EEI Financial Conference November 9 - 11, 2025

Safe harbor statement 2 The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this document as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated or budgeted. Many factors may impact forward-looking statements including, but not limited to, the following: the impact of regulation by the EPA, EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility in prices in international steel markets and in prices of environmental attributes generated from renewable natural gas investments on the operations of DTE Vantage; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets and customer data against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce or increase power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning trust and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; impacts of inflation, tariffs, and the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena, including climate change, on operations and sales to customers, and purchases from suppliers; unplanned outages at our generation plants; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of generation and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; successful execution of new business development and future growth plans; contract disputes, binding arbitration, litigation, and related appeals; the ability of the electric and gas utilities to achieve goals for carbon emission reductions; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section in DTE Energy’s public filings with the Securities and Exchange Commission.

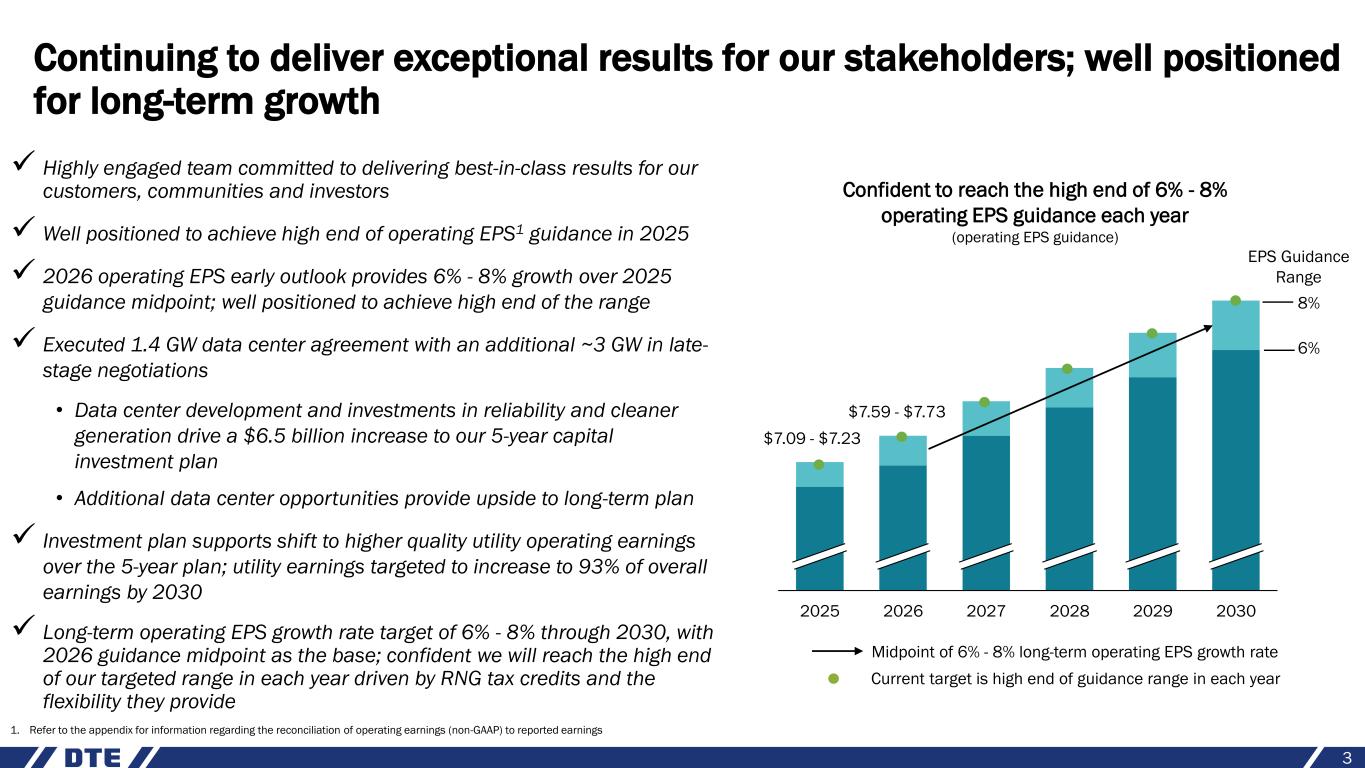

Continuing to deliver exceptional results for our stakeholders; well positioned for long-term growth 3 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings ✓ Highly engaged team committed to delivering best-in-class results for our customers, communities and investors ✓ Well positioned to achieve high end of operating EPS1 guidance in 2025 ✓ 2026 operating EPS early outlook provides 6% - 8% growth over 2025 guidance midpoint; well positioned to achieve high end of the range ✓ Executed 1.4 GW data center agreement with an additional ~3 GW in late- stage negotiations • Data center development and investments in reliability and cleaner generation drive a $6.5 billion increase to our 5-year capital investment plan • Additional data center opportunities provide upside to long-term plan ✓ Investment plan supports shift to higher quality utility operating earnings over the 5-year plan; utility earnings targeted to increase to 93% of overall earnings by 2030 ✓ Long-term operating EPS growth rate target of 6% - 8% through 2030, with 2026 guidance midpoint as the base; confident we will reach the high end of our targeted range in each year driven by RNG tax credits and the flexibility they provide 2025 2026 2027 2028 2029 2030 $7.09 - $7.23 $7.59 - $7.73 EPS Guidance Range Confident to reach the high end of 6% - 8% operating EPS guidance each year (operating EPS guidance) Current target is high end of guidance range in each year Midpoint of 6% - 8% long-term operating EPS growth rate 8% 6%

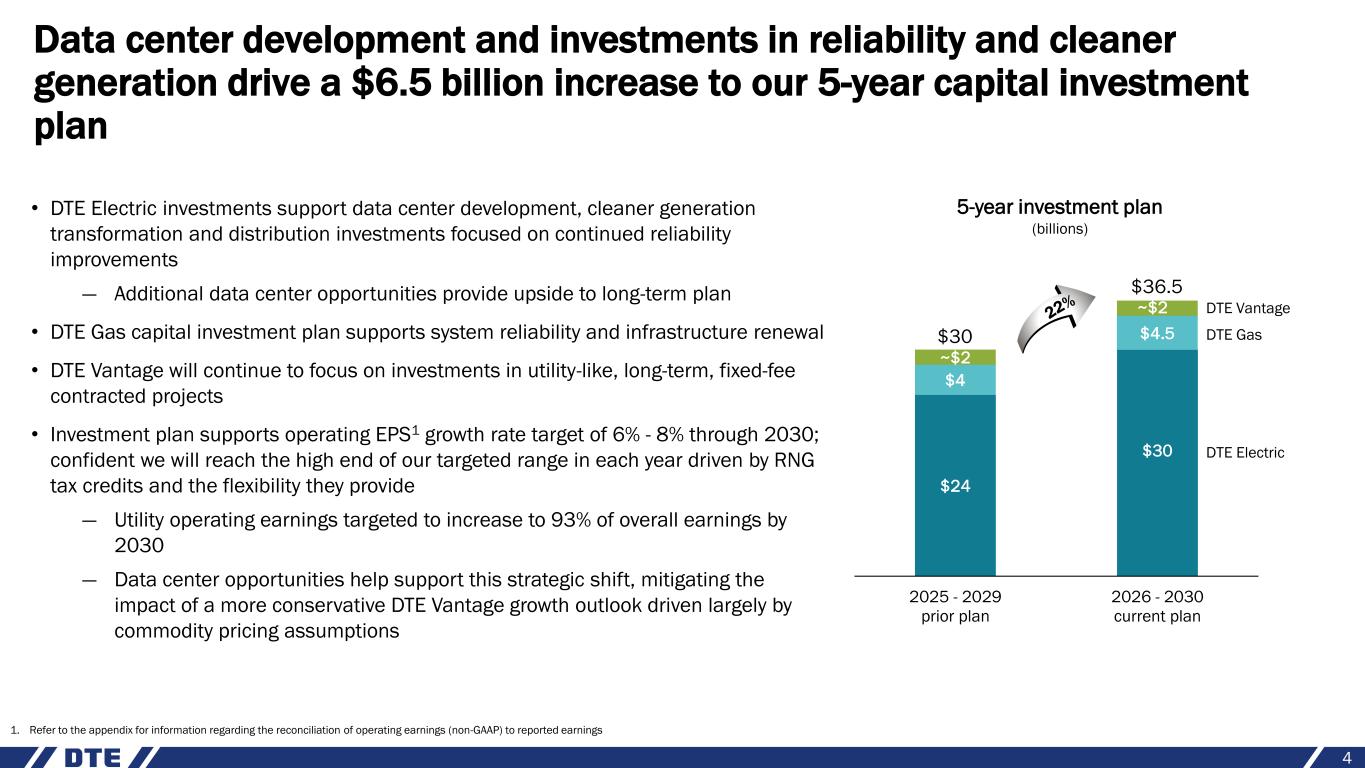

Data center development and investments in reliability and cleaner generation drive a $6.5 billion increase to our 5-year capital investment plan 4 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings $24 $4 ~$2 2025 - 2029 prior plan 2026 - 2030 current plan $30 $36.5 DTE Electric DTE Gas DTE Vantage22 % 5-year investment plan (billions) ~$2 $4.5 $30 • DTE Electric investments support data center development, cleaner generation transformation and distribution investments focused on continued reliability improvements — Additional data center opportunities provide upside to long-term plan • DTE Gas capital investment plan supports system reliability and infrastructure renewal • DTE Vantage will continue to focus on investments in utility-like, long-term, fixed-fee contracted projects • Investment plan supports operating EPS1 growth rate target of 6% - 8% through 2030; confident we will reach the high end of our targeted range in each year driven by RNG tax credits and the flexibility they provide — Utility operating earnings targeted to increase to 93% of overall earnings by 2030 — Data center opportunities help support this strategic shift, mitigating the impact of a more conservative DTE Vantage growth outlook driven largely by commodity pricing assumptions

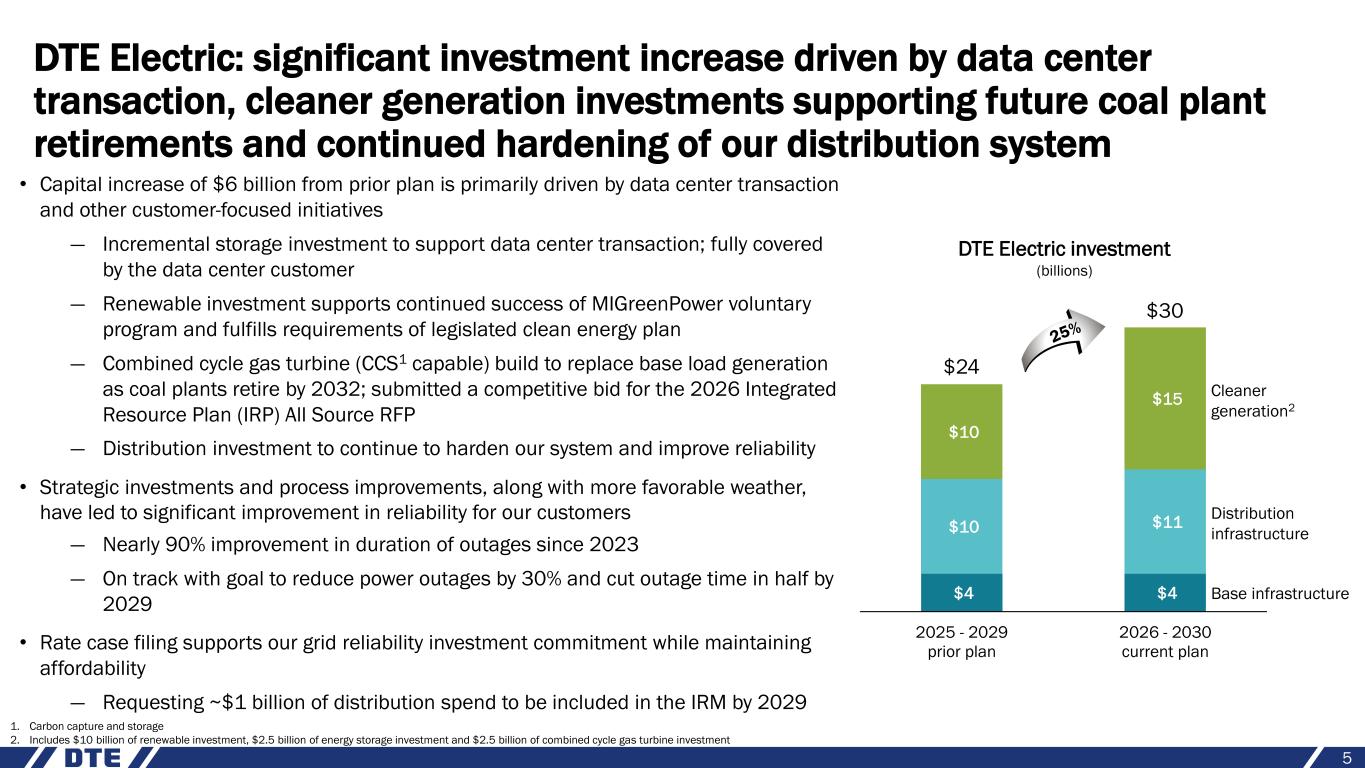

• Capital increase of $6 billion from prior plan is primarily driven by data center transaction and other customer-focused initiatives — Incremental storage investment to support data center transaction; fully covered by the data center customer — Renewable investment supports continued success of MIGreenPower voluntary program and fulfills requirements of legislated clean energy plan — Combined cycle gas turbine (CCS1 capable) build to replace base load generation as coal plants retire by 2032; submitted a competitive bid for the 2026 Integrated Resource Plan (IRP) All Source RFP — Distribution investment to continue to harden our system and improve reliability • Strategic investments and process improvements, along with more favorable weather, have led to significant improvement in reliability for our customers — Nearly 90% improvement in duration of outages since 2023 — On track with goal to reduce power outages by 30% and cut outage time in half by 2029 • Rate case filing supports our grid reliability investment commitment while maintaining affordability — Requesting ~$1 billion of distribution spend to be included in the IRM by 2029 5 DTE Electric: significant investment increase driven by data center transaction, cleaner generation investments supporting future coal plant retirements and continued hardening of our distribution system $4 $4 $10 $11 $10 $15 2025 - 2029 prior plan 2026 - 2030 current plan Base infrastructure Cleaner generation2 $24 DTE Electric investment (billions) $30 25 % Distribution infrastructure 1. Carbon capture and storage 2. Includes $10 billion of renewable investment, $2.5 billion of energy storage investment and $2.5 billion of combined cycle gas turbine investment

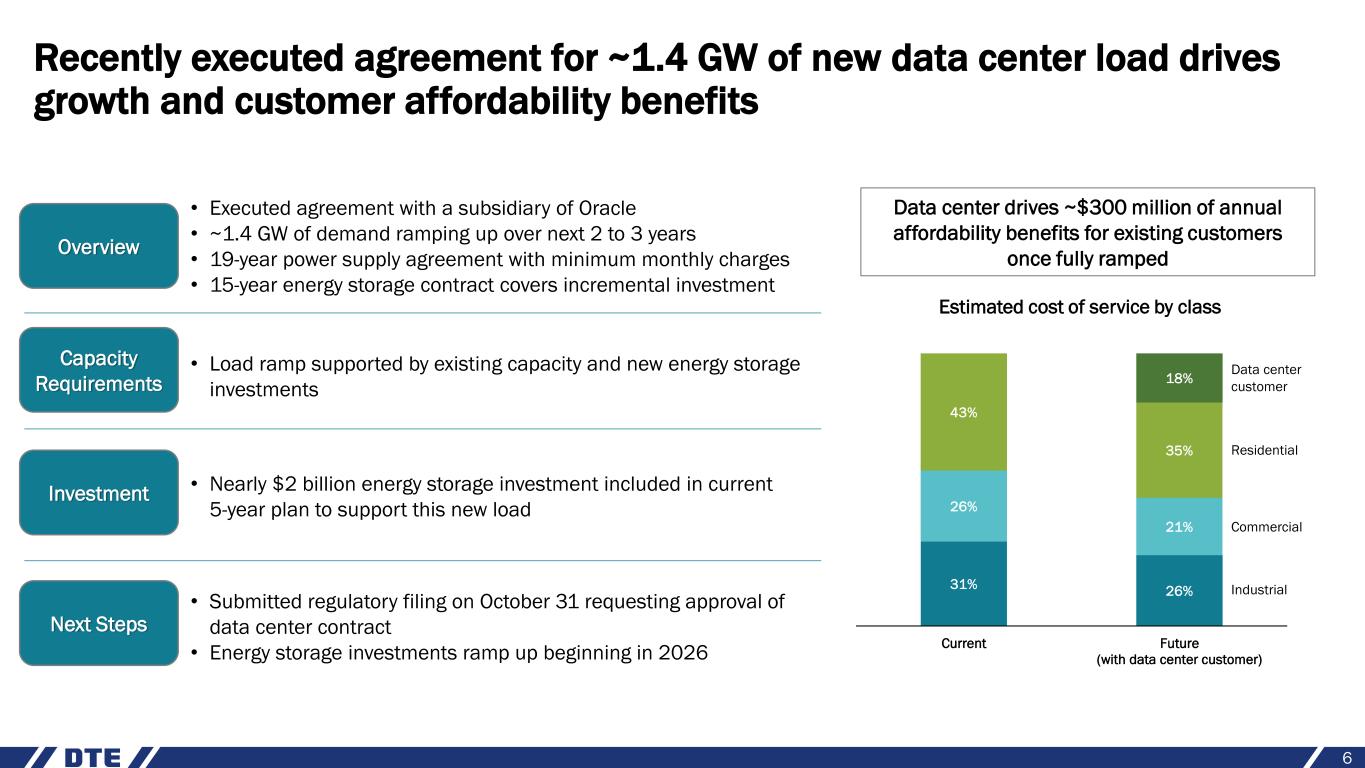

Recently executed agreement for ~1.4 GW of new data center load drives growth and customer affordability benefits Overview Capacity Requirements Investment Next Steps • Executed agreement with a subsidiary of Oracle • ~1.4 GW of demand ramping up over next 2 to 3 years • 19-year power supply agreement with minimum monthly charges • 15-year energy storage contract covers incremental investment • Load ramp supported by existing capacity and new energy storage investments • Nearly $2 billion energy storage investment included in current 5-year plan to support this new load • Submitted regulatory filing on October 31 requesting approval of data center contract • Energy storage investments ramp up beginning in 2026 6 Data center drives ~$300 million of annual affordability benefits for existing customers once fully ramped Estimated cost of service by class 31% 26% 26% 21% 43% 35% 18% Current Future (with data center customer) Data center customer Residential Commercial Industrial

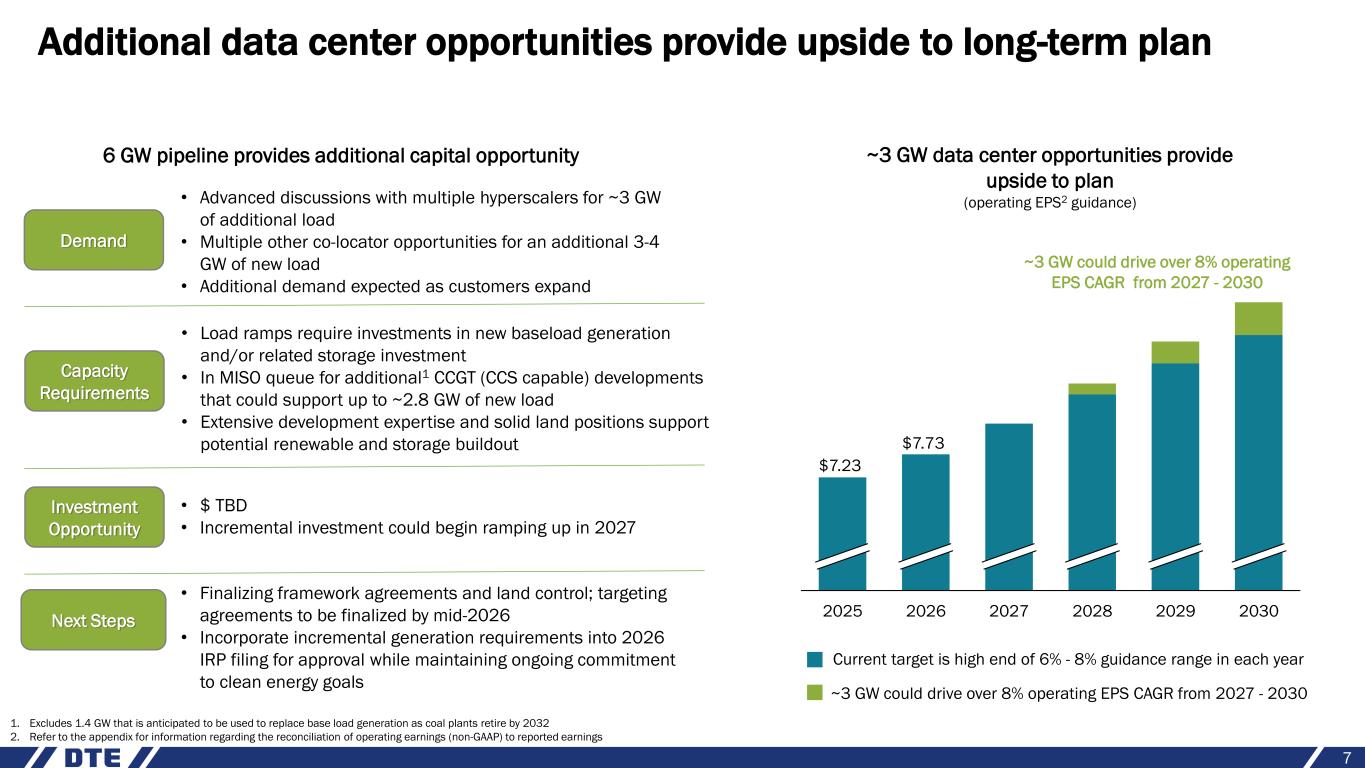

2025 2026 2027 2028 2029 2030 Additional data center opportunities provide upside to long-term plan 7 $7.23 $7.73 ~3 GW data center opportunities provide upside to plan (operating EPS2 guidance) ~3 GW could drive over 8% operating EPS CAGR from 2027 - 2030 6 GW pipeline provides additional capital opportunity Demand Capacity Requirements Investment Opportunity Next Steps • Advanced discussions with multiple hyperscalers for ~3 GW of additional load • Multiple other co-locator opportunities for an additional 3-4 GW of new load • Additional demand expected as customers expand • Load ramps require investments in new baseload generation and/or related storage investment • In MISO queue for additional1 CCGT (CCS capable) developments that could support up to ~2.8 GW of new load • Extensive development expertise and solid land positions support potential renewable and storage buildout • $ TBD • Incremental investment could begin ramping up in 2027 • Finalizing framework agreements and land control; targeting agreements to be finalized by mid-2026 • Incorporate incremental generation requirements into 2026 IRP filing for approval while maintaining ongoing commitment to clean energy goals ~3 GW could drive over 8% operating EPS CAGR from 2027 - 2030 Current target is high end of 6% - 8% guidance range in each year 1. Excludes 1.4 GW that is anticipated to be used to replace base load generation as coal plants retire by 2032 2. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings

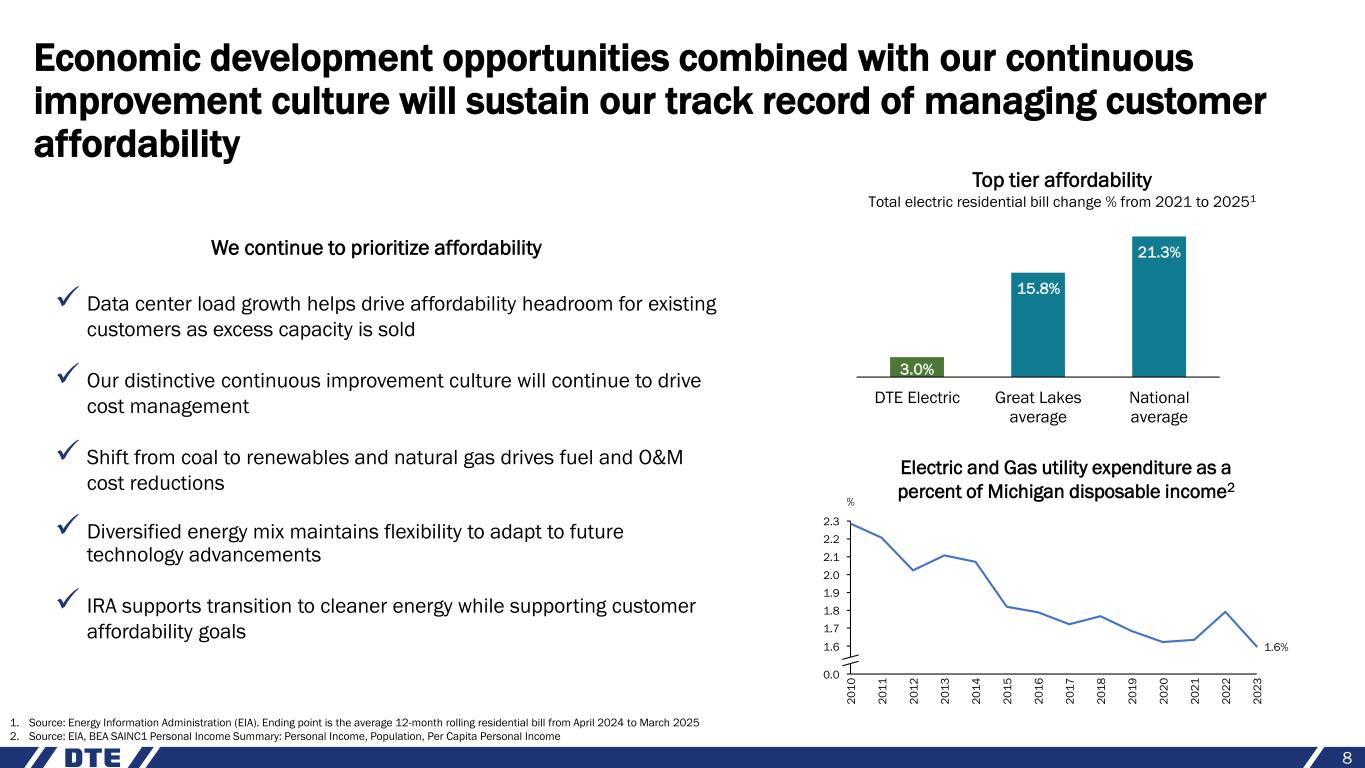

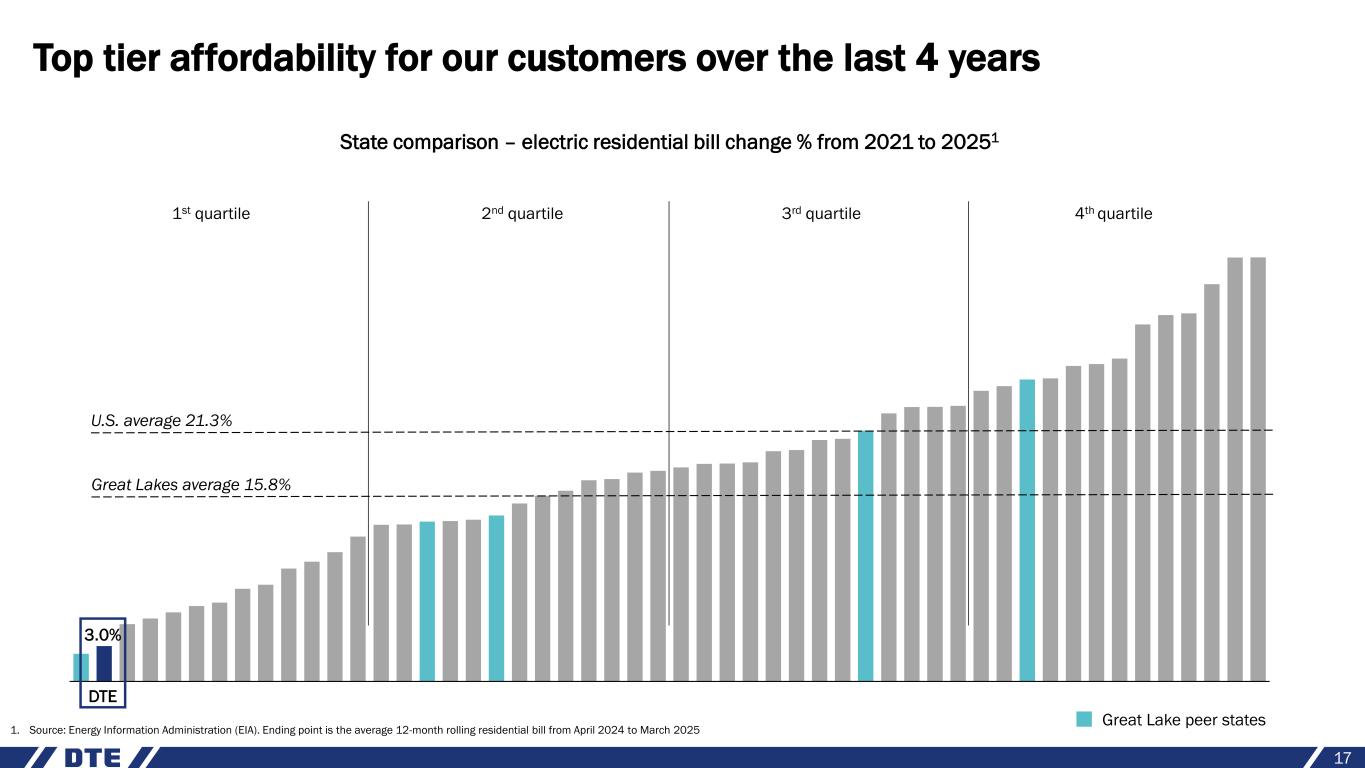

Economic development opportunities combined with our continuous improvement culture will sustain our track record of managing customer affordability 3.0% 15.8% 21.3% DTE Electric Great Lakes average National average Top tier affordability Total electric residential bill change % from 2021 to 20251 ✓ Data center load growth helps drive affordability headroom for existing customers as excess capacity is sold ✓ Our distinctive continuous improvement culture will continue to drive cost management ✓ Shift from coal to renewables and natural gas drives fuel and O&M cost reductions ✓ Diversified energy mix maintains flexibility to adapt to future technology advancements ✓ IRA supports transition to cleaner energy while supporting customer affordability goals 8 Electric and Gas utility expenditure as a percent of Michigan disposable income2 1.7 0.0 1.6 1.8 2.0 2.2 2.3 2.1 1.9 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 1.6% 2 0 2 3 2 0 1 4 2 0 1 3 2 0 1 2 2 0 1 1 2 0 1 0 % 2 0 1 6 2 0 1 7 2 0 1 5 1. Source: Energy Information Administration (EIA). Ending point is the average 12-month rolling residential bill from April 2024 to March 2025 2. Source: EIA, BEA SAINC1 Personal Income Summary: Personal Income, Population, Per Capita Personal Income We continue to prioritize affordability

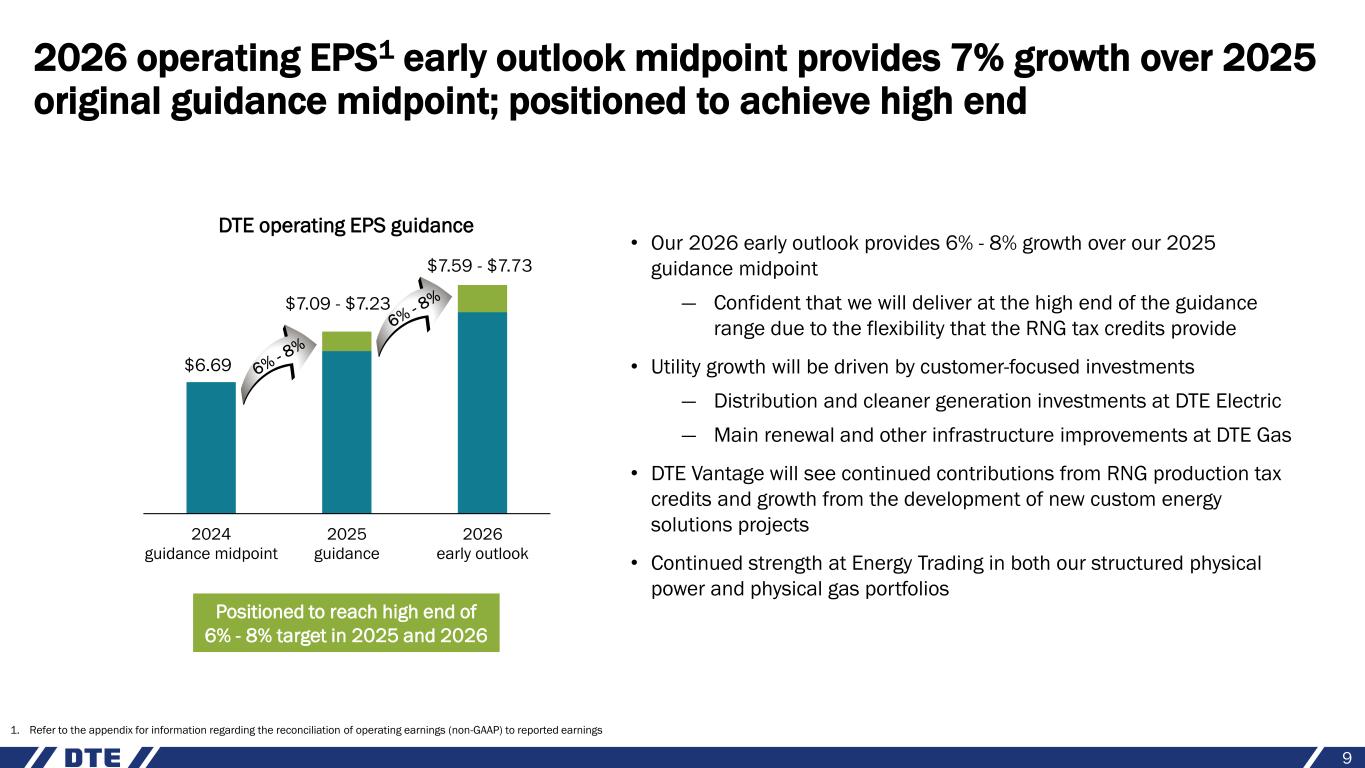

2026 operating EPS1 early outlook midpoint provides 7% growth over 2025 original guidance midpoint; positioned to achieve high end 9 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 2024 guidance midpoint 2025 guidance 2026 early outlook $7.59 - $7.73 $7.09 - $7.23 DTE operating EPS guidance Positioned to reach high end of 6% - 8% target in 2025 and 2026 $6.69 • Our 2026 early outlook provides 6% - 8% growth over our 2025 guidance midpoint — Confident that we will deliver at the high end of the guidance range due to the flexibility that the RNG tax credits provide • Utility growth will be driven by customer-focused investments — Distribution and cleaner generation investments at DTE Electric — Main renewal and other infrastructure improvements at DTE Gas • DTE Vantage will see continued contributions from RNG production tax credits and growth from the development of new custom energy solutions projects • Continued strength at Energy Trading in both our structured physical power and physical gas portfolios

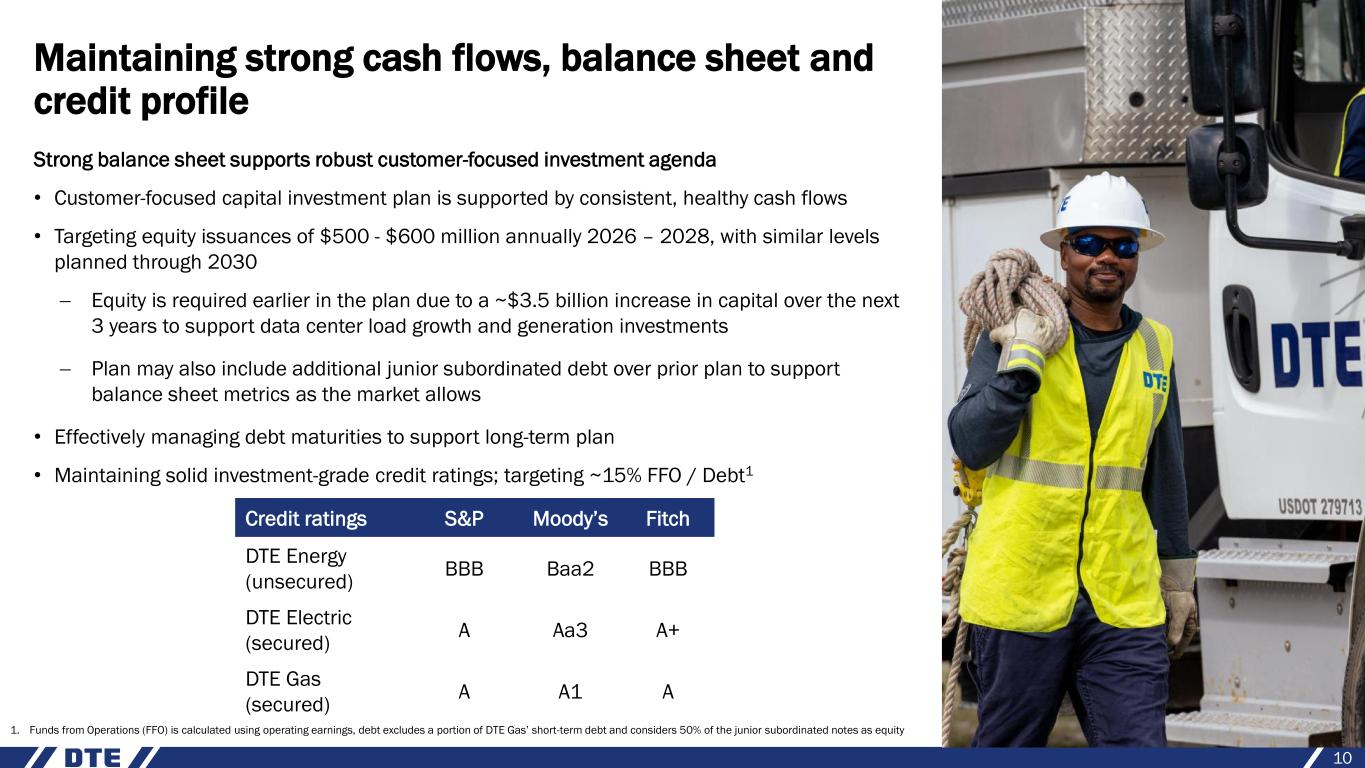

Maintaining strong cash flows, balance sheet and credit profile 10 Credit ratings S&P Moody’s Fitch DTE Energy (unsecured) BBB Baa2 BBB DTE Electric (secured) A Aa3 A+ DTE Gas (secured) A A1 A Strong balance sheet supports robust customer-focused investment agenda • Customer-focused capital investment plan is supported by consistent, healthy cash flows • Targeting equity issuances of $500 - $600 million annually 2026 – 2028, with similar levels planned through 2030 − Equity is required earlier in the plan due to a ~$3.5 billion increase in capital over the next 3 years to support data center load growth and generation investments − Plan may also include additional junior subordinated debt over prior plan to support balance sheet metrics as the market allows • Effectively managing debt maturities to support long-term plan • Maintaining solid investment-grade credit ratings; targeting ~15% FFO / Debt1 1. Funds from Operations (FFO) is calculated using operating earnings, debt excludes a portion of DTE Gas’ short-term debt and considers 50% of the junior subordinated notes as equity

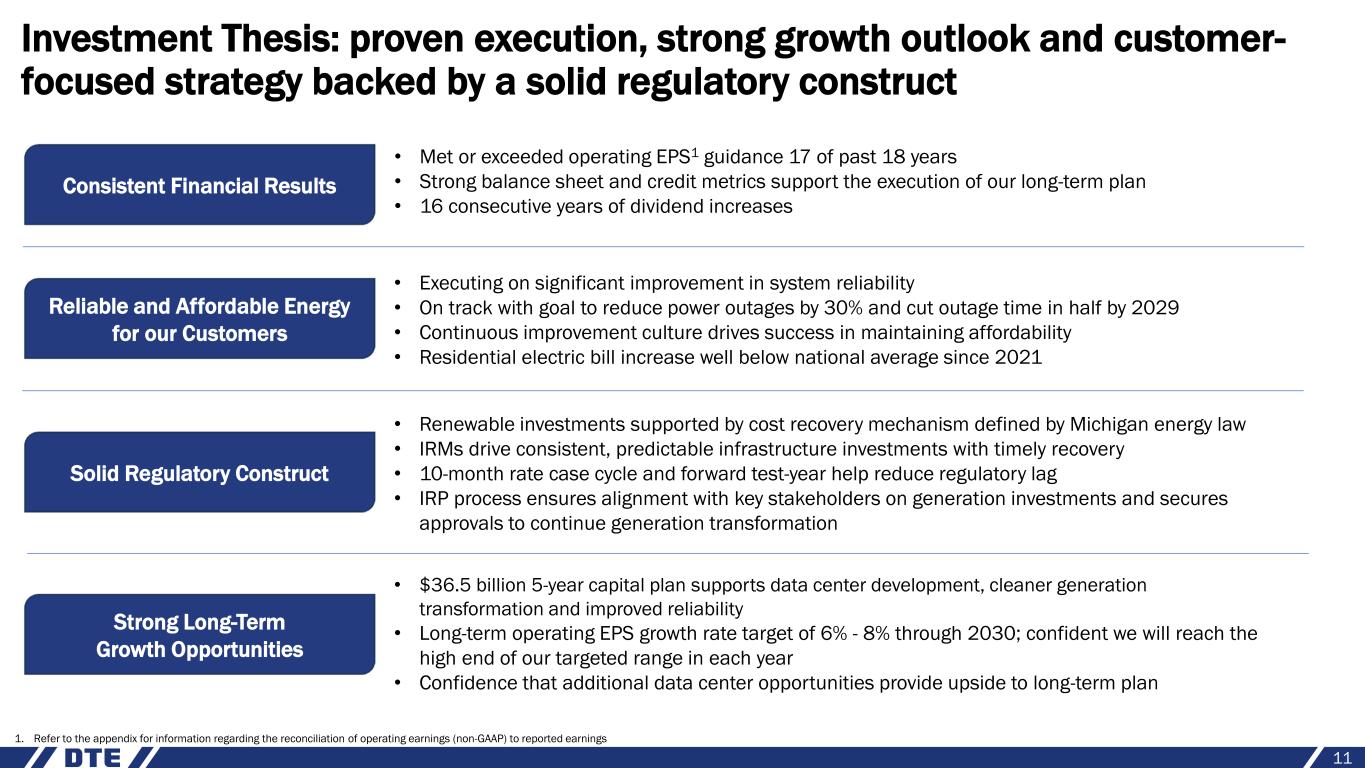

11 Investment Thesis: proven execution, strong growth outlook and customer- focused strategy backed by a solid regulatory construct Strong Long-Term Growth Opportunities Solid Regulatory Construct Reliable and Affordable Energy for our Customers Consistent Financial Results • Met or exceeded operating EPS1 guidance 17 of past 18 years • Strong balance sheet and credit metrics support the execution of our long-term plan • 16 consecutive years of dividend increases • Executing on significant improvement in system reliability • On track with goal to reduce power outages by 30% and cut outage time in half by 2029 • Continuous improvement culture drives success in maintaining affordability • Residential electric bill increase well below national average since 2021 • Renewable investments supported by cost recovery mechanism defined by Michigan energy law • IRMs drive consistent, predictable infrastructure investments with timely recovery • 10-month rate case cycle and forward test-year help reduce regulatory lag • IRP process ensures alignment with key stakeholders on generation investments and secures approvals to continue generation transformation • $36.5 billion 5-year capital plan supports data center development, cleaner generation transformation and improved reliability • Long-term operating EPS growth rate target of 6% - 8% through 2030; confident we will reach the high end of our targeted range in each year • Confidence that additional data center opportunities provide upside to long-term plan 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings

12 Appendix

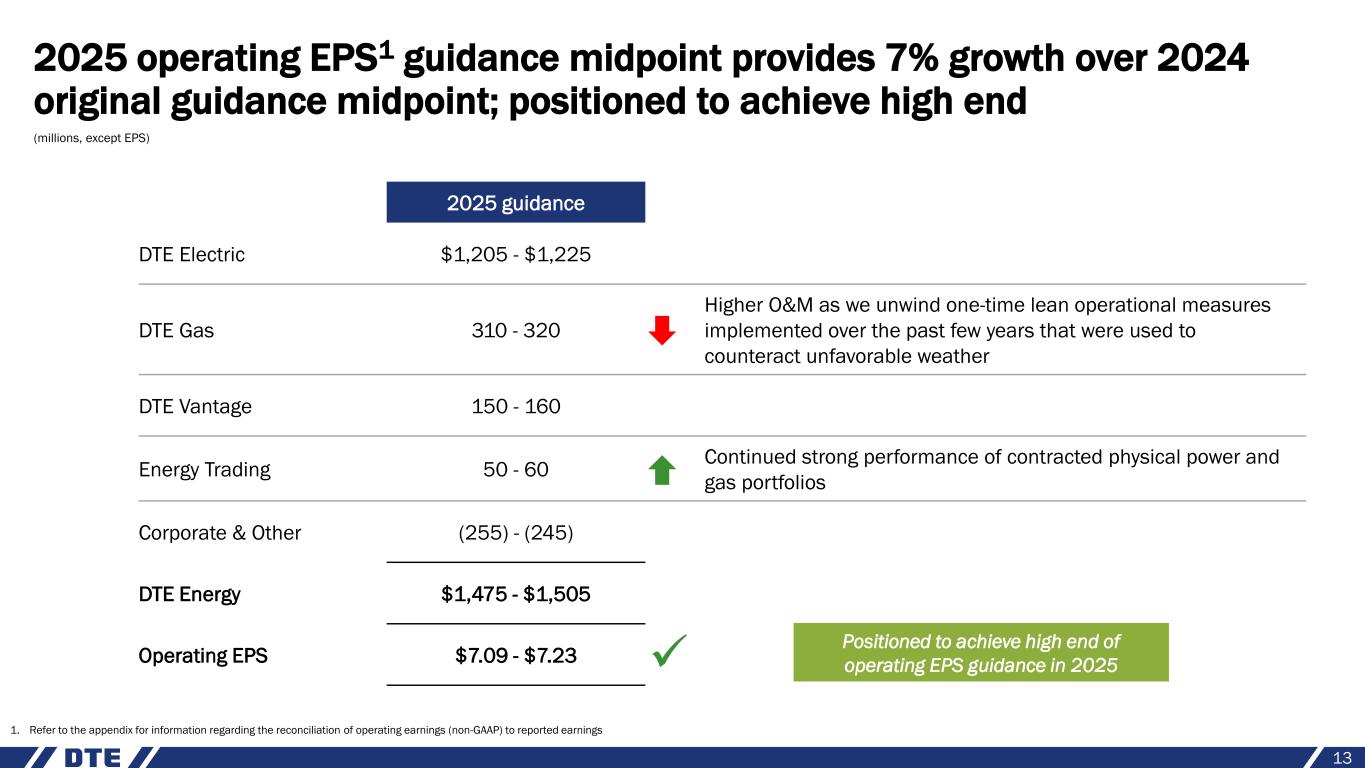

2025 operating EPS1 guidance midpoint provides 7% growth over 2024 original guidance midpoint; positioned to achieve high end (millions, except EPS) 2025 guidance DTE Electric $1,205 - $1,225 DTE Gas 310 - 320 Higher O&M as we unwind one-time lean operational measures implemented over the past few years that were used to counteract unfavorable weather DTE Vantage 150 - 160 Energy Trading 50 - 60 Continued strong performance of contracted physical power and gas portfolios Corporate & Other (255) - (245) DTE Energy $1,475 - $1,505 Operating EPS $7.09 - $7.23 ✓ 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 13 Positioned to achieve high end of operating EPS guidance in 2025

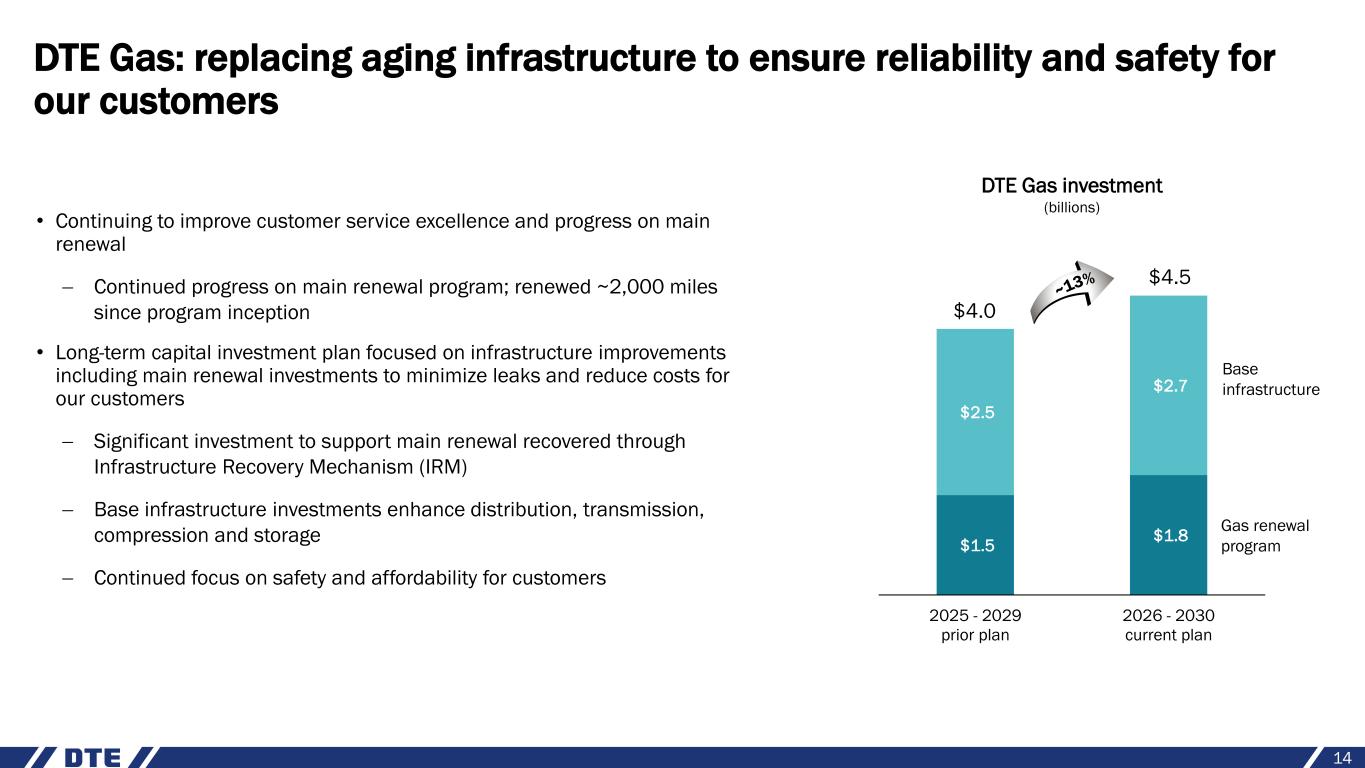

DTE Gas: replacing aging infrastructure to ensure reliability and safety for our customers 14 Gas renewal program Base infrastructure $1.5 $1.8 $2.5 $2.7 2025 - 2029 prior plan 2026 - 2030 current plan $4.0 $4.5 DTE Gas investment (billions) • Continuing to improve customer service excellence and progress on main renewal − Continued progress on main renewal program; renewed ~2,000 miles since program inception • Long-term capital investment plan focused on infrastructure improvements including main renewal investments to minimize leaks and reduce costs for our customers − Significant investment to support main renewal recovered through Infrastructure Recovery Mechanism (IRM) − Base infrastructure investments enhance distribution, transmission, compression and storage − Continued focus on safety and affordability for customers ~1 3%

DTE Vantage: strategic focus on decarbonization solutions for customers 15 JN • Progressing on project development − Continuing construction on the long-term, fixed-fee custom energy solutions project with Ford Motor Company; expecting commercial operation in 2026 − Progressing on project to design, build, own, operate and maintain a 42 MW combined heat and power project serving a large industrial customer; expect construction to begin later this year − ~$2 billion 5-year capital investment plan supports continued execution of utility- like, long-term, fixed-fee contracted projects and decarbonization growth opportunities • New projects coming on-line in 2026 and 2027, combined with a solid long-term development pipeline, provide confidence we can achieve our DTE 6% - 8% operating EPS1 growth through 2030 − 2030 operating earnings projection of $150 - $160 million is flat compared to 2025 operating earnings due to the expiration of 45Z tax credits in 2029 and a more conservative outlook driven largely by commodity pricing assumptions 1. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings

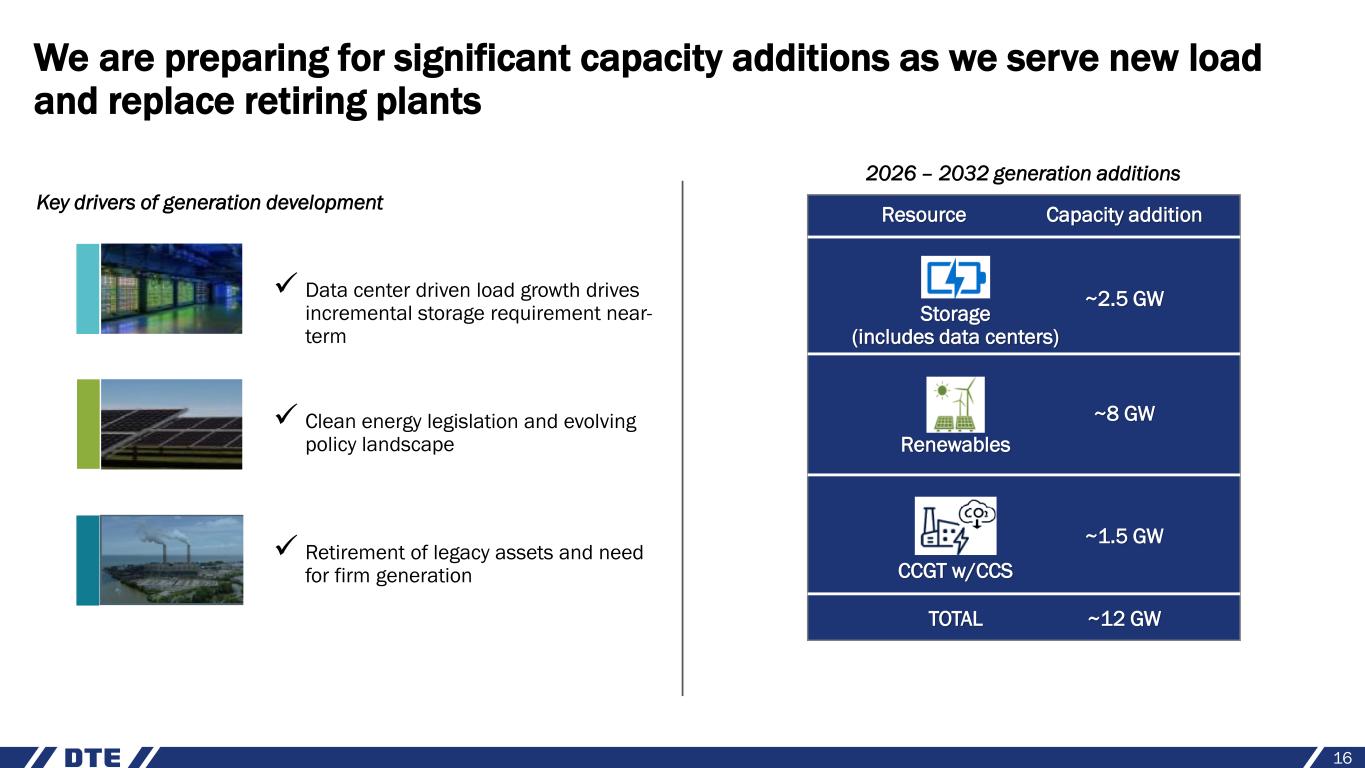

We are preparing for significant capacity additions as we serve new load and replace retiring plants 16 ✓ Data center driven load growth drives incremental storage requirement near- term Key drivers of generation development ✓ Clean energy legislation and evolving policy landscape ✓ Retirement of legacy assets and need for firm generation 2026 – 2032 generation additions Resource Capacity addition Renewables Storage (includes data centers) TOTAL ~12 GW ~2.5 GW ~8 GW CCGT w/CCS ~1.5 GW

Top tier affordability for our customers over the last 4 years 17 State comparison – electric residential bill change % from 2021 to 20251 DTE 3.0% Great Lakes average 15.8% U.S. average 21.3% 1st quartile 2nd quartile 3rd quartile 4th quartile Great Lake peer states 1. Source: Energy Information Administration (EIA). Ending point is the average 12-month rolling residential bill from April 2024 to March 2025

Environmental, social and governance (ESG) efforts are key priorities; aspiring to be the best in the industry Environment • Transitioning towards net zero1 emissions at both utilities • Accelerating transition to cleaner generation • Protecting our natural resources Social • Focusing on the diversity, safety, well-being and success of employees • Investing in communities • Leader in volunteerism Governance • Focusing on the oversight of environmental sustainability, social and governance • Ensuring board diversity • Providing incentive plans tied to safety and customer satisfaction targets 18 1. Definition of net zero included in the appendix 2024 Sustainability Report https://empoweringmichigan.com/dte-impact/performance Link:

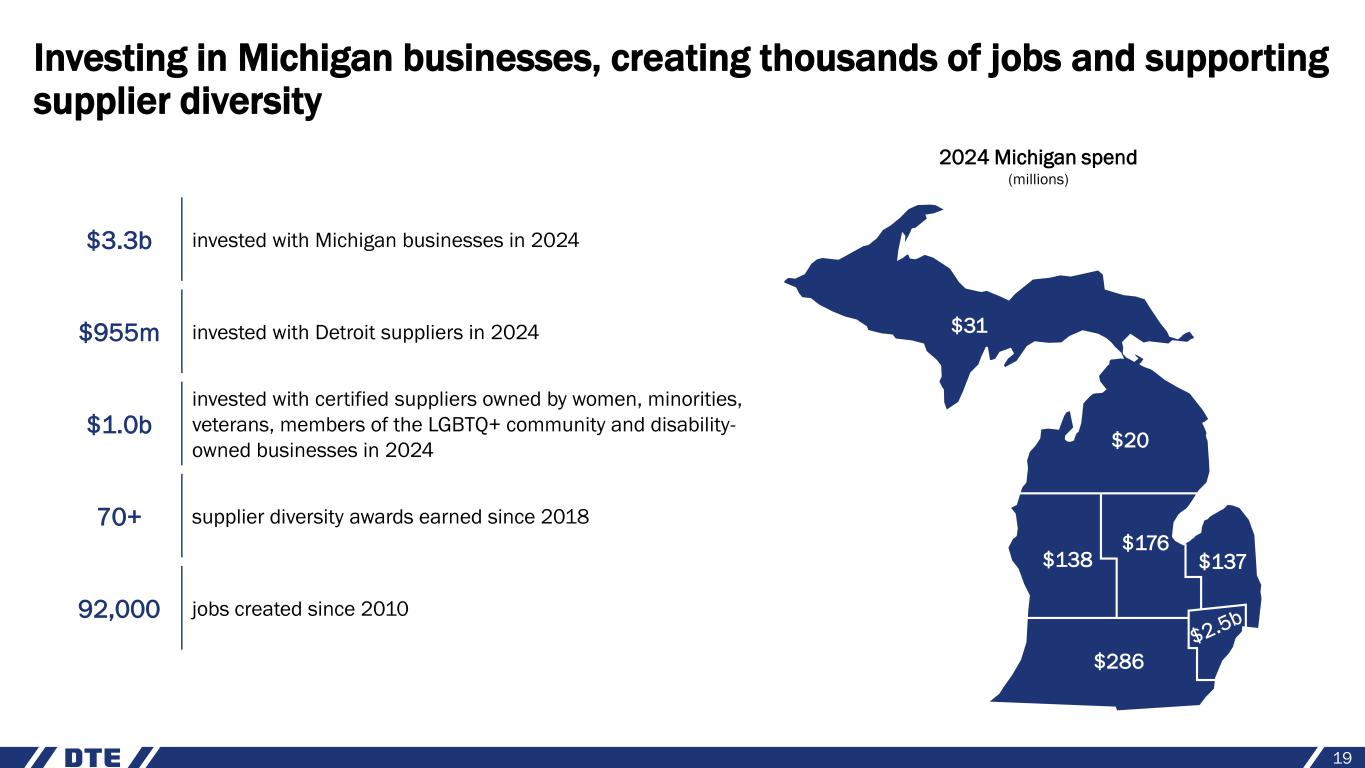

$3.3b invested with Michigan businesses in 2024 $955m invested with Detroit suppliers in 2024 $1.0b invested with certified suppliers owned by women, minorities, veterans, members of the LGBTQ+ community and disability- owned businesses in 2024 70+ supplier diversity awards earned since 2018 92,000 jobs created since 2010 Investing in Michigan businesses, creating thousands of jobs and supporting supplier diversity $31 $20 $138 $176 $137 $286 2024 Michigan spend (millions) 19

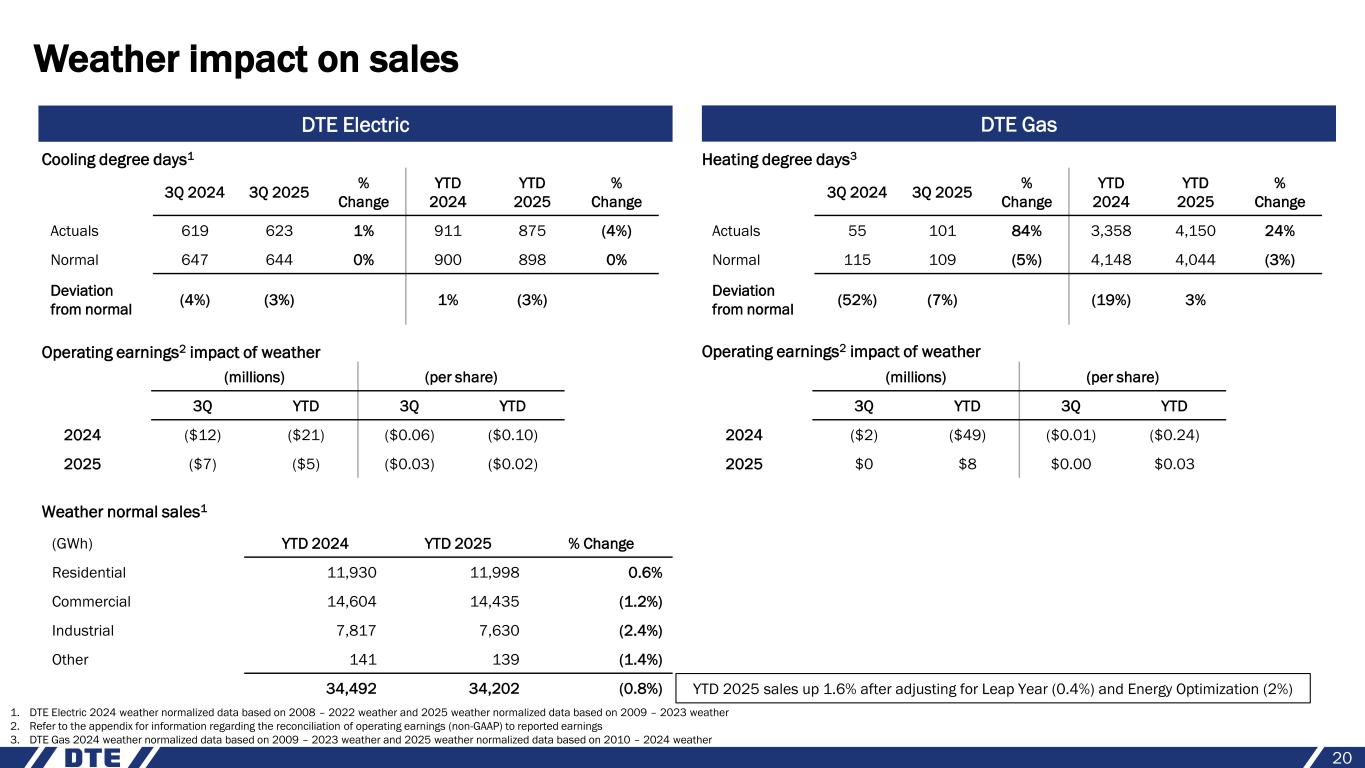

Weather impact on sales Cooling degree days1 Operating earnings2 impact of weather Weather normal sales1 DTE Electric Heating degree days3 Operating earnings2 impact of weather DTE Gas (GWh) YTD 2024 YTD 2025 % Change Residential 11,930 11,998 0.6% Commercial 14,604 14,435 (1.2%) Industrial 7,817 7,630 (2.4%) Other 141 139 (1.4%) 34,492 34,202 (0.8%) (millions) (per share) 3Q YTD 3Q YTD 2024 ($12) ($21) ($0.06) ($0.10) 2025 ($7) ($5) ($0.03) ($0.02) (millions) (per share) 3Q YTD 3Q YTD 2024 ($2) ($49) ($0.01) ($0.24) 2025 $0 $8 $0.00 $0.03 3Q 2024 3Q 2025 % Change YTD 2024 YTD 2025 % Change Actuals 619 623 1% 911 875 (4%) Normal 647 644 0% 900 898 0% Deviation from normal (4%) (3%) 1% (3%) 3Q 2024 3Q 2025 % Change YTD 2024 YTD 2025 % Change Actuals 55 101 84% 3,358 4,150 24% Normal 115 109 (5%) 4,148 4,044 (3%) Deviation from normal (52%) (7%) (19%) 3% 20 1. DTE Electric 2024 weather normalized data based on 2008 – 2022 weather and 2025 weather normalized data based on 2009 – 2023 weather 2. Refer to the appendix for information regarding the reconciliation of operating earnings (non-GAAP) to reported earnings 3. DTE Gas 2024 weather normalized data based on 2009 – 2023 weather and 2025 weather normalized data based on 2010 – 2024 weather YTD 2025 sales up 1.6% after adjusting for Leap Year (0.4%) and Energy Optimization (2%)

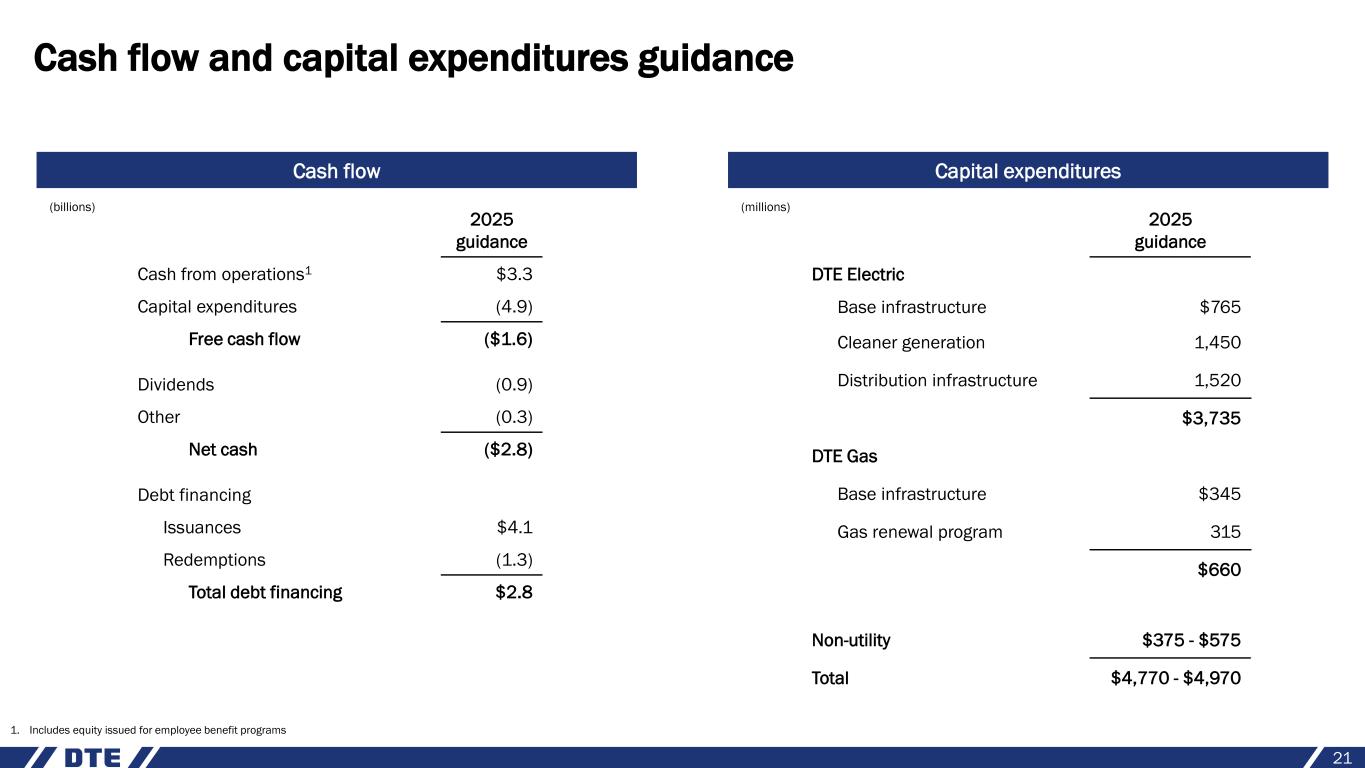

Cash flow and capital expenditures guidance 21 1. Includes equity issued for employee benefit programs 2025 guidance DTE Electric Base infrastructure $765 Cleaner generation 1,450 Distribution infrastructure 1,520 $3,735 DTE Gas Base infrastructure $345 Gas renewal program 315 $660 Non-utility $375 - $575 Total $4,770 - $4,970 2025 guidance Cash from operations1 $3.3 Capital expenditures (4.9) Free cash flow ($1.6) Dividends (0.9) Other (0.3) Net cash ($2.8) Debt financing Issuances $4.1 Redemptions (1.3) Total debt financing $2.8 (millions) Cash flow Capital expenditures (billions)

Reconciliation of reported to operating earnings (non-GAAP) 22 Use of Operating Earnings Information – Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. DTE Energy management believes that operating earnings provide a meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings is a non-GAAP measure and should be viewed as a supplement and not a substitute for reported earnings, which represents the company’s net income and the most comparable GAAP measure. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items (i.e., future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. Definition of net zero Goal for DTE Energy's utility operations and gas suppliers at DTE Gas that any carbon emissions put into the atmosphere will be balanced by those taken out of the atmosphere. Achieving this goal will include collective efforts to reduce carbon emissions and actions to offset any remaining emissions. Progress towards net zero goals is estimated and methodologies and calculations may vary from those of other utility businesses with similar targets. Carbon emissions is defined as emissions of carbon containing compounds, including carbon dioxide and methane, that are identified as greenhouse gases.