|

|

ISSUER FREE WRITING PROSPECTUS

|

|

Filed Pursuant to Rule 433

|

|

|

Registration Statement No. 333-283969

|

|

|

Dated February 13, 2026

|

Dual Directional Trigger PLUS Based on the Performance of the Shares of the iShares® Silver Trust due June 3, 2027

Trigger Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

This document provides a summary of the terms of the Dual Directional Trigger Performance Leveraged Upside SecuritiesSM (the “Dual

Directional Trigger PLUS” or “Trigger PLUS”). Investors should carefully review the accompanying preliminary pricing supplement for the Trigger PLUS, the accompanying product supplement, the underlier supplement and the prospectus, as well as the

“Risk Considerations” section below, before making an investment decision.

The Trigger PLUS do not guarantee any return of principal at maturity and you could lose up to your entire investment. The Trigger PLUS are senior debt securities issued by The

Toronto-Dominion Bank (“TD”), and all payments on the Trigger PLUS are subject to the credit risk of TD. As used in this document, “we,” “us,” or “our” refers to TD.

|

SUMMARY TERMS

|

|

|

Issuer:

|

The Toronto-Dominion Bank

|

|

Issue:

|

Senior Debt Securities, Series H

|

|

Underlying shares:

|

Shares of the iShares® Silver Trust (Bloomberg Ticker: “SLV UP”)

|

|

Stated principal amount:

|

$1,000.00 per Trigger PLUS

|

|

Issue price:

|

$1,000.00 per Trigger PLUS

|

|

Minimum investment:

|

$1,000.00 (1 Trigger PLUS)

|

|

Coupon:

|

None

|

|

Pricing date:

|

February 27, 2026

|

|

Original issue date:

|

March 4, 2026 (3 business days after the pricing date; see preliminary pricing supplement).

|

|

Valuation date:

|

May 28, 2027, subject to postponement for certain market disruption events and as described in the accompanying product supplement.

|

|

Maturity date:

|

June 3, 2027, subject to postponement for certain market disruption events and as described in the accompanying product supplement.

|

|

Payment at maturity per

Trigger PLUS:

|

◾ If

the final share price is greater than the initial share price:

$1,000.00 + leveraged upside payment

In no event will the payment at maturity from any increase in the value of the underlying shares

exceed the maximum upside payment at maturity.

◾ If

the final share price is less than or equal to the initial share price but greater than or equal to the trigger price:

$1,000.00 + ($1,000.00 × absolute underlying return)

In this scenario, you will receive a 1% positive return on the Trigger PLUS for each 1% negative

return on the underlying shares. In no event will this amount exceed the stated principal amount plus $300.00. You will not benefit from the upside leverage feature in this scenario.

◾ If

the final share price is less than the trigger price:

$1,000.00 + ($1,000.00 × underlying return)

If the final share price is less than the trigger price, you will lose 1% for every 1% that the

final share price falls below the initial share price and you could lose up to your entire investment in the Trigger PLUS.

|

|

Underlying return:

|

(final share price – initial share price) / initial share price

|

|

Absolute underlying

return:

|

The absolute value of the underlying return. For example, a -5% underlying return will result in a +5% absolute underlying return.

|

|

Upside leverage factor:

|

200%

|

|

Leveraged upside

payment:

|

$1,000.00 × upside leverage factor × underlying return

|

|

Maximum upside gain:

|

40.00%

|

|

Maximum upside payment

at maturity:

|

$1,400.00 per Trigger PLUS (140.00% of the stated principal amount)

|

|

Trigger price:

|

70.00% of the initial share price, as may be adjusted in the case of certain adjustment events as described in the accompanying product supplement

|

|

Initial share price:

|

The closing price of the underlying shares on the pricing date, as may be adjusted in the case of certain adjustment events as described in the accompanying product supplement

|

|

Final share price:

|

The closing price of the underlying shares on the valuation date, as may be adjusted in the case of certain adjustment events as described in the accompanying product supplement

|

|

CUSIP/ISIN:

|

89115LH84 / US89115LH846

|

|

Listing:

|

The Trigger PLUS will not be listed or displayed on any securities exchange or any electronic communications network.

|

|

Commission:

|

$22.50 per stated principal amount

|

|

Estimated value on the

pricing date:

|

Expected to be between $930.00 and $945.00 per Trigger PLUS. See “Risk Factors” in the preliminary pricing supplement.

|

|

Preliminary pricing

supplement

|

|

|

HYPOTHETICAL PAYOUT

|

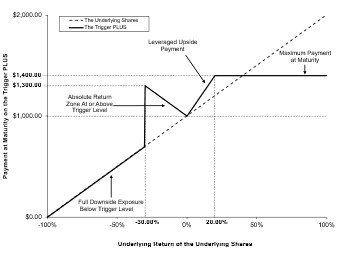

The below graph and table are based on a hypothetical upside leverage factor of 200%, a hypothetical maximum upside gain of 40.00% and hypothetical trigger price of 70.00% and are

purely hypothetical (the actual terms of your Trigger PLUS will be determined on the pricing date and will be specified in the final pricing supplement).

Hypothetical Payment at Maturity

|

Underlying Return

|

Payment at Maturity

|

|

+50.00%

|

$1,400.00

|

|

+40.00%

|

$1,400.00

|

|

+30.00%

|

$1,400.00

|

|

+20.00%

|

$1,400.00

|

|

+15.00%

|

$1,300.00

|

|

+10.00%

|

$1,200.00

|

|

+5.00%

|

$1,100.00

|

|

0.00%

|

$1,000.00

|

|

-10.00%

|

$1,100.00

|

|

-20.00%

|

$1,200.00

|

|

-30.00%

|

$1,300.00

|

|

-31.00%

|

$690.00

|

|

-40.00%

|

$600.00

|

|

-50.00%

|

$500.00

|

|

-25.00%

|

$250.00

|

|

-100.00%

|

$0.00

|

|

|