Exhibit 15.2

| Annual Report and Financial Statements 2019 |

Exhibit 15.2

| Annual Report and Financial Statements 2019 |

|

RELX is a global provider of information-based analytics and decision tools for professional and business customers.

We help scientists make new discoveries, doctors and nurses improve the lives of patients and lawyers win cases. We prevent online fraud and money laundering, and help insurance companies evaluate and predict risk. Our events enable customers to learn about markets, source products and complete transactions.

In short, we enable our customers to make better decisions, get better results and be more productive.

Forward-looking statements This Annual Report contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to risks and uncertainties that could cause actual results or outcomes of RELX PLC (together with its subsidiaries, “RELX”, “we” or “our”) to differ materially from those expressed in any forward-looking statement. The terms “outlook”, “estimate”, “project”, “plan”, “intend”, “expect”, “should”, “will”, “believe”, “trends” and similar expressions may indicate a forward-looking statement. Important factors that could cause actual results or outcomes to differ materially from estimates or forecasts contained in the forward-looking statements include, among others, current and future economic, political and market forces; changes in law and legal interpretations affecting RELX intellectual property rights and internet communications; regulatory and other changes regarding the collection, transfer or use of third-party content and data; demand for RELX products and services; competitive factors in the industries in which RELX operates; ability to realise the future anticipated benefits of acquisitions; significant failure or interruption of our systems; compromises of our data security systems or other unauthorised access to our databases; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC with the US Securities and Exchange Commission.

|

| RELX Annual report and financial statements 2019 | 1 | |

|

| ||

| 2 | RELX Annual report and financial statements 2019 | Overview | |

|

| ||

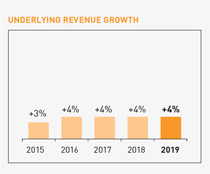

| ◾ | Underlying revenue growth of 4% |

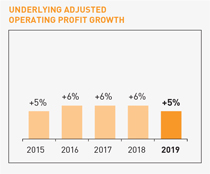

| ◾ | Underlying adjusted operating profit growth of 5% |

| ◾ | Reported operating profit £2,101m (£1,964m) |

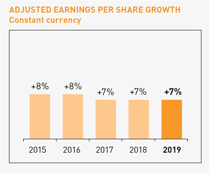

| ◾ | Adjusted EPS at constant currency up 7%; in sterling up 10% to 93.0p |

| ◾ | Reported EPS 77.4p (71.9p) |

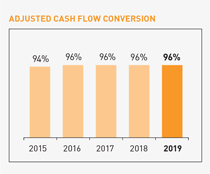

| ◾ | Full-year dividend up 9% to 45.7p |

| ◾ | Strong financial position and cash flow; cash flow conversion at 96% |

RELX financial summary

| REPORTED FIGURES | Change at | |||||||||||||||||||

| 2019 | 2018 | constant | Change | |||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

| Revenue |

7,874 | 7,492 | +5% | +2% | +4% | |||||||||||||||

| Operating profit |

2,101 | 1,964 | +7% | |||||||||||||||||

| Profit before tax |

1,847 | 1,720 | +7% | |||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,505 | 1,422 | +6% | |||||||||||||||||

| Net margin |

19.1% | 19.0% | ||||||||||||||||||

| Net borrowings |

6,191 | 6,177 | ||||||||||||||||||

| Reported earnings per share |

77.4p | 71.9p | +8% | |||||||||||||||||

| Ordinary dividend per RELX PLC share |

45.7p | 42.1p | +9% | |||||||||||||||||

| ADJUSTED FIGURES | Change at | |||||||||||||||||||

| 2019 | 2018 | constant | Change | |||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

| Operating profit |

2,491 | 2,346 | +6% | +3% | +5% | |||||||||||||||

| Operating margin |

31.6% | 31.3% | ||||||||||||||||||

| Profit before tax |

2,200 | 2,145 | +3% | 0% | ||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,808 | 1,674 | +8% | +5% | ||||||||||||||||

| Net margin |

23.0% | 22.3% | ||||||||||||||||||

| Cash flow |

2,402 | 2,243 | +7% | |||||||||||||||||

| Cash flow conversion |

96% | 96% | ||||||||||||||||||

| Return on invested capital |

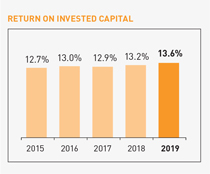

13.6% | 13.2% | ||||||||||||||||||

| Adjusted earnings per share |

93.0p | 84.7p | +10% | +7% | ||||||||||||||||

The shares of RELX PLC are traded on the London, Amsterdam and New York stock exchanges. RELX PLC and its subsidiaries, joint ventures and associates are together known as ‘RELX’.

RELX uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. In 2018, we excluded exceptional tax credits, see note 9 on page 145. Reconciliations between the reported and adjusted figures are set out on page 184. Underlying growth rates are calculated at constant currencies, excluding the results of acquisitions until twelve months after purchase, and excluding the results of disposals and assets held for sale. Underlying revenue growth rates also exclude exhibition cycling. Constant currency growth rates are based on 2018 full-year average and hedge exchange rates.

| RELX Annual report and financial statements 2019 | 3 | |

|

| ||

| RELX Annual report and financial statements 2019 | 5 | |

|

| ||

| 6 | RELX Annual report and financial statements 2019 | Overview | |

|

| ||

Financial KPIs

|

|

| ||

|

|

|

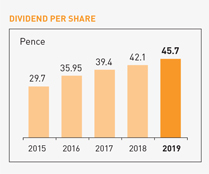

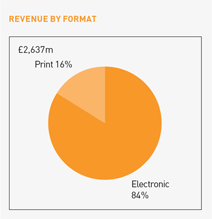

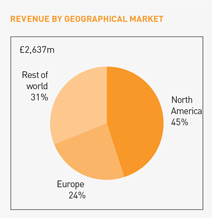

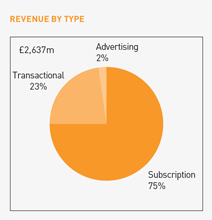

Revenue by category

| RELX Annual report and financial statements 2019 | RELX business overview | 7 | |

|

| ||

| 8 | RELX Annual report and financial statements 2019 | Overview | |

|

| ||

| Harnessing technology across RELX

Around 9,000 technologists, half of whom are software engineers, work at RELX. Annually, the company spends $1.4bn on technology. The combination of our rich data assets, technology infrastructure and knowledge of how to use next generation technologies, such as machine learning and natural language processing, allows us to create effective solutions for our customers. |

| 4

new drug candidates to treat chronic pancreatitis, identified on Elsevier’s AI-powered life sciences platform Entellect in 60 days through analysis of 10 million drug target interactions |

Helping discover new drugs to treat rare diseases

Chronic pancreatitis, which affects about one million people globally, is a painful disease with no current cure. Because of the high cost and low return for finding treatments for such relatively rare diseases, drug makers devote little time and effort to finding cures.

Elsevier, with its vast stores of drug data and artificial intelligence (AI) technologies, including Entellect, its newest AI-powered life sciences platform, felt this was the perfect opportunity to make a difference in the community. Elsevier teamed with non-profit organisations, industry and academic partners, as well as researchers across the globe to find drugs already in existence that could be repurposed to treat the rare disease.

The company hosted a datathon collaboration ‘Repurposing Drugs for Rare Diseases’ with non-profit organisations Cures Within Reach, Mission: Cure, and the Pistoia Alliance (which represents 14 of the top 20 global pharmaceutical companies), life sciences and technology companies including Ariel Precision Medicine, and academia including Cincinnati Children’s Hospital Medical Center and University of Northern Iowa.

The datathon leveraged Elsevier’s expertise, with Entellect as the underpinning AI platform. They combined data from Elsevier’s Life Sciences products (including Reaxys) and third party external data from Open Targets, including data scientists and researchers from the participating organisations.

After 60 days of intense work, the datathon revealed four drugs that could potentially be repurposed to treat chronic pancreatitis. These drugs were validated by independent experts and will now be taken for clinical testing. |

We are enthusiastic about the discoveries made in the Elsevier-Pistoia Alliance datathon. The problem-solving and teamwork focused on chronic pancreatitis were inspiring. We look forward to taking the promising candidates to the next step where we hope they will help us find effective treatments for this difficult, rare disease. The datathon exceeded our expectations, producing four repurposing candidates to address multiple chronic pancreatitis targets.

Megan Golden co-founder and co-director, Mission: Cure |

| RELX Annual report and financial statements 2019 | 9 | |

|

| ||

|

|

| 10m financial transactions processed every day using machine learning capabilities from LexisNexis Risk Solutions’ HPCC Systems

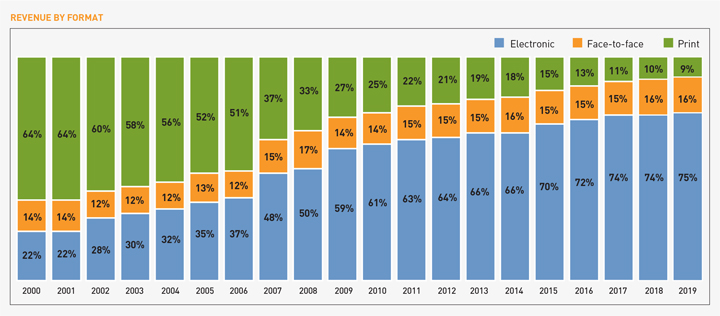

DataSeers is based in Atlanta, Georgia |

Managing complex financial data quickly and efficiently with HPCC Systems

DataSeers is a Georgia-based company that was created in 2017 and provides a reconciliation, analytics and fraud-prevention engine (FinanSeer) for the financial services space. The DataSeers platform is comprised of four modules, one of which is ReconSeer – a rule-based engine that oversees reconciliation of millions of prepaid cards and accounts at unprecedented speeds, helping make monetary decisions in a fast and efficient manner.

The global market for prepaid cards is expected to reach $3,600bn by 2022. Much of this growth is fuelled by the rising need for financial inclusion of unbanked consumers, increasing volumes of online transactions, and the demand for cost-effective payment solutions. The industry continues to be plagued with problems when it comes to back office data management.

Prepaid cards generate a tremendous amount of data that need to be linked and analysed quickly. Companies must replicate data within multiple systems which can create trust issues.

DataSeers needed a big data partner that could handle what it termed the 4V big data conundrum – volume, velocity, variety, and veracity. DataSeers decided to leverage the robust capabilities of LexisNexis Risk Solutions’ HPCC Systems to create a machine learning-based approach to managing financial data.

Typically it takes hours to reconcile records, but with ReconSeer, millions of records on various platforms can be reconciled within seconds, enabling clients to make smarter decisions faster than ever before. The system identifies fraud and compliance issues using machine learning capabilities from HPCC Systems, which is important since FinTech companies have very little to no time to react to these transactions. Ultimately, this helps increase trust in the use of prepaid cards and helps prevent fraud and money laundering. |

Our choice of HPCC Systems as a core technology has allowed us to reduce our integration time to customers and provide results back in a timeline that was not possible before. A great partnership with LexisNexis Risk Solutions around Know Your Customer and Know Your Business helps us even further, and we can now provide a completely unified experience from onboarding to account closure all on a single platform.

Adwait Joshi CEO and founder, DataSeers |

| 10

|

RELX Annual report and financial statements 2019 | Market segments

|

| RELX Annual report and financial statements 2019 | Scientific, Technical & Medical | 13 | |

|

| ||

| 14 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2019 | Scientific, Technical & Medical | 15 | |

|

| ||

| 16 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

| Pure: Building a scholarly reporting system to capture university success

1000

number of faculty days saved annually by using CityU Scholars based on Pure to maintain a comprehensive and up-to-date overview of research production data across CityU. |

| RELX Annual report and financial statements 2019 | Scientific, Technical & Medical | 17 | |

|

| ||

| RELX Annual report and financial statements 2019 | Risk & Business Analytics | 19 | |

|

| ||

| 20 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2019 | Risk & Business Analytics | 21 | |

|

| ||

| 22 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

| LexisNexis Risk Solutions: reducing customer friction and stopping fraud for Commercial Bank of Dubai

87% decrease in managing the number of Commercial Bank of Dubai’s policies leading to improved efficiency and a reduction in overall operating cost |

| RELX Annual report and financial statements 2019 | Risk & Business Analytics | 23 | |

|

| ||

| RELX Annual report and financial statements 2019 | Legal | 25 | |

|

| ||

| 26 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2019 | Legal | 27 | |

|

| ||

| 28 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

| LexisNexis Practical Guidance: helping specialist and boutique law firms to grow

80% time saved for Curlington Legal, when conducting research for clients using LexisNexis products |

| RELX Annual report and financial statements 2019 | Legal | 29 | |

|

| ||

| RELX Annual report and financial statements 2019 | Exhibitions | 31 | |

|

| ||

| 32 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

|

|

|

| ||

| The world’s property market | Asia’s sourcing and networking platform for the complete aluminium industry chain | International trade fair for the building industry | ||

|

|

|

| ||

| CHINA DAILY-USE ARTICLES TRADE FAIR China’s event for suppliers and buyers in the housewares industry |

A premier comic book and pop culture convention | Latin America’s event for hardware, electronics and construction | ||

|

|

|

| ||

| The leading international trade show for fitness, wellness & health | Asia Pacific’s luxury travel event | International exhibition for airport equipment, technology, design and services | ||

|

|

|

| ||

| The North American jewellery industry’s premier event | International perfumery and cosmetics exhibition | The No.1 machine tools and metalworking exhibition serving ASEAN | ||

|

|

|

| ||

| Leading international exhibition for personal care ingredients | International Security Conference & Exposition | An exhibition gathering equipment, solutions and services for electronics manufacturing | ||

|

|

|

| ||

| Japan’s one-stop shop for office related products and services | Premier global event for the travel industry | International trade fair for autoparts, equipment and services | ||

|

|

||||

| International art fair for photography | ||||

|

|

|

| RELX Annual report and financial statements 2019 | Exhibitions | 33 | |

|

| ||

| 34 | RELX Annual report and financial statements 2019 | Market segments | |

|

| ||

| We have a lot of people who ask us how to get started in this business and we say there’s one show you have to go to and that’s the National Hardware Show.

Bob Thorsen Founder The Little Burros |

| RELX Annual report and financial statements 2019 | Exhibitions | 35 | |

|

| ||

| The National Hardware Show: the event that powers businesses

| ||

|

1200 Little Burros secured its first order of 1,200 pieces from a major retailer at the National Hardware Show

About the National Hardware Show

The National Hardware Show, which takes place annually in Las Vegas, is a showcase for home improvement innovations and retail trends.

Each year it brings together over 25,000+ home improvement professionals and some 120 media outlets for three days of face-to-face sourcing, trading, networking and learning.

The Little Burros Burro Buddy in use |

The Little Burros is a family operated, garden tool brand, co-founded, owned and run by innovator Bob Thorsen and his family.

The family of five launched their brand at The National Hardware Show in 2014 and in five years have built an impressive following by providing innovative solutions to everyday garden problems.

Based in Virginia, US, Bob and his wife Sudie were working in the garden when Bob thought up an ingenious tool organiser for attaching to your wheelbarrow. The whole family came together to build a 3D prototype of the ‘Original Little Burro’ and decided to present it at the National Hardware Show. They ended up securing their first order of 1,200 pieces from a major retailer at the show.

The Thorsen family, who have won countless awards for their innovative product, attribute their initial success to The National Hardware Show, and return to the event each year with their expanded offering of garden products. | |

| RELX Annual report and financial statements 2019

|

37

|

|

|

Responsibility

| The Corporate Responsibility Report is

Non-financial information statement RELX is required to comply with the

Reporting Requirement: |

||||

| Environmental matters | 48-49 | |||

| Employees | 45-46 | |||

| Social matters | 38-42, 44-47 | |||

| Human rights | 38, 40-42, 44, 46-48 |

|||

| Anti-corruption and anti-bribery matters |

40, 42-43, 47-48 |

|||

| Policies, due diligence processes and outcomes | 42-43, 47-48 | |||

| Description and management of principal and emerging risks and impact of business activity |

58-61 | |||

| Description of business model |

5, 14-15, 21, 26, 31 |

|||

| Non-financial metrics | 12, 18, 24, 30, 38, 45-49 |

|||

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 39 | |

|

| ||

| Technology unites missing people with their families

“I’ve lost touch with someone and am not sure what to do.” This statement on the website of Missing People – the only British organisation focused on uniting missing children and adults with their families and others of importance in their lives – is apt. According to Missing People, 186,000 people are reported missing each year in the United Kingdom. |

| 300

applications to Missing People’s Lost Contact service

Missing People’s Lost Contact service uses LexisNexis Risk Solutions tools to reconnect missing people with their families and others |

According to Missing People,

186,000 people are reported missing each year

In 2019, with free access to LexisNexis Risk Solutions’ TraceIQ, Missing People re-launched its Lost Contact service. Lost Contact helps people reconnect with someone missing who is not at risk or missing in the eyes of the law.

TraceIQ allowed Missing People to find more people through faster and more efficient searches. During 2019, the relaunch led to over 300 applications for support. Of completed cases, 64% of missing family members were found and given the chance to reconnect. This was the result for three brothers, separated for over a decade: “We lost contact with my younger brother 12 years ago and had been unable to find him through other channels but Missing People found him and we had an amazing reunion with all the family so thank you for your amazing work.” |

TraceIQ has enabled Missing People to reinvigorate our vital Lost Contact service which can reunite the missing with the people who matter most to them.

Jo Youle CEO Missing People |

| 40 | RELX Annual report and financial statements 2019 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 41 | |

|

| ||

| 42 | RELX Annual report and financial statements 2019 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 43 | |

|

| ||

| 44 | RELX Annual report and financial statements 2019 | Corporate responsibility | |

|

| ||

| Inspiring Action on the SDGs in Delhi

On 2 May 2019, we held the fourth RELX SDG Inspiration Day in Delhi, India to catalyse action on the UN Sustainable Development Goals (SDGs). The focus, in partnership with the Ban Ki-Moon Centre for Global Citizens, (UN) Global Compact India, and the Responsible Media Forum, was SDG 11, Sustainable Cities and Communities, and the interconnection with the other 16 SDGs, including Good Health and Well-being (SDG 3) and the Rule of Law (SDG 16). |

| 4th

global RELX SDG Inspiration Day

RELX SDG Inspiration Day Delhi in May 2019 engaged stakeholders on SDG 11, Sustainable Cities and Communities

|

Business, government, investors, academia, youth and NGOs – all stakeholders needed to advance the SDGs – came together to discuss positive, collaborative action.

Kamal Singh, Executive Director of Global Compact India, cited the importance of India; if India achieves the goals , he said, the world is half way to realising the SDGs. Yet the task globally, according to Anna French, Deputy Director of the UK’s Department for International Development India, requires around $5tn USD each year. New approaches are needed to fund the goals, she said, and business must do its part.

There was an Expert Café allowing participants to engage with experts including Arunava Dasgupta, Head of Urban Design at Delhi’s School of Planning and Architecture; Amit Sharma, Head of Energy and Sustainability Services at Schneider Electric India and Aditi Haldar, South-Asia Director of GRI. Themes included: health and urban populations, the role of data and technology, green city energy systems and the implications for skills and jobs.

Barbara Müller, Senior Manager at BMW Foundation, highlighted the Foundation’s Responsible Leader Networks mobilising leaders to collaborate for a sustainable and just future, such as Yash Ranga, Stakeholder Engagement Partner at Jaipur Rugs Foundation. Ranga stated, “hope is a beggar that makes you walk on fire,” don’t hope for change, make it happen.

Ambassador Kim Won-Soo, former UN High Representative for Disarmament Affairs and Board Member of the Ban Ki-moon Centre for Global Citizens, made the case for smaller, smart municipalities. |

The RELX SDG Inspiration Day positively connected those working to achieve the SDGs in India.

Kamal Singh Executive Director (UN) Global Compact India |

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 45 | |

|

| ||

| 46 | RELX Annual report and financial statements 2019 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 47 | |

|

| ||

| 48 | RELX Annual report and financial statements 2019 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate responsibility overview | 49 | |

|

| ||

| RELX Annual report and financial statements 2019 | Chief Financial Officer’s report | 53 | |

|

| ||

| 54 | RELX Annual report and financial statements 2019 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2019 | Chief Financial Officer’s report | 55 | |

|

| ||

| 56 | RELX Annual report and financial statements 2019 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2019 | Chief Financial Officer’s report | 57 | |

|

| ||

| 58 | RELX Annual report and financial statements 2019 | Financial review | |

|

| ||

| EXTERNAL RISKS |

||||

| Risk | Description and impact | Mitigation | ||

| Economy and market conditions |

Demand for our products and services may be adversely impacted by factors beyond our control, such as the economic environment in the United States, Europe and other major economies, international trading relations, political uncertainties, epidemics, acts of war and civil unrest, and levels of government funding available to our customers. | Our businesses are focused on professional markets which have generally been more resilient in periods of economic downturn. We deliver information solutions, many on a subscription and recurring revenue basis, which are important to our customers’ effectiveness and efficiency. We operate diversified businesses in terms of sectors, markets, customers, geographies and products and services. We have extended our position in long-term global growth markets through organic new launches supported by the selective acquisition of small content and data sets. | ||

| We continue to dispose of businesses that no longer fit our strategy. We continuously monitor economic and political developments to assess their impact on our strategy which is designed to mitigate these risks. In response to specific uncertainties, our businesses engage in scenario planning and develop contingency plans where relevant. | ||||

| Intellectual property rights | Our products and services include and utilise intellectual property. We rely on trademark, copyright, patent and other intellectual property laws to establish and protect our proprietary rights in this intellectual property. There is a risk that our proprietary rights could be challenged, limited, invalidated or circumvented, which may impact demand for and pricing of our products and services. Copyright laws are subject to national legislative initiatives, as well as cross- border initiatives such as those from the European Commission and increased judicial scrutiny in several jurisdictions in which we operate. This creates additional challenges for us in protecting our proprietary rights in content delivered through the internet and electronic platforms. | We actively engage in developing and promoting the legal protection of intellectual property rights. Our subscription contracts with customers contain provisions regarding the use of proprietary content. We are vigilant as to the use of our intellectual property and, as appropriate, take legal action to challenge illegal content distribution sources. | ||

| RELX Annual report and financial statements 2019 | Principal and emerging risks | 59 | |

|

| ||

| 60 | RELX Annual report and financial statements 2019 | Financial review | |

|

| ||

| OPERATIONAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Technology and business resilience | Our businesses are dependent on electronic platforms and networks, primarily the internet, for delivery of our products and services. These could be adversely affected if our electronic delivery platforms, networks or supporting infrastructure experience a significant failure, interruption or security breach. | We have established procedures for the protection of our businesses and technology assets. These include the development and testing of business continuity plans, including IT disaster recovery plans and back-up delivery systems, to reduce business disruption in the event of major technology or infrastructure failure, terrorism or adverse weather incidents. | ||

| Cyber security | Our businesses maintain online databases and platforms delivering our products and services, which we rely on, and provide data to third parties, including customers and service providers. These databases and information are a target for compromise and face a risk of unauthorised access and use by unauthorised parties.

Our cyber security measures, and the measures used by our third-party service providers, may not detect or prevent all attempts to compromise our systems, which may jeopardise the security of the data we maintain or may disrupt our systems. Failures of our cyber security measures could result in unauthorised access to our systems, misappropriation of our or our users’ data, deletion or modification of stored information or other interruption to our business operations. As techniques used to obtain unauthorised access to or to sabotage systems change frequently and may not be known until launched against us or our third-party service providers, we may be unable to anticipate or implement adequate measures to protect against these attacks and our service providers and customers may likewise be unable to do so.

Compromises of our or our third-party service providers’ systems, or failure to comply with applicable legislation or regulatory or contractual requirements could adversely affect our financial performance, damage our reputation and expose us to risk of loss, fines and penalties, litigation and increased regulation. |

We have established security programmes with the aim of ensuring that data is protected, our business infrastructures continue to operate and that we comply with relevant legislative, regulatory and contractual requirements.

We have governance mechanisms in place to design and monitor common policies and standards across our businesses.

We invest in appropriate technological and physical controls which are applied across the enterprise in a risk-based security programme which operates at the infrastructure, application and user levels. These controls include, but are not limited to, infrastructure vulnerability management, application scanning and penetration testing, network segmentation, encryption and logging and monitoring. We provide regular training and communication initiatives to establish and maintain awareness of risks at all levels of our businesses. We have appropriate incident response plans to respond to threats and attacks. We maintain appropriate information security policies and contractual requirements for our businesses and run programmes monitoring the application of our data security policies by third-party service providers. We use independent internal and third-party auditors to test, evaluate, and help enhance our procedures and controls. | ||

| Supply chain dependencies | Our organisational and operational structures depend on outsourced and offshored functions, including use of cloud service providers. Poor performance, failure or breach of third parties to whom we have outsourced activities, could adversely affect our business performance, reputation and financial condition. | We select our vendors with care and establish contractual service levels that we closely monitor, including through key performance indicators and targeted supplier audits and security assessments. We have developed business continuity plans to reduce disruption in the event of a major failure by a vendor. | ||

| Talent | The implementation and execution of our strategies and business plans depend on our ability to recruit, motivate and retain skilled employees and management. We compete globally and across business sectors for talented management and skilled individuals, particularly those with technology and data analytics capabilities. An inability to recruit, motivate or retain such people could adversely affect our business performance. Failure to recruit and develop talent regardless of gender, race, national origin or other characteristics could adversely affect our reputation and business performance. | We have well established management development and talent review programmes. We monitor capability needs and remuneration schemes are tailored to attract and motivate the best talent available at an appropriate level of cost. We actively seek feedback from employees, which feeds into plans to enhance employee engagement and motivation. Our Inclusion and Diversity Policy fosters a diverse workforce and environment that respects all individuals and their contributions. |

| RELX Annual report and financial statements 2019 | Principal and emerging risks | 61 | |

|

| ||

| RELX Annual report and financial statements 2019

|

63

|

| Governance | ||||

| In this section | ||||

| 64 |

||||

| 66 |

||||

| 68 |

||||

| 70 |

||||

| 85 |

||||

| 88 |

||||

| 112 |

||||

| 115 |

||||

| 64 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| Executive Directors | Non-Executive Directors | |||||||

|

|

|

| ||||||

| Erik Engstrom (56) Chief Executive Officer

Appointed: Chief Executive Officer of RELX since November 2009. Joined as Chief Executive Officer of Elsevier in 2004. Other appointments: Non-Executive Director of Smith & Nephew plc and Bonnier Group. Past appointments: Prior to joining was a partner at General Atlantic Partners. Before that was President and Chief Operating Officer of Random House Inc and President and Chief Executive Officer of Bantam Doubleday Dell, North America. Began his career as a consultant with McKinsey. Served as a Non-Executive Director of Eniro AB and Svenska Cellulosa Aktiebolaget SCA. Education: Holds a BSc from Stockholm School of Economics, an MSc from the Royal Institute of Technology in Stockholm, and gained an MBA from Harvard Business School as a Fulbright Scholar. Nationality: Swedish |

Sir Anthony Habgood (73)

Chair

Appointed: June 2009 Other appointments: Chair of Preqin Holding Limited and Deputy Chair of RG Carter Holdings Limited. Past appointments: Previously was Chair of the Court of the Bank of England, Whitbread plc, Bunzl plc, Mölnlycke Health Care Limited and Norwich Research Partners LLP and served as Chief Executive of Bunzl plc, Chief Executive of Tootal Group plc and a Director of The Boston Consulting Group. Formerly Non-Executive Director of Geest plc, Marks and Spencer plc, National Westminster Bank plc, Powergen plc, SVG Capital plc, and Norfolk and Norwich University Hospitals Trust. Education: Holds an MA in Economics from Cambridge University, an MS in Industrial Administration from Carnegie Mellon University and an Honorary Doctorate of Civil Law from the University of East Anglia. He is a visiting Fellow at Oxford University. Nationality: British |

Adrian Hennah

(62)

Non-Executive Director Chair of the Audit Committee

Appointed: April 2011 Other appointments: Chief Financial Officer of Reckitt Benckiser Group plc. Past appointments: Chief Financial Officer of Smith & Nephew plc from 2006 to 2012. Before that was Chief Financial Officer of Invensys plc, having previously held various senior finance and management positions with GlaxoSmithKline for 18 years. Formerly, a Non-Executive Director of Indivior PLC. Nationality: British | ||||||

|

|

| ||||||

|

Nick Luff (52) Chief Financial Officer

Appointed: September 2014 Other appointments: Non-Executive Director of Rolls-Royce Holdings plc. Past appointments: Prior to joining the Group was Group Finance Director of Centrica plc from 2007. Before that was Chief Financial Officer at The Peninsular & Oriental Steam Navigation Company (P&O) and its affiliated companies, having previously held a number of senior finance roles at P&O. Began his career as an accountant with KPMG. Formerly a Non-Executive Director of QinetiQ Group plc and Lloyds Banking Group plc. Education: Has a degree in Mathematics from Oxford University and is a qualified UK Chartered Accountant. Nationality: British

|

Wolfhart Hauser

(70)

Non-Executive Director Senior Independent Director Chair of the Remuneration Committee

Appointed: April 2013 Other appointments: Non-Executive Director of Associated British Foods plc. Past appointments: Chair of FirstGroup plc until July 2019. Chief Executive Officer of Intertek Group plc from 2005 until 2015. Prior to that he was Chief Executive Officer of TÜV Sud AG between 1998 and 2002 and Chief Executive Officer of TÜV Product Service GmbH for ten years. Formerly a Non-Executive Director of Logica plc. Education: Holds a master’s degree in Medicine from Ludwig-Maximilian-University Munich and a Medical Doctorate from Technical University Munich. Nationality: German

|

Charlotte Hogg

(49)

Non-Executive Director

Appointed: December 2019 Other appointments: Executive Vice President and Chief Executive Officer for the European Region of Visa Inc. Executive Director of Visa Europe Limited. Non-Executive Director of UK Finance and NowTeach. Past appointments: Chief Operating Officer at the Bank of England. Before that was Head of Retail Banking for Santander UK, Managing Director UK and Ireland for Experian plc, and held senior roles at Morgan Stanley in New York and London. Nationality: British and American |

| RELX Annual report and financial statements 2019 | Board Directors | 65 | |

|

| ||

| 66 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| Mark Kelsey | Kumsal Bayazit | Mike Walsh | Hugh M Jones IV | |||

| Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | |||

| Risk & Business Analytics | Scientific, Technical | Legal | Exhibitions | |||

| & Medical and Chair, | ||||||

| RELX Technology Forum | ||||||

|

|

|

|

| |||

| Joined in 1983. Appointed to current position in 2012. |

Joined in 2004. Appointed to current position in 2019. |

Joined in 2003. Appointed to current position in 2011. |

Joined in 2011. Appointed to current position in 2020. | |||

| Has held a number of senior positions across the Group over the past 30 years. Previously Chief Operating Officer and then Chief Executive Officer of Reed Business Information. Studied at Liverpool University and received his MBA from Bradford University. | Previously President, Exhibitions Europe, Chief Strategy Officer, RELX, and Executive Vice President of Global Strategy and Business Development for LexisNexis. Prior to that worked with Bain & Company in New York, Los Angeles, Johannesburg and Sydney. Holds an MBA from Harvard Business School and is a Graduate of the University of California at Berkeley. | Previously CEO of LexisNexis US Legal Markets and Director of Strategic Business Development Home Depot. Prior to that was a practising attorney at Weil, Gotshal and Manges in Washington DC and served as a consultant with The Boston Consulting Group. Holds a Juris Doctor degree from Harvard Law School and is a graduate of Yale University. | Previously Group Managing Director, Accuity, ICIS, Cirium, and EG within Risk & Business Analytics. Prior to that was Chief Executive Officer, Accuity. Holds an MBA from the Ross School of Business at the University of Michigan and is a graduate of Yale University. | |||

| RELX Annual report and financial statements 2019 | RELX Senior Executives | 67 | |

|

| ||

| RELX Annual report and financial statements 2019 | Chair’s introduction to corporate governance | 69 | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 71 | |

|

| ||

| 72 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 73 | |

|

| ||

| 74 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 75 | |

|

| ||

| 76 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

Stakeholder engagement

The Board recognises that relationships with RELX’s key stakeholders, including its investors, employees, customers, suppliers and the communities in which we operate, are important in allowing the Company to achieve its business aims. Engagement takes place with our stakeholders at all levels across RELX, and the size, diversity of our business and global nature of the Group means that it can take many different forms. Much of it takes place at an operational level, and this is especially true in respect of our customers and suppliers, with whom we deal in the ordinary course of business on a day-to-day basis. In addition to the activities set out on pages 76 to 78, in 2019 to help the organisation and the Board understand the issues that our stakeholders believe we should be focused on, we asked an external third party to test our ranking of 14 issues that we consider to be material with our stakeholders. The results of this engagement, which are seen by the Board and indicate that RELX is focusing on the right issues, are set out on page 8 of our 2019 Corporate Responsibility Report.

| Stakeholder: Investors

| ||

| Why effective engagement is important:

|

This helps investors to understand our strategy, performance and governance arrangements, and to make informed and effective investment decisions concerning RELX. It also makes clear our prioritisation of the long-term in our decision-making and focus on delivery of consistent financial performance.

| |

| How the Board ensures effective engagement with investors, understands their views and considered these in its discussions and decision-making in 2019: | RELX’s material communications to investors, such as its trading results and updates, other regulatory announcements, Annual Report and Accounts and Notice of Annual General Meeting must be reviewed and approved by the Board under our corporate governance framework. The Board also receives regular reports on investor engagement activities and outcomes from each of the Chief Executive Officer, Chief Financial Officer, Head of Investor Relations and Director of Corporate Responsibility. In 2019, these updates provided the Board with information arising from or relating to: the completion of investor roadshows; ad hoc interaction with institutional shareholders on significant issues; and ongoing dialogue with investors through our dedicated Investor Relations, Corporate Responsibility and Treasury teams, concerning our recent and proposed activities. The Board also received a full update from the Chair of the Remuneration Committee on the results of a consultation exercise with major investors concerning the proposed 2020 Directors’ Remuneration Policy, and had direct interaction with shareholders at the 2019 Annual General Meeting, at which it received their thoughts and views on Company performance.

| |

| During the year, the views of our investors informed Board discussions and decision-making in respect of its: approval of the quantum of the Company’s share buy back programme, dividend declarations and dividend policy; recommendation to shareholders to increase the distributable reserves of the Company through a capital reduction; approval of the RELX three-year strategy plan, priority order for the use of cash generated by the Group, and annual budgets and targets; and approval of the Group’s risk appetite. It also assisted the Board in recommending the proposed 2020 Directors’ Remuneration Policy be put to shareholders for approval at the Company’s 2020 AGM, and in respect of its approval of the Group’s 2019 annual and interim results announcements and reports. | ||

| Stakeholder: Employees

| ||

| Why effective engagement is important: | Our people are essential to our success, future growth, and our aim to build leading positions in long-term global growth markets. We continue to invest substantial time and effort to employ, train, develop and retain employees who are passionate about our markets and have up-to-date knowledge and world class expertise in our key functional areas. Hearing their views on what we do well, and what we can do better, is an important driver for improvement and retaining our best talent.

| |

| How the Board ensures effective engagement with employees, understands their views and considered these in its discussions and decision-making in 2019: | In accordance with the Code, the Board appointed Marike van Lier Lels as Workforce Engagement Director, with effect from 1 January 2019. In this role, and supported by the Chief Human Resources Officer, she has overseen the RELX Workforce Engagement Programme for 2019. During the year, she met with European, US and Asia-Pacific workforce representatives, and reported to the Board on engagement processes, outcomes and findings. A wide range of topics were discussed, which included employee views and perspectives on areas including pay and benefits, career development, training, inclusion and diversity, working environment, flexible working, corporate responsibility and the effectiveness and frequency of employee surveys. The Directors’ Remuneration Policy, in so far as it applies to the Executive Directors and how it aligns with broader workforce policies, was also discussed. As a result of the findings, the Board provided direction on providing employees with greater transparency on career development, and its review of flexible working policies and their implementation in 2020. Marike will continue the programme of engagement in 2020, which will be broadened to include her meeting with HR Business Leaders, Heads of Talent and Heads of Recruitment. Additionally in 2019, the Board also reviewed net promoter score survey results for individual business areas, and met and received presentations from Group employees in London, Atlanta and Amsterdam. As a regular item on its agendas, the Board received internal Group-wide communications to employees, and received an update from the Chief Compliance Officer on reports submitted by RELX employees, in confidence, on potential breaches of RELX approved policies or procedures. | |

| The Board considered the information provided to it to assist in its discussions and decision-making in the following areas: its assessment and monitoring of RELX’s culture, and its alignment with our strategy, values and purpose; its discussion and approval of updated RELX Inclusion and Diversity Policies, applicable to each of the Board and the rest of the Group; its review and approval of RELX Workforce Policies in the areas of reward, recruitment and flexible working; and its approval of the proposed Workforce Engagement programme for 2020.

| ||

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 77 | |

|

| ||

| 78 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

|

Stakeholder: Community

| ||

| Why effective engagement is important: | Contributing to our local and global communities is a responsibility and an opportunity. Our employees feel passionately about supporting scientific research throughout the scientific community and advancing the rule of law throughout the global community. Our commitments help us to be an employer of choice.

| |

| How the Board ensures effective engagement with the community, understands its views and considered these in its discussions and decision-making in 2019:

|

The Company’s engagement with the community is completed primarily through our annual RE Cares programme, by which our businesses pursue Corporate Responsibility activities that maximise RELX’s positive impact on society through its Unique Contributions, which include fostering communities. The Board receives an update on the RE Cares programme, and our engagement with the communities in which we operate, from the Director of Corporate Responsibility. This included detail on our UN Sustainable Development Goals (SDG) Resource Centre, participation in UN SDG Action Platforms, and engagement processes through which RELX individuals serve on the boards of UN Global Compact networks in the UK and the Netherlands. The Board was also provided with an overview of the materials provided on the corporate responsibility section of our website, and received updates on our involvement and participation in corporate responsibility forums, initiatives and workshops through our dedicated team and network of 240 RE Cares Champions across our businesses, who ensure the vibrancy of our engagement with the community. | |

Attendance at meetings of the Board and Board Committees

The table below shows the attendance of Directors at meetings of the Board and its Committees during the year. Attendance is expressed as the number of meetings attended out of the number eligible to be attended.

| Director | |

Committee |

|

|

|

|

Board | (1) | Audit | Remuneration | Nominations | |

Corporate Governance |

|

||||||||||||||||||||

| Anthony Habgood (Chair) |

|

7/7 | – | 3/3 | 4/4 | 6/6 | Board Committee membership key

| |||||||||||||||||||||||||||

| Erik Engstrom |

– | 7/7 | – | – | – | – | ||||||||||||||||||||||||||||

| Nick Luff |

– | 7/7 | – | – | – | – | ||||||||||||||||||||||||||||

| Wolfhart Hauser |

|

7/7 | – | 3/3 | 4/4 | 6/6 | ||||||||||||||||||||||||||||

| Adrian Hennah |

|

7/7 | 4/4 | – | 4/4 | 6/6 | ||||||||||||||||||||||||||||

| Marike van Lier Lels (2) |

|

6/7 | 1/2 | – | 3/4 | 5/6 | ||||||||||||||||||||||||||||

| Robert MacLeod (3) |

|

7/7 | – | 3/3 | 1/1 | 6/6 | ||||||||||||||||||||||||||||

| Carol Mills (4) |

|

2/2 | 1/1 | – | – | 2/2 | ||||||||||||||||||||||||||||

| Linda Sanford |

|

7/7 | – | 3/3 | – | 6/6 | ||||||||||||||||||||||||||||

| Ben van der Veer (4) |

|

2/2 | – | – | – | 2/2 | ||||||||||||||||||||||||||||

| Andrew Sukawaty (5) |

|

5/5 | 3/3 | – | – | 4/4 | ||||||||||||||||||||||||||||

| Suzanne Wood |

|

7/7 | 4/4 | – | – | 6/6 | ||||||||||||||||||||||||||||

| Charlotte Hogg (6) |

|

– | – | – | – | – |

| (1) | In addition to the seven scheduled meetings, serving Directors also attended two full-day strategy and business review meetings. |

| (2) | Ms van Lier Lels stepped down as a member of the Audit Committee on 6 June 2019, to focus on her responsibilities as Workforce Engagement Director. She was unable to attend the February Board and Committee meetings due to unforeseen personal circumstances. |

| (3) | Robert MacLeod was appointed to the Nominations Committee on 25 September 2019. |

| (4) | Ms Mills and Mr van der Veer each stepped down as a member of the Board on 25 April 2019. Ms Mills also stepped down as a member of the Audit Committee from that time. |

| (5) | Andrew Sukawaty was appointed as a member of the Board and Corporate Governance Committee on 25 April 2019, and as a member of the Audit Committee with effect from 6 June 2019. |

| (6) | Charlotte Hogg was appointed to the Board with effect from 16 December 2019. Therefore, she did not attend any Board or Committee meetings during the year. |

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 79 | |

|

| ||

| 80 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

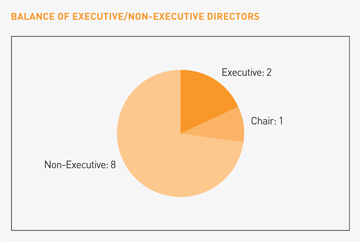

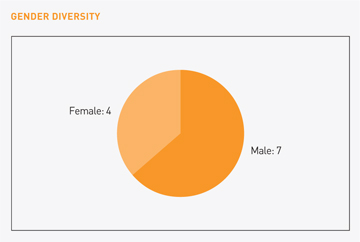

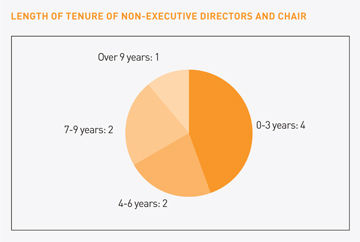

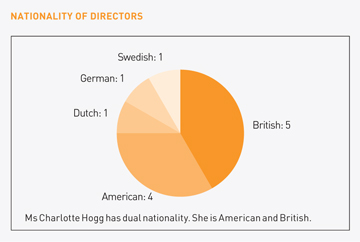

Balance of our Board as at 31 December 2019

|

| |

|

|

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 81 | |

|

| ||

| 82 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| RELX Annual report and financial statements 2019 | Corporate Governance Review | 83 | |

|

| ||

| 84 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

|

Viability statement |

||

|

Viability statement The Code requires Directors to assess the prospects of the Group over a period significantly longer than twelve months and to state whether they have a reasonable expectation that the Company will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment.

Assessing the Group’s prospects The Group develops information-based analytics and decision tools for professional and business customers in the Scientific, Technical & Medical, Risk and Business Analytics, Legal and Exhibitions sectors. The Group has leading positions in long-term growth markets, deep customer understanding and has developed innovative solutions that often account for about 1% of our customers’ cost base but can have a significant and positive impact on the economics of the remaining 99%. Having effectively transitioned the business from print to digital, the Group is systematically migrating its information solutions toward higher value-add decision tools, adding broader data sets, embedding more sophisticated analytics and leveraging more powerful technology. We believe this evolution is improving our business profile and positions the Group for future business success.

The Group’s prospects are assessed through the annual strategy planning process. This process includes a review of assumptions made and assesses each business area’s longer-term plan. The resulting three-year strategy plan forms the basis for Group and divisional targets and in-year budgets. Objectives are set with consideration given to the economic and regulatory environment, and to customer trends, as well as incorporating risks and opportunities. The most recent three-year strategy business plan was agreed by the Directors in September 2019.

In assessing the Group’s prospects, our current position and principal risks are considered as follows:

Current position and business model ◾ Diversified business in terms of sectors, markets, customers, geographies and products and services so that we are not dependent on any one business, customer, region or product

◾ High percentage of subscription and recurring revenue streams

◾ Leading positions in long-term global growth markets

◾ Low working capital and capital investment requirements leading to high levels of cash generation

◾ Clear strategy focused on organic growth supplemented by selective acquisitions in higher growth areas

◾ Continued development of increasingly sophisticated information-based analytics and decision tools

◾ Expansion into higher growth adjacencies and geographies primarily through organic investment augmented with selective acquisitions

Further details on our strategy and 2019 progress are on pages 4 and 5.

Principal risks related to our business model ◾ Challenges to the intellectual property rights of content embedded in our products and services

◾ Disruption or loss of data sources that our businesses rely on due to regulation or other reasons

◾ Changes to the paid subscription model for our primary research business within Scientific, Technical and Medical

◾ Technological failure of our electronic platforms and networks

|

◾ Failure of our cyber security measures resulting in unauthorised access to our systems and breach of data privacy

Detailed descriptions of all principal and emerging risks and mitigations are on pages 58-61

Assessing the Group’s viability The three-year strategy plan for our businesses includes management’s assessment of the anticipated operational risks affecting the business and assumes that current economic conditions broadly persist, financing will be available on similar terms to those negotiated recently and interest rates will follow market expectations. Management then considers the viability of the business should unexpected events, linked to the principal and emerging risks, occur. To first make the assessment, the financial impact of each principal risk on revenue and cashflow is estimated. Owing to the diversified nature of the Group, no individual risk was estimated to have an impact necessary for a breach in the Group’s $3.0bn committed bank facility, broadly estimated at one third of total Group cashflow assuming no mitigating actions.

The assessment then considers various stress-test scenarios under which multiple risks occur simultaneously accompanied by an inability to access the debt capital markets to refinance scheduled liabilities as they become due, together with an increase in interest rates faster than currently expected. The resulting analysis, which assumes share buybacks and acquisition activity are suspended but dividends continue uninterrupted, then considers the impact on available headroom and whether any scenario results in breaching the covenant in the committed bank facility.

The worst-case stress case modelled a combination of the following risks: (a) the inability to use certain third-party data resources; (b) an adverse impact on revenue from a shift away from the paid subscription model; and (c) having our systems disrupted by a cyber security event. The analysis concluded that with the simultaneous occurrence of these three risks, no access to the debt capital markets and a rising interest rate environment, the Group would still have sufficient funds to trade, settle its liabilities as they come due and remain compliant with the covenant in its committed bank facility, whilst still paying dividends.

In addition to scenario modelling, the Directors bi-annually review the Group’s principal risks, assess the likelihood and impact of each risk together with the effectiveness of mitigating controls, and consider emerging risks. The Directors also receive regular updates from management on treasury, tax, acquisitions and divestments, and significant risk areas including information security, technology and legal and regulatory matters. Finally, separate from the annual strategy plan, the Directors periodically receive updates from business area management on their operations, prospects and risks. Whilst these reviews and discussions naturally focus more closely on the quantifiable risks facing the business within the three-year planning period, they also cover longer-term risks.

As a result of stress-testing the three-year strategy plan, supported by regular reviews of risk during the year, the Directors confirm that they have a reasonable expectation that the Group will be able to continue its operations and meet its liabilities as they fall due over the next three years and are not aware of any longer-term operational or strategic risks that would result in a different outcome from the three-year review. |

| RELX Annual report and financial statements 2019 | 85 | |

|

| ||

| 86 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

| RELX Annual report and financial statements 2019 | Report of the Nominations Committee | 87 | |

|

| ||

| 88 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

Directors’ Remuneration Report

The Directors’ Remuneration Report (the Report) has been prepared by the Remuneration Committee (the Committee) in accordance with the UK Corporate Governance Code, the UK Listing Rules and Schedule 8 of the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, as amended (the UK Regulations).

The Report was approved by the Board.

Introduction

The current remuneration policy was approved by shareholders at the 2017 Annual General Meetings (AGM) for three years and can be found at www.relx.com/go/remunerationpolicy or on pages 84 to 90 of the 2016 Annual Reports and Financial Statements. As a result, an updated remuneration policy is being proposed to shareholders for approval (by way of a binding vote) at the 2020 AGM, with the first awards under the new policy to be granted in the first quarter of 2021. The updated remuneration policy, which is proposed to apply for three years from the conclusion of the 2020 AGM, is set out on pages 90 to 96.

The implementation of the current remuneration policy during 2019 is described on pages 99 to 111 (the Annual Remuneration Report). Shareholders will be invited to vote (by way of a non-binding advisory vote) on the 2019 Annual Remuneration Report at the 2020 AGM.

Our report therefore has two parts, the first part starts immediately below and relates to the new proposed remuneration policy and the second part starts on page 97 and describes the implementation of the current remuneration policy in 2019.

Proposed new remuneration policy

The Committee reviewed the Directors’ current remuneration policy during 2019. In doing so, it took into account the Company’s desire to retain and attract top executive talent, promote the continued strong strategic and financial performance of the business and maintain executive alignment with long-term shareholder interests. The Committee considered feedback received from shareholders since the adoption of the current policy in 2017, as well as developments in UK corporate governance and trends in market practice. The Committee also reviewed the pay practices of the FTSE 30, reflective of the Company’s position around the middle of this group and considered the fact that, as a global data analytics and technology-driven business with half of its revenue derived from the US market, the Group primarily competes for talent with global information and technology companies.

In 2019, the Committee undertook a review of workforce remuneration and related policies and the alignment of incentives and rewards with culture. Further detail is set out on page 98. The Committee took this into account when considering the proposed new remuneration policy for Executive Directors. The Committee was also mindful to ensure that the proposed new remuneration policy is transparent, easy to understand, consistent with the Company’s purpose, values and strategy and provides an appropriate link to long-term performance.

Earlier this year, we consulted with shareholders (representing a total of c60% of our issued share capital) and shareholder representative bodies. I would like to express my gratitude for the feedback received, which confirmed our proposal to maintain the same overall incentive structure as previously and helped to shape the changes to the current policy which we have decided to propose. We had a high level of engagement and are pleased to report that virtually all investors who provided feedback indicated support for the proposed approach.

Aspects of the current policy which we are proposing to keep the same

Incentive structure: In our last remuneration policy review, we simplified our incentive structure by reducing the number of plans we operated to one Annual Incentive Plan (AIP) (with a share deferral element) and one Long Term Incentive Plan (LTIP). The Committee is comfortable with this simplified incentive structure and is therefore proposing to continue with it under the new policy.

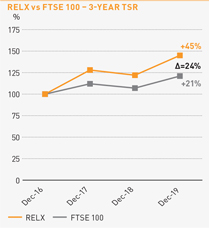

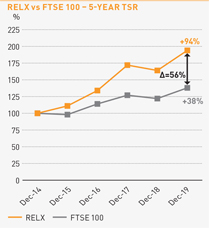

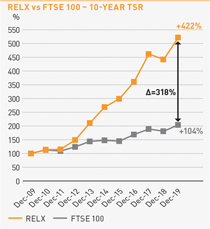

Performance measures: The Committee proposes to use the same combination of financial performance measures for the incentive plans as these have supported consistent, predictable and strong financial performance by the business and significant value creation for shareholders over the last eight years. Our business strategy continues to be to grow the core business through organic investment and the build-out of new products, with bolt-on acquisitions where we are the natural owner, as well as portfolio rationalisation through selective divestments. The EPS, ROIC and TSR performance metrics for the LTIP align with, and support, our strategy by focussing on sustained earnings growth, return on invested capital and shareholder returns.

Discretion and recovery provisions: The Committee has discretion to vary the level of payout under the AIP and LTIP, taking into account RELX’s overall business performance including environmental, social and governance matters and value created for shareholders over the period and other relevant factors. AIP and LTIP are also subject to malus and claw-back provisions in case of materially misstated financial or other data, serious misconduct and breach of post-termination restrictive covenants.

| RELX Annual report and financial statements 2019 | Directors’ Remuneration Report | 89 | |

|

| ||

| 90 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

Remuneration Policy Report

Set out in this section is the Company’s proposed new remuneration policy for Directors, which, subject to approval by shareholders, will apply for three years from the conclusion of the RELX PLC AGM to be held on 23 April 2020. The key changes from the previous remuneration policy (which was first published on pages 84 to 90 of the 2016 Annual Reports and Financial Statements and was approved by shareholders at the April 2017 Annual General Meetings) and the rationale for the changes are explained in the Committee Chair’s introduction on pages 88 and 89.

Remuneration policy table – Executive Directors

All footnotes to the policy table can be found on page 93.

|

ANNUAL BASE SALARY

|

Purpose and link to strategy

| To recruit and retain the best executive talent globally to execute our strategic objectives at appropriate cost. |

Operation

Salaries for Executive Directors are set and reviewed annually by the Remuneration Committee (the Committee) with changes typically taking effect on 1 January. In exceptional circumstances, the Committee may review salaries more frequently.

When reviewing salaries, the Committee considers the executive’s role and sustained value to the Company in terms of skill, experience and overall contribution and the Company’s guidelines for salaries for all employees for the year. Periodically, competitiveness with companies which are comparable in respect of industry, size, international scope and complexity is also considered in order to ensure the Company’s ability to attract and retain executives.

| For the last eight years, Executive Directors’ salary increases have been 2.5% per annum. |

Performance framework

| N/A |

Maximum value

| Salary increases will continue to be aligned with the range of increases for the wider employee population and subject to annual all-employee guidelines. However, as for all employees, the Committee has discretion to exceed this to take account of individual circumstances such as change in responsibility, increases in scale or complexity of the business, inflation or alignment to market level. |

Recovery of sums paid

No provision.

|

RETIREMENT BENEFITS

|

Purpose and link to strategy

| Retirement plans are part of remuneration packages designed to recruit and retain the best executive talent at appropriate cost. |

Operation

Policy for new appointments

Executive Directors appointed after the effective date of this policy will receive pension benefits up to the value equivalent to the maximum level of pension benefits provided under the Company’s regular defined contribution pension plans as may be in effect or amended from time to time (currently capped at 11% of base salary in the UK). The defined contribution pension plans are designed to be competitive and sustainable long-term. Any amount payable may be paid wholly or partly as cash in lieu and may be subject to tax and social security deductions in various jurisdictions.

Transition arrangements for existing Executive Directors

The existing directors will transition from their current arrangements to the above new appointment policy by the end of 2022.

The CFO currently receives a company contribution paid as cash in lieu of pension. The CFO’s company contribution decreased by five percentage points to 20% of base salary from January 2020 and further decreases to 18% from January 2021, to 16% from January 2022 and from the end of 2022, he will be subject to the above new appointment policy (currently capped at 11% of base salary in the UK).

The CEO is a member of a UK legacy defined benefit pension scheme, accruing 1/30th of final year pensionable earnings for each year (pro-rated for part years) of service, with a normal retirement age of 60. In line with all UK defined benefit scheme members, the CEO’s contributions to the plan and fees he pays to participate in the plan (together the ‘Total Plan Fees’) have been increasing annually since 2011. However, the CEO now pays a higher percentage of pensionable earnings as Total Plan Fees in each calendar year than other legacy members. In 2019, his Total Plan Fees were 20% of pensionable earnings, up from 12.5% in 2018. His total Plan Fees are 25% in 2020 and increase to 30% in 2021 and to 35% in 2022. A cap applies of 2% per annum on the increase in the CEO’s pensionable earnings (in place since 2017). Like all other members of the legacy defined benefit pension scheme, the CEO is allowed to switch to the defined contribution plan at any time. At the end of 2022, the CEO will cease to accrue any further benefits under the legacy defined benefit pension scheme. After 31 December 2022, he will be subject to the above new appointment policy (currently capped at 11% of base salary in the UK).

| Performance framework |

| N/A |

| RELX Annual report and financial statements 2019 | Directors’ Remuneration Report | 91 | |

|

| ||

| 92 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

AIP CONTINUED

Performance framework

The AIP includes financial measures with a weighting of at least 85% and may also include non-financial measures with a weighting of up to 15%. Each measure is assessed separately.

| ◾ | The minimum payout is zero. |

| ◾ | Each measure is assessed independently and payout for each measure at threshold is 10% of the maximum opportunity for that measure. If the financial measures have a weighting of 100% and threshold is reached for each of the financial measures, the overall payout for the financial measures is 13.5% of salary. If the financial measures have a weighting of 85% and threshold is reached for each of the financial measures, the overall payout for the financial measures is 11.5% of salary. |

| ◾ | Payout for target performance is 135% of salary. |

Following an assessment of financial achievement, and scoring of any non-financial measures, the Committee agrees the overall level of earned incentive for each Executive Director.

Committee discretion applies.1,2,3

Maximum value

The maximum potential annual incentive is 200% of annual base salary. This includes the deferred share element but excludes dividend equivalents payable in respect of the deferred shares.

Recovery of sums paid

Claw-back applies.4

LONG TERM INCENTIVE PLAN (LTIP)

Purpose and link to strategy

The Long-Term Incentive Plan (LTIP) is designed to provide a long-term incentive for Executive Directors to achieve the key performance measures that support the Company’s strategy, and to align their interests with shareholders.

Why performance measures are chosen and how targets are set

Our strategic focus is on continuing to transform the core business through organic investment and the build-out of new products into adjacent markets and geographies, supplemented by selective portfolio acquisitions and divestments. The performance measures in the LTIP are chosen to support this strategy by focusing on sustained earnings growth, return on invested capital and shareholder return.

Targets are set with regard to previous results and internal and external forecasts for the performance period and the strategic plan for the business. They are designed to provide exceptional reward for exceptional performance, whilst allowing a reasonable expectation that reward at the lower end of the scale is attainable, subject to robust performance.

Operation

Annual awards of performance shares, with vesting subject to:

| ◾ | performance measured over three financial years |

| ◾ | continued employment (subject to the provisions set out in the Policy on payments for loss of office section) |

| ◾ | meeting shareholding requirements (450% of salary for the CEO and 300% of salary for the CFO) |

Executive Directors are to retain their net (after tax) vested shares for a holding period of two years after vesting.

Dividend equivalents accrued during the performance period are payable in respect of the performance shares that vest.

On a change of control, the default position is that awards vest on a pro-rated basis, subject to an assessment of performance against targets at that time. Alternatively, the Committee may determine that the awards will not vest and will instead be exchanged for equivalent awards in the acquiring company.

Performance framework

The performance measures are EPS, ROIC and relative TSR, weighted 40%:40%:20% respectively and assessed independently, such that a payout can be received under any one of the measures (or, for TSR, in respect of one of the three comparator groups).

| ◾ | The minimum payout is zero. |

| ◾ | Each measure is assessed independently and payout for each measure at threshold is 25% of the maximum opportunity for that measure. If only one measure vests at threshold, and it has a weighting of 40%, then the overall payout would be 10% of the maximum award. If only one measure with a weighting of 20% vests at threshold, the overall payout would be 5% of the maximum award. |

| ◾ | Payout in line with expectations is 50% of the maximum award. |

Dividend equivalents are not taken into account in the above payout levels.

Committee discretion applies.1,2,3

Maximum value

The maximum grant in any year is up to 450% of base salary for the CEO and up to 375% of base salary for other Executive Directors (not including dividend equivalents).

Recovery of sums paid

Claw-back applies.4

| RELX Annual report and financial statements 2019 | Directors’ Remuneration Report | 93 | |

|

| ||

| 94 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

Approach to recruitment remuneration – Executive Directors

When agreeing the components of a remuneration package on the appointment of a new Executive Director, or an internal promotion to the Board, the Committee would seek to align the package with the remuneration policy stated in the policy table.

The Committee’s general principle on recruitment is to offer a competitive remuneration package to attract high-calibre candidates from a global talent pool. Basic salary would be set at an appropriate level for the candidate, taking into account all relevant factors. As a data analytics and technology-driven business, with half of its revenue in the US, the Company primarily competes for talent with global information and technology companies.

The various components and the Company’s approach are as follows:

Standard package on recruitment*

To offer remuneration in line with the policy table (including the limits), taking into account the principles set out above.

Compensation for forfeited entitlements

The Committee may make awards and payments on hiring an external candidate to compensate him or her for entitlements forfeited on leaving the previous employer. If such a decision is made, the Committee will attempt to reflect previous entitlements as closely as possible using a variety of tools, including cash and share based awards. Malus and claw-back provisions will apply where appropriate. If necessary to facilitate the grant of awards, the Committee may rely on the one person exemption from shareholder approval in the UK Listing Rules.

Relocation allowances and expenses

The type and size of relocation allowances and expenses will be determined by the specific circumstances of the new recruit.

* The standard package comprises annual base salary, retirement benefits, other benefits, AIP and LTIP.

Shareholding requirement

The Executive Directors are subject to shareholding requirements. These are a minimum of 450% of annual base salary for the CEO and 300% of annual base salary for other Executive Directors. On joining or promotion to the Board, Executive Directors are given a period of time, typically up to five years, to build up to their requirement. On termination of employment, Executive Directors are to maintain their full shareholding requirement (or, if lower, their actual level of shareholding at the time of leaving) for two years after leaving employment.

Shares which count for shareholding purposes are shares beneficially owned by the Executive Director, their spouse, civil partner or dependent child and AIP deferred shares which are within their three-year deferral period, on a notional net of tax basis.

Policy on payments for loss of office

In line with the Company’s policy, the service contracts of the existing Executive Directors contain 12-month notice periods.

The circumstances in which an Executive Director’s employment is terminated will affect the Committee’s determination of any payment for loss of office, but it expects to apply the principles outlined in the table on the next page. The Committee reserves the right to depart from these principles where appropriate in light of any taxation requirements to which the Company or the Executive Director is subject (including, without limitation, section 409A of the US Internal Revenue Code), or other legal obligations.

| RELX Annual report and financial statements 2019 | Directors’ Remuneration Report | 95 | |

|

| ||

| 96 | RELX Annual report and financial statements 2019 | Governance | |

|

| ||

Remuneration policy table – Non-Executive Directors