TRANSFORMED AND READY TO LAUNCH Gabelli Funds 49th Annual Automotive Symposium November 2025

This presentation contains express and implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our financial outlook for the full year of fiscal 2025, the impact of, and our ability to execute, our corporate strategies and business initiatives and the potential impact tariffs, high interest rates, high metal costs and additional economic uncertainties may have on our financial statements and results of operations. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “growth,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project”, “trajectory” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the potential impacts of tariffs on the U.S. economy, the economy of other countries in which we conduct operations and our industry, as well as the potential implications and ramifications of tariffs on our business and the local and global supply chains supporting the same, and our ability to mitigate any adverse impacts of such; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; uncertainty of government policies and actions after recent U.S. elections in respect to global trade, tariffs and international trade agreements; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in NN, Inc.'s (the "Company") filings made with the U.S. Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this presentation and are based on information available to the Company at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements. In this presentation, we use the following non-GAAP measures: adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share and free cash flow. See the Appendix to this presentation for definitions of each non-GAAP measure and reconciliations to the most comparable GAAP measure. FORWARD LOOKING STATEMENTS 2

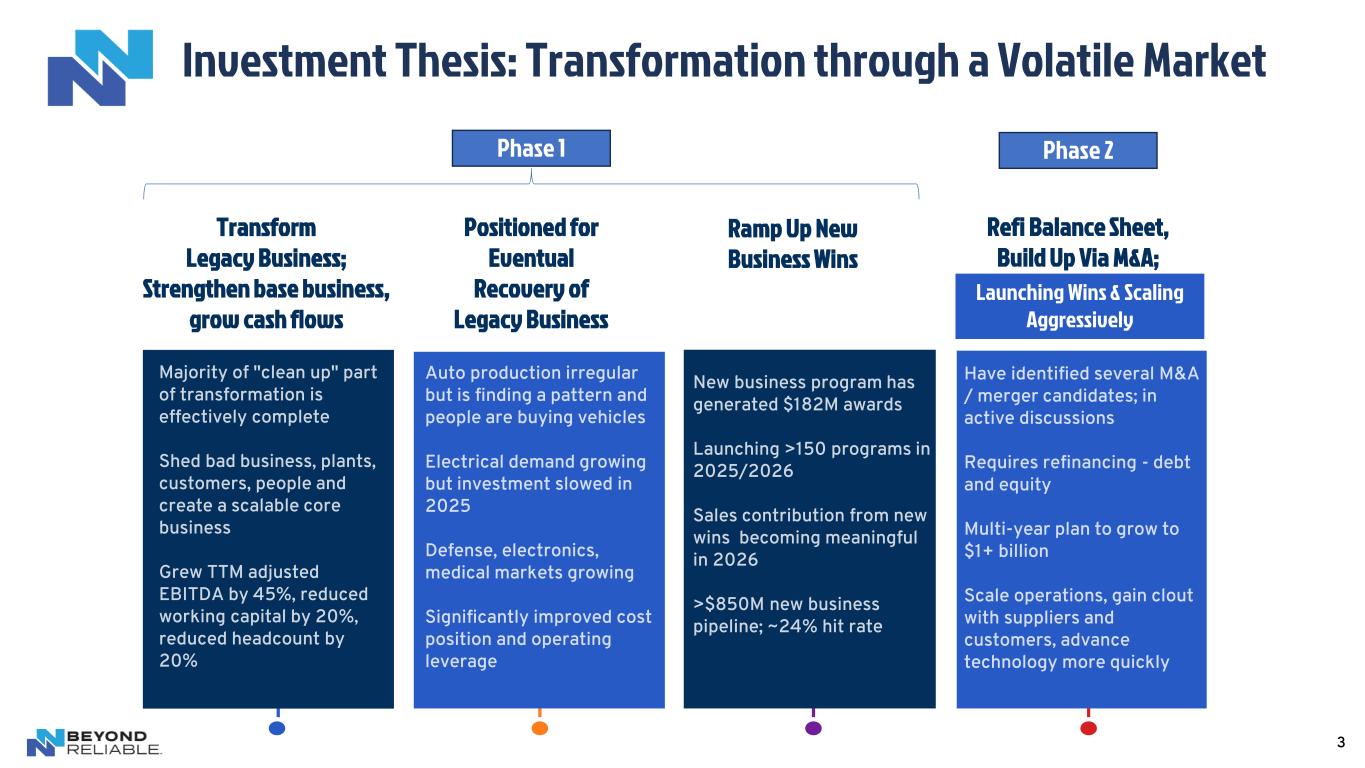

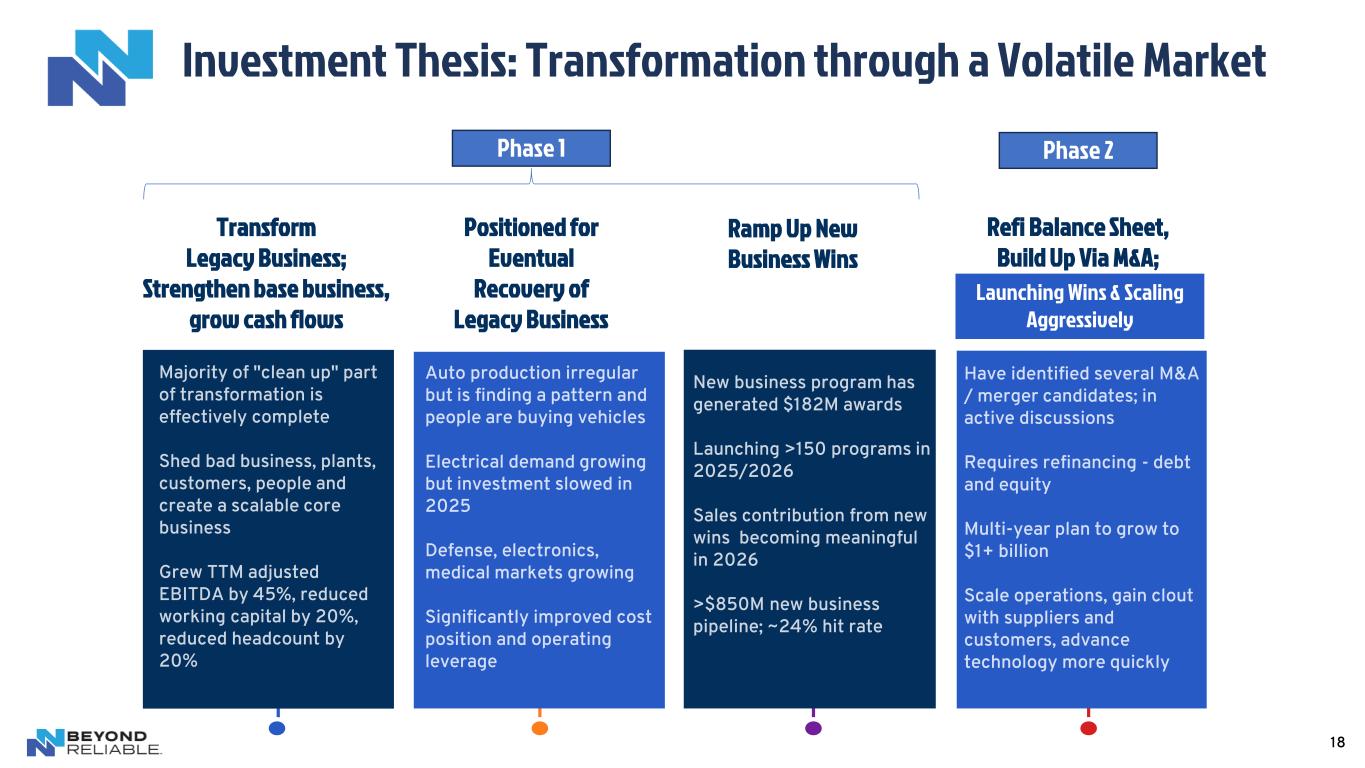

3 Investment Thesis: Transformation through a Volatile Market Transform Legacy Business; Strengthen base business, grow cash flows Positioned for Eventual Recovery of Legacy Business Ramp Up New Business Wins Refi Balance Sheet, Build Up Via M&A; Phase 1 Phase 2 Launching Wins & Scaling Aggressively

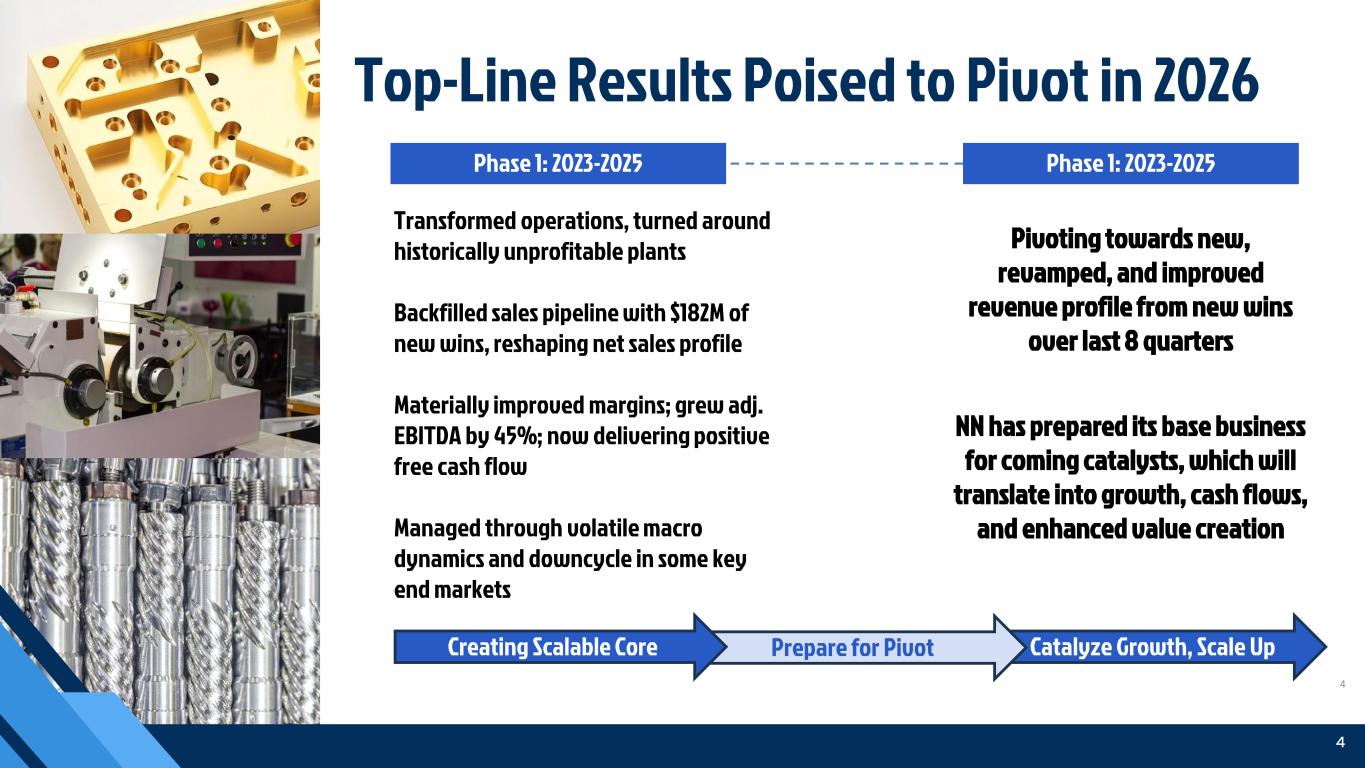

Catalyze Growth, Scale UpPrepare for Pivot Top-Line Results Poised to Pivot in 2026 4 4 Creating Scalable Core Pivoting towards new, revamped, and improved revenue profile from new wins over last 8 quarters NN has prepared its base business for coming catalysts, which will translate into growth, cash flows, and enhanced value creation Transformed operations, turned around historically unprofitable plants Backfilled sales pipeline with $182M of new wins, reshaping net sales profile Materially improved margins; grew adj. EBITDA by 45%; now delivering positive free cash flow Managed through volatile macro dynamics and downcycle in some key end markets Phase 1: 2023-2025 Phase 1: 2023-2025

5 At a Glance ▪ NN is a precision component producer, adding value through co- development in the design for manufacturing with innovative, bespoke processing and continuous improvement with exceptional quality that makes us Beyond Reliable ▪ Award winning developer and manufacturer of custom metal parts and assemblies for ~45 years; public company for ~30 years. Go to market under well-known brand names ▪ Balanced business model serving multiple markets ➢ Auto: engine and powertrain products ➢ Electric Grid: electricity control products ➢ Defense & Electronics: electrical control products ➢ Commercial Vehicle: engine components ➢ Construction & Industrial: metal components ➢ Medical: surgery & equipment products ▪ Competitive global operational platform - local-for-local when needed and global for low-cost solutions, consistent re-investment 9001:2015 13485:2016 Sales $424 Million (+$130 Million JV) Adjusted EBITDA $48 Million 11% Margin Employees ~2,600 (+700 JV) Customers ~600

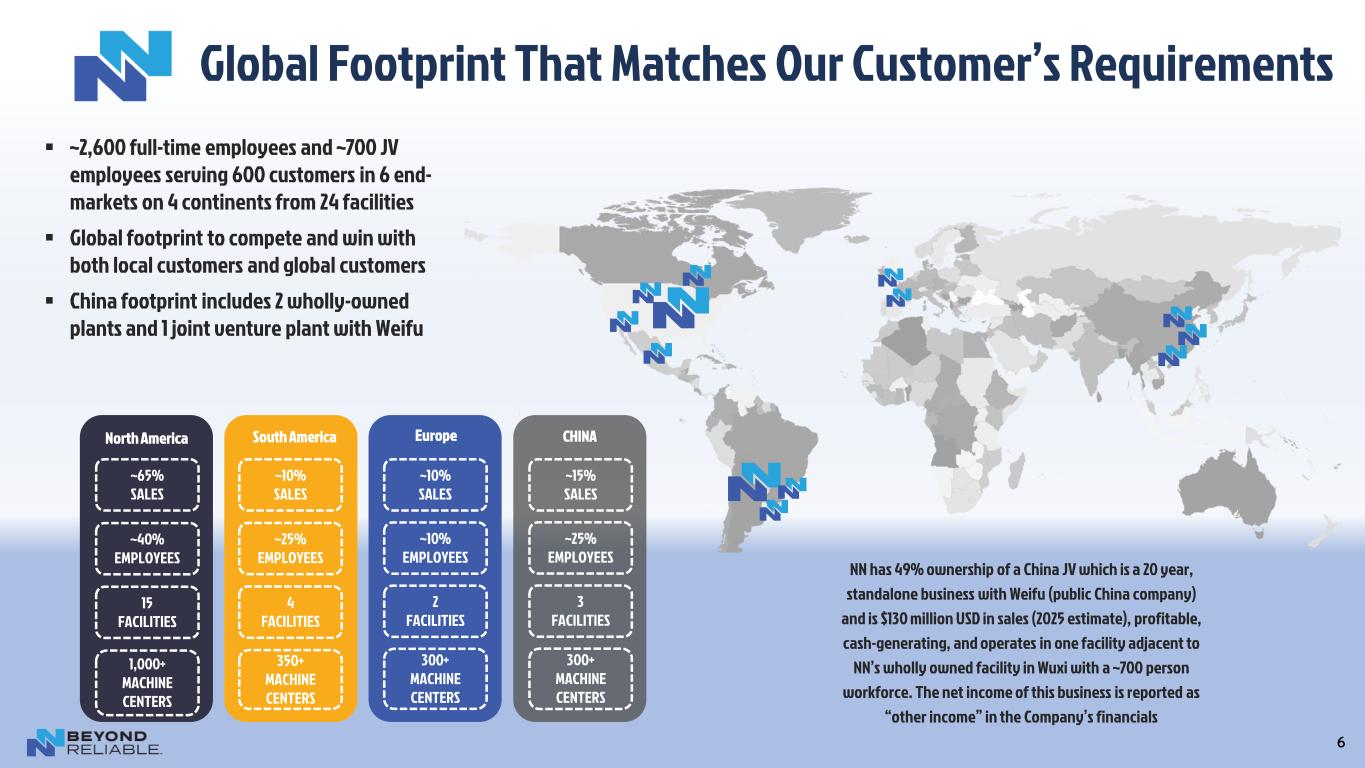

6 ▪ ~2,600 full-time employees and ~700 JV employees serving 600 customers in 6 end- markets on 4 continents from 24 facilities ▪ Global footprint to compete and win with both local customers and global customers ▪ China footprint includes 2 wholly-owned plants and 1 joint venture plant with Weifu Global Footprint That Matches Our Customer’s Requirements North America ~65% SALES ~40% EMPLOYEES 15 FACILITIES Europe ~10% SALES ~10% EMPLOYEES 2 FACILITIES South America ~10% SALES ~25% EMPLOYEES 4 FACILITIES ~15% SALES ~25% EMPLOYEES 3 FACILITIES 1,000+ MACHINE CENTERS 350+ MACHINE CENTERS 300+ MACHINE CENTERS 300+ MACHINE CENTERS NN has 49% ownership of a China JV which is a 20 year, standalone business with Weifu (public China company) and is $130 million USD in sales (2025 estimate), profitable, cash-generating, and operates in one facility adjacent to NN’s wholly owned facility in Wuxi with a ~700 person workforce. The net income of this business is reported as “other income” in the Company’s financials CHINA

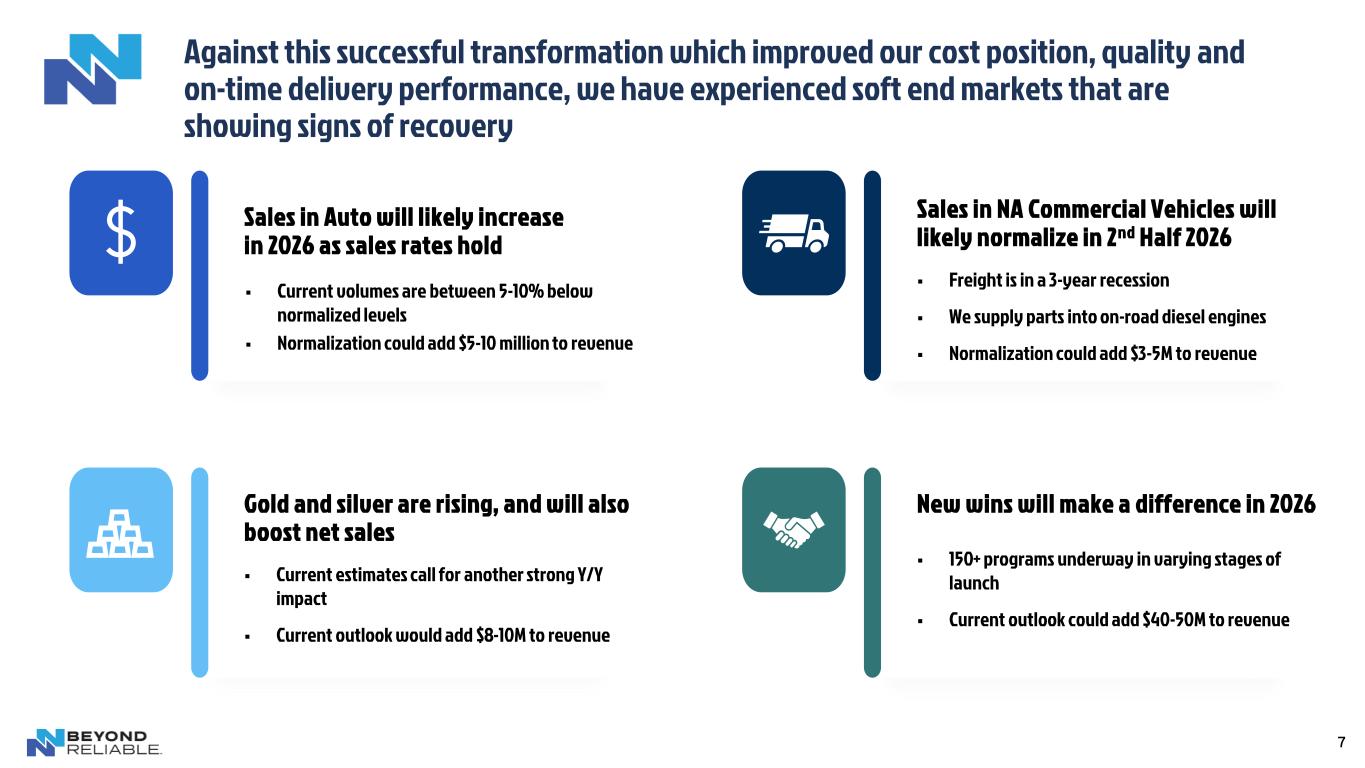

Against this successful transformation which improved our cost position, quality and on-time delivery performance, we have experienced soft end markets that are showing signs of recovery 7 Sales in NA Commercial Vehicles will likely normalize in 2nd Half 2026 ▪ Freight is in a 3-year recession ▪ We supply parts into on-road diesel engines ▪ Normalization could add $3-5M to revenue Sales in Auto will likely increase in 2026 as sales rates hold ▪ Current volumes are between 5-10% below normalized levels ▪ Normalization could add $5-10 million to revenue Gold and silver are rising, and will also boost net sales ▪ Current estimates call for another strong Y/Y impact ▪ Current outlook would add $8-10M to revenue New wins will make a difference in 2026 ▪ 150+ programs underway in varying stages of launch ▪ Current outlook could add $40-50M to revenue

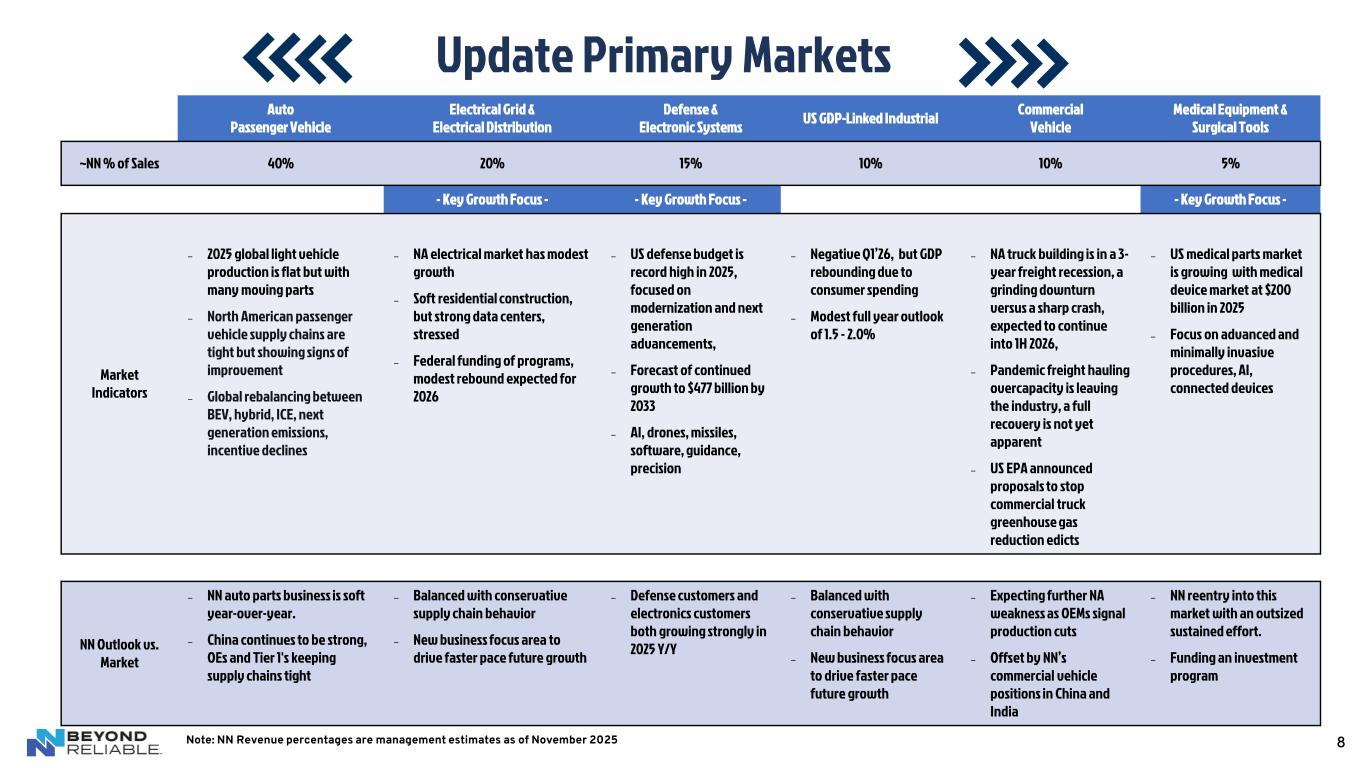

8 Update Primary Markets Note: NN Revenue percentages are management estimates as of November 2025 Auto Passenger Vehicle Electrical Grid & Electrical Distribution Defense & Electronic Systems US GDP-Linked Industrial Commercial Vehicle Medical Equipment & Surgical Tools ~NN % of Sales 40% 20% 15% 10% 10% 5% - Key Growth Focus - - Key Growth Focus - - Key Growth Focus - Market Indicators ― 2025 global light vehicle production is flat but with many moving parts ― North American passenger vehicle supply chains are tight but showing signs of improvement ― Global rebalancing between BEV, hybrid, ICE, next generation emissions, incentive declines ― NA electrical market has modest growth ― Soft residential construction, but strong data centers, stressed ― Federal funding of programs, modest rebound expected for 2026 ― US defense budget is record high in 2025, focused on modernization and next generation advancements, ― Forecast of continued growth to $477 billion by 2033 ― AI, drones, missiles, software, guidance, precision ― Negative Q1’26, but GDP rebounding due to consumer spending ― Modest full year outlook of 1.5 - 2.0% ― NA truck building is in a 3- year freight recession, a grinding downturn versus a sharp crash, expected to continue into 1H 2026, ― Pandemic freight hauling overcapacity is leaving the industry, a full recovery is not yet apparent ― US EPA announced proposals to stop commercial truck greenhouse gas reduction edicts ― US medical parts market is growing with medical device market at $200 billion in 2025 ― Focus on advanced and minimally invasive procedures, AI, connected devices NN Outlook vs. Market ― NN auto parts business is soft year-over-year. ― China continues to be strong, OEs and Tier 1's keeping supply chains tight ― Balanced with conservative supply chain behavior ― New business focus area to drive faster pace future growth ― Defense customers and electronics customers both growing strongly in 2025 Y/Y ― Balanced with conservative supply chain behavior ― New business focus area to drive faster pace future growth ― Expecting further NA weakness as OEMs signal production cuts ― Offset by NN’s commercial vehicle positions in China and India ― NN reentry into this market with an outsized sustained effort. ― Funding an investment program

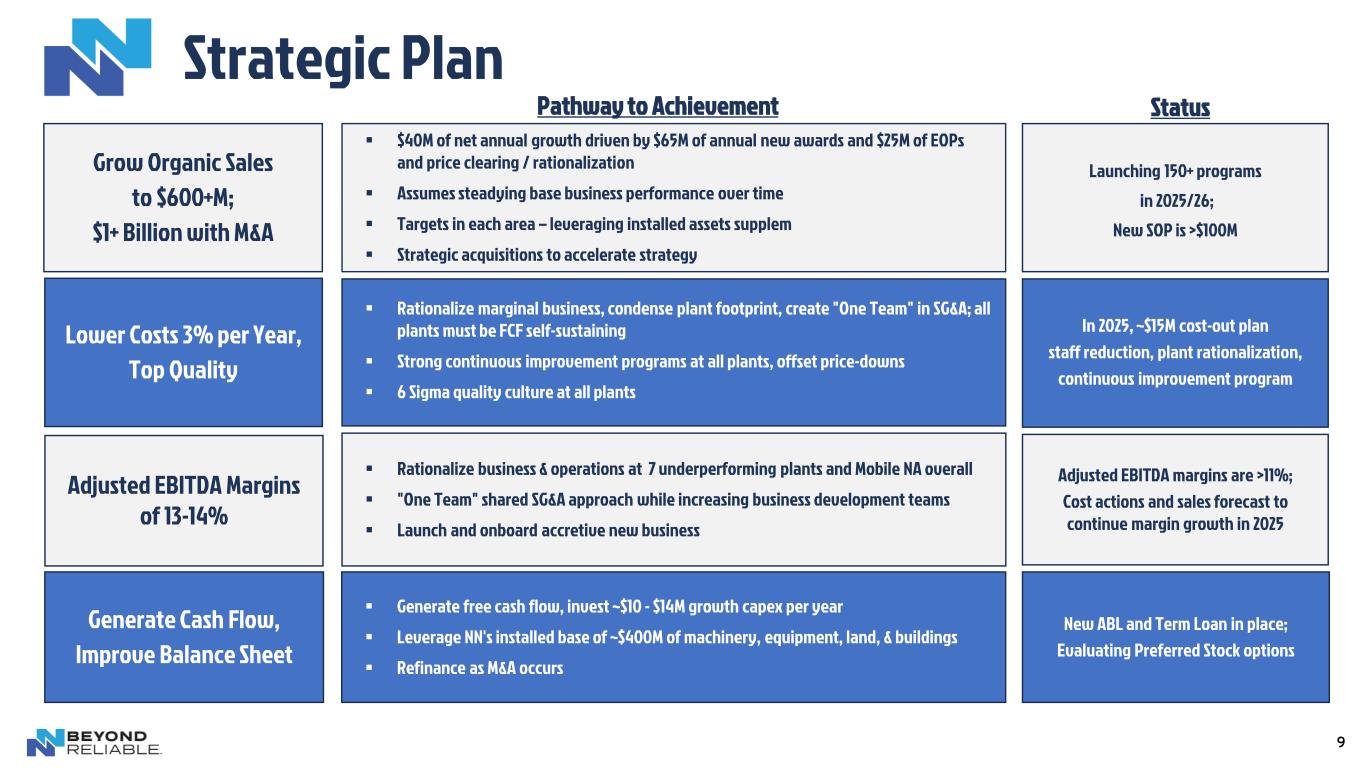

9 Strategic Plan ▪ $40M of net annual growth driven by $65M of annual new awards and $25M of EOPs and price clearing / rationalization ▪ Assumes steadying base business performance over time ▪ Targets in each area – leveraging installed assets supplem ▪ Strategic acquisitions to accelerate strategy Grow Organic Sales to $600+M; $1+ Billion with M&A Lower Costs 3% per Year, Top Quality Launching 150+ programs in 2025/26; New SOP is >$100M Status In 2025, ~$15M cost-out plan staff reduction, plant rationalization, continuous improvement program Generate Cash Flow, Improve Balance Sheet ▪ Generate free cash flow, invest ~$10 - $14M growth capex per year ▪ Leverage NN's installed base of ~$400M of machinery, equipment, land, & buildings ▪ Refinance as M&A occurs New ABL and Term Loan in place; Evaluating Preferred Stock options Adjusted EBITDA Margins of 13-14% ▪ Rationalize business & operations at 7 underperforming plants and Mobile NA overall ▪ "One Team" shared SG&A approach while increasing business development teams ▪ Launch and onboard accretive new business Adjusted EBITDA margins are >11%; Cost actions and sales forecast to continue margin growth in 2025 Pathway to Achievement ▪ Rationalize marginal business, condense plant footprint, create "One Team" in SG&A; all plants must be FCF self-sustaining ▪ Strong continuous improvement programs at all plants, offset price-downs ▪ 6 Sigma quality culture at all plants

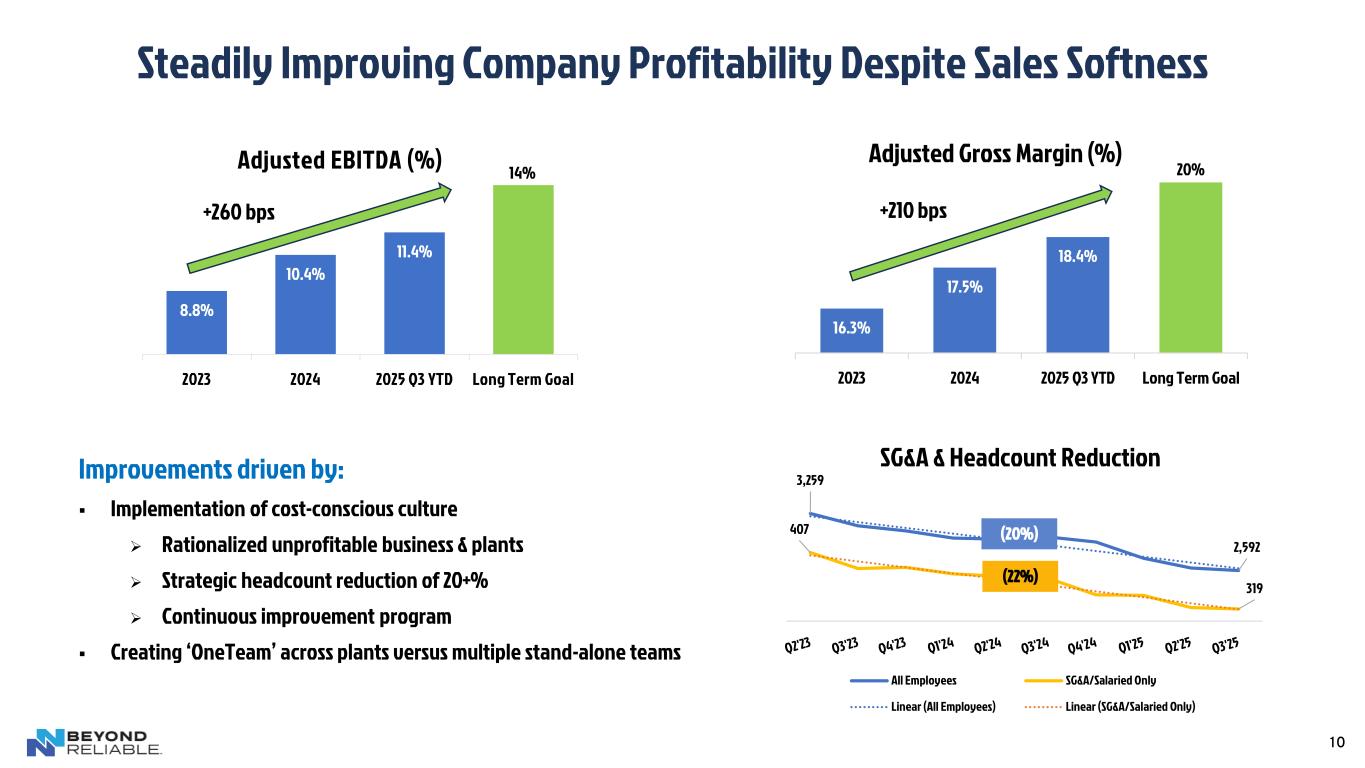

10 Steadily Improving Company Profitability Despite Sales Softness 16.3% 17.5% 18.4% 2023 2024 2025 Q3 YTD Long Term Goal Adjusted Gross Margin (%) 20% +210 bps 8.8% 10.4% 11.4% 2023 2024 2025 Q3 YTD Long Term Goal Adjusted EBITDA (%) +260 bps 14% Improvements driven by: ▪ Implementation of cost-conscious culture ➢ Rationalized unprofitable business & plants ➢ Strategic headcount reduction of 20+% ➢ Continuous improvement program ▪ Creating ‘OneTeam’ across plants versus multiple stand-alone teams 3,259 2,592 407 319 300 400 500 2,000 2,500 3,000 3,500 SG&A & Headcount Reduction All Employees SG&A/Salaried Only Linear (All Employees) Linear (SG&A/Salaried Only) (20%) (22%)

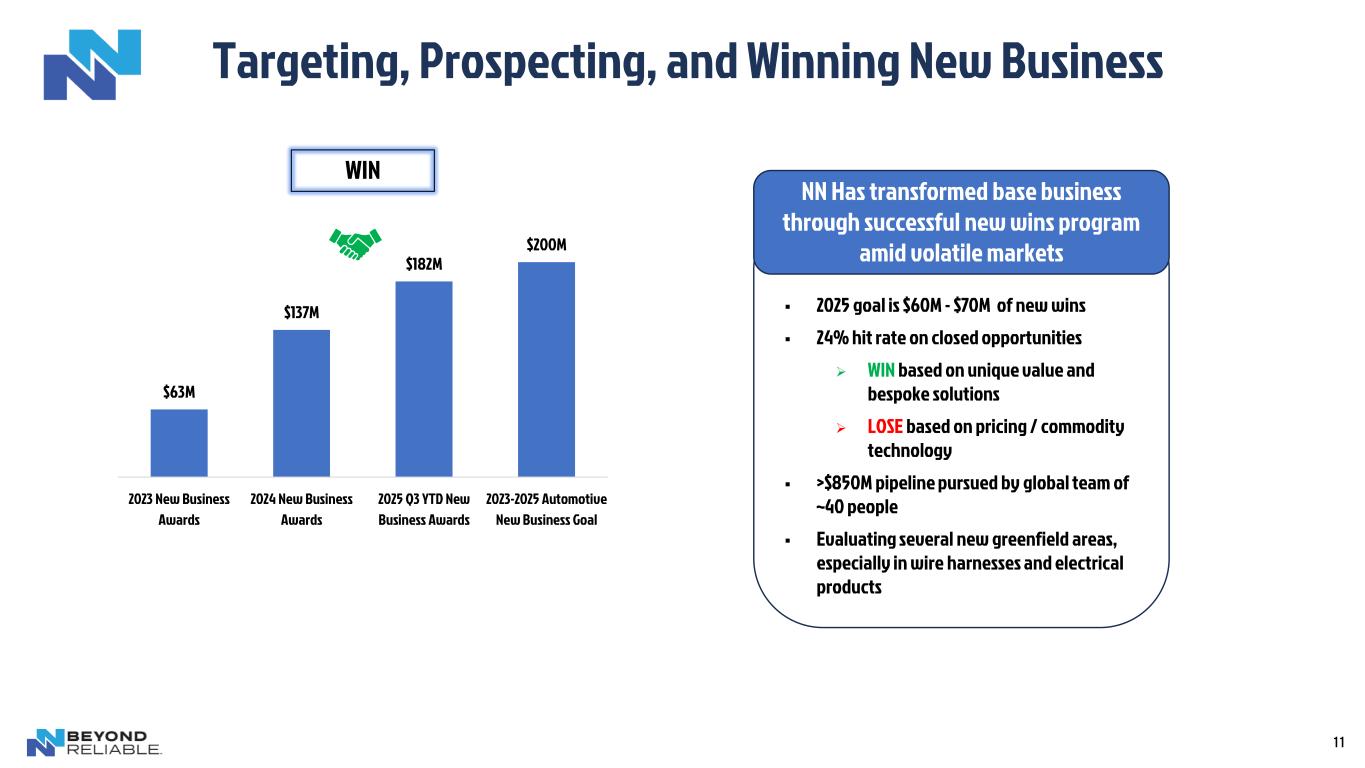

▪ 2025 goal is $60M - $70M of new wins ▪ 24% hit rate on closed opportunities ➢ WIN based on unique value and bespoke solutions ➢ LOSE based on pricing / commodity technology ▪ >$850M pipeline pursued by global team of ~40 people ▪ Evaluating several new greenfield areas, especially in wire harnesses and electrical products Targeting, Prospecting, and Winning New Business $63M $137M $182M $200M 2023 New Business Awards 2024 New Business Awards 2025 Q3 YTD New Business Awards 2023-2025 Automotive New Business Goal WIN 11 NN Has transformed base business through successful new wins program amid volatile markets

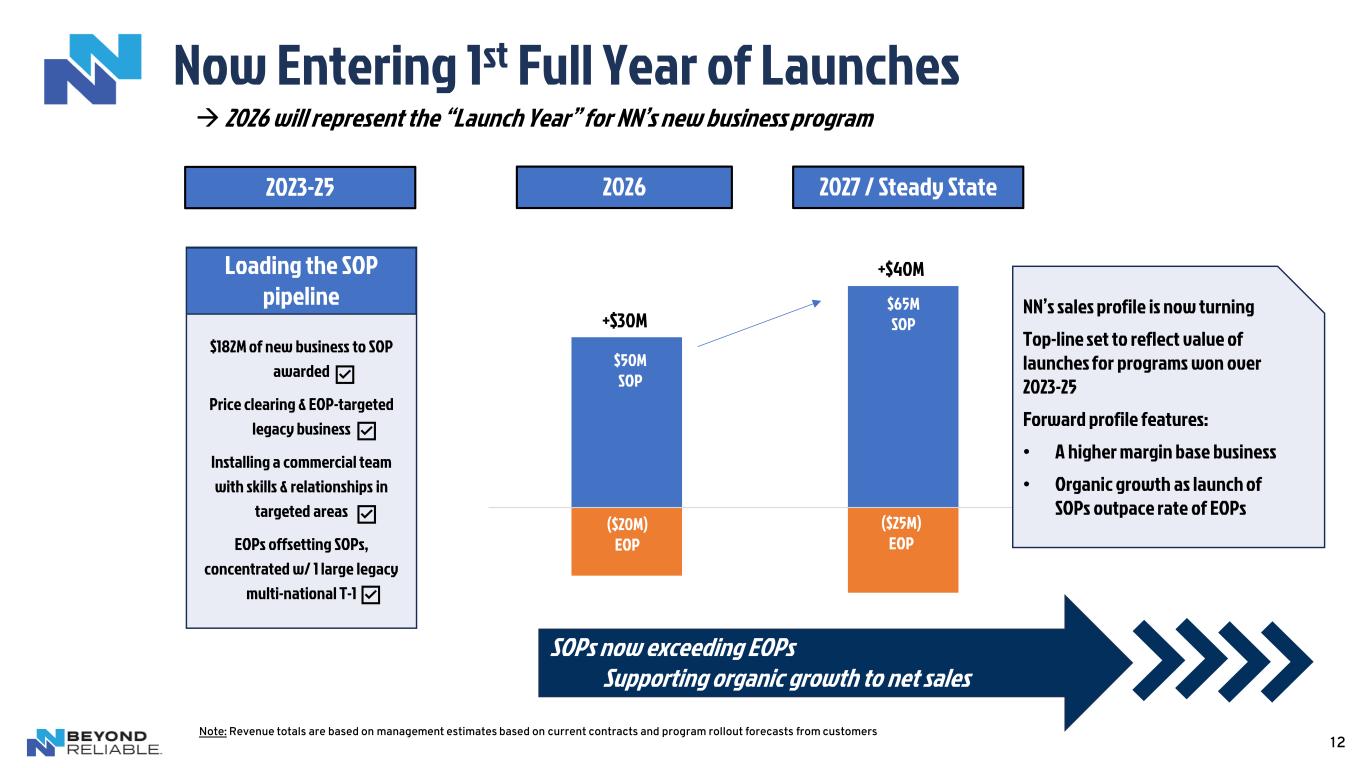

Now Entering 1st Full Year of Launches 12 Note: Revenue totals are based on management estimates based on current contracts and program rollout forecasts from customers 2023-25 $182M of new business to SOP awarded Price clearing & EOP-targeted legacy business Installing a commercial team with skills & relationships in targeted areas EOPs offsetting SOPs, concentrated w/ 1 large legacy multi-national T-1 Loading the SOP pipeline SOPs now exceeding EOPs Supporting organic growth to net sales 2026 2027 $50M SOP ($20M) EOP ($25M) EOP $65M SOP 2026 2027 / Steady State +$30M +$40M NN’s sales profile is now turning Top-line set to reflect value of launches for programs won over 2023-25 Forward profile features: • A higher margin base business • Organic growth as launch of SOPs outpace rate of EOPs → 2026 will represent the “Launch Year” for NN’s new business program

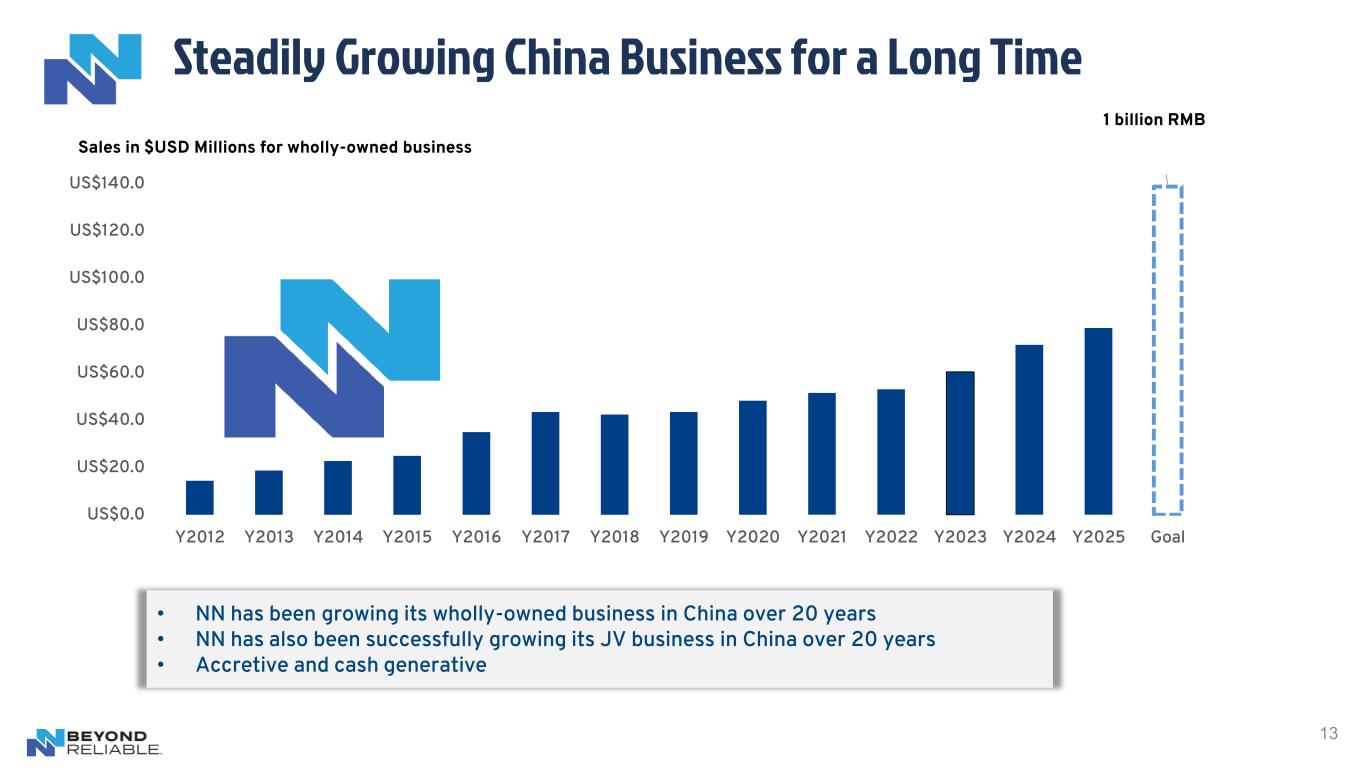

Steadily Growing China Business for a Long Time 13 … US$0.0 US$20.0 US$40.0 US$60.0 US$80.0 US$100.0 US$120.0 US$140.0 Y2012 Y2013 Y2014 Y2015 Y2016 Y2017 Y2018 Y2019 Y2020 Y2021 Y2022 Y2023 Y2024 Y2025 Goal Sales in $USD Millions for wholly-owned business • NN has been growing its wholly-owned business in China over 20 years • NN has also been successfully growing its JV business in China over 20 years • Accretive and cash generative 1 billion RMB

▪ NN is progressing from Phase 1 of its transformation and entering Phase 2 ▪ Phase 1: Creating a scalable core business that generates cash ▪ Optimizing cost structure resetting commercial gameplans ▪ Phase 2: Scale up and grow aggressively ▪ NN is actively evaluating acquisitions to accelerate growth ▪ Larger transformational merger opportunities ▪ Potentially requires balance sheet work in parallel ▪ Small tuck-in acquisitions ▪ Key important aspects of the M&A program are to gain scale in served markets – people, footprint, procurement - increase supplier importance, increase customer importance, technology advancement, capital avoidance and measured diversification by adding attractive new markets Strategic M&A Program Update 14

Strategic Value Enhancement Q3 2025 Highlights New Business Momentum Key wins in defense, medical; expanded team with industry hires Portfolio Management Completing Phase 1 in creating scalable core business; preparing to expand via M&A Preferred Equity Refinancing Initiated discussions to refinance preferred equity; create new capital structure for sustained M&A program and common equity value accretion Strategic M&A Program Underway Evaluating multiple acquisition targets to scale and accelerate growth Strong Free Cash Flow Generation Stronger adjusted operating earnings & consistent improvements in working capital management 15

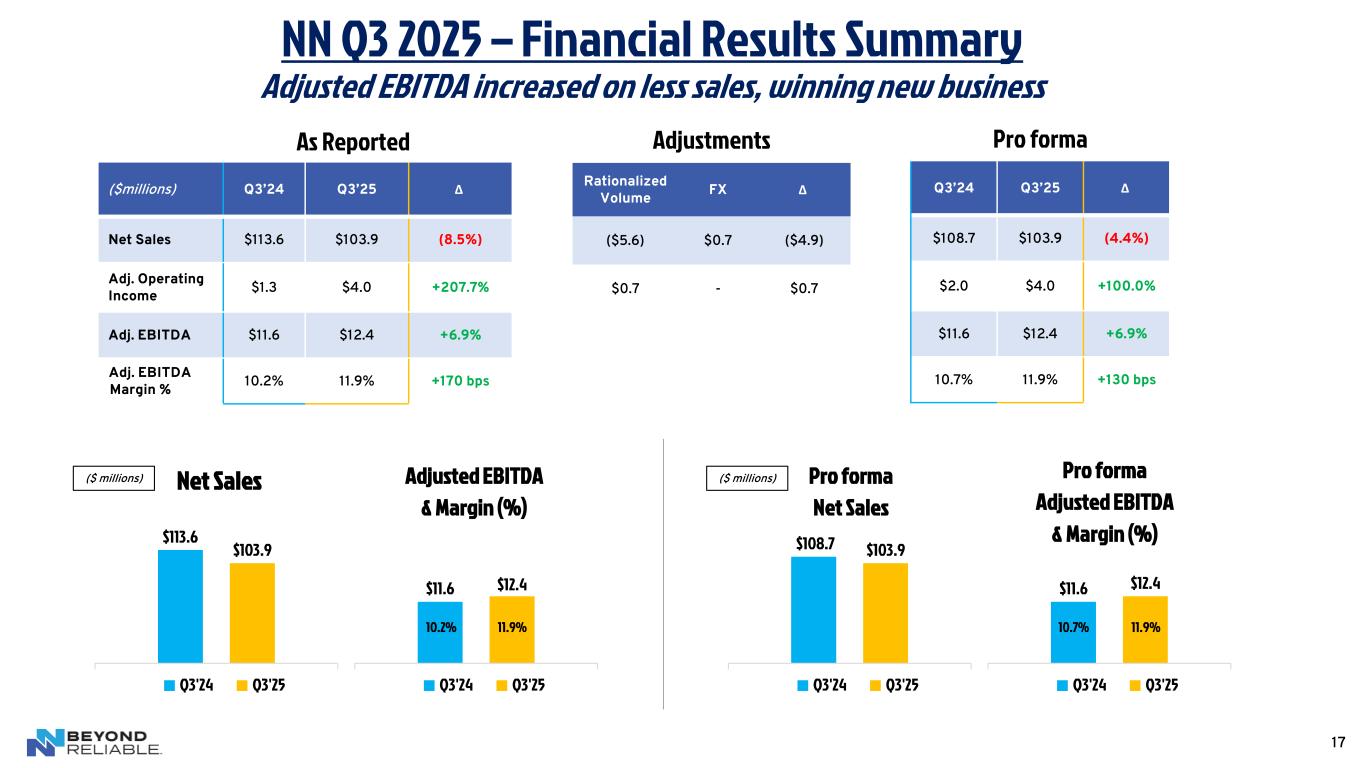

16 Q3 2025 Key Metrics Net Sales: $103.9M Adjusted EBITDA: $12.4M; 11.9% Margin • (+) Power Solutions growth, new launches • (-) Mobile Solutions rationalization, auto production conservatism / uncertainty • 7.9% growth Y/Y growth on lower sales • Margins +170bps, on track for 13-14% 01 02 04 06 03 Adjusted Gross Margin: 18.8% • Operating performance & portfolio shift • Margins +350bps vs. Q1’25 05 Adjusted Operating Income: $4.0M New Business Wins: $11.3M • Results up 3x vs. Q3’24 • 3.9% of net sales, continues strong trend • Foundational wins in defense & medical • 2026 positioned for growth Free Cash Flow: $9.1M • Working capital program performing • $20.9M improvement over last 2+ years • Does not include CARES Act proceeds Softness in North American automotive production has created the opportunity for consolidation of the final high-cost, unprofitable plant in NN’s 5-year plan

($millions) Q3’24 Q3’25 Δ Net Sales $113.6 $103.9 (8.5%) Adj. Operating Income $1.3 $4.0 +207.7% Adj. EBITDA $11.6 $12.4 +6.9% Adj. EBITDA Margin % 10.2% 11.9% +170 bps NN Q3 2025 – Financial Results Summary Adjusted EBITDA increased on less sales, winning new business 17 $11.6 $12.4 Adjusted EBITDA & Margin (%) Q3'24 Q3'25 $113.6 $103.9 Net Sales Q3'24 Q3'25 11.9%10.2% ($ millions) Rationalized Volume FX Δ ($5.6) $0.7 ($4.9) $0.7 - $0.7 Q3’24 Q3’25 Δ $108.7 $103.9 (4.4%) $2.0 $4.0 +100.0% $11.6 $12.4 +6.9% 10.7% 11.9% +130 bps $11.6 $12.4 Pro forma Adjusted EBITDA & Margin (%) Q3'24 Q3'25 $108.7 $103.9 Pro forma Net Sales Q3'24 Q3'25 ($ millions) As Reported Adjustments Pro forma 11.9%10.7%

18 Investment Thesis: Transformation through a Volatile Market Transform Legacy Business; Strengthen base business, grow cash flows Positioned for Eventual Recovery of Legacy Business Ramp Up New Business Wins Refi Balance Sheet, Build Up Via M&A; Phase 1 Phase 2 Launching Wins & Scaling Aggressively

Positioned for Success 19 NN is uniquely positioned to drive meaningful performance and value creation + The cyclical recovery of our legacy markets + Steady ramp up of new business + Atop a materially more profitable, streamlined footprint = Significant leverage to our bottom line!

Appendix 20

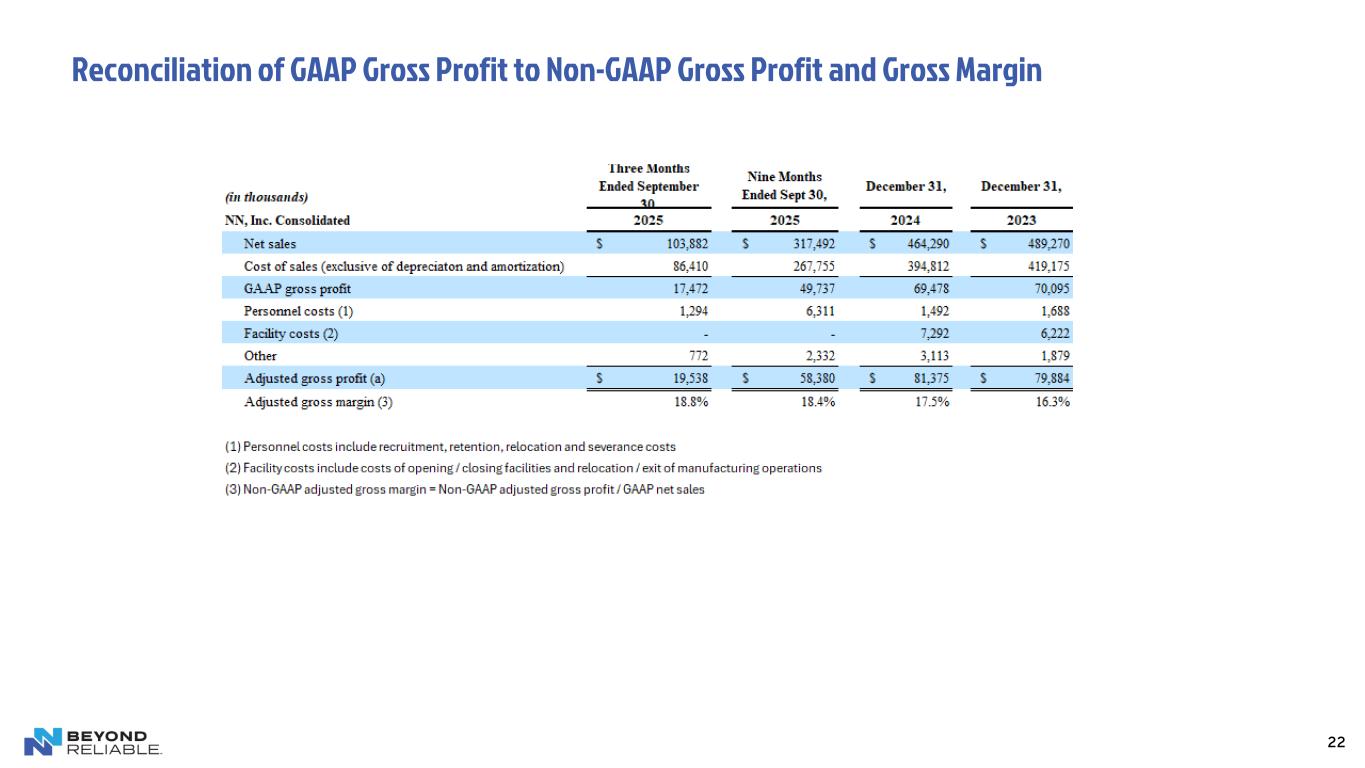

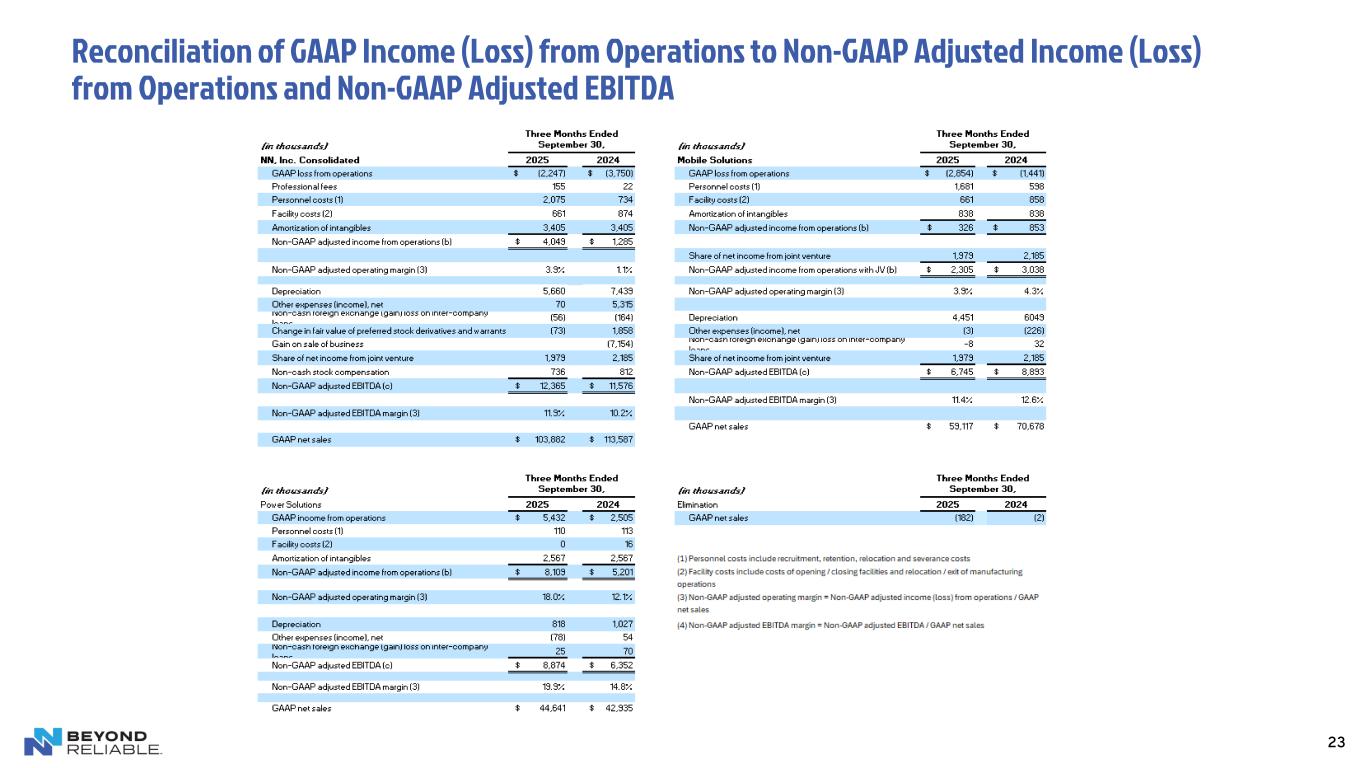

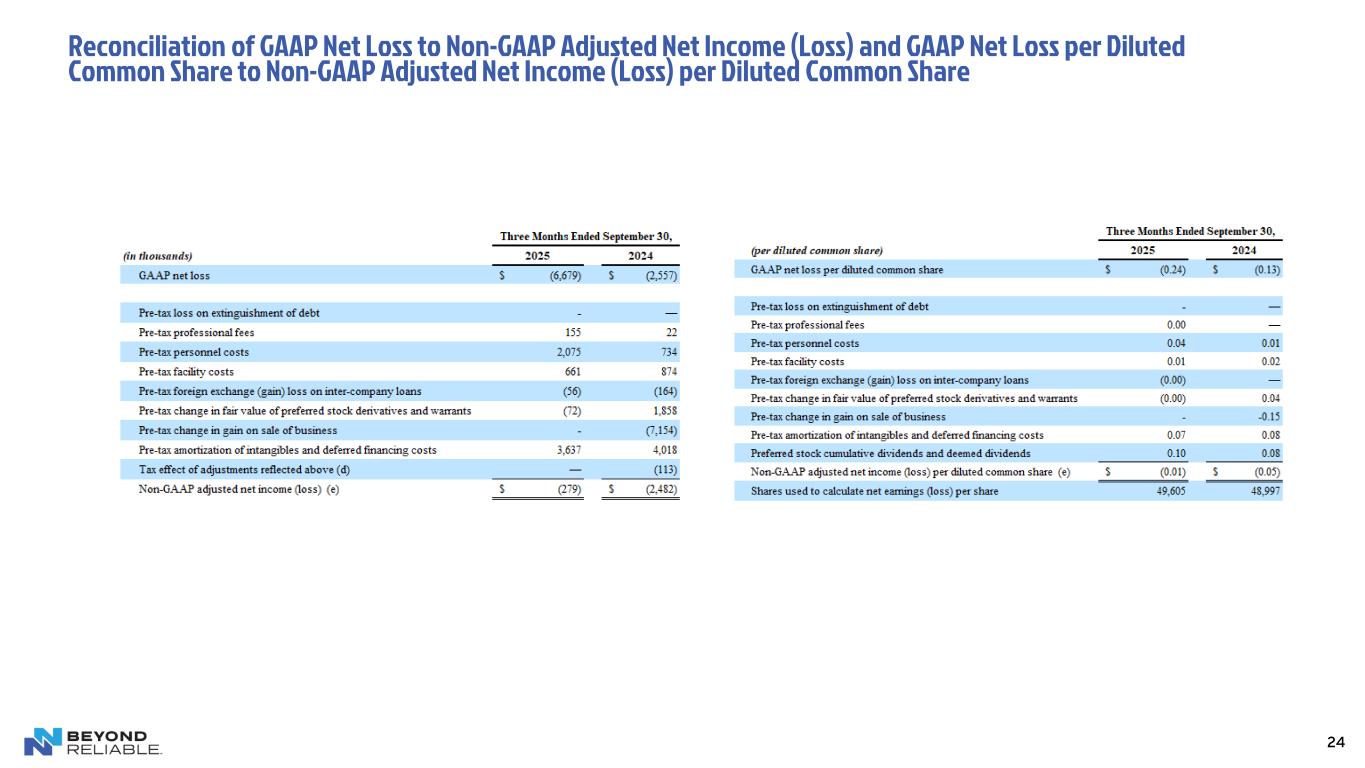

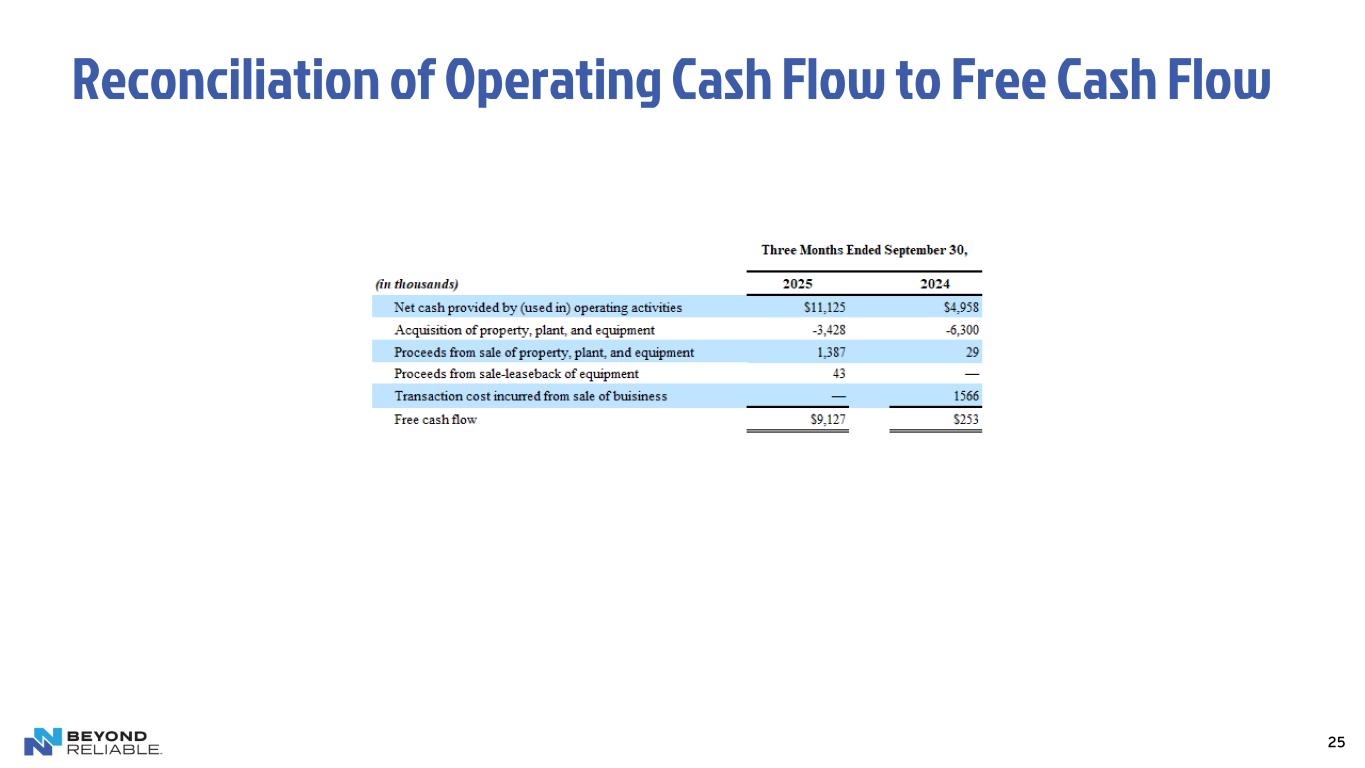

21 The Company discloses in this presentation the non-GAAP financial measures of adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign- exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded, as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods. The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. (a) Non-GAAP adjusted gross margin represents GAAP gross profit, adjusted to exclude the effects of restructuring and integration expense and non-operational charges related to acquisition and transition expense. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted gross margin is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP gross margin. (b) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations. (c) Non-GAAP adjusted EBITDA represents GAAP income (loss) from operations, adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. (d) This line item reflects the aggregate tax effect of all non-GAAP adjustments reflected in the respective table. The Company estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment. (e) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income e (loss) from segment operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. Non-GAAP Financial Measures Footnotes

22 Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit and Gross Margin

23 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA

24 Reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net Income (Loss) and GAAP Net Loss per Diluted Common Share to Non-GAAP Adjusted Net Income (Loss) per Diluted Common Share

25 Reconciliation of Operating Cash Flow to Free Cash Flow

Thank You 26 Joe Caminiti or Stephen Poe NNBR@alpha-ir.com 312-445-2870 Investor & Media Contacts