PRELIMINARY PROXY STATEMENT DATED DECEMBER 15, 2025, SUBJECT TO COMPLETION

|

|

4582 South Ulster Street Suite 1450 | ||

| Denver, Colorado 80237 | ||||

| 833-373-1300 | ||||

| www.aimco.com | ||||

[●]

Dear Fellow Stockholders:

You are cordially invited to attend a special meeting of stockholders of Apartment Investment and Management Company, a Maryland corporation (“Aimco”, the “Company”, “our” or “we”), to be held on [●], 2026 at [●] a.m., Mountain Standard Time (the “Special Meeting”) at the Company’s corporate headquarters, 4582 South Ulster Street, Suite 1450, Denver, CO 80237.

In January 2025, we announced that our previously announced strategic review process, which sought to explore a broad range of options to enhance stockholder value, had expanded to include, among other things, an acceleration of individual asset sales, potential sales of the major components of the business (in one or a series of transactions) and the exploration of a sale or merger of the Company as a whole. In November 2025, we announced the conclusion of the strategic review process. Given the disparate composition of the Company’s remaining assets and market feedback received during the strategic review process, with Morgan Stanley & Co. LLC (“Morgan Stanley”) and Wachtell, Lipton, Rosen & Katz (“Wachtell”) serving as our financial and legal advisors, respectively, the Board of Directors (the “Board”) of the Company unanimously deemed advisable and approved a plan of sale and liquidation (the “Plan of Sale and Liquidation”), conditioned on stockholder approval. We refer to the transactions contemplated by the Plan of Sale and Liquidation, collectively, as the “Plan of Sale and Liquidation”.

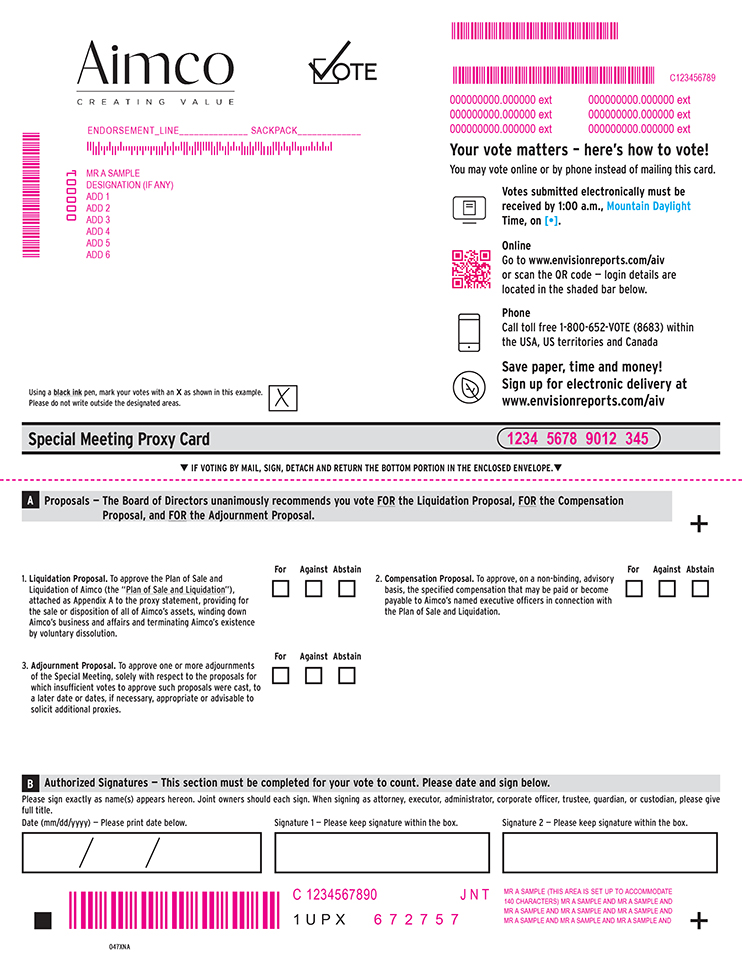

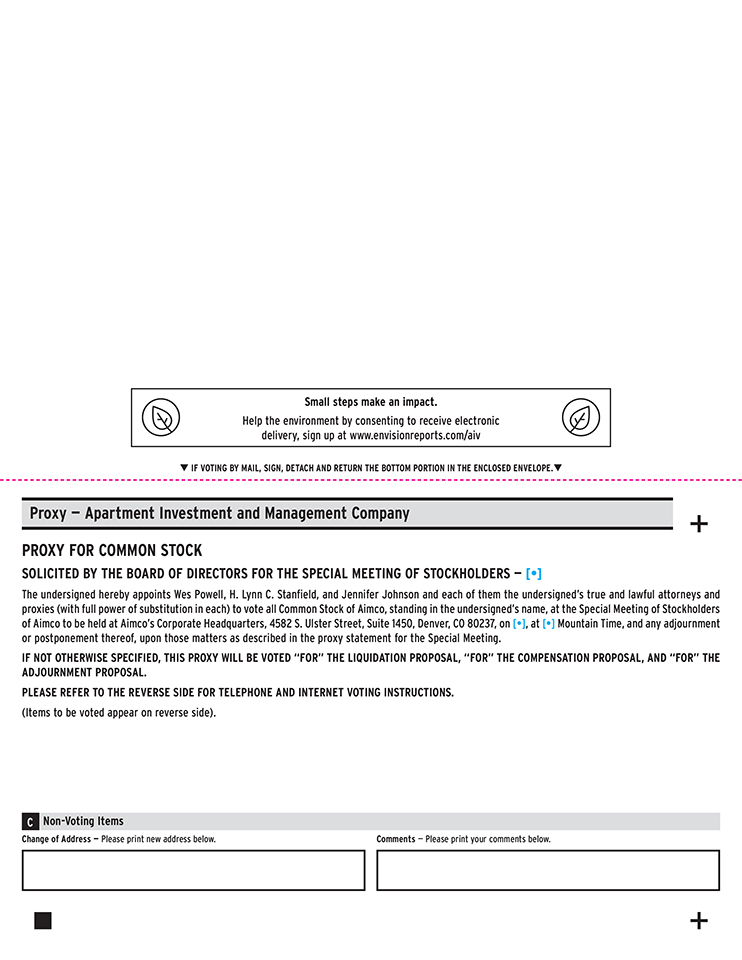

At the Special Meeting, we are asking you to consider and vote upon a proposal to approve the Plan of Sale and Liquidation, as further described below and in the enclosed proxy statement. We are also asking you to consider and cast a non-binding, advisory vote upon a proposal to approve the specified compensation that may be paid or become payable to the named executive officers of Aimco in connection with the Plan of Sale and Liquidation. Finally, we are asking you to consider and vote upon a proposal to adjourn the Special Meeting, solely with respect to the proposals for which insufficient votes to approve such proposals were cast, to a later date or dates, if necessary, appropriate or advisable, to solicit additional proxies.

If the Liquidation Proposal (as defined below) is approved by our stockholders, the Company intends to return net proceeds from asset sales and cash on hand to our stockholders, subject to payment of our liabilities and obligations and the creation of associated reserves. As of the date of this proxy statement, it is estimated that net proceeds from the sale of the Company’s remaining assets, including the Brickell Assemblage and Chicago, IL Portfolio, which are under contract to be sold for $520 million and $455 million, respectively, and cash on hand could result in total distributions of between $5.75 and $7.10 per share of the Company’s Class A common stock, $0.01 par value per share (the “Common Shares”), given current market conditions and inclusive of estimated transaction and wind-down costs and subject to the other estimates and assumptions more fully described in the enclosed proxy statement. When combined with the $2.83 per share in special dividends returned to shareholders in 2025 (as of December 12, 2025), Aimco’s total distribution estimate is between $8.58 and $9.93 per share. The timing and amount of any distributions remain subject to numerous factors, including the discretion of the Board and applicable law.

For the avoidance of doubt, the accompanying proxy statement does not constitute any solicitation of consents in respect of the common partnership units of Aimco OP L.P.