2025 Proxy Statement

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under §240.14a-12 | |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2025 Proxy Statement

Notice of Capital One Financial Corporation’s

2025 Annual Stockholder Meeting

Important Notice Regarding the Availability of Proxy Materials for

the Stockholder Meeting to be held on May 8, 2025

The Proxy Statement and Annual Report to Stockholders are available at www.proxyvote.com

The 2025 Annual Stockholder Meeting of Capital One Financial Corporation (“Capital One” or “Company”) will be held at Capital One’s campus at 1600 Capital One Drive, McLean, Virginia 22102 on May 8, 2025, at 10:00 a.m. Eastern Time.

Items of Business

As a stockholder, you will be asked to:

| 1. |

Elect twelve nominated directors, who are listed in the proxy statement, as directors of Capital One; | |

| 2. |

Approve, on a non-binding advisory basis, our Named Executive Officer compensation (“Say on Pay”); | |

| 3. |

Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2025; and | |

| 4. |

Consider a stockholder proposal, if properly presented at the meeting. | |

Stockholders will also transact other business that may properly come before the meeting.

Record Date

You may vote if you held shares of Capital One common stock as of the close of business on March 12, 2025 (“Record Date”).

Proxy Voting

Your vote is important. You may vote your shares in advance of the meeting via the Internet, by telephone, by mail, or in person at the 2025 Annual Stockholder Meeting. Please refer to the section “How do I vote?” in the proxy statement for detailed voting instructions. If you vote via the Internet, by telephone, or plan to vote in person during the 2025 Annual Stockholder Meeting, you do not need to mail in a proxy card.

2025 Annual Stockholder Meeting Admission

Due to space limitations, attendance is limited to stockholders and persons holding valid legal proxies from those stockholders. Admission to the meeting is on a first-come, first-served basis. Registration will begin at 9:00 a.m. Eastern Time. Valid government-issued identification must be presented to attend the meeting. If you hold Capital One common stock through a broker, bank, trust, or other nominee, you must bring a copy of a statement reflecting your stock ownership as of the Record Date, and if you wish to vote in person, you must also bring a legal proxy from your broker, bank, trust, or other nominee. Cameras, recording devices, and other electronic devices are not permitted. If you require special assistance at the meeting, please contact the Corporate Secretary at 1600 Capital One Drive, McLean, VA 22102.

We look forward to seeing you at the meeting.

On behalf of the Board,

Matthew W. Cooper

Corporate Secretary

March 27, 2025

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider in voting your shares. Please read the complete proxy statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2024 (“Annual Report”) carefully before voting.

|

Meeting Information | ||

|

Date: |

Thursday, May 8, 2025 | |

|

Time: |

10:00 a.m. Eastern Time | |

|

Location: |

1600 Capital One Drive, McLean, Virginia 22102 | |

|

Record Date: |

March 12, 2025 | |

| How to Vote | ||

Your vote is important. You may vote your shares in advance of the meeting via the Internet, by telephone, by mail, or in person at the 2025 Annual Stockholder Meeting. Please refer to the section “How do I vote?” on page 131 for detailed voting instructions. If you vote via the Internet, by telephone, or plan to vote in person at the 2025 Annual Stockholder Meeting, you do not need to mail in a proxy card.

| INTERNET | TELEPHONE |

|

IN PERSON | |||

|

|

|

| |||

| Visit www.proxyvote.com. You will need the control number printed on your notice, proxy card, or voting instruction form. |

If you received a paper copy of the proxy materials, dial toll-free (1-800-690-6903) or use the telephone number on your voting instruction form. You will need the control number printed on your proxy card or voting instruction form. |

If you received a paper copy of the proxy materials, send your completed and signed proxy card or voting instruction form using the enclosed postage- paid envelope. |

Follow the instructions under “Can I attend the 2025 Annual Stockholder Meeting?” on page 130 and request a ballot when you arrive at the meeting. | |||

On March 27, 2025, we began sending our stockholders a Notice Regarding the Internet Availability of Proxy Materials (“Notice”).

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

1

|

Voting Item 1: Election of Directors

| Item 1 | You are being asked to elect the following twelve candidates for director: Richard D. Fairbank, Ime Archibong, Christine Detrick, Ann Fritz Hackett, Suni P. Harford, Peter Thomas Killalea, Cornelis Petrus Adrianus Joseph (“Eli”) Leenaars, François Locoh-Donou, Peter E. Raskind, Eileen Serra, Mayo A. Shattuck III, and Craig Anthony Williams. Each nominee to our Board of Directors (“Board”) is standing for election to hold office until our next annual stockholder meeting or until their successor is duly elected and qualified. For additional information regarding our director nominees, see “Our Director Nominees” beginning on page 12 and “Skills and Experience of Our Director Nominees” beginning on page 19 of this proxy statement. For a description of our corporate governance practices, see “Corporate Governance at Capital One” beginning on page 21 of this proxy statement.

✓ Our Board unanimously recommends that you vote “FOR” each of these director nominees. | |

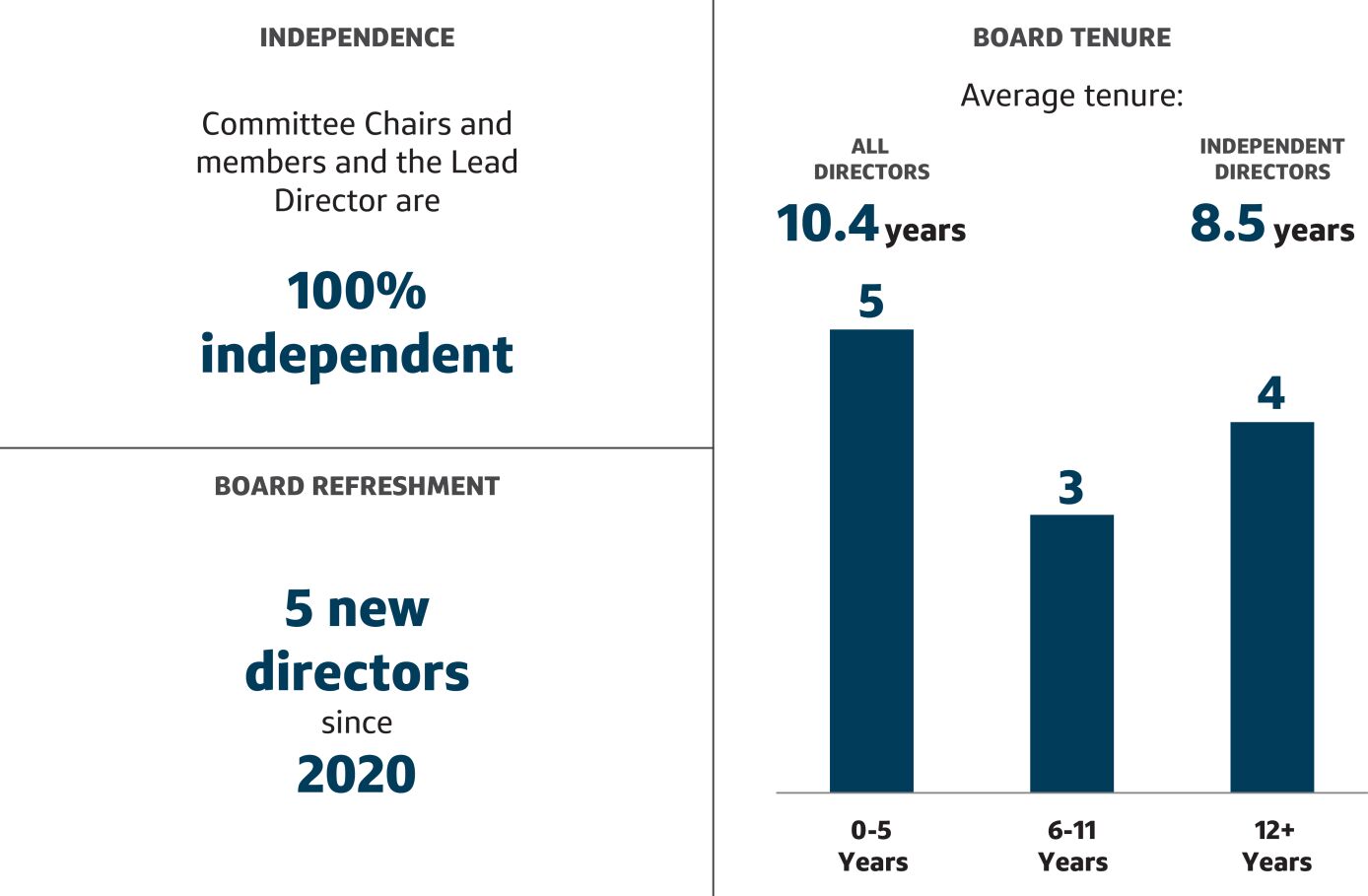

Corporate Governance Highlights

|

Board Members and Leadership |

Board Governance Best Practices | |||||

|

∎ Eleven of our twelve director nominees are independent; our Chief Executive Officer (“CEO”) and founder is the only member of management who serves as a director

∎ Appointment of five new independent directors since 2020, all of whom are current director nominees

∎ Active and empowered Lead Independent Director elected annually by the independent members of our Board (“Independent Directors”)

∎ Active and empowered committee chairs, all of whom are independent

∎ Directors have a mix of tenures, including long-standing members, relatively new members, and others at different points along the tenure continuum

∎ Directors reflect a variety of experiences and skills that match the Company’s complexity and strategic direction, and give the Board the collective capability necessary to oversee the Company’s activities

∎ Regular discussions regarding Board recruiting, succession, and refreshment, including director skills and qualifications, that support the Company’s long-term strategic objectives

|

∎ Regular executive sessions of the Independent Directors that regularly include separate meetings with our CEO, Chief Financial Officer (“CFO”), General Counsel and Corporate Secretary, Chief Enterprise Risk Officer, Chief Credit and Financial Risk Officer (together with the Chief Enterprise Risk Officer, the “Chief Risk Officers”), Chief Audit Officer, Chief Information Security Officer, Chief Technology Risk Officer, Chief Credit Review Officer, and/or Chief Compliance Officer

∎ Annual assessments of the Board and each of its committees, the Independent Directors, and the Lead Independent Director

∎ Active engagement and oversight of Company strategy; risk management (including technology risk management); the Company’s political activities and contributions; and environmental, social, and governance (“ESG”) matters

∎ Direct access to members of management by the Board

∎ Annual CEO evaluation process led by the Lead Independent Director

∎ Regular talent and succession planning discussions regarding the CEO and other key executives

∎ Regular meetings between the Board and federal banking regulators

| |||||

| 2

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

|

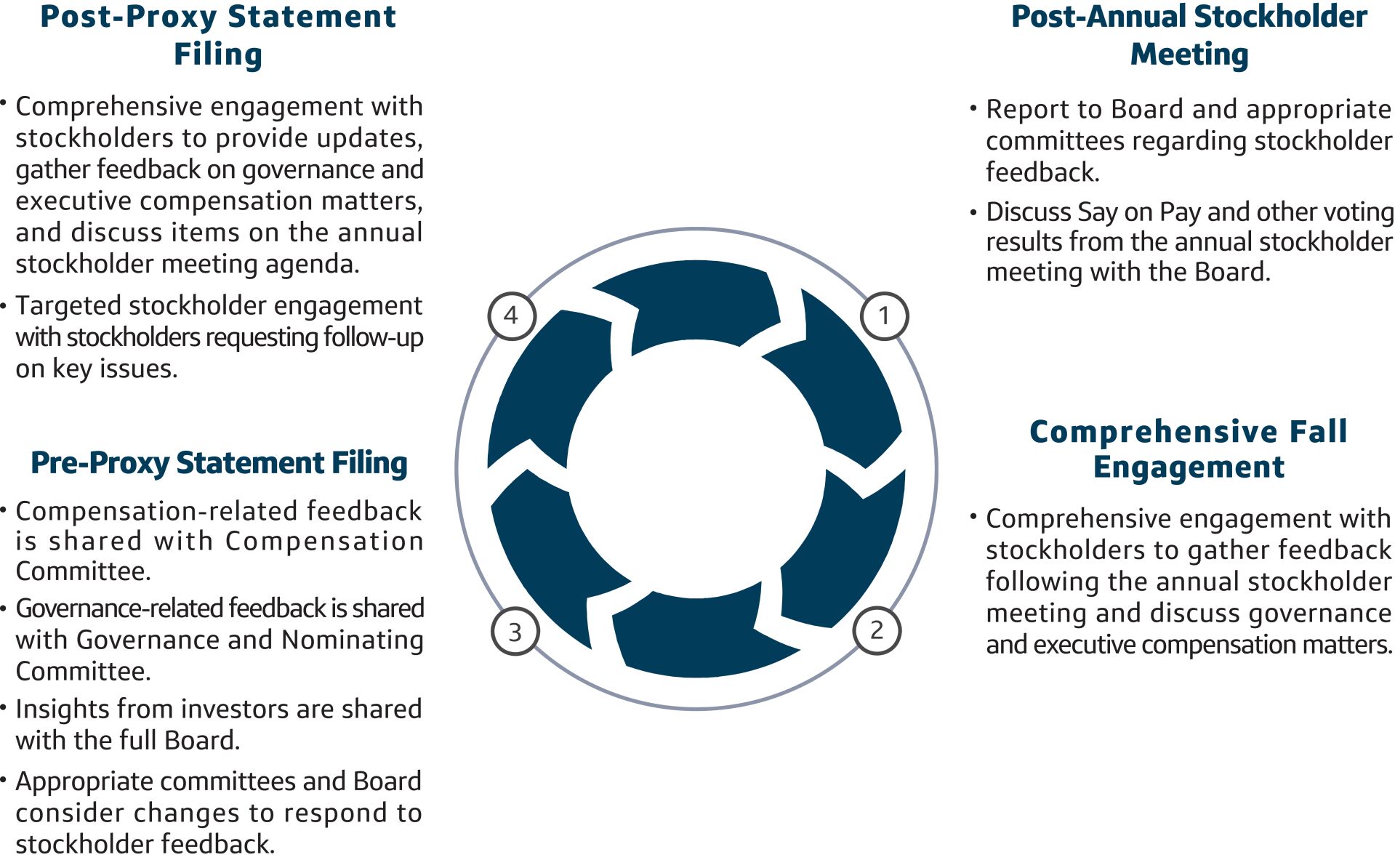

Stockholder Engagement and Stockholder Role in Governance

| ||

| ∎ Regular outreach and engagement throughout the year by our CEO, CFO, and Investor Relations team with stockholders regarding Company strategy and performance

∎ Formal outreach and engagement with governance representatives of our largest stockholders at least two times per year

∎ Feedback from investors regularly shared with our Board and its committees to ensure that our Board has insight on investor views

∎ The Board and its Governance and Nominating Committee review extensive briefings and benchmarking reports on corporate governance practices and emerging corporate governance issues

∎ Majority voting for directors with resignation policy in uncontested elections

∎ Stockholders can act by written consent, subject to certain procedural and other safeguards that the Board believes are in the best interests of Capital One and our stockholders

∎ Stockholders holding at least 25% of outstanding common stock may request a special meeting

∎ Stockholders holding at least 3% of outstanding common stock continuously for at least three years can nominate director candidates for inclusion in our proxy materials

∎ No supermajority vote provisions in Bylaws and Certificate of Incorporation

∎ No stockholder rights plan (commonly referred to as a “poison pill”)

∎ Detailed director skills matrix, showing each individual nominee’s self-identified diversity, skills, and attributes that are most relevant to fulfill the Board’s oversight responsibilities considering the Company’s business, strategy, and risk management | ||

Voting Item 2: Advisory Vote on Our Named Executive Officer Compensation (“Say on Pay”)

| Item 2 |

You are being asked to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”). For additional information regarding our executive compensation program and our NEO compensation, see “Compensation Discussion and Analysis” beginning on page 55 and “Named Executive Officer Compensation” beginning on page 96 of this proxy statement.

✓ Our Board unanimously recommends that you vote “FOR” the advisory approval of our 2024 NEO Compensation as disclosed in this proxy statement.

| |

Our executive compensation program is designed to attract, retain, motivate, and reward leaders who drive growth and innovation, deliver strong business results, and facilitate the long-term success of the Company. We believe our executive compensation program strongly links rewards with both business and individual performance over multiple time horizons. We aim to align our executives’ interests with those of our stockholders while supporting safety and soundness, and appropriately balancing risk.

2024 Company Performance

Each year the Compensation Committee (“Committee”) and the Independent Directors review and evaluate the Company’s performance using qualitative and quantitative assessments in order to make determinations regarding the compensation of our NEOs based on Capital One’s pay-for-performance philosophy. The Committee seeks to directly link the compensation of the NEOs with the Company’s performance and the executives’ contributions to that performance over multiple time horizons.

In 2024, Capital One delivered strong financial results and made significant progress on our long-term strategic initiatives–enabled by years of strategic choices; sound operating performance; and long-term investments in

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

3

|

technology, growth, talent and risk management. In 2024, the combination of continued-strong top-line revenue growth, higher margins and disciplined expense management aided profitability and capital generation even as consumer credit losses increased primarily as a result of delayed charge-offs from the pandemic. The Company also announced the signing in February 2024 of an agreement and plan of merger to acquire Discover Financial Services, a digital banking and payment services company (“Discover”). The proposed transaction with Discover (the “Discover Transaction”) is subject to regulatory approval and closing conditions and we anticipate that the Discover Transaction will close in early 2025. The Committee and the Independent Directors specifically considered the following quantitative and qualitative results when awarding NEO compensation for the 2024 performance year(1):

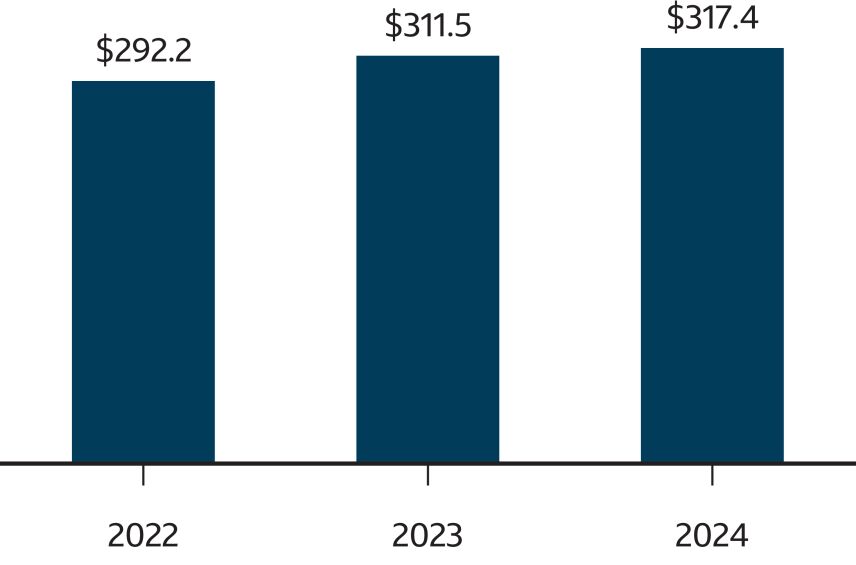

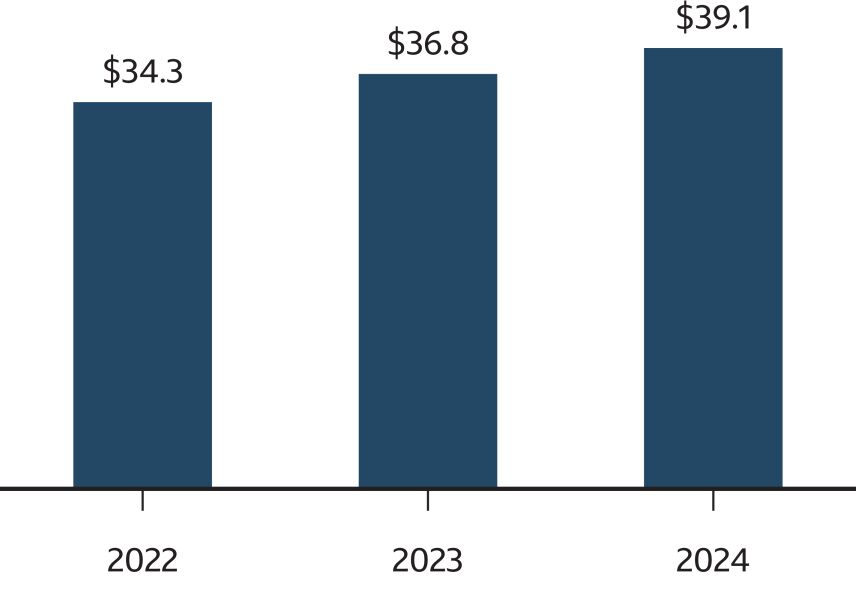

| ∎ | Net Revenue of $39.1 billion, an increase of 6% from 2023, driven by strong loan growth in Domestic Card. Total loans as of December 31, 2024 were $328 billion, an increase of 2% from 2023. |

| ∎ | Net Interest Margin of 6.88%, a 25 basis point (“bps”) increase from 2023. |

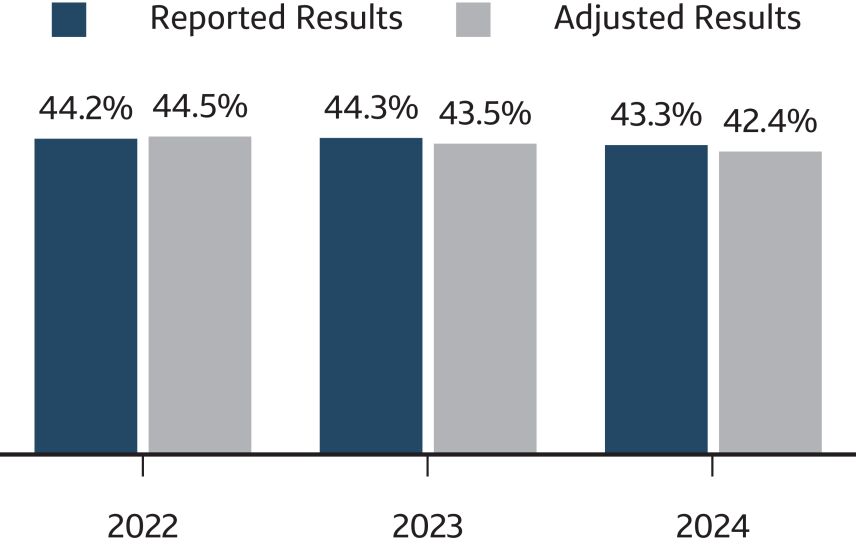

| ∎ | Operating Efficiency Ratio(2) of 43.3%, an improvement from 44.3% in 2023. Adjusted operating efficiency ratio(1)(3) improved to 42.4% in 2024 from 43.5% in 2023. |

| ∎ | Efficiency Ratio(2) of 54.9% in 2024, an improvement from 55.2% in 2023 despite an increase in our marketing investments. Adjusted efficiency ratio(1)(3) was 54.0% in 2024 compared to 54.4% in 2023. |

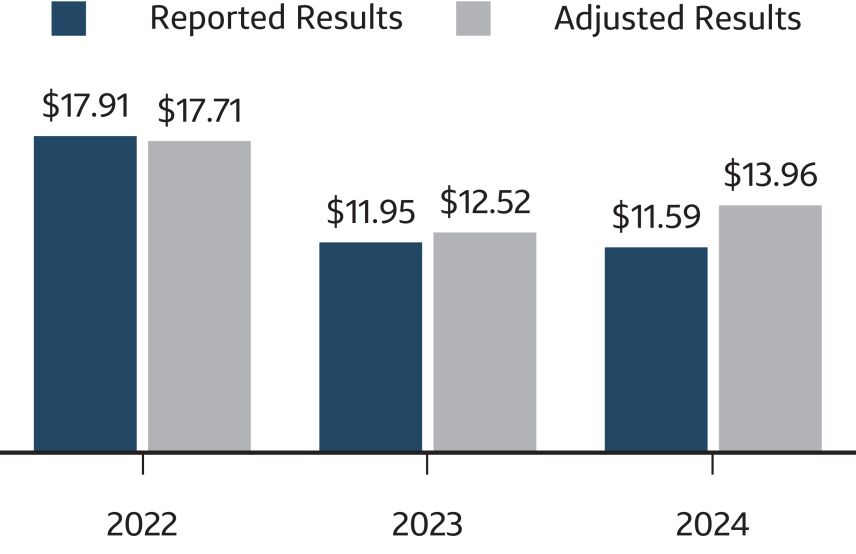

| ∎ | Diluted Earnings Per Share (“EPS”) of $11.59. Adjusted diluted EPS(1)(3) of $13.96, an increase of 12% from 2023. |

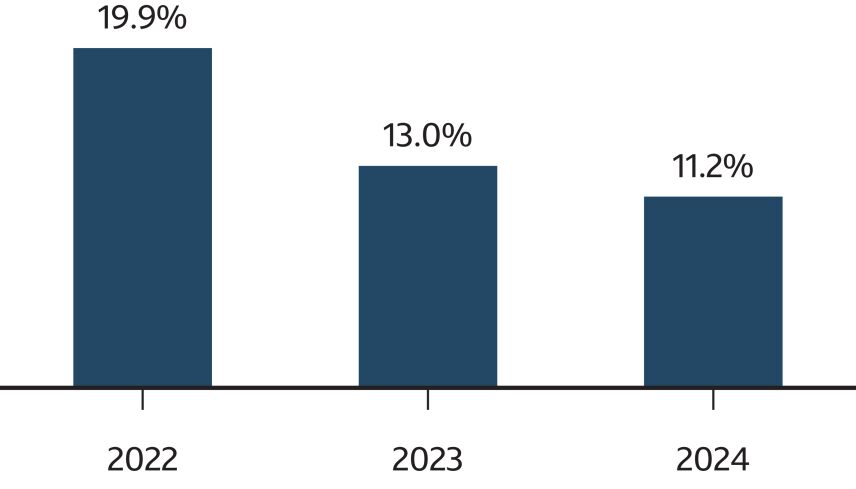

| ∎ | Return On Average Tangible Common Equity (“ROTCE”)(4) of 11.2%, compared to 13.0% in 2023. |

| ∎ | Potential Acquisition of Discover. We announced the Discover Transaction in February 2024 with strong market and investor reaction. |

| ∎ | Strong Liquidity and Capital Management with continued balance sheet strength. Total deposits of $363 billion, an increase of 4% from 2023, with approximately 82% of total deposits being Federal Deposit Insurance Corporation (“FDIC”) insured. Common equity Tier 1 capital ratio(5) was at 13.5% at year end, an increase from 12.9% at year end 2023 and significantly above regulatory requirements. |

| ∎ | Strong Credit Risk Management with a net charge-off rate of 3.4%, compared to 2.7% in 2023. Business line credit trends in Card, Auto, and Commercial were favorable to market and industry peers, primarily as a result of management’s choices and actions to successfully navigate the pandemic and post-pandemic credit environment. |

| ∎ | Tangible Book Value Per Common Share(6) was $106.97, an increase of 7% from $99.78 in 2023. |

| ∎ | Total Shareholder Return (“TSR”) of 38.3% for the one-year period ended December 31, 2024, outpacing the KBW Bank Index TSR of 37.2%, and the S&P 500 TSR of 25%. Capital One’s three-year and five-year TSR for the periods ended December 31, 2024 were 30.4%, and 89.4%, respectively, significantly outperforming the TSR of the KBW Bank Index, which was 6.9%, and 32.6% over the same time periods. |

| ∎ | Strong Enterprise Risk Management. We continued to deliver high-quality foundational risk management activities and achieve strong results on our critical regulatory exams and engagements. |

| ∎ | Customer Service and Advocacy. We continued to enjoy strong customer advocacy; achieve high Net Promoter Scores across our businesses, products, and digital experiences; and earn external accolades for our customer service. |

| 4

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

See “Executive Summary” beginning on page 56 and “Company Performance Assessment” beginning on page 74 for more information regarding the Company’s 2024 performance.

| (1) | The Committee considers these metrics to be key financial performance measures in its assessment of the Company’s performance, including certain non-GAAP measures. We believe our non-GAAP measures help investors and other users of our financial information understand the effect of adjusting items on our selected reported results. These measures may not be comparable to similarly titled measures reported by other companies. See Appendix A for our definition and reconciliation of these non-GAAP measures to the applicable amounts measured in accordance with GAAP. |

| (2) | Operating efficiency ratio is calculated based on operating expense for the period divided by total net revenue for the period and reflects as-reported results in accordance with GAAP. Efficiency ratio is calculated based on total non-interest expense for the period divided by total net revenue for the period and reflects as-reported results in accordance with GAAP. |

| (3) | Adjusted diluted EPS, adjusted operating efficiency ratio, and adjusted efficiency ratio are non-GAAP measures. See Appendix A for our reconciliation of these non-GAAP measures to the applicable amounts measured in accordance with GAAP. |

| (4) | ROTCE is a non-GAAP measure calculated based on annualized net income (loss) available to common stockholders less income (loss) from discontinued operations, net of tax, for the period, divided by average tangible common equity. We consider this metric to be a key financial performance measure that management uses in assessing capital adequacy and the level of returns generated. While this non-GAAP measure is widely used by investors, analysts, and bank regulatory agencies to assess the operating performance and capital position of financial services companies, it may not be comparable to similarly-titled measures reported by other companies. See Appendix A for our reconciliation of this non-GAAP measure to the applicable amounts measured in accordance with GAAP. |

| (5) | Common equity Tier 1 capital ratio is a regulatory capital measure calculated based on common equity Tier 1 capital divided by risk-weighted assets. |

| (6) | Tangible book value per common share is a non-GAAP measure calculated based on tangible common equity divided by common shares outstanding. We consider this metric to be a key financial performance measure that management uses in assessing capital adequacy and the level of returns generated. While this non-GAAP measure is widely used by investors, analysts and bank regulatory agencies to assess the operating performance and capital position of financial services companies, it may not be comparable to similarly-titled measures reported by other companies. See Appendix A for our reconciliation of this non-GAAP measure to the applicable amounts measured in accordance with GAAP. |

Highlights of Our 2024 Compensation Programs

We believe that our NEO compensation programs balance risk and financial results, reward NEOs for their achievements, promote our overall compensation objectives, and encourage appropriate, but not excessive, risk-taking. Our compensation programs are structured to encourage our executives to deliver strong results over the short term while making decisions that create sustained value for our stockholders over the long term. Key features of our 2024 compensation programs include:

| ∎ | No CEO Cash Salary. Our CEO does not receive a cash salary. |

| ∎ | Fully-Deferred CEO Pay. 100% of CEO compensation is deferred for at least three years. |

| ∎ | The Payout of a Majority of CEO Year-End Incentive Compensation Determined by Formula. A majority of our CEO’s year-end incentive compensation for the 2024 performance year was awarded in the form of performance share awards that vest based entirely on the Company’s three-year performance on an absolute basis and/or relative to the Company’s peers (“Performance Share Peers”) in the KBW Bank Index (Index members, excluding non-traditional banks that do not focus on lending to consumers and businesses). |

| ∎ | A Portion of CEO 2024 Performance Share Awards Linked to TSR. A portion of our CEO year-end incentive performance share awards will vest based entirely on the Company’s TSR performance relative to the Performance Share Peers over a three-year period. |

| ∎ | Awards Based on Company and Individual Performance. All NEOs receive incentive awards based on Company and/or individual performance. For 2024, 100% of CEO compensation and approximately 83% of the compensation for the other NEOs was based on Company and/or individual performance. |

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

5

|

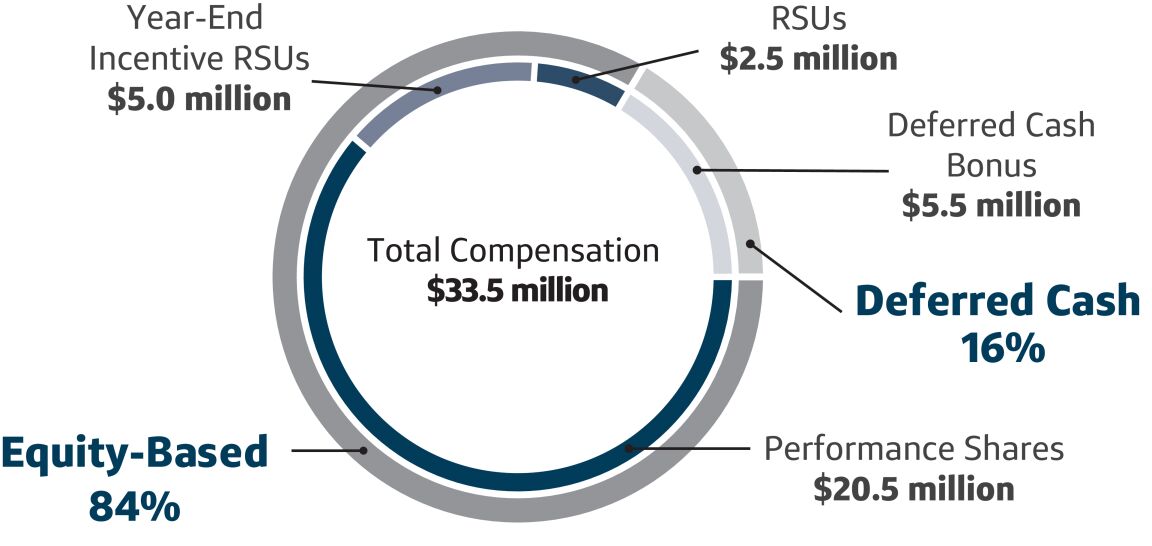

| ∎ | The Majority of CEO Compensation and Nearly Half of All Other NEO Compensation is Equity-Based and Determined After Performance Year-End. 84% of our CEO’s and approximately 50% of all other NEOs’ total compensation for the 2024 performance year was equity-based to align with stockholder interests. In addition, 93% of CEO compensation and the majority of all other NEO compensation was determined after the conclusion of the performance year, allowing the Board to consider the actions and results of the executive management team and the full year of Company and individual performance when awarding year-end incentive awards. |

| ∎ | All Equity and Equity-Based Awards Contain Performance and Recovery Provisions. All equity awards contain performance and recovery provisions that are designed to further enhance alignment between pay and performance, balance appropriate risk taking, and align with the best interests of stockholders. All incentive-based compensation is subject to the Capital One Financial Corporation Recoupment Policy (“Clawback Policy”). See “Additional Performance Conditions and Recovery Provisions” beginning on page 87 for more information. |

2024 Compensation Decisions

2024 CEO Performance Year Compensation

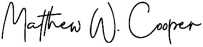

The CEO’s compensation for the 2024 performance year was composed of an equity award designed to provide the CEO with an incentive to focus on long-term performance and the opportunity for a year-end incentive award based on the Committee’s evaluation of the Company’s performance and the CEO’s contributions to that performance. Mr. Fairbank’s total compensation for performance year 2024 was approximately $33.5 million and consisted of:

| ∎ | Restricted Stock Units (“RSUs”) granted in February 2024, which had a total grant date value of approximately $2.5 million, totaling 18,580 RSUs. The RSUs will vest in full on February 15, 2027, settle in cash based on the Company’s average stock price over the 15 trading days preceding the vesting date, and are subject to performance-based vesting provisions. |

| ∎ | Year-End Incentive Award totaling approximately $31.0 million granted in February 2025 in recognition of the Company’s performance and the CEO’s contribution to that performance in 2024 and consisting of: |

| ∎ | Performance Share Units. Performance share unit awards with an aggregate value of approximately $20.5 million, for which the CEO may receive from 0% to 150% of a total target number of 102,440 shares of the Company’s common stock based on the Company’s financial performance (with respect to 91,196 shares, or $18.25 million of the awards) and TSR (with respect to 11,244 shares, or approximately $2.25 million of the awards) over a three-year period from January 1, 2025 through December 31, 2027. |

| ∎ | RSUs. 24,986 cash-settled RSUs (“Year-End Incentive RSUs”) valued at $5.0 million, which vest in full on February 15, 2028, settle in cash based on the Company’s average stock price over the 15 trading days preceding the vesting date, and are subject to performance-based vesting provisions. |

| ∎ | Deferred Cash Bonus. A deferred cash bonus of $5.5 million, which is mandatorily deferred for three years into the Company’s Voluntary Non-Qualified Deferred Compensation Plan (“VNQDCP”) and will pay out in the first calendar quarter of 2028. |

| 6

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

The chart below shows Mr. Fairbank’s actual total compensation for performance year 2024:

Year-End RSUs Incentive RSUs $2.5 million $5.0 million Deferred Cash Bonus TSR Performance $5.5 million Shares Total Compensation $- million $33.5 million Deferred Cash 16% Equity-Based Financial 84% Performance Shares $20.5 million

The table below shows Mr. Fairbank’s compensation awards as they are attributable to the performance years indicated. The table shows how the Committee views compensation actions and to which year the compensation awards relate. This table differs substantially from the Summary Compensation Table and Pay Versus Performance Table required for this proxy statement beginning on page 96 and page 113, respectively, and is therefore not a substitute for the information required in those tables. See “Chief Executive Officer Compensation” beginning on page 67 for a description of the compensation paid to our CEO and additional information regarding Mr. Fairbank’s 2024 performance year compensation.

| Performance Year |

Cash Salary |

Long-Term Incentive | Year-End Incentive | Total | ||||||||||||||||||||

| Cash-Settled RSUs |

Deferred Bonus |

Cash- Settled |

Performance Shares(1) | |||||||||||||||||||||

| 2024 |

$— | $2,500,125 | $5,500,000 | $5,000,198 | $20,500,293 | $33,500,616 | ||||||||||||||||||

| 2023 |

$— | $2,500,032 | $5,000,000 | $4,700,046 | $16,800,085 | $29,000,163 | ||||||||||||||||||

| 2022 |

$— | $2,500,021 | $4,250,000 | $2,850,099 | $16,525,118 | $26,125,238 | ||||||||||||||||||

| (1) | See “Performance Share Award Metrics” beginning on page 69 for a description of the metrics applicable to the performance shares. |

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

7

|

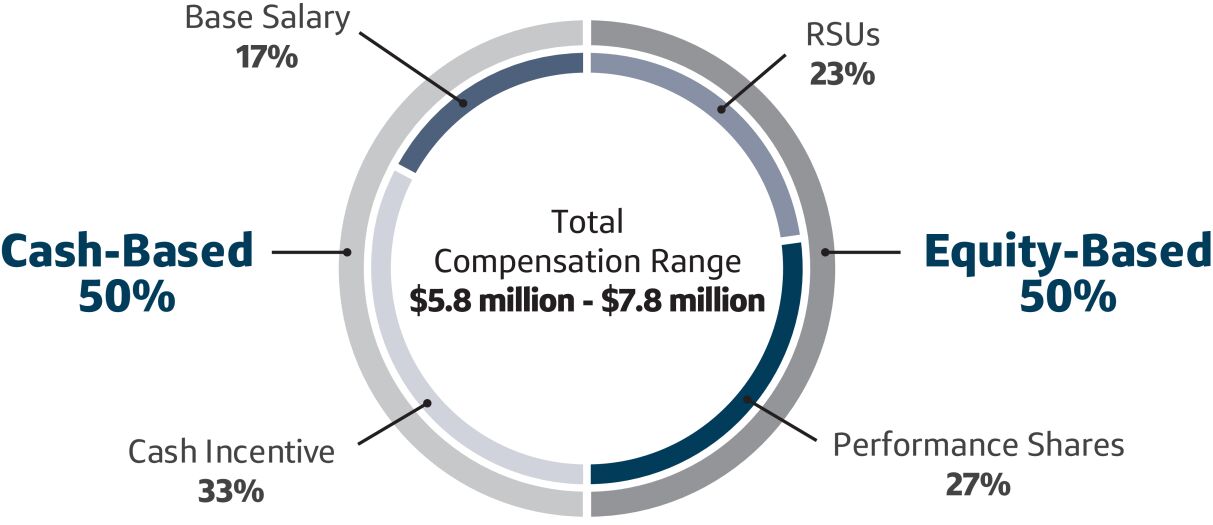

2024 NEO Performance Year Compensation

NEO (other than the CEO) compensation for the 2024 performance year was composed of a mix of cash and equity-based compensation and consisted of (i) a base salary and (ii) an annual year-end incentive opportunity which consisted of a cash incentive and a long-term incentive opportunity. The long-term incentive opportunity was comprised of performance shares and stock-settled RSUs as determined by the Committee and the Independent Directors. The chart below shows the elements of NEO compensation as an approximate percentage of NEO 2024 actual total compensation:

Base Salary RSUs 17% 23% Cash-Based Total Equity-Based Compensation Range 50% $5.8 million - $7.8 million 50% Cash Incentive Performance Shares 33% 27%

See “NEO Compensation” beginning on page 81 for a description of compensation to the NEOs (other than the CEO)

Voting Item 3: Ratification of the Selection of Ernst & Young LLP as Our Independent Registered Public Accounting Firm for 2025

| Item 3 |

You are being asked to ratify the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for 2025. For additional information regarding the Audit Committee’s selection of and the fees paid to Ernst & Young LLP, see “Audit Committee Report” on page 124 and “Ratification of Selection of Our Independent Registered Public Accounting Firm” beginning on page 122 of this proxy statement.

✓ Our Board unanimously recommends that you vote “FOR” the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for 2025. | |

Voting Item 4: Stockholder Proposal

| Item 4 |

You are being asked to vote on one stockholder proposal. For additional information regarding the proposal, see “Stockholder Proposal” beginning on page 125 of this proxy statement.

û Our Board unanimously recommends that you vote “AGAINST” the stockholder proposal as disclosed in this proxy statement. | |

| 8

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

Table of Contents

| CORPORATE GOVERNANCE | ||

| 11 | ||

| 12 | ||

| 19 | ||

| 21 | ||

| 21 | ||

| 21 | ||

| 24 | ||

| 30 | ||

| 34 | ||

| 38 | ||

| 41 | ||

| 44 | ||

| 45 | ||

| 49 | ||

| 50 | ||

| 50 | ||

| 50 | ||

| 50 | ||

| 51 | ||

| 52 | ||

| 53 | ||

| EXECUTIVE COMPENSATION | ||

| 54 | ||

| 55 | ||

| 56 | ||

| 64 | ||

| 66 | ||

| 67 | ||

| 81 | ||

| 87 | ||

| 89 | ||

| 91 | ||

| 93 | ||

| 96 | ||

| 96 | ||

| 98 | ||

| 100 | ||

| 101 | ||

| 102 | ||

| 103 | ||

| 104 | ||

| Capital One’s Voluntary Non-Qualified Deferred |

104 | |

| 105 | ||

| 105 | ||

| 2024 Potential Payments and Benefits Upon |

110 | |

| Estimated Ratio of CEO Compensation to Median |

112 | |

| 113 | ||

| 113 | ||

| 117 | ||

| 117 | ||

| 117 | ||

| 118 | ||

| 118 | ||

| Security Ownership of Directors and Named |

119 | |

| 121 | ||

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

9

|

| TABLE OF CONTENTS |

| AUDIT MATTERS | ||

| 122 | ||

| 124 | ||

| STOCKHOLDER PROPOSAL | ||

| 125 | ||

| OTHER MATTERS | ||

| 129 | ||

| 129 | ||

| 129 | ||

| 129 | ||

| 130 | ||

| Appendix A - Information Regarding Non-GAAP Financial Measures |

134 | |

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this proxy statement may constitute forward-looking statements, which involve a number of risks and uncertainties. Capital One cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that Capital One files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on the Form 10-K for the year ended December 31, 2024 (“Form 10-K”). The forward-looking statements in this proxy statement are made as of the date of this proxy statement, unless otherwise indicated, and Capital One undertakes no obligation to revise or update any forward-looking statements, except to the extent required by applicable law or regulation.

This proxy statement also contains statements regarding ESG commitments, goals, and metrics. Such statements are not guarantees or promises that such metrics, goals, or commitments will be met and are based on current strategy, assumptions, estimates, methodologies, standards, and currently available data, which continue to evolve and develop.

No reports, documents, or websites that are cited or referred to in this proxy statement shall be deemed to be incorporated by reference into this document.

| 10

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

Section I - Election of Directors (Item 1 on Proxy Card)

All of Capital One’s directors are elected for one-year terms at each annual stockholder meeting and hold office until their successors are duly elected and qualified. Our Board is presenting the following twelve nominees for election as directors at the 2025 Annual Stockholder Meeting. Each nominee is a current Board member who was elected by stockholders at the 2024 Annual Stockholder Meeting. Each nominee has consented to serve a one-year term. Information about the nominees for election as directors is set forth under “Our Director Nominees” beginning on page 12.

In the event a nominee becomes unable to serve, or for good cause, will not serve as a director, the Board may designate a substitute nominee or reduce the size of the Board. If the Board designates a substitute nominee, proxies will be voted for the election of such substitute. As of the date of this proxy statement, the Board has no reason to believe that any of the nominees will be unable or unwilling to serve as a director.

The nominees for election as directors at the 2025 Annual Stockholder Meeting are:

| Name(1) | Age | Occupation | Director Since |

Independent | Other Public Boards(2) | |||||||||||||||

| Richard D. Fairbank |

74 | Chairman and Chief Executive Officer, Capital One Financial Corporation |

1994 | No | 0 | |||||||||||||||

| Ime Archibong |

43 | Vice President, Product Management and Head of Product at Messenger, Meta |

2021 | Yes | 0 | |||||||||||||||

| Christine Detrick |

66 | Former Director, Head of the Americas Financial Services Practice; Former Senior Advisor, Bain & Company |

2021 | Yes | 2 | |||||||||||||||

| Ann Fritz Hackett |

71 | Former Strategy Consulting Partner | 2004 | Yes | 2 | |||||||||||||||

| Suni P. Harford |

62 | Former President, UBS Asset Management | 2024 | Yes | 0 | |||||||||||||||

| Peter Thomas Killalea |

57 | Former Vice President of Technology, Amazon.com |

2016 | Yes | 3 | |||||||||||||||

| Eli Leenaars |

64 | Former Group Chief Operating Officer, Quintet Private Bank |

2019 | Yes | 0 | |||||||||||||||

| François Locoh-Donou |

53 | President, Chief Executive Officer, and Director, F5 Networks, Inc. |

2019 | Yes | 1 | |||||||||||||||

| Peter E. Raskind |

68 | Former Chairman, President and Chief Executive Officer, National City Corporation |

2012 | Yes | 0 | |||||||||||||||

| Eileen Serra |

70 | Former Senior Advisor, JP Morgan Chase & Co.; Former Chief Executive Officer, Chase Card Services |

2020 | Yes | 1 | |||||||||||||||

| Mayo A. Shattuck III |

70 | Former Chairman, Exelon Corporation; Former Chairman, President and Chief |

2003 | Yes | 2 | |||||||||||||||

| Craig Anthony Williams |

55 | President, Geographies and Marketplace at NIKE, Inc. |

2021 | Yes | 0 | |||||||||||||||

| (1) | Each nominee also serves on the Board of Directors of Capital One, National Association, our principal operating subsidiary. Mr. Fairbank serves as Chair of the Board of Directors of Capital One, National Association. |

| (2) | Capital One’s Corporate Governance Guidelines limit the number of public company boards on which our directors may serve to four boards (including the Capital One Board) for non-executive directors, and two boards (including the Capital One Board) for executive officer directors. |

***

The Board unanimously recommends that you vote “FOR” each of these director nominees.

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

11

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

Our Director Nominees

Biographies of Director Nominees

|

Director Since: 1994

Age: 74

Capital One Committees:

∎ None

|

Richard D. Fairbank Chairman and Chief Executive Officer, Capital One Financial Corporation

Mr. Fairbank is the founder, CEO and Chairman of Capital One and one of just a few founder-CEOs among America’s largest public companies. In 1987, Mr. Fairbank founded Capital One on the belief that data and technology could change how banking works. He has been the CEO since the Company’s initial public offering in November 1994, and has served as the Chairman since February 1995.

Mr. Fairbank’s vision and leadership have positioned Capital One as a leader in technology, data, and cloud capabilities and the Company has been recognized as one of the most innovative financial services providers in the world. Today, Capital One serves over 100 million customers and has reimagined the banking experience, built an iconic and respected brand, and been consistently recognized as one of the best companies to work for.

Prior to Capital One, Mr. Fairbank earned his BA and MBA from Stanford University. He became a strategy consultant, advising leading companies on long-term business strategy and growth opportunities. Mr. Fairbank has over three decades of experience in banking and financial services and is deeply knowledgeable about all aspects of the Company’s businesses, strategies, capabilities and culture. His qualifications as a Director also include his broad range of skills in the areas of strategy, technology, risk management, customer experience, talent, and public company leadership and governance.

Additional Public Directorships:

∎ None

|

|

Director Since: 2021

Age: 43

Capital One Committees:

∎ Compensation Committee

|

Ime Archibong Vice President, Product Management and Head of Product at Messenger, Meta

Mr. Archibong is a seasoned product and business development technology executive. He has served as Vice President, Product Management and Head of Product at Messenger at Meta Platforms, Inc. (formerly known as Facebook, Inc.) since March 2023. From August 2019 until March 2023, Mr. Archibong served as Meta’s Head of New Product Experimentation, where he led a multi-disciplinary group focused on product research and development. Prior to that role, Mr. Archibong served as Meta’s Vice President, Product Partnerships from November 2010 to June 2020.

Prior to joining Meta, from February 2004 to October 2010, Mr. Archibong held roles of increasing responsibility at International Business Machines (IBM), including serving on the Advanced Technology Professional Business Development team focused on the future of storage, the Corporate Strategy team laying the foundation for IBM’s Smarter Cities initiative, and as a software engineer in the Systems and Technology Group.

Additional Public Directorships:

∎ None

|

| 12

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

|

Director Since: 2021

Age: 66

Capital One Committees:

∎ Audit Committee

∎ Risk Committee

|

Christine Detrick Former Director, Head of the Americas Financial Services Practice; Former Senior Advisor, Bain & Company

Ms. Detrick is a financial services industry veteran with more than 35 years of senior operating and executive leadership experience. She has deep expertise in the banking and insurance industries across a wide array of sectors, including asset management, credit cards, property and casualty, and life insurance, payments, and other consumer finance segments. From 2002 until 2012, Ms. Detrick was a Senior Partner, Leader of the Financial Services Practice, and a Senior Advisor at Bain & Company, a management consulting firm. Before joining Bain, she served for ten years at A.T. Kearney, Inc., a management consulting firm, including as Leader of the Global Financial Institutions group and a member of the firm’s Board of Management and Board of Directors. At Bain and A.T. Kearney, Ms. Detrick served banks on issues of strategy, operational transformation, risk management, and technology.

Prior to those roles, she was a founding member of a venture capital firm specializing in savings and loan institution turnarounds and served as the Chief Executive Officer of St. Louis Bank for Savings. She was also a consultant at McKinsey and Company earlier in her career. Ms. Detrick also serves on the board of Hartford Mutual Funds, a mutual fund company, as chairman of the board. She previously served on the board of directors of Forest City Realty Trust, a public real estate investment trust, as chair of the Compensation Committee, and Reinsurance Group of America, a public reinsurance company, as chair of the Nominating and Governance Committee.

Additional Public Directorships:

∎ Altus Power America, Inc.

∎ CRA International, Inc.

|

|

Lead Independent Director

Director Since: 2004

Age: 71

Capital One Committees:

∎ Compensation Committee

∎ Governance and Nominating Committee (Chair)

∎ Risk Committee

|

Ann Fritz Hackett Former Strategy Consulting Partner

Ms. Hackett has extensive experience in leading companies that provide strategy and human capital consulting services to boards of directors and senior management teams. She has experience developing corporate and business strategy, leading change initiatives, risk management, talent management and succession planning, and creating performance-based compensation programs, as well as significant international and technology experience. Ms. Hackett also has extensive board experience.

Ms. Hackett is a former Strategy Consulting Partner. From 2015 through January 2020 she was a Partner and Co-founder of Personal Pathways, LLC, a technology company providing a web-based enterprise collaboration insights platform to advance high performance professional relationships required in today’s distributed workplace. Prior to her role at Personal Pathways, she was President of Horizon Consulting Group, LLC, a firm founded by Ms. Hackett in 1996, providing global consumer product and service companies with innovative strategy and human capital initiatives. Prior to launching Horizon Consulting, Ms. Hackett spent 11 years at a leading national strategy consulting firm where she served as Vice President and Partner in the strategy practice, served on the Management Committee, and led Human Resources. She also previously served as a director of Beam, Inc. (predecessor to Suntory Global Spirits) from December 2007 until April 2014.

Additional Public Directorships:

∎ Fortune Brands Innovations, Inc.

∎ MasterBrand, Inc.

|

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

13

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

|

Director Since: 2024

Age: 62

Capital One Committees:

∎ Audit Committee

∎ Risk Committee |

Suni P. Harford Former President, UBS Asset Management

Ms. Harford is a seasoned financial services industry executive with over 30 years of risk management, compliance and banking experience. Ms. Harford served as the President of UBS Asset Management as well as Chair of UBS Asset Management’s Executive Committee and Risk Committee from October 2019 until her retirement in February 2024. From April 2021 until February 2024, Ms. Harford also served as the UBS Group Executive Board Lead for the firm’s sustainability and impact efforts. As head of UBS Group’s Sustainability and Impact organization, Ms. Harford had oversight of the Chief Sustainability Office, responsible for sustainability strategy, external engagement and corporate responsibility across UBS. Ms. Harford joined UBS as the Head of Investments in July 2017, where she was responsible for the investment teams for traditional asset classes and UBS O’Connor, a multi-strategy hedge fund, until September 2019.

Prior to joining UBS, Ms. Harford worked at Citigroup, Inc., an investment bank and financial services corporation, for almost 25 years, most recently as the Regional Head of Markets for North America. Ms. Harford was also a member of Citibank’s Pension Plan Investment Committee and a director on the board of Citibank Canada.

Ms. Harford served as a co-chair of the World Economic Forum Global Future Council on Investing and has held seats on the board of several industry associations, including the Depository Trust and Clearing Corporation and the Securities Industry Financial Management Association.

Additional Public Directorships:

∎ None

|

|

Director Since: 2016

Age: 57

Capital One Committees:

∎ Compensation Committee

∎ Risk Committee

|

Peter Thomas Killalea

Former Vice President of Technology, Amazon.com

Mr. Killalea, a seasoned technology executive and advisor, has deep expertise in product development, digital innovation, customer experience, and security. From November 2014 to December 2021, Mr. Killalea served as the owner and President of Aoinle, LLC, a consulting firm. From May 1998 to November 2014, Mr. Killalea served in various senior executive leadership roles at Amazon, most recently as Vice President of Technology for the Kindle Content Ecosystem. He led Amazon’s Infrastructure and Distributed Systems team, which later became a key part of the Amazon Web Services Platform. Prior to that, he served as Amazon’s Chief Information Security Officer and Vice President of Security.

Mr. Killalea previously served on the board of Xoom Corporation (acquired by PayPal Inc.) from March 2015 to November 2015 and Carbon Black, Inc. (acquired by VMware) from April 2017 to October 2019.

Additional Public Directorships:

∎ Akamai Technologies, Inc.

∎ MongoDB, Inc.

∎ Satellogic, Inc.

|

| 14

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

|

Director Since: 2019

Age: 64

Capital One Committees:

∎ Audit Committee

∎ Compensation Committee

∎ Risk Committee (Chair)

|

Eli Leenaars Former Group Chief Operating Officer, Quintet Private Bank

Mr. Leenaars has over 30 years of experience in the financial services sector, including institutional and investment banking, asset management, corporate and retail banking, and in cultivating sophisticated client relationships. A respected expert on the future of digital banking, as well as global industry trends in finance, investment, banking, and leadership, Mr. Leenaars has experience managing businesses through a wide range of matters including mergers and acquisitions, complex corporate restructuring, strategic initiatives, and challenging financial environments.

From June 2021 through December 2023, Mr. Leenaars served as Group Chief Operating Officer of Quintet Private Bank and was a member of its Authorized Management Committee. Prior to joining Quintet, Mr. Leenaars served as Vice Chairman of the Global Wealth Management Division at UBS Group AG, a Swiss multinational investment bank and financial services company, from April 2015 to May 2021. In this role, he engaged on senior relationship management with a focus on UBS’ largest non-U.S. clientele.

Prior to joining UBS, Mr. Leenaars had a 24-year career at ING Group N.V., a Dutch multinational banking and financial services company, and various of its subsidiaries. From January 2010 until March 2015, he served as the CEO of ING Retail Banking Direct and International for ING, where he was responsible for Retail Banking and Private Banking worldwide. This included serving as CEO of ING Direct N.V., the parent company of ING Direct in the U.S., which pioneered the national direct deposit platform. Between 2004 and 2010, Mr. Leenaars was also a member of ING’s Executive Board with responsibility for ING’s Global Retail and Private Banking operations and Group Technology and Operations. In addition, Mr. Leenaars previously served as a member of our Board from May 2012 to September 2012 in connection with Capital One’s acquisition of ING Direct.

Mr. Leenaars is a member of the Executive Committee of the Trilateral Commission (Paris, Tokyo, and Washington, DC).

Additional Public Directorships:

∎ None

|

|

Director Since: 2019

Age: 53

Capital One Committees:

∎ Compensation Committee (Chair)

∎ Governance and Nominating Committee

|

François Locoh-Donou President, Chief Executive Officer, and Director, F5, Inc.

Mr. Locoh-Donou is President and Chief Executive Officer of F5 and a member of the company’s Board of Directors. Since joining F5 as CEO in April 2017, he has spearheaded the company’s business transformation from a networking hardware maker to a software- and SaaS-first leader in multi-cloud application security and delivery. He has also been instrumental in the company’s cultural transformation to a high-performance, human-first organization energized by F5’s purpose to bring a better digital world to life.

Prior to joining F5, Locoh-Donou served as Chief Operating Officer at Ciena, a global networking solutions provider to the telecom industry; his leadership positions there also included executive roles in the Product, Sales, and Marketing organizations. He also held research and development roles at Photonetics, a French opto-electronics company.

Raised in Togo and France, Locoh-Donou holds engineering degrees from École Centrale de Marseille and Télécom ParisTech in France, as well as an MBA from the Stanford Graduate School of Business. He is the co-founder and chairman of Cajou Espoir, a cashew processing business employing several hundred people, mostly women, in rural Togo.

Additional Public Directorships:

∎ F5, Inc.

|

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

15

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

|

Director Since: 2012

Age: 68

Capital One Committees:

∎ Governance and Nominating Committee

∎ Risk Committee |

Peter E. Raskind Former Chairman, President, and Chief Executive Officer, National City Corporation

Mr. Raskind has more than 45 years of banking experience, including in corporate banking, retail banking, wealth management/trust, mortgage, operations, technology, strategy, product management, asset/liability management, risk management and acquisition integration. Through his extensive banking career, he has served in a number of senior executive leadership roles and held positions of successively greater responsibility in a broad range of consumer and commercial banking disciplines, including cash management services, corporate finance, international banking, wealth management and corporate trust, retail and small business banking, operations and strategic planning.

Most recently, Mr. Raskind was a consultant to banks and equity bank investors as the owner of JMB Consulting, LLC, which he established in February 2009 and managed through 2017. Prior to founding JMB Consulting, Mr. Raskind served as Chairman, President and Chief Executive Officer of National City Corporation, one of the largest banks in the United States, until its merger with PNC Financial Services Group in December 2008. Mr. Raskind has served as a director of United Community Banks, Inc. and Visa USA and Visa International. He also served on the board of directors of the Consumer Bankers Association, was a member of the Financial Services Roundtable, and on the executive committee of the National Automated Clearing House Association. In addition, Mr. Raskind served as Interim Chief Executive Officer of the Cleveland Metropolitan School District in 2011, and in 2010, he served as Interim Chief Executive Officer of the Cleveland-Cuyahoga County Port Authority.

Additional Public Directorships:

∎ None

|

|

Director Since: 2020

Age: 70

Capital One Committees:

∎ Audit Committee (Chair)

∎ Risk Committee

|

Eileen Serra Former Senior Advisor, JPMorgan Chase & Co.; Former Chief Executive Officer, Chase Card Services

Ms. Serra served in various leadership roles over the course of her more than 20 years in the financial services industry, which included responsibility for operations, product development, customer engagement, digital transformation, strategic and growth initiatives, and talent management. Prior to her financial services experience, Ms. Serra was a partner in a strategy consulting firm.

A seasoned credit card industry executive, Ms. Serra served in a variety of executive positions at JPMorgan Chase & Co., including as Chief Executive Officer of Chase Card Services from 2012 to 2016 and most recently as Senior Advisor focusing on strategic growth initiatives from 2016 until her retirement in February 2018. While at JPMorgan Chase, Ms. Serra established and developed successful consumer credit card products and brands, loyalty programs, partner relationships, and digital mobile payment solutions.

Prior to joining JPMorgan Chase in 2006, Ms. Serra was a Managing Director and Head of Private Client Banking Solutions at Merrill Lynch. She also served as Senior Vice President at American Express where, among other responsibilities, she led the Small Business Credit Card and Lending businesses. Prior to American Express, she was a partner at McKinsey & Company. Ms. Serra previously served as a director and member of the audit committee of Boxed, Inc.

Additional Public Directorships:

∎ Gartner, Inc.

|

| 16

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

|

Director Since: 2003

Age: 70

Capital One Committees:

∎ Compensation Committee

∎ Governance and Nominating Committee

|

Mayo A. Shattuck III Former Chairman, Exelon Corporation; Former Chairman, President, and Chief Executive Officer, Constellation Energy Group

Mr. Shattuck has decades of experience in global corporate finance and lending, corporate strategy, capital markets, risk management, executive compensation, and private banking. He has led two large, publicly held companies and has served on other public company boards.

From 2013 to April 2022, Mr. Shattuck served as Chairman of the Board of Chicago-based Exelon Corporation, a Fortune 100 company that owns six utilities and is the nation’s largest competitive energy provider and commercial nuclear plant operator. Previously, Mr. Shattuck was Chairman, President, and Chief Executive Officer of Constellation Energy Group, a position he held from 2001 to 2012.

Mr. Shattuck has extensive experience in the financial services industry. He was previously at Deutsche Bank, where he served as Global Head of Investment Banking, Global Head of Private Banking and Chairman of Deutsche Bank Alex. Brown. From 1997 to 1999, Mr. Shattuck served as Vice Chairman of Bankers Trust Corporation, which merged with Deutsche Bank in 1999. In addition, from 1991 to 1997, Mr. Shattuck was President, Chief Operating Officer and a director of Alex. Brown & Sons, an investment bank, which merged with Bankers Trust in 1997. Mr. Shattuck is the former Chairman of the Institute of Nuclear Power Operations.

Additional Public Directorships:

∎ Gap, Inc.

∎ Hut 8 Corp.

|

|

Director Since: 2021

Age: 55

Capital One Committees:

∎ Audit Committee

∎ Compensation Committee

|

Craig Anthony Williams President, Geographies and Marketplace, NIKE, Inc.

Mr. Williams, a seasoned business executive, has extensive experience in general management, marketing, product development, cross-functional team leadership and driving global strategy and operations. He has served as President, Geographies and Marketplace at NIKE, Inc. since May 2023, where he leads NIKE’s four geographies and marketplace across its direct and wholesale business in addition to leading NIKE’s supply chain and logistics. From January 2019 until May 2023, he served as President of Jordan Brand at NIKE, Inc., where he led a cross-functional team focused on the brand’s vision, strategy and global revenue growth.

Prior to joining NIKE, Inc., Mr. Williams was the Senior Vice President, The Coca-Cola Co. and President of The Global McDonald’s Division (TMD) from January 2016 to January 2019, where he was responsible for brand and category growth. During his time at The Coca-Cola Co., Mr. Williams held a variety of executive roles within TMD Worldwide, including Senior Vice President and Chief Operating Officer, Vice President U.S., Assistant Vice President of U.S. Marketing and Group Director of U.S. Marketing. Prior to joining The Coca-Cola Co. in June 2005, Mr. Williams was a Global Marketing Director at CIBA Vision Corporation, a contact lenses and lens care product manufacturer, a brand management executive at Kraft Foods Inc., and served as a Naval Nuclear Power Officer in the U.S. Navy.

Additional Public Directorships:

∎ None

|

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

17

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

Director Nominee Highlights

What We Look for in Individual Director Nominees

The evaluation and selection of director nominees is a key aspect of the Governance and Nominating Committee’s regular evaluation of the composition of, and criteria for membership on, the Board and its commitment to ongoing Board refreshment. When considering director nominees, including incumbent directors standing for re-election, nominees to fill vacancies on the Board, and nominees recommended by stockholders, the Governance and Nominating Committee focuses on certain criteria when developing and evaluating the Board’s composition. Among the criteria considered, the Governance and Nominating Committee considers each director nominee’s relevant skills and experience, commitment to the Company, diversity of experience and background, and relevant personal characteristics. For more information regarding our Governance and Nominating Committee’s and our Board’s perspectives on Board composition, recruitment priorities, and refreshment, see “Corporate Governance at Capital One—Key Board Governance Practices—Our Perspectives on Overall Board Composition and Refreshment” beginning on page 24.

Other Considerations

For new candidates, the Governance and Nominating Committee also considers the results of the candidate’s interviews with directors and/or members of senior management and any background checks the Governance and Nominating Committee deems appropriate. In 2024, Capital One continued its engagement with Spencer Stuart, a third-party director search firm, to identify and evaluate potential director candidates based on the criteria and principles described above.

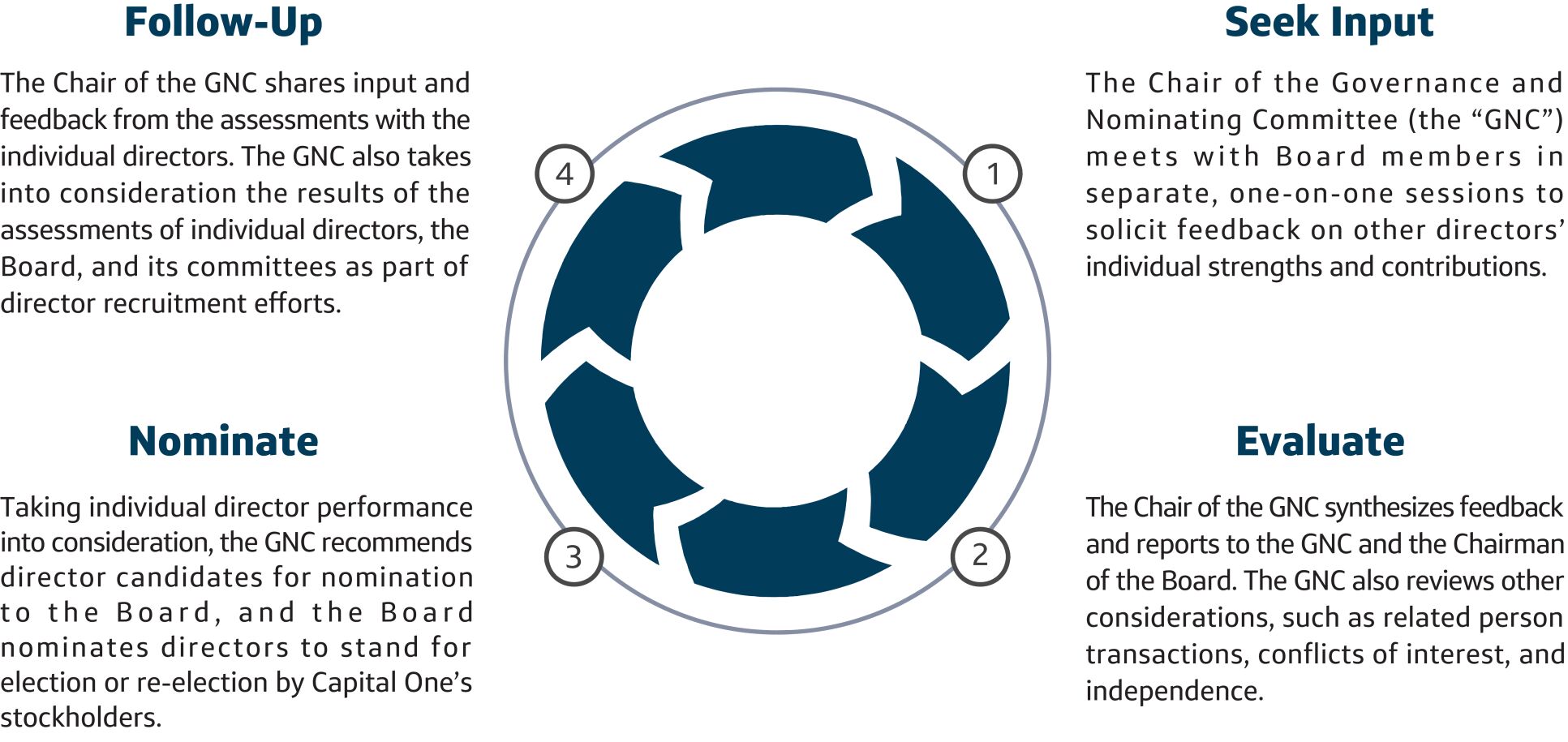

When evaluating incumbent directors, the Governance and Nominating Committee also considers each director’s performance throughout the year, including the director’s attendance, preparation for, and participation in Board and committee meetings, the director’s annual evaluation, including feedback received from fellow Board members, the director’s outside commitments, and the director’s willingness to serve for an additional term, as further described in the section “Annual Assessment of Individual Director Nominees” on page 29.

| 18

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

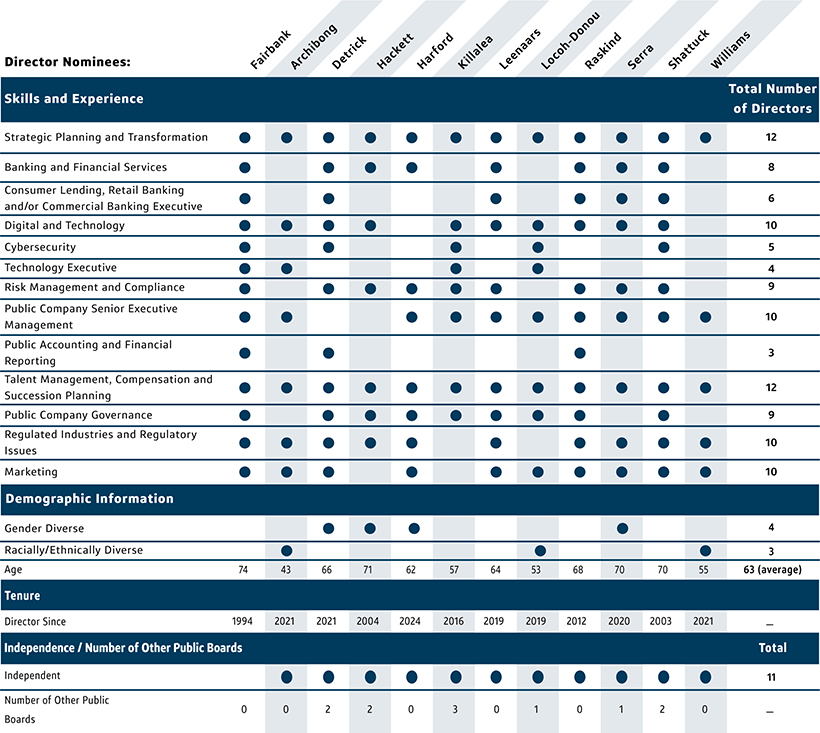

Skills and Experience of Our Director Nominees

The Governance and Nominating Committee and the Board regularly review the Board’s membership in light of Capital One’s business model and strategic goals and objectives, the regulatory environment, and financial market conditions. In its review, the Governance and Nominating Committee considers whether the Board continues to possess the appropriate mix of skills and experience to oversee the Company in achieving these goals, and may seek additional directors as a result of this review. Our director nominees have the requisite experiences that, in the aggregate, meet an articulated set of director skills established by the Governance and Nominating Committee. These skills collectively allow our director nominees to effectively oversee the Company and create an engaged, effective, and strategically oriented board. For more information on our Board’s skills, experience, tenure, and independence, please see the detailed director skills matrix below.

Director Nominees: Fairbank Archibong Detrick Hackett Harford Killalea Leenaars Locoh-Donou Raskind Serra Shattuck Williams Skills and Experience Total Number of Directors Strategic Planning and Transformation Banking and Financial Services Consumer Lending, Retail Banking and/or Commercial Banking Executive Digital and Technology Cybersecurity Technology Executive Risk Management and Compliance Public Company Senior Executive Management Public Accounting and Financial Reporting Talent Management, Compensation and Succession Planning Public Company Governance Regulated Industries and Regulatory Issues Marketing Demographic Information Gender Diverse Racially/Ethnically Diverse Age Tenure Director Since "Independence / Number of Other Public Boards" Independent "Number of Other Public Boards" Total Number of Directors 12 8 6 10 5 4 9 103 12 9 10 10 4 3 63 (average) - Total 11 - 74 43 66 71 62 57 64 53 68 70 70 55 1994 2021 2021 2004 2024 2016 2019 2019 2012 2020 2003 2021 0 0 2 2 0 3 0 1 0 1 2 0

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

19

|

| CORPORATE GOVERNANCE |

| Section I - Election of Directors (Item 1 on Proxy Card) |

| Strategic Planning and Transformation | Experience setting a long-term corporate vision or direction, developing desirable products and customer segments, assessing geographies in which to operate, and evaluating competitive positioning | |

| Banking and Financial Services |

Extended board experience or management experience in Retail Banking, Commercial Banking, Consumer Lending, Small Business Banking, Investment Banking, and/or other financial services | |

| Consumer Lending, Retail Banking and/or Commercial Banking Executive | Executive level experience and oversight of Retail Banking, Consumer Lending, and/or Commercial Banking | |

| Digital and Technology | Leadership and understanding of technology and digital platforms | |

| Cybersecurity | Experience with or oversight of cybersecurity (e.g., prior work experience, possession of a cybersecurity certification or degree or other knowledge, skills or background in cybersecurity) | |

| Technology Executive | Executive-level experience with direct oversight and expertise in technology, digital platforms, and cybersecurity risk | |

| Risk Management and Compliance | Significant understanding with respect to the identification, assessment, and oversight of risk management programs and practices | |

| Public Company Senior Executive Management | Experience as a CEO or other senior executive at a public company | |

| Public Accounting and Financial Reporting |

Experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing, or evaluation of financial statements | |

| Talent Management, Compensation, and Succession Planning |

Understanding of the issues involved with executive compensation, succession planning, human capital management, and talent management and development | |

| Public Company Governance | Extended experience serving as a director on a large public company board and/or experience with public company governance issues and policies, including governance best practices | |

| Regulated Industries and Regulatory Issues | Experience with regulated businesses, regulatory requirements, and relationships with state and federal agencies | |

| Marketing | Experience with or oversight of marketing strategy and brand management | |

| 20

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

Section II - Corporate Governance at Capital One

Overview of Corporate Governance at Capital One

Capital One is dedicated to strong and effective corporate governance that is designed to provide the appropriate framework for the Board to engage with and oversee the management of the Company. Robust and dynamic corporate governance policies and practices are the foundation of an effective and well-functioning board and are vital to preserving the trust of our stakeholders, including customers, stockholders, regulators, suppliers, associates, our communities, and the general public.

Information About Our Corporate Governance Policies and Guidelines

The Board has adopted Corporate Governance Guidelines to formalize its governance practices and provide its view of effective governance. Our Corporate Governance Guidelines embody many of our long-standing practices, policies, and procedures, which collectively form a corporate governance framework that promotes the long-term interests of our stockholders, promotes responsible decision-making and accountability, and fosters a culture that allows our Board and management to pursue Capital One’s strategic objectives.

To maintain and enhance independent oversight, our Board regularly reviews and refreshes its governance policies and practices in connection with changes in corporate strategy, the regulatory environment, financial market conditions, industry best practices, or other significant events, as well as in response to investor and other stakeholder feedback and engagement.

The Board has also adopted Capital One’s Code of Conduct, which applies to Capital One’s directors, executives, and associates, including Capital One’s CEO, CFO, Principal Accounting Officer, Chief Risk Officers, and other associates performing similar functions. The Code of Conduct reflects Capital One’s commitment to honesty, fair dealing, and integrity, and guides the ethical actions and working relationships of Capital One’s directors, executives, and associates.

For a description of the key governance practices of our Board, see “Key Board Governance Practices” beginning on page 24.

The following corporate governance documents are available at www.capitalone.com under “Investors,” then “Governance & Leadership,” then “Board of Directors and Committee Documents” or “Organizational and Governance Documents,” as applicable.

| ∎ | Amended and Restated Bylaws |

| ∎ | Corporate Governance Guidelines |

| ∎ | Board Committee Charters |

| ∎ | Restated Certificate of Incorporation |

| ∎ | Code of Conduct |

Board Leadership Structure

The Independent Directors annually evaluate the continued effectiveness of the Board’s leadership structure, including the effectiveness of the combined Chairman/CEO and Lead Independent Director leadership structure, in the context of Capital One’s specific circumstances, culture, strategic objectives, and challenges. The Board currently believes that it is in the best interests of the Company and its stockholders that the Chairman and CEO roles should be held by the same person.

We believe that our existing Board leadership structure of a combined Chairman/CEO and a Lead Independent Director provides the most effective governance framework and allows our Company to benefit from Mr. Fairbank’s talent, knowledge, and leadership as the founder of Capital One and allows him to use the in-depth

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

21

|

| CORPORATE GOVERNANCE |

| Section II - Corporate Governance at Capital One |

focus and perspective gained in operating the Company’s day-to-day operations, strategic planning, and risk management to effectively and efficiently lead our Board. Recognizing the importance of independent perspectives on the Board, Capital One appropriately maintains a strong counterbalance and effective oversight of our business and affairs through our Lead Independent Director and our Independent Directors; fully independent Board committees with independent chairs who oversee the Company’s operations, risks, performance, and business strategy; experienced and committed directors; and regular executive sessions.

Lead Independent Director

Our Board believes that an active and empowered Lead Independent Director is key to providing strong, independent leadership for the Board. The Lead Independent Director position, elected annually by the other Independent Directors upon the recommendation of the Governance and Nominating Committee, is a critical aspect of our corporate governance framework. The Board believes that Ms. Hackett’s experience enables her to provide valuable and independent views to the boardroom and ensure active communication between management and our Independent Directors to support their oversight responsibilities, including with respect to management of risks and opportunities presented by the markets in which Capital One competes.

| 22

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section II - Corporate Governance at Capital One |

In accordance with our Corporate Governance Guidelines, the Lead Independent Director’s responsibilities include:

|

Board Leadership |

|

∎ Organizing, setting agendas for, and leading executive sessions of the Board

∎ Having authority to call meetings of the Independent Directors

∎ Soliciting feedback for and engaging the CEO on executive sessions

∎ Advising the Governance and Nominating Committee and the Chairman of the Board on the membership of Board committees and the selection of committee chairs

∎ Acting as a key advisor to the CEO and Chairman of the Board on a wide variety of Company matters, including the retention of advisors and consultants who report directly to the Board

|

|

Board Culture |

|

∎ Serving as liaison between the Chairman of the Board and the Independent Directors

∎ Fostering an environment that facilitates engagement and discussion, teamwork, and communication among the Independent Directors on key issues and concerns, including risk management

∎ Ensuring Board discussions demonstrate appropriate effective challenge of management, including risk management

∎ In a crisis, calling together the Independent Directors to establish appropriate Board leadership responsibility

|

|

Board Meetings |

|

∎ Approving meeting agendas for the Board, including addition or removal of items, as appropriate

∎ Advising on the type of information to be provided to the Board

∎ Approving Board meeting schedules and working with the Chairman of the Board and committee chairs to ensure there is sufficient time for discussion of all agenda items

∎ Presiding at all meetings of the Board at which the Chairman of the Board is not present

|

|

Performance and Development |

|

∎ Leading the annual performance assessment of the CEO

∎ Facilitating the Board’s engagement with the CEO with respect to the CEO’s performance assessment and CEO succession planning

∎ Leading the Board’s annual self-assessment and providing recommendations for improvement, if any

|

|

Stockholder Engagement |

|

∎ Ensuring that the Lead Independent Director is available for consultation and direct communication with stockholders and stakeholders, upon request

∎ Reviewing stockholder communications addressed to the full Board, to the Lead Independent Director, or the Independent Directors, as appropriate |

In evaluating candidates for Lead Independent Director, the Independent Directors consider several factors, including each candidate’s corporate governance experience, Board service and tenure, Board leadership roles, and ability to meet the necessary time commitment. For an incumbent Lead Independent Director, the Independent Directors also consider the results of the candidate’s annual Lead Independent Director assessment. For a description of the Lead Independent Director annual assessment process, see “Annual Assessment of the Lead Independent Director” beginning on page 29.

| CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

23

|

| CORPORATE GOVERNANCE |

| Section II - Corporate Governance at Capital One |

Key Board Governance Practices

2024 Board Meetings and Attendance

| ∎ | The Board held 14 meetings and the Board’s committees collectively held 32 meetings |

| ∎ | In carrying out its responsibilities, the Audit Committee met a total of 11 times, the Risk Committee met a total of seven times, the Governance and Nominating Committee met a total of eight times, and the Compensation Committee met a total of six times |

| ∎ | All directors then serving attended the 2024 Annual Stockholder Meeting, and Capital One expects all director nominees to attend the 2025 Annual Stockholder Meeting |

| ∎ | Each of our current directors attended at least 75% of the aggregate number of the meetings of the Board and the committees on which they served during the period the director was on the Board or committee, other than Mr. Williams. Mr. Williams’s attendance was approximately 74.2% and was impacted by an unexpected family emergency. Mr. Williams has consistently maintained greater than 75% attendance during his tenure on the Board, and the Board believes he has sufficient time to serve on the Board. |

Our Perspectives on Overall Board Composition and Refreshment

In recent years, investors have become increasingly focused on the composition of corporate boards and policies and practices that encourage board refreshment. At Capital One, we appreciate that our investors share our passion for cultivating a board that encompasses the optimal mix of diverse backgrounds, experiences, skills, expertise, qualifications, and an unwavering commitment to integrity and good judgment, all in order to thoughtfully oversee, advise, and guide management as they work to achieve our long-term strategic objectives.

The Governance and Nominating Committee takes a long-term view and continuously assesses the composition and resiliency of the Board over the next ten to 15 years in alignment with the Company’s strategic direction to determine what actions may be desirable to best position the Board and the Company for success. In assessing Board resiliency, the Governance and Nominating Committee considers a variety of factors and has articulated a set of principles on board composition, including the following:

| Board Skills |

∎ Consider the collective set of skills that allows the Board to act independently and provide an effective challenge to management, especially in the areas of business strategy, financial performance, enterprise risk management, cybersecurity risk, technology innovation, and executive talent and leadership

∎ Ensure collective Board skill sets evolve with our long-term strategic objectives | |

| Industry

Experience |

∎ Seek and retain Board members with industry experience, both in banking and technology, that align with our long-term strategy

∎ Recognize that the financial services industry is complex and understand the importance of having directors who have witnessed banking business and credit cycles over time and can share the wisdom of those experiences | |

| Diversity |

∎ Believe having a Board with members who demonstrate a diversity of thought, perspectives, skills, backgrounds, and personal and professional experiences is important to building an effective and resilient board, and as a result, have a goal of identifying candidates that can contribute to that diversity in a variety of ways | |

| Board Size |

∎ Consider the appropriate size of the Board in relation to promoting active engagement and open discussion

∎ Continuously assess the depth of successors available to assume Board leadership positions for both expected and unexpected departures |

| 24

|

CAPITAL ONE FINANCIAL CORPORATION

|

2025 PROXY STATEMENT

|

| CORPORATE GOVERNANCE |

| Section II - Corporate Governance at Capital One |

| Tenure |

∎ Believe that it is critical to have members across a continuum of director tenure to ensure the effective oversight of a large financial institution, which must simultaneously embrace innovation and changing market and customer expectations and prudently preserve the safety and soundness of the institution through long-term business and credit cycles

∎ Seek to have a mix of members at different points along the tenure continuum to cultivate Board membership that collectively represents members who have actively overseen the Company’s strategic journey through various business cycles, who have sufficient experience to assume Board leadership positions, who bring fresh ideas and perspectives, and who have a firm understanding of the cultural strengths of the Board and the Company | |

| Evergreen Recruiting |

∎ Engage in a continuous process of identifying and assessing potential director candidates in light of the Board’s collective set of skills and future needs

∎ Recognize that recruiting new directors is not one-dimensional and that effective Board members should be as described under the “What We Look for in Individual Director Nominees” section, beginning on page 18 | |

| Staged Refreshment |

∎ Take a long-term view to enable thoughtful director refreshment that meets strategic needs while avoiding disruption

∎ Take a planned approach to changes in Board membership, considering the timing of new director onboarding relative to planned retirements and departures

∎ Recognize that new directors need time to become familiar with the Company’s business model and strategy and become deeply grounded in these matters to be well-positioned to provide effective challenge to management

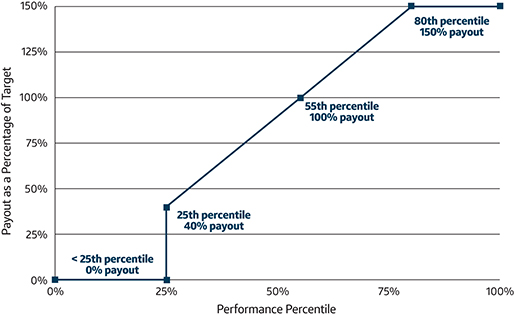

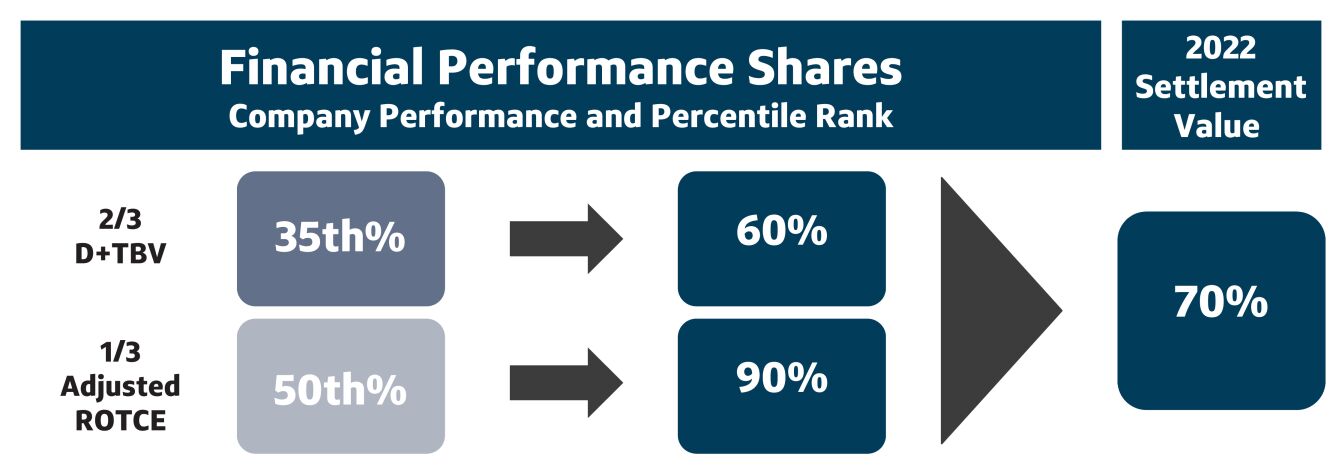

∎ Acknowledge that relationships among Board members develop organically over time and recognize the importance of protecting and nurturing the open, values-based culture that the Board enjoys to appropriately oversee and provide effective challenge to management |