UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☑ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Autoscope Technologies Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☑ |

No fee required. |

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

(1) Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

|

(2) Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

|

|

|

|

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

|

|

|

|

(4) Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

|

|

|

|

(5) Total fee paid: |

|

|

|

|

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

(1) Amount Previously Paid: |

|

|

|

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No: |

|

|

|

|

|

|

|

|

|

|

|

(3) Filing Party: |

|

|

|

|

|

|

|

|

|

|

|

(4) Date Filed: |

|

|

|

|

|

March 21, 2022

Dear Shareholder:

We are pleased to invite you to attend the annual meeting of shareholders of Autoscope Technologies Corporation ("Autoscope") on Tuesday, May 10, 2022 at 10:00 a.m., Central Time. This year's annual meeting will be a completely virtual meeting of shareholders, which will be conducted via the internet. You will be able to attend the meeting of shareholders online and listen and submit your questions during the meeting by visiting https://agm.issuerdirect.com/aatc and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials and voting instruction form. Online access to the virtual meeting will open approximately 15 minutes prior to the start of the annual meeting. You also will be able to vote your shares electronically at the annual meeting. You will not be able to attend the annual meeting of shareholders in person.

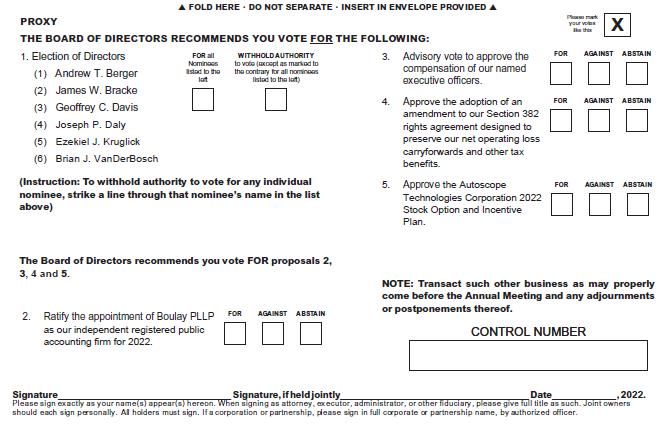

At the annual meeting, you will be asked to vote for the election of Autoscope's Board of Directors; on the ratification of the selection of Boulay PLLP as our independent registered public accounting firm for 2022; on the approval of an advisory resolution to approve executive compensation (the "say-on-pay" vote); on the approval of the adoption of an amendment to Autoscope's Section 382 rights agreement designed to preserve our net operating loss carryforwards and other tax benefits; and on the approval of the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan. I encourage you to vote for each of the director nominees, for ratification of the appointment of Boulay PLLP, for the advisory resolution to approve executive compensation, to approve the amendment to Autoscope's Section 382 rights agreement, and for the Board's proposal to approve the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan.

Under the Securities and Exchange Commission’s rules, we have elected to deliver our proxy materials to Autoscope's shareholders over the internet. This delivery process allows us to provide shareholders with the information they need while lowering the cost of delivery. We intend to begin mailing to Autoscope's shareholders a Notice of Internet Availability of Proxy Materials on or about March 21, 2022 containing instructions on how to access our proxy statement and proxy for Autoscope's 2022 annual meeting of shareholders and our 2021 annual report to shareholders. The Notice of Internet Availability of Proxy Materials will also provide instructions on how to vote over the internet or by telephone and will include instructions on how to receive a paper copy of the proxy materials by mail.

We hope that you will be able to join us at the annual meeting. Whether or not you expect to attend the meeting, it is important that you cast your vote either by voting at the virtual 2022 annual meeting of shareholders or by proxy before the annual meeting. You may vote by attending the meeting virtually, by telephone, or over the internet or by mailing a completed proxy card if you elect to receive written proxy materials.

Changes in regulations effective in 2010 eliminated the ability of your bank or broker to vote your uninstructed shares on certain matters, including the election of directors, so it is important that you vote your proxy.

| Very truly yours, |

| Autoscope Technologies Corporation |

|

| Andrew T. Berger |

| Executive Chair and Chief Executive Officer |

(This page has been left intentionally blank.)

Autoscope Technologies Corporation

1115 Hennepin Avenue

Minneapolis, MN 55403

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 2022

TO THE SHAREHOLDERS OF AUTOSCOPE TECHNOLOGIES CORPORATION:

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Autoscope Technologies Corporation ("Autoscope") will be held at 10:00 a.m., Central Time, on Tuesday, May 10, 2022, in a virtual-only format and not in person, for the following purposes:

| 1. | To elect six directors to serve on Autoscope's Board of Directors. |

| 2. | To ratify the appointment of Boulay PLLP as our independent registered public accounting firm for the 2022 fiscal year. |

| 3. | To vote on an advisory resolution to approve the compensation of our named executive officers. |

| 4. | To approve the adoption of an amendment to Autoscope's Section 382 rights agreement designed to preserve our net operating loss carryforwards and other tax benefits. |

| 5. | To approve the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan. |

| 6. | To transact such other business as may properly come before the meeting. |

You may attend the meeting by visiting https://agm.issuerdirect.com/aatc and entering the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, and the voting instruction form (printed in the box and marked by the arrow). Online access to the virtual meeting will open approximately 15 minutes prior to the start of the annual meeting. To submit questions in advance of the annual meeting, please email Investorrelations@autoscope.com before 5:00 p.m., Central Time, on Wednesday, May 4, 2022. You will not be able to attend the annual meeting of shareholders in person.

The Board of Directors has fixed the close of business on March 14, 2022 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting.

We encourage you to take part in the affairs of our company either by attending the virtual annual meeting or by voting your proxy as promptly as possible. To ensure that your shares are represented, we request that you vote your proxy before the meeting whether or not you plan to attend the meeting.

| BY ORDER OF THE BOARD OF DIRECTORS, |

|

| Andrew T. Berger |

| Executive Chair and Chief Executive Officer |

Dated: March 21, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 10, 2022

This notice, the accompanying proxy statement and proxy and the Autoscope Technologies Corporation 2021 Annual Report to Shareholders, which includes the Autoscope Technologies Corporation Annual Report on Form 10-K for the year ended December 31, 2021, are available at https://www.autoscope.com/financial-information.html. Additionally, and in accordance with the rules of the Securities and Exchange Commission, shareholders may access these materials at the website indicated in the Notice of Internet Availability of Proxy Materials that you receive in connection with this notice and the accompanying proxy statement.

(This page has been left intentionally blank.)

PROXY STATEMENT

| ii |

PROXY STATEMENT

2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 10, 2022

The Board of Directors of Autoscope Technologies Corporation is soliciting proxies for use at the annual meeting of shareholders to be held on May 10, 2022 and at any adjournment of the meeting. This proxy statement and the proxy are being made available to shareholders on the internet or mailed to shareholders on or about March 21, 2022.

EXPLANATORY NOTE ABOUT HOLDING COMPANY REORGANIZATION

On April 29, 2021, Image Sensing Systems, Inc. ("ISNS") announced plans to implement a holding company reorganization. Following the implementation of the reorganization on July 21, 2021, ISNS became a wholly-owned subsidiary of the new holding company, Autoscope Technologies Corporation ("Autoscope"), which replaced ISNS as the public company trading on The Nasdaq Capital Market under a new ticker symbol, "AATC." As used in this proxy statement, the terms "Company", "we", "us" and "our" or their management or business at any time before the effective date of the reorganization refer to those of ISNS as the predecessor company and its wholly-owned subsidiaries and thereafter to Autoscope and its wholly-owned subsidiaries, except as otherwise specified or to the extent the context otherwise indicates.

At the annual meeting, shareholders will act upon the matters described in the Notice of Annual Meeting of Shareholders. These consist of the election of directors, the ratification of the appointment of our independent registered public accounting firm, the vote on the advisory resolution to approve the compensation of our named executive officers (the “say-on-pay” vote), the vote on the adoption of an amendment to Autoscope's Section 382 rights agreement to preserve our net operating loss carryforwards and other tax benefits, and to approve the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan. Also, management will report on our performance during the last fiscal year and respond to questions from shareholders.

The Board of Directors has set March 14, 2022 as the record date for the annual meeting. If you were a shareholder of record at the close of business on March 14, 2022, you are entitled to notice of and to vote at the annual meeting.

As of the record date, 5,378,857 shares of common stock, par value $.01 per share, were issued and outstanding and, therefore, eligible to vote at the annual meeting.

Holders of Autoscope's common stock are entitled to one vote per share. Therefore, a total of 5,378,857 votes are entitled to be cast at the meeting. There is no cumulative voting for directors.

In accordance with Autoscope's bylaws, shares equal to at least a majority of the voting power of the outstanding shares of Autoscope's common stock as of the record date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Therefore, the holders of at least 2,689,429 shares constitute a quorum for the 2022 annual meeting. Shares are counted as present at the meeting if:

• you are present and vote them at the meeting; or

• you have properly submitted a proxy.

If you are a shareholder of record, you can give a proxy to be voted at the meeting by voting your proxy over the internet or by telephone or, if you elect by receive written proxy materials, by completing, signing and mailing the proxy card. If you properly vote and do not revoke your proxy, it will be voted in the manner you specify.

| 1 |

We are making proxy materials for the annual meeting available over the internet. Therefore, we are mailing to Autoscope's shareholders a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials. All shareholders receiving the Notice of Internet Availability of Proxy Materials will have the ability to access the proxy materials over the internet and to request to receive paper copies of the proxy materials by mail. Instructions on how to access the proxy materials over the internet or to request paper copies may be found on the Notice of Internet Availability of Proxy Materials. Autoscope's proxy materials may also be accessed on Autoscope's website at https://www.autoscope.com/financial-information.html.

If you are a shareholder of record, you will have the opportunity to vote your shares at the virtual annual meeting of shareholders. Even if you currently plan to attend the virtual meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting.

In accordance with Minnesota law, if a quorum is present, the nominees for election as directors will be elected by a plurality of the votes cast at the annual meeting. This means that because shareholders will be electing six directors, the six nominees receiving the highest number of votes will be elected. The affirmative vote of a majority of the shares of Autoscope's common stock present in person or by proxy and entitled to vote at the annual meeting is required to approve Proposals 2, 3, 4 and 5 (provided that a quorum is present at the meeting).

You may either vote “FOR” or “WITHHOLD AUTHORITY” to vote for each nominee for the Board of Directors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on Proposals 2, 3, 4 and 5.

If you submit your proxy but abstain from voting or withhold authority to vote on one or more matters, your shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote.

If you withhold authority to vote for one or more of the directors, this has no effect on the election of those directors. If you abstain from voting on a proposal, your abstention has the same effect as a vote against that proposal.

If you hold your shares in “street name” and do not provide voting instructions to your broker, your shares will be considered to be “broker non‑votes” and will not be voted on any proposal on which your broker does not have discretionary authority to vote. Shares that constitute broker non‑votes will be counted as present at the meeting for the purpose of determining a quorum but will not be represented at the meeting for purposes of calculating the vote with respect to such matter or matters. This effectively reduces the number of shares needed to approve such matter or matters.

If you hold Autoscope's shares directly in your name with Autoscope's transfer agent, Continental Stock Transfer & Trust Company, you are a “shareholder of record” (also known as a “registered shareholder”). The Notice of Internet Availability of Proxy Materials and, if you elect to receive written proxy materials, the Notice of Annual Meeting, Proxy Statement, 2021 Annual Report to Shareholders, and proxy card have been sent directly to you by us or Autoscope's representative.

If you own your shares indirectly through a broker, bank, or other financial institution, your shares are said to be held in “street name.” Technically, the bank or broker is the shareholder of record with respect to those shares. In this case, the Notice of Internet Availability of Proxy Materials and, if you elect to receive written proxy materials, the Notice of Annual Meeting of Shareholders, Proxy Statement, 2021 Annual Report to Shareholders, and a voting instruction form have been forwarded to you by your broker, bank or other financial institution or its designated representative. Through this process, your bank or broker collects the voting instructions from all of its customers who hold Autoscope's shares and then submits those votes to us.

Because of a change in the rules of The Nasdaq Stock Market ("Nasdaq") effective in 2010, your broker will NOT be able to vote your shares with respect to the election of directors, the advisory resolution to approve executive compensation, the approval of the amendment to Autoscope's Section 382 rights agreement, or to approve the 2022 Stock Option and Incentive Plan. We strongly encourage you to exercise your right to vote.

| 2 |

A broker non‑vote occurs when a broker’s or bank’s customer does not provide the broker or bank with voting instructions on “non‑routine” matters for shares owned by the customer (sometimes referred to as the “beneficial owner”) but held in the name of the broker or bank. For such matters, the broker or bank cannot vote on behalf of the beneficial owner and reports the number of such shares as “non‑votes.” By contrast, if a proposal is considered “routine,” the broker or bank, in its discretion, may vote any shares as to which it has not received specific instructions from its customer. Each bank or broker has its own policies that control whether or not it casts votes for routine matters.

Whether the proposal is non‑routine or routine is governed by Nasdaq rules. The election of directors (Proposal 1), the vote on the advisory resolution to approve the compensation of our named executive officers (Proposal 3), the approval of the amendment to Autoscope's Section 382 rights agreement (Proposal 4), and the vote to approve the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan (Proposal 5) are considered non‑routine by Nasdaq; the ratification of our independent registered public accounting firm (Proposal 2) is considered routine.

Changes in Nasdaq regulations in 2010 eliminated the ability of your bank or broker to vote your uninstructed shares in the election of directors on a discretionary basis. Therefore, if you hold your shares in street name and you do not instruct your bank or broker how to vote in the election of directors (Proposal 1), the vote on the advisory resolution to approve the compensation of our named executive officers (Proposal 3), the approval of the amendment to Autoscope's Section 382 rights agreement (Proposal 4), or the vote to approve the 2022 Stock Option and Incentive Plan (Proposal 5), no votes will be cast on your behalf.

Your bank or broker will, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal 2). If you are a shareholder of record and you do not cast your vote, no votes will be cast on your behalf on any proposals at the annual meeting.

The Board of Directors recommends a vote:

- FOR all of the nominees for director;

- FOR the ratification of the appointment of Boulay PLLP as our independent registered public accounting firm for the 2022 fiscal year;

- FOR the advisory resolution approving the compensation of our named executive officers;

- FOR approval of the amendment to Autoscope's Section 382 rights agreement; and

- FOR approval of the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan.

| 3 |

If you vote your proxy and do not specify how you want to vote your shares, we will vote your shares:

- FOR all of the nominees for director;

- FOR the ratification of the appointment of Boulay PLLP as our independent registered public accounting firm for the 2022 fiscal year;

- FOR the advisory resolution approving the compensation of our named executive officers;

- FOR approval of the amendment to Autoscope's Section 382 rights agreement;

- FOR approval of the Autoscope Technologies Corporation 2022 Stock Option and Incentive Plan; and

- in the discretion of the persons named in the proxy on any other proposals that properly come before the meeting and as to which we did not receive notice within a reasonable time before the annual meeting of shareholders.

Yes. You may revoke your proxy at any time before the proxy vote is cast at the annual meeting in any of the following ways:

- by giving written notice of revocation to Autoscope's Corporate Secretary (whose address is set forth below);

- by submitting a later‑dated proxy; or

- by voting in person at the meeting.

We pay for the cost of proxy preparation and solicitation.

We are soliciting proxies by making Autoscope's proxy materials available over the internet and by providing paper copies of Autoscope's proxy materials to shareholders who request them. In addition, some of our officers, directors and regular employees may solicit proxies by telephone, letter, facsimile or personally. These individuals will receive no additional compensation for these services.

Shareholders may communicate with Autoscope's Board of Directors by sending a letter addressed to the Board of Directors or specified individual directors to:

The Office of the Corporate Secretary

Autoscope Technologies Corporation

1115 Hennepin Avenue

Minneapolis, MN 55403

Autoscope's Corporate Secretary will deliver such letters to a director that can address the matter or to a specified director if so addressed.

| 4 |

The following table sets forth certain information with respect to the beneficial ownership of Autoscope's common stock as of March 14, 2022 by (1) each person or entity known by us to own beneficially more than five percent of Autoscope's common stock; (2) each director and nominee for election as a director of Autoscope Technologies Corporation; (3) each of our executive officers named in the Summary Compensation Table below; and (4) all of our directors and executive officers as a group.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and includes voting power and investment power with respect to Autoscope's securities. Shares of Autoscope's common stock issuable pursuant to stock options and convertible securities that are exercisable or convertible as of or within 60 days after March 14, 2022 are deemed outstanding for computing the beneficial ownership percentage of the person or member of a group holding the options but are not deemed outstanding for computing the beneficial ownership percentage of any other person. Except as indicated by footnote, the persons named in the table below have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The address of each director and executive officer named below is the same as that of Autoscope Technologies Corporation.

|

Name and Address of Beneficial Owner |

|

Amount and Nature of |

|

Percent of Common |

||

|

Five Percent Shareholders |

|

|

|

|

|

|

|

John Lewis 300 Drakes Landing Road, Suite 172 Greenbrae, CA 94904 |

|

481,927 |

(2) |

|

9.0 |

% |

|

|

|

|

|

|

|

|

|

Nicusa Capital Partners L.P. 19 West 34th Street New York, NY 10001 |

|

470,660 |

(3) |

|

8.8 |

% |

|

|

|

|

|

|

|

|

|

AB Value Management LLC 208 Lenox Avenue, #409 Westfield, NJ 07090 |

|

466,642 |

(4) |

|

8.7 |

% |

|

Norman Pessin 366 Madison Avenue, 14th Floor New York, NY 10017 |

432,205 |

(5) |

8.0 |

% | ||

|

|

|

|

|

|

|

|

|

Executive Officers and Directors |

|

|

|

|

|

|

|

Andrew T. Berger |

|

582,884 |

(4) |

|

10.8 |

% |

|

Ezekiel J. Kruglick |

|

188,468 |

|

|

3.5 |

% |

|

Joseph P. Daly |

|

135,408 |

|

2.5 |

% |

|

|

James W. Bracke |

|

94,406 |

|

|

1.8 |

% |

| Frank G. Hallowell | 70,516 | (6) | 1.3 | % | ||

| Chad A. Stelzig(7) | 52,995 | (6) | 1.0 | % | ||

| Geoffrey C. Davis | 32,079 | * | ||||

| Brian J. VanDerBosch | 5,294 | * | ||||

|

All directors and executive officers as a group (7 persons) |

|

1,162,050 |

(6) |

|

21.6 |

% |

_________________

* Less than one percent.

| 5 |

| (1) | Based on 5,378,857 shares outstanding as of March 14, 2022. | |

| (2) | We have relied upon the information supplied by John H. Lewis in a Schedule 13G/A he filed with the SEC on February 12, 2014. Since February 12, 2014, no additional information has been supplied by John H. Lewis, and he has not been identified as a registered shareholder during the search conducted by our proxy group. As a result, we do not believe that John H. Lewis continues to hold a position in the Autoscope's common stock. |

|

| (3) | We have relied upon the information supplied by Nicusa Capital Partners L.P. in a Schedule 13G/A it filed with the SEC on February 23, 2012. Since February 23, 2012, no additional information has been supplied by Nicusa Capital Partners L.P., and it has not been identified as a registered shareholder during the search conducted by our proxy group. As a result, we do not believe that Nicusa Capital Partners L.P. continues to hold a position in the Autoscope's common stock. |

|

| (4) | Mr. Berger has 116,242 shares under his direct ownership. By virtue of his relationships with AB Value Management LLC and AB Value Partners, LP, Mr. Berger may be deemed to beneficially own the 466,642 shares owned by AB Value Partners, LP. Of the 582,884 shares beneficially owned by Mr. Berger, 400,000 shares are pledged as security. The 582,884 shares shown as being beneficially owned by Mr. Berger include the 466,642 shares shown as being beneficially owned by AB Value Management LLC. |

|

| (5) | We have relied upon the information supplied by Norman H. Pessin in a Schedule 13D/A he filed with the SEC on October 11, 2016. | |

| (6) | Includes the following shares issuable pursuant to options exercisable as of or within 60 days after March 14, 2022: for Mr. Hallowell, 60,000 shares; for Mr. Stelzig, 9,000 shares; and for all directors and executive officers as a group, 69,000 shares. | |

| (7) | Mr. Stelzig resigned as President and Chief Executive Officer of ISNS effective December 31, 2021. | |

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who beneficially own more than 10% of our common to file initial reports of ownership and reports of changes in ownership of our common stock with the SEC. Executive officers, directors and beneficial owners of more than 10% of our common stock are required by regulations of the SEC to furnish us with copies of all Section 16(a) reports they file. Based solely on a review of the copies of such forms furnished to us and written representations from the executive officers and directors, we believe that all of our executive officers, directors and beneficial owners of more than 10% of our common stock complied with all Section 16(a) filing requirements applicable to them for 2021, except as follows: one report on Form 4 reporting the transfer, with no consideration, of common stock on May 28, 2021 for shares beneficially owned by Andrew T. Berger, and one report on Form 4 reporting the purchase of common stock on November 23, 2021 by Brian J. VanDerBosch, were not filed on a timely basis.

| 6 |

The business and affairs of Autoscope Technologies Corporation are managed under the direction of Autoscope's Board of Directors, which presently is comprised of six members. Each of Autoscope's directors is elected until the next annual meeting of shareholders and until the director’s successor has been elected and qualifies to serve as a director or until the director’s earlier removal, death or resignation. All of the nominees are currently members of the Board of Directors.

The Board of Directors recommends that you vote FOR election of the six nominated directors. Proxies will be voted FOR the election of the six nominees unless otherwise specified.

If for any reason any nominee shall be unavailable for election to the Board of Directors, the named proxies will vote for such other candidate or candidates as may be nominated by the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unable to serve.

The nominees for election to Autoscope's Board of Directors provided the following information about themselves as of March 14, 2022.

Andrew T. Berger, age 49, has been a director of ISNS since October 2015, Executive Chair of ISNS since June 2016, a director and Chief Executive Officer of Autoscope since April 2021, and the Executive Chair of Autoscope since March 10, 2022. Mr. Berger was Chair of the Nominating and Corporate Governance Committee and a member of the Audit Committee and Compensation Committee until his appointment as Chief Executive Officer of Autoscope. Mr. Berger is the Managing Member of AB Value Management LLC, which serves as the General Partner of AB Value Partners, LP. Mr. Berger has nearly two decades of experience in investment analysis, investment management, and business consulting. From 1998 through 2002, Mr. Berger served as Equity Analyst for Value Line, Inc. Since 2002, Mr. Berger has served as President of Walker's Manual, Inc., an investment publisher that he transformed into a business consulting company whose clients have included public and private companies. Since May 2017, Mr. Berger has been Chief Executive Officer of Cosi, Inc, a fast-casual restaurant chain that operates and franchises more than 25 domestic and international restaurants. In 2020, Cosi, Inc. filed for Chapter 11 protection under the federal bankruptcy laws, but it has since withdrawn its filing. From January 2020 through October 2021, Mr. Berger served on the board of directors of Rock Mountain Chocolate Factory, Inc., and international franchisor, confectionary manufacturer and retail operator, which has securities registered under Section 12 of the Securities Exchange Act of 1934.

Mr. Berger is qualified to serve on Autoscope's Board due to his experience in investment analysis, management, and business consulting for both public and private companies.

Mr. Bracke is qualified to serve on Autoscope's Board due to his management, technical and public company experiences, most significantly his 20 years as President and Chief Executive Officer of Lifecore Biomedical, Inc., a publicly‑held medical device manufacturer, from 1983 to 2004.

Geoffrey C. Davis, age 63, has been a director of ISNS since November 2016 and a director of Autoscope since April 2021. Mr. Davis is Chair and a member of Autoscope's Compensation Committee, a member of the Audit Committee and a member of the Nominating and Corporate Governance Committee. Mr. Davis is a principal at Republic Consulting, LLC. From 2005 to 2012, Mr. Davis served as a U.S. Congressman from the Commonwealth of Kentucky, and he represented the Fourth District in the United States House of Representatives. During his tenure in Congress, Mr. Davis earned a leadership role within the Republican Conference as a Deputy Whip, which is a close advisor to Congressional Leadership. Mr. Davis also served on the House and Finance Services and Armed Services Committees from 2005 to 2008. Late in 2008, he was appointed to the Ways and Means Committee. Prior to serving in Congress, Mr. Davis owned and operated a consulting firm specializing in lean manufacturing and systems integrations. Mr. Davis graduated from the U.S. Military Academy at West Point, New York.

Mr. Davis is qualified to serve on Autoscope's Board due to his extensive experience working in senior positions in government and the manufacturing industry sector.

| 7 |

Joseph P. Daly, age 60, has been a director of ISNS since January 2019, a director of Autoscope since April 2021, and the Lead Independent Director of Autoscope since March 10, 2022. Mr. Daly is Chair and a member of Autoscope's Nomination and Corporate Governance Committee, a member the Audit Committee and a member of the Compensation Committee. Mr. Daly is the Chief Executive Officer of Essig Research, Inc., a global engineering services company specializing in the design and repair of large, infrastructure related equipment, which he founded in October 1993. Since January 2012, Mr. Daly has been a business and finance instructor at Northeastern University in Boston, Massachusetts. In October 2016, Mr. Daly acquired the product lifecycle management ("PLM") software assets of SofTech Inc. and formed EssigPLM, which offers PLM related solutions to a broad, global client base. Mr. Daly was also a director from December 2013 through July 2016 and largest shareholder of Kreisler Manufacturing Inc., which was acquired by Arlington Capital Partners in July 2016. Mr. Daly received his BSME from Rensselaer Polytechnic Institute and his MBA/MSF from Northeastern University.

Mr. Daly is qualified to serve on Autoscope's Board due to his extensive experience in senior positions in companies offering engineering services, software solutions, and manufacturing capabilities.

Mr. VanDerBosch is qualified to serve on Autoscope's Board due to his extensive experience in senior positions in companies offering traffic detection technologies and manufacturing capabilities.

Our executive officers and their biographical information as of the date of this proxy statement are as follows:

Frank G. Hallowell, age 64, was appointed as Chief Financial Officer of ISNS in April 2019 and as Chief Financial Officer of Autoscope in April 2021. Mr. Hallowell most recently served as the Vice President and Chief Financial Officer for Wipaire Inc. from January 2016 to April 2019. Prior to his appointment at Wipaire Inc., Mr. Hallowell served as Chief Financial Officer and other senior financial roles at WellClub, LLC from May 2015 to January 2016, Logic PD, Inc. from December 2008 to March 2015, Pearson PLC from December 2006 to December 2008, and ExpressPoint Technology Services, Inc. from December 1997 to December 2006.

| 8 |

Our Boards of Directors and management are dedicated to exemplary corporate governance. In 2004, we adopted a Code of Ethics and Business Conduct. This Code is a statement of our high standards for ethical behavior and legal compliance, and it governs the manner in which we conduct our business. In addition, our directors, officers, employees, and their family members are subject to our Policy Against Insider Trading - Procedures and Guidelines Governing Insider Trading and Tipping. Copies of our Code of Ethics and Business Conduct and our Policy Against Insider Trading can be found on our website at www.autoscope.com by clicking on "Governance."

Autoscope's Board of Directors has determined that James W. Bracke, Geoffrey C. Davis, Joseph P. Daly and Brian J. VanDerBosch are independent directors as defined under the applicable rules of the SEC and Nasdaq, who are our current independent directors of the Board. Each of the Committees of Autoscope's Board is composed of independent directors. In making the independence determinations, Autoscope's Board of Directors reviewed all of Autoscope's directors’ and the nominee's relationships with us based primarily on a review of the responses of the directors and the nominee to questions regarding employment, business, familial, compensation and other relationships with us and our management.

We believe Autoscope's Board of Directors, taken as a whole, possesses an appropriate combination of skills and experiences. The majority of Autoscope's Board members have experience in operating and advising high‑growth technology‑based businesses. Individually, Autoscope's directors have varied experiences in small and large publicly‑held companies in the operational areas of engineering, sales, marketing and finance.

Before July 21, 2021, which was the closing date of the holding company reorganization, the Board of Directors of ISNS held one meeting during 2021 in addition to Board Committee meetings and acted by written action in lieu of a meeting three times. After July 21, 2021, the Autoscope Board of Directors held three meetings during 2021 in addition to Board Committee meetings, and it acted by written action in lieu of a meeting five times. Each director who was a director in 2021 of ISNS and Autoscope attended each of the meetings held in 2021 of the Board and the Board Committees on which the director served during 2021, except for two Board Meetings held in 2021 that were attended by six of the seven Board members, two Audit Committee meetings held in 2021 that were attended by three of the four Committee members, and one Compensation Committee meeting held in 2021 that was attended by two of the three Committee members.

Before the effective date of the holding company reorganization in July 2021, ISNS separated the roles of Chief Executive Officer and Executive Chair of the Board of Directors. ISNS believed that such a separation benefited ISNS by enhancing the opportunities for checks and balances between the Company’s strategies and its objectives and ensuring that a wider selection of alternative measures are considered. On March 10, 2022, the Autoscope Board appointed Andrew T. Berger as Executive Chair and Joseph P. Daly as the Lead Independent Director. Autoscope’s Board of Directors has determined that this structure, with a combined Executive Chair and Chief Executive Officer and a Lead Independent Director, is in the best interests of the Company and its shareholders at this time.

As set forth in the Lead Independent Director Charter adopted by the Autoscope Board, the Lead Independent Director’s duties and responsibilities include presiding at all meetings of the Board of Directors at which the Executive Chair is not present, including executive sessions of the independent Directors; calling meetings of the independent Directors; serving as the principal liaison between the Executive Chair and the independent Directors; approving all information sent to the Board of Directors, including the quality, quantity, appropriateness and timeliness of such information; approving meeting agendas for the Board of Directors; approving the frequency of Board meetings and meeting schedules; and recommending to the Nominating and Corporate Governance Committee and to the Executive Chair individuals for the membership and chair position for each Board committee.

Autoscope's Board of Directors, in conjunction with management, has identified and prioritized various enterprise risks, and each prioritized risk is assigned to a Board Committee or the full Board for oversight. For example, financial risks are overseen by the Audit Committee; compensation risks are overseen by the Compensation Committee; Chief Executive Officer succession planning is overseen by the Governance and Nominating Committee; and strategic, legal and compliance risks are typically overseen by the full Board. Management regularly reports on each such risk to the relevant Committee of the Board, and material risks identified by a relevant Committee are then presented to the full Board. Additional review or reporting on enterprise risks is conducted as needed or as requested by the Board or Committee. Coordination of management’s review of risks is performed by the Chief Financial Officer, who reports to the Board of Directors.

| 9 |

Autoscope's Board of Directors conducts its business through meetings of the Board and the following three standing Committees: Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of these Committees has adopted and operates under a written charter. Copies of the charters are posted on Autoscope's website at https://www.autoscope.com/corporate-governance.html. The current membership of these Committees is described below.

|

Audit Committee(1) |

|

Compensation Committee(2) |

|

|

Nominating and Corporate |

|

James W. Bracke (Chair) |

|

Geoffrey C. Davis (Chair) |

|

|

Joseph P. Daly (Chair) |

|

Geoffrey C. Davis |

|

James W. Bracke |

|

|

James W. Bracke |

| Brian J. VanDerBosch | Brian J. VanDerBosch | Geoffrey C. Davis | |||

| Joseph P. Daly | Joseph P. Daly |

(1) Mr. Bracke was appointed Chair of the Audit Committee on November 1, 2016. Before the effective date of the holding company reorganization in July 2021, the ISNS Audit Committee consisted of Mr. Bracke, Paul F. Lidsky, Andrew T. Berger, and Mr. Davis. Since the effective date of the reorganization, the Autoscope Audit Committee has consisted of Mr. Bracke (Chair), Mr. Davis, Mr. Lidsky (until his resignation from the Autoscope and ISNS Boards effective on December 31, 2021), Mr. VanDerBosch, and Mr. Daly (who was appointed to the Audit Committee on March 10, 2022).

(2) Mr. Davis was appointed as Chair of the Compensation Committee effective on July 21, 2021. Before the effective date of the holding company reorganization in July 2021, the ISNS Compensation Committee consisted of Mr. Lidsky (Chair), Mr. Bracke, Mr. Berger and Mr. Davis. Since the effective date of the reorganization, the Autoscope Compensation Committee has consisted of Mr. Davis (Chair), Mr. Lidsky (until his resignation from the Autoscope and ISNS Boards effective on December 31, 2021), Mr. Bracke, Mr. VanDerBosch (who was appointed to the Compensation Committee on February 1, 2022), and Mr. Daly (who was appointed to the Compensation Committee on March 10, 2022).

(3) Mr. Daly was appointed as Chair of the Nominating and Corporate Governance Committee on February 1, 2022. Before the effective date of the holding company reorganization in July 2021, the ISNS Nominating and Corporate Governance Committee consisted of Mr. Berger (Chair), Mr. Lidsky, and Mr. Bracke. Since the effective date of the reorganization, the Autoscope Nominating and Corporate Governance Committee has consisted of Mr. Lidsky (Chair) (until his resignation from the Autoscope and ISNS Boards effective on December 31, 2021), Mr. Bracke, Mr. Daly, and Mr. Davis (who was appointed to the Nominating and Corporate Governance Committee on March 10, 2022).

The Audit Committee is responsible for the selection and compensation of the Company's independent registered public accounting firm, and it reviews with the independent registered public accounting firm the scope of the annual audit, matters of internal control and procedure and the adequacy thereof, the audit results and reports and other general matters relating to our accounts, records, controls and financial reporting. Each current member of Autoscope's Audit Committee possesses the financial qualifications required of audit committee members under the rules and regulations of Nasdaq and the SEC. For 2021, our Board of Directors identified James W. Bracke and Brian J. VanDerBosch as audit committee financial experts as defined in the applicable rules of the SEC. During 2021, the Audit Committee held five meetings.

The Compensation Committee reviews and recommends to the Board of Directors the compensation guidelines and stock award grants for executive officers and other key personnel. During 2021, the Compensation Committee held five meetings. The Committee’s primary responsibilities include:

• annually reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s Chief Executive Officer and Chief Financial Officer, evaluating their performances in light of those goals and objectives, and subsequently determining their incentive compensation levels based on this evaluation and other factors deemed relevant and appropriate by the Committee;

• annually reviewing and determining for our Chief Executive Officer and Chief Financial Officer their annual base salary levels, annual incentive opportunity levels, employment agreements, severance arrangements and change of control agreements/provisions, and special or supplemental benefits, if any; and

• reviewing and making recommendations to the Board of Directors with respect to compensation programs and policies, including incentive compensation plans and equity‑based plans and the compensation of members of the Company's Board of Directors.

| 10 |

At least twice annually, Autoscope's independent directors meet in executive session without any director being present who does not meet the independence requirements of the listing standards of Nasdaq. During 2021, our independent directors met four times in executive session.

The Nominating and Corporate Governance Committee determines the required selection criteria and qualifications of director nominees based upon our needs at the time nominees are considered. Directors should possess the highest personal and professional ethics, integrity and values and be committed to representing the long‑term interests of Autoscope's shareholders. In evaluating a candidate for nomination as a director of Autoscope Technologies Corporation, the Nominating and Corporate Governance Committee considers criteria including business and financial expertise; where the director resides; experience as a director of a public company; diversity of background and experience on the Board; and general criteria such as ethical standards, independent thought, practical wisdom and mature judgment. The Nominating and Corporate Governance Committee will consider these criteria for nominees identified by the Nominating and Corporate Governance Committee, by shareholders, or through some other source. The Nominating and Corporate Governance Committee does not have a policy that specifically addresses diversity in its nominating process.

The Nominating and Corporate Governance Committee will consider qualified candidates for possible nomination that are submitted by Autoscope's shareholders. Shareholders wishing to make such a submission may do so by sending the following information to the Nominating and Corporate Governance Committee, c/o Corporate Secretary, at the address indicated on the Notice of Annual Meeting of Shareholders: (1) name of the candidate and a brief biographical sketch and resume; (2) contact information for the candidate and a document evidencing the candidate’s willingness to serve as a director if elected; and (3) a signed statement as to the submitting shareholder’s current status as a shareholder and the number of shares currently held.

The Nominating and Corporate Governance Committee conducts a process of making a preliminary assessment of each proposed nominee based upon the nominee’s resume and biographical information, an indication of the nominee’s willingness to serve and other background information. This information is evaluated against the criteria set forth above and our specific needs at that time. Based upon a preliminary assessment of the candidate(s), those who appear best suited to meet our needs may be invited to participate in a series of interviews, which are used as a further means of evaluating potential candidates. On the basis of information learned during this process, the Nominating and Corporate Governance Committee determines which nominee(s) to recommend to the Board to submit for election at the next annual meeting. The Nominating and Corporate Governance Committee uses the same process for evaluating all nominees, regardless of the original source of the nomination.

No candidates for director nominations were submitted by any shareholder for consideration at the 2022 annual meeting.

| 11 |

We encourage, but do not require, Autoscope's Board members to attend the annual meeting of shareholders. At the Company's last annual meeting of shareholders held in 2021, all of our then elected directors attended the annual shareholders meeting.

During 2021, each of Autoscope's non‑employee directors received an annual $50,000 retainer, of which $25,000 was paid in cash and $25,000 was paid in the form of a common stock award grant, with the per share value of the common stock based on the closing price of the common stock on the trading day before the grant date of the award. The Executive Chair of the Board of ISNS received an additional $22,500 annual cash retainer. The Committee Chairs of the following standing Committees of the Company received the following additional annual cash retainers: Audit Committee ‑ $10,000; Compensation Committee ‑ $7,000; and Nominating and Corporate Governance Committee ‑ $5,000. Members of the Committees received the following additional annual cash retainers: Audit Committee - $6,000; Compensation Committee - $5,000; and Nominating and Corporation Governance Committee - $4,000. Members of any special Committees formed by the Board received a $1,500 quarterly retainer for each special Committee on which they served, with the Chair of each special Committee receiving an additional $4,000 quarterly retainer. The Company had no special Committees during 2021.

The following table provides information regarding the compensation earned by the members of the Company's Board of Directors in 2021.

|

Name |

|

|

Fees Earned or |

|

|

Stock |

|

|

Total |

|

James W. Bracke |

|

$ |

50,000 |

|

$ |

25,004 |

|

$ |

75,004 |

|

Andrew T. Berger(3) |

|

$ |

58,587 |

|

$ |

25,004 |

|

$ |

83,591 |

|

Paul F. Lidsky |

|

$ |

46,109 |

|

$ |

25,004 |

|

$ |

71,113 |

|

Geoffrey C. Davis |

|

$ |

39,120 |

|

$ |

25,004 |

|

$ |

64,124 |

| Joseph P. Daly | $ | 26,783 | $ | 25,004 | $ | 51,787 | |||

| Brian J. VanDerBosch | $ | 19,089 | $ | 16,407 | $ | 35,496 | |||

| Ezekiel J. Kruglick | $ | 8,288 | $ | 8,310 | $ | 16,598 |

(1) Consists of fees earned and paid in 2021.

(2) Represents the grant date fair value of stock awards during the year determined pursuant to Financial Accounting Standards Board Accounting Standard Codification Topic 718, Compensation – Stock Compensation (ASC Topic 718). Refer to “Note 11 ‑ Stock-Based Compensation” in our Annual Report on Form 10‑K for the year ended December 31, 2021 for a discussion of the assumptions used in calculating the grant date fair value.

(3) Consists of compensation paid to Mr. Berger as an independent member of the Company's Board of Directors in 2021 until the effective date of the holding company reorganization on July 21, 2021.

Each director is reimbursed by the Company for the director's actual out‑of‑pocket expenses, including telephone, travel and miscellaneous items incurred on behalf of the Company.

Under an Independent Consulting Agreement between Brian J. VanDerBosch and the Company dated November 20, 2017, the Company paid to Mr. VanDerBosch a total of $15,904 in consulting fees in fiscal 2021, none of which was related to his nomination to the Company's Board.

| 12 |

Overview

This compensation discussion describes the material elements of compensation awarded to, earned by or paid to each of our named executive officers (the “Named Executive Officers”), as that term is defined in Item 402(a)(3) of the SEC’s Regulation S-K. During 2021, our Named Executive Officers consisted of Chad A. Stelzig, who served in the capacity of President and Chief Executive Officer of ISNS from June 2016 until he resigned effective on December 31, 2021; Andrew T. Berger, the Chief Executive Officer of Autoscope, who began serving in that capacity in April 2021; and Frank G. Hallowell, who served as the Chief Financial Officer of ISNS throughout 2021 and as Chief Financial Officer of Autoscope beginning in April 2021. During 2020, our Named Executive Officers consisted of Chad A. Stelzig, ISNS's President and Chief Executive Officer; and Frank G. Hallowell, ISNS's Chief Financial Officer.

Objectives of the Compensation Program

The Compensation Committee recommends the compensation programs for the Named Executive Officers, and the independent members of our Board approve the compensation of the Named Executive Officers

The primary objective of our various compensation programs is to attract, motivate and retain key executives and align their compensation with our overall performance. Autoscope's Compensation Committee believes that incentive, performance‑based compensation can be a key factor in motivating executive performance to maximize shareholder value and align executive performance with our corporate objectives and shareholder interests. To this end, the Committee has established a compensation philosophy that includes the following considerations:

| • | an emphasis on performance‑based compensation that differentiates compensation results based upon varying elements of Company and individual performance; |

| • | a recognition of both quantitative and qualitative performance objectives based upon an executive officer’s responsibilities; and |

| • |

a mix of short‑term cash and long‑term equity‑based compensation. |

The Committee and the Board believe it is important, when making their compensation‑related decisions, to be informed as to current practices of similarly situated companies. Members of Autoscope's Board of Directors and members of the Committee are experienced in compensation matters and leverage such experience in addressing compensation matters and practices.

Design of the Compensation Program for the Named Executive Officers

The Committee and the Board have designed the compensation program for the Named Executive Officers to achieve the objectives described above, to ensure market competitiveness and to assure satisfaction of our objective of providing total executive pay that achieves an appropriate balance of variable pay‑for‑performance and at‑risk compensation. The compensation program will reward the Named Executive Officers based upon corporate performance as well as the performance of the Named Executive Officers.

The compensation program for the Named Executive Officers includes the following elements: base salary, annual cash incentives, restricted stock grants and other benefits. We characterize the annual cash incentives and the restricted stock grants as performance‑based compensation. Our executive compensation policy for the Named Executive Officers provides that a significant portion of the total compensation payable to them will be in the form of performance‑based compensation. We do not have a target for each element of performance‑based compensation relative to total compensation. The elements of our compensation program are described below.

| 13 |

Base Salaries. Base salary is an important element of executive compensation because it provides executives with a fixed level of regular periodic income. In determining base salaries for our Named Executive Officers, the Committee and the Board consider historic individual and corporate performance, level of responsibility and market and competitive data. The Committee establishes base salaries for the Named Executive Officers at a level such that a significant portion of the total compensation that they can earn is performance‑based cash incentives and equity awards.

Annual Cash Incentive. As part of our executive compensation program, the Named Executive Officers may receive annual cash incentive awards pursuant to our annual cash bonus program. Targeted bonus amounts are designed to provide competitive incentive pay and reflect our pay‑for‑performance philosophy. The Committee historically has reviewed and determined target bonus amounts annually.

Performance objectives intended to focus attention on achieving key goals are established at the beginning of each fiscal year. The primary quantitative objective is achievement of revenue and net income targets set forth in our annual operating plan established by the Board of Directors. Specifically, these include metrics such as revenue and net profit (after tax), international operations revenue and operating profit. Additionally, the performance of the Named Executive Officers is judged on success in achieving certain strategic and operational initiatives. In evaluating their performance, the Committee may consider other factors in awarding bonuses and may, in its discretion, award as a discretionary bonus a portion of any bonus amount that is not earned based upon achievement of the financial and other metrics described above. The Committee reviews the individual incentive components of the Named Executive Officers’ employment agreements, described below, and evaluates the objective portions relative to the Company’s performance. The Committee also evaluates subjective, individual performance goals in determining the total amount of bonus to be awarded and has the ability to exercise discretion with respect to this portion. For the Named Executive Officers, up to one‑third of the bonus calculation may be associated with strategic and operational initiatives and is considered to be discretionary.

Grants of Stock Options and Stock Awards. Our executive officers also may receive equity‑based incentive compensation under stock plans approved by our shareholders and administered under the supervision of our Board of Directors. Grants under these plans are designed to align a significant portion of the executive compensation package with the long‑term interests of our shareholders. Stock options are generally granted with an exercise price equal to the closing sale price of the stock on the trading day before the date of grant, and they provide no cash benefit if the price of the stock does not exceed the grant price during the option’s term. Therefore, for any value to be derived from an option grant, our performance needs to result in increased stock price performance and shareholder value over a multi‑year period. Individual equity awards historically have been recommended by the Committee based on an officer’s current performance, potential for future contribution and responsibility and market competitiveness.

For 2021, there was no grant of a stock award to the Named Executive Officers under the terms of the Image Sensing Systems, Inc. 2014 Stock Option and Incentive Plan (the "2014 Plan"), which was assumed by Autoscope effective on July 21, 2021.

For 2020, there was no grant of a stock award to the Named Executive Officers under the terms of the 2014 Plan.

Retirement Plans. We generally expect executives to plan for and fund their own retirement. We maintain a 401(k) plan that permits eligible employees, including our Named Executive Officers, to defer a limited portion of salary and bonus into any of several investment alternatives. We make matching contributions equal to 50% of the first 6% of compensation deferred by employees subject to a maximum annual match of $8,250 and maximums established under the Internal Revenue Code (the “Code”). We may also make discretionary contributions to the 401(k) plan. Payments made to the Named Executive Officers for matching contributions are included in the Summary Compensation Table below. We do not maintain defined benefit retirement or senior executive retirement plans, or provide post‑retirement medical benefits, for our Named Executive Officers.

| 14 |

Other Benefits and Perquisites. Our executive compensation program also includes other benefits and perquisites. The Named Executive Officers participate in Company‑sponsored group benefit plans such as health, life and disability insurance plans available to all employees. In addition, Named Executive Officers may upon joining the Company receive assistance in relocating in the discretion of our Board of Directors. For more detailed information regarding benefits and perquisites provided to our Named Executive Officers, see the Summary Compensation Table included elsewhere in this proxy statement.

2021 Compensation Program. In November 2021, the Compensation Committee recommended and the Board of Directors approved a 2021 compensation plan for Chad A. Stelzig, ISNS's President and Chief Executive Officer, and Frank G. Hallowell, ISNS's Chief Financial Officer. Under the compensation plan, Mr. Stelzig received an annual base salary of $275,000, the same as his annual compensation for 2020, and Mr. Hallowell received an annual base salary of $245,000, an increase from his 2020 base salary of $235,000. The increase in base salary for Mr. Hallowell was effective September 1, 2021. In addition, the compensation plan included a target cash bonus for Mr. Stelzig and Mr. Hallowell if the Company achieved performance criteria for 2021 set by the Board. Andrew T. Berger received no compensation in 2021 as Chief Executive Officer of Autoscope.

2020 Compensation Program. In March 2020, the Compensation Committee recommended and the Board of Directors approved a 2020 compensation plan for Chad A. Stelzig, ISNS's President and Chief Executive Officer, and Frank G. Hallowell, ISNS's Chief Financial Officer. Under the compensation plan, Mr. Stelzig received an annual base salary of $260,000, and Mr. Hallowell received an annual base salary of $220,000, both of which were the same as their annual compensation for 2019 (which was annualized in the case of Mr. Hallowell, who became Chief Financial Officer on April 29, 2019). In addition, the compensation plan included a target cash bonus for Mr. Stelzig and Mr. Hallowell if ISNS achieved performance criteria for 2020 set by the Board. In December 2020, the Compensation Committee recommended and the Board of Directors approved an increase in base salary for Mr. Stelzig from $260,000 to $275,000, and for Frank G. Hallowell from $220,000 to $235,000. The increase in base salaries for Mr. Stelzig and Mr. Hallowell were effective November 1, 2020.

Named Executive Officers’ Role in Compensation Decisions

The Committee recommends to the Board of Directors the actual and targeted compensation of the Company’s Named Executive Officers. The Board, with any non‑independent members abstaining, approves the compensation of the Named Executive Officers. (During 2020, all members of the Board were independent, and, during 2021, all members of the Board, except for Andrew T. Berger (since July 21, 2021) and Ezekiel J. Kruglick were independent.) The Committee determines its recommendations regarding the compensation plan for the Named Executive Officers based on major goals and objectives established by the Board of Directors. When applicable, the Committee also receives input from the Company's Chief Executive Officer regarding another Named Executive Officer’s leadership capabilities, past performance and potential for future contributions when making its recommendations on actual and targeted compensation amounts for Named Executive Officers.

Compensation Committee's Independent Consultant

The Compensation Committee has the authority to retain and terminate any compensation and benefits consultant and the authority to approve the related fees and other retention terms of the consultant. In October 2021, the Compensation Committee directly retained the services of Semler Brossy Consulting Group, LLC ("Semler Brossy"), an independent compensation firm to advise the committee on certain executive compensation and benefit matters. The Compensation Committee directed Semler Brossy to provide a competitive assessment of the compensation of our Chief Executive Officer and Chief Financial Officer (who are named executive officers for 2021), the Senior Vice President of Sales and Vice President of Engineering of ISNS (who are not named executive officers), and our Board of Directors; conduct a competitive assessment of the compensation of these officers and total Board and Board Committee

| 15 |

compensation; draft a report summarizing Semler Brossy's findings and recommendations; and present the final results to the Compensation Committee that could be considered by the Compensation Committee and then recommended to the full Board of Directors for approval. Semler Brossy provided compensation consulting services to the Compensation Committee only on matters for which the Compensation Committee is responsible. Semler Brossy did not provide the Compensation Committee or the Company's management with any additional services, and Semler Brossy does not have any additional relationship with Autoscope, ISNS, or their management in addition to the services that it provided to the Compensation Committee. The Compensation Committee assessed Semler Brossy's independence in light of applicable rules of the SEC and Nasdaq and determined that no conflict of interest or independence concerns exist.

Other Considerations and Factors

Although the Committee and the Board consider tax and accounting issues in connection with their compensation decisions, those have not become material factors in their compensation decisions to date.

As disclosed elsewhere in this proxy statement, our directors, officers, employees, and their family members are subject to our Policy Against Insider Trading – Procedures and Guidelines Governing Insider Trading and Tipping. Among other requirements, the Policy provides that these individuals are prohibited from engaging in hedging or monetization transactions with respect to the Company’s securities. For purposes of the Policy, “hedge” and “hedging” include financial instruments that are designed to hedge or offset decreases in the value of equity securities (including prepaid variable forward contracts, equity swaps, collars and exchange funds); short sales that hedge the economic risk of ownership; entering into borrowing or other arrangements involving a nonrecourse pledge of securities; selling security futures that establish a position that increase in value as the value of the underlying equity security decreases; and transactions that involve pledges of the underlying Company equity securities as collateral. These types of transactions and all similar transactions denominated in the Company’s securities are prohibited by the Policy. Individuals covered by the Policy also are prohibited from holding Company securities in a margin account or otherwise pledging Company securities as collateral for a loan. In certain limited circumstances, the Board may consider and grant waivers of the Policy's prohibitions on these individuals from holding Company securities in a margin account or pledging such securities.

| 16 |

Summary Compensation Table ‑ 2021 and 2020

The following table sets forth information about compensation awarded to, earned by or paid to our Named Executive Officers for 2021 and 2020.

|

Name and Principal Position |

|

Year |

|

|

Salary |

|

|

Stock- Based Compensation (1) ($) |

|

|

Non-Equity Incentive Plan Compensation |

|

|

All Other Compensation |

|

|

Total |

|

Chad A. Stelzig |

|

2021 |

|

$ |

275,000 |

|

$ |

18,174 |

|

$ |

-- |

|

$ |

11,973(2) |

|

$ |

305,148 |

|

Former President and Chief Executive Officer |

|

2020 |

|

$ |

262,500 |

|

$ |

46,571 |

|

$ |

-- |

|

$ |

11,601(3) |

|

$ |

320,672 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank G. Hallowell |

|

2021 |

|

$ |

238,333 |

|

$ |

18,316 |

|

$ |

-- |

|

$ |

11,096(4) |

|

$ |

267,745 |

|

Chief Financial Officer |

|

2020 | $ | 222,500 | $ | 18,366 | $ | -- | $ | 8,907(5) | $ | 249,773 | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Andrew T. Berger |

|

2021 |

|

$ |

-- |

|

$ |

-- |

|

$ |

-- |

|

$ |

-- |

|

$ |

-- |

|

Chief Executive Officer(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________

(1) Consists of the grant date fair value of stock option awards during each year determined pursuant to Accounting Standards Codification (“ASC”) Topic 718. Refer to “Note 11 – Stock-Based Compensation” in our Annual Report on Form 10-K for the year ended December 31, 2021 and “Note 11 – Stock-Based Compensation” in our Annual Report on Form 10‑K for the year ended December 31, 2020 for a discussion of the assumptions used in calculating the grant date fair value. There can be no assurance that the amounts reflected in the table will ever be realized.

(2) For Mr. Stelzig, the $11,973 in All Other Compensation for 2021 consists of $8,265 in Company match paid into his 401(k) plan account in 2021, $1,200 of Company contributions paid into his health savings account in 2021 and $2,508 for executive life premiums paid for Mr. Stelzig in 2021. Mr. Stelzig served as ISNS's President and Chief Executive Officer throughout all of 2020 and 2021, and he resigned effective December 31, 2021.

(3) For Mr. Stelzig, the $11,601 in All Other Compensation for 2020 consists of $7,896 in Company match paid into his 401(k) plan account in 2020, $1,200 of Company contributions paid into his health savings account in 2020 and $2,505 for executive life premiums paid for Mr. Stelzig in 2020.

(4) For Mr. Hallowell, the $11,096 in All Other Compensation for 2021 consists of $7,150 in Company match paid into his 401(k) plan account in 2021, $1,200 of Company contributions paid into his health savings account in 2021 and $2,746 for executive life insurance premiums paid for Mr. Hallowell in 2021.

(5) For Mr. Hallowell, the $8,907 in All Other Compensation for 2020 consists of $5,000 in Company match paid into his 401(k) plan account in 2020, $1,200 of Company contributions paid into his health savings account in 2020 and $2,707 for executive life insurance premiums paid for Mr. Hallowell in 2020.

(6) Mr. Berger has served as Chief Executive Officer of Autoscope beginning in April 2021 and received no compensation in 2021 for serving in such position.

| 17 |

Grants of Equity and Non-Equity Awards ‑ 2021

In the following table, we have provided information regarding equity awards under the 2014 Plan and non-equity incentive plan awards made to Mr. Stelzig and Mr. Hallowell for 2021.

|

Name |

|

Grant Date |

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) |

|

All Other |

|

|

Exercise |

|

|

Grant Date |

|||||||

|

|

|

|

|

|

Threshold($) |

|

|

Target($) |

|

|

Maximum($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chad A. Stelzig |

|

1/1/21 |

|

$ |

110,000 |

|

$ |

137,500 |

|

$ |

220,000 |

|

-- |

|

|

-- |

|

|

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frank G. Hallowell |

|

1/1/21 |

|

$ |

98,000 |

|

$ |

122,500 |

|

$ |

196,000 |

|

-- |

|

|

-- |

|

|

-- |

_________________

(1) Represents the range of awards under the incentive component for 2021 under the incentive cash bonus plans for Mr. Stelzig and Mr. Hallowell. The amounts in these columns reflect the minimum payment level if an award is achieved, the target payment level and the maximum payment level under each plan if superior performance is attained. Amounts actually paid for 2021 are set forth in the “Non‑Equity Incentive Plan Compensation” column of the “Summary Compensation Table ‑ 2021 and 2020” above.

(2) Represents the grant date fair value determined pursuant to ASC Topic 718. Generally, the grant date fair value is the amount expensed in our financial statements over the vesting schedule of the stock options or restricted stock awards.

Outstanding Equity Awards at Fiscal Year‑End ‑ 2021

In April 2005, we adopted the Image Sensing Systems, Inc. 2005 Stock Incentive Plan (the "2005 Plan"), and in April 2014, we adopted the 2014 Plan (collectively, the “Plans”), which provide for the granting of incentive stock options, non‑qualified stock options, stock appreciation rights, restricted stock awards and performance awards to our officers, directors, employees, consultants and independent contractors. Options granted to employees under the Plans generally vest over three to five years based on service and have a contractual term of nine to 10 years. As of December 31, 2021, there were options outstanding under the Plans to purchase a total of 12,000 shares with a weighted average exercise price per share of $4.90.

| 18 |

In the following table, we have provided information regarding outstanding equity awards held at December 31, 2021 by the Named Executive Officers:

| Option Awards | Stock Awards | |||||||||||||

| Number of Securities Underlying Unexercised Options | ||||||||||||||

| Name |

Exercisable (#) |

Un-Exercisable (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares That Have Not Vested (#) |

Market Value of Shares That Have Not Vested(1) ($) |

||||||||

| Chad A. Stelzig | 3,000 | — | $ | 5.00 | 09/17/2022 | |||||||||

| 2,000 | — |

$ | 7.10 | 08/20/2023 | ||||||||||

| 4,000 | — |

$ |

4.22 |

05/13/2024 | ||||||||||

| 4,225 | $ | 26,575 | ||||||||||||

| Frank G. Hallowell | 3,506 | $ | 22,053 | |||||||||||

(1) The market value of unvested restricted stock awards ("RSAs") equal the closing price of our common stock on The Nasdaq Capital Market at the end of fiscal year 2021 ($6.29) multiplied by the number of shares. The RSAs vest in three equal installments beginning on the first anniversary of the grant date.

_________________

Option Exercises and Stock Vested – 2021

| Option Awards | Stock Awards | ||||||||

| Number of Shares Acquired on Exercise (#) |

Value Realized on Exercise ($) |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting(2) ($) |

||||||

| Chad A. Stelzig | — | — |

11,220(1) | $ | 50,070 | ||||

| Frank G. Hallowell | — |

— | 3,505 | $ | 16,158 | ||||

(1) Mr. Stelzig authorized the Company to withhold 4,028 shares of stock to cover tax obligations. The number of shares subject to RSAs acquired by Mr. Stelzig after fulfilling all tax obligations was 7,192 shares, and the value realized on vesting following the withholding of shares was $32,095.

(2) The value realized on the vesting of the RSAs is the fair market value of our common stock at the time of vesting.

Under the terms of the 2005 Plan and 2014 Plan, if a participant’s employment with the Company terminates by reason of the participant’s death or disability, then, to the extent a stock option held by the participant is vested as of the date of death or disability, the stock option may be exercised by the participant, the legal representative of the participant’s estate, the legatee of the participant under the will of the participant, or the distributee of the participant’s estate, whichever is applicable, for a period of one year from the date of death or disability or until the expiration of the stated term of the stock option, whichever period is shorter. Any options that are not vested as of the date of death or termination due to disability will immediately lapse and be of no further force or effect.