Third Quarter 2025 Earnings November 4, 2025 1

Safe Harbor Statement Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of federal securities laws, including, among others, statements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assume,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend,” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of this presentation are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this presentation. The risks and uncertainties that may cause actual results to differ materially from Masimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10-K and Form 10-Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request. Non-GAAP Financial Measures: The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The non- GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on-going core operating performance. These non- GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has provided and will continue to provide certain non-GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non-GAAP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adjusted results under the line item business transition and related costs in non-GAAP gross profit. The Company is making these changes to its presentation of non-GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission. The Company has presented the following non-GAAP financial measures to assist investors in understanding the Company’s core net operating results on an on-going basis: non-GAAP revenue (constant currency), non-GAAP revenue (constant currency), non-GAAP revenue growth (constant currency), non-GAAP gross profit/margin %, non-GAAP SG&A expense, non-GAAP R&D expense, non-GAAP litigation settlements and awards, non-GAAP impairment charge, non-GAAP operating expense %, non-GAAP operating profit/margin %, non-GAAP non-operating income (expense), non-GAAP provision for income taxes, non-GAAP net income (loss), non-GAAP net income (loss) per share. These non-GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes these non-GAAP financial measures are important in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non-GAAP reconciliations, please visit the Investor Relations section of the Company’s website at www.investor.masimo.com to access Supplementary Financial Information. Forward-Looking Non-GAAP Financial Measures: This presentation also includes certain forward-looking non-GAAP financial measures. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, we exclude the impact of certain charges related to acquisitions, integrations, divestitures and related costs; business transition and related costs; litigation related expenses and settlements; realized and unrealized gains or losses; tax related adjustments; and other adjustments. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management's plans may change. In addition, the Company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is probable that these forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. 2

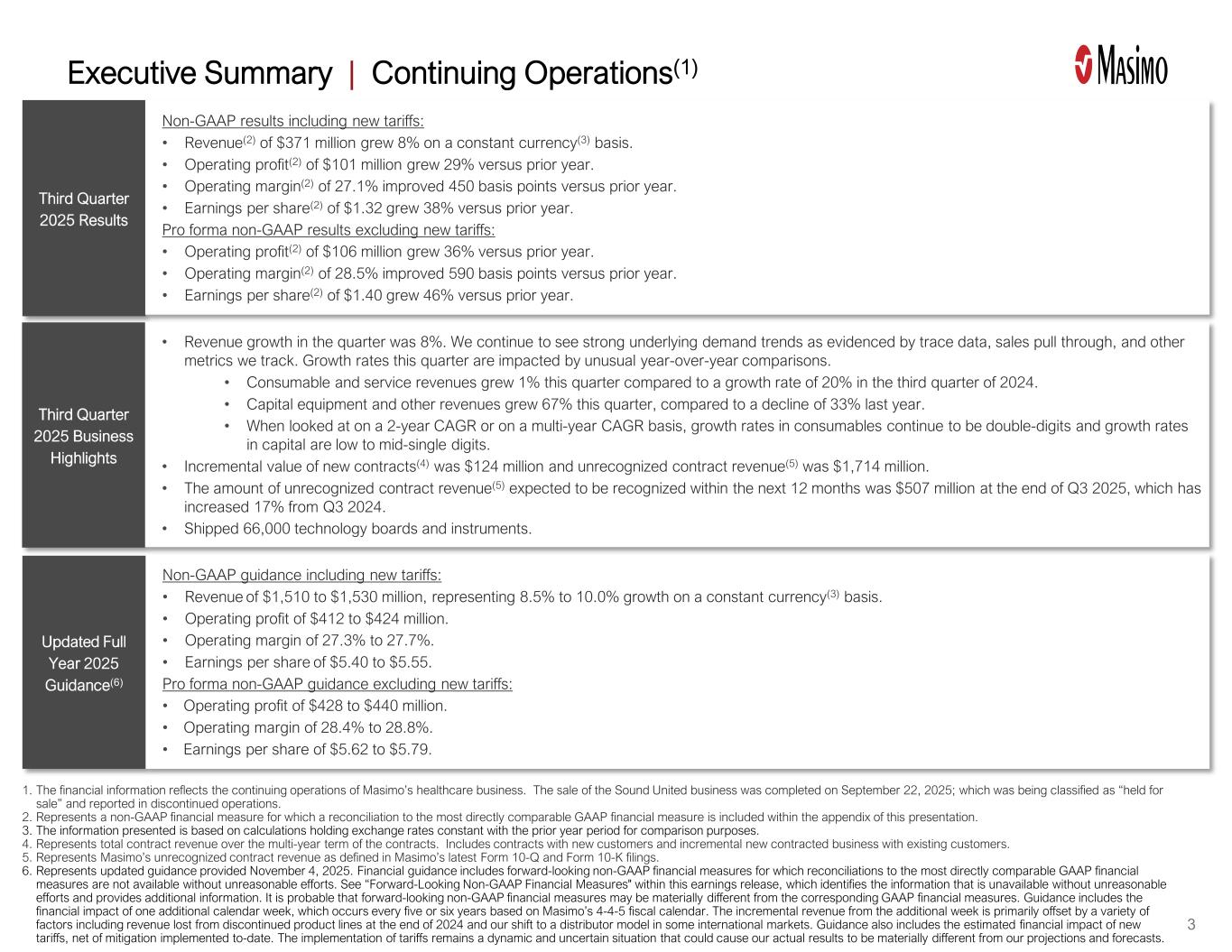

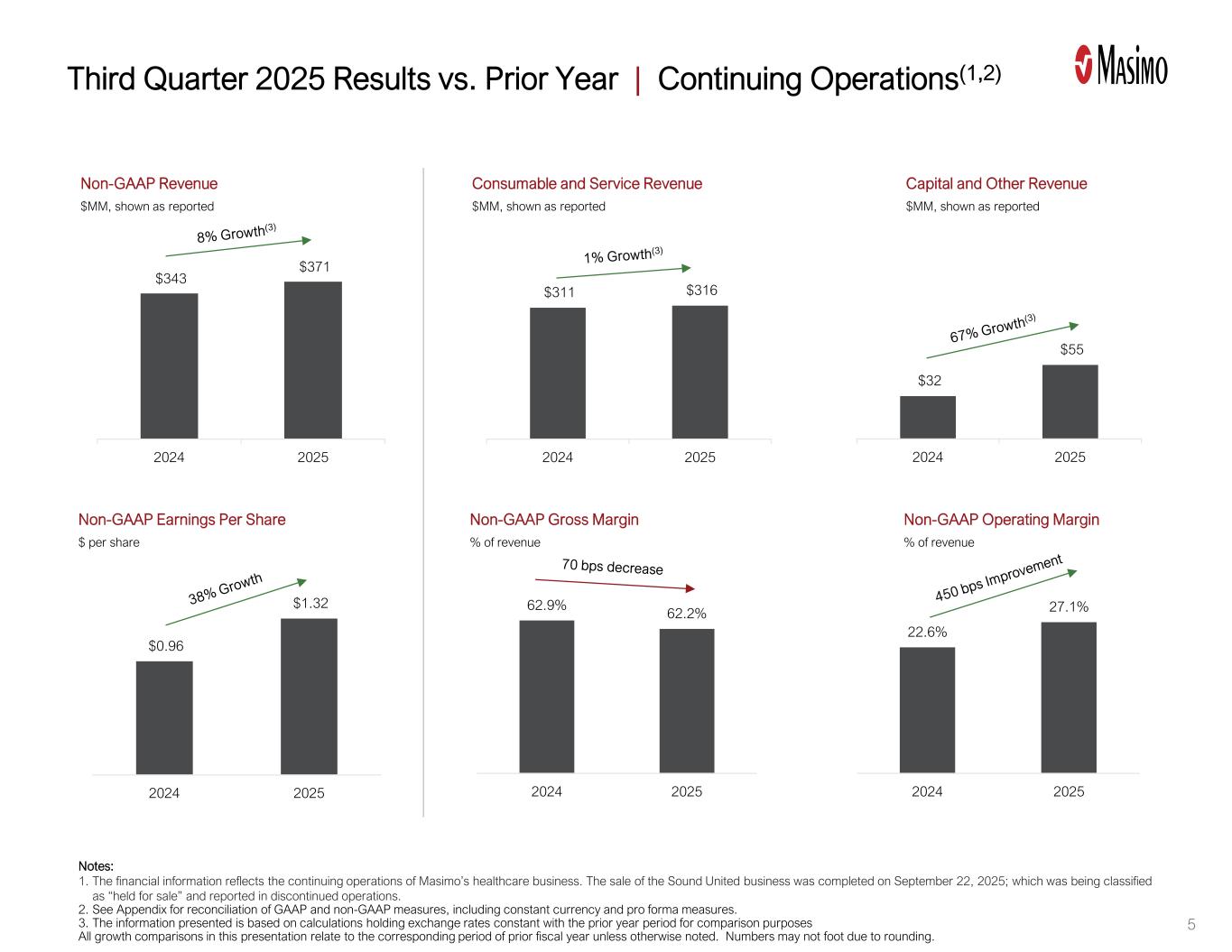

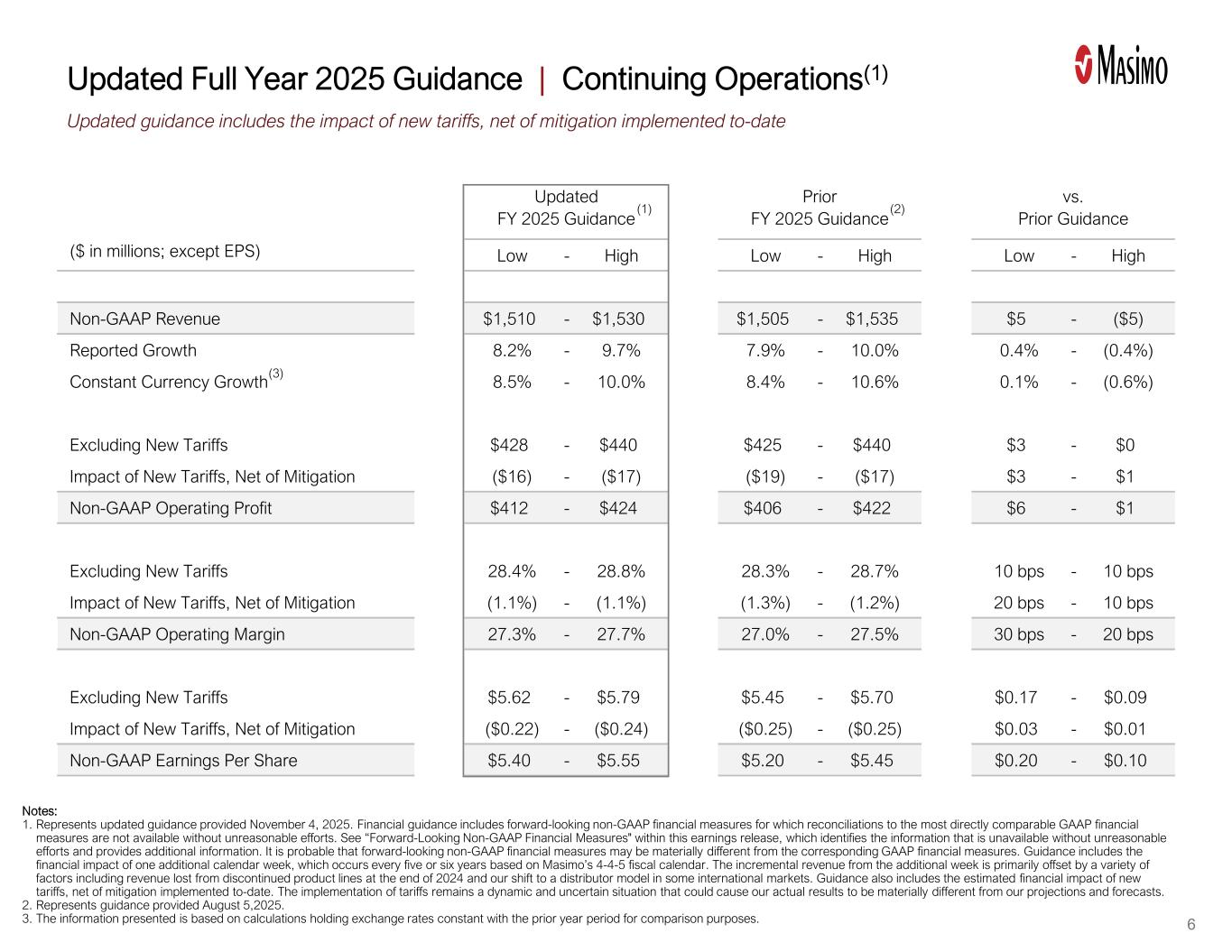

Executive Summary | Continuing Operations(1) Third Quarter 2025 Results Non-GAAP results including new tariffs: • Revenue(2) of $371 million grew 8% on a constant currency(3) basis. • Operating profit(2) of $101 million grew 29% versus prior year. • Operating margin(2) of 27.1% improved 450 basis points versus prior year. • Earnings per share(2) of $1.32 grew 38% versus prior year. Pro forma non-GAAP results excluding new tariffs: • Operating profit(2) of $106 million grew 36% versus prior year. • Operating margin(2) of 28.5% improved 590 basis points versus prior year. • Earnings per share(2) of $1.40 grew 46% versus prior year. 3 1. The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. 2. Represents a non-GAAP financial measure for which a reconciliation to the most directly comparable GAAP financial measure is included within the appendix of this presentation. 3. The information presented is based on calculations holding exchange rates constant with the prior year period for comparison purposes. 4. Represents total contract revenue over the multi-year term of the contracts. Includes contracts with new customers and incremental new contracted business with existing customers. 5. Represents Masimo’s unrecognized contract revenue as defined in Masimo’s latest Form 10-Q and Form 10-K filings. 6. Represents updated guidance provided November 4, 2025. Financial guidance includes forward-looking non-GAAP financial measures for which reconciliations to the most directly comparable GAAP financial measures are not available without unreasonable efforts. See “Forward-Looking Non-GAAP Financial Measures" within this earnings release, which identifies the information that is unavailable without unreasonable efforts and provides additional information. It is probable that forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. Guidance includes the financial impact of one additional calendar week, which occurs every five or six years based on Masimo’s 4-4-5 fiscal calendar. The incremental revenue from the additional week is primarily offset by a variety of factors including revenue lost from discontinued product lines at the end of 2024 and our shift to a distributor model in some international markets. Guidance also includes the estimated financial impact of new tariffs, net of mitigation implemented to-date. The implementation of tariffs remains a dynamic and uncertain situation that could cause our actual results to be materially different from our projections and forecasts. Updated Full Year 2025 Guidance(6) Non-GAAP guidance including new tariffs: • Revenue of $1,510 to $1,530 million, representing 8.5% to 10.0% growth on a constant currency(3) basis. • Operating profit of $412 to $424 million. • Operating margin of 27.3% to 27.7%. • Earnings per share of $5.40 to $5.55. Pro forma non-GAAP guidance excluding new tariffs: • Operating profit of $428 to $440 million. • Operating margin of 28.4% to 28.8%. • Earnings per share of $5.62 to $5.79. Third Quarter 2025 Business Highlights • Revenue growth in the quarter was 8%. We continue to see strong underlying demand trends as evidenced by trace data, sales pull through, and other metrics we track. Growth rates this quarter are impacted by unusual year-over-year comparisons. • Consumable and service revenues grew 1% this quarter compared to a growth rate of 20% in the third quarter of 2024. • Capital equipment and other revenues grew 67% this quarter, compared to a decline of 33% last year. • When looked at on a 2-year CAGR or on a multi-year CAGR basis, growth rates in consumables continue to be double-digits and growth rates in capital are low to mid-single digits. • Incremental value of new contracts(4) was $124 million and unrecognized contract revenue(5) was $1,714 million. • The amount of unrecognized contract revenue(5) expected to be recognized within the next 12 months was $507 million at the end of Q3 2025, which has increased 17% from Q3 2024. • Shipped 66,000 technology boards and instruments.

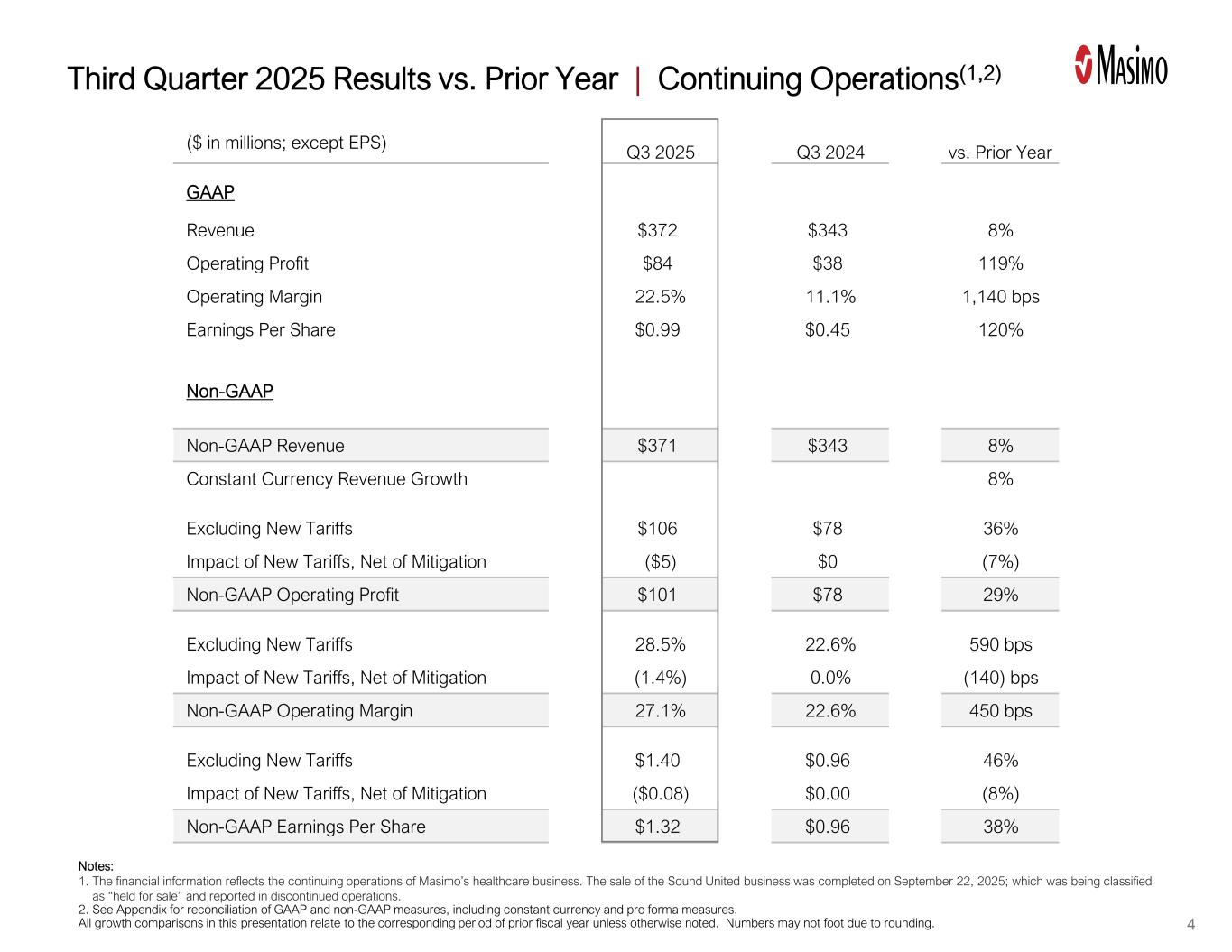

($ in millions; except EPS) GAAP Revenue $372 $343 8% Operating Profit $84 $38 119% Operating Margin 22.5% 11.1% 1,140 bps Earnings Per Share $0.99 $0.45 120% Non-GAAP Non-GAAP Revenue $371 $343 8% Constant Currency Revenue Growth 8% Excluding New Tariffs $106 $78 36% Impact of New Tariffs, Net of Mitigation ($5) $0 (7%) Non-GAAP Operating Profit $101 $78 29% Excluding New Tariffs 28.5% 22.6% 590 bps Impact of New Tariffs, Net of Mitigation (1.4%) 0.0% (140) bps Non-GAAP Operating Margin 27.1% 22.6% 450 bps Excluding New Tariffs $1.40 $0.96 46% Impact of New Tariffs, Net of Mitigation ($0.08) $0.00 (8%) Non-GAAP Earnings Per Share $1.32 $0.96 38% vs. Prior YearQ3 2025 Q3 2024 Third Quarter 2025 Results vs. Prior Year | Continuing Operations(1,2) Notes: 1. The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. 2. See Appendix for reconciliation of GAAP and non-GAAP measures, including constant currency and pro forma measures. All growth comparisons in this presentation relate to the corresponding period of prior fiscal year unless otherwise noted. Numbers may not foot due to rounding. 4

22.6% 27.1% 2024 2025 62.9% 62.2% 2024 2025 $0.96 $1.32 2024 2025 5 Non-GAAP Revenue $MM, shown as reported $343 $371 2024 2025 $311 $316 2024 2025 $32 $55 2024 2025 Consumable and Service Revenue $MM, shown as reported Capital and Other Revenue $MM, shown as reported Notes: 1. The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. 2. See Appendix for reconciliation of GAAP and non-GAAP measures, including constant currency and pro forma measures. 3. The information presented is based on calculations holding exchange rates constant with the prior year period for comparison purposes All growth comparisons in this presentation relate to the corresponding period of prior fiscal year unless otherwise noted. Numbers may not foot due to rounding. Third Quarter 2025 Results vs. Prior Year | Continuing Operations(1,2) Non-GAAP Earnings Per Share $ per share Non-GAAP Gross Margin % of revenue Non-GAAP Operating Margin % of revenue

($ in millions; except EPS) Low - High Low - High Low - High Non-GAAP Revenue $1,510 - $1,530 $1,505 - $1,535 $5 - ($5) Reported Growth 8.2% - 9.7% 7.9% - 10.0% 0.4% - (0.4%) Constant Currency Growth 8.5% - 10.0% 8.4% - 10.6% 0.1% - (0.6%) Excluding New Tariffs $428 - $440 $425 - $440 $3 - $0 Impact of New Tariffs, Net of Mitigation ($16) - ($17) ($19) - ($17) $3 - $1 Non-GAAP Operating Profit $412 - $424 $406 - $422 $6 - $1 Excluding New Tariffs 28.4% - 28.8% 28.3% - 28.7% 10 bps - 10 bps Impact of New Tariffs, Net of Mitigation (1.1%) - (1.1%) (1.3%) - (1.2%) 20 bps - 10 bps Non-GAAP Operating Margin 27.3% - 27.7% 27.0% - 27.5% 30 bps - 20 bps Excluding New Tariffs $5.62 - $5.79 $5.45 - $5.70 $0.17 - $0.09 Impact of New Tariffs, Net of Mitigation ($0.22) - ($0.24) ($0.25) - ($0.25) $0.03 - $0.01 Non-GAAP Earnings Per Share $5.40 - $5.55 $5.20 - $5.45 $0.20 - $0.10 Updated FY 2025 Guidance Prior FY 2025 Guidance vs. Prior Guidance 6 Updated guidance includes the impact of new tariffs, net of mitigation implemented to-date Notes: 1. Represents updated guidance provided November 4, 2025. Financial guidance includes forward-looking non-GAAP financial measures for which reconciliations to the most directly comparable GAAP financial measures are not available without unreasonable efforts. See “Forward-Looking Non-GAAP Financial Measures" within this earnings release, which identifies the information that is unavailable without unreasonable efforts and provides additional information. It is probable that forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. Guidance includes the financial impact of one additional calendar week, which occurs every five or six years based on Masimo’s 4-4-5 fiscal calendar. The incremental revenue from the additional week is primarily offset by a variety of factors including revenue lost from discontinued product lines at the end of 2024 and our shift to a distributor model in some international markets. Guidance also includes the estimated financial impact of new tariffs, net of mitigation implemented to-date. The implementation of tariffs remains a dynamic and uncertain situation that could cause our actual results to be materially different from our projections and forecasts. 2. Represents guidance provided August 5,2025. 3. The information presented is based on calculations holding exchange rates constant with the prior year period for comparison purposes. (1) (2) Updated Full Year 2025 Guidance | Continuing Operations(1) (3)

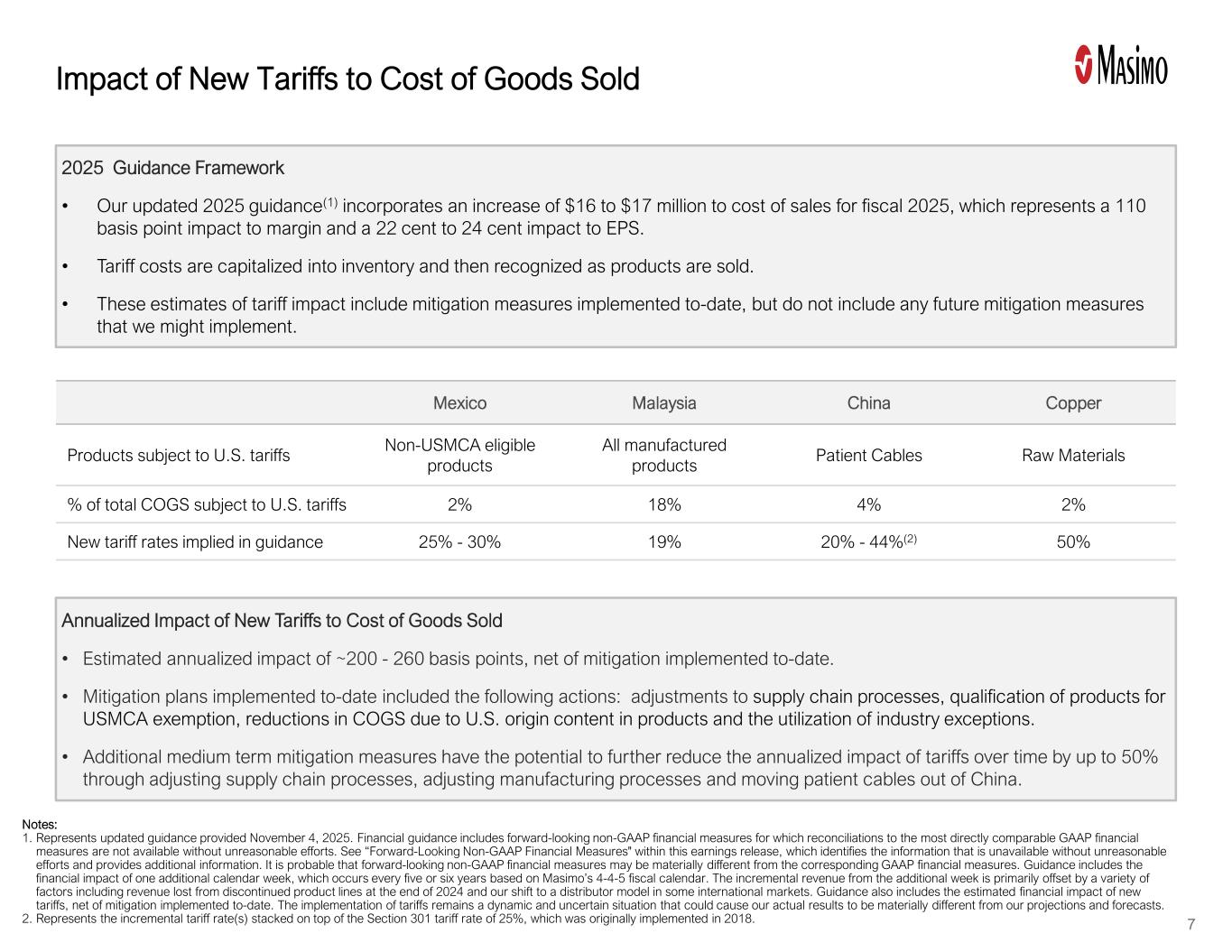

7 Notes: 1. Represents updated guidance provided November 4, 2025. Financial guidance includes forward-looking non-GAAP financial measures for which reconciliations to the most directly comparable GAAP financial measures are not available without unreasonable efforts. See “Forward-Looking Non-GAAP Financial Measures" within this earnings release, which identifies the information that is unavailable without unreasonable efforts and provides additional information. It is probable that forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. Guidance includes the financial impact of one additional calendar week, which occurs every five or six years based on Masimo’s 4-4-5 fiscal calendar. The incremental revenue from the additional week is primarily offset by a variety of factors including revenue lost from discontinued product lines at the end of 2024 and our shift to a distributor model in some international markets. Guidance also includes the estimated financial impact of new tariffs, net of mitigation implemented to-date. The implementation of tariffs remains a dynamic and uncertain situation that could cause our actual results to be materially different from our projections and forecasts. 2. Represents the incremental tariff rate(s) stacked on top of the Section 301 tariff rate of 25%, which was originally implemented in 2018. Impact of New Tariffs to Cost of Goods Sold Mexico Malaysia China Copper Products subject to U.S. tariffs Non-USMCA eligible products All manufactured products Patient Cables Raw Materials % of total COGS subject to U.S. tariffs 2% 18% 4% 2% New tariff rates implied in guidance 25% - 30% 19% 20% - 44%(2) 50% 2025 Guidance Framework • Our updated 2025 guidance(1) incorporates an increase of $16 to $17 million to cost of sales for fiscal 2025, which represents a 110 basis point impact to margin and a 22 cent to 24 cent impact to EPS. • Tariff costs are capitalized into inventory and then recognized as products are sold. • These estimates of tariff impact include mitigation measures implemented to-date, but do not include any future mitigation measures that we might implement. Annualized Impact of New Tariffs to Cost of Goods Sold • Estimated annualized impact of ~200 - 260 basis points, net of mitigation implemented to-date. • Mitigation plans implemented to-date included the following actions: adjustments to supply chain processes, qualification of products for USMCA exemption, reductions in COGS due to U.S. origin content in products and the utilization of industry exceptions. • Additional medium term mitigation measures have the potential to further reduce the annualized impact of tariffs over time by up to 50% through adjusting supply chain processes, adjusting manufacturing processes and moving patient cables out of China.

Appendix • GAAP to Non-GAAP Reconciliations 8

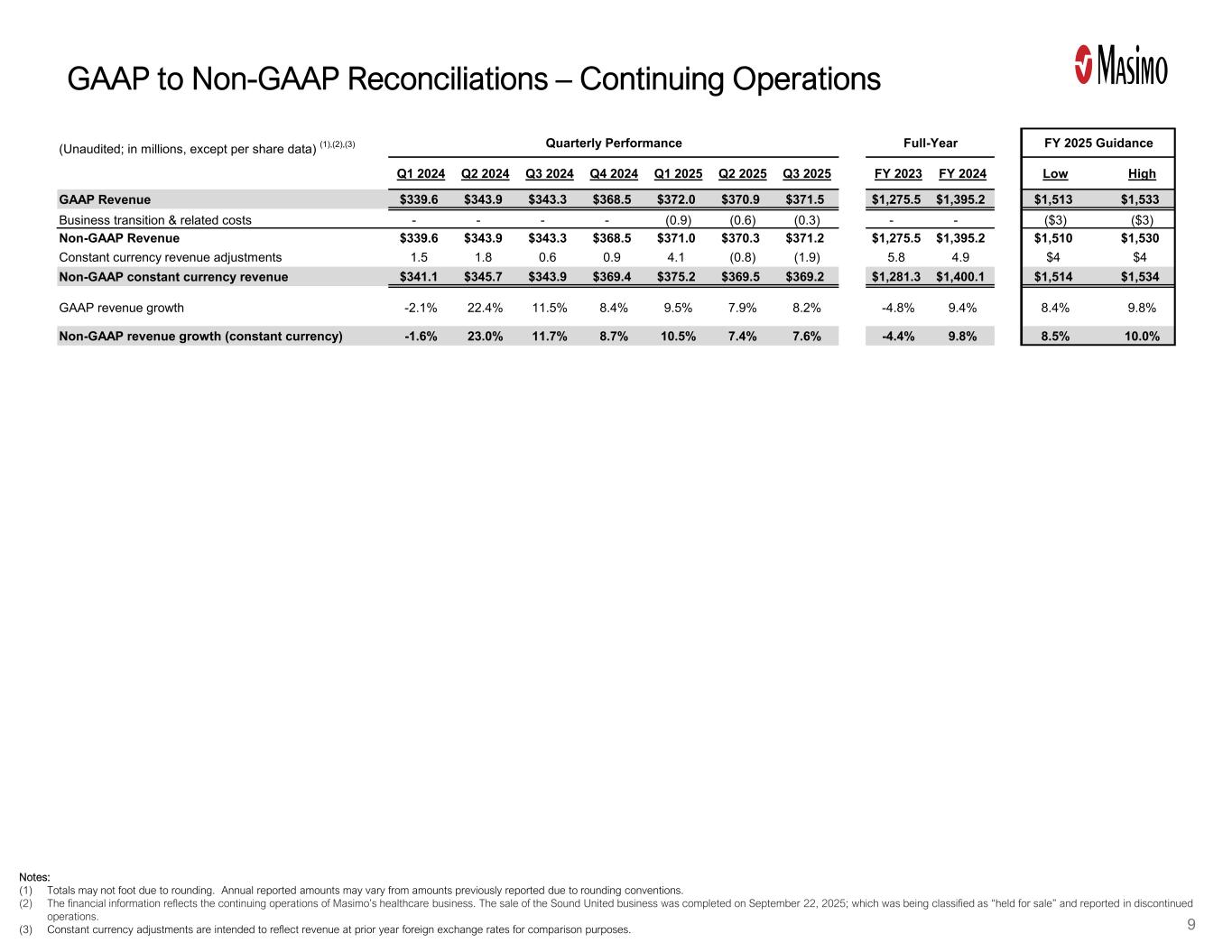

GAAP to Non-GAAP Reconciliations – Continuing Operations Notes: (1) Totals may not foot due to rounding. Annual reported amounts may vary from amounts previously reported due to rounding conventions. (2) The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. (3) Constant currency adjustments are intended to reflect revenue at prior year foreign exchange rates for comparison purposes. 9 (Unaudited; in millions, except per share data) (1),(2),(3) Quarterly Performance Full-Year FY 2025 Guidance Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 FY 2023 FY 2024 Low High GAAP Revenue $339.6 $343.9 $343.3 $368.5 $372.0 $370.9 $371.5 $1,275.5 $1,395.2 $1,513 $1,533 Business transition & related costs - - - - (0.9) (0.6) (0.3) - - ($3) ($3) Non-GAAP Revenue $339.6 $343.9 $343.3 $368.5 $371.0 $370.3 $371.2 $1,275.5 $1,395.2 $1,510 $1,530 Constant currency revenue adjustments 1.5 1.8 0.6 0.9 4.1 (0.8) (1.9) 5.8 4.9 $4 $4 Non-GAAP constant currency revenue $341.1 $345.7 $343.9 $369.4 $375.2 $369.5 $369.2 $1,281.3 $1,400.1 $1,514 $1,534 GAAP revenue growth -2.1% 22.4% 11.5% 8.4% 9.5% 7.9% 8.2% -4.8% 9.4% 8.4% 9.8% Non-GAAP revenue growth (constant currency) -1.6% 23.0% 11.7% 8.7% 10.5% 7.4% 7.6% -4.4% 9.8% 8.5% 10.0%

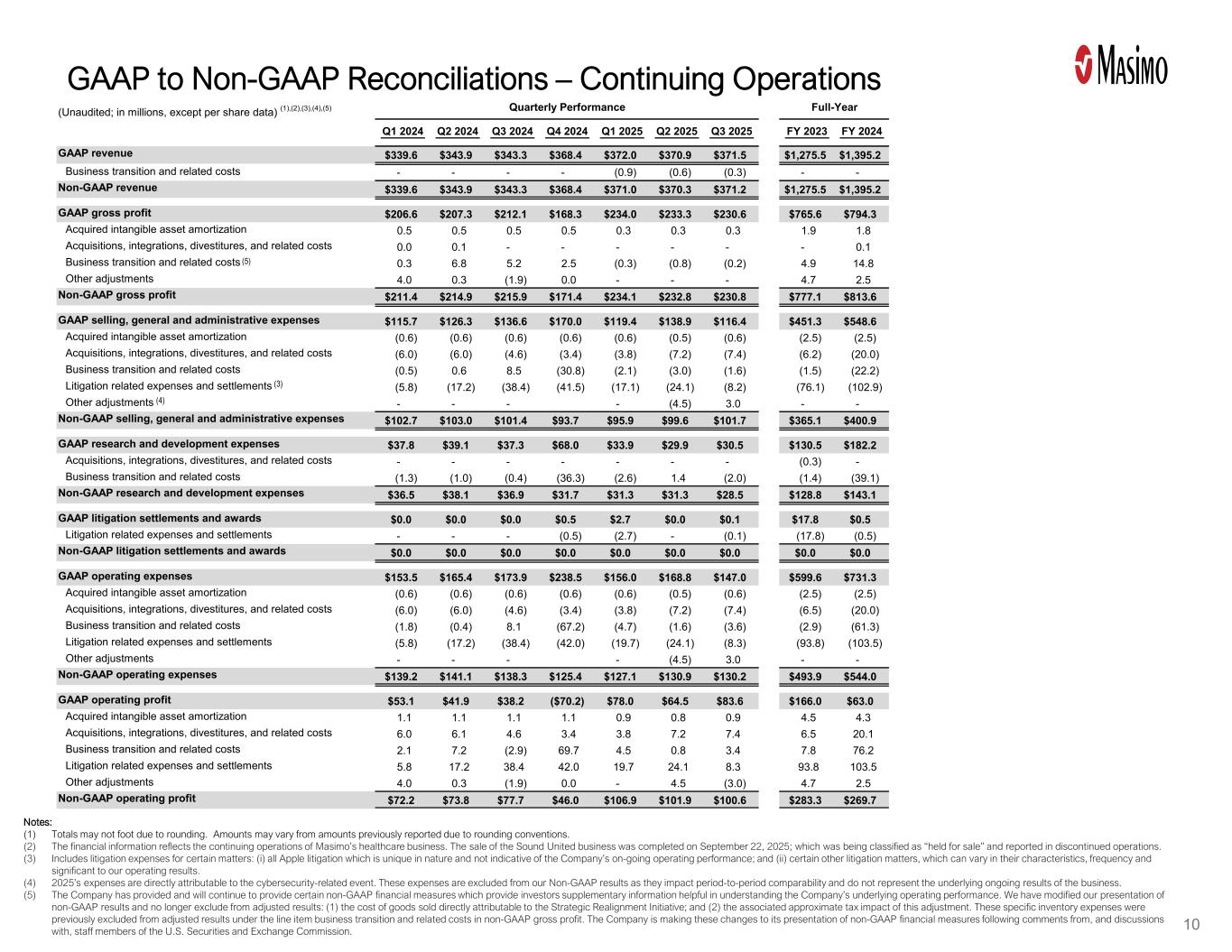

(Unaudited; in millions, except per share data) (1),(2),(3),(4),(5) Quarterly Performance Full-Year Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 FY 2023 FY 2024 GAAP revenue $339.6 $343.9 $343.3 $368.4 $372.0 $370.9 $371.5 $1,275.5 $1,395.2 Business transition and related costs - - - - (0.9) (0.6) (0.3) - - Non-GAAP revenue $339.6 $343.9 $343.3 $368.4 $371.0 $370.3 $371.2 $1,275.5 $1,395.2 GAAP gross profit $206.6 $207.3 $212.1 $168.3 $234.0 $233.3 $230.6 $765.6 $794.3 Acquired intangible asset amortization 0.5 0.5 0.5 0.5 0.3 0.3 0.3 1.9 1.8 Acquisitions, integrations, divestitures, and related costs 0.0 0.1 - - - - - - 0.1 Business transition and related costs 0.3 6.8 5.2 2.5 (0.3) (0.8) (0.2) 4.9 14.8 Other adjustments 4.0 0.3 (1.9) 0.0 - - - 4.7 2.5 Non-GAAP gross profit $211.4 $214.9 $215.9 $171.4 $234.1 $232.8 $230.8 $777.1 $813.6 GAAP selling, general and administrative expenses $115.7 $126.3 $136.6 $170.0 $119.4 $138.9 $116.4 $451.3 $548.6 Acquired intangible asset amortization (0.6) (0.6) (0.6) (0.6) (0.6) (0.5) (0.6) (2.5) (2.5) Acquisitions, integrations, divestitures, and related costs (6.0) (6.0) (4.6) (3.4) (3.8) (7.2) (7.4) (6.2) (20.0) Business transition and related costs (0.5) 0.6 8.5 (30.8) (2.1) (3.0) (1.6) (1.5) (22.2) Litigation related expenses and settlements (5.8) (17.2) (38.4) (41.5) (17.1) (24.1) (8.2) (76.1) (102.9) Other adjustments - - - - (4.5) 3.0 - - Non-GAAP selling, general and administrative expenses $102.7 $103.0 $101.4 $93.7 $95.9 $99.6 $101.7 $365.1 $400.9 GAAP research and development expenses $37.8 $39.1 $37.3 $68.0 $33.9 $29.9 $30.5 $130.5 $182.2 Acquisitions, integrations, divestitures, and related costs - - - - - - - (0.3) - Business transition and related costs (1.3) (1.0) (0.4) (36.3) (2.6) 1.4 (2.0) (1.4) (39.1) Non-GAAP research and development expenses $36.5 $38.1 $36.9 $31.7 $31.3 $31.3 $28.5 $128.8 $143.1 GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.5 $2.7 $0.0 $0.1 $17.8 $0.5 Litigation related expenses and settlements - - - (0.5) (2.7) - (0.1) (17.8) (0.5) Non-GAAP litigation settlements and awards $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 $0.0 GAAP operating expenses $153.5 $165.4 $173.9 $238.5 $156.0 $168.8 $147.0 $599.6 $731.3 Acquired intangible asset amortization (0.6) (0.6) (0.6) (0.6) (0.6) (0.5) (0.6) (2.5) (2.5) Acquisitions, integrations, divestitures, and related costs (6.0) (6.0) (4.6) (3.4) (3.8) (7.2) (7.4) (6.5) (20.0) Business transition and related costs (1.8) (0.4) 8.1 (67.2) (4.7) (1.6) (3.6) (2.9) (61.3) Litigation related expenses and settlements (5.8) (17.2) (38.4) (42.0) (19.7) (24.1) (8.3) (93.8) (103.5) Other adjustments - - - - (4.5) 3.0 - - Non-GAAP operating expenses $139.2 $141.1 $138.3 $125.4 $127.1 $130.9 $130.2 $493.9 $544.0 GAAP operating profit $53.1 $41.9 $38.2 ($70.2) $78.0 $64.5 $83.6 $166.0 $63.0 Acquired intangible asset amortization 1.1 1.1 1.1 1.1 0.9 0.8 0.9 4.5 4.3 Acquisitions, integrations, divestitures, and related costs 6.0 6.1 4.6 3.4 3.8 7.2 7.4 6.5 20.1 Business transition and related costs 2.1 7.2 (2.9) 69.7 4.5 0.8 3.4 7.8 76.2 Litigation related expenses and settlements 5.8 17.2 38.4 42.0 19.7 24.1 8.3 93.8 103.5 Other adjustments 4.0 0.3 (1.9) 0.0 - 4.5 (3.0) 4.7 2.5 Non-GAAP operating profit $72.2 $73.8 $77.7 $46.0 $106.9 $101.9 $100.6 $283.3 $269.7 GAAP to Non-GAAP Reconciliations – Continuing Operations Notes: (1) Totals may not foot due to rounding. Amounts may vary from amounts previously reported due to rounding conventions. (2) The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. (3) Includes litigation expenses for certain matters: (i) all Apple litigation which is unique in nature and not indicative of the Company’s on-going operating performance; and (ii) certain other litigation matters, which can vary in their characteristics, frequency and significant to our operating results. (4) 2025’s expenses are directly attributable to the cybersecurity-related event. These expenses are excluded from our Non-GAAP results as they impact period-to-period comparability and do not represent the underlying ongoing results of the business. (5) The Company has provided and will continue to provide certain non-GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non-GAAP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adjusted results under the line item business transition and related costs in non-GAAP gross profit. The Company is making these changes to its presentation of non-GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission. 10 (3) (4) (5)

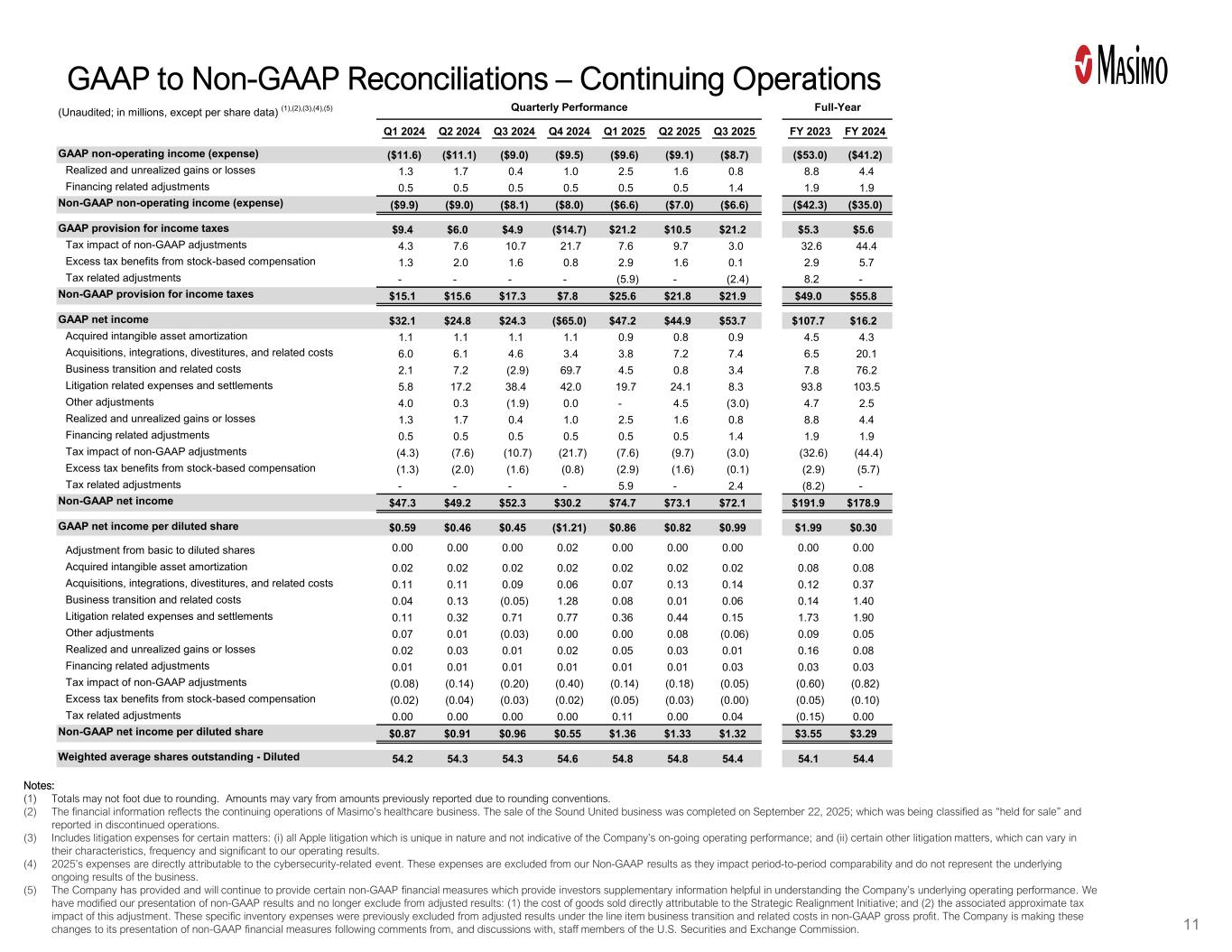

(Unaudited; in millions, except per share data) (1),(2),(3),(4),(5) Quarterly Performance Full-Year Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 FY 2023 FY 2024 GAAP non-operating income (expense) ($11.6) ($11.1) ($9.0) ($9.5) ($9.6) ($9.1) ($8.7) ($53.0) ($41.2) Realized and unrealized gains or losses 1.3 1.7 0.4 1.0 2.5 1.6 0.8 8.8 4.4 Financing related adjustments 0.5 0.5 0.5 0.5 0.5 0.5 1.4 1.9 1.9 Non-GAAP non-operating income (expense) ($9.9) ($9.0) ($8.1) ($8.0) ($6.6) ($7.0) ($6.6) ($42.3) ($35.0) GAAP provision for income taxes $9.4 $6.0 $4.9 ($14.7) $21.2 $10.5 $21.2 $5.3 $5.6 Tax impact of non-GAAP adjustments 4.3 7.6 10.7 21.7 7.6 9.7 3.0 32.6 44.4 Excess tax benefits from stock-based compensation 1.3 2.0 1.6 0.8 2.9 1.6 0.1 2.9 5.7 Tax related adjustments - - - - (5.9) - (2.4) 8.2 - Non-GAAP provision for income taxes $15.1 $15.6 $17.3 $7.8 $25.6 $21.8 $21.9 $49.0 $55.8 GAAP net income $32.1 $24.8 $24.3 ($65.0) $47.2 $44.9 $53.7 $107.7 $16.2 Acquired intangible asset amortization 1.1 1.1 1.1 1.1 0.9 0.8 0.9 4.5 4.3 Acquisitions, integrations, divestitures, and related costs 6.0 6.1 4.6 3.4 3.8 7.2 7.4 6.5 20.1 Business transition and related costs 2.1 7.2 (2.9) 69.7 4.5 0.8 3.4 7.8 76.2 Litigation related expenses and settlements 5.8 17.2 38.4 42.0 19.7 24.1 8.3 93.8 103.5 Other adjustments 4.0 0.3 (1.9) 0.0 - 4.5 (3.0) 4.7 2.5 Realized and unrealized gains or losses 1.3 1.7 0.4 1.0 2.5 1.6 0.8 8.8 4.4 Financing related adjustments 0.5 0.5 0.5 0.5 0.5 0.5 1.4 1.9 1.9 Tax impact of non-GAAP adjustments (4.3) (7.6) (10.7) (21.7) (7.6) (9.7) (3.0) (32.6) (44.4) Excess tax benefits from stock-based compensation (1.3) (2.0) (1.6) (0.8) (2.9) (1.6) (0.1) (2.9) (5.7) Tax related adjustments - - - - 5.9 - 2.4 (8.2) - Non-GAAP net income $47.3 $49.2 $52.3 $30.2 $74.7 $73.1 $72.1 $191.9 $178.9 GAAP net income per diluted share $0.59 $0.46 $0.45 ($1.21) $0.86 $0.82 $0.99 $1.99 $0.30 Adjustment from basic to diluted shares 0.00 0.00 0.00 0.02 0.00 0.00 0.00 0.00 0.00 Acquired intangible asset amortization 0.02 0.02 0.02 0.02 0.02 0.02 0.02 0.08 0.08 Acquisitions, integrations, divestitures, and related costs 0.11 0.11 0.09 0.06 0.07 0.13 0.14 0.12 0.37 Business transition and related costs 0.04 0.13 (0.05) 1.28 0.08 0.01 0.06 0.14 1.40 Litigation related expenses and settlements 0.11 0.32 0.71 0.77 0.36 0.44 0.15 1.73 1.90 Other adjustments 0.07 0.01 (0.03) 0.00 0.00 0.08 (0.06) 0.09 0.05 Realized and unrealized gains or losses 0.02 0.03 0.01 0.02 0.05 0.03 0.01 0.16 0.08 Financing related adjustments 0.01 0.01 0.01 0.01 0.01 0.01 0.03 0.03 0.03 Tax impact of non-GAAP adjustments (0.08) (0.14) (0.20) (0.40) (0.14) (0.18) (0.05) (0.60) (0.82) Excess tax benefits from stock-based compensation (0.02) (0.04) (0.03) (0.02) (0.05) (0.03) (0.00) (0.05) (0.10) Tax related adjustments 0.00 0.00 0.00 0.00 0.11 0.00 0.04 (0.15) 0.00 Non-GAAP net income per diluted share $0.87 $0.91 $0.96 $0.55 $1.36 $1.33 $1.32 $3.55 $3.29 Weighted average shares outstanding - Diluted 54.2 54.3 54.3 54.6 54.8 54.8 54.4 54.1 54.4 GAAP to Non-GAAP Reconciliations – Continuing Operations 11 Notes: (1) Totals may not foot due to rounding. Amounts may vary from amounts previously reported due to rounding conventions. (2) The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United business was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operations. (3) Includes litigation expenses for certain matters: (i) all Apple litigation which is unique in nature and not indicative of the Company’s on-going operating performance; and (ii) certain other litigation matters, which can vary in their characteristics, frequency and significant to our operating results. (4) 2025’s expenses are directly attributable to the cybersecurity-related event. These expenses are excluded from our Non-GAAP results as they impact period-to-period comparability and do not represent the underlying ongoing results of the business. (5) The Company has provided and will continue to provide certain non-GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non-GAAP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adjusted results under the line item business transition and related costs in non-GAAP gross profit. The Company is making these changes to its presentation of non-GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission.