, Voisey's Bay and Thompson), in line with the 176,500 tons produced in the 12 months that ended September 2025; and aims to increase production further to 175,000-210,000 tons in 2026, supported by projects in Canada and Brazil (Onça Puma and Voisey's Bay Mine Expansion (VBME) ramp-up). VBM has revised its long-term goal (2030 and beyond) for annual nickel production to 210,000-250,000 tons from 300,000 tons, following the reduction in its stake in PTVI in Indonesia, which is no longer consolidated within VBM. For copper, growth will come from projects in Brazil and Canada, with annual production estimated at 340,000-370,000 tons in 2025 and 350,000-380,000 tons in 2026, supported by Salobo III. In the long run (beyond 2030), Vale plans to reach about 700,000 tons of copper production, supported by growth in Brazil, with Alemão and other projects in the Carajás region (Novo Carajás, announced in February 2025). 5 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Exhibit 8 Nickel production will increase, supported by Onça Puma, Sudbury and Voisey's Bay, while costs will decline Exhibit 9 Copper production will increase as well, and Vale will become a key participant in this commodity 215 168 179 165 132 177 168 193 210 2.8 4.2 6.1 7.6 7.0 6.8 6.1 6.0 6.0 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 0 50 100 150 200 250 2020 2021 2022 2023 2024 LTM Sep-25 2025E 2026E 2027E Cash cost ($/lb) Production (kt) Production (kt) Cash cost ($/lb) Historical includes New Caledonia. The forecasts are Moody's opinion and do not represent the views of the issuer. Sources: Company's filings and Moody's Ratings 360 297 253 327 348 376 365 369 393 0.5 0.9 2.0 1.6 1.2 0.5 0.6 0.8 0.8 0.0 0.5 1.0 1.5 2.0 2.5 0 50 100 150 200 250 300 350 400 450 2020 2021 2022 2023 2024 LTM Sep-25 2025E 2026E 2027E Cash cost ($/lb) Production (kt) Production (kt) Cash cost ($/lb) The forecasts are Moody's opinion and do not represent the views of the issuer. Sources: Company's filings and Moody's Ratings All-in costs for base metals (copper and nickel) will remain below market prices. In Q3 2025, all-in costs for nickel and copper were revised down, driven by solid operational performance and strong metal prices. For 2025, copper all-in cost guidance was revised to $1,000-$1,500 per ton and nickel all-in cost was revised to $13,000-$14,000 per ton. All-in sustaining costs for copper and nickel decreased in the first nine months of 2025, driven by higher production volumes, operational efficiencies and enhanced byproduct revenue. We expect further savings on operational expenses and capex through 2027. Over time, energy transition will further support demand for nickel and copper, and we expect stronger EBITDA contribution from these two metals to the consolidated cash flow of Vale. Exhibit 10 EBITDA breakeven for nickel has remained below average realized prices during 2025 $/ton (t) Exhibit 11 EBITDA breakeven for copper better positioned relative to average realized prices $/ton (t) 22,195 26,221 21,672 24,454 25,260 23,070 21,237 18,420 16,848 18,638 17,012 16,163 16,106 15,800 15,445 9,628 11,220 17,066 14,454 17,143 17,083 18,570 15,021 14,778 15,000 18,073 13,881 15,730 12,396 12,347 0 5,000 10,000 15,000 20,000 25,000 30,000 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 USD/t Average nickel realized price EBITDA breakeven Source: Company filings 10,848 6,493 6,663 8,774 9,425 7,025 7,731 7,941 7,687 9,202 9,016 9,187 8,891 8,985 9,818 4,673 6,273 4,189 5,569 4,892 3,112 3,924 3,600 3,293 3,651 2,850 1,098 1,212 1,450 994 0 2,000 4,000 6,000 8,000 10,000 12,000 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 USD/t Average copper realized price EBITDA breakeven Consider EBITDA break-even (ex-Hu'u, copper project in Indonesia) for Q3 2023 and Q4 2023. Source: Company filings Iron ore asset concentration in Brazil constrains the rating Vale is currently rated two notches above the rating of the Government of Brazil, supported by the company's position as the largest iron ore producer globally, with its cash flow and profitability having minimal correlation with domestic economic conditions. Vale is highly unlikely to default as a consequence of sovereign credit stress or default because its high reliance on China and large developed countries provides reasonable insulation from Brazil’s macroeconomic and political environment. About 90% of Vale’s revenue is generated outside Brazil. Moreover, cash generated outside Brazil covers debt service and principal payments; therefore, restrictions on capital flows are unlikely to constrain Vale’s ability to service debt. 6 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates However, about 75% of Vale's total fixed assets are located in Brazil, most of which are iron ore, followed by Canada at about 20%. To be rated more than two notches above the sovereign rating, a company would need to have a substantial majority of its operating assets located outside the country and generate a significant portion of its cash flow outside of the country. Given Vale's large share of assets in Brazil and high cash flow reliance on assets located in the country, the sovereign rating remains a constraint to the company's rating. Exhibit 12 Significant asset concentration in Brazil, followed by Canada In $ million 64.7% 64.9% 63.4% 65.9% 61.9% 61.8% 67.4% 73.4% 71.9% 74.6% 18.7% 19.5% 20.0% 22.0% 26.2% 27.3% 22.9% 22.1% 20.2% 18.5% 65,562 66,939 59,442 57,873 52,475 52,693 56,974 61,899 55,045 61,398 0% 20% 40% 60% 80% 100% 120% 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (09/25) Brazil Canada Europe Indonesia Nouvelle Caledonie Mozambique Oman Others Source: Company filings Settlement for the Fundão dam collapse reduces uncertainty related to Samarco In October 2024, Samarco, Vale and BHP Billiton Brasil LTDA entered a final agreement with the Federal Government of Brazil, the states of Minas Gerais and Espirito Santo, public prosecutors and public defenders (public authorities) to settle the Framework Agreement obligations, the Federal Public Prosecution Office civil claim and other claims by public authorities related to Samarco's Fundão dam collapse in November 2015. The agreement was approved by Brazil's Supreme Court in November 2024. The settlement agreement defines Samarco's legal liabilities, enhances cash flow visibility and reduces the risk of future disbursements from Samarco, Vale and BHP. Furthermore, in August 2025, Samarco's judicial reorganization process was concluded, and the company will comply with the remaining obligations, according to the terms established. The BRL170 billion ($31.7 billion) final agreement includes past and future obligations: BRL38 billion ($7.9 billion) had already been disbursed for remediation and compensation measures by Q3 2024 (as of Q3 2025, $13.1 billion had been already disbursed); BRL100 billion ($18 billion) to be paid in 20 installments over 20 years to the federal government, the states of Minas Gerais and Espírito Santo, and the municipalities to fund compensatory programs and actions tied to public policies; and BRL32 billion ($5.8 billion) in performance obligations by Samarco to the Brazilian government for initiatives related to individual indemnification, resettlement and environmental recovery. Exhibit 13 Provisions and expenses related to the Samarco accident since 2016 In USD million 2016 2017 2018 2019 2020 2021 2022 2023 2024 LTM (09/25) Balance at the beginning of period 1,077 996 1,121 1,700 2,074 3,112 3,321 4,427 3,663 Provisions 1,163 38 403 758 1,095 1,700 89 1,200 956 182 Disbursements (139) (294) (290) (315) (394) (392) (338) (553) (808) (2,122) Others adjustments 53 175 12 136 (327) (270) 458 459 (912) 678 Balance at the end of period 1,077 996 1,121 1,700 2,074 3,112 3,321 4,427 3,663 2,401 Working capital contributions to Samarco 71 142 84 102 166 21 0 0 0 0 Source: Company filings 7 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Legal uncertainties persist for Vale and BHP related to lawsuits in the UK and the Netherlands stemming from the Samarco dam collapse. In December 2022, BHP filed a Contribution Claim against Vale in the UK, seeking shared responsibility for potential indemnification in a group action. Separately, in March 2024, a Dutch court froze shares in Vale Holdings B.V. as a guarantee for claims initially valued at $986 million, later reduced to $877 million. These actions were initiated by Brazilian municipalities and organizations representing affected individuals and businesses. In July 2024, Vale and BHP entered a confidential agreement to equally share any liabilities arising from these cases, without admitting fault. The UK trial’s first phase concluded in early 2025, and the case is scheduled to proceed in three stages — jurisdiction, liability and damages. On November 14, Vale confirmed that the English Court has found BHP Group Ltd and BHP Group UK (“BHP”) liable for the failure of the tailings dam. A second-stage trial is currently scheduled to start in October 2026 and run until Q2 2027. Following any decisions and appeals, a third-stage trial may be scheduled. Vale has announced that it will add $500 million in provisions to reflect a potential increase in claims coming from these trials. Continued improvements in safety of tailings dams reduce risks related to Brumadinho An important component of lowering risk of tailings dams is the continuous increase in the share of dry processing production. In 2024, about 77% of total iron ore production did not rely on tailings dams, which compares to 40% in 2014. Since 2019, Vale has consistently made progress in its commitment to eliminate all its upstream tailings dams in Brazil. To execute the program, Vale has already disbursed more than BRL12.8 billion ($2.3 billion). Out of the 30 inactive upstream dams of Vale in 2019, 18 had been decharacterized by October 2025, while the remaining 12 are undergoing decharacterization. As of the end of September 2025, Vale had $2.3 billion in provisions for the de-characterization of tailings dams and $1.9 billion related to the Brumadinho dam incident, including provisions for remediation and reparation obligations under the judicial settlement for reparation, individual indemnification and other commitments. Out of a total of BRL37.7 billion under the framework agreement settled in February 2021, Vale had already achieved 79% of reparations as of September 2025. Exhibit 14 Provisions and expenses related to the Brumadinho accident since 2019 In USD millions 2019 2020 2021 2022 2023 2024 LTM (09/25) Balance at the beginning of the period 0 5,472 6,864 7,060 6,611 6,511 4,183 Provisions 6,550 4,747 1,926 472 629 (90) (64) Disbursements (989) (2,122) (1,726) (1,440) (1,788) (1,442) (866) Other adjustments (89) (1,233) (4) 578 1,059 (796) 1,013 Balance at the end of period 5,472 6,864 7,060 6,611 6,511 4,183 4,266 Source: Company filings Exhibit 15 Vale has been fulfilling all agreed commitments, and visibility of future cash outflows reduces liquidity risk Future expected cash flows (in USD billion) 2025 2026 2027 2028 2029 2030 Average 2031-2035 Brumadinho 0.9 0.7 0.5 0.2 0.2 0.2 0.2 Samarco 2.5 0.9 0.6 0.4 0.3 0.3 0.0 Decharacterization of tailing dams 0.4 0.5 0.4 0.2 0.2 0.2 0.2 Others 0.4 0.3 0.3 0.2 0.2 0.0 0.0 Total 4.2 2.4 1.8 1.0 0.9 0.7 0.4 Source: Company fillings 8 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates ESG considerations Vale S.A.'s ESG credit impact score is CIS-2 Exhibit 16 ESG credit impact score Source: Moody's Ratings Vale's credit Impact score reflects our assessment that ESG attributes are overall considered as having a neutral-to-low impact on the current rating, because the rating is constrained by the sovereign rating of the government of Brazil. Still, Vale has high exposure to environmental risks associated primarily with natural capital (mine closure and decommissioning of structures) and waste and pollution (including tailings dams). Vale's high exposure to social risks arises mainly from health and safety concerns around the operations as well as responsible production, given the previous tailings dams' accidents. The company's governance considerations reflect Vale's financial strategy, strong balance sheet, solid liquidity and enhanced risk management following the dam collapse in 2019. Exhibit 17 ESG issuer profile scores Source: Moody's Ratings Environmental Vale credit exposure to environmental risks mainly related to natural capital and waste and pollution. The tailing dam incident in Brumadinho in 2019, which resulted in a large number of fatalities, extensive environmental damage and loss of production, and resulted in fines ($7 billion settlement) and litigations is an important consideration, as tailings dam management is the primary waste and pollution risk for this sector. Vale's operations are located in areas of abundant water availability, but has certain exposure to physical climate risk, in particular floods during the summer season in southern Brazil. However, Vale’s large scale and footprint, and mine diversification mitigates climate hazards. Moreover, carbon transition risk is mitigated by the growing portfolio of base metals products, including nickel and copper, which will benefit by growing demand from energy transition. Social Vale is exposed to social risks, in particular those related to health and safety and responsible production. Improvements in safety of operations through initiatives taken to enhance the risk management control, particularly as the company progresses with the decommissioning of upstream tailings dams, jointly with the construction of backup dams (containment structures) and preventive removal of workers and civil population of riskier areas, have reduced the exposure to social risks, in particular health and safety. However, the tailings dam incident and its implications related to safety of operations, employee well-being and community stakeholder engagement and reputation remains an important credit consideration, reflected mostly in responsible production. Vale's 9 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates exposure to other social risks such as human capital is not as high as most mining companies, given the absence of union disputes and strikes, while exposure to demographic and societal trends is somewhat mitigated by the company's exposure to commodities (copper, nickel) that are linked to battery production and the green economy, despite the concentration in iron ore. Governance Vale's governance score reflects Vale's solid financial strategy, strong balance sheet, robust liquidity and enhanced risk management after the tailings dam accident in January 2019. ESG Issuer Profile Scores and Credit Impact Scores for the rated entity/transaction are available on Moodys.com. In order to view the latest scores, please click here to go to the landing page for the entity/transaction on MDC and view the ESG Scores section. Liquidity analysis Vale has excellent liquidity, supported by $6.1 billion in cash and the $5.0 billion available under its revolving credit facility agreements ($2 billion due in November 2026 and $3 billion due in February 2029) as of the end of Q3 2025. The company generated cash flow from operations of $9.2 billion in the 12 months that ended September 2025, and after dividend distribution of $3.5 billion and capex of $6.3 billion, FCF was negative at $545 million. All figures include our standard adjustments. Exhibit 18 Stronger positive free cash flow driven by higher volumes, stable iron ore prices ($90-$100/ton) and relatively stable capital spending 14.4 25.8 11.7 13.4 9.5 9.2 9.2 9.8 10.1 (4.4) (5.2) (5.6) (6.2) (6.6) (6.3) (5.7) (5.9) (6.2) (3.4) (13.5) (6.6) (5.6) (3.9) (3.5) (3.4) (2.4) (2.5) 0.0 (5.5) (6.0) (2.7) (0.4) 0.0 0.0 0.0 0.0 6.7 1.6 (6.6) (1.0) (1.1) (0.5) 0.1 1.4 1.4 (20.0) (15.0) (10.0) (5.0) 0.0 5.0 10.0 15.0 20.0 25.0 30.0 2020 2021 2022 2023 2024 LTM (09/25) 2025E 2026E 2027E $ billions CFO CAPEX Dividends Share buyback FCF Source: Company filings Vale has a conservative approach to capital allocation relative to capital spending, dividend distribution and debt levels. The company aims to maintain expanded net financial debt between $10 billion and $20 billion, aiming at the center of the range ($15 billion), and including commitments related to Brumadinho and Samarco. The company's debt amortization schedule is very comfortable, with maturities concentrated beyond 2029. Vale's dividend payout is based on the policy established in March 2018, which is 30% of EBITDA minus sustaining capex, with payments set twice a year — in September for H1 results and in March of the following year for H2 results. In the first nine months of 2025, Vale increased its 30-year $1 billion bond issued in 2024 by $750 million, using the proceeds to repurchase bonds maturing in 2034, 2036, and 2039. Additionally, Vale issued $1.1 billion in debentures to support infrastructure investments in railway concessions. Moreover, in November 2025 Vale issued $750 million in hybrid notes for general corporate purposes, including replenishing part of Vale's cash used for funding the optional tender offer for the “debentures participativas”, announced in early October. These liability management initiatives are part of Vale’s ongoing efforts to reduce debt costs and optimize overall financial expenses. 10 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Exhibit 19 Debt amortization schedule as of September 2025; total reported financial debt of $18.3 billion* *Considers $1 billion hybrid notes issuance, which Moody's treats as 50% equity and 50% debt 6,091 5,000 406 156 1,686 838 4,478 7,370 279 500 0 2,000 4,000 6,000 8,000 10,000 12,000 Cash & Equivalents 2025 2026 2027 2028 2029-2031 2032 onwards $ millions Cash & Equivalents Revolving credit facility Loans and borrowings Vale Canada Bond Hybrid issuance Does not include accrued interest and leases.* Sources: Company filings and Moody's Ratings Vale's leverage (Moody's-adjusted total gross debt/EBITDA) was 1.3x for the 12 months that ended September 2025, and it has remained close to (or below) 1x since 2020. Some of the company's financing documents contain covenants related to debt/EBITDA and the interest coverage ratio, but debt with financial covenants represents less than 20% of its total debt. The company is in full compliance with these covenants. Hybrid notes will fund the tender offer for debentures participativas Vale issued a hybrid instrument for general corporate purposes, including to replenish part of Vale's cash used to fund an optional tender offer to acquire the “debentures participativas”, which was announced on October 6, 2025, and settled on November 5, 2025. The hybrid bond is an unsecured and subordinated obligation, junior to all senior unsecured debt instruments issued by Vale Overseas Limited (Baa2 stable) and guaranteed by Vale S.A. Key features of the bond include optional coupon deferral with mandatory interest arrear settlement; initial maturity of at least 30 years; and no significant coupon step-up before year 10, with any increase capped at 100 basis points. Under our methodology, the hybrid notes have equity-like features, and are treated as 50% equity and 50% debt when calculating credit ratios. As the notes are a junior, subordinated instrument, they should be rated one notch below the senior unsecured debt instruments issued by Vale Overseas and by the guarantor (Vale), currently rated at Baa2. The issuance has no impact on leverage from Vale’s perspective because the “debentures participativas” are not considered financial debt on the company’s balance sheet, and the hybrid instrument will receive the same treatment. As the hybrid notes have 50% equity credit, the impact on leverage will not be substantial. The transaction amounted to $750 million which represents an additional debt of $375 million (50% debt and 50% equity). Structural considerations Vale Base Metal (VBM) and Vale Canada Ltd. (VC) Baa3 senior unsecured ratings reflect the intrinsic operational, financial, strategic and legal links between VBM, VC and Vale S.A. The current one-notch differential to Vale's rating reflects the fact that Vale does not guarantee Vale Canada's 2032 notes ($279 million outstanding as of September 2025) and debt at VBM. But the ratings incorporates Vale's ability to support VBM and VC. Although VBM's contribution to Vale's consolidated revenue (20.2% as of the 12 months that ended September 2025) is still relatively small, the business is an important component of the parent company's strategy for growth and diversification in base metals. Vale Canada is part of VBM, a company created in 2023 that incorporates base metal assets within Vale, namely nickel and copper assets in Brazil, Canada and Indonesia. While most of Vale's iron ore and mining operations are under the parent company, it also has subsidiaries, associates and joint venture interests, both domestically and abroad. Although some of these entities may have debt and creditor obligations, which have the first claim on cash flow before distribution to the parent, they are relatively modest compared with the assets held within and the 11 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates earnings generated by the parent company. Vale's debt-financing requirements are met by bonds, bank loans, debentures and other trade finance vehicles. Vale Overseas, incorporated as a Cayman Islands-domiciled company, is a wholly owned finance subsidiary of Vale and is used as a vehicle to issue US dollar-denominated notes. Methodology and scorecard Vale's scorecard-indicated outcome under our Mining rating methodology is Baa1, based on data for the 12 months that ended September 2025. On a forward-looking basis for the next 12-18 months, the scorecard-indicated outcome maps to Baa1, under our 12-month price assumption of iron ore at $90/ton, but with higher volumes offsetting weaker prices. The current rating is Baa2, which remains constrained by the sovereign rating. Exhibit 20 Vale S.A. Global Mining Industry Scorecard Measure Score Sub-Factor Scorecard Indicated Outcome Factor 1: Scale (15%) a) Revenue (USD Billion) 37.5 A 38.0 - 40.0 A Factor 2: Business Profile (30%) a) Business Profile Baa Baa Baa Baa Factor 3: Profitability And Efficiency (10%) a) EBIT Margin 30.6% A 25.0% - 30.0% A Factor 4: Leverage And Coverage (25%) a) Debt / EBITDA 1.3x A 1.0x - 1.5x A b) (EBITDA - CAPEX) / Interest Expense 7.3x Baa 6.0x - 8.0x Baa c) RCF / Debt 45.3% Baa 50.0% - 55.0% A Factor 5: Financial Policy (20%) a) Financial Policy Baa Baa Baa Baa Rating: a) Scorecard-Indicated Outcome Baa1 Baa1 b) Actual Rating Assigned Baa2 Current LTM September 30 2025 12-18 Month Forward View [1] All ratios are based on 'Adjusted' financial data and incorporate Moody's Global Standard Adjustments for Non-Financial Corporations. [2] As of September 30, 2025(LTM) [3] This represents Moody's Forward View; not the view of the issuer; and unless noted in the text, does not incorporate significant acquisitions and divestitures Source: Moody's Ratings 12 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Ratings Exhibit 21 Category Moody's Rating VALE S.A. Outlook Stable Issuer Rating -Dom Curr Baa2 Senior Unsecured Baa2 VALE OVERSEAS LIMITED Outlook Stable Bkd Senior Unsecured Baa2 Subordinate Baa3 VALE BASE METALS LIMITED Outlook Stable Issuer Rating Baa3 VALE CANADA LTD. Outlook Stable Senior Unsecured Baa3 Source: Moody's Ratings 13 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Appendix Exhibit 22 Peer comparison Vale S.A. (in US millions) FYE Dec-23 FYE Dec-24 LTM Sep-25 FYE Dec-23 FYE Dec-24 LTM Jun-25 FYE Jun-24 FYE Jun-25 LTM Jun-25 FYE Dec-23 FYE Dec-24 LTM Jun-25 FYE Jun-24 FYE Jun-25 LTM Jun-25 Revenue $41,784 $38,056 $37,467 $54,041 $53,658 $53,729 $18,220 $15,541 $15,541 $30,656 $27,354 $26,740 $55,658 $51,262 $51,262 EBITDA $16,199 $15,078 $15,340 $20,954 $21,660 $20,745 $10,757 $7,804 $7,804 $9,644 $7,924 $7,351 $25,436 $24,900 $24,900 Total Debt $14,226 $16,685 $19,723 $14,913 $14,342 $24,127 $5,400 $5,439 $5,439 $17,705 $19,027 $17,808 $22,242 $25,284 $25,284 EBIT Margin 31.7% 31.1% 30.6% 29.3% 29.3% 27.0% 47.3% 34.1% 34.1% 22.7% 18.2% 16.3% 36.2% 37.6% 37.6% EBIT/Avg. Tang. Assets 16.6% 15.6% 14.6% 16.7% 16.0% 13.8% 29.9% 17.8% 17.8% 10.8% 7.8% 7.1% 19.9% 18.5% 18.5% EBIT / Int. Exp. 11.5x 10.6x 9.3x 12.3x 12.9x 10.9x 27.5x 17.2x 17.2x 5.0x 3.2x 2.8x 12.1x 12.8x 12.8x (EBITDA - Capex)/ Int Expense 8.7x 7.5x 7.3x 10.4x 9.5x 7.4x 30.1x 24.9x 13.4x 2.4x 1.2x 1.3x 17.6x 9.7x 9.9x Debt / EBITDA 0.9x 1.1x 1.3x 0.7x 0.7x 1.2x 0.5x 0.7x 0.7x 1.8x 2.4x 2.4x 0.9x 1.0x 1.0x Total Debt/Capital 25.4% 32.3% 31.8% 20.3% 19.2% 26.8% 20.4% 20.2% 20.2% 32.9% 36.2% 37.7% 29.9% 31.4% 31.4% (CFO - Dividends) / Debt 55.0% 33.5% 29.3% 59.1% 59.8% 36.5% 69.3% 66.0% 66.0% 20.5% 31.8% 25.3% 49.6% 38.8% 38.8% RCF/Debt 79.4% 49.2% 45.3% 63.0% 64.2% 38.7% 74.6% 74.4% 64.8% 25.3% 19.4% 17.4% 29.5% 53.7% 40.2% Vale S.A. Rio Tinto plc Fortescue Ltd Anglo American plc BHP Group Limited Baa2 stable A1 stable Ba1 Stable (P)Baa2 Stable (P)A1 Stable All figures and ratios calculated using Moody’s estimates and standard adjustments. FYE = Financial year-end. LTM = Last 12 months. Source: Moody's Ratings Exhibit 23 Moody's-adjusted debt breakdown Vale S.A. (in US Millions) FYE Dec-20 FYE Dec-21 FYE Dec-22 FYE Dec-23 FYE Dec-24 LTM Ending Sep-25 As Reported Debt 15,027.0 13,782.0 12,712.0 13,923.0 15,505.0 18,543.0 Pensions 641.0 204.0 269.0 303.0 1,180.0 1,180.0 Operating Leases 0.0 0.0 0.0 0.0 0.0 0.0 Non-Standard Adjustments 431.0 0.0 0.0 0.0 0.0 0.0 Moody's-Adjusted Debt 15,668.0 13,986.0 12,981.0 14,226.0 16,685.0 19,723.0 All figures are calculated using Moody’s estimates and standard adjustments. Source: Moody's Ratings Exhibit 24 Moody's-adjusted EBITDA breakdown Vale S.A. (in US Millions) FYE Dec-20 FYE Dec-21 FYE Dec-22 FYE Dec-23 FYE Dec-24 LTM Ending Sep-25 As Reported EBITDA 11,434.0 33,299.0 23,489.0 15,252.0 12,958.0 12,837.0 Pensions 25.0 21.0 19.0 28.0 78.0 78.0 Unusual 4,824.0 -3,215.0 -2,927.0 919.0 97.0 480.0 Moody's-Adjusted EBITDA 16,283.0 30,105.0 20,581.0 16,199.0 15,078.0 15,340.0 All figures are calculated using Moody’s estimates and standard adjustments. Source: Moody's Ratings Endnotes 1 C1 cost is a standard metric of the mining industry to denote the direct production costs of mining operations. 14 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates © 2025 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved. CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED OR OTHERWISE MADE AVAILABLE BY MOODY’S (COLLECTIVELY, “MATERIALS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S MATERIALS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S MATERIALS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES OR OTHERWISE MAKES AVAILABLE ITS MATERIALS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND MATERIALS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR MATERIALS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT. FOR CLARITY, NO INFORMATION CONTAINED HEREIN MAY BE USED TO DEVELOP, IMPROVE, TRAIN OR RETRAIN ANY SOFTWARE PROGRAM OR DATABASE, INCLUDING, BUT NOT LIMITED TO, FOR ANY ARTIFICIAL INTELLIGENCE, MACHINE LEARNING OR NATURAL LANGUAGE PROCESSING SOFTWARE, ALGORITHM, METHODOLOGY AND/OR MODEL. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND MATERIALS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK. All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the credit rating process or in preparing its Materials. To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY’S. To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER. Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating, agreed to pay Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it. MCO and all MCO entities that issue ratings under the “Moody’s Ratings” brand name (“Moody’s Ratings”), also maintain policies and procedures to address the independence of Moody’s Ratings’ credit ratings and credit rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service, Inc. and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at ir.moodys.com under the heading “Investor Relations — Corporate Governance — Charter and Governance Documents - Director and Shareholder Affiliation Policy.” Moody's SF Japan K.K., Moody's Local AR Agente de Calificación de Riesgo S.A., Moody’s Local BR Agência de Classificação de Risco LTDA, Moody’s Local MX S.A. de C.V, I.C.V., Moody's Local PE Clasificadora de Riesgo S.A., and Moody's Local PA Calificadora de Riesgo S.A. (collectively, the “Moody’s Non-NRSRO CRAs”) are all indirectly wholly-owned credit rating agency subsidiaries of MCO. None of the Moody’s Non-NRSRO CRAs is a Nationally Recognized Statistical Rating Organization. Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors. Additional terms for India only: Moody’s credit ratings, Assessments, other opinions and Materials are not intended to be and shall not be relied upon or used by any users located in India in relation to securities listed or proposed to be listed on Indian stock exchanges. Additional terms with respect to Second Party Opinions and Net Zero Assessments (as defined in Moody’s Ratings Rating Symbols and Definitions): Please note that neither a Second Party Opinion (“SPO”) nor a Net Zero Assessment (“NZA”) is a “credit rating”. The issuance of SPOs and NZAs is not a regulated activity in many jurisdictions, including Singapore. JAPAN: In Japan, development and provision of SPOs and NZAs fall under the category of “Ancillary Businesses”, not “Credit Rating Business”, and are not subject to the regulations applicable to “Credit Rating Business” under the Financial Instruments and Exchange Act of Japan and its relevant regulation. PRC: Any SPO: (1) does not constitute a PRC Green Bond Assessment as defined under any relevant PRC laws or regulations; (2) cannot be included in any registration statement, offering circular, prospectus or any other documents submitted to the PRC regulatory authorities or otherwise used to satisfy any PRC regulatory disclosure requirement; and (3) cannot be used within the PRC for any regulatory purpose or for any other purpose which is not permitted under relevant PRC laws or regulations. For the purposes of this disclaimer, “PRC” refers to the mainland of the People’s Republic of China, excluding Hong Kong, Macau and Taiwan. 15 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates REPORT NUMBER 1465151 16 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating Moody's Ratings Corporates Contacts Clara Tobar +55.11.3956.8777 Sr Ratings Associate clara.tobar@moodys.com CLIENT SERVICES Americas 1-212-553-1653 Asia Pacific 852-3551-3077 Japan 81-3-5408-4100 EMEA 44-20-7772-5454 17 19 November 2025 Vale S.A.: Update following affirmation of Baa2 rating

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Vale S.A. (Registrant) | ||

| By: | /s/ Thiago Lofiego | |

| Date: November 19, 2025 | Director of Investor Relations | |