J.P. Morgan Healthcare Conference J a n u a r y 1 4 , 2 0 2 6

Safe Harbor Statement Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws, including, among others, statements about our expectations, plans, strategies or prospects. We generally use the words “may,” “will,” “expect,” “believe,” “anticipate,” “plan,” “estimate,” “project,” “assume,” “guide,” “target,” “forecast,” “see,” “seek,” “can,” “should,” “could,” “would,” “intend,” “predict,” “potential,” “strategy,” “is confident that,” “future,” “opportunity,” “work toward,” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be, forward-looking statements. Such statements are based upon the current beliefs, expectations and assumptions of management and are subject to significant risks, uncertainties and changes in circumstances that could cause actual results to differ materially from the forward-looking statements. Forward-looking statements speak only as of the date they are made, and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers of this presentation are cautioned not to rely on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. This cautionary statement is applicable to all forward-looking statements contained in this presentation. The risks and uncertainties that may cause actual results to differ materially from Masimo’s current expectations are more fully described in Masimo’s reports filed with the U.S. Securities and Exchange Commission (SEC), including our most recent Form 10-K and Form 10-Q. Copies of these filings, as well as subsequent filings, are available online at www.sec.gov, www.masimo.com or upon request. Non-GAAP Financial Measures The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. GAAP. The following financial data is presented on a non-GAAP basis, unless stated otherwise. The non-GAAP financial measures presented exclude certain items that are more fully described in the Appendix. Management believes that adjustments for these items assist investors in making comparisons of period-to-period operating results. Furthermore, management also believes that these items are not indicative of the Company’s on-going core operating performance. These non-GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the Company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the Company may be different from the non-GAAP financial measures used by other companies. The Company has provided and will continue to provide certain non-GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non-GAAP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adjusted results under the line item business transition and related costs in non-GAAP gross profit. The Company is making these changes to its presentation of non-GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission. The Company has presented the following non-GAAP financial measures to assist investors in understanding the Company’s core net operating results on an on-going basis: non-GAAP revenue (constant currency), non-GAAP revenue growth (constant currency), non-GAAP gross profit/margin %, non-GAAP SG&A expense, non-GAAP R&D expense, non-GAAP litigation settlements and awards, non-GAAP impairment charge, non-GAAP operating expense %, non-GAAP operating profit/margin %, non-GAAP non-operating income (expense), non-GAAP provision for income taxes, non-GAAP net income (loss), non-GAAP net income (loss) per share. These non-GAAP financial measures may also assist investors in making comparisons of the Company’s core operating results with those of other companies. Management believes these non-GAAP financial measures are important in the evaluation of the Company’s performance and uses these measures to better understand and evaluate our business. For additional financial details, including GAAP to non-GAAP reconciliations, please visit the Investor Relations section of the Company’s website at https://investor.masimo.com/overview/default.aspx to access Supplementary Financial Information. Forward-Looking Non-GAAP Financial Measures This presentation also includes certain forward-looking non-GAAP financial measures. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, we exclude the impact of certain charges related to acquisitions, integrations, divestitures and related costs; business transition and related costs; litigation related expenses and settlements; realized and unrealized gains or losses; tax related adjustments; and other adjustments. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the timing of certain transactions is difficult to predict because management's plans may change. In addition, the Company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. These forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures. 2

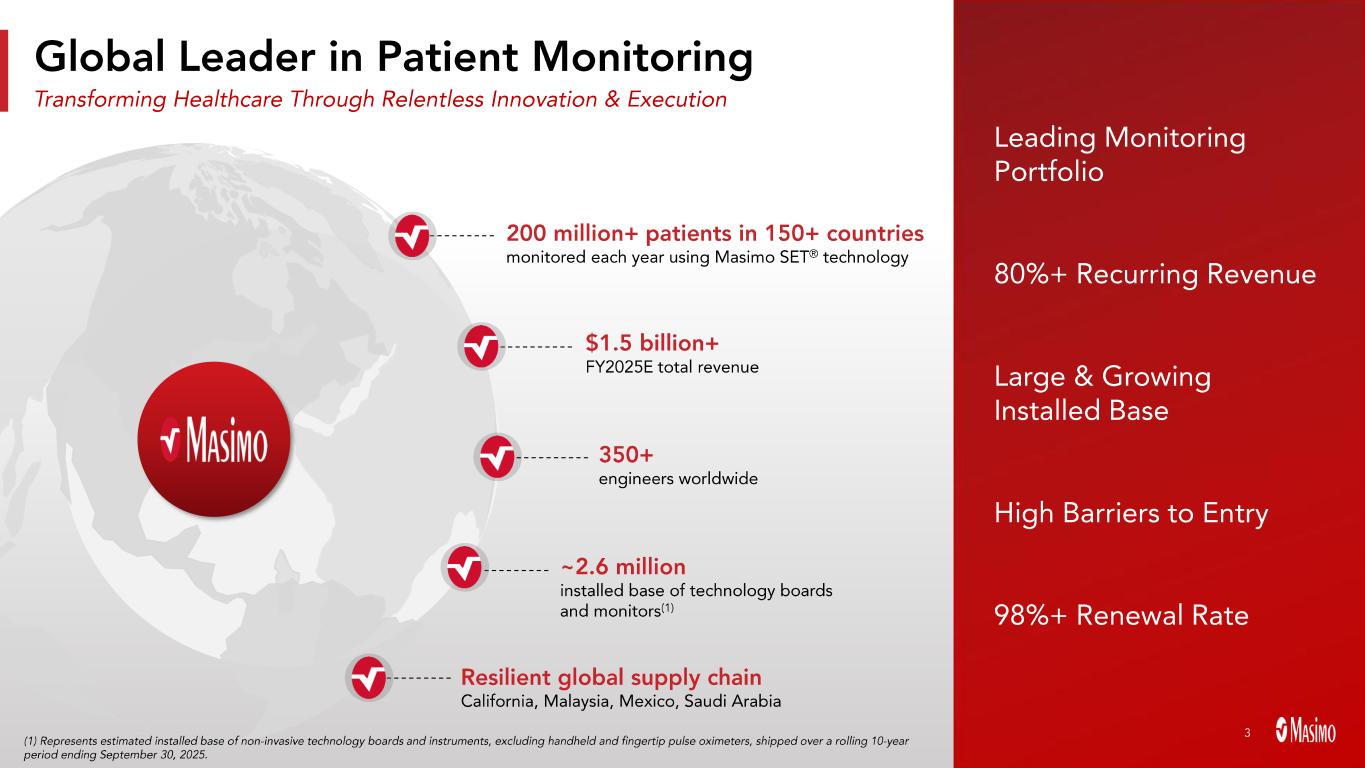

Global Leader in Patient Monitoring (1) Represents estimated installed base of non -invasive technology boards and instruments, excluding handheld and fingertip puls e oximeters, shipped over a rolling 10 -year period ending September 30, 2025. 350+ engineers worldwide 200 million+ patients in 150+ countries monitored each year using Masimo SET ® technology ~2.6 million installed base of technology boards and monitors (1) $1.5 billion+ FY2025E total revenue Transforming Healthcare Through Relentless Innovation & Execution Resilient global supply chain California, Malaysia, Mexico, Saudi Arabia Leading Monitoring Portfolio 80%+ Recurring Revenue Large & Growing Installed Base High Barriers to Entry 98%+ Renewal Rate 3

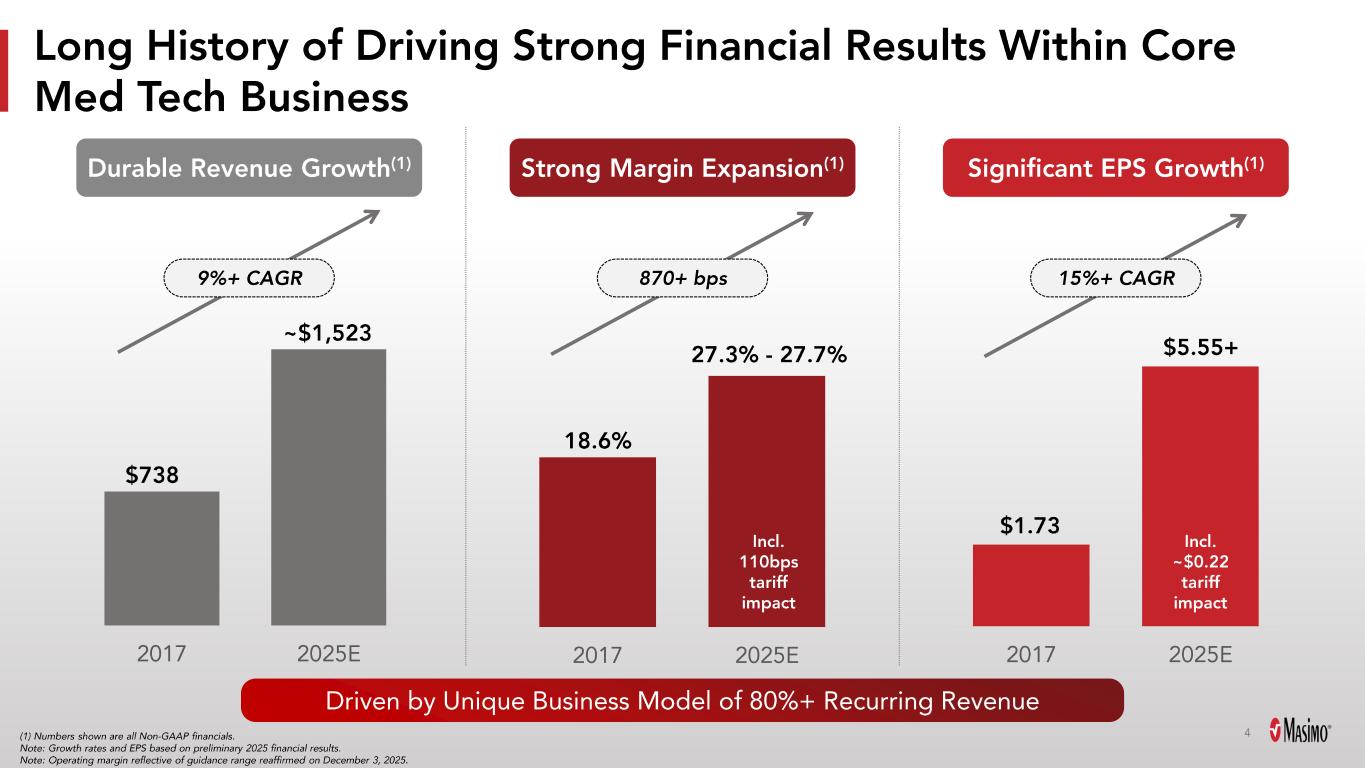

(1) Numbers shown are all Non -GAAP financials. Note: Growth rates and EPS based on preliminary 2025 financial results. Note: Operating margin reflective of guidance range reaffirmed on December 3, 2025. Long History of Driving Strong Financial Results Within Core Med Tech Business 2017 2025E $738 ~$1,523 Durable Revenue Growth (1) 9%+ CAGR 2017 2025E 18.6% 27.3% - 27.7% Incl. 110bps tariff impact Strong Margin Expansion (1) 870+ bps Significant EPS Growth (1) 2017 2025E $1.73 $5.55+ Incl. ~$0.22 tariff impact 15%+ CAGR Driven by Unique Business Model of 80%+ Recurring Revenue 4

Positioned to Succeed Long -Range Plan (Targets Through 2028) Note: Revenue growth excluding the impact of the 53 rd selling week in 2025. 7% –10% Revenue CAGR $8.00 Adj. EPS by 2028 ~$1B 2026 –2028 Cumulative Operating Cash Flow ~30% Operating Margin by 2028 World -class execution -oriented leadership team Targeted growth strategy in our core markets Refocused innovation to accelerate growth Market -leading growth in EPS and free cash flow Ready to execute into 2026 and beyond 5

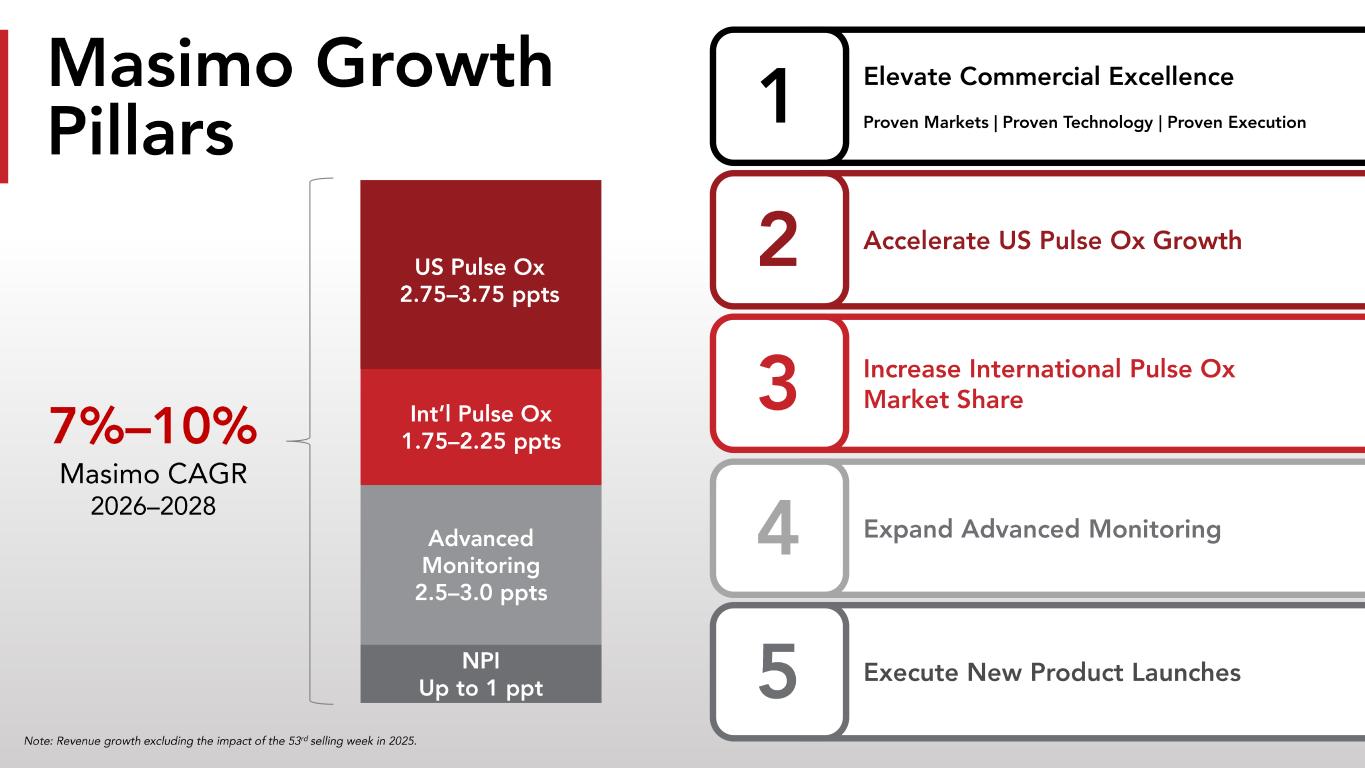

NPI Up to 1 ppt Ad vanced Monitoring 2.5 –3.0 ppts Int’l Pulse Ox 1.75 –2.25 ppts US Pulse Ox 2.75 –3.75 ppts 6 Note: Revenue growth excluding the impact of the 53 rd selling week in 2025. Masimo Growth Pillars 7% –10% Masimo CAGR 2026 –2028 Elevate Commercial Excellence Proven Markets | Proven Technology | Proven Execution1 Elevate Commercial Excellence Proven Markets | Proven Technology | Proven Execution2 Accelerate US Pulse Ox Growth Accelerate US Pulse Ox Growth3 Increase International Pulse Ox Market Share Expand Advanced Monitoring 4 5 Execute New Product Launches

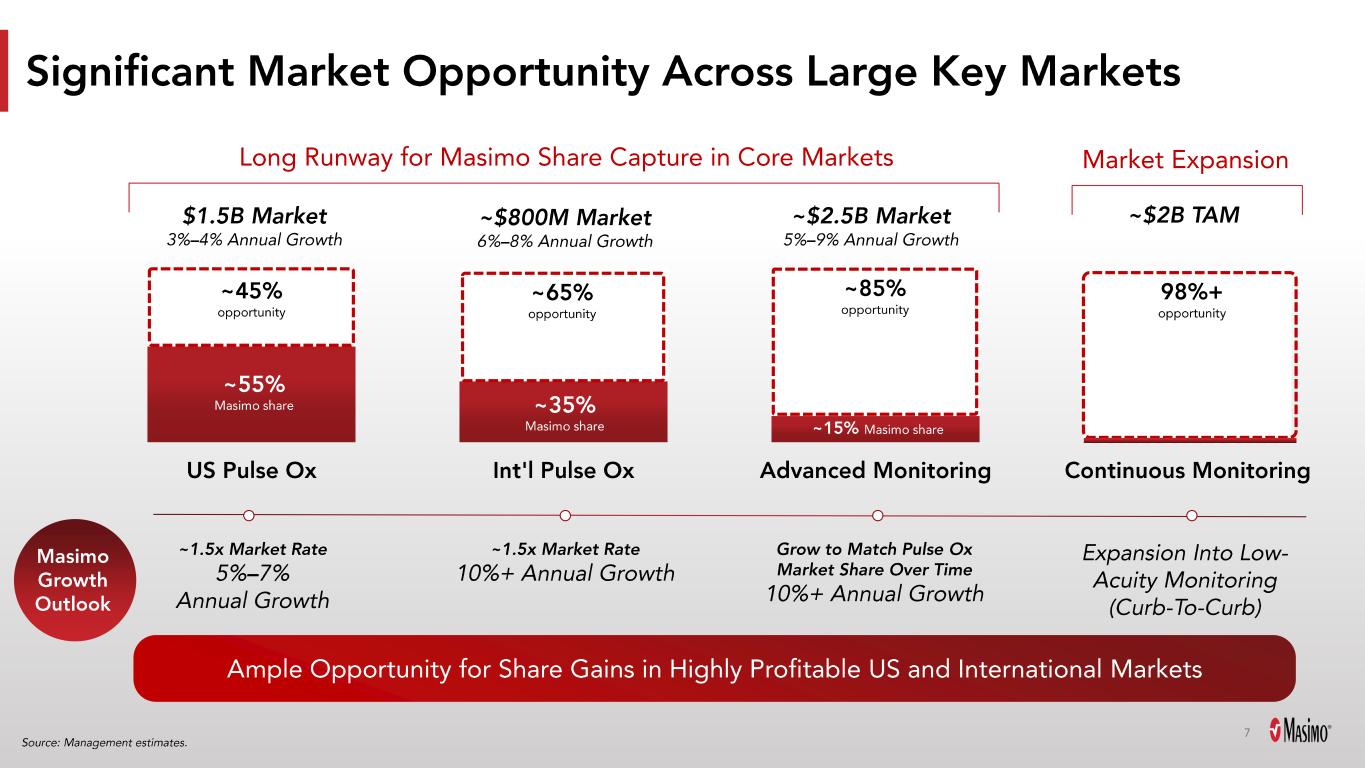

Significant Market Opportunity Across Large Key Markets US Pulse Ox Int'l Pulse Ox Advanced Monitoring Continuous Monitoring ~55% Masimo share ~35% Masimo share ~15% Masimo share $1.5B Market 3% –4% Annual Growth ~$800M Market 6% –8% Annual Growth ~$2.5B Market 5% –9% Annual Growth ~45% opportunity ~65% opportunity ~85% opportunity 98%+ opportunity ~$2B TAM ~1.5x Market Rate 5% –7% Annual Growth ~1.5x Market Rate 10%+ Annual Growth Grow to Match Pulse Ox Market Share Over Time 10%+ Annual Growth Expansion Into Low - Acuity Monitoring (Curb -To-Curb) Long Runway for Masimo Share Capture in Core Markets Market Expansion Masimo Growth Outlook Ample Opportunity for Share Gains in Highly Profitable US and International Markets Source: Management estimates. 7

Building Upon Our Commercial Leadership Winning portfolio supported by real -world evidence Strengthening market -leading commercial channel and elevating marketing strategy Expansive installed base via OEM partnerships with high recurring revenue Deep customer relationships with 98%+ renewal rates Masimo’s Commercial Playbook 8

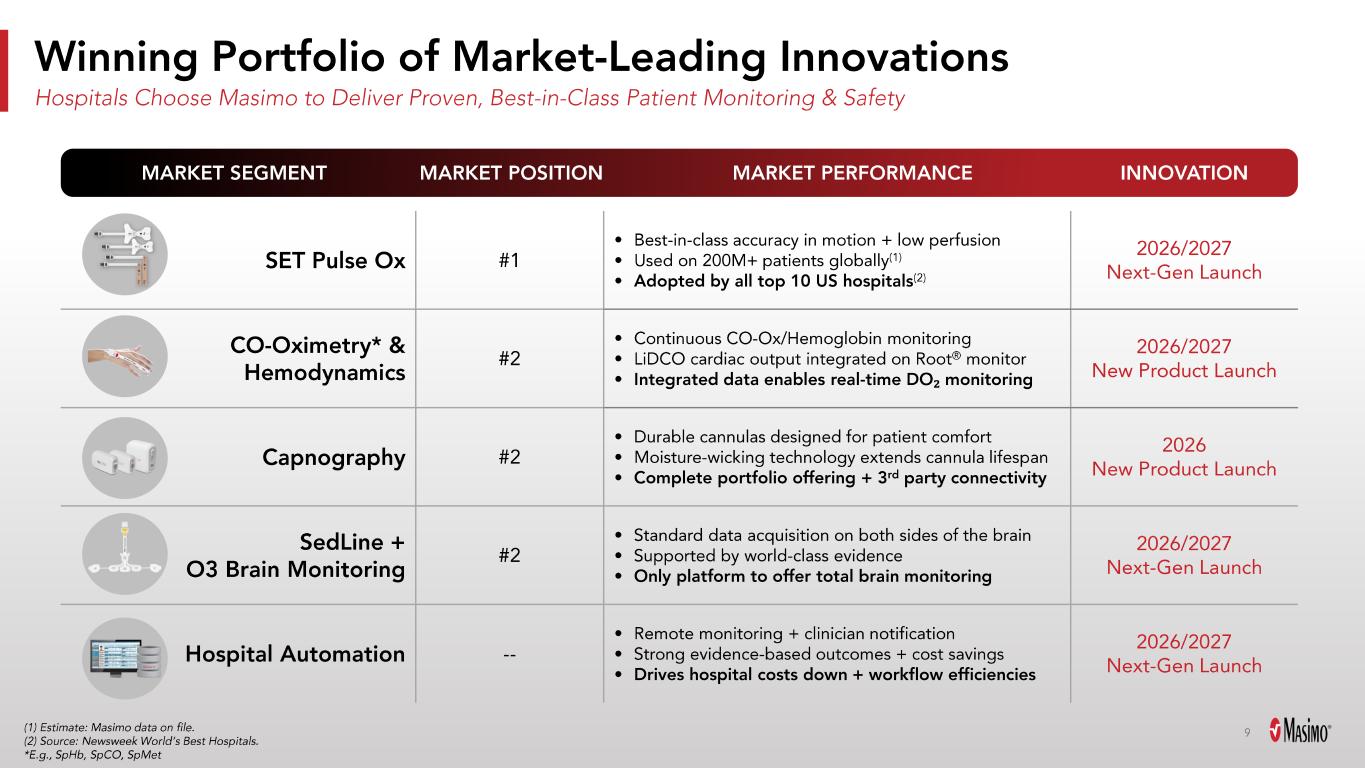

SET Pulse Ox #1 • Best -in-class accuracy in motion + low perfusion • Used on 200M+ patients globally (1) • Adopted by all top 10 US hospitals (2) 2026/2027 Next -Gen Launch CO -Oximetry* & Hemodynamics #2 • Continuous CO -Ox/Hemoglobin monitoring • LiDCO cardiac output integrated on Root ® monitor • Integrated data enables real -time DO ₂ monitoring 2026/2027 New Product Launch Capnography #2 • Durable cannulas designed for patient comfort • Moisture -wicking technology extends cannula lifespan • Complete portfolio offering + 3 rd party connectivity 2026 New Product Launch SedLine + O3 Brain Monitoring #2 • Standard data acquisition on both sides of the brain • Supported by world -class evidence • Only platform to offer total brain monitoring 2026/2027 Next -Gen Launch Hospital Automation -- • Remote monitoring + clinician notification • Strong evidence -based outcomes + cost savings • Drives hospital costs down + workflow efficiencies 2026/2027 Next -Gen Launch Winning Portfolio of Market -Leading Innovations 9 Hospitals Choose Masimo to Deliver Proven, Best -in-Class Patient Monitoring & Safety MARKET SEGMENT MARKET POSITION MARKET PERFORMANCE INNOVATION (1) Estimate: Masimo data on file. (2) Source: Newsweek World’s Best Hospitals. *E.g., SpHb , SpCO , SpMet

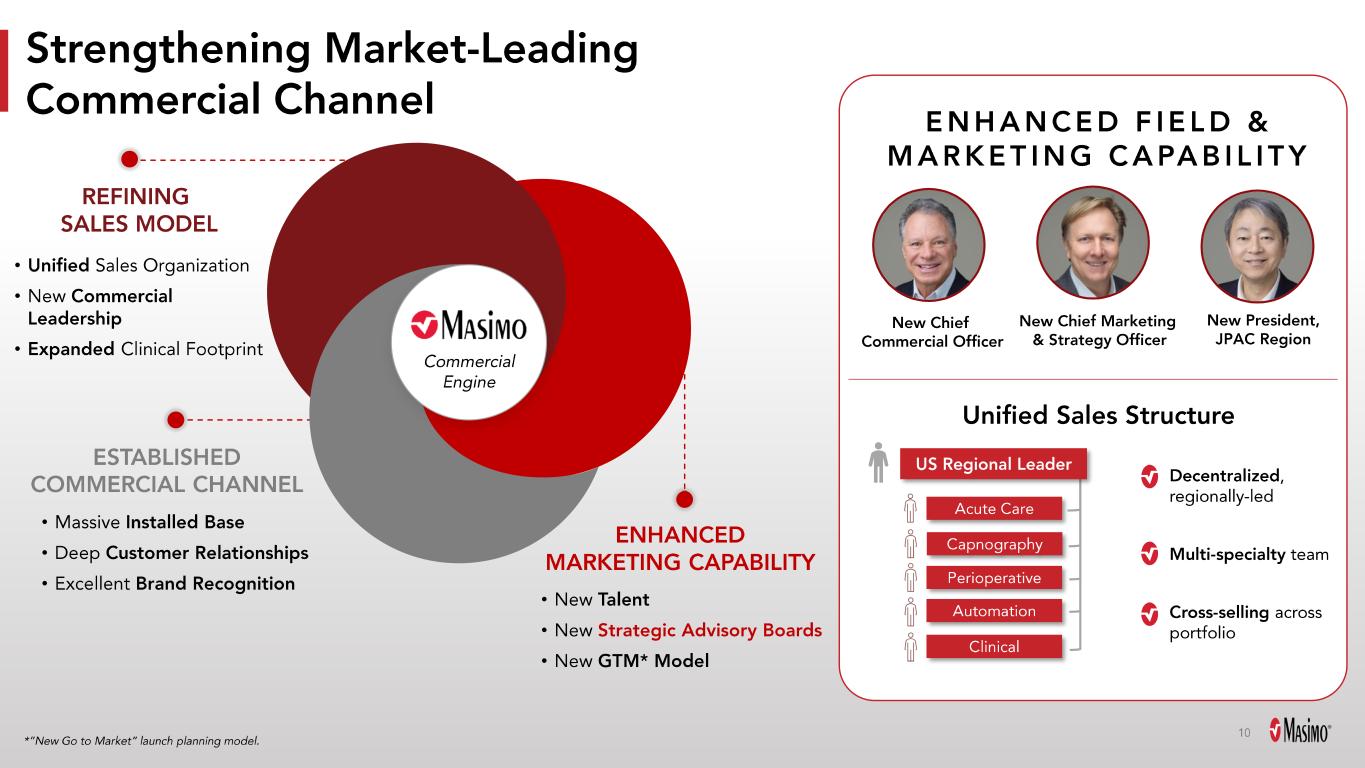

10 *”New Go to Market” launch planning model. Strengthening Market -Leading Commercial Channel Unified Sales Structure New Chief Commercial Officer New Chief Marketing & Strategy Officer New President, JPAC Region ENHANCED FIELD & MARKETING CAPABILITY ENHANCED MARKETING CAPABILITY Commercial Engine ESTABLISHED COMMERCIAL CHANNEL • Massive Installed Base • Deep Customer Relationships • Excellent Brand Recognition REFINING SALES MODEL • Unified Sales Organization • New Commercial Leadership • Expanded Clinical Footprint • New Talent • New Strategic Advisory Boards • New GTM* Model Decentralized , regionally -led Multi -specialty team Cross -selling across portfolio Acute Care Capnography Perioperative Automation Clinical US Regional Leader

Installed Base via OEM Partnerships Creates Durable Revenue Sept. 2025: Multi -Year Partnership Renewal With Broadened Focus 90+ Strong OEM Partnerships Create High Barriers to Entry Large and Growing Installed Base Creates High Recurring Revenue New Philips Partnership With Equivalent Share Gain Opportunity + = ~2.6M shipped over last 10 years MonitorsTechnology Boards 11

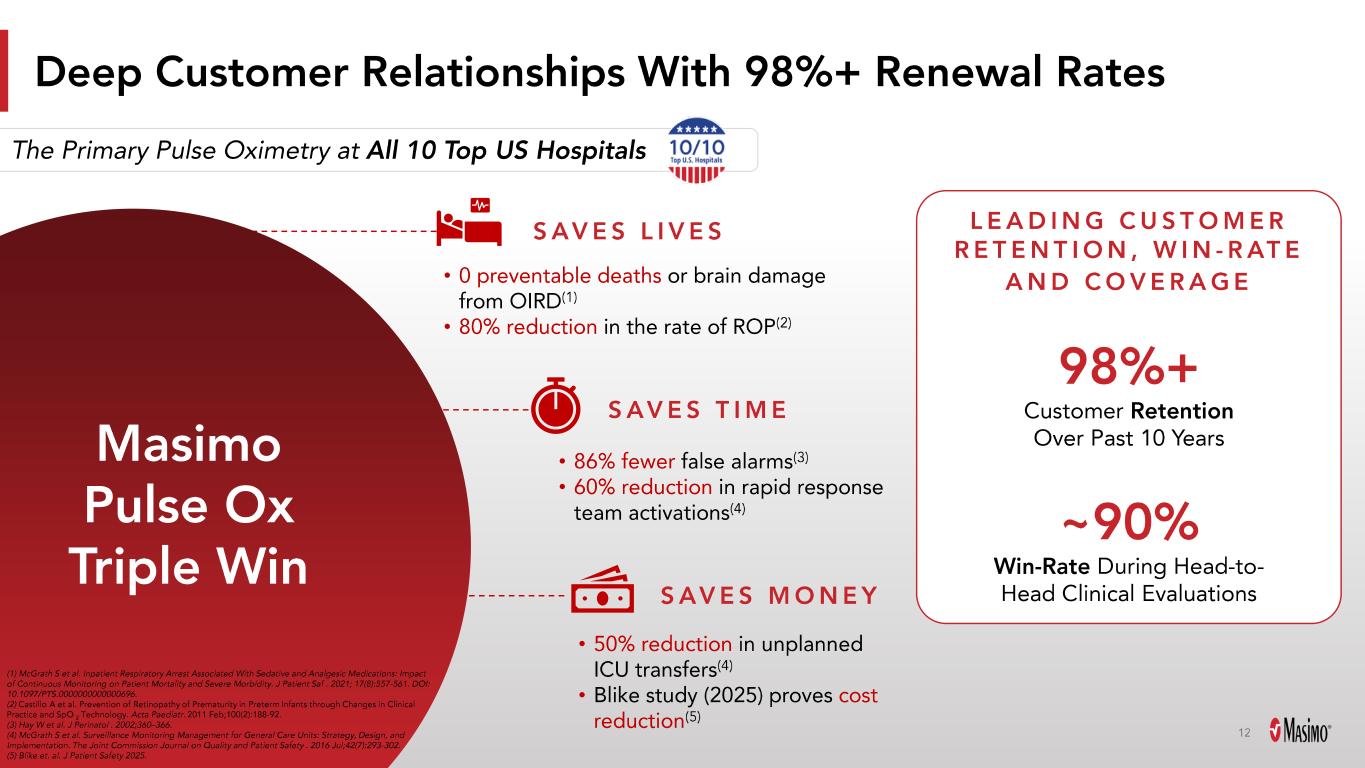

Deep Customer Relationships With 98%+ Renewal Rates 12 • 50% reduction in unplanned ICU transfers (4) • Blike study (2025) proves cost reduction (5) The Primary Pulse Oximetry at All 10 Top US Hospitals 98%+ Customer Retention Over Past 10 Years ~90% Win -Rate During Head -to- Head Clinical Evaluations LEADING CUSTOMER RETENTION, WIN - RATE AND COVERAGE • 0 preventable deaths or brain damage from OIRD (1) • 80% reduction in the rate of ROP (2) SAVES LIVES SAVES MONEY • 86% fewer false alarms (3) • 60% reduction in rapid response team activations (4) SAVES TIME Masimo Pulse Ox Triple Win (1) McGrath S et al. Inpatient Respiratory Arrest Associated With Sedative and Analgesic Medications: Impact of Continuous Monitoring on Patient Mortality and Severe Morbidity. J Patient Saf . 2021; 17(8):557 -561. DOI: 10.1097/PTS.0000000000000696. (2) Castillo A et al. Prevention of Retinopathy of Prematurity in Preterm Infants through Changes in Clinical Practice and SpO 2 Technology. Acta Paediatr . 2011 Feb;100(2):188 -92. (3) Hay W et al. J Perinatol . 2002;360 –366. (4) McGrath S et al. Surveillance Monitoring Management for General Care Units: Strategy, Design, and Implementation. The Joint Commission Journal on Quality and Patient Safety . 2016 Jul;42(7):293 -302. (5) Blike et. al. J Patient Safety 2025.

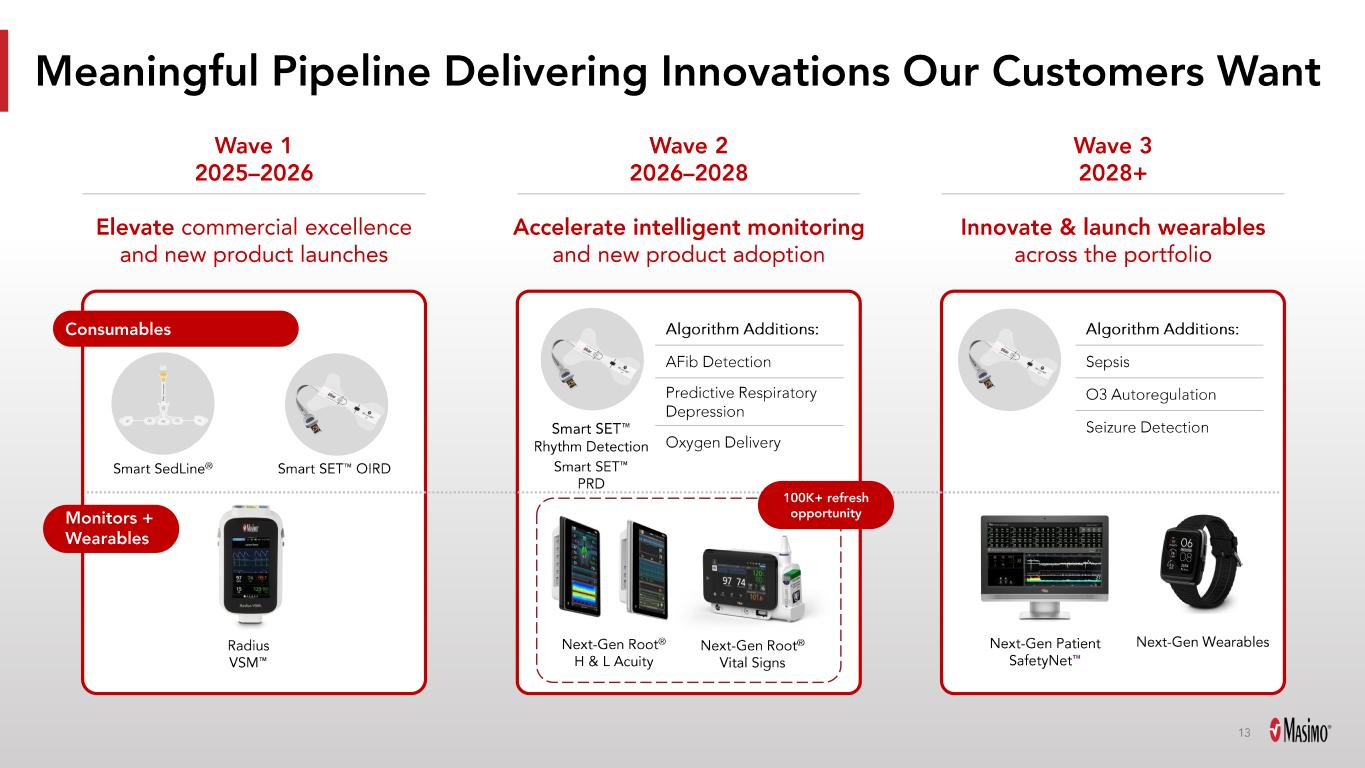

Meaningful Pipeline Delivering Innovations Our Customers Want Next -Gen Root ® H & L Acuity Next -Gen Root ® Vital Signs Next -Gen Patient SafetyNet Radius VSM Algorithm Additions: Sepsis O3 Autoregulation Seizure Detection Consumables Elevate commercial excellence and new product launches Wave 1 2025 –2026 Monitors + Wearables Accelerate intelligent monitoring and new product adoption Wave 2 2026 –2028 Next -Gen Wearables Innovate & launch wearables across the portfolio Wave 3 2028+ Algorithm Additions: AFib Detection Predictive Respiratory Depression Oxygen Delivery 100K+ refresh opportunity Smart SET Rhythm Detection Smart SET PRD Smart SedLine ® Smart SET OIRD 13

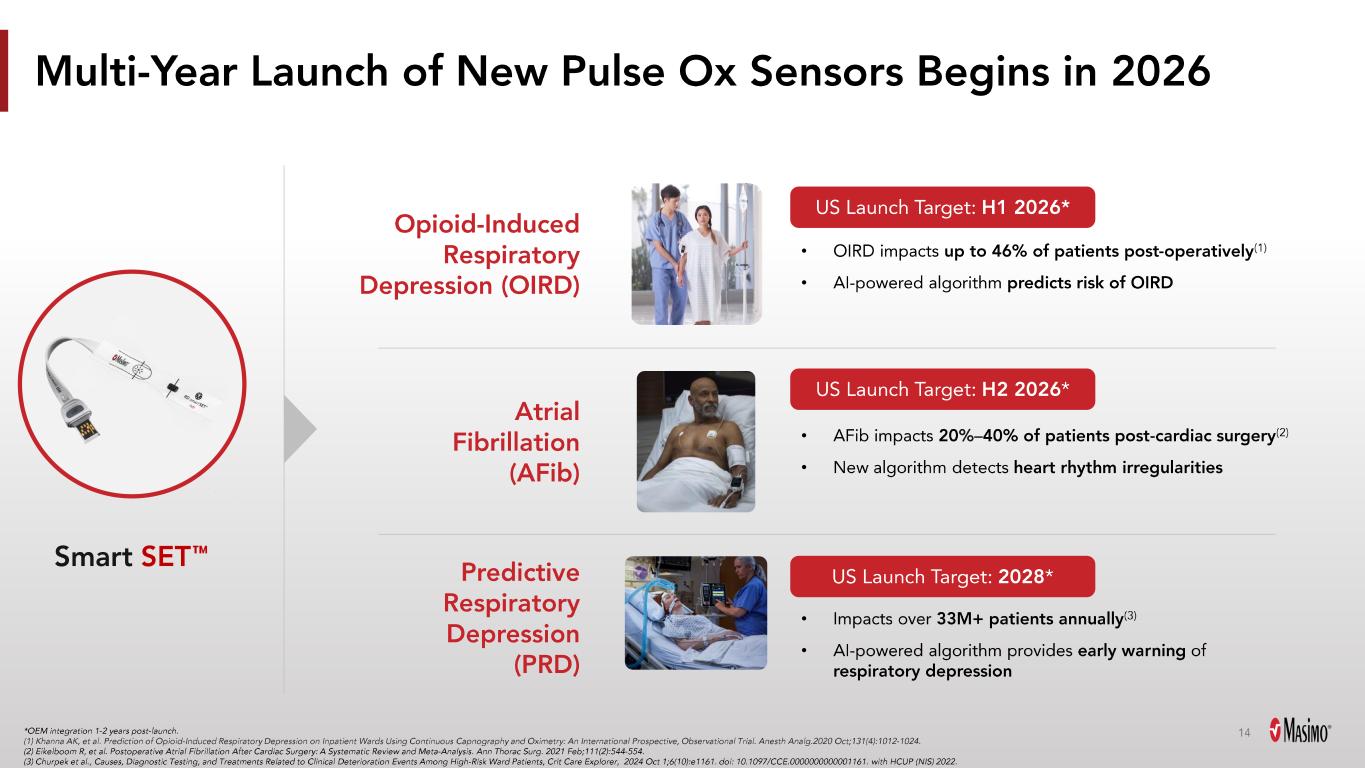

Multi -Year Launch of New Pulse Ox Sensors Begins in 2026 *OEM integration 1 -2 years post -launch. (1) Khanna AK, et al. Prediction of Opioid -Induced Respiratory Depression on Inpatient Wards Using Continuous Capnography and Ox imetry: An International Prospective, Observational Trial. Anesth Analg.2020 Oct;131(4):1012 -1024. (2) Eikelboom R, et al. Postoperative Atrial Fibrillation After Cardiac Surgery: A Systematic Review and Meta -Analysis. Ann Thorac Surg. 2021 Feb;111(2):544 -554. (3) Churpek et al., Causes, Diagnostic Testing, and Treatments Related to Clinical Deterioration Events Among High -Risk Ward Patients, Crit Care Explorer, 2024 Oct 1;6(10):e1161. doi : 10.1097/CCE.0000000000001161. with HCUP (NIS) 2022. Smart SET Opioid -Induced Respiratory Depression (OIRD) • OIRD impacts up to 46% of patients post -operatively (1) • AI -powered algorithm predicts risk of OIRD US Launch Target: H1 2026* Atrial Fibrillation (AFib) US Launch Target: H2 2026 * • AFib impacts 20 % –40% of patients post -cardiac surgery (2) • New algorithm detects heart rhythm irregularities Predictive Respiratory Depression (PRD) • Impacts over 33M+ patients annually (3) • AI -powered algorithm provides early warning of respiratory depression US Launch Target: 2028 * 14

Key Takeaways Long -Range Plan (Targets Through 2028) Note: Revenue growth excluding the impact of the 53 rd selling week in 2025. 7% –10% Revenue CAGR $8.00 Adj. EPS by 2028 ~$1B 2026 –2028 Cumulative Operating Cash Flow ~30% Operating Margin by 2028 Finishing the year with a strong foundation to execute our long -range plan A ccelerating growth over time through new product introductions Positioned to deliver meaningful g rowth , margin expansion and cash g eneration 15

200M Patients and Counting…

17 Appendix

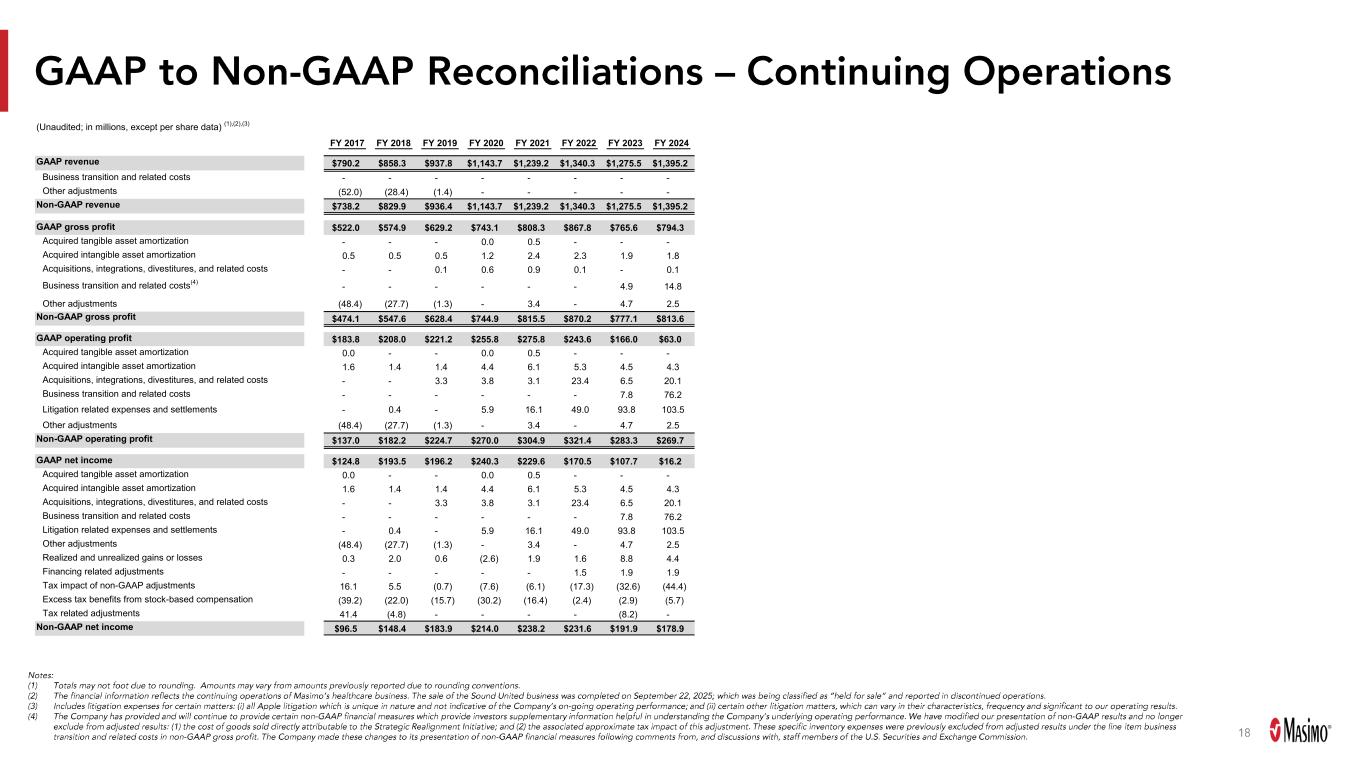

GAAP to Non -GAAP Reconciliations – Continuing Operations Notes: (1) Totals may not foot due to rounding. Amounts may vary from amounts previously reported due to rounding conventions. (2) The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United bu siness was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operation s. (3) Includes litigation expenses for certain matters: (i) all Apple litigation which is unique in nature and not indicative of th e C ompany’s on -going operating performance; and (ii) certain other litigation matters, which can vary in their characteristics, fre quency and significant to our operating results. (4) The Company has provided and will continue to provide certain non -GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non -GA AP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adj usted results under the line item business transition and related costs in non -GAAP gross profit. The Company made these changes to its presentation of non -GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission. (Unaudited; in millions, except per share data) (1),(2),(3) FY 2025 Guidance FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Low High GAAP revenue $790.2 $858.3 $937.8 $1,143.7 $1,239.2 $1,340.3 $1,275.5 $1,395.2 $1,513 $1,533 Business transition and related costs - - - - - - - - ($3) ($3) Other adjustments (52.0) (28.4) (1.4) - - - - - $0 $0 Non-GAAP revenue $738.2 $829.9 $936.4 $1,143.7 $1,239.2 $1,340.3 $1,275.5 $1,395.2 $1,510 $1,530 GAAP gross profit $522.0 $574.9 $629.2 $743.1 $808.3 $867.8 $765.6 $794.3 Acquired tangible asset amortization - - - 0.0 0.5 - - - Acquired intangible asset amortization 0.5 0.5 0.5 1.2 2.4 2.3 1.9 1.8 Acquisitions, integrations, divestitures, and related costs - - 0.1 0.6 0.9 0.1 - 0.1 Business transition and related costs (4) - - - - - - 4.9 14.8 Other adjustments (48.4) (27.7) (1.3) - 3.4 - 4.7 2.5 Non-GAAP gross profit $474.1 $547.6 $628.4 $744.9 $815.5 $870.2 $777.1 $813.6 GAAP operating profit $183.8 $208.0 $221.2 $255.8 $275.8 $243.6 $166.0 $63.0 Acquired tangible asset amortization 0.0 - - 0.0 0.5 - - - Acquired intangible asset amortization 1.6 1.4 1.4 4.4 6.1 5.3 4.5 4.3 Acquisitions, integrations, divestitures, and related costs - - 3.3 3.8 3.1 23.4 6.5 20.1 Business transition and related costs - - - - - - 7.8 76.2 Litigation related expenses and settlements - 0.4 - 5.9 16.1 49.0 93.8 103.5 Other adjustments (48.4) (27.7) (1.3) - 3.4 - 4.7 2.5 Non-GAAP operating profit $137.0 $182.2 $224.7 $270.0 $304.9 $321.4 $283.3 $269.7 $412 $424 GAAP net income $124.8 $193.5 $196.2 $240.3 $229.6 $170.5 $107.7 $16.2 Acquired tangible asset amortization 0.0 - - 0.0 0.5 - - - Acquired intangible asset amortization 1.6 1.4 1.4 4.4 6.1 5.3 4.5 4.3 Acquisitions, integrations, divestitures, and related costs - - 3.3 3.8 3.1 23.4 6.5 20.1 Business transition and related costs - - - - - - 7.8 76.2 Litigation related expenses and settlements - 0.4 - 5.9 16.1 49.0 93.8 103.5 Other adjustments (48.4) (27.7) (1.3) - 3.4 - 4.7 2.5 Realized and unrealized gains or losses 0.3 2.0 0.6 (2.6) 1.9 1.6 8.8 4.4 Financing related adjustments - - - - - 1.5 1.9 1.9 Tax impact of non-GAAP adjustments 16.1 5.5 (0.7) (7.6) (6.1) (17.3) (32.6) (44.4) Excess tax benefits from stock-based compensation (39.2) (22.0) (15.7) (30.2) (16.4) (2.4) (2.9) (5.7) Tax related adjustments 41.4 (4.8) - - - - (8.2) - Non-GAAP net income $96.5 $148.4 $183.9 $214.0 $238.2 $231.6 $191.9 $178.9 $294 $302 18

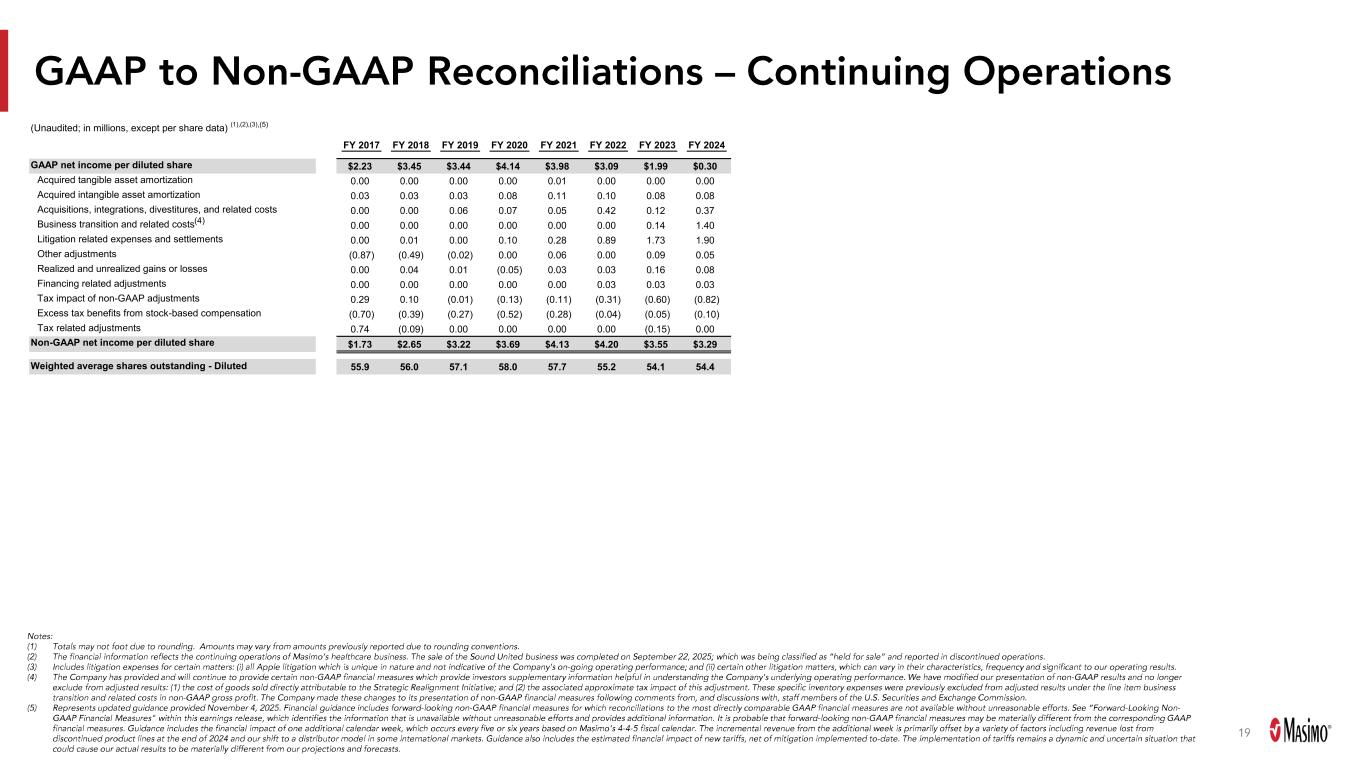

GAAP to Non -GAAP Reconciliations – Continuing Operations Notes: (1) Totals may not foot due to rounding. Amounts may vary from amounts previously reported due to rounding conventions. (2) The financial information reflects the continuing operations of Masimo’s healthcare business. The sale of the Sound United bu siness was completed on September 22, 2025; which was being classified as “held for sale” and reported in discontinued operation s. (3) Includes litigation expenses for certain matters: (i) all Apple litigation which is unique in nature and not indicative of th e C ompany’s on -going operating performance; and (ii) certain other litigation matters, which can vary in their characteristics, fre quency and significant to our operating results. (4) The Company has provided and will continue to provide certain non -GAAP financial measures which provide investors supplementary information helpful in understanding the Company’s underlying operating performance. We have modified our presentation of non -GA AP results and no longer exclude from adjusted results: (1) the cost of goods sold directly attributable to the Strategic Realignment Initiative; and (2) the associated approximate tax impact of this adjustment. These specific inventory expenses were previously excluded from adj usted results under the line item business transition and related costs in non -GAAP gross profit. The Company made these changes to its presentation of non -GAAP financial measures following comments from, and discussions with, staff members of the U.S. Securities and Exchange Commission. (5) Represents updated guidance provided November 4, 2025. Financial guidance includes forward -looking non -GAAP financial measures f or which reconciliations to the most directly comparable GAAP financial measures are not available without unreasonable effor ts. See “Forward -Looking Non - GAAP Financial Measures" within this earnings release, which identifies the information that is unavailable without unreasona ble efforts and provides additional information. It is probable that forward -looking non -GAAP financial measures may be materially different from the corresponding GAAP financial measures. Guidance includes the financial impact of one additional calendar week, which occurs every five or six ye ars based on Masimo’s 4 -4-5 fiscal calendar. The incremental revenue from the additional week is primarily offset by a variety of f actors including revenue lost from discontinued product lines at the end of 2024 and our shift to a distributor model in some international markets. Guidance al so includes the estimated financial impact of new tariffs, net of mitigation implemented to -date. The implementation of tariffs rem ains a dynamic and uncertain situation that could cause our actual results to be materially different from our projections and forecasts. (4) (Unaudited; in millions, except per share data) (1),(2),(3) FY 2025 Guidance FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 Low High GAAP net income per diluted share $2.23 $3.45 $3.44 $4.14 $3.98 $3.09 $1.99 $0.30 Acquired tangible asset amortization 0.00 0.00 0.00 0.00 0.01 0.00 0.00 0.00 Acquired intangible asset amortization 0.03 0.03 0.03 0.08 0.11 0.10 0.08 0.08 Acquisitions, integrations, divestitures, and related costs 0.00 0.00 0.06 0.07 0.05 0.42 0.12 0.37 Business transition and related costs 0.00 0.00 0.00 0.00 0.00 0.00 0.14 1.40 Litigation related expenses and settlements 0.00 0.01 0.00 0.10 0.28 0.89 1.73 1.90 Other adjustments (0.87) (0.49) (0.02) 0.00 0.06 0.00 0.09 0.05 Realized and unrealized gains or losses 0.00 0.04 0.01 (0.05) 0.03 0.03 0.16 0.08 Financing related adjustments 0.00 0.00 0.00 0.00 0.00 0.03 0.03 0.03 Tax impact of non-GAAP adjustments 0.29 0.10 (0.01) (0.13) (0.11) (0.31) (0.60) (0.82) Excess tax benefits from stock-based compensation (0.70) (0.39) (0.27) (0.52) (0.28) (0.04) (0.05) (0.10) Tax related adjustments 0.74 (0.09) 0.00 0.00 0.00 0.00 (0.15) 0.00 Non-GAAP net income per diluted share $1.73 $2.65 $3.22 $3.69 $4.13 $4.20 $3.55 $3.29 $5.40 $5.55 Weighted average shares outstanding - Diluted 55.9 56.0 57.1 58.0 57.7 55.2 54.1 54.4 54.4 54.4 ,(5) 19