Please wait

EXHIBIT 4.1

ELDORADO GOLD CORPORATION

RESTRICTED

SHARE UNIT PLAN

for Designated Participants

amended

and restated as of March 27, 2019

1.1

The purposes of the

Plan are to:

(a)

promote the

alignment of interests between Designated Participants and the

shareholders of the Company;

(b)

assist the Company

in attracting, retaining and motivating employees and officers of

the Company and of its related entities; and

(c)

provide a

compensation system for Designated Participants that is reflective

of the responsibility, commitment and risk accompanying their

management role over the medium term.

2.1

For the purposes of

the Plan, the following terms have the respective meanings set

forth below:

(a)

“Black-Out Period” means that

period during which a trading black-out period is imposed by the

Company to restrict trades in the Company’s securities by a

Designated Participant;

(b)

“Board” means the board of

directors of the Company;

(c)

“Business Combination” has the

meaning ascribed to that term in Subsection 9.7;

(d)

“Cause” means any act, which at

common law in the applicable jurisdiction, would be considered

cause for dismissal without the obligation to provide notice or pay

in lieu of notice;

(e)

“Change of Control”

means:

(i)

an acquisition of

40% or more of the voting rights attached to all outstanding voting

shares of the Company by a person or combination of persons acting

in concert by virtue of an agreement, arrangement, commitment or

understanding, or by virtue of a related series of such events, and

whether by transfer of existing shares or by issuance of shares

from treasury or both; or

(ii)

the amalgamation,

consolidation or combination of the Company with, or merger of the

Company into, any other person, whether by way of amalgamation,

arrangement or otherwise, unless (1) the Company is the surviving

person or the person formed by such amalgamation, consolidation or

combination, or into which the Company has merged, is a corporation

and (2) immediately after giving effect to such transaction at

least 60% of the voting rights attached to all outstanding voting

shares of the Company or the corporation resulting from such

amalgamation, consolidation or combination, or into which the

Company is merged, as the case may be are owned by persons who held

the voting rights attached to all outstanding voting shares of the

Company immediately before giving effect to such transaction;

or

(iii)

the direct or

indirect transfer, conveyance, sale, lease or other disposition, by

virtue of a single event or a related series of such events, of 90%

or more of the assets of the Company based on gross fair market

value to any person unless (1) such disposition is to a corporation

and (2) immediately after giving effect to such disposition, at

least 60% of the voting rights attached to all outstanding voting

shares of such corporation are owned by the Company or its related

entities or by persons who held the voting rights attached to all

outstanding voting shares of the Company immediately before giving

effect to such disposition; or

(iv)

at least 50% of the

directors constituting the Board cease to be directors as a result

of, in connection with, or pursuant to a contract relating to (a) a

Change of Control as defined in paragraphs (i), (ii) or (iii), or

(b) an actual or threatened contest with respect to the election or

removal of directors or other actual or threatened solicitation of

proxies by or on behalf of a person or persons (other than a

solicitation that was approved by directors constituting a majority

of the Board);

(f)

“Company” means Eldorado Gold

Corporation;

(g)

“Compensation Committee” means the

compensation committee of the Board and if there is none, means the

full Board;

(h)

“Designated Participant” means such

employees or officers of the Company or a related entity of the

Company as the Board may designate from time to time as eligible to

participate in the Plan;

(i)

“Disability” means a physical or

mental incapacity of a nature which the Board determines prevents

or would prevent the Designated Participant from satisfactorily

performing the substantial and material duties of his or her

position with the Company or the related entity of the Company, as

the case may be;

(j)

“Distributions” means dividends or

other distributions or proceeds received by the Trustee on the

account of the Shares held in trust by the Trustee for the RSU

Plan, and includes proceeds raised by the Trustee on any sale of

rights issued in connection with a rights offering by the

Company;

(k)

“Exchange” means, if the Shares are

listed on the TSX, the TSX and, if the Shares are not listed on the

TSX, any other principal exchange upon which the Shares are

listed;

(l)

“Grant Date” has the meaning

ascribed thereto in Subsection 5.1;

(m)

“Market Value” of a Restricted

Share Unit or a Share means, on any given date, the closing trading

price per share of the Shares on the Exchange on the trading day

immediately preceding the relevant date, provided that if the

Shares are suspended from trading or have not traded on the

Exchange for an extended period of time, then the market value will

be the fair market value of a Share as determined by the Board in

its sole discretion;

(n)

“NI 45-106” means National

Instrument 45-106 – Prospectus and Registration

Exemptions;

(o)

“Plan” or “RSU Plan” means this Restricted

Share Unit Plan of the Company as set forth herein as the same may

be amended and/or restated from time to time;

(p)

“Redemption Date” means, subject to

Subsection 7.3, in respect of an RSU, the earlier of the last

day of the Restricted Period applicable to the RSU and the date of

termination of employment or engagement of the holder of the RSU,

provided that for U.S. Designated Participants Redemption Date

shall have the meaning set forth in Subsection 7.7

hereof;

(q)

“Redemption Notice” means a notice

of redemption substantially in the form of Schedule B –

Redemption Notice;

(r)

“Regulators” has the meaning

ascribed thereto in Subsection 10.1;

(s)

“related entity” has the meaning

ascribed to that term in Section 2.22 of

NI 45-106;

(t)

“Restricted Period” means a period

as specified by the Board in accordance with Subsection 5.1

after the expiration of which and subject to the terms herein, a

Designated Participant may be or becomes entitled to receive Shares

and/or amount payable on account of the redemption of Restricted

Share Units;

(u)

“Restricted Share Unit Account” has

the meaning ascribed thereto in Subsection 6.1;

(v)

“Restricted Share Units” or

“RSUs” means a

bookkeeping entry, denominated in Shares (on a one for one basis),

credited to the Restricted Share Unit Account of a Designated

Participant in accordance with the provisions hereof;

(w)

“RSU Agreement” has the meaning

ascribed thereto in Subsection 5.3;

(x)

“Share” means, subject to

Section 9 hereof, a Common share without par value in the

capital of the Company;

(y)

“Take-Over Bid” has the meaning

ascribed to that term in Subsection 9.6;

(z)

“Trading Day” means any day on

which the Exchange is open for trading of Shares provided that if

the Shares are no longer listed on any stock exchange, means any

day which is a business day in British Columbia;

(aa)

“Trust” means the trust established

in respect of this Plan under the terms of a trust agreement

between the Trustee and the Company;

(bb)

“Trustee” means a qualified trust

company designated by the Board to administer the acquisition of

Shares in the open market for the purposes of the Plan and to hold

Shares purchased in connection with the Plan in trust for the

purposes of the Plan; and

(cc)

“TSX” means the Toronto Stock

Exchange;

(dd)

“U.S. Designated Participant” means

any Designated Participant subject to tax under the United States

Internal Revenue Code of 1986 in respect of compensation from the

Company or its related entity; and

(ee)

“Vested RSU” has the meaning

ascribed to that term in Subsection 7.1.

2.2

Unless otherwise

agreed to in writing by the Board, a reference in respect of

employment or engagement of employees or officers to

“termination”, “termination date”,

“date of termination” or similar terms herein is deemed

to be the day that is the last day of active employment or

engagement with the Company or its related entity, as the case may

be, regardless of any salary continuance or notice period provided

or required under applicable law or the reason for termination of

employment or engagement (whether with or without Cause or with or

without notice). For greater certainty, any such reference to

termination means termination of the last position (whether as an

employee or officer) that the Designated Participant had with the

Company or its related entity, as applicable.

2.3

Unless otherwise

indicated, all dollar amounts referred to in this RSU Plan are in

Canadian funds.

2.4

As used in this

Plan,

(a)

unless the context

otherwise requires, words importing the masculine gender shall

include the feminine and neuter genders, and words importing the

singular shall include the plural and vice versa;

(b)

unless the context

otherwise requires, the expressions “herein”,

“hereto”, “hereof”,” hereunder”

or other similar terms refer to the Plan as a whole, together with

the schedules, and references to a Section, Subsection, paragraph

or Schedule by number or letter or both refer to the Section,

Subsection, paragraph or Schedule, respectively, bearing that

designation in the Plan; and

(c)

the term

“include” (or words of similar import) is not limiting

whether or not non-limiting language (such as “without

limitation” or words of similar import) is used with

reference thereto.

3.

Administration of the Plan

3.1

The Plan shall be

administered by the Compensation Committee.

3.2

The Chief Executive

Officer of the Company or the Chairman of the Board shall

periodically make recommendations to the Compensation Committee as

to the grant of RSUs.

3.3

The Compensation

Committee shall, periodically, after considering the

recommendations of the Chief Executive Officer and the Chairman,

make recommendations to the Board as to the grant of

RSUs.

3.4

In addition to the

powers granted to the Board under the Plan and subject to the terms

of the Plan, the Board shall have full and complete authority to

grant RSUs, to interpret the Plan, to prescribe such rules and

regulations as it deems necessary for the proper administration of

the Plan and to make such determinations and to take such actions

in connection therewith as it deems necessary or advisable. Any

such interpretation, rule, determination or other act of the Board

shall be conclusively binding upon all persons.

3.5

The Board shall

appoint a Trustee:

(a)

to administer the

acquisition of Shares in the open market for the purposes of the

Plan;

(b)

subject to the

terms of the Plan, to hold the Shares acquired in the market in

trust for the Designated Participants entitled to redeem RSUs in

accordance with the terms of the Plan;

(c)

subject to the

terms of the Plan, to hold in trust for, or in respect of Vested

RSUs, pay to, Designated Participants the Distributions received in

respect of the Shares referred to in paragraph 3.5(b) in accordance

with the terms of the Plan;

(d)

upon direction of

the Company, deliver Shares and/or a cash payment to Designated

Participants entitled to redemption of Vested RSUs in accordance

with and subject to the terms of the Plan, pursuant to the terms of

the Plan;

(e)

to record and

provide to the Company all necessary information to permit the

Company to attend to all income tax, social security contributions

withholding and other source deductions and reporting requirements

in respect of the Plan and the Designated Participants, under

applicable income tax legislation social security legislation, or

any income source deduction legislation;

(f)

upon direction of

the Company, attend to the timely filing of a T3 tax return and

other applicable tax returns for the Trust for each calendar year

for which such filing is required and to the payment, when due, of

all taxes payable under such returns, and attend to such other tax

compliance steps within its power as may be requested by the

Company; and

(g)

such other duties

in respect of the administration of the Plan as deemed appropriate

or desirable by the Compensation Committee and as set out in a

trust agreement approved by the Compensation

Committee.

3.6

The Board may

authorize one or more officers of the Company to execute and

deliver and to receive documents on behalf of the

Company.

4.

Shares Subject to the Plan

4.1

The maximum number

of Shares which may be delivered under the Plan shall not exceed

5,000,000 Shares, subject to adjustment as provided in

Section 9.

4.2

The Shares that may

be delivered pursuant to the Plan may be acquired subsequently to

or in anticipation of a redemption hereunder in the open market to

satisfy the redemption requirements under the Plan.

4.3

The Board will

cause and fund the Trustee to arrange for the purchase of a

sufficient number of Shares to satisfy the redemption of

outstanding RSUs granted under the Plan. Any Shares acquired in excess of

the number of Shares required to satisfy redemptions, including

without limitation any Shares that become excess Shares upon

cancellation of an RSU as provided herein shall remain in trust

until the Plan is terminated and, upon termination of the Plan,

such Shares shall be returned to treasury for cancellation. For

greater certainty, no Shares or any Distributions or any interest

thereon will be transferred by the Trustee to the Company or a

related entity of the Company. Subject to Subsections 7.5 and

7.6, unless and until

the RSU granted to a Designated Participant vests and is redeemed

in accordance with the terms herein, the Designated Participant

does not have any right, title or interest in any Shares held by

the Trustee or any proceeds in respect thereof.

5.1

Subject to the

provisions of the Plan, the Board shall have the right to grant, in

its sole discretion and from time to time, to any Designated

Participants RSUs as a discretionary grant in consideration of

services to the Company with such terms and conditions as the Board

may determine. The Board shall also determine, in its sole

discretion, in connection with each grant of RSUs:

(a)

the date on which

such RSUs are to be granted (the “Grant Date”);

(b)

the number of RSUs

to be granted;

(c)

the terms under

which an RSU shall vest;

(d)

the Restricted

Period, provided that the Restricted Period with respect to a grant

of RSUs shall not exceed that period commencing on January 1

coincident with or immediately preceding the grant and ending on

November 30 of the third year following the calendar year in which

such RSUs were granted; and

(e)

any other terms and

conditions (which need not be identical) of all RSUs covered by any

grant.

5.2

If the RSUs are

inadvertently granted during a Black-Out Period, then the Grant

Date shall be deemed to be the first Trading Day following the end

of the Black-Out Period and any adjustment to the terms as may be

required by applicable law shall be made to such

terms.

5.3

Upon the grant of

an RSU, the Designated Participant and the Company shall enter into

an RSU agreement (“RSU

Agreement”) in a form set out in Schedule A1 (for time

based vesting), Schedule A2 (for performance based vesting) or in

such other form as approved by the Board, which shall set out the

name of the Designated Participant, the number of RSUs, the

Restricted Period, the vesting terms, the Grant Date, and such

other terms and conditions as the Board may deem

appropriate.

5.4

An RSU is personal

to the Designated Participant and is non-assignable and

non-transferable other than by will or by the laws governing the

devolution of property in the event of death of the Designated

Participant.

6.1

An account, to be

known as a “Restricted Share

Unit Account”, shall be maintained by or on behalf of

the Company for each Designated Participant and shall be credited

with such number of RSUs as are granted to a Designated Participant

from time to time. Each Designated Participant’s Restricted

Share Unit Account shall indicate the number of RSUs which have

been credited to such account from time to time together with the

Restricted Period, vesting terms and, if applicable, any

accumulated Distributions or other rights applicable to such RSU as

expressly provided for herein.

6.2

RSUs that have not

vested in accordance with the Plan prior to the earlier of the last

day of the Restricted Period and the date the relevant termination

event referred to in Section 8 occurred, or that are redeemed

in accordance with the Plan, shall be cancelled and a notation to

such effect shall be recorded in the Designated Participant’s

Restricted Share Unit Account and the Designated Participant will

have no further right, title or interest in such RSUs and, for

greater certainty, in any related payment (cash or Share) or other

right, including any right to Distributions, except in the case of

Vested RSUs that have been redeemed but the payment has not been

paid to the Designated Participant, the right to receive the

payment applicable to the redeemed Vested RSU less any amounts that

may be withheld or deducted hereunder.

7.

Vesting, Redemption and Payment of Restricted Share

Units

7.1

Unless otherwise

specified by the Board, subject to the remaining provisions of this

Section 7, RSUs granted to a Designated Participant shall vest in

accordance with the vesting schedule established by the Board at

the time of the grant or on the achievement of performance vesting

targets as determined by the Board in its sole discretion and in

each case as set out in the Designated Participant's RSU Agreement.

RSUs may not be redeemed until the required period or periods have

elapsed or the performance targets have been met as determined by

the Board in its sole discretion, as the case may be. Except where

the context requires otherwise, each RSU which is vested pursuant

to this Section 7, Subsection 8.5 or as a result of action by the

Board to accelerate the vesting period or waive the vesting terms

pursuant to its authority under Subsections 8.4, 9.6 or 9.7 shall

be referred to herein as a “Vested RSU”.

7.2

Unless previously

redeemed in accordance with Subsection 7.3, subject to

Subsection 11.1, all Vested RSUs shall be redeemed by the

Company on the Redemption Date of the Vested RSU and subject to the

remaining provisions of this Section 7 (including any

withholding requirements) and Section 8, each Designated

Participant shall receive, with respect to all RSUs that are Vested

RSUs, at the election

of the Board in its sole discretion:

(a)

a cash payment

equal to the Market Value of such Vested RSUs as of the Redemption

Date; or

(b)

such number of

Shares delivered by the Trustee, as are equal to the number of such

Vested RSUs; or

(c)

any combination of

the foregoing, such that the cash payment plus such number of

Shares delivered by the Trustee, have a value equal to the Market

Value of such Vested RSUs as of the Redemption Date;

in each

case as soon as practicable following the Redemption Date, and in

any event, for non-US Designated Participants, no later than

December 31 of the third calendar year following the calendar year

in which the RSUs were granted, and for US Designated Participants,

no later than 30 days following the Redemption Date.

7.3

Provided that the

RSU has vested, a Designated Participant may elect early redemption

of a Vested RSU by filing a Redemption Notice with the Corporate

Secretary specifying the Redemption Date, which shall not be less

than 5 days after the date the Redemption Notice is received by the

Company, but may not be later than the earlier of the last day of

the Restricted Period applicable to the Vested RSU and the date of

termination of employment or engagement of the holder of the Vested

RSU, which Redemption Notice acknowledges that such Vested RSUs are

to be redeemed. A Redemption Notice shall specify how many Vested

RSUs held by the Designated Participant at the time the Redemption

Notice is filed are to be redeemed, and Subsection 7.2 shall

apply mutatis mutandis to any such early redemption.

7.4

The Company shall not be required to

deliver fractional Shares on account of the redemption of RSUs. If

any fractional interest in a Share would, except for this

provision, be deliverable on account of the redemption of RSUs,

such fractional interest shall be rounded down to the next whole

number of such Shares.

7.5

Upon the redemption

of any Vested RSU, a Designated Participant shall be entitled to be

paid and shall be paid as soon as practicable following redemption,

a pro rata share of any Distributions that have been paid to the

Trustee on account of the Shares held by the Trustee in respect of

the Vested RSUs being redeemed and that have not previously been

distributed to the Designated Participant, less any withholding

taxes, social security contributions and other source deductions

applicable thereon and less the pro rata portion of any taxes paid

by the Trustee in respect of such Distributions. For greater

certainty, the Distributions on a Vested RSU to which a Designated

Participant is entitled under and subject to this Subsection will

be the Distributions that are paid to the Trustee on the Share

which was acquired for and is represented by the Vested RSU being

redeemed for the period commencing on the date of the grant of the

Vested RSU to the Designated Participant and ending on the

redemption of the Vested RSU of the Designated

Participant.

7.6

Once an RSU becomes

vested, a Designated Participant shall be entitled to be paid a pro

rata share of any Distributions that have been paid to the Trustee

on Shares held by the Trustee in respect of the Vested RSUs of the

Designated Participant and that have not been previously

distributed to the Designated Participant, less any withholding

taxes, social security contributions and other source deductions

applicable thereon and less the pro rata portion of any taxes paid

by the Trustee in respect of the Distributions. For greater

certainty, the Distributions on a Vested RSU to which a Designated

Participant is entitled under and subject to this Subsection will

be the Distributions that are paid to the Trustee on the Share

which was acquired for and is represented by the RSU that has

vested for the period commencing on the date of the grant of the

Vested RSU to the Designated Participant and ending on the

redemption of the Vested RSU of the Designated Participant.

Payments required to be made under this Subsection shall be made as

soon as practicable and in any event not later than the end of the

calendar year during which the Designated Participant payment

entitlement arises under this Subsection.

7.7

The Redemption Date

for RSUs held by U.S. Designated Participants shall be the date on

which such RSUs become Vested RSUs, provided that the Redemption

Date shall not be later than the earlier of the last day of the

Restricted Period and the date of termination of employment or

engagement. Notwithstanding anything to the contrary in Sections

7.5 and 7.6, for U.S. Designated Participants the payment of

Distributions with respect to Vested RSUs will occur at the time of

the payment on redemption of the Vested RSUs but in any event not

later than the end of the calendar year in which the Redemption

Date occurs. Subsection 7.3 shall not apply to RSUs held by U.S.

Designated Participants.

8.

Termination of

Employment and Engagement

8.1

Any Designated

Participant whose employment or engagement with the Company or its

related entity is terminated for any reason whatsoever including

resignation, retirement or Disability, but excluding termination in

the circumstances described in Subsections 8.2 and 8.3, shall

be entitled to have any outstanding RSUs of the Designated

Participant redeemed on the Redemption Date applicable to the RSUs

to the extent such RSUs had vested on the termination date and had

not yet been redeemed and the redemption amount paid to the

Designated Participant in accordance with the terms

herein.

8.2

In the event of the

death of a Designated Participant, either while in the employment

or engagement of the Company, the Designated Participant’s

estate shall be entitled to have any outstanding RSUs of the

Designated Participant redeemed on the Redemption Date applicable

to the RSUs to the extent such RSUs had vested on the date of the

Designated Participant’s death and had not yet been redeemed

and the redemption amount paid to the Designated

Participant’s estate in accordance with the terms herein. The

Designated Participant’s estate shall include only the

executors or administrators of such estate and persons who have

acquired the right to redeem such Vested RSUs directly from the

Designated Participant by bequest or inheritance.

8.3

Notwithstanding any

other provision herein, in the event a Designated

Participant’s employment or engagement is terminated for

Cause, unless the Board, in its sole discretion, determines

otherwise, all outstanding RSUs, whether or not vested, and any and

all rights to a payment with respect to such outstanding RSUs,

including all rights to payment of any Distributions hereunder,

shall be forfeited and cancelled effective as of the termination

date. Any Distributions relinquished and cancelled under this

Subsection less the pro rata portion of any taxes paid by the

Trustee in respect of such Distributions shall be paid to a charity

registered under the Income Tax

Act (Canada) as the Company directs.

8.4

Except as otherwise

determined by the Board and following a termination of employment

or engagement, as the case may be, all rights with respect to RSUs

that are not vested as of the termination date, and any and all

rights to a payment with respect to such outstanding RSUs,

including all rights to payment of any Distribution hereunder, are

relinquished and cancelled. The Board may in its sole discretion

accelerate the vesting period, or otherwise waive the vesting

terms. Any Distributions relinquished and cancelled under this

Subsection less the pro rata portion of any taxes paid by the

Trustee in respect of such Distributions shall be paid to a charity

registered under the Income Tax

Act (Canada) as the Company directs.

8.5

Notwithstanding

Subsection 8.4, above, where any Designated

Participant’s employment or engagement with the Company or

its related entity is terminated:

(a)

by the Company or

its related entity, for any reason other than for Cause, at any

time in the 12 months

following a Change of Control of the Company, or

(b)

by the Designated

Participant, if the Company or its related entity makes a material

adverse change in the location, salary, duties or responsibilities

assigned to the Designated Participant, at any time in the

12 months following a

Change of Control of the Company and the Designated Participant has

provided notice in writing to the Company within 30 days of such

material adverse change to terminate employment, engagement or

directorship,

then

any outstanding RSUs that have not yet vested on the date of

termination shall be deemed to have vested on such

date.

9.

Adjustment on Alteration of Share Capital

9.1

In the event of a

subdivision, consolidation or reclassification of outstanding

Shares or other capital adjustment, or the payment of a stock

dividend thereon, then the number of Shares equal to an RSU shall

be increased or reduced proportionately and such other adjustments

shall be made as may be deemed necessary or equitable by the Board

in its sole discretion and such adjustment shall be binding for all

purposes.

9.2

In the event of a

change to the Company’s currently authorized Shares which is

limited to a change in the designation thereof, the shares

resulting from any such change shall be deemed to be Shares within

the meaning of the Plan.

9.3

Unless the Board

otherwise determines in good faith, if the Company amalgamates,

consolidates or combines with or merges with or into another body

corporate, whether by way of amalgamation, arrangement or otherwise

(the right to do so being hereby expressly reserved), then the

obligation to deliver a Share pursuant to the redemption of a RSU

under Subsection 7.2 may be satisfied by the delivery of the

securities, property and/or cash which the Designated Participant

would have received upon such amalgamation, consolidation,

combination or merger if the Designated Participant’s RSU was

redeemed immediately prior to the effective date of such

amalgamation, consolidation, combination or merger.

9.4

Unless the Board

otherwise determines in good faith, if the Company amalgamates,

consolidates or combines with or merges with or into another body

corporate, whether by way of amalgamation, arrangement or otherwise

(the right to do so being hereby expressly reserved) or a

successful take-over bid is made for all or substantially all of

the Shares, then for the purposes of determining the cash payment

to be made to a Designated Participant on the redemption of a RSU

under Subsection 7.2, the cash payment shall be equal to the fair

market value on the Redemption Date of the securities, property

and/or cash which the Designated Participant would have received

upon such amalgamation, consolidation, combination or merger if the

Designated Participant’s RSU was redeemed immediately prior

to the effective date of such amalgamation, consolidation,

combination or merger or take-over, as determined in good faith by

the Board in its sole discretion and such determination shall be

binding for all purposes of the Plan.

9.5

In the event of any

other change affecting the Shares, then if deemed necessary or

equitable by the Board in its sole discretion to properly reflect

such change, an adjustment may be made which shall be binding for

all purposes of the Plan.

9.6

If, at any time

when an RSU granted under the Plan has not been redeemed, an offer

(“Take-Over

Bid”) to purchase all or substantially all of the

Shares of the Company is made by a third party by means of a

take-over bid circular, the Company shall use its best efforts to

bring such offer to the attention of the Designated Participant as

soon as practicable and the Board may, in a fair and equitable

manner, in its sole discretion, require the acceleration of the

vesting or redemption of the RSU granted under the Plan and of the

satisfaction of or waiver of the fulfillment of any conditions or

restrictions on such redemption (including without limitation,

vesting requirements).

9.7

Notwithstanding any

other provision herein, if because of a proposed merger,

amalgamation, compulsory acquisition or other corporate arrangement

or reorganization, the exchange or replacement of Shares in the

Company for securities, property or cash in or from another company

is imminent (“Business

Combination”), the Board may, in a fair and equitable

manner in its sole discretion, determine the manner in which all

outstanding RSUs shall be treated including, for example, requiring

the acceleration of the vesting and redemption of the RSU by the

Designated Participant and of the satisfaction of or waiver of the

fulfillment of any conditions or restrictions on such redemption

(including without limitation, vesting requirements) or providing

that any Share which would be receivable by a Designated

Participant in respect of a redemption of an RSU prior to the

effective time of the Business Combination be replaced with the

securities, property or cash which the Designated Participant would

have received if the Designated Participant had redeemed his or her

RSU immediately prior to the effective time of the Business

Combination and received Shares, and make any adjustment as may be

deemed necessary or equitable by the Board in its sole discretion

(including consideration of tax law implications). All

determinations of the Board under this Subsection shall be

binding for all purposes of the Plan.

9.8

In order to permit

Designated Participants to participate in a proposed Take-Over Bid

or a proposed Business Combination that could result in a Change of

Control, the Board may in its sole discretion make appropriate

provisions for the redemption of RSUs (whether vested or not)

conditional upon the Shares resulting therefrom being taken up and

paid for under the Take-Over Bid or the completion of the Business

Combination, as applicable.

9.9

No adjustment

provided in this Section 9 shall require the Company to

deliver a fractional RSU or Share or cash payment in lieu thereof

and the total adjustment with respect to each RSU or Share shall be

limited accordingly.

10.1

Notwithstanding any

of the provisions contained in the Plan, Designated

Participant’s RSU Agreement or any term of an RSU, the

Company’s obligations hereunder including obligations to

grant RSUs, deliver Shares hereunder or make payments to a

Designated Participant hereunder shall be subject to:

(a)

compliance with all

applicable laws, regulations, rules, orders of governmental or

regulatory authorities, including without limitation, any stock

exchange on which the Shares are listed (“Regulators”);

(b)

compliance with the

Company’s insider trading policy; and

(c)

receipt from the

Designated Participant of such covenants, agreements,

representations and undertakings, including as to future dealings

in such RSUs, as the Company determines to be necessary or

advisable in order to safeguard against the violation of the

securities laws of any jurisdiction.

If the

Board determines that compliance with all applicable laws,

regulations, rules, orders referenced above (including a

consideration of tax law implications) require changes to the terms

of an RSU, such change shall be determined in good faith by the

Board in its sole discretion.

10.2

Notwithstanding any

provisions in the Plan, Designated Participant’s RSU

Agreement or any term of an RSU, if any amendment, modification or

termination to the provisions hereof or any RSU made pursuant

hereto are required by any Regulator, a stock exchange or a market

as a condition of approval to a distribution to the public of any

Shares or to obtain or maintain a listing or quotation of any

Shares, the Board is authorized to make such amendments as

determined appropriate and in good faith by the Board (including

consideration of tax law implications) and thereupon the terms of

the Plan, Designated Participant’s RSU Agreement and any

RSUs, shall be deemed to be amended accordingly without requiring

the consent or agreement of any Designated Participant or holder of

an RSU.

11.1

If a Restricted

Share Unit is to be redeemed during a Black-Out Period imposed by

the Company, then, notwithstanding any other provision of the Plan,

the Restricted Share Unit shall be redeemed immediately after the

Black-Out Period is lifted by the Company.

11.2

The Plan shall not

confer upon any Designated Participant any right with respect to a

continuation of employment with or engagement by, the Company or a

related entity of the Company nor shall it interfere in any way

with the right of the Company or the related entity to terminate

any Designated Participant’s employment or engagement at any

time.

11.3

For greater

certainty, no interest shall accrue to, or be credited to, the

Designated Participant on any amount payable under the

Plan.

11.4

RSUs are not Shares

and the grant of RSUs does not entitle a Designated Participant to

any rights as a shareholder of the Company nor to any rights to the

Shares or any securities of the Company. Except as expressly

provided for in Subsections 7.5 and 7.6, no holder of any RSU

shall be entitled to receive and no adjustment shall be made for

any Distributions or any other rights declared on the

Shares.

11.5

The Company makes

no representation or warranty as to the future market value of any

RSUs or Shares granted or delivered in accordance with the

provisions of the Plan.

11.6 (a) If

the Company or any of its related entities shall be required to

withhold any amounts by reason of any federal, provincial, state,

local or other laws of any jurisdiction concerning taxes, social

security contributions or other source deductions in connection

with the grants, redemption, Distributions or other payments

hereunder the Company or any such related entity may deduct and

withhold such amount or amounts from any payment made by the

Company or the related entity to a Designated Participant, whether

or not such payment is made pursuant to this Plan. In addition, or as an alternative

to such withholding from payments, the Company or any related

entity of the Company having a withholding obligation as described

above may require a Designated Participant, as a condition of the

grant or redemption of an RSU, to pay to the Company or related

entity, or to the Trust, as the case may be, an amount not

exceeding the total of the withholding obligation of the Company or

related entity arising in respect of the issuance or delivery of

Shares or cash payment to the Designated Participant hereunder, or

to reimburse the Company or the related entity for such

amount.

(b)

If the Trustee

shall be required to withhold any amounts by reason of any federal,

provincial, state, local or other rules or regulations of any

jurisdiction concerning taxes, social security contributions or

other source deductions in connection with the redemption of RSUs,

Distributions, distribution of Shares or other property or other

payments hereunder, the Trustee may deduct and withhold such amount

or amounts from any payment made by the Trustee to a Designated

Participant. In addition, or as an alternative to such withholding

from payments, the Trustee may require a Designated Participant, as

a condition of the redemption of an RSU, payment of Distributions,

or distribution of Shares or other property pay to the Trustee an

amount not exceeding the total of the withholding obligation of the

Trustee arising in respect of the issuance or delivery of Shares or

cash payment to the Designated Participant hereunder, or to

reimburse the Trustee for such amount.

(c)

Under no

circumstances shall the Company, any related entity or the Trustee

be responsible for funding the payment of any tax or amount on

account of social security or other source deductions on behalf of

any Designated Participant or for providing any tax advice to any

Designated Participant.

12.

Effective Date, Amendment and Termination

12.1

The Plan is

effective as of March 16, 2011 and amended and restated as of

October 25, 2012, February 21, 2013, February 20, 2014, July 26,

2018 and March 27, 2019.

12.2

Except as set out

below, the Board may (without Shareholder approval) amend, modify

or terminate any outstanding RSU, including, but not limited to,

substituting another award of the same or of a different type or

changing the date of redemption; provided, however that, the

Designated Participant’s consent to such action shall be

required unless the Board determines that the action, when taken

with any related action, would not materially and adversely affect

the Designated Participant or is specifically permitted

hereunder.

12.3

The Board may

amend, suspend or terminate the Plan at any time. No action by the

Board to terminate the Plan pursuant to this Section 12 shall

affect any RSUs granted pursuant to the Plan prior to such

action.

12.4

In the event that

the Plan is terminated, any assets, excluding the Shares (which are

to be returned to treasury for cancellation in accordance with

Subsection 4.3), but including any assets resulting from the

exchange or replacement of the Shares in connection with a

Take-over Bid or Business Combination, held by the Trustee that are

not required to satisfy obligations to Designated Participants with

respect to outstanding RSUs or to pay any tax liabilities

applicable to the Trust, will be paid to a charity registered under

the Income Tax Act (Canada)

as the Company directs and no Designated Participant will have any

right, title or interest in such assets.

RESTRICTED SHARE UNIT PLAN OF ELDORADO GOLD

CORPORATION

SCHEDULE A1

DESIGNATED PARTICIPANT’S AGREEMENT FOR TIME BASED

VESTING

1.

Agreement: This agreement

(“Agreement”)

has been entered into by Eldorado Gold Corporation (the

“Company”) and

the Designated Participant as defined below.

2.

Acknowledgment: The Designated

Participant acknowledges having received a copy of the Restricted

Share Unit Plan as amended and/or restated from time to time (the

“Plan”) and that

he or she has read and understands the Plan and agrees that the

terms therein (including any amendments thereto since the date of

grant) govern the grant hereunder.

3.

Grant: Subject to the terms and

conditions of the Plan, the Company grants the Designated

Participant the Restricted Share Units (“RSUs”) set out below on the terms

and conditions set out below.

(a)

Name of Designated

Participant: ______________ (the “Designated

Participant”)

(b)

Date of grant:

_______________

(c)

Number of RSUs:

_______________

(d)

Vesting Terms:

_______________ [insert vesting terms]

(e)

Restricted Period:

_______________ [see paragraph 5.1(d) of Plan]

(f)

Other Terms:

_______________ [insert other terms if applicable]

4.

Representations: The Designated

Participant acknowledges that the Company makes no representation

or warranty as to the future value of any RSU granted in accordance

with the provisions of the Plan.

5.

Withholding Obligations: The Designated

Participant acknowledges and agrees that the Company or a related

entity of the Company or the Trustee may be required to withhold

from the undersigned's cash compensation or entitlements under the

Plan and remit to the Canada Revenue Agency or the tax agency of

the country in which the Designated Participant resides or is

otherwise subject to tax, income taxes, social security

contributions and other required source deductions in respect of

entitlements under the Plan. Under no circumstances shall the

Company, a related entity to the Company or Trustee be responsible

for the payment of any tax, social security contributions or any

other source deductions on behalf of any Designated

Participant.

6.

Tax Advice: The Designated Participant

hereby acknowledges that the grant and redemption of RSUs may be

subject to tax under applicable federal, provincial, state or other

laws of any jurisdiction, that no representation has been made and

he or she has not received any advice from the Company as to tax or

legal ramifications of the grant or redemption of RSUs hereunder

and that he or she has been advised to seek independent tax advice

as he or she deems necessary.

7.

Consent to Use of Personal Information:

The Designated Participant agrees that the Company may collect and

use personal information for any purpose that is permitted by law

to be made without the consent of the Designated Participant, or is

required by law, or by the by-laws, rules, regulations or policies

or any regulatory organization governing the Company and that the

Company may further use or disclose such information for the

following purposes:

(a)

to comply with

securities and tax regulatory requirements;

(b)

to provide the

Trustee with information needed to carry out its duties for the

purposes of the Plan and under the trust agreement with the

Trustee;

(c)

to provide the

Designated Participant with information; and

(d)

to otherwise

administer the Plan.

8.

Compliance with Laws and Policies: The

Designated Participant acknowledges and agrees that the undersigned

will, at all times, act in strict compliance with any and all

applicable laws and any policies of the Company applicable to the

Designated Participant in connection with the Plan.

9.

Terms and Conditions: This Agreement is

subject to the terms and conditions set out in the Plan, and such

terms and conditions are incorporated herein by this reference and

agreed to by the Designated Participant. In the case of any

inconsistency between this Agreement and the Plan, the Plan shall

govern. Unless otherwise indicated, all defined terms shall have

the respective meanings attributed thereto in the

Plan.

[Remainder

of page intentionally left blank]

Effective

as of the _____ day of ___________________, 20____.

|

|

|

ELDORADO GOLD CORPORATION

|

|

|

|

|

Per:

|

|

|

|

|

|

|

Authorized

Signatory

|

Acknowledged and Agreed to:

|

|

|

|

|

|

)

)

)

|

|

|

Signature

of Designated Participant

|

)

|

Signature

of Witness

|

|

|

)

)

)

|

|

|

Name

and Title of Designated Participant

|

)

|

Name of

Witness

|

RESTRICTED SHARE UNIT PLAN OF ELDORADO GOLD

CORPORATION

SCHEDULE A2

DESIGNATED PARTICIPANT’S AGREEMENT FOR

PERFORMANCE BASED VESTING

1.

Agreement: This agreement

(“Agreement”)

has been entered into by Eldorado Gold Corporation (the

“Company”) and

the Designated Participant as defined below.

2.

Acknowledgment: The Designated

Participant acknowledges having received a copy of the Restricted

Share Unit Plan as amended and/or restated from time to time (the

“Plan”) and that

he or she has read and understands the Plan and agrees that the

terms therein (including any amendments thereto since the date of

grant) govern the grant hereunder.

3.

Grant: Subject to the terms and

conditions of the Plan, the Company grants the Designated

Participant the Restricted Share Units (“RSUs”) set out below on the terms

and conditions set out below.

(a)

Name of Designated

Participant: ______________ (the “Designated

Participant”)

(b)

Date of grant:

____________

(c)

Initial Number of

RSUs: _____________

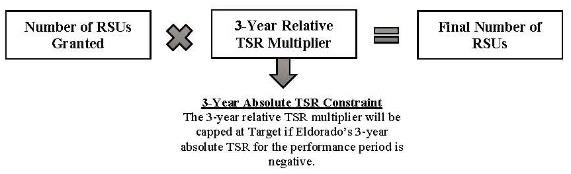

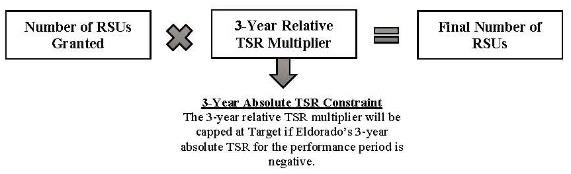

(d)

Final Number of

RSUs:

The

final number of RSUs that are earned and redeemed may be higher or

lower than the number of RSUs initially granted, depending on

Eldorado’s relative 3-year TSR performance over the

Performance Period against the S&P/TSX Global Gold Index

(Index) and Absolute TSR performance, as follows:

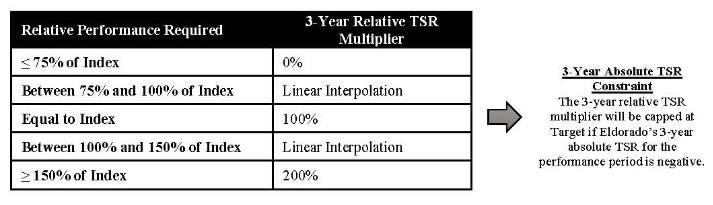

As

shown in the table below, payouts will range from 0% for a 3-year

Relative TSR of less than 75% of the Index, to 200% of Target for a

3-year Relative TSR greater than or equal to 150% of the

Index.

(e)

Restricted

(Performance) Period: _________________

(f)

Other Terms –

Adjustment to Final Number of RSUs:

Notwithstanding the

terms of the Plan, if the Designated Participant’s employment

is terminated due to retirement or if the Designated Participant is

terminated (without Cause) following a Change of Control prior to

the completion of the Performance Period, the RSUs will be treated

as follows:

|

Reason

for Termination of Employment

|

Treatment

of RSUs

|

|

● Retirement

|

In the

event of the retirement of a Designated Participant, the Final

Number of RSUs to be received by the Designated Participant will be

equal to A* (B/C) where:

A = the

Final Number of RSUs that the Designated Participant would be

entitled to under Section 3(d) above, had they remained employed

until the end of the Performance Period

and

B= the

number of days from and including the commencement of the

Performance Period to and including the date of retirement of the

Designated Participant;

and

C= the

number of days from and including the commencement of the

Performance Period to and including the last day of the Performance

Period.

The

Performance Period will be the period set out in Section 3(e)

above, provided that, in the event that there is a Change of

Control following the date of retirement but prior to the expiry of

the Performance Period and the Shares are not listed on the TSX

after such Change of Control, the Performance Period shall be

deemed to have ended on the date of the Change of Control and the

Market Value of the RSUs shall be the higher of the Market Value as

determined under the Plan and the Market Value on the date of the

Change of Control and payment for the redemption of such RSUs shall

be in cash.

|

●

Termination of

Employment (other than for Cause) following a Change of Control in

the circumstances identified in Sections 8.5(a) and (b) of the

Plan

|

In the

event that the Designated Participant is terminated in the

circumstances described in Section 8.5 of the Plan, the Designated

Participant will be entitled to the Final Number of RSUs that they

would have been entitled to under Section 3(d) above had they been

employed until the end of the Performance Period.

The

Performance Period will be the period set out in Section 3(e)

above, provided that, in the event that there is a Change of

Control prior to the expiry of the Performance Period and the

Shares are not listed on the TSX after such Change of Control, the

Performance Period shall be deemed to have ended on the date of the

Change of Control and the Market Value of the RSUs shall be the

higher of the Market Value as determined under the Plan and the

Market Value on the date of the Change of Control and payment for

the redemption of such RSUs shall be in cash.

|

4.

Representations: The Designated

Participant acknowledges that the Company makes no representation

or warranty as to the future value of any RSU granted in accordance

with the provisions of the Plan.

5.

Withholding Obligations: The Designated

Participant acknowledges and agrees that the Company or a related

entity of the Company or the Trustee may be required to withhold

from the undersigned's cash compensation or entitlements under the

Plan and remit to the Canada Revenue Agency or the tax agency of

the country in which the Designated Participant resides or is

otherwise subject to tax, income taxes, social security

contributions and other required source deductions in respect of

entitlements under the Plan. Under no circumstances shall the

Company, a related entity to the Company or Trustee be responsible

for the payment of any tax, social security contributions or any

other source deductions on behalf of any Designated

Participant.

6.

Tax Advice: The Designated Participant

hereby acknowledges that the grant and redemption of RSUs may be

subject to tax under applicable federal, provincial, state or other

laws of any jurisdiction, that no representation has been made and

he or she has not received any advice from the Company as to tax or

legal ramifications of the grant or redemption of RSUs hereunder

and that he or she has been advised to seek independent tax advice

as he or she deems necessary.

7.

Consent to Use of Personal Information:

The Designated Participant agrees that the Company may collect and

use personal information for any purpose that is permitted by law

to be made without the consent of the Designated Participant, or is

required by law, or by the by-laws, rules, regulations or policies

or any regulatory organization governing the Company and that the

Company may further use or disclose such information for the

following purposes:

(a)

to comply with

securities and tax regulatory requirements;

(b)

to provide the

Trustee with information needed to carry out its duties for the

purposes of the Plan and under the trust agreement with the

Trustee;

(c)

to provide the

Designated Participant with information; and

(d)

to otherwise

administer the Plan.

8.

Compliance with Laws and Policies: The

Designated Participant acknowledges and agrees that the undersigned

will, at all times, act in strict compliance with any and all

applicable laws and any policies of the Company applicable to the

Designated Participant in connection with the Plan.

9.

Terms and Conditions: This Agreement is

subject to the terms and conditions set out in the Plan, and such

terms and conditions are incorporated herein by this reference and

agreed to by the Designated Participant. Except with respect to the

terms of Section 3(f) above, in the case of any inconsistency

between this Agreement and the Plan, the Plan shall govern. Unless

otherwise indicated, all defined terms shall have the respective

meanings attributed thereto in the Plan.

Effective

as of the _____ day of ___________________, 20____.

|

|

|

ELDORADO GOLD CORPORATION

|

|

|

|

|

Per:

|

|

|

|

|

|

|

Authorized

Signatory

|

Acknowledged and Agreed to:

|

|

|

|

|

|

)

)

)

|

|

|

Signature

of Designated Participant

|

)

|

Signature

of Witness

|

|

|

)

)

)

|

|

|

Name

and Title of Designated Participant

|

)

|

Name of

Witness

|

RESTRICTED SHARE UNIT PLAN OF ELDORADO GOLD

CORPORATION

SCHEDULE B

REDEMPTION NOTICE

To:

Eldorado Gold Corporation (the “Company”)

Attention: Corporate Secretary

I

hereby advise the Company that:

I wish

the Company to redeem _______________ of the vested RSUs credited

to the account of ____________________ [insert name of Designated

Participant] under the Company’s Restricted Share Unit Plan

as amended from time to time (the “Plan”) on _________________

(insert Redemption Date, which shall be a date no earlier than 5

days after the date this Redemption Notice is received by the

Company and not later than the earlier of the last day of the

Restricted Period applicable to any vested RSU and the date of

termination of my employment or engagement with the

Company1.

I

hereby acknowledge and agree that the redemption requested is

subject to the terms and conditions set out in the Plan, and such

terms and conditions are incorporated herein by this reference. In

the case of any inconsistency between this Notice and the Plan, the

Plan shall govern. Unless otherwise indicated, all defined terms

shall have the respective meanings attributed thereto in the

Plan.

|

|

|

|

|

Date

|

|

(Signature

of Designated Participant or in the case of an Estate, the

Designated Participant’s legal representative)

|

|

|

|

|

|

|

|

(Print

Name of Designated Participant in Block Letters or in the case of

an Estate, the Designated Participant’s legal representative

and the name of the Designated Participant on whose behalf the

legal representative is acting2)

|

1

The Redemption Date

must comply with the Plan requirements. This form is not applicable to U.S. Designated

Participants.