Please wait

0.2

8.4

2.7

0.5

19.1

19.1

0.0

87.1

29.5

8.4

9.6

2.5

12.3

0.5

8.7

21.0

11.2

19.1

18.5

87.1

4.5

4.5

0.2

26.7

11.2

4.6

21.0

9.6

21.0

9.6

87.1

4.3

1.0

8.4

11.2

4.5

0.5

2.7

0.2

91.3

4.3

18.5

14.7

4.3

2.7

18.5

0000924727

false

N-1A

N-CSRS

0000924727

imstiii:C000243218Member

2025-05-31

2025-11-30

0000924727

imstiii:C000244000Member

2025-05-31

2025-11-30

0000924727

imstiii:C000244001Member

2025-05-31

2025-11-30

0000924727

imstiii:C000244002Member

2025-05-31

2025-11-30

0000924727

2025-05-31

2025-11-30

0000924727

imstiii:C000243218Member

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:AmericanExpressCoMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:AmeripriseFinancialIncMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:BerkshireHathawayIncClassAMember

2025-11-30

0000924727

imstiii:C000243218Member

us-gaap:CommonStockMember

2025-11-30

0000924727

imstiii:C000243218Member

oef:CommunicationsSectorMember

2025-11-30

0000924727

imstiii:C000243218Member

oef:ConsumerDiscretionarySectorMember

2025-11-30

0000924727

imstiii:C000243218Member

oef:ConsumerStaplesSectorMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:EatonCorpPLCMember

2025-11-30

0000924727

imstiii:C000243218Member

us-gaap:FinancialServicesSectorMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:GeneralDynamicsCorpMember

2025-11-30

0000924727

imstiii:C000243218Member

us-gaap:HealthcareSectorMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:HersheyCoMember

2025-11-30

0000924727

imstiii:C000243218Member

oef:IndustrialSectorMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:JPMorganChaseAndCoMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:OracleCorpMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:OtherAssetsInExcessOfLiabilitiesMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:PfizerIncMember

2025-11-30

0000924727

imstiii:C000243218Member

us-gaap:ShortTermInvestmentsMember

2025-11-30

0000924727

imstiii:C000243218Member

us-gaap:TechnologySectorMember

2025-11-30

0000924727

imstiii:C000243218Member

imstiii:TraneTechnologiesPLCMember

2025-11-30

0000924727

imstiii:C000244000Member

2025-11-30

0000924727

imstiii:C000244000Member

us-gaap:CommonStockMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:CommunicationsSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:ConsumerDiscretionarySectorMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:ConsumerStaplesSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:CSGSystemsInternationalIncMember

2025-11-30

0000924727

imstiii:C000244000Member

us-gaap:ExchangeTradedFundsMember

2025-11-30

0000924727

imstiii:C000244000Member

us-gaap:FinancialServicesSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:IndustrialSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:InterDigitalIncMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:MaterialsSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:NewJerseyResourcesCorpMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:OshkoshCorpMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:OtherAssetsInExcessOfLiabilitiesMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:PVHCorpMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:REVGroupIncMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:RLICorpMember

2025-11-30

0000924727

imstiii:C000244000Member

us-gaap:ShortTermInvestmentsMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:TDSYNNEXCorpMember

2025-11-30

0000924727

imstiii:C000244000Member

us-gaap:TechnologySectorMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:UGICorpMember

2025-11-30

0000924727

imstiii:C000244000Member

oef:UtilitiesSectorMember

2025-11-30

0000924727

imstiii:C000244000Member

imstiii:Vanguard03MonthTreasuryBillETF0238Member

2025-11-30

0000924727

imstiii:C000244001Member

2025-11-30

0000924727

imstiii:C000244001Member

us-gaap:CommonStockMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:CommunicationsSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:ConsumerDiscretionarySectorMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:ConsumerStaplesSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:CSGSystemsInternationalIncMember

2025-11-30

0000924727

imstiii:C000244001Member

us-gaap:ExchangeTradedFundsMember

2025-11-30

0000924727

imstiii:C000244001Member

us-gaap:FinancialServicesSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:IndustrialSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:InterDigitalIncMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:MaterialsSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:NewJerseyResourcesCorpMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:OshkoshCorpMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:OtherAssetsInExcessOfLiabilitiesMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:PVHCorpMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:REVGroupIncMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:RLICorpMember

2025-11-30

0000924727

imstiii:C000244001Member

us-gaap:ShortTermInvestmentsMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:TDSYNNEXCorpMember

2025-11-30

0000924727

imstiii:C000244001Member

us-gaap:TechnologySectorMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:UGICorpMember

2025-11-30

0000924727

imstiii:C000244001Member

oef:UtilitiesSectorMember

2025-11-30

0000924727

imstiii:C000244001Member

imstiii:Vanguard03MonthTreasuryBillETF0238Member

2025-11-30

0000924727

imstiii:C000244002Member

2025-11-30

0000924727

imstiii:C000244002Member

us-gaap:CommonStockMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:CommunicationsSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:ConsumerDiscretionarySectorMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:ConsumerStaplesSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:CSGSystemsInternationalIncMember

2025-11-30

0000924727

imstiii:C000244002Member

us-gaap:ExchangeTradedFundsMember

2025-11-30

0000924727

imstiii:C000244002Member

us-gaap:FinancialServicesSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:IndustrialSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:InterDigitalIncMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:MaterialsSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:NewJerseyResourcesCorpMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:OshkoshCorpMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:OtherAssetsInExcessOfLiabilitiesMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:PVHCorpMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:REVGroupIncMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:RLICorpMember

2025-11-30

0000924727

imstiii:C000244002Member

us-gaap:ShortTermInvestmentsMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:TDSYNNEXCorpMember

2025-11-30

0000924727

imstiii:C000244002Member

us-gaap:TechnologySectorMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:UGICorpMember

2025-11-30

0000924727

imstiii:C000244002Member

oef:UtilitiesSectorMember

2025-11-30

0000924727

imstiii:C000244002Member

imstiii:Vanguard03MonthTreasuryBillETF0238Member

2025-11-30

iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:sharesutr:Dimstiii:Holding

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Investment Managers Series Trust III

(Exact name of registrant as specified in charter)

235 West Galena Street

Milwaukee, Wisconsin 53212

(Address of Principal Executive Offices, including Zip Code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, California 91740

(Name and Address of Agent for Service)

COPIES TO:

Laurie Anne Dee

Morgan, Lewis & Bockius LLP

600 Anton Boulevard, Suite 1800

Costa Mesa, California 92626

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Act”), is as follows:

FPA Queens Road Small Cap Value Fund

Advisor Class/QRSAX

SEMI-ANNUAL SHAREHOLDER REPORT | November 30, 2025

This semi-annual shareholder report contains important information about the FPA Queens Road Small Cap Value Fund (“Fund”) for the period of June 1, 2025 to November 30, 2025. You can find additional information about the Fund at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA Queens Road Small Cap Value Fund

(Advisor Class/QRSAX) |

$46 |

0.86%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,076,396,133 |

| Total number of portfolio holdings |

48 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

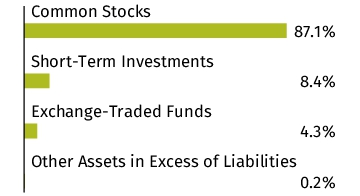

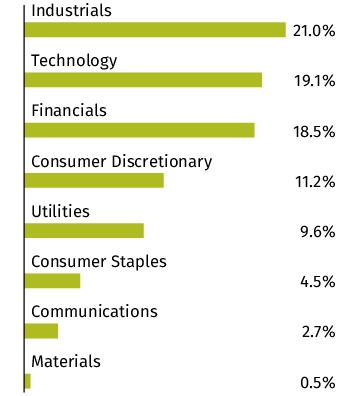

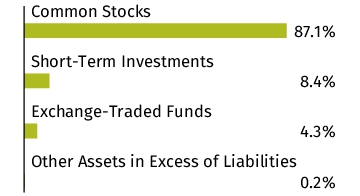

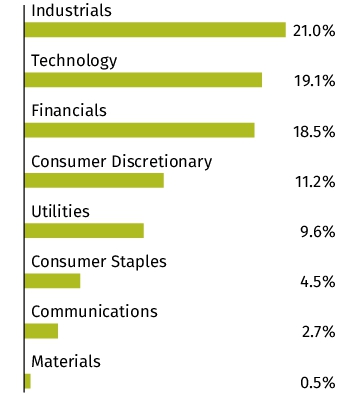

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| UGI Corp. |

4.5% |

| Vanguard 0-3 Month Treasury Bill ETF, 0.238% |

4.3% |

| RLI Corp. |

4.2% |

| TD SYNNEX Corp. |

4.0% |

| InterDigital, Inc. |

3.8% |

| PVH Corp. |

2.9% |

| Oshkosh Corp. |

2.8% |

| CSG Systems International, Inc. |

2.8% |

| REV Group, Inc. |

2.7% |

| New Jersey Resources Corp. |

2.6% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

FPA Queens Road Small Cap Value Fund - Advisor Class

FPA Queens Road Small Cap Value Fund

Institutional Class/QRSIX

SEMI-ANNUAL SHAREHOLDER REPORT | November 30, 2025

This semi-annual shareholder report contains important information about the FPA Queens Road Small Cap Value Fund (“Fund”) for the period of June 1, 2025 to November 30, 2025. You can find additional information about the Fund at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA Queens Road Small Cap Value Fund

(Institutional Class/QRSIX) |

$40 |

0.76%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,076,396,133 |

| Total number of portfolio holdings |

48 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

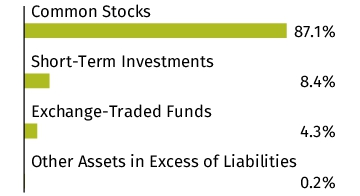

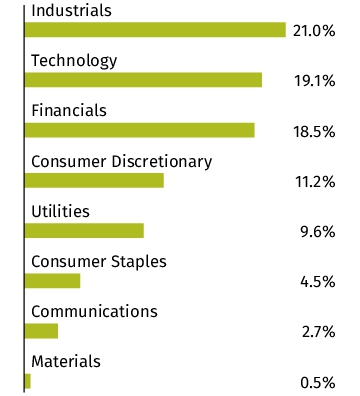

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| UGI Corp. |

4.5% |

| Vanguard 0-3 Month Treasury Bill ETF, 0.238% |

4.3% |

| RLI Corp. |

4.2% |

| TD SYNNEX Corp. |

4.0% |

| InterDigital, Inc. |

3.8% |

| PVH Corp. |

2.9% |

| Oshkosh Corp. |

2.8% |

| CSG Systems International, Inc. |

2.8% |

| REV Group, Inc. |

2.7% |

| New Jersey Resources Corp. |

2.6% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

FPA Queens Road Small Cap Value Fund - Institutional Class

FPA Queens Road Small Cap Value Fund

Investor Class/QRSVX

SEMI-ANNUAL SHAREHOLDER REPORT | November 30, 2025

This semi-annual shareholder report contains important information about the FPA Queens Road Small Cap Value Fund (“Fund”) for the period of June 1, 2025 to November 30, 2025. You can find additional information about the Fund at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA Queens Road Small Cap Value Fund

(Investor Class/QRSVX) |

$47 |

0.89%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$1,076,396,133 |

| Total number of portfolio holdings |

48 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| UGI Corp. |

4.5% |

| Vanguard 0-3 Month Treasury Bill ETF, 0.238% |

4.3% |

| RLI Corp. |

4.2% |

| TD SYNNEX Corp. |

4.0% |

| InterDigital, Inc. |

3.8% |

| PVH Corp. |

2.9% |

| Oshkosh Corp. |

2.8% |

| CSG Systems International, Inc. |

2.8% |

| REV Group, Inc. |

2.7% |

| New Jersey Resources Corp. |

2.6% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/fpa-queens-road-small-cap-value-fund. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

FPA Queens Road Small Cap Value Fund - Investor Class

FPA Queens Road Value Fund

QRVLX

SEMI-ANNUAL SHAREHOLDER REPORT | November 30, 2025

This semi-annual shareholder report contains important information about the FPA Queens Road Value Fund (“Fund”) for the period of June 1, 2025 to November 30, 2025. You can find additional information about the Fund at https://fpa.com/funds/overview/fpa-queens-value-fund. You can also request this information by contacting us at (800) 638-3060.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA Queens Road Value Fund

(QRVLX) |

$35 |

0.67%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$51,981,955 |

| Total number of portfolio holdings |

29 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

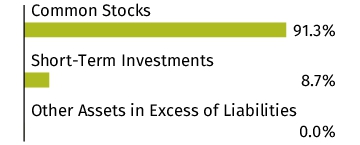

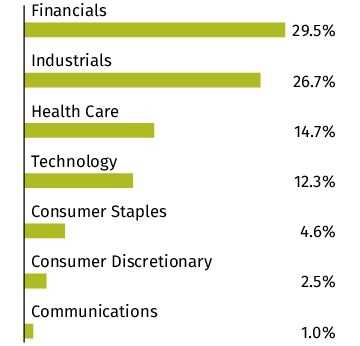

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. The Sector Allocation chart represents Common Stocks of the Fund.

| American Express Co. |

7.7% |

| Trane Technologies PLC |

7.5% |

| Oracle Corp. |

7.2% |

| Eaton Corp. PLC |

6.6% |

| JPMorgan Chase & Co. |

5.4% |

| Ameriprise Financial, Inc. |

5.3% |

| General Dynamics Corp. |

5.3% |

| Berkshire Hathaway, Inc. - Class A |

4.4% |

| Pfizer, Inc. |

3.8% |

| Hershey Co. |

3.6% |

Material Fund Changes

Effective October 1, 2025, the Fund's expense limitation is increased to 0.73% from 0.65%.

On October 14, 2025, based on the recommendation of the Fund’s adviser, First Pacific Advisors, L.P. (the “Adviser”) and the Fund’s sub-adviser, Bragg Financial Advisors, Inc. (the “Sub-Adviser”), the Board of Trustees of the Trust has approved the reorganization of the Fund (the “Fund”) into an exchange-traded fund (the “Reorganization”). The Reorganization of the Fund is subject to approval by its shareholders and will occur pursuant to an Agreement and Plan of Reorganization whereby the Fund will transfer all of its assets and liabilities to the FPA Queens Road Value ETF (the “ETF”), a newly created series of the Trust. If approved, each shareholder of the Fund will receive shares of the ETF and/or cash equal to the value of the shares of the Fund owned by the shareholder.

The Trust will call a shareholder meeting at which shareholders of the Fund will be asked to consider and vote on the Reorganization. If the required shareholder approval for the Reorganization of the Fund is obtained, the Reorganization is expected to take effect in the fourth quarter of 2026.

This is a summary of certain changes to the Fund since June 1, 2025. For more complete information, you may review the Fund's prospectus, which is dated September 30, 2025, at https://fpa.com/funds/overview/fpa-queens-value-fund.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://fpa.com/funds/overview/fpa-queens-value-fund. You can also request this information by contacting us at (800) 638-3060.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (800) 638-3060 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

FPA Queens Road Value Fund

(b) Not applicable.

Item

2. Code of Ethics.

Not applicable.

Item

3. Audit Committee Financial Expert.

Not applicable.

Item

4. Principal Accountant Fees and Services.

Not applicable.

Item

5. Audit Committee of Listed Registrants.

Not applicable.

Item

6. Investments.

|

| (a) |

Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

Item

7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

FPA Queens Road Small Cap Value Fund

(Investor Class: QRSVX)

(Institutional Class: QRSIX)

(Advisor Class: QRSAX)

SEMI-ANNUAL FINANCIALS AND OTHER INFORMATION

NOVEMBER 30, 2025

FPA Queens Road Small Cap Value Fund

A series of Investment Managers Series Trust

III

Table of Contents

Please note the Financials and Other Information only contains Items

7-11 required in Form N-CSR. All other required items will be filed with the SEC.

| Item 7. Financial Statements and Financial Highlights |

|

| Schedule of Investments |

1 |

| Statement of Assets and Liabilities |

4 |

| Statement of Operations |

5 |

| Statements of Changes in Net Assets |

6 |

| Financial Highlights |

|

| Investor Class |

7 |

| Institutional Class |

8 |

| Advisor Class |

9 |

| Notes to Financial Statements |

10 |

This report and the financial statements contained

herein are provided for the general information of the shareholders of the FPA Queens Road Small Cap Value Fund (the “Fund”).

This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective shareholder

report and prospectus.

https://fpa.com

FPA Queens Road Small Cap Value Fund

SCHEDULE OF INVESTMENTS

As of November 30, 2025 (Unaudited)

|

Number

of Shares |

|

|

|

|

Value |

|

| |

|

|

|

COMMON STOCKS — 87.1% |

|

|

|

|

| |

|

|

|

AEROSPACE & DEFENSE — 0.9% |

|

|

|

|

| |

109,929 |

|

|

Ducommun, Inc.* |

|

$ |

10,079,390 |

|

| |

|

|

|

APPAREL & TEXTILE PRODUCTS — 4.9% |

|

|

|

|

| |

23,807 |

|

|

Deckers Outdoor Corp.* |

|

|

2,095,730 |

|

| |

878,700 |

|

|

Levi Strauss & Co. - Class A |

|

|

19,357,761 |

|

| |

371,552 |

|

|

PVH Corp. |

|

|

31,492,748 |

|

| |

|

|

|

|

|

|

52,946,239 |

|

| |

|

|

|

BANKING — 5.3% |

|

|

|

|

| |

323,282 |

|

|

Axos Financial, Inc.* |

|

|

26,567,315 |

|

| |

97,223 |

|

|

Five Star Bancorp |

|

|

3,353,221 |

|

| |

384,754 |

|

|

ServisFirst Bancshares, Inc. |

|

|

27,367,552 |

|

| |

|

|

|

|

|

|

57,288,088 |

|

| |

|

|

|

COMMERCIAL SUPPORT SERVICES — 2.8% |

|

|

|

|

| |

376,114 |

|

|

CSG Systems International, Inc. |

|

|

29,626,500 |

|

| |

|

|

|

CONSUMER SERVICES — 1.6% |

|

|

|

|

| |

955,661 |

|

|

Upbound Group, Inc. |

|

|

17,125,445 |

|

| |

|

|

|

CONTAINERS & PACKAGING — 0.5% |

|

|

|

|

| |

363,852 |

|

|

Graphic Packaging Holding Co. |

|

|

5,887,125 |

|

| |

|

|

|

ELECTRICAL EQUIPMENT — 2.2% |

|

|

|

|

| |

93,761 |

|

|

Littelfuse, Inc. |

|

|

24,004,691 |

|

| |

|

|

|

ENGINEERING & CONSTRUCTION — 1.2% |

|

|

|

|

| |

139,479 |

|

|

Everus Construction Group, Inc.* |

|

|

12,826,489 |

|

| |

|

|

|

FOOD — 1.1% |

|

|

|

|

| |

331,396 |

|

|

Darling Ingredients, Inc.* |

|

|

12,132,408 |

|

| |

|

|

|

GAS & WATER UTILITIES — 9.6% |

|

|

|

|

| |

1,234,938 |

|

|

MDU Resources Group, Inc. |

|

|

26,328,878 |

|

| |

590,009 |

|

|

New Jersey Resources Corp. |

|

|

28,367,633 |

|

| |

1,228,590 |

|

|

UGI Corp. |

|

|

48,590,734 |

|

| |

|

|

|

|

|

|

103,287,245 |

|

| |

|

|

|

INDUSTRIAL INTERMEDIATE PRODUCTS — 0.3% |

|

|

|

|

| |

102,635 |

|

|

L B Foster Co. - Class A* |

|

|

2,769,092 |

|

| |

|

|

|

INDUSTRIAL SUPPORT SERVICES — 2.6% |

|

|

|

|

| |

258,539 |

|

|

MSC Industrial Direct Co., Inc. - Class A |

|

|

22,999,629 |

|

| |

30,204 |

|

|

VSE Corp. |

|

|

5,442,459 |

|

| |

|

|

|

|

|

|

28,442,088 |

|

| |

|

|

|

INSURANCE — 8.4% |

|

|

|

|

| |

639,304 |

|

|

CNO Financial Group, Inc. |

|

|

26,166,713 |

|

| |

415,832 |

|

|

Horace Mann Educators Corp. |

|

|

19,036,789 |

|

| |

726,288 |

|

|

RLI Corp. |

|

|

44,782,918 |

|

| |

|

|

|

|

|

|

89,986,420 |

|

FPA Queens Road Small Cap Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of November 30, 2025 (Unaudited)

|

Number

of Shares |

|

|

|

|

Value |

|

| |

|

|

|

COMMON STOCKS (Continued) |

|

|

|

|

| |

|

|

|

INTERNET MEDIA & SERVICES — 1.1% |

|

|

|

|

| |

341,303 |

|

|

IAC, Inc.* |

|

$ |

11,969,496 |

|

| |

|

|

|

MACHINERY — 8.3% |

|

|

|

|

| |

224,475 |

|

|

AGCO Corp. |

|

|

23,785,371 |

|

| |

15,520 |

|

|

CSW Industrials, Inc. |

|

|

4,219,423 |

|

| |

81,171 |

|

|

Graco, Inc. |

|

|

6,691,737 |

|

| |

173,045 |

|

|

JBT Marel Corp. |

|

|

24,318,014 |

|

| |

235,640 |

|

|

Oshkosh Corp. |

|

|

30,204,335 |

|

| |

|

|

|

|

|

|

89,218,880 |

|

| |

|

|

|

PUBLISHING & BROADCASTING — 1.6% |

|

|

|

|

| |

581,707 |

|

|

Scholastic Corp. |

|

|

17,183,625 |

|

| |

|

|

|

RETAIL - CONSUMER STAPLES — 3.4% |

|

|

|

|

| |

325,061 |

|

|

Ingles Markets, Inc. - Class A |

|

|

25,003,692 |

|

| |

139,656 |

|

|

Sprouts Farmers Market, Inc.* |

|

|

11,704,569 |

|

| |

|

|

|

|

|

|

36,708,261 |

|

| |

|

|

|

RETAIL - DISCRETIONARY — 1.7% |

|

|

|

|

| |

343,013 |

|

|

Advance Auto Parts, Inc. |

|

|

17,795,514 |

|

| |

|

|

|

SEMICONDUCTORS — 5.3% |

|

|

|

|

| |

136,153 |

|

|

Qorvo, Inc.* |

|

|

11,694,181 |

|

| |

332,713 |

|

|

Synaptics, Inc.* |

|

|

22,794,168 |

|

| |

1,665,006 |

|

|

Vishay Intertechnology, Inc. |

|

|

22,760,632 |

|

| |

|

|

|

|

|

|

57,248,981 |

|

| |

|

|

|

SOFTWARE — 0.4% |

|

|

|

|

| |

125,731 |

|

|

Concentrix Corp. |

|

|

4,552,719 |

|

| |

|

|

|

SPECIALTY FINANCE — 4.8% |

|

|

|

|

| |

891,532 |

|

|

MGIC Investment Corp. |

|

|

25,274,932 |

|

| |

200,594 |

|

|

Nelnet, Inc., Class A |

|

|

25,924,769 |

|

| |

|

|

|

|

|

|

51,199,701 |

|

| |

|

|

|

TECHNOLOGY HARDWARE — 12.2% |

|

|

|

|

| |

249,675 |

|

|

Arrow Electronics, Inc.* |

|

|

26,967,397 |

|

| |

43,673 |

|

|

Fabrinet* |

|

|

20,063,813 |

|

| |

115,774 |

|

|

InterDigital, Inc. |

|

|

41,418,149 |

|

| |

284,230 |

|

|

TD SYNNEX Corp. |

|

|

43,339,390 |

|

| |

|

|

|

|

|

|

131,788,749 |

|

| |

|

|

|

TECHNOLOGY SERVICES — 1.2% |

|

|

|

|

| |

154,904 |

|

|

Science Applications International Corp. |

|

|

13,354,274 |

|

| |

|

|

|

TRANSPORTATION EQUIPMENT — 2.7% |

|

|

|

|

| |

539,334 |

|

|

REV Group, Inc. |

|

|

28,730,322 |

|

| |

|

|

|

WHOLESALE - DISCRETIONARY — 3.0% |

|

|

|

|

| |

134,726 |

|

|

ePlus, Inc. |

|

|

12,071,450 |

|

FPA Queens Road Small Cap Value Fund

SCHEDULE OF INVESTMENTS - Continued

As of November 30, 2025 (Unaudited)

|

Number

of Shares |

|

|

|

|

Value |

|

| |

|

|

|

COMMON STOCKS (Continued) |

|

|

|

|

| |

|

|

|

WHOLESALE - DISCRETIONARY (Continued) |

|

|

|

|

| |

677,440 |

|

|

G-III Apparel Group Ltd.* |

|

$ |

19,747,376 |

|

| |

|

|

|

|

|

|

31,818,826 |

|

| |

|

|

|

TOTAL COMMON STOCKS |

|

|

|

|

| |

|

|

|

(Cost $683,783,952) |

|

|

937,970,568 |

|

| |

|

|

|

EXCHANGE-TRADED FUNDS — 4.3% |

|

|

|

|

| |

605,802 |

|

|

Vanguard 0-3 Month Treasury Bill ETF |

|

|

45,813,776 |

|

| |

|

|

|

TOTAL EXCHANGE-TRADED FUNDS |

|

|

|

|

| |

|

|

|

(Cost $45,682,494) |

|

|

45,813,776 |

|

| |

|

|

|

SHORT-TERM INVESTMENTS — 8.4% |

|

|

|

|

| |

|

|

|

MONEY MARKET INVESTMENTS — 8.4% |

|

|

|

|

| |

90,941,933 |

|

|

Morgan Stanley Institutional Liquidity Treasury Portfolio

- Institutional Class, 3.77%(a) |

|

|

90,941,933 |

|

| |

|

|

|

TOTAL SHORT-TERM INVESTMENTS |

|

|

|

|

| |

|

|

|

(Cost $90,941,933) |

|

|

90,941,933 |

|

| |

|

|

|

TOTAL INVESTMENTS — 99.8% |

|

|

|

|

| |

|

|

|

(Cost $820,408,379) |

|

|

1,074,726,277 |

|

| |

|

|

|

Other Assets in Excess of Liabilities — 0.2% |

|

|

1,669,856 |

|

| |

|

|

|

TOTAL NET ASSETS — 100.0% |

|

$ |

1,076,396,133 |

|

ETF – Exchange-Traded Fund

|

| * |

Non-income producing security. |

|

| (a) |

The rate is the annualized seven-day yield at period end. |

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

STATEMENT OF ASSETS AND LIABILITIES

As of November 30, 2025 (Unaudited)

| Assets: |

|

|

|

|

| Investments, at value (cost $820,408,379) |

|

$ |

1,074,726,277 |

|

| Receivables: |

|

|

|

|

| Fund shares sold |

|

|

644,866 |

|

| Dividends and interest |

|

|

2,260,508 |

|

| Prepaid expenses |

|

|

29,845 |

|

| Total assets |

|

|

1,077,661,496 |

|

| |

|

|

|

|

| Liabilities: |

|

|

|

|

| Payables: |

|

|

|

|

| Fund shares redeemed |

|

|

550,219 |

|

| Advisory fees |

|

|

566,277 |

|

| Shareholder servicing fees (Note 7) |

|

|

49,651 |

|

| Fund services fees |

|

|

33,816 |

|

| Shareholder reporting fees |

|

|

16,429 |

|

| Legal fees |

|

|

12,144 |

|

| Trustees' deferred compensation (Note 3) |

|

|

8,760 |

|

| Auditing fees |

|

|

8,608 |

|

| Chief Compliance Officer fees |

|

|

2,994 |

|

| Trustees' fees and expenses |

|

|

1,754 |

|

| Accrued other expenses |

|

|

14,711 |

|

| Total liabilities |

|

|

1,265,363 |

|

| |

|

|

|

|

| Net Assets |

|

$ |

1,076,396,133 |

|

| |

|

|

|

|

| Components of Net Assets: |

|

|

|

|

| Capital Stock (no par value with an unlimited number of shares authorized) |

|

$ |

742,071,344 |

|

| Total distributable earnings (accumulated deficit) |

|

|

334,324,789 |

|

| Net Assets |

|

$ |

1,076,396,133 |

|

| |

|

|

|

|

| Maximum Offering Price per Share: |

|

|

|

|

| Investor Class Shares: |

|

|

|

|

| Net assets applicable to shares outstanding |

|

$ |

128,379,195 |

|

| Shares of beneficial interest issued and outstanding |

|

|

2,874,874 |

|

| Redemption price per share |

|

$ |

44.66 |

|

| |

|

|

|

|

| Institutional Class Shares: |

|

|

|

|

| Net assets applicable to shares outstanding |

|

$ |

903,824,786 |

|

| Shares of beneficial interest issued and outstanding |

|

|

20,243,489 |

|

| Redemption price per share |

|

$ |

44.65 |

|

| |

|

|

|

|

| Advisor Class Shares: |

|

|

|

|

| Net assets applicable to shares outstanding |

|

$ |

44,192,152 |

|

| Shares of beneficial interest issued and outstanding |

|

|

992,786 |

|

| Redemption price per share |

|

$ |

44.51 |

|

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

STATEMENT OF OPERATIONS

For the Six Months Ended November 30, 2025 (Unaudited)

| Investment income: |

|

|

|

| Dividends |

|

$ |

8,830,134 |

|

| Interest |

|

|

1,261,105 |

|

| Total investment income |

|

|

10,091,239 |

|

| |

|

|

|

|

| Expenses: |

|

|

|

|

| Advisory fees |

|

|

3,337,475 |

|

| Shareholder servicing fees - Investor Class (Note 7) |

|

|

105,078 |

|

| Shareholder servicing fees - Institutional Class (Note 7) |

|

|

229,485 |

|

| Shareholder servicing fees - Advisor Class (Note 7) |

|

|

29,238 |

|

| Fund services fees |

|

|

118,715 |

|

| Registration fees |

|

|

38,067 |

|

| Trustees' fees and expenses |

|

|

24,144 |

|

| Miscellaneous |

|

|

23,693 |

|

| Shareholder reporting fees |

|

|

19,821 |

|

| Redemption liquidity service |

|

|

12,795 |

|

| Legal fees |

|

|

12,453 |

|

| Insurance fees |

|

|

10,021 |

|

| Auditing fees |

|

|

9,089 |

|

| Chief Compliance Officer fees |

|

|

5,364 |

|

| Total expenses |

|

|

3,975,438 |

|

| Net investment income (loss) |

|

|

6,115,801 |

|

| |

|

|

|

|

| Realized and Unrealized Gain (Loss): |

|

|

|

|

| Net realized gain (loss) on: |

|

|

|

|

| Investments |

|

|

44,973,901 |

|

| In-kind redemptions |

|

|

8,425,352 |

|

| Total realized gain (loss) |

|

|

53,399,253 |

|

| Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

| Investments |

|

|

53,968,321 |

|

| Net change in unrealized appreciation (depreciation) |

|

|

53,968,321 |

|

| Net realized and unrealized gain (loss) |

|

|

107,367,574 |

|

| |

|

|

|

|

| Net Increase (Decrease) in Net Assets from Operations |

|

$ |

113,483,375 |

|

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

STATEMENTS OF CHANGES

IN NET ASSETS

| |

|

For the

Six Months Ended

November

30, 2025

(Unaudited) |

|

|

For the

Year Ended

May 31, 2025 |

|

| Increase (Decrease) in Net Assets from: |

|

|

|

|

|

|

|

|

| Operations: |

|

|

|

|

|

|

|

|

| Net investment income (loss) |

|

$ |

6,115,801 |

|

|

$ |

8,038,370 |

|

| Total realized gain (loss) on investments |

|

|

53,399,253 |

|

|

|

32,898,512 |

|

| Net change in unrealized appreciation (depreciation) on investments |

|

|

53,968,321 |

|

|

|

25,946,662 |

|

| Net increase (decrease) in net assets resulting from

operations |

|

|

113,483,375 |

|

|

|

66,883,544 |

|

| |

|

|

|

|

|

|

|

|

| Distributions to Shareholders: |

|

|

|

|

|

|

|

|

| Distributions: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

- |

|

|

|

(4,334,028 |

) |

| Institutional Class |

|

|

- |

|

|

|

(32,840,884 |

) |

| Advisor Class |

|

|

- |

|

|

|

(1,546,449 |

) |

| Total distributions to shareholders |

|

|

- |

|

|

|

(38,721,361 |

) |

| |

|

|

|

|

|

|

|

|

| Capital Transactions: |

|

|

|

|

|

|

|

|

| Net proceeds from shares sold: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

41,282,663 |

|

|

|

31,256,196 |

|

| Institutional Class |

|

|

83,662,670 |

|

|

|

215,903,807 |

|

| Advisor Class |

|

|

9,387,677 |

|

|

|

12,763,673 |

|

| Reinvestment of distributions: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

- |

|

|

|

4,326,093 |

|

| Institutional Class |

|

|

- |

|

|

|

30,073,326 |

|

| Advisor Class |

|

|

- |

|

|

|

1,510,109 |

|

| Cost of shares redeemed: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

(20,208,564 |

) |

|

|

(25,937,442 |

) |

| Institutional Class |

|

|

(58,282,058 |

) |

|

|

(89,648,643 |

) |

| Advisor Class |

|

|

(2,409,491 |

) |

|

|

(23,869,104 |

) |

| Net increase (decrease) in net assets from capital

transactions |

|

|

53,432,897 |

|

|

|

156,378,015 |

|

| |

|

|

|

|

|

|

|

|

| Total increase (decrease) in net assets |

|

|

166,916,272 |

|

|

|

184,540,198 |

|

| |

|

|

|

|

|

|

|

|

| Net Assets: |

|

|

|

|

|

|

|

|

| Beginning of period |

|

|

909,479,861 |

|

|

|

724,939,663 |

|

| End of period |

|

$ |

1,076,396,133 |

|

|

$ |

909,479,861 |

|

| Capital Share Transactions: |

|

|

|

|

|

|

|

|

| Shares sold: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

945,557 |

|

|

|

795,691 |

|

| Institutional Class |

|

|

1,935,219 |

|

|

|

5,549,972 |

|

| Advisor Class |

|

|

217,093 |

|

|

|

323,488 |

|

| Shares reinvested: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

- |

|

|

|

111,411 |

|

| Institutional Class |

|

|

- |

|

|

|

775,485 |

|

| Advisor Class |

|

|

- |

|

|

|

39,001 |

|

| Shares redeemed: |

|

|

|

|

|

|

|

|

| Investor Class |

|

|

(465,901 |

) |

|

|

(668,386 |

) |

| Institutional Class |

|

|

(1,342,745 |

) |

|

|

(2,330,783 |

) |

| Advisor Class |

|

|

(56,229 |

) |

|

|

(611,069 |

) |

| Net increase (decrease) in capital share transactions |

|

|

1,232,994 |

|

|

|

3,984,810 |

|

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

FINANCIAL HIGHLIGHTS

Investor Class

Per share operating performance.

For a capital share outstanding throughout each period.

| |

|

For the

Six Months

Ended

November 30,

2025 |

|

|

For the

Year Ended

May 31, |

|

| |

|

(Unaudited) |

|

|

2025 |

|

|

2024 |

|

|

20231 |

|

|

20221 |

|

|

20211 |

|

| Net asset value, beginning of period |

|

$ |

39.79 |

|

|

$ |

38.40 |

|

|

$ |

32.12 |

|

|

$ |

34.03 |

|

|

$ |

35.52 |

|

|

$ |

23.22 |

|

| Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment

income (loss)2 |

|

|

0.24 |

|

|

|

0.35 |

|

|

|

0.27 |

|

|

|

0.31 |

|

|

|

0.07 |

|

|

|

0.06 |

|

| Net realized and unrealized gain (loss) |

|

|

4.63 |

|

|

|

2.93 |

|

|

|

6.96 |

|

|

|

(1.54 |

) |

|

|

(0.95 |

) |

|

|

12.34 |

|

| Total from investment operations |

|

|

4.87 |

|

|

|

3.28 |

|

|

|

7.23 |

|

|

|

(1.23 |

) |

|

|

(0.88 |

) |

|

|

12.40 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From net investment income |

|

|

- |

|

|

|

(0.31 |

) |

|

|

(0.44 |

) |

|

|

- |

|

|

|

- |

|

|

|

(0.09 |

) |

| From net realized gain |

|

|

- |

|

|

|

(1.58 |

) |

|

|

(0.51 |

) |

|

|

(0.68 |

) |

|

|

(0.61 |

) |

|

|

(0.01 |

) |

| Total distributions |

|

|

- |

|

|

|

(1.89 |

) |

|

|

(0.95 |

) |

|

|

(0.68 |

) |

|

|

(0.61 |

) |

|

|

(0.10 |

) |

| Net asset value, end of period |

|

$ |

44.66 |

|

|

$ |

39.79 |

|

|

$ |

38.40 |

|

|

$ |

32.12 |

|

|

$ |

34.03 |

|

|

$ |

35.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total return3 |

|

|

12.24 |

%4 |

|

|

8.67 |

% |

|

|

22.62 |

% |

|

|

(3.63 |

)% |

|

|

(2.52 |

)% |

|

|

53.51 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of period (in thousands) |

|

$ |

128,379 |

|

|

$ |

95,295 |

|

|

$ |

82,801 |

|

|

$ |

72,820 |

|

|

$ |

82,461 |

|

|

$ |

193,922 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of expenses to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

0.89 |

%5 |

|

|

0.92 |

% |

|

|

0.98 |

% |

|

|

1.00 |

% |

|

|

1.00 |

% |

|

|

1.11 |

% |

| After fees waived and expenses absorbed |

|

|

0.89 |

%5 |

|

|

0.92 |

% |

|

|

0.98 |

% |

|

|

1.00 |

% |

|

|

1.00 |

% |

|

|

1.09 |

%6 |

| Ratio of net investment income (loss) to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

1.09 |

%5 |

|

|

0.89 |

% |

|

|

0.77 |

% |

|

|

0.95 |

% |

|

|

0.21 |

% |

|

|

0.22 |

% |

| After fees waived and expenses absorbed |

|

|

1.09 |

%5 |

|

|

0.89 |

% |

|

|

0.77 |

% |

|

|

0.95 |

% |

|

|

0.21 |

% |

|

|

0.20 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Portfolio turnover rate |

|

|

13 |

%4 |

|

|

15 |

% |

|

|

19 |

% |

|

|

13 |

% |

|

|

10 |

% |

|

|

15 |

% |

|

| 1 |

Audits performed for the fiscal years indicated by the Fund's previous auditor, Ernst & Young LLP. |

|

| 2 |

Based on average shares outstanding for the period. |

|

| 3 |

Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect

deduction of the sales charge. |

|

| 6 |

Effective November 1, 2020, the Advisor has contractually agreed to limit the annual fund operating expenses

to 1.04%. Prior to November 1, 2020, the Fund had a unitary fee structure that limited annual operating expenses to 1.18%. |

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

FINANCIAL HIGHLIGHTS

Institutional Class

Per share operating performance.

For a capital share outstanding throughout each period.

| |

|

For the

Six Months

Ended

November

30,

2025 |

|

|

For the

Year Ended

May 31, |

|

|

For the

Period Ended

May 31, |

|

| |

|

(Unaudited) |

|

|

2025 |

|

|

2024 |

|

|

20231 |

|

|

20221 |

|

|

20211,2 |

|

| Net asset value, beginning of period |

|

$ |

39.75 |

|

|

$ |

38.37 |

|

|

$ |

32.10 |

|

|

$ |

33.99 |

|

|

$ |

35.52 |

|

|

$ |

28.16 |

|

| Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment

income (loss)3 |

|

|

0.26 |

|

|

|

0.41 |

|

|

|

0.34 |

|

|

|

0.37 |

|

|

|

0.13 |

|

|

|

0.02 |

|

| Net realized and unrealized gain (loss) |

|

|

4.64 |

|

|

|

2.93 |

|

|

|

6.95 |

|

|

|

(1.54 |

) |

|

|

(0.94 |

) |

|

|

7.44 |

|

| Total from investment operations |

|

|

4.90 |

|

|

|

3.34 |

|

|

|

7.29 |

|

|

|

(1.17 |

) |

|

|

(0.81 |

) |

|

|

7.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From net investment income |

|

|

- |

|

|

|

(0.38 |

) |

|

|

(0.51 |

) |

|

|

(0.04 |

) |

|

|

(0.11 |

) |

|

|

(0.09 |

) |

| From net realized gain |

|

|

- |

|

|

|

(1.58 |

) |

|

|

(0.51 |

) |

|

|

(0.68 |

) |

|

|

(0.61 |

) |

|

|

(0.01 |

) |

| Total distributions |

|

|

- |

|

|

|

(1.96 |

) |

|

|

(1.02 |

) |

|

|

(0.72 |

) |

|

|

(0.72 |

) |

|

|

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redemption fee proceeds |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net asset value, end of period |

|

$ |

44.65 |

|

|

$ |

39.75 |

|

|

$ |

38.37 |

|

|

$ |

32.10 |

|

|

$ |

33.99 |

|

|

$ |

35.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total return4 |

|

|

12.33 |

%5 |

|

|

8.82 |

% |

|

|

22.82 |

% |

|

|

(3.44 |

)% |

|

|

(2.34 |

)% |

|

|

26.59 |

%5 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of period (in thousands) |

|

$ |

903,825 |

|

|

$ |

781,187 |

|

|

$ |

600,743 |

|

|

$ |

367,607 |

|

|

$ |

376,221 |

|

|

$ |

301,941 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of expenses to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

0.76 |

%6 |

|

|

0.78 |

% |

|

|

0.79 |

% |

|

|

0.81 |

% |

|

|

0.83 |

% |

|

|

0.91 |

%6 |

| After fees waived and expenses absorbed |

|

|

0.76 |

%6 |

|

|

0.78 |

% |

|

|

0.79 |

% |

|

|

0.81 |

% |

|

|

0.83 |

% |

|

|

0.89 |

%6 |

| Ratio of net investment income (loss) to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

1.22 |

%6 |

|

|

1.03 |

% |

|

|

0.97 |

% |

|

|

1.14 |

% |

|

|

0.38 |

% |

|

|

0.08 |

%6 |

| After fees waived and expenses absorbed |

|

|

1.22 |

%6 |

|

|

1.03 |

% |

|

|

0.97 |

% |

|

|

1.14 |

% |

|

|

0.38 |

% |

|

|

0.10 |

%6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Portfolio turnover rate |

|

|

13 |

%5 |

|

|

15 |

% |

|

|

19 |

% |

|

|

13 |

% |

|

|

10 |

% |

|

|

15 |

%5 |

|

| 1 |

Audits performed for the fiscal years indicated by the Fund's previous auditor, Ernst & Young LLP. |

|

| 2 |

The Institutional Class commenced operations on December 1, 2020. The data shown reflects operations for the

period December 1, 2020 to May 31, 2021. |

|

| 3 |

Based on average shares outstanding for the period. |

|

| 4 |

Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect

deduction of the sales charge. |

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

FINANCIAL HIGHLIGHTS

Advisor Class

Per share operating performance.

For a capital share outstanding throughout each period.

| |

|

For the

Six Months

Ended

November

30,

2025 |

|

|

For the

Year Ended

May 31, |

|

|

For the

Period Ended

May 31, |

|

| |

|

(Unaudited) |

|

|

2025 |

|

|

2024 |

|

|

20231 |

|

|

20221 |

|

|

20211,2 |

|

| Net asset value, beginning of period |

|

$ |

39.67 |

|

|

$ |

38.31 |

|

|

$ |

32.05 |

|

|

$ |

33.94 |

|

|

$ |

35.52 |

|

|

$ |

28.16 |

|

| Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income (loss) 3 |

|

|

0.24 |

|

|

|

0.37 |

|

|

|

0.30 |

|

|

|

0.34 |

|

|

|

0.10 |

|

|

|

0.02 |

|

| Net realized and unrealized gain (loss) |

|

|

4.60 |

|

|

|

2.90 |

|

|

|

6.94 |

|

|

|

(1.54 |

) |

|

|

(0.95 |

) |

|

|

7.44 |

|

| Total from investment operations |

|

|

4.84 |

|

|

|

3.27 |

|

|

|

7.24 |

|

|

|

(1.20 |

) |

|

|

(0.85 |

) |

|

|

7.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From net investment income |

|

|

- |

|

|

|

(0.33 |

) |

|

|

(0.47 |

) |

|

|

(0.01 |

) |

|

|

(0.12 |

) |

|

|

(0.09 |

) |

| From net realized gain |

|

|

- |

|

|

|

(1.58 |

) |

|

|

(0.51 |

) |

|

|

(0.68 |

) |

|

|

(0.61 |

) |

|

|

(0.01 |

) |

| Total distributions |

|

|

- |

|

|

|

(1.91 |

) |

|

|

(0.98 |

) |

|

|

(0.69 |

) |

|

|

(0.73 |

) |

|

|

(0.10 |

) |

| Net asset value, end of period |

|

$ |

44.51 |

|

|

$ |

39.67 |

|

|

$ |

38.31 |

|

|

$ |

32.05 |

|

|

$ |

33.94 |

|

|

$ |

35.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total return4 |

|

|

12.20 |

%5 |

|

|

8.66 |

% |

|

|

22.69 |

% |

|

|

(3.56 |

)% |

|

|

(2.46 |

)% |

|

|

26.58 |

%5 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios and Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets, end of period (in thousands) |

|

$ |

44,192 |

|

|

$ |

32,998 |

|

|

$ |

41,396 |

|

|

$ |

43,514 |

|

|

$ |

39,219 |

|

|

$ |

724 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of expenses to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

0.86 |

%6 |

|

|

0.86 |

% |

|

|

0.90 |

% |

|

|

0.93 |

% |

|

|

0.93 |

% |

|

|

0.90 |

%6 |

| After fees waived and expenses absorbed |

|

|

0.86 |

%6 |

|

|

0.86 |

% |

|

|

0.90 |

% |

|

|

0.93 |

% |

|

|

0.93 |

% |

|

|

0.90 |

%6 |

| Ratio of net investment income to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Before fees waived and expenses absorbed |

|

|

1.12 |

%6 |

|

|

0.95 |

% |

|

|

0.85 |

% |

|

|

1.04 |

% |

|

|

0.28 |

% |

|

|

0.10 |

%6 |

| After fees waived and expenses absorbed |

|

|

1.12 |

%6 |

|

|

0.95 |

% |

|

|

0.85 |

% |

|

|

1.04 |

% |

|

|

0.28 |

% |

|

|

0.10 |

%6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Portfolio turnover rate |

|

|

13 |

%5 |

|

|

15 |

% |

|

|

19 |

% |

|

|

13 |

% |

|

|

10 |

% |

|

|

15 |

%5 |

|

| 1 |

Audits performed for the fiscal years indicated by the Fund's previous auditor, Ernst & Young LLP. |

|

| 2 |

The Advisor Class commenced operations on December 1, 2020. The data shown reflects operations for the period

December 1, 2020 to May 31, 2021. |

|

| 3 |

Based on average shares outstanding for the period. |

|

| 4 |

Return is based on net asset value per share, adjusted for reinvestment of distributions, and does not reflect

deduction of the sales charge. |

See accompanying Notes to Financial Statements.

FPA Queens Road Small Cap Value Fund

NOTES TO FINANCIAL STATEMENTS

November 30, 2025 (Unaudited)

Note 1 – Organization

FPA Queens Road Small Cap Value Fund (the “Fund”)

is a diversified series of Investment Managers Series Trust III (the “Trust”), which is registered as an open-end management

investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s primary investment

objective is to seek long-term capital growth. First Pacific Advisors, LP (the “Adviser”) has served as the Fund’s investment

adviser since November 1, 2020.

On July 28, 2023, the Fund acquired the assets

and assumed the liabilities of FPA Queens Road Small Cap Value Fund, a series of Bragg Capital Trust, (the “Predecessor Fund”)

in a tax-free reorganization pursuant to the Agreement and Plan of Reorganization (the “Plan of Reorganization”). The Plan

of Reorganization was approved by the Trust’s Board and by the Predecessor Fund’s Board on May 8, 2023. The tax-free reorganization

was accomplished on July 28, 2023. As a result of the reorganization, the Fund assumed the performance and accounting history of the Predecessor

Fund. Financial information included for the dates prior to the reorganization is that of the Predecessor Fund.

The reorganization was accomplished by the following

tax-free exchange in which each shareholder of the Fund received the same aggregate share net asset value as noted below:

| Shares Issued |

|

|

Net Assets |

|

| Investor Class |

|

|

2,273,407 |

|

|

$ |

80,361,287 |

|

| Institutional Class |

|

|

11,451,635 |

|

|

|

404,622,337 |

|

| Advisor Class |

|

|

1,384,548 |

|

|

|

48,836,652 |

|

The net unrealized appreciation of investments

transferred was $138,240,430 as of the date of the acquisition.

The Fund is an investment company and accordingly

follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard

Codification Topic 946 “Financial Services— Investment Companies”.

The Fund is deemed to be an individual reporting

segment and is not part of a consolidated reporting entity. The objective and strategy of the Fund is used by the Adviser to make investment