FOURTH QUARTER 2025 Wabtec Financial Results & Company Highlights .2

Forward Looking Statements & Non-GAAP Financial Information This communication contains “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. All statements, other than historical facts, including statements regarding Wabtec’s plans, objectives, expectations and intentions; Wabtec’s expectations about future sales, earnings and cash conversion; Wabtec’s projected expenses and cost savings associated with its Integration 2.0 and 3.0 initia tives and its portfolio optimization; Wabtec’s 5-year outlook; Wabtec’s expectations for evolving global industry, market and macro-economic conditions and their impact on Wabtec’s business; synergies and other expected benefits from Wabtec’s acquisitions; Wabtec’s expectations for production and demand conditions; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) changes in general economic and/or industry specific conditions, including the impacts of significant recent shifts in trade policies (including the actual or threatened imposition of tariffs and retaliatory tariff measures) as well as tax programs, inflation, supply chain disruptions, foreign currency exchange and industry consolidation and market reactions to these factors; (2) changes in the financial condition or operating strategies of Wabtec's customers; (3) unexpected costs, charges or expenses resulting from acquisitions and potential failure to realize synergies and other anticipated benefits of acquisitions, including as a result of integrating acquired targets into Wabtec; (4) inability to retain and hire key personnel; (5) evolving legal, regulatory and tax regimes; (6) changes in the expected timing of projects; (7) a decrease in freight or passenger rail traffic; (8) an increase in manufacturing costs; (9) actions by third parties, including government agencies; (10) the impacts of epidemics, pandemics or similar public health crises on the global economy and, in particular, our customers, suppliers and end-markets, (11) potential disruptions, instability and volatility in global markets as a result of global military action, acts of terrorism or armed conflict, including Russia’s invasion of Ukraine; (12) cybersecurity and data protection risks and (13) other risk factors as detailed from time to time in Wabtec’s reports filed with the SEC, including Wabtec’s annual report on Form 10-K, periodic quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this communication. Wabtec does not undertake any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. This presentation as well as Wabtec’s earnings release and financial guidance mention certain non-GAAP financial performance measures, including adjusted gross profit, adjusted operating expenses, adjusted income from operations, adjusted interest and other expense, adjusted net income, adjusted operating margin, adjusted gross margin, adjusted income tax expense, adjusted earnings per diluted share, EBITDA and adjusted EBITDA, net debt and operating cash flow conversion rate. Wabtec defines EBITDA as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is further adjusted for restructuring costs. Wabtec defines operating cash flow conversion as net cash provided by operating activities divided by net income plus depreciation and amortization including deferred debt cost amortization. While Wabtec believes these are useful supplemental measures for investors, they are not presented in accordance with GAAP. Investors should not consider non-GAAP measures in isolation or as a substitute for net income, cash flows from operations, or any other items calculated in accordance with GAAP. In addition, the non-GAAP financial measures included in this presentation have inherent material limitations as performance measures because they add back certain expenses incurred by the Company to GAAP financial measures, resulting in those expenses not being taken into account in the applicable non-GAAP financial measure. Because not all companies use identical calculations, Wabtec’s presentation of non-GAAP financial measures may not be comparable to other similarly titled measures of other companies. Included in this presentation are reconciliation tables that provide details about how adjusted results relate to GAAP results. Wabtec is not presenting a quantitative reconciliation of its forecasted GAAP earnings per diluted share to forecasted adjusted earnings per diluted share as it is unable to predict with reasonable certainty and without unreasonable effort the impact and timing of restructuring-related and other charges, including acquisition-related expenses and the outcome of certain regulatory, legal and tax matters; the financial impact of these items is uncertain and is dependent on various factors, including the timing, and could be material to Wabtec’s Consolidated Statement of Earnings. 2

3 RAFAEL SANTANA President & Chief Executive Officer JOHN OLIN Executive Vice President & Chief Financial Officer KYRA YATES Vice President, Investor Relations Today’s Participants

Wabtec Highlights Very strong financial performance in Q4 and FY 2025 Strong orders, backlog & pipeline momentum moving into 2026 M&A and integration initiatives driving value creation Positive financial outlook for 2026 & Beyond 4

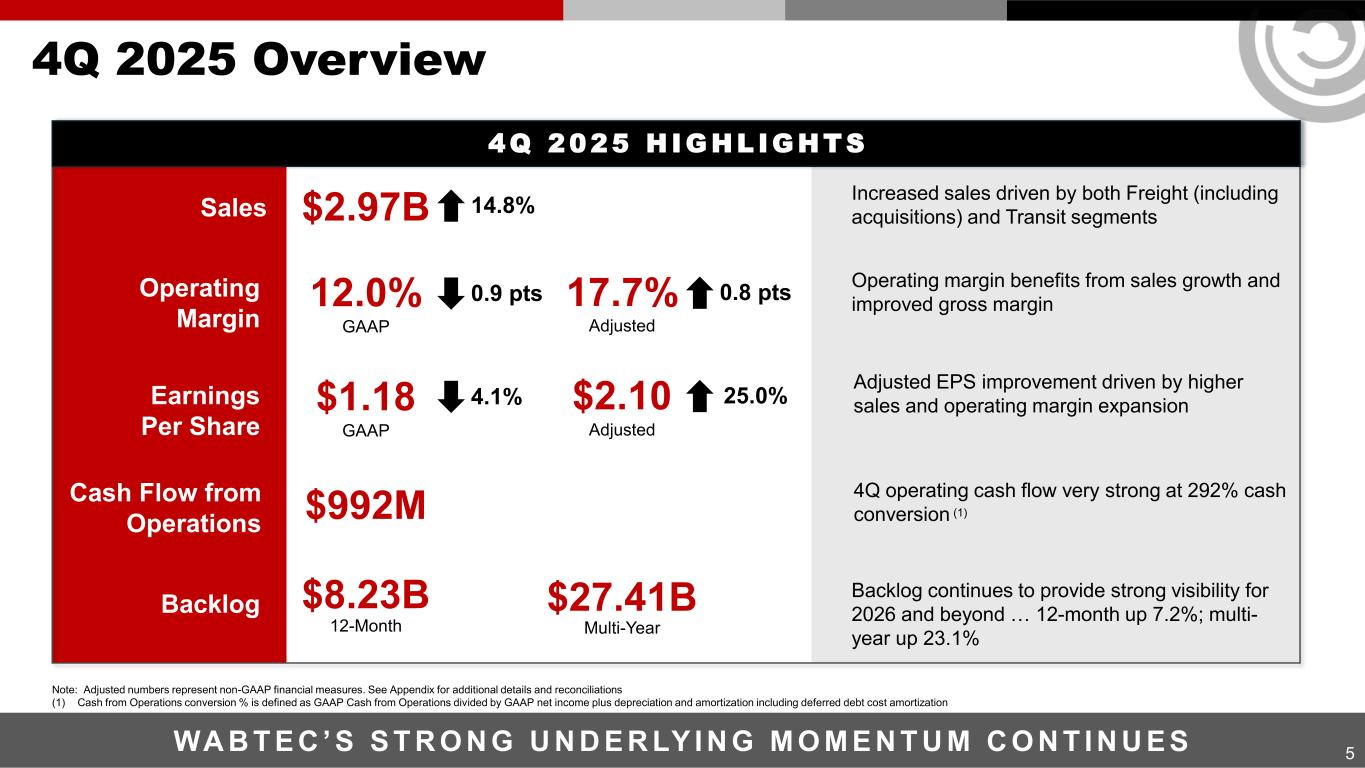

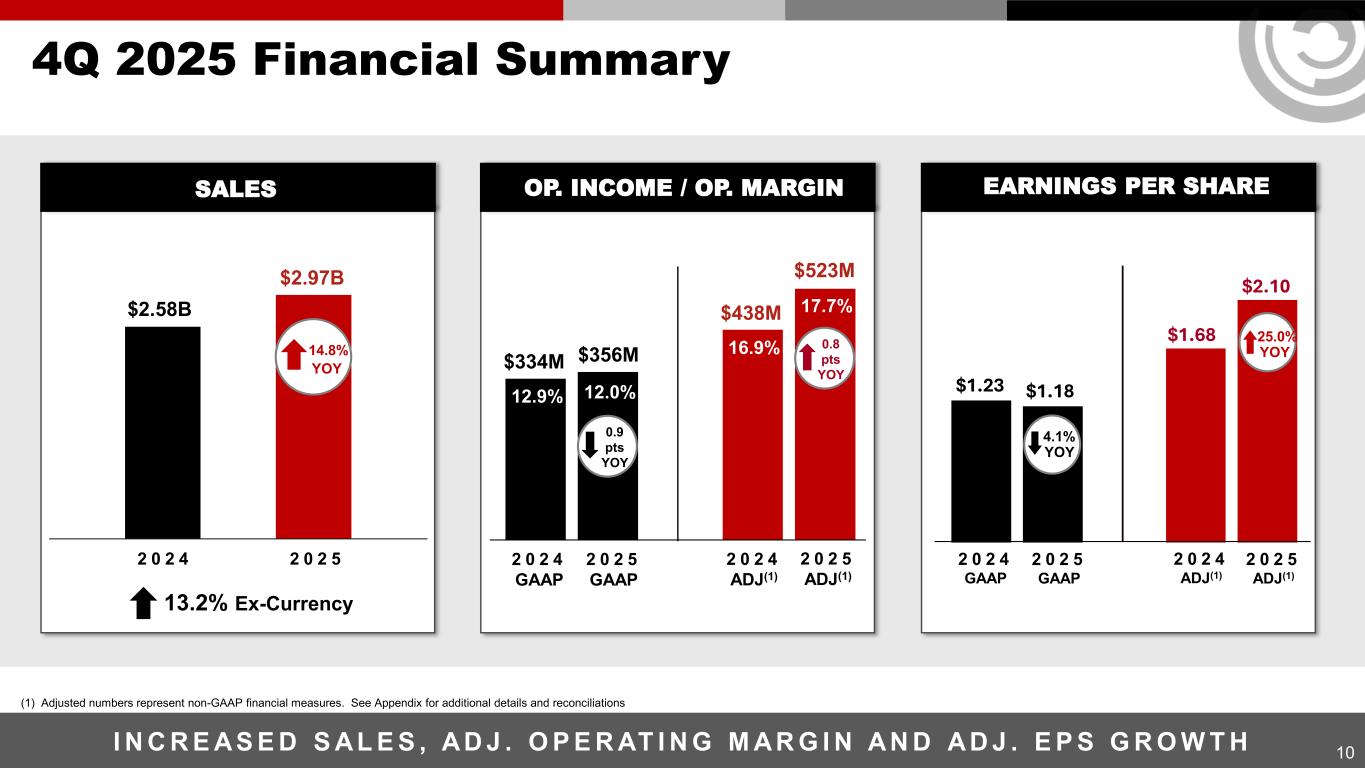

5 4Q 2025 Overview WA B T E C ’ S S T R O N G U N D E R LY I N G M O M E N T U M C O N T I N U E S Sales Increased sales driven by both Freight (including acquisitions) and Transit segments Operating margin benefits from sales growth and improved gross margin Adjusted EPS improvement driven by higher sales and operating margin expansion 4Q operating cash flow very strong at 292% cash conversion (1) Backlog continues to provide strong visibility for 2026 and beyond … 12-month up 7.2%; multi- year up 23.1% Cash Flow from Operations $992M Backlog $8.23B 12-Month Multi-Year $27.41B Operating Margin 12.0% GAAP 0.9 pts 17.7% Adjusted 0.8 pts Earnings Per Share $1.18 GAAP 4.1% $2.10 Adjusted 25.0% $2.97B 14.8% 4Q 2025 H IGHLIGHTS Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization

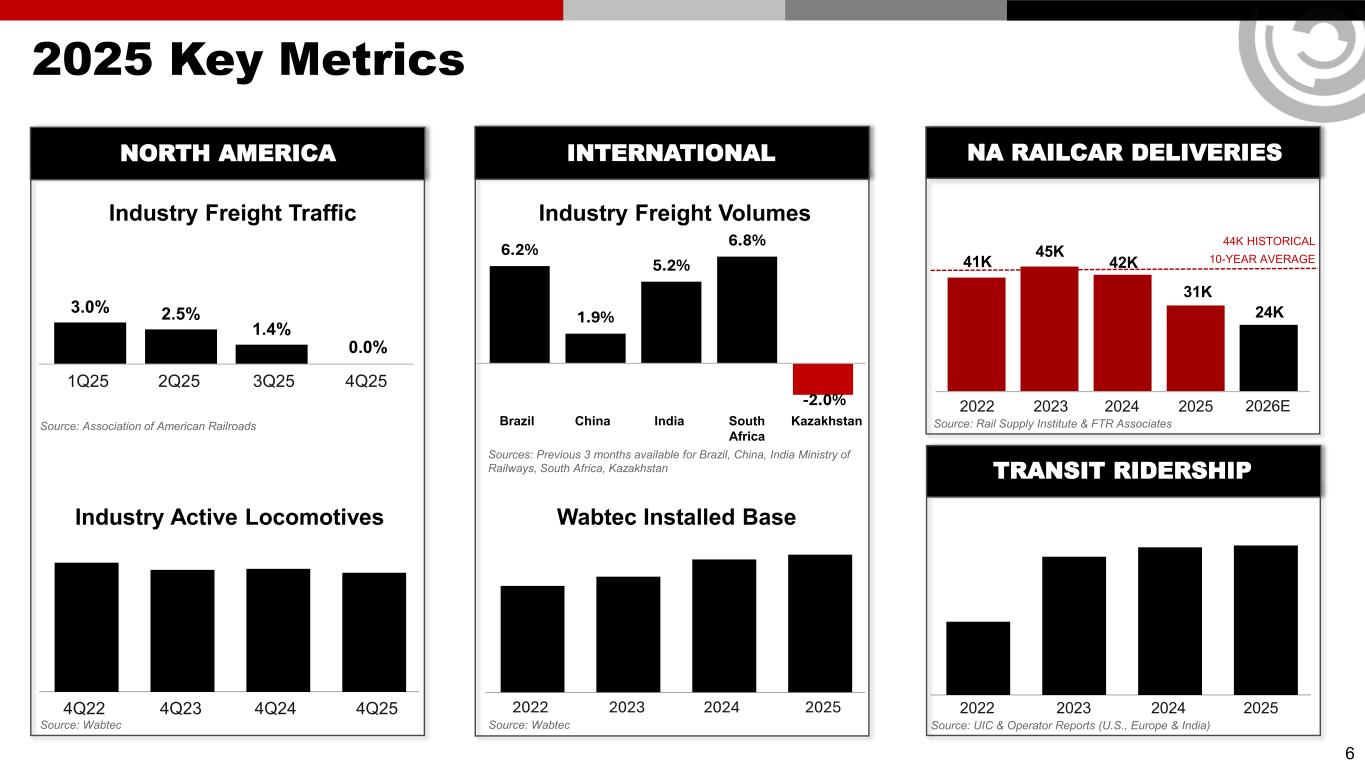

3.0% 2.5% 1.4% 0.0% 6 2025 Key Metrics 1Q25 2Q25 3Q25 4Q25 Industry Active Locomotives 4Q22 4Q23 4Q24 4Q25 Source: Association of American Railroads Source: Wabtec Industry Freight Traffic Source: UIC & Operator Reports (U.S., Europe & India) 2022 2023 2024 2025 6.2% 1.9% 5.2% 6.8% -2.0% Wabtec Installed Base 2022 2023 2024 2025 Industry Freight Volumes Sources: Previous 3 months available for Brazil, China, India Ministry of Railways, South Africa, Kazakhstan Brazil China India South Africa Kazakhstan Source: Wabtec TRANSIT RIDERSHIP NORTH AMERICA INTERNATIONAL NA RAILCAR DELIVERIES Source: Rail Supply Institute & FTR Associates 2022 2023 2024 2025 2026E 41K 45K 42K 31K 44K HISTORICAL 10-YEAR AVERAGE 24K

▪ Secured $2.2 billion in N.A. loco & mods orders - $1.3 billion orders for modernizations - $0.9 billion orders for new locomotives ▪ Digital signed $75 million of orders for PTC & KinetiX in key international markets ▪ First Battery Electric Locomotives delivered to BHP ▪ Completed the acquisition of Frauscher Sensor Technology on December 1st ▪ Closed on the acquisition of Dellner Couplers on February 10th 7 RECENT WINS Accelerate innovation of scalable technologies Grow and refresh expansive global installed base Drive efficiencies through emerging technologies Expand high-margin recurring revenue streams Drive continuous operational improvement Executing On Our Value Creation Framework S T R O N G P I P E L I N E C O N T I N U E S … M U LT I - Y E AR B AC K L O G U P 2 3 % V S P Y

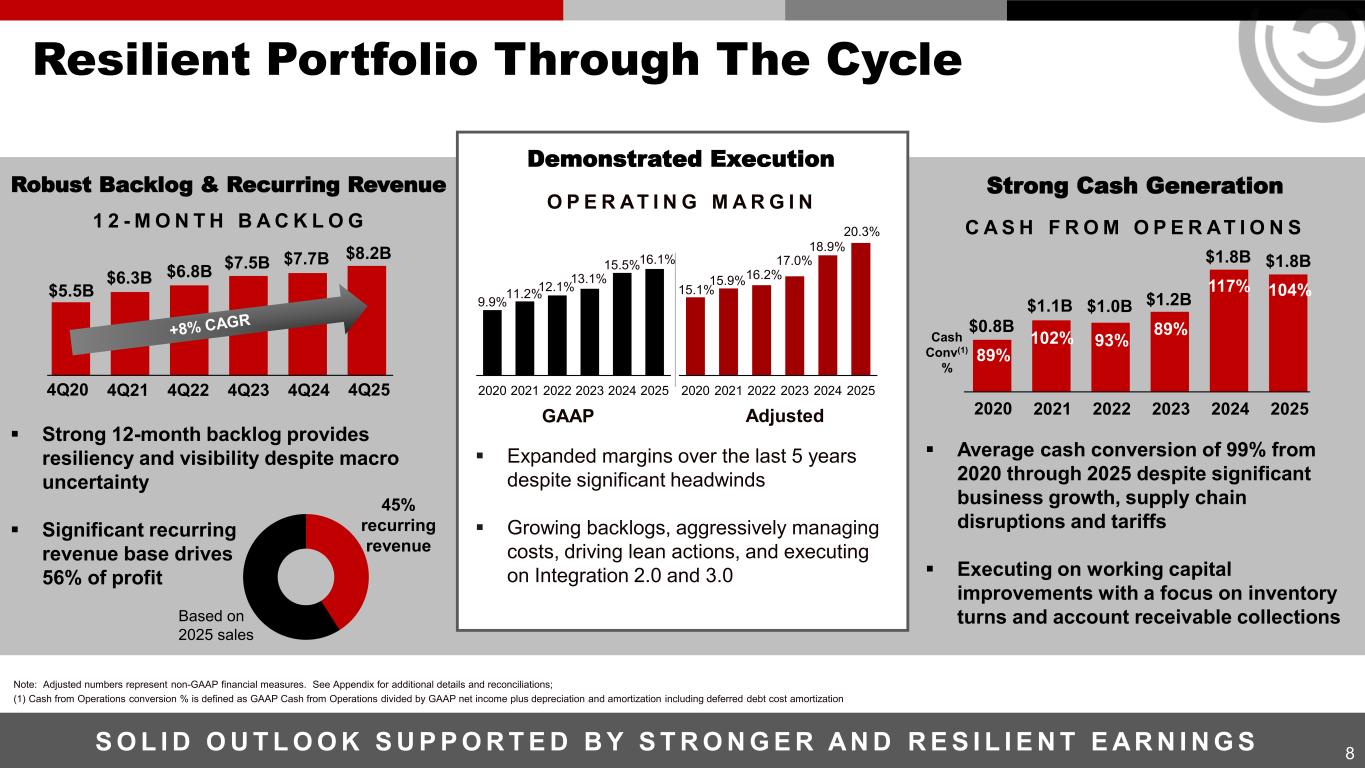

8 Resilient Portfolio Through The Cycle Demonstrated Execution Robust Backlog & Recurring Revenue Strong Cash Generation 2020 2021 2022 2023 2024 20252020 2021 2022 2023 2024 2025 ▪ Expanded margins over the last 5 years despite significant headwinds ▪ Growing backlogs, aggressively managing costs, driving lean actions, and executing on Integration 2.0 and 3.0 16.2% O P E R AT I N G M A R G I N 18.9% 17.0%15.5% 13.1% 12.1% GAAP Adjusted 15.9% 16.1% 20.3% 11.2% ▪ Strong 12-month backlog provides resiliency and visibility despite macro uncertainty ▪ Significant recurring revenue base drives 56% of profit 4Q21 4Q24 $7.7B$7.5B 45% recurring revenue 4Q22 4Q23 $6.8B$6.3B Based on 2025 sales 4Q25 $8.2B S O L I D O U T L O O K S U P P O R T E D B Y S T R O N G E R AN D R E S I L I E N T E AR N I N G S Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations; (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization $1.1B $1.0B $1.2B $1.8B 2021 2022 2023 2024 2025 $1.8B C A S H F R O M O P E R AT I O N S ▪ Average cash conversion of 99% from 2020 through 2025 despite significant business growth, supply chain disruptions and tariffs ▪ Executing on working capital improvements with a focus on inventory turns and account receivable collections 104% 102% 93% 89% 117% Cash Conv(1) % 1 2 - M O N T H B A C K L O G $5.5B 4Q20 $0.8B 89% 2020 15.1% 9.9%

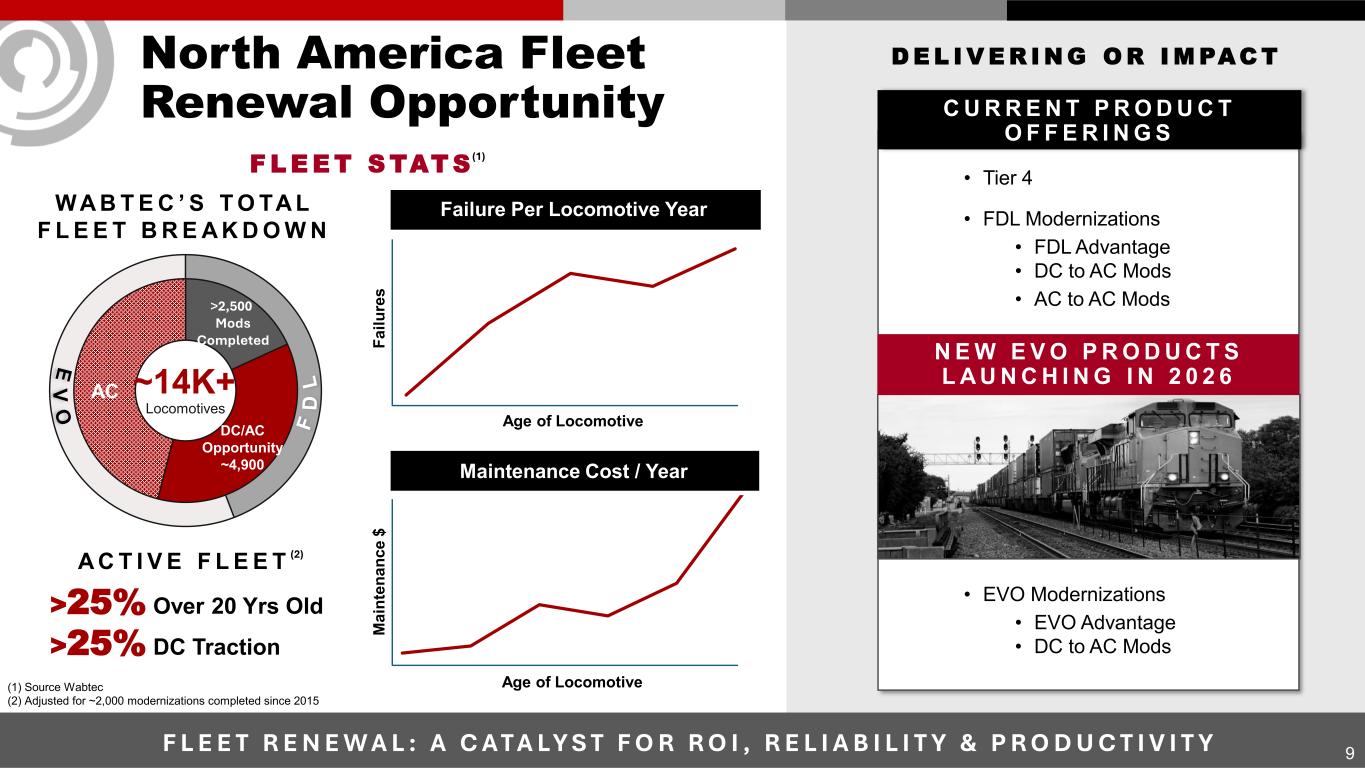

>2,500 Mods Completed ~14K+ Locomotives E V O F D L AC DC/AC Opportunity ~4,900 F L E E T S TAT S C U R R E N T P R O D U C T O F F E R I N G S Failure Per Locomotive Year Maintenance Cost / Year Age of Locomotive Age of Locomotive WA B T E C ’ S T O TA L F L E E T B R E A K D O W N • EVO Modernizations • EVO Advantage • DC to AC Mods N E W E V O P R O D U C T S L A U N C H I N G I N 2 0 2 6 >25% Over 20 Yrs Old >25% DC Traction North America Fleet Renewal Opportunity 9 D E L I V E R I N G O R I M PA C T A C T I V E F L E E T • Tier 4 • FDL Modernizations • FDL Advantage • DC to AC Mods • AC to AC Mods (2) (1) Source Wabtec (2) Adjusted for ~2,000 modernizations completed since 2015 (1) F L E E T R E N E W A L : A C A T A L Y S T F O R R O I , R E L I A B I L I T Y & P R O D U C T I V I T Y M a in te n a n c e $ F a il u re s

$1.23 $1.18 $1.68 $2.10 10 4Q 2025 Financial Summary I N C R E AS E D S AL E S , AD J . O P E R AT I N G M AR G I N AN D AD J . E P S G R O W T H (1) Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations 2 0 2 4 GAAP 2 0 2 5 GAAP 2 0 2 4 ADJ(1) 2 0 2 5 ADJ(1) $334M 12.9% 12.0% $438M 16.9% $523M 17.7% $356M 2 0 2 4 2 0 2 5 2 0 2 4 GAAP 2 0 2 5 GAAP 2 0 2 4 ADJ(1) 2 0 2 5 ADJ(1) $2.97B $2.58B 14.8% YOY 4.1% YOY 25.0% YOY 13.2% Ex-Currency OP. INCOME / OP. MARGIN EARNINGS PER SHARESALES 0.9 pts YOY 0.8 pts YOY

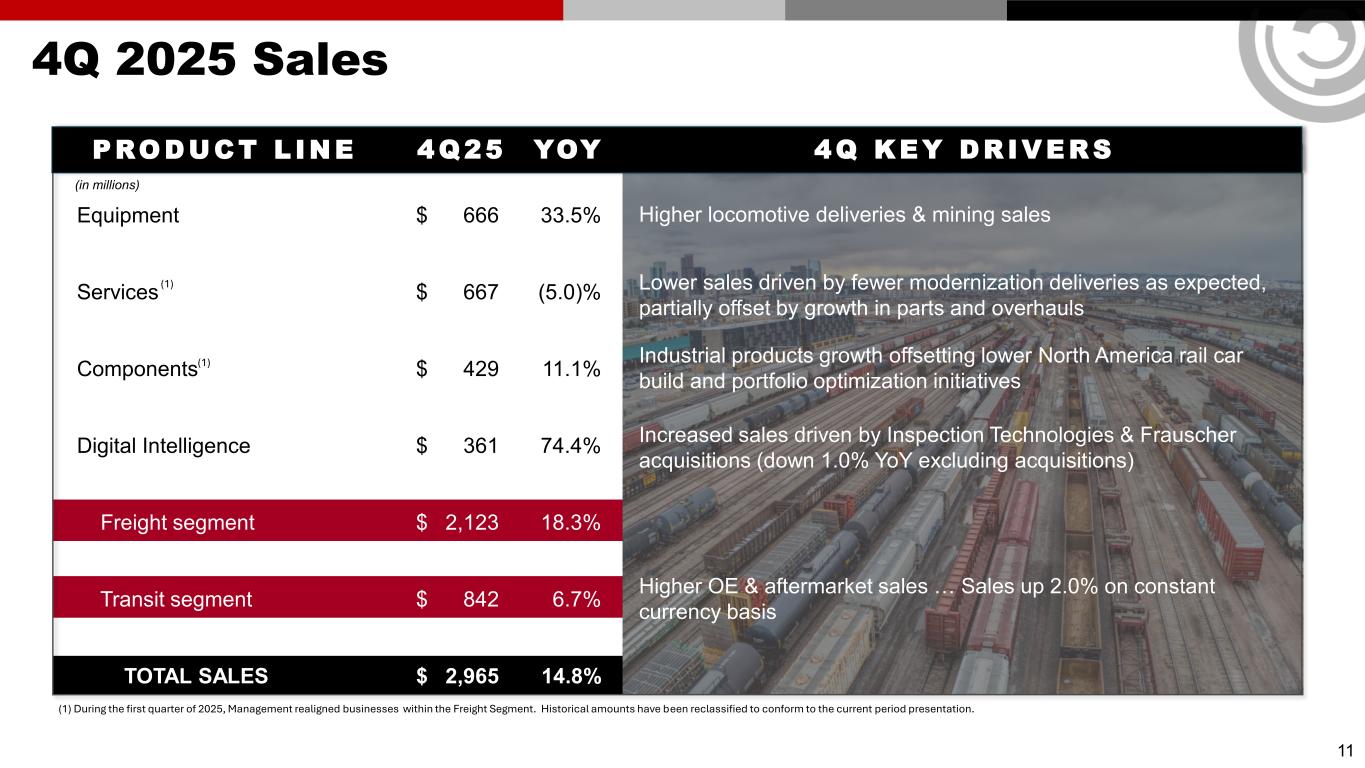

4Q 2025 Sales 11 PROD UC T L INE 4Q25 YOY 4Q KEY D R IV ER S (in millions) Equipment $ 666 33.5% Services $ 667 (5.0)% Components $ 429 11.1% Digital Intelligence $ 361 74.4% Freight segment $ 2,123 18.3% Transit segment $ 842 6.7% TOTAL SALES $ 2,965 14.8% Lower sales driven by fewer modernization deliveries as expected, partially offset by growth in parts and overhauls Higher locomotive deliveries & mining sales Industrial products growth offsetting lower North America rail car build and portfolio optimization initiatives Increased sales driven by Inspection Technologies & Frauscher acquisitions (down 1.0% YoY excluding acquisitions) Higher OE & aftermarket sales … Sales up 2.0% on constant currency basis (1) During the first quarter of 2025, Management realigned businesses within the Freight Segment. Historical amounts have been reclassified to conform to the current period presentation. (1) (1)

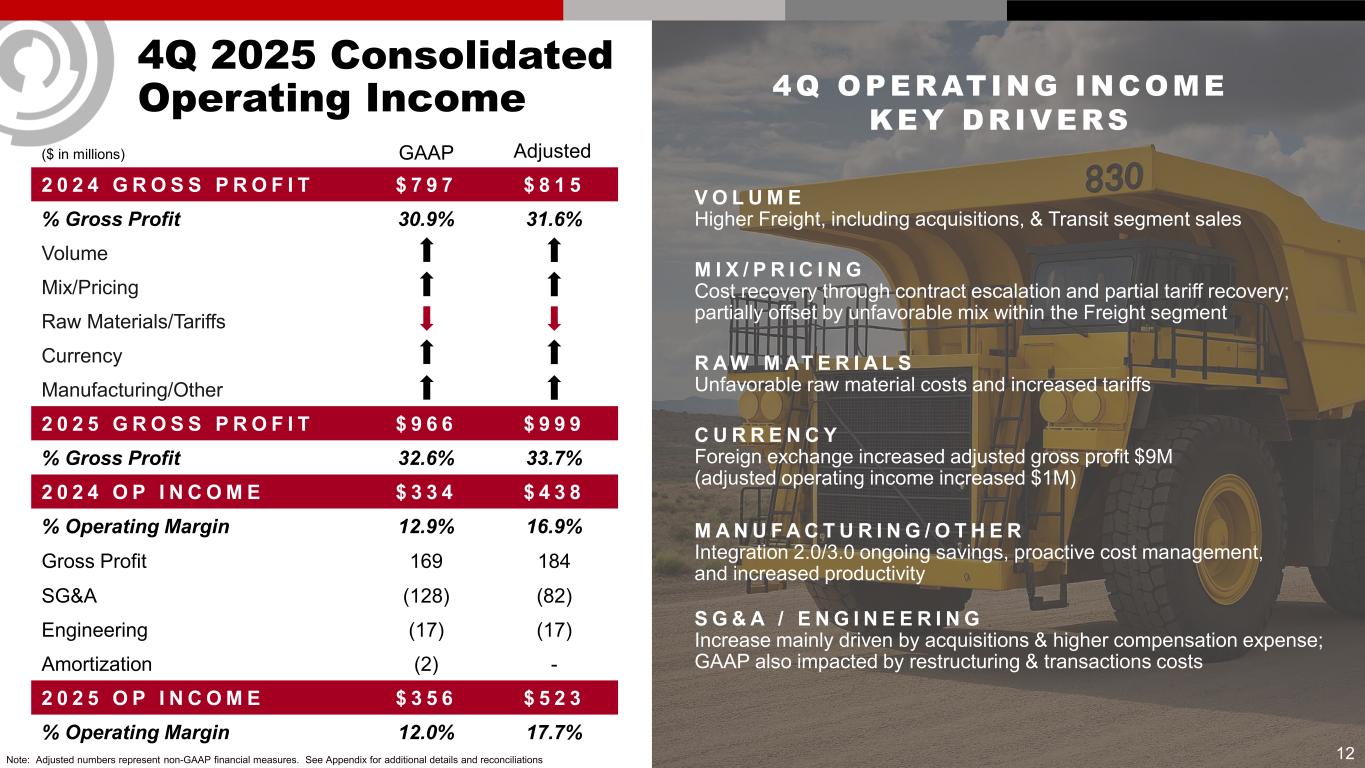

12 4Q 2025 Consolidated Operating Income ($ in millions) 2 0 2 4 G R O S S P R O F I T $ 7 9 7 $ 8 1 5 % Gross Profit 30.9% 31.6% Volume Mix/Pricing Raw Materials/Tariffs Currency Manufacturing/Other 2 0 2 5 G R O S S P R O F I T $ 9 6 6 $ 9 9 9 % Gross Profit 32.6% 33.7% 2 0 2 4 O P I N C O M E $ 3 3 4 $ 4 3 8 % Operating Margin 12.9% 16.9% Gross Profit 169 184 SG&A (128) (82) Engineering (17) (17) Amortization (2) - 2 0 2 5 O P I N C O M E $ 3 5 6 $ 5 2 3 % Operating Margin 12.0% 17.7% GAAP Adjusted Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations V O L U M E Higher Freight, including acquisitions, & Transit segment sales M I X / P R I C I N G Cost recovery through contract escalation and partial tariff recovery; partially offset by unfavorable mix within the Freight segment R AW M AT E R I A L S Unfavorable raw material costs and increased tariffs C U R R E N C Y Foreign exchange increased adjusted gross profit $9M (adjusted operating income increased $1M) M A N U F A C T U R I N G / O T H E R Integration 2.0/3.0 ongoing savings, proactive cost management, and increased productivity S G & A / E N G I N E E R I N G Increase mainly driven by acquisitions & higher compensation expense; GAAP also impacted by restructuring & transactions costs 4Q OPERATING INCOME KEY DRIVERS

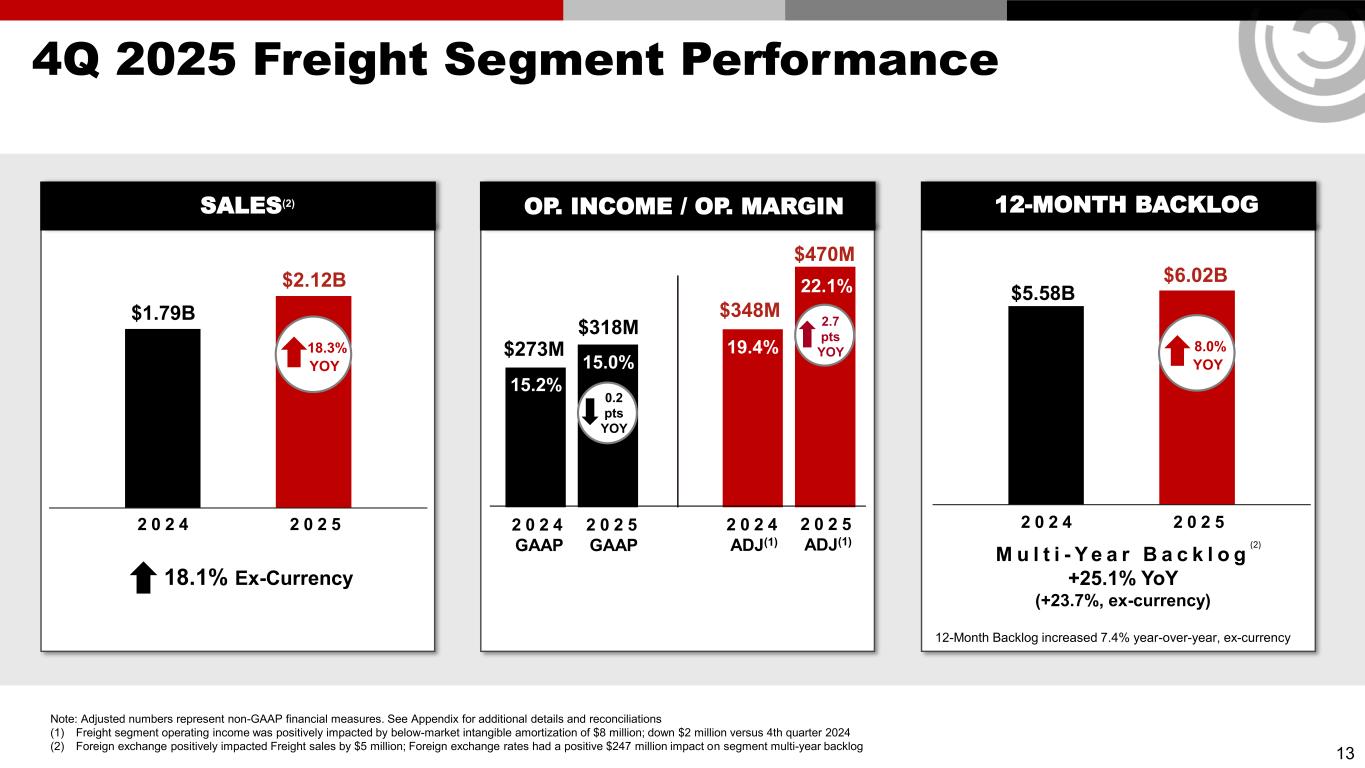

13 4Q 2025 Freight Segment Performance 2 0 2 4 GAAP 2 0 2 5 GAAP 2 0 2 4 ADJ(1) 2 0 2 5 ADJ(1) $273M 15.0% 15.2% $348M 19.4% $470M 22.1% $318M 2 0 2 4 2 0 2 5 $2.12B $1.79B 18.3% YOY 2 0 2 4 2 0 2 5 $6.02B $5.58B 8.0% YOY Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (1) Freight segment operating income was positively impacted by below-market intangible amortization of $8 million; down $2 million versus 4th quarter 2024 (2) Foreign exchange positively impacted Freight sales by $5 million; Foreign exchange rates had a positive $247 million impact on segment multi-year backlog 12-Month Backlog increased 7.4% year-over-year, ex-currency M u l t i - Y e a r B a c k l o g +25.1% YoY (+23.7%, ex-currency) 18.1% Ex-Currency OP. INCOME / OP. MARGIN 12-MONTH BACKLOGSALES(2) 0.2 pts YOY 2.7 pts YOY (2)

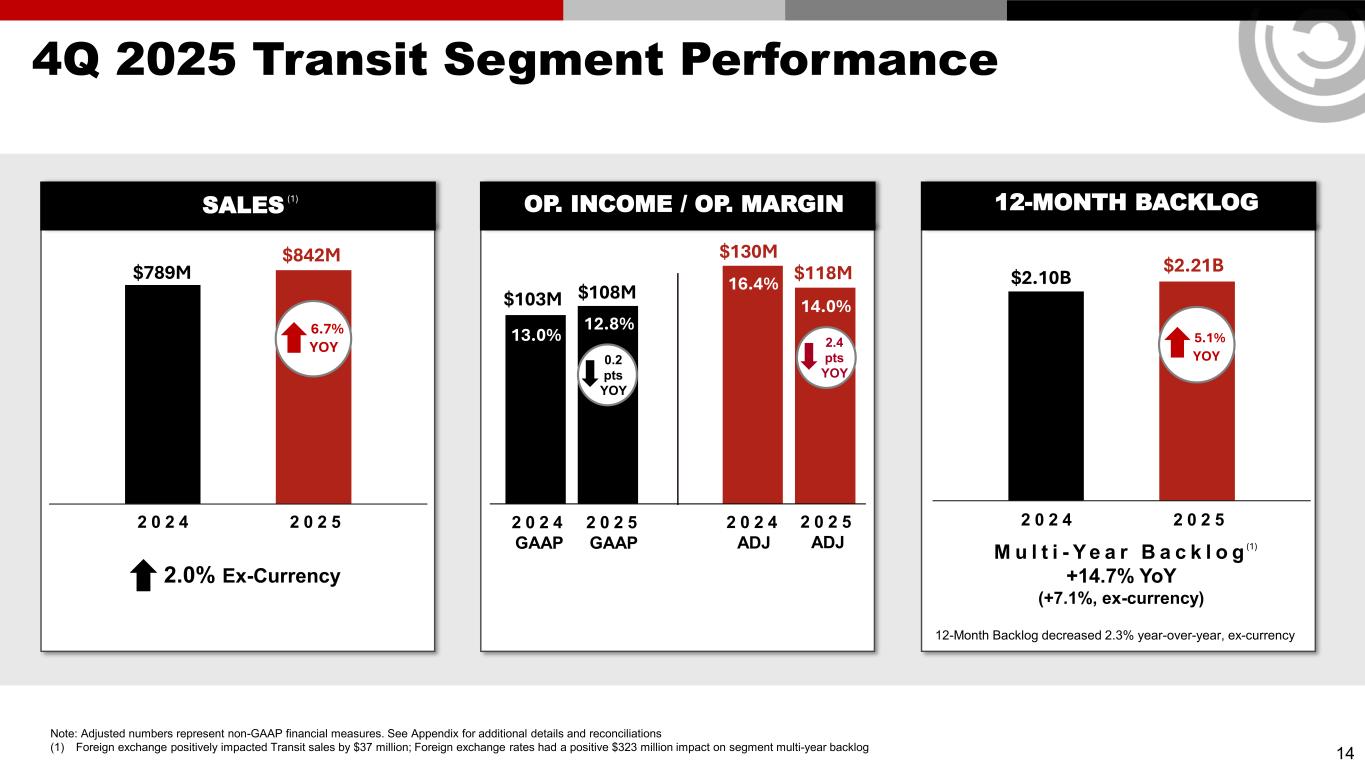

14 4Q 2025 Transit Segment Performance 2 0 2 4 GAAP 2 0 2 5 GAAP 2 0 2 4 ADJ 2 0 2 5 ADJ 2 0 2 4 2 0 2 5 2 0 2 4 2 0 2 5 12-Month Backlog decreased 2.3% year-over-year, ex-currency M u l t i - Y e a r B a c k l o g +14.7% YoY (+7.1%, ex-currency) 2.0% Ex-Currency OP. INCOME / OP. MARGIN 12-MONTH BACKLOGSALES $103M 13.0% 12.8% $130M 16.4% $118M 14.0% $108M $842M $789M 6.7% YOY $2.21B $2.10B 5.1% YOY Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (1) Foreign exchange positively impacted Transit sales by $37 million; Foreign exchange rates had a positive $323 million impact on segment multi-year backlog 0.2 pts YOY 2.4 pts YOY (1) (1)

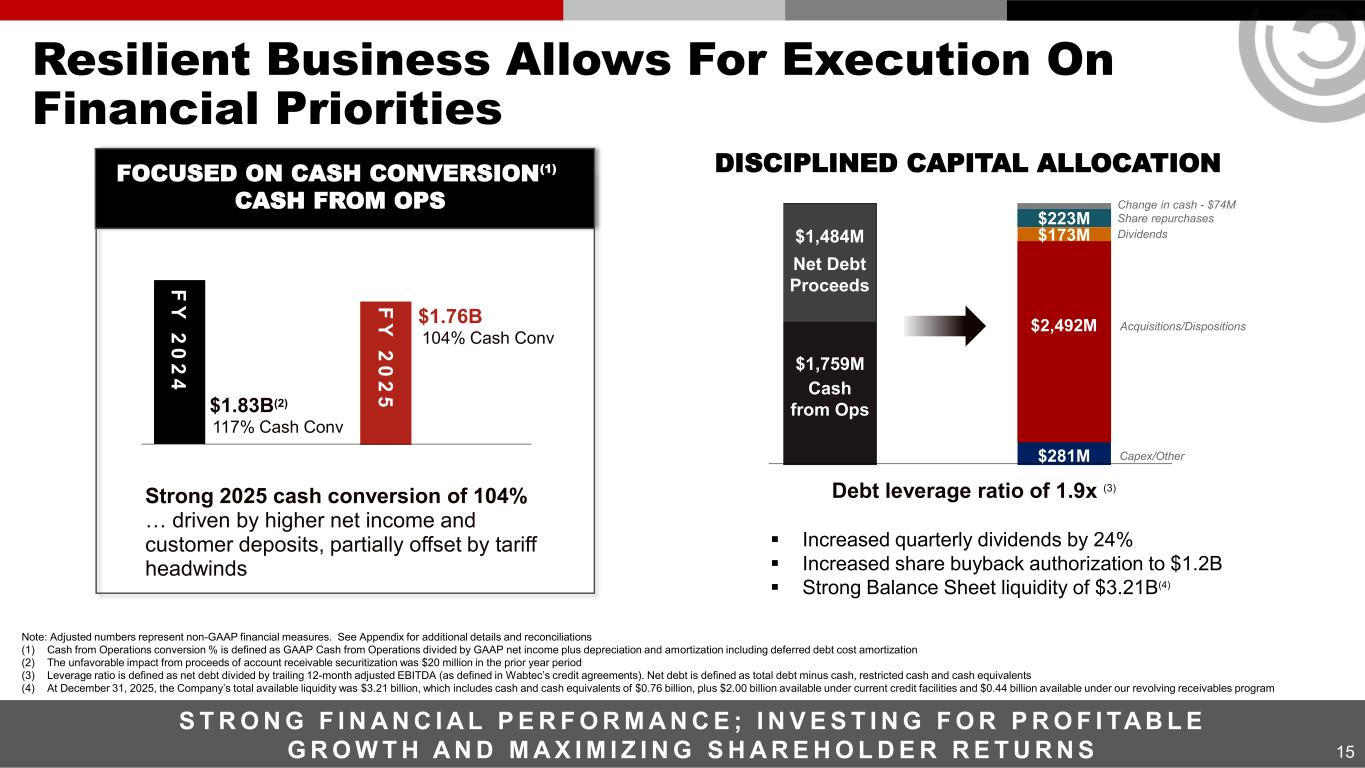

15 Resilient Business Allows For Execution On Financial Priorities S T R O N G F I N A N C I A L P E R F O R M A N C E ; I N V E S T I N G F O R P R O F I TA B L E G R O W T H A N D M A X I M I Z I N G S H A R E H O L D E R R E T U R N S Strong 2025 cash conversion of 104% … driven by higher net income and customer deposits, partially offset by tariff headwinds 117% Cash Conv $1.83B(2) $1.76B F Y 2 0 2 5 104% Cash Conv F Y 2 0 2 4 Debt leverage ratio of 1.9x (3) FOCUSED ON CASH CONVERSION(1) CASH FROM OPS DISCIPLINED CAPITAL ALLOCATION $1,759M Cash from Ops $2,492M Capex/Other Dividends$173M $281M $223M $1,484M Net Debt Proceeds Acquisitions/Dispositions Share repurchases ▪ Increased quarterly dividends by 24% ▪ Increased share buyback authorization to $1.2B ▪ Strong Balance Sheet liquidity of $3.21B(4) Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization (2) The unfavorable impact from proceeds of account receivable securitization was $20 million in the prior year period (3) Leverage ratio is defined as net debt divided by trailing 12-month adjusted EBITDA (as defined in Wabtec’s credit agreements). Net debt is defined as total debt minus cash, restricted cash and cash equivalents (4) At December 31, 2025, the Company’s total available liquidity was $3.21 billion, which includes cash and cash equivalents of $0.76 billion, plus $2.00 billion available under current credit facilities and $0.44 billion available under our revolving receivables program Change in cash - $74M

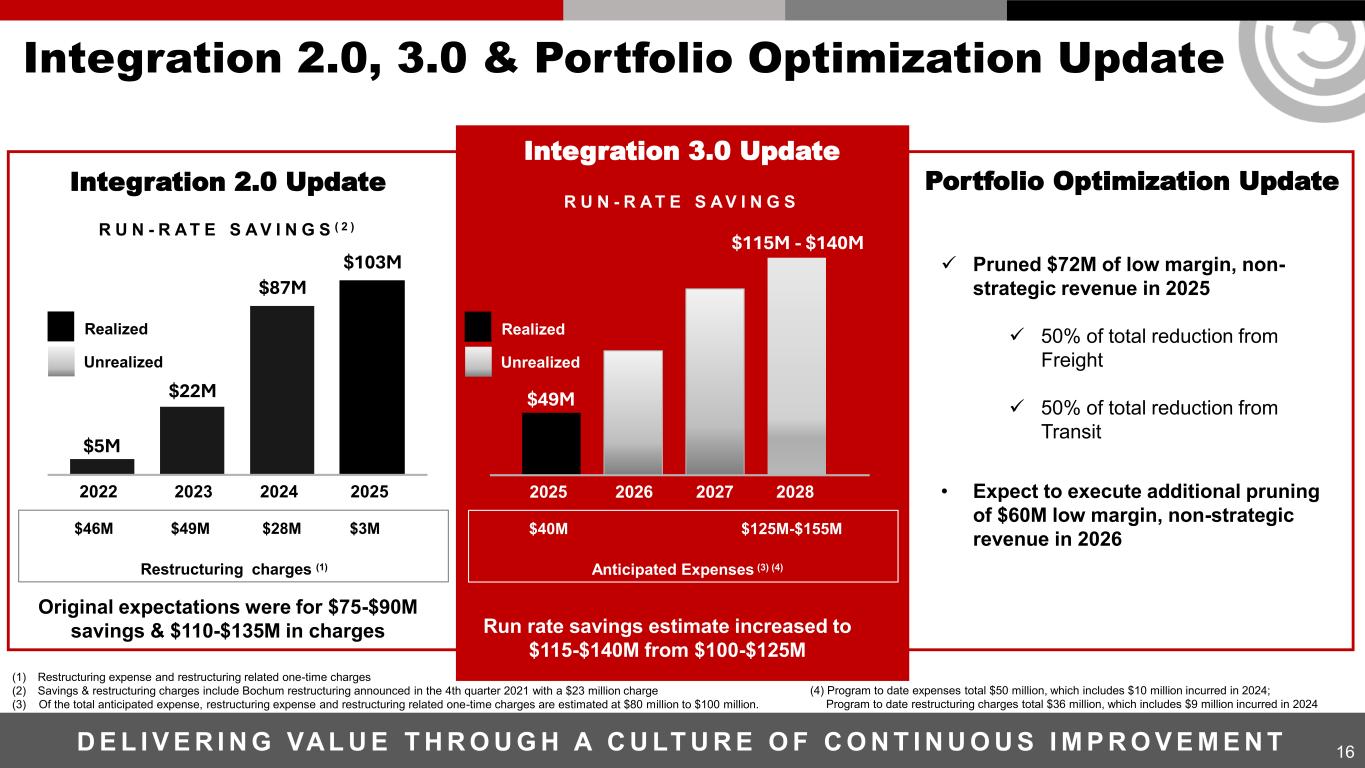

16 Integration 2.0, 3.0 & Portfolio Optimization Update Integration 2.0 Update Integration 3.0 Update $5M R U N - R A T E S A V I N G S ( 2 ) Unrealized Restructuring charges (1) $46M $3M $22M $49M $87M $28M $103M Realized Original expectations were for $75-$90M savings & $110-$135M in charges (1) Restructuring expense and restructuring related one-time charges (2) Savings & restructuring charges include Bochum restructuring announced in the 4th quarter 2021 with a $23 million charge (3) Of the total anticipated expense, restructuring expense and restructuring related one-time charges are estimated at $80 million to $100 million. 2022 2023 2024 2025 $49M R U N - R A T E S A V I N G S Unrealized Anticipated Expenses (3) (4) $40M $125M-$155M $115M - $140M Realized Run rate savings estimate increased to $115-$140M from $100-$125M 2025 2026 2027 2028 Portfolio Optimization Update ✓ Pruned $72M of low margin, non- strategic revenue in 2025 ✓ 50% of total reduction from Freight ✓ 50% of total reduction from Transit • Expect to execute additional pruning of $60M low margin, non-strategic revenue in 2026 D E L I V E R I N G VAL U E T H R O U G H A C U LT U R E O F C O N T I N U O U S I M P R O V E M E N T (4) Program to date expenses total $50 million, which includes $10 million incurred in 2024; Program to date restructuring charges total $36 million, which includes $9 million incurred in 2024

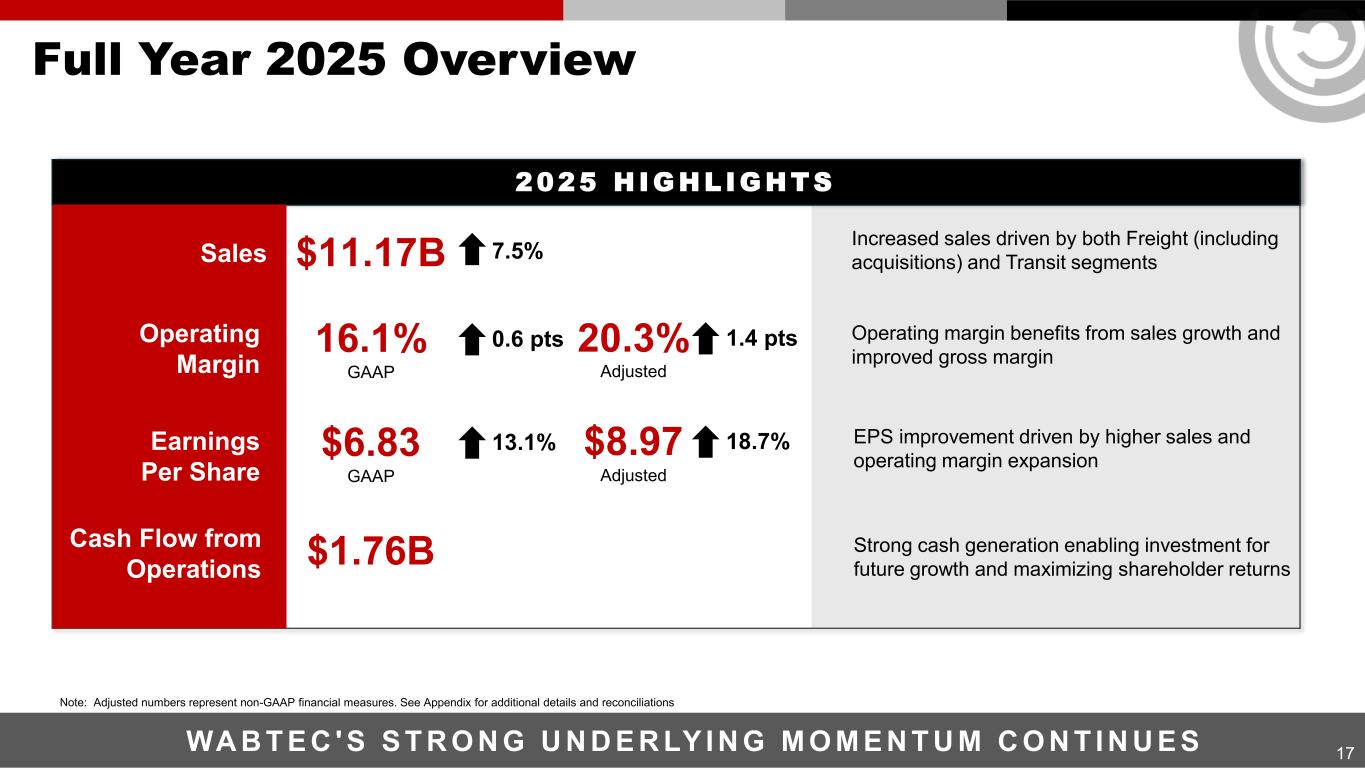

17 Full Year 2025 Overview WA B T E C ' S S T R O N G U N D E R LY I N G M O M E N T U M C O N T I N U E S Sales Increased sales driven by both Freight (including acquisitions) and Transit segments Operating margin benefits from sales growth and improved gross margin EPS improvement driven by higher sales and operating margin expansion Strong cash generation enabling investment for future growth and maximizing shareholder returns Cash Flow from Operations $1.76B Operating Margin 16.1% GAAP 0.6 pts 20.3% Adjusted 1.4 pts Earnings Per Share $6.83 GAAP 13.1% $8.97 Adjusted 18.7% $11.17B 7.5% 2025 H IGHLIGHTS Note: Adjusted numbers represent non-GAAP financial measures. See Appendix for additional details and reconciliations

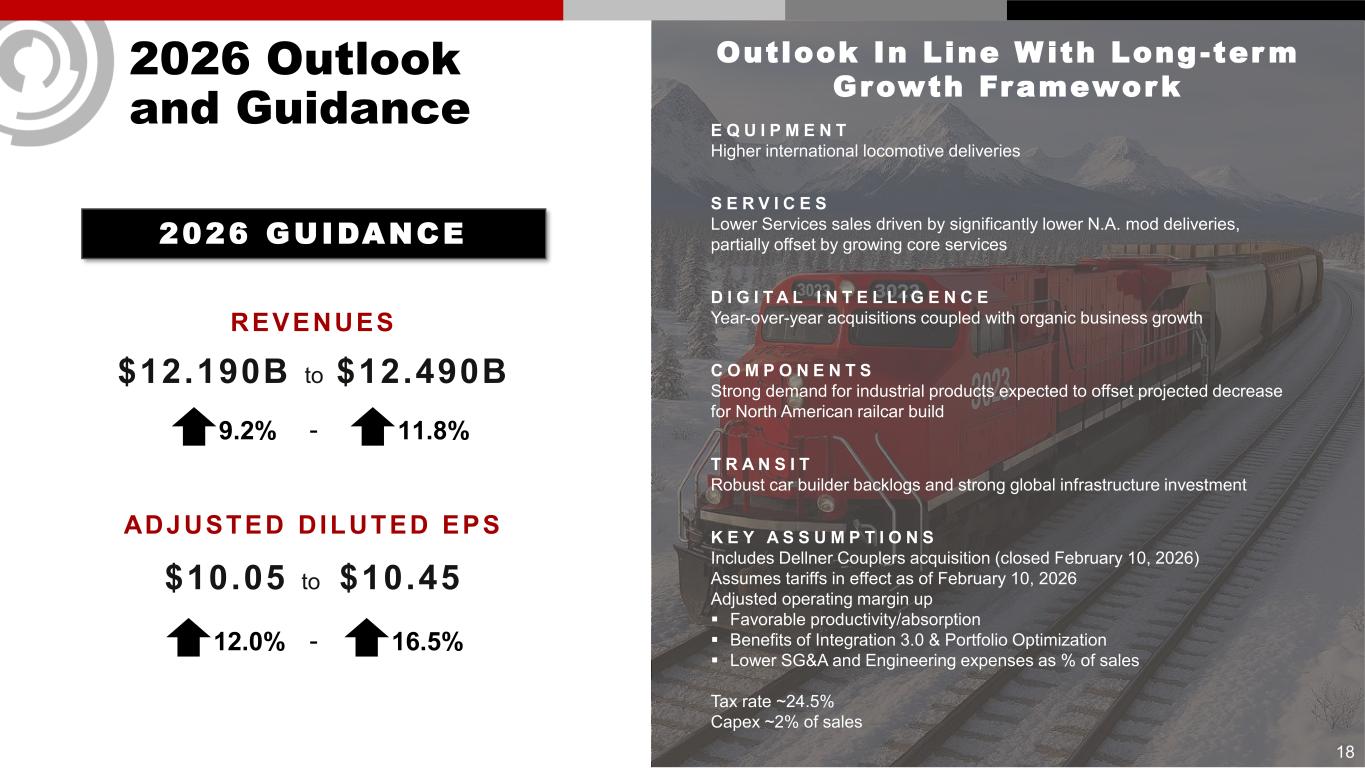

2026 Outlook and Guidance 2026 GUIDANCE REVENUES $12.190B to $12.490B ADJUSTED DILUTED EPS $10.05 to $10.45 9.2% 11.8% 12.0% 16.5%- - Outlook In Line With Long-term Growth Framework E Q U I P M E N T Higher international locomotive deliveries C O M P O N E N T S Strong demand for industrial products expected to offset projected decrease for North American railcar build S E R V I C E S Lower Services sales driven by significantly lower N.A. mod deliveries, partially offset by growing core services D I G I T A L I N T E L L I G E N C E Year-over-year acquisitions coupled with organic business growth T R A N S I T Robust car builder backlogs and strong global infrastructure investment K E Y A S S U M P T I O N S Includes Dellner Couplers acquisition (closed February 10, 2026) Assumes tariffs in effect as of February 10, 2026 Adjusted operating margin up ▪ Favorable productivity/absorption ▪ Benefits of Integration 3.0 & Portfolio Optimization ▪ Lower SG&A and Engineering expenses as % of sales Tax rate ~24.5% Capex ~2% of sales 18

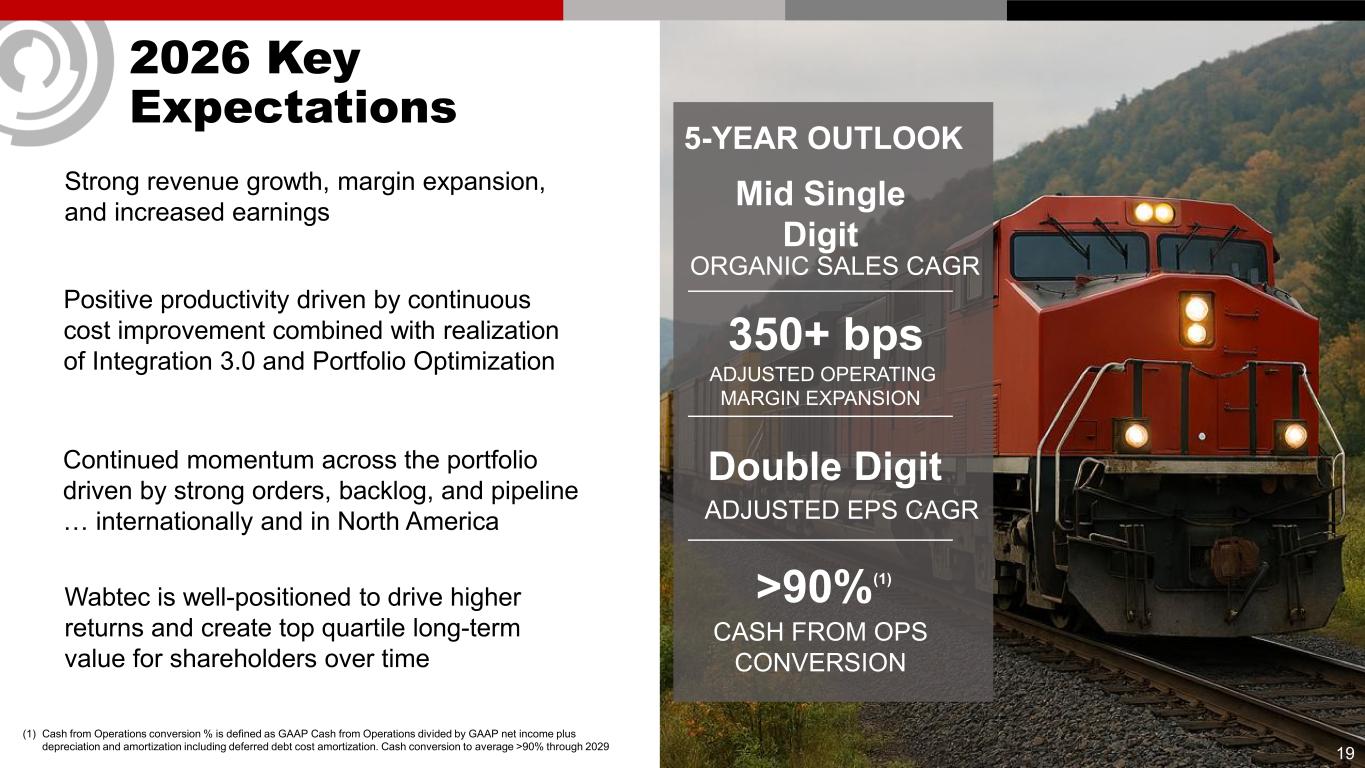

19 2026 Key Expectations Continued momentum across the portfolio driven by strong orders, backlog, and pipeline … internationally and in North America Positive productivity driven by continuous cost improvement combined with realization of Integration 3.0 and Portfolio Optimization Wabtec is well-positioned to drive higher returns and create top quartile long-term value for shareholders over time Strong revenue growth, margin expansion, and increased earnings 5-YEAR OUTLOOK Mid Single Digit ORGANIC SALES CAGR Double Digit ADJUSTED EPS CAGR >90%(1) CASH FROM OPS CONVERSION 350+ bps ADJUSTED OPERATING MARGIN EXPANSION (1) Cash from Operations conversion % is defined as GAAP Cash from Operations divided by GAAP net income plus depreciation and amortization including deferred debt cost amortization. Cash conversion to average >90% through 2029

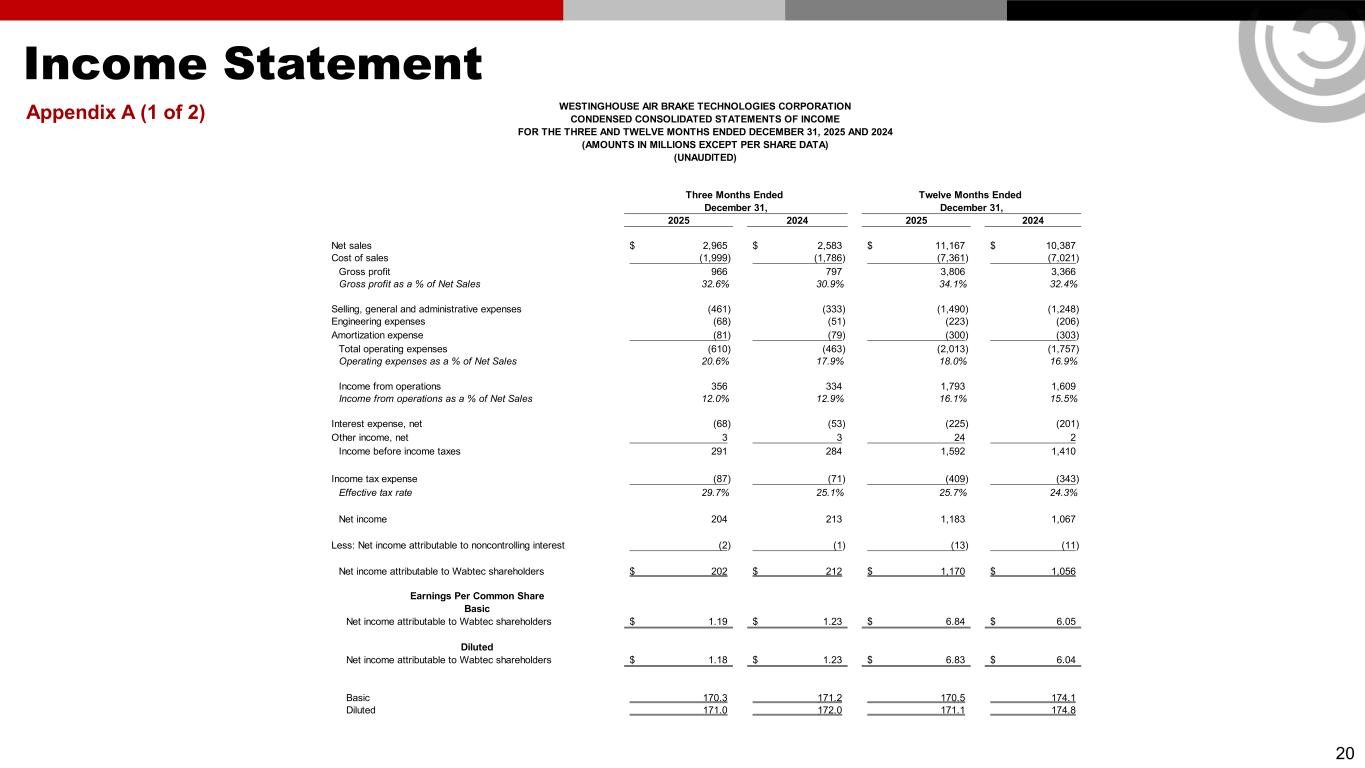

Income Statement Appendix A (1 of 2) 20 2025 2024 2025 2024 Net sales 2,965$ 2,583$ 11,167$ 10,387$ Cost of sales (1,999) (1,786) (7,361) (7,021) Gross profit 966 797 3,806 3,366 Gross profit as a % of Net Sales 32.6% 30.9% 34.1% 32.4% Selling, general and administrative expenses (461) (333) (1,490) (1,248) Engineering expenses (68) (51) (223) (206) Amortization expense (81) (79) (300) (303) Total operating expenses (610) (463) (2,013) (1,757) Operating expenses as a % of Net Sales 20.6% 17.9% 18.0% 16.9% Income from operations 356 334 1,793 1,609 Income from operations as a % of Net Sales 12.0% 12.9% 16.1% 15.5% Interest expense, net (68) (53) (225) (201) Other income, net 3 3 24 2 Income before income taxes 291 284 1,592 1,410 Income tax expense (87) (71) (409) (343) Effective tax rate 29.7% 25.1% 25.7% 24.3% Net income 204 213 1,183 1,067 Less: Net income attributable to noncontrolling interest (2) (1) (13) (11) Net income attributable to Wabtec shareholders 202$ 212$ 1,170$ 1,056$ Earnings Per Common Share Basic Net income attributable to Wabtec shareholders 1.19$ 1.23$ 6.84$ 6.05$ Diluted Net income attributable to Wabtec shareholders 1.18$ 1.23$ 6.83$ 6.04$ Basic 170.3 171.2 170.5 174.1 Diluted 171.0 172.0 171.1 174.8 December 31, December 31, Three Months Ended Twelve Months Ended WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2025 AND 2024 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED)

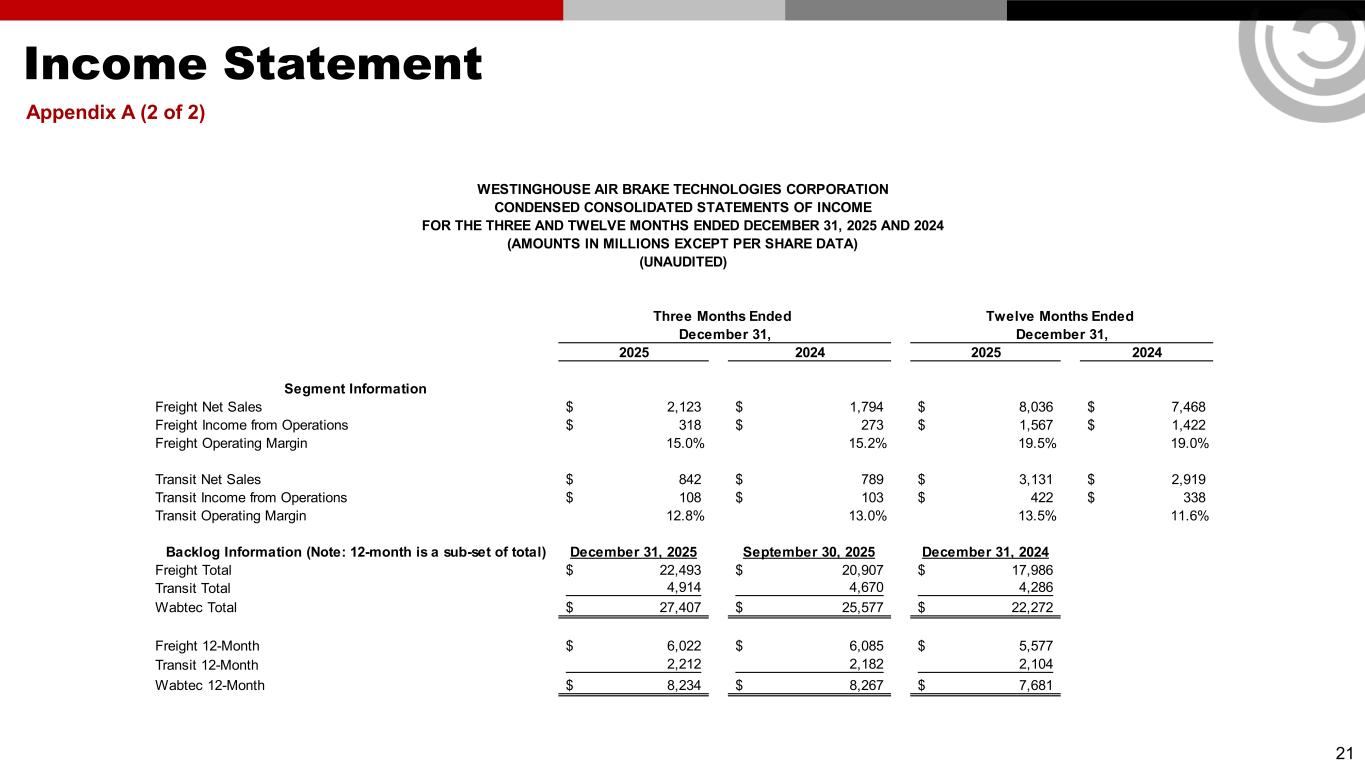

Income Statement Appendix A (2 of 2) 21 2025 2024 2025 2024 Segment Information Freight Net Sales 2,123$ 1,794$ 8,036$ 7,468$ Freight Income from Operations 318$ 273$ 1,567$ 1,422$ Freight Operating Margin 15.0% 15.2% 19.5% 19.0% Transit Net Sales 842$ 789$ 3,131$ 2,919$ Transit Income from Operations 108$ 103$ 422$ 338$ Transit Operating Margin 12.8% 13.0% 13.5% 11.6% Backlog Information (Note: 12-month is a sub-set of total) December 31, 2025 September 30, 2025 December 31, 2024 Freight Total 22,493$ 20,907$ 17,986$ Transit Total 4,914 4,670 4,286 Wabtec Total 27,407$ 25,577$ 22,272$ Freight 12-Month 6,022$ 6,085$ 5,577$ Transit 12-Month 2,212 2,182 2,104 Wabtec 12-Month 8,234$ 8,267$ 7,681$ December 31, December 31, Three Months Ended Twelve Months Ended WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF INCOME FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2025 AND 2024 (AMOUNTS IN MILLIONS EXCEPT PER SHARE DATA) (UNAUDITED)

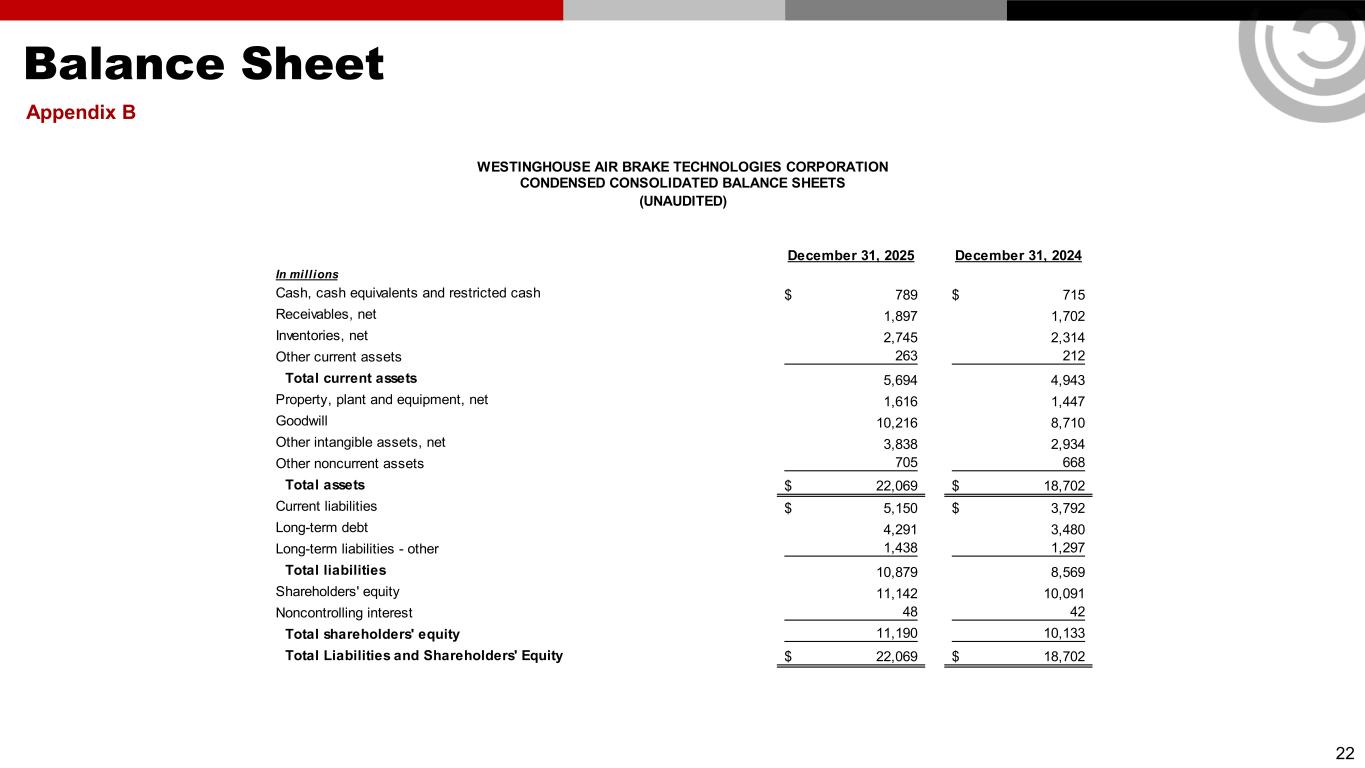

Balance Sheet Appendix B 22 December 31, 2025 December 31, 2024 In millions Cash, cash equivalents and restricted cash 789$ 715$ Receivables, net 1,897 1,702 Inventories, net 2,745 2,314 Other current assets 263 212 Total current assets 5,694 4,943 Property, plant and equipment, net 1,616 1,447 Goodwill 10,216 8,710 Other intangible assets, net 3,838 2,934 Other noncurrent assets 705 668 Total assets 22,069$ 18,702$ Current liabilities 5,150$ 3,792$ Long-term debt 4,291 3,480 Long-term liabilities - other 1,438 1,297 Total liabilities 10,879 8,569 Shareholders' equity 11,142 10,091 Noncontrolling interest 48 42 Total shareholders' equity 11,190 10,133 Total Liabilities and Shareholders' Equity 22,069$ 18,702$ WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

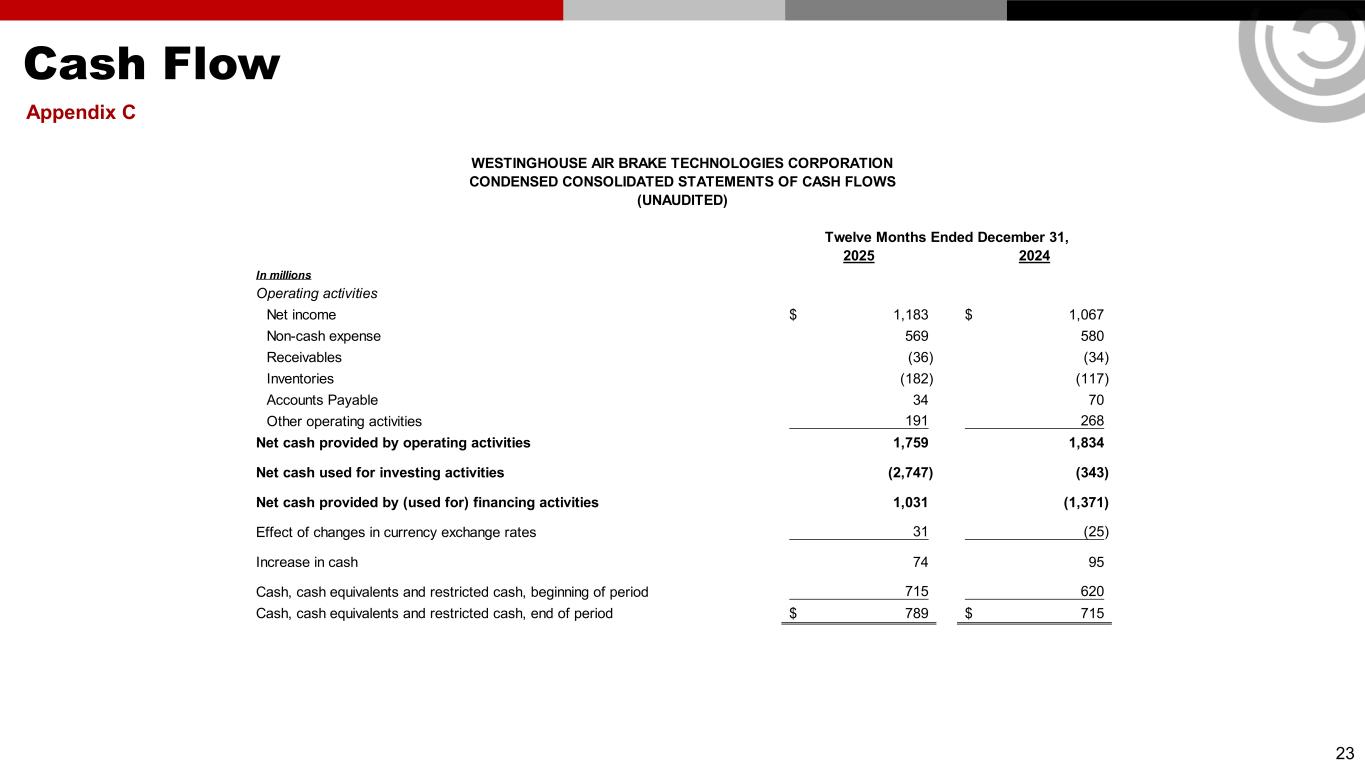

Cash Flow Appendix C 23 2025 2024 In millions Operating activities Net income 1,183$ 1,067$ Non-cash expense 569 580 Receivables (36) (34) Inventories (182) (117) Accounts Payable 34 70 Other operating activities 191 268 Net cash provided by operating activities 1,759 1,834 Net cash used for investing activities (2,747) (343) Net cash provided by (used for) financing activities 1,031 (1,371) Effect of changes in currency exchange rates 31 (25) Increase in cash 74 95 Cash, cash equivalents and restricted cash, beginning of period 715 620 Cash, cash equivalents and restricted cash, end of period 789$ 715$ WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Twelve Months Ended December 31,

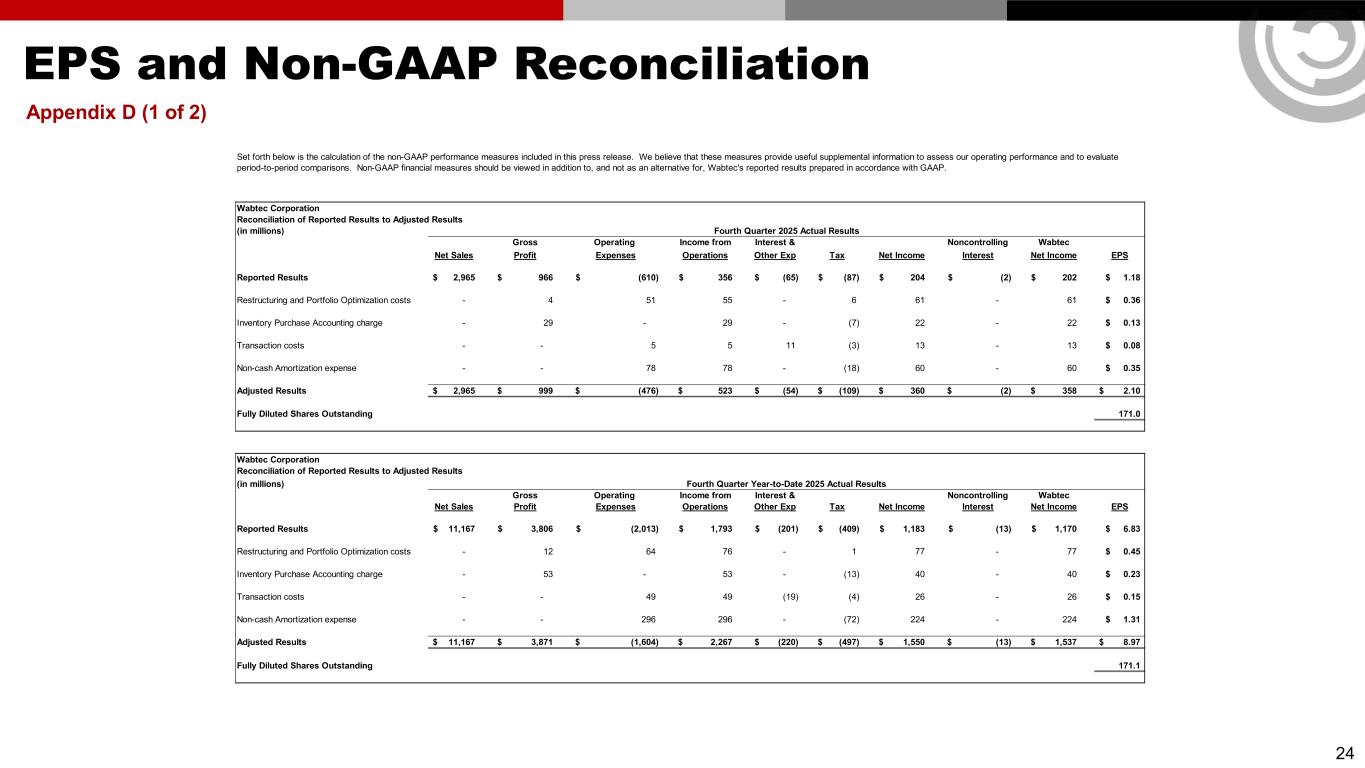

EPS and Non-GAAP Reconciliation Appendix D (1 of 2) 24 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,965$ 966$ (610)$ 356$ (65)$ (87)$ 204$ (2)$ 202$ 1.18$ Restructuring and Portfolio Optimization costs - 4 51 55 - 6 61 - 61 0.36$ Inventory Purchase Accounting charge - 29 - 29 - (7) 22 - 22 0.13$ Transaction costs - - 5 5 11 (3) 13 - 13 0.08$ Non-cash Amortization expense - - 78 78 - (18) 60 - 60 0.35$ Adjusted Results 2,965$ 999$ (476)$ 523$ (54)$ (109)$ 360$ (2)$ 358$ 2.10$ Fully Diluted Shares Outstanding 171.0 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 11,167$ 3,806$ (2,013)$ 1,793$ (201)$ (409)$ 1,183$ (13)$ 1,170$ 6.83$ Restructuring and Portfolio Optimization costs - 12 64 76 - 1 77 - 77 0.45$ Inventory Purchase Accounting charge - 53 - 53 - (13) 40 - 40 0.23$ Transaction costs - - 49 49 (19) (4) 26 - 26 0.15$ Non-cash Amortization expense - - 296 296 - (72) 224 - 224 1.31$ Adjusted Results 11,167$ 3,871$ (1,604)$ 2,267$ (220)$ (497)$ 1,550$ (13)$ 1,537$ 8.97$ Fully Diluted Shares Outstanding 171.1 Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Fourth Quarter 2025 Actual Results Fourth Quarter Year-to-Date 2025 Actual Results

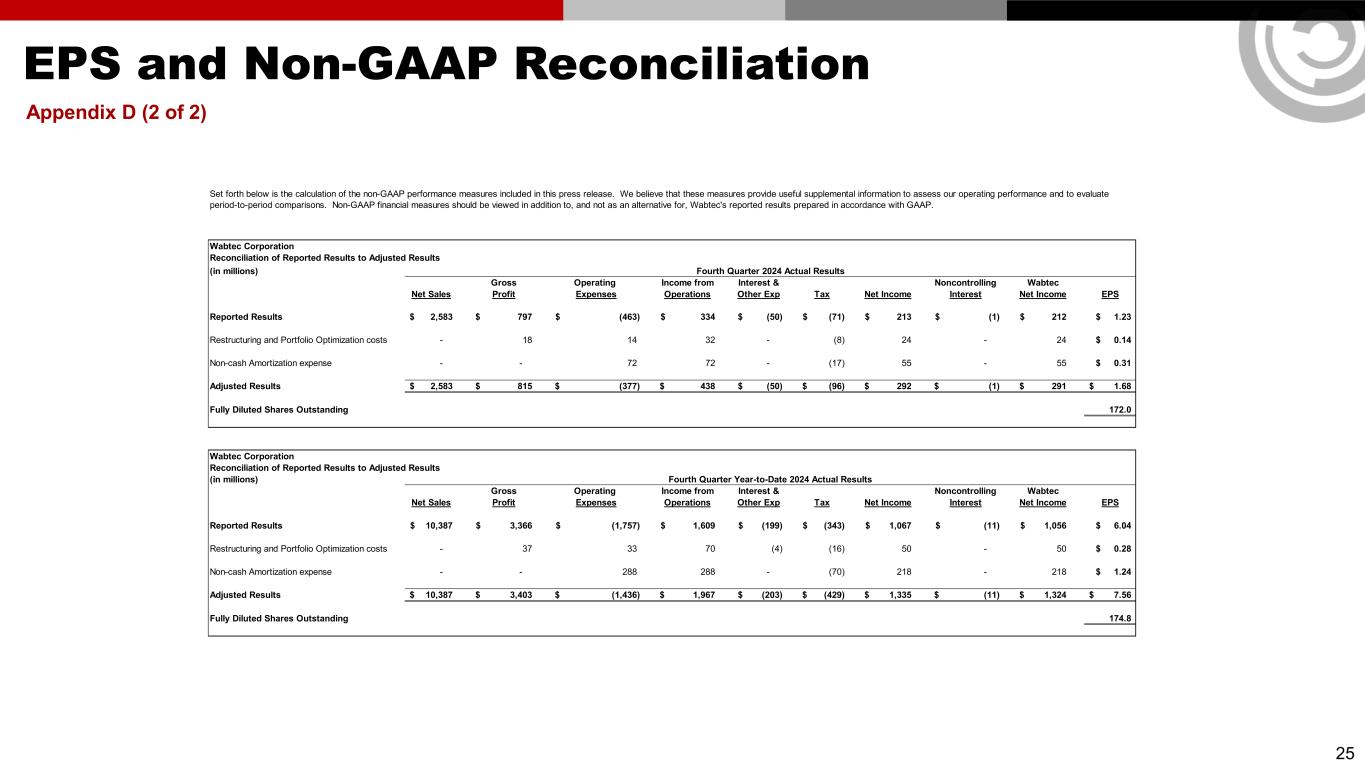

EPS and Non-GAAP Reconciliation Appendix D (2 of 2) 25 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 2,583$ 797$ (463)$ 334$ (50)$ (71)$ 213$ (1)$ 212$ 1.23$ Restructuring and Portfolio Optimization costs - 18 14 32 - (8) 24 - 24 0.14$ Non-cash Amortization expense - - 72 72 - (17) 55 - 55 0.31$ Adjusted Results 2,583$ 815$ (377)$ 438$ (50)$ (96)$ 292$ (1)$ 291$ 1.68$ Fully Diluted Shares Outstanding 172.0 Wabtec Corporation Reconciliation of Reported Results to Adjusted Results (in millions) Gross Operating Income from Interest & Noncontrolling Wabtec Net Sales Profit Expenses Operations Other Exp Tax Net Income Interest Net Income EPS Reported Results 10,387$ 3,366$ (1,757)$ 1,609$ (199)$ (343)$ 1,067$ (11)$ 1,056$ 6.04$ Restructuring and Portfolio Optimization costs - 37 33 70 (4) (16) 50 - 50 0.28$ Non-cash Amortization expense - - 288 288 - (70) 218 - 218 1.24$ Adjusted Results 10,387$ 3,403$ (1,436)$ 1,967$ (203)$ (429)$ 1,335$ (11)$ 1,324$ 7.56$ Fully Diluted Shares Outstanding 174.8 Fourth Quarter Year-to-Date 2024 Actual Results Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. Fourth Quarter 2024 Actual Results

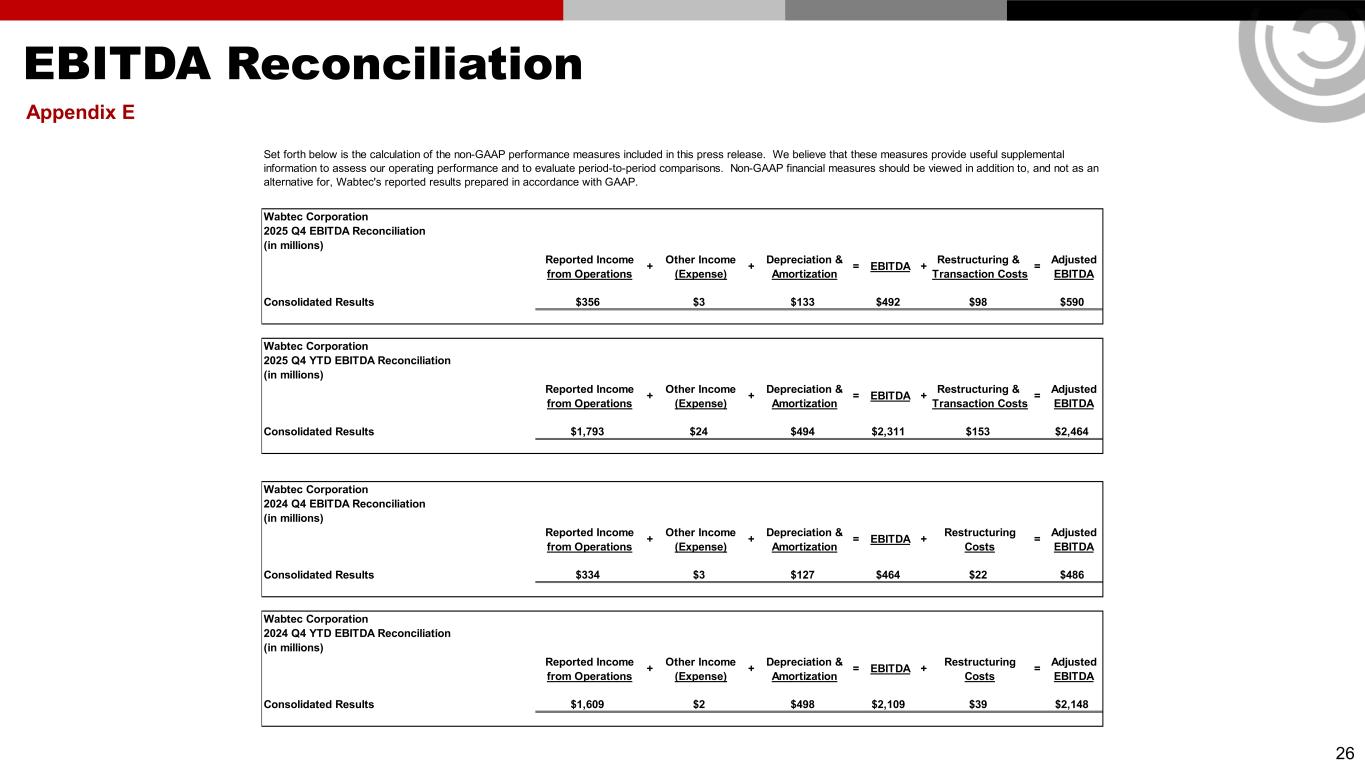

EBITDA Reconciliation Appendix E 26 Wabtec Corporation 2025 Q4 EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring & Adjusted from Operations (Expense) Amortization Transaction Costs EBITDA Consolidated Results $356 $3 $133 $492 $98 $590 Wabtec Corporation 2025 Q4 YTD EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring & Adjusted from Operations (Expense) Amortization Transaction Costs EBITDA Consolidated Results $1,793 $24 $494 $2,311 $153 $2,464 Wabtec Corporation 2024 Q4 EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $334 $3 $127 $464 $22 $486 Wabtec Corporation 2024 Q4 YTD EBITDA Reconciliation (in millions) Reported Income Other Income Depreciation & Restructuring Adjusted from Operations (Expense) Amortization Costs EBITDA Consolidated Results $1,609 $2 $498 $2,109 $39 $2,148 Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. + + = EBITDA + = = =+ + = EBITDA + + + = EBITDA + =+ + = EBITDA +

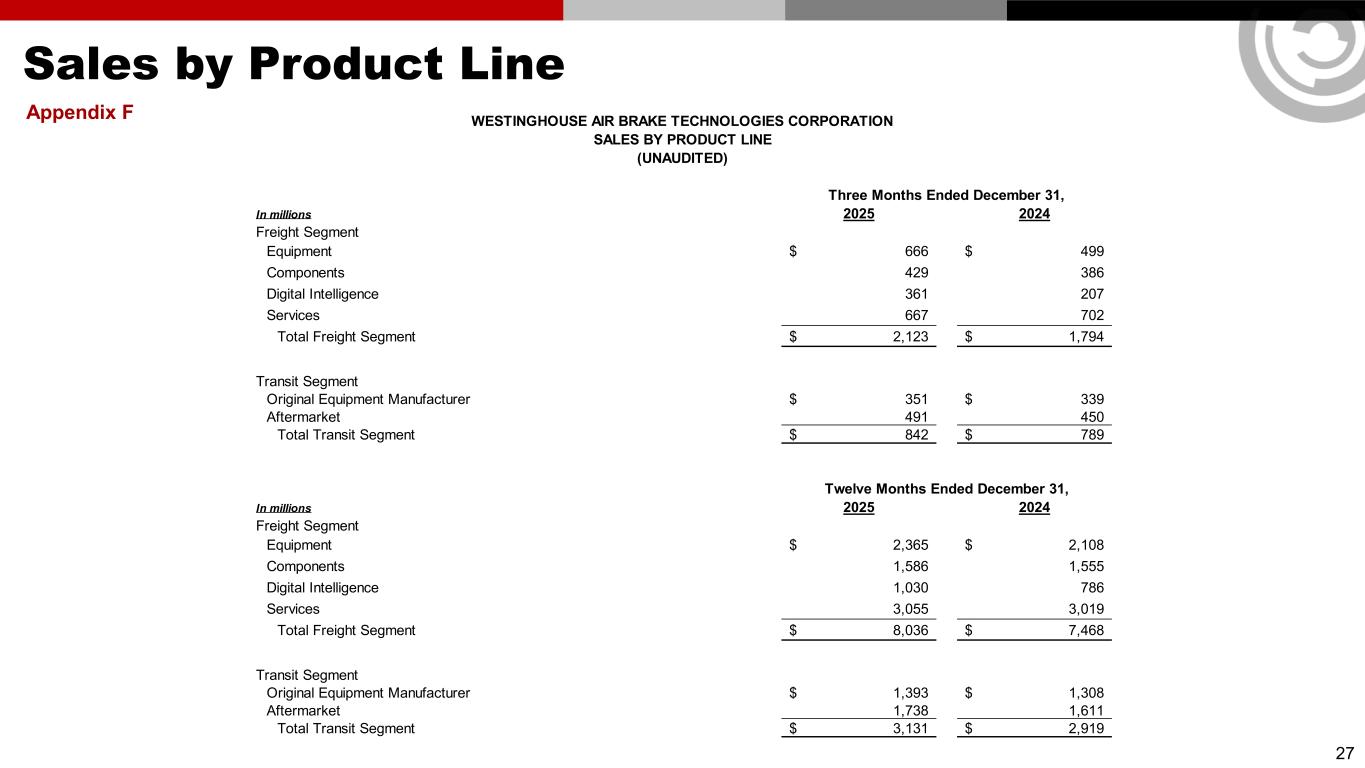

Sales by Product Line Appendix F 27 In millions 2025 2024 Freight Segment Equipment 666$ 499$ Components 429 386 Digital Intelligence 361 207 Services 667 702 Total Freight Segment 2,123$ 1,794$ Transit Segment Original Equipment Manufacturer 351$ 339$ Aftermarket 491 450 Total Transit Segment 842$ 789$ In millions 2025 2024 Freight Segment Equipment 2,365$ 2,108$ Components 1,586 1,555 Digital Intelligence 1,030 786 Services 3,055 3,019 Total Freight Segment 8,036$ 7,468$ Transit Segment Original Equipment Manufacturer 1,393$ 1,308$ Aftermarket 1,738 1,611 Total Transit Segment 3,131$ 2,919$ Twelve Months Ended December 31, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION SALES BY PRODUCT LINE (UNAUDITED) Three Months Ended December 31,

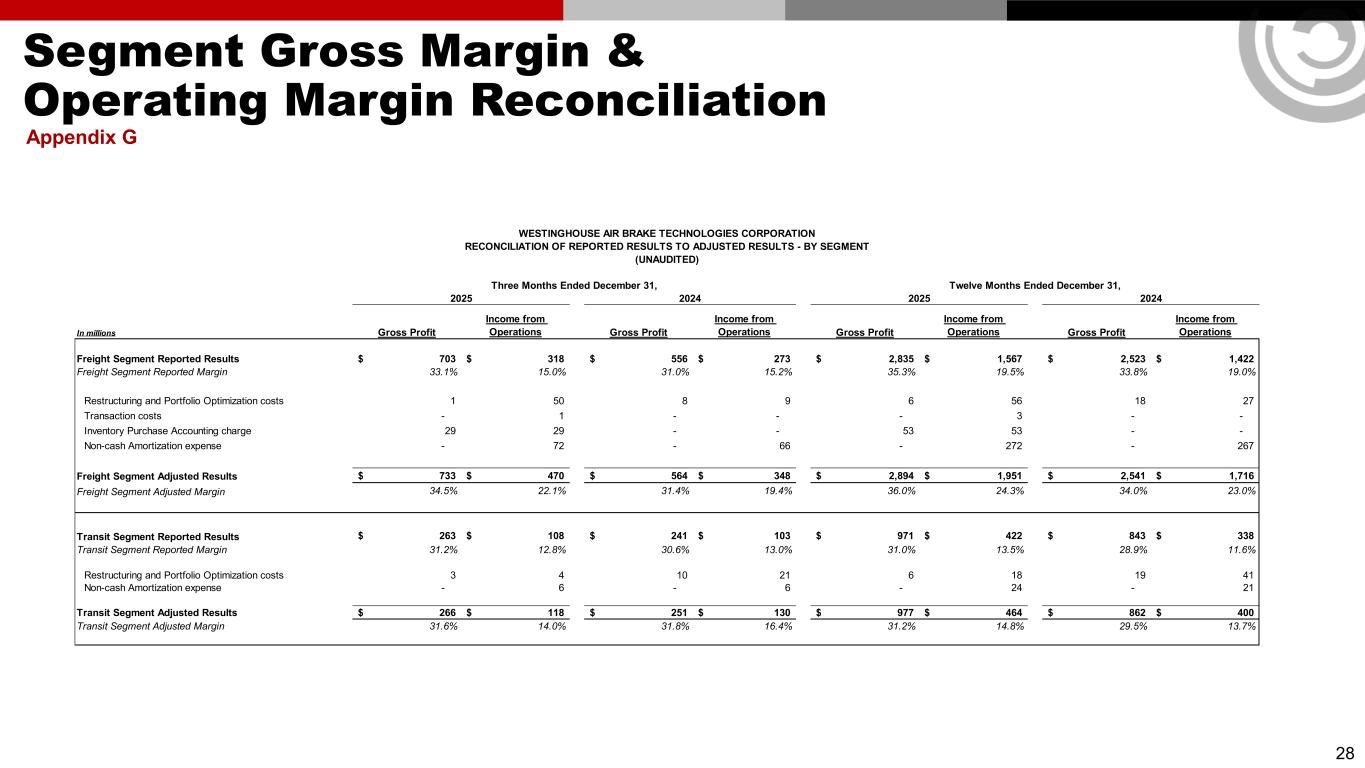

Segment Gross Margin & Operating Margin Reconciliation Appendix G 28 In millions Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Gross Profit Income from Operations Freight Segment Reported Results 703$ 318$ 556$ 273$ 2,835$ 1,567$ 2,523$ 1,422$ Freight Segment Reported Margin 33.1% 15.0% 31.0% 15.2% 35.3% 19.5% 33.8% 19.0% Restructuring and Portfolio Optimization costs 1 50 8 9 6 56 18 27 Transaction costs - 1 - - - 3 - - Inventory Purchase Accounting charge 29 29 - - 53 53 - - Non-cash Amortization expense - 72 - 66 - 272 - 267 Freight Segment Adjusted Results 733$ 470$ 564$ 348$ 2,894$ 1,951$ 2,541$ 1,716$ Freight Segment Adjusted Margin 34.5% 22.1% 31.4% 19.4% 36.0% 24.3% 34.0% 23.0% Transit Segment Reported Results 263$ 108$ 241$ 103$ 971$ 422$ 843$ 338$ Transit Segment Reported Margin 31.2% 12.8% 30.6% 13.0% 31.0% 13.5% 28.9% 11.6% Restructuring and Portfolio Optimization costs 3 4 10 21 6 18 19 41 Non-cash Amortization expense - 6 - 6 - 24 - 21 Transit Segment Adjusted Results 266$ 118$ 251$ 130$ 977$ 464$ 862$ 400$ Transit Segment Adjusted Margin 31.6% 14.0% 31.8% 16.4% 31.2% 14.8% 29.5% 13.7% 2025 2024 2025 2024 WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION RECONCILIATION OF REPORTED RESULTS TO ADJUSTED RESULTS - BY SEGMENT (UNAUDITED) Three Months Ended December 31, Twelve Months Ended December 31,

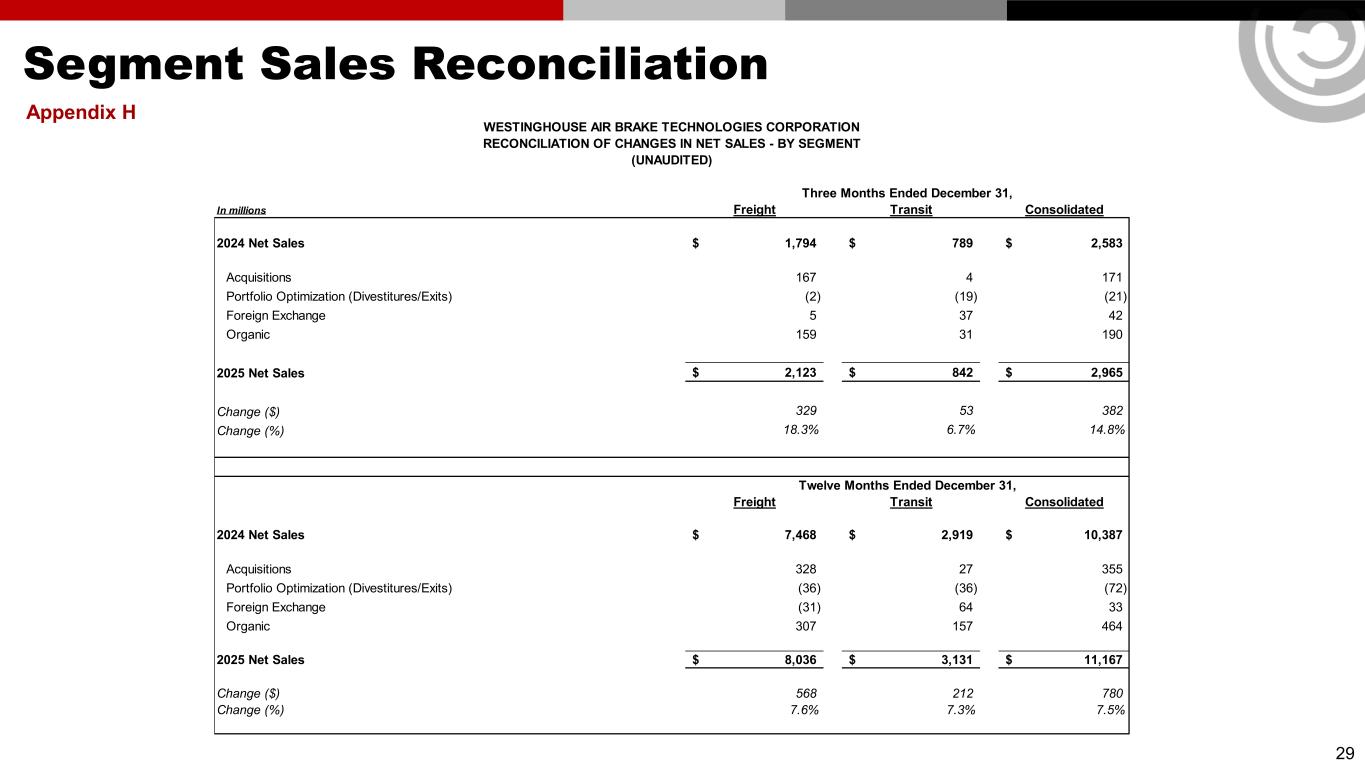

Segment Sales Reconciliation Appendix H 29 In millions Freight Transit Consolidated 2024 Net Sales 1,794$ 789$ 2,583$ Acquisitions 167 4 171 Portfolio Optimization (Divestitures/Exits) (2) (19) (21) Foreign Exchange 5 37 42 Organic 159 31 190 2025 Net Sales 2,123$ 842$ 2,965$ Change ($) 329 53 382 Change (%) 18.3% 6.7% 14.8% Freight Transit Consolidated 2024 Net Sales 7,468$ 2,919$ 10,387$ Acquisitions 328 27 355 Portfolio Optimization (Divestitures/Exits) (36) (36) (72) Foreign Exchange (31) 64 33 Organic 307 157 464 2025 Net Sales 8,036$ 3,131$ 11,167$ Change ($) 568 212 780 Change (%) 7.6% 7.3% 7.5% Twelve Months Ended December 31, WESTINGHOUSE AIR BRAKE TECHNOLOGIES CORPORATION RECONCILIATION OF CHANGES IN NET SALES - BY SEGMENT (UNAUDITED) Three Months Ended December 31,

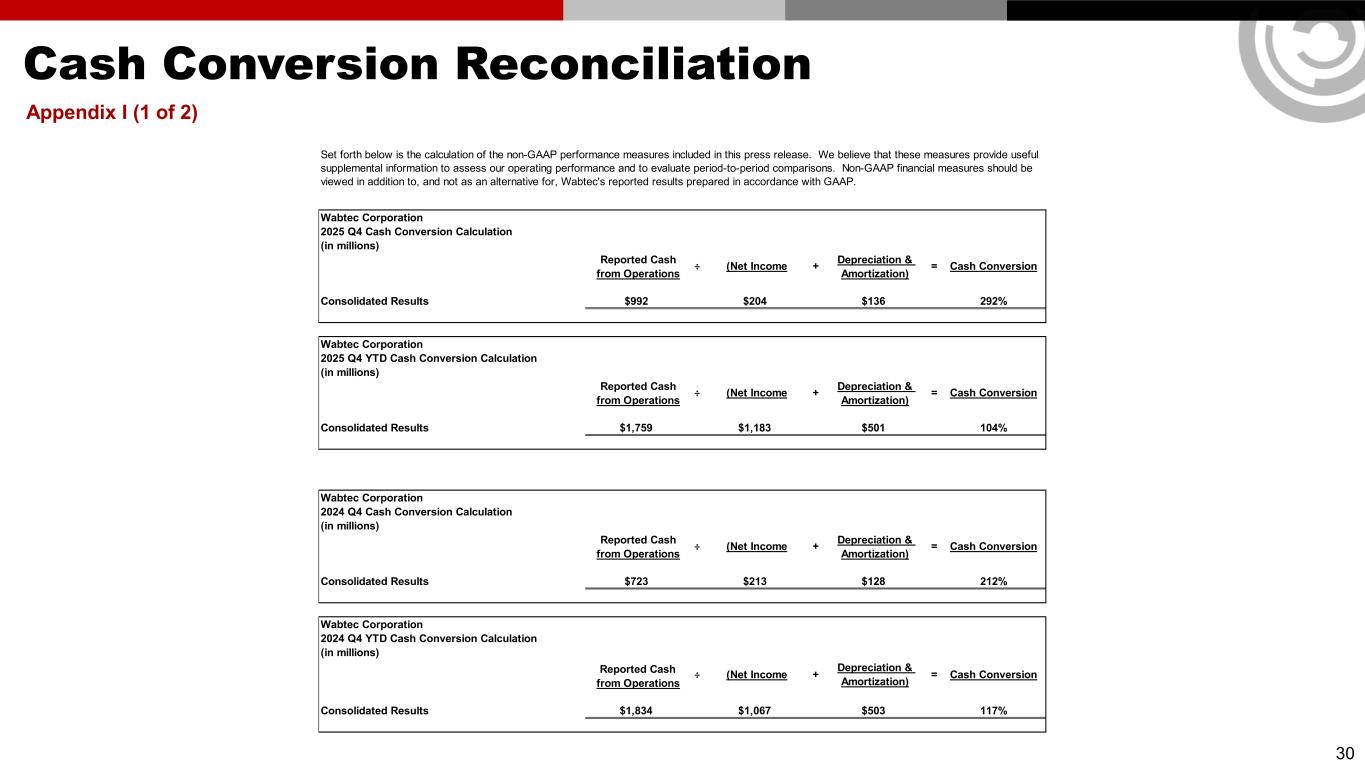

Cash Conversion Reconciliation Appendix I (1 of 2) 30 Wabtec Corporation 2025 Q4 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $992 $204 $136 292% Wabtec Corporation 2025 Q4 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $1,759 $1,183 $501 104% Wabtec Corporation 2024 Q4 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $723 $213 $128 212% Wabtec Corporation 2024 Q4 YTD Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $1,834 $1,067 $503 117% Cash Conversion Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) =

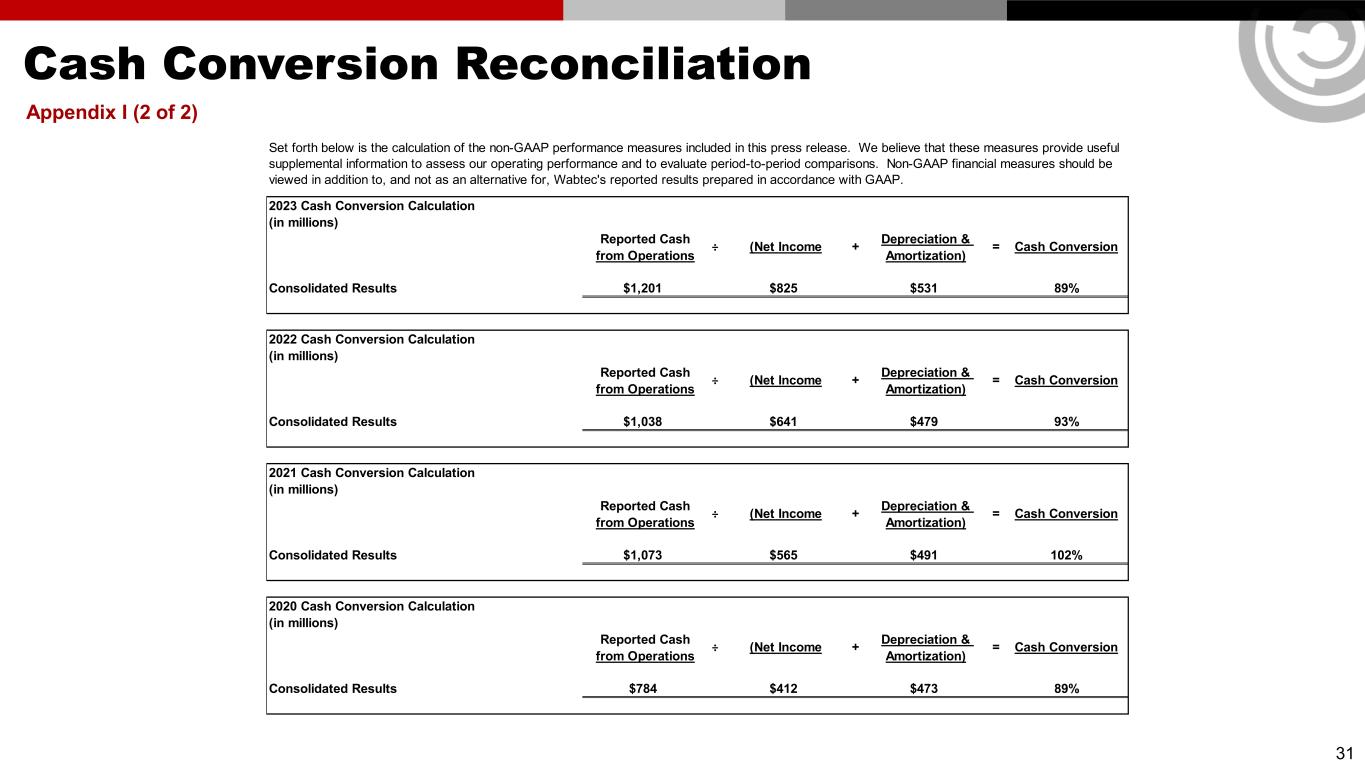

Cash Conversion Reconciliation Appendix I (2 of 2) 31 2023 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $1,201 $825 $531 89% 2022 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $1,038 $641 $479 93% 2021 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $1,073 $565 $491 102% 2020 Cash Conversion Calculation (in millions) Reported Cash from Operations Consolidated Results $784 $412 $473 89% Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP. ÷ (Net Income + Depreciation & Amortization) = Cash Conversion ÷ (Net Income + Depreciation & Amortization) = Cash Conversion

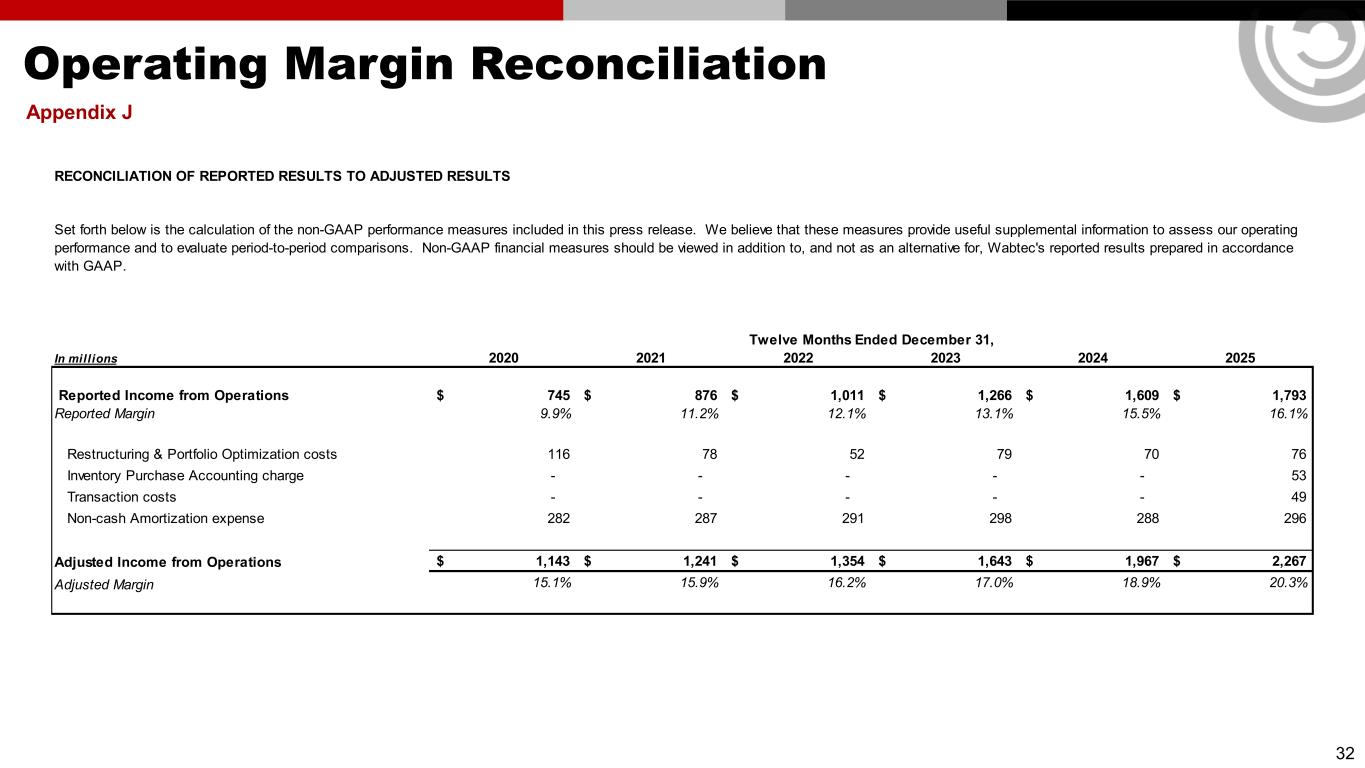

Operating Margin Reconciliation Appendix J 32 In millions 2020 2021 2022 2023 2024 2025 Reported Income from Operations 745$ 876$ 1,011$ 1,266$ 1,609$ 1,793$ Reported Margin 9.9% 11.2% 12.1% 13.1% 15.5% 16.1% Restructuring & Portfolio Optimization costs 116 78 52 79 70 76 Inventory Purchase Accounting charge - - - - - 53 Transaction costs - - - - - 49 Non-cash Amortization expense 282 287 291 298 288 296 Adjusted Income from Operations 1,143$ 1,241$ 1,354$ 1,643$ 1,967$ 2,267$ Adjusted Margin 15.1% 15.9% 16.2% 17.0% 18.9% 20.3% RECONCILIATION OF REPORTED RESULTS TO ADJUSTED RESULTS Twelve Months Ended December 31, Set forth below is the calculation of the non-GAAP performance measures included in this press release. We believe that these measures provide useful supplemental information to assess our operating performance and to evaluate period-to-period comparisons. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Wabtec's reported results prepared in accordance with GAAP.