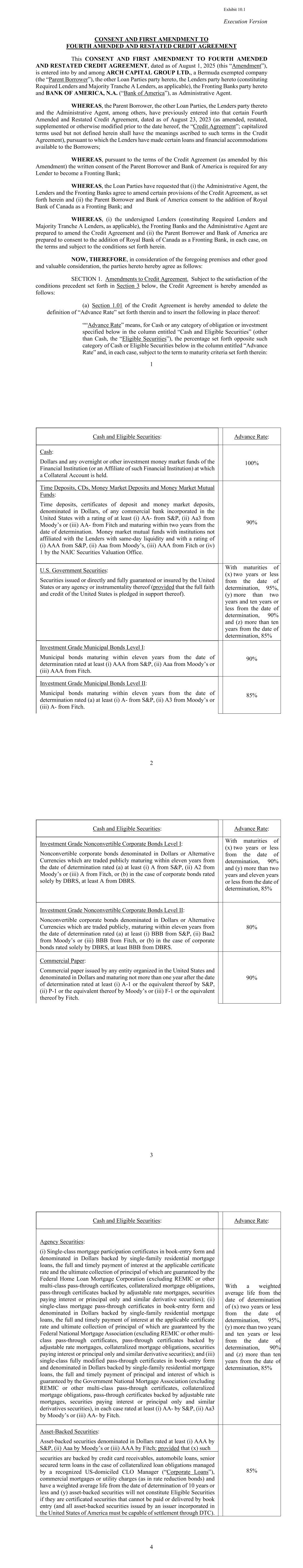

Execution Version 1 CONSENT AND FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT This CONSENT AND FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT, dated as of August 1, 2025 (this “Amendment”), is entered into by and among ARCH CAPITAL GROUP LTD., a Bermuda exempted company (the “Parent Borrower”), the other Loan Parties party hereto, the Lenders party hereto (constituting Required Lenders and Majority Tranche A Lenders, as applicable), the Fronting Banks party hereto and BANK OF AMERICA, N.A. (“Bank of America”), as Administrative Agent. WHEREAS, the Parent Borrower, the other Loan Parties, the Lenders party thereto and the Administrative Agent, among others, have previously entered into that certain Fourth Amended and Restated Credit Agreement, dated as of August 23, 2023 (as amended, restated, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”; capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Credit Agreement), pursuant to which the Lenders have made certain loans and financial accommodations available to the Borrowers; WHEREAS, pursuant to the terms of the Credit Agreement (as amended by this Amendment) the written consent of the Parent Borrower and Bank of America is required for any Lender to become a Fronting Bank; WHEREAS, the Loan Parties have requested that (i) the Administrative Agent, the Lenders and the Fronting Banks agree to amend certain provisions of the Credit Agreement, as set forth herein and (ii) the Parent Borrower and Bank of America consent to the addition of Royal Bank of Canada as a Fronting Bank; and WHEREAS, (i) the undersigned Lenders (constituting Required Lenders and Majority Tranche A Lenders, as applicable), the Fronting Banks and the Administrative Agent are prepared to amend the Credit Agreement and (ii) the Parent Borrower and Bank of America are prepared to consent to the addition of Royal Bank of Canada as a Fronting Bank, in each case, on the terms and subject to the conditions set forth herein. NOW, THEREFORE, in consideration of the foregoing premises and other good and valuable consideration, the parties hereto hereby agree as follows: SECTION 1. Amendments to Credit Agreement. Subject to the satisfaction of the conditions precedent set forth in Section 3 below, the Credit Agreement is hereby amended as follows: (a) Section 1.01 of the Credit Agreement is hereby amended to delete the definition of “Advance Rate” set forth therein and to insert the following in place thereof: ““Advance Rate” means, for Cash or any category of obligation or investment specified below in the column entitled “Cash and Eligible Securities” (other than Cash, the “Eligible Securities”), the percentage set forth opposite such category of Cash or Eligible Securities below in the column entitled “Advance Rate” and, in each case, subject to the term to maturity criteria set forth therein: Exhibit 10.1 2 Cash and Eligible Securities: Advance Rate: Cash: Dollars and any overnight or other investment money market funds of the Financial Institution (or an Affiliate of such Financial Institution) at which a Collateral Account is held. 100% Time Deposits, CDs, Money Market Deposits and Money Market Mutual Funds: Time deposits, certificates of deposit and money market deposits, denominated in Dollars, of any commercial bank incorporated in the United States with a rating of at least (i) AA- from S&P, (ii) Aa3 from Moody’s or (iii) AA- from Fitch and maturing within two years from the date of determination. Money market mutual funds with institutions not affiliated with the Lenders with same-day liquidity and with a rating of (i) AAA from S&P, (ii) Aaa from Moody’s, (iii) AAA from Fitch or (iv) 1 by the NAIC Securities Valuation Office. 90% U.S. Government Securities: Securities issued or directly and fully guaranteed or insured by the United States or any agency or instrumentality thereof (provided that the full faith and credit of the United States is pledged in support thereof). With maturities of (x) two years or less from the date of determination, 95%, (y) more than two years and ten years or less from the date of determination, 90% and (z) more than ten years from the date of determination, 85% Investment Grade Municipal Bonds Level I: Municipal bonds maturing within eleven years from the date of determination rated at least (i) AAA from S&P, (ii) Aaa from Moody’s or (iii) AAA from Fitch. 90% Investment Grade Municipal Bonds Level II: Municipal bonds maturing within eleven years from the date of determination rated (a) at least (i) A- from S&P, (ii) A3 from Moody’s or (iii) A- from Fitch. 85% 3 Cash and Eligible Securities: Advance Rate: Investment Grade Nonconvertible Corporate Bonds Level I: Nonconvertible corporate bonds denominated in Dollars or Alternative Currencies which are traded publicly maturing within eleven years from the date of determination rated (a) at least (i) A from S&P, (ii) A2 from Moody’s or (iii) A from Fitch, or (b) in the case of corporate bonds rated solely by DBRS, at least A from DBRS. With maturities of (x) two years or less from the date of determination, 90% and (y) more than two years and eleven years or less from the date of determination, 85% Investment Grade Nonconvertible Corporate Bonds Level II: Nonconvertible corporate bonds denominated in Dollars or Alternative Currencies which are traded publicly, maturing within eleven years from the date of determination rated (a) at least (i) BBB from S&P, (ii) Baa2 from Moody’s or (iii) BBB from Fitch, or (b) in the case of corporate bonds rated solely by DBRS, at least BBB from DBRS. 80% Commercial Paper: Commercial paper issued by any entity organized in the United States and denominated in Dollars and maturing not more than one year after the date of determination rated at least (i) A-1 or the equivalent thereof by S&P, (ii) P-1 or the equivalent thereof by Moody’s or (iii) F-1 or the equivalent thereof by Fitch. 90% 4 Cash and Eligible Securities: Advance Rate: Agency Securities: (i) Single-class mortgage participation certificates in book-entry form and denominated in Dollars backed by single-family residential mortgage loans, the full and timely payment of interest at the applicable certificate rate and the ultimate collection of principal of which are guaranteed by the Federal Home Loan Mortgage Corporation (excluding REMIC or other multi-class pass-through certificates, collateralized mortgage obligations, pass-through certificates backed by adjustable rate mortgages, securities paying interest or principal only and similar derivative securities); (ii) single-class mortgage pass-through certificates in book-entry form and denominated in Dollars backed by single-family residential mortgage loans, the full and timely payment of interest at the applicable certificate rate and ultimate collection of principal of which are guaranteed by the Federal National Mortgage Association (excluding REMIC or other multi- class pass-through certificates, pass-through certificates backed by adjustable rate mortgages, collateralized mortgage obligations, securities paying interest or principal only and similar derivative securities); and (iii) single-class fully modified pass-through certificates in book-entry form and denominated in Dollars backed by single-family residential mortgage loans, the full and timely payment of principal and interest of which is guaranteed by the Government National Mortgage Association (excluding REMIC or other multi-class pass-through certificates, collateralized mortgage obligations, pass-through certificates backed by adjustable rate mortgages, securities paying interest or principal only and similar derivatives securities), in each case rated at least (i) AA- by S&P, (ii) Aa3 by Moody’s or (iii) AA- by Fitch. With a weighted average life from the date of determination of (x) two years or less from the date of determination, 95%, (y) more than two years and ten years or less from the date of determination, 90% and (z) more than ten years from the date of determination, 85% Asset-Backed Securities: Asset-backed securities denominated in Dollars rated at least (i) AAA by S&P, (ii) Aaa by Moody’s or (iii) AAA by Fitch; provided that (x) such 85% securities are backed by credit card receivables, automobile loans, senior secured term loans in the case of collateralized loan obligations managed by a recognized US-domiciled CLO Manager (“Corporate Loans”), commercial mortgages or utility charges (as in rate reduction bonds) and have a weighted average life from the date of determination of 10 years or less and (y) asset-backed securities will not constitute Eligible Securities if they are certificated securities that cannot be paid or delivered by book entry (and all asset-backed securities issued by an issuer incorporated in the United States of America must be capable of settlement through DTC).

5 Cash and Eligible Securities: Advance Rate: Supranational Securities: Securities issued or backed by the International Bank for Reconstruction & Development, European Bank for Reconstruction & Development, Inter American Development Bank, International Monetary Fund, European Investment Bank, Asian Development Bank, African Development Bank and Nordic Development Bank as long as the credit ratings are at or above (i) AAA by S&P, (ii) Aaa by Moody’s or (iii) AAA by Fitch. With maturities of (x) two years or less from the date of determination, 95 %, (y) more than two years and ten years or less from the date of determination, 90% and (z) more than ten years from the date of determination, 80% OECD Government Securities: Securities issued or backed by the Government of any member of the Organization for Economic Cooperation and Development which has the credit ratings of at least (i) AA- by S&P, (ii) Aa3 by Moody’s or (iii) AA- by Fitch. With maturities of (x) two years or less from the date of determination, 95%, (y) more than two years and ten years or less from the date of determination, 90% and (z) more than ten years from the date of determination, 80% Other Securities: All other cash, investments, obligations or securities 0% Notwithstanding the foregoing, (A) the value of Eligible Securities at any time shall be determined based on the Borrowing Base Certificate then most recently delivered, (B) if any single corporate issuer (or any Affiliate thereof) represents more than 10% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 10% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (C) the weighted average rating of all Agency Securities (as described above) constituting Eligible Securities shall at all times be at least (x) AA+ from S&P, (y) Aa1 from Moody’s or (z) AA+ by Fitch, (D) if Investment Grade Nonconvertible Corporate Bonds with a rating lower than (x)(i) A- from S&P, (ii) A3 from Moody’s, or (iii) A- from Fitch or (y) in the case of corporate bonds rated solely by DBRS, A low from DBRS represent more than 30% of the aggregate 6 market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 30% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (E) if Asset-Backed Securities (as described above) (including CMBS and Corporate Loans) represent more than 20% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 20% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (F) if Asset-Backed Securities constituting CMBS represent more than 10% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 10% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (G) if Asset-Backed Securities constituting Corporate Loans represent more than 10% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 10% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (H) if OECD Government Securities (as described above) represent more than 20% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 20% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time), (I) if Supranational Securities (as described above) represent more than 20% of the aggregate market value of all Cash and Eligible Securities comprising the aggregate amount of all Borrowing Bases, the excess over 20% shall be excluded (with such exclusion being allocated in equal parts to each Borrowing Base at such time) and (J) any Eligible Securities issued by Bank of America or any other Lender, or any of their respective Affiliates, shall be excluded. With respect to any Eligible Securities denominated in a currency other than Dollars, the Dollar equivalent thereof (using a method agreed upon by the Parent Borrower and the Administrative Agent) shall be used for purposes of determining the value of such Eligible Securities.” (b) Section 1.01 of the Credit Agreement is hereby amended to delete the definition of “Fronting Bank” set forth therein and to insert the following in place thereof: ““Fronting Bank” means (a) in the case of Fronted Letters of Credit, Bank of America and any other Lender that, with the written consent of the Parent Borrower and Bank of America, is a fronting bank; provided that such Lender has agreed to be a Fronting Bank and (b) in the case of Several Letters of Credit, any Person described in clause (a) who has agreed to act as fronting bank on behalf of any Participating Bank.” (c) Section 1.01 of the Credit Agreement is hereby amended to insert the following additional definitions in applicable alphabetical order: ““First Amendment” means that certain Consent and First Amendment to Fourth Amended and Restated Credit Agreement dated as of August 1, 2025 7 by and among the Parent Borrower, the other Loan Parties party thereto, the Lenders party thereto, the Fronting Banks and the Administrative Agent. “First Amendment Effective Date” has the meaning specified in the First Amendment.” (d) Section 2.01(a)(D) of the Credit Agreement is hereby deleted in its entirety and replaced with the following: “(D) the total outstanding stated amount of Fronted Letters of Credit, inclusive of Tranche A Fronted Letters of Credit and Tranche B Fronted Letters of Credit, shall not exceed the Fronted Letter of Credit Sublimit and” (e) Section 2.01(b)(D) of the Credit Agreement is hereby deleted in its entirety and replaced with the following: “(D) the total outstanding stated amount of Fronted Letters of Credit, inclusive of Tranche A Fronted Letters of Credit and Tranche B Fronted Letters of Credit, shall not exceed the Fronted Letter of Credit Sublimit.” (f) Section 2.03(b)(i)(K) of the Credit Agreement is hereby deleted in its entirety and replaced with the following: “(K) whether such Letter of Credit is to be a Fronted Letter of Credit or a Several Letter of Credit; and, in the case of Several Letters of Credit, in the event a Lender advises the applicable L/C Administrator that such Lender is a Participating Bank, such Participating Bank’s Applicable Percentage of such Several Letter of Credit will be issued by the applicable Fronting Bank);” (g) Schedule 2.01 to the Credit Agreement is hereby deleted in its entirety and replaced with Schedule 2.01 attached at Annex A hereto. SECTION 2. Consent. Subject to the satisfaction of the conditions precedent set forth in Section 3 below, each of Bank of America and the Parent Borrower hereby consents to the addition of Royal Bank of Canada as a Fronting Bank for all purposes under the Credit Agreement and the other Credit Documents and, by its execution of this Amendment, Royal Bank of Canada hereby agrees to become a Fronting Bank under the Credit Agreement and the other Credit Documents, effective as of the First Amendment Effective Date (as defined below). SECTION 3. Conditions Precedent. This Amendment shall become effective (such date, the “First Amendment Effective Date”) upon receipt by the Administrative Agent of counterparts of this Amendment, duly executed by (i) with respect to the amendments contemplated by Section 1(a) hereof, Lenders constituting Majority Tranche A Lenders, (ii) with respect to the amendments contemplated by Sections 1(b) through 1(g) hereof, Lenders constituting Required Lenders, which, for the avoidance of doubt, shall include Royal Bank of Canada, (iii) the Fronting Banks, (iv) the Parent Borrower and (v) each of the other Loan Parties party hereto. 8 SECTION 4. Representations and Warranties. Each of the Loan Parties hereby represents and warrants to the Administrative Agent and the Lenders as follows: (a) The representations and warranties of each Loan Party contained in Article V of the Credit Agreement or any other Credit Document are true and correct in all material respects (or with respect to representations and warranties qualified by materiality, in all respects) on and as of the First Amendment Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they were true and correct in all material respects as of such earlier date (or with respect to representations and warranties qualified by materiality, in all respects). (b) Each Loan Party has the corporate power and authority to execute, deliver and carry out the terms and provisions of this Amendment, and has taken all necessary corporate action to authorize the execution, delivery and performance of this Amendment. (c) Each Loan Party has duly executed and delivered this Amendment and this Amendment and the Amended Credit Agreement constitute the legal, valid and binding obligation of such Loan Party enforceable against such Loan Party in accordance with their terms, except to the extent that enforceability thereof may be limited by applicable bankruptcy, insolvency, moratorium or similar laws affecting creditors’ rights generally and general principles of equity regardless of whether enforcement is sought in a proceeding in equity or at law. (d) On the First Amendment Effective Date, after giving effect to this Amendment and the transactions contemplated hereby, no Default or Event of Default has occurred and is continuing. (e) Neither the execution, delivery and performance by any Loan Party of this Amendment nor compliance with the terms and provisions hereof, nor the consummation of the transactions contemplated herein, (i) will contravene any applicable provision of any law, statute, rule, regulation, order, writ, injunction or decree of any court or governmental instrumentality, except as would not have a Material Adverse Effect, (ii) will conflict or be inconsistent with or result in any breach of any of the terms, covenants, conditions or provisions of, or constitute a default under, or result in the creation or imposition of (or the obligation to create or impose) any Lien upon any of the property or assets of any Loan Party or any of its Subsidiaries pursuant to the terms of, any material indenture, mortgage, deed of trust, loan agreement, credit agreement or any other material instrument to which such Loan Party or any of its Subsidiaries is a party or by which it or any of its property or assets are bound or to which it may be subject, except as would not have a Material Adverse Effect, or (iii) will violate any provision of the Organization Documents of any Loan Party or any of its Subsidiaries. SECTION 5. Continued Validity of Credit Documents; Reaffirmations and Acknowledgements. (a) Other than as amended by the amendments contemplated in Section 1 hereof and the consent contemplated in Section 2 hereof, this Amendment shall not, by

9 implication or otherwise, limit, impair, constitute a waiver of or otherwise affect any rights or remedies of the Administrative Agent or any Lender under the Credit Agreement or any of the other Credit Documents, nor alter, modify, amend or in any way affect any of the rights, remedies, terms and conditions, obligations or any covenant of any Loan Party contained in the Credit Agreement or any of the other Credit Documents, all of which are ratified and confirmed in all respects and shall continue unchanged and in full force and effect. (b) Each of the Security Documents to which a Loan Party is a party and all of the Collateral described therein do and shall continue to secure the payment of the Tranche A L/C Obligations of each Tranche A Designated Subsidiary Borrower, as set forth in such respective Security Documents. Each Loan Party that is a party to any of the Security Documents hereby reaffirms its grant of a security interest in the applicable Collateral to the Administrative Agent for the ratable benefit of the Secured Parties (as defined in the Security Agreement), as collateral security for the prompt and complete payment and performance when due of the Tranche A L/C Obligations of each Tranche A Designated Subsidiary Borrower. Upon the effectiveness hereof, all references to the Credit Agreement set forth in any other agreement or instrument shall, unless otherwise specifically provided, be references to the Credit Agreement as amended hereby. SECTION 6. Amendment as Credit Document. This Amendment constitutes a “Credit Document” under the Credit Agreement. SECTION 7. Costs and Expenses. The Borrowers shall promptly pay all reasonable and documented out-of-pocket costs and expenses of the Administrative Agent (including the reasonable fees, costs and expenses of counsel to the Administrative Agent) incurred in connection with the preparation, execution and delivery of this Amendment. SECTION 8. Ratification by Guarantors. Each of the guarantors agrees and acknowledges that (i) notwithstanding the effectiveness of this Amendment, such guarantor’s Guarantee of the applicable Obligations shall remain in full force and effect without modification thereto and (ii) nothing herein shall in any way limit any of the terms or provisions of such guarantor’s Guarantee of the applicable Obligations or any other Credit Document executed by such guarantor (as the same may be amended from time to time), all of which are hereby ratified, confirmed and affirmed in all respects. SECTION 9. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. The other provisions of Sections 10.14 and 10.15 of the Credit Agreement are incorporated herein as if expressly set forth herein, mutatis mutandis. SECTION 10. This Amendment may be in the form of an Electronic Record and may be executed using Electronic Signatures (including, without limitation, facsimile and .pdf) and shall be considered an original, and shall have the same legal effect, validity and enforceability as a paper record. This Amendment may be executed in one or more counterparts (both paper and electronic counterparts), each of which shall be deemed to be an original, but all of which taken together shall constitute one and the same agreement. Delivery by facsimile or other electronic means of an executed counterpart of a signature page to this Amendment shall be effective as 10 delivery of a manually executed counterpart of this Amendment. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by the Administrative Agent of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 USC §7006, as it may be amended from time to time and “Communication” shall mean, any document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Amendment. [Signature Pages Follow] [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed and delivered as of the date first above written. PARENT BORROWER: ARCH CAPITAL GROUP LTD. By: /s/ François Morin_______ Name: François Morin Title: Executive Vice President, Chief Financial Officer and Treasurer [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] LOAN PARTIES: ARCH REINSURANCE COMPANY By: /s/ Barry Golub Name: Barry Golub Title: Chief Financial Officer

[Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH REINSURANCE LTD. By: /s/ Jim Paugh Name: Jim Paugh Title: General Counsel [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH INSURANCE (UK) LIMITED By: /s/ Marie Penberthy Name: Marie Penberthy Title: Chief Financial Officer [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH REINSURANCE EUROPE UNDERWRITING DESIGNATED ACTIVITY COMPANY By: /s/ Deirdre Casey Name: Deirdre Casey Title: Director, Finance Director [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH CAPITAL GROUP (U.S.) INC. By: /s/ Elizabeth DiChiara Name: Elizabeth DiChiara Title: Vice President, Financial Compliance

[Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH U.S. MI HOLDINGS INC. By: /s/ Thomas Jeter Name: Thomas Jeter Title: EVP, Chief Financial Officer [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ARCH GROUP REINSURANCE LTD. By: /s/ Jim Paugh Name: Jim Paugh Title: General Counsel [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ADMINISTRATIVE AGENT: BANK OF AMERICA, N.A. By: /s/ Angela Larkin Name: Angela Larkin Title: Vice President [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] LENDERS: BANK OF AMERICA, N.A., as a Fronting Bank and a Lender By: /s/ Sidhima Daruka Name: Sidhima Daruka Title: Director

[Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] ROYAL BANK OF CANADA, as a Fronting Bank and a Lender By: Name: Title: Kevin Bemben Authorized Signatory /s/ Kevin Bemben [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] BARCLAYS BANK PLC, as a Lender By: /s/ Stephanie Fried Name: Stephanie Fried Title: Authorized Signatory [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] HSBC BANK USA, N.A., as a Lender By: /s/ Mrudul Kotia Name: Mrudul Kotia Title: Vice President [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] LLOYDS BANK CORPORATE MARKETS PLC, as a Lender By: Name: Kamala Basdeo Title: Vice President By: Name: Catherine Lim Title: Assistant Vice President ~~ 7 /s/ Kamala Basdeo /s/ Catherine Lim

[Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] JPMORGAN CHASE BANK, N.A., as a Lender By: /s/ Barbara Ingrassia Name: Barbara Ingrassia Title: Vice President [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] THE BANK OF NEW YORK MELLON, as a Lender By: /s/ Yadilsa Fernandez Name: Yadilsa Fernandez Title: Director [Signature Page to Consent and First Amendment to Fourth Amended and Restated Credit Agreement] WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender By: /s/ Charles Mentkowski Name: Charles Mentkowski Title: Vice President