Exhibit 15.2

| Annual Report and Financial Statements 2018 |

Exhibit 15.2

| Annual Report and Financial Statements 2018 |

RELX is a global provider of information-based

analytics and decision tools for professional and

business customers.

We help scientists make new discoveries, doctors and

nurses improve the lives of patients and lawyers win

cases. We prevent online fraud and money laundering,

and help insurance companies evaluate and predict risk.

Our events enable customers to learn about markets,

source products and complete transactions.

In short, we enable our customers to make better

decisions, get better results and be more productive.

Forward-looking statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to risks and uncertainties that could cause actual results or outcomes of RELX PLC (together with its subsidiaries, “RELX”, “we” or “our”) to differ materially from those expressed in any forward-looking statement. The terms “outlook”, “estimate”, “project”, “plan”, “intend”, “expect”, “should”, “will”, “believe”, “trends” and similar expressions may indicate a forward-looking statement. Important factors that could cause actual results or outcomes to differ materially from estimates or forecasts contained in the forward-looking statements include, among others, current and future economic, political and market forces; changes in law and legal interpretations affecting RELX intellectual property rights and internet communications; regulatory and other changes regarding the collection, transfer or use of third-party content and data; demand for RELX products and services; competitive factors in the industries in which RELX operates; ability to realise the future anticipated benefits of acquisitions; significant failure or interruption of our systems; compromises of our data security systems or other unauthorised access to our databases; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC with the US Securities and Exchange Commission.

| RELX Annual report and financial statements 2018 | 1 | |

|

| ||

| 2 | RELX Annual report and financial statements 2018 | Overview | |

|

| ||

| ◾ | Underlying revenue growth of 4% |

| ◾ | Underlying adjusted operating profit growth of 6% |

| ◾ | Reported operating profit £1,964m (£1,905m) |

| ◾ | Adjusted EPS growth at constant currency up 7%; in sterling up 6% to 84.7p |

| ◾ | Reported EPS 71.9p (81.6p) |

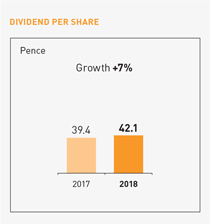

| ◾ | Full-year dividend up 7% to 42.1p |

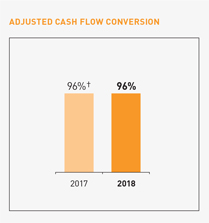

| ◾ | Strong financial position and cash flow; cash flow conversion at 96% |

RELX

|

|

| ||

|

|

|

RELX PLC and its subsidiaries, joint ventures and associates are together known as “RELX”

† 2017 restated for adoption of new accounting standards IFRS 9, IFRS 15 and IFRS 16. See note 1 on page 126 for further details.

RELX uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. In 2018 and 2017, we also excluded exceptional tax credits, see note 9 on page 138. Reconciliations between the reported and adjusted figures are set out on page 176. Underlying growth rates are calculated at constant currencies, excluding the results of acquisitions until twelve months after purchase, and excluding the results of disposals and assets held for sale. Underlying revenue growth rates also exclude exhibition cycling. Constant currency growth rates are based on 2017 full-year average and hedge exchange rates.

| RELX Annual report and financial statements 2018 | 3 | |

|

| ||

| RELX Annual report and financial statements 2018 | Chief Executive Officer’s report | 5 | |

|

| ||

| 6 | RELX Annual report and financial statements 2018 | Overview | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2018 | 7 | |

|

| ||

|

review | ||

| In this section | ||

| 8 | RELX business overview | |

| 14 | Scientific, Technical & Medical | |

| 20 | Risk & Business Analytics | |

| 28 | Legal | |

| 34 | Exhibitions | |

| 41 | Corporate Responsibility | |

| 8 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

RELX is a global provider of information-based analytics and decision tools for professional and business customers.

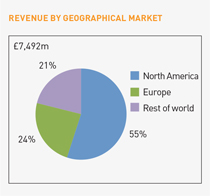

The Group serves customers in more than 180 countries and has offices in about 40 countries. It employs over 30,000 people, of whom almost half are in North America.

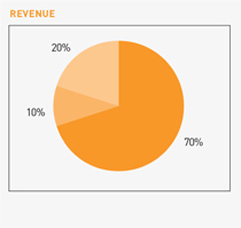

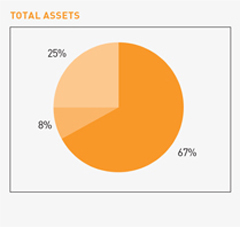

RELX financial summary

| REPORTED FIGURES | Change at | |||||||||||||||||||

| 2018 | 2017 | † | constant | Change | ||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

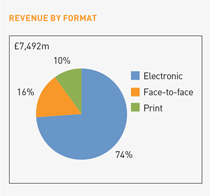

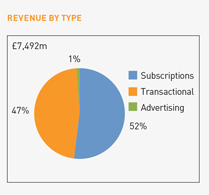

| Revenue |

7,492 | 7,341 | +2% | +4% | +4% | |||||||||||||||

| Operating profit |

1,964 | 1,905 | +3% | |||||||||||||||||

| Profit before tax |

1,720 | 1,721 | 0% | |||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,422 | 1,648 | -14% | |||||||||||||||||

| Net margin |

19.0% | 22.4% | ||||||||||||||||||

| Net borrowings |

6,177 | 5,042 | ||||||||||||||||||

| Reported earnings per share |

71.9p | 81.6p | -12% | |||||||||||||||||

| Ordinary dividend per RELX PLC share |

42.1p | 39.4p | +7% | |||||||||||||||||

| ADJUSTED FIGURES | Change at | |||||||||||||||||||

| 2018 | 2017 | † | constant | Change | ||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

| Operating profit |

2,346 | 2,284 | +3% | +4% | +6% | |||||||||||||||

| Operating margin |

31.3% | 31.1% | ||||||||||||||||||

| Profit before tax |

2,145 | 2,101 | +2% | +3% | ||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,674 | 1,620 | +3% | +5% | ||||||||||||||||

| Net margin |

22.3% | 22.1% | ||||||||||||||||||

| Cash flow |

2,243 | 2,197 | +2% | |||||||||||||||||

| Cash flow conversion |

96% | 96% | ||||||||||||||||||

| Return on invested capital |

13.2% | 12.9% | ||||||||||||||||||

| Adjusted earnings per share |

84.7p | 80.2p | +6% | +7% | ||||||||||||||||

† 2017 numbers have been restated to reflect the adoption of new accounting standards. See note 1 on page 126 for further details.

The shares of RELX PLC are traded on the London, Amsterdam and New York stock exchanges. RELX PLC and its subsidiaries, joint ventures and associates are together known as ‘RELX’.

| RELX Annual report and financial statements 2018 | RELX business overview | 9 | |

|

| ||

| 10 RELX Annual report and financial statements 2018 | Business review |

||||||

|

|

||||||

| Harnessing technology across RELX |

| Around 8,000 technologists, half of whom are software engineers, work at RELX. Annually, the company spends $1.4bn on technology. The combination of our rich data assets, technology infrastructure and knowledge of how to use next generation technologies, such as machine learning and natural language processing, allows us to create effective solutions for our customers. |

| Helping research chemists with Elsevier’s Reaxys

Reaxys enables the shortest path to chemistry research answers, supporting the early stages of drug development in the pharmaceutical industry, exploratory chemistry research in academia, and product development in industries such as chemicals and oil & gas.

The amount of chemical information published each year is increasing exponentially, making it more and more challenging for research chemists to quickly find targeted and actionable information to help support their research.

To help researchers stay on top of their field, Elsevier developed a new chemistry text mining engine, using state-of-the-art natural language processing that identified 4.9m key substances in 5.2m documents from more than 15,000 journal titles in 2018.

This significantly increased the content coverage and substance information searchable on Reaxys, addressing a key pain point in customer efforts to find the data they need for drug discovery. |

4.9m

key chemical substances identified using Elsevier’s natural language processing technology |

Providing comprehensive and relevant information as fast as possible is a critical challenge for our customers in a highly competitive environment. Elsevier’s sophisticated automatic processing methods have helped make Reaxys, where this information is contained, an indispensable tool for chemical research.

Dr Juergen Swienty-Busch

Director of Product Management, Chemistry Solutions, Elsevier |

|

| RELX Annual report and financial statements 2018 | RELX business overview 11 |

||||||

|

|

||||||

|

|

Making legal research faster and more intuitive with Lexis Answers

Every year, an immense volume of legal data is generated, adding to the existing collection of more than 16m case law legal decisions and 91m statutes, regulations, constitutions and legislative documents in the US alone. As the amount of electronic data increases, legal research, analysis and discovery has become increasingly challenging and time-consuming.

Traditional legal database searches require legal researchers to make their query using precise key words or phrases. This can often produce multiple responses which may not give the specific answer needed.

As part of the Lexis Advance online legal research tool, LexisNexis developed the Lexis Answers service which allows users to enter their query in the form of a natural language question. Using machine learning, cognitive computing and advanced natural language processing technologies, Lexis Answers anticipates a user’s research path, curating and delivering relevant answers based on their question type. The result is faster answers in fewer searches. |

44%

time saved per research query using Lexis Answers |

Lexis Answers is one of several features within Lexis Advance that brings the power of artificial intelligence and machine learning to our customers – ultimately improving their research efficiency, enhancing their legal workflow and transforming legal research.

Jeff Pfeifer Vice President of Product Management, LexisNexis

|

|

RELX data centre

| 12 RELX Annual report and financial statements 2018 | Business review |

||||||

|

|

||||||

| RELX Annual report and financial statements 2018 | 13 | |

|

| ||

|

segments | ||

| In this section | ||

| 14 | Scientific, Technical & Medical | |

| 20 | Risk & Business Analytics | |

| 28 | Legal | |

| 34 | Exhibitions | |

| RELX Annual report and financial statements 2018 | Scientific, Technical & Medical | 15 | |

|

| ||

| 16 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2018 | Scientific, Technical & Medical | 17 | |

|

| ||

| 18 RELX Annual report and financial statements 2018 | Business review |

||||||

|

|

||||||

Via Oncology

| helping The Center for Cancer and Blood Disorders improve patient treatment |

| The Center for Cancer and Blood Disorders in Fort Worth, Texas, treats more than 6,000 new cancer patients annually. That equates to more than 300,000 patient visits every year. It has over 25 specialist oncologists and 150 healthcare professionals across nine locations throughout North Texas. |

|

Elsevier’s Via Oncology partnered with The Center over ten years ago after oncologists at the clinic identified a need to ensure that patients experience consistent, standardised treatment across their many locations and oncologists.

Via Oncology’s sophisticated online clinical pathway system, Via Pathways, is an advanced clinical decision support system that provides points of care recommendations for diagnostics and treatment. By using Via Pathways, oncologists can follow evidence-based care maps based upon the most current medical evidence and reduce unwarranted care variability. |

Oncologists also are presented with all locally available clinical trials prior to starting a treatment pathway for new patients, ensuring they are presented with all options for treatment.

Since implementing Via Pathways, The Center’s oncologists can review more data on their patients’ outcomes, demonstrating that the care they deliver is consistent across their network. For example, The Center’s capture rate, which measures how consistently doctors use Via Pathways and tracks all patient visits, has reached 89% across 34 disease pathways representing over 95% of cancer types.

The Center considers Via Oncology to be at the crux of its value-based care initiatives, enabling participation in studies of new care models. |

25% clinical trials participation rate for lung cancer patients as a result of using Via Pathways, more than five times higher than the national average |

| RELX Annual report and financial statements 2018 | Scientific, Technical & Medical | 19 | |

| About Via Oncology

Part of Elsevier, Via Oncology is a Pittsburgh, Pennsylvania-based business that provides decision support and best practices in cancer care management.

It helps cancer centres demonstrate the value of their care to patients, doctors and payers by developing and implementing clinical pathways in collaboration with its network of more than 1,500 US cancer care providers. Via Oncology’s evidence-based proprietary content, Via Pathways, is developed by leading oncologists and forms the basis of clinical algorithms covering 95% of cancer types treated in the US. This content is deployed to doctors and their staff at the point of care through the Via Portal, a patient-specific decision support tool that is integrated with electronic medical records and provides seamless measurements of adherence to treatment. |

Oncology doctor and nurse at The Center for Cancer and Blood Disorders | |||||

| Via Pathways is a great tool that we can use to standardize our therapies. We can show that physicians are being congruent with standards of care and are taking into account the effectiveness, toxicity and cost, and making appropriate treatment choices. That means we’re providing the highest standard of care to our patients.

Dr Ray Page, DO, PhD President of The Center for Cancer and Blood Disorders, Texas | ||||||

| RELX Annual report and financial statements 2018 | Risk & Business Analytics | 21 | |

|

| ||

| 22 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2018 | Risk & Business Analytics | 23 | |

|

| ||

| 24

|

RELX Annual report and financial statements 2018 | Business review

|

Cirium

managing the cost

of disrupted flights

Gant Travel Management is an innovative travel

management company based in Bloomington,

Indiana, with more than 80 years of experience.

It is expert in optimising the performance of the

world’s largest travel and expense reporting

platform. Its people and technology help

manage the expense and experience of

corporate travel.

| Labour strikes, natural disasters and extreme weather all cause flight disruption, which has a significant impact on traveller experience and travel industry costs. In 2017, 3.6m flights were cancelled or delayed by over 30 minutes. Every year, airlines lose approximately $35bn because of these irregular operations. This cost jumps to more than $60bn when considering the impact to travellers and the broader ecosystem.

When disruption happens, most airlines publish waivers to allow travellers to change their flight plans ahead of the disruption with no change fee. Most waivers are handled manually on a reactive basis. There isn’t a standardised format and travellers often aren’t alerted effectively or quickly enough.

Cirium’s Travel Waiver Services automate the process of matching trips to waivers, making it easier and quicker for agents to find waiver details and understand if a traveller’s flight qualifies. |

These services allow agents to reallocate travellers proactively with new travel plans when needed, reducing the average handling time for incoming calls and ultimately saving the traveller time and worry about flight changes.

By integrating Cirium’s service, Gant reduced the amount of time needed to resolve a traveller’s disrupted flight by a third. It also contributed to a reduction in the number of calls agents had to make to airlines to solve problems by an average of 50%. Having the right information at the right time means that Gant could save costs and provide a superior level of service for travellers affected by disruption. |

30%

reduction in time spent resolving a traveller’s disrupted flight using Cirium’s services |

| RELX Annual report and financial statements 2018 | Risk & Business Analytics

|

25

| |

|

| ||

| Cirium holds data on more than 100,000 commercial aircraft including the Airbus A330 |

| About Cirium

Cirium brings together powerful data and analytics to keep the world in motion. Delivering insight, built from decades of experience in the sector, enabling travel companies, aircraft manufacturers, airports, airlines and financial institutions, among others, to make logical and informed decisions which shape the future of travel, growing revenues and enhancing customer experiences. |

Cirium worked in concert with us and the travel ecosystem suppliers to fix a broken process that we all thought was unfixable. The results were innovation that saved us over 10% labor costs during key periods of disruption. This gave us a significant advantage in staffing and directly benefited our traveller experience. Cirium made our new process possible.

Patrick Linnihan President & CEO of Gant Travel Management |

| 26

|

RELX Annual report and financial statements 2018 | Business review

|

ThreatMetrix

identifying and blocking

fraud in real time

Gumtree was founded in 2000 as a classified

adverts site for travellers arriving in London.

From these modest beginnings, Gumtree.com

is now the UK’s leading classifieds site, with

16.4m unique visitors and 12.6m replies

to adverts each month.

| Gumtree brings together an eclectic collection of like-minded buyers, sellers and other users ranging from flat-sharers looking to fill a vacant room to cars, clothes and vintage furniture sales. The platform does not process any payment transactions and therefore relies on the safety, trustworthiness and authenticity of users.

Historically fraudsters have seen a clear opportunity to exploit the platform. They sign up for accounts in order to make fake listings or dupe unsuspecting users into transferring money for an item that never materialises. Gumtree needed a solution that could maintain the integrity of the platform while keeping fraudsters out. It harnessed intelligence from the ThreatMetrix Digital Identity Network to better identify high-risk users before they opened a Gumtree account. |

The ThreatMetrix Digital Identity Network crowdsources intelligence from millions of daily consumer interactions including logins, payments, and new account applications across thousands of global businesses. Using this information, ThreatMetrix creates a unique digital identity for each user by analysing the myriad connections between devices, locations and anonymised personal information.

Behaviour that deviates from this trusted digital identity can be accurately identified in real time, alerting Gumtree to new users who may be using stolen identity data, obfuscating their location or attempting to sign up for multiple accounts from the same device. |

84%

increased fraud detection rate forecasted by using ThreatMetrix’s data and analysis |

| RELX Annual report and financial statements 2018 | Risk & Business Analytics

|

27

| |

|

| ||

| Gumtree was founded in London in 2000 |

| About ThreatMetrix

ThreatMetrix, a LexisNexis Risk Solutions Company, empowers the global economy to grow profitably and securely without compromise.

With deep insight into anonymised digital identities, ThreatMetrix ID delivers the intelligence behind 30bn annual authentication and trust decisions, to differentiate legitimate customers from fraudsters in real time. |

The ThreatMetrix team has been really proactive in helping us improve our rules for detecting fraud, so much so that we have seen a significant increase in the fraud detection rate since we worked together to improve the performance of the model.

Fergus Campbell Head of Communications, Gumtree

|

| RELX Annual report and financial statements 2018 | Legal | 29 | |

|

| ||

| 30 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2018 | Legal | 31 | |

|

| ||

| 32

|

RELX Annual report and financial statements 2018 | Business review

|

Intelligize

helping law firms advise on complex financial disclosures

Mayer Brown is a global law firm that advises

the world’s leading companies and financial

institutions on their most complex deals and

disputes. With extensive reach across four

continents, it is the only integrated law firm in

the world with approximately 200 lawyers in

each of the world’s largest financial centres

– New York, London and Hong Kong.

| Mayer Brown advises issuers, investment banks and investors in making disclosures to the US Securities and Exchange Commission (SEC). These disclosures relate to transactions such as public offerings. The firm’s clients are under constant pressure to stay up to date with regulatory change. They depend on Mayer Brown partner Anna Pinedo and her colleagues to help them ensure the disclosures are accurate and that they are aware of disclosure trends, peer company disclosures and related matters. However, researching relevant precedents can take a lot of time – so finding a more efficient way of working is critical to Mayer Brown and its clients.

When Mayer Brown is engaged on a new securities offering, it regularly uses Intelligize to quickly find peer companies in the same industry for insights on similar disclosures. Intelligize instantly provides links to relevant SEC comments and responses from multiple peer companies. This puts clients in a position to anticipate potential problems and put forward disclosures that avoid expensive and time consuming comment letters from the regulator. |

About Intelligize

Intelligize pulls together and automatically links a broad set of SEC disclosure documents from filings to comment letters, agreements and other exhibits – enabling customers to navigate between related content with ease.

With advanced search tools and graphical analytical views, the solution rapidly delivers deep insights into filing and disclosure characteristics that would otherwise require extensive research effort. Intelligize makes it easy to identify market standard language and mitigate risk in disclosures by benchmarking output from multiple peer companies. |

| RELX Annual report and financial statements 2018 | Legal

|

33

| |

|

| ||

| Mayer Brown LLP’s offices in New York |

| Intelligize makes it easy to find the precedents you know are out there for specific transaction types and peer companies. It allows us to very efficiently analyze massive amounts of disclosure documents, efficiencies we can pass on to our clients.

Anna Pinedo Partner, Mayer Brown LLP

|

| RELX Annual report and financial statements 2018 | Exhibitions | 35 | |

|

| ||

| 36 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

|

|

|

| ||

| MIPIM: The world’s property market | Everything about information security | China (Shenzhen) International Gifts, Handicrafts, Watches & Houseware Fair: One of the largest business gifts & home fairs in China | ||

|

|

|

| ||

| World Travel Market: Premier global event for the travel industry |

Salão Internacional do Automóvel: Brazil’s automobile event |

Bar Convent Berlin: International bar & beverage trade show | ||

|

|

|

| ||

| National Hardware Show: US home improvement and DIY trade fair |

Interphex Japan: Japan’s pharmaceutical R&D and manufacturing show |

Expoprotection: The exhibition for risk prevention & management | ||

|

|

|

| ||

| One of the largest & longest standing electronics manufacturing trade shows |

The world’s entertainment content market | The destination for the global aircraft interiors industry | ||

|

|

|

| ||

| Leading international exhibition for personal care ingredients |

International security conference | Focused on the culture & community that is gaming | ||

|

|

|

| ||

| The golf business show | The trade show for the doors and windows industry |

New York Comic Con: The East Coast’s largest pop culture convention

| ||

|

|

|

| RELX Annual report and financial statements 2018 | Exhibitions | 37 | |

|

| ||

| 38

|

RELX Annual report and financial statements 2018 | Business review

|

Vision Expo

bringing clarity and vision

to small business growth

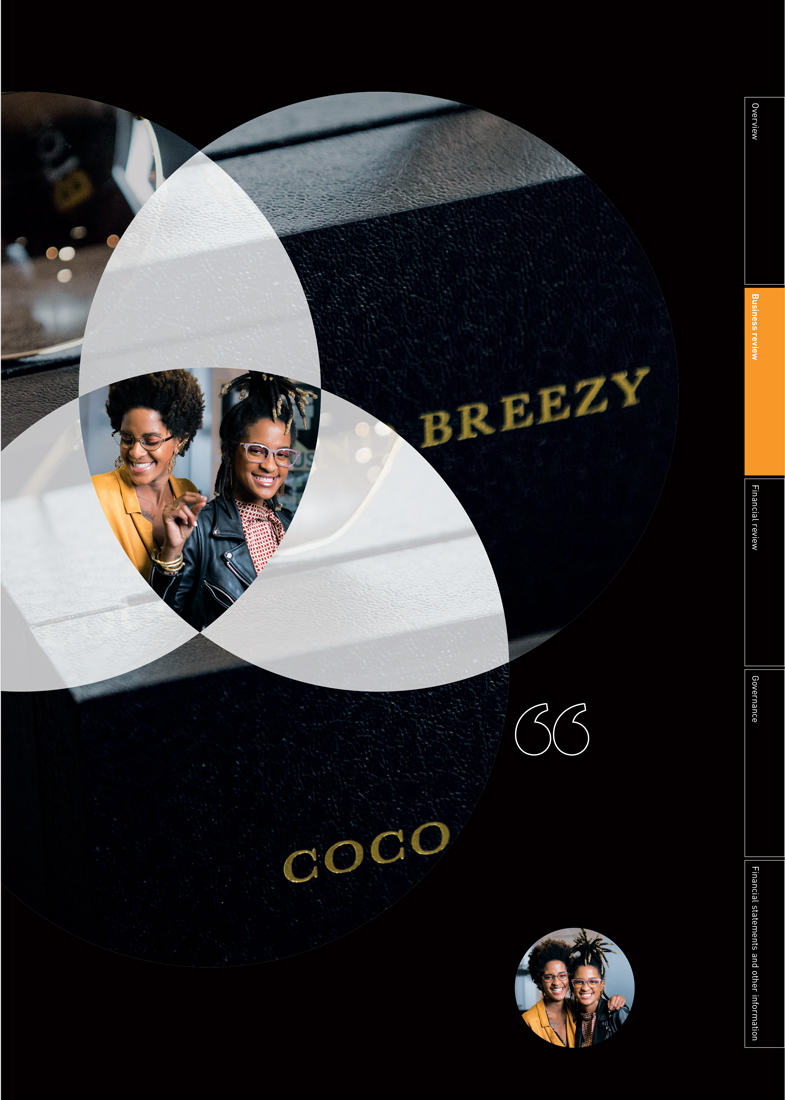

Coco and Breezy is a designer glasses and

sunglasses brand co-founded, owned and

designed by twins Corianna and Brianna

Dotson. The sisters launched their brand

in 2009 at the age of 19 and in a few short

years have built a successful and high-profile

business with innovative eyewear designs

that have been worn by celebrities including

Prince, Beyoncé, Lady Gaga and Rihanna.

| Based in New York, the twins channel their unique style to create frames using a variety of materials, patterns and colours. Over the past four years, Coco and Breezy have presented their brand and unveiled new frames and products to an audience of experts at Vision Expo. They attribute a component of their growth to showcasing their products via multiple platforms at the show including fashion shows, panel discussions, style events, interviews, and press previews. Vision Expo has enabled Coco and Breezy to make the shift from being a fashion brand, sold only in fashion stores, to embedding their company into the eyewear and eye care industry. | 400

stores across North America now stock Coco and Breezy eyewear thanks in part to business growth opportunities at Vision Expo |

About Vision Expo

Vision Expo is one of the leading shows for eye care professionals to discover and learn about the latest technologies, trends and products in the sector.

The exhibition has two locations – Vision Expo East based in New York and Vision Expo West in Las Vegas. Combined, the shows bring together over 700 exhibitors and 27,000 global industry professionals to network and share knowledge on the latest innovations in products, solutions and fashion in the industry. Through the collaboration of The Vision Council, the exhibition also invests in programmes to drive market growth and promote awareness of eye health. |

| RELX Annual report and financial statements 2018 | Exhibitions

|

39

| |

|

| ||

| Coco and Breezy at Vision Expo West |

| Before we started showing at Vision Expo our eyewear was sold in about 30 fashion stores. Now our eyewear is sold in about 400 optical practices in North America.

Corianna and Brianna Dotson Co-founders, Owners and Designers, Coco and Breezy

|

| 40

|

RELX Annual report and financial statements 2018 | Business review

|

| RELX Annual report and financial statements 2018 | 41

| |

|

| ||

Responsibility

| The Corporate Responsibility Report is an integral part of our Annual Report and Financial Statements. This section highlights progress on our 2018 czorporate responsibility objectives. The full 2018 Corporate Responsibility Report is available at www.relx.com/go/CRReport

Non-financial information statement RELX is required to comply with the reporting requirements of sections 414CA and 414CB of the Companies Act 2006, which relate to non-financial information. The list below outlines for our stakeholders where this information for RELX can be found:

Reporting Requirement: |

||||

| Environmental matters | 51 – 52 | |||

| Employees | 47 | |||

| Social matters | 43, 45, 49, 50 | |||

| Human rights, | 42, 46, 49, 50 | |||

| Anti-corruption and anti-bribery matters, | 42, 46, 49, 50 | |||

| Policies, due diligence processes and outcomes | 45 – 46 | |||

| Description and management of principal risks and impact of business activity, |

60 – 63 | |||

| Description of business model | 16, 23, 30, 35 | |||

| Non-financial metrics | 14 – 52 | |||

| 42 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

Corporate responsibility

| RELX Annual report and financial statements 2018 | Corporate responsibility | 43 | |

| REACT

Digital expertise to deploy educational resources quickly in emergencies

The private sector wants to support children’s education in emergencies with their skills and expertise, but do not know how to be most effective. REACT matches leading corporations with education needs on the ground in real time. We are using tech solutions to tackle the global education crisis.”

Sarah Brown GBC-Education Executive Chair |

The Global Business Coalition |

|

60 companies have joined REACT to ensure education for the most disadvantaged children around the world |

In 2018, LexisNexis Risk Solutions launched the Rapid Education Action (REACT) online platform for the Global Business Coalition for Education (GBC-Education) to allow companies to pledge and deploy their resources quickly in emergencies and disasters. The aim is to get millions of displaced and marginalised children whose learning has been disrupted by humanitarian crises back into education.

REACT was established to channel private sector engagement in support of Education Cannot Wait, a fund dedicated to education in emergencies launched at the 2016 World Humanitarian Summit in Istanbul, Turkey. |

To date more than 60 firms have signed up to the digital platform. One of them, software company Cerego, brokered a partnership with Thaki, a charity supporting education for refugee and migrant children in Lebanon. Thaki founder, Rudayna Abdo, says: “Providing online literacy training for dispersed migrant communities comes with many challenges. We were introduced to Cerego through REACT which is helping us pursue a successful, scalable, affordable, self-paced solution that can be replicated across geographies.” |

| 44 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

| RELX Annual report and financial statements 2018 | Corporate responsibility | 45 | |

|

| ||

| 46 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

| RELX Annual report and financial statements 2018 | Corporate responsibility | 47 | |

|

| ||

| 48

|

RELX Annual report and financial statements 2018 | Business review

|

| Advancing the RELX SDG Resource Centre

Access to critical knowledge to advance the United Nations Sustainable Development Goals | ||||

|

The RELX SDG Resource Centre was an essential tool for the women entrepreneurs who took part in the We Empower UN SDG Challenge for women from around the world supporting the SDGs through their businesses who are helping to create the world we want by 2030.

Amanda Ellis Former New Zealand Ambassador to the United Nations in Geneva, Senior Special Adviser for International Diplomacy and the SDGs at the Julie Ann Wrigley Global Institute of Sustainability |

||||

| The RELX SDG Resource Centre advances awareness, understanding and implementation of the 17 global goals |

| 75,000+

sources in the RELX SDG Resource Centre’s SDG News Tracker for up-to-the-minute news on the SDGs from around the world |

The free RELX SDG Resource Centre (sdgresources.relx.com) advances awareness, understanding and implementation of the 17 UN SDGs which aim to end poverty, protect the planet and ensure prosperity for all people by 2030.

The site provides leading edge articles, reports, tools, events, videos and legal practical guidance from across RELX. It also features content from partners, including the UNGC and the United Nations Development Programme.

In 2018, we released original research on the state of science underpinning SDG 3 (good health and well-being) and added content from Scientific African. This is a partnership between the Next Einstein Forum and Elsevier, bringing state-of-the-art technology and processes to create an open access megajournal to accelerate scientific capacity-building across Africa. |

Scientific African will provide African researchers with a new platform to boost the impact and discoverability of their research.

Also in the year, we held two RELX SDG Inspiration Days to showcase the SDG Resource Centre and the importance of knowledge to advance the SDGs bringing together more than 100 business colleagues, government representatives, NGO leaders, and young people.

RELX SDG Inspiration Day Silicon Valley focused on disruptive technology to advance the SDGs and SDG Inspiration Day Amsterdam concentrated on The Power of Partnerships to advance the SDGs: what partners, what responsibilities, what innovation, and how to scale and measure impact. Partners on the events included the UNGC, the Ban Ki-Moon Centre for Global Citizens and the Responsible Media Forum. |

| RELX Annual report and financial statements 2018 | Corporate responsibility | 49 | |

|

| ||

| 50 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

| RELX Annual report and financial statements 2018 | Corporate responsibility | 51 | |

|

| ||

| 52 | RELX Annual report and financial statements 2018 | Business review | |

|

| ||

7. Environment (continued)

| ENVIRONMENTAL TARGETS | ||||||

| Focus area | Targets 2020 | 2018 Performance |

||||

| Climate change | Reduce Scope 1 and 2 location-based carbon emissions by 40% against a 2010 baseline | -49% | ||||

| Energy | Reduce energy and fuel consumption by 30% against a 2010 baseline | -35% | ||||

| Purchase renewable electricity equivalent to 100% of RELX’s global electricity consumption | 81% | |||||

| Waste | Decrease total waste generated at reporting locations by 40% against a 2010 baseline | -52% | ||||

| 90% of waste from reporting locations to be diverted from landfill | 88% | |||||

| Production paper* | 100% of RELX production papers, graded in PREPS, to be rated as ‘known and responsible sources’ | 100% | ||||

| Environmental | Achieve ISO 14001 certification for 50% of the business by 2020 | 25% | ||||

| Management System | Reporting locations achieving five or more RELX Environmental Standards | 41% | ||||

| * | All paper we graded in 2018 – 90% of total production stock – was graded 3 or 5 stars (known and responsible sources). |

We have reported on all emission sources required under the Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013. We have included emissions from all operating companies within the Group.

We have used the GHG Protocol Corporate Accounting and Reporting Standard (revised edition) and the data has been assured by an independent third party, EY. Details on methodology and the assurance statement can be viewed in the 2018 Corporate Responsibility Report at www.relx.com/go/CRReport.

| 2018 investor and other recognition | ||||||

|

|

|

|

| |||

| Constituent of the Ethibel | CDP | EPA Green Power Leader | FTSE4Good Index | |||

| Sustainability Index | – Climate programme score: A | – Top 100 | Included in | |||

| Included in | – Forest programme score: B | – FTSE4Good Global Index | ||||

| – Excellence Europe | – Water programme score: B- | – FTSE4Good UK Index | ||||

| – Excellence Global | – FTSE4Good Europe Index | |||||

|

|

|

|

| |||

| RE100 | Dow Jones Sustainability | ISO 14001 | STOXX Global ESG | |||

| – Member | Index Europe | – Certified | Leaders Indices | |||

| – Constituent | – Included | |||||

|

|

|

|

| |||

| ECPI Indices | Forbes | Oekom Corporate | Philippine Quality Award | |||

| – Included | – The World’s Most Innovative | Responsibility Rating | – Recipient | |||

| Companies 2018

|

– Prime status | |||||

|

The full 2018 Corporate Responsibility Report is available at www.relx.com/go/CRReport |

| RELX Annual report and financial statements 2018

|

53

| |

|

| ||

|

review |

| In this section | ||

| 54 |

||

| 60 |

||

| RELX Annual report and financial statements 2018 | Chief Financial Officer’s report | 55 | |

|

| ||

| 56 | RELX Annual report and financial statements 2018 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2018 | Chief Financial Officer’s report | 57 | |

|

| ||

| 58 | RELX Annual report and financial statements 2018 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2018 | Chief Financial Officer’s report | 59 | |

|

| ||

| 60 | RELX Annual report and financial statements 2018 | Financial review | |

|

| ||

| EXTERNAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Economy and market conditions | Demand for our products and services may be adversely impacted by factors beyond our control, such as the economic environment in the United States, Europe and other major economies, political uncertainties (including the potential consequences of the United Kingdom’s withdrawal from the European Union under Article 50 of the Treaty of Lisbon (“Brexit”)), acts of war and civil unrest as well as levels of government and private funding provided to academic and research institutions. | Our businesses are focused on professional markets which have generally been more resilient in periods of economic downturn. We deliver information solutions, many on a subscription and recurring revenue basis, which are important to our customers’ effectiveness and efficiency. We operate diversified businesses in terms of sectors, markets, customers, geographies and products and services. We have extended our position in long-term global growth markets through organic new launches supported by the selective acquisition of small content and data sets. We continue to dispose of businesses that no longer fit our strategy. | ||

| We continuously monitor economic and political developments to assess their impact on our strategy which is designed to mitigate these risks. In response to specific uncertainties, such as Brexit, our businesses engage in scenario planning and develop contingency plans where relevant. | ||||

|

|

||||

| Intellectual property rights | Our products and services include and utilise intellectual property. We rely on trademark, copyright, patent and other intellectual property laws to establish and protect our proprietary rights in this intellectual property. There is a risk that our proprietary rights could be challenged, limited, invalidated or circumvented, which may impact demand for and pricing of our products and services. Copyright laws are subject to national legislative initiatives, as well as cross border initiatives such as those from the European Commission and increased judicial scrutiny in several jurisdictions in which we operate. This creates additional challenges for us in protecting our proprietary rights in content delivered through the internet and electronic platforms. | We actively engage in developing and promoting the legal protection of intellectual property rights. Our subscription contracts with customers contain provisions regarding the use of proprietary content. We are vigilant as to the use of our intellectual property and, as appropriate, take legal action to challenge illegal content distribution sources. | ||

|

|

||||

| RELX Annual report and financial statements 2018 | Principal risks | 61 | |

|

| ||

| 62 | RELX Annual report and financial statements 2018 | Financial review | |

|

| ||

| OPERATIONAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Technology and business resilience | Our businesses are dependent on electronic platforms and networks, primarily the internet, for delivery of our products and services. These could be adversely affected if our electronic delivery platforms, networks or supporting infrastructure experience a significant failure, interruption or security breach. | We have established procedures for the protection of our businesses and technology assets. These include the development and testing of business continuity plans, including IT disaster recovery plans and back-up delivery systems, to reduce business disruption in the event of major technology or infrastructure failure, terrorism or adverse weather incidents. | ||

|

|

||||

| Cyber security | Our businesses maintain online databases and platforms delivering our products and services, which we rely on, and provide data to third parties, including customers and service providers. These databases and information are a target for compromise and face a risk of unauthorised access and use by unauthorised parties.

Our cyber security measures, and the measures used by our third-party service providers, may not detect or prevent all attempts to compromise our systems, which may jeopardise the security of the data we maintain or may disrupt our systems. Failures of our cyber security measures could result in unauthorised access to our systems, misappropriation of our or our users’ data, deletion or modification of stored information or other interruption to our business operations. As techniques used to obtain unauthorised access to or to sabotage systems change frequently and may not be known until launched against us or our third-party service providers, we may be unable to anticipate or implement adequate measures to protect against these attacks and our service providers and customers may likewise be unable to do so.

Compromises of our or our third-party service providers’ systems, or failure to comply with applicable legislation or regulatory or contractual requirements could adversely affect our financial performance, damage our reputation and expose us to risk of loss, fines and penalties, litigation and increased regulation. |

We have established security programmes with the aim of ensuring that data is protected, our business infrastructures continue to operate and that we comply with relevant legislative, regulatory and contractual requirements.

We have governance mechanisms in place to design and monitor common policies and standards across our businesses.

We invest in appropriate technological and physical controls which are applied across the enterprise in a risk-based security programme which operates at the infrastructure, application and user levels. These controls include, but are not limited to, infrastructure vulnerability management, application scanning and penetration testing, network segmentation, encryption and logging and monitoring. We provide regular training and communication initiatives to establish and maintain awareness of risks at all levels of our businesses. We have appropriate incident response plans to respond to threats and attacks. We maintain appropriate information security policies and contractual requirements for our businesses and run programmes monitoring the application of our data security policies by third-party service providers. We use independent internal and third-party auditors to test, evaluate, and help enhance our procedures and controls. | ||

|

|

||||

| Supply Chain dependencies | Our organisational and operational structures depend on outsourced and offshored functions, including use of cloud service providers. Poor performance, failure or breach of third parties to whom we have outsourced activities, could adversely affect our business performance, reputation and financial condition. | We select our vendors with care and establish contractual service levels that we closely monitor, including through key performance indicators and targeted supplier audits and security assessments. We have developed business continuity plans to reduce disruption in the event of a major failure by a vendor. | ||

|

|

||||

| Talent | The implementation and execution of our strategies and business plans depend on our ability to recruit, motivate and retain skilled employees and management. We compete globally and across business sectors for talented management and skilled individuals, particularly those with technology and data analytics capabilities. An inability to recruit, motivate or retain such people could adversely affect our business performance. Failure to recruit and develop talent regardless of gender, race or other characteristics could adversely affect our reputation and business performance. | We have well established management development and talent review programmes. We monitor capability needs and remuneration schemes are tailored to attract and motivate the best talent available at an appropriate level of cost. We actively seek feedback from employees, which feeds into plans to enhance employee engagement and motivation. Our Diversity and Inclusion Strategy creates a diverse workforce and environment that respects individuals and their contributions. |

| RELX Annual report and financial statements 2018 | Principal risks | 63 | |

|

| ||

| 64 | RELX Annual report and financial statements 2018 | Governance | |

| RELX Annual report and financial statements 2018 | 65 | |

| Governance |

| In this section | ||

| 66 |

||

| 68 |

||

| 70 |

Chairman’s introduction to corporate governance | |

| 72 |

||

| 83 |

||

| 85 |

||

| 106 |

||

| 108 |

||

| 66 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

| Executive Directors | Non-Executive Directors | |||||||

|

|

| ||||||

| Erik Engstrom (55) Chief Executive Officer

Appointed: Chief Executive Officer of RELX since November 2009. Joined as Chief Executive Officer of Elsevier in 2004. Other appointments: Non-Executive Director of Smith & Nephew plc. Past appointments: Prior to joining was a partner at General Atlantic Partners. Before that was President and Chief Operating Officer of Random House Inc and President and Chief Executive Officer of Bantam Doubleday Dell, North America. Began his career as a consultant with McKinsey. Served as a Non-Executive Director of Eniro AB and Svenska Cellulosa Aktiebolaget SCA. Education: Holds a BSc from Stockholm School of Economics, an MSc from the Royal Institute of Technology in Stockholm, and gained an MBA from Harvard Business School as a Fulbright Scholar. Nationality: Swedish |

Sir Anthony Habgood (72)

Chairman

Appointed: June 2009 Other appointments: Chairman of Preqin Holding Limited and Deputy Chairman of RG Carter Holdings Limited. Past appointments: Previously was Chairman of the Court of the Bank of England, Whitbread plc, Bunzl plc, Mölnlycke Health Care Limited and Norwich Research Partners LLP and served as Chief Executive of Bunzl plc, Chief Executive of Tootal Group plc and a Director of The Boston Consulting Group. Formerly Non-Executive Director of Geest plc, Marks and Spencer plc, National Westminster Bank plc, Powergen plc, SVG Capital plc, and Norfolk and Norwich University Hospitals Trust. Education: Holds an MA in Economics from Cambridge University, an MS in Industrial Administration from Carnegie Mellon University and an Honorary Doctorate of Civil Law from the University of East Anglia. He is a visiting Fellow at Oxford University. Nationality: British |

Wolfhart Hauser (69)

Non-Executive Director Senior Independent Director Chairman of the Remuneration Committee

Appointed: April 2013 Other appointments: Chairman of FirstGroup plc and a Non-Executive Director of Associated British Foods plc. Past appointments: Chief Executive Officer of Intertek Group plc from 2005 until 2015. Prior to that he was Chief Executive Officer of TÜV Sud AG between 1998 and 2002 and Chief Executive Officer of TÜV Product Service GmbH for ten years. Formerly a Non-Executive Director of Logica plc. Education: Holds a master’s degree in Medicine from Ludwig-Maximilian- University Munich and a Medical Doctorate from Technical University Munich. Nationality: German | ||||||

|

|

| ||||||

| Nick Luff (51) Chief Financial Officer

|

Robert MacLeod (54)

Non-Executive Director

|

Carol Mills (65)

Non-Executive Director

| ||||||

|

Appointed: September 2014 Other appointments: Non-Executive Director of Rolls-Royce Holdings plc. Past appointments: Prior to joining the Group was Group Finance Director of Centrica plc from 2007. Before that was Chief Financial Officer at The Peninsular & Oriental Steam Navigation Company (P&O) and its affiliated companies, having previously held a number of senior finance roles at P&O. Began his career as an accountant with KPMG. Formerly a Non-Executive Director of QinetiQ Group plc and Lloyds Banking Group plc. Education: Has a degree in Mathematics from Oxford University and is a qualified UK Chartered Accountant. Nationality: British |

Appointed: April 2016 Other appointments: Appointed as Chief Executive of Johnson Matthey plc in June 2014 after five years as Group Finance Director. Past appointments: Prior to joining Johnson Matthey, spent five years as Group Finance Director of WS Atkins plc, having joined as Group Financial Controller in 2003. From 1993 to 2002, held a variety of senior finance and M&A roles with Enterprise Oil plc in the UK and US. Formerly a Non-Executive Director of Aggreko plc. Nationality: British |

Appointed: April 2016 Other appointments: Independent Director of Zynga Inc and Entertainment Partners. Past appointments: A member of the Boards of Adobe Systems, Alaska Communications, Tekelec Corporation, Blue Coat Systems, Xactly Corporation, WhiteHat Security and Ingram Micro. From 2004 to 2006, was Executive Vice President and General Manager of the Infrastructure Products Group at Juniper Networks. From 1998 to 2002 was Chief Executive Officer of Acta Technology, and before Acta, spent 16 years at Hewlett-Packard in a number of executive roles. Nationality: American |

| RELX Annual report and financial statements 2018 | Board Directors | 67 | |

|

| ||

| 68 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

Senior Business Executives

| ||||||

| Kumsal Bayazit | Mark Kelsey | Chet Burchett | Mike Walsh | |||

| Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | |||

| Scientific, Technical | Risk & Business Analytics | Exhibitions | Legal | |||

| & Medical and Chairwoman, | ||||||

| RELX Technology Forum | ||||||

|

|

|

|

| |||

| Joined in 2004. Appointed to current position in 2019. | Joined in 1989. Appointed CEO Business Information in 2010 and CEO Risk Solutions in 2012. | Joined in 2004. Appointed to current position in 2015. | Joined in 2003. Appointed to current position in 2011. | |||

|

|

||||||

| Previously President, Exhibitions Europe, Chief Strategy Officer, RELX, and Executive Vice President of Global Strategy and Business Development for LexisNexis. Prior to that worked with Bain & Company in New York, Los Angeles, Johannesburg and Sydney. Holds an MBA from Harvard Business School and is a Graduate of the University of California at Berkeley. | Has held a number of senior positions across the Group over the past 30 years. Previously Chief Operating Officer and then Chief Executive Officer of Reed Business Information. Studied at Liverpool University and received his MBA from Bradford University. | Previously President of the Americas for Reed Exhibitions. Prior to that was President and Chief Executive Officer, USA, for Burson-Marsteller, a leading global public relations agency. Holds a degree from Baylor University. | Previously CEO of LexisNexis US Legal Markets and Director of Strategic Business Development Home Depot. Prior to that was a practising attorney at Weil, Gotshal and Manges in Washington DC and served as a consultant with The Boston Consulting Group. Holds a Juris Doctor degree from Harvard Law School and is a graduate of Yale University. | |||

| RELX Annual report and financial statements 2018 | RELX Business Leaders | 69 | |

|

| ||

| RELX Annual report and financial statements 2018 | Chairman’s introduction to Corporate Governance | 71 | |

|

| ||

| RELX Annual report and financial statements 2018 | Corporate Governance Review | 73 | |

|

| ||

| 74 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

|

Key roles of the Directors

Chairman

◾ Provides leadership of the Board, ensuring that it functions effectively

◾ Ensures that all Directors are sufficiently apprised of matters to make informed judgements, through the provision of accurate, timely and clear information

◾ Promotes high standards of corporate governance and a Board culture of openness and debate

◾ Sets the agenda and chairs meetings of the Board

◾ Chairs the Nominations and Corporate Governance Committees

◾ Facilitates the effective contribution of all of the Directors

◾ Ensures effective dialogue with shareholders

◾ Ensures the performance of the Board, its Committees and individual Directors is assessed annually

◾ Ensures effective induction and development of Directors

Chief Executive Officer

◾ Day-to-day management of the Group, within the delegated authority limits set by the Board

◾ Develops the Group’s strategy for consideration and approval by the Board

◾ Ensures that the decisions of the Board are implemented

◾ Informs and advises the Chairman and Nominations Committee on executive succession planning

◾ Leads communication with shareholders

◾ Promotes and conducts the affairs of the Company with the highest standards of integrity, probity and corporate governance |

Chief Financial Officer

◾ Day-to-day management of the Group’s financial affairs

◾ Responsible for the Group’s financial planning, reporting and analysis

◾ Ensures that a robust system of internal control and risk management is in place

◾ Maintains high-quality reporting of financial and environmental performance internally and externally

◾ Supports the Chief Executive Officer in developing and implementing strategy

Senior Independent Director

◾ Leads the Board’s annual assessment of the performance of the Chairman

◾ Available to meet with shareholders on matters where usual channels are deemed inappropriate

◾ Deputises for the Chairman, as necessary

◾ Serves as a sounding board for the Chairman and acts as an intermediary between the other Directors, when necessary

Non-Executive Directors

◾ Bring an external perspective and constructively challenge and provide advice to the Executive Directors

◾ Effectively contribute to the development of strategy

◾ Scrutinise the performance of management in meeting agreed goals and monitor the delivery of the Group’s strategy

◾ Serve as members of Board Committees and chair the Audit and Remuneration Committees

|

Effectiveness

| RELX Annual report and financial statements 2018 | Corporate Governance Review | 75 | |

|

| ||

| 76 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

Key activities of the Board

The Board met regularly through the year and, in 2018, held seven scheduled meetings. There was also one additional meeting held in February 2018, to deal with matters solely related to the Simplification. The Board’s programme ensures that all relevant matters are considered during scheduled meetings. Additionally, throughout the year, the Non-Executive Directors meet without the Executive Directors present on a regular basis.

In 2018, the Board considered the following:

|

Business and financial performance ◾ Reports from the Chief Executive Officer and Chief Financial Officer on the Group’s actual and forecast operational and financial performance

◾ Annual and interim financial results

◾ Annual review of invested capital |

Strategy, business and functional reviews ◾ Strategy and business presentations, including two full-day strategy reviews

◾ Budgets and Annual Strategy

◾ Updates on major acquisitions, investments and disposals

◾ Capital structure and funding requirements

◾ Group tax strategy review

◾ Prospects of the Group and Viability Statement |

Risk, legal, governance and regulatory matters ◾ The Group’s principal risks and ongoing monitoring of risk management and internal control

◾ The Group’s operating and governance principles

◾ Board succession and executive talent management

◾ Appointments and re-appointments to the Board and appointments to Board Committees

◾ Litigation update

◾ Reports from the Committee Chairmen on the key activities of the Board’s Committees

◾ Matters Reserved for the Board and the Terms of Reference for each Board Committee

◾ Corporate structure simplification

◾ Modern Slavery Act Statement/Gender Pay Gap Report/General Data Protection Regulation readiness and compliance with data privacy legislation

◾ Cyber security

◾ Approve updated Group Ethics and Business Conduct Policy

◾ The requirements of the New Code and associated action for the Group |

Stakeholders ◾ Investor relations activities including feedback from investors

◾ Dividend declarations and policy

◾ Share buyback programme

◾ Approval of shareholder communications, such as the Annual Report, Notices of Meetings, and the Corporate Simplification Prospectus and Circular

◾ Review of Corporate Responsibility Programme

◾ Updates on media relations

◾ Assessing customer satisfaction

◾ Reviewing the Group’s Supply Chain

◾ Review of the results of 2018 group-wide employee engagement survey |

| RELX Annual report and financial statements 2018 | Corporate Governance Review | 77 | |

|

| ||

| 78 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

Attendance at meetings of the Board and Board Committees

The table below shows the attendance of Directors at meetings of the Board and the Board Committees during the year. Attendance is expressed as the number of meetings attended out of the number eligible to be attended.

| Director | |

Committee appointments |

|

Board | (1) | Audit | Remuneration | Nominations | |

Corporate Governance |

|

|||||||||||||||

| Anthony Habgood (Chairman) |

|

8/8 | – | 4/4 | 4/4 | 4/4 | Board Committee membership key

| |||||||||||||||||||

| Erik Engstrom |

– | 8/8 | – | – | – | – | ||||||||||||||||||||

| Nick Luff |

– | 8/8 | – | – | – | – | ||||||||||||||||||||

| Wolfhart Hauser |

|

8/8 | – | 4/4 | 4/4 | 4/4 | ||||||||||||||||||||

| Adrian Hennah (2) |

|

8/8 | 4/4 | – | 1/1 | 4/4 | ||||||||||||||||||||

| Marike van Lier Lels (3) |

|

8/8 | 4/4 | – | 1/1 | 4/4 | ||||||||||||||||||||

| Robert MacLeod |

|

8/8 | – | 4/4 | – | 4/4 | ||||||||||||||||||||

| Carol Mills (4) |

|

7/8 | 4/4 | – | – | 4/4 | ||||||||||||||||||||

| Linda Sanford |

|

8/8 | – | 4/4 | – | 4/4 | ||||||||||||||||||||

| Ben van der Veer (5) |

|

8/8 | 2/3 | – | 3/3 | 4/4 | ||||||||||||||||||||

| Suzanne Wood |

|

8/8 | 4/4 | – | – | 4/4 |

| (1) | In addition to the seven scheduled meetings , there was an additional meeting to discuss matters related to the Simplification. Serving Directors also attended two full-day strategy and business review meetings. |

| (2) | Mr Hennah was appointed as Chairman of the Audit Committee with effect from 19 April 2018, and a member of the Nominations Committee with effect from 1 September 2018. |

| (3) | Ms van Lier Lels was appointed as a member of the Nominations Committee with effect from 1 September 2018. |

| (4) | Ms Mills was unable to attend the unscheduled February meeting of the Board, held at short notice to discuss matters related to the Simplification. She was provided with the papers in advance of the meeting for her review and comment (which was provided to the Chairman), and subsequent to the meeting taking place was provided with a copy of the minutes. |

| (5) | Mr van der Veer stepped down as Chairman of the Audit Committee on 19 April 2018, and as a member of the Audit and Nominations Committees with effect from 1 September 2018. |

| RELX Annual report and financial statements 2018 | Corporate Governance Review | 79 | |

|

| ||

| 80 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

| RELX Annual report and financial statements 2018 | Corporate Governance Review | 81 | |

|

| ||

| 82 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

|

Viability statement

|

||

| The UK Corporate Governance Code requires Directors to assess the prospects of the Group over a period significantly longer than twelve months and to state whether they have a reasonable expectation that the Company will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment.

Assessing the Group’s Prospects The Group develops information-based analytics and decision tools for professional and business customers in the Scientific, Technical &Medical, Risk and Business Analytics, Legal and Exhibitions sectors. The Group has leading positions in long-term growth markets, deep customer understanding and has developed innovative solutions that often account for about 1% of our customers’ cost base but can have a significant and positive impact on the economics of the remaining 99%. Having effectively transitioned the business from print to digital, the Group is systematically migrating its information solutions toward higher value-add decision tools, adding broader data sets, embedding more sophisticated analytics and leveraging more powerful technology. We believe this evolution is improving our business profile and positions the Group for future business success.

The Group’s prospects are assessed through the annual strategy planning process. This process includes a review of assumptions made and assesses each business area’s longer-term plan. The resulting three-year strategy plan forms the basis for Group and divisional targets and in-year budgets. Objectives are set with consideration given to the economic and regulatory environment, and to customer trends, as well as incorporating risks and opportunities. The most recent three-year strategy business plan was agreed by the Directors in September 2018.

In assessing the Group’s prospects, our current position and principal risks are considered as follows:

Current position and business model ◾ Diversified business in terms of sectors, markets, customers, geographies and products and services so that we are not dependent on any one business, customer, region or product

◾ High percentage of subscription and recurring revenue streams

◾ Leading positions in long-term global growth markets

◾ Low working capital and capital investment requirements leading to high levels of cash generation

◾ Clear strategy focused on organic growth supplemented by selective acquisitions in higher growth areas

◾ Continued development of increasingly sophisticated information-based analytics and decision tools

◾ Expansion into higher growth adjacencies and geographies primarily through organic investment augmented with selective acquisitions

Further details on our strategy and 2018 progress are on pages 4 and 5.

Principal risks related to our business model ◾ Challenges to the intellectual property rights of content embedded in our products and services

◾ Disruption or loss of data sources that our businesses rely on due to regulation or other reasons

◾ Changes to the paid subscription model for our primary research business within Scientific, Technical & Medical

|

◾ Technological failure of our electronic platforms and networks

◾ Failure of our cyber security measures resulting in unauthorised access to our systems and breach of data privacy

Detailed descriptions of all principal risks and mitigations are on pages 60 to 63.

Assessing the Group’s Viability The three-year strategy plan for our businesses includes management’s assessment of the anticipated operational risks affecting the business and assumes that current economic conditions broadly persist, financing will be available on similar terms to those negotiated recently and interest rates will follow market expectations. Management then considers the viability of the business should unexpected events, linked to the principal risks, occur. To first make the assessment, the financial impact of each principal risk on revenue and cashflow is estimated. Owing to the diversified nature of the Group, no individual risk was estimated to have an impact close to the amount, broadly estimated at one third of total Group cashflow, necessary for a breach of the covenant in the Group’s $3.0bn committed bank facility.

The assessment then considers various stress-test scenarios under which multiple risks occur simultaneously accompanied by an inability to access the debt capital markets to refinance scheduled liabilities as they become due, together with an increase in interest rates much faster than currently expected. The resulting analysis, which assumes share buybacks are suspended but dividends continue uninterrupted, then considers the impact on available headroom and whether any scenario results in breaching the covenant in the committed bank facility.

The worst-case stress case modelled a combination of the following risks: (a) the inability to use certain third-party data resources; (b) an adverse impact on revenue from a shift away from the paid subscription model; and (c) having our systems disrupted by a cyber security event. The analysis concluded that even with the simultaneous occurrence of these three risks, no access to the debt capital markets and a sharply rising interest rate environment, the Group would still have sufficient funds to trade, settle its liabilities as they come due and remain compliant with the covenant in its committed bank facility, whilst still paying forecast dividends.

In addition to scenario modelling, the Directors bi-annually review the Group’s principal risks, assess the likelihood and impact of each risk together with the effectiveness of mitigating controls, and consider emerging risks. The Directors also receive regular updates from management on treasury, tax, acquisitions and divestments, and significant risk areas including information security, technology and legal and regulatory matters. Finally, separate from the annual strategy plan, the Directors periodically receive updates from business area management on their operations, prospects and risks. Whilst these reviews and discussions naturally focus more closely on the quantifiable risks facing the business within the three-year planning period, they also cover longer-term risks.

As a result of stress-testing the three-year strategy plan, supported by regular reviews of risk during the year, the Directors confirm that they have a reasonable expectation that the Group will be able to continue its operations and meet its liabilities as they fall due over the next three years and are not aware of any longer-term operational or strategic risks that would result in a different outcome from the three-year review. |

| RELX Annual report and financial statements 2018 | 83 | |

|

| ||

| 84 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

| RELX Annual report and financial statements 2018 | 85 | |

|

| ||

| 86 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

2018 Corporate Governance Code

Following the publication by the FRC of the new Corporate Governance Code in July 2018, the Committee has reviewed the updated provisions relating to remuneration matters. The Committee will report on how these have been implemented in next year’s Report. You will see that with respect to workforce engagement, we have decided to designate a non-executive director to take on responsibility for this and have introduced a fee for this activity.

2019 Implementation of Remuneration Policy

In line with increases for the wider employee population, and consistent with the 2019 salary increase guidelines for UK based employees, the Committee has approved 2019 salary increases for the Executive Directors of 2.5%. As the CEO pays pension contributions and a participation fee which increase each year, after taking into account these increasing fees, his 2019 salary after these increasing deductions will decrease again in 2019 compared to 2018.

Following a review in 2019, we will propose a directors’ remuneration policy for approval by shareholders at the AGM in April 2020.

The audited sections of the Report are clearly marked.

Wolfhart Hauser

Chairman, Remuneration Committee

| RELX Annual report and financial statements 2018 | Directors’ Remuneration Report | 87 | |

|

| ||

| 88 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

2018 Annual Incentive

Set out below is a summary of performance against each financial measure and Key Performance Objective and the resulting annual incentive payout for 2018:

| Erik Engstrom | Nick Luff | |||||||||||||||

| Performance measure |

Relative weighting % at target |

Achievement vs target | Payout % of target |

Payout % of target |

||||||||||||

| Revenue | 35% | Revenue was £7,492m versus a target(1) of £7,499m, resulting in achievement versus target of 99.9% and a payout(2) of 98.5% of 35%. | 34.5% | 34.5% | ||||||||||||

| Adjusted net profit after tax |

35% | Adjusted net profit after tax was £1,674m versus a target(1) of £1,665m, resulting in achievement versus target of 100.5% and a payout(2) of 105.0% of 35%. | 36.8% | 36.8% | ||||||||||||

| Cash conversion | 15% | Cash flow was £2,243m (96% conversion) versus a target(1) of £2,182m, resulting in achievement versus target of 102.8% and a payout(2) of 128.0% of 15%. | 19.2% | 19.2% | ||||||||||||

| Key Performance Objectives (KPOs)(3) | 15% | A detailed description of the KPOs and achievement against those KPOs for each Executive Director is set out below. | 13.75% | 14.5% | ||||||||||||

| Total | 100% | 104.2% | 104.9% | |||||||||||||

| Total AIP payout as % of salary | ||||||||||||||||

| Cash | 100% | 104.2% | 104.9% | |||||||||||||

| Deferred Shares | 50% | 52.1% | 52.5% | |||||||||||||

| Total | 150% | 156.3% | 157.4% | |||||||||||||

The Cash AIP (£1,269,277 for the CEO and £752,818 for the CFO) will be paid in Q1 2019 and the Deferred Shares (with a current value of £634,639 in the case of the CEO and £376,409 in the case of the CFO) will be released in Q1 2022. The release of Deferred Shares is not subject to any further performance conditions, but is subject to malus and claw-back.

| (1) | On an equivalent basis (at actual exchange rates and after the net impact of acquisitions and disposals completed during the year). |

| (2) | For achievement above target, each 0.1% of overachievement increased the payout ratio for that component by 1 percentage point up to a maximum payout ratio of 150% at 105% achievement vs target. For achievement below target, each 0.1% of underachievement reduced the payout ratio by 1.5 percentage points down to a threshold payout ratio of 10% at 94% achievement vs target. |

KPOs – Erik Engstrom

| KPO | Relative weighting % at target |

Achievement vs KPO | Payout % of target |

|||||||||

| Risk Mitigation |

3% | This KPO was almost fully achieved. | 2.5% | |||||||||

| ◾ Cyber security training provided to 100% of employees, social engineering testing (e.g. phishing simulations) covering RELX globally completed and requirement to continue re-training and re-testing of employees introduced. Met target. ◾ Three cyber security incident response simulations completed at senior levels within the business divisions; six security awareness training sessions delivered; four penetration tests of financial integrity processes performed; lessons learned incorporated into Incident Response Plan. Met target. |

||||||||||||

|

◾ Five out of six elements of the Compliance Testing and Monitoring Plan were completed and an In-Person Training Assessment was completed and recommendations for implementation were agreed. Target almost fully met. |

||||||||||||

| Customers | 3% | This KPO was almost fully achieved. |

2.5% | |||||||||

| ◾ Expanded use of customer satisfaction and loyalty metrics in business reviews and in some of the business areas’ annual incentive plans. Target almost fully met. |

||||||||||||

| ◾ RELX Accessibility awards introduced to recognise exceptional employee efforts to advance accessibility. Met target. |

||||||||||||

|

◾ Increased the number and reach of our business community working groups and projects which focus on the advancement of the rule of law. Met target. |

||||||||||||

| People | 3% | This KPO was fully achieved. |

3.0% | |||||||||

| ◾ Assessed and reported on employee engagement via employee opinion surveys, with the highest employee participation rates and employee satisfaction scores in the last 15 years. Exceeded target. |

||||||||||||

| ◾ Employee alignment with company strategy and values measured via employee opinion survey and workshops held throughout the business to further drive alignment. Met target. |

||||||||||||

|

◾ New diversity and inclusion (D&I) initiatives launched/existing initiatives expanded and indicators to track D&I progress established. Met target. |

||||||||||||

| RELX Annual report and financial statements 2018 | Directors’ Remuneration Report | 89 | |

|

| ||

| 90 | RELX Annual report and financial statements 2018 | Governance | |

|

| ||

Multi-year incentives (granted under the Remuneration Policy in effect prior to the approval by shareholders of the current Remuneration Policy at the Annual General Meetings in April 2017)

Multi-year incentives with a performance period ended 31 December 2018 were the 2016–2018 cycles of BIP, LTIP and ESOS granted to Executive Directors.

The Committee assessed the performance measures for these awards and made an overall assessment of underlying business performance and other relevant factors. The vesting outcome resulting from this review is summarised below.

| LTIP: 2016–18 cycle performance outcome

|

||||||||||||||||||||

| Performance measure |

Weighting | Performance range and vesting levels set at grant(1) |

Achievement against the performance range |

Resulting vesting percentage |

||||||||||||||||

| TSR over the three-year |

1/3rd | below median | 0% | Near the upper | 59.8% | |||||||||||||||

| performance period(2) |

median | 30% | quartile of sterling | |||||||||||||||||

| upper quartile | 100% | and euro comparator | ||||||||||||||||||

| groups and below | ||||||||||||||||||||

| median of US dollar | ||||||||||||||||||||

| comparator group | ||||||||||||||||||||

| Average growth in adjusted EPS over |

1/3rd | below 5% p.a. | 0% | 7.0% p.a. | 65.0% | |||||||||||||||

| the three-year performance period(3) |

5% p.a. | 33% | ||||||||||||||||||