Exhibit 15.2

Annual Report and Financial Statements 2020

Exhibit 15.2

Annual Report and Financial Statements 2020

RELX is a global provider of information-based analytics and decision tools for professional and business customers.

We help researchers make new discoveries, doctors and nurses improve the lives of patients, and lawyers develop winning strategies. We prevent online fraud and money laundering, and help insurance companies evaluate and predict risk. Our events combine in-person and digital experiences to help customers learn about markets, source products and complete transactions.

In short, we enable our customers to make better decisions, get better results and be more productive.

Forward-looking statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended. These statements are subject to risks and uncertainties that could cause actual results or outcomes of RELX PLC (together with its subsidiaries, “RELX”, “we” or “our”) to differ materially from those expressed in any forward-looking statement. We consider any statements that are not historical facts to be “forward-looking statements”. The terms “outlook”, “estimate”, “forecast”, “project”, “plan”, “intend”, “expect”, “should”, “will”, “believe”, “trends” and similar expressions may indicate a forward-looking statement. Important factors that could cause actual results or outcomes to differ materially from estimates or forecasts contained in the forward-looking statements include, among others: current and future economic, political and market forces; the impact of the Covid-19 pandemic as well as other pandemics or epidemics; changes in law and legal interpretations affecting RELX intellectual property rights and internet communications; regulatory and other changes regarding the collection, transfer or use of third-party content and data; changes in the payment model for our products; demand for RELX products and services; competitive factors in the industries in which RELX operates; ability to realise the future anticipated benefits of acquisitions; significant failure or interruption of our systems; exhibitors’ and attendees’ ability and desire to attend face-to-face events and availability of event venues; compromises of our data security systems or other unauthorised access to our databases; legislative, fiscal, tax and regulatory developments and political risks; exchange rate fluctuations; and other risks referenced from time to time in the filings of RELX PLC with the US Securities and Exchange Commission (SEC). You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. Except as may be required by law, we undertake no obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Report or to reflect the occurrence of unanticipated events.

| RELX Annual report and financial statements 2020 | 1 | |

|

| ||

| 2 | RELX Annual report and financial statements 2020 | Overview | |

|

| ||

| ◾ | Our three largest business areas, Scientific, Technical & Medical, Risk and Legal, which together accounted for 95% of RELX revenue in 2020, reported combined revenue of £6,748m, up 2%, and adjusted operating profit of £2,245m, up 4%, for the year. All three business areas continued to deliver underlying revenue and adjusted operating profit growth. |

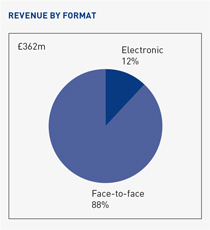

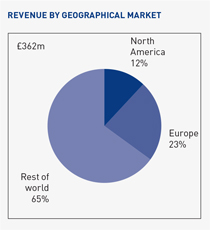

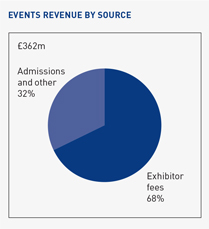

| ◾ | Exhibitions, which accounted for 5% of revenue in 2020, has been impacted significantly by the Covid-19 pandemic, with revenue of £362m, down 71%, and an adjusted operating loss of £164m (£331m profit). |

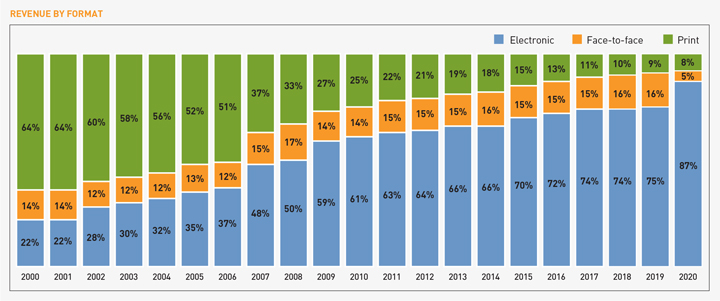

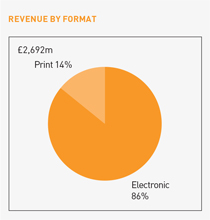

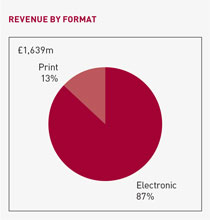

| ◾ | By format, electronic revenue across all divisions, representing 87% of the total, grew 4%. Print revenue, which represented 8% of the total, declined 14%, more steeply than in recent years, and face-to-face revenue, which represented around 5% of the total, was down by 73%. |

RELX financial summary

| REPORTED FIGURES | Change at | |||||||||||||||||||

| 2020 | 2019 | constant | Change | |||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

| Revenue |

7,110 | 7,874 | -10% | -10% | -9% | |||||||||||||||

| Operating profit |

1,525 | 2,101 | -27% | |||||||||||||||||

| Profit before tax |

1,483 | 1,847 | -20% | |||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,224 | 1,505 | -19% | |||||||||||||||||

| Net margin |

17.2% | 19.1% | ||||||||||||||||||

| Net borrowings |

6,898 | 6,191 | ||||||||||||||||||

| Reported earnings per share |

63.5p | 77.4p | -18% | |||||||||||||||||

| Ordinary dividend per RELX PLC share |

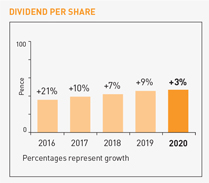

47.0p | 45.7p | +3% | |||||||||||||||||

| ADJUSTED FIGURES | Change at | |||||||||||||||||||

| 2020 | 2019 | constant | Change | |||||||||||||||||

| For the year ended 31 December | £m | £m | Change | currencies | underlying | |||||||||||||||

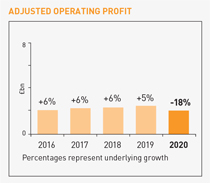

| Operating profit |

2,076 | 2,491 | -17% | -18% | -18% | |||||||||||||||

| Operating margin |

29.2% | 31.6% | ||||||||||||||||||

| Profit before tax |

1,916 | 2,200 | -13% | -15% | ||||||||||||||||

| Net profit attributable to RELX PLC shareholders |

1,543 | 1,808 | -15% | -16% | ||||||||||||||||

| Net margin |

21.7% | 23.0% | ||||||||||||||||||

| Cash flow |

2,009 | 2,402 | -16% | |||||||||||||||||

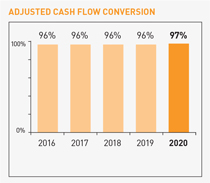

| Cash flow conversion |

97% | 96% | ||||||||||||||||||

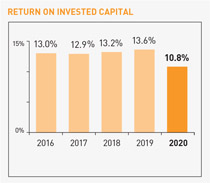

| Return on invested capital |

10.8% | 13.6% | ||||||||||||||||||

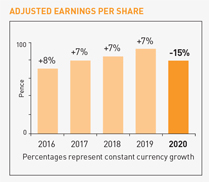

| Adjusted earnings per share |

80.1p | 93.0p | -14% | -15% | ||||||||||||||||

The shares of RELX PLC are traded on the London, Amsterdam and New York stock exchanges. RELX PLC and its subsidiaries, joint ventures and associates are together known as ‘RELX’.

RELX uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other items related to acquisitions and disposals, and the associated deferred tax movements. In 2020, we also excluded exceptional costs in the Exhibitions business. Reconciliations between the reported and adjusted figures are set out on page 188. Underlying growth rates are calculated at constant currencies, excluding the results of acquisitions until 12 months after purchase, and excluding the results of disposals and assets held for sale. Underlying revenue growth rates also exclude exhibition cycling. Constant currency growth rates are based on 2019 full-year average and hedge exchange rates.

| RELX Annual report and financial statements 2020 | 3 | |

|

| ||

| RELX Annual report and financial statements 2020 | 5 | |

|

| ||

| 6 | RELX Annual report and financial statements 2020 | Overview | |

|

| ||

Financial KPIs

|

|

| ||

|

|

|

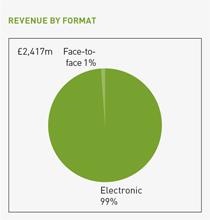

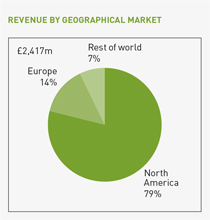

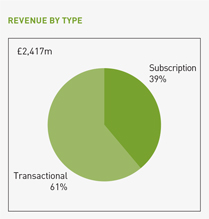

Revenue by category

| RELX Annual report and financial statements 2020 | RELX business overview | 7 | |

|

| ||

| 8 | RELX Annual report and financial statements 2020 | Overview | |

|

| ||

|

Harnessing technology across RELX

Around 9,000 technologists, half of whom are software engineers, work at RELX. Annually, the company spends $1.5bn on technology. The combination of our rich data assets, technology infrastructure and knowledge of how to use next generation technologies, such as machine learning and natural language processing, allows us to create effective solutions for our customers. |

|

This project illustrates the power of the HPCC Systems platform and the Data Lake methodology to quickly extract valuable information and insight from readily available data. These metrics and visualisations were not developed in a vacuum. They are the result of an iterative methodology that layers knowledge upon knowledge to continuously extract deeper and deeper insights.

Roger Dev Senior Architect, LexisNexis Risk Solutions |

Helping advance research and provide the public with powerful analytics on global Covid-19 trends

Using HPCC Systems Data Lake Technology, RELX created a Covid-19 Tracker to monitor and report the progress of the Covid-19 virus and provide better contextual understanding of the pandemic’s evolution.

Using data from Johns Hopkins University (daily cases and deaths), the US Census Bureau (US population) and the UN DESA (world population), the tracker provides metrics and analysis for locations across the globe, with maps that drill down to country and regional levels, helping to understand how the virus is propagating.

The data is presented in a balanced, digestible form, using plain language, allowing individuals sufficient information and context to make reasonable decisions. For each location, the tracker includes a ‘Hot Spot’ module that identifies the worst outbreaks at any given time, infection rate trends, weekly statistics and commentaries. The animation controls show the progression of the virus in time and hence can help point to events that could have contributed to the rapid spread of the virus.

The HPCC Systems Covid-19 Tracker is a free resource and available to the public. It is used to advance research by partners at Oxford University and Florida Atlantic University.

The tracker runs on RELX’s HPCC Systems Data Lake platform. The Data Lake is a collaboration environment for universities and researchers to access, share and process data assets that enhance the metrics for the project. This allows easy incorporation of new data sources and a rapid transition from development to production.

Providing comprehensive, quality data during a fast-developing pandemic is a challenge. Public data sites often present raw statistics but provide little context with which to understand what exactly is happening and how the pandemic is spreading.

The teams behind the tracker wanted to delve deeper and provide commentary that was actionable as well as drill down to the narrowest location possible in order to make projections. In addition to daily cases, daily deaths and testing, the model integrates data on transportation and tourism infrastructure, hospitalisation, socioeconomic indicators, flight schedules, people density and people movements. |

30,000 +

over 30,000 unique visitors (as at November 2020)

Viewing data by region using the Covid-19 Tracker |

| RELX Annual report and financial statements 2020 | 9 | |

|

| ||

| +90%

Significant reduction in the fraud-to-sales ratio, with over 90% of users now rated as trusted, dramatically reducing potential friction on the customer experience

|

||||

| paysafecard online | LexisNexis ThreatMetrix helps paysafecard reduce fraud and friction for good customers

paysafecard is an online payment method that allows users to pay for goods and services securely and privately at a huge range of global online merchants in 50 markets. paysafecard vouchers are sold at more than 650,000 retail outlets, gas stations and grocery stores, providing a simple, prepaid alternative to online payments.

With a strong market position and a large customer base, paysafecard was a key target for fraudsters looking to exploit process and data loopholes, and test fraud defences. Fraudsters were using credentials stolen from high-profile data breaches to perpetrate payment fraud.

However, despite the need to address the payment threat from fraudsters, paysafecard also understands the potential impact on good customers. paysafecard enhanced its risk decisioning with new capabilities which enabled it to promote and reward positive, trusted behaviour while also detecting fraudulent payments in near real time.

Leveraging this trust, paysafecard could focus on reducing customer friction. False positives fell by approximately 70% while the business continued to grow. This led to happier customers while simultaneously reducing operational costs.

LexisNexis ThreatMetrix provided paysafecard with a layered defence solution, designed to enhance near real time fraud detection and risk-decisioning amidst a constantly evolving cybercrime landscape. Layering digital and physical identity intelligence with behavioural biometrics enabled paysafecard to detect high-risk and fraudulent payments, while recognising more transactions as trusted across the customer journey. |

LexisNexis ThreatMetrix has delivered remarkable product developments that have aligned closely with our internal drive to reduce fraud without impacting good customers. Recently released behavioural biometrics capabilities have further enhanced our ability to identify clusters of fraudulent accounts, adding an extra layer of precision to our fraud detection.

Hany Razi Head of Global Financial Crime Intelligence & Analytics Paysafe Group |

| 10 | RELX Annual report and financial statements 2020 | Overview | |

|

| ||

| Continuing to deliver for our customers

In what turns out to have been a truly extraordinary year the whole organisation rose to the challenge of maintaining high levels of customer service in hugely changed working conditions reflecting the quality and dedication of our staff around the world. |

| RELX Annual report and financial statements 2020 | 11 | |

|

| ||

| Read our stories on how we enable our customers to make better decisions, get better results and be more productive: relx.com/our-business/our-stories |

| 12

|

RELX Annual report and financial statements 2020 | Market segments

|

| RELX Annual report and financial statements 2020

|

13

|

| Market segments | ||||

| In this section | ||||

| 14 |

||||

| 20 |

||||

| 26 |

||||

| 32 |

||||

| RELX Annual report and financial statements 2020 | Scientific, Technical & Medical | 15 | |

|

| ||

| 16 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2020 | Scientific, Technical & Medical | 17 | |

|

| ||

| 18 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

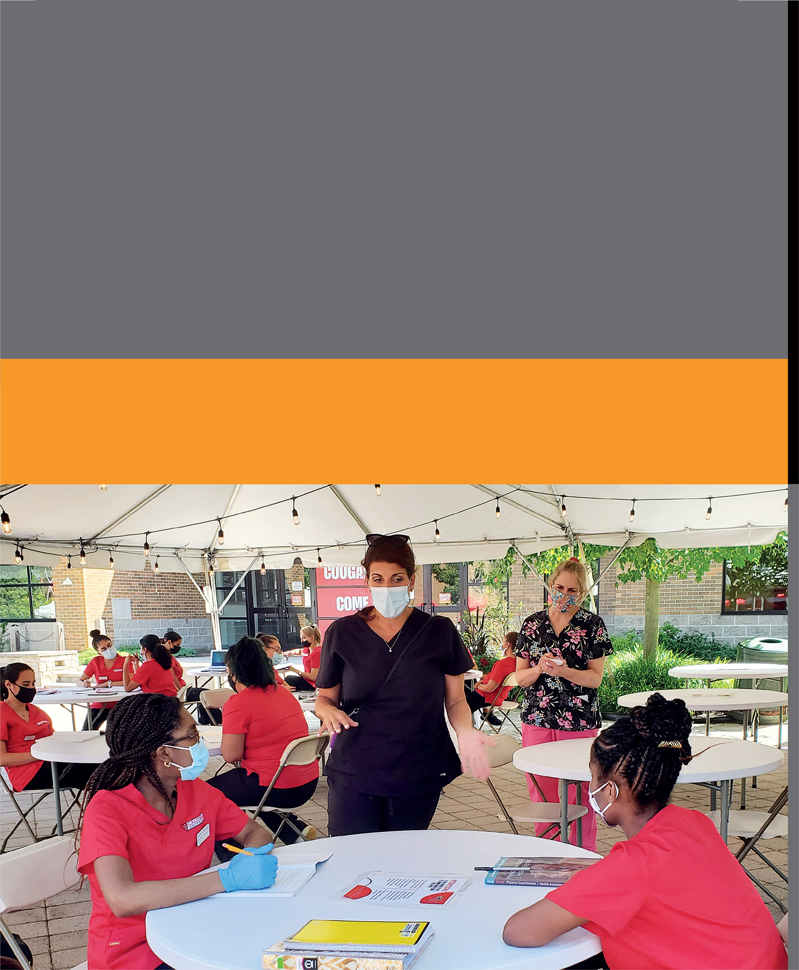

| HESI: Improving knowledge retention, increasing exam scores, and setting students up for career success as health professionals

98% overall pass rate in May 2018, an improvement of over 30 percentage points – 20 percentage points over the national average |

| RELX Annual report and financial statements 2020 | Scientific, Technical & Medical | 19 | |

|

| ||

|

The health assessment HESI and fundamentals HESI are really the tenets of nursing. They’re the basic building blocks and the students have to excel in those two areas. It’s a big part of the NCLEX.

Dr Kathleen Kelley Director of Undergraduate Nursing Education, Caldwell University

About HESI

HESI is a product suite of testing and test preparation solutions for nursing students that analyse and improve student performance, promote clinical judgement, and help students and the nursing programmes overall achieve even greater levels of success.

An outdoor lesson at Caldwell Campus

|

Caldwell University’s Bachelor of Nursing Degree (BSN) programme provides an exceptional curriculum to prepare nurses for professional practice.

In 2019 Caldwell University’s undergraduate nursing programme was named one of the top 10 nursing schools in New Jersey, with an impressive 95% of their 2019 graduates either working, enrolled in further education or serving in the military.

This success rate hasn’t always been the case. Before 2015 when Caldwell University implemented Elsevier’s HESI suite of products across its entire BSN curriculum, its National Council Licensure Examination (NCLEX) pass rates hovered under 60%. However, since incorporating HESI into its programme, it has seen exam scores rise into the high 90s. In May 2018 it achieved a 98% overall pass rate, 100% for BSN graduates and 94.7% for nursing as second degree. This represents an improvement of over 30 percentage points, 20 percentage points over the national average when compared with a pass rate for all candidates of 73%.

Under the leadership of Dr Kathleen Kelley, Director of Undergraduate Nursing Education, the faculty is now able to use HESI to test and analyse the data to make sure its programme outcomes are constantly adapted and on track to reach the highest possible pass rates.

HESI not only helps to prepare students to pass the critical NCLEX exam, but the data also help faculty understand how they can improve the programme by finding gaps in the curriculum based on students’ performance. HESI, for example, was instrumental in identifying that knowledge retention was their biggest challenge, enabling faculty to prioritise and address the issue.

Having identified these gaps, the faculty was also able to use other tools from Elsevier to develop a remediation strategy. Retention activities were developed for students during term breaks to help students achieve better test outcomes. Caldwell’s focus on high retention ensures students are set up for success both in terms of exams and in their future nursing careers.

The integration of Elsevier products throughout its curriculum also helps Caldwell see how it ranks compared with the national benchmark. With data from HESI exams, faculty continues to adapt its curriculum and shape its courses around the gaps that need to be addressed in student learning. By analysing the data from HESI exams, Caldwell continues to build on its students’ success. |

| RELX Annual report and financial statements 2020 | Risk | 21 | |

|

| ||

| 22 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2020 | Risk | 23 | |

|

| ||

| 24 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

LexisNexis

Risk Solutions:

Redefining the consumer

insurance experience

<1 minute

Consumers can get renters and

auto quotes in less than a minute

and purchase in seven minutes

| RELX Annual report and financial statements 2020 | Risk | 25 | |

|

| ||

|

The team at LexisNexis Risk Solutions has been instrumental in helping us meet our aggressive timeline to launch a new insurance concept within mere months and gain acceptance with consumers. The data we use helps Toggle understand our customers better so that we can design a great experience, offer the right products and execute on our vision to be the insurance innovation leader and “we get you” brand.

Stephanie Lloyd Head of Toggle Insurance

About LexisNexis Risk Solutions

LexisNexis Risk Solutions provides data and analytics to help insurers automate critical business processes and deliver higher levels of customer experience.

Leveraging our vast data resources, including public and insurance contributory data, LexisNexis Risk Solutions drive 188m annual insurance purchase decisions across the entire policy lifecycle — from acquisition to renewal to claim.

San Francisco apartments |

Toggle, a Farmers Company, launched in 2018 to serve the next-generation insurance consumer with a brand new renters policy, has since expanded to offer an auto insurance quoting experience reimagined for the tech-savvy buyer.

The Woodland Hills, California-based insuretech is now offering renters policies in 70% of the addressable US insurance market and still growing.

A start-up within a long-standing, trusted insurance brand, the team at Toggle was tasked with reimagining the insurance buying journey, providing consumers with affordable, portable and highly customisable solutions that fit their daily lives. The team utilises next-level technology and user experiences typical of top-tier technology companies and designs products and services around modern lifestyles, attitudes and behaviours.

Toggle is committed to providing customers with easy to understand descriptions and known dependencies, along with choice, more control and confidence in their insurance purchase decisions. To help deliver a frictionless quote and policy bind experience, Toggle harnessed the power of LexisNexis Risk Solutions data and advanced analytics from the beginning of the transaction to the end.

The process starts with identity authentication to confirm individuals are who they say they are. Customers are then empowered to choose what’s best for them. Toggle’s relatable approach helps reduce the complexity of price options and give the consumer clarity about what’s covered by the policy, and LexisNexis’ prefill solutions help customers validate the accuracy of their information, rather than fill out a long form.

Using an arsenal of data and advanced analytics such as past claims, driving violations and vehicle history to better understand risk, Toggle can offer consumers renters and auto quotes in less than a minute and complete the whole binding process in five to seven minutes. This can help meet the needs of today’s time-starved consumer so they can quickly make informed insurance decisions. |

|

| RELX Annual report and financial statements 2020 | Legal | 27 | |

|

| ||

| 28 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

|

|

|

| RELX Annual report and financial statements 2020 | Legal | 29 | |

|

| ||

| 30 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

LexisNexis

PatentSight:

increasing patent

portfolio strength

and patent income

47.2%

increased patent portfolio strength

in IoT technologies since 2016;

the only player showing a clear

upwards quality development.

| RELX Annual report and financial statements 2020 | Legal | 31 | |

|

| ||

|

LexisNexis PatentSight software features empirically validated quality metrics and the well-presented analytics create transparency in the ever-increasing mass of global patent applications. The software provides insights on where to focus, enables us to report on the development of our patent portfolio and benchmarks against competitors. With PatentSight and their support team, we make better informed investment decisions on our IP portfolio.

Beat Weibel Chief IP Counsel, Siemens

About LexisNexis PatentSight

LexisNexis PatentSight provides patent analytics.

It is used by corporations, law firms and governmental institutions worldwide to stay ahead of the innovation curve and to uncover what their competitors are hatching long before they come to market.

IoT: Siemens best in class, Patent Quality Development based on selected technology fields: Data Security, ML&AI, Robotics, Smart City, AM, Autonomous Driving, Blockchain Data base: active only, patents only

Source: PatentSight, 2020-08-13 |

Siemens is a global powerhouse in the areas of electrification, automation and digitalisation. One of the world’s largest producers of energy-efficient, resource-saving technologies, the organisation is a leading supplier of systems for power generation and transmission, building and transportation infrastructure, industrial automation as well as medical diagnosis.

Beat Weibel, Siemens’ Chief Intellectual Property (IP) Counsel, always believed in quality over quantity. In 2013, when taking responsibility for Siemen’s patent portfolio, Beat set out to change the group’s intellectual property strategy from a volume-driven to a quality-driven approach. This new perspective was designed to yield a higher share of patents with tangible business outcomes while also delivering competitive insights to support strategic decision-making and stay ahead of the innovation curve.

PatentSight, a spin-off from WHU – Otto Beisheim School of Management, one of Germany’s leading business schools, developed the Patent Asset Index (PAI), a metric that differentiates high value patents from low value patents. Beat Weibel decided to use the PatentSight software to support Siemens’ strategic change.

First, Beat’s team needed to have sufficient confidence in PatentSights’ metrics and methodology before introducing them to the Siemens Board. They compared the PAI findings with Siemens’ own high value patents and those of competitors and found a high percentage match. This allowed the IP team to validate the use of PatentSight’s Patent Asset Index as a long-term, objective indicator for improved patent quality.

Managing IP based on quality metrics paid off. Siemens has achieved significant return on investment (ROI) on its IP portfolio with increased commercial utilisation of patents. Compared with other major software companies and Internet of Things (IoT) competitors, the PatentSight Asset Index shows Siemens is the only company to substantially and persistently increase its patent portfolio quality. The Siemens IP department has evolved into a strategic consulting unit supporting the entire business with quality-based innovation insights derived from LexisNexis PatentSight. |

|

| RELX Annual report and financial statements 2020 | Exhibitions | 33 | |

|

| ||

| 34 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

|

|

| ||

|

|

|

| ||

| Machine tools and metalworking exhibition serving ASEAN | South East Asia’s one-stop market for the maritime community | International exhibition of environmental equipment, technologies and services | ||

|

|

| ||

|

|

|

| ||

| Innovations for smart sheet metal working | The East Coast’s largest pop culture convention | International trade fair for the building industry | ||

|

|

| ||

|

|

|

| ||

| The Middle East’s meeting place for the travel trade | Latin America’s exhibition for security products and solutions | An international exhibition dedicated to comfort & living technology | ||

|

|

| ||

|

|

|

| ||

| The North American jewellery industry’s premier event | International perfumery and cosmetics exhibition | Japan’s manufacturing industry trade event | ||

|

|

| ||

|

|

|

| ||

| Australia’s trade event for the retail industry | International Security Conference & Exhibition | China’s electronics manufacturing trade shows | ||

|

|

| ||

|

|

|

| ||

| International trade fair for the catering, restaurant and hotel trade | Premier global event for the travel industry | The world’s entertainment content market | ||

|

|

| ||

|

|

|

| ||

| The UK’s meeting place for the book industry | China’s business gifts & home fair | Japan’s comprehensive exhibition for smart and renewable energy

| ||

|

|

|

| RELX Annual report and financial statements 2020 | Exhibitions |

35 | |

|

| ||

| 36 | RELX Annual report and financial statements 2020 | Market segments | |

|

| ||

MIPIM:

Reimagining MIPIM as a

hybrid event in response

to the Covid-19 pandemic

Over

788,000

social reach

|

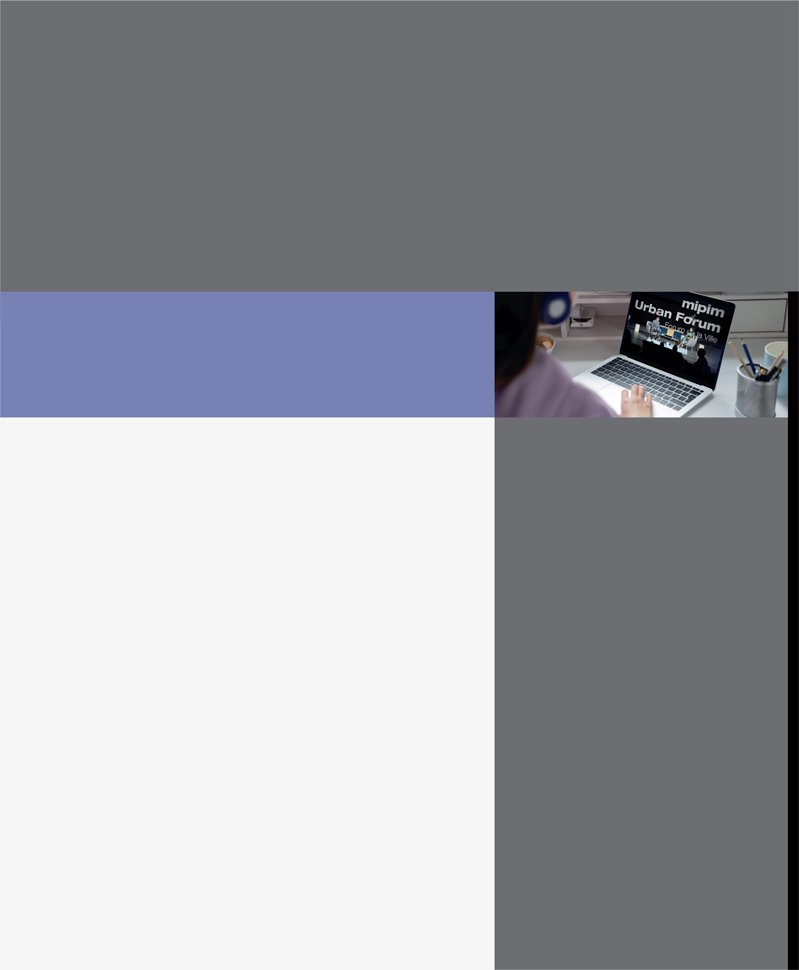

Challenging times call for innovative solutions, not least in the global property market, which has been impacted by Covid-19 in unprecedented ways.

Uniting the international real estate community around the twin goals of recovery and sustainability, MIPIM Paris Real Estate Week (14–17 September) enabled the industry to reconnect for the first time in 2020.

Reimagined as a hybrid event, the new format combined a safe physical gathering of over 1,100 senior real estate professionals, livestreamed across social media, with a sophisticated online platform, opening the content and meetings up to an additional 7,000 views by remote attendees from the world’s property sector.

Headlining an outstanding line-up of over 120 speakers were Apple co-founder, Steve Wozniak, and former French President, Nicolas Sarkozy. At the heart of the event was Propel by MIPIM, two days of thought-leadership, networking and deal making, devoted to innovation and digital transformation in the property sector. This was followed by the first-ever MIPIM Urban Forum, where leading public and private sector voices shared their visions of the post-Covid city and the MIPIM Awards which honoured the world’s most outstanding real estate projects.

Underpinning the physical event, and transforming its entire scope and reach, was the augmented digital platform. This enabled remote speakers to seamlessly join the live debates, and participants from all over the world to network with their peers, engage with the event’s essential content both live and on-demand, generate new leads, and arrange one to one meetings. The platform, which remained open for a month after the event, had over 2,000 registrants, delivered over 9,600 personal recommendations and generated 727 meeting requests. |

About MIPIM

MIPIM is the world’s premier property market.

Established in Cannes in 1990, it brings together the global leaders of the real estate industry including investors, political institutions, property companies, advisors and city administrators who attend to discover new large-scale projects, hold one-to-one business meetings, and learn the latest market trends and insights. Sister event MIPIM Asia was launched in Hong Kong in 2006 and is now an established real estate event for Asia Pacific real estate professionals. 2017 and 2018 each saw the launch of a dedicated event devoted to technology for the property sector, Propel by MIPIM, in New York and Paris respectively. MIPIM’s enhanced online marketplace supports its clients’ business needs and is expected to further extend the brand’s global reach and influence. |

| RELX Annual report and financial statements 2020 | Exhibitions | 37 | |

|

| ||

|

Combining a safe physical gathering (right) with a sophisticated online platform (left) |

| MIPIM Paris Real Estate Week was an innovative way of keeping the industry connected and informed at this difficult time. The opportunity to share expert insights and conduct critical business meetings physically and digitally was invaluable for Choose Paris Region and the future of the business of our companies.

Lionel Grotto CEO Choose Paris Region |

| 38 | RELX Annual report and financial statements 2020 | Corporate responsibility |

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 41 | |

|

| ||

Advancing

the RELX SDG

Resource Centre

In 2017, we launched the free RELX SDG Resource Centre to advance awareness,

understanding and implementation of the UN’s SDGs. In 2020, we increased the

amount of content on the site by 57% from 2019. This included curated special

issues to mark eight UN international days, such as World Environment Day,

the International Day for the Elimination of Violence Against Women, World

Mental Health Day and the International Day of Persons with Disabilities.

We also published 17 RELX SDG Graphics on the state of

knowledge underpinning all 17 of the global goals.

| 42 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 43 | |

|

| ||

| 44 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 45 | |

|

| ||

| 46 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

|

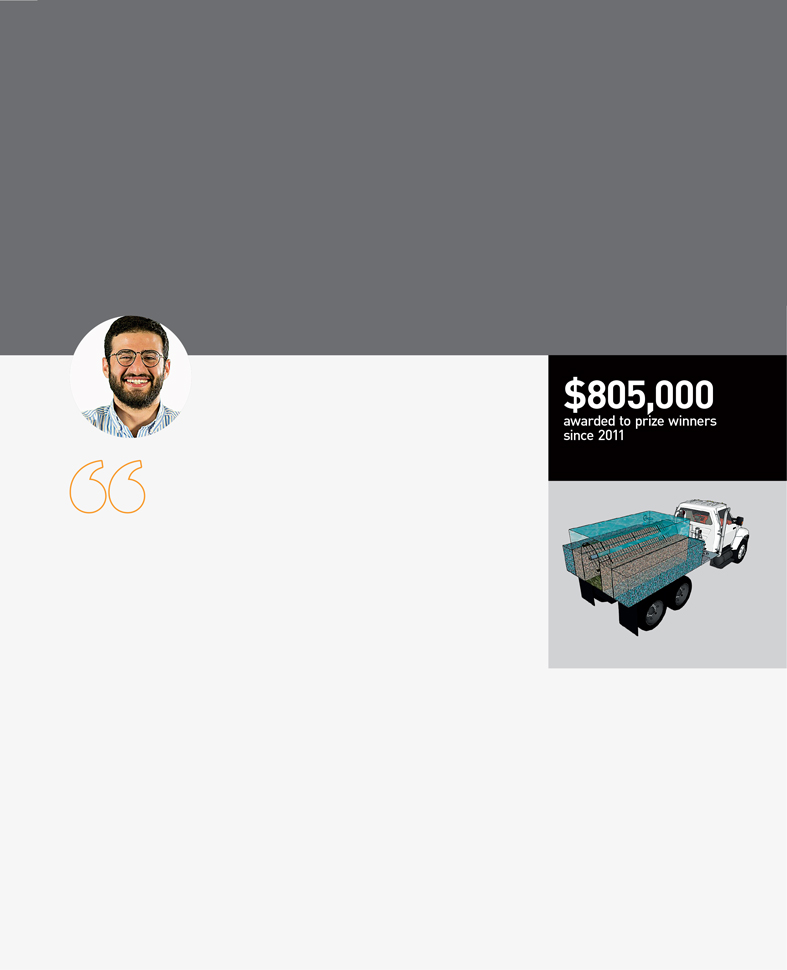

Ten years of the RELX Environmental Challenge

Since 2011, the RELX Environmental Challenge has supported innovative solutions that improve sustainable access to safe water and sanitation where it is most at risk, advancing SDG 6 (Clean Water and Sanitation). The diversity of ideas, technologies and business models has been remarkable – from a social enterprise that uses the hydroenergy to pump water to high altitudes, and a system for harnessing ultraviolet light to purify water, to a new approach for emptying pit latrines safely and efficiently. |

|

Thanks to the RELX Environmental Challenge, we will be able to attract strategic partners working in the development sector on improved sanitation, including additional investors to get us to the next stage of growth.

Marc Aoun

Founder and General Manager, CUBEX S.A.L |

In 2020, a shortlist of seven projects was chosen from a record 170 applications from 44 countries. The $50,000 first-prize winner was CUBEX S.A.L, a Lebanese social enterprise whose mobile dewatering unit collects and treats sewage from septic systems in an ecologically safe and affordable way. The $25,000 second-prize winner was BlueTap, which has developed a 3D printed chlorine doser to improve access to high-quality drinking water in low-resource settings. Both winners received access to Science Direct, Elsevier’s leading platform of peer-reviewed literature to help advance their research.

The winners were announced at a virtual event celebrating ten years of the competition and exploring the next decade of water, sanitation and hygiene action. Featured speakers included: inaugural first prize winner of the RELX Environmental Challenge (2011), Dr Arup K. SenGupta, Chemical Engineering Professor at Lehigh University and Co-Founder of Drinkwell; Cheryl Hicks, CEO and Executive Director of the Toilet Board Coalition; Valeri Labi, Director of Water, Sanitation and Hygiene at iDE Ghana and a RELX Environmental Challenge judge; and Tim Brewer, Research Practice Lead at Water Witness International.

In addition to the two annual prizes, three past RELX Environmental Challenge Winners, CAWST, AIDFI and Sanergy, won a $25,000 special Partnership Prize for a collaborative project to create online training and outreach to support water and sanitation networks and practitioners in Africa and Colombia in the wake of the Covid-19 pandemic. |

Image caption (above): The mobile de-watering unit designed by CUBEX S.A.L, 2020 RELX Environmental Challenge first prize winner |

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 47 | |

|

| ||

| 48 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 49 | |

|

| ||

| 50 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate responsibility overview | 51 | |

|

| ||

| 52 | RELX Annual report and financial statements 2020 | Corporate responsibility | |

|

| ||

| ENVIRONMENTAL TARGETS | ||||||

| Focus area | Targets 2020 | 2020 Performance |

||||

| Climate change | Reduce Scope 1 and 2 location-based carbon emissions by 40% against a 2010 baseline | -64% | ||||

| Energy | Reduce energy and fuel consumption by 30% against a 2010 baseline | -52% | ||||

| Purchase renewable electricity equivalent to 100% of RELX’s global electricity consumption | 100% | |||||

| Waste | Decrease total waste generated at reporting locations by 40% against a 2010 baseline | -78% | ||||

| 90% of waste from reporting locations to be diverted from landfill | 93% | |||||

| Production paper* | 100% of RELX production papers, graded in PREPS, to be rated as ‘known and responsible sources’ | 100% | ||||

| Environmental Management System | Achieve ISO 14001 certification for 50% of the business by 2020 | 55% | ||||

| * | All paper we graded in 2020 – 92% of total production stock – was graded 3 or 5 stars (known and responsible sources). |

We have reported on all emission sources required under the Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013. We have included emissions from all operating companies within the Group.

We have used the GHG Protocol Corporate Accounting and Reporting Standard (revised edition) and the data has been assured by an independent third party, Environmental data covers 12 months December to November. EY. Details on methodology and the assurance statement can be viewed in the 2020 Corporate Responsibility Report at www.relx.com/go/CRReport.

| NEW ENVIRONMENTAL TARGETS | ||||||

| Focus area |

Targets 2025 |

2019 Performance |

||||

| Climate change | Reduce Scope 1 and 2 location-based carbon emissions by 46% against a 2015 baseline | -26% | ||||

| Energy | Reduce energy and fuel consumption by 30% against a 2015 baseline | -21% | ||||

| Continue to purchase renewable electricity equivalent to 100% of RELX’s global electricity consumption | 96% | |||||

| Waste | Decrease waste sent to landfill from reporting locations to 35% below 2015 levels | -32% | ||||

| Production paper | 100% of RELX production papers to be graded in PREPS as ‘known and responsible sources’ or certified to FSC or PEFC by 2025 | 96% | ||||

| Environmental |

42% | |||||

| Management System |

Achieve Group ISO14001 certification across the business by 2025 |

|||||

| 100% of new office fit outs to achieve the RELX Sustainable Fit Out standard by 2025 | New target | |||||

The above table shows performance against the new targets using 2019 figures - the latest year in which performance was not impacted by Covid-19.

| 2020 investor and other recognition | ||||||

|

|

|

|

| |||

| Constituent of the Ethibel | CDP | Sustainalytics ESG Risk Rating | FTSE4Good Index | |||

| Sustainability Index | – Climate programme score: B | 1st percentile for | Included in | |||

| Included in | – Forest programme score: B | – Global Universe: 21 out of 13,559 | – FTSE4Good Global Index | |||

| – Excellence Europe | – Water programme score: B | – Media: 2 out of 275 | – FTSE4Good UK Index | |||

| – Excellence Global | – FTSE4Good Europe Index | |||||

|

|

|

|

| |||

| RE100 | Dow Jones Sustainability Index | ISO 14001 | STOXX Global ESG | |||

| – Member | Included in | – Certified | Leaders Indices | |||

| – Europe | – Included | |||||

| – World |

||||||

|

|

|

|

| |||

| ECPI Indices | Tortoise Responsibility100 | Workplace Pride Global | Bloomberg’s Gender-Equality | |||

| – Included | Index | Benchmark | Index | |||

| – 4th out of 100 | – Most Improved Private Sector | – Included | ||||

|

|

The use by RELX of any MSCI ESG RESEARCH LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of RELX by MSCI. MSCI SERVICES and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI. | |||||

| MSCI ESG Ratings assessment |

||||||

| – AAA rating |

||||||

|

The full 2020 Corporate Responsibility Report is available at www.relx.com/go/CRReport |

| RELX Annual report and financial statements 2020 | Chief Financial Officer’s report | 55 | |

|

| ||

| 56 | RELX Annual report and financial statements 2020 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2020 | Chief Financial Officer’s report | 57 | |

|

| ||

| 58 | RELX Annual report and financial statements 2020 | Financial review | |

|

| ||

| RELX Annual report and financial statements 2020 | Chief Financial Officer’s report | 59 | |

|

| ||

| 60 | RELX Annual report and financial statements 2020 | Financial review | |

|

| ||

| EXTERNAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Economy and market conditions |

Demand for our products and services may be adversely impacted by factors beyond our control, such as the economic environment in, and trading relations between, the United States, Europe and other major economies (including the evolution of the United Kingdom’s trading relationship with the European Union), political uncertainties, acts of war and civil unrest as well as levels of government and private funding provided to academic and research institutions. | Our businesses are focused on professional markets which have generally been more resilient in periods of economic downturn. We deliver information solutions, many on a subscription and recurring revenue basis, which are important to our customers’ effectiveness and efficiency. We operate diversified businesses in terms of sectors, markets, customers, geographies and products and services. We have extended our position in long-term global growth markets through organic new launches supported by the selective acquisition of small content and data sets. We continue to dispose of businesses that no longer fit our strategy. | ||

| We continuously monitor economic and political developments to assess their impact on our strategy which is designed to mitigate these risks. In response to specific uncertainties, our businesses engage in scenario planning and develop contingency plans where relevant. | ||||

| RELX Annual report and financial statements 2020 | Principal and emerging risks | 61 | |

|

| ||

| 62 | RELX Annual report and financial statements 2020 | Financial review | |

|

| ||

| STRATEGIC RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Customer acceptance of products | Our businesses are dependent on the continued demand by our customers for our products and services and the value placed on them. They operate in highly competitive and dynamic markets, and the means of delivery, customer demand for, and the products and services themselves, continue to change in response to rapid technological innovations, legislative and regulatory changes, the entrance of new competitors, and other factors. Failure to anticipate and quickly adapt to these changes, or to deliver enhanced value to our customers, could impact demand for our products and services and consequently adversely affect our revenue or the long-term returns from our investment in electronic product and platform initiatives. | We are focused on the needs and economics of our customers. We gain insights into our markets, evolving customers’ needs, the potential application of new technologies and business models, and the actions of competitors and disrupters. These insights inform our market strategies and operational priorities. We continuously invest significant resources in our products and services, and the infrastructure to support them. We leverage user centred design and development methods and customer analytics and invest in new and enhanced technologies to provide content and innovative solutions that help them achieve better outcomes and enhance productivity. | ||

| Acquisitions | We supplement our organic development with selected acquisitions. If we are unable to generate the anticipated benefits such as revenue growth and/or cost savings associated with these acquisitions this could adversely affect return on invested capital and financial condition or lead to an impairment of goodwill. | Acquisitions are made within the framework of our overall strategy, which emphasises organic development. We have a well formulated process for reviewing and executing acquisitions and for managing the post-acquisition integration. This process is underpinned with clear strategic, financial and ethical criteria. We closely monitor the integration and performance of acquisitions.

| ||

| OPERATIONAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Technology and business resilience |

Our businesses are dependent on electronic platforms and networks, primarily the internet, for delivery of our products and services. These could be adversely affected if our electronic delivery platforms, networks or supporting infrastructure experience a significant failure, interruption or security breach. | We have established procedures for the protection of our businesses and technology assets. These include the development and testing of business continuity plans, including IT disaster recovery plans and back-up delivery systems, to reduce business disruption in the event of major technology or infrastructure failure, terrorism or adverse weather incidents. | ||

| Face-to-face events | Face-to-face events are susceptible to economic cycles, communicable diseases, severe weather events and other natural disasters, terrorism and assignment of venues to alternative uses. Each or any of these may impact exhibitors’ and visitors’ desire and ability to travel in person to events and the availability of event venues. These factors each have the potential to reduce revenues, increase the costs of organising events and adversely affect cash flows and reputation. | We actively review our ability to host events considering the availability of venues and national and local regulations including those related to health, travel and security. Where regulations permit us to hold events, we take appropriate measures for the well being and safety of exhibitors, visitors and employees. The physical events being run are supported by enhanced digital services, including remote participation by both exhibitors and attendees. In addition, we are holding a number of standalone virtual events and are further developing and delivering complementary digital offerings in order to maintain our presence in the industry communities that we serve. | ||

| RELX Annual report and financial statements 2020 | Principal and emerging risks | 63 | |

|

| ||

| 64 | RELX Annual report and financial statements 2020 | Financial review | |

|

| ||

| FINANCIAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Tax | Our businesses operate globally, and our profits are subject to taxation in many different jurisdictions and at differing tax rates. The Organisation for Economic Co-operation and Development (OECD) is continuing to explore changes to the way in which profits are allocated for tax purposes between jurisdictions and other reforms with a view to obtaining consensus in 2021. As a result of the OECD’s work and other initiatives, tax laws that currently apply to our businesses may be amended by the relevant authorities or interpreted differently by them, and these changes could adversely affect our reported results. | We maintain an open dialogue with tax authorities and are vigilant in ensuring that we comply with current tax legislation. We have clear and consistent tax policies and tax matters are dealt with by a professional tax function, supported by external advisers. As outlined in the Chief Financial Officer’s report on page 58 we engage with tax authorities and international organisations. We continue to monitor further developments arising from the OECD process and consider potential impacts of proposals under various scenarios. The principles we adopt in our approach to tax matters can be found on our website at www.relx.com/go/taxprinciples. | ||

| Treasury | The RELX PLC consolidated financial statements are expressed in pounds sterling and are subject to movements in exchange rates on the translation of the financial information of businesses whose operational currencies are other than sterling. The United States is our most important market and, accordingly, significant fluctuations in the US dollar exchange rate could significantly affect our reported results. We also earn revenues and incur costs in a range of other currencies, including the euro and the yen, and significant fluctuations in these exchange rates could also significantly impact our reported results.

Macroeconomic, political and market conditions may adversely affect the availability and terms of short and long-term funding, volatility of interest rates, the credit quality of our counterparties, currency exchange rates and inflation. The majority of our outstanding debt instruments are, and any of our future debt instruments may be, publicly rated by independent rating agencies. Our borrowing costs and access to capital may be adversely affected if the credit ratings assigned to our debt are downgraded.

|

Our approach to capital structure and funding is described in the Chief Financial Officer’s report on pages 54 to 59. The approach to the management of treasury risks is described in note 18 to the consolidated financial statements. | ||

| REPUTATIONAL RISKS | ||||

| Risk | Description and impact | Mitigation | ||

| Ethics | As a global provider of professional information solutions to the STM, risk, legal and exhibitions markets we, our employees and major suppliers are expected to adhere to high standards of integrity and ethical conduct, including those related to anti-bribery and anti-corruption, fraud, sanctions, competition and principled business conduct. A breach of generally accepted ethical business standards or applicable laws could adversely affect our business performance, reputation and financial condition.

|

Our Code of Ethics and Business Conduct is provided to every employee and is supported by training and communication. It encompasses such topics as competing fairly, prohibiting corrupt business practice and fair employment practices and encouraging open and principled behaviour. We have well-established processes for monitoring, reporting and investigating instances of unethical conduct. Our major suppliers are required to adhere to our Supplier Code of Conduct.

| ||

The Strategic Report, as set out on pages 2 to 64, has been approved by the Board of RELX PLC.

| By order of the Board |

Registered Office | |

| Henry Udow |

1-3 Strand | |

| Company Secretary |

London | |

| 10 February 2021 |

WC2N 5JR |

| RELX Annual report and financial statements 2020 | 65 | |

| Governance | ||||

| In this section | ||||

| 66 |

||||

| 68 |

||||

| 70 |

||||

| 71 |

||||

| 90 |

||||

| 93 |

||||

| 115 |

||||

| 118 |

||||

| 66 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| Executive Directors | Non-Executive Directors | |||||||

|

|

|

| ||||||

|

Erik Engstrom (57) Chief Executive Officer

Appointed: Chief Executive Officer of RELX since November 2009. Joined as Chief Executive Officer of Elsevier in 2004. Other appointments: Non-Executive Director of Smith & Nephew plc and Bonnier Group. Past appointments: Prior to joining was a partner at General Atlantic Partners. Before that was President and Chief Operating Officer of Random House Inc and President and Chief Executive Officer of Bantam Doubleday Dell, North America. Began his career as a consultant with McKinsey. Served as a Non-Executive Director of Eniro AB and Svenska Cellulosa Aktiebolaget SCA. Education: Holds a BSc from Stockholm School of Economics, an MSc from the Royal Institute of Technology in Stockholm, and gained an MBA from Harvard Business School as a Fulbright Scholar. Nationality: Swedish |

Sir Anthony Habgood (74)

Chair

Appointed: June 2009 Other appointments: Chair of Preqin Holding Limited and Deputy Chair of RG Carter Holdings Limited. Past appointments: Previously was Chair of the Court of the Bank of England, Whitbread plc, Bunzl plc, Mölnlycke Health Care Limited and Norwich Research Partners LLP and served as Chief Executive of Bunzl plc, Chief Executive of Tootal Group plc and a Director of The Boston Consulting Group. Formerly Non-Executive Director of Geest plc, Marks and Spencer plc, National Westminster Bank plc, Powergen plc, SVG Capital plc, and Norfolk and Norwich University Hospitals Trust. Education: Holds an MA in Economics from Cambridge University, an MS in Industrial Administration from Carnegie Mellon University and an Honorary Doctorate of Civil Law from the University of East Anglia. He is a visiting Fellow at Oxford University. Nationality: British |

June Felix (64)

Non-Executive Director

Appointed: October 2020 Other appointments: Chief Executive Officer of IG Group Holdings plc. Member of the Board of Advisers of the London Technology Club. Past appointments: Served as a Non-Executive Director of IG Group Holdings plc from 2015 until the time of her appointment as Chief Executive Officer in October 2018. Previously she held various executive management positions at a number of large multinational businesses in Hong Kong, London and New York, including Verifone, IBM, Citibank and Chase Manhattan. Earlier in her career, June was a strategy consultant with Booz Allen Hamilton. Nationality: American | ||||||

|

|

|

| ||||||

|

Nick Luff (53) Chief Financial Officer

Appointed: September 2014 Other appointments: Non-Executive Director of Rolls-Royce Holdings plc. Past appointments: Prior to joining the Group was Group Finance Director of Centrica plc from 2007. Before that was Chief Financial Officer at The Peninsular & Oriental Steam Navigation Company (P&O) and its affiliated companies, having previously held a number of senior finance roles at P&O. Began his career as an accountant with KPMG. Formerly a Non-Executive Director of QinetiQ Group plc and Lloyds Banking Group plc. Education: Has a degree in Mathematics from Oxford University and is a qualified UK Chartered Accountant. Nationality: British

|

Wolfhart Hauser

(71)

Non-Executive Director Senior Independent Director Chair of the Remuneration Committee

Appointed: April 2013 Other appointments: Non-Executive Director of Associated British Foods plc. Past appointments: Chair of FirstGroup plc until July 2019. Chief Executive Officer of Intertek Group plc from 2005 until 2015. Prior to that he was Chief Executive Officer of TÜV Sud AG between 1998 and 2002 and Chief Executive Officer of TÜV Product Service GmbH for ten years. Formerly a Non-Executive Director of Logica plc. Education: Holds a master’s degree in Medicine from Ludwig-Maximilian- University Munich and a Medical Doctorate from Technical University Munich. Nationality: German

|

Charlotte Hogg

(50)

Non-Executive Director

Appointed: December 2019 Other appointments: Executive Vice President and Chief Executive Officer for the European Region of Visa Inc. Executive Director of Visa Europe Limited. Non-Executive Director of NowTeach and a Director of Kettlethorpe Sport Horses Limited. Past appointments: Chief Operating Officer at the Bank of England. Before that Head of Retail Banking for Santander UK, Managing Director UK and Ireland for Experian plc, and held senior roles at Morgan Stanley in New York and London. Nationality: British, American and Irish |

| RELX Annual report and financial statements 2020 | Board Directors | 67 | |

|

| ||

| 68 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| Mark Kelsey | Kumsal Bayazit | Mike Walsh | Hugh M Jones IV | |||

| Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | Chief Executive Officer | |||

| Risk | Scientific, Technical | Legal | Exhibitions | |||

| & Medical and Chair, | ||||||

| RELX Technology Forum | ||||||

|

|

|

|

| |||

| Joined in 1983. Appointed to current position in 2012. |

Joined in 2004. Appointed to current position in 2019. |

Joined in 2003. Appointed to current position in 2011. |

Joined in 2011. Appointed to current position in 2020. | |||

| Has held a number of senior positions across the Group over the past 30 years. Previously Chief Operating Officer and then Chief Executive Officer of Reed Business Information. Studied at Liverpool University and received his MBA from Bradford University. | Previously President, Exhibitions Europe, Chief Strategy Officer, RELX, and Executive Vice President of Global Strategy and Business Development for LexisNexis. Prior to that worked with Bain & Company in New York, Los Angeles, Johannesburg and Sydney. Holds an MBA from Harvard Business School and is a graduate of the University of California at Berkeley. | Previously CEO of LexisNexis US Legal Markets and Director of Strategic Business Development Home Depot. Prior to that was a practising attorney at Weil, Gotshal and Manges in Washington DC and served as a consultant with The Boston Consulting Group. Holds a Juris Doctor degree from Harvard Law School and is a graduate of Yale University. | Previously Group Managing Director, Accuity, ICIS, Cirium, and EG within Risk. Prior to that was Chief Executive Officer, Accuity. Holds an MBA from the Ross School of Business at the University of Michigan and is a graduate of Yale University. | |||

| RELX Annual report and financial statements 2020 | RELX Senior Executives | 69 | |

|

| ||

| RELX Annual report and financial statements 2020 | 71 | |

|

| ||

| 72 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 73 | |

|

| ||

| 74 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

|

Board Committees

The structure of the Board’s main Committees and a

summary of their key responsibilities are set out below. All of the Committees have written Terms of Reference, which are available on our website,

Board Committees are principally supported by the Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and Company Secretary, and the Chief Human Resources Officer, although senior managers within the Group are invited to attend meetings where appropriate. The Board’s annual programme and the agendas for the Committees are prepared by their respective Chairs with support from the Company Secretary.

|

||||

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 75 | |

|

| ||

| 76 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 77 | |

|

| ||

| 78 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

Stakeholder engagement

During the year, the Board considered our key stakeholders as a specific agenda item, and concluded that our list of key stakeholders remains unchanged from 2019, as set out below. It also confirmed that it had adequate visibility of the views of key stakeholders and considered these in its decision-making. Further detail on the nature and results of RELX’s engagement with its key stakeholders is included throughout our 2020 Corporate Responsibility Report.

| Stakeholder: Investors

| ||

| Why effective engagement is important: | Engagement with our investors helps them to understand our strategy, performance and governance arrangements, and to make informed and effective investment decisions concerning RELX. It also makes clear our prioritisation of the long-term in our decision-making and focus on delivery of consistent financial performance. Our investors provide us with input and feedback concerning the development and implementation of our strategy, and we consider their views when making investment decisions.

| |

| Principal forms of engagement with our investors in 2020, the outcomes of this engagement, how this is fed back to the Board, and how it impacted Board decision- making in 2020: | Engagement with our investors is undertaken by the Chair, the Senior Independent Director, Chief Executive Officer, Chief Financial Officer, Head of Investor Relations and the Director of Corporate Responsibility, as well as through our dedicated Investor Relations, Corporate Responsibility and Treasury teams. The Board receives regular updates on these interactions, which include key issues raised by investors, and discussions and outcomes from the completion of investor roadshows and ad hoc meetings with institutional shareholders on significant issues and our recent and proposed activities. The Board also receives an update on investor relations as a standing item at its meetings which includes: the Group’s share price performance, its total shareholder return performance and a review of analyst comments made in response to our scheduled results releases. RELX’s material communications to its investors, such as its trading results and updates, other regulatory announcements, our Annual Report and Accounts and Notice of AGM must be reviewed and approved by the Board under our corporate governance framework. As an alternative to direct interactions at the AGM, the Board encouraged shareholders to submit questions prior to it taking place. A number of questions were received and answered during the Chair’s audiocast on the day of the meeting.

Our engagement processes confirmed that RELX’s strategic and financial priorities are well understood by investors. They generally appreciate the consistency of RELX’s strategy, and our focus on the organic development of information-based analytics and decision tools that deliver enhanced value to our professional and business customers. The Board considered this when approving the RELX three-year strategy plan for 2021-2023, which leaves our strategic focus (as set out on page 72), and our priority use of cash generated by the Group, broadly unchanged. The Board also reviewed investor views on strategy when approving investment decisions, including those relating to new or emerging technologies, or acquisitions which were completed in 2020. Our investors’ focus has been on the impact of Covid-19 in four key areas: the resilience of our business model and any long-term impact of Covid-19; the in-year and future performance of our businesses; ensuring that RELX has sufficient liquidity and balance sheet strength to be viable over the long-term; and shareholder returns through our interim and final dividends, and our share buyback programme. Our investors vary substantially in their reasons for investing in RELX and in their appetite for risk. The Board considered these differing interests in its decision-making during the year.

The Group’s response to investor interest regarding the performance of our businesses was considered and addressed by the Board in its approval of our full-year and interim results announcements, and quarterly updates to the market. These highlighted the resilience of our Scientific, Technical & Medical (STM), Risk and Legal businesses, which held up well in the face of the pandemic, with good growth in electronic revenues, whilst acknowledging the significant current and future disruption faced by our Exhibitions business as a result of Covid-19 and associated restrictions put in place at a local level. In respect of our shareholder returns, the Board considered a range of investor and analyst views, balancing the impact of returns against stakeholder interests in other key RELX financial metrics. As a result of its deliberations, the Board declared an 2020 interim dividend of 13.6p per share (unchanged from the 2019 interim dividend rate), a final dividend of 33.4p per share, and suspended the Group’s share buyback programme, having completed £150m of the £400m initially approved at the beginning of 2020.

Similarly, in making the decision to issue debt securities in the first half of the year, the Board considered investor views and risk appetite relating to the Group’s viability, security of funding, liquidity and balance sheet strength. As a result, all of the Group’s debt security issuances were issued or put in place in the first half of 2020, giving the Group ample liquidity and balance sheet strength, and providing further comfort to the Directors when approving the Group’s 2020 Going Concern and Viability Statements.

The Board has also considered the views of the wider investment community when approving areas of focus for RELX’s environmental, social and governance activities, including actions that RELX can take to mitigate against the impact of climate change. It also considered RELX’s approach to compliance with the requirements of the Task Force on Climate-Related Financial Disclosures as a standalone agenda item for the first time in 2020.

| |

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 79 | |

|

| ||

| 80 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| Stakeholder: Customers

| ||

| Why effective engagement is important: | Our goal is to help customers make better decisions, get better results and be more productive. We can only do this by leveraging a deep understanding of their needs and views to create innovative solutions, which combine content and data with analytics and technology in global platforms. Collaborating closely with our customers allows us to understand where and how we can improve the quality of services and products which we provide them with, and ensures that we make accurate and targeted investment decisions (such as for developing new or emerging technologies or complementing our existing capabilities through acquisition activity). Customer acceptance of products is set out as a principal risk on page 62. Regular engagement with our customers has also remained extremely important at a time when many have been affected, to varying degrees, by Covid-19.

| |

| Principal forms of engagement with our customers in 2020, the outcomes of this engagement, how this is fed back to the Board, and how it impacted Board decision- making in 2020: | Our engagement with customers during the year took place mainly at an operational level within our business areas through face-to-face (where local law permitted this) and virtual meetings, customer training and workshops, ongoing dialogue through our dedicated sales and operations teams, customer relationship managers, and in respect of material customer issues, through our business area senior management teams. The Board received a number of online presentations during the year from customer-facing employees which detailed the nature of our customer engagement and the actions taken by the business areas as a result. In particular in 2020, the Board received regular reports from senior management on the impact of Covid-19 on key customers, including analysis by sector and geography, and their current and anticipated future demand for our products and services. The Board also received feedback concerning the resilience of the markets that we operate in over the short-term and, where relevant, the likelihood and rate of their recovery over the longer term. In addition, the Board reviewed customer survey data, Net Promoter Scores and customer usage volumes across our business areas.

There were few Board decisions made during the year which were not directly or indirectly linked to the future needs of our customers, or which resulted from their past and present demand for our products. Engagement with our customers confirmed that there is significant disparity in the extent to which they have been affected by Covid-19. The engagement feedback provided has assisted the Board in maintaining its understanding of customer and market trends, issues and likely future needs, and how these can be addressed. It was considered as part of Board strategy-related discussions during the year, and resulted in our strategic objectives remaining unchanged, as part of the Board’s approval of the three-year strategy plan for 2021-2023. Feedback from our customers also helped the Board and management to assess at what pace and in which areas RELX should build out new products and services, and where it should look to expand into higher growth adjacencies and geographies over varying time horizons. Customer demand impacts our financial performance, and was also considered by the Board in setting appropriate financial targets for 2021, assessing the amount of investment required for RELX to be able to meet its customers’ current and future needs, and for RELX to grow its customer base and market share across its business areas. It also helped management and the Board to recognise and identify areas requiring cost rationalisation.

Customer-related views, behaviours and profiles also assisted management and the Board in considering selected acquisitions of targeted data sets, analytics and assets in high-growth markets that support high-growth strategies, and which are natural additions to our existing businesses. As a result of these reviews, areas were identified in which potential acquisitions could supplement our customer offerings in certain sectors. Whilst a number of acquisitions and disposals were completed without requiring Board approval due to the level of consideration being paid or received for the target, the Board approved four significant acquisitions which completed in 2020. The first of these was SciBite, a provider of big data analytics for the pharmaceutical and healthcare industries, which will help our customers make faster, more effective research and development- based decisions through access to advanced text and data intelligence solutions. It also approved the acquisition of Shadow Health, a developer of virtual simulations in nursing and healthcare education, extending our extensive portfolio of digital health solutions available to our customers. The Board also approved acquisitions to complement our existing fraud prevention services within our Risk business. These included ID Analytics, a provider of credit and fraud risk solutions, and Emailage, a provider of email-based fraud prevention solutions.

| |

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 81 | |

|

| ||

| 82 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

| Stakeholder: Community

| ||

| Why effective engagement is important: | Our focus on community includes those where we, our customers and suppliers work around the world, as well as the communities we serve, including in science, academia, risk, law and many other fields. We prioritise positive dialogue with our community stakeholders; they collectively provide our ‘licence to operate’. Our efforts are informed by our commitment to the United Nations Global Compact and its ten principles focused on human rights, labour, the environment and anti-corruption - all issues with wide societal impact.

| |

| Principal forms of engagement with the community in 2020, the outcomes of this engagement, how this is fed back to the Board, and how it impacted Board decision- making in 2020: | We contribute to our communities through our unique contributions to society (see pages 40 to 44), and through a comprehensive global community programme, RELX Cares. The RELX Cares mission is education for disadvantaged young people that aligns with our unique contributions including promoting science and health, protection of society, the rule of law and access to justice and fostering communities. RELX Cares promotes employee volunteering and each year staff have two days paid leave in order to undertake community work. A network of over 230 RELX Cares Champions across the Group ensures the vibrancy of this community engagement. In the wake of Covid-19, our people worked primarily from home, with limited opportunities for in-person, communal volunteer activities. In spite of this, responding to the pandemic was a key concentration and 26% of employees volunteered in the year, contributing 6,821 days in company time.

RELX Cares also features philanthropic giving. Given the challenge facing charities in an unprecedented year, we decided to suspend our usual funding application process. Instead, RELX Cares Champions allocated its budget to charities we funded in 2019 and 2018, allowing them to use the grants to aid their sustainability, including funds for both operational and project costs.

In accordance with the Business for Societal Impact model, we monitor the short- and long-term benefit of our community engagement. To increase transparency and awareness, we ask beneficiaries to report on their progress, sharing feedback on a RELX Cares section of our corporate internet. In addition, we survey RELX Cares volunteers to understand the impact of the programme on their personal development and how it affects the way they feel about working at RELX.

Another cornerstone of our community engagement is information provision. In 2020, this included making scientific articles, data and news, useful in the fight against coronavirus, freely available and aggregated on the RELX SDG Resource Centre. These included Elsevier’s Novel Coronavirus Centre with the latest medical and scientific information on Covid-19; LexisNexis Risk Solutions’ data set and interactive visualisations that provide insights on vulnerable populations and care capacity risks; and LexisNexis Legal and Professional’s coronavirus global media and news tracker with interactive charts. RELX also contributed to the World Health Organization’s Solidarity Response Fund and worked with Global Citizen to support the organisation’s major televised and live-stream event, One World: Together At Home.

Elsevier is a founding partner and leading contributor to Research4Life, providing a quarter of the material available. In 2020, there were over 1.1m Research4Life downloads from ScienceDirect, benefitting researchers in low- and middle-income countries. In the year, the Elsevier Foundation worked to improve access to healthcare and science in vulnerable communities and the LexisNexis Rule of Law Foundation supported projects that advance access to justice. LexisNexis Risk Solutions advanced pilots using its tools to help qualified citizens gain access to credit in Mexico and Colombia.

Responsibility for updating the Board on community engagement sits with the Chief Executive Officer. He is supported in this activity by the Group Head of Corporate Responsibility who in 2020 provided comprehensive feedback on RELX Cares and other activities to the Board, including key metrics, objectives and outcomes. Board feedback and support for community engagement shapes the direction of the programme and future plans which include evaluating the impact of the pandemic on volunteering and new ways to promote distance volunteering.

| |

| RELX Annual report and financial statements 2020 | Corporate Governance Review | 83 | |

|

| ||

| 84 | RELX Annual report and financial statements 2020 | Governance | |

|

| ||

Division of responsibilities

| Key roles of the Directors

Chair ◾ Provides leadership of the Board, and is responsible for its overall effectiveness in directing the Company

◾ Ensures that all Directors are sufficiently apprised of matters to make informed judgements, through the provision of accurate, timely and clear information

◾ Promotes high standards of corporate governance, demonstrates objective judgement and promotes a Board culture of openness and debate

◾ Sets the agenda and chairs meetings of the Board

◾ Chairs the Nominations and Corporate Governance Committees

◾ Facilitates constructive Board relations and the effective contribution of all of the Directors

◾ Ensures effective dialogue with shareholders

◾ Ensures the performance of the Board, its Committees and individual Directors is assessed annually

◾ Ensures effective induction and development of Directors

Chief Executive Officer ◾ Day-to-day management of the Group, within the delegated authority limits set by the Board

◾ Develops the Group’s strategy for consideration and approval by the Board

◾ Ensures that the decisions of the Board are implemented

◾ Informs and advises the Chair and Nominations Committee on executive succession planning

◾ Leads communication with shareholders

◾ Promotes and conducts the affairs of the Company with the highest standards of integrity, probity and corporate governance

|

Chief Financial Officer ◾ Day-to-day management of the Group’s financial affairs

◾ Responsible for the Group’s financial planning, reporting and analysis

◾ Ensures that a robust system of internal control and risk management is in place

◾ Maintains high-quality reporting of financial and environmental performance internally and externally

◾ Supports the Chief Executive Officer in developing and implementing strategy

Senior Independent Director ◾ Leads the Board’s annual assessment of the performance of the Chair

◾ Available to meet with shareholders on matters where usual channels are deemed inappropriate

◾ Deputises for the Chair, as necessary

◾ Serves as a sounding board for the Chair and acts as an intermediary between the other Directors, when necessary

Non-Executive Directors ◾ Bring an external perspective, and constructively challenge and provide advice to the Executive Directors

◾ Effectively contribute to the development of strategy

◾ Scrutinise the performance of management in meeting agreed goals and monitor the delivery of the Group’s strategy

◾ Serve as members of Board Committees and chair the Audit and Remuneration Committees | |