☑ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☑ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

FROM OUR BOARD

Dear Shareholders:

On behalf of our Board of Directors, we are pleased to invite you to Greenbrier’s 2026 Annual Meeting of Shareholders.

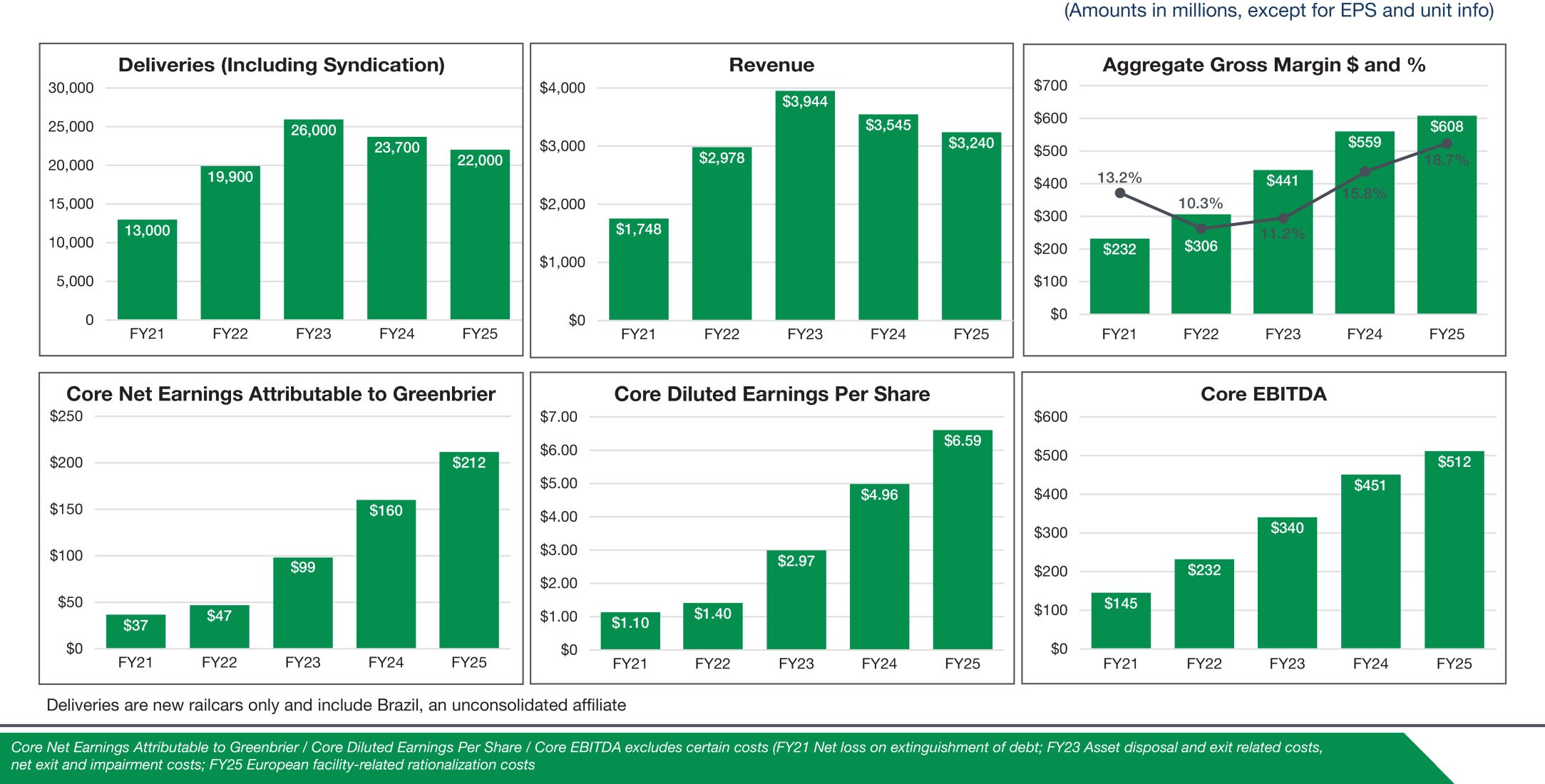

Fiscal 2025 was a very successful year for Greenbrier. We achieved a diluted EPS of $6.35, the highest in our Company’s history. We continued to achieve higher core net earnings on fewer deliveries year-over-year as we successfully executed our multi-year strategy launched in 2023. We have implemented capacity rationalization, which has resulted in improved operational and financial performance. We also welcomed Stevan Bobb and Jeffrey Songer to the Board of Directors in June 2025. Each brings decades of experience in the rail industry, and together they increase the representation of independent directors on our Board. These Directors’ perspectives, skills, and expertise embody our ongoing commitment to Board refreshment.

We are optimistic about our future. Greenbrier will strive to achieve increasingly better financial results across various market conditions. We will continue to execute our multi-year strategy and to restructure our business for increased efficiency and reduced risk. In doing so, we continue to create long-term shareholder value. We are confident in our ability to drive growth and increase shareholder returns while positively influencing corporate governance, environmental sustainability, and the communities where we operate.

We value feedback as engagement with our shareholders enhances our decision-making. Along with the Board of Directors, our leadership team and our employees, we thank you for your continued support and investment. We look forward to your participation at the Annual Meeting on January 7, 2026.

|

|

||||

|

ADMIRAL THOMAS B. FARGO Board Chair |

LORIE L. TEKORIUS CEO and President | |||

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

2026 ANNUAL MEETING INFORMATION

|

|

|

|

| |||

| Meeting Date: Wednesday, January 7, 2026 |

Meeting Access: www.virtualshareholder meeting.com/GBX2026 |

Meeting Time: 7:30 a.m. (Pacific Time) |

Record Date: November 4, 2025 |

PROXY VOTING

Your vote is very important. Whether or not you plan to virtually attend the Annual Meeting, please promptly vote by telephone or over the internet, or by completing, signing, dating and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting.

|

|

ONLINE

|

|

BY PHONE

|

|

BY MAIL

|

Our Notice of Annual Meeting, Proxy Statement and Annual Report for the fiscal year ended August 31, 2025, are available at http://materials.proxyvote.com/393657

Our Board of Directors (the “Board”) has determined and authorized that the Annual Meeting be conducted virtually solely by remote communication beginning at 7:30 a.m. Pacific Time on January 7, 2026, via webcast at www.virtualshareholdermeeting.com/GBX2026. You may notify the Company of your desire to participate in the Annual Meeting by logging into the online site in advance. Please see “Annual Meeting Information” on page 68 of this Proxy Statement for details on how to access and participate in our virtual Annual Meeting. The Annual Meeting is being held for the purpose of voting on the items set forth below and to transact such other business as may properly come before the meeting.

ITEMS TO BE VOTED ON

| Proposal 1 |

— | Election of Directors | Page 26 | |||

| Proposal 2 |

— | Advisory Approval of Executive Compensation | Page 53 | |||

| Proposal 3 |

— | Approval of the 2021 Stock Incentive Plan, As Amended | Page 56 | |||

| Proposal 4 |

— | Approval of the Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of Common Stock | Page 64 | |||

| Proposal 5 |

— | Ratification of Appointment of Independent Auditors | Page 66 | |||

As of the date of this Notice, the Company has not received notice of any matters, other than those set forth above, that may properly be presented at the Annual Meeting. If any other matters are properly presented for consideration at the meeting, the persons named as proxies on the proxy card, or their duly constituted substitutes, are authorized to vote the shares represented by proxy or otherwise act on those matters in accordance with their judgment.

Holders of record of our Common Stock at the close of business on November 4, 2025, are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

By Order of the Board,

Christian M. Lucky

Senior Vice President, Chief Legal & Compliance Officer

November 17, 2025

TABLE OF CONTENTS

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read this entire Proxy Statement carefully before voting. This Proxy Statement is first being released to shareholders on November 17, 2025.

PROPOSAL 1

Election of Directors

|

THE BOARD RECOMMENDS A VOTE FOR ALL DIRECTOR NOMINEES

Our Nominating and Corporate Governance Committee and our Board recommend that shareholders vote “FOR” all director nominees, as they have determined that each of the nominees possesses the right experience and qualifications to effectively oversee Greenbrier’s business strategy and risk management. Three of the nominees below are Class II directors nominated for a three-year term. Jeffrey Songer was appointed as a Class I director and Stevan Bobb was appointed as a Class III director by the Board in June 2025. Under Greenbrier’s Amended and Restated Bylaws (“Bylaws”), directors appointed by the Board stand for election at the next Annual Meeting of Shareholders. As a result, Messrs. Songer and Bobb are standing for election at this Annual Meeting.

See “Proposal 1, Election of Directors” on page 26 of this Proxy Statement. |

Director Nominees

The following table summarizes the qualifications of the director nominees.

|

|

STEVAN B. BOBB Mr. Bobb has served as a member of the Board since June 2025. His 36-year career with the Class I railroad BNSF Railway (BNSF) included prominent roles in strategic commercial and operational leadership within the rail industry, with Mr. Bobb serving most recently as Executive Vice President and Chief Marketing Officer of BNSF from 2013 to 2024. Mr. Bobb brings expertise in business strategy, cybersecurity, the rail industry, and financial matters to the Board. The Board recommends a vote “FOR” Mr. Bobb. | |

|

|

WANDA F. FELTON Ms. Felton has served as a member of the Board since 2017. Ms. Felton has over 30 years of financial industry experience in commercial and investment banking. Ms. Felton was a Presidential Appointee and was confirmed twice by the U.S. Senate to serve on the board of the Export Import Bank of the United States as Vice Chair of the Board and First Vice President from June 2011 to November 2016. Ms. Felton brings her significant prior experience with emerging markets business development and capital raising to the Board. Additionally, Ms. Felton is an “audit committee financial expert” under NYSE and SEC rules. The Board recommends a vote “FOR” Ms. Felton. | |

|

|

GRAEME A. JACK Mr. Jack has served as a member of the Board since 2006. He is a retired partner of PricewaterhouseCoopers LLP in Hong Kong. Mr. Jack brings accounting, financial reporting and cybersecurity expertise to the Board as well as extensive experience in international business transactions. Mr. Jack provides critical experience and continuity in guiding the Company through times of macroeconomic and market turbulence. Additionally, Mr. Jack is an “audit committee financial expert” under NYSE and SEC rules, The Board recommends a vote “FOR” Mr. Jack. | |

| 2026 PROXY STATEMENT |

|

1

PROXY SUMMARY

|

|

JEFFREY M. SONGER Mr. Songer has served as a member of the Board since June 2025. Mr. Songer has over 30 years of expertise in operations, engineering, and finance, 18 of which were spent at Kansas City Southern, a Class I railroad, where he served in leadership roles through the completion of the merger creating Canadian Pacific Kansas City Limited in April 2023. Mr. Songer brings a combination of railroad industry experience, cybersecurity expertise, and a deep understanding of international labor relations, particularly in Mexico, where Greenbrier employs thousands of individuals. Additionally, Mr. Songer is an “audit committee financial expert” under NYSE and SEC rules. The Board recommends a vote “FOR” Mr. Songer. | |

|

|

WENDY L. TERAMOTO Ms. Teramoto has served as a member of the Board since 2019. She has been a senior investment management professional with an affiliate of Fairfax Financial Holdings Limited since 2018. Ms. Teramoto brings to the Board investment management and financial expertise, experience with manufacturing and other heavy industry companies and critical experience in guiding the Company through times of macroeconomic and market turbulence. Additionally, Ms. Teramoto is an “audit committee financial expert” under NYSE and SEC rules. The Board recommends a vote “FOR” Ms. Teramoto. | |

DIRECTOR EXPERIENCE

The Nominating and Corporate Governance Committee considers a variety of factors, including professional experience, demonstrated skills, and diversity of background in evaluating candidates for membership on the Board. As demonstrated in the matrix below, which reflects certain categories of experience and expertise represented by the directors serving on the Board after the 2026 Annual Meeting, Greenbrier’s directors provide a diverse mix of skills, knowledge, attributes, and experiences that cover the spectrum of areas that affect the Company’s business and its stakeholders.

(Summary of our ten-person Board as of November 2025. See “Corporate Governance—Board Experience” for more detail.)

|

THE GREENBRIER COMPANIES |

2

PROXY SUMMARY

Our Board believes that shareholder interests are best represented by directors with the right mix of skills, experience, and expertise to actively oversee strategy, risk management, and governance at Greenbrier. An independent, engaged, and diverse Board enhances representation of shareholder and stakeholder interests and promotes thoughtful and effective Board deliberation. Our Board is focused on its continued independent oversight of Greenbrier while maintaining high governance standards. The Board carries out this goal through a variety of policies and practices, including an independent Chair of the Board, regular executive sessions of independent directors at Board and committee meetings, Board and committee refreshment, substantial director stock ownership guidelines, director engagement with shareholders and stakeholders, continuing education, consultations with highly-qualified independent external advisors, and annual evaluations of the Board, its committees and each director.

The composition of the Board reflects its commitment to Board refreshment, independence, and relevant expertise:

| • | Nine of our ten directors are independent, with all nine such independent directors meeting the heightened standard of independence established by the Board as described in “Board Independence” on page 14 of this Proxy Statement. |

| • | 60% of our directors have joined the Board in the last six years. |

| • | Our directors with longer tenures provide critical experience in guiding the Company through macroeconomic and industry downturns and up-cycles. |

See “Corporate Governance” on page 7 of this Proxy Statement for more information about our governance profile, achievements and initiatives.

PROPOSAL 2

Advisory Approval of Executive Compensation

|

THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL

Our Board recommends that shareholders vote “FOR” the advisory approval of the compensation of our named executive officers for fiscal 2025.

See “Proposal 2, Advisory Approval of Executive Compensation” on page 53 of this Proxy Statement. |

Executive Compensation Highlights

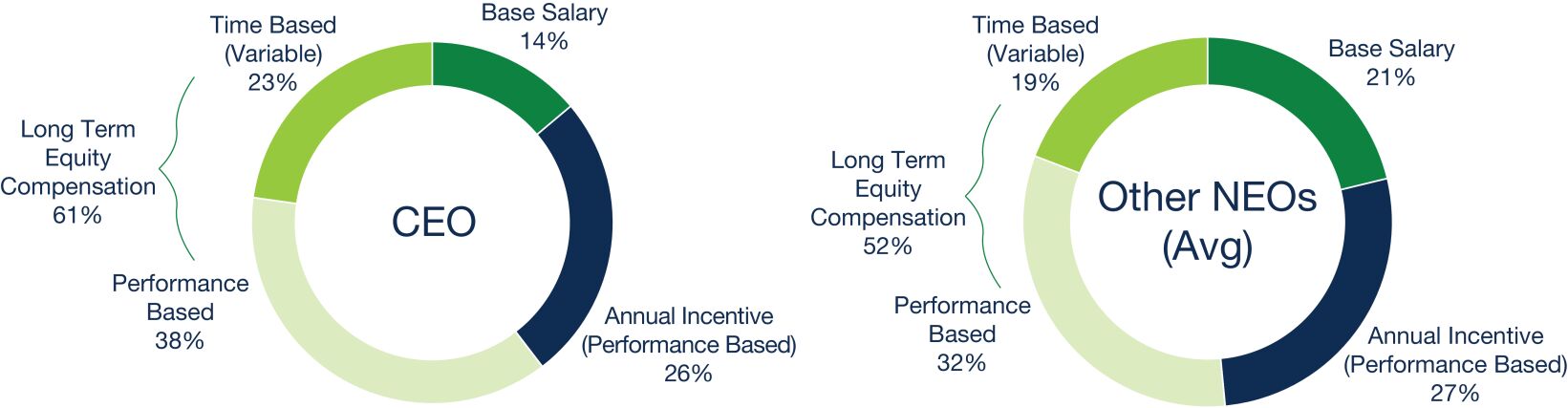

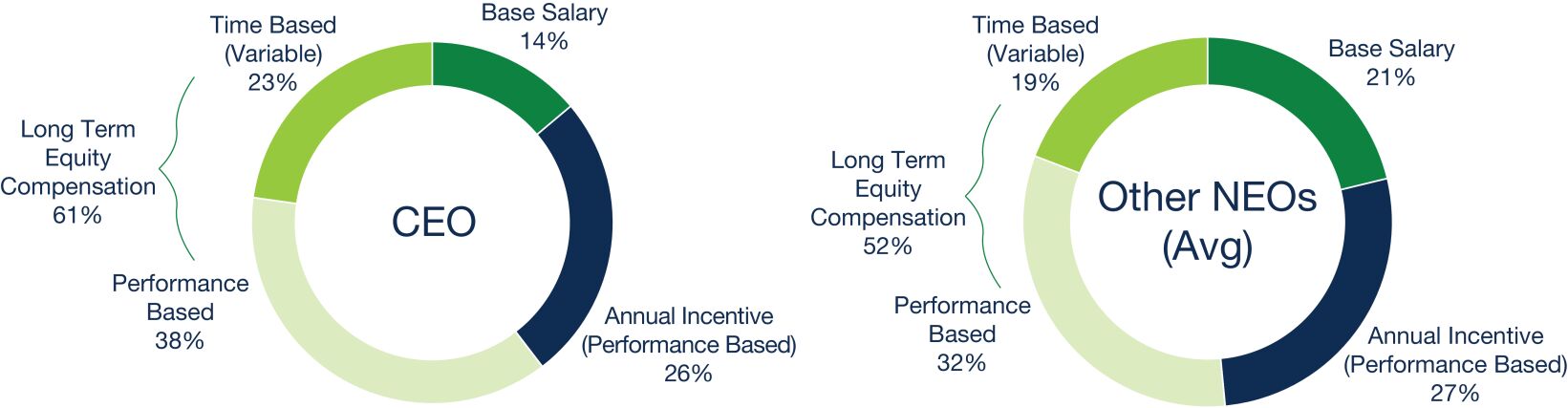

Our executive compensation program is designed to attract, motivate, and retain the key executives who drive our success. Our compensation philosophy focuses on pay that reflects performance and aligns with the interests of shareholders. A key objective of that philosophy is to link a significant portion of the compensation of our executive officers to achievement of pre-established financial and strategic goals that are directly tied to our overall business strategy. In fiscal 2025, over 60% of the compensation of our Chief Executive Officer and, on average, over 55% of the compensation of our other “named executive officers” or “NEOs” (discussed later in this Proxy Statement), was conditioned on the achievement of pre-established financial and strategic goals, using grant date accounting fair values for fiscal 2025 equity awards, and annual base salaries and annual bonuses earned for fiscal 2025.

We believe our performance in fiscal 2025 is a testament to the strength and effectiveness of our compensation philosophy. As described later in this Proxy Statement, in fiscal 2025 we achieved annual revenue of $3.2 billion, gross margin expansion by 290 bps to 18.7% from fiscal 2024, and diluted EPS of $6.35, the highest in our history.

| 2026 PROXY STATEMENT |

|

3

PROXY SUMMARY

Listed below are highlights of our fiscal 2025 executive compensation policies and practices:

| WHAT WE DO | ||

|

✔ |

Ongoing engagement with our institutional shareholders regarding our executive compensation policies and practices | |

|

✔ |

Performance-based cash and equity incentive compensation | |

|

✔ |

Caps on performance-based cash and equity incentive compensation | |

|

✔ |

Significant portion of executive compensation at risk based on company performance | |

|

✔ |

Multi-year equity award vesting periods, including three-year performance periods for performance-based equity awards | |

|

✔ |

One-year minimum vesting requirement under equity incentive plan, with limited exceptions | |

|

✔ |

Annual review and approval of our executive compensation program | |

|

✔ |

Annual compensation risk assessment | |

|

✔ |

Annual “Say on Pay” vote | |

|

✔ |

Clawback policy on cash and equity incentive compensation | |

|

✔ |

Stock ownership and stock retention guidelines for executive officers | |

|

✔ |

Independent compensation consultant engaged by the Compensation Committee | |

|

✔ |

100% independent directors on the Compensation Committee | |

|

✔ |

Limited perquisites | |

| WHAT WE DON’T DO | ||

|

✖ |

No “single trigger” change of control severance payments and benefits | |

|

✖ |

No gross-ups for change of control related excise tax payments | |

|

✖ |

No short sales, hedging, pledging of stock ownership positions, or transactions involving derivatives of our common stock | |

|

✖ |

No strict benchmarking of executive compensation to a specific percentile of our compensation peer group | |

|

✖ |

No pension benefits | |

|

✖ |

No dividend payments on awards that do not vest | |

|

✖ |

No ‘repricing’ of out-of-the-money stock options or similar awards without shareholder approval | |

|

✖ |

No incentivizing unnecessary or excessive risk taking | |

|

✖ |

No employment agreements with executive officers that provide for a guaranteed term of employment | |

PROPOSAL 3

Approval of the 2021 Stock Incentive Plan, As Amended

|

THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL

Our Board recommends that shareholders vote “FOR” the approval of the 2021 Stock Incentive Plan, As Amended.

See “Proposal 3, Approval of the 2021 Stock Incentive Plan, As Amended” on page 56 of this Proxy Statement. |

|

THE GREENBRIER COMPANIES |

4

PROXY SUMMARY

Our existing 2021 Stock Incentive Plan (the “2021 Plan”) has been a key part of the Company’s compensation philosophy and programs. Our ability to attract, retain, and motivate highly qualified non-employee directors, employees, consultants, and advisors is critical to our success. The Board believes the interests of the Company and its shareholders will be advanced if we can continue to offer these service providers the opportunity to acquire or increase a direct proprietary interest in the operations and future success of the Company through the 2021 Stock Incentive Plan, As Amended (the “Amended Plan”). The Amended Plan includes the following provisions, which are considered best practice for compensation and corporate governance purposes and are intended to protect our shareholders’ interests:

|

✔ |

No Evergreen Provision. There is no evergreen feature under which shares authorized for issuance under the Amended Plan can be automatically replenished. | |

|

✔ |

Certain Shares Are No Longer Returned to the Share Reserve. Shares used to pay the exercise price of a stock option or stock appreciation right, or to satisfy tax withholding obligations for a stock option or stock appreciation right, will not become available for future grant under the Amended Plan. | |

|

✔ |

Repricing is Not Allowed without Shareholder Approval. The Amended Plan does not permit “underwater” option and similar awards to be repriced or exchanged for other awards unless our shareholders approve the repricing or exchange. | |

|

✔ |

Reasonable Annual Limits on Non-Employee Director Compensation. The Amended Plan sets limits as to the total compensation that a non-employee director may receive during each fiscal year (for service as a non-employee director). | |

|

✔ |

No Tax Gross-ups. The Amended Plan does not provide for any tax gross-ups. | |

|

✔ |

Subject to Clawback. Each award under the Amended Plan will be subject to the Company’s clawback policy. | |

|

✔ |

No Dividends on Unvested Awards. No dividends or other distributions may be paid with respect to any shares underlying the unvested portion of an award until such portion vests, and no dividends or other distributions may be paid with respect to options or stock appreciation rights. | |

|

✔ |

Minimum Exercise Price. Other than options and stock appreciation rights assumed in connection with acquisitions, options and stock appreciation rights granted under the Amended Plan must have a per-share exercise price no less than 100% of the fair market value per share on the date of grant of the relevant award. | |

|

✔ |

Certain Limits Related to Options. The Amended Plan prohibits “reload” options, as well as the payment of the exercise price of options with a promissory note. | |

|

✔ |

No Liberal Change in Control Definition. The announcement or shareholder approval of (rather than a consummation of) a change in control transaction is not a change in control under the Amended Plan. | |

|

✔ |

Transfer Restrictions. Awards may not be transferred to financial institutions. | |

PROPOSAL 4

Approval of Amended and Restated Articles of Incorporation to Increase the Number of Authorized Shares of Common Stock

|

THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL

Our Board recommends that shareholders vote “FOR” the approval of the Amended and Restated Articles of Incorporation to increase the number of authorized shares of Common Stock.

See “Proposal 4, Approval of the Amended and Restated Articles of Incorporation” on page 64 of this Proxy Statement. |

Our existing Articles of Incorporation authorize the issuance of a maximum of 50,000,000 shares of common stock. As of October 24, 2025, only a fraction of this authorized share amount remains available for future issuance, as we have:

| • | approximately 31,190,881 shares of common stock outstanding; |

| • | an additional 854,677 shares of common stock reserved for future issuance for existing equity awards outstanding under the 2021 Plan; |

| 2026 PROXY STATEMENT |

|

5

PROXY SUMMARY

| • | an additional 476,748 shares of common stock reserved for future issuance under future equity awards under the 2021 Plan (without taking into account the proposed 1,000,000 share reserve increase under the Amended Plan proposed in Proposal 3); and |

| • | an additional 8,123,421 shares of common stock reserved for future issuance in the event of conversions of our outstanding convertible senior notes due in 2028. |

The Board recommends that our shareholders approve the Amended and Restated Articles of Incorporation to revise Article 6 of our current Articles of Incorporation to increase the authorized common stock from 50,000,000 to 100,000,000 shares. The proposed increase will support our ongoing flexibility to engage in capital-raising transactions, grant equity awards to employees, and issue stock for other corporate purposes. The text of the proposed Amended and Restated Articles of Incorporation is attached to this Proxy Statement as Appendix B.

PROPOSAL 5

Ratification of Appointment of Independent Auditors

|

THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL

Our Board recommends that shareholders vote “FOR” ratification of the appointment of KPMG LLP as auditors for fiscal 2026.

See “Proposal 5, Ratification of Appointment of Independent Auditors” on page 66 of this Proxy Statement. |

|

THE GREENBRIER COMPANIES |

6

CORPORATE

GOVERNANCE

Board Composition

Our Board is currently composed of ten directors, of whom nine are independent, non-employee directors. Each of our directors serves for a three-year term, as follows:

| • | Wanda Felton, Graeme Jack, and Wendy Teramoto currently serve as Class II directors, with terms expiring at this Annual Meeting; |

| • | Lorie Tekorius, Kelly Williams, and Stevan Bobb currently serve as Class III directors, with terms expiring at our annual meeting of shareholders to be held in 2027; and |

| • | Thomas Fargo, Antonio Garza, James Huffines, and Jeffrey Songer currently serve as Class I directors, with terms expiring at our annual meeting of shareholders to be held in 2028. |

Mr. Songer was appointed as a Class I director and Mr. Bobb was appointed as a Class III director by the Board in June 2025. Under Greenbrier’s Bylaws, directors appointed by the Board stand for election at the next Annual Meeting of Shareholders. As a result, Messrs. Songer and Bobb are standing for election at this Annual Meeting and are standing for election as Class I and Class III directors, respectively, in order that the classes remain as nearly equal in number as possible.

In the following pages, we highlight key areas of experience that qualify each director to serve on the Board. The Board has determined it is in the best interests of the Company and its shareholders for each of the directors to continue serving on the Board.

NOMINEES FOR ELECTION AT THE ANNUAL MEETING

|

Stevan B. Bobb (Director) | |||

| Age: 65 Director Since: 2025

|

Current Term Expiration: 2027 | |||

Experience

Mr. Bobb has served as a member of the Board since June 2025. During his 36 years with the Class I railroad BNSF Railway (BNSF) he held prominent roles in strategic commercial and operational leadership within the rail industry. From January 2013 to August 2024, Mr. Bobb served as Executive Vice President and Chief Marketing Officer for BNSF. During this time, he led the company’s sales and marketing activities, customer service, shortline relations, planning and forecasting, and economic development activities. Mr. Bobb also chaired the Board of Directors for BNSF Logistics, a subsidiary of BNSF. He represented BNSF on TTX’s board from 2016 to 2024, serving as audit committee chair and on the compensation committee. TTX is a railcar pool operator owned by several railroad companies. From 2006 to 2013, Mr. Bobb held the position of Group VP Coal, where he led the marketing and coal equipment management teams. From 2005 to 2006, he oversaw the Texas Division front-line rail operations as General Manager of Division Operations. Prior to his General Manager responsibilities Mr. Bobb led BNSF’s intermodal hub and automotive facilities operating team and BNSF’s equipment management teams.

Qualifications

Mr. Bobb brings expertise in business strategy, cybersecurity, the rail industry and financial matters to the Board.

| 2026 PROXY STATEMENT |

|

7

CORPORATE GOVERNANCE

|

Wanda F. Felton (Director) | |||

| Age: 67 Director Since: 2017

|

Current Term Expiration: 2026 | |||

Experience

Ms. Felton has served as a member of the Board since 2017. Ms. Felton has over 30 years of financial industry experience, including in commercial and investment banking and private equity. Ms. Felton was a Presidential Appointee and was confirmed twice by the U.S. Senate to serve on the board of the Export Import Bank of the United States as Vice Chair of the Board and First Vice President from June 2011 to November 2016. In that role, she was on the team of economic deputies that advised the National Security Staff and the President’s Export Council on trade and investment. Ms. Felton was actively engaged in helping U.S. companies penetrate international markets and develop pragmatic financing solutions to win sales. Ms. Felton had oversight responsibility for the Office of the Chief Financial Officer and enterprise risk management functions, and served on the bank’s credit committee, which was responsible for approving debt financings over $10 million for a broad range of financing types across a range of industries. A significant portion of such financings supported the export of U.S.-manufactured transportation equipment, including rail equipment and aircraft, to emerging markets. She was also an ex officio member of the Enterprise Risk Management Committee. Ms. Felton served as a Senior Advisor to Spencer Stuart’s North American Board Practice from October 2020 until August 2022. In November 2021, she joined Demopolis Equity Partners, a private equity fund that invests in technology-enabled businesses (primarily fintech and e-commerce).

Qualifications

Ms. Felton brings her significant prior experience with emerging markets business development, financing transportation equipment, and capital raising to the Board. Additionally, Ms. Felton is an “audit committee financial expert” under NYSE and SEC rules.

|

Graeme A. Jack (Director) | |||

| Age: 74 Director Since: 2006

|

Current Term Expiration: 2026 | |||

Experience

Mr. Jack has served as a member of the Board since 2006. He is a retired partner of PricewaterhouseCoopers LLP in Hong Kong. He also serves, since December 2024, as an independent non-executive director and member of the audit committee of CK Hutchison Holdings Limited. Mr. Jack previously served as an independent non-executive director of HUTCHMED (China) Limited from March 2017 to May 2025. Additionally, Mr. Jack was an independent non-executive director of Hutchison Port Holdings Management Pte. Limited, the trustee manager of Hutchison Port Holdings Trust from 2011 until 2023, and COSCO SHIPPING Development Company Limited from 2015 to 2021. Mr. Jack provides critical experience and continuity in guiding the Company through times of macroeconomic and market turbulence.

Qualifications

Mr. Jack brings accounting, financial reporting and cybersecurity expertise to the Board as well as extensive experience in international business transactions. Additionally, Mr. Jack is an “audit committee financial expert” under NYSE and SEC rules.

|

THE GREENBRIER COMPANIES |

8

CORPORATE GOVERNANCE

|

Jeffrey M. Songer (Director) | |||

| Age: 56 Director Since: 2025

|

Current Term Expiration: 2028 | |||

Experience

Mr. Songer has served as a member of the Board since June 2025. Mr. Songer has over 30 years of expertise in operations, engineering and finance, 18 of which were spent in leadership roles at Kansas City Southern (KCS), a Class I railroad, through April 2023. From 2021 to 2023, Mr. Songer served as Executive Vice President of Strategic Merger and Planning for KCS during the $34 billion merger that created Canadian Pacific Kansas City Limited (CPKC), and from 2016 to 2021, he served as KCS’s Executive Vice President and Chief Operating Officer. Mr. Songer has served as a board member for several organizations in the rail industry. From 2014 to 2021, he was a member of the Association of American Railroads (AAR) Safety and Operations Management Committee, serving as Chair from 2019 to 2021. Mr. Songer previously served as a director of Panama Canal Railway (2014-2023) and Transportation Technology Center, Inc. (2016-2021). Additionally, Mr. Songer served on joint operating and executive management committees of Meridan Speedway LLC from 2014 to 2023 and served as chairperson of the project support working committee of Railinc Corp from 2016 to 2021.

Qualifications

Mr. Songer brings a combination of railroad industry experience, cybersecurity expertise, and a deep understanding of international labor relations, particularly in Mexico, where Greenbrier employs thousands of individuals. Additionally, Mr. Songer is an “audit committee financial expert” under NYSE and SEC rules.

|

Wendy L. Teramoto (Director) | |||

| Age: 51 Director Since: 2019

|

Current Term Expiration: 2026 | |||

Experience

Ms. Teramoto has served as a member of the Board since 2019. She has been a senior investment management professional with an affiliate of Fairfax Financial Holdings Limited since 2018. From 2017 to 2018, she served in a senior capacity at the United States Department of Commerce. Until 2017, Ms. Teramoto was a Managing Director and a senior investment management professional, and a founding partner, at a New York-based private equity firm affiliated with Invesco Ltd. Ms. Teramoto has served as a board member for several companies in the transportation sector. In addition to serving on many private boards, Ms. Teramoto previously served on the Greenbrier Board from 2009 to 2017, and on the board for Navigator Holdings Ltd. from 2014 to 2017. Ms. Teramoto provides critical experience and continuity in guiding the Company through times of macroeconomic and market turbulence.

Qualifications

Ms. Teramoto brings investment management and financial expertise, and experience with manufacturing and other heavy industry companies to the Board. Additionally, Ms. Teramoto is an “audit committee financial expert” under NYSE and SEC rules.

| 2026 PROXY STATEMENT |

|

9

CORPORATE GOVERNANCE

CONTINUING DIRECTORS

|

Lorie L. Tekorius (Director and Chief Executive Officer) | |||

| Age: 58 Director Since: 2022

|

Current Term Expiration: 2027 | |||

Experience

In March 2022, Ms. Tekorius became Greenbrier’s Chief Executive Officer and President. Prior to this, she was Greenbrier’s President and Chief Operating Officer (COO), leading strategic planning, maintenance services, management services and the accounting, finance, human resources and other administrative functions. Ms. Tekorius joined Greenbrier in 1995 and served in various financial and operating roles of increasing responsibility. In 2016, she was appointed Executive Vice President (EVP), Chief Financial Officer (CFO), a role where she was recognized as Oregon’s 2017 CFO of the Year by the Portland Business Journal. In 2018, she was promoted to EVP, COO. Also in 2018, Ms. Tekorius was recognized as one of 14 “Women in Rail” by Railway Age in recognition of her contributions to the industry. She is a member of the Board of Directors of the Alamo Group, Inc. and sits on the Audit and Nominating and Corporate Governance Committees. Ms. Tekorius serves as a director on the Portland Branch of the Federal Reserve Bank of San Francisco.

Qualifications

As a 30+ year employee of Greenbrier, Ms. Tekorius provides significant company-specific and industry knowledge, in addition to organizational leadership, cybersecurity expertise, and financial and operational expertise.

|

Thomas B. Fargo (Chair of the Board) | |||

| Age: 77 Director Since: 2015

|

Current Term Expiration: 2028 | |||

Experience

Admiral Fargo has served as a member of the Board since 2015. He was Lead Director from January 2021 through August 2022, and was elected Chair of the Board of Directors in September 2022. He is a retired military commander with subsequent private sector experience in maritime and other transportation industries. As commander of the U.S. Pacific Command from 2002 until 2005, Admiral Fargo led the world’s largest unified command while directing the joint operations of the Army, Navy, Marine Corps and Air Force in the Asia-Pacific Theater. He serves as the Board Chair of Hawaiian Electric Industries. Previously, Admiral Fargo served as the Board Chair of USAA and Huntington Ingalls Industries and served on the Boards of Northrop Grumman Corporation, Alexander & Baldwin, Inc., Matson, Inc. and Hawaiian Airlines.

Qualifications

Admiral Fargo brings executive leadership and operational, manufacturing, cybersecurity, and international expertise to the Board.

|

THE GREENBRIER COMPANIES |

10

CORPORATE GOVERNANCE

|

Antonio O. Garza (Director and Chair of the Nominating and Corporate Governance Committee) | |||

| Age: 66 Director Since: 2021

|

Current Term Expiration: 2028 | |||

Experience

Ambassador Garza has served as a member of the Board since 2021. He acts as a Senior Advisor to the Mexico City office of White & Case LLP, a global law firm. Prior to joining White & Case, Ambassador Garza served as the U.S. Ambassador to Mexico from 2002 to 2009. He has been a director of Canadian Pacific Kansas City Limited (CPCK), a Class 1 railroad, since 2023, and served as a director of Kansas City Southern, a Class 1 railroad, from 2010 until the completion of the merger creating CPKC in April 2023. Ambassador Garza also served on the Board of MoneyGram International, Inc. from 2012 through 2023. He is a past Chairman of the Railroad Commission of Texas, elected to that statewide office in 1998, and served through 2002. Ambassador Garza is a member of the Board of Trustees of Southern Methodist University, a Director to the Bush Presidential Center and Chairman of its Advisory Council. Mr. Garza is also a director of the Americas Society, the U.S. Chamber of Commerce in Mexico and is a member of the Council on Foreign Relations (CFR) and COMEXI, the CFR’s Mexican counterpart. From 1994 through 1997, he was the State of Texas Secretary of State, and Senior Policy Advisor to the Governor of Texas. He is a member of the State Bar of Texas, the District of Columbia Bar and is admitted to practice before the United States Supreme Court. Ambassador Garza is a past recipient of the Aguila Azteca (Aztec Eagle), the highest honor bestowed by the Mexican government on a foreign national.

Qualifications

Ambassador Garza brings international expertise as well as rail, legal and governmental experience to the Board.

|

James R. Huffines ( Director and Chair of the Audit Committee) | |||

| Age: 74 Director Since: 2021

|

Current Term Expiration: 2028 | |||

Experience

Mr. Huffines has served as a member of the Board since 2021. Mr. Huffines has over 40 years of experience in banking and finance. He most recently served as Chief Operating Officer for subsidiaries of Hilltop Holdings, Inc., an NYSE publicly-traded financial company, and on the Board from 2012 to 2017. From 2007 to 2012, Mr. Huffines also served on the Board of Energy Future Holdings as an independent director and as the Board’s Audit Committee Chairman. Mr. Huffines presided as Chairman on the University of Texas System board of regents for four years during his seven years as a Regent. The UT System had an annual budget of $21 billion. He also was on the Board and served on the Audit and Compensation Committee of the UTIMCO, a $35 billion endowment fund for higher education in Texas. Mr. Huffines currently serves on the holding company board of Susser Bank Holdings, a $2.5 billion privately owned financial institution.

Qualifications

Mr. Huffines brings banking and finance expertise, public company and governmental experience to the Board. Additionally, Mr. Huffines is an “audit committee financial expert” under NYSE and SEC rules.

| 2026 PROXY STATEMENT |

|

11

CORPORATE GOVERNANCE

|

Kelly M. Williams ( Director and Chair of the Compensation Committee) | |||

| Age: 61 Director Since: 2015

|

Current Term Expiration: 2027 | |||

Experience

Ms. Williams has served as a member of the Board since 2015. Ms. Williams is the CEO of the Williams Legacy Foundation and is on the Board of Directors of KKR Private Equity Conglomerate LLC. Ms. Williams was a senior advisor of GCM Grosvenor Private Markets from June 2015 until January 2019. Until June 1, 2015, Ms. Williams was President of GCM Grosvenor Private Markets, a member of its Management Committee and a member of its Investment Committee. Prior to joining GCM Grosvenor, Ms. Williams was a Managing Director, the Group Head and the chair of the compensation committee of the Customized Fund Investment Group of Credit Suisse Group AG from 2000 through 2014, after Credit Suisse acquired Donaldson, Lufkin and Jenrette, where Ms. Williams was director of the Customized Fund Investment Group. She was with the Prudential Insurance Company of America from 1993 to 2000, where she was an Executive Director and a founder of the Customized Fund Investment Group in 1999. Prior to joining Prudential, Ms. Williams was an attorney at Milbank, Tweed, Hadley & McCloy LLP, where she specialized in global project finance. She graduated magna cum laude from Union College in 1986 with a Bachelor of Arts degree in Political Science and Mathematics and received her Juris Doctor from New York University School of Law in 1989. Ms. Williams serves in leadership positions on the boards of several for profit and not-for profits and has won numerous awards for leadership and public service. In addition, Ms. Williams was named as one of the Most Powerful Women in Finance by American Banker Magazine from 2011-2014. Ms. Williams is the Chair of the board of the Norton Museum of Art and serves on the board of the Smithsonian American Art Museum and The Brooklyn Museum.

Qualifications

Ms. Williams brings executive management and financial and investment expertise to the Board.

|

THE GREENBRIER COMPANIES |

12

CORPORATE GOVERNANCE

Governance Highlights

| Independent Oversight |

• Nine of the 10 members (90%) of our Board meet the independence criteria established by the New York Stock Exchange and the Securities and Exchange Commission. Lorie L. Tekorius (our CEO and President) is the only non-independent member of the Board | |

• The Chair of the Board, Thomas Fargo, is an independent director | ||

• All 9 independent directors of the Board, including all committee members, committee chairs, and the Board Chair, meet the heightened standard of independence described below in “Board Independence” | ||

• Our independent directors regularly hold separate executive sessions at Board meetings | ||

• The Board undertakes regular review of independent directors’ committee roles | ||

• The Board actively oversees strategy, risk management, cybersecurity, regulatory compliance, sustainability, and human capital management | ||

| Board Refreshment and Executive Succession Planning |

• Six of our current directors, or 60%, have joined the Board in the last 6 years | |

• Average tenure of the Board is approximately 6.5 years | ||

• The Board promotes refreshment through a policy that a director will not be nominated for election if such director’s age would be greater than 77 at the time of election | ||

• The Board promotes ongoing director education, including through our membership in the National Association of Corporate Directors | ||

• Board succession planning is an ongoing process with a focus on integrity, experience, expertise and mix of tenure of directors | ||

• The Board regularly engages in identifying highly qualified candidates for future Board service | ||

• The Board also oversees regular review and implementation of the Company’s succession planning process for key leadership and operational positions | ||

| High Governance Standards |

• Demonstrated commitment to shareholder and stakeholder engagement, including through year-round shareholder outreach | |

• Our Code of Conduct applies to all directors, officers, employees, and consultants | ||

• Average attendance of directors at Board and committee meetings exceeded 95% over the last 5 years | ||

• The Company maintains substantial director and officer stock ownership requirements | ||

• The Board reviews each director’s independence qualifications annually | ||

• Pledging or hedging of Company stock by directors and executives is prohibited | ||

| Recent Accomplishments |

• Successfully identified and onboarded two new independent directors, Messrs. Bobb and Songer, in June 2025. Mr. Bobb joined the compensation committee of the Board (the “Compensation Committee”) and Mr. Songer joined the audit committee of the Board (the “Audit Committee”) | |

• Rotated the roles of the Chair of the Audit Committee, the Compensation Committee, and the nominating and corporate governance committee of the Board (the “Nominating and Corporate Governance Committee”). Specifically, James R. Huffines was appointed the Chair of the Audit Committee, Kelly M. Williams was appointed the Chair of the Compensation Committee, and Antonio O. Garza was appointed the Chair of the Nominating and Corporate Governance Committee | ||

• The Board sincerely thanks former Compensation Committee Chair Thomas B. Fargo and former Nominating and Corporate Governance Committee Chair Kelly M. Williams for their service and leadership. The Board also sincerely thanks Graeme A. Jack for his over 10 years of service and leadership as Audit Committee Chair | ||

• Received “3+ Company” rating from the 50/50 Women on Boards organization in 2025 for having three or more of our board seats held by women | ||

• Published the Company’s seventh annual Sustainability Report, which describes the Company’s first double materiality assessment conducted in fiscal 2025, the Company’s greenhouse gas emissions data, and various safety improvements including advancements to our Safety Culture metrics (1) | ||

| (1) | For additional information, please see Greenbrier’s 2025 Sustainability Update Report, which can be found at www.gbrx.com/sustainability. The information found on our website or in our 2025 Sustainability Update Report is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with, or furnish to, the SEC. |

| 2026 PROXY STATEMENT |

|

13

CORPORATE GOVERNANCE

Board Independence

The Board makes all determinations with respect to director independence in accordance with NYSE and SEC requirements. Based on its annual assessment of director independence, the Board has determined affirmatively that all of its directors other than Lorie L. Tekorius, our Chief Executive Officer and President, meet the independence criteria established by NYSE and SEC rules as set forth in the table on page 18. In addition, the Board established enhanced guidelines to assist in making determinations regarding director independence (the “Independence Guidelines”), which are set forth in our Corporate Governance Guidelines and are available on the Company’s website at https://investors.gbrx.com/corporate-governance. Among other things, this heightened standard prohibits directors from serving on a committee if they receive any compensation from the Company in addition to their compensation for Board service. All of our independent directors satisfy this heightened standard of independence, which further safeguards our Board’s autonomy and alignment with shareholders.

In fiscal 2025, the independent directors met without Company management present in conjunction with all regular meetings of the Board.

Board Leadership

The Board has adopted a policy of only independent directors being eligible for the role of Chair of the Board. Admiral Thomas Fargo has served as independent Chair of the Board since September 1, 2022.

The independent Chair of the Board serves stakeholder interests by:

| • | Presiding at all meetings of the Board |

| • | Leading regular executive sessions of the independent directors, which are held in conjunction with regularly scheduled Board meetings |

| • | Approving Board schedules, meeting agendas and other Board matters |

| • | Making requests of the CEO and providing feedback regarding the Board’s requirements and observations |

| • | Consulting with the CEO on Company strategy and providing advice and feedback |

| • | With the Chair of the Nominating and Corporate Governance Committee, implementing and participating in the Board self-evaluations process |

| • | Acting as a liaison between the independent directors and the CEO and generally representing the independent directors on the Board |

| • | Engaging with shareholders and supporting committee chairs in engagements as appropriate |

Annual Evaluations

Our Board, through the Nominating and Corporate Governance Committee, conducts an annual self-assessment and an annual evaluation of its committees, and each director, individually, to ensure effective functioning. In addition:

| • | The Chair of the Board and Chair of the Nominating and Corporate Governance Committee meet individually with each director to discuss goals, solicit feedback, gather views regarding Board composition, and address other important matters |

| • | The Chair of the Board works with each committee chair to assess development opportunities and implement changes based on feedback received in the annual evaluations |

| • | The Board receives regular anti-bribery and Foreign Corrupt Practices Act training |

|

THE GREENBRIER COMPANIES |

14

CORPORATE GOVERNANCE

Board Refreshment

Our Board best serves the Company and its stakeholders when there is a balance between new directors with fresh perspectives and longer-serving directors who provide experience and continuity in guiding the Company through business cycles.

To promote thoughtful Board refreshment, we have:

| Appointed 6 of our current directors, or over 60% of the Board in the last 6 years, to maintain a broad base of experience, supplement the Board’s existing skills, prepare for future retirements, and respond to unexpected departures |

|

|

|

Maintained a retirement policy, whereby a director will not be nominated for election if such director’s age would be greater than 77 at the time of election |

|

Appointed two new directors in 2025 to independent board committees, with Stevan B. Bobb joining the Compensation Committee and Jeffrey M. Songer joining the Audit Committee |

|

Rotated leadership of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee with the appointments in 2025 of James R. Huffines, Kelly M. Williams, and Antonio O. Garza as Chair, respectively |

|

|

| |||||||

Board Education

To ensure the Board operates at the highest level, Greenbrier supports continuing education programs and performs annual evaluations, in addition to maintaining a comprehensive orientation program for all new directors. These programs, including a membership with the National Association of Corporate Directors, contribute to increased levels of Board skills and knowledge as well as a current understanding of the landscape of risks and opportunities, best practices, and current governance trends. The Company is continually seeking to improve Board performance, including through additional training, if needed, when a director assumes a new leadership role. The Company pays the reasonable expenses of directors who attend continuing education programs.

| 2026 PROXY STATEMENT |

|

15

CORPORATE GOVERNANCE

Board Experience

| Categories |

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

|

|

CEO/PRESIDENT |

l | l | l | l | |||||||||||||||||||

|

|

CYBERSECURITY |

l | l | l | l | l | ||||||||||||||||||

|

|

FINANCIAL EXPERTISE |

l | l | l | l | l | l | l | l | l | l | |||||||||||||

|

|

GOVERNMENT/MILITARY |

l | l | l | l | l | ||||||||||||||||||

|

|

INTERNATIONAL |

l | l | l | l | l | l | l | l | l | ||||||||||||||

|

LEGAL TRAINING |

l | l | |||||||||||||||||||||

|

|

PUBLIC COMPANY |

l | l | l | l | l | l | l | l | |||||||||||||||

|

|

PUBLIC POLICY |

l | l | l | l | l | ||||||||||||||||||

|

|

RAIL/TRANSPORT/INDUSTRIAL |

l | l | l | l | l | l | l | l | |||||||||||||||

|

|

RISK MANAGEMENT |

l | l | l | l | l | l | l | l | l | ||||||||||||||

|

|

TALENT DEVELOPMENT |

l | l | l | l | l | l | l | l | l | l | |||||||||||||

|

|

SUSTAINABILITY |

l | l | l | l | l | l | l | ||||||||||||||||

The Nominating and Corporate Governance Committee considers a variety of factors, including professional experience, demonstrated expertise and personal attributes in evaluating candidates for membership on the Board. The Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a broad range of experience, expertise, and attributes that cover the spectrum of areas that affect the Company’s business and its stakeholders. The experience and expertise of our directors ranges across commercial, financial, operational, accounting, legal, and corporate governance, as well as within the Company’s business and industry, including in global markets, public policy, manufacturing, finance, and rail. All candidates for director nominees, including self-nominated candidates, shareholder suggested candidates, and board-identified candidates, are thoroughly evaluated and considered in the context of current perceived needs of the Board as a whole. The Nominating and Corporate Governance Committee regularly assesses whether the mix of experience, expertise, and attributes of our Board is appropriate for the Company, including through the Chair of the Board and Chair of the Nominating and Corporate Governance Committee soliciting feedback from each director individually regarding areas of strength and opportunities to supplement the Board’s existing experience and expertise.

|

THE GREENBRIER COMPANIES |

16

CORPORATE GOVERNANCE

Board Committees, Meetings, and Charters

Below is a general overview of the role of each committee.

|

Compensation Committee

|

Audit Committee

|

Nominating and Corporate Governance Committee | ||||||

| The Compensation Committee focuses on increasing shareholder value by setting compensation for executive officers and is responsible for:

1) Oversight of compensation program and incentive plans design, metrics and targets for Company executives

2) Oversight of executive officer compensation, evaluating CEO performance and determining CEO compensation

3) Reviewing policies relating to director compensation and stock ownership guidelines

4) Assessing the independence of any compensation consultants

5) Engaging with shareholders to solicit feedback and understand compensation priorities

6) Oversight of the Company’s clawback policy

7) Engaging with management about risks arising from compensation policies and practices

|

The Audit Committee safeguards our shareholders’ investment in the Company by overseeing:

1) The integrity and public reporting of the Company’s financial statements

2) Company compliance with legal and regulatory requirements

3) Performance of the Company’s internal audit plan and functions and internal controls

4) Engagement and oversight of the Company’s independent registered public accounting firm

5) Cybersecurity, including information technology resilience and data security

6) Identification and evaluation of any related person transactions

7) The administration of the Company Code of Conduct |

The Nominating and Corporate Governance Committee works to ensure that stakeholders are effectively represented by overseeing:

1) Board refreshment, including the identification of director nominees

2) The process and protocols regarding CEO succession

3) The structure and composition of Board committees

4) Annual evaluations of the Board, its committees and each director, individually

5) Risk monitoring, except matters specifically reserved to another committee

6) Monitoring the sustainability profile of the Company

7) Shareholder engagement to solicit feedback and understand governance priorities

8) Human capital management

| ||||||

| 2026 PROXY STATEMENT |

|

17

CORPORATE GOVERNANCE

During fiscal 2025, the Board at large held 6 meetings, the Audit Committee held 7 meetings, the Nominating and Corporate Governance Committee held 5 meetings, and the Compensation Committee held 6 meetings. Each of our current directors attended 75% or more of the total Board and Board committee meetings for committees on which the director served in fiscal year 2025. All directors are invited and encouraged to attend all committee meetings. The independent directors met regularly in executive sessions without Company management present throughout fiscal 2025. The Chair of the Board conducts and presides at each executive session. The Company’s policy is to encourage Board members to attend the Company’s Annual Meetings of Shareholders. All of the Company’s then-serving directors attended the Annual Meeting of Shareholders held on January 9, 2025. The composition of each of the Board committees as of the date of this Proxy Statement is set out below.

| Name |

Independent | Audit Committee | Compensation Committee |

Nominating and Corporate Governance Committee |

||||||||

| Stevan B. Bobb |

l |

|

|

|

|

|

|

| ||||

| Thomas B. Fargo (Board Chair) |

l |

|

|

|

|

|

||||||

| Wanda F. Felton |

l |

F

F |

|

|

||||||||

| Antonio O. Garza |

l |

|

|

Chair

Chair |

||||||||

| James R. Huffines |

l |

Chair, F

Chair, F |

|

|

|

| ||||||

| Graeme A. Jack |

l |

F

F |

|

|

||||||||

| Jeffrey M. Songer |

l |

F

F |

|

|

|

| ||||||

| Lorie L. Tekorius (CEO) |

|

|

|

|

|

|

|

| ||||

| Wendy L. Teramoto |

l |

F

F |

|

|

|

| ||||||

| Kelly M. Williams |

l |

|

Chair

Chair |

|

||||||||

l Independent

Member F Audit Committee Financial Expert

Member F Audit Committee Financial Expert

The Board has determined that each member of the Audit Committee is financially literate and that Directors Jack, Felton, Huffines, Songer and Teramoto qualify as “audit committee financial experts” under NYSE and SEC rules. Each of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee maintains a written charter. These charters, along with the Company’s Corporate Governance Guidelines, are available on the Company’s website at https://investors.gbrx.com/corporate-governance.

Succession Planning

The Board provides oversight of key executive officer transitions. The Board, together with the Nominating and Corporate Governance Committee, exercises this oversight role through regular review and implementation of the Company’s succession planning process for key leadership and operational positions. Our succession planning efforts enable the business to quickly pivot, fill key critical roles and further focus on organization transformation.

Our CEO and our Chief Human Resources Officer, in partnership with senior leaders, prioritize talent development throughout the organization. This includes implementing tailored development plans, facilitating stretch assignments and fostering a culture of continuous improvement and learning. The Board reviews our talent pipeline activities regularly, and meets formally and informally with our CEO, key executives, and other high-potential members of senior management.

Risk Oversight

The Board has delegated to the Nominating and Corporate Governance Committee primary responsibility for risk management oversight. In order to ensure that Board expertise is utilized most effectively in risk management, certain other standing committees are given primary risk management oversight responsibility of certain categories of risks, such as the Compensation Committee’s oversight of compensation risk and the Audit Committee’s oversight of certain financial controls and cybersecurity risks. Greenbrier has established an Enterprise Risk Management (ERM) program to ensure risks are addressed in a manner consistent with the Company’s overall corporate strategy, including a strong focus on preservation of shareholder investments, railcar safety, employee safety, and cybersecurity. Key risk identification, evaluation, and mitigation actions are reviewed quarterly by the Nominating and Corporate Governance Committee, other committees, and, as appropriate, are considered by the entire Board. The entire Board remains actively engaged in the oversight and effective implementation of the ERM program. The Board as a whole is directly engaged in overseeing the

|

THE GREENBRIER COMPANIES |

18

CORPORATE GOVERNANCE

management of all significant risks, especially risks that implicate public safety. See “Environmental and Social” below for more information regarding our strategy and Board oversight with respect to employee safety and human capital management.

The Nominating and Corporate Governance Committee oversees the Company’s financial and accounting risk assessment and risk management policies, including monitoring and recommending to the Board any modifications regarding the Company’s Code of Conduct and Policy Regarding Trading in Company Securities.

The Compensation Committee evaluates the Company’s compensation programs and has concluded that its risks are effectively mitigated by a variety of policies including clawback, anti-hedging, and stock ownership policies. The compensation program balances short-term and long-term incentives and establishes multiple and strategically weighted performance measures. Based on the results of its evaluation, the Compensation Committee concluded that any risks associated with the Company’s compensation programs are not reasonably likely to have a material adverse effect on the Company.

Cybersecurity Risk Oversight

Cybersecurity represents an important component of our overall approach to risk management. Our information security risk management policies, standards and practices are integrated into our overall enterprise risk management approach. The Board of Directors, in coordination with the Audit Committee, oversees the management of risks from cybersecurity threats. Admiral Thomas B. Fargo, Chair of the Board, has significant experience in cybersecurity including supervising extensive, national level cybersecurity programs and teams as Commander of the U.S. Pacific Command. Our Chief Information Security Officer (“CISO”) is principally responsible for managing our cybersecurity risk management program, in partnership with other business leaders across the Company. The CISO has decades of experience in the cybersecurity and information security fields, including experience with both private and public companies and the military, as well as experience in the transportation and rail industry. We have developed and implemented, and update on an ongoing basis, a risk-based information security program designed to identify, assess and manage material risks from cybersecurity threats. We have adopted physical, technological, and administrative controls on data security, and have a defined procedure for data incident detection, containment, response, remediation, and reporting. The Audit Committee reviews cybersecurity on a quarterly basis. The Board of Directors and the Audit Committee each receive regular presentations and reports on cybersecurity from our CISO and other members of senior management.

Our Code of Conduct and FCPA Compliance

We strive for the highest ethical standards in all of our business dealings. Our Code of Conduct guides our Board, executive officers, and employees in the work they do for the Company. We work diligently to ensure that all our employees fully understand our Code of Conduct, and are empowered to implement ethical practices and promptly report any noncompliant or suspicious activity. The Company maintains the right to require any employee to supply a written statement certifying compliance with our Code of Conduct. The Code of Conduct applies to all of the Company’s directors, officers, employees, and consultants, including its principal executive officer, principal financial officer, and principal accounting officer. The Company intends to post amendments to, or waivers from, our Code of Conduct on the Company’s website at https://investors.gbrx.com/corporate-governance.

Our Code of Conduct is closely tied to our FCPA and Anti-Corruption Policy. We operate globally, and as such, compliance with all anti-bribery and anti-corruption laws is a key component of our ethics commitment. We conduct ongoing FCPA compliance training at all our locations across the globe.

| 2026 PROXY STATEMENT |

|

19

CORPORATE GOVERNANCE

Fiscal 2025 Non-Employee Director Compensation

Our non-employee director compensation program is designed to attract, retain, and reward qualified non-employee directors and align the financial interests of non-employee directors with those of our shareholders. The program addresses the time, effort, expertise, and accountability required of active Board membership. Pursuant to this program, each non-employee member of our Board received the cash and equity compensation described below for fiscal 2025 Board service. We also reimbursed our non-employee directors for expenses incurred in connection with attending Board and committee meetings, assisting with other Company business, such as meeting with potential director candidates, as well as continuing director education. Members of the Board who are our employees are not separately compensated for serving on the Board.

Our Compensation Committee has the primary responsibility for reviewing the compensation paid to our non-employee directors and making recommendations for adjustments, as appropriate, to the full Board. The Compensation Committee undertakes an annual review of the type and form of compensation paid to our non-employee directors, which includes a market assessment and analysis by its independent compensation consultant, Mercer, a national compensation consulting firm (“Mercer”). The Board believes that the fiscal 2025 compensation program for our non-employee directors attracted, retained, and rewarded qualified non-employee directors, consistent with market practices and the demands placed on our Board.

FISCAL 2025 CASH COMPENSATION

In fiscal 2025, non-employee directors received an annual cash retainer of $100,000. Additionally, members of the Audit Committee received an annual cash retainer of $10,000, and members of the Compensation and the Nominating and Corporate Governance Committees received an annual cash retainer of $7,500. In addition to the annual board and committee retainers, the Chair of the Board, Admiral Fargo, received an additional cash retainer of $165,000. The Audit Committee chair received an additional cash retainer of $20,000, and each other committee chair received an additional cash retainer of $15,000, in each case prorated for partial year of service as chair. All annual retainer fees generally were paid quarterly.

FISCAL 2025 EQUITY COMPENSATION

Fiscal 2025 equity awards to our non-employee directors were made under the Company Stock Incentive Grant Program for Non-Employee Directors under the 2021 Plan. Under the program, upon a director’s initial election to the Board, the director automatically receives an “initial” award of restricted stock units (RSUs) with a value of $160,000. If such initial election occurs prior to the next annual meeting of shareholders, this initial award is prorated. A director who is also an employee of the Company, and who subsequently ceases such employment status but remains a director, is not eligible for such an initial award. Immediately following each annual meeting of shareholders, each director automatically receives an “annual” award of RSUs with a value of $160,000. Under the program for fiscal 2025, both the initial award and the annual award for fiscal year 2025 vest on the earlier of (a) the one-year anniversary of grant and (b) the next annual meeting of shareholders (if such meeting is at least 50 weeks after the prior year’s annual meeting of shareholders). In the event of a director’s termination of service due to death, disability, or retirement, or because such director is not nominated or re-elected to serve an additional term as a director, any unvested portion of the director’s initial award or annual award granted in fiscal 2025 will vest. In the event of a director’s termination of service due to such director’s removal or resignation, any unvested portion of the director’s initial award or annual award granted in fiscal 2025 will be forfeited. Dividends on unvested RSUs granted in fiscal 2025 are subject to the same vesting terms as the unvested RSUs to which they relate. Upon a Company change of control, all unvested initial and annual director awards granted in fiscal 2025 will vest.

For fiscal 2025, all our continuing non-employee directors received an annual award of RSUs covering 2,466 shares, determined by dividing $160,000 by the average closing price of a share for the 30 trading days immediately preceding the grant date, rounded up to the nearest whole share. For fiscal 2025, our new non-employee directors received an initial award of RSUs covering 1,752 shares, determined by prorating $160,000 for their partial year of service and dividing the result by the average closing price of a share for the 30 trading days immediately preceding the grant date, rounded up to the nearest whole share.

|

THE GREENBRIER COMPANIES |

20

CORPORATE GOVERNANCE

FISCAL 2025 DIRECTOR COMPENSATION

The following table summarizes the compensation of the non-employee Board members for fiscal year 2025. Ms. Tekorius did not receive compensation for her service as a director in fiscal 2025. Ms. Tekorius’ compensation for her service as an employee is discussed in the executive compensation disclosures below.

FISCAL 2025 DIRECTOR COMPENSATION

| Name |

Fees Earned ($) |

Stock Awards ($)(1) |

All Other ($) |

Total ($) |

| |||||||||||||||||

| Stevan B. Bobb |

16,666 | 79,611 | — | 96,277 |

| |||||||||||||||||

| Thomas B. Fargo |

291,250 | 149,045 | — | 440,295 |

| |||||||||||||||||

| Wanda F. Felton |

|

117,500 |

|

149,045 |

— | 266,545 |

| |||||||||||||||

| Antonio O. Garza |

123,750 | 149,045 | — | 272,795 |

| |||||||||||||||||

| James R. Huffines |

117,500 | 149,045 | — | 266,545 |

| |||||||||||||||||

| Graeme A. Jack |

145,000 | 149,045 | — | 294,045 |

| |||||||||||||||||

| Jefferey M. Songer |

16,666 | 79,611 |

|

— |

96,277 |

| ||||||||||||||||

| Wendy L. Teramoto |

|

117,500 |

149,045 |

|

— |

266,545 |

| |||||||||||||||

| Kelly M. Williams |

140,000 | 149,045 | — | 289,045 |

| |||||||||||||||||

| (1) |

The amounts in the Stock Awards column reflect the aggregate grant date fair value of RSUs granted to directors in fiscal 2025 calculated in accordance with FASB ASC Topic 718 (Compensation – Stock Compensation), excluding estimated forfeitures. Such amounts may not correspond to the actual value that will be realized by the director if and when the RSU awards vest. As of August 31, 2025, each director, except for Messrs. Bobb and Songer, held 2,511 unvested RSUs (including dividend equivalents); Messrs. Bobb and Songer held 1,764 unvested RSUs (including dividend equivalents). |

NONQUALIFIED DEFERRED COMPENSATION

We maintain an unfunded, voluntary non-qualified deferred compensation plan for our non-employee directors, which allows our non-employee directors to defer compensation received in exchange for their non-employee director services to us. We do not contribute to the plan. We do not guarantee any returns on participant contributions to the plan. The plan does not pay or provide for preferential or above-market earnings. Amounts deferred under the plan are credited with hypothetical and/or actual investment earnings based on participant investment elections made from among investment options available under the plan. Distributions may be made in lump-sum or in installments (subject to certain restrictions in the plan) upon the non-employee director’s death, disability, other termination of service, a change of control of us, and certain unforeseeable emergencies, each as defined in the plan.

STOCK OWNERSHIP AND STOCK RETENTION

We believe that our non-employee directors should hold a meaningful financial stake in the Company to further align their interests with those of our shareholders. To promote this belief, the Company maintains stock ownership guidelines for its non-employee directors pursuant to which all non-employee directors of the Company are required to acquire and retain holdings of Company stock with a value equal to five times the annual cash retainer within five years of their initial election or appointment to the Board, as applicable. As of the end of fiscal 2025, all of our non-employee directors met these guidelines.

Shareholder Engagement

We regularly engage with shareholders to understand their perspective and identify matters important to them. Our independent Chair of the Board, Board Committee Chairs and Management team are directly involved in these efforts and outcomes are reported to the entire Board. In fiscal 2025, we contacted institutional shareholders representing approximately 77% of our shares (including all of our top 20 shareholders) to solicit feedback and ensure that we had insight into the issues that were most important to our shareholders. We met with institutional shareholders representing 26% of our shares and received valuable feedback. These figures are based on the number of shares outstanding as of the end of fiscal year 2025.

| 2026 PROXY STATEMENT |

|

21

CORPORATE GOVERNANCE

WHAT WE DISCUSSED

| • | Greenbrier’s strategy and execution |

| • | Business outlook and demand environment |

| • | Board structure and composition, including our classified board structure and our ongoing Board refreshment initiatives |

The Chair of the Board, Chair of the Compensation Committee and/or Chair of the Nominating and Corporate Governance Committee often participate with senior management in these calls. Shareholder engagement activity and feedback is reported directly to the Board, either by the Committee Chairs, if they participated, or by Management. See “Say-on-Pay Vote and Shareholder Engagement on Compensation” on page 30 of this Proxy Statement for further information regarding key feedback from shareholders related to our executive compensation program and our responses.

Environmental and Social

Guided by our business strategy and informed by stakeholder engagement and materiality assessments, we aim to align sustainability with business goals to manage risk, drive innovation, and create long-term value for our stakeholders. Greenbrier’s Better Together business strategy and sustainability priorities complement each other and form a strong framework for advancing our goals. Grounded in our Core Values—Safety, Quality, Respect for People, and Customer Satisfaction—our sustainability approach revolves around five key pillars: Product Safety & Quality, Our People, Environmental Sustainability, Governance & Ethics, and Communities.

In fiscal 2025, to prepare for the future and meet the evolving regulatory reporting requirements of the European Union, we conducted a double materiality assessment (DMA) to understand the financial impacts of sustainability topics on our business, and our operations impact on the environment and society. We applied consistent thresholds from our Enterprise Risk Management (ERM) system to ensure alignment when identifying the material topics. Our updated sustainability strategy, guided by the DMA, will help us address emerging issues and foster innovation. Greenbrier’s 2025 Sustainability Report provides further detail about our priorities and the actions we took in fiscal 2025 and that we will take in the future. It can be found at www.gbrx.com/sustainability.

ENVIRONMENTAL SUSTAINABILITY

Our sustainability strategy begins with our own operations, focusing on resource efficiency, emissions management, and responsible materials sourcing, and extends through our products and services to support a lower-carbon transportation system. Our core product offerings are not only among the most fuel-efficient modes of transport globally, but freight railcars are designed for a 30-to-50-year lifespan.

We embed lifecycle management into every phase to deliver products that meet stakeholder expectations while advancing efficiency.

| • | In the design phase, we focus on creating railcars that optimize safety, freight capacity, environmental performance, and cost effectiveness for our customers. Features like lower tare weight and aerodynamic shapes aim to reduce locomotive fuel consumption, lowering customers’ emissions. |

| • | In production, we optimize manufacturing processes to reduce waste and energy consumption, such as using precision cutting to minimize material scrap. |

| • | Our materials sourcing strategy emphasizes resource efficiency, local supply chains, and supplier accountability to strengthen our environmental performance. Our Supplier Code of Conduct also encourages suppliers to minimize environmental impacts through responsible resource use and emissions reduction. |

| • | We implement rigorous quality controls to ensure railcars can withstand heavy-duty use, aiming to reduce maintenance needs and extend service life. |

| • | By investing in our facilities and bringing additional manufacturing capabilities in-house, we have lowered trucking emissions while maintaining tighter control over production schedules and quality standards. |

|

THE GREENBRIER COMPANIES |

22

CORPORATE GOVERNANCE

| • | At the end of a railcar’s life, we prioritize recycling and responsible disposal. Our railcars are designed with modular components and recyclable materials, which can be repurposed for new railcars or other products. We partner with steel recycling facilities to ensure efficient material recovery and minimize landfill waste. Our refurbishment programs allow certain components to be reused or railcars to be retrofitted, supporting circular economy principles and reducing environmental impact. |