| THE WORLD’S LARGEST MANUFACTURER OF TOWING AND RECOVERY EQUIPMENT Q3 2025 INVESTOR PRESENTATION |

| MILLER INDUSTRIES FORWARD LOOKING STATEMENTS SAFE HARBOR STATEMENT Certain statements in this presentation may be deemed to be forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “may”, “will”, “should”, “could”, “continue”, “future”, “potential”, “believe”, “project”, “plan”, “intend”, “seek”, “estimate”, “predict”, “expect”, “anticipate” and similar expressions, or the negative of such terms, or other comparable terminology and include, without limitation, any statements relating our 2025 guidance (including under the heading “2025 Guidance”), our ability to effectively monitor and adjust production levels to meet current demand and accelerate the reduction of channel inventory, the success of steps we may take to improve our costs, our ability to secure our supply chain to mitigate the long-term risks of tariffs, the growth and effect of the drivers of our long-term business performance, the potential improvement of our market environment and recovery of the commercial market, our future production capacity expansion plans, our priorities for the remainder of 2025 relating to operational efficiency and capital allocation, and any potential upside from pending military contracts and their potential effect on revenue and earnings growth. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements. Such forward-looking statements are made based on our management’s beliefs as well as assumptions made by, and information currently available to, our management. Our actual results may differ materially from the results anticipated in these forward-looking statements due to, among other things: our dependence upon outside suppliers for component parts, chassis and raw materials, including aluminum, steel, and petroleum-related products leaves us subject to changes in price and availability, the cadence and quantity of deliveries from our suppliers, and delays in receiving supplies of such materials, component parts or chassis; our customers’ and towing operators’ access to capital and credit to fund purchases; the implementation of new or increased tariffs and any resulting trade wars and any resulting macroeconomic uncertainty; the rising costs of equipment ownership, including continuing increases in insurance premiums and elevated interest rates that have added cost pressures to our end users, and fluctuations in the value of used trucks; macroeconomic trends, availability of financing, and changing interest rates; our customers’ ability to fund purchases of our products increases in the cost of skilled labor; the cyclical nature of our industry and changes in consumer confidence and in economic conditions in general; special risks from our sales to U.S. and other governmental entities through prime contractors; changes in fuel and other transportation costs, insurance costs and weather conditions; changes in government regulations, including environmental and health and safety regulations; failure to comply with domestic and foreign anti-corruption laws; competition in our industry and our ability to attract or retain customers; our ability to develop or acquire proprietary products and technology; assertions against us relating to intellectual property rights; changes in the tax regimes and related government policies and regulations in the countries in which we operate; the effects of regulations relating to conflict minerals; the catastrophic loss of one of our manufacturing facilities; environmental and health and safety liabilities and requirements; loss of the services of our key executives; product warranty or product liability claims in excess of our insurance coverage; potential recalls of components or parts manufactured for us by suppliers or potential recalls of defective products; an inability to acquire insurance at commercially reasonable rates; a disruption in, or breach in security of, our information technology systems or any violation of data protection laws; and those other risks discussed in our filings with the Securities and Exchange Commission, including those risks discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024 and subsequent Quarterly Reports on Form 10-Q, which discussion is incorporated herein by this reference. Such factors are not exclusive. We do not undertake to update any forward-looking statement that may be made from time to time by, or on behalf of, the Company. |

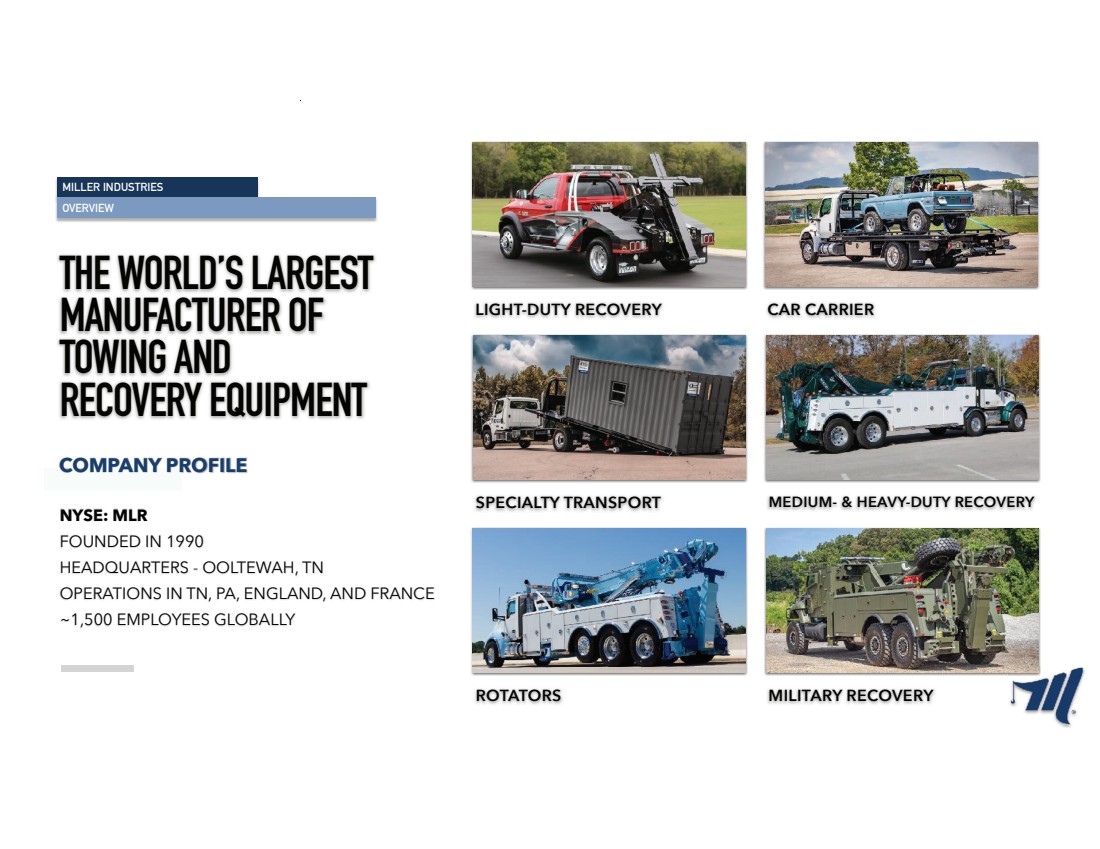

| MILLER INDUSTRIES OVERVIEW THE WORLD’S LARGEST MANUFACTURER OF TOWING AND RECOVERY EQUIPMENT LIGHT-DUTY RECOVERY CAR CARRIER SPECIALTY TRANSPORT MEDIUM- & HEAVY-DUTY RECOVERY ROTATORS MILITARY RECOVERY NYSE: MLR FOUNDED IN 1990 HEADQUARTERS - OOLTEWAH, TN OPERATIONS IN TN, PA, ENGLAND, AND FRANCE ~1,500 EMPLOYEES GLOBALLY COMPANY PROFILE |

| “ MILLER INDUSTRIES CORE PHILOSOPHY WE HAVE THE BEST PEOPLE, THE BEST PRODUCTS, AND THE BEST DISTRIBUTION NETWORK IN THE TOWING AND RECOVERY INDUSTRY.” - BILL MILLER - 1990 |

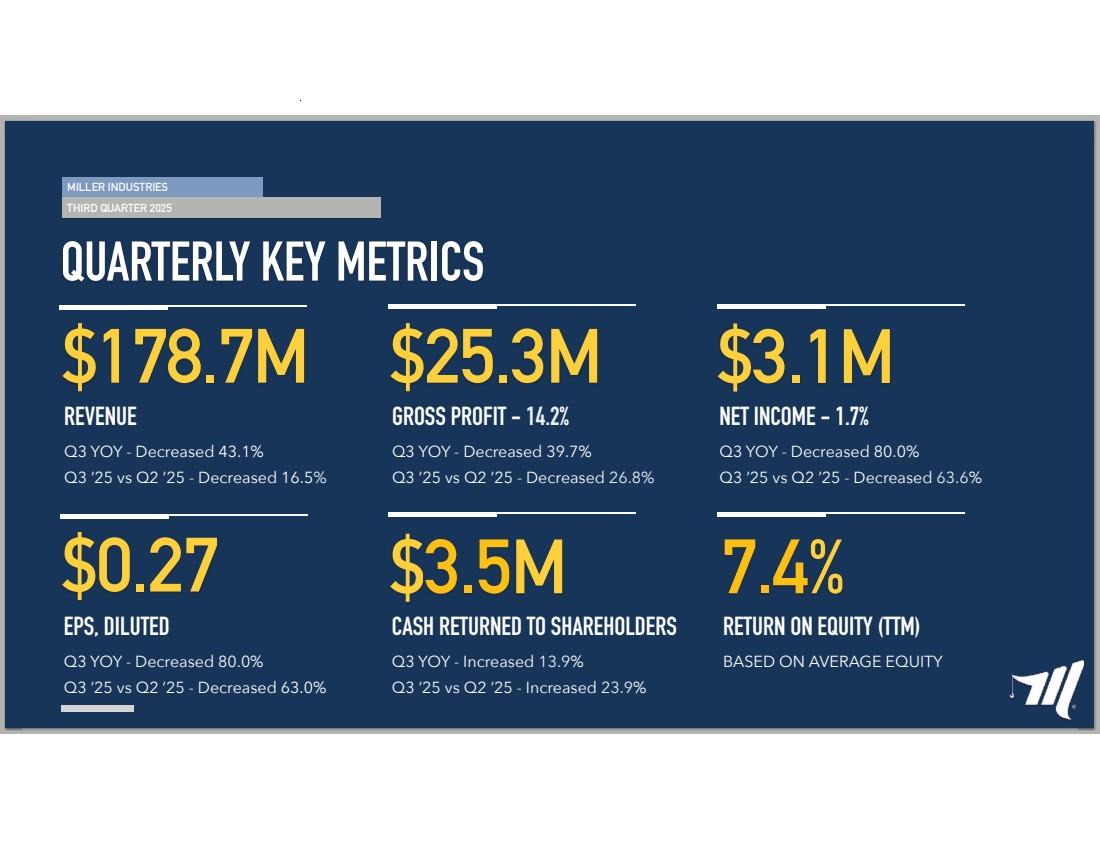

| MILLER INDUSTRIES THIRD QUARTER 2025 QUARTERLY KEY METRICS Q3 YOY - Decreased 43.1% Q3 ’25 vs Q2 ’25 - Decreased 16.5% REVENUE GROSS PROFIT - 14.2% $178.7M $25.3M NET INCOME - 1.7% $3.1M EPS, DILUTED $0.27 $3.5M CASH RETURNED TO SHAREHOLDERS Q3 YOY - Decreased 39.7% Q3 ’25 vs Q2 ’25 - Decreased 26.8% Q3 YOY - Decreased 80.0% Q3 ’25 vs Q2 ’25 - Decreased 63.6% Q3 YOY - Decreased 80.0% Q3 ’25 vs Q2 ’25 - Decreased 63.0% Q3 YOY - Increased 13.9% Q3 ’25 vs Q2 ’25 - Increased 23.9% 7.4% RETURN ON EQUITY (TTM) BASED ON AVERAGE EQUITY |

| MILLER INDUSTRIES MARKET OVERVIEW 2025 4TH QUARTER OUTLOOK ■ COST REDUCTION INITIATIVES ■ INDUSTRY DEMAND ■ DISTRIBUTOR INVENTORY ■ PRODUCTION LEVELS ■ TARIFFS |

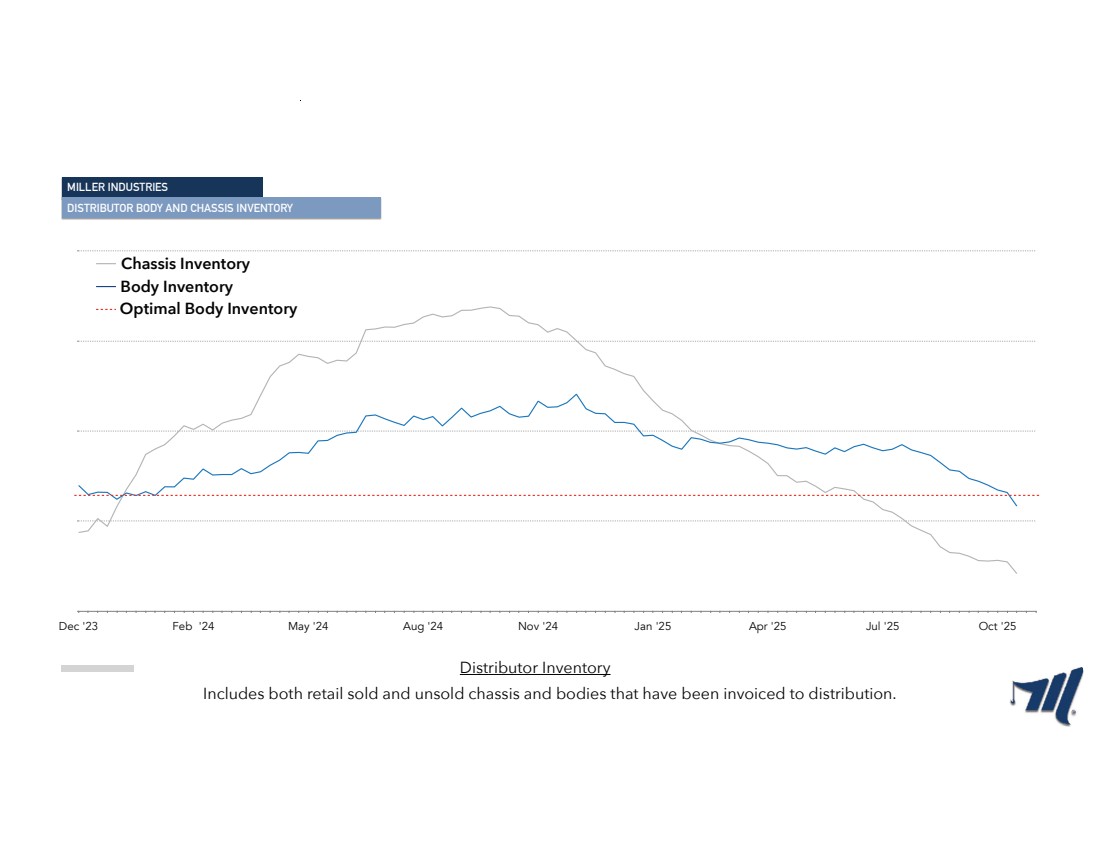

| MILLER INDUSTRIES DISTRIBUTOR BODY AND CHASSIS INVENTORY 3000 3750 4500 5250 6000 Dec '23 Feb '24 May '24 Aug '24 Nov '24 Jan '25 Apr '25 Jul '25 Oct '25 Chassis Inventory Body Inventory Optimal Body Inventory Distributor Inventory Includes both retail sold and unsold chassis and bodies that have been invoiced to distribution. |

| MILLER INDUSTRIES MARKET OVERVIEW 2026 OUTLOOK ■ STRONG BALANCE SHEET ■ COMMERCIAL MARKET RECOVERY ■ EUROPEAN GROWTH ■ MILITARY RFQ’S |

| MILLER INDUSTRIES CAPITAL ALLOCATION CAPITAL ALLOCATION STRATEGY ■Quarterly Dividend ■Debt Reduction ■Share Repurchase ■M&A Opportunities ■Innovation ■Automation ■Human Capital ■Capacity Expansion |

| MILLER INDUSTRIES 2025 AND BEYOND 2025 GUIDANCE ■ REAFFIRM 2025 GUIDANCE ■ ESTIMATED REVENUE $750M - $800M ■ 4TH QUARTER REMINDERS (HOLIDAYS & INVENTORY) |

| MILLER INDUSTRIES INVESTOR RELATIONS INVESTOR RELATIONS SCHEDULE 2025 ■ SOUTHWEST IDEAS CONFERENCE NOVEMBER 19-20 ■ ROADSHOWS ■ REACH OUT TO INVESTOR.RELATIONS@MILLERIND.COM FOR MORE INFORMATION |

| THANK YOU |