Financial Results and Supplemental Information THIRD QUARTER 2025 November 5, 2025 .2 24225 W. Lorenzo Road Wilmington, IL

2 Table of Contents QUARTERLY RESULTS Service Properties Trust Announces Third Quarter 2025 Financial Results .......................................................................................................................... 4 Third Quarter 2025 Highlights ....................................................................................................................................................................................................... 5 FINANCIALS Key Financial Data ............................................................................................................................................................................................................................ 8 Condensed Consolidated Statements of Income (Loss) .......................................................................................................................................................... 9 Condensed Consolidated Balance Sheets .................................................................................................................................................................................. 10 Debt Summary .................................................................................................................................................................................................................................. 11 Debt Maturity Schedule .................................................................................................................................................................................................................. 12 Leverage Ratios, Coverage Ratios and Debt Covenants .......................................................................................................................................................... 13 Capital Expenditures Summary ..................................................................................................................................................................................................... 14 Property Acquisitions and Dispositions ....................................................................................................................................................................................... 15 PORTFOLIO INFORMATION Portfolio Summary ............................................................................................................................................................................................................................ 17 Consolidated Portfolio Diversification by Industry .................................................................................................................................................................... 18 Consolidated Portfolio by Geographical Diversification .......................................................................................................................................................... 19 Hotel Portfolio by Brand .................................................................................................................................................................................................................. 20 Hotel Operating Statistics by Service Level - All Hotels - Three Months Ended September 30, 2025 ............................................................................ 21 Hotel Operating Statistics by Service Level - All Hotels - Nine Months Ended September 30, 2025 .............................................................................. 22 Net Lease Portfolio by Brand ......................................................................................................................................................................................................... 23 Net Lease Portfolio by Industry ...................................................................................................................................................................................................... 24 Net Lease Portfolio by Tenant (Top 10) ....................................................................................................................................................................................... 25 Net Lease Portfolio - Expiration Schedule ................................................................................................................................................................................... 26 Net Lease Portfolio - Occupancy Summary ................................................................................................................................................................................. 27 APPENDIX Company Profile and Research Coverage .................................................................................................................................................................................. 29 Governance Information ................................................................................................................................................................................................................. 30 Calculation of FFO, Normalized FFO and CAD .......................................................................................................................................................................... 31 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre ..................................................................................................................................................... 32 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - All Hotels ................................................................................................ 33 Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, CAD, EBITDA, EBITDAre, Adjusted EBITDAre, Hotel EBITDA and Adjusted Hotel EBITDA ........................................................................................................................................ 34 Non-GAAP Financial Measures and Certain Definitions ........................................................................................................................................................... 35 WARNING CONCERNING FORWARD-LOOKING STATEMENTS .................................................................................................................................................................... 38 SVC Nasdaq Listed Trading Symbols: Common Shares: SVC Investor Relations Contact: Kevin Barry, Senior Director (617) 796-8232 kbarry@svcreit.com ir@svcreit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 www.svcreit.com All amounts in this presentation are unaudited. Additional information and reconciliations of Non-GAAP Financial Measures to amounts determined in accordance with U.S. GAAP appear in the Appendix to this presentation. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this presentation.

3RETURN TO TABLE OF CONTENTS Quarterly Results

4RETURN TO TABLE OF CONTENTS Newton, MA (November 5, 2025): Service Properties Trust (Nasdaq: SVC) today announced its financial results for the quarter ended September 30, 2025. Distribution: SVC declared a quarterly distribution on its common shares of $0.01 per share to shareholders of record as of the close of business on October 27, 2025. This distribution will be paid on or about November 13, 2025. Conference Call: A conference call to discuss SVC’s third quarter results will be held on Thursday, November 6, 2025 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 329-3720 or (412) 317-5434 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (877) 344-7529; the replay pass code is 1667248. A live audio webcast of the conference call will also be available in a listen only mode on SVC’s website, at www.svcreit.com. The archived webcast will be available for replay on SVC’s website after the call. The transcription, recording and retransmission in any way of SVC’s third quarter conference call are strictly prohibited without the prior written consent of SVC. About Service Properties Trust: SVC is a real estate investment trust, or REIT, with over $10 billion invested in two asset categories: hotels and service-focused retail net lease properties. As of September 30, 2025, SVC owned 160 hotels with over 29,000 guest rooms throughout the United States and in Puerto Rico and Canada. As of September 30, 2025, SVC also owned 752 service-focused retail net lease properties with over 13.1 million square feet throughout the United States. SVC is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with approximately $39 billion in assets under management as of September 30, 2025, and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. SVC is headquartered in Newton, MA. For more information, visit www.svcreit.com. Service Properties Trust Announces Third Quarter 2025 Financial Results “SVC’s third quarter performance underscores our ongoing efforts to reposition the company and enhance our financial stability. We were active in the capital markets, successfully completing a zero-coupon bond offering that raised $490 million in net proceeds, and we generated nearly $300 million through hotel asset sales. We used the net proceeds of the offering to reduce near-term debt, resulting in no significant maturities until 2027. Within our hotel portfolio, RevPAR was consistent with our guidance, while hotel EBITDA fell below our expectations, primarily due to the impact of hotel dispositions during the quarter. Looking ahead to 2026, our priorities remain centered on driving EBITDA growth within our hotel portfolio, supported by the completion of multiple renovations in 2024 and 2025, and a disciplined approach to acquiring net lease assets to further optimize our portfolio. We believe these initiatives will continue to strengthen the resilience and growth potential of our cash flows, delivering meaningful value to our shareholders.” Christopher Bilotto President and Chief Executive Officer Christopher Bilotto President and Chief Executive Officer

5RETURN TO TABLE OF CONTENTS Third Quarter 2025 Highlights Financial Results • Net loss of $46.9 million, or $0.28 per common share. • Normalized FFO of $33.9 million, or $0.20 per common share. • Adjusted EBITDAre of $145.0 million. Portfolio Update • Hotel RevPAR of $100.25. • Adjusted Hotel EBITDA of $45.4 million. • Net Lease occupancy of 97.3% as of September 30, 2025. • Net Lease rent coverage of 2.04x. Update on Hotel Sales • During the third quarter, sold 40 hotels with a total of 5,565 keys for a combined sales price of $292.4 million. • Since October 1st, sold six hotels with a total of 777 keys for a combined sales price of $66.5 million. • Remain under purchase and sale agreements for 69 hotels with a total of 8,695 keys for a combined sales price of $567.5 million. ◦ Closings expected to occur in Q4 2025. • Hotel sales proceeds expected to total $958.9 million in 2025. Note: All sales prices referenced above exclude closing costs.

6RETURN TO TABLE OF CONTENTS Third Quarter 2025 Highlights (Continued) Other Investment Activity • Invested $47.0 million in CapEx during the third quarter. • During the third quarter, acquired 13 net lease properties with a total of 67,450 square feet for a combined purchase price of $24.8 million, a weighted average lease term of 13.9 years and rent coverage of 2.61x. • Since October 1st, acquired four net lease properties with a total of 21,703 square feet for a combined purchase price of $15.9 million and entered into agreements to acquire five net lease properties with a total of 111,279 square feet for a combined purchase price of $25.4 million. • During the third quarter, sold three net lease properties with a total of 43,407 square feet for a combined sales price of $2.2 million. • Sold one net lease property in November 2025 with 37,440 square feet for a sales price of $0.6 million. Note: All sales and purchase prices referenced above exclude closing costs. Financing/ Liquidity • Redeemed $350.0 million of 5.25% senior unsecured notes due 2026 at par plus accrued interest using cash on hand. • Issued $580.2 million of zero coupon senior secured notes due September 2027, with a one-year extension option. The net proceeds from this offering were approximately $490.0 million. • In October 2025, SVC redeemed all $450.0 million of 4.75% senior unsecured notes due 2026 at par plus accrued interest and the make whole amount of $1.8 million using cash on hand and borrowings under its revolving credit facility. • SVC is currently in compliance with all of its debt covenants and has no significant debt maturities until February 2027 and $650.0 million of available borrowing capacity under its revolving credit facility.

7RETURN TO TABLE OF CONTENTS Financials

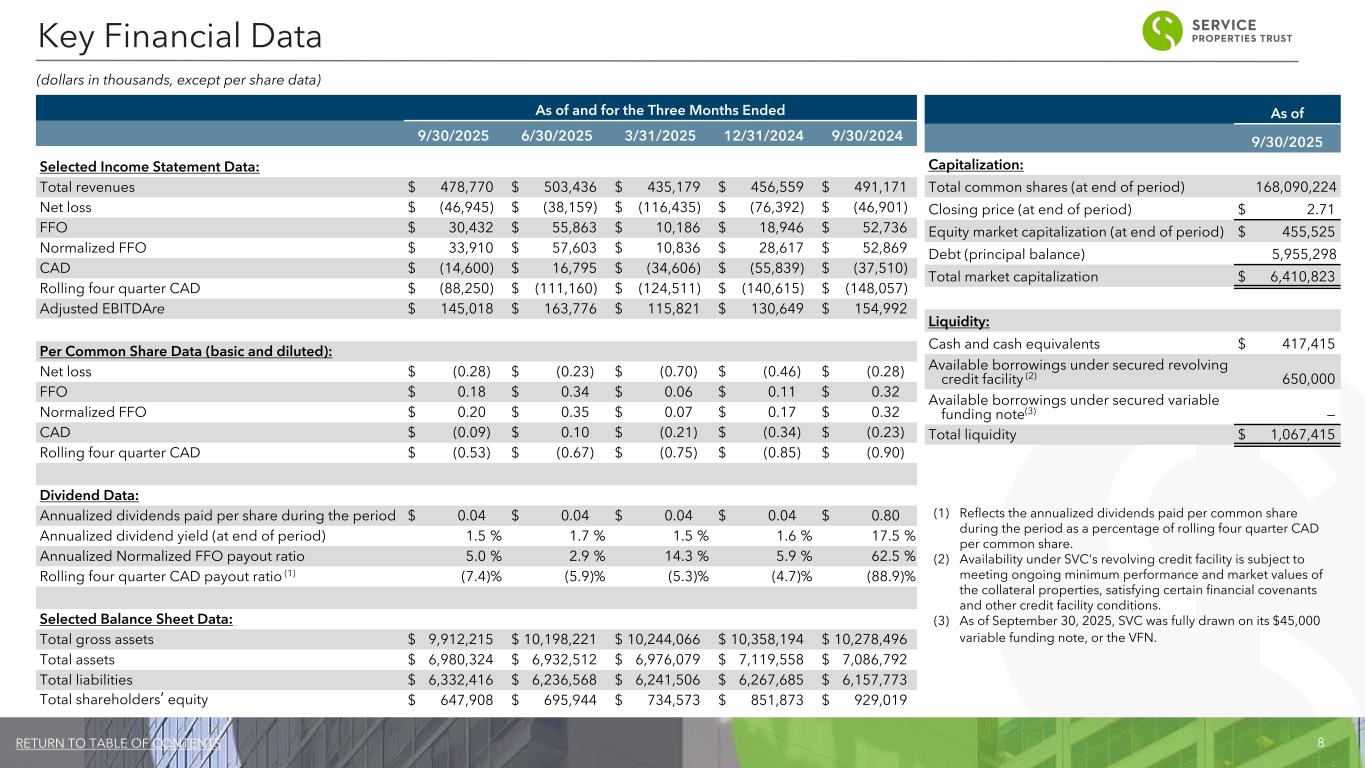

8RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Selected Income Statement Data: Total revenues $ 478,770 $ 503,436 $ 435,179 $ 456,559 $ 491,171 Net loss $ (46,945) $ (38,159) $ (116,435) $ (76,392) $ (46,901) FFO $ 30,432 $ 55,863 $ 10,186 $ 18,946 $ 52,736 Normalized FFO $ 33,910 $ 57,603 $ 10,836 $ 28,617 $ 52,869 CAD $ (14,600) $ 16,795 $ (34,606) $ (55,839) $ (37,510) Rolling four quarter CAD $ (88,250) $ (111,160) $ (124,511) $ (140,615) $ (148,057) Adjusted EBITDAre $ 145,018 $ 163,776 $ 115,821 $ 130,649 $ 154,992 Per Common Share Data (basic and diluted): Net loss $ (0.28) $ (0.23) $ (0.70) $ (0.46) $ (0.28) FFO $ 0.18 $ 0.34 $ 0.06 $ 0.11 $ 0.32 Normalized FFO $ 0.20 $ 0.35 $ 0.07 $ 0.17 $ 0.32 CAD $ (0.09) $ 0.10 $ (0.21) $ (0.34) $ (0.23) Rolling four quarter CAD $ (0.53) $ (0.67) $ (0.75) $ (0.85) $ (0.90) Dividend Data: Annualized dividends paid per share during the period $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 0.80 Annualized dividend yield (at end of period) 1.5 % 1.7 % 1.5 % 1.6 % 17.5 % Annualized Normalized FFO payout ratio 5.0 % 2.9 % 14.3 % 5.9 % 62.5 % Rolling four quarter CAD payout ratio (1) (7.4) % (5.9) % (5.3) % (4.7) % (88.9) % Selected Balance Sheet Data: Total gross assets $ 9,912,215 $ 10,198,221 $ 10,244,066 $ 10,358,194 $ 10,278,496 Total assets $ 6,980,324 $ 6,932,512 $ 6,976,079 $ 7,119,558 $ 7,086,792 Total liabilities $ 6,332,416 $ 6,236,568 $ 6,241,506 $ 6,267,685 $ 6,157,773 Total shareholders’ equity $ 647,908 $ 695,944 $ 734,573 $ 851,873 $ 929,019 (dollars in thousands, except per share data) Key Financial Data Sonesta ES Suites Fort Lauderdale, FL As of 9/30/2025 Capitalization: Total common shares (at end of period) 168,090,224 Closing price (at end of period) $ 2.71 Equity market capitalization (at end of period) $ 455,525 Debt (principal balance) 5,955,298 Total market capitalization $ 6,410,823 Liquidity: Cash and cash equivalents $ 417,415 Available borrowings under secured revolving credit facility (2) 650,000 Available borrowings under secured variable funding note(3) — Total liquidity $ 1,067,415 (1) Reflects the annualized dividends paid per common share during the period as a percentage of rolling four quarter CAD per common share. (2) Availability under SVC's revolving credit facility is subject to meeting ongoing minimum performance and market values of the collateral properties, satisfying certain financial covenants and other credit facility conditions. (3) As of September 30, 2025, SVC was fully drawn on its $45,000 variable funding note, or the VFN.

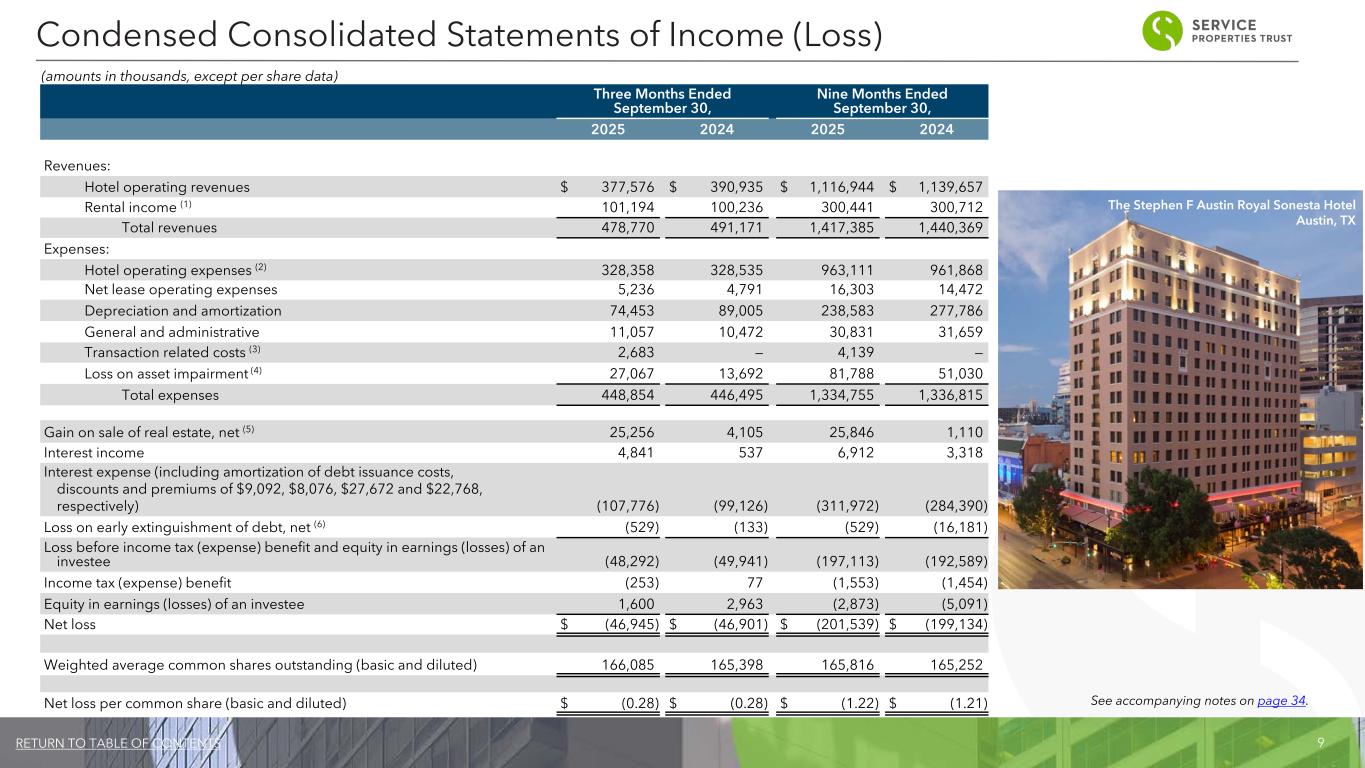

9RETURN TO TABLE OF CONTENTS Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Revenues: Hotel operating revenues $ 377,576 $ 390,935 $ 1,116,944 $ 1,139,657 Rental income (1) 101,194 100,236 300,441 300,712 Total revenues 478,770 491,171 1,417,385 1,440,369 Expenses: Hotel operating expenses (2) 328,358 328,535 963,111 961,868 Net lease operating expenses 5,236 4,791 16,303 14,472 Depreciation and amortization 74,453 89,005 238,583 277,786 General and administrative 11,057 10,472 30,831 31,659 Transaction related costs (3) 2,683 — 4,139 — Loss on asset impairment (4) 27,067 13,692 81,788 51,030 Total expenses 448,854 446,495 1,334,755 1,336,815 Gain on sale of real estate, net (5) 25,256 4,105 25,846 1,110 Interest income 4,841 537 6,912 3,318 Interest expense (including amortization of debt issuance costs, discounts and premiums of $9,092, $8,076, $27,672 and $22,768, respectively) (107,776) (99,126) (311,972) (284,390) Loss on early extinguishment of debt, net (6) (529) (133) (529) (16,181) Loss before income tax (expense) benefit and equity in earnings (losses) of an investee (48,292) (49,941) (197,113) (192,589) Income tax (expense) benefit (253) 77 (1,553) (1,454) Equity in earnings (losses) of an investee 1,600 2,963 (2,873) (5,091) Net loss $ (46,945) $ (46,901) $ (201,539) $ (199,134) Weighted average common shares outstanding (basic and diluted) 166,085 165,398 165,816 165,252 Net loss per common share (basic and diluted) $ (0.28) $ (0.28) $ (1.22) $ (1.21) (amounts in thousands, except per share data) Condensed Consolidated Statements of Income (Loss) See accompanying notes on page 34. The Stephen F Austin Royal Sonesta Hotel Austin, TX

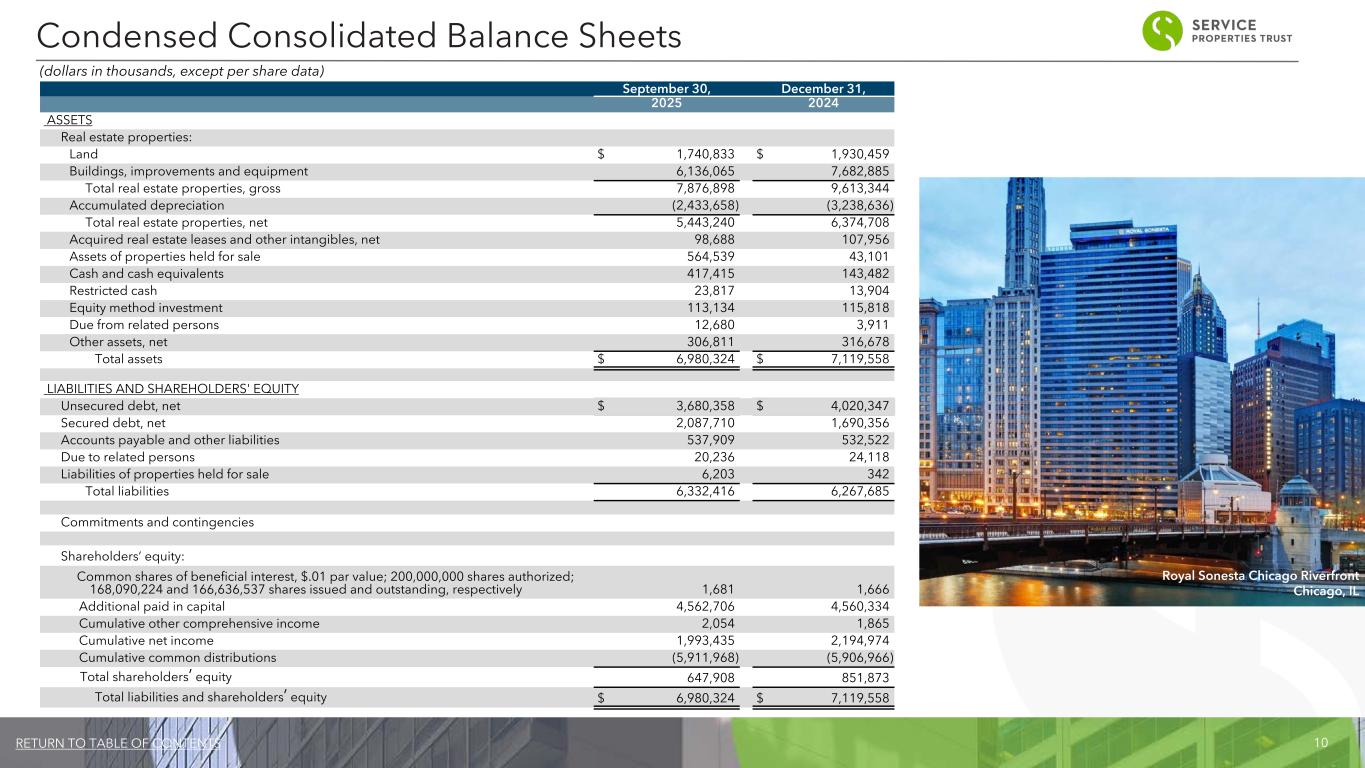

10RETURN TO TABLE OF CONTENTS Condensed Consolidated Balance Sheets September 30, December 31, 2025 2024 ASSETS Real estate properties: Land $ 1,740,833 $ 1,930,459 Buildings, improvements and equipment 6,136,065 7,682,885 Total real estate properties, gross 7,876,898 9,613,344 Accumulated depreciation (2,433,658) (3,238,636) Total real estate properties, net 5,443,240 6,374,708 Acquired real estate leases and other intangibles, net 98,688 107,956 Assets of properties held for sale 564,539 43,101 Cash and cash equivalents 417,415 143,482 Restricted cash 23,817 13,904 Equity method investment 113,134 115,818 Due from related persons 12,680 3,911 Other assets, net 306,811 316,678 Total assets $ 6,980,324 $ 7,119,558 LIABILITIES AND SHAREHOLDERS' EQUITY Unsecured debt, net $ 3,680,358 $ 4,020,347 Secured debt, net 2,087,710 1,690,356 Accounts payable and other liabilities 537,909 532,522 Due to related persons 20,236 24,118 Liabilities of properties held for sale 6,203 342 Total liabilities 6,332,416 6,267,685 Commitments and contingencies Shareholders’ equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 168,090,224 and 166,636,537 shares issued and outstanding, respectively 1,681 1,666 Additional paid in capital 4,562,706 4,560,334 Cumulative other comprehensive income 2,054 1,865 Cumulative net income 1,993,435 2,194,974 Cumulative common distributions (5,911,968) (5,906,966) Total shareholders’ equity 647,908 851,873 Total liabilities and shareholders’ equity $ 6,980,324 $ 7,119,558 (dollars in thousands, except per share data) Royal Sonesta Chicago Riverfront Chicago, IL

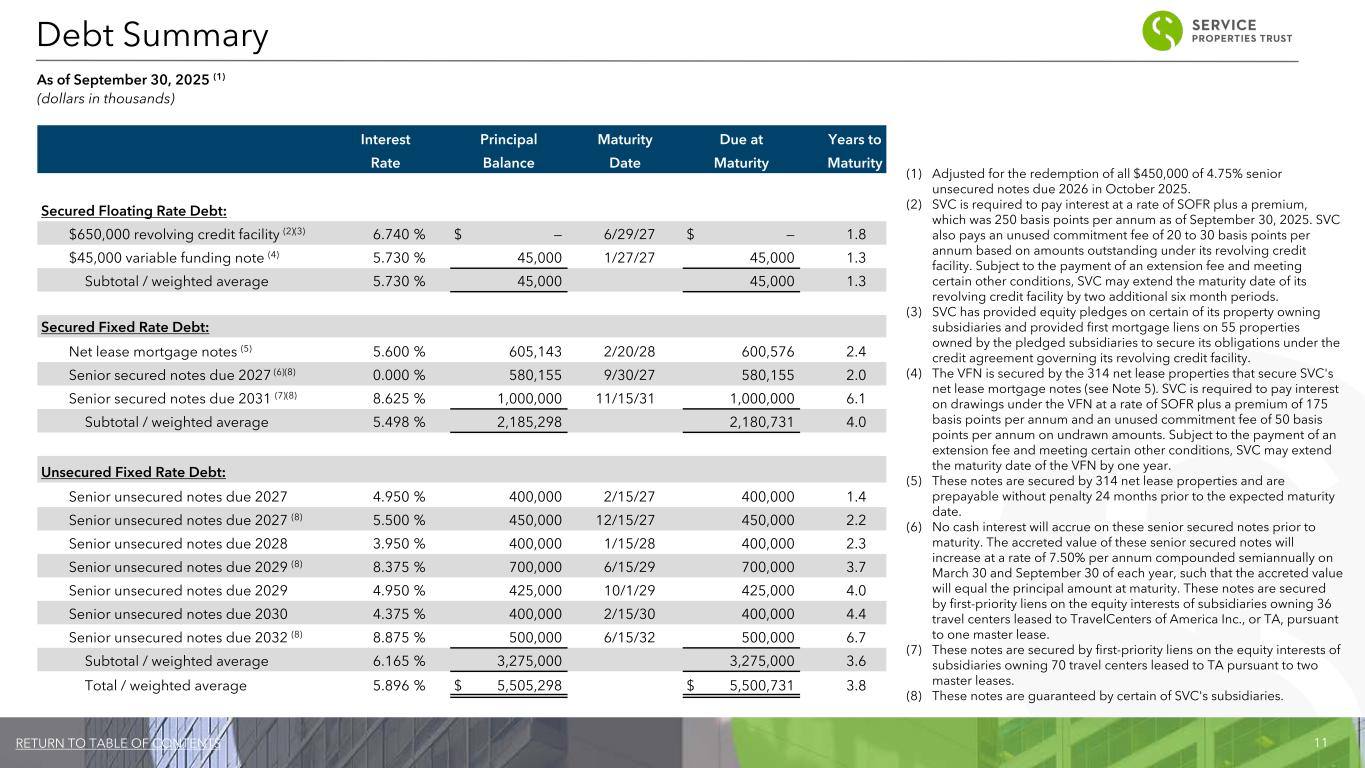

11RETURN TO TABLE OF CONTENTS (1) Adjusted for the redemption of all $450,000 of 4.75% senior unsecured notes due 2026 in October 2025. (2) SVC is required to pay interest at a rate of SOFR plus a premium, which was 250 basis points per annum as of September 30, 2025. SVC also pays an unused commitment fee of 20 to 30 basis points per annum based on amounts outstanding under its revolving credit facility. Subject to the payment of an extension fee and meeting certain other conditions, SVC may extend the maturity date of its revolving credit facility by two additional six month periods. (3) SVC has provided equity pledges on certain of its property owning subsidiaries and provided first mortgage liens on 55 properties owned by the pledged subsidiaries to secure its obligations under the credit agreement governing its revolving credit facility. (4) The VFN is secured by the 314 net lease properties that secure SVC's net lease mortgage notes (see Note 5). SVC is required to pay interest on drawings under the VFN at a rate of SOFR plus a premium of 175 basis points per annum and an unused commitment fee of 50 basis points per annum on undrawn amounts. Subject to the payment of an extension fee and meeting certain other conditions, SVC may extend the maturity date of the VFN by one year. (5) These notes are secured by 314 net lease properties and are prepayable without penalty 24 months prior to the expected maturity date. (6) No cash interest will accrue on these senior secured notes prior to maturity. The accreted value of these senior secured notes will increase at a rate of 7.50% per annum compounded semiannually on March 30 and September 30 of each year, such that the accreted value will equal the principal amount at maturity. These notes are secured by first-priority liens on the equity interests of subsidiaries owning 36 travel centers leased to TravelCenters of America Inc., or TA, pursuant to one master lease. (7) These notes are secured by first-priority liens on the equity interests of subsidiaries owning 70 travel centers leased to TA pursuant to two master leases. (8) These notes are guaranteed by certain of SVC's subsidiaries. Interest Principal Maturity Due at Years to Rate Balance Date Maturity Maturity Secured Floating Rate Debt: $650,000 revolving credit facility (2)(3) 6.740 % $ — 6/29/27 $ — 1.8 $45,000 variable funding note (4) 5.730 % 45,000 1/27/27 45,000 1.3 Subtotal / weighted average 5.730 % 45,000 45,000 1.3 Secured Fixed Rate Debt: Net lease mortgage notes (5) 5.600 % 605,143 2/20/28 600,576 2.4 Senior secured notes due 2027 (6)(8) 0.000 % 580,155 9/30/27 580,155 2.0 Senior secured notes due 2031 (7)(8) 8.625 % 1,000,000 11/15/31 1,000,000 6.1 Subtotal / weighted average 5.498 % 2,185,298 2,180,731 4.0 Unsecured Fixed Rate Debt: Senior unsecured notes due 2027 4.950 % 400,000 2/15/27 400,000 1.4 Senior unsecured notes due 2027 (8) 5.500 % 450,000 12/15/27 450,000 2.2 Senior unsecured notes due 2028 3.950 % 400,000 1/15/28 400,000 2.3 Senior unsecured notes due 2029 (8) 8.375 % 700,000 6/15/29 700,000 3.7 Senior unsecured notes due 2029 4.950 % 425,000 10/1/29 425,000 4.0 Senior unsecured notes due 2030 4.375 % 400,000 2/15/30 400,000 4.4 Senior unsecured notes due 2032 (8) 8.875 % 500,000 6/15/32 500,000 6.7 Subtotal / weighted average 6.165 % 3,275,000 3,275,000 3.6 Total / weighted average 5.896 % $ 5,505,298 $ 5,500,731 3.8 Debt Summary As of September 30, 2025 (1) (dollars in thousands)

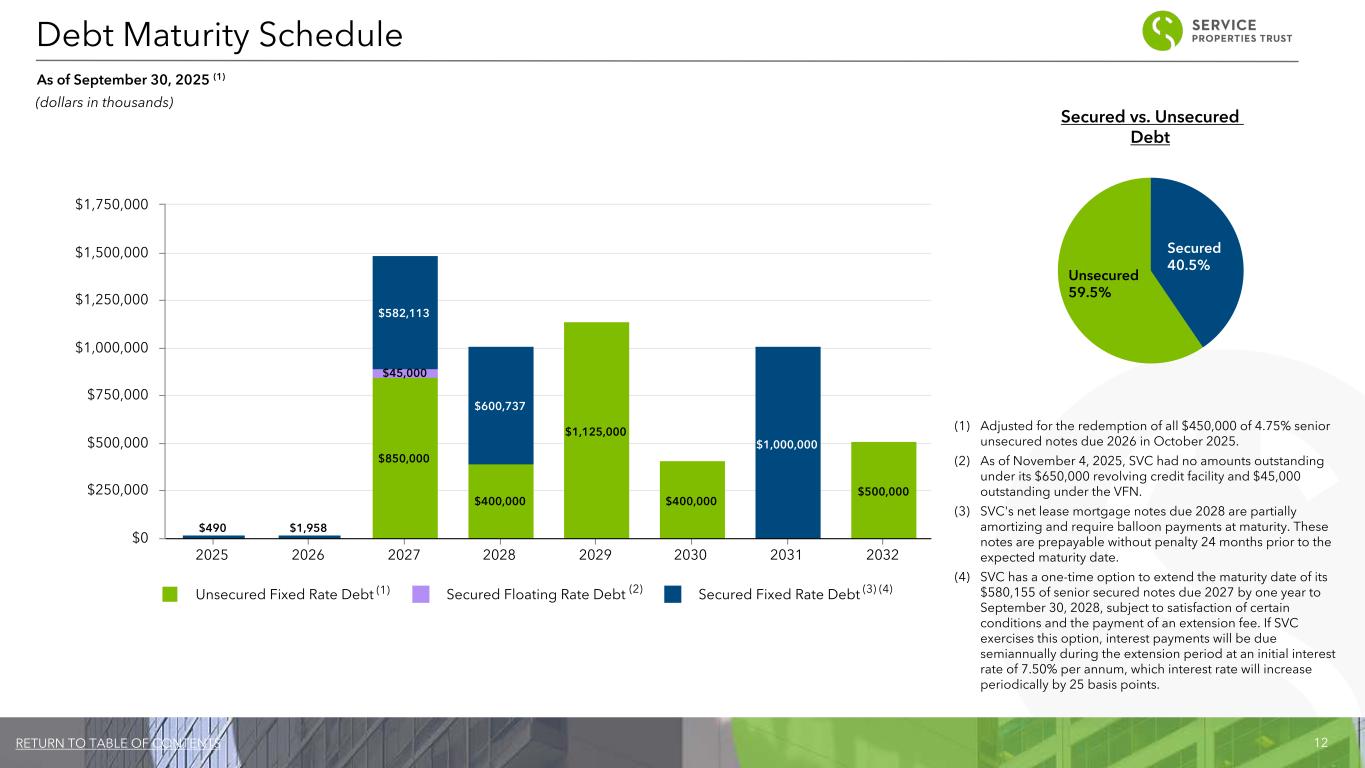

12RETURN TO TABLE OF CONTENTS $850,000 $400,000 $1,125,000 $400,000 $500,000 $45,000 $490 $1,958 $582,113 $600,737 $1,000,000 Unsecured Fixed Rate Debt Secured Floating Rate Debt Secured Fixed Rate Debt 2025 2026 2027 2028 2029 2030 2031 2032 $0 $250,000 $500,000 $750,000 $1,000,000 $1,250,000 $1,500,000 $1,750,000 Debt Maturity Schedule As of September 30, 2025 (1) (2) (1) Adjusted for the redemption of all $450,000 of 4.75% senior unsecured notes due 2026 in October 2025. (2) As of November 4, 2025, SVC had no amounts outstanding under its $650,000 revolving credit facility and $45,000 outstanding under the VFN. (3) SVC's net lease mortgage notes due 2028 are partially amortizing and require balloon payments at maturity. These notes are prepayable without penalty 24 months prior to the expected maturity date. (4) SVC has a one-time option to extend the maturity date of its $580,155 of senior secured notes due 2027 by one year to September 30, 2028, subject to satisfaction of certain conditions and the payment of an extension fee. If SVC exercises this option, interest payments will be due semiannually during the extension period at an initial interest rate of 7.50% per annum, which interest rate will increase periodically by 25 basis points. (3) (4) (dollars in thousands) Secured vs. Unsecured Debt Secured 40.5% Unsecured 59.5% (1)

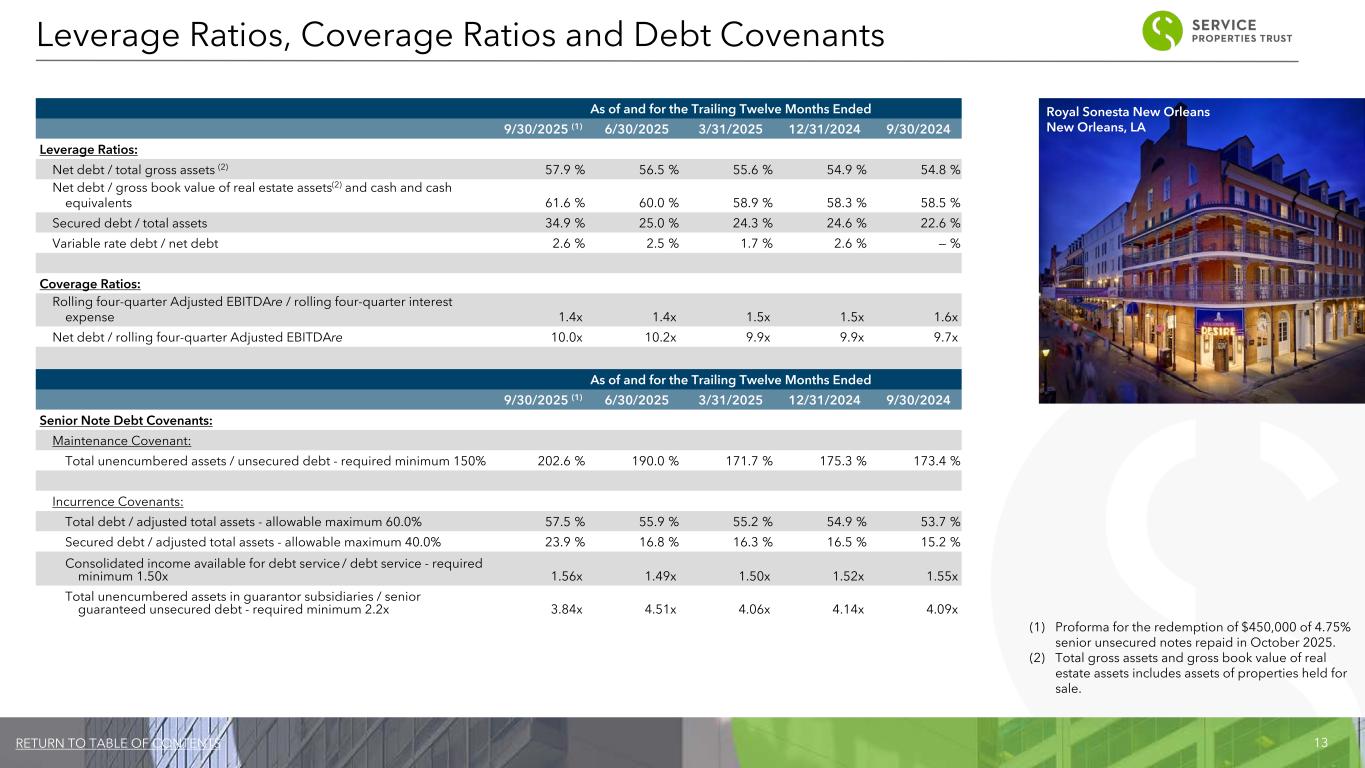

13RETURN TO TABLE OF CONTENTS Leverage Ratios, Coverage Ratios and Debt Covenants Royal Sonesta New Orleans New Orleans, LA (1) Proforma for the redemption of $450,000 of 4.75% senior unsecured notes repaid in October 2025. (2) Total gross assets and gross book value of real estate assets includes assets of properties held for sale. As of and for the Trailing Twelve Months Ended 9/30/2025 (1) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Leverage Ratios: Net debt / total gross assets (2) 57.9 % 56.5 % 55.6 % 54.9 % 54.8 % Net debt / gross book value of real estate assets(2) and cash and cash equivalents 61.6 % 60.0 % 58.9 % 58.3 % 58.5 % Secured debt / total assets 34.9 % 25.0 % 24.3 % 24.6 % 22.6 % Variable rate debt / net debt 2.6 % 2.5 % 1.7 % 2.6 % — % Coverage Ratios: Rolling four-quarter Adjusted EBITDAre / rolling four-quarter interest expense 1.4x 1.4x 1.5x 1.5x 1.6x Net debt / rolling four-quarter Adjusted EBITDAre 10.0x 10.2x 9.9x 9.9x 9.7x As of and for the Trailing Twelve Months Ended 9/30/2025 (1) 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Senior Note Debt Covenants: Maintenance Covenant: Total unencumbered assets / unsecured debt - required minimum 150% 202.6 % 190.0 % 171.7 % 175.3 % 173.4 % Incurrence Covenants: Total debt / adjusted total assets - allowable maximum 60.0% 57.5 % 55.9 % 55.2 % 54.9 % 53.7 % Secured debt / adjusted total assets - allowable maximum 40.0% 23.9 % 16.8 % 16.3 % 16.5 % 15.2 % Consolidated income available for debt service / debt service - required minimum 1.50x 1.56x 1.49x 1.50x 1.52x 1.55x Total unencumbered assets in guarantor subsidiaries / senior guaranteed unsecured debt - required minimum 2.2x 3.84x 4.51x 4.06x 4.14x 4.09x

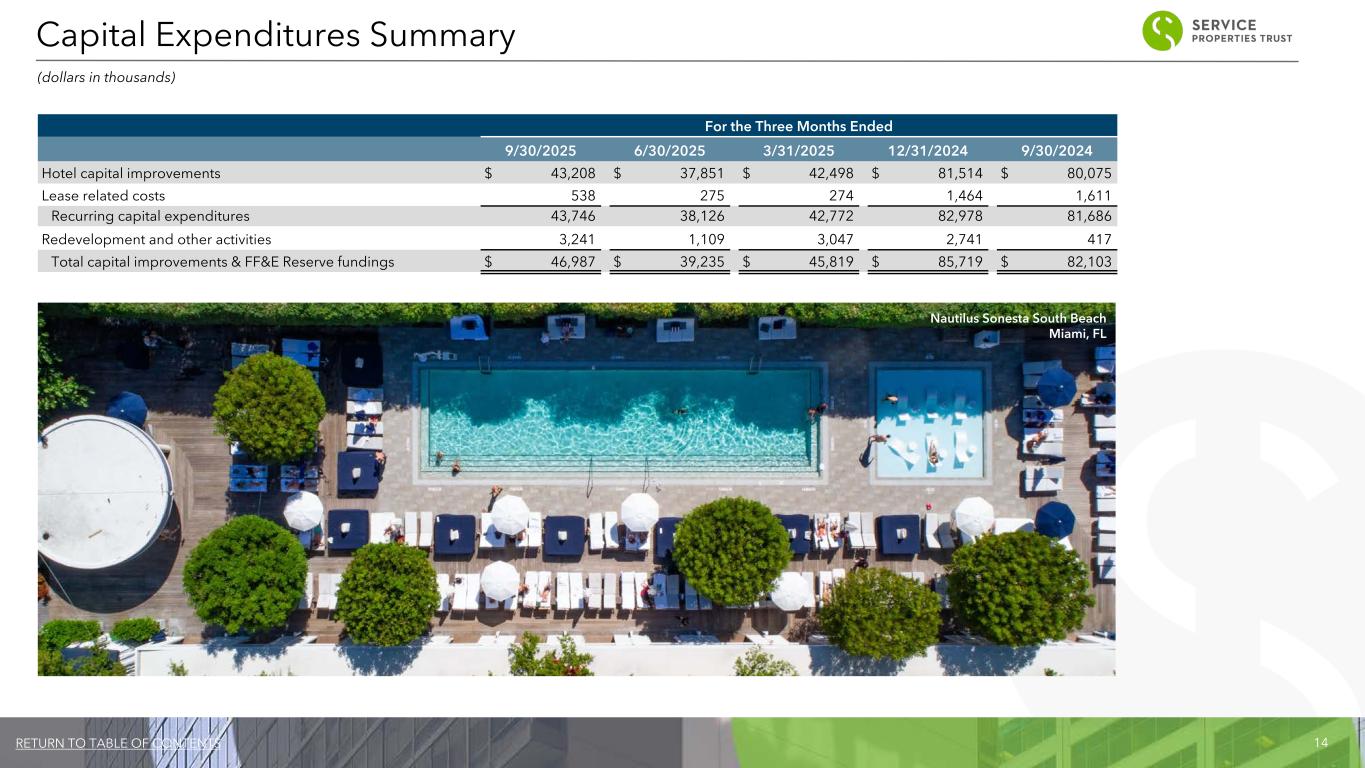

14RETURN TO TABLE OF CONTENTS For the Three Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Hotel capital improvements $ 43,208 $ 37,851 $ 42,498 $ 81,514 $ 80,075 Lease related costs 538 275 274 1,464 1,611 Recurring capital expenditures 43,746 38,126 42,772 82,978 81,686 Redevelopment and other activities 3,241 1,109 3,047 2,741 417 Total capital improvements & FF&E Reserve fundings $ 46,987 $ 39,235 $ 45,819 $ 85,719 $ 82,103 (dollars in thousands) Capital Expenditures Summary Nautilus Sonesta South Beach Miami, FL

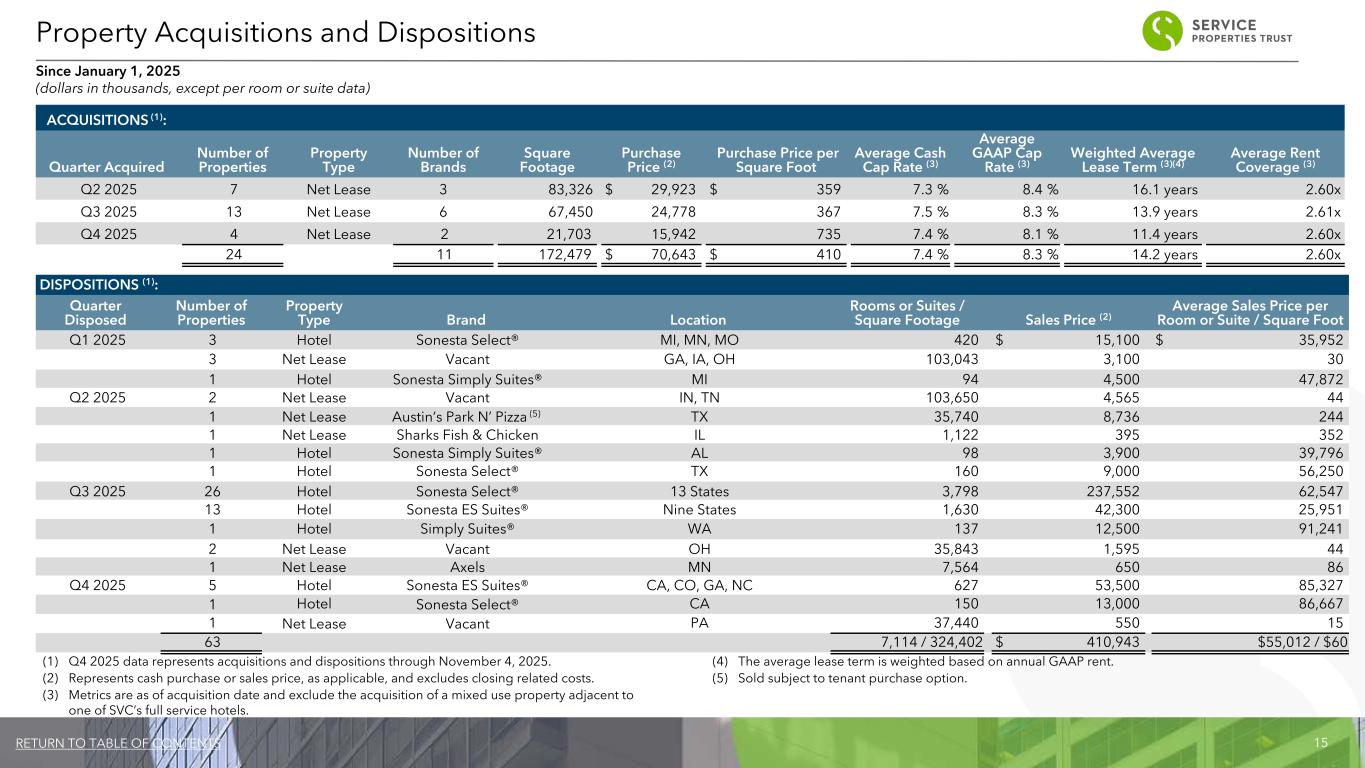

15RETURN TO TABLE OF CONTENTS ACQUISITIONS (1): Quarter Acquired Number of Properties Property Type Number of Brands Square Footage Purchase Price (2) Purchase Price per Square Foot Average Cash Cap Rate (3) Average GAAP Cap Rate (3) Weighted Average Lease Term (3)(4) Average Rent Coverage (3) Q2 2025 7 Net Lease 3 83,326 $ 29,923 $ 359 7.3 % 8.4 % 16.1 years 2.60x Q3 2025 13 Net Lease 6 67,450 24,778 367 7.5 % 8.3 % 13.9 years 2.61x Q4 2025 4 Net Lease 2 21,703 15,942 735 7.4 % 8.1 % 11.4 years 2.60x 24 11 172,479 $ 70,643 $ 410 7.4 % 8.3 % 14.2 years 2.60x Property Acquisitions and Dispositions Since January 1, 2025 (dollars in thousands, except per room or suite data) (4) The average lease term is weighted based on annual GAAP rent. (5) Sold subject to tenant purchase option. DISPOSITIONS (1): Quarter Disposed Number of Properties Property Type Brand Location Rooms or Suites / Square Footage Sales Price (2) Average Sales Price per Room or Suite / Square Foot Q1 2025 3 Hotel Sonesta Select® MI, MN, MO 420 $ 15,100 $ 35,952 3 Net Lease Vacant GA, IA, OH 103,043 3,100 30 1 Hotel Sonesta Simply Suites® MI 94 4,500 47,872 Q2 2025 2 Net Lease Vacant IN, TN 103,650 4,565 44 1 Net Lease Austin’s Park N’ Pizza (5) TX 35,740 8,736 244 1 Net Lease Sharks Fish & Chicken IL 1,122 395 352 1 Hotel Sonesta Simply Suites® AL 98 3,900 39,796 1 Hotel Sonesta Select® TX 160 9,000 56,250 Q3 2025 26 Hotel Sonesta Select® 13 States 3,798 237,552 62,547 13 Hotel Sonesta ES Suites® Nine States 1,630 42,300 25,951 1 Hotel Simply Suites® WA 137 12,500 91,241 2 Net Lease Vacant OH 35,843 1,595 44 1 Net Lease Axels MN 7,564 650 86 Q4 2025 5 Hotel Sonesta ES Suites® CA, CO, GA, NC 627 53,500 85,327 1 Hotel Sonesta Select® CA 150 13,000 86,667 1 Net Lease Vacant PA 37,440 550 15 63 7,114 / 324,402 $ 410,943 $55,012 / $60 (1) Q4 2025 data represents acquisitions and dispositions through November 4, 2025. (2) Represents cash purchase or sales price, as applicable, and excludes closing related costs. (3) Metrics are as of acquisition date and exclude the acquisition of a mixed use property adjacent to one of SVC’s full service hotels.

16RETURN TO TABLE OF CONTENTS Portfolio Information

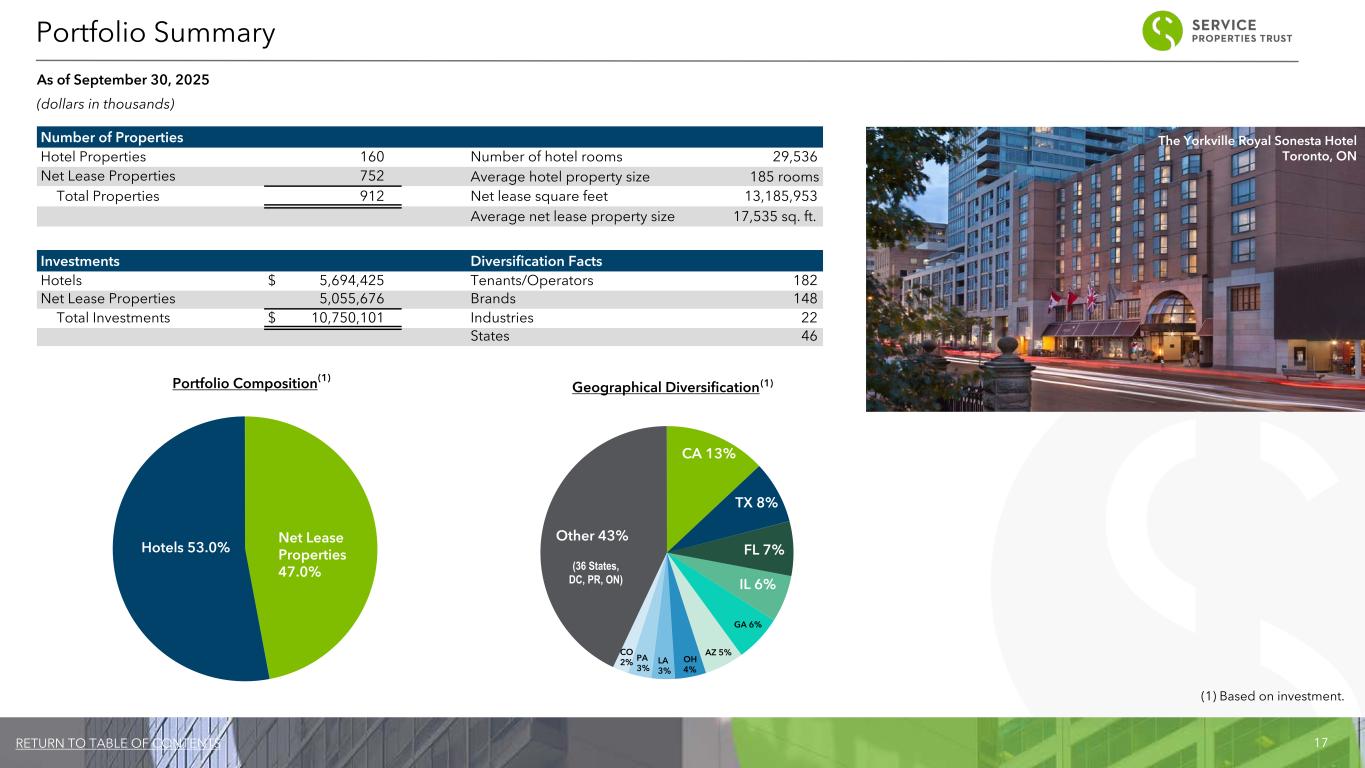

17RETURN TO TABLE OF CONTENTS Portfolio Composition Net Lease Properties 47.0% Hotels 53.0% Number of Properties Hotel Properties 160 Number of hotel rooms 29,536 Net Lease Properties 752 Average hotel property size 185 rooms Total Properties 912 Net lease square feet 13,185,953 Average net lease property size 17,535 sq. ft. Investments Diversification Facts Hotels $ 5,694,425 Tenants/Operators 182 Net Lease Properties 5,055,676 Brands 148 Total Investments $ 10,750,101 Industries 22 States 46 Geographical Diversification CA 13% TX 8% FL 7% IL 6% GA 6% AZ 5% OH 4% LA 3% PA 3% CO 2% Other 43% (36 States, DC, PR, ON) Portfolio Summary As of September 30, 2025 (dollars in thousands) (1) Based on investment. (1) (1) The Yorkville Royal Sonesta Hotel Toronto, ON

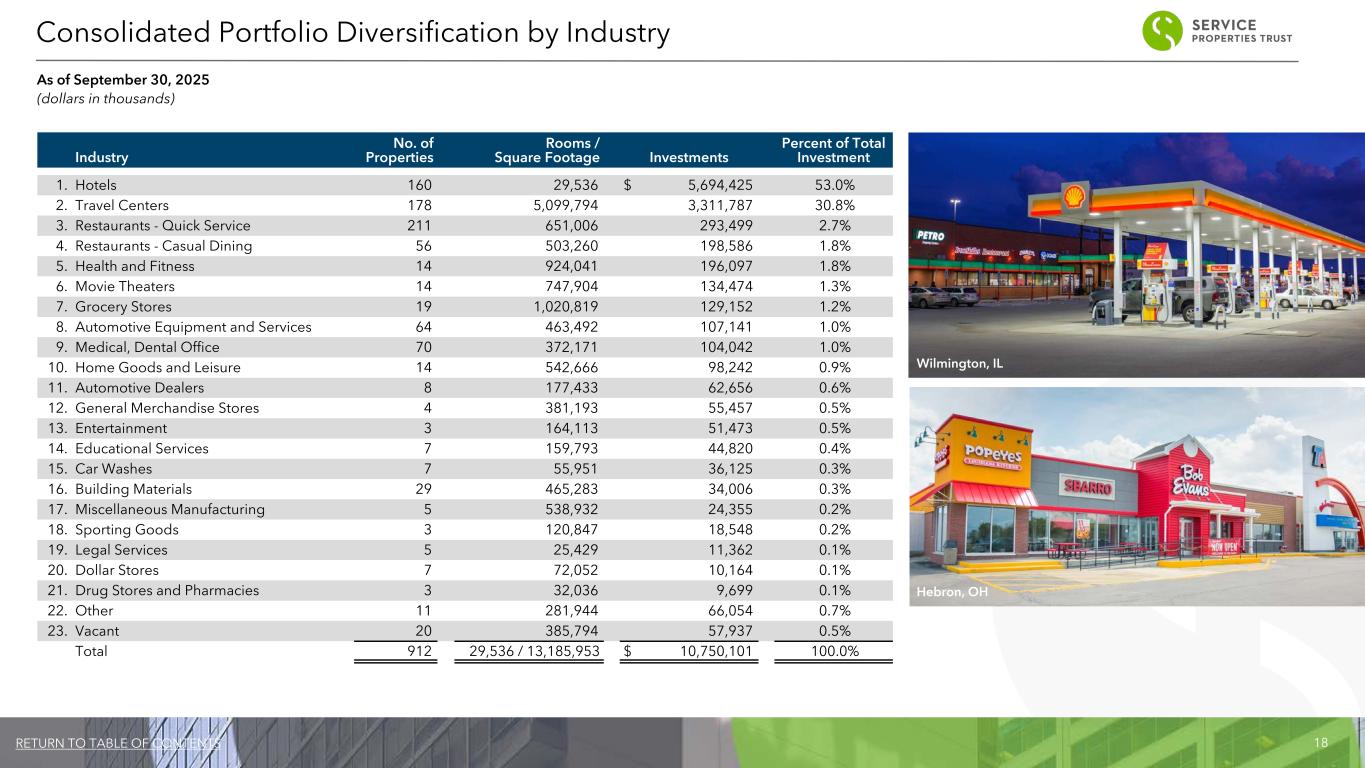

18RETURN TO TABLE OF CONTENTS Industry No. of Properties Rooms / Square Footage Investments Percent of Total Investment 1. Hotels 160 29,536 $ 5,694,425 53.0% 2. Travel Centers 178 5,099,794 3,311,787 30.8% 3. Restaurants - Quick Service 211 651,006 293,499 2.7% 4. Restaurants - Casual Dining 56 503,260 198,586 1.8% 5. Health and Fitness 14 924,041 196,097 1.8% 6. Movie Theaters 14 747,904 134,474 1.3% 7. Grocery Stores 19 1,020,819 129,152 1.2% 8. Automotive Equipment and Services 64 463,492 107,141 1.0% 9. Medical, Dental Office 70 372,171 104,042 1.0% 10. Home Goods and Leisure 14 542,666 98,242 0.9% 11. Automotive Dealers 8 177,433 62,656 0.6% 12. General Merchandise Stores 4 381,193 55,457 0.5% 13. Entertainment 3 164,113 51,473 0.5% 14. Educational Services 7 159,793 44,820 0.4% 15. Car Washes 7 55,951 36,125 0.3% 16. Building Materials 29 465,283 34,006 0.3% 17. Miscellaneous Manufacturing 5 538,932 24,355 0.2% 18. Sporting Goods 3 120,847 18,548 0.2% 19. Legal Services 5 25,429 11,362 0.1% 20. Dollar Stores 7 72,052 10,164 0.1% 21. Drug Stores and Pharmacies 3 32,036 9,699 0.1% 22. Other 11 281,944 66,054 0.7% 23. Vacant 20 385,794 57,937 0.5% Total 912 29,536 / 13,185,953 $ 10,750,101 100.0% Consolidated Portfolio Diversification by Industry As of September 30, 2025 (dollars in thousands) Wilmington, IL Hebron, OH

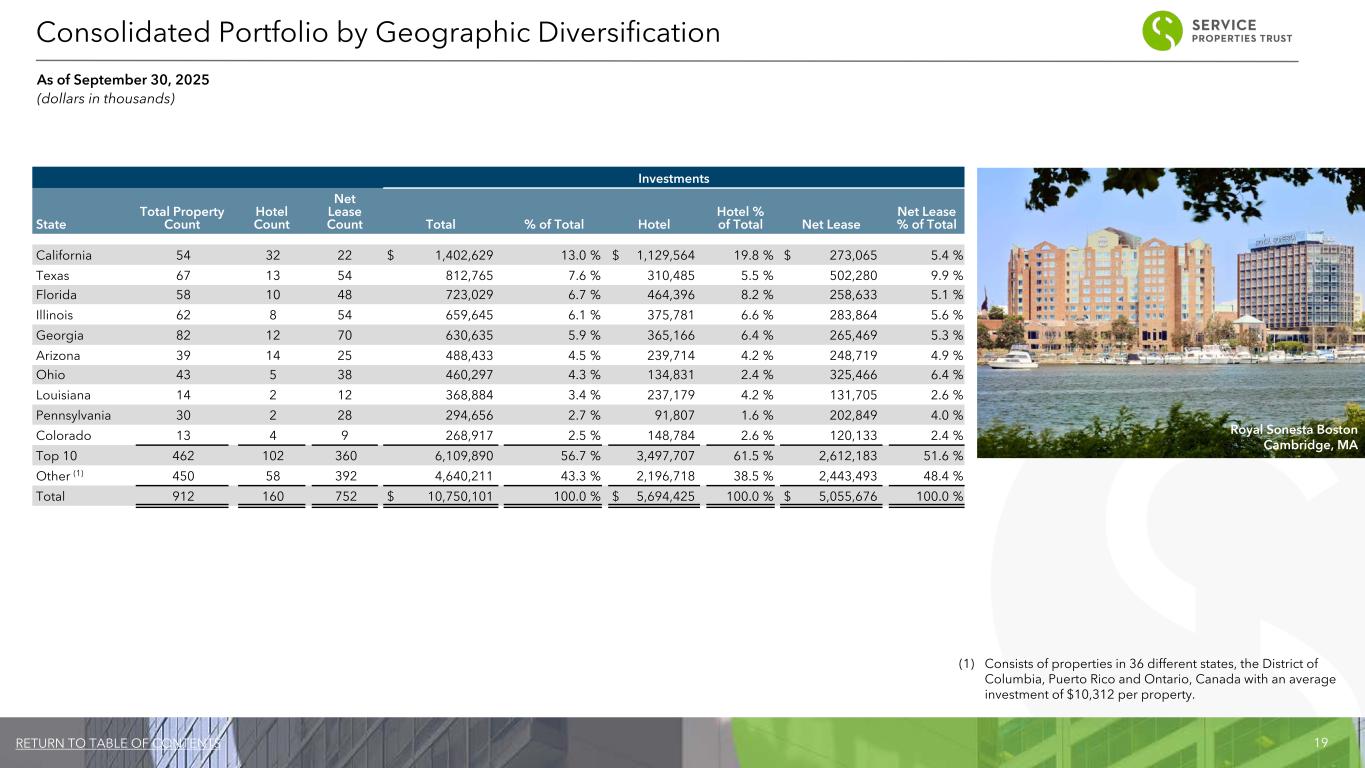

19RETURN TO TABLE OF CONTENTS Investments State Total Property Count Hotel Count Net Lease Count Total % of Total Hotel Hotel % of Total Net Lease Net Lease % of Total California 54 32 22 $ 1,402,629 13.0 % $ 1,129,564 19.8 % $ 273,065 5.4 % Texas 67 13 54 812,765 7.6 % 310,485 5.5 % 502,280 9.9 % Florida 58 10 48 723,029 6.7 % 464,396 8.2 % 258,633 5.1 % Illinois 62 8 54 659,645 6.1 % 375,781 6.6 % 283,864 5.6 % Georgia 82 12 70 630,635 5.9 % 365,166 6.4 % 265,469 5.3 % Arizona 39 14 25 488,433 4.5 % 239,714 4.2 % 248,719 4.9 % Ohio 43 5 38 460,297 4.3 % 134,831 2.4 % 325,466 6.4 % Louisiana 14 2 12 368,884 3.4 % 237,179 4.2 % 131,705 2.6 % Pennsylvania 30 2 28 294,656 2.7 % 91,807 1.6 % 202,849 4.0 % Colorado 13 4 9 268,917 2.5 % 148,784 2.6 % 120,133 2.4 % Top 10 462 102 360 6,109,890 56.7 % 3,497,707 61.5 % 2,612,183 51.6 % Other (1) 450 58 392 4,640,211 43.3 % 2,196,718 38.5 % 2,443,493 48.4 % Total 912 160 752 $ 10,750,101 100.0 % $ 5,694,425 100.0 % $ 5,055,676 100.0 % (1) Consists of properties in 36 different states, the District of Columbia, Puerto Rico and Ontario, Canada with an average investment of $10,312 per property. Consolidated Portfolio by Geographic Diversification As of September 30, 2025 (dollars in thousands) Royal Sonesta Boston Cambridge, MA

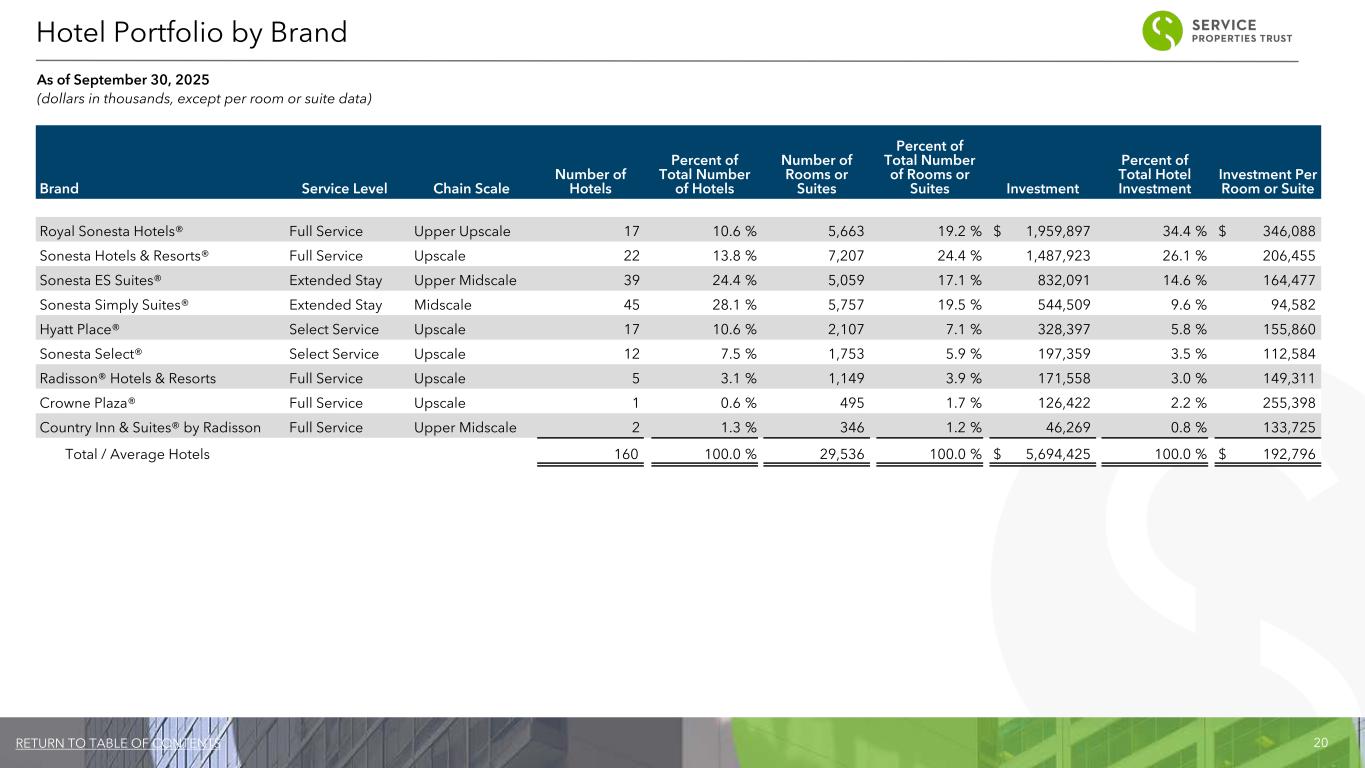

20RETURN TO TABLE OF CONTENTS Brand Service Level Chain Scale Number of Hotels Percent of Total Number of Hotels Number of Rooms or Suites Percent of Total Number of Rooms or Suites Investment Percent of Total Hotel Investment Investment Per Room or Suite Royal Sonesta Hotels® Full Service Upper Upscale 17 10.6 % 5,663 19.2 % $ 1,959,897 34.4 % $ 346,088 Sonesta Hotels & Resorts® Full Service Upscale 22 13.8 % 7,207 24.4 % 1,487,923 26.1 % 206,455 Sonesta ES Suites® Extended Stay Upper Midscale 39 24.4 % 5,059 17.1 % 832,091 14.6 % 164,477 Sonesta Simply Suites® Extended Stay Midscale 45 28.1 % 5,757 19.5 % 544,509 9.6 % 94,582 Hyatt Place® Select Service Upscale 17 10.6 % 2,107 7.1 % 328,397 5.8 % 155,860 Sonesta Select® Select Service Upscale 12 7.5 % 1,753 5.9 % 197,359 3.5 % 112,584 Radisson® Hotels & Resorts Full Service Upscale 5 3.1 % 1,149 3.9 % 171,558 3.0 % 149,311 Crowne Plaza® Full Service Upscale 1 0.6 % 495 1.7 % 126,422 2.2 % 255,398 Country Inn & Suites® by Radisson Full Service Upper Midscale 2 1.3 % 346 1.2 % 46,269 0.8 % 133,725 Total / Average Hotels 160 100.0 % 29,536 100.0 % $ 5,694,425 100.0 % $ 192,796 Hotel Portfolio by Brand As of September 30, 2025 (dollars in thousands, except per room or suite data)

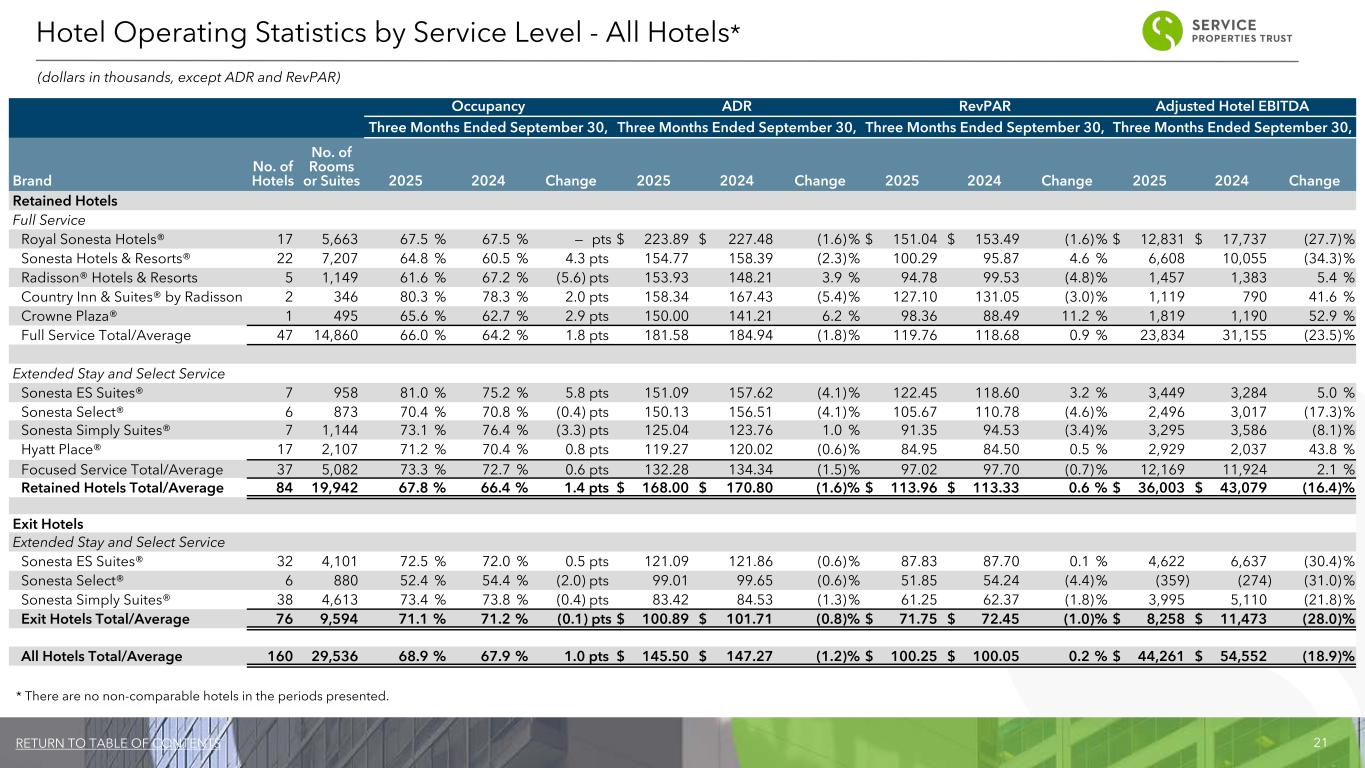

21RETURN TO TABLE OF CONTENTS Hotel Operating Statistics by Service Level - All Hotels* Occupancy ADR RevPAR Adjusted Hotel EBITDA Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Brand No. of Hotels No. of Rooms or Suites 2025 2024 Change 2025 2024 Change 2025 2024 Change 2025 2024 Change Retained Hotels Full Service Royal Sonesta Hotels® 17 5,663 67.5 % 67.5 % — pts $ 223.89 $ 227.48 (1.6) % $ 151.04 $ 153.49 (1.6) % $ 12,831 $ 17,737 (27.7) % Sonesta Hotels & Resorts® 22 7,207 64.8 % 60.5 % 4.3 pts 154.77 158.39 (2.3) % 100.29 95.87 4.6 % 6,608 10,055 (34.3) % Radisson® Hotels & Resorts 5 1,149 61.6 % 67.2 % (5.6) pts 153.93 148.21 3.9 % 94.78 99.53 (4.8) % 1,457 1,383 5.4 % Country Inn & Suites® by Radisson 2 346 80.3 % 78.3 % 2.0 pts 158.34 167.43 (5.4) % 127.10 131.05 (3.0) % 1,119 790 41.6 % Crowne Plaza® 1 495 65.6 % 62.7 % 2.9 pts 150.00 141.21 6.2 % 98.36 88.49 11.2 % 1,819 1,190 52.9 % Full Service Total/Average 47 14,860 66.0 % 64.2 % 1.8 pts 181.58 184.94 (1.8) % 119.76 118.68 0.9 % 23,834 31,155 (23.5) % Extended Stay and Select Service Sonesta ES Suites® 7 958 81.0 % 75.2 % 5.8 pts 151.09 157.62 (4.1) % 122.45 118.60 3.2 % 3,449 3,284 5.0 % Sonesta Select® 6 873 70.4 % 70.8 % (0.4) pts 150.13 156.51 (4.1) % 105.67 110.78 (4.6) % 2,496 3,017 (17.3) % Sonesta Simply Suites® 7 1,144 73.1 % 76.4 % (3.3) pts 125.04 123.76 1.0 % 91.35 94.53 (3.4) % 3,295 3,586 (8.1) % Hyatt Place® 17 2,107 71.2 % 70.4 % 0.8 pts 119.27 120.02 (0.6) % 84.95 84.50 0.5 % 2,929 2,037 43.8 % Focused Service Total/Average 37 5,082 73.3 % 72.7 % 0.6 pts 132.28 134.34 (1.5) % 97.02 97.70 (0.7) % 12,169 11,924 2.1 % Retained Hotels Total/Average 84 19,942 67.8 % 66.4 % 1.4 pts $ 168.00 $ 170.80 (1.6) % $ 113.96 $ 113.33 0.6 % $ 36,003 $ 43,079 (16.4) % Exit Hotels Extended Stay and Select Service Sonesta ES Suites® 32 4,101 72.5 % 72.0 % 0.5 pts 121.09 121.86 (0.6) % 87.83 87.70 0.1 % 4,622 6,637 (30.4) % Sonesta Select® 6 880 52.4 % 54.4 % (2.0) pts 99.01 99.65 (0.6) % 51.85 54.24 (4.4) % (359) (274) (31.0) % Sonesta Simply Suites® 38 4,613 73.4 % 73.8 % (0.4) pts 83.42 84.53 (1.3) % 61.25 62.37 (1.8) % 3,995 5,110 (21.8) % Exit Hotels Total/Average 76 9,594 71.1 % 71.2 % (0.1) pts $ 100.89 $ 101.71 (0.8) % $ 71.75 $ 72.45 (1.0) % $ 8,258 $ 11,473 (28.0) % All Hotels Total/Average 160 29,536 68.9 % 67.9 % 1.0 pts $ 145.50 $ 147.27 (1.2) % $ 100.25 $ 100.05 0.2 % $ 44,261 $ 54,552 (18.9) % (dollars in thousands, except ADR and RevPAR) * There are no non-comparable hotels in the periods presented.

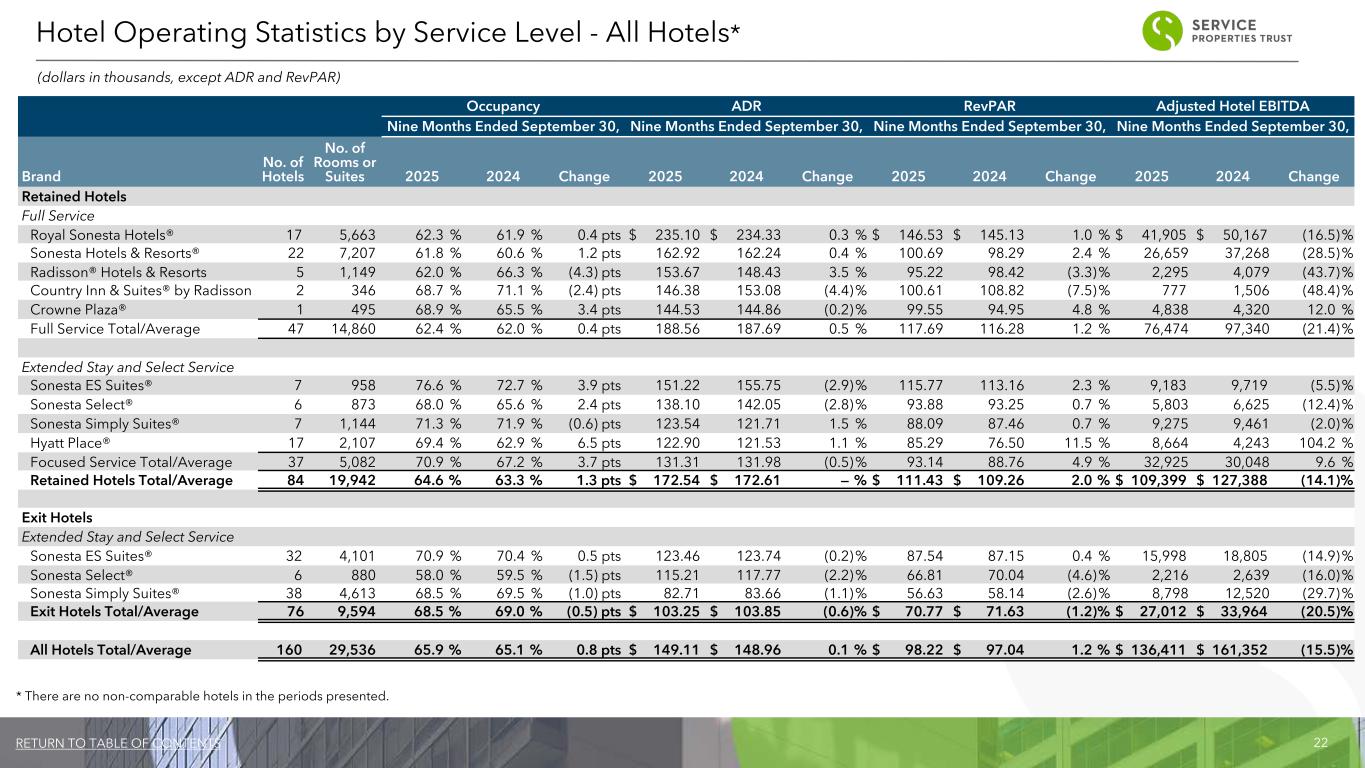

22RETURN TO TABLE OF CONTENTS Hotel Operating Statistics by Service Level - All Hotels* Occupancy ADR RevPAR Adjusted Hotel EBITDA Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Brand No. of Hotels No. of Rooms or Suites 2025 2024 Change 2025 2024 Change 2025 2024 Change 2025 2024 Change Retained Hotels Full Service Royal Sonesta Hotels® 17 5,663 62.3 % 61.9 % 0.4 pts $ 235.10 $ 234.33 0.3 % $ 146.53 $ 145.13 1.0 % $ 41,905 $ 50,167 (16.5) % Sonesta Hotels & Resorts® 22 7,207 61.8 % 60.6 % 1.2 pts 162.92 162.24 0.4 % 100.69 98.29 2.4 % 26,659 37,268 (28.5) % Radisson® Hotels & Resorts 5 1,149 62.0 % 66.3 % (4.3) pts 153.67 148.43 3.5 % 95.22 98.42 (3.3) % 2,295 4,079 (43.7) % Country Inn & Suites® by Radisson 2 346 68.7 % 71.1 % (2.4) pts 146.38 153.08 (4.4) % 100.61 108.82 (7.5) % 777 1,506 (48.4) % Crowne Plaza® 1 495 68.9 % 65.5 % 3.4 pts 144.53 144.86 (0.2) % 99.55 94.95 4.8 % 4,838 4,320 12.0 % Full Service Total/Average 47 14,860 62.4 % 62.0 % 0.4 pts 188.56 187.69 0.5 % 117.69 116.28 1.2 % 76,474 97,340 (21.4) % Extended Stay and Select Service Sonesta ES Suites® 7 958 76.6 % 72.7 % 3.9 pts 151.22 155.75 (2.9) % 115.77 113.16 2.3 % 9,183 9,719 (5.5) % Sonesta Select® 6 873 68.0 % 65.6 % 2.4 pts 138.10 142.05 (2.8) % 93.88 93.25 0.7 % 5,803 6,625 (12.4) % Sonesta Simply Suites® 7 1,144 71.3 % 71.9 % (0.6) pts 123.54 121.71 1.5 % 88.09 87.46 0.7 % 9,275 9,461 (2.0) % Hyatt Place® 17 2,107 69.4 % 62.9 % 6.5 pts 122.90 121.53 1.1 % 85.29 76.50 11.5 % 8,664 4,243 104.2 % Focused Service Total/Average 37 5,082 70.9 % 67.2 % 3.7 pts 131.31 131.98 (0.5) % 93.14 88.76 4.9 % 32,925 30,048 9.6 % Retained Hotels Total/Average 84 19,942 64.6 % 63.3 % 1.3 pts $ 172.54 $ 172.61 — % $ 111.43 $ 109.26 2.0 % $ 109,399 $ 127,388 (14.1) % Exit Hotels Extended Stay and Select Service Sonesta ES Suites® 32 4,101 70.9 % 70.4 % 0.5 pts 123.46 123.74 (0.2) % 87.54 87.15 0.4 % 15,998 18,805 (14.9) % Sonesta Select® 6 880 58.0 % 59.5 % (1.5) pts 115.21 117.77 (2.2) % 66.81 70.04 (4.6) % 2,216 2,639 (16.0) % Sonesta Simply Suites® 38 4,613 68.5 % 69.5 % (1.0) pts 82.71 83.66 (1.1) % 56.63 58.14 (2.6) % 8,798 12,520 (29.7) % Exit Hotels Total/Average 76 9,594 68.5 % 69.0 % (0.5) pts $ 103.25 $ 103.85 (0.6) % $ 70.77 $ 71.63 (1.2) % $ 27,012 $ 33,964 (20.5) % All Hotels Total/Average 160 29,536 65.9 % 65.1 % 0.8 pts $ 149.11 $ 148.96 0.1 % $ 98.22 $ 97.04 1.2 % $ 136,411 $ 161,352 (15.5) % (dollars in thousands, except ADR and RevPAR) * There are no non-comparable hotels in the periods presented.

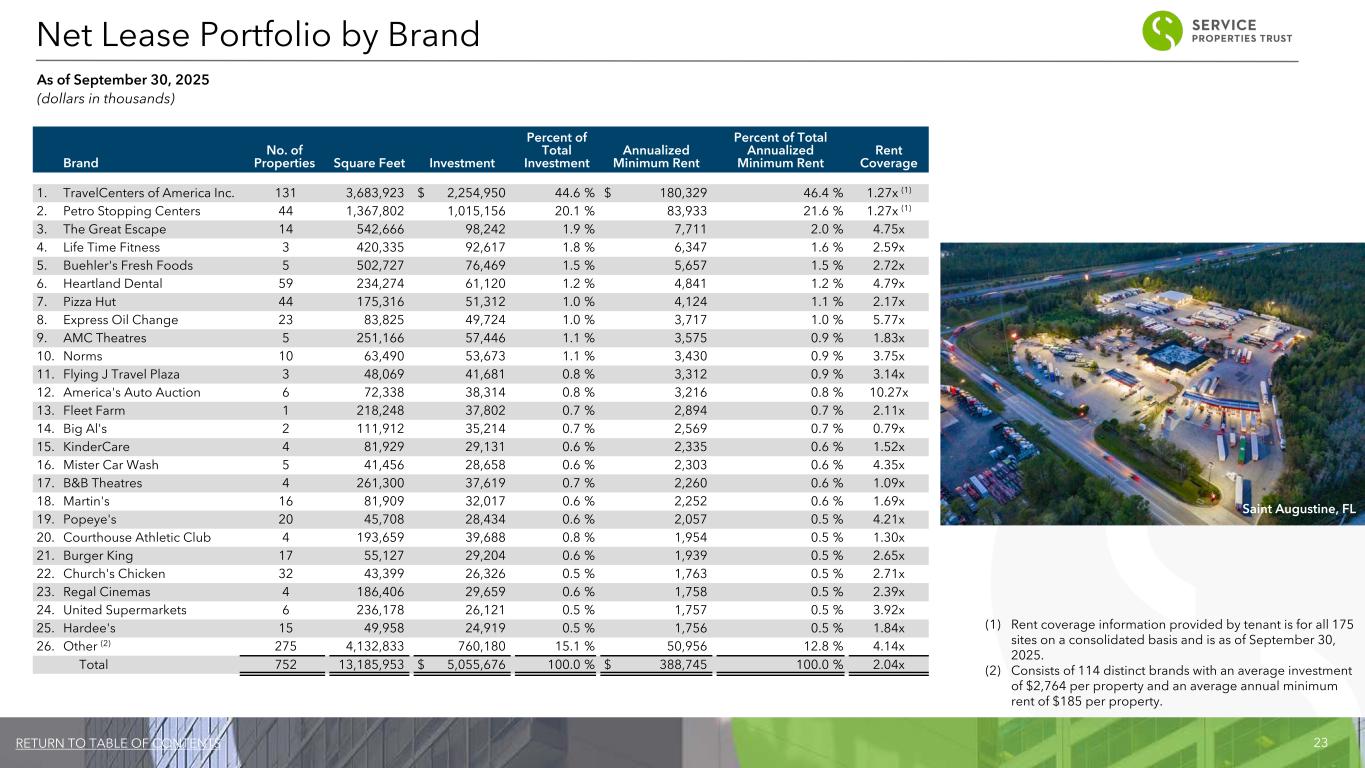

23RETURN TO TABLE OF CONTENTS Brand No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. TravelCenters of America Inc. 131 3,683,923 $ 2,254,950 44.6 % $ 180,329 46.4 % 1.27x (1) 2. Petro Stopping Centers 44 1,367,802 1,015,156 20.1 % 83,933 21.6 % 1.27x (1) 3. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.0 % 4.75x 4. Life Time Fitness 3 420,335 92,617 1.8 % 6,347 1.6 % 2.59x 5. Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 2.72x 6. Heartland Dental 59 234,274 61,120 1.2 % 4,841 1.2 % 4.79x 7. Pizza Hut 44 175,316 51,312 1.0 % 4,124 1.1 % 2.17x 8. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 5.77x 9. AMC Theatres 5 251,166 57,446 1.1 % 3,575 0.9 % 1.83x 10. Norms 10 63,490 53,673 1.1 % 3,430 0.9 % 3.75x 11. Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,312 0.9 % 3.14x 12. America's Auto Auction 6 72,338 38,314 0.8 % 3,216 0.8 % 10.27x 13. Fleet Farm 1 218,248 37,802 0.7 % 2,894 0.7 % 2.11x 14. Big Al's 2 111,912 35,214 0.7 % 2,569 0.7 % 0.79x 15. KinderCare 4 81,929 29,131 0.6 % 2,335 0.6 % 1.52x 16. Mister Car Wash 5 41,456 28,658 0.6 % 2,303 0.6 % 4.35x 17. B&B Theatres 4 261,300 37,619 0.7 % 2,260 0.6 % 1.09x 18. Martin's 16 81,909 32,017 0.6 % 2,252 0.6 % 1.69x 19. Popeye's 20 45,708 28,434 0.6 % 2,057 0.5 % 4.21x 20. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,954 0.5 % 1.30x 21. Burger King 17 55,127 29,204 0.6 % 1,939 0.5 % 2.65x 22. Church's Chicken 32 43,399 26,326 0.5 % 1,763 0.5 % 2.71x 23. Regal Cinemas 4 186,406 29,659 0.6 % 1,758 0.5 % 2.39x 24. United Supermarkets 6 236,178 26,121 0.5 % 1,757 0.5 % 3.92x 25. Hardee's 15 49,958 24,919 0.5 % 1,756 0.5 % 1.84x 26. Other (2) 275 4,132,833 760,180 15.1 % 50,956 12.8 % 4.14x Total 752 13,185,953 $ 5,055,676 100.0 % $ 388,745 100.0 % 2.04x (1) Rent coverage information provided by tenant is for all 175 sites on a consolidated basis and is as of September 30, 2025. (2) Consists of 114 distinct brands with an average investment of $2,764 per property and an average annual minimum rent of $185 per property. Net Lease Portfolio by Brand As of September 30, 2025 (dollars in thousands) Saint Augustine, FL

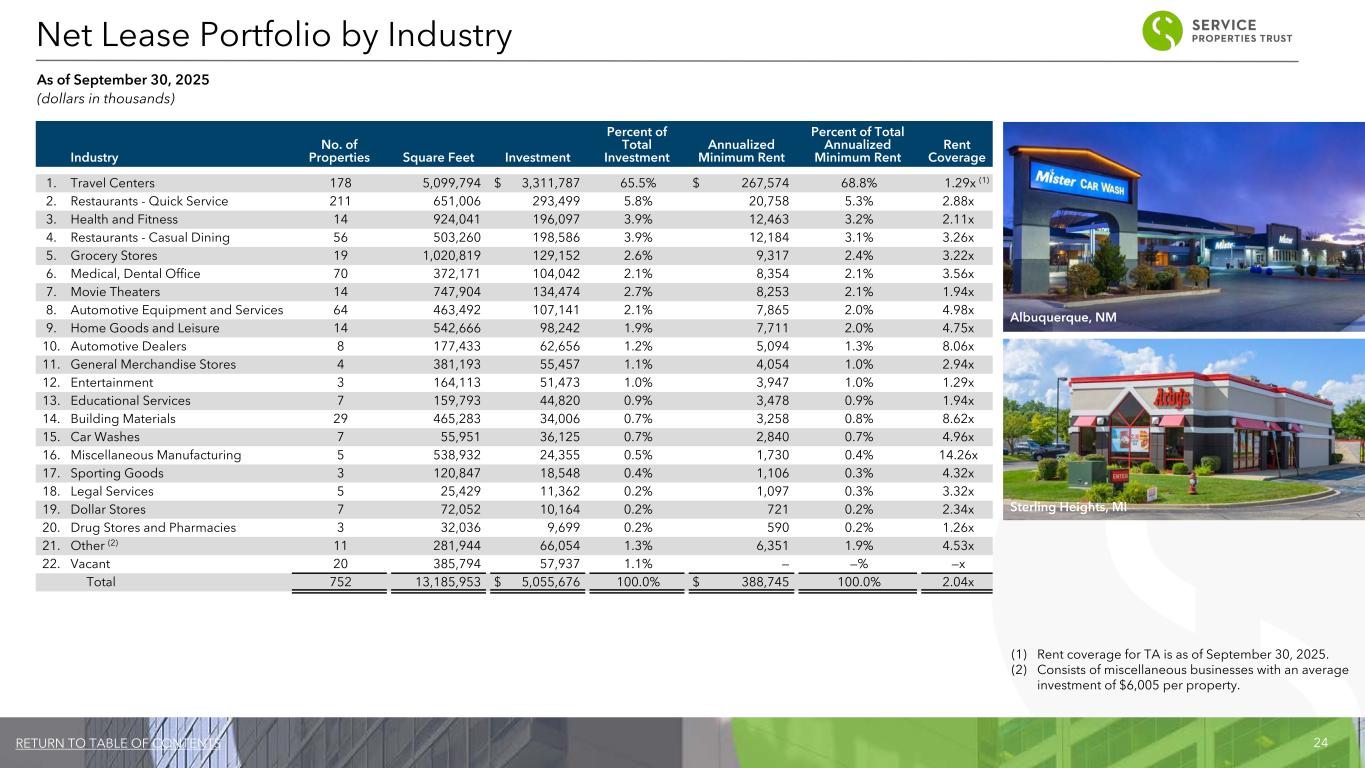

24RETURN TO TABLE OF CONTENTS Industry No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. Travel Centers 178 5,099,794 $ 3,311,787 65.5% $ 267,574 68.8% 1.29x (1) 2. Restaurants - Quick Service 211 651,006 293,499 5.8% 20,758 5.3% 2.88x 3. Health and Fitness 14 924,041 196,097 3.9% 12,463 3.2% 2.11x 4. Restaurants - Casual Dining 56 503,260 198,586 3.9% 12,184 3.1% 3.26x 5. Grocery Stores 19 1,020,819 129,152 2.6% 9,317 2.4% 3.22x 6. Medical, Dental Office 70 372,171 104,042 2.1% 8,354 2.1% 3.56x 7. Movie Theaters 14 747,904 134,474 2.7% 8,253 2.1% 1.94x 8. Automotive Equipment and Services 64 463,492 107,141 2.1% 7,865 2.0% 4.98x 9. Home Goods and Leisure 14 542,666 98,242 1.9% 7,711 2.0% 4.75x 10. Automotive Dealers 8 177,433 62,656 1.2% 5,094 1.3% 8.06x 11. General Merchandise Stores 4 381,193 55,457 1.1% 4,054 1.0% 2.94x 12. Entertainment 3 164,113 51,473 1.0% 3,947 1.0% 1.29x 13. Educational Services 7 159,793 44,820 0.9% 3,478 0.9% 1.94x 14. Building Materials 29 465,283 34,006 0.7% 3,258 0.8% 8.62x 15. Car Washes 7 55,951 36,125 0.7% 2,840 0.7% 4.96x 16. Miscellaneous Manufacturing 5 538,932 24,355 0.5% 1,730 0.4% 14.26x 17. Sporting Goods 3 120,847 18,548 0.4% 1,106 0.3% 4.32x 18. Legal Services 5 25,429 11,362 0.2% 1,097 0.3% 3.32x 19. Dollar Stores 7 72,052 10,164 0.2% 721 0.2% 2.34x 20. Drug Stores and Pharmacies 3 32,036 9,699 0.2% 590 0.2% 1.26x 21. Other (2) 11 281,944 66,054 1.3% 6,351 1.9% 4.53x 22. Vacant 20 385,794 57,937 1.1% — —% —x Total 752 13,185,953 $ 5,055,676 100.0% $ 388,745 100.0% 2.04x (1) Rent coverage for TA is as of September 30, 2025. (2) Consists of miscellaneous businesses with an average investment of $6,005 per property. Net Lease Portfolio by Industry As of September 30, 2025 (dollars in thousands) Albuquerque, NM Sterling Heights, MI

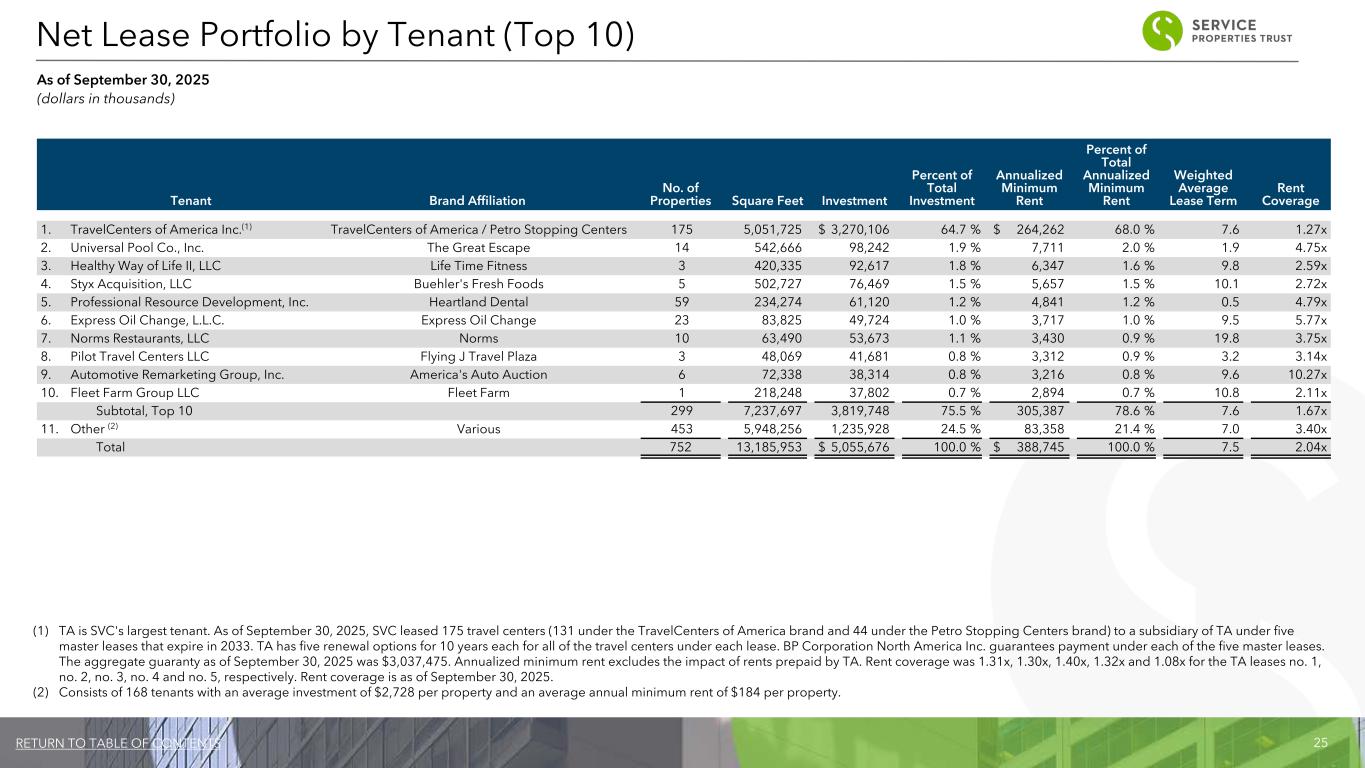

25RETURN TO TABLE OF CONTENTS (1) TA is SVC's largest tenant. As of September 30, 2025, SVC leased 175 travel centers (131 under the TravelCenters of America brand and 44 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2033. TA has five renewal options for 10 years each for all of the travel centers under each lease. BP Corporation North America Inc. guarantees payment under each of the five master leases. The aggregate guaranty as of September 30, 2025 was $3,037,475. Annualized minimum rent excludes the impact of rents prepaid by TA. Rent coverage was 1.31x, 1.30x, 1.40x, 1.32x and 1.08x for the TA leases no. 1, no. 2, no. 3, no. 4 and no. 5, respectively. Rent coverage is as of September 30, 2025. (2) Consists of 168 tenants with an average investment of $2,728 per property and an average annual minimum rent of $184 per property. Tenant Brand Affiliation No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Weighted Average Lease Term Rent Coverage 1. TravelCenters of America Inc.(1) TravelCenters of America / Petro Stopping Centers 175 5,051,725 $ 3,270,106 64.7 % $ 264,262 68.0 % 7.6 1.27x 2. Universal Pool Co., Inc. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.0 % 1.9 4.75x 3. Healthy Way of Life II, LLC Life Time Fitness 3 420,335 92,617 1.8 % 6,347 1.6 % 9.8 2.59x 4. Styx Acquisition, LLC Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 10.1 2.72x 5. Professional Resource Development, Inc. Heartland Dental 59 234,274 61,120 1.2 % 4,841 1.2 % 0.5 4.79x 6. Express Oil Change, L.L.C. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 9.5 5.77x 7. Norms Restaurants, LLC Norms 10 63,490 53,673 1.1 % 3,430 0.9 % 19.8 3.75x 8. Pilot Travel Centers LLC Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,312 0.9 % 3.2 3.14x 9. Automotive Remarketing Group, Inc. America's Auto Auction 6 72,338 38,314 0.8 % 3,216 0.8 % 9.6 10.27x 10. Fleet Farm Group LLC Fleet Farm 1 218,248 37,802 0.7 % 2,894 0.7 % 10.8 2.11x Subtotal, Top 10 299 7,237,697 3,819,748 75.5 % 305,387 78.6 % 7.6 1.67x 11. Other (2) Various 453 5,948,256 1,235,928 24.5 % 83,358 21.4 % 7.0 3.40x Total 752 13,185,953 $ 5,055,676 100.0 % $ 388,745 100.0 % 7.5 2.04x Net Lease Portfolio by Tenant (Top 10) As of September 30, 2025 (dollars in thousands)

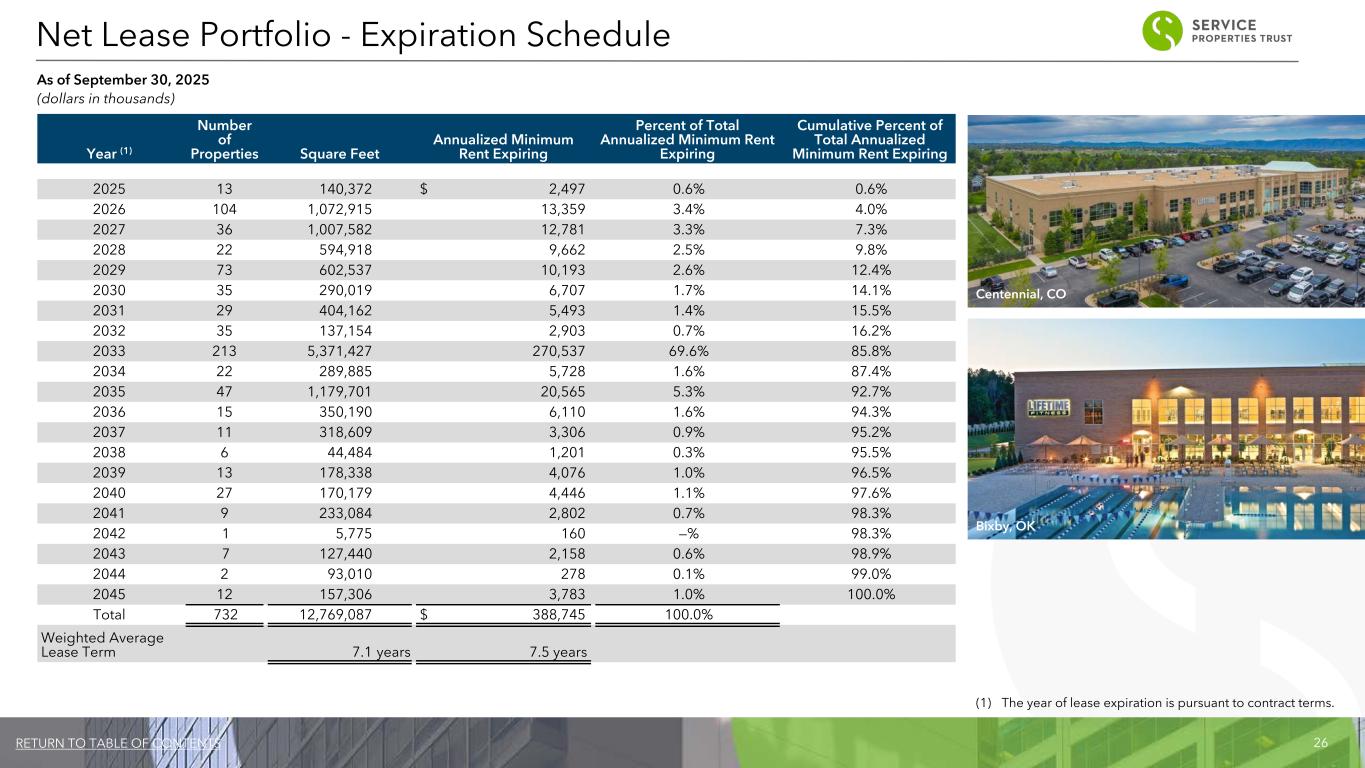

26RETURN TO TABLE OF CONTENTS Year (1) Number of Properties Square Feet Annualized Minimum Rent Expiring Percent of Total Annualized Minimum Rent Expiring Cumulative Percent of Total Annualized Minimum Rent Expiring 2025 13 140,372 $ 2,497 0.6% 0.6% 2026 104 1,072,915 13,359 3.4% 4.0% 2027 36 1,007,582 12,781 3.3% 7.3% 2028 22 594,918 9,662 2.5% 9.8% 2029 73 602,537 10,193 2.6% 12.4% 2030 35 290,019 6,707 1.7% 14.1% 2031 29 404,162 5,493 1.4% 15.5% 2032 35 137,154 2,903 0.7% 16.2% 2033 213 5,371,427 270,537 69.6% 85.8% 2034 22 289,885 5,728 1.6% 87.4% 2035 47 1,179,701 20,565 5.3% 92.7% 2036 15 350,190 6,110 1.6% 94.3% 2037 11 318,609 3,306 0.9% 95.2% 2038 6 44,484 1,201 0.3% 95.5% 2039 13 178,338 4,076 1.0% 96.5% 2040 27 170,179 4,446 1.1% 97.6% 2041 9 233,084 2,802 0.7% 98.3% 2042 1 5,775 160 —% 98.3% 2043 7 127,440 2,158 0.6% 98.9% 2044 2 93,010 278 0.1% 99.0% 2045 12 157,306 3,783 1.0% 100.0% Total 732 12,769,087 $ 388,745 100.0% Weighted Average Lease Term 7.1 years 7.5 years (1) The year of lease expiration is pursuant to contract terms. Net Lease Portfolio - Expiration Schedule As of September 30, 2025 (dollars in thousands) Centennial, CO Bixby, OK

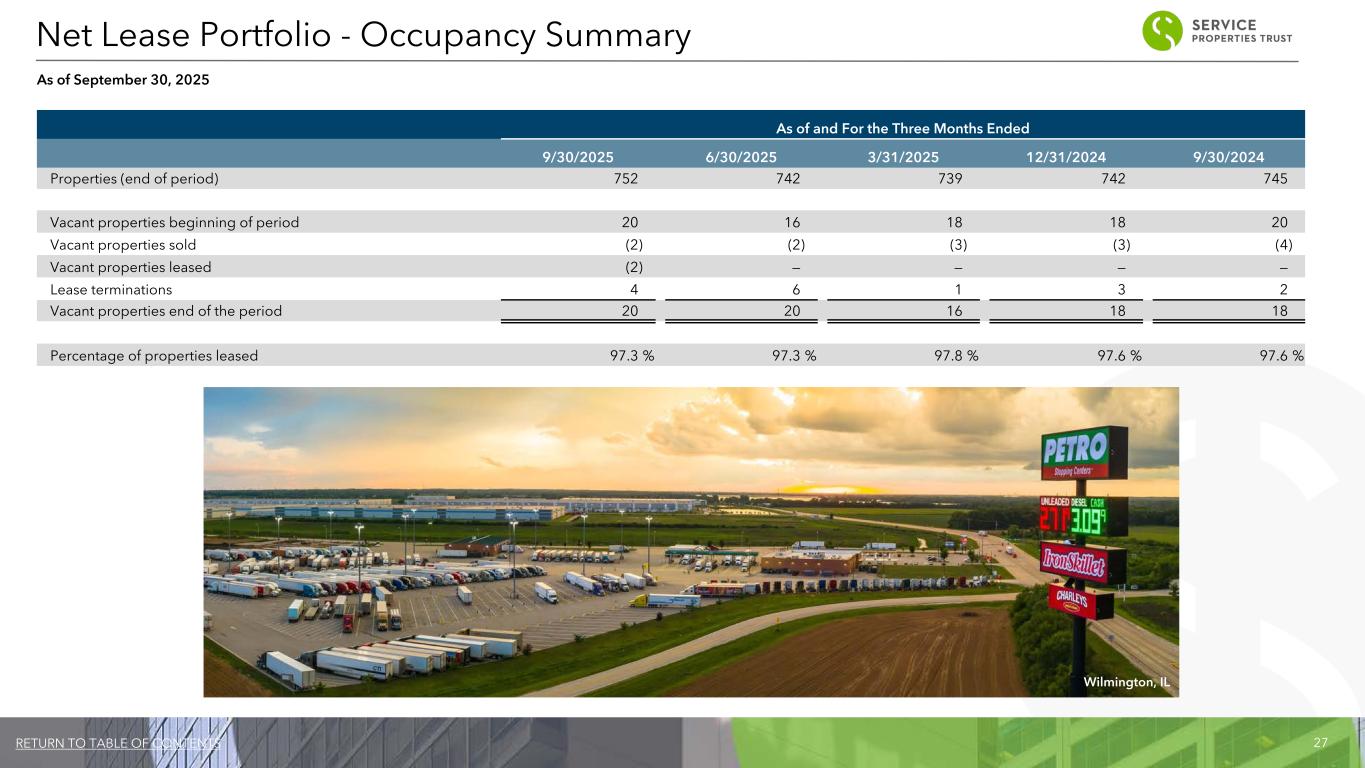

27RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 Properties (end of period) 752 742 739 742 745 Vacant properties beginning of period 20 16 18 18 20 Vacant properties sold (2) (2) (3) (3) (4) Vacant properties leased (2) — — — — Lease terminations 4 6 1 3 2 Vacant properties end of the period 20 20 16 18 18 Percentage of properties leased 97.3 % 97.3 % 97.8 % 97.6 % 97.6 % Net Lease Portfolio - Occupancy Summary As of September 30, 2025 Wilmington, IL

28RETURN TO TABLE OF CONTENTS Appendix

29RETURN TO TABLE OF CONTENTS Company Profile and Research Coverage The Company: SVC is a REIT that owns hotels and service-focused retail net lease properties throughout the United States and in Puerto Rico and Canada. Management: SVC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. As of September 30, 2025, RMR had approximately $39 billion in assets under management and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. SVC believes that being managed by RMR is a competitive advantage for SVC because of RMR’s depth of management and experience in the real estate industry. SVC also believes RMR provides management services to it at a lower cost than it would have to pay for similar quality services if it were self managed. Equity Research Coverage B. Riley Securities, Inc. Oppenheimer & Co. Inc. John Massocca Tyler Batory (646) 885-5424 (212) 667-7230 jmassocca@brileysecurities.com tyler.batory@opco.com Wells Fargo Securities James Feldman (212) 214-5328 james.feldman@wellsfargo.com Rating Agencies Moody’s Investors Service S&P Global Lori Marks Alan Zigman (212) 553-1098 (416) 507-2556 lori.marks@moodys.com alan.zigman@spglobal.com SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

30RETURN TO TABLE OF CONTENTS Board of Trustees Christopher J. Bilotto Donna D. Fraiche Rajan C. Penkar Managing Trustee Lead Independent Trustee Independent Trustee Laurie B. Burns William A. Lamkin Adam D. Portnoy Independent Trustee Independent Trustee Chair of the Board & Managing Trustee Robert E. Cramer Independent Trustee Officers Christopher J. Bilotto Brian E. Donley President and Chief Executive Officer Chief Financial Officer and Treasurer Jesse W. Abair Vice President Governance Information Royal Sonesta Kaua`i Resort Lihue, HI

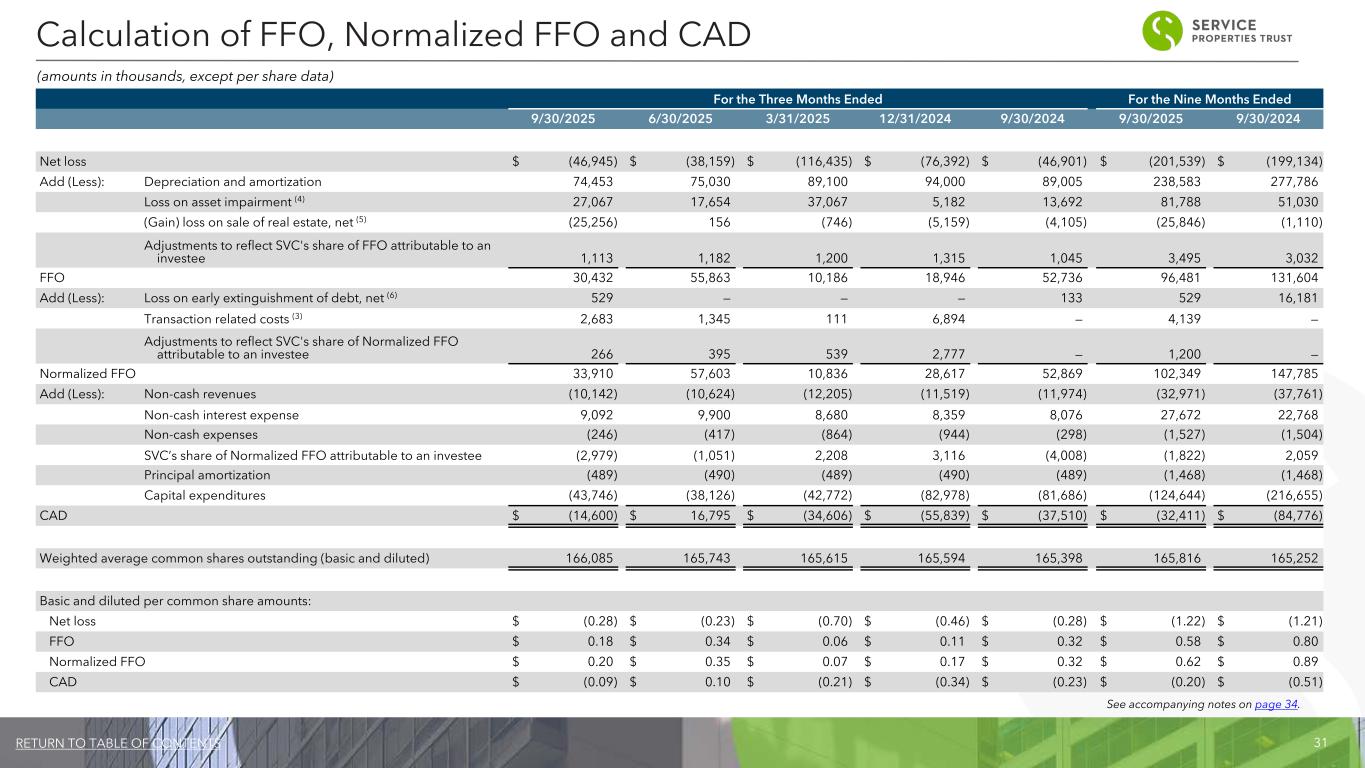

31RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Net loss $ (46,945) $ (38,159) $ (116,435) $ (76,392) $ (46,901) $ (201,539) $ (199,134) Add (Less): Depreciation and amortization 74,453 75,030 89,100 94,000 89,005 238,583 277,786 Loss on asset impairment (4) 27,067 17,654 37,067 5,182 13,692 81,788 51,030 (Gain) loss on sale of real estate, net (5) (25,256) 156 (746) (5,159) (4,105) (25,846) (1,110) Adjustments to reflect SVC's share of FFO attributable to an investee 1,113 1,182 1,200 1,315 1,045 3,495 3,032 FFO 30,432 55,863 10,186 18,946 52,736 96,481 131,604 Add (Less): Loss on early extinguishment of debt, net (6) 529 — — — 133 529 16,181 Transaction related costs (3) 2,683 1,345 111 6,894 — 4,139 — Adjustments to reflect SVC's share of Normalized FFO attributable to an investee 266 395 539 2,777 — 1,200 — Normalized FFO 33,910 57,603 10,836 28,617 52,869 102,349 147,785 Add (Less): Non-cash revenues (10,142) (10,624) (12,205) (11,519) (11,974) (32,971) (37,761) Non-cash interest expense 9,092 9,900 8,680 8,359 8,076 27,672 22,768 Non-cash expenses (246) (417) (864) (944) (298) (1,527) (1,504) SVC’s share of Normalized FFO attributable to an investee (2,979) (1,051) 2,208 3,116 (4,008) (1,822) 2,059 Principal amortization (489) (490) (489) (490) (489) (1,468) (1,468) Capital expenditures (43,746) (38,126) (42,772) (82,978) (81,686) (124,644) (216,655) CAD $ (14,600) $ 16,795 $ (34,606) $ (55,839) $ (37,510) $ (32,411) $ (84,776) Weighted average common shares outstanding (basic and diluted) 166,085 165,743 165,615 165,594 165,398 165,816 165,252 Basic and diluted per common share amounts: Net loss $ (0.28) $ (0.23) $ (0.70) $ (0.46) $ (0.28) $ (1.22) $ (1.21) FFO $ 0.18 $ 0.34 $ 0.06 $ 0.11 $ 0.32 $ 0.58 $ 0.80 Normalized FFO $ 0.20 $ 0.35 $ 0.07 $ 0.17 $ 0.32 $ 0.62 $ 0.89 CAD $ (0.09) $ 0.10 $ (0.21) $ (0.34) $ (0.23) $ (0.20) $ (0.51) Calculation of FFO, Normalized FFO and CAD (amounts in thousands, except per share data) See accompanying notes on page 34.

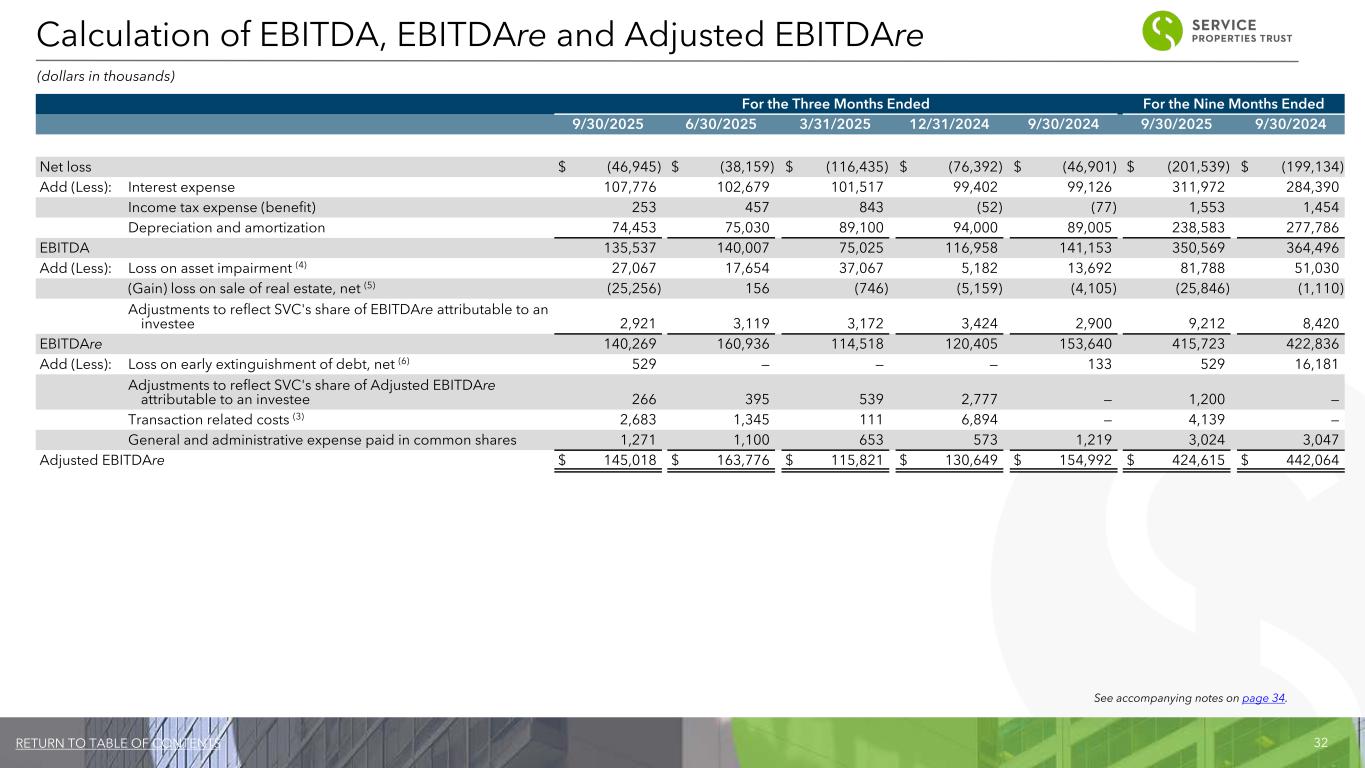

32RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Net loss $ (46,945) $ (38,159) $ (116,435) $ (76,392) $ (46,901) $ (201,539) $ (199,134) Add (Less): Interest expense 107,776 102,679 101,517 99,402 99,126 311,972 284,390 Income tax expense (benefit) 253 457 843 (52) (77) 1,553 1,454 Depreciation and amortization 74,453 75,030 89,100 94,000 89,005 238,583 277,786 EBITDA 135,537 140,007 75,025 116,958 141,153 350,569 364,496 Add (Less): Loss on asset impairment (4) 27,067 17,654 37,067 5,182 13,692 81,788 51,030 (Gain) loss on sale of real estate, net (5) (25,256) 156 (746) (5,159) (4,105) (25,846) (1,110) Adjustments to reflect SVC's share of EBITDAre attributable to an investee 2,921 3,119 3,172 3,424 2,900 9,212 8,420 EBITDAre 140,269 160,936 114,518 120,405 153,640 415,723 422,836 Add (Less): Loss on early extinguishment of debt, net (6) 529 — — — 133 529 16,181 Adjustments to reflect SVC's share of Adjusted EBITDAre attributable to an investee 266 395 539 2,777 — 1,200 — Transaction related costs (3) 2,683 1,345 111 6,894 — 4,139 — General and administrative expense paid in common shares 1,271 1,100 653 573 1,219 3,024 3,047 Adjusted EBITDAre $ 145,018 $ 163,776 $ 115,821 $ 130,649 $ 154,992 $ 424,615 $ 442,064 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) See accompanying notes on page 34.

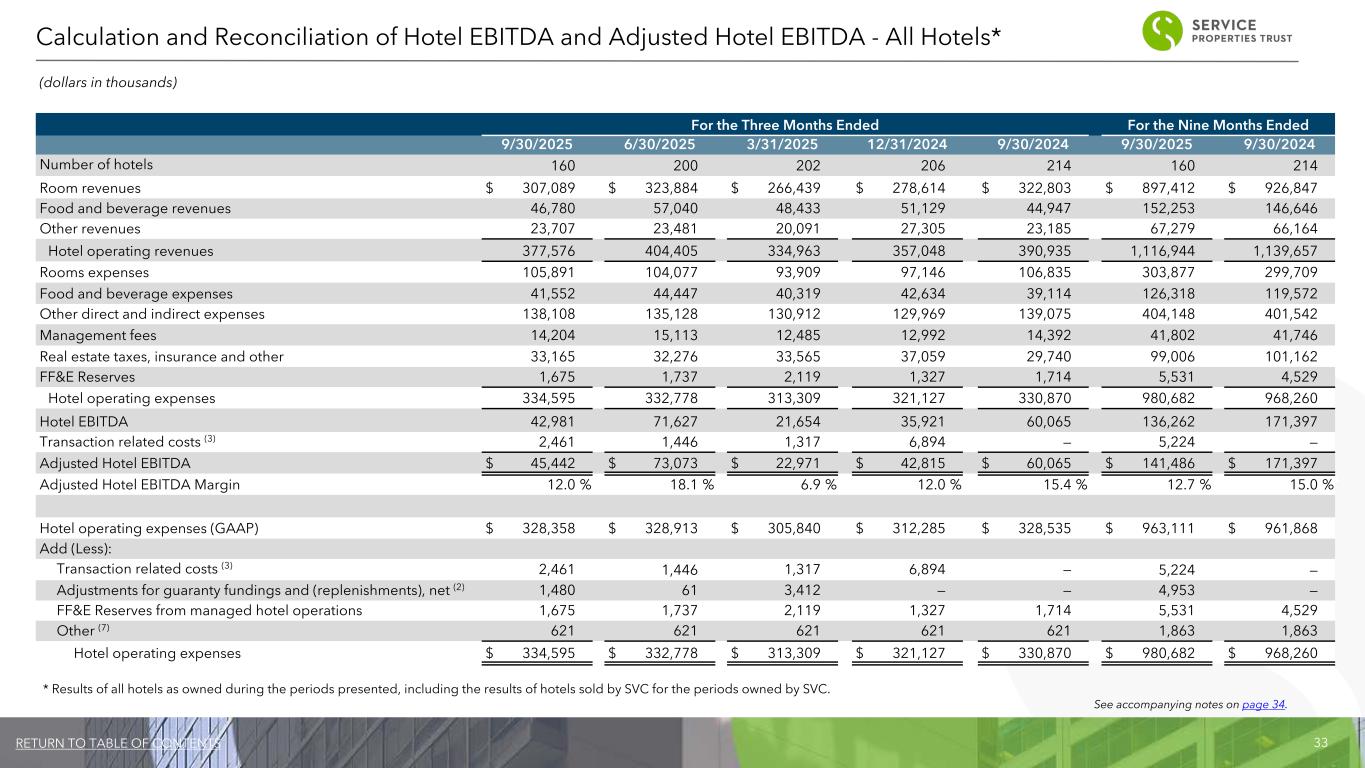

33RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2025 6/30/2025 3/31/2025 12/31/2024 9/30/2024 9/30/2025 9/30/2024 Number of hotels 160 200 202 206 214 160 214 Room revenues $ 307,089 $ 323,884 $ 266,439 $ 278,614 $ 322,803 $ 897,412 $ 926,847 Food and beverage revenues 46,780 57,040 48,433 51,129 44,947 152,253 146,646 Other revenues 23,707 23,481 20,091 27,305 23,185 67,279 66,164 Hotel operating revenues 377,576 404,405 334,963 357,048 390,935 1,116,944 1,139,657 Rooms expenses 105,891 104,077 93,909 97,146 106,835 303,877 299,709 Food and beverage expenses 41,552 44,447 40,319 42,634 39,114 126,318 119,572 Other direct and indirect expenses 138,108 135,128 130,912 129,969 139,075 404,148 401,542 Management fees 14,204 15,113 12,485 12,992 14,392 41,802 41,746 Real estate taxes, insurance and other 33,165 32,276 33,565 37,059 29,740 99,006 101,162 FF&E Reserves 1,675 1,737 2,119 1,327 1,714 5,531 4,529 Hotel operating expenses 334,595 332,778 313,309 321,127 330,870 980,682 968,260 Hotel EBITDA 42,981 71,627 21,654 35,921 60,065 136,262 171,397 Transaction related costs (3) 2,461 1,446 1,317 6,894 — 5,224 — Adjusted Hotel EBITDA $ 45,442 $ 73,073 $ 22,971 $ 42,815 $ 60,065 $ 141,486 $ 171,397 Adjusted Hotel EBITDA Margin 12.0 % 18.1 % 6.9 % 12.0 % 15.4 % 12.7 % 15.0 % Hotel operating expenses (GAAP) $ 328,358 $ 328,913 $ 305,840 $ 312,285 $ 328,535 $ 963,111 $ 961,868 Add (Less): Transaction related costs (3) 2,461 1,446 1,317 6,894 — 5,224 — Adjustments for guaranty fundings and (replenishments), net (2) 1,480 61 3,412 — — 4,953 — FF&E Reserves from managed hotel operations 1,675 1,737 2,119 1,327 1,714 5,531 4,529 Other (7) 621 621 621 621 621 1,863 1,863 Hotel operating expenses $ 334,595 $ 332,778 $ 313,309 $ 321,127 $ 330,870 $ 980,682 $ 968,260 Calculation and Reconciliation of Hotel EBITDA and Adjusted Hotel EBITDA - All Hotels* See accompanying notes on page 34. * Results of all hotels as owned during the periods presented, including the results of hotels sold by SVC for the periods owned by SVC.

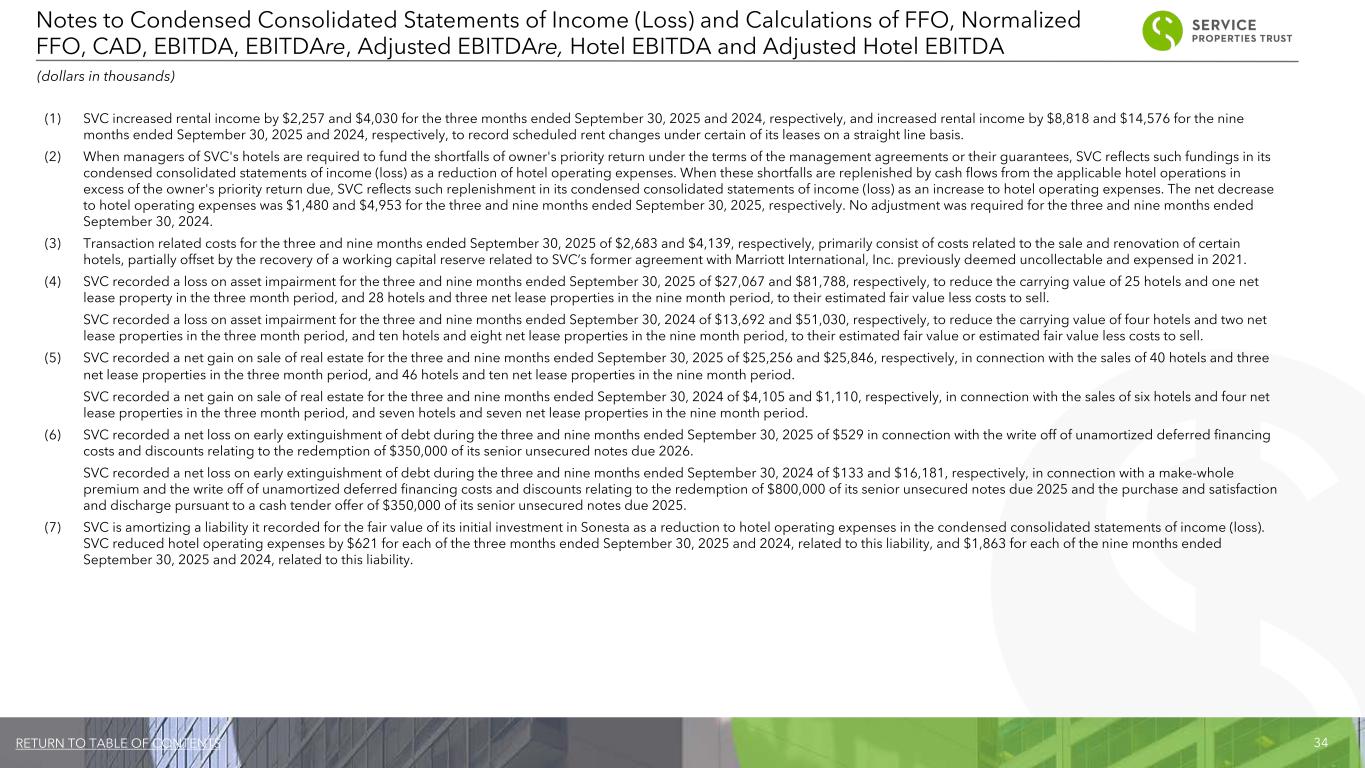

34RETURN TO TABLE OF CONTENTS Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, CAD, EBITDA, EBITDAre, Adjusted EBITDAre, Hotel EBITDA and Adjusted Hotel EBITDA (dollars in thousands) (1) SVC increased rental income by $2,257 and $4,030 for the three months ended September 30, 2025 and 2024, respectively, and increased rental income by $8,818 and $14,576 for the nine months ended September 30, 2025 and 2024, respectively, to record scheduled rent changes under certain of its leases on a straight line basis. (2) When managers of SVC's hotels are required to fund the shortfalls of owner's priority return under the terms of the management agreements or their guarantees, SVC reflects such fundings in its condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. When these shortfalls are replenished by cash flows from the applicable hotel operations in excess of the owner's priority return due, SVC reflects such replenishment in its condensed consolidated statements of income (loss) as an increase to hotel operating expenses. The net decrease to hotel operating expenses was $1,480 and $4,953 for the three and nine months ended September 30, 2025, respectively. No adjustment was required for the three and nine months ended September 30, 2024. (3) Transaction related costs for the three and nine months ended September 30, 2025 of $2,683 and $4,139, respectively, primarily consist of costs related to the sale and renovation of certain hotels, partially offset by the recovery of a working capital reserve related to SVC’s former agreement with Marriott International, Inc. previously deemed uncollectable and expensed in 2021. (4) SVC recorded a loss on asset impairment for the three and nine months ended September 30, 2025 of $27,067 and $81,788, respectively, to reduce the carrying value of 25 hotels and one net lease property in the three month period, and 28 hotels and three net lease properties in the nine month period, to their estimated fair value less costs to sell. SVC recorded a loss on asset impairment for the three and nine months ended September 30, 2024 of $13,692 and $51,030, respectively, to reduce the carrying value of four hotels and two net lease properties in the three month period, and ten hotels and eight net lease properties in the nine month period, to their estimated fair value or estimated fair value less costs to sell. (5) SVC recorded a net gain on sale of real estate for the three and nine months ended September 30, 2025 of $25,256 and $25,846, respectively, in connection with the sales of 40 hotels and three net lease properties in the three month period, and 46 hotels and ten net lease properties in the nine month period. SVC recorded a net gain on sale of real estate for the three and nine months ended September 30, 2024 of $4,105 and $1,110, respectively, in connection with the sales of six hotels and four net lease properties in the three month period, and seven hotels and seven net lease properties in the nine month period. (6) SVC recorded a net loss on early extinguishment of debt during the three and nine months ended September 30, 2025 of $529 in connection with the write off of unamortized deferred financing costs and discounts relating to the redemption of $350,000 of its senior unsecured notes due 2026. SVC recorded a net loss on early extinguishment of debt during the three and nine months ended September 30, 2024 of $133 and $16,181, respectively, in connection with a make-whole premium and the write off of unamortized deferred financing costs and discounts relating to the redemption of $800,000 of its senior unsecured notes due 2025 and the purchase and satisfaction and discharge pursuant to a cash tender offer of $350,000 of its senior unsecured notes due 2025. (7) SVC is amortizing a liability it recorded for the fair value of its initial investment in Sonesta as a reduction to hotel operating expenses in the condensed consolidated statements of income (loss). SVC reduced hotel operating expenses by $621 for each of the three months ended September 30, 2025 and 2024, related to this liability, and $1,863 for each of the nine months ended September 30, 2025 and 2024, related to this liability.

35RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures SVC presents certain “non-GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, CAD, EBITDA, Hotel EBITDA, Adjusted Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of SVC's operating performance or as measures of its liquidity. These measures should be considered in conjunction with net income (loss) as presented in SVC's condensed consolidated statements of income (loss). SVC considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). SVC believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of its operating performance between periods and with other REITs and, in the case of Hotel EBITDA and Adjusted Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of its hotels. FFO and Normalized FFO: SVC calculates funds from operations, or FFO, and normalized funds from operations, or Normalized FFO, as shown on page 31. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net income (loss), calculated in accordance with GAAP, excluding any gain or loss on sale of real estate and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, as well as adjustments to reflect SVC's share of FFO attributable to an investee and certain other adjustments currently not applicable to SVC. In calculating Normalized FFO, SVC adjusts for the items shown on page 31. FFO and Normalized FFO are among the factors considered by SVC's Board of Trustees when determining the amount of distributions to SVC's shareholders. Other factors include, but are not limited to, requirements to satisfy SVC’s REIT distribution requirements, limitations in its debt agreements, the availability to SVC of debt and equity capital, SVC's distribution rate as a percentage of the trading price of its common shares, or dividend yield, and SVC’s dividend yield compared to the dividend yields of other REITs, SVC's expectation of its future capital requirements and operating performance and its expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than SVC does. Cash Available for Distribution: SVC calculates cash available for distribution, or CAD, as shown on page 31. SVC defines CAD as Normalized FFO minus SVC’s proportionate share of Normalized FFO from its equity method investment, plus operating cash flow distributions from its equity method investment, if any, less real estate related capital expenditures and adjusted for other non-cash and nonrecurring items. CAD is among the factors considered by SVC's Board of Trustees when determining the amount of distributions to SVC's shareholders. Other real estate companies and REITs may calculate CAD differently than SVC does. EBITDA, EBITDAre and Adjusted EBITDAre: SVC calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 32. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect SVC's share of EBITDAre attributable to an investee. In calculating Adjusted EBITDAre, SVC adjusts for the items shown on page 32. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than SVC does. Hotel EBITDA and Adjusted Hotel EBITDA: SVC calculates Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in its condensed consolidated statements of income (loss) in accordance with GAAP. Adjusted Hotel EBITDA excludes certain items SVC believes do not reflect the ongoing operating performance of SVC’s hotels. SVC believes that Hotel EBITDA and Adjusted Hotel EBITDA provide useful information to management and investors as a key measure of the profitability of its hotel operations. Non-GAAP Financial Measures and Certain Definitions

36RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures and Certain Definitions (Continued) Other Definitions Adjusted Hotel EBITDA Margin: Adjusted Hotel EBITDA as a percentage of hotel operating revenues. Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include the original cost of real estate assets calculated in accordance with GAAP, before impairment write-downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of SVC's common shares at the end of the period. Annualized Minimum Rent: Generally, SVC's lease agreements with its net lease tenants require payment of minimum rent to SVC. Certain of these minimum rent payment amounts are secured by full or limited guarantees. Annualized minimum rent represents cash amounts and excludes adjustments, if any, necessary to record scheduled rent changes on a straight line basis or any expense reimbursements. Annualized minimum rent for TA excludes the impact of rents prepaid by TA. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at SVC's hotels and is a measure widely used in the hotel industry. Cash Cap Rate: Represents the ratio of the in place annual minimum cash rent divided by the purchase price. Chain Scale: As characterized by STR Global Limited, a data benchmark and analytics provider for the lodging industry. Comparable Hotels Data: SVC presents RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. SVC defines comparable hotels as those that it owned on September 30, 2025 and were open and operating for the entirety of the periods being compared. There were no non-comparable hotels in the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in SVC's debt agreements, is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets of properties held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. Earnings and Adjustments Attributable to an Investee: Represents SVC's proportionate share from its equity investment in Sonesta Holdco Corporation and its subsidiaries, or Sonesta. Exit Hotels: Exit Hotels represent 76 hotels managed by Sonesta that SVC plans to sell. FF&E Reserves: FF&E Reserves, or FF&E Reserves from managed hotel operations, represent various percentages of total sales at certain of SVC's hotels that are escrowed as reserves for future renovations or refurbishments, or FF&E Reserve escrows. SVC owns all the FF&E Reserve escrows for its hotels. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for SVC's hotels generally provide that, if necessary, SVC will provide FF&E funding in excess of escrowed reserves. To the extent SVC makes such fundings, its contractual owner's priority returns or rents generally increase by a percentage of the amounts it funds. GAAP: is U.S. generally accepted accounting principles. GAAP Cap Rate: Represents the ratio of the annual average minimum cash rent over the life of the lease term divided by the purchase price. General and Administrative Expense Paid in Common Shares: Amounts represent the equity compensation for SVC’s Trustees, officers and certain other officers and employees of RMR. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel Capital Improvements and FF&E Reserve Fundings: Generally include the replacement or upgrades of obsolete building components and expenditures that extend the useful life of existing assets or replacement of furniture, fixtures and equipment (FF&E).

37RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures and Certain Definitions (Continued) Investment: SVC defines hotel investment as historical cost of its properties plus capital improvements funded by it less impairment write-downs, if any, and excludes capital improvements made from FF&E Reserves funded from hotel operations that do not result in increases in owner’s priority return or rents. SVC defines net lease investment as historical cost of its properties plus capital improvements funded by SVC less impairment write-downs, if any. Lease Related Costs: Generally include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space and leasing related costs, such as brokerage commissions and tenant inducements. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels, and represents occupied properties as of the end of the period shown for net lease properties. Occupancy is an important measure of the utilization rate and demand of SVC's properties. Non-Cash Expenses: Non-cash expenses represent general and administrative expense paid in common shares and amortization of liabilities relating to SVC’s initial investment in Sonesta and its former investment in The RMR Group, Inc. Non-Cash Interest Expense: Non-cash interest expense represents amortization of debt issuance costs, discounts and premiums. Non-Cash Revenues: Non-cash revenues represent straight-line rent adjustments, lease value amortization, FF&E Reserves, including interest income earned, and the impact of rents prepaid by TA. Owner's Priority Return: Each of its management agreements or leases with hotel operators provides for payment to SVC of an annual owner’s priority return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees. In addition, certain of its hotel management agreements provide for payment to SVC of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed. Redevelopment and Other Activities: Redevelopment and Other Activities generally include projects that reposition a property or result in new sources of revenue and other non-recurring capital expenditures. Rent Coverage: SVC defines rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to SVC weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. Tenants with no minimum rent required under the lease are excluded. EBITDAR amounts used to determine rent coverage are generally for the latest twelve-month period, based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by SVC. In instances where SVC does not have tenant financial information, it calculates an implied coverage ratio for the period based on other tenants with available financial statements operating the same brand or within the same industry. As a result, SVC believes using this implied coverage metric provides a more reasonable estimated representation of recent operating results and the financial condition for those tenants. Retained Hotels: Retained Hotels represents 59 hotels managed by Sonesta, 17 hotels managed by Hyatt Hotels Corporation, seven hotels managed by Radisson Hospitality, Inc. and one hotel managed by InterContinental Hotels Group, plc that SVC will continue to own after the Exit Hotels are sold. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure revenue performance over comparable periods. Rolling Four Quarter CAD: Represents CAD for the preceding twelve month period as of the respective quarter end date. SOFR: SOFR is the secured overnight financing rate. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation, including assets of properties held for sale. Weighted Average Lease Term: The average lease term in years weighted on annualized minimum rent.

38RETURN TO TABLE OF CONTENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: efforts to reposition SVC and enhance its financial stability; driving EBITDA growth within SVC’s hotel portfolio; potential acquisitions of net lease assets to further optimize SVC’s portfolio; SVC’s ability to continue to strengthen the resilience and growth potential of its cash flows and deliver meaningful value to its shareholders; and the planned sales of hotels, including the expected timing thereof. Forward-looking statements reflect management's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SVC's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause SVC's actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: the ability of Sonesta to successfully operate the hotels it manages for SVC; SVC's ability and the ability of SVC's managers and tenants to operate under unfavorable market and commercial real estate industry conditions due to, among other things, uncertainties surrounding interest rates and inflation, supply chain disruptions, emerging technologies, volatility in the public equity and debt markets, effect of or changes to tariffs or trading policies, pandemics, geopolitical instability and tensions, any U.S. government shutdown, economic downturns or a possible recession, labor market conditions or changes in real estate utilization; SVC's ability to sell properties at prices it targets, and the timing of such sales; continued availability of borrowings under SVC’s revolving credit facility is subject to SVC satisfying certain financial covenants and other credit facility conditions; SVC's ability to repay or refinance its debts as they mature or otherwise become due; SVC's ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility and the VFN; SVC's ability to pay interest on and principal of its debt; the impact of changes in U.S. and foreign government administrative policies, including the imposition of or increases in tariffs and changes to existing trade agreements, on macroeconomic conditions, supply chains and the cost of products SVC’s operators use, and on the results of operations of SVC’s operators and SVC; whether and the extent to which SVC's managers and tenants will pay the contractual amounts of returns, rents or other obligations due to SVC; competition within the commercial real estate, hotel, transportation and travel center and other industries in which SVC's managers and tenants operate, particularly in those markets in which SVC's properties are located; SVC's ability to make cost-effective improvements to SVC's properties that enhance their appeal to hotel guests and net lease tenants; SVC's ability to pay distributions to its shareholders and to increase or sustain the amount of such distributions; SVC's ability to acquire properties that realize its targeted returns; SVC’s ability to identify properties that it wants to acquire or to negotiate acceptable purchase prices, acquisition financing terms, management agreements or lease terms for new properties, or ability to complete acquisitions; SVC's ability to raise or appropriately balance the use of debt or equity capital; potential defaults under SVC's management agreements and leases by its managers and tenants; SVC's ability to increase hotel room rates and rents at its net leased properties as SVC's leases expire in excess of its operating expenses and to grow its business; SVC's ability to increase and maintain hotel room and net lease property occupancy at its properties; SVC’s ability to engage and retain qualified managers and tenants for its hotels and net lease properties on satisfactory terms; SVC's ability to diversify its sources of rents and returns that improve the security of its cash flows; SVC's credit ratings; the ability of SVC's manager, RMR, to successfully manage SVC; actual and potential conflicts of interest with SVC's related parties, including its Managing Trustees, Sonesta, RMR and others affiliated with them; SVC's ability to realize benefits from the scale, geographic diversity, strategic locations and variety of service levels of its hotels; limitations imposed by and SVC's ability to satisfy complex rules to maintain its qualification for taxation as a REIT for U.S. federal income tax purposes; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; acts of terrorism, outbreaks of pandemics or other public health safety events or conditions, war or other hostilities, global climate change or other man-made or natural disasters beyond its control; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SVC's periodic filings. The information contained in SVC's filings with the SEC, including under the caption "Risk Factors" in SVC's periodic reports, or incorporated therein, identifies important factors that could cause differences from SVC's forward-looking statements in this presentation. SVC's filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon SVC's forward-looking statements. Except as required by law, SVC does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements