TRANSFORMED AND READY TO LAUNCH Investor Presentation December 2025

2 Forward Looking Statements This presentation contains express and implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our long-term targets, the impact of, and our ability to execute, our corporate strategies and business initiatives and the current contracts and program rollout forecasts may have on our financial statements and results of operations. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “growth,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project”, “trajectory” or other similar words, phrases or expressions. Forward-looking statements involve a number of risks and uncertainties that are outside of management’s control and that may cause actual results to be materially different from such statements. Such factors include, among others, general economic conditions and economic conditions in the industrial sector; the potential impacts of tariffs on the U.S. economy, the economy of other countries in which we conduct operations and our industry, as well as the potential implications and ramifications of tariffs on our business and the local and global supply chains supporting the same, and our ability to mitigate any adverse impacts of such; competitive influences; risks that current customers will commence or increase captive production; risks of capacity underutilization; quality issues; material changes in the costs and availability of raw materials; economic, social, political and geopolitical instability, military conflict, currency fluctuation, and other risks of doing business outside of the United States; inflationary pressures and changes in the cost or availability of materials, supply chain shortages and disruptions, the availability of labor and labor disruptions along the supply chain; our dependence on certain major customers, some of whom are not parties to long-term agreements (and/or are terminable on short notice); the impact of acquisitions and divestitures, as well as expansion of end markets and product offerings; our ability to hire or retain key personnel; the level of our indebtedness; the restrictions contained in our debt agreements; our ability to obtain financing at favorable rates, if at all, and to refinance existing debt as it matures; our ability to secure, maintain or enforce patents or other appropriate protections for our intellectual property; uncertainty of government policies and actions after recent U.S. elections in respect to global trade, tariffs and international trade agreements; and cyber liability or potential liability for breaches of our or our service providers’ information technology systems or business operations disruptions. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in NN, Inc.'s (the "Company") filings made with the U.S. Securities and Exchange Commission. Any forward-looking statement speaks only as of the date of this presentation and are based on information available to the Company at the time those statements are made and/or management’s good faith belief as of that time with respect to future events. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. The Company qualifies all forward-looking statements by these cautionary statements. In this presentation, we use the following non-GAAP measures: adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted EBITDA margin, and free cash flow. See the Appendix to this presentation for definitions of each non-GAAP measure and reconciliations to the most comparable GAAP measure.

3 At a Glance ▪ NN is a precision component producer that delivers custom-made products and processes through customer co-development ▪ NN is known for delivering exceptional functionality and delivered quality that makes us BEYOND RELIABLE ▪ Well positioned in several attractive end-markets 9001:2015 13485:2016 Sales $424 Million (+$130 Million JV) Adjusted EBITDA $48 Million 11% Margin Employees ~2,600 (+700 JV) Customers ~700 Other Key End Markets: • Americas and EMEA Automotive • Commercial Vehicle • Industrial & Construction • Medical ~50% of NN sales NN’s Top 3 End Markets: 1. Electrical Grid & Distribution 2. Defense & Electronics 3. China Automotive TTM as of 9/30/2025

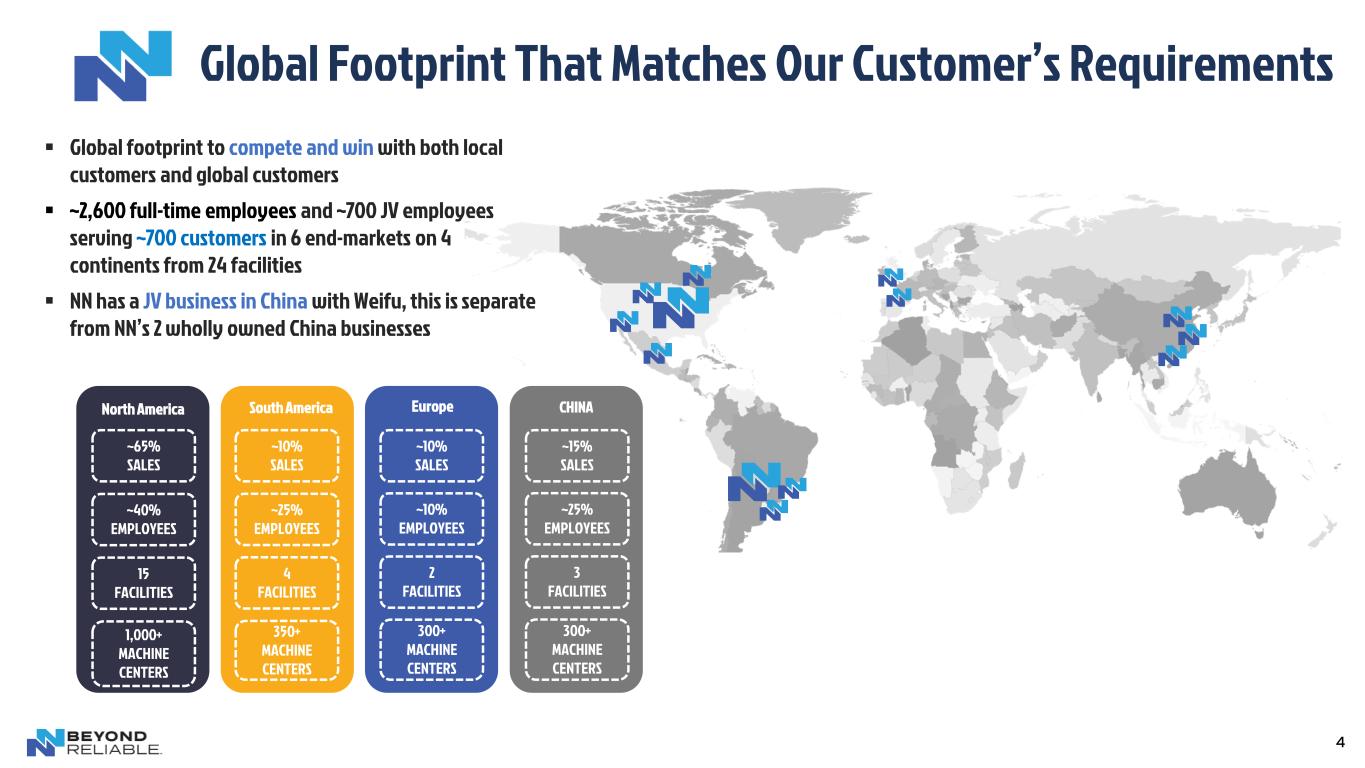

4 ▪ Global footprint to compete and win with both local customers and global customers ▪ ~2,600 full-time employees and ~700 JV employees serving ~700 customers in 6 end-markets on 4 continents from 24 facilities ▪ NN has a JV business in China with Weifu, this is separate from NN’s 2 wholly owned China businesses Global Footprint That Matches Our Customer’s Requirements North America ~65% SALES ~40% EMPLOYEES 15 FACILITIES Europe ~10% SALES ~10% EMPLOYEES 2 FACILITIES South America ~10% SALES ~25% EMPLOYEES 4 FACILITIES ~15% SALES ~25% EMPLOYEES 3 FACILITIES 1,000+ MACHINE CENTERS 350+ MACHINE CENTERS 300+ MACHINE CENTERS 300+ MACHINE CENTERS CHINA

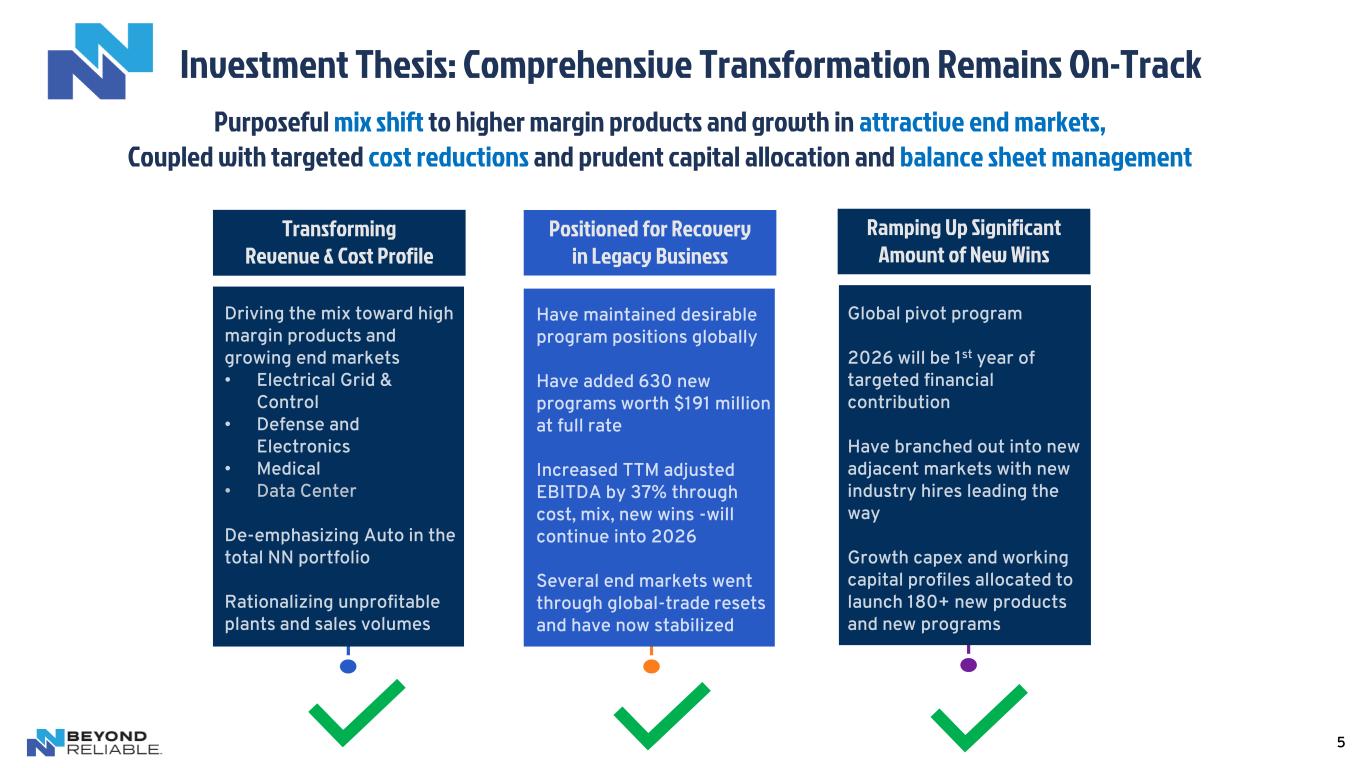

5 Investment Thesis: Comprehensive Transformation Remains On-Track Ramping Up Significant Amount of New Wins Positioned for Recovery in Legacy Business Transforming Revenue & Cost Profile Purposeful mix shift to higher margin products and growth in attractive end markets, Coupled with targeted cost reductions and prudent capital allocation and balance sheet management

On-Track for Long-Term Targets 6 Net sales of $600M through organic growth & market recovery • $325M of new business wins driving multi-year growth & improved mix Adjusted EBITDA margins of 13-14%; Gross Margin 18-20% • Consistent, focused program delivering continuous improvement Optimize balance sheet, but at the right time • Monitoring capital markets during 2026 / 2027 for financial alternatives and strategic alternatives

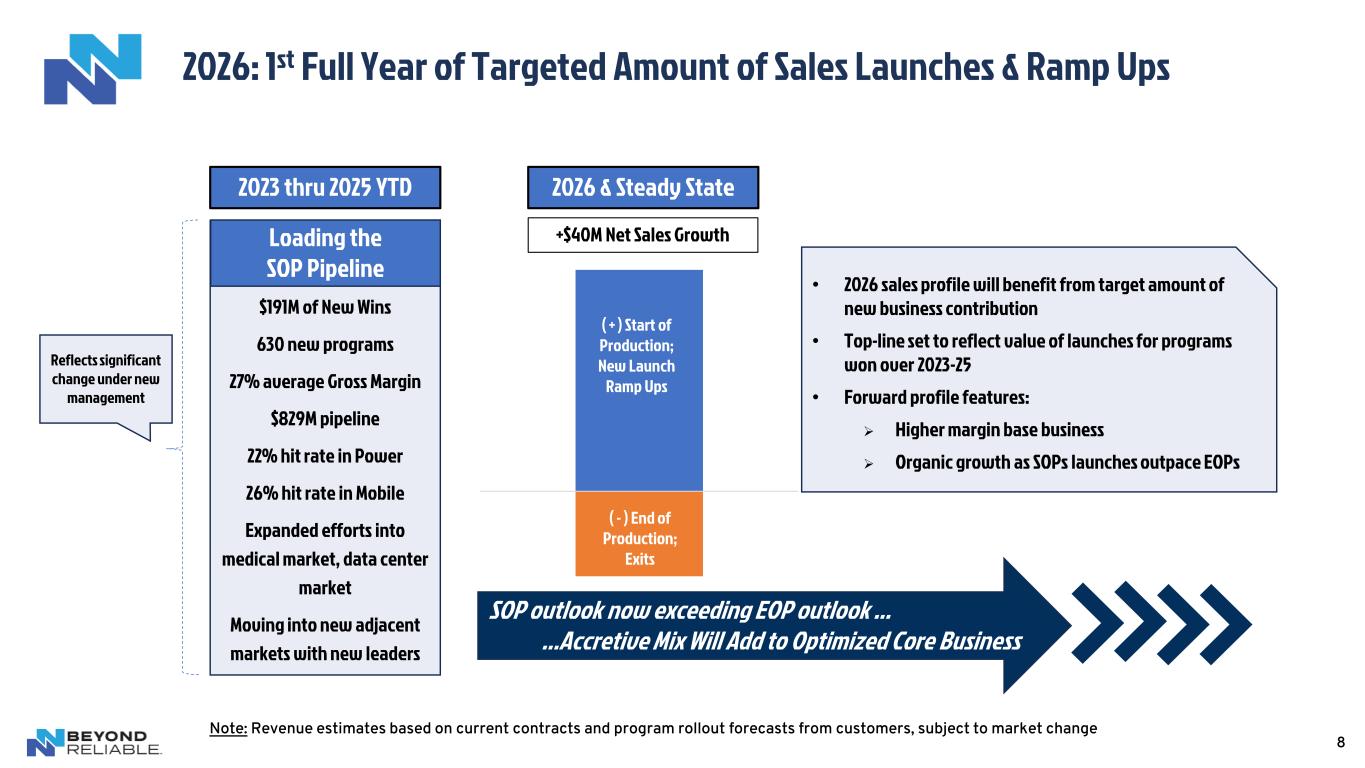

7 New Win Program: Driving Growth, Transforming Sales Mix New Wins Are Transforming Sales Profile • Will return to Y/Y sales growth in 2026 • 2026: 1st year of targeted amount of launches from ~$191M new business wins from 2023 thru Nov. 25, 2025 • De-emphasizing U.S. Auto • Now ~10% of NN portfolio • China auto remains attractive long-term • Portfolio now skewed towards defense & electronics, electrical grid & distribution, China auto 2026 and Beyond: Consistent Top-Line Growth • Forecasting continuous annual sales growth • $829M pipeline – winning with solid hit rates • $40M expected annual targeted net contribution from expected organic sales – upside as currently sluggish markets recover • Operating within strict cash flow profile Investing for Next Stage of Growth • Growth capex allocated to higher value segments fitting NN capabilities • Invested in stronger, more diverse sales organization, accountable teams • Strong prospects in wire harnessing for electrical, aero & defense, data center ecosystems • New business program targets high- growth verticals with stronger margins

2026: 1st Full Year of Targeted Amount of Sales Launches & Ramp Ups 8 Note: Revenue estimates based on current contracts and program rollout forecasts from customers, subject to market change 2023 thru 2025 YTD $191M of New Wins 630 new programs 27% average Gross Margin $829M pipeline 22% hit rate in Power 26% hit rate in Mobile Expanded efforts into medical market, data center market Moving into new adjacent markets with new leaders Loading the SOP Pipeline SOP outlook now exceeding EOP outlook ... ...Accretive Mix Will Add to Optimized Core Business 2026 & Steady State 2027( - ) End of Production; Exits ( + ) Start of Production; New Launch Ramp Ups +$40M Net Sales Growth • 2026 sales profile will benefit from target amount of new business contribution • Top-line set to reflect value of launches for programs won over 2023-25 • Forward profile features: ➢ Higher margin base business ➢ Organic growth as SOPs launches outpace EOPs Reflects significant change under new management

Intentionally Shifting the Sales Mix -- Customers, Products, End Markets 9 Current Sales Mix & End Market Ranking 1 Electrical Grid / Electrical Distribution 2 Defense and Electronics 3 Auto – China 4 Commercial Vehicle 5 Industrial / Other 6 N. American Auto 7 S. American Auto 8 European Auto 9 Medical 10 Data Center Top 3 End Markets Stay at the Top of the Mix From New Win Focus and Market Performance Changing the Mix Data Center and Medical Rise De-emphasizing Commodity Auto Business Globally 2029 Goals & Target End Marketing Ranking 1 Electrical Grid / Electrical Distribution 2 Defense and Electronics 3 Auto – China 4 Medical 5 Data Center 6 Commercial Vehicle 7 Industrial / Other 8 Auto - NA 9 Auto - SA 10 Auto - EU ~50% of NN Business

10 Recently Added Multiple Industry Veterans to Strengthen Sales Push into New, Adjacent Markets New Adjacent Complementary MarketsCore Markets Automotive Electrical Medical Defense General Industrial Infotainment Drones Data Centers AGV (Automated Guided) Vehicles) Robots Power Generation Laser Optics OphthalmologyDental IVD Defense Tiers AutonomousBattery Alternative Energy Oil & Gas

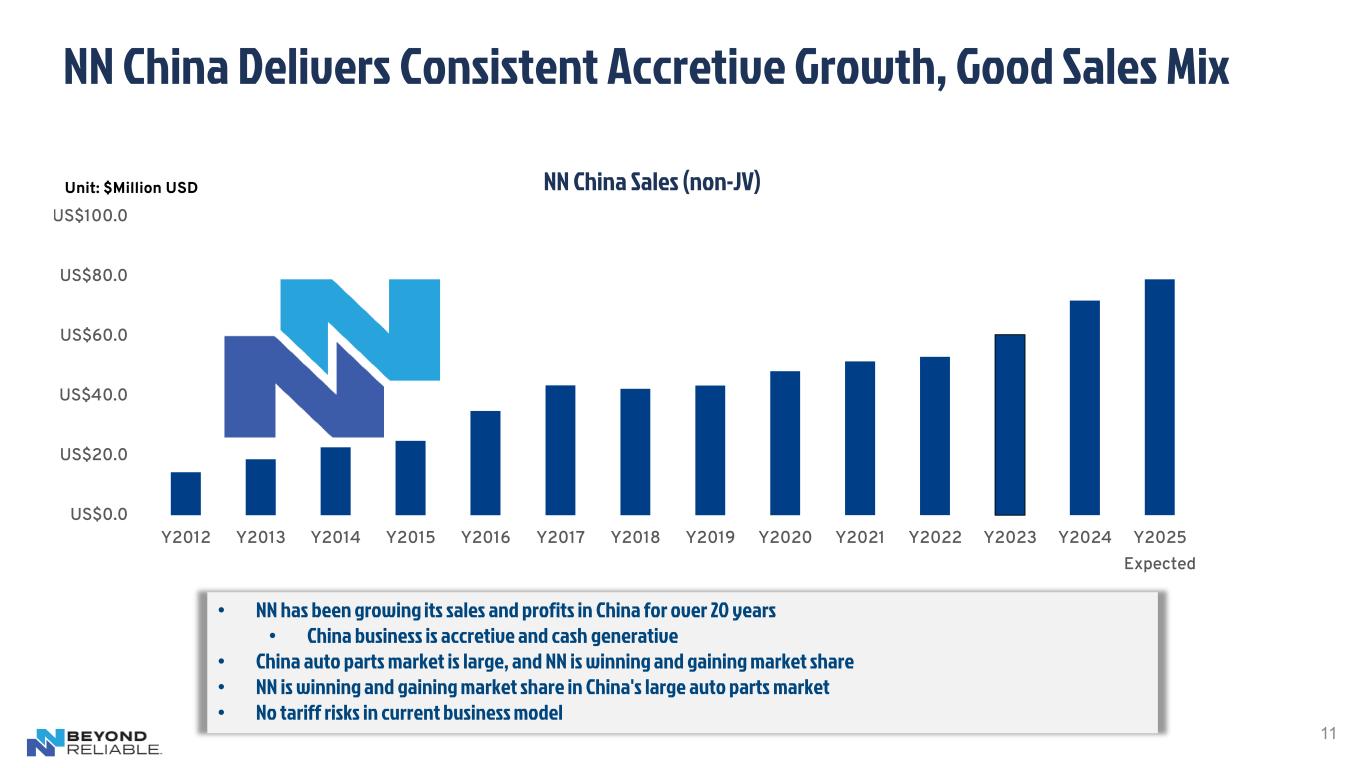

NN China Delivers Consistent Accretive Growth, Good Sales Mix 11 $79.0 US$0.0 US$20.0 US$40.0 US$60.0 US$80.0 US$100.0 Y2012 Y2013 Y2014 Y2015 Y2016 Y2017 Y2018 Y2019 Y2020 Y2021 Y2022 Y2023 Y2024 Y2025 Expected Unit: $Million USD • NN has been growing its sales and profits in China for over 20 years • China business is accretive and cash generative • China auto parts market is large, and NN is winning and gaining market share • NN is winning and gaining market share in China's large auto parts market • No tariff risks in current business model NN China Sales (non-JV)

12 Q3 2025 Key Metrics Business Improving Y/Y on Less Global Auto Sales Net Sales: $103.9M Adjusted EBITDA: $12.4M; 11.9% Margin (+) Power Solutions growth, new launches (-) Mobile Solutions “80/20” rationalization, auto production uncertainty • Growing 7.9% Y/Y on “80/20” focused sales, improving mix • Margins +170bps, on track for 13-14% 01 02 04 06 03 Adjusted Gross Margin: 18.8% • Rationalizing certain sales, improving operating performance, growing good mix, lowering costs 05 Adjusted Operating Income: $4.0M New Business Wins: $11.3M • 3.9% of net sales, continues strong improvement trend • On-track for benchmark performance • On track for 2026 target, 3-Year target • 2026 will feature 1st year of targeted new win contribution Free Cash Flow: $9.1M • $20.9M improvement over last 2+ years • Does not include CARES Act proceeds • Funding growth capex and working capital

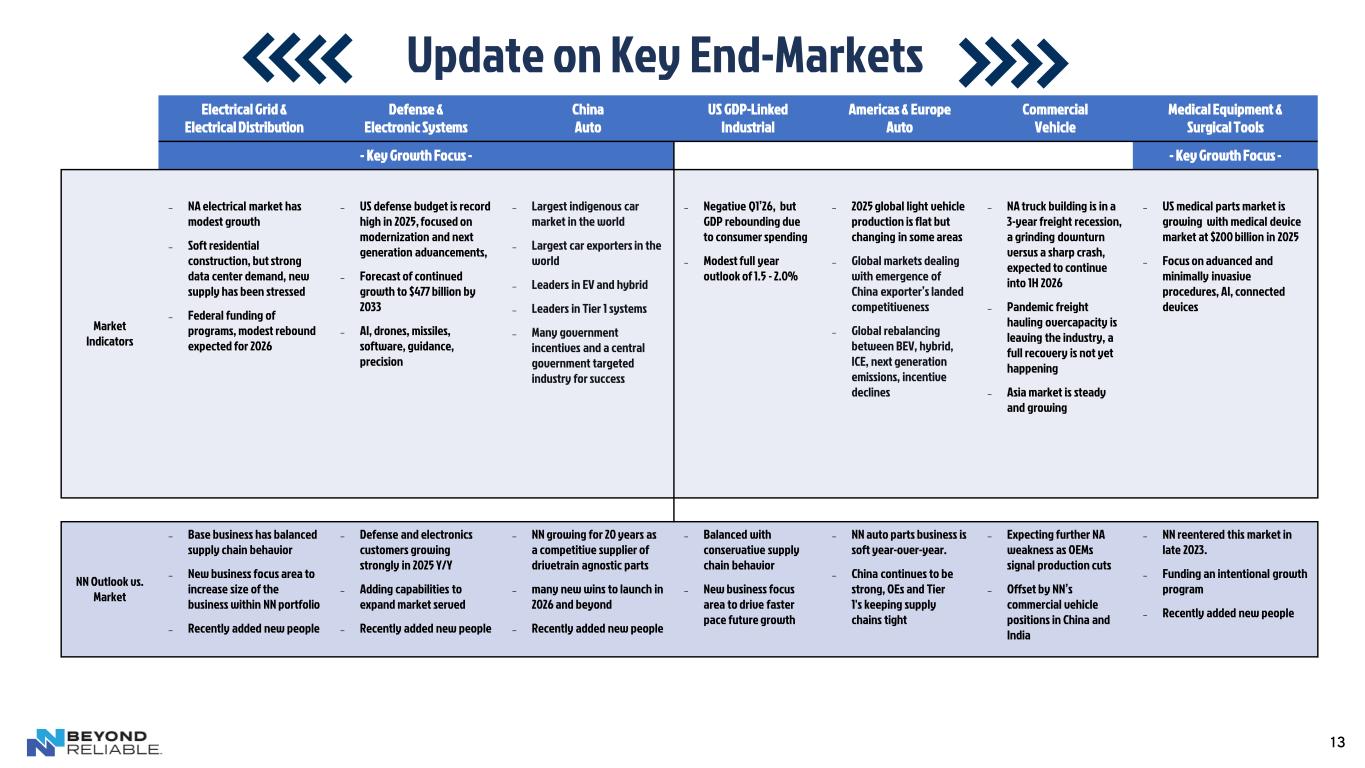

13 Update on Key End-Markets Electrical Grid & Electrical Distribution Defense & Electronic Systems China Auto US GDP-Linked Industrial Americas & Europe Auto Commercial Vehicle Medical Equipment & Surgical Tools - Key Growth Focus - - Key Growth Focus - Market Indicators ― NA electrical market has modest growth ― Soft residential construction, but strong data center demand, new supply has been stressed ― Federal funding of programs, modest rebound expected for 2026 ― US defense budget is record high in 2025, focused on modernization and next generation advancements, ― Forecast of continued growth to $477 billion by 2033 ― AI, drones, missiles, software, guidance, precision ― Largest indigenous car market in the world ― Largest car exporters in the world ― Leaders in EV and hybrid ― Leaders in Tier 1 systems ― Many government incentives and a central government targeted industry for success ― Negative Q1’26, but GDP rebounding due to consumer spending ― Modest full year outlook of 1.5 - 2.0% ― 2025 global light vehicle production is flat but changing in some areas ― Global markets dealing with emergence of China exporter’s landed competitiveness ― Global rebalancing between BEV, hybrid, ICE, next generation emissions, incentive declines ― NA truck building is in a 3-year freight recession, a grinding downturn versus a sharp crash, expected to continue into 1H 2026 ― Pandemic freight hauling overcapacity is leaving the industry, a full recovery is not yet happening ― Asia market is steady and growing ― US medical parts market is growing with medical device market at $200 billion in 2025 ― Focus on advanced and minimally invasive procedures, AI, connected devices NN Outlook vs. Market ― Base business has balanced supply chain behavior ― New business focus area to increase size of the business within NN portfolio ― Recently added new people ― Defense and electronics customers growing strongly in 2025 Y/Y ― Adding capabilities to expand market served ― Recently added new people ― NN growing for 20 years as a competitive supplier of drivetrain agnostic parts ― many new wins to launch in 2026 and beyond ― Recently added new people ― Balanced with conservative supply chain behavior ― New business focus area to drive faster pace future growth ― NN auto parts business is soft year-over-year. ― China continues to be strong, OEs and Tier 1's keeping supply chains tight ― Expecting further NA weakness as OEMs signal production cuts ― Offset by NN’s commercial vehicle positions in China and India ― NN reentered this market in late 2023. ― Funding an intentional growth program ― Recently added new people

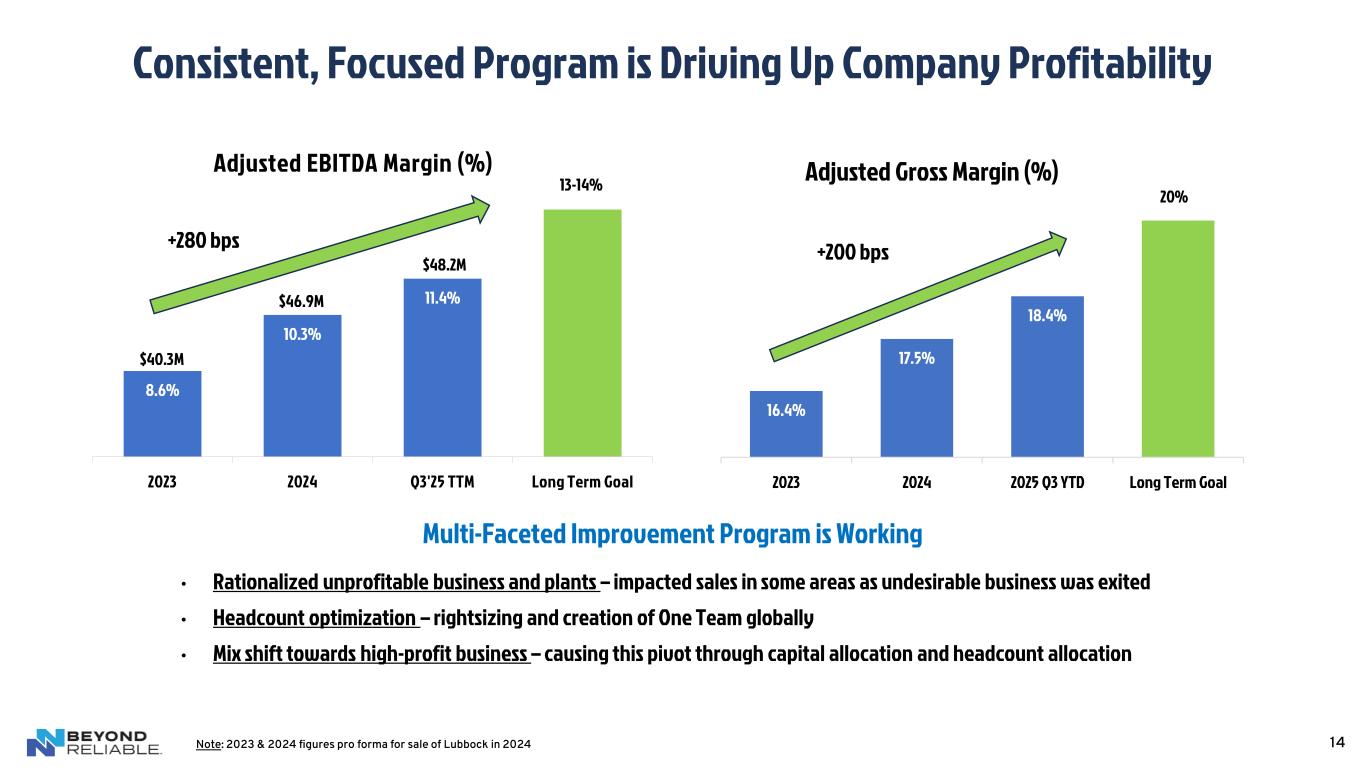

14 Consistent, Focused Program is Driving Up Company Profitability 16.4% 17.5% 18.4% 2023 2024 2025 Q3 YTD Long Term Goal Adjusted Gross Margin (%) 20% +200 bps 8.6% 10.3% 11.4% 2023 2024 Q3'25 TTM Long Term Goal Adjusted EBITDA Margin (%) +280 bps 13-14% Multi-Faceted Improvement Program is Working • Rationalized unprofitable business and plants – impacted sales in some areas as undesirable business was exited • Headcount optimization – rightsizing and creation of One Team globally • Mix shift towards high-profit business – causing this pivot through capital allocation and headcount allocation $40.3M $46.9M $48.2M Note: 2023 & 2024 figures pro forma for sale of Lubbock in 2024

Positioned for Success 15 NN is uniquely positioned to drive meaningful performance and value creation + Cyclical Recovery of Legacy Markets + Ramp up of New Business + Materially Lower Cost Footprint = Significant Leverage to our Bottom Line!

16 What’s Next? Momentum into 2026 Transformation will continue to deliver results Prioritizing shareholder value: evaluating all value maximizing options Value unlock through balance sheet • Markets and New Wins driving towards Y/Y sales growth in 2026 • Transformation advancing and continuing on all fronts • Forecast for 4th consecutive year of Y/Y improvement across key profit metrics • Create a strong and scalable core business through focus and “80/20” approaches ➢ Eliminate unprofitable, cash consuming business and plants ➢ Replace with accretive new business and higher margins • When time is right - targeted M&A to accelerate pace and scale of transformation • Capital structure optimization continues in parallel • Will monitor capital markets during 2026-27 while evaluating financial alternatives and strategic alternatives • Goal is to have a balance sheet that enables growth and cost / competitive leadership Commitment to Value Creation 1 2 3

Appendix 17

18 The Company discloses in this presentation the non-GAAP financial measures of adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted EBITDA margin, adjusted net income (loss), adjusted net income (loss) per diluted share and free cash flow. Each of these non-GAAP financial measures provides supplementary information about the impacts of acquisition, divestiture and integration related expenses, foreign-exchange impacts on inter-company loans, reorganizational and impairment charges. The costs we incur in completing acquisitions, including the amortization of intangibles and deferred financing costs, and divestitures are excluded from these measures because their size and inconsistent frequency are unrelated to our commercial performance during the period, and we believe are not indicative of our ongoing operating costs. We exclude the impact of currency translation from these measures because foreign exchange rates are not under management’s control and are subject to volatility. Other non-operating charges are excluded, as the charges are not indicative of our ongoing operating cost. We believe the presentation of adjusted gross margin, adjusted income (loss) from operations, adjusted EBITDA, adjusted net income (loss), adjusted net income (loss) per diluted share and free cash flow provides useful information in assessing our underlying business trends and facilitates comparison of our long-term performance over given periods. The non-GAAP financial measures provided herein may not provide information that is directly comparable to that provided by other companies in the Company's industry, as other companies may calculate such financial results differently. The Company's non-GAAP financial measures are not measurements of financial performance under GAAP and should not be considered as alternatives to actual income growth derived from income amounts presented in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. (a) Non-GAAP adjusted gross margin represents GAAP gross profit, adjusted to exclude the effects of restructuring and integration expense and non-operational charges related to acquisition and transition expense. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted gross margin is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP gross margin. (b) Non-GAAP adjusted income (loss) from operations represents GAAP income (loss) from operations, adjusted to exclude the effects of restructuring and integration expense; non-operational charges related to acquisition and transition expense, intangible amortization costs for fair value step-up in values related to acquisitions, non-cash impairment charges, and when applicable, our share of income from joint venture operations. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income (loss) from operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from operations. (c) Non-GAAP adjusted EBITDA represents GAAP income (loss) from operations, adjusted to include income taxes, interest expense, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, depreciation and amortization, charges related to acquisition and transition costs, non-cash stock compensation expense, foreign exchange gain (loss) on inter-company loans, restructuring and integration expense, costs related to divested businesses and litigation settlements, income from discontinued operations, and non-cash impairment charges, to the extent applicable. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. (d) This line item reflects the aggregate tax effect of all non-GAAP adjustments reflected in the respective table. The Company estimates the tax effect of the adjustment items identified in the reconciliation schedule above by applying the applicable statutory rates by tax jurisdiction unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment. (e) Non-GAAP adjusted net income (loss) represents GAAP net income (loss) adjusted to exclude the tax-affected effects of charges related to acquisition and transition costs, foreign exchange gain (loss) on inter-company loans, restructuring and integration charges, amortization of intangibles costs for fair value step-up in values related to acquisitions and amortization of deferred financing costs, non-cash impairment charges, write-off of unamortized debt issuance costs, interest rate swap payments and change in fair value, change in fair value of preferred stock derivatives and warrants, costs related to divested businesses and litigation settlements, income (loss) from discontinued operations, and preferred stock cumulative dividends and deemed dividends. We believe this presentation is commonly used by investors and professional research analysts in the valuation, comparison, rating, and investment recommendations of companies in the industrial industry. We use this information for comparative purposes within the industry. Non-GAAP adjusted income e (loss) from segment operations is not a measure of financial performance under GAAP and should not be considered as a measure of liquidity or as an alternative to GAAP income (loss) from continuing operations. Non-GAAP Financial Measures Footnotes

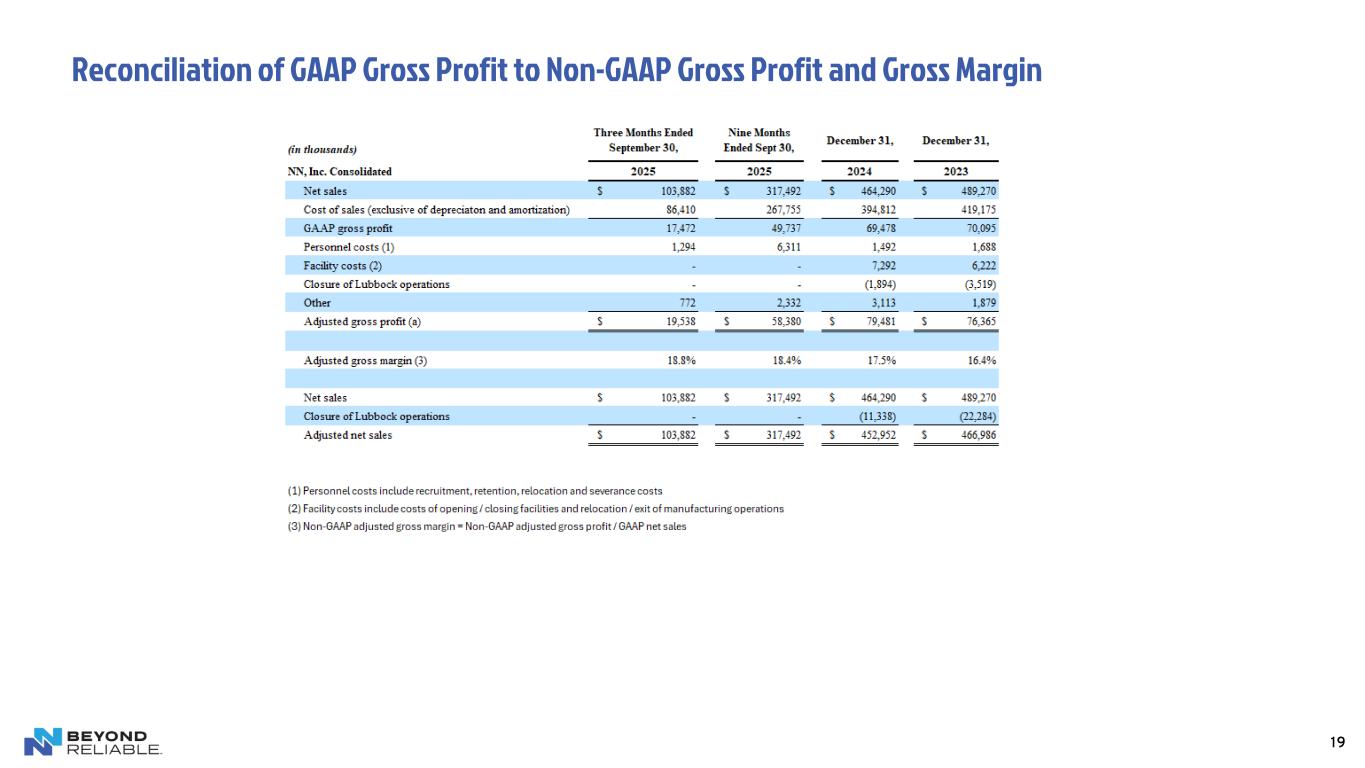

19 Reconciliation of GAAP Gross Profit to Non-GAAP Gross Profit and Gross Margin

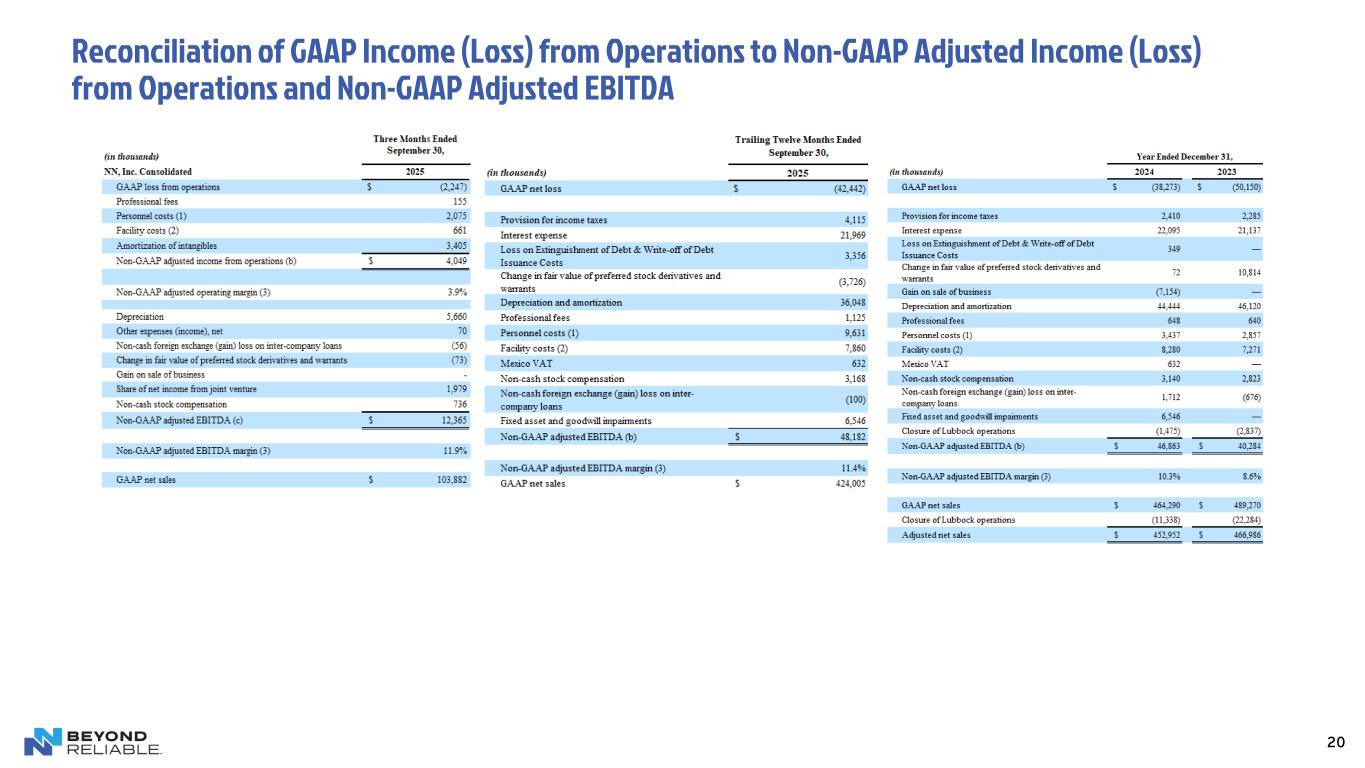

20 Reconciliation of GAAP Income (Loss) from Operations to Non-GAAP Adjusted Income (Loss) from Operations and Non-GAAP Adjusted EBITDA

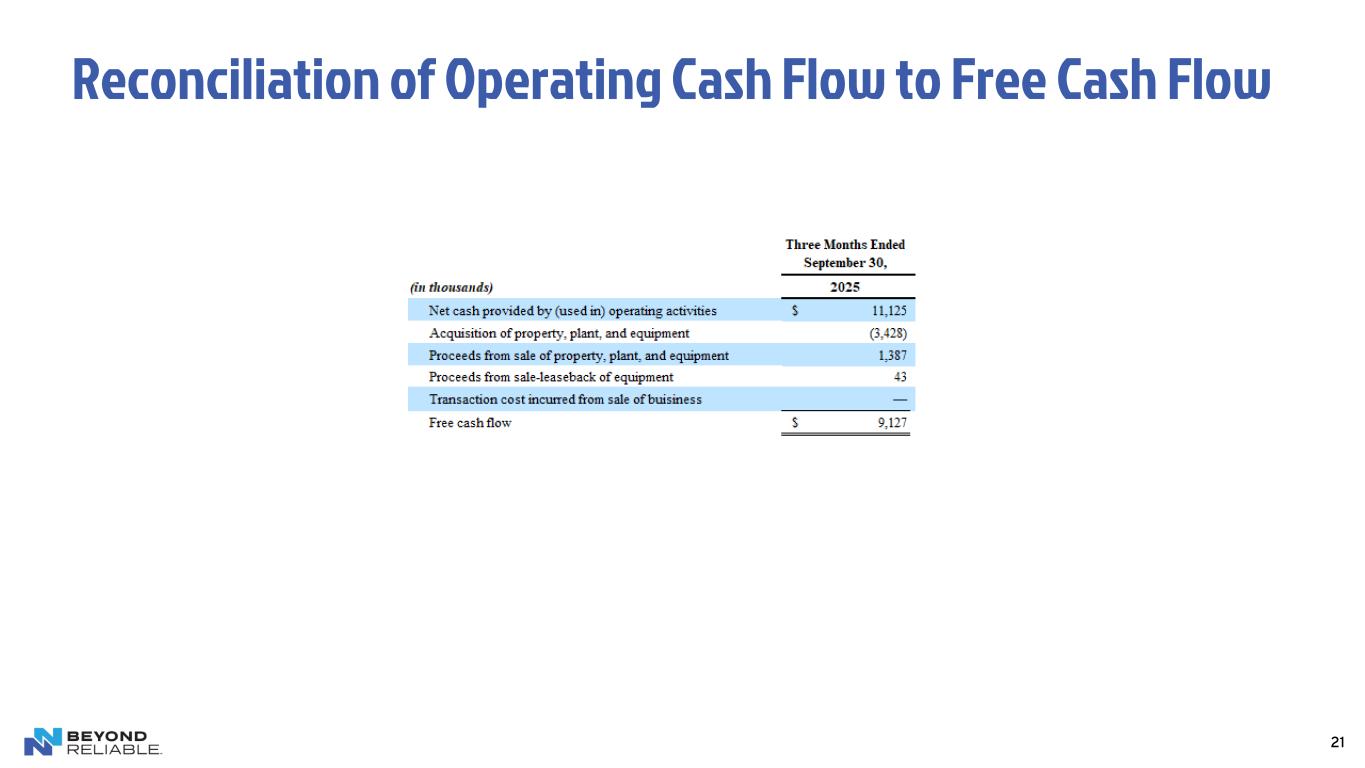

21 Reconciliation of Operating Cash Flow to Free Cash Flow