UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| PHARMACYCLICS, INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

PHARMACYCLICS, INC.

995 East Arques Avenue

Sunnyvale, California 94085

April 9, 2013

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (“Annual Meeting”) of Pharmacyclics, Inc. (the “Company”), which will be held at 1:00 p.m. local time on Thursday May 9, 2013 at the Company’s offices, 995 East Arques Avenue, Sunnyvale, California 94085. The Annual Meeting will be held for the following purposes:

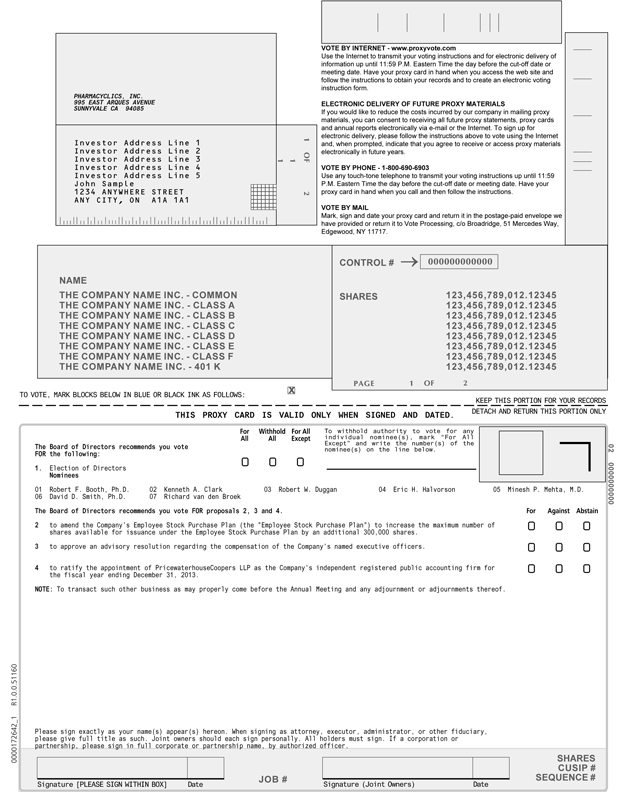

| 1. | to elect seven (7) directors to serve until the 2014 annual meeting or until their successors are elected and qualified; |

| 2. | to amend the Company’s Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”) to increase the maximum number of shares available for issuance under the Employee Stock Purchase plan by an additional 300,000 shares; |

| 3. | to consider and approve an advisory resolution regarding the compensation of the Company’s named executive officers; |

| 4. | to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| 5. | to transact such other business as may properly come before the Annual Meeting and any adjournment or adjournments thereof. |

The enclosed Notice of Annual Meeting of Stockholders and Proxy Statement more fully describe the details of the business to be conducted at the Annual Meeting.

After careful consideration, the Company’s Board of Directors has unanimously approved proposals 1, 2, 3 and 4 and recommends that you vote IN FAVOR OF each such proposal.

After reading the Proxy Statement, please sign and promptly return the enclosed proxy card in the accompanying postage-paid return envelope. If you later decide to attend the Annual Meeting in person and vote by ballot, only your vote at the Annual Meeting will be counted.

We look forward to seeing you at the Annual Meeting.

| Sincerely, |

| /s/ Robert W. Duggan |

| Robert W. Duggan Chairman of the Board and Chief Executive Officer |

1

IMPORTANT

Please sign and promptly return the enclosed proxy card in the accompanying postage-paid return envelope so that your shares may be voted if you are unable to attend the Annual Meeting.

2

PHARMACYCLICS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 9, 2013

TO THE STOCKHOLDERS OF PHARMACYCLICS, INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (“Annual Meeting”) of Pharmacyclics, Inc., a Delaware corporation (the “Company”), will be held at 1:00 p.m. local time on May 9, 2013 at the Company’s offices, 995 East Arques Avenue, Sunnyvale, CA 94085, for the following purposes:

| 1. | to elect seven (7) directors to serve until the 2014 annual meeting or until their successors are elected and qualified; |

| 2. | to amend the Company’s Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”) to increase the maximum number of shares available for issuance under the Employee Stock Purchase plan by an additional 300,000 shares; |

| 3. | to consider and approve an advisory resolution regarding the compensation of the Company’s named executive officers; |

| 4. | to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| 5. | to transact such other business as may properly come before the Annual Meeting and any adjournment or adjournments thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on March 28, 2013 are entitled to receive notice of and to vote at the Annual Meeting and any adjournment thereof. A list of the stockholders entitled to vote at the Annual Meeting will be available for inspection at the Company’s principal executive offices at 995 East Arques Avenue, Sunnyvale, California 94085, for a period of ten (10) days immediately prior to the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting. However, to assure your representation at the meeting, please carefully read the accompanying Proxy Statement, which describes the matters to be voted upon at the Annual Meeting. Then, please sign and promptly return the enclosed proxy card in the accompanying postage-paid return envelope. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to ensure that all your shares will be voted. You may revoke your proxy at any time prior to the Annual

3

Meeting. If you decide to attend the Annual Meeting, and vote by ballot, only your vote at the Annual Meeting will be counted. The prompt return of your proxy card will assist us in preparing for the Annual Meeting.

This proxy statement and the accompanying Proxy were first mailed to all stockholders entitled to vote at the Annual Meeting on or about April 9, 2013.

| Sincerely, |

| /s/ Richard B. Love |

| Secretary |

Sunnyvale, California

April 9, 2013

YOUR VOTE IS VERY IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE READ THE ATTACHED PROXY STATEMENT CAREFULLY. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING ENVELOPE AS PROMPTLY AS POSSIBLE.

4

PROXY STATEMENT

OF

2013 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

Why am I receiving these materials?

Pharmacyclics, Inc. (the “Company”) has delivered printed versions of these materials to you, in connection with the Company’s solicitation of proxies for use at the 2013 annual meeting of stockholders (the “Annual Meeting”) to be held on Thursday, May 9, 2013 at 1:00 p.m. local time and at any postponement(s) or adjournment(s) thereof. These materials were first sent or made available to stockholders on April 9, 2013. You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement (the “Proxy Statement”). The Annual Meeting will be held at the Company’s offices, 995 East Arques Avenue, Sunnyvale, California 94085.

What is included in these materials?

These materials include:

| • | This Proxy Statement for the Annual Meeting; |

| • | The Company’s Transition Report on Form 10-K for the transition period ended December 31, 2012, as filed with the Securities and Exchange Commission (the “SEC”) on February 26, 2013 (the “Transition Report”); and |

| • | The proxy card or vote instruction form for the Annual Meeting. |

What items will be voted on at the Annual Meeting?

Stockholders will vote on four items at the Annual Meeting:

| • | The election of seven (7) directors to serve until the 2014 Annual Meeting of Stockholders and until their successors are duly elected and qualify (Proposal No. 1); |

| • | An amendment of the Company’s Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”) to increase the maximum number of shares available for issuance under the Employee Stock Purchase plan by an additional 300,000 shares (Proposal No. 2); |

| • | To consider and approve an advisory resolution regarding the compensation of the Company’s named executive officers (Proposal No. 3); and |

| • | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 (Proposal No. 4). |

5

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| • | “FOR” each of the nominees to the Board (Proposal No. 1); |

| • | “FOR” the amendment of the Company’s Employee Stock Purchase Plan (Proposal No. 2); |

| • | “FOR” the approval of the advisory resolution regarding the compensation of the Company’s named executive officers (Proposal No. 3); and |

| • | “FOR” ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2013 (Proposal No. 4). |

Where are the Company’s principal executive offices located and what is the Company’s main telephone number?

The Company’s principal executive offices are located at 995 East Arques Avenue, Sunnyvale, California 94085. The Company’s main telephone number is (408) 774-0330.

What is the Company’s fiscal year?

The Company recently changed its fiscal year end from June 30 to December 31 and filed the Transition Report for the six month transition period ended December 31, 2012. Unless otherwise stated, all information presented in this Proxy Statement is based on the Company’s transition period.

How may I obtain an additional set of proxy materials?

All stockholders may write to us at the following address to request an additional copy of these materials:

Pharmacyclics, Inc.

995 East Arques Avenue

Sunnyvale, California 94085

Attention: Corporate Secretary

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive.

6

Who may vote at the Annual Meeting?

Each share of the Company’s common stock has one vote on each matter. Only stockholders of record as of the close of business on March 28, 2013 (the “Record Date”) are entitled to receive notice of, to attend, and to vote at the Annual Meeting. As of the Record Date, there were 72,778,875 shares of the Company’s common stock issued and outstanding, held by 93 holders of record.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Stockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Computer Share Investor Services, LLC, you are considered the stockholder of record with respect to those shares, and the proxy card was sent directly to you by the Company.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name.” The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a “vote instruction form.”

How do I vote?

You may vote using any of the following methods:

| • | Proxy card. Be sure to complete, sign and date the card and return it in the prepaid envelope. |

| • | By telephone or the Internet. If you own shares held in street name, you will receive voting instructions from your bank, broker or other nominee and may vote by telephone or on the Internet if they offer that alternative. |

| • | In person at the Annual Meeting. All stockholders may vote in person at the Annual Meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person. If you own shares held in street name, you must obtain a legal proxy from your bank, broker or other nominee and present it to the inspector of election with your ballot when you vote at the Annual Meeting. |

What is the deadline for voting my shares?

If you hold shares as the stockholder of record, your vote by proxy must be received before the polls close at the Annual Meeting.

If you hold shares beneficially in street name, please follow the voting instructions provided by your broker, bank or nominee. You may vote these shares in person at the

7

Annual Meeting only if at the Annual Meeting you provide a legal proxy obtained from your broker, bank or nominee.

How can I attend the Annual Meeting?

You are entitled to attend the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. You should be prepared to present photo identification for admittance. If you are a stockholder of record, your name will be verified against the list of stockholders of record on the Record Date prior to your admission to the Annual Meeting. If you are not a stockholder of record, but hold shares through a broker, bank or nominee (i.e., in street name), you should provide proof of beneficial ownership on the Record Date, such as your most recent account statement prior to March 28, 2013, a copy of the voting instruction card provided by your broker, bank or nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting.

The Annual Meeting will begin promptly on May 9, 2013 at 1:00 p.m., local time. You should allow adequate time for check-in procedures.

What are the voting requirements with respect to each of the proposals?

In the election of directors (Proposal No. 1), each director receiving an affirmative (“FOR”) plurality of the votes cast will be elected. You may withhold votes from any or all nominees.

The proposal to approve an advisory resolution regarding the compensation of the Company’s named executive officers (Proposal No. 2) requires the affirmative (“FOR”) votes of a majority of the votes cast on the matter. Thus, abstentions will not affect the outcome of the vote on the proposal.

The proposal to approve an advisory resolution regarding the compensation of the Company’s named executive officers (Proposal No. 3) requires the affirmative (“FOR”) votes of a majority of the votes cast on the matter. Thus, abstentions will not affect the outcome of the vote on the proposal.

The proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 (Proposal No. 4) requires the affirmative (“FOR”) votes of a majority of the votes cast on the matter. Thus, abstentions will not affect the outcome of the vote on the proposal.

How are votes counted?

For the election of directors, you may vote “FOR” all or some of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. For the other items of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you elect to “ABSTAIN,” the abstention will be counted for the purpose of establishing a quorum, but otherwise will have no effect on the outcome of the vote.

8

What can I do if I change my mind after I vote my shares?

If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | sending written notice of revocation to our Corporate Secretary; |

| • | submitting a new, proper proxy dated later than the date of the revoked proxy; or |

| • | attending the Annual Meeting and voting in person. |

If you own shares held in street name, you may submit new voting instructions by contacting your broker, bank or nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the answer to the previous question. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

What is the quorum requirement for the Annual Meeting?

A majority of the shares entitled to vote at the Annual Meeting must be present at the Annual Meeting in person or by proxy for the transaction of business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum if you:

| • | Are entitled to vote and you are present in person at the Annual Meeting; or |

| • | Have properly voted on the Internet, by telephone or by submitting a proxy card by mail. |

If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

How are proxies voted?

All shares represented by valid proxies received prior to the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you:

| • | Indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board; or |

| • | Sign and return a proxy card without giving specific voting instructions, |

then the persons named as proxy holders, Robert W. Duggan and Joshua T. Brumm, and each of them, will vote your shares in the manner recommended by the Board on

9

all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Which ballot measures are considered “routine” or “non-routine”?

The ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013 (Proposal No. 4) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 4.

The election of directors (Proposal No. 1), the amendment to the Company’s Employee Stock Purchase Plan (Proposal No. 2), and the advisory resolution approving the compensation of the Company’s named executive officers (Proposal No. 3) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with Proposals No. 1, No. 2, and No. 3.

Can my shares be voted if I do not return my proxy card or voting instruction card and do not attend the Annual Meeting?

If you do not vote your shares held of record (registered directly in your name, not in the name of a bank or broker), your shares will not be voted.

If you do not vote your shares held in street name with a broker, your broker will not be authorized to vote on most items being put to a vote, including the election of directors. If your broker is not able to vote your shares, they will constitute “broker non-votes,” which are counted for the purpose of determining the presence of a quorum, but otherwise do not affect the outcome of any matter being voted on at a stockholder meeting.

Can my broker vote my shares for me on the election of directors?

No. Brokers may not use discretionary authority to vote shares on the election of directors if they have not received instructions from their clients. Please provide voting instructions on the election of directors so your vote can be counted.

10

How many votes do I have?

You are entitled to one vote for each share of common stock that you hold. As of the Record Date, there were 72,778,875 shares of common stock outstanding.

Is cumulative voting permitted for the election of directors?

The Company does not use cumulative voting for the election of directors.

What happens if a nominee for director does not stand for election?

If for any reason any nominee does not stand for election, any proxies that are received will be voted in favor of the remaining nominees and may be voted for a substitute nominee in place of the nominee who does not stand. The Company has no reason to expect that any of the nominees will not stand for election.

What happens if additional matters are presented at the Annual Meeting?

Other than the four items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Robert W. Duggan and Joshua T. Brumm, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| • | As necessary to meet applicable legal requirements; |

| • | To allow for the tabulation and certification of votes; and |

| • | To facilitate a successful proxy solicitation. |

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I obtain the Company’s corporate governance information?

The following information is available in print to any stockholder who requests it:

| • | Restated Certificate of Incorporation of the Company, as amended |

| • | Amended and Restated By-laws of the Company |

| • | The charters of the following committees of the Board: the Audit Committee, the Nominating Committee and the Compensation Committee |

11

| • | Code of Business Conduct and Ethics |

| • | Policy regarding stockholder communications with the Board |

How may I obtain the 2012 Transition Report and other financial information?

A copy of the 2012 Transition Report is enclosed with this Proxy Statement. Stockholders may request another free copy of the 2012 Transition Report and other financial information by contacting the Company at:

Pharmacyclics, Inc.

995 East Arques Avenue

Sunnyvale, California 94085

Attention: Corporate Secretary

Alternatively, current and prospective investors can access the 2012 Transition Report at http://ir.pharmacyclics.com/annuals.cfm. We will also furnish any exhibit to the 2012 Transition Report if specifically requested. Our SEC filings are also available free of charge at the SEC’s website, www.sec.gov, and at the Investor Relations; SEC Filings, portion of our website, http://www.pharmacyclics.com/.

What if I have questions for the Company’s transfer agent?

Please contact our transfer agent at the telephone number or address listed below with any questions concerning stock certificates, transfer of ownership or other matters pertaining to your stock account.

Jim Walsh

Computershare Investor Services, LLC

250 Royall Street

Canton, Massachusetts 02021

(781) 575-3008

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by the inspector of election and published in the Company’s Current Report on Form 8-K, which the Company is required to file with the SEC within four business days following the Annual Meeting.

Who is paying for the cost of this proxy solicitation?

The Company is making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes.

In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities.

12

Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 2014 annual meeting of stockholders?

Requirements for Stockholder Proposals to Be Considered for Inclusion in the Company’s Proxy Materials. Stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2014 annual meeting of stockholders must be received no later than December 10, 2013. In addition, all proposals will need to comply with Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals must be delivered to the Company’s Corporate Secretary by mail at 995 East Arques Avenue, Sunnyvale, California 94085.

Requirements for Stockholder Proposals to Be Brought Before the 2014 Annual Meeting of Stockholders and Director Nominations. Notice of any proposal that a stockholder intends to present at the 2014 annual meeting of stockholders, but does not intend to have included in the proxy statement and form of proxy relating to the 2014 annual meeting of stockholders, as well as any director nominations, must be delivered to the Company’s Corporate Secretary by mail at 995 East Arques Avenue, Sunnyvale, California 94085, not earlier than the close of business on January 9, 2014 and not later than the close of business on February 8, 2014. In addition, the notice must set forth the information required by the Company’s bylaws with respect to each director nomination or other proposal that the stockholder intends to present at the 2014 annual meeting of stockholders.

Who can help answer my questions?

If you have any questions about the Annual Meeting or how to vote or revoke your proxy, please contact us at:

Pharmacyclics, Inc.

995 East Arques Avenue

Sunnyvale, California 94085

Attention: Corporate Secretary

Important Notice Regarding The Availability Of Proxy Materials For The Stockholders Meeting To Be Held On May 9, 2013

Under rules adopted by the Securities and Exchange Commission (“SEC”), we are now furnishing proxy materials on the Internet in addition to mailing paper copies of the materials to each stockholder of record. This Proxy Statement and our Transition Report on Form 10-K for the transition period ended December 31, 2012 are available at: http://ir.pharmacyclics.com/annuals.cfm

13

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL ONE – ELECTION OF DIRECTORS

At the Annual Meeting, a Board consisting of seven (7) members will be elected to serve until the Company’s next Annual Meeting or until their successors shall have been duly elected and qualified or until their earlier death, resignation or removal. The independent members of the Board have accepted the recommendation of the Nominating and Corporate Governance Committee and have selected seven (7) nominees, all of whom are current directors of the Company. Each person nominated for election has agreed to serve if elected, and the Company has no reason to believe that any nominee will be unavailable or will decline to serve. Unless otherwise instructed, the Proxy holders will vote the Proxies received by them IN FAVOR OF each of the nominees named below. The seven (7) candidates receiving the highest number of affirmative votes of all of the Votes Cast at the Annual Meeting will be elected. If any nominee is unable to or declines to serve as a director, the Proxies may be voted for a substitute nominee designated by the Nominating and Corporate Governance Committee.

Vote Required and Board Recommendation

The seven (7) nominees receiving the highest number of affirmative votes of the shares present in person or represented by Proxy and entitled to vote at the Annual Meeting shall be elected as directors of the Company.

The Board recommends that stockholders vote IN FAVOR OF the election of each of the following nominees to serve as directors of the Company.

Information with Respect to Director Nominees

Set forth below is information regarding the nominees.

| Name |

Age |

Position(s) with the Company |

Director Since | |||

| Robert W. Duggan |

68 | Director, Chairman and CEO | 2007 | |||

| Robert F. Booth, Ph.D. |

59 | Director | 2010 | |||

| Kenneth A. Clark |

54 | Director | 2012 | |||

| Eric H. Halvorson |

64 | Director | 2011 | |||

| Minesh P. Mehta, M.D. |

55 | Director | 2008 | |||

| David D. Smith, Ph.D. |

42 | Director | 2008 | |||

| Richard A. van den Broek |

47 | Director | 2009 |

Business Experience of Directors

Mr. Duggan has been a member of our Board since September 2007 and has served as Chief Executive Officer since September 2008. Mr. Duggan served as Chairman of the Board of Directors of Computer Motion, Inc., a computerized surgical systems company, from 1990 to 2003 and Chief Executive Officer from 1997. Computer Motion was acquired by Intuitive Surgical, Inc. in 2003. Mr. Duggan served on the Intuitive Surgical, Inc. Board from 2003 through March 2011. Mr. Duggan has been a private venture investor for more

14

than 30 years and has participated as a director of, investor in, and advisor to numerous small and large businesses in the medical equipment, computer local and wide area network, PC hardware and software distribution, digital encryption, consumer retail goods and outdoor media communication industries. Mr. Duggan has also assisted in corporate planning, capital formation and management for his various investments. He received a U.S. Congressman’s Medal of Merit from Ron Paul in 1985 and in 2000 he was named a Knight of the Legion of Honor by President Jacques Chirac. He is a member of the University of California at Santa Barbara Foundation Board of Trustees. With over 10 years of combined service as Chief Executive Officer of two innovative health care companies and with a career spanning over 30 years as a venture investor and advisor for a broad range of companies, Mr. Duggan brings extensive expertise in vision, strategic development, planning, finance and management to our Board.

Dr. Booth joined the Company as a director in December 2010. Dr. Booth is currently the Chief Executive Officer of Virobay, Inc., a drug discovery and development company. Dr. Booth was also the Executive Chairman of Virobay, Inc. from 2006 to 2010 and served concurrently as an Operating Partner and Senior Advisor at TPG Biotech, a venture capital company. From 2006 to 2007, Dr. Booth served as the acting Chief Scientific Officer of Galleon Pharmaceuticals, a company which is developing new therapeutics for diseases of the respiratory system. From 2002 to 2006, Dr. Booth was the Chief Scientific Officer at Celera Genomics, where he was responsible for leading all discovery and development activities. The therapeutic areas pursued by Celera included oncology, autoimmunity, respiratory diseases and thrombosis. Dr. Booth was Senior Vice President at Roche Bioscience from 1989 to 2002, and was responsible for research and early development activities in the therapeutic areas of inflammation, autoimmunity, respiratory diseases, transplantation, bone diseases and viral diseases. Dr. Booth was a member of the Global Research Management Team and a member of the Business Development Committee, which oversaw licensing opportunities for Roche. During his time at Roche, Dr. Booth managed R&D organizations in both the United States and Europe. The Biology team for which Dr. Booth was responsible in the United Kingdom discovered and contributed to the development of saquinavir, the first HIV protease inhibitor to be launched. This achievement was recognized by the winning of the Prix Galien for Roche. Dr. Booth is currently Chairman of the Scientific Advisory Board and a Board Observer at Galleon Pharmaceuticals and a member of the Scientific Advisory Board of ShangPharma and Elcelyx Therapeutics. Dr. Booth is also an advisor to Glialogix Inc. and to the SPARK program at Stanford University. Dr. Booth received his Ph.D. and B.Sc. from the University of London in the field of biochemistry.

With over 25 years of experience in biopharmaceutical companies in Europe and the USA as well as his experience with the venture capital industry, Dr. Booth brings extensive technical and business expertise to our Board.

Mr. Clark has been a director of the Company since November 2012. Mr. Clark has been a member of the law firm Wilson Sonsini Goodrich & Rosati, PC, since 1993, and currently serves as a member of its Board of Directors. His practice has focused on strategic transactions in the biopharmaceutical industry for over 25 years, and has included several of the largest partnering transactions in the industry over that period. He holds a B.A. degree from Vanderbilt University and a law degree from the University of Texas at Austin.

15

With extensive experience in the biopharmaceutical industry and his more than twenty-five (25) years of experience with growth enterprises, Mr. Clark’s qualifications are of considerable importance to our Board.

Mr. Halvorson was elected as a director of the Company in December 2011. Mr. Halvorson is engaged in the practice of law and has been Of Counsel to the law firm of Stowell, Zeilenga, Ruth, Vaughn & Treiger, LLP since 2010. Mr. Halvorson was President and Chief Operating Officer of Salem Communications Corporation from 2007 to 2008. He was Executive Vice President and Chief Operating Officer of Salem Communications Corporation from 1995 to 2000. Prior to becoming Chief Operating Officer, he was the company’s Vice President and General Counsel for ten years. Mr. Halvorson was a member of the Board of Directors of Salem Communications Corporation from 1988 to 2008. He has been a member of the Board of Directors of Intuitive Surgical, Inc. since 2003. From 2000-2003, 2005-2007 and 2009-2011, Mr. Halvorson was Executive in Residence at Pepperdine University and Adjunct Professor of Law at Pepperdine Law School. From 2003-2005, Mr. Halvorson served as President and Chief Executive Officer of The Thomas Kinkade Company. He was a partner at Godfrey & Kahn, a law firm based in Milwaukee, Wisconsin, from 1976-1985. Mr. Halvorson holds a B.S. in Accounting from Bob Jones University and a J.D. from Duke University School of Law.

With his substantial business, financial, legal and operational experience developed from working in a broad assortment of fields, Mr. Halvorson’s qualifications are of considerable importance to our Board.

Dr. Mehta was elected as a director of the Company in September 2008. Dr. Mehta is internationally recognized with respect to human clinical drug trial strategy, design and execution and has managed national and international trials of all sizes including International Phase 3 trials. He was Professor in the Department of Human Oncology at the University of Wisconsin’s School of Medicine and Public Health from 2002-2010, including being the Program Leader of the Imaging and Radiation Sciences Program of the Paul P. Carbone Comprehensive Cancer Center (UWCCC). Dr. Mehta was Chairman of the Department of Human Oncology from 1997 to 2007. From 2010-2012, he served as Professor of Radiation Oncology at Northwestern University in Chicago. Currently (since October 2012), he is Professor of Radiation Oncology at University of Maryland, and Director of the Maryland Proton Treatment Center in Baltimore, Maryland. He has been a member of the Board of Directors of the American Society for Therapeutic Radiology and Oncology (ASTRO) since 2006 and Chair of the Radiation Therapy Oncology Group (RTOG) Brain Tumor Committee since 1998. From 1997 to 2001, he served as an ad-hoc member of the FDA’s Technology Assessment Committee and from 2001 to 2005, he served on and eventually Chaired the FDA Radiological Devices Panel. He has more than 400 publications to his credit, especially in the areas of radiation therapy and translational and clinical cancer research. Dr. Mehta obtained his medical degree at the University of Zambia in 1981 and commenced his residency there at the Ndola Central Hospital. He moved to the University of Wisconsin, Madison, in 1984 and completed his residency in radiation oncology in 1988 when he took up an Assistant Professorship in Human Oncology, was promoted to Associate Professor and became the Director of the Radiation Oncology Residency Training Program. After serving as Vice-Chairman and Interim Chairman, Dr. Mehta became Chair of Human Oncology and also a Professor in the Department of Neurological Surgery. Dr. Mehta has authored over 100 clinical protocols.

16

With his vast practical and academic oncology background, experience serving on several Scientific Advisory Boards and the experience gained from developing and managing a multi center radiotherapy academic-community system, Dr. Mehta provides our Board with medical and scientific expertise as well as the benefit of his significant knowledge of all aspects of clinical drug trial strategy, design and execution.

Dr. Smith was elected as a director of the Company in October 2008. Dr. Smith is a professor of biostatistics at City of Hope, a cancer research hospital in Los Angeles and holds a B.A. in Mathematics and a Ph.D. in Statistics. After his dissertation on integrating and synthesizing information in clinical and observational studies in oncology, he served as a Biostatistical Reviewer for the Division of Oncology Drug Products, U.S. Food and Drug Administration (FDA) for 3 years. During his tenure at the FDA, he reviewed more than 40 chemotherapy INDs and NDAs. He represented the FDA statistical perspective at five Oncologic Drugs Advisory Committee sessions, including three on the problems of missing data in outcomes research. After leaving the FDA in 2000, he went to City of Hope and the front lines of cancer research. While at City of Hope, he has designed and analyzed over 50 solid tumor and hematology protocols at all levels of development, from pre-clinical and marker discovery studies to Phase II/III trials. Dr. Smith has been a co-investigator on grants from the National Cancer Institute, National Institutes of Health, the American Cancer Society, the Susan G. Komen Breast Cancer Foundation and the Leukemia-Lymphoma Society. Dr. Smith is an author and coauthor of over 40 papers in peer-reviewed biostatistics, oncology, surgery, radiation, and immunology journals.

Dr. Smith provides our Board with the benefit of his experience as an FDA reviewer and his continuing professional interactions with the FDA, including preparing correspondence and developing clinical trial methodology alongside FDA statisticians.

Mr. van den Broek joined the Company as a director in December 2009. Since 2004, Mr. van den Broek has been Managing Partner of HSMR Advisors, LLC, an investment fund focused on the biotechnology industry. From 2000 through 2003 he was a Partner at Cooper Hill Partners, LLC, an investment fund focused on the healthcare sector. Prior to that Mr. van den Broek had a ten year career as a biotech analyst, starting at Oppenheimer & Co., then Merrill Lynch, and finally at Hambrecht & Quist. Mr. van den Broek is a Director and member of the Strategy Committee of Strategic Diagnostics, Inc. and is a Director and member of the Remuneration Committee of Pharmaxis, Ltd., which is an Australia listed company. He is a graduate of Harvard University and is a Chartered Financial Analyst.

With his experience as a Partner in investment funds with investments in a wide variety of biotechnology and other healthcare companies and his years as a respected biotechnology analyst, Mr. van den Broek brings deep industry and financial expertise to our Board.

There are no family relationships among executive officers or directors of the Company.

Board Meetings, Independence, Committees and Compensation

We have changed our fiscal year end from June 30 to December 31.

17

Our Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. During the six month transition period ended December 31, 2012, the Board held three meetings. All directors attended at least 75% of the aggregate of all meetings of our Board and of the committees on which they served during the six month transition period ended December 31, 2012.

Current committee membership is as follows:

| Current Directors: |

Board |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee | ||||

| Robert W. Duggan |

Chairman | |||||||

| Robert F. Booth, Ph.D. |

Member | Member | Chairman | |||||

| Kenneth A. Clark |

Member | |||||||

| Eric H. Halvorson |

Member | Chairman | Member | |||||

| Minesh P. Mehta, M.D. |

Member | Member | ||||||

| David D. Smith, Ph.D. |

Member | Member | Member | |||||

| Richard A. van den Broek |

Member | Member | Chairman | Member |

Although the Company does not have a formal policy regarding attendance by members of the Board at its Annual Meeting, the Board encourages directors to attend. One of the current Board members attended our 2012 annual stockholder meeting.

The Board has determined that, other than Mr. Duggan, all of the members of the Board during the six month transition period ended December 31, 2012 were “independent” as that term is defined in the Nasdaq Marketplace Rules. Mr. Duggan is not considered independent because he is an executive officer of the Company. The Board has further determined that each of Eric H. Halvorson, Richard A. van den Broek and Minesh P. Mehta, M.D., the members of the Company’s Audit Committee, satisfy the more restrictive independence requirements for Audit Committee members set forth in United States securities laws. The Board considered that Mr. Clark has been a member of the law firm Wilson Sonsini Goodrich & Rosati, PC (“WSGR”), since 1993, and currently serves as a member of its Board of Directors and that the Company has paid fees to WSGR during the transition period ended December 31, 2012 and the fiscal years ended June 30, 2012, 2011 and 2010. The Company determined that such fees paid to WSGR were less than 5% of the recipient’s consolidated gross revenue for the transition period ended December 31, 2012 and the fiscal years ended June 30, 2012, 2011 and 2010 and as such, determined that Mr. Clark is independent. As required under applicable Nasdaq Marketplace Rules, the Company’s independent directors meet regularly in executive session at which only they are present.

Audit Committee

The primary purpose of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit Committee is also charged with the review and approval of all related

18

party transactions involving the Company. The Audit Committee acts pursuant to a written charter that has been adopted by the Board. A more complete description of the powers and responsibilities delegated to the Committee is set forth in the Audit Committee charter. The Board had determined that all of the members of the Audit Committee for the six month transition period ended December 31, 2012 were “independent” as that term is defined in Rule 4200(a)(15) of the Nasdaq Marketplace Rules. The Board has determined that Mr. Halvorson, the current Audit Committee Chairman, and Mr. van den Broek, the former Audit Committee Chairman, are both “audit committee financial experts” as defined by Item 407(d)(5) of Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”). The Audit Committee held six meetings during the six month transition period ended December 31, 2012.

Compensation Committee

The Compensation Committee reviews and approves the Company’s general compensation policies, sets compensation levels for the Company’s executive officers and administers the 2004 Equity Incentive Award Plan (the “2004 Plan”) and the Employee Stock Purchase Plan. The Compensation Committee has adopted a written charter. The Board had determined that all of the members of the Compensation Committee for the six month transition period ended December 31, 2012, were “independent” as that term is defined in the Nasdaq Marketplace Rules. The Compensation Committee held three meetings during the six month transition period ended December 31, 2012.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance (“NCG”) Committee establishes qualification standards for Board membership, identifies qualified individuals for Board membership and considers and recommends director nominees for approval by the Board and the stockholders. The NCG Committee has adopted a written charter. The NCG Committee considers suggestions from many sources, including stockholders, regarding possible candidates for director. The NCG Committee also takes a leadership role in shaping the corporate governance of the Company. The Board had determined that all of the members of the NCG Committee for the six month transition period ended December 31, 2012 were “independent” as that term is defined in the Nasdaq Marketplace Rules. The NCG Governance Committee held one meeting during the six month transition period ended December 31, 2012.

Board Leadership Structure

Our governing documents provide the Board with flexibility to determine the appropriate leadership structure for the Board and the Company, including but not limited to whether it is appropriate to separate the roles of Chairman of the Board and Chief Executive Officer. In making these determinations, the Board considers numerous factors, including the specific needs and strategic direction of the Company and the size and membership of the Board at the time.

At this time, the Board believes that Mr. Duggan, the Company’s Chief Executive Officer, is best situated to serve as Chairman of the Board because he is the director most familiar

19

with the Company’s business and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. The Board also believes that combining the positions of Chairman of the Board and Chief Executive Officer is the most effective leadership structure for the Company at this time, as the combined position enhances Mr. Duggan’s ability to provide insight and direction on strategic initiatives to both management and the Board, facilitating the type of information flow between management and the Board that is necessary for effective governance. Although the Board does not have a Lead Independent Director position, the Board believes that each director’s knowledge of the Company and industry as a result of his or her years of service on the Board and in the industry, and the fact that, other than Mr. Duggan, each of the current directors is independent, the independent directors are able to provide appropriate independent oversight of management and to hold management accountable for the execution of strategy.

Board Role in Risk Oversight

Senior management is responsible for assessing and managing the Company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies. The Board is responsible for overseeing management in the execution of its responsibilities and for assessing the Company’s approach to risk management. The Board exercises these responsibilities periodically as part of its meetings and also through the Board’s committees, each of which examines various components of enterprise risk as part of its responsibilities. Members of each committee report to the full Board as necessary at Board meetings regarding risks discussed by such committee. In addition, an overall review of risk is inherent in the Board’s consideration of the Company’s long-term strategies and in the transactions and other matters presented to the Board, including capital expenditures, acquisitions and divestitures, and financial matters.

Director Nomination and Communication with Directors

Criteria for Nomination to the Board

In evaluating director nominees, the NCG Committee considers the following factors:

| • | the appropriate size of the Board; |

| • | the level of technical, scientific, operational, strategic and/or economic knowledge of the Company’s business and industry; |

| • | experience at the senior executive or board level of a public company; |

| • | integrity and commitment to the highest ethical standards; |

| • | whether the candidate possesses complementary skills and background with respect to other Board members; and |

| • | the ability to devote a sufficient amount of time to carry out the duties and responsibilities as a director. |

20

In selecting the slate of nominees to be recommended by the NCG Committee to the Board, and in an effort to maintain a proper mix of directors that results in a highly effective governing body, the NCG Committee also considers such factors as the diverse skills and characteristics of all director nominees; the occupational, geographic and age diversity of all director nominees; the particular skills and ability of each nominee to understand financial statements and finance matters generally; the particular skills and experience of each nominee in managing and/or assessing risk; community involvement of each nominee; and, the independence status of each nominee under the Nasdaq Marketplace Rules and applicable law and regulation.

The objective of the NCG Committee is to structure a Board that brings to the Company a variety of skills and perspectives developed through high-quality business and professional experience. In doing so, the NCG Committee also considers candidates with appropriate non-business backgrounds. Other than the foregoing, there are no stated minimum criteria for director nominees. The NCG Committee may, however, consider such other factors as it deems are in the best interests of the Company and its stockholders.

The NCG Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining new perspectives. If any member of the Board does not wish to continue in service, or if the NCG Committee decides not to nominate a member for re-election, the Committee will identify the desired skills and experience of a new nominee as outlined above, providing that the Board determines to fill the vacancy. To date, the Company has not engaged a third party to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right to do so in the future.

Stockholder Proposals for Nominees and Other Communications

The NCG Committee will consider proposed nominees whose names are submitted to it by stockholders. If a stockholder wishes to suggest a proposed name for consideration, he or she must follow our procedures regarding the submission of stockholder proposals. Our amended and restated bylaws permit stockholders to nominate directors for election at our annual meeting of stockholders as long as stockholders provide the Company with proper notice of such nomination. Any notice of director nomination must meet all of the requirements contained in our bylaws and include other information required pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including the nominee’s consent to serve as a director. Stockholders may send recommendations for director nominees or other communications to the Board or any individual director c/o Corporate Secretary, Pharmacyclics, Inc., 995 East Arques Avenue, Sunnyvale, California, 94085. All communications received are reported to the Board or the individual directors, as appropriate. For any stockholder to make a director nomination at the Company’s 2014 annual meeting, the stockholder must follow the procedures which are described above under “Deadline for Receipt of Stockholder Proposals.”

21

Code of Ethics and Committee Charters

The Board has also adopted a formal code of conduct that applies to all of our employees, officers and directors. The latest copy of our Code of Business Conduct and Ethics, as well as the Charters of the Audit Committee, the Compensation Committee and the NCG Committee of the Board are available in the “Investors & Media Corporate Governance” section of our website at www.pharmacyclics.com. Any person may obtain a copy of the Code of Business Conduct and Ethics, without charge, by writing to Pharmacyclics, Inc., 995 East Arques Avenue, Sunnyvale, California 94085, Attn: Corporate Secretary.

22

PROPOSAL TWO - AMENDMENT TO THE EMPLOYEE STOCK PURCHASE PLAN

Stockholders are requested in this Proposal Four to approve the amendment to the Employee Stock Purchase Plan to increase the maximum number of shares available for issuance under the Employee Stock Purchase Plan by an additional 300,000 shares.

Prior to the amendment to the Employee Stock Purchase Plan, we reserved an aggregate of 1,500,000 shares of our Common Stock for issuance under the Employee Stock Purchase Plan and all such shares were approved by our stockholders. As of March 28, 2013, a total of 1,108,326 shares had been issued under the Employee Stock Purchase Plan and 391,674 shares were available for future issuance (not including the 300,000 share increase).

Vote Required and Board Recommendation

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote on this proposal at the Annual Meeting is required for approval of the amendment to the Employee Stock Purchase Plan. Abstentions will be counted towards the tabulation of Votes Cast and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purposes in determining whether this matter has been approved.

The Board of Directors recommends that the stockholders vote IN FAVOR OF the amendment to the Employee Stock Purchase Plan.

A summary of the key features, other than the amendments described above, of the Employee Stock Purchase Plan, as amended to date. This summary is not a complete description of all the provisions of the Employee Stock Purchase Plan and is therefore qualified by reference to the Employee Stock Purchase Plan. Any stockholder of the Company who wishes to obtain a copy of the actual Employee Stock Purchase Plan document may do so upon written request to the Company c/o Corporate Secretary, Pharmacyclics, Inc., 995 East Arques Avenue, Sunnyvale, California, 94085.

Purpose

The Employee Stock Purchase Plan allows the Company to provide employees with the opportunity to acquire an equity interest in the Company. The Board believes that equity incentives are a significant factor in attracting and motivating eligible persons whose present and potential contributions are important to the Company.

The rights to purchase common stock granted under the Employee Stock Purchase Plan are intended to qualify as options issued under an “employee stock purchase plan” as that term is defined in Section 423 (b) of the Internal Revenue Code.

Administration

The Employee Stock Purchase Plan is administered by the Compensation Committee of the Board. Such committee, as Plan Administrator, will have full authority to adopt such rules and procedures as it may deem necessary for proper plan administration and to interpret the

23

provisions of the Employee Stock Purchase Plan. All costs and expenses incurred in plan administration will be paid by the Company without charge to participants.

Offering Periods and Purchase Periods

The Employee Stock Purchase Plan is comprised of a series of successive offering periods, each with a maximum duration (not to exceed twenty-four (24) months) designated by the Plan Administrator prior to the start date. The current offering period began on November 1, 2011 and will end on October 31, 2013, and the next offering period is scheduled to commence on November 1, 2013 (the “next offering period”). On and after the first day of the next offering period, if the fair market value of a share of our Common Stock (except the final scheduled purchase date of the offering period) is lower than the fair market value of a share of our Common Stock on the first day of the offering period in which the purchase date occurs, then the offering period in progress will end immediately following the close of trading on such purchase date and a new offering period will begin on the next subsequent business day of May or November, as applicable.

Shares will be purchased during the offering period at successive semi-annual intervals. Each such interval will constitute a purchase period. Purchase periods under the Employee Stock Purchase Plan will begin on the first business day in May and November each year and end on the last business day in the immediately succeeding October and April, respectively, each year. The current purchase period began on November 1, 2012 and will end on April 30, 2013.

Eligibility

Any individual who customarily works more than twenty (20) hours per week for more than five (5) months per calendar year in the employ of the Company or any participating affiliate will become eligible to participate in an offering period on the start date of any purchase period (within that offering period). The date such individual enters the offering period will be designated his or her entry date for purposes of that offering period.

Participating affiliates include any parent or subsidiary corporations of the Company, whether now existing or hereafter organized, that elect, with the approval of the Plan Administrator, to extend the benefits of the Employee Stock Purchase Plan to their eligible employees.

As of March 28, 2013 approximately 250 employees, including 21 executive officers, were eligible to participate in the Employee Stock Purchase Plan.

Purchase Provisions

Each participant will be granted a separate purchase right for each offering period in which he or she participates. The purchase right will be granted on his or her entry date into that offering period and will be automatically exercised on the last business day of each purchase period within that offering period on which he or she remains an eligible employee.

24

Each participant may authorize period payroll deductions in any multiple of 1% of his or her total cash earnings per pay period, up to a maximum of twenty percent (20%).

On the last business day of each purchase period, the accumulated payroll deductions of each participant will automatically be applied to the purchase of whole shares of Common Stock at the purchase price in effect for the participant for that purchase period.

Purchase Price

The purchase price per share at which Common Stock will be purchased by the participant on each purchase date within the offering period will be equal to eighty-five percent (85%) of the lower of (i) the fair market value per share of Common Stock on the participant’s entry date into that offering period or (ii) the fair market value per share of Common Stock on the purchase date.

Valuation

The fair market value per share of Common Stock on any relevant date will be deemed equal to the closing selling price per share on such date on the NASDAQ Stock Market LLC. On March 28, 2013, the closing selling price per share of Common Stock on NASDAQ was $80.41 per share.

Special Limitations

The Employee Stock Purchase Plan imposes certain limitations upon a participant’s rights to acquire Common Stock, including the following limitations:

(i) No purchase right may be granted to any individual who owns stock (including stock purchasable under any outstanding purchase rights) possessing 5% or more of the total combined voting power or value of all classes of stock of the Company of any of its affiliates.

(ii) No purchase right granted to a participant may permit such individual to purchase Common Stock at a rate greater than $25,000 worth of such Common Stock (valued at the time such purchase right is granted) for each calendar year the purchase right remains outstanding at any time.

(iii) The maximum number of shares of our Common Stock purchasable per participant on any purchase date may not exceed 10,000 shares.

Reduction of Payroll Deductions

The participant may at any time during a participation period reduce his or her rate of payroll deduction to become effective as soon as possible after filing the requisite forms with the plan administrator. Prior to the first day of the next offering period, the participant may not effect more than one reduction per participation period. On and after the first day of the next offering period, the participant may reduce his or her rate of payroll deduction without limitation as to the maximum number of reductions allowed.

25

Termination of Purchase Rights

The purchase right will immediately terminate upon the participant’s loss of eligible employee status or upon his or her affirmative withdrawal from the offering period. Upon a loss of eligible employee status, the payroll deductions collected for the purpose period in which the purchase right terminates will be immediately refunded. Upon an eligible employee’s affirmative withdrawal from the offering period, the payroll deductions collected for the purchase period in which the purchase right terminates may, at the participant’s election, be immediately refunded or applied to the purchase of Common Stock at the end of that purchase period.

Stockholder Rights

No participant will have any stockholder rights with respect to the shares of Common Stock covered by his or her purchase right until the shares are actually purchased by the participant. No adjustment will be made for dividends, distributions or other rights for which the record date is prior to the date of such purchase.

Assignability

No purchase right will be assignable or transferable other than in connection with the participant’s death, pursuant to a divorce or a domestic relations order or as otherwise required by law and will be exercisable only by the participant during his or her lifetime.

Effect of Acquisition of the Company

Should the Company be acquired by merger or asset sale during an offering period, all outstanding purchase rights will automatically be exercised immediately prior to the effective date of such acquisition. The purchase price will be 85% of the lower of (i) the fair market value per share of Common Stock on the participant’s entry date into that offering period or (ii) the fair market value per share of Common Stock immediately prior to such acquisition.

Amendment and Termination of the Employee Stock Purchase Plan

The Employee Stock Purchase Plan will terminate upon the earliest to occur of (i) the date on which all available shares are issued or (ii) the date on which all outstanding purchase rights are exercised in connection with an acquisition of the Company.

The Board of Directors may at any time alter, suspend or discontinue the Employee Stock Purchase Plan. However, the Board of Directors may not, without stockholder approval, (i) materially increase the number of shares issuable under the Employee Stock Purchase Plan or the number purchasable per participant on any one purchase date, except in connection with certain changes in the Company’s capital structure, (ii) alter the purchase price formula so as to reduce the purchase price, (iii) materially increase the benefits accruing to participants or (iv) materially modify the requirements for eligibility to participate in the Employee Stock Purchase Plan.

26

New Plan Benefits

The amounts of future stock purchases under the Employee Stock Purchase Plan are not determinable because, under the terms of the Employee Stock Purchase Plan, purchases are based upon elections made by participants. Future purchase prices are not determinable because they are based upon fair market value of our common stock. The following table shows the participation in the Purchase Plan by our named executive officers:

| Name |

Number of shares purchased through March 28, 2013 |

Currently participating in the Purchase Plan? | ||||

| Robert W. Duggan |

- | No | ||||

| Mahkam Zanganeh, D.D.S., MBA |

5,180 | Yes | ||||

| Joshua T. Brumm |

- | No | ||||

| Rainer M. Erdtmann |

27,485 | Yes | ||||

| Lori Kunkel, M.D. |

921 | Yes | ||||

| Joseph J. Buggy, Ph.D. |

6,701 | Yes | ||||

Federal Tax Consequences

Rights granted under the Employee Stock Purchase Plan are intended to qualify for favorable federal income tax treatment associated with rights granted under an employee stock purchase plan that qualifies under the provisions of Section 423 of the Internal Revenue Code.

A participant will be taxed on amounts withheld for the purchase of shares of common stock as if such amounts were actually received. Other than this, no income will be taxable to a participant until disposition of the acquired shares, and the method of taxation will depend upon the holding period of the acquired shares.

If the stock is disposed of at least two years after the participant’s entry date into the offering period in which such shares of stock were acquired and at least one year after the stock is transferred to the participant, then the lesser of (i) the excess of the fair market value of the stock at the time of such disposition over the exercise price or (ii) 15% of the fair market value of the stock as of the participant’s entry date into that offering period will be treated as ordinary income. Any further gain or any loss will be taxed as a long-term capital gain or loss. Such capital gains currently are generally subject to lower tax rates than ordinary income.

If the stock is sold or disposed of before the expiration of either of the holding periods described above, then the excess of the fair market value of the stock on the exercise date over the exercise price will be treated as ordinary income at the time of such disposition. The balance of any gain will be treated as a capital gain. Even if the stock is later disposed of for less than its fair market value on the exercise date, the same amount of ordinary income is attributed to the participant, and a capital loss is recognized equal to the difference between the sales price and the fair market value of the stock on such exercise date. Any capital gain or loss will be short-term or long-term, depending on how long the stock has been held.

27

There are no federal income tax consequences to the Company by reason of the grant or exercise of rights under the Employee Stock Purchase Plan. The Company is entitled to a deduction to the extent amounts are taxed as ordinary income to a participant (subject to the requirement of reasonableness and the satisfaction of tax reporting obligations).

The foregoing is only a brief summary of the effect of U.S. federal income taxation upon the participant and the Company with respect to the issuance and exercise of options under the Employee Stock Purchase Plan. It does not purport to be complete, and does not discuss the tax consequences of a participant’s death or the income tax laws of any municipality, state or foreign country in which the participant may reside.

28

PROPOSAL THREE - ADVISORY RESOLUTION

REGARDING EXECUTIVE COMPENSATION

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Section 14A of the Exchange Act enables stockholders to vote to approve, on an advisory, non-binding basis, the compensation of the named executive officers as disclosed in this Proxy Statement in accordance with the SEC’s rules.

As described in detail under the heading “Executive and Director Compensation – Compensation Discussion and Analysis,” the Company’s executive compensation is designed to (i) pay our executive officers for performance and (ii) provide a compensation package that is competitive with the compensation paid to employees with similar responsibilities and experience at companies of comparable size, capitalization, and complexity in the biotechnology and pharmaceutical industries in the United States, in order to ensure the Company’s continued ability to hire and retain superior employees in key positions, while balancing an amount and structure that is efficient and affordable for the Company. Please read the “Compensation Discussion and Analysis” for additional details about the Company’s executive compensation programs for the named executive officers, including information about the six month transition period ended December 31, 2012.

We are asking stockholders to indicate their support for the compensation of the executive officers named in the “Summary Compensation Table” included in this Proxy Statement (referred to as the “Named Executive Officers”). This proposal, commonly known as a “say-on-pay” proposal, gives stockholders the opportunity to express their views on the Named Executive Officers’ compensation. Accordingly, we will ask stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2013 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the December 31, 2012 Summary Compensation Table and the other related tables and disclosure.”

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board. The Board and the Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the Named Executive Officer compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

The approval of this resolution requires the affirmative vote of a majority of the votes cast at the Annual Meeting. While this vote is required by law, it will neither be binding on the Company or the Board, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company or the Board.

Recommendation

THE COMPANY’S BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ADVISORY RESOLUTION REGARDING THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

29

PROPOSAL FOUR - RATIFICATION OF SELECTION

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013, and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited the Company’s financial statements since 1993. A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting to respond to appropriate questions, and will be given the opportunity to make a statement if he or she so desires.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm is not required by law or the Company’s bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the appointment, the Audit Committee of the Board will reconsider its selection. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

Independent Registered Public Accounting Firm Fees

The following table sets forth the aggregate fees billed or to be billed by PricewaterhouseCoopers LLP for the following services during the six month transition period ended December 31, 2012, fiscal 2012 and fiscal 2011:

| Transition Period | Fiscal 2012 |

Fiscal 2011 |

||||||||||

| Audit fees |

$ | 544,300 | $ | 804,865(1) | $ | 368,300 | ||||||

| Audit-related fees |

22,875 | 333,384 | - | |||||||||

| Tax fees |

44,920 | 378,201 | 39,800 | |||||||||

| All other fees |

- | 2,600 | - | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 612,095 | $ | 1,519,050 | $ | 408,100 | ||||||

|

|

|

|

|

|

|

|||||||

(1) Amount has been updated to include an additional $90,000 which relates to the fiscal 2012 audit that was not finalized as of the mailing date of our proxy statement related to the 2012 annual meeting.

In the above table, “audit fees” are fees for professional services for the audit of the Company’s financial statements included in its Annual Report on Form 10-K for the fiscal years ended June 30, 2012, and 2011 and the Transition Report on Form 10-K for the transition period ended December 31, 2012, and review of financial statements included in

30

its quarterly reports on Form 10-Q and for services that are normally provided in connection with statutory and regulatory filings. For fiscal 2012, audit fees included fees related to assistance with SEC comment letter responses and consultations in connection with the Company’s worldwide collaboration and license agreement with Janssen Biotech, Inc. which it entered into in December 2011 (see Note 4 to the Company’s audited financial statements included in its Annual Report on Form 10-K filed with the Securities and Exchange Commission for the fiscal year ended June 30, 2012). “Audit-related fees” represent fees for professional services for assurance and related services that are reasonably related to the performance of the audit or review of financial statements and that are not reported under the “audit fees” category. For fiscal 2012, audit-related fees included fees related to assistance with the Company’s international taxes and transfer pricing accounting. “Tax fees” are fees for tax compliance, tax advice and tax planning. All fees described above were approved by the Audit Committee, pursuant to the pre-approved policy described below.

Pre-Approval Policy and Procedures