Adtran Holdings (Nasdaq: ADTN) Investor presentation November 4, 2025

Cautionary note regarding forward-looking statements This investor presentation contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include, among other things, statements and graphics reflecting the Company’s beliefs and expectations relating to future customer spending and market trends; future fiber and cloud infrastructure growth, including the role of AI in driving growth; fiber networking market forecasts; customers’ future vendor choices; future demand for modernizing and upgrading critical infrastructure within government, utilities and large enterprise applications; future segment growth drivers; expected customer demand for specific solutions; the outlook with respect to the Company’s fourth quarter revenue and non-GAAP operating margin; and the Company’s long-term target operating model. Forward-looking statements can also generally be identified by the use of words such as “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “may,” “could,” “look forward,” and similar expressions. In addition, ADTRAN Holdings, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such projections and other forward-looking information speak only as of the date hereof, and ADTRAN Holdings undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise, except to the extent as may be required by law. All such forward-looking statements are necessarily estimates and reflect management’s best judgment based upon current information. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which have caused and may in the future cause actual events or results to differ materially from those estimated by ADTRAN Holdings include, but are not limited to: (i) risks and uncertainties relating to our ability to remain in compliance with the covenants set forth in and satisfy the payment obligations under our credit agreement, and convertible notes, to satisfy our payment obligations to Adtran Networks’ minority shareholders under the Domination and Profit and Loss Transfer Agreement between us and Adtran Networks (the “DPLTA”), and to make payments to Adtran Networks in order to absorb its annual net loss pursuant to the DPLTA; (ii) the risk of fluctuations in revenue due to lengthy sales and approval processes required by major and other service providers for new products, as well as shifting customer spending patterns; (iii) risks and uncertainties related to our inventory practices and ability to match customer demand; (iv) risks and uncertainties relating to our level of indebtedness and our ability to generate cash; (v) risks and uncertainties relating to ongoing material weaknesses in our internal control over financial reporting; (vi) risks posed by changes in general economic conditions and monetary, fiscal and trade policies, including tariffs; (vii) risks posed by potential breaches of information systems and cyber-attacks; (viii) the risk that we may not be able to effectively compete, including through product improvements and development; and (ix) other risks set forth in our public filings made with the SEC, including our most recent Annual Report on Form 10-K for the year ended December 31, 2024, as amended, our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, and our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2025 to be filed with the SEC. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this presentation, except as required by applicable law or regulation.

Introduction and business model

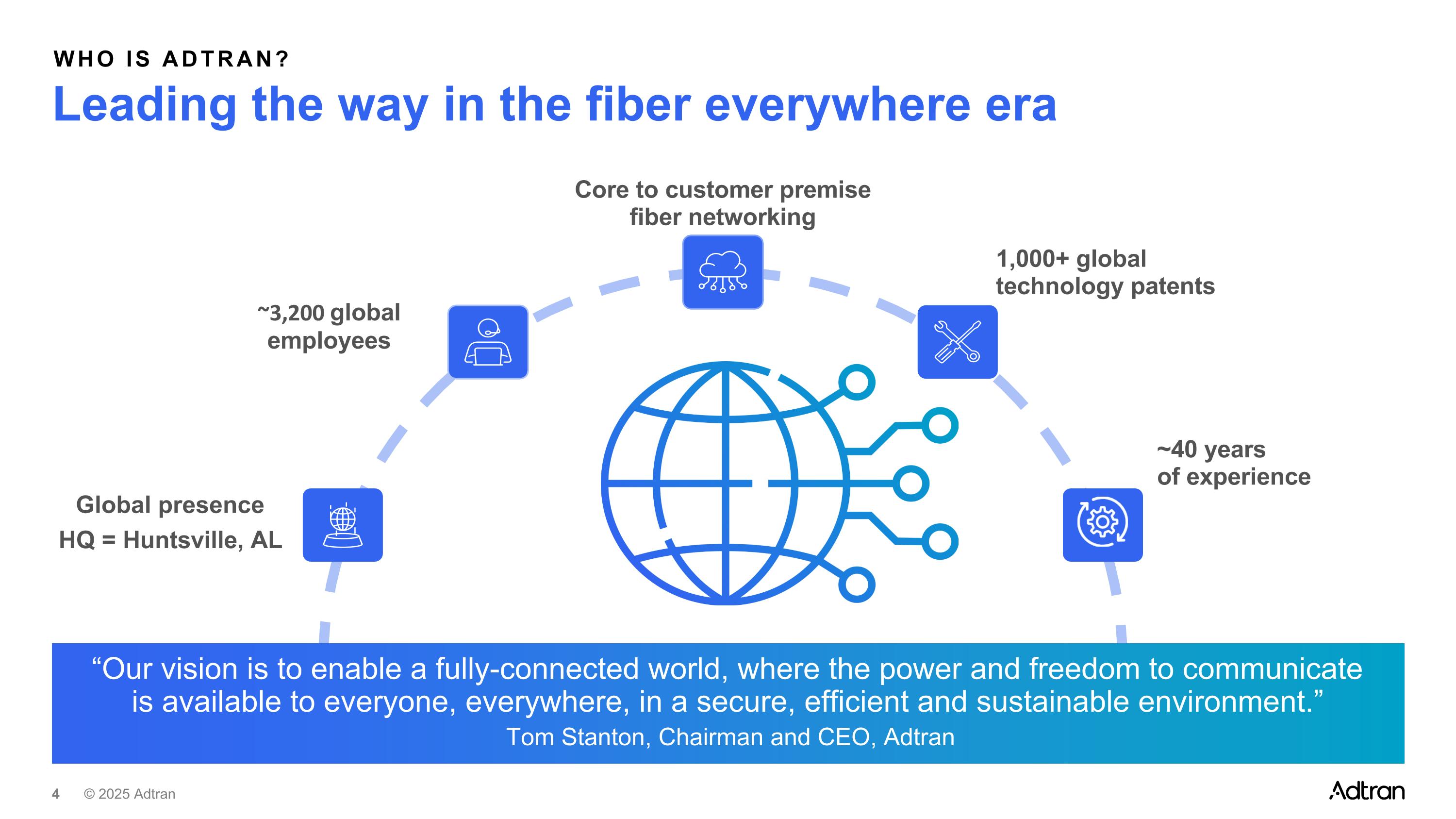

Leading the way in the fiber everywhere era Who is adtran? “Our vision is to enable a fully-connected world, where the power and freedom to communicate is available to everyone, everywhere, in a secure, efficient and sustainable environment.” Tom Stanton, Chairman and CEO, Adtran Global presence HQ = Huntsville, AL ~40 years of experience 1,000+ global technology patents ~3,200 global employees Core to customer premise fiber networking

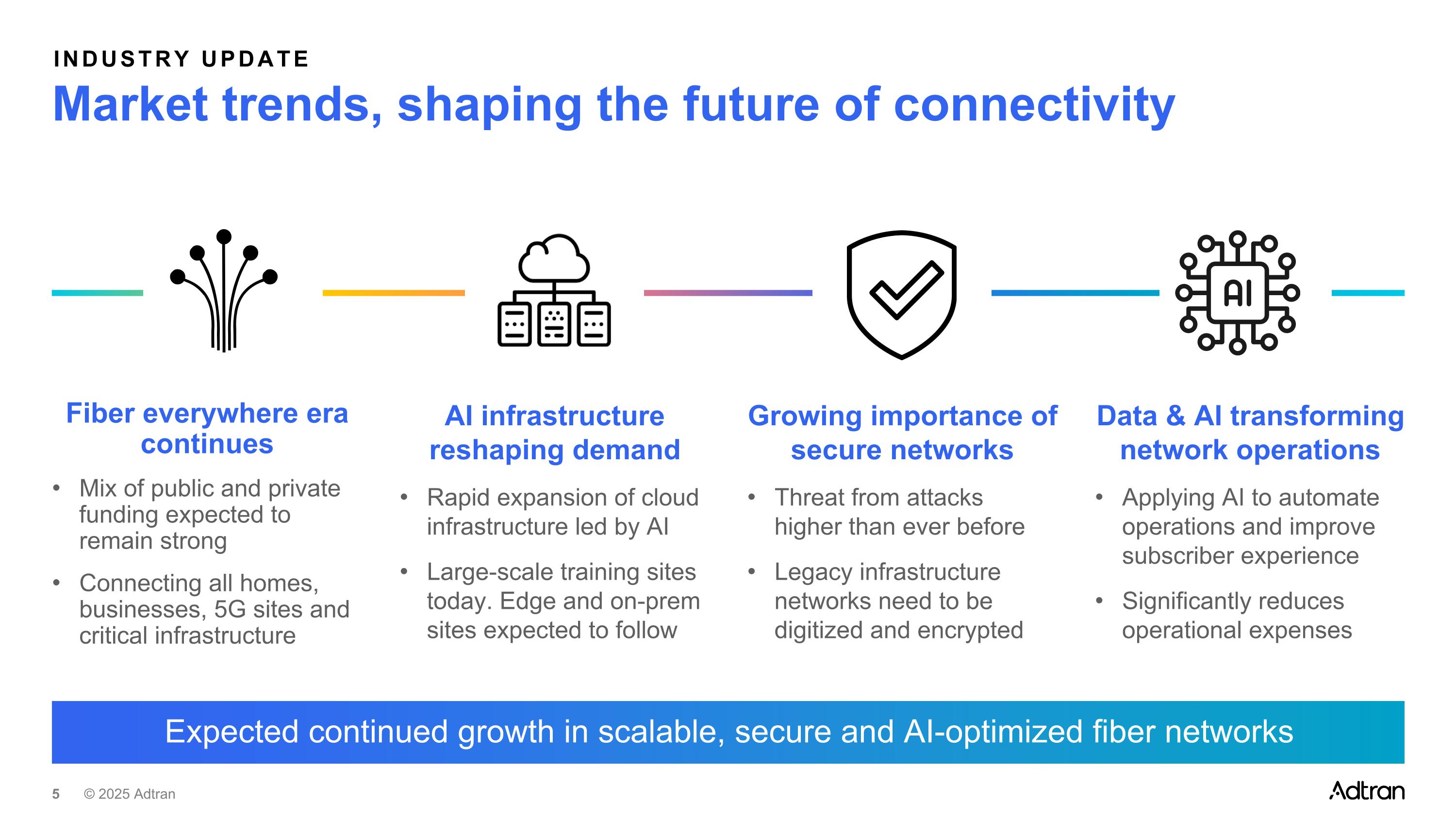

Market trends, shaping the future of connectivity Industry update Expected continued growth in scalable, secure and AI-optimized fiber networks Fiber everywhere era continues Mix of public and private funding expected to remain strong Connecting all homes, businesses, 5G sites and critical infrastructure AI infrastructure reshaping demand Rapid expansion of cloud infrastructure led by AI Large-scale training sites today. Edge and on-prem sites expected to follow Growing importance of secure networks Threat from attacks higher than ever before Legacy infrastructure networks need to be digitized and encrypted Data & AI transforming network operations Applying AI to automate operations and improve subscriber experience Significantly reduces operational expenses

Business model Adtran is a global vendor with scale and diversity Portfolio differentiation Customer diversity Global presence Trusted vendor Optical core to customer premise End-to-end automation & insights Enhanced security and assurance Balanced mix of national SPs, regional SPs, enterprise and ICP customers Projected growth opportunities in each segment Geo-diverse supply chain Globally diverse R&D, sales and support Strong geographic mix of customers Secure networking specialist Long history with top tier SP, enterprise and government customers Leading alternative to high-risk vendors

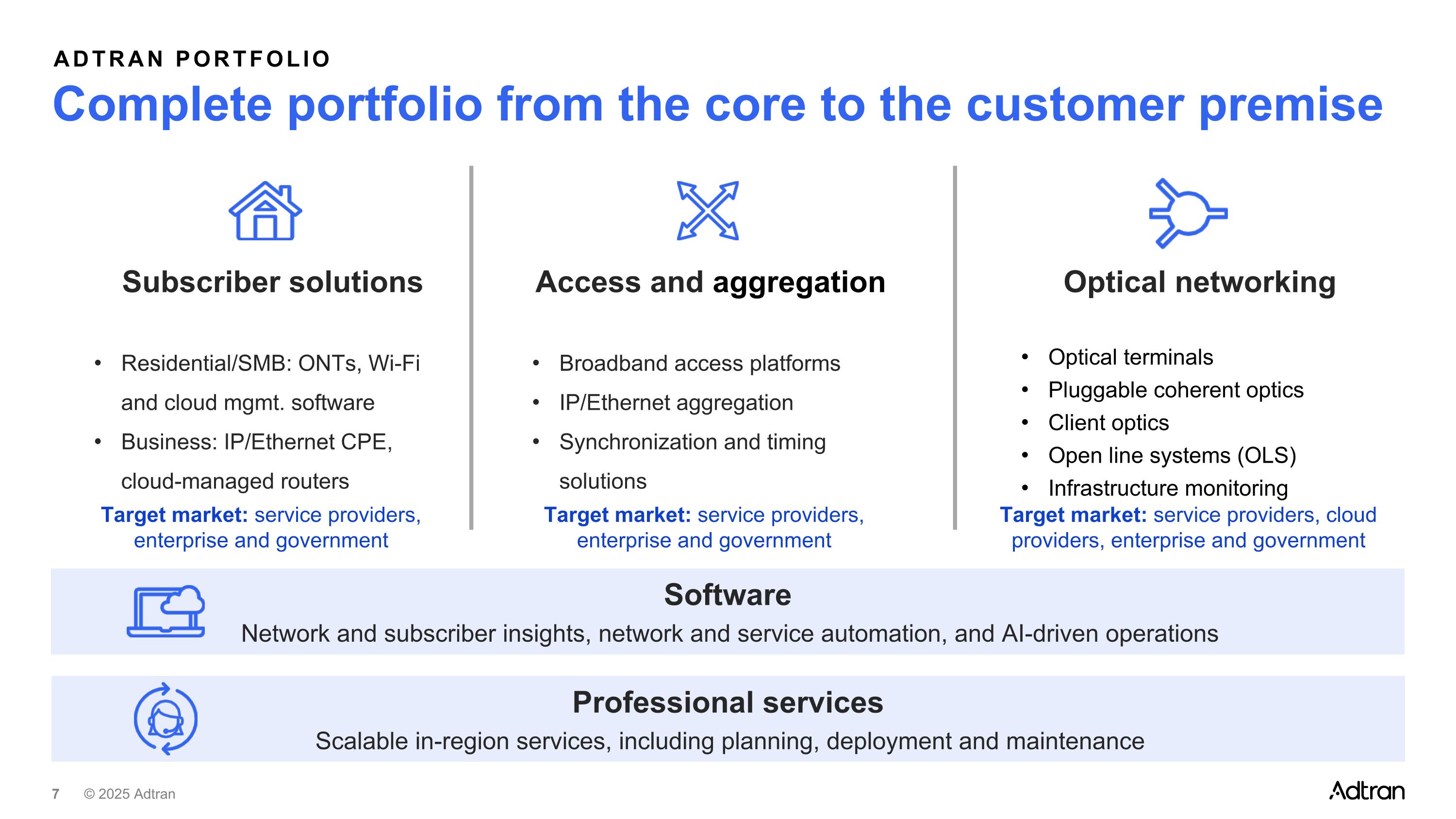

Adtran portfolio Complete portfolio from the core to the customer premise Subscriber solutions Residential/SMB: ONTs, Wi-Fi and cloud mgmt. software Business: IP/Ethernet CPE, cloud-managed routers Optical networking Optical terminals Pluggable coherent optics Client optics Open line systems (OLS) Infrastructure monitoring Access and aggregation Broadband access platforms IP/Ethernet aggregation Synchronization and timing solutions Software Network and subscriber insights, network and service automation, and AI-driven operations Professional services Scalable in-region services, including planning, deployment and maintenance Target market: service providers, enterprise and government Target market: service providers, enterprise and government Target market: service providers, cloud providers, enterprise and government

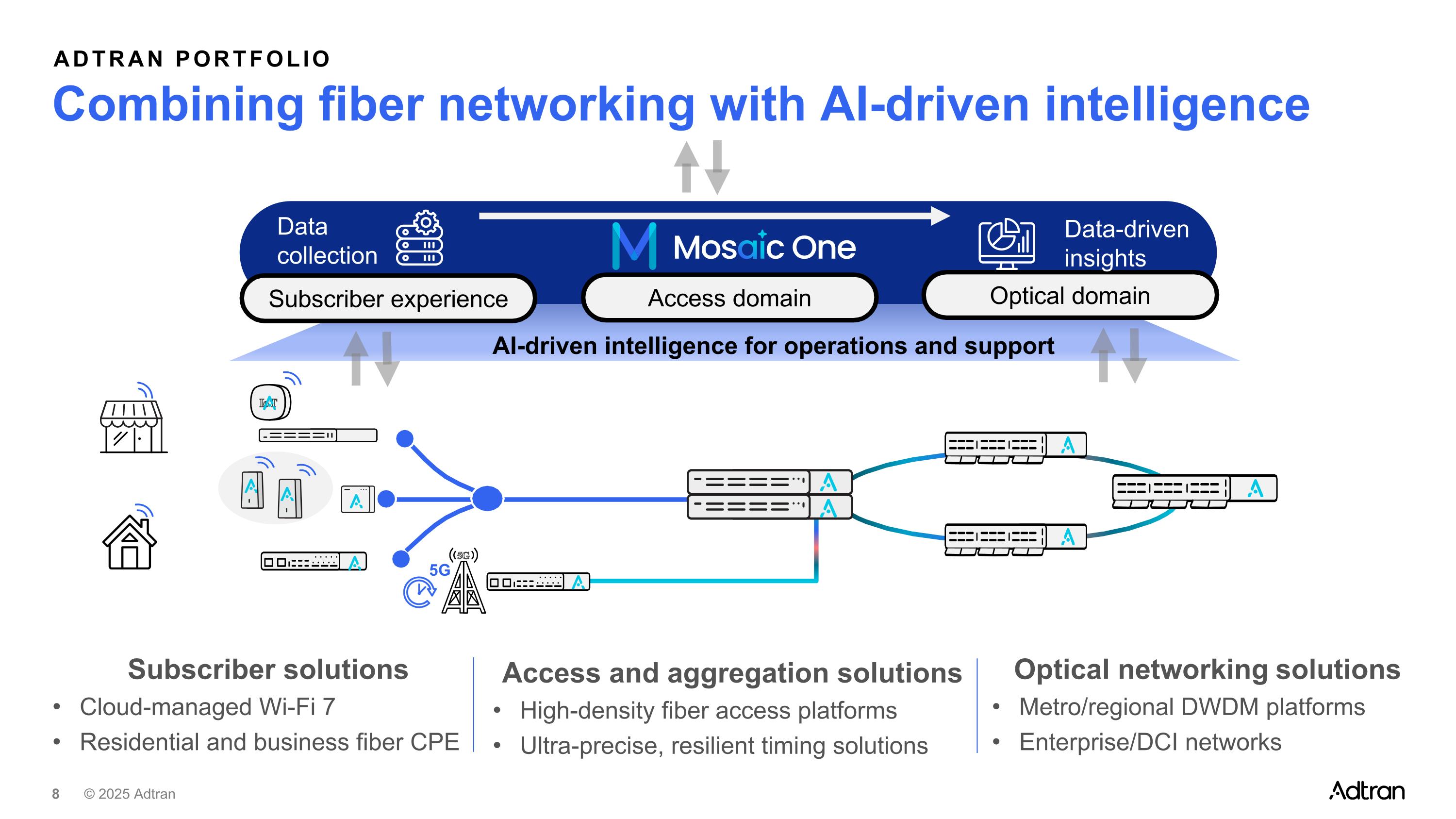

Adtran portfolio Combining fiber networking with AI-driven intelligence 5G AI-driven intelligence for operations and support Subscriber experience Access domain Optical domain Subscriber solutions Cloud-managed Wi-Fi 7 Residential and business fiber CPE Data collection Data-driven insights Access and aggregation solutions High-density fiber access platforms Ultra-precise, resilient timing solutions Optical networking solutions Metro/regional DWDM platforms Enterprise/DCI networks

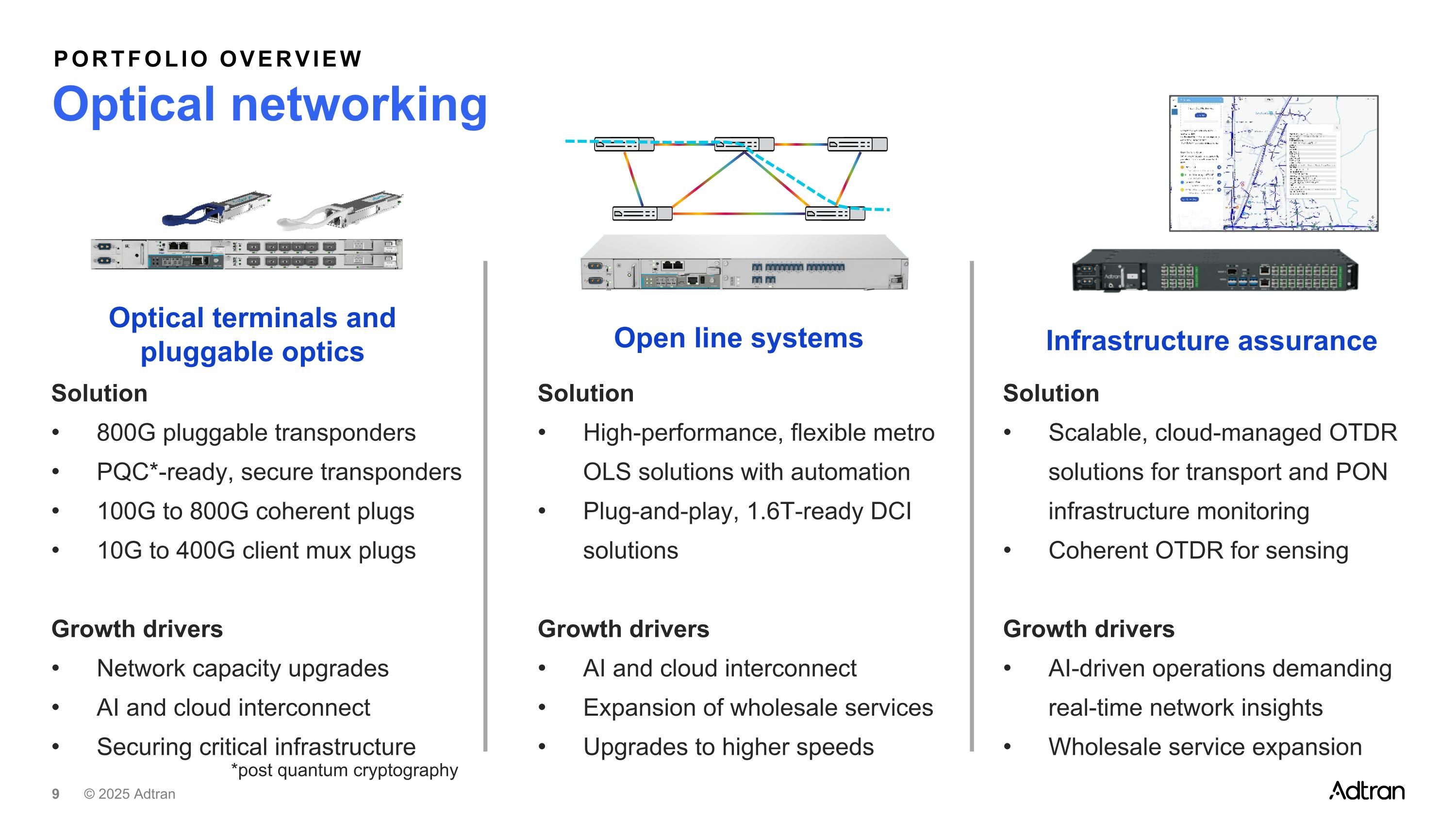

Portfolio overview Optical networking Solution 800G pluggable transponders PQC*-ready, secure transponders 100G to 800G coherent plugs 10G to 400G client mux plugs Growth drivers Network capacity upgrades AI and cloud interconnect Securing critical infrastructure Optical terminals and pluggable optics Solution High-performance, flexible metro OLS solutions with automation Plug-and-play, 1.6T-ready DCI solutions Growth drivers AI and cloud interconnect Expansion of wholesale services Upgrades to higher speeds Open line systems Solution Scalable, cloud-managed OTDR solutions for transport and PON infrastructure monitoring Coherent OTDR for sensing Growth drivers AI-driven operations demanding real-time network insights Wholesale service expansion Infrastructure assurance *post quantum cryptography

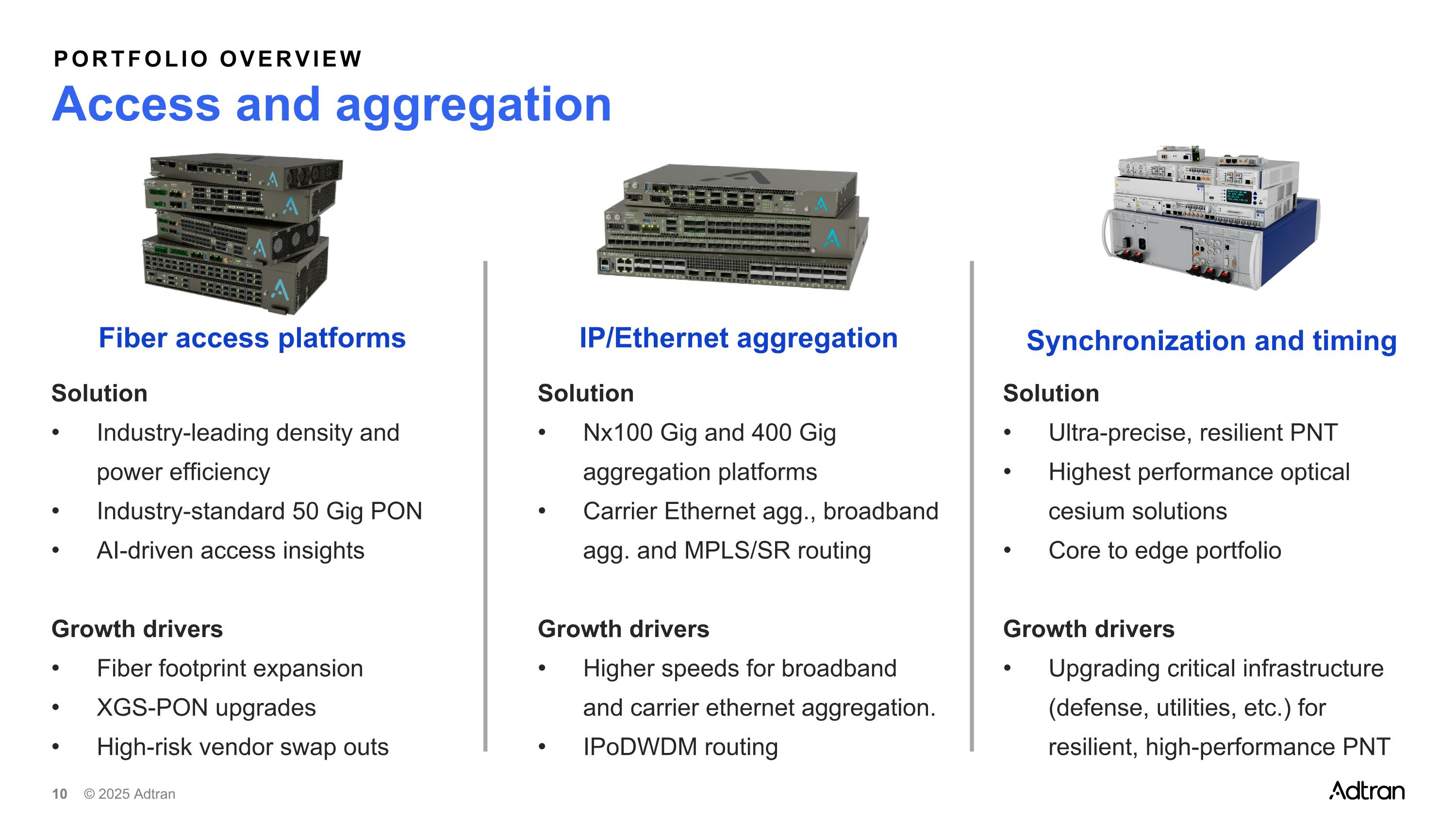

Portfolio overview Access and aggregation Solution Industry-leading density and power efficiency Industry-standard 50 Gig PON AI-driven access insights Growth drivers Fiber footprint expansion XGS-PON upgrades High-risk vendor swap outs Fiber access platforms Solution Nx100 Gig and 400 Gig aggregation platforms Carrier Ethernet agg., broadband agg. and MPLS/SR routing Growth drivers Higher speeds for broadband and carrier ethernet aggregation. IPoDWDM routing IP/Ethernet aggregation Solution Ultra-precise, resilient PNT Highest performance optical cesium solutions Core to edge portfolio Growth drivers Upgrading critical infrastructure (defense, utilities, etc.) for resilient, high-performance PNT Synchronization and timing

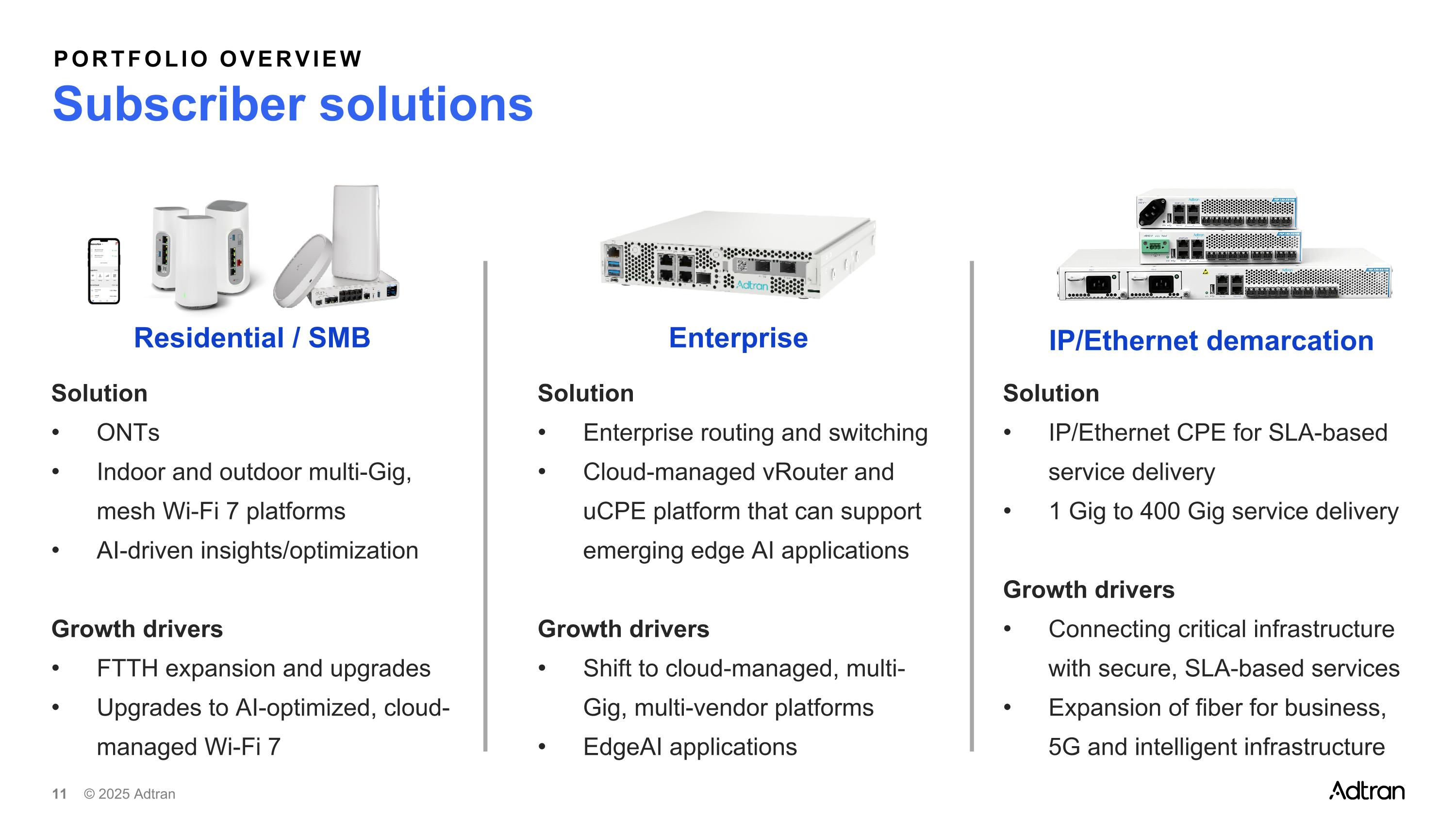

Portfolio overview Subscriber solutions Solution ONTs Indoor and outdoor multi-Gig, mesh Wi-Fi 7 platforms AI-driven insights/optimization Growth drivers FTTH expansion and upgrades Upgrades to AI-optimized, cloud-managed Wi-Fi 7 Residential / SMB Solution Enterprise routing and switching Cloud-managed vRouter and uCPE platform that can support emerging edge AI applications Growth drivers Shift to cloud-managed, multi-Gig, multi-vendor platforms EdgeAI applications Enterprise Solution IP/Ethernet CPE for SLA-based service delivery 1 Gig to 400 Gig service delivery Growth drivers Connecting critical infrastructure with secure, SLA-based services Expansion of fiber for business, 5G and intelligent infrastructure IP/Ethernet demarcation

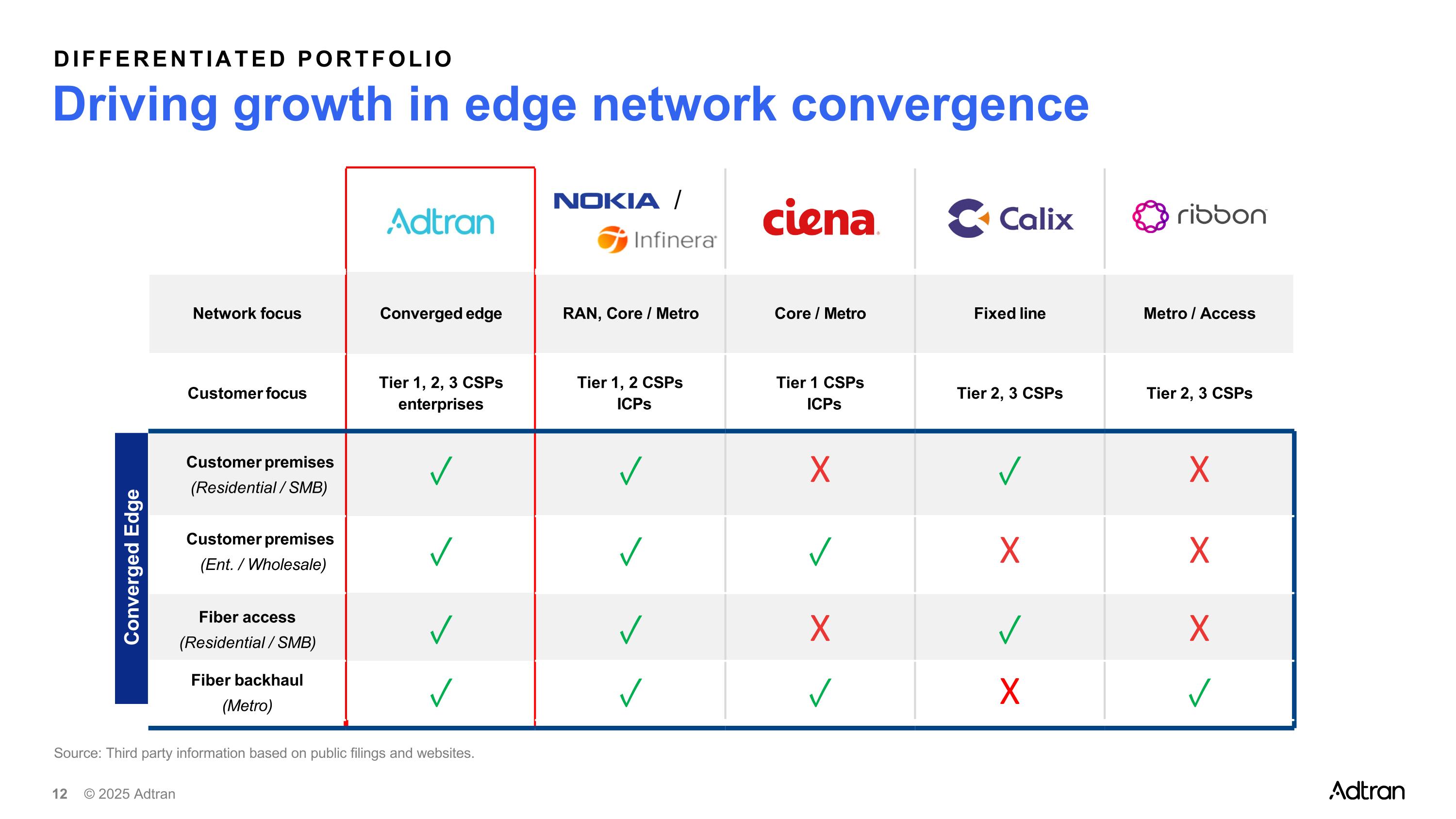

Network focus Converged edge RAN, Core / Metro Core / Metro Fixed line Metro / Access Customer focus Tier 1, 2, 3 CSPs enterprises Tier 1, 2 CSPs ICPs Tier 1 CSPs ICPs Tier 2, 3 CSPs Tier 2, 3 CSPs Customer premises (Residential / SMB) ✓ ✓ X ✓ X Customer premises (Ent. / Wholesale) ✓ ✓ ✓ X X Fiber access (Residential / SMB) ✓ ✓ X ✓ X Fiber backhaul (Metro) ✓ ✓ ✓ X ✓ Source: Third party information based on public filings and websites. Differentiated portfolio Driving growth in edge network convergence Converged Edge /

Business model Factors expected to drive long-term growth Expansion of fiber networks Strong mix of public and private funds to build out fiber to homes, businesses, 5G sites, and critical infrastructure In-home networks upgrading to multi-Gig Wi-Fi to match access network speeds Adtran has strong presence and broad portfolio in high growth markets High-risk vendor replacement Shift away from Chinese vendors continues given geopolitical situation Adtran is leading alternative to high-risk vendors in optical transport and fiber access given our portfolio strengths and broad global presence Securing critical networks Increased demand for modernizing and upgrading critical infrastructure within government, utilities and large enterprise applications AI applications drive further demand for securing connectivity at the network edge Adtran is a secure networks specialist with top tier customers and portfolio in this space

Business update

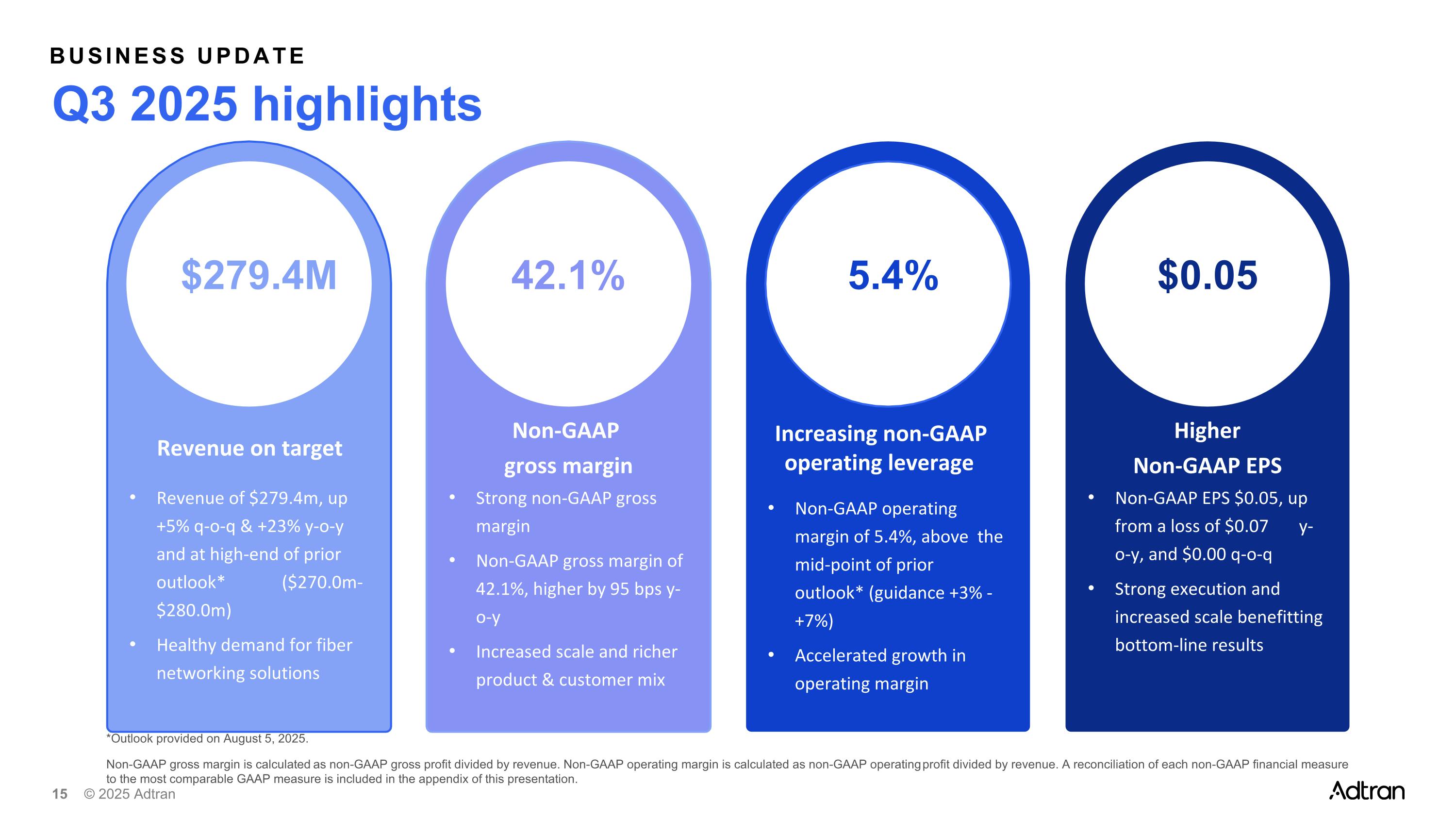

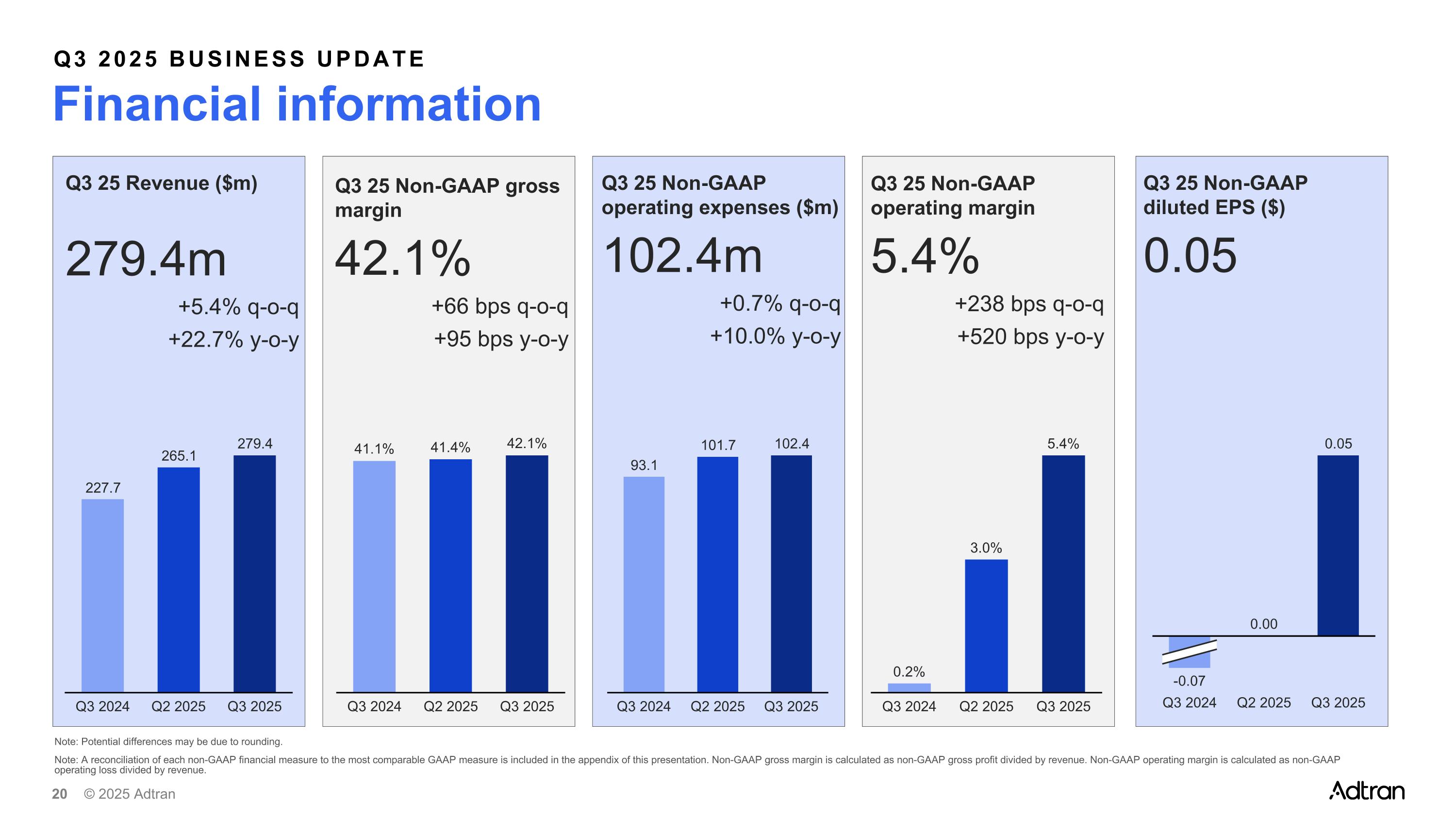

Revenue on target Non-GAAP gross margin Increasing non-GAAP operating leverage Higher Non-GAAP EPS Revenue of $279.4m, up +5% q-o-q & +23% y-o-y and at high-end of prior outlook* ($270.0m-$280.0m) Healthy demand for fiber networking solutions Strong non-GAAP gross margin Non-GAAP gross margin of 42.1%, higher by 95 bps y-o-y Increased scale and richer product & customer mix Non-GAAP operating margin of 5.4%, above the mid-point of prior outlook* (guidance +3% - +7%) Accelerated growth in operating margin Non-GAAP EPS $0.05, up from a loss of $0.07 y-o-y, and $0.00 q-o-q Strong execution and increased scale benefitting bottom-line results Business update Q3 2025 highlights Non-GAAP gross margin is calculated as non-GAAP gross profit divided by revenue. Non-GAAP operating margin is calculated as non-GAAP operating profit divided by revenue. A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. *Outlook provided on August 5, 2025. $279.4M 42.1% 5.4% $0.05

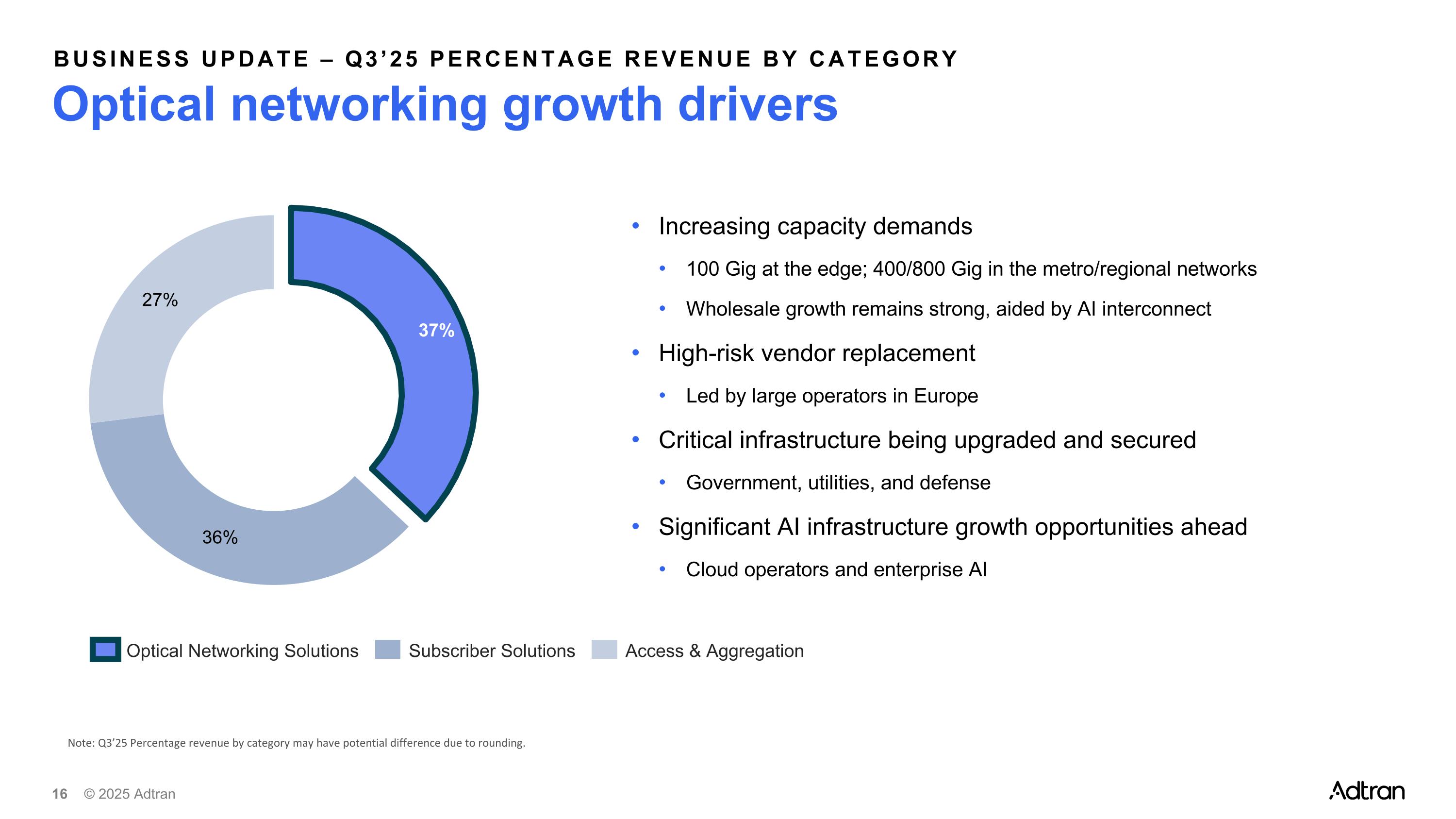

business update – Q3’25 percentage REVENUE BY CATEGORY Optical networking growth drivers Optical Networking Solutions Subscriber Solutions Access & Aggregation Note: Q3’25 Percentage revenue by category may have potential difference due to rounding. Increasing capacity demands 100 Gig at the edge; 400/800 Gig in the metro/regional networks Wholesale growth remains strong, aided by AI interconnect High-risk vendor replacement Led by large operators in Europe Critical infrastructure being upgraded and secured Government, utilities, and defense Significant AI infrastructure growth opportunities ahead Cloud operators and enterprise AI

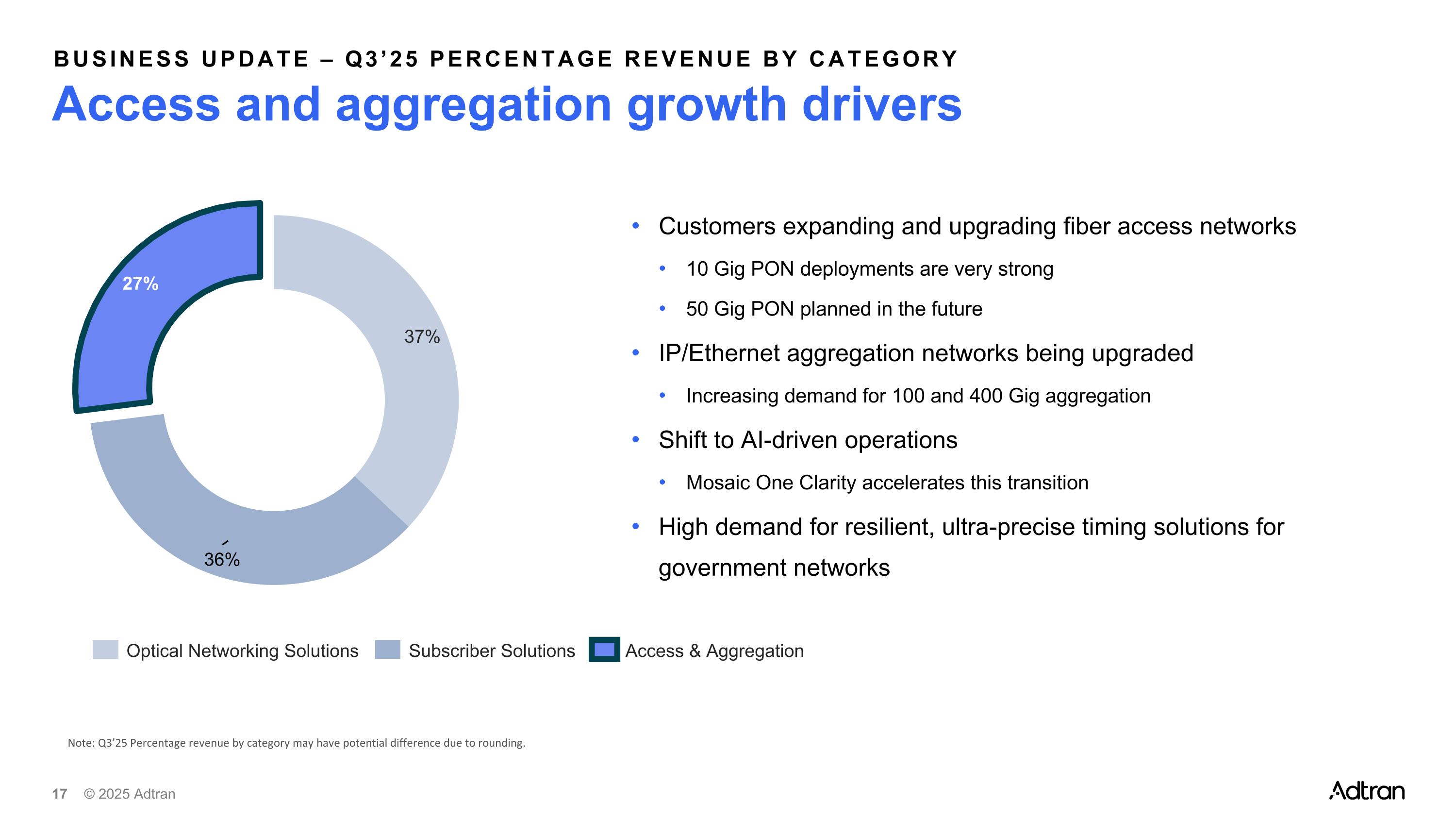

business update – Q3’25 percentage REVENUE BY CATEGORY Access and aggregation growth drivers Note: Q3’25 Percentage revenue by category may have potential difference due to rounding. Customers expanding and upgrading fiber access networks 10 Gig PON deployments are very strong 50 Gig PON planned in the future IP/Ethernet aggregation networks being upgraded Increasing demand for 100 and 400 Gig aggregation Shift to AI-driven operations Mosaic One Clarity accelerates this transition High demand for resilient, ultra-precise timing solutions for government networks Optical Networking Solutions Subscriber Solutions Access & Aggregation

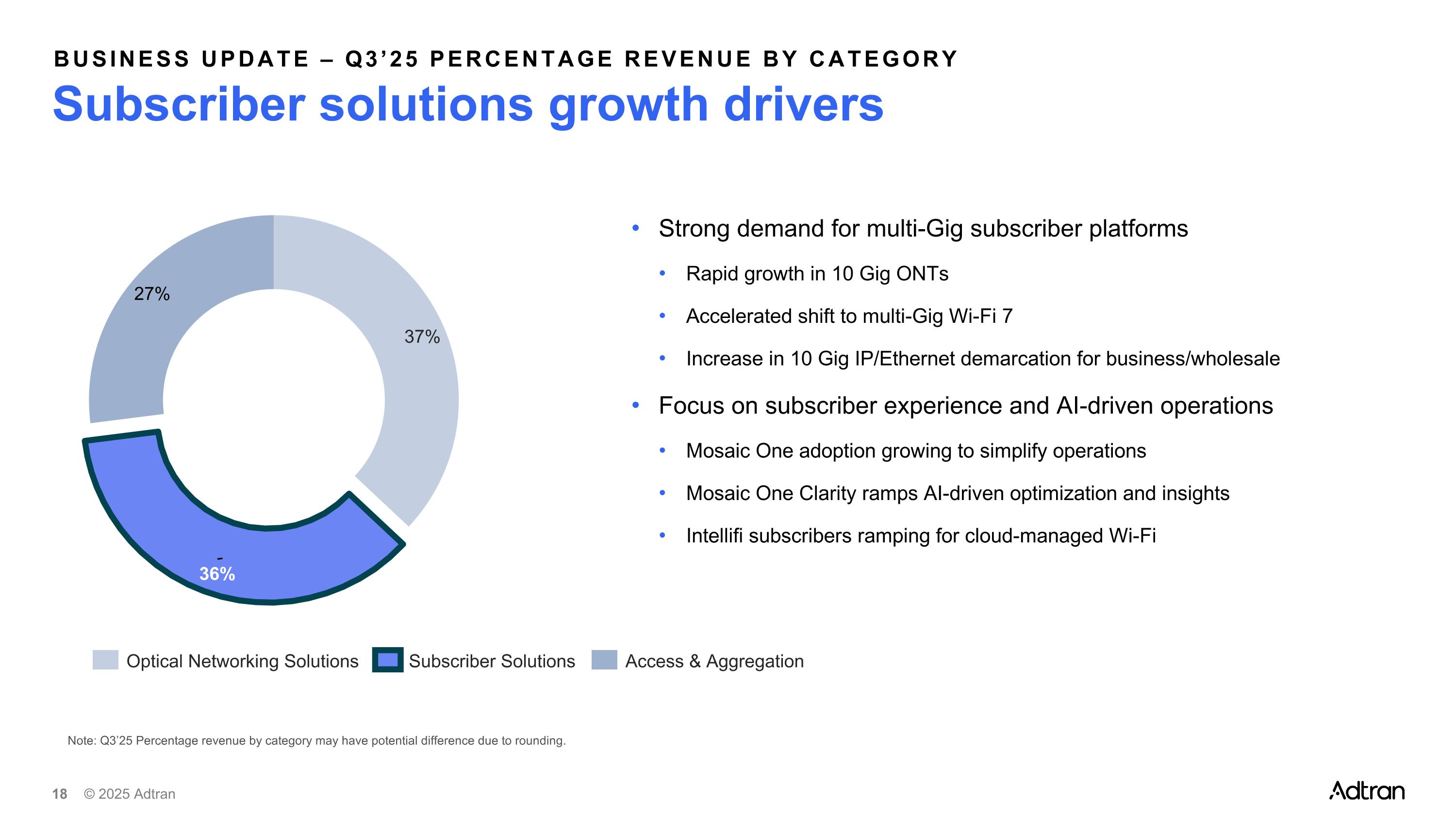

business update – Q3’25 percentage REVENUE BY CATEGORY Subscriber solutions growth drivers Note: Q3’25 Percentage revenue by category may have potential difference due to rounding. Strong demand for multi-Gig subscriber platforms Rapid growth in 10 Gig ONTs Accelerated shift to multi-Gig Wi-Fi 7 Increase in 10 Gig IP/Ethernet demarcation for business/wholesale Focus on subscriber experience and AI-driven operations Mosaic One adoption growing to simplify operations Mosaic One Clarity ramps AI-driven optimization and insights Intellifi subscribers ramping for cloud-managed Wi-Fi Optical Networking Solutions Subscriber Solutions Access & Aggregation

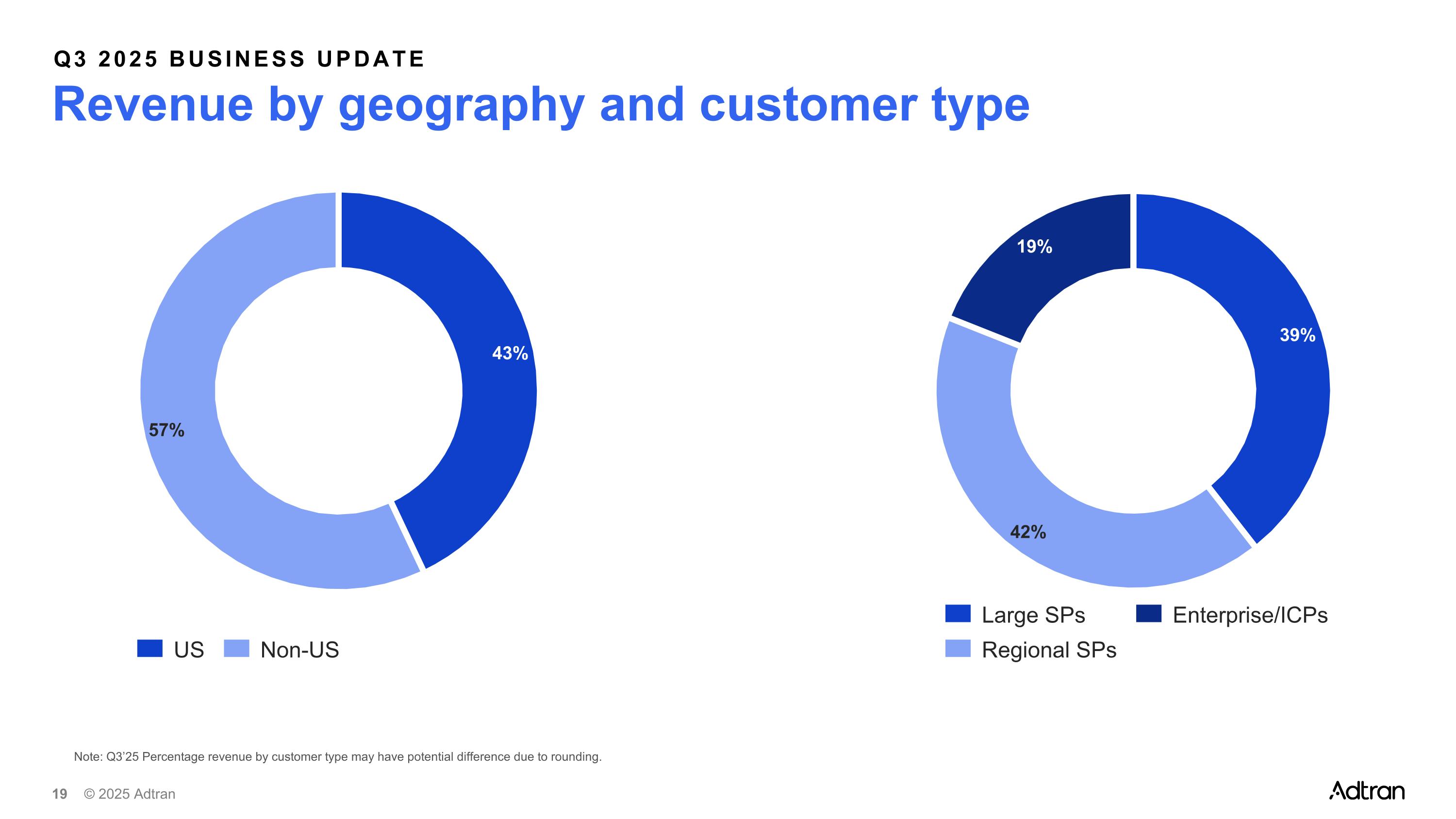

Q3 2025 business update Revenue by geography and customer type Note: Q3’25 Percentage revenue by customer type may have potential difference due to rounding. US Non-US Large SPs Regional SPs Enterprise/ICPs

Q3 2025 business update Financial information Q3 2024 Q2 2025 Q3 2025 Q3 2024 Q2 2025 Q3 2025 41.1% 41.4% 42.1% Q3 2024 Q2 2025 Q3 2025 Q4 2023 Q3 2024 Q4 2024 Q3 2024 Q2 2025 Q3 2025 Note: Potential differences may be due to rounding. Note: A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. Non-GAAP gross margin is calculated as non-GAAP gross profit divided by revenue. Non-GAAP operating margin is calculated as non-GAAP operating loss divided by revenue. Q3 25 Revenue ($m) 279.4m +5.4% q-o-q +22.7% y-o-y Q3 25 Non-GAAP gross margin 42.1% +66 bps q-o-q +95 bps y-o-y Q3 25 Non-GAAP operating expenses ($m) 102.4m +0.7% q-o-q +10.0% y-o-y Q3 25 Non-GAAP operating margin 5.4% +238 bps q-o-q +520 bps y-o-y Q4 24 Non-GAAP diluted EPS ($) -0.01 Q3 2024 Q2 2025 Q3 2025 -0.07 0.00 Q3 25 Non-GAAP diluted EPS ($) 0.05

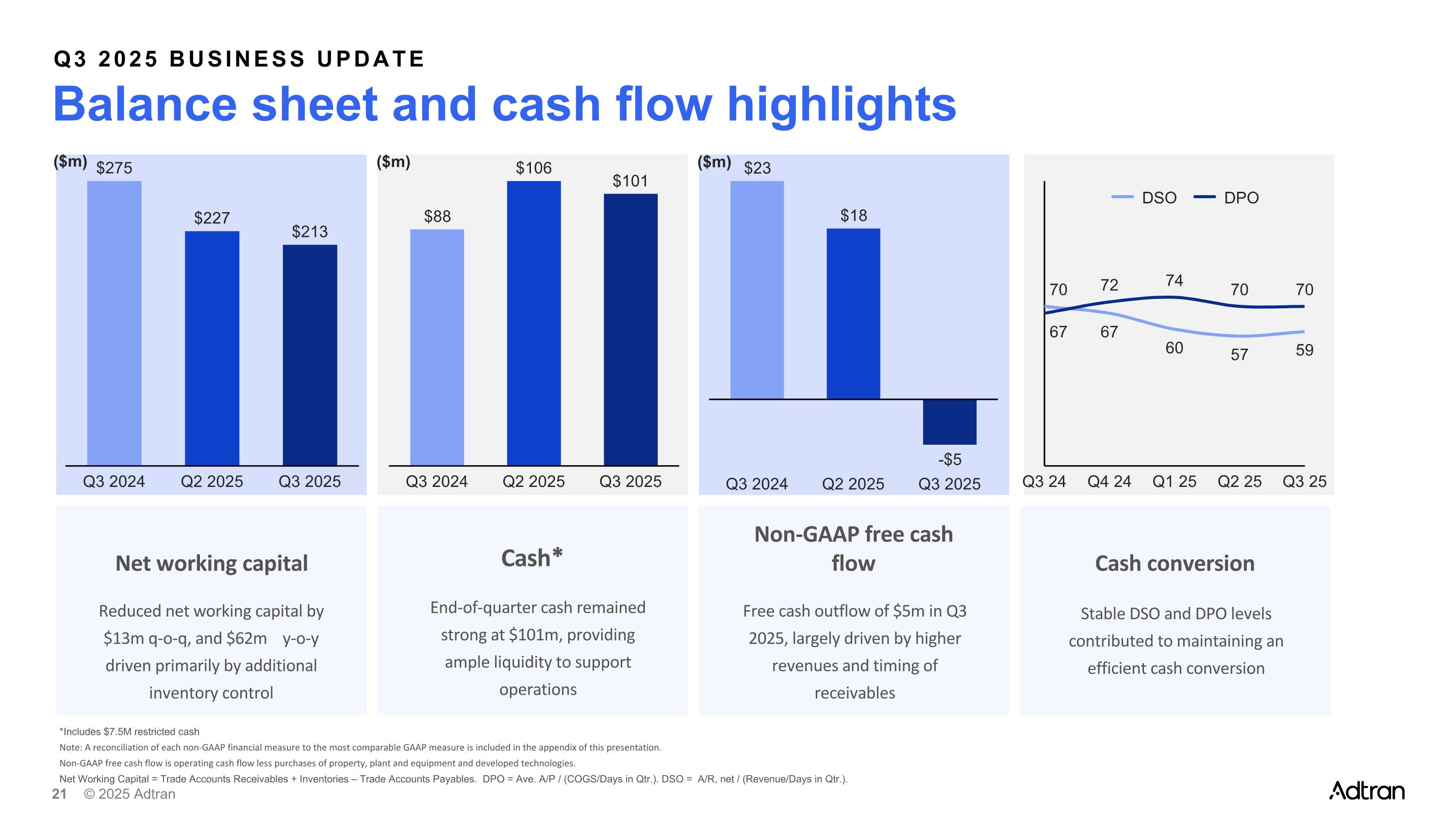

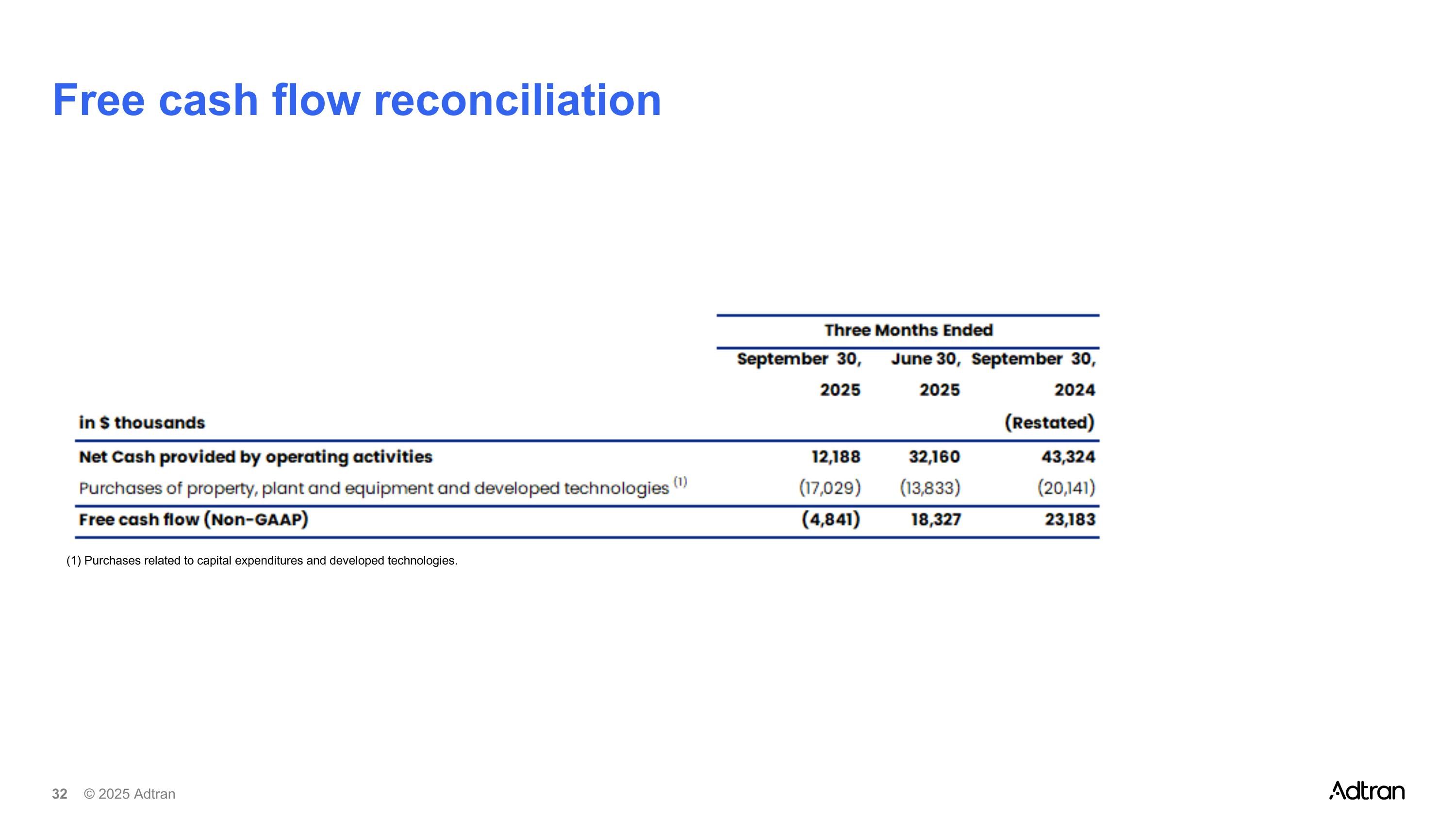

Net working capital Reduced net working capital by $13m q-o-q, and $62m y-o-y driven primarily by additional inventory control Cash* End-of-quarter cash remained strong at $101m, providing ample liquidity to support operations Non-GAAP free cash flow Free cash outflow of $5m in Q3 2025, largely driven by higher revenues and timing of receivables Cash conversion Stable DSO and DPO levels contributed to maintaining an efficient cash conversion Q3 2024 Q2 2025 Q3 2025 Q3 2025 business update Balance sheet and cash flow highlights Q3 2024 Q2 2025 Q3 2025 Q3 2024 Q2 2025 Q3 2025 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 DSO DPO *Includes $7.5M restricted cash Note: A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. Non-GAAP free cash flow is operating cash flow less purchases of property, plant and equipment and developed technologies. Net Working Capital = Trade Accounts Receivables + Inventories – Trade Accounts Payables. DPO = Ave. A/P / (COGS/Days in Qtr.). DSO = A/R, net / (Revenue/Days in Qtr.). ($m) ($m) ($m)

Business outlook

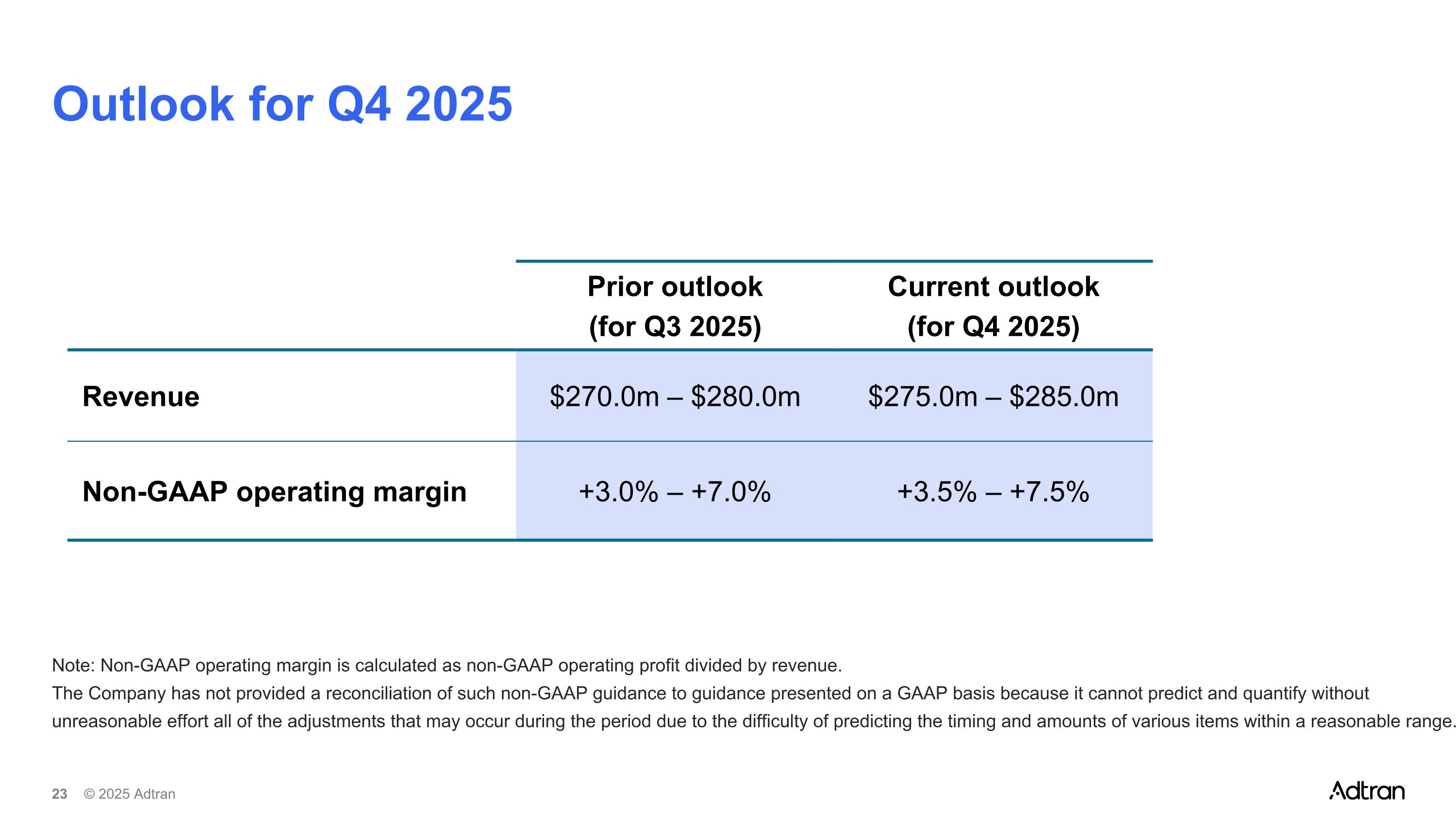

Outlook for Q4 2025 Prior outlook (for Q3 2025) Current outlook (for Q4 2025) Revenue $270.0m – $280.0m $275.0m – $285.0m Non-GAAP operating margin +3.0% – +7.0% +3.5% – +7.5% Note: Non-GAAP operating margin is calculated as non-GAAP operating profit divided by revenue. The Company has not provided a reconciliation of such non-GAAP guidance to guidance presented on a GAAP basis because it cannot predict and quantify without unreasonable effort all of the adjustments that may occur during the period due to the difficulty of predicting the timing and amounts of various items within a reasonable range.

GAAP to non-GAAP reconciliations

Explanation of use of non-GAAP financial measures Set forth in the tables below are reconciliations of gross profit, gross margin, operating expenses, operating loss, operating margin, other expense, net loss inclusive of the non-controlling interest, net loss attributable to the Company, and loss per share - basic and diluted, attributable to the Company, and net cash provided by operating activities, in each case as reported based on generally accepted accounting principles in the United States (“GAAP”), to non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP other expense, non-GAAP net income (loss) inclusive of the non-controlling interest, non-GAAP net income (loss) attributable to the Company, non-GAAP net earnings (loss) per share - basic and diluted, attributable to the Company, and free cash flow, respectively. Such non-GAAP measures exclude acquisition-related expenses, amortization and adjustments (consisting of intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations), stock-based compensation expense, restructuring expenses, integration expenses, deferred compensation adjustments, goodwill impairments, professional fees and other expenses, amortization of pension actuarial losses, the tax effect of these adjustments to net loss and purchases of property, plant, equipment, and developed technologies. These measures are used by management in our ongoing planning and annual budgeting processes. Additionally, we believe the presentation of these non-GAAP measures, when combined with the presentation of the most directly comparable GAAP financial measure, is beneficial to the overall understanding of ongoing operating performance of the Company. These non-GAAP financial measures are not prepared in accordance with, or an alternative for, GAAP and therefore should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Additionally, our calculation of non-GAAP measures may not be comparable to similar measures calculated by other companies. Non-GAAP operating margin (which is calculated as non-GAAP operating income (loss) divided by revenue) is a non-GAAP financial measure. The Company has provided third quarter 2025 guidance with regard to non-GAAP operating margin. This measure excludes from the corresponding GAAP financial measure the effect of adjustments as described below. The Company has not provided a reconciliation of such non-GAAP guidance to guidance presented on a GAAP basis because it cannot predict and quantify without unreasonable effort all of the adjustments that may occur during the period due to the difficulty of predicting the timing and amounts of various items within a reasonable range. In particular, non-GAAP operating margin excludes certain items, such as acquisition related expenses, amortizations and adjustments, stock-based compensation expense, restructuring expenses, integration expenses, deferred compensation adjustments, and goodwill impairment that the Company is unable to quantitatively predict. Depending on the materiality of these items, they could have a significant impact on the Company's GAAP financial results.

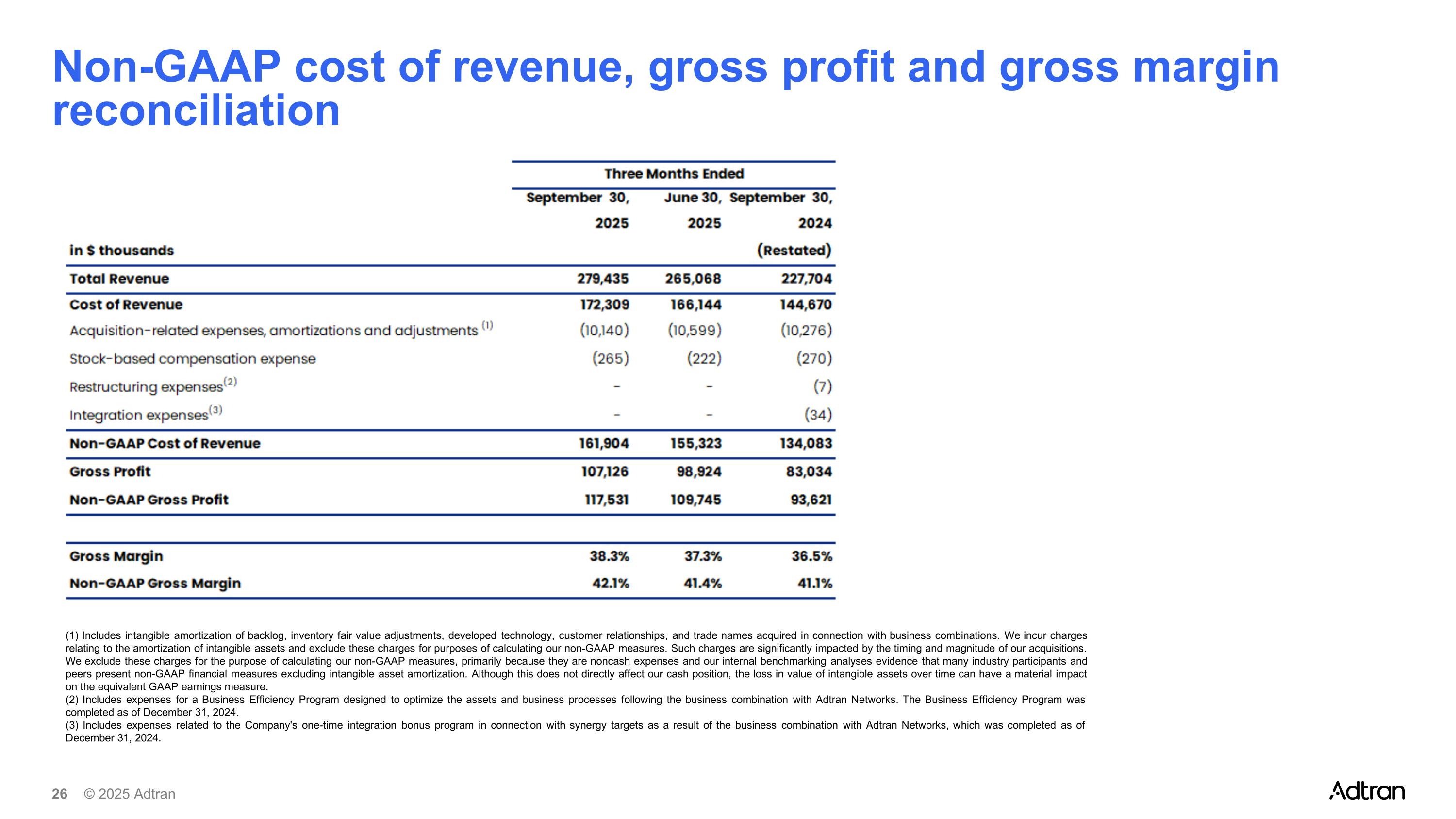

Non-GAAP cost of revenue, gross profit and gross margin reconciliation (1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations. We incur charges relating to the amortization of intangible assets and exclude these charges for purposes of calculating our non-GAAP measures. Such charges are significantly impacted by the timing and magnitude of our acquisitions. We exclude these charges for the purpose of calculating our non-GAAP measures, primarily because they are noncash expenses and our internal benchmarking analyses evidence that many industry participants and peers present non-GAAP financial measures excluding intangible asset amortization. Although this does not directly affect our cash position, the loss in value of intangible assets over time can have a material impact on the equivalent GAAP earnings measure. (2) Includes expenses for a Business Efficiency Program designed to optimize the assets and business processes following the business combination with Adtran Networks. The Business Efficiency Program was completed as of December 31, 2024. (3) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks, which was completed as of December 31, 2024.

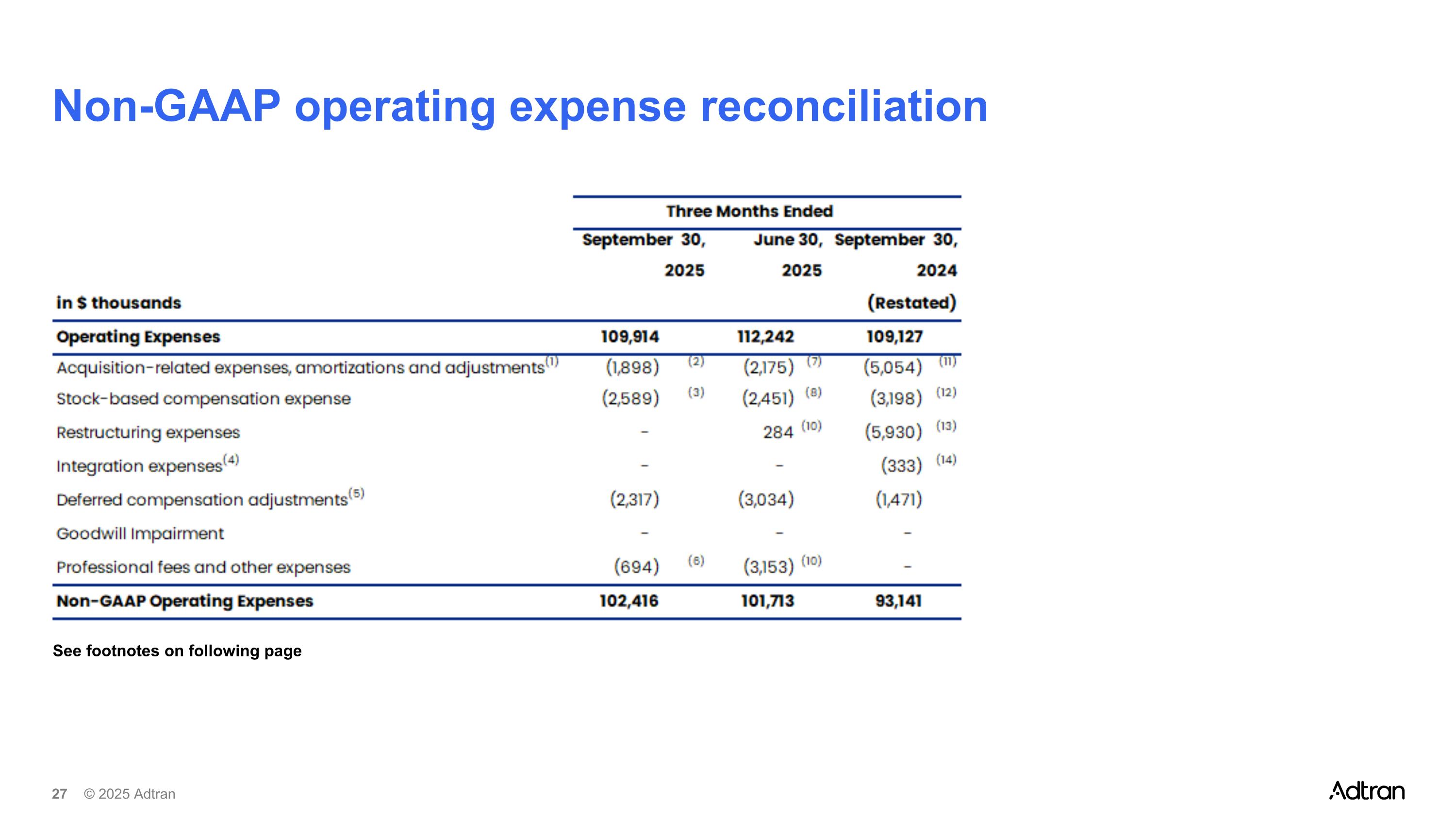

Non-GAAP operating expense reconciliation See footnotes on following page

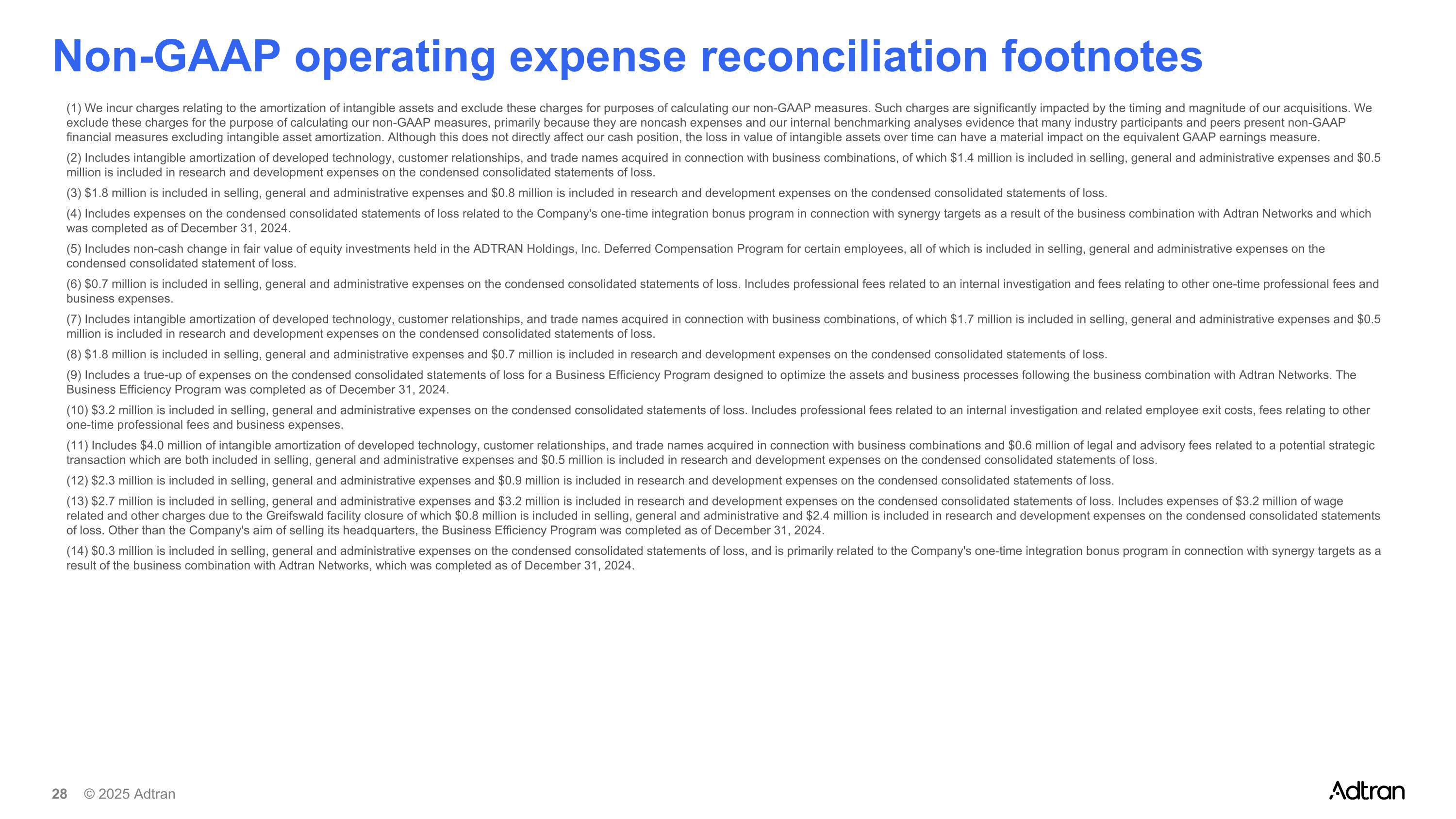

Non-GAAP operating expense reconciliation footnotes (1) We incur charges relating to the amortization of intangible assets and exclude these charges for purposes of calculating our non-GAAP measures. Such charges are significantly impacted by the timing and magnitude of our acquisitions. We exclude these charges for the purpose of calculating our non-GAAP measures, primarily because they are noncash expenses and our internal benchmarking analyses evidence that many industry participants and peers present non-GAAP financial measures excluding intangible asset amortization. Although this does not directly affect our cash position, the loss in value of intangible assets over time can have a material impact on the equivalent GAAP earnings measure. (2) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $1.4 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (3) $1.8 million is included in selling, general and administrative expenses and $0.8 million is included in research and development expenses on the condensed consolidated statements of loss. (4) Includes expenses on the condensed consolidated statements of loss related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks and which was completed as of December 31, 2024. (5) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for certain employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss. (6) $0.7 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss. Includes professional fees related to an internal investigation and fees relating to other one-time professional fees and business expenses. (7) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $1.7 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (8) $1.8 million is included in selling, general and administrative expenses and $0.7 million is included in research and development expenses on the condensed consolidated statements of loss. (9) Includes a true-up of expenses on the condensed consolidated statements of loss for a Business Efficiency Program designed to optimize the assets and business processes following the business combination with Adtran Networks. The Business Efficiency Program was completed as of December 31, 2024. (10) $3.2 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss. Includes professional fees related to an internal investigation and related employee exit costs, fees relating to other one-time professional fees and business expenses. (11) Includes $4.0 million of intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations and $0.6 million of legal and advisory fees related to a potential strategic transaction which are both included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (12) $2.3 million is included in selling, general and administrative expenses and $0.9 million is included in research and development expenses on the condensed consolidated statements of loss. (13) $2.7 million is included in selling, general and administrative expenses and $3.2 million is included in research and development expenses on the condensed consolidated statements of loss. Includes expenses of $3.2 million of wage related and other charges due to the Greifswald facility closure of which $0.8 million is included in selling, general and administrative and $2.4 million is included in research and development expenses on the condensed consolidated statements of loss. Other than the Company's aim of selling its headquarters, the Business Efficiency Program was completed as of December 31, 2024. (14) $0.3 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss, and is primarily related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks, which was completed as of December 31, 2024.

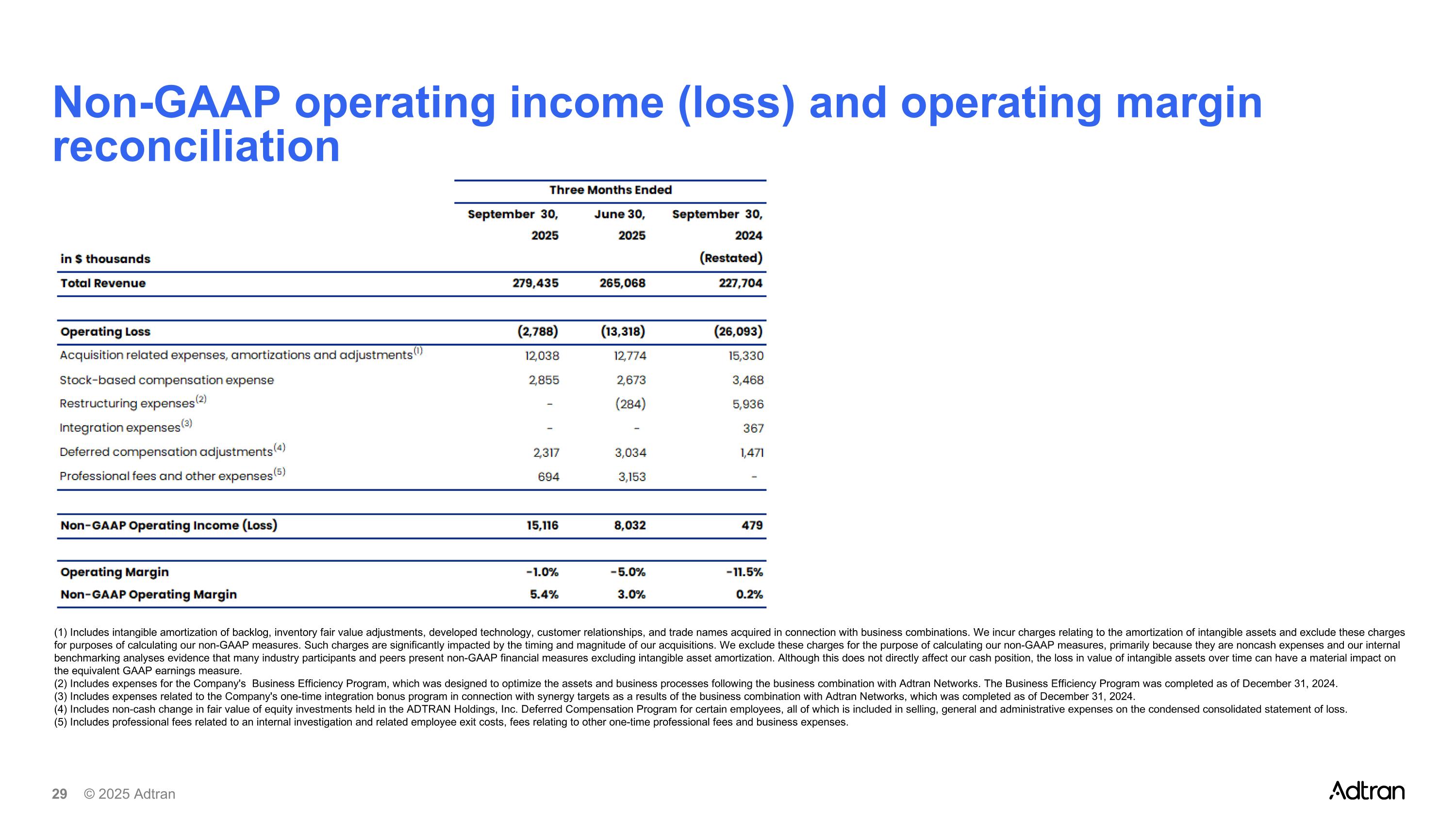

Non-GAAP operating income (loss) and operating margin reconciliation (1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations. We incur charges relating to the amortization of intangible assets and exclude these charges for purposes of calculating our non-GAAP measures. Such charges are significantly impacted by the timing and magnitude of our acquisitions. We exclude these charges for the purpose of calculating our non-GAAP measures, primarily because they are noncash expenses and our internal benchmarking analyses evidence that many industry participants and peers present non-GAAP financial measures excluding intangible asset amortization. Although this does not directly affect our cash position, the loss in value of intangible assets over time can have a material impact on the equivalent GAAP earnings measure. (2) Includes expenses for the Company's Business Efficiency Program, which was designed to optimize the assets and business processes following the business combination with Adtran Networks. The Business Efficiency Program was completed as of December 31, 2024. (3) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a results of the business combination with Adtran Networks, which was completed as of December 31, 2024. (4) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for certain employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss. (5) Includes professional fees related to an internal investigation and related employee exit costs, fees relating to other one-time professional fees and business expenses.

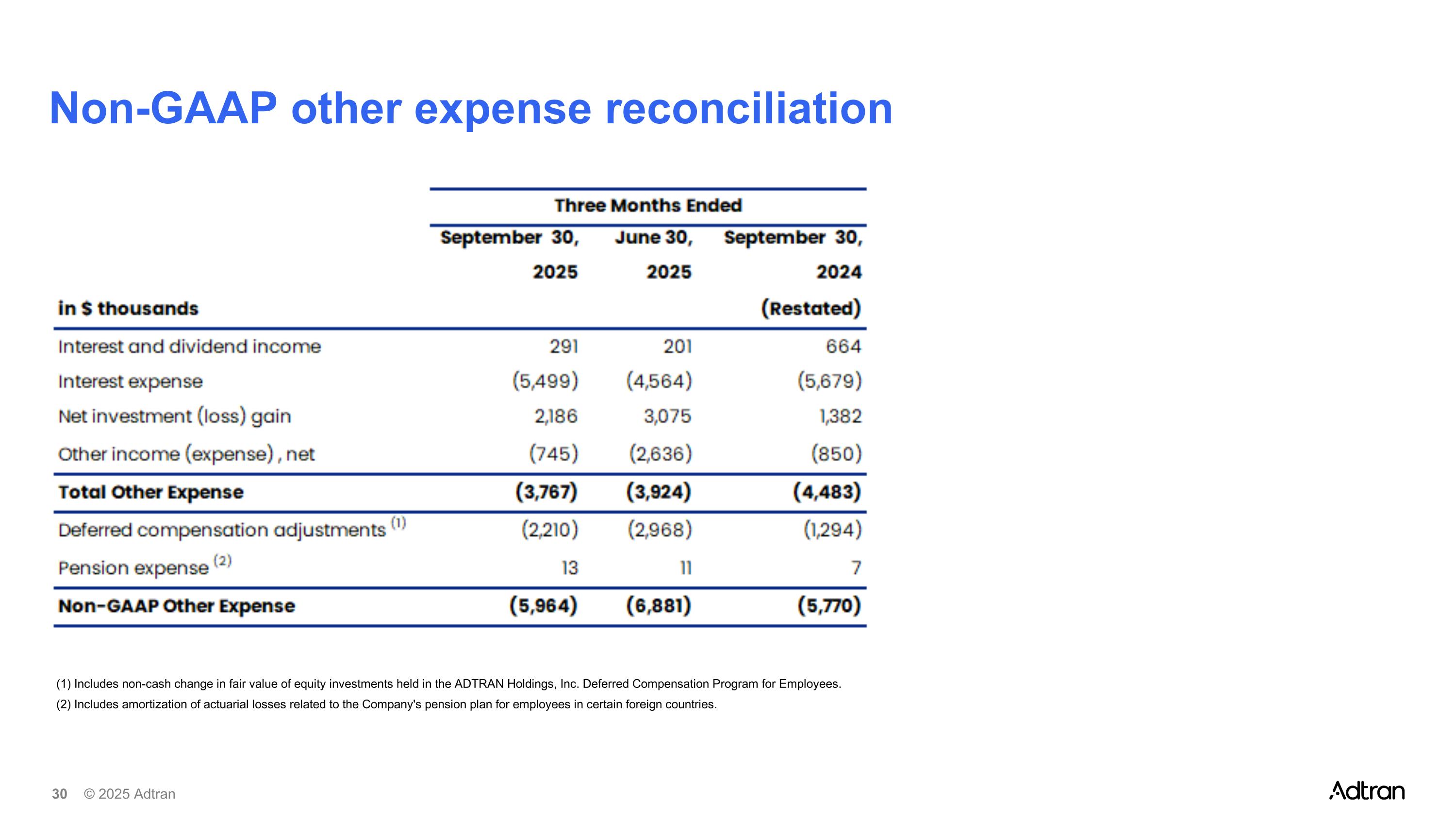

Non-GAAP other expense reconciliation (1) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees. (2) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries.

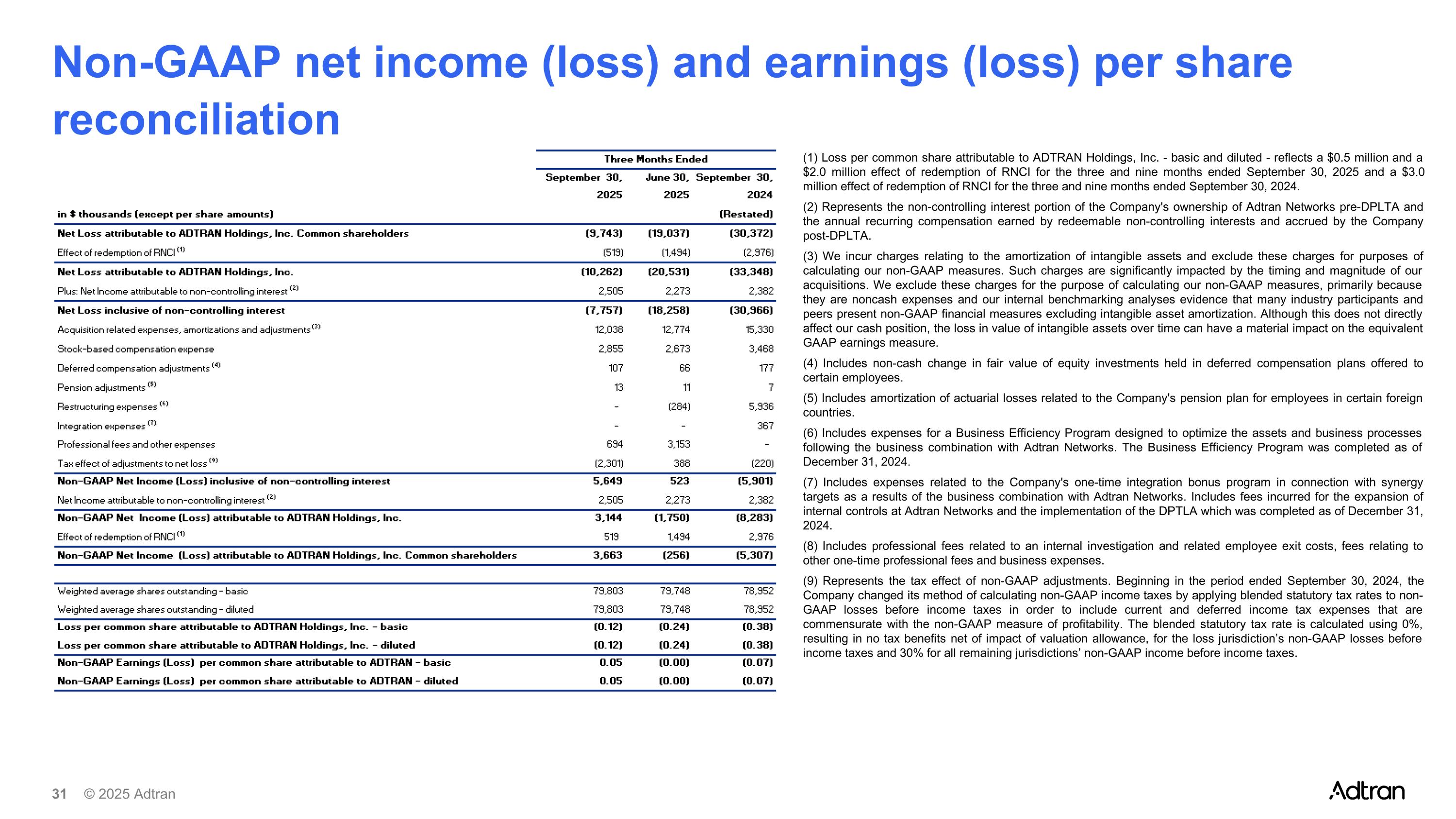

Non-GAAP net income (loss) and earnings (loss) per share reconciliation (1) Loss per common share attributable to ADTRAN Holdings, Inc. - basic and diluted - reflects a $0.5 million and a $2.0 million effect of redemption of RNCI for the three and nine months ended September 30, 2025 and a $3.0 million effect of redemption of RNCI for the three and nine months ended September 30, 2024. (2) Represents the non-controlling interest portion of the Company's ownership of Adtran Networks pre-DPLTA and the annual recurring compensation earned by redeemable non-controlling interests and accrued by the Company post-DPLTA. (3) We incur charges relating to the amortization of intangible assets and exclude these charges for purposes of calculating our non-GAAP measures. Such charges are significantly impacted by the timing and magnitude of our acquisitions. We exclude these charges for the purpose of calculating our non-GAAP measures, primarily because they are noncash expenses and our internal benchmarking analyses evidence that many industry participants and peers present non-GAAP financial measures excluding intangible asset amortization. Although this does not directly affect our cash position, the loss in value of intangible assets over time can have a material impact on the equivalent GAAP earnings measure. (4) Includes non-cash change in fair value of equity investments held in deferred compensation plans offered to certain employees. (5) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries. (6) Includes expenses for a Business Efficiency Program designed to optimize the assets and business processes following the business combination with Adtran Networks. The Business Efficiency Program was completed as of December 31, 2024. (7) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a results of the business combination with Adtran Networks. Includes fees incurred for the expansion of internal controls at Adtran Networks and the implementation of the DPTLA which was completed as of December 31, 2024. (8) Includes professional fees related to an internal investigation and related employee exit costs, fees relating to other one-time professional fees and business expenses. (9) Represents the tax effect of non-GAAP adjustments. Beginning in the period ended September 30, 2024, the Company changed its method of calculating non-GAAP income taxes by applying blended statutory tax rates to non-GAAP losses before income taxes in order to include current and deferred income tax expenses that are commensurate with the non-GAAP measure of profitability. The blended statutory tax rate is calculated using 0%, resulting in no tax benefits net of impact of valuation allowance, for the loss jurisdiction’s non-GAAP losses before income taxes and 30% for all remaining jurisdictions’ non-GAAP income before income taxes.

Free cash flow reconciliation (1) Purchases related to capital expenditures and developed technologies.

Appendix

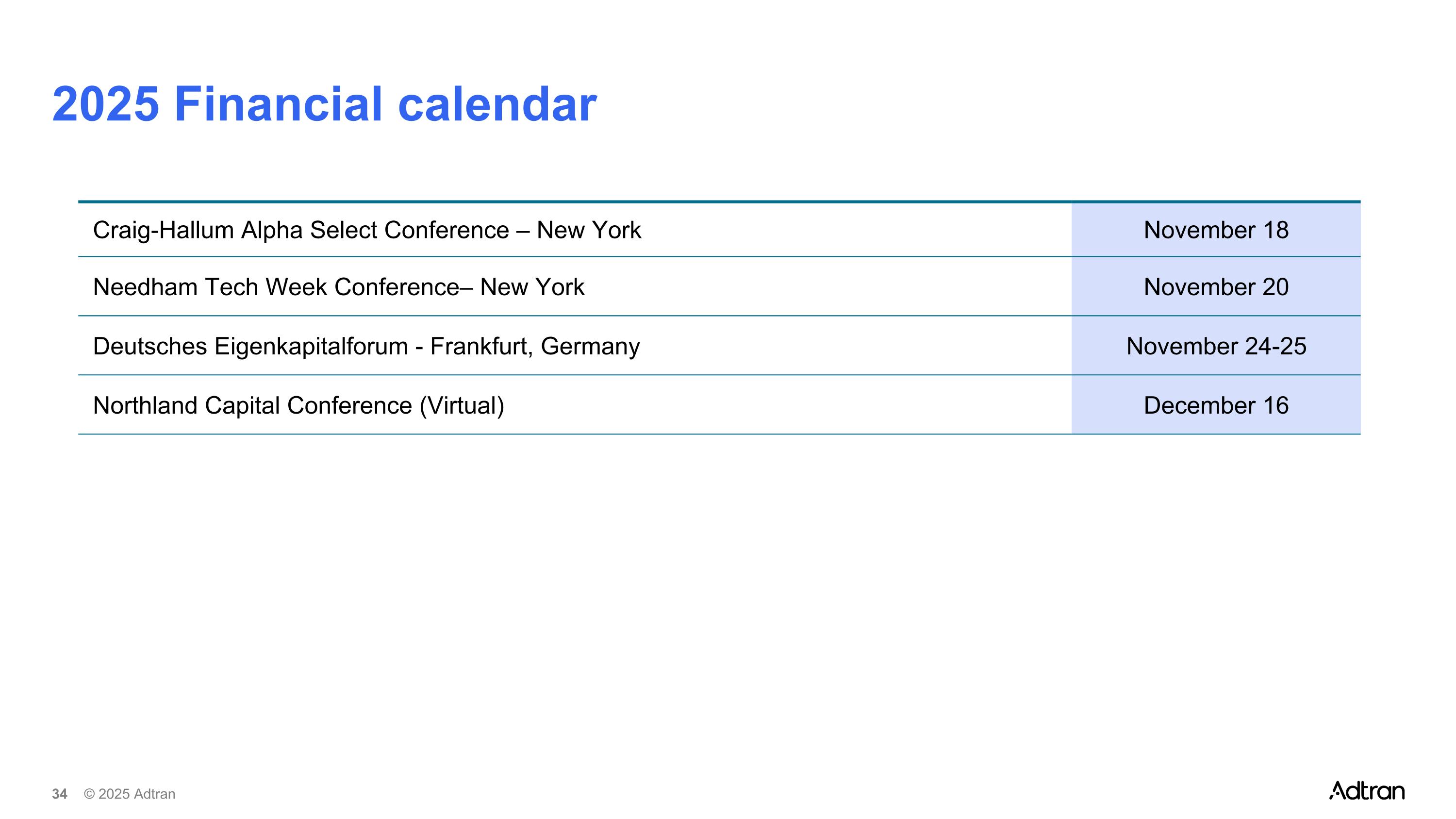

2025 Financial calendar Craig-Hallum Alpha Select Conference – New York November 18 Needham Tech Week Conference– New York November 20 Deutsches Eigenkapitalforum - Frankfurt, Germany November 24-25 Northland Capital Conference (Virtual) December 16