UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ⌧

Filed by a Party other than the Registrant ◻

Check the appropriate box:

◻Preliminary Proxy Statement

◻Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

⌧Definitive Proxy Statement

◻Definitive Additional Materials

◻Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

⌧No fee required.

◻Fee paid previously with preliminary materials.

◻Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

MESSAGE FROM THE EXECUTIVE CHAIR

March 14, 2025

Dear Fellow Shareholders,

You are cordially invited to attend the 2025 Annual Meeting of Shareholders of Republic Bancorp, Inc. (“Republic” or the “Company”) (the “Annual Meeting”). The Annual Meeting will be held at our Springhurst location, 9600 Brownsboro Road, Louisville, Kentucky 40241 on Thursday, April 24, 2025, at 10:00 a.m. Eastern Daylight Time.

The attached Notice of Meeting and Proxy Statement, as well as the Notice of Internet Availability of Proxy Materials we are sending in the mail, describe the formal business to be conducted at the Annual Meeting. Members of our Board of Directors and Executive Officers will be present at the Annual Meeting to respond to questions that our shareholders may have.

We have elected to provide access to our proxy materials over the Internet under the U.S. Securities and Exchange Commission’s “notice and access” rules. We are constantly focused on improving the ways our shareholders connect with information about Republic and believe that providing our proxy materials over the Internet increases the ability of our shareholders to connect with the information they need, while simultaneously reducing (i) the environmental impact and (ii) printing and mailing costs of our Annual Meeting.

Our Board of Directors has determined that the proposals to be considered at the Annual Meeting, as described in the attached Notice of Meeting and Proxy Statement, as well as in the Notice of Internet Availability of Proxy Materials, are in the best interests of Republic and its shareholders. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends that you vote:

| ● | “FOR” the election of each of the 15 director nominees named in the Proxy Statement; |

| ● | “FOR” the non-binding advisory vote on the compensation of the Company’s named executive officers; |

| ● | “FOR” the approval of the Republic Bancorp, Inc. 2025 Stock Incentive Plan; and |

| ● | “FOR” the ratification of the appointment of Forvis Mazars as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. |

Whether or not you plan to attend the Annual Meeting, please vote and submit your proxy as soon as possible via the Internet, by telephone, or, if you have requested to receive printed proxy materials, by mailing a proxy or voting instruction card enclosed with those materials. Your vote is important.

On behalf of the Board of Directors and the officers and associates of Republic, I would like to take this opportunity to thank our shareholders for your continued support.

By Order of the Board of Directors,

Steven E. Trager Republic Bancorp, Inc. |

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

You are cordially invited to attend the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) of Republic Bancorp, Inc. (the “Company”). The following are details for the meeting:

| Date Thursday |

| Time 10:00 a.m. EDT |

| Place Republic Bank Building, Lower Level |

| Record Date The close of business on February 14, 2025 |

Agenda Item |

| Board |

| Read More |

Proposal 1 | FOR each | Page 15 | ||

Proposal 2 To hold a non-binding advisory vote on the compensation of our Named Executive Officers. | FOR this proposal | Page 37 | ||

Proposal 3 To approve the Republic Bancorp, Inc. 2025 Stock Incentive Plan. | FOR this proposal | Page 74 | ||

Proposal 4 | FOR this proposal | Page 80 | ||

To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | ||||

We are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to many of our common shareholders instead of paper copies of our proxy statement (the “Proxy Statement”) and our annual report to shareholders for the fiscal year ended December 31, 2024 (“Annual Report”). The Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how common shareholders can receive a paper copy of our (i) proxy materials, including the Proxy Statement, (ii) Annual Report, and (iii) proxy card.

Your vote is important. For holders of Class A common stock or Class B common stock, whether or not you plan to attend the Annual Meeting, we urge you to vote as soon as possible. Promptly voting will help ensure that the greatest number of common shareholders are present whether in person or by proxy. You may vote in person at the Annual Meeting, over the Internet, by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card enclosed with those materials. Please review the instructions with respect to each of your voting options described in the Proxy Statement and the Notice.

| Internet Go to www.investorvote.com/RBCAA |

| Proxy Services c/o Computershare Investor Services PO Box 43101 |

| In Person Attend the Annual Meeting and cast your vote in person |

| Phone Call toll free |

Very truly yours,

Christy A. Ames March 14, 2025 | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on April 24, 2025. Beginning on or about March 14, 2025, the Company mailed the Notice to its shareholders. Instructions for requesting a paper copy of the proxy materials are contained in the Notice. The Proxy Statement and Annual Report to shareholders are available online at www.investorvote.com/RBCAA. |

TABLE OF CONTENTS

| 1 | |

4 | ||

5 | ||

6 | ||

8 | ||

10 | ||

15 | ||

15 | ||

15 | ||

16 | ||

16 | ||

17 | ||

Director Nominees’ Names and Principal Occupations for the Past Five Years | 18 | |

26 | ||

32 | ||

35 | ||

Proposal Two: Advisory Vote on the Compensation of Our Named Executive Officers | 37 | |

38 | ||

41 | ||

41 | ||

43 | ||

43 | ||

46 | ||

51 | ||

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Republic Bancorp, Inc. (the “Company” or “Republic”). The proxies will be voted at the 2025 Annual Meeting of Shareholders of Republic on April 24, 2025 and at any adjournments or postponements thereof (the “Annual Meeting”). The close of business on February 14, 2025 is the record date (the “Record Date”) for the determination of common shareholders entitled to notice of, and to vote at, the Annual Meeting. We first mailed the Notice of Internet Availability of Proxy Materials to our common shareholders on or about March 14, 2025. As used in this document, the terms “Republic,” the “Company,” “we,” and “our” refer to Republic Bancorp, Inc., a Kentucky corporation. |

PROXY STATEMENT SUMMARY

The following is only a summary of highlights information about Republic Bancorp, Inc. and certain information contained elsewhere in this Proxy Statement, which has been prepared in connection with the Annual Meeting. This summary does not contain all the information that you should consider in voting your shares. You should read the entire Proxy Statement carefully before voting.

About Republic

Republic is a financial holding company headquartered in Louisville, Kentucky. Republic Bank & Trust Company (“Republic Bank” or the “Bank”) is a Kentucky-based, state-chartered nonmember financial institution that provides both traditional and non-traditional banking products. The Bank is a wholly-owned subsidiary of the Company.

Republic Bank offers its clients deposit products, including savings, checking, and money market accounts; individual retirement accounts (IRAs), and certificates of deposit (CDs). The Bank originates residential mortgage loans, home equity loans and lines, and consumer loans, as well as commercial real estate loans, commercial and industrial (C&I) loans, business loans and lines of credit, equipment leasing through its Republic Bank Finance division, and warehouse lines of credit. The Bank also offers personal and business online banking at www.republicbank.com and mobile banking on its mobile apps for both iOS and Android devices.

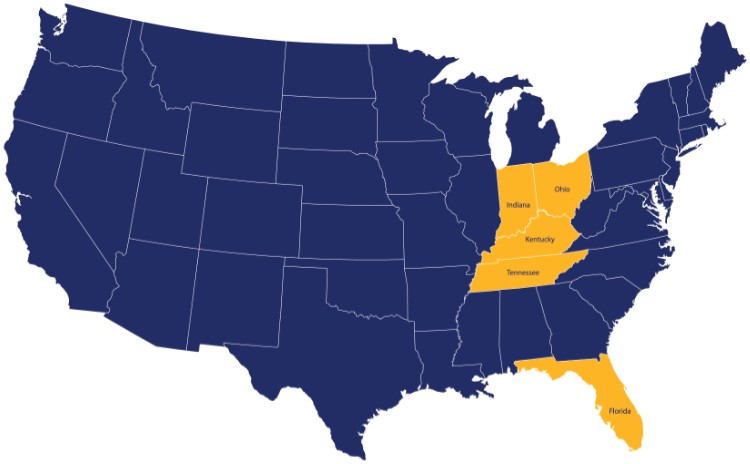

Republic Bank Banking Center Locations

As of December 31, 2024, the Bank has 47 banking centers in communities within five metropolitan statistical areas (“MSAs”) across five states: 22 banking centers located within the Louisville/Jefferson County, Kentucky-Indiana MSA (the “Louisville MSA”) in Louisville, Prospect, Shelbyville, and Shepherdsville in Kentucky, and Floyds Knobs, Jeffersonville, and New Albany in Indiana; six banking centers within the Lexington-Fayette, Kentucky MSA in

Georgetown and Lexington in Kentucky; eight banking centers within the Cincinnati, Ohio-Kentucky-Indiana MSA in Cincinnati and West Chester in Ohio, and Bellevue, Covington, Crestview Hills, and Florence in Kentucky; seven banking centers within the Tampa-St. Petersburg-Clearwater, Florida MSA in Largo, New Port Richey, St. Petersburg, Seminole, and Tampa in Florida; and four banking centers within the Nashville-Davidson—Murfreesboro—Franklin, Tennessee MSA in Franklin, Murfreesboro, Nashville, and Spring Hill, Tennessee. In addition, Republic Bank Finance has one loan production office in St. Louis, Missouri.

In addition to full-service banking services offered in the Bank’s retail footprint, Republic also provides mortgage banking services and financial products to customers in select states across the U.S. Some financial products are also offered through the Company’s Republic Processing Group (“RPG”). Sponsorship of prepaid card products, small dollar credit programs, and payment processing are areas of the fintech ecosystem where RPG is active in the U.S.

As of December 31, 2024, Republic had total assets of $6.8 billion, total deposits of $5.2 billion, and total shareholders’ equity of $992 million. Republic’s executive offices are located at 601 West Market Street, Louisville, Kentucky 40202.

Our Purpose

Republic exists to enable our clients, company, associates, and the communities we serve to THRIVE.

How We Fulfill Our Purpose

Republic’s values are built upon making an IMPACT for our clients, our associates, and the communities we serve. IMPACT is an acronym for the actions we do to fulfill our purpose.

I | M | P | A | C | T | |||||

Our Clients

Since its founding over 40 years ago, Republic has had an unwavering focus on customer service and satisfaction.

The Net Promoter Score® (“NPS®”) is one of the most widely used measures of customer satisfaction, utilized by hundreds of leading U.S. companies. Republic’s most recent NPS score, measured in Q4 2024, was 75.5, over two and one-half times the average NPS score for all banks measured in 2024. As important, this was a 12% increase from our score in Q1 2024, and a 30% increase from Q3 of the previous year, showing the results of our constant efforts to provide industry-leading customer service.

Expanding Republic’s client base to communities that have been historically marginalized continues to be a priority for Republic. The Bank’s Community Loan Fund in Louisville, Kentucky and beyond, has provided small business clients over $5 million in funding and has promoted business development, expanded services, and job creation in low-to-moderate income communities.

1Qualtrics XM Institute Q3 2024 Consumer Benchmark Study. The score is not a percentage, but a figure resulting from a formula that weighs satisfied, neutral, and dissatisfied customers.

Our Company

Governance is an essential element of ensuring the Company, and our clients, associates, and communities thrive.

| ● | Board – Each of the Republic Board of Directors (the “Board” or the “Board of Directors”) and the Republic Bank Board of Directors (the “Bank Board” or “Bank Board of Directors”) is a distinct group of esteemed professionals across a variety of industries. Their direction, advice, and voices represent broad viewpoints. |

| ● | Fraud & Cybersecurity – The Company invests significant resources to prevent and combat fraud and cybersecurity issues, including robust processes and tools, annual associate and Board training and awareness, and regular assessments of our practices reported to the Risk Committee of the Board (the “Risk Committee”), which is tasked, in part, with overseeing operational risks, including cybersecurity, as well as the full Board. |

| ● | Ethics and Compliance Hotline – Republic has established an independent hotline available 24 hours a day, seven days a week, for the anonymous reporting of ethics and compliance issues in such areas as discrimination, criminal misconduct, accounting or auditing matters, and security. Findings are investigated and reported to the Audit Committee of the Board (the “Audit Committee”). |

| ● | Training – All associates are required to take specific functional, regulatory, and governance-related training. Talent Development assigns and monitors completion of these trainings. |

| ● | Vendor Management – Republic Bank’s processes provide end-to-end and regular oversight of vendor partnerships. |

Our Associates

We are continuing to take significant actions to enhance our workplace through education, mentorship, and recruiting.

Republic Bank facilitates Business Resource Groups (“BRGs”) for its associates to foster education and learning opportunities to the entire organization. The BRGs actively support recruitment and education, and they provide advice to Bank leadership on how the Bank conducts day-to-day and long-term business. We recently launched our seventh BRG and have active participation and self-leadership by associates at all levels who identify, or ally, with each BRG.

Republic Bank’s “Building Bridges” program provides associates the opportunity to pair with mentors or mentees to exchange valuable Bank and business leadership skills, and to make lasting connections in the Bank and beyond.

2025 PROXY STATEMENT | 3 |

Formal programming and training help ensure participants get the most from their mentoring experiences and continue to grow both professionally and personally. Since the program began, over 300 associates have benefited from the program as mentors or mentees.

In addition to health benefits, including medical, dental, vision, and Teladoc services, the Bank helps its associates thrive with programs, including hybrid and work-from-home opportunities; a 401(k) plan with a Company match; Company paid short term disability; an Employee Stock Purchase Plan providing discounted opportunities to participate in Company ownership; college tuition reimbursement; and an Employee Assistance Program for our associates and their family members to support mental health, wellness, and to provide legal support.

Key to the Bank’s continued improvement and success are formal and informal listening programs such as the below that allow leadership to learn from associates at all levels – those who are closest to (i) our clients, (ii) their fellow associates, and (iii) our communities.

| ● | An annual anonymous associate engagement survey has nearly 90% associate participation and guides leadership on key planning and decision making. |

| ● | A CEO Council consisting of associates from throughout the organization meets regularly with our top executives and provides insight and ideas. |

| ● | A “Suggestions to the CEO” e-mail mailbox provides daily opportunities for associates at all levels to share their ideas. |

Our Communities

Republic recognizes the importance of making a lasting IMPACT, and that starts by strengthening the communities in which we live and work. As an organization, we devote time and funding to help support and build a foundation for the future.

| ● | Republic recognizes the importance of making a lasting IMPACT, and that starts by strengthening the communities in which we live and work. As an organization, we devote time and funding to help support and build a foundation for the future. |

| ● | During the same period, the Bank has made more than $275 million in community development loans for affordable housing, community services, and economic development and the revitalization and stabilization of underserved communities. |

| ● | Over $83.8 million in non-conventional mortgage loans were made to nearly 2,135 low- to moderate-income families and individuals helping them achieve the American dream of homeownership in the last three years. |

In 2024, Republic Bank continued a multi-year ongoing relocation plan, bringing nearly 100 associates back to downtown Louisville from locations in Louisville’s East End. The move reflects the Bank’s commitment to creating a more vibrant downtown community in Louisville.

Annual Meeting

|

|

| ||

5BWHEN Thursday, April 24, 2025 | Where Republic Bank Building, Lower Level | 7RECORD DATE February 14, 2025 |

4 | Republic Bancorp, Inc. |

Voting Guide

Proposal 1: Election of 15 Directors (see page 15) |

The Board of Directors believes that each of these nominees brings a range of relevant experiences and overall diversity of perspectives that is essential to good governance and leadership of our Company. | OUR BOARD RECOMMENDS A VOTE FOR EACH DIRECTOR NOMINEE |

|

Proposal 2: NON-BINDING ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (Say-ON-PAY) (see page 37) | ||

The Board of Directors believes that our compensation policies and practices are effective in rewarding Named Executive Officers for job performance and motivating them to achieve our collective goals as an organization. | OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

Proposal 3: Approve the republic bancorp, inc. 2025 stock incentive plan) (see page 74) | ||

The Board of Directors believes that the Republic Bancorp, Inc. 2025 Stock Incentive Plan is an important tool to promote the interests of the Company and our shareholders, attract, retain, and motivate associates and directors of the Company, encourage stock ownership in the Company, and to provide these individuals with a means to acquire a proprietary interest in the Company. | OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

Proposal 4: Ratification of Independent Registered Public Accounting Firm (see page 80) |

The Audit Committee has selected Forvis Mazars to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2025 and is asking shareholders to ratify this selection. | OUR BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL |

|

2025 PROXY STATEMENT | 5 |

Snapshot of Board Nominees

Company Committee Membership March 14, 2025 | Other | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name |

| Primary Occupation | Independent | Audit | Compensation | Nominating | Risk | Company | |||||||

Yoania Cannon | Previously VP Director, Global Brand Strategy/Analytics & Finance Capabilities, Brown-Forman Corporation |

|

|

|

| ||||||||||

David P. Feaster | Retired, Consultant to Republic Bank & Trust Company | ||||||||||||||

Jennifer N. Green | Chief Legal Officer, Yum! Digital & Technology, Yum! Brands |

|

|

|

|

| |||||||||

Heather V. Howell | President, GREATER THAN Beverages |

|

|

|

| ||||||||||

Timothy S. Huval | Chief Administrative Officer and Chief Human Resources Officer, Humana, Inc. |

|

|

|

|

| |||||||||

Ernest W. Marshall, Jr. | Executive Vice President and Chief Human Resources Officer, Eaton Corporation |

|

|

|

|

|

| ||||||||

W. Patrick Mulloy, II | Interim Chief Executive Officer, Louisville Economic Development Alliance, Inc. |

|

|

|

| ||||||||||

W. Kennett Oyler, III | CEO, OPM Services, Inc. a Financial Services and Investment Firm |

|

|

|

|

| |||||||||

Logan M. Pichel | President and CEO, Republic Bank & Trust Company |

|

|

| |||||||||||

Vidya Ravichandran | CEO, GlowTouch, LLC, a Business Process Outsourcing Provider for Customer Care and Technology Services |

|

|

| |||||||||||

Alejandro M. Sanchez | President and CEO, Salva Financial Group of Florida |

|

| ||||||||||||

A. Scott Trager | President, Republic Bancorp, Inc. and Vice Chair, Republic Bank & Trust Company | ||||||||||||||

Steven E. Trager | Executive Chair & CEO, Republic Bancorp, Inc. and Executive Chair, Republic Bank & Trust Company |

|

| ||||||||||||

6 | Republic Bancorp, Inc. |

Company Committee Membership March 14, 2025 | Other | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name |

| Primary Occupation | Independent | Audit | Compensation | Nominating | Risk | Company | |||||||

Andrew Trager-Kusman | Senior Vice President, and Chief Strategy Officer, Republic Bank & Trust Company |

|

| ||||||||||||

Mark A. Vogt | CEO, Galen College of Nursing |

|

|

|

| ||||||||||

|

|

|

2025 PROXY STATEMENT | 7 |

VOTING

Record Date. You are entitled to notice of and to vote at the Annual Meeting if you held of record shares of our Class A Common Stock or Class B Common Stock at the close of business on February 14, 2025. On that date, 17,333,993 shares of Class A Common Stock and 2,150,090 shares of Class B Common Stock were issued and outstanding for purposes of the Annual Meeting.

Voting Rights. Each share of Class A Common Stock is entitled to one (1) vote and each share of Class B Common Stock is entitled to ten (10) votes. Based on the number of shares outstanding as of the record date, the shares of Class A Common Stock are entitled to an aggregate of 17,333,993 votes, and the shares of Class B Common Stock are entitled to an aggregate of 21,500,900 votes at the Annual Meeting.

Voting by Proxy. If you received the Notice of Internet Availability of Proxy Materials, you may follow the instructions on that notice to access the proxy materials and download the proxy and vote online via the Internet. If you request a paper or electronic copy of the proxy materials, the proxy will be mailed or e-mailed to you along with the other proxy materials. If you received a paper copy of this Proxy Statement, the proxy card is enclosed. If a proxy card is properly executed, returned to Republic and not revoked, the shares represented by the proxy card will be voted in accordance with the instructions set forth on the proxy card. If you are a shareholder of record and you return a signed and dated proxy card without marking any voting selections, the shares represented will be voted (i) “For” each of the Board nominees named in this Proxy Statement (“Director Nominees”); (ii) “For” the approval, on an advisory basis, of the compensation of our Named Executive Officers, as disclosed in this Proxy Statement; (iii) “For” the approval of the Republic Bancorp, Inc. 2025 Stock Incentive Plan; and (iv) “For” the ratification of Forvis Mazars (“FORVIS”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. For participants in the Republic Bancorp, Inc. 401(k) Retirement Plan (the “Retirement Plan”), the Retirement Plan Trustee shall vote the shares for which it has not received voting direction from the Retirement Plan participants utilizing the same voting percentages derived from the Retirement Plan participants who did direct how their shares are to be voted.

If your shares are held by your broker, bank, or other agent as your nominee, you will need to obtain a proxy card from the organization that holds your shares and follow the instructions on that form regarding how to instruct your broker, bank, or other agent to vote your shares. Brokers, banks, or other agents that have not received voting instructions from their clients cannot vote on their clients’ behalf with respect to proposals that are not “routine” but may vote their clients’ shares on “routine” proposals. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner (“broker non-vote”). Proposals 1, 2, and 3 are considered non-routine matters. Proposal 4 is considered a routine matter. Therefore, your broker has discretionary authority to vote your shares only with respect to Proposal 4. Although broker non-votes are counted as shares that are present at the Annual Meeting and entitled to vote for purposes of determining the presence of a quorum, they will not be counted as votes cast and will not have any effect on voting for a non-routine proposal presented at the Annual Meeting.

The Board of Directors at present knows of no other business to be brought before the Annual Meeting. However, persons named in the proxy, or their substitutes, will have discretionary authority to vote on any other business which may properly come before the Annual Meeting and will vote the proxies in accordance with the recommendations of the Board of Directors.

You may attend the Annual Meeting even though you have executed a proxy. You may revoke your proxy at any time before it is voted at the Annual Meeting by delivering written notice of revocation to the Secretary of Republic, by delivering a subsequent dated proxy, by voting by telephone or online through the Internet on a later date, or by attending the Annual Meeting and voting in person.

8 | Republic Bancorp, Inc. |

Quorum and Voting Requirements and Counting Votes. A majority of the votes entitled to be cast on the matter by the voting group, represented in person or by proxy, shall constitute a quorum of that voting group for action on that matter at the Annual Meeting.

There were 17,333,993 shares of our Class A Common Stock and 2,150,090 (each share of Class B Common Stock is entitled to ten (10) votes, or 21,500,900 votes) shares of our Class B Common Stock outstanding and entitled to vote at the Annual Meeting on the record date. Therefore, a quorum will be present if 19,417,448 votes are present in person or represented by executed proxies timely and properly received by us at the Annual Meeting. Withheld, abstentions, and broker non-votes will be counted as being present or represented at the Annual Meeting for the purpose of establishing a quorum.

The affirmative vote of a plurality of the votes duly cast is required for the election of each Director in Proposal 1. Proposals 2, 3, and 4 will be approved if the votes cast in favor of the proposal exceed the votes cast opposing the proposals. Abstentions and broker non-votes are not counted as votes cast on any matter to which they relate and will have no impact on the outcome of any matter except for quorum purposes.

The following table sets forth, among other things, the vote required for approval of each of the proposals to be presented at the Annual Meeting:

Proposal |

|

|

|

|

| |||||

Voting Options | Vote Required for Approval | Impact of Withhold or Abstentions (as applicable) | Broker Discretionary Voting Allowed? | Effect of Broker Non-Votes | ||||||

Election of Director Nominees | FOR WITHHOLD | At least one FOR vote. Director Nominees receiving the highest number of FOR votes are elected. If Director Nominees are unopposed, election requires only a single vote or more. | Withheld votes have no effect; not treated as a vote cast, except for quorum purposes | No | No effect | |||||

Advisory vote on the compensation of our Named Executive Officers | FOR AGAINST ABSTAIN | More FOR votes than AGAINST votes | Abstention votes have no effect; not treated as a vote cast, except for quorum purposes | No | No effect | |||||

Approval of Republic Bancorp, Inc. 2025 Stock Incentive Plan | FOR AGAINST ABSTAIN | More FOR votes than AGAINST votes | Abstention votes have no effect; not treated as a vote cast, except for quorum purposes | No | No effect | |||||

Ratification of Independent Registered Public Accounting Firm | FOR AGAINST ABSTAIN | More FOR votes than AGAINST votes | Abstention votes have no effect; not treated as a vote cast, except for quorum purposes | Yes | Not applicable |

SHARE OWNERSHIP

The following table sets forth certain information regarding the beneficial ownership of the outstanding shares of Republic common stock as of February 14, 2025, based on information available to the Company. On that date, 17,333,993 shares of Class A Common Stock and 2,150,090 shares of Class B Common Stock were issued and outstanding. The Class B Common Stock is convertible into Class A Common Stock on a share-for-share basis. In the following table, information in the column headed “Class A Common Stock” does not reflect the shares of Class A Common Stock issuable upon conversion of Class B Common Stock. Information is included for:

| (1) | persons or entities who own more than 5% of the Class A Common Stock or Class B Common Stock outstanding; |

| (2) | all Directors and Director Nominees; |

| (3) | the Executive Chair and Chief Executive Officer (“Chair/CEO”), the Chief Financial Officer (“CFO”), and three other executive officers (“Executive Officers”) of Republic, including its subsidiary Republic Bank, who earned the highest total compensation payout during 2024 (collectively, with the Chair/CEO and CFO, the “Named Executive Officers” or the “NEOs”); and |

| (4) | all Executive Officers, Directors, and Director Nominees of Republic and Republic Bank as a group. |

Except as otherwise noted, Republic believes that each person named below has the sole power to vote and dispose of all shares shown as owned by such person. The amounts and percentages of common stock beneficially owned are reported on the basis of the regulations of the U.S. Securities and Exchange Commission (the “SEC”) governing the determination of beneficial ownership of securities. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of such security, or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days of February 14, 2025. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities. Included in the amount of common stock beneficially owned are shares of common stock underlying options and other derivative securities that are currently exercisable or will become exercisable within 60 days of February 14, 2025. Ownership percentages reflect the ownership percentage assuming that such person, but no other person, exercises all options and other derivative securities to acquire shares of our common stock held by such person that are currently exercisable or exercisable within 60 days of February 14, 2025. The ownership percentage of all Executive Officers and Directors, as a group, assumes that all 25 persons, but no other persons, exercise all options and other derivative securities to acquire shares of our common stock held by such persons that are currently exercisable or exercisable within 60 days of February 14, 2025. Unless otherwise indicated, the mailing address for each beneficial owner is c/o Republic Bancorp, Inc., 601 West Market Street, Louisville, Kentucky, 40202. If applicable, fractional shares are rounded to the closest whole number.

10 | Republic Bancorp, Inc. |

Executive Officers and Directors as a group (collectively 25 persons) beneficially own approximately 73% of the combined voting power of the Class A Common Stock and Class B Common Stock, which represents approximately 56% of the total number of shares of Class A Common Stock and Class B Common Stock outstanding as of February 14, 2025 as detailed below:

| Class A and Class B Common | ||||||||||||

| Class A Common Stock |

| Class B Common Stock |

| Stock Combined | ||||||||

Name |

| Shares |

| Percent |

| Shares |

| Percent |

| Shares |

| Percent | |

Five Percent Shareholders: | |||||||||||||

Steven E. Trager | 8,399,127 | (1) | 48.4 | % | 1,940,091 | (2) | 90.2 | % | 10,339,218 | (1)(2) | 53.0 | % | |

601 West Market Street |

|

|

|

|

|

|

|

|

| ||||

Louisville, Kentucky 40202 |

|

|

|

|

|

|

|

|

| ||||

Trager Trust of 2012 | 7,915,343 | (3) | 45.6 |

| 1,921,862 | (4) | 89.4 |

| 9,837,205 | (3)(4) | 50.4 | ||

601 West Market Street |

|

|

|

|

|

| |||||||

Louisville, Kentucky 40202 |

|

|

|

|

|

| |||||||

A. Scott Trager | 8,233,941 | (5) | 47.4 |

| 1,923,916 | (6) | 89.5 |

| 10,157,857 | (5)(6) | 52.0 | ||

601 West Market Street |

|

|

|

|

|

| |||||||

Louisville, Kentucky 40202 |

|

|

|

|

|

| |||||||

Sheldon G. Gilman | 7,967,617 | (7) | 45.9 |

| 1,921,862 | (8) | 89.4 |

| 9,889,479 | (7)(8) | 50.7 | ||

3513 Winterberry Cir |

|

|

|

|

|

| |||||||

Louisville, Kentucky 40207 |

|

|

|

|

|

| |||||||

Teebank Family | 7,165,276 | 41.3 |

| 1,753,796 | 81.6 |

| 8,919,072 | 45.7 | |||||

Limited Partnership (9) |

|

|

|

|

|

| |||||||

601 West Market Street |

|

|

|

|

|

| |||||||

Louisville, Kentucky 40202 |

|

|

|

|

|

| |||||||

Jaytee Properties | 750,067 | 4.3 |

| 168,066 | 7.8 |

| 918,133 | 4.7 | |||||

Limited Partnership (9) |

|

|

|

|

|

| |||||||

601 West Market Street |

|

|

|

|

|

| |||||||

Louisville, Kentucky 40202 |

|

|

|

|

|

| |||||||

Dimensional Fund Advisors LP (10) | 927,375 | 5.3 |

| — | * |

| 927,375 | 4.8 | |||||

6300 Bee Cave Road |

|

|

|

|

|

| |||||||

Building One |

|

|

|

|

|

| |||||||

Austin, Texas 78746 |

|

|

|

|

|

| |||||||

Directors, Director Nominees, and |

|

|

|

|

|

| |||||||

Named Executive Officers: |

|

|

|

|

|

| |||||||

Yoania Cannon | — | (11) | * |

| — | * |

| — | (11) | * | |||

David P. Feaster | 2,032 | (12) | * |

| — | * |

| 2,032 | (12) | * | |||

Jennifer N. Green | 622 | (13) | * |

| — | * |

| 622 | (13) | * | |||

Heather V. Howell | — | (14) | * |

| — | * |

| — | (14) | * | |||

Timothy S. Huval | — | (15) | * |

| — | * |

| — | (15) | * | |||

Ernest W. Marshall, Jr. | 190 | (16) | * |

| — | * |

| 190 | (16) | * | |||

W. Patrick Mulloy, II | 16,636 | (17) | * |

| — | * |

| 16,636 | (17) | * | |||

W. Kennett Oyler, III | 1,116 | (18) | * |

| — | * |

| 1,116 | (18) | * | |||

Vidya Ravichandran | 888 | (19) | * |

| — | * |

| 888 | (19) | * | |||

Alejandro M. Sanchez | 460 | * |

| — | * |

| 460 | * | |||||

Andrew Trager-Kusman | 1,666 | (20) | * |

| — | * |

| 1,666 | (20) | * | |||

Mark A. Vogt | 17,391 | (21) | * |

| — | * |

| 17,391 | (21) | * | |||

William R. Nelson | 34,007 | (22) | * |

| — | * |

| 34,007 | (22) | * | |||

Logan M. Pichel | 52,856 | (23) | * |

| — | * |

| 52,856 | (23) | * | |||

Kevin D. Sipes | 76,176 | (24) | * |

| — | * |

| 76,176 | (24) | * | |||

Jeffrey A. Starke | 10,617 | (25) | * |

| — | * |

| 10,617 | (25) | * | |||

A. Scott Trager | 8,233,941 | (5) | 47.4 |

| 1,923,916 | (6) | 89.5 |

| 10,157,857 | (5)(6) | 52.0 | ||

Steven E. Trager | 8,399,127 | (1) | 48.4 |

| 1,940,091 | (2) | 90.2 |

| 10,339,218 | (1)(2) | 53.0 | ||

All directors and executive officers |

|

|

|

|

|

| |||||||

as a group (25 persons): | 9,069,877 | (26) | 52.2 | % | 1,942,145 | (25) | 90.3 | % | 11,012,022 | (26) | 56.4 | % | |

*Represents less than 1% of total

2025 PROXY STATEMENT | 11 |

| (1) | Includes 7,165,276 shares held of record by Teebank Family Limited Partnership (“Teebank”) and 750,067 shares held of record by Jaytee Properties Limited Partnership (“Jaytee”). With respect to Teebank and Jaytee, Steven E. Trager is trustee of two trusts that are co-general partners and limited partners of each of these limited partnerships. Steven E. Trager shares voting authority over shares held by both Teebank and Jaytee as a member of each partnership’s voting committee. Trusts for the benefit of, among others, Steven E. Trager’s two children, are limited partners of both Teebank and Jaytee. Includes 7,478 shares held by Steven E. Trager’s spouse, Amy Trager. Includes 382,945 shares held of record by the Trager Family Foundation Trust, a charitable foundation organized under Section 501(c)(3) of the Internal Revenue Code. Steven E. Trager shares voting and investment power over these shares with Jean S. Trager, Shelley L. Kusman, and Amy Trager. Also includes 12,085 shares held by Steven E. Trager in Republic’s 401(k) plan. |

| (2) | Includes 1,753,796 shares held of record by Teebank and 168,066 shares held of record by Jaytee. With respect to Teebank and Jaytee, Steven E. Trager is trustee of two trusts that are co-general partners and limited partners of each of these limited partnerships. Steven E. Trager shares voting authority over shares held by both Teebank and Jaytee as a member of each partnership’s voting committee. Trusts for the benefit of, among others, Steven E. Trager’s two children are limited partners of both Teebank and Jaytee. Also includes 1,215 shares held by Steven E. Trager in Republic’s 401(k) plan. |

| (3) | Includes 7,165,276 shares held of record by Teebank and 750,067 shares held of record by Jaytee. With respect to Teebank and Jaytee, Trager Trust of 2012, of which Steven E. Trager is trustee, is a co-general partner and a limited partner of each of those limited partnerships. |

| (4) | Includes 1,753,796 shares held of record by Teebank and 168,066 shares held of record by Jaytee. With respect to Teebank and Jaytee, Trager Trust of 2012, of which Steven E. Trager is trustee, is a co-general and a limited partner of each of those limited partnerships. |

| (5) | Includes 7,165,276 shares held of record by Teebank and 750,067 shares held of record by Jaytee. A. Scott Trager is a limited partner of both Teebank and Jaytee. A. Scott Trager shares voting authority over shares held by both Teebank and Jaytee as a member of each partnership’s voting committee. Includes 60,420 shares held of record by a family trust of which A. Scott Trager is a co-trustee and a beneficiary. Also includes 54,963 shares held by A. Scott Trager in Republic’s 401(k) Plan. |

| (6) | Includes 1,753,796 shares held of record by Teebank and 168,066 shares held of record by Jaytee. A. Scott Trager is a limited partner of both Teebank and Jaytee. A. Scott Trager shares voting authority over shares held by both Teebank and Jaytee as a member of each partnership’s voting committee. Includes 2,054 shares held of record by a family trust of which A. Scott Trager is a co-trustee and a beneficiary. |

| (7) | Includes 7,165,276 shares held of record by Teebank and 750,067 shares held of record by Jaytee. Sheldon G. Gilman, as trustee of trusts, is a limited partner of both Teebank and Jaytee. Sheldon G. Gilman shares voting authority over shares held by both Teebank and Jaytee as a member of each partnership’s voting committee. Also includes 39,307 shares held by Sheldon G. Gilman’s spouse. |

| (8) | Includes 1,753,796 shares held of record by Teebank and 168,066 shares held of record by Jaytee. Sheldon G. Gilman, as trustee of trusts, is a limited partner of both Teebank and Jaytee. Sheldon G. Gilman shares voting authority of both Teebank and Jaytee as a member of each partnership’s voting committee. |

12 | Republic Bancorp, Inc. |

| (9) | Teebank and Jaytee are limited partnerships, the limited partners of which include A. Scott Trager, Andrew Trager-Kusman, and trusts for which each of Steven E. Trager and Sheldon G. Gilman serve as trustees. Steven E. Trager is trustee of two trusts that are co-general partners and limited partners of each partnership. Teebank and Jaytee each have voting committees comprised of Steven E. Trager, A. Scott Trager, and Sheldon G. Gilman. These committees direct the voting of the shares held by Teebank and Jaytee. Teebank has a total of 2,201,017 units outstanding, and Jaytee has a total of 2,000,000 units outstanding. The following table provides information about the units of Teebank and Jaytee beneficially owned by Directors, Director Nominees, Executive Officers, and 5% shareholders of Republic: |

|

|

|

|

|

|

|

| ||

Number of | Percent of Jaytee | Number of | Percent of Teebank |

| |||||

Name |

| Jaytee Units |

| Units Outstanding |

| Teebank Units |

| Units Outstanding |

|

Trager Trust of 2012 |

| 32,284 | (a) | 1.6 | % | 200,442 | (c) | 9.1 | % |

Steven E. Trager |

| 1,548,297 | (b) | 77.4 | % | 1,596,496 | (d) | 72.5 | % |

A. Scott Trager |

| 5,293 | * | % | 5,293 | * | % | ||

Andrew Trager-Kusman |

| 28,978 | 1.4 | % | 80,666 | (e) | 3.7 | % | |

Sheldon G. Gilman, Trustee |

| 44,050 | 2.2 | % | 156,608 | 7.1 | % |

*Represents less than 1% of total

| (a) | Includes 20,000 general partner units and 12,284 limited partner units held by the Trager Trust of 2012, of which Steven E. Trager is trustee. |

| (b) | Includes 20,000 general partner units and 268,130 limited partner units held in a revocable trust and 20,000 general partner units and 12,284 limited partner units held by the Trager Trust of 2012, both of which Steven E. Trager is trustee. Also includes 1,227,883 limited partner units held in trusts for family members, of which Steven E. Trager is trustee. |

| (c) | Includes 20,000 general partner units and 180,442 limited partner units held by the Trager Trust of 2012, of which Steven E. Trager is trustee. |

| (d) | Includes 20,001 general partner units and 36,905 limited partner units held in a revocable trust and 20,000 general partner units and 180,442 limited partner units held by the Trager Trust of 2012, both of which Steven E. Trager is trustee. Also includes 1,222,784 limited partner units held in trusts for family members, of which Steven E. Trager is trustee. Also includes 116,364 limited partner units held in an irrevocable trust of which Steven E. Trager’s spouse is co-trustee. |

| (e) | Includes 54,545 limited partner units held in an irrevocable trust for Andrew Trager-Kusman’s mother of which Andrew Trager-Kusman is co-trustee. |

| (10) | Based on information disclosed in a Schedule 13G filed by Dimensional Fund Advisors LP (“Dimensional”) with the SEC on February 9, 2024, Dimensional, a registered investment adviser, may be deemed to have beneficial ownership of these shares which are held by certain investment companies, trusts, and accounts for which Dimensional serves as investment manager, adviser, or sub-adviser. Dimensional indicated sole voting power over 907,862 shares, sole dispositive power over 927,375 shares and no shared voting power or shared dispositive power. |

| (11) | Does not include 803 shares issuable beyond 60 days of February 14, 2025 to Yoania Cannon upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (12) | Does not include 2,272 shares issuable beyond 60 days of February 14, 2025 to David P. Feaster upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (13) | Does not include 1,500 shares issuable beyond 60 days of February 14, 2025 to Jennifer N. Green upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (14) | Does not include 7,621 shares issuable beyond 60 days of February 14, 2025 to Heather V. Howell upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

2025 PROXY STATEMENT | 13 |

| (15) | Does not include 1,735 shares issuable beyond 60 days of February 14, 2025 to Timothy S. Huval upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (16) | Does not include 6,712 shares issuable beyond 60 days of February 14, 2025 to Ernest W. Marshall, Jr. upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (17) | Includes 15,510 shares held jointly by W. Patrick Mulloy, II with his spouse. W. Patrick Mulloy, II shares investment and voting power over these shares. Does not include 9,775 shares issuable beyond 60 days of February 14, 2025 to W. Patrick Mulloy, II upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (18) | Does not include 2,084 shares issuable beyond 60 days of February 14, 2025 to W. Kennett Oyler, III upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (19) | Does not include 906 shares issuable beyond 60 days of February 14, 2025 to Vidya Ravichandran upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (20) | Includes voting rights for 400 restricted shares that vest in October 2026. Includes 1,000 shares for stock options held by Andrew Trager-Kusman that are exercisable within 60 days of February 14, 2025. Andrew Trager-Kusman owns Jaytee and Teebank limited partnership units, both individually and through various trusts, as disclosed in Footnote 9. Does not include 478 shares issuable beyond 60 days of February 14, 2025 to Andrew Trager-Kusman upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (21) | Includes 3,000 shares held jointly by Mark A. Vogt with his spouse. Mark A. Vogt shares investment and voting power over these shares. Also includes 10,000 shares held in a Delaware Trust. Does not include 11,986 shares issuable beyond 60 days of February 14, 2025 to Mark A. Vogt upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (22) | Includes voting rights for 1,433 restricted shares that vest in January 2027. Includes 6,368 shares for stock options held by William R. Nelson that are exercisable within 60 days of February 14, 2025. Does not include 2,202 shares issuable beyond 60 days of February 14, 2025 to William R. Nelson upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (23) | Includes 1,318 shares held by Logan M. Pichel in Republic’s 401(k) Plan. Also includes 1,316 shares held by Logan M. Pichel in Republic’s Employee Stock Purchase Plan. Includes voting rights for 4,757 restricted shares that vest in December 2025, 9,563 restricted shares that vest in January 2027, and 2,759 restricted shares that vest in January 2028. Does not include 3,966 shares issuable beyond 60 days of February 14, 2025 to Logan M. Pichel upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (24) | Includes 3,980 shares held by Kevin D. Sipes in Republic’s 401(k) Plan. Also includes 1,478 shares held by Kevin D. Sipes in Republic’s Employee Stock Purchase Plan. Includes voting rights for 1,433 restricted shares that vest in January 2027. Includes 6,368 shares for stock options held by Kevin D. Sipes that are exercisable within 60 days of February 14, 2025. Does not include 6,152 shares issuable beyond 60 days of February 14, 2025 to Kevin D. Sipes upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (25) | Includes 804 shares held by Jeffrey A. Starke in Republic’s 401(k) Plan. Also includes 1,790 restricted shares that vest in January 2027. Does not include 997 shares issuable beyond 60 days of February 14, 2025 to Jeffrey A. Starke upon vesting in accordance with the terms of the Company’s Non-Employee Director and Key Employee Deferred Compensation Plan. |

| (26) | Includes the shares as described above held by the Directors and the NEOs, along with an additional 137,495 shares held by other Executive Officers. Shares held by the Director Nominees are not included. |

14 | Republic Bancorp, Inc. |

PROPOSAL ONE:

ELECTION OF DIRECTORS

Recommendation of Republic’s Board of Directors | The Board of Directors recommends that shareholders vote “FOR” all of the proposed Director Nominees named in this Proxy Statement. |

The Board of Directors is comprised of one class of Directors that is elected annually. Each Director serves a term of one (1) year until the next annual meeting and shall serve until his or her successor is elected and qualified or his or her earlier resignation or removal. All of Republic’s current Directors were elected to a one (1) year term at the most recent Annual Meeting held on April 25, 2024.

Number of Directors

Republic’s Bylaws (the “Bylaws”) currently provide for not less than five (5) nor more than eighteen (18) Directors. In accordance with the Bylaws, the Board of Directors has fixed the number of Directors to be elected at the Annual Meeting at fifteen (15).

Mandatory | ||

72 | ||

Mandatory Retirement Age

The mandatory retirement age for a Director is seventy-two (72) years old, excepting Directors of record as of January 1990. A Director’s age shall be determined as of December 31 of the year prior to the Director’s election, i.e., a person can be elected as a Director if that person is under age seventy-two (72) as of December 31 of the year prior to that election. Any Director who is or reaches age seventy-two (72) during the Director’s term shall serve until the expiration of the Director’s term and shall serve until his or her successor is elected and qualified or his or her earlier resignation or removal. No current Director will retire from the Board at this Annual Meeting due to the mandatory retirement age.

2025 PROXY STATEMENT | 15 |

2025 Director Nominees

The Nominating Committee of the Board of Directors (the “Nominating Committee”) and the Board of Directors have nominated the following Director Nominees for election:

§ Yoania Cannon § David P. Feaster § Jennifer N. Green § Heather V. Howell § Timothy S. Huval § Ernest W. Marshall, Jr. § W. Patrick Mulloy, II § W. Kennett Oyler, III | § Logan M. Pichel § Vidya Ravichandran § Alejandro M. Sanchez § A. Scott Trager § Steven E. Trager § Andrew Trager-Kusman § Mark A. Vogt |

All Director Nominees are current members of the Board of Directors and the Bank Board. The Director Nominees would serve a one (1) year term until the Company’s 2026 annual meeting of shareholders (the “2026 Annual Meeting”) and shall serve until their successor is elected and qualified or their earlier resignation or removal.

The Nominating Committee considers recommendations of the Chief Executive Officer of the Bank (“CEO/Bank”) and the Trager family members (“Trager Family Members”) (generally defined to include (i) Steven E. Trager, who is Chair/CEO, (ii) Jean S. Trager, the mother of Steven E. Trager, and (iii) their descendants, companies, partnerships, or trusts in which they are majority owners, trustees, or beneficiaries) as well as prior service and performance as a Director. In 2025, the Nominating Committee and the Board of Directors approved the Director Nominees to be considered for election at the Annual Meeting. No candidate that was recommended by a beneficial owner of more than five percent (5%) of the Company’s voting common stock was rejected. The Trager Family Members recommended all Director Nominees submitted to the Nominating Committee and the Board of Directors. No other shareholder submitted a recommendation for a Director Nominee for the Annual Meeting.

The Nominating Committee will consider candidates for Director Nominees at the 2026 Annual Meeting properly put forth by Republic shareholders. Shareholders should submit such nominations, if any, to the Company’s Secretary, at 601 West Market Street, Louisville, Kentucky, 40202, along with the information required in the Bylaws, no later than January 24, 2026. Shareholder nominations must be made according to the procedures contained in the Bylaws and described in this Proxy Statement under the heading “Shareholder Proposals”.

Any shareholder notice of nomination must include the information required by the Bylaws with respect to the nomination and all other information regarding the proposed nominee and the nominating shareholder required by Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder. The Company may refuse to consider any nomination that is not timely or otherwise fails to meet the requirements of the Bylaws or the SEC’s rules with respect to the submission of Director nominations. A written statement from the proposed nominee consenting to be named as a candidate and, if nominated and elected, to serve as a Director should accompany any shareholder nomination.

2025 Independent Director Nominees

Non-employee Director Nominees Yoania Cannon, Jennifer N. Green, Heather V. Howell, Timothy S. Huval, Ernest W. Marshall, Jr., W. Patrick Mulloy, II, W. Kennett Oyler, III, Vidya Ravichandran, Alejandro M. Sanchez, and Mark A. Vogt would collectively comprise a majority of the Board of Directors, and the Board has determined that each is an “independent director” as defined in Rule 5605(a)(2) of the NASDAQ listing standards (“Independent Directors”). Director Nominee David P. Feaster, while a non-employee Director Nominee, retired from the Bank in 2019 and currently provides consulting services to the Bank. Accordingly, Mr. Feaster is not identified as an Independent Director.

While the Company is a “controlled company” as defined under the NASDAQ rules and thus is entitled to an exemption from the majority independence rule, the Company has not elected this exemption for its 2025 election of Directors but reserves the right to claim this exemption in the future.

16 | Republic Bancorp, Inc. |

Director Nominee Availability

Neither the Nominating Committee nor the Board of Directors has reason to believe that any Director Nominee will not be available for election or to serve following election. However, if any of the Director Nominees should become unavailable for election, and unless authority is withheld, the holders of the proxies solicited hereby will vote for such other individual(s) as the Nominating Committee or the Board of Directors may recommend.

Director Skills Matrix

|

|

|

|

|

|

|

| |

(as of December 31, 2024) | Accounting | Banking | Technology | Human | Legal/ | CEO & | Environmental/ | Mergers & |

Yoania Cannon |

|

|

|

| ||||

David P. Feaster |

|

|

|

|

| |||

Jennifer N. Green |

|

|

|

|

|

| ||

Heather V. Howell |

|

|

|

| ||||

Timothy S. Huval |

|

|

|

|

|

| ||

Ernest W. Marshall, Jr. |

|

|

|

| ||||

W. Patrick Mulloy, II |

|

|

|

|

|

| ||

W. Kennett Oyler, III |

|

|

|

|

|

| ||

Logan M. Pichel |

|

|

|

|

| |||

Vidya Ravichandran |

|

|

|

|

| |||

Alejandro M. Sanchez |

|

|

|

|

|

|

|

|

A. Scott Trager |

|

|

| |||||

Steven E. Trager |

|

|

|

|

|

| ||

Andrew Trager-Kusman |

|

|

| |||||

Mark A. Vogt |

|

|

|

|

|

.

2025 PROXY STATEMENT | 17 |

Director Nominees’ Names and Principal Occupations for the Past Five Years

The following table details the indicated information for each Director Nominee as of December 31, 2024, including service as a Director of the Company or its predecessors:

YOANIA CANNON | DAVID P. FEASTER | |||

COMMITTEE: Audit Age: 44 Director of Republic and Director of the Bank since 2024 |

|

| COMMITTEES: Loan Trust - Chair Age: 71 Director of Republic since 2020 and Director of the Bank since 2019 Consultant, Republic Bank & Trust Company |

|

KEY EXPERIENCE AND QUALIFICATIONS ● Vice President, Global Brand Strategy and Finance Capabilities with Brown-Forman Corporation (February 2023 – January 2025). ● Prior experience with Brown-Forman Corporation includes Director, Strategy and Brand Analytics (2020 – 2023); Finance Director Global Travel Retail and Developed APAC (2018 – 2020); Controller, Americas (2016 – 2018); Division Finance Manager, West Division (2014 – 2016); Commercial Finance Manager (2012 – 2014); Finance Sales Operations Manager (2009 – 2011); and Finance Analyst (2007 – 2009). EDUCATION ● University of Louisville, Master of Accountancy, MBA, and Bachelor of Science in Accounting REASON FOR NOMINATION As a member of the Audit Committee, Ms. Cannon meets NASDAQ’s financial knowledge and sophistication requirements and qualifies as an “audit committee financial expert” under SEC rules. Based on Ms. Cannon’s managerial, business, and accounting background and her specific experience, qualifications and attributes disclosed, the Board has determined that she should continue to serve as a Director. |

| KEY EXPERIENCE AND QUALIFICATIONS ● Retired, consultant to the Bank since 2019. ● Previously, having 49 years of banking experience, Florida Market President for the Bank (2016-2019); CEO, President, and Director of Cornerstone Community Bank (2009 – 2016, when Cornerstone Bank merged with the Bank); founder, CEO, and President of Signature Bank in St. Petersburg, Florida (which merged into Whitney National Bank); Area President of Whitney National Bank after merger; an executive at a number of banks in Florida, including Sun Bank, Bank of America, C&S, and Northern Trust Bank. ● Member of the Florida Bankers Association Board, former chair of the St. Petersburg Area Chamber of Commerce, former chair of All Children’s Hospital Board, and a member of the St. Petersburg College Banking School Board. EDUCATION ● University of Florida, Business Administration, with honors REASON FOR NOMINATION Based on Mr. Feaster’s experience as a Republic and Bank Board Director, his extensive banking experience, his significant community involvement, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | ||

18 | Republic Bancorp, Inc. |

jennifer n. green | HEATHER V. HOWELL | |||

COMMITTEE: Risk – Chair Nominating Age: 40 Director of Republic and Director of the Bank since 2022 |

|

| COMMITTEE: Nominating Age: 51 Director of Republic since 2020 and Director of the Bank since 2015 |

|

KEY EXPERIENCE AND QUALIFICATIONS ● Chief Legal Officer, Yum! Digital & Technology at Yum! Brands. Reporting to the Chief Digital & Technology Officer, leads a team of U.S.- and non-U.S.-based lawyers and legal professionals responsible for providing strategic advice and legal support on a range of matters related to the development, rollout and commercialization of internally-owned digital and technology products and services. ● Previously YUM! Brands Vice President, Global Mergers & Acquisitions (2020-2023); YUM! Brands’ Director of Transformation & Chief of Staff (2020-2021) and Director, Corporate Counsel (2016-2020); Vice President and Counsel, Corporate Secretary Americas for Credit Suisse (2014-2016); and attorney with Davis Polk & Wardwell LLP (2012 - 2014), with practice areas including Capital Markets, Mergers & Acquisitions, and Derivatives and Structured Products. ● Member of the City of Louisville’s Civilian Review & Accountability Board (Board’s inaugural Chair) and the Greater Louisville Inc. Business Council to End Racism, and former board member for Stage One Family Theatre and Maryhurst. ● Member of the New York Bar Association, the Kentucky Bar Association, the Charles W. Anderson, Jr. Chapter of the National Bar Association, and the Brandeis Inn of Court. EDUCATION ● Columbia Law School, Juris Doctor; Harlan Fiske Stone Scholar and Articles Editor of the Columbia Law Review ● Harvard University, Bachelor of Arts in Government, and a French Language Citation HONORS AND RECOGNITION ● 2024 Presentation Academy Tower Award in Business, Technology and Trade ● 2024 Central High School Law & Government Hall of Fame Inductee ● 2024 Savoy Magazine Most Influential Lawyers Designee ● 2024 Louisville Business First Forty Under 40 Honoree ● 2021 On Deck Fellow ● 2019 Leadership Council on Legal Diversity Fellow ● 2017 graduate of Ignite Louisville REASON FOR NOMINATION Based on Ms. Green’s experience as a Republic and Bank Board Director, her managerial and business background, her educational and legal background, and her specific experience, qualifications, and attributes disclosed, the Board has determined that she should continue to serve as a Director. | KEY EXPERIENCE AND QUALIFICATIONS ● President of GREATER THAN Beverages since January 2024. ● Previously Director of Global Innovation and Trademark Development for the Jack Daniel’s Family of Brands (through October 2023), having been employed by Brown-Forman Corporation since 2015. ● Previously CEO and Chief Tea Officer (2010-2015) of Rooibee Red Tea, launching Rooibee Roo in 2014, a line of ready-to-drink tea with less calories and sugar for children, a brand extension for Rooibee Red Tea. ● Member of the Greater Louisville Project Board of Directors. EDUCATION ● Bellarmine University, Executive MBA ● Eastern Kentucky University, Bachelor of Arts HONORS AND RECOGNITION ● 2013 Ernst & Young E.D.G.E. Award ● 2014 Business First Enterprising Woman to Watch ● Finalist in 2013 Business First Business Leader of the Year REASON FOR NOMINATION Based on Ms. Howell’s experience as a Republic and Bank Board Director, her education, her business and entrepreneurial experience, and her specific experience, qualifications, and attributes disclosed, the Board has determined that she should continue to serve as a Director. | |||

2025 PROXY STATEMENT | 19 |

timothy s. huval | eRNEST W. MARSHALL, JR. | |||

COMMITTEE: Audit Compensation Age: 58 Director of Republic and Director of the Bank since 2022 |

|

| COMMITTEES: Compensation - Chair Nominating Age: 56 Director of Republic since 2020 and Director of the Bank since 2017 |

|

KEY EXPERIENCE AND QUALIFICATIONS ● Chief Administrative Officer (2019 - Present) and Chief Human Resources Officer (2013 - Present) of Humana, Inc. ● Previously held a number of positions at Bank of America (2002-2013), including Human Resources Executive, Global Treasury Services/Technology Division; Senior Human Resources Executive, Global Wealth & Investment Management; Chief Information Officer, Global Wealth & Investment Management; Head of Operations, Credit Card Services; Head of Operations, Mortgage Business; and Senior Vice President, Consumer Service & Operations, and served in various roles at Gateway Computers (1997-2002), including Training and Development Manager, Global Operations; Sr. Manager, Human Resources; General Manager, Factory & Call Center; and Director, Human Resources, Global Operations & Consumer. ● Advisory board member for MyCareGorithm, LLC. ● Former member of the NASDAQ-listed Seacoast Banking Corporation board of directors (2016 - 2019). EDUCATION ● Brigham Young University, Master’s in Public Administration ● Weber State University, Bachelor of Arts, Marketing ● Salt Lake City Community College, Associate’s Degree; Honorary Doctor of Humane Letters REASON FOR NOMINATION As a member of the Audit Committee, Mr. Huval meets NASDAQ’s financial knowledge and sophistication requirements. | KEY EXPERIENCE AND QUALIFICATIONS ● Executive Vice President and Chief Human Resources Officer at Eaton Corporation since 2018. ● Vice President of Human Resources of GE Aviation at the General Electric Company (2013-2018). ● Board member for Kindway and the Rock and Roll Hall of Fame. ● Director for the NASDAQ-listed LSI Industries Inc. since August 16, 2022. EDUCATION ● Indiana University, Bloomington, MBA/Juris Doctor ● Bellarmine University, Bachelor’s degree with a dual major in Accounting and Business Administration; including two semesters abroad at New College in Oxford, England HONORS AND RECOGNITION ● 2024 Distinguished Fellow, National Academy of Human Resources ● One of 2020’s Most Influential Black Executives in Corporate America, Savoy Magazine ● ’50 under 50’ feature, Black MBA Magazine REASON FOR NOMINATION Based on Mr. Marshall’s experience as a Republic and Bank Board Director, his legal and business experience and accomplishments, his extensive civic and community involvement, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | |||

20 | Republic Bancorp, Inc. |

W. PATRICK MULLOY, II | W. KENNETT OYLER, III | |||

COMMITTEES: Audit Loan Age: 71 Director of Republic since 2020 and Director of the Bank since 2012 |

|

| COMMITTEE: Risk Age: 66 Director of Republic since 2020 and Director of the Bank since 2008 |

|

KEY EXPERIENCE AND QUALIFICATIONS ● Interim Chief Executive Officer, Louisville Economic Development Alliance, Inc. ● Member, Advisory Board Savoy Life, LLC; Previously Director and CEO of Sharps Compliance, Inc. (April 2022 – September 2022); Of Counsel with Wyatt, Tarrant & Combs, LLP (2018-2022); Chairman and CEO of Elmcroft Senior Living (2006-2018), a national provider of senior housing services; President and CEO of two other senior housing companies, LifeTrust America, Inc., and Atria, Inc.; an attorney with the regional law firm of Greenebaum, Doll & McDonald PLLC (1994-1996); the Secretary of Finance to the Governor of Kentucky (1992-1994); and an attorney at a Louisville law firm (1978 - 1992). ● Investor and director of Assembly Healthcare, an ancillary service provider to healthcare providers. ● Member of Advisory Board of Apploi, Inc., the Board of Advisors of Vanderbilt University School of Law, and the Board Chair of University of Louisville Health, Inc. ● Director for the NASDAQ-listed Sharps Compliance Corp. from February 1, 2021 – September 2022. EDUCATION ● Vanderbilt University School of Law, Juris Doctor ● Vanderbilt University, Bachelor of Arts, interdisciplinary major in History, Economics, Philosophy, summa cum laude REASON FOR NOMINATION As a member of the Audit Committee, Mr. Mulloy meets NASDAQ’s financial knowledge and sophistication requirements. Based on Mr. Mulloy’s experience as a Republic and Bank Board Director, his managerial and business background, his educational and legal background, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | KEY EXPERIENCE AND QUALIFICATIONS ● CEO of OPM Services, Inc., a financial-services and investment firm Mr. Oyler founded in 1992. ● Executive in Residence at University of Louisville College of Business. ● Previously President and CEO of Greater Louisville, Inc., the Louisville, Kentucky Metro Chamber of Commerce (2014 - 2020); Managing Partner of OPM (1992 - 2015); Cash Management Officer of Citizens Fidelity (now PNC) Bank; President, CEO, CSO of High Speed Access Corp.; and Treasurer, VP of Finance and CFO of Henry Vogt Machine Co. ● Founded or co-founded twenty businesses in various industries, including financial services, real estate, internet access, manufacturing, railway, equipment leasing, and consumer research, and in 1997, co-founded a broadband internet provider, High Speed Access Corp., which he took public in 1999. ● Experience in leadership roles and directorships, including sixteen roles as chair, with dozens of civic and community organizations, including Leadership Louisville, Metro YMCA, University of Louisville, Metro United Way, Kentuckiana Works, the Metro Police Foundation, GLI, Canopy, Louisville Ballet, Junior Achievement, Louisville Science Center, and Downtown Development Corp. ● Serves as Director for Alliance Cost Containment, LLC and Thornton Capital. EDUCATION ● University of Louisville, Master of Business Administration ● University of Louisville, Bachelor of Science, Commerce, Marketing HONORS AND RECOGNITION ● Inducted into Kentucky Entrepreneur Hall of Fame, 2016 ● E&Y Entrepreneur of the Year, 2000 ● Cashflow Magazine Treasurer of the Year, 1985 REASON FOR NOMINATION Based on Mr. Oyler’s experience as a Republic and Bank Board Director, his education, his entrepreneurial and business background, his significant civic and community involvement, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | |||

2025 PROXY STATEMENT | 21 |

LOGAN M. PICHEL | VIDYA RAVICHANDRAN | |||

COMMITTEE: Risk Age: 60 Director of Republic and Director of the Bank since 2021 President & CEO of Republic Bank & Trust Company |

|

| COMMITTEE: Risk Compensation Age: 52 Director of Republic and Director of the Bank since 2023 |

|

KEY EXPERIENCE AND QUALIFICATIONS ● President and CEO of the Bank since 2021. ● Previously, having over 30 years of banking and financial services experience, served as President for the Bank (2020-2021) and held various positions with Regions Bank (2005-2020), including, Executive Vice President and Head of Corporate Development – Financial Planning and Analysis and Mergers and Acquisitions (2019-2020) (responsible for company budgeting, forecasting, capital allocation, business and product profitability analytics and reporting, and bank and non-bank mergers and acquisitions), Head of Consumer Lending (2010-2018) (mortgage, home equity, auto and personal loans as well as fintech and small dollar lending), Head of Enterprise Operations (2018-2019) (bank operations, loan fulfillment and servicing, collections, and contact centers), and National Production Manager for Mortgage (2005-2010). ● Leader of Regions Bank’s Simplify and Grow initiative (2018-2020), which focused on making banking easier for customers, improving efficiencies of internal processes, and accelerating revenue growth. EDUCATION ● University of Michigan, Master of Business Administration ● Ohio Northern University, Finance REASON FOR NOMINATION Based on Mr. Pichel's banking experience, his experience as a Republic and Bank Board Director, his proven leadership skills, his education and background, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | KEY EXPERIENCE AND QUALIFICATIONS ● CEO and founder of GlowTouch, a global enterprise that provides customer care and technology outsourcing services, headquartered in Louisville, Kentucky, with more than 3,000 employees throughout the United States, India, Philippines, and the Dominican Republic, since 2002. ● Founded StemWizard (2013), a software platform that allows students, teachers, judges, volunteers, and administrators to set up and run STEM competitions, such as science fairs, the Science Olympiad, and robotics events, through a cloud-enabled platform. ● Member of the Kentucky Council for Postsecondary Education Board, Young Presidents’ Organization, and C200. EDUCATION ● Virginia Polytechnic Institute and State University, Master of Science ● University of Agricultural Sciences, Bangalore, Bachelor of Science HONORS AND RECOGNITION ● Inductee of CCWomen Hall of Fame ● Louisville’s Most Admired CEOs, Business First REASON FOR NOMINATION Based on Ms. Ravichandran’s background in technology, her leadership and entrepreneurial achievements, her educational background, and her specific experience, qualifications, and attributes disclosed, the Board has determined that she should be nominated to serve as a Director. | |||

22 | Republic Bancorp, Inc. |

ALEJANDRO M. SANCHEZ | a. scott trager | |||

COMMITTEE: Risk Age: 66 Director of Republic and Director of the Bank since 2024 |

|

| COMMITTEE: Loan Age: 72 Director of Republic and Director of the Bank since 1990 President & Vice Chair, Republic Vice Chair, Republic Bank |

|

KEY EXPERIENCE AND QUALIFICATIONS ● Executive Advisor to NASDAQ, contractor. ● President and CEO of Salva Financial Group of Florida since 2024. ● CEO Emeritus for the Florida Bankers Association since November 2023. ● Board Director for Poplar Bank since 2023. ● Board Member for Apalachee Center Hospital, Inc. since 2022. ● Previously President and CEO for the Florida Bankers Association (1998-2023); a Board Director for Trustco Bank (2022-2023); Board Member for the Exim Bank Advisory Committee (2018-2020); and a Member of the Federal Retirement Thrift Investment Board (2002-2010). EDUCATION ● University of Iowa, College of Law, Juris Doctor ● Troy University, Bachelor of Science in Business and Social Science HONORS AND RECOGNITION ● Served in United States Air Force 1976-1981, Honorable Discharge. REASON FOR NOMINATION Based on Mr. Sanchez’s banking, managerial, business, educational, and legal background and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | KEY EXPERIENCE AND QUALIFICATIONS ● President of Republic since 2012; Vice Chairman of Republic since 2017; and Vice Chair of the Bank since 2017. ● Previously Vice Chairman of Republic (1994-2012). ● Entire working career spent in various finance and banking capacities. ● Leadership experience in marketing, operations, and community bank management. ● Extensive community board experience and broad-based community connections in the metropolitan Louisville area. EDUCATION ● University of Tennessee, Business Administration REASON FOR NOMINATION Based on Mr. Trager's experience as a Republic and Bank Board Director, his direct banking experience, his proven leadership skills, his educational background, his extensive community involvement, and his specific experience, qualifications, and attributes disclosed, the Board has determined that he should continue to serve as a Director. | |||

2025 PROXY STATEMENT | 23 |

steven e. trager | andrew trager-kusman | |||

Age: 64 Director of Republic and Director of the Bank since 1988 Executive Chair & CEO, Republic Executive Chair, Republic Bank |

|

| COMMITTEES: Loan Trust Age: 38 Director of Republic since 2019 and Director of the Bank since 2020 Senior Vice President, Chief Strategy Officer, Republic Bank |

|