Second Quarter 2025 Earnings Presentation August 6, 2025

Forward-Looking Statements Certain statements set forth in this presentation constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this presentation. Although forward-looking statements in this presentation reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K and Form 10-Q (including, without limitation, in the "Risk Factors" section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this presentation. This presentation includes certain non-GAAP measures. Please refer to the reconciliations provided in the earnings press release and the appendix in this presentation for the most comparable GAAP measure. // 2

// 3 11 Consecutive Quarters of Improved Adj. EBITDA* Growing High-Margin Data Analytics Backlog Data Analytics Technology with High ROI Long-term Contracts Insulate Market Risk Outstanding HS&E Record Flotek Industries CHEMISTRY AS THE COMMON VALUE CREATION PLATFORM Value Creation through Chemistry & Data * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure

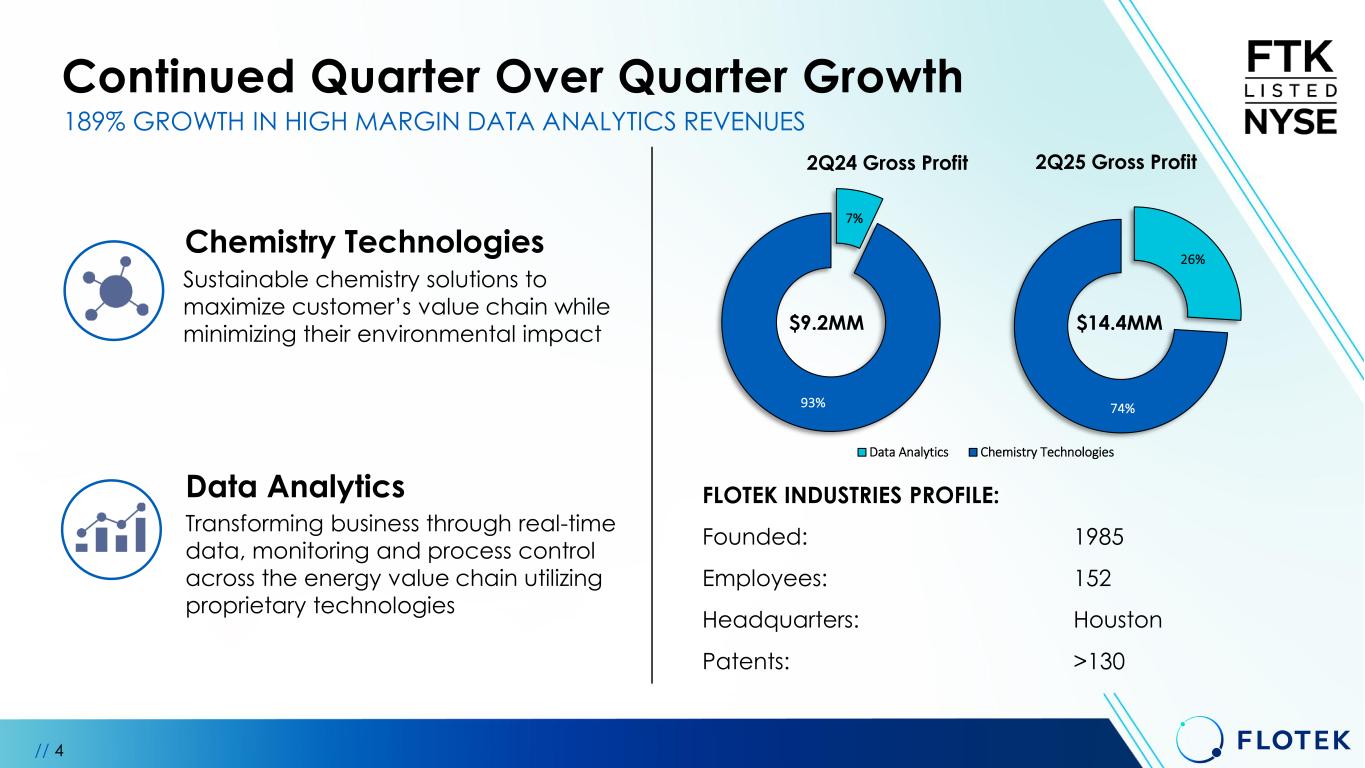

7% 93% 2Q24 Gross Profit Data Analytics Chemistry Technologies Continued Quarter Over Quarter Growth // 4 Sustainable chemistry solutions to maximize customer’s value chain while minimizing their environmental impact Transforming business through real-time data, monitoring and process control across the energy value chain utilizing proprietary technologies Chemistry Technologies Data Analytics 189% GROWTH IN HIGH MARGIN DATA ANALYTICS REVENUES FLOTEK INDUSTRIES PROFILE: Founded: 1985 Employees: 152 Headquarters: Houston Patents: >130 26% 74% 2Q25 Gross Profit $9.2MM $14.4MM

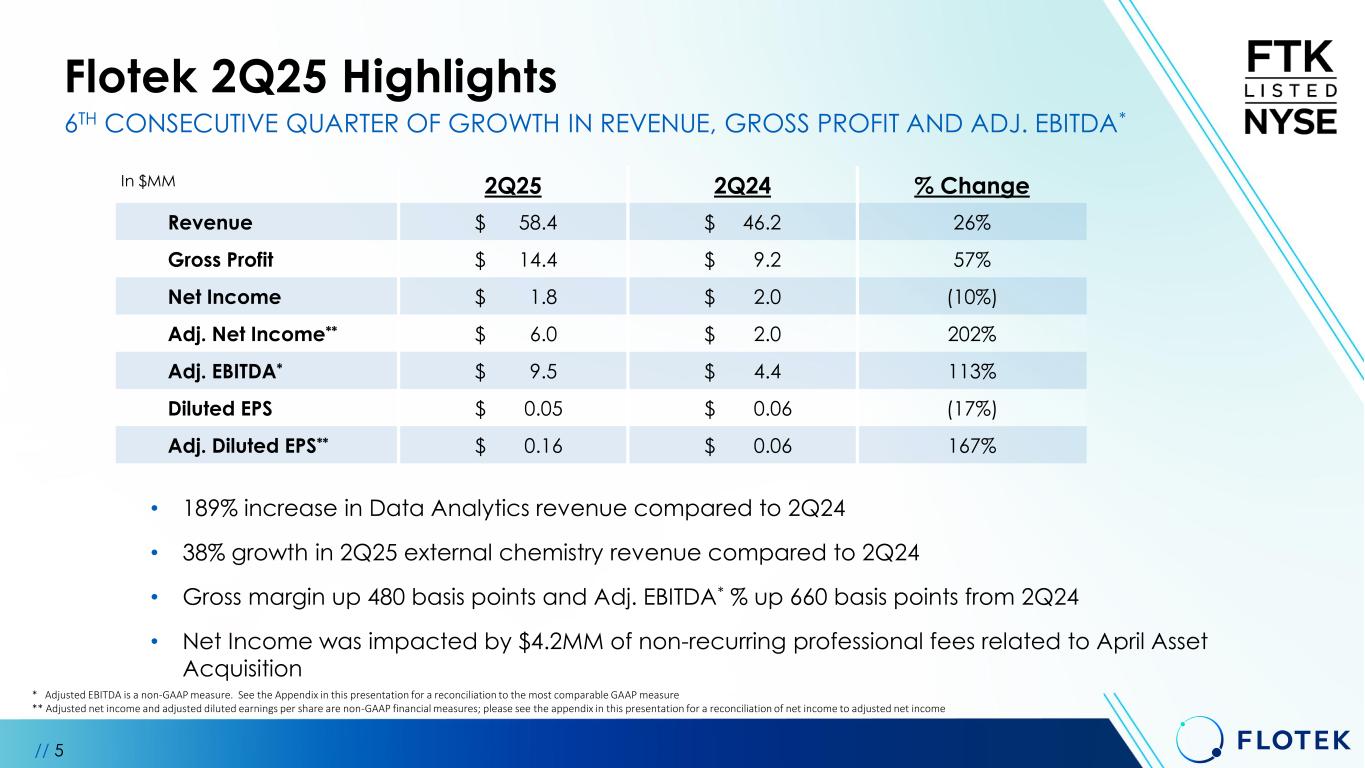

• 189% increase in Data Analytics revenue compared to 2Q24 • 38% growth in 2Q25 external chemistry revenue compared to 2Q24 • Gross margin up 480 basis points and Adj. EBITDA* % up 660 basis points from 2Q24 • Net Income was impacted by $4.2MM of non-recurring professional fees related to April Asset Acquisition Flotek 2Q25 Highlights // 5 6TH CONSECUTIVE QUARTER OF GROWTH IN REVENUE, GROSS PROFIT AND ADJ. EBITDA* * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure ** Adjusted net income and adjusted diluted earnings per share are non-GAAP financial measures; please see the appendix in this presentation for a reconciliation of net income to adjusted net income In $MM 2Q25 2Q24 % Change Revenue $ 58.4 $ 46.2 26% Gross Profit $ 14.4 $ 9.2 57% Net Income $ 1.8 $ 2.0 (10%) Adj. Net Income** $ 6.0 $ 2.0 202% Adj. EBITDA* $ 9.5 $ 4.4 113% Diluted EPS $ 0.05 $ 0.06 (17%) Adj. Diluted EPS** $ 0.16 $ 0.06 167%

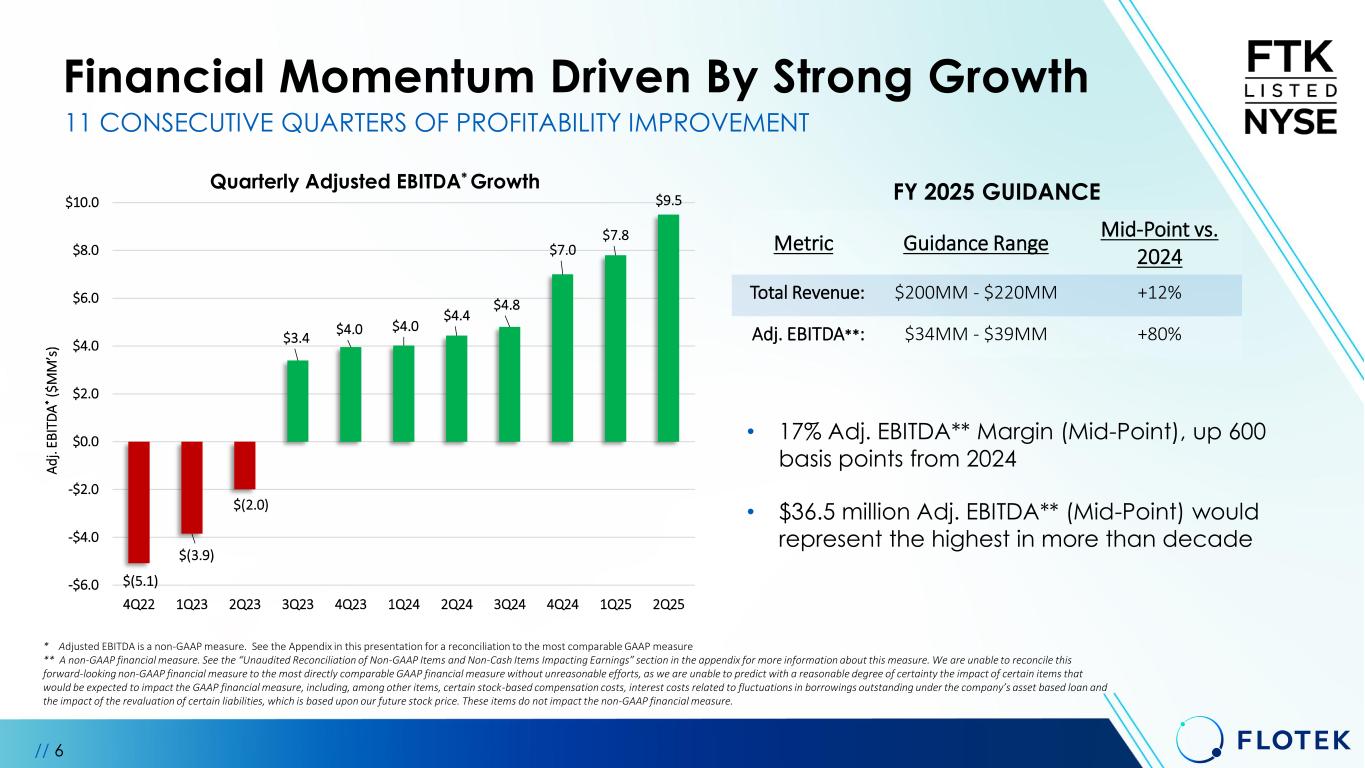

Financial Momentum Driven By Strong Growth // 6 Quarterly Adjusted EBITDA* Growth * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure ** A non-GAAP financial measure. See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in the appendix for more information about this measure. We are unable to reconcile this forward-looking non-GAAP financial measure to the most directly comparable GAAP financial measure without unreasonable efforts, as we are unable to predict with a reasonable degree of certainty the impact of certain items that would be expected to impact the GAAP financial measure, including, among other items, certain stock-based compensation costs, interest costs related to fluctuations in borrowings outstanding under the company’s asset based loan and the impact of the revaluation of certain liabilities, which is based upon our future stock price. These items do not impact the non-GAAP financial measure. $(5.1) $(3.9) $(2.0) $3.4 $4.0 $4.0 $4.4 $4.8 $7.0 $7.8 $9.5 -$6.0 -$4.0 -$2.0 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 A d j. EB IT D A * ($ M M ’s ) 11 CONSECUTIVE QUARTERS OF PROFITABILITY IMPROVEMENT FY 2025 GUIDANCE Metric Guidance Range Mid-Point vs. 2024 Total Revenue: $200MM - $220MM +12% Adj. EBITDA**: $34MM - $39MM +80% • 17% Adj. EBITDA** Margin (Mid-Point), up 600 basis points from 2024 • $36.5 million Adj. EBITDA** (Mid-Point) would represent the highest in more than decade

THE CONVERGENCE OF DATA AND CHEMISTRY SOLUTIONS COMPLETION CHEMISTRY FRAC POWER GENERATION TRANSMIX MONITORING TREATMENT/STABILIZATION FLARE MONITORING DATA CENTER POWER GRID POWER TERMINAL & STORAGE MONITORING LNG TERMINALING AND EXPORTATION WATER TREATMENT ACID TREATMENT CEMENTING ADDITIVES ADDRESSABLE MARKET GROWTH 2021: $2.6B 2025: ~$15B+ * // 7 Innovation & Strategy Drive Market Growth * Estimated based upon data provided by Enverus, Spears OMR, IEA, Technvio, and DEP

Data Analytics: “Measure More Strategy” Upstream • Power Services: facilitate field gas utilization in powering mobile turbines and dual-fuel fleets • Custody Transfer: improves accuracy of payments to royalty owners and operators • Flare Monitoring: comply with EPA regulations and commercial non- regulatory applications Midstream • Gas/Oil processing plant control and optimization • TransMix Pipeline batch detection to optimize pipeline transfer processes • Vapor Pressure Monitoring controls to achieve product specifications Downstream • Process Controls: to optimize distillation tower efficiency • Chemical Quality Measurements in pipelines and terminals • Carbon Capture measurement for carbon credits and reporting UTILIZING TECHNOLOGIES FOR EXPANSION INTO NEW MARKETS // 8 Growth

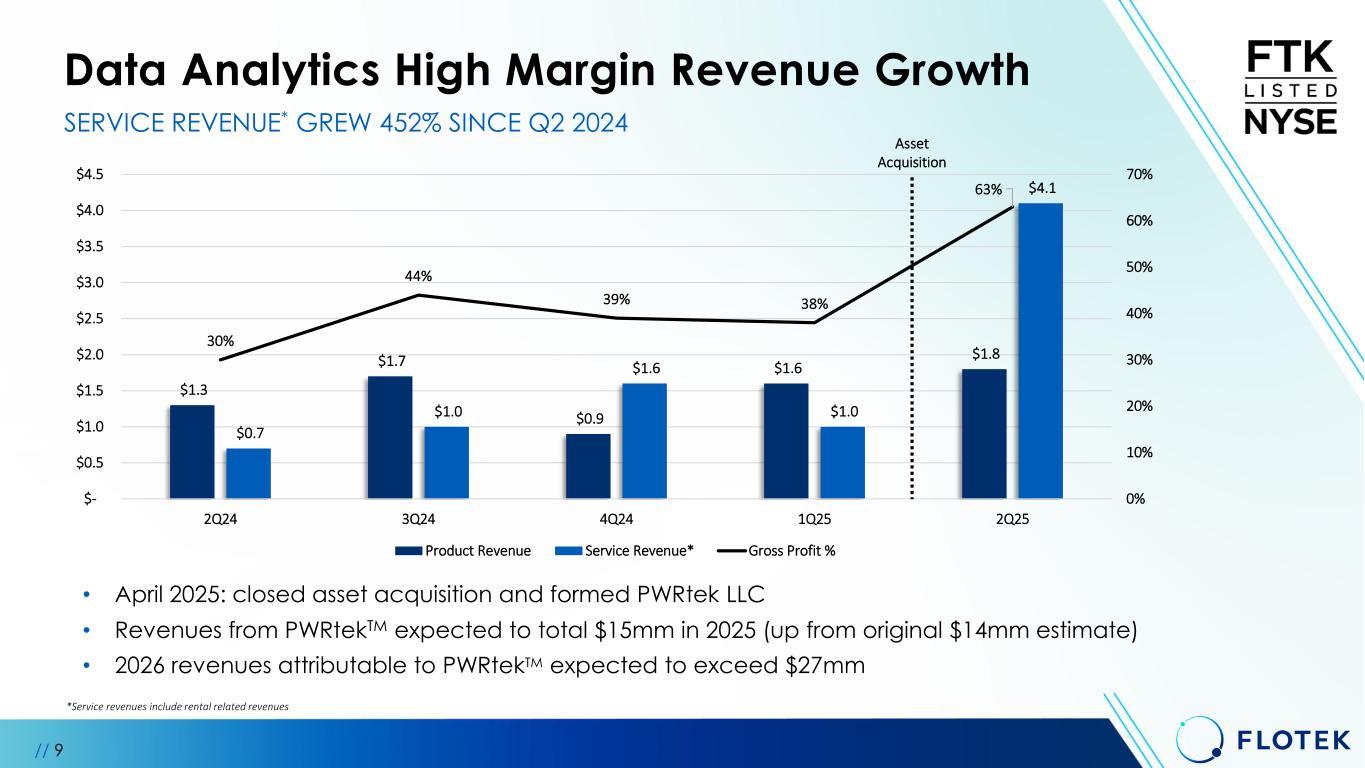

SERVICE REVENUE* GREW 452% SINCE Q2 2024 Data Analytics High Margin Revenue Growth • April 2025: closed asset acquisition and formed PWRtek LLC • Revenues from PWRtekTM expected to total $15mm in 2025 (up from original $14mm estimate) • 2026 revenues attributable to PWRtekTM expected to exceed $27mm Asset Acquisition // 9 $1.3 $1.7 $0.9 $1.6 $1.8 $0.7 $1.0 $1.6 $1.0 $4.1 30% 44% 39% 38% 63% 0% 10% 20% 30% 40% 50% 60% 70% $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 2Q24 3Q24 4Q24 1Q25 2Q25 Product Revenue Service Revenue* Gross Profit % *Service revenues include rental related revenues

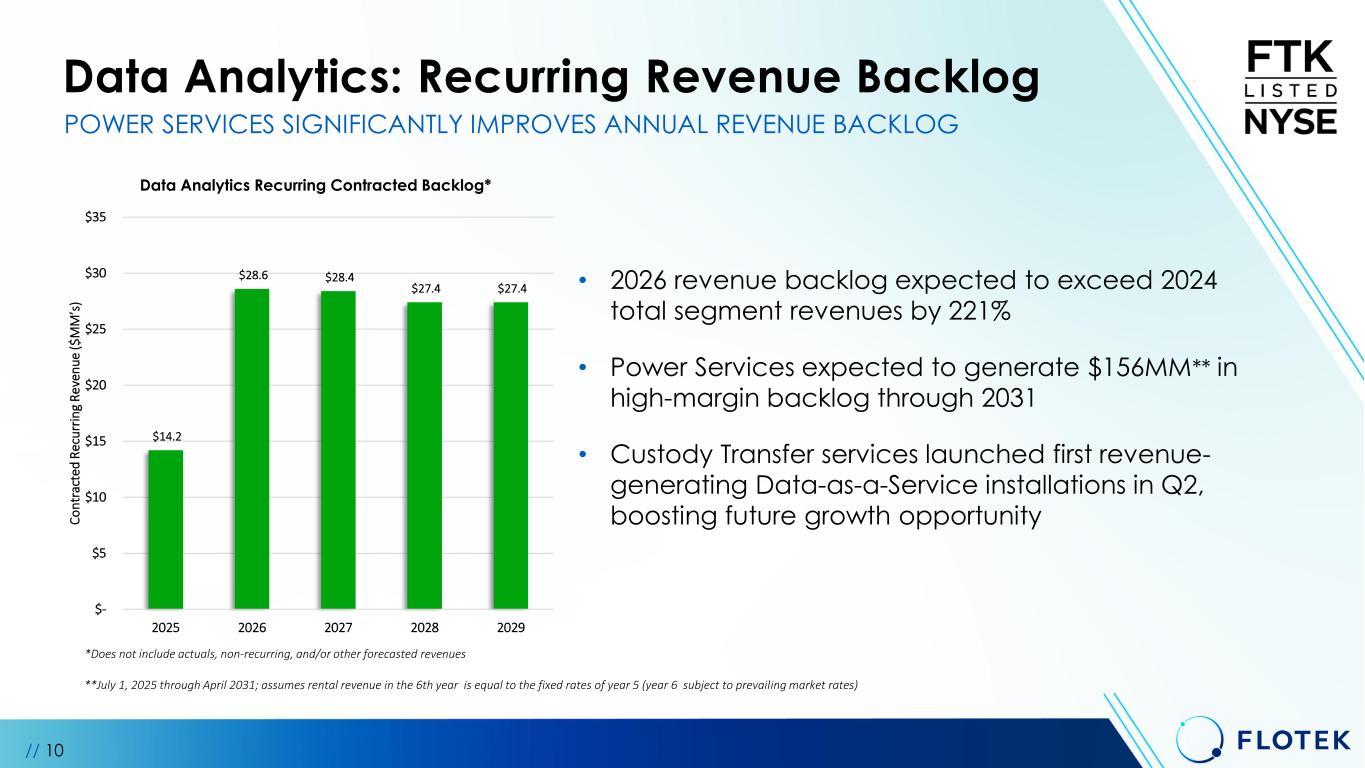

Data Analytics: Recurring Revenue Backlog // 10 • 2026 revenue backlog expected to exceed 2024 total segment revenues by 221% • Power Services expected to generate $156MM** in high-margin backlog through 2031 • Custody Transfer services launched first revenue- generating Data-as-a-Service installations in Q2, boosting future growth opportunity POWER SERVICES SIGNIFICANTLY IMPROVES ANNUAL REVENUE BACKLOG $14.2 $28.6 $28.4 $27.4 $27.4 $- $5 $10 $15 $20 $25 $30 $35 2025 2026 2027 2028 2029 C o n tr ac te d R ec u rr in g R e ve n u e ($ M M ’s ) Data Analytics Recurring Contracted Backlog* *Does not include actuals, non-recurring, and/or other forecasted revenues **July 1, 2025 through April 2031; assumes rental revenue in the 6th year is equal to the fixed rates of year 5 (year 6 subject to prevailing market rates)

Data Analytics: Power Services Update // 11 • In April 2025 acquired 30 real-time gas monitoring and conditioning assets with 24 active at the end of June • Secured a 6-year agreement with an estimated $156MM* in recurring revenue backlog • 54% of total DA revenue at ~90% margin in 2Q25 • In July we commissioned 2 additional PWRtekTM assets • Took delivery of newly developed Smart Filtration Skid focused on high-margin third-party market growth PWRTEK’S PATENTED TECHNOLOGY ENABLES SCALABLE, GRID-FREE ENERGY Newly Developed Smart Filtration Skid PWRtek Digital Interface and Controls *July 1, 2025 through April 2031; assumes rental revenue in the 6th year is equal to the fixed rates of year 5 (year 6 subject to prevailing market rates)

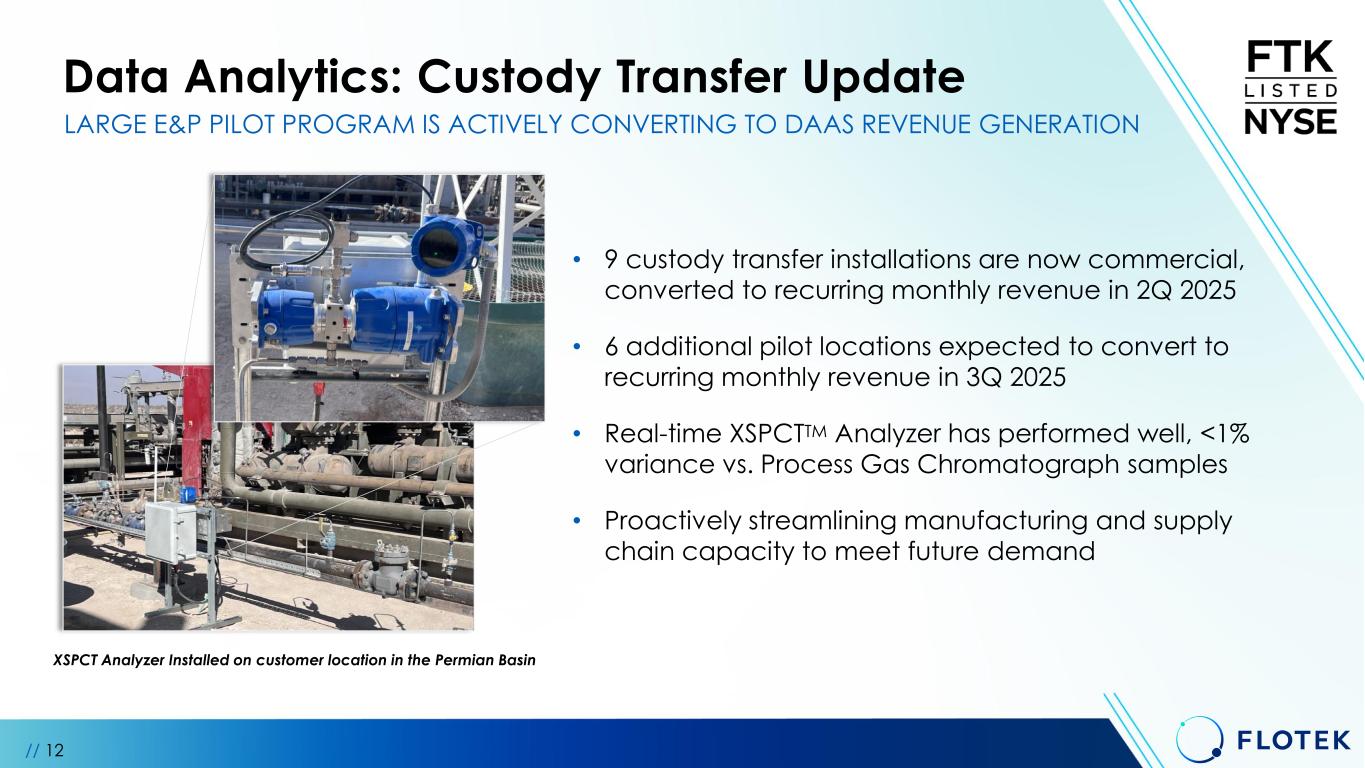

Data Analytics: Custody Transfer Update // 12 • 9 custody transfer installations are now commercial, converted to recurring monthly revenue in 2Q 2025 • 6 additional pilot locations expected to convert to recurring monthly revenue in 3Q 2025 • Real-time XSPCTTM Analyzer has performed well, <1% variance vs. Process Gas Chromatograph samples • Proactively streamlining manufacturing and supply chain capacity to meet future demand LARGE E&P PILOT PROGRAM IS ACTIVELY CONVERTING TO DAAS REVENUE GENERATION XSPCT Analyzer Installed on customer location in the Permian Basin

// 13 • Prescriptive Chemistry Management (PCM)TM • Proprietary energy chemistry solutions • Experienced chemistry energy team • Customized solutions to each well’s geology • AI Driven Analytics from >20,000 wells • Real-Time Field Data to Enhance Performance • Field Correlated Diagnostics • +130 Patents * Data derived from 2019-2023 Enverus Prism Platform (1,878 Permian wells) DELIVERING THE BEST WELL PERFORMANCE IN INDUSTRY 26% INCREASE IN PRODUCTION* PERFORMANCE VERSUS COMPETITION Chemistry Technologies: Competitive Advantage

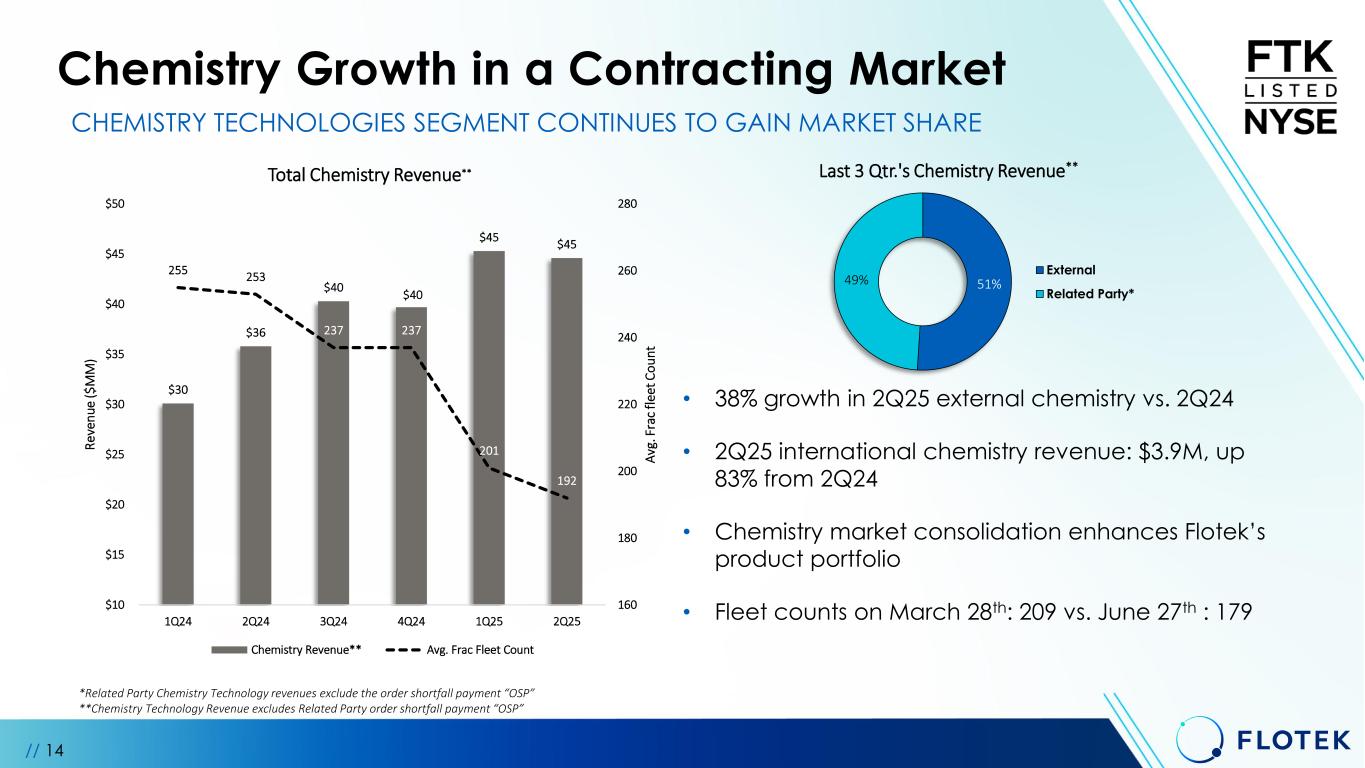

Chemistry Growth in a Contracting Market // 14 • 38% growth in 2Q25 external chemistry vs. 2Q24 • 2Q25 international chemistry revenue: $3.9M, up 83% from 2Q24 • Chemistry market consolidation enhances Flotek’s product portfolio • Fleet counts on March 28th: 209 vs. June 27th : 179 CHEMISTRY TECHNOLOGIES SEGMENT CONTINUES TO GAIN MARKET SHARE *Related Party Chemistry Technology revenues exclude the order shortfall payment “OSP” **Chemistry Technology Revenue excludes Related Party order shortfall payment “OSP” 51%49% Last 3 Qtr.'s Chemistry Revenue** External Related Party* $30 $36 $40 $40 $45 $45 255 253 237 237 201 192 160 180 200 220 240 260 280 $10 $15 $20 $25 $30 $35 $40 $45 $50 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 A vg . F ra c fl ee t C o u n t R e ve n u e ($ M M ) Total Chemistry Revenue** Chemistry Revenue** Avg. Frac Fleet Count

// 15 Flotek Industries 2Q25 Summary CHEMISTRY AS THE COMMON VALUE CREATION PLATFORM * Adjusted EBITDA is a non-GAAP measure. See the Appendix in this presentation for a reconciliation to the most comparable GAAP measure ✓ Data Analytics grew YoY Revenue 189% and Gross Margin 110% ✓ Custody Transfer Pilot has begun converting to revenue ✓ Power services revenue carried ~90% Gross Margin ✓ External Chemistry Technologies grew YOY Revenue 38% in a slowing Oilfield market ✓ 6th consecutive quarter of improved revenue and gross profit ✓ 11th consecutive quarter of improved Adj. EBITDA* ✓ Proven safety culture and track record

// 16 Enercom: The Energy Investment Conference August 17-20th 2025 The Westin Denver, CO The Gateway Conference September 3-4th 2025 Four Seasons Hotel San Francisco, CA Permian Power Connection Conference September 29-30th 2025 Horseshoe Arena Midland, TX NYSE Technology Summit October 14th, 2025 NY Stock Exchange New York City, NY Investor Contact: Mike Critelli Director of Finance & Investor Relations ir@flotekind.com Upcoming 2025 Events SIGN UP NOW & COME JOIN US

Appendix

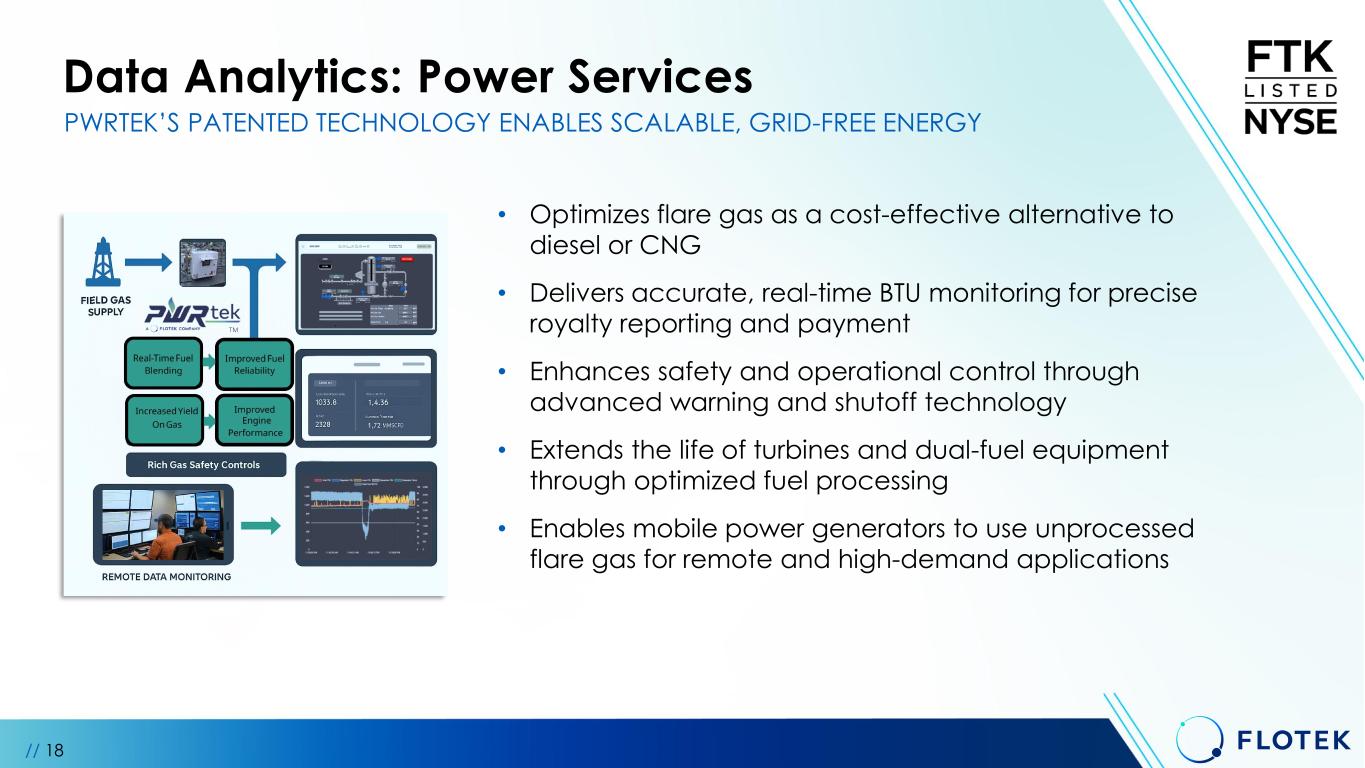

Data Analytics: Power Services // 18 • Optimizes flare gas as a cost-effective alternative to diesel or CNG • Delivers accurate, real-time BTU monitoring for precise royalty reporting and payment • Enhances safety and operational control through advanced warning and shutoff technology • Extends the life of turbines and dual-fuel equipment through optimized fuel processing • Enables mobile power generators to use unprocessed flare gas for remote and high-demand applications PWRTEK’S PATENTED TECHNOLOGY ENABLES SCALABLE, GRID-FREE ENERGY TM

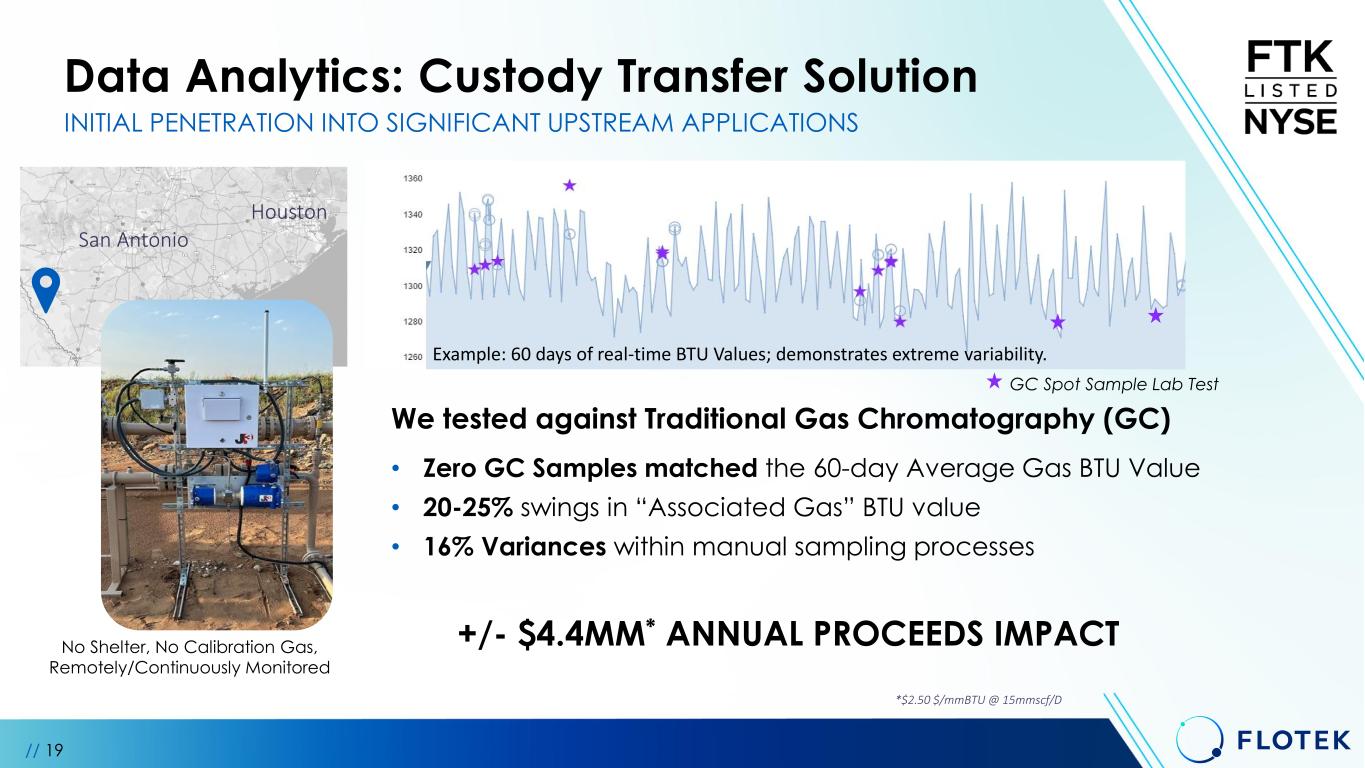

We tested against Traditional Gas Chromatography (GC) • Zero GC Samples matched the 60-day Average Gas BTU Value • 20-25% swings in “Associated Gas” BTU value • 16% Variances within manual sampling processes Data Analytics: Custody Transfer Solution // 19 INITIAL PENETRATION INTO SIGNIFICANT UPSTREAM APPLICATIONS No Shelter, No Calibration Gas, Remotely/Continuously Monitored San Antonio Houston Example: 60 days of real-time BTU Values; demonstrates extreme variability. GC Spot Sample Lab Test +/- $4.4MM* ANNUAL PROCEEDS IMPACT *$2.50 $/mmBTU @ 15mmscf/D

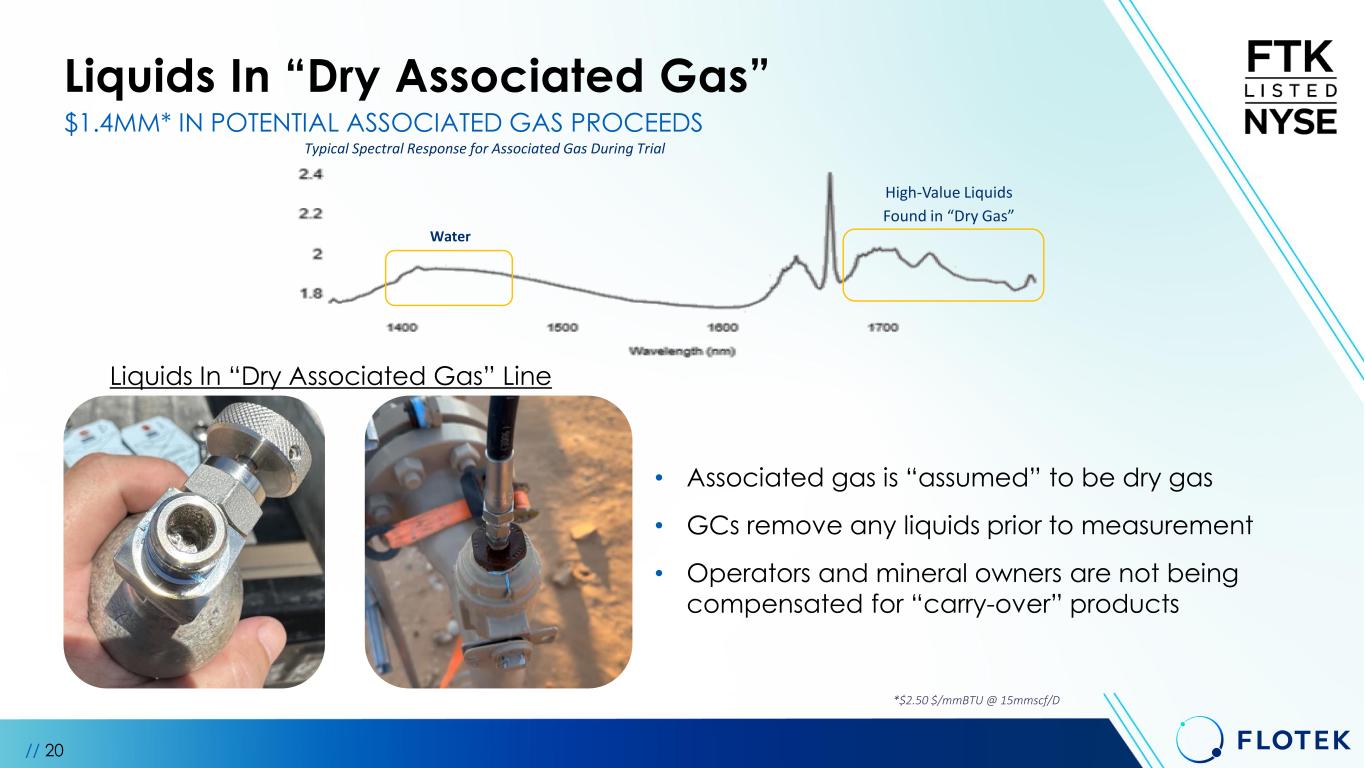

Liquids In “Dry Associated Gas” // 20 $1.4MM* IN POTENTIAL ASSOCIATED GAS PROCEEDS High-Value Liquids Found in “Dry Gas” Typical Spectral Response for Associated Gas During Trial Water • Associated gas is “assumed” to be dry gas • GCs remove any liquids prior to measurement • Operators and mineral owners are not being compensated for “carry-over” products Liquids In “Dry Associated Gas” Line *$2.50 $/mmBTU @ 15mmscf/D

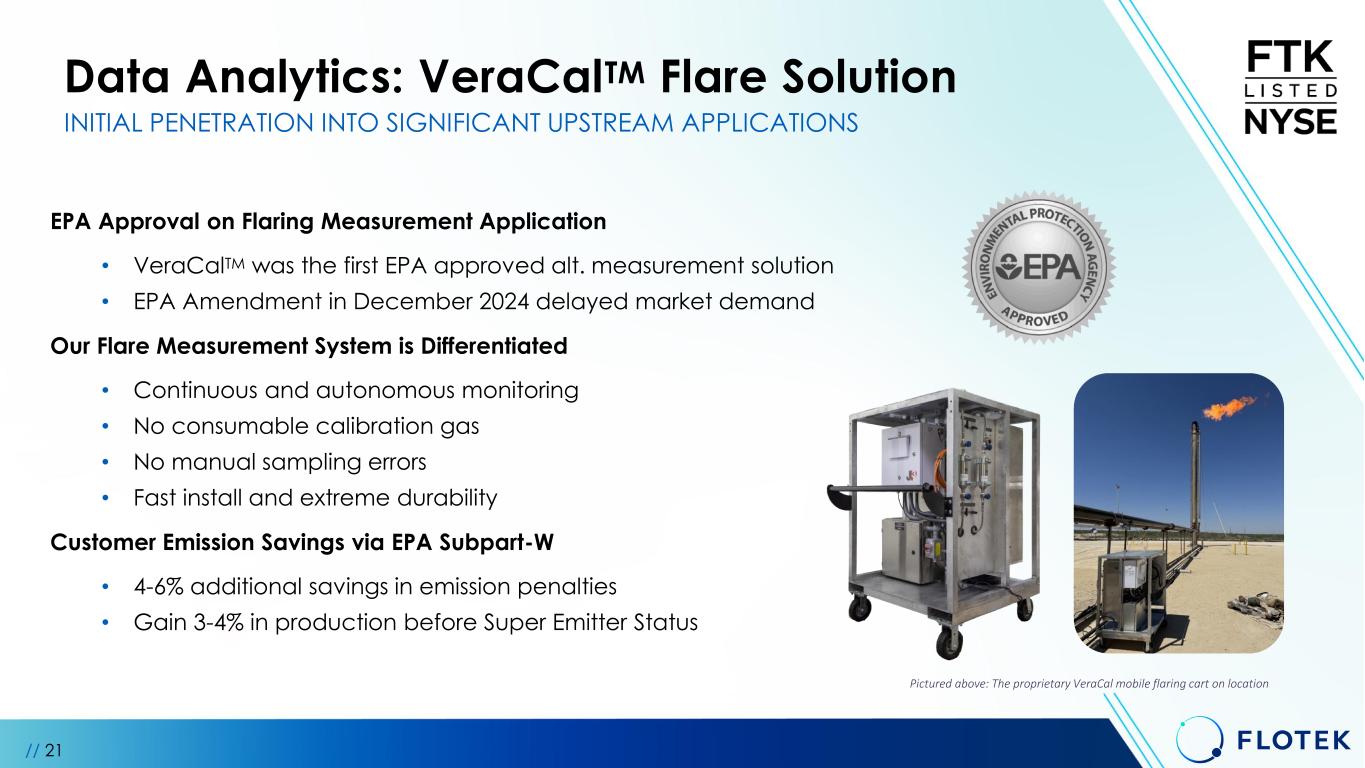

Data Analytics: VeraCalTM Flare Solution // 21 INITIAL PENETRATION INTO SIGNIFICANT UPSTREAM APPLICATIONS Pictured above: The proprietary VeraCal mobile flaring cart on location EPA Approval on Flaring Measurement Application • VeraCalTM was the first EPA approved alt. measurement solution • EPA Amendment in December 2024 delayed market demand Our Flare Measurement System is Differentiated • Continuous and autonomous monitoring • No consumable calibration gas • No manual sampling errors • Fast install and extreme durability Customer Emission Savings via EPA Subpart-W • 4-6% additional savings in emission penalties • Gain 3-4% in production before Super Emitter Status

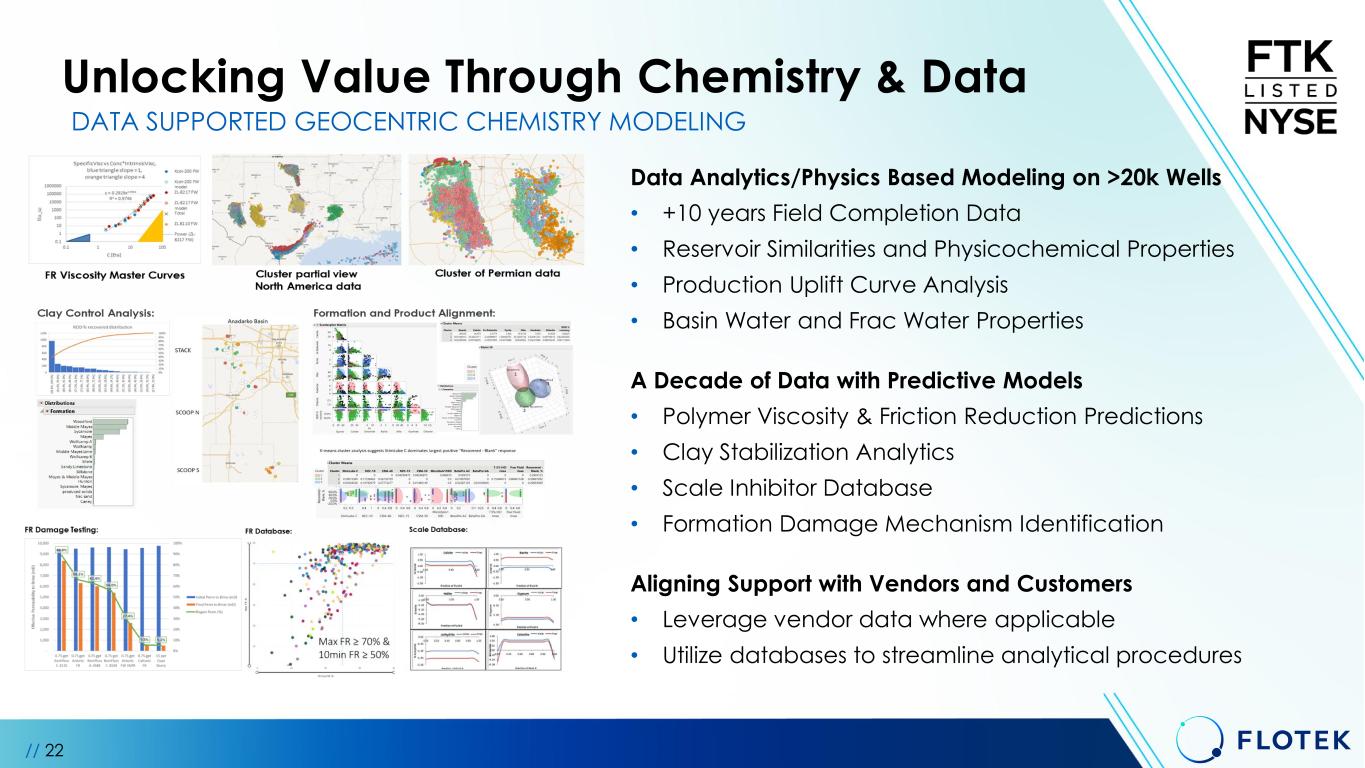

Unlocking Value Through Chemistry & Data Data Analytics/Physics Based Modeling on >20k Wells • +10 years Field Completion Data • Reservoir Similarities and Physicochemical Properties • Production Uplift Curve Analysis • Basin Water and Frac Water Properties A Decade of Data with Predictive Models • Polymer Viscosity & Friction Reduction Predictions • Clay Stabilization Analytics • Scale Inhibitor Database • Formation Damage Mechanism Identification Aligning Support with Vendors and Customers • Leverage vendor data where applicable • Utilize databases to streamline analytical procedures DATA SUPPORTED GEOCENTRIC CHEMISTRY MODELING // 22

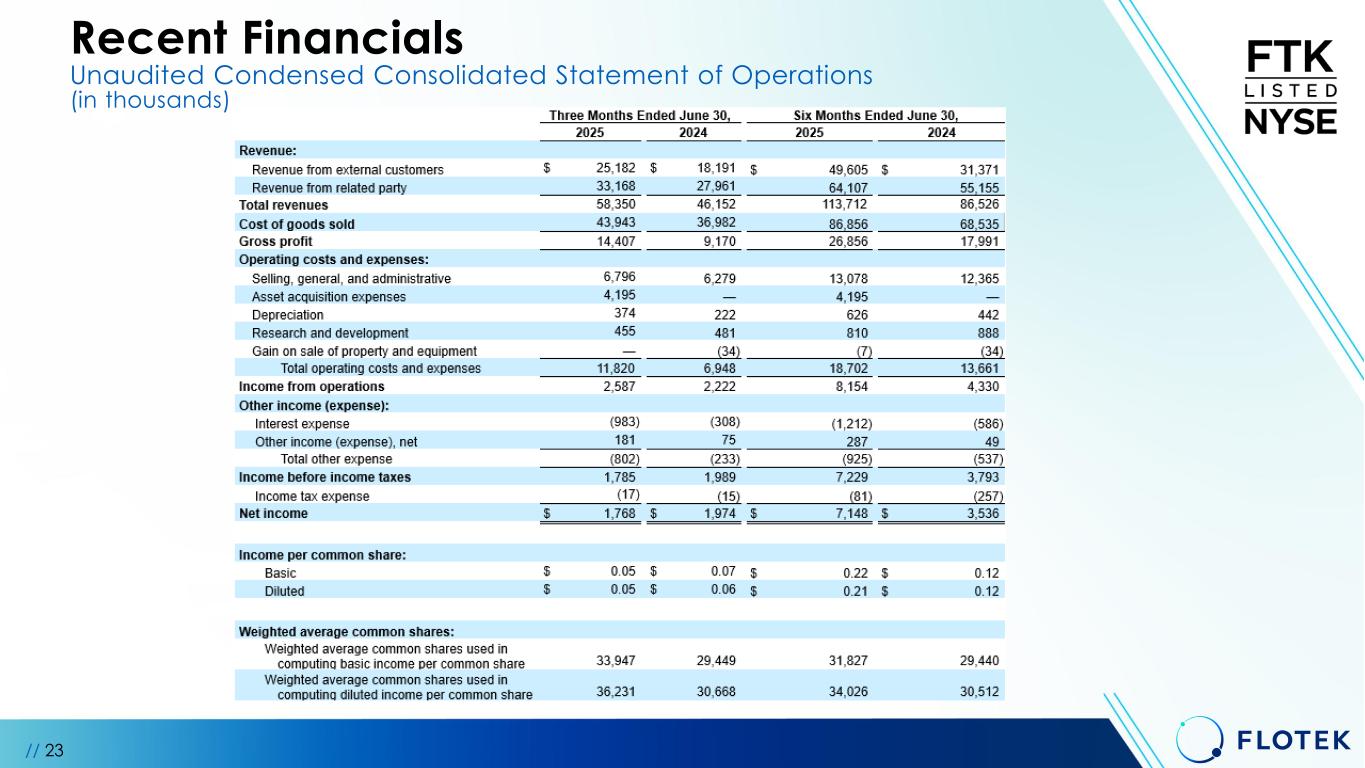

Recent Financials Unaudited Condensed Consolidated Statement of Operations (in thousands) // 23

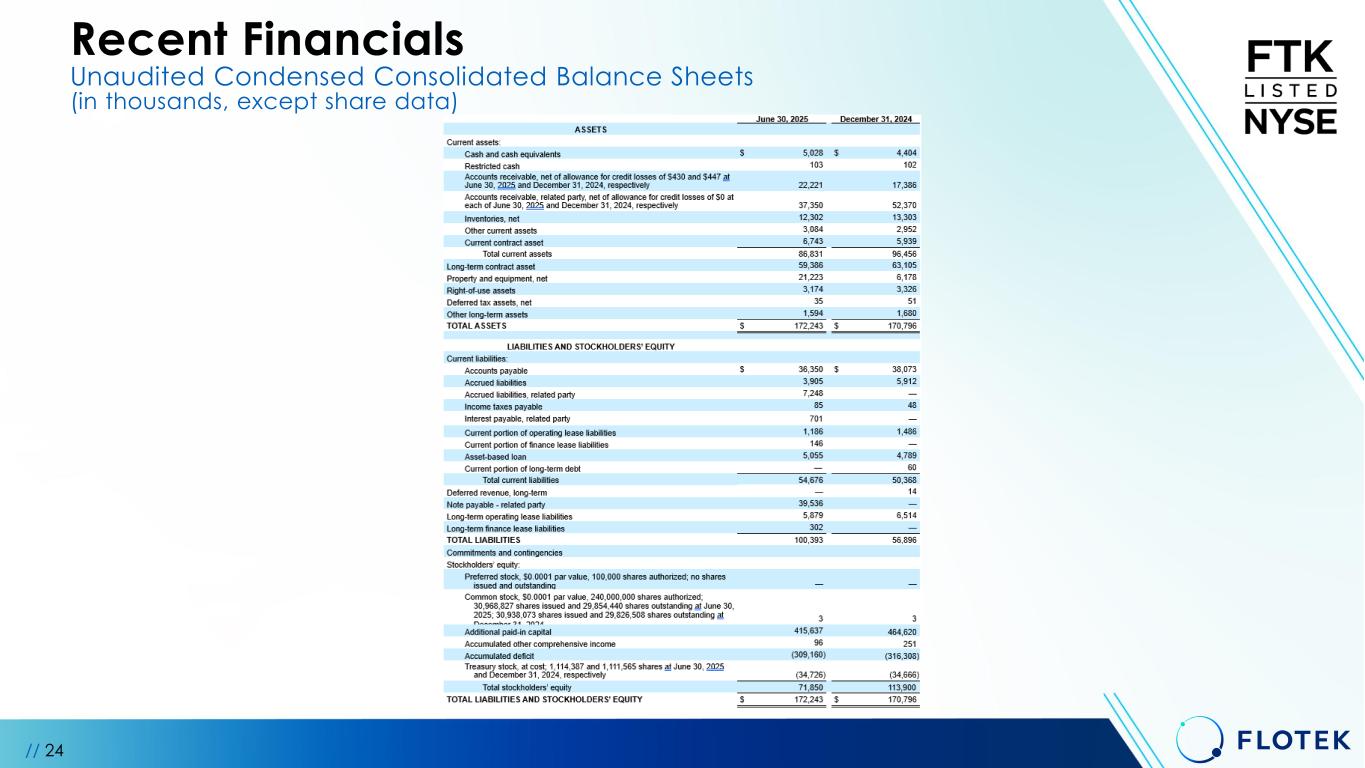

// 24 Recent Financials Unaudited Condensed Consolidated Balance Sheets (in thousands, except share data)

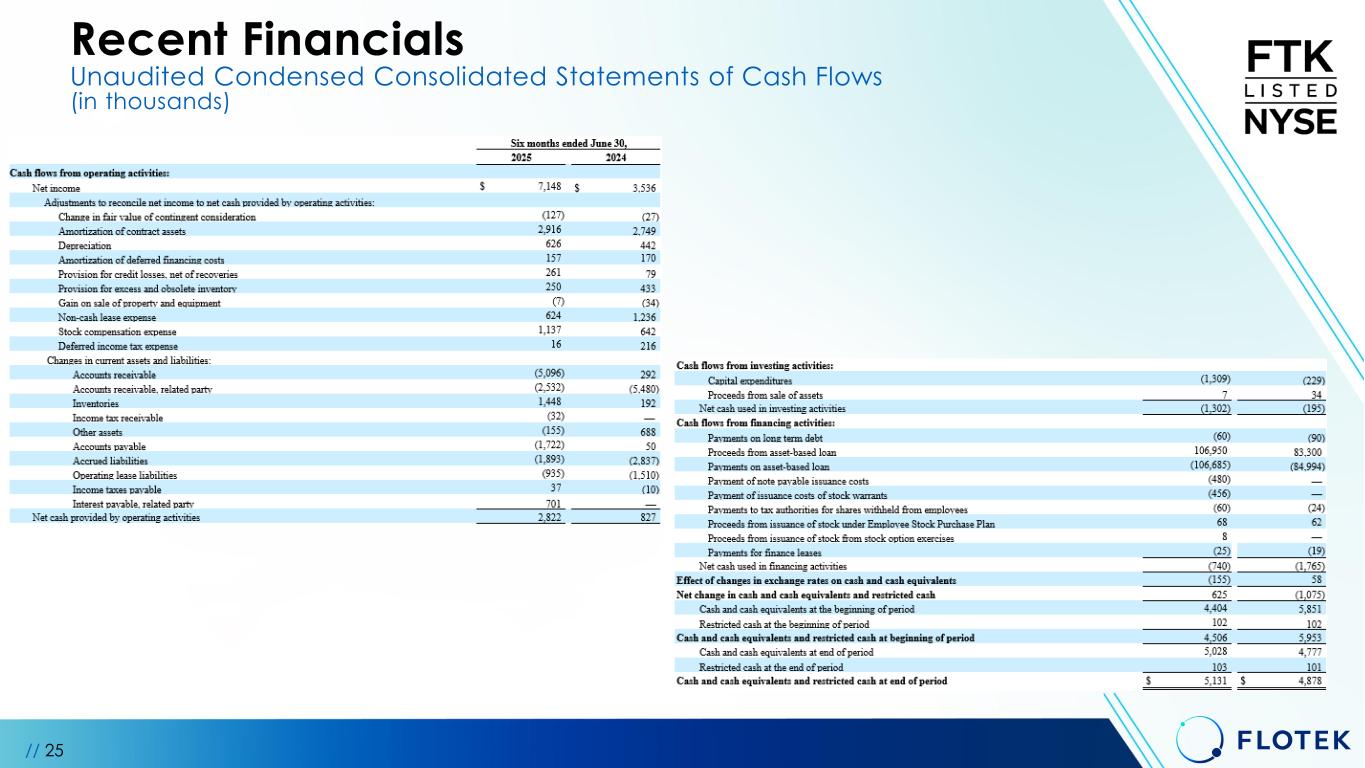

// 25 Recent Financials Unaudited Condensed Consolidated Statements of Cash Flows (in thousands)

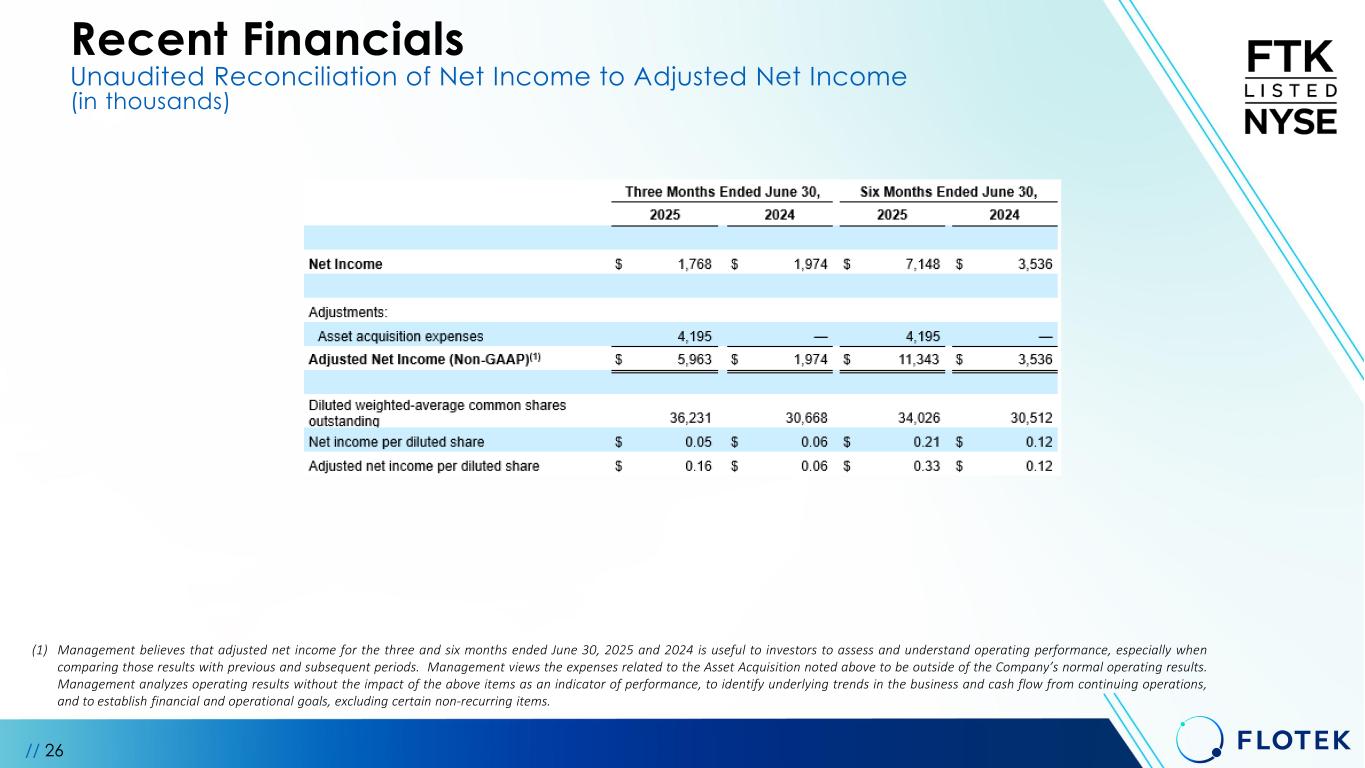

// 26 Recent Financials Unaudited Reconciliation of Net Income to Adjusted Net Income (in thousands) (1) Management believes that adjusted net income for the three and six months ended June 30, 2025 and 2024 is useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the expenses related to the Asset Acquisition noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-recurring items.

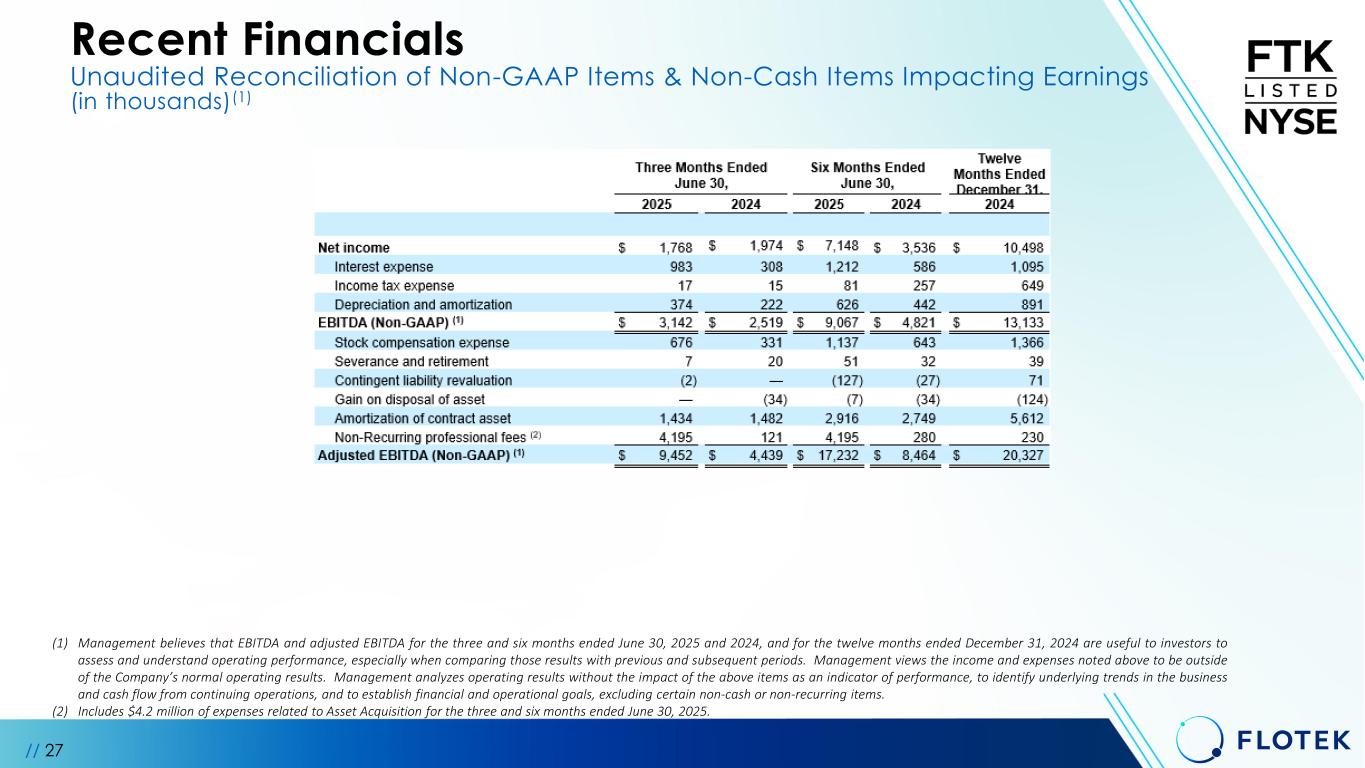

// 27 (1) Management believes that EBITDA and adjusted EBITDA for the three and six months ended June 30, 2025 and 2024, and for the twelve months ended December 31, 2024 are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items. (2) Includes $4.2 million of expenses related to Asset Acquisition for the three and six months ended June 30, 2025. Recent Financials Unaudited Reconciliation of Non-GAAP Items & Non-Cash Items Impacting Earnings (in thousands)(1)