UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

Preliminary Proxy Statement ☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☐

Definitive Proxy Statement ☒

Definitive Additional Materials ☐

Soliciting Material under §240.14a-12 ☐

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

No fee required. ☒

Fee paid previously with preliminary materials. ☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. ☐

March 21, 2025

TO OUR STOCKHOLDERS:

On behalf of the Board of Directors and management of Mativ Holdings, Inc., I cordially invite you to the Annual Meeting of Stockholders on Wednesday, April 30, 2025 at 11:00 a.m. Eastern Time via live audio webcast in a virtual meeting format at www.virtualshareholdermeeting.com/MATV2025.

Details about the Annual Meeting and the matters to be acted on at the Annual Meeting are presented in the Notice of Annual Meeting and Proxy Statement that follow.

It is important that your stock be represented at the Annual Meeting regardless of the number of shares you hold. Please vote promptly by Internet or by returning a proxy card, whether or not you plan to attend the Annual Meeting. If you do attend the Annual Meeting and wish to change your prior vote, you may do so at that time.

Thank you for your support.

Sincerely, | |||

| |||

Kimberly E. Ritrievi, ScD | |||

Chair, Board of Directors | |||

MATIV HOLDINGS, INC.

100 Kimball Place, Suite 600

Alpharetta, Georgia 30009

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The Annual Meeting of Stockholders of Mativ Holdings, Inc. will be held via live audio webcast in a virtual meeting format at www.virtualshareholdermeeting.com/MATV2025 on Wednesday, April 30, 2025 at 11:00 a.m. Eastern Time for the following purposes:

1. | To elect Kimberly E. Ritrievi, ScD as a Class III director for a term expiring at the 2028 Annual Meeting of Stockholders; |

2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2025; |

3. | To hold a non-binding advisory vote to approve executive compensation; |

4. | To approve the adoption of an amendment to the Mativ Holdings, Inc. 2024 Equity and Incentive Plan; and |

5. | To transact such other business as may properly be brought before the meeting or any adjournments or postponements thereof. |

We currently are not aware of any other business to be brought before the Annual Meeting.

Your vote is important. You may vote all shares that you owned as of March 10, 2025, which is the record date for the Annual Meeting. A majority of the outstanding shares of our common stock must be represented virtually at the Annual Meeting or by proxy to constitute a quorum at the Annual Meeting for the conduct of business. The attached Proxy Statement includes important information regarding the Annual Meeting, including what you need to do in order to participate and how to vote prior to the meeting. I urge you to vote promptly by Internet or by returning a proxy card.

Sincerely, | |||

| |||

Mark W. Johnson Chief Legal and Administrative Officer and Corporate Secretary | |||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 30, 2025. Our Proxy Statement and the Mativ Holdings, Inc. 2024 Annual Report on Form 10-K are available online at our Investor Relations website at http://ir.mativ.com/ or at www.proxyvote.com.

MATIV HOLDINGS, INC.

100 Kimball Place, Suite 600

Alpharetta, Georgia 30009

PROXY STATEMENT

INTRODUCTION

This Proxy Statement and the accompanying proxy card are being furnished to the stockholders of Mativ Holdings, Inc., a Delaware corporation, formerly known as Schweitzer-Mauduit International, Inc. and referred to as either the “Company” or “Mativ,” in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment or postponement thereof. The Company intends to mail proxy materials on or about March 21, 2025.

When and Where is the Annual Meeting?

The Annual Meeting will be held via live audio webcast on April 30, 2025, at 11:00 a.m. Eastern Time, in a virtual meeting format at www.virtualshareholdermeeting.com/MATV2025.

How May I Participate in the Virtual Annual Meeting?

You may attend the virtual Annual Meeting, ask questions, and vote your shares during the Annual Meeting at www.virtualshareholdermeeting.com/MATV2025. If you are a stockholder of record as of March 10, 2025, the record date for the Annual Meeting, you should log into the meeting website with your 16-digit control number found on your proxy materials, which will allow you to vote and ask questions during the meeting.

Online check-in will begin at 10:45 a.m. Eastern Time. We encourage you to access the Annual Meeting prior to the start time, leaving ample time for the check-in process. There will be technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual shareholder meeting login page.

The Company will post the rules of conduct for the Annual Meeting to the virtual meeting website. We will post a recording of the entire meeting, including appropriate questions received during the meeting and the Company’s answers, on http://ir.mativ.com/ as soon as practicable after the Annual Meeting.

As always, you are encouraged to vote your shares prior to the Annual Meeting.

What is the Purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters listed in the attached Notice of Annual Meeting of Stockholders, including (i) to elect one director for a term expiring in 2028; (ii) to ratify the Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2025; (iii) to hold a non-binding advisory vote to approve executive compensation; and (iv) to approve the adoption of an amendment to the Mativ Holdings, Inc. 2024 Equity and Incentive Plan.

We currently are not aware of any business to be acted upon at the Annual Meeting other than that described in this Proxy Statement. If, however, other matters are properly brought before the Annual Meeting, or any adjournment or postponement of the Annual Meeting, your proxy includes discretionary authority on the part of the individuals appointed to vote your shares to act on those matters according to their best judgment.

Adjournment of the Annual Meeting may be made for the purpose of, among other things, soliciting additional proxies to obtain a quorum. Any adjournment may be made from time to time by the chair of the Annual Meeting.

Who May Attend the Annual Meeting?

All stockholders of record at the close of business on March 10, 2025, the record date for the Annual Meeting, or their duly appointed proxies may attend the Annual Meeting. Although we encourage you to promptly vote over the Internet, by phone, or by mailing a proxy card to ensure your vote is counted, you may also attend the virtual Annual Meeting and vote your shares during the meeting.

1

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of the Proxy Materials Instead of a Paper Copy of the Proxy Materials?

The Notice of Internet Availability of Proxy Materials (the “Internet Notice”) that we mail to our stockholders (other than those who previously requested printed copies or electronic delivery) directs you to a website where you can access our proxy materials and view instructions on how to vote. By providing access to our proxy materials and 2024 Annual Report on the Internet rather than mailing printed copies, we save natural resources and reduce printing and distribution costs, while providing a convenient way to access the materials and vote. If you would prefer to receive a paper copy of these materials, please follow the instructions included in the Internet Notice.

What Constitutes a Quorum for Purposes of the Annual Meeting?

A quorum for the Annual Meeting will be a majority of the outstanding shares of the Company’s common stock, par value $0.10 per share (the “Common Stock”), represented by proxy or present at the virtual Annual Meeting. Abstentions and “broker non-votes” are counted as present for purposes of determining a quorum.

Can I Ask Questions at the Virtual Annual Meeting?

Yes. Stockholders as of the record date who properly log in and participate in our virtual Annual Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the meeting. During the question and answer session, we intend to answer all questions submitted during the meeting which are pertinent to the Company and the meeting matters, as time permits.

Who is Entitled to Vote at the Annual Meeting?

Each stockholder of record at the close of business on March 10, 2025, the record date for the Annual Meeting, will be entitled to one vote for each share registered in such stockholder’s name. As of March 10, 2025, there were 54,517,608 shares of Common Stock outstanding.

Participants in the Company’s Retirement Savings Plan, the Neenah, Inc. 401(k) Plan and the Neenah, Inc. Retirement Contribution Plan (093861) (the “Plans”) may vote the number of shares they hold in that plan. The number of shares shown on a participant’s proxy card includes the stock units the participant holds in the Plans and serves as a voting instruction to the trustee of the Plans for the account in the participant’s name. Information as to the voting instructions given by individuals who are participants in the Plans will not be disclosed to the Company.

A list of stockholders entitled to vote at the Annual Meeting will be available to stockholders for examination 10 days prior to the Annual Meeting. To review the list of stockholders, please contact Investor Relations at investors@mativ.com.

How May I Vote My Shares?

If you are a stockholder of record and hold your shares in your own name with our transfer agent, Equiniti Trust Company, LLC, you can vote over the Internet until 11:59 p.m. Eastern Time the day before the Annual Meeting by following the instructions on your proxy card or notice or you may vote during the virtual Annual Meeting by logging into the website with your 16-digit control number found on your proxy materials. You may also vote by completing, signing, dating and mailing a proxy card to: Mativ Holdings, Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

If your shares are held in “street name” (i.e., if they are held through a broker, bank or other nominee), you may receive a separate voting instruction form, or you may need to contact your broker, bank or other nominee to determine whether you will be able to vote electronically by using the Internet or by telephone prior to the Annual Meeting. You may also vote during the virtual Annual Meeting by logging into the website with your 16-digit control number found on your proxy materials.

If your vote is received before the Annual Meeting, the named proxies will vote your shares as you direct. If you return a validly executed proxy but do not make voting selections, your shares will be voted in accordance with the Board’s recommendations on each proposal, discussed below.

2

How Does the Board Recommend that I Vote?

The Board unanimously recommends that you vote:

• | FOR Proposal One – electing Kimberly E. Ritrievi, ScD as a Class III director for a term expiring at the 2028 Annual Meeting of Stockholders; |

• | FOR Proposal Two - Ratification of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2025; |

• | FOR Proposal Three - Non-Binding Advisory Vote to Approve Executive Compensation; and |

• | FOR Proposal Four - Adoption of an amendment to the Mativ Holdings, Inc. 2024 Equity and Incentive Plan. |

What Vote is Required to Approve Each Proposal?

Proposal One - Election of Directors. Directors will be elected by receiving a plurality of the votes cast of shares entitled to vote on the election of directors at the Annual Meeting. This means that the individuals who receive the greatest number of votes cast “FOR” will be elected as directors, up to the maximum number of directors to be chosen at the meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement, which is one. Votes may be cast in favor of, or withheld from, the nominee. Votes that are withheld will be excluded entirely from the vote and will have no effect.

Proposal Two - Ratification of the Appointment of the Independent Registered Public Accounting Firm. The vote will be decided by the affirmative vote of a majority of shares virtually present in person or represented by proxy and entitled to vote on the subject matter at the Annual Meeting.

Proposal Three - Non-Binding Advisory Vote to Approve Executive Compensation. The vote will be decided by the affirmative vote of a majority of shares virtually present in person or represented by proxy and entitled to vote on the subject matter at the Annual Meeting. This is an advisory vote and is not binding on the Board of Directors. However, the Compensation Committee and the Board of Directors expect to take into account the outcome of the vote when considering future decisions regarding executive compensation.

Proposal Four - Approval of the Adoption of an Amendment to the Mativ Holdings, Inc. 2024 Equity and Incentive Plan. The vote shall be decided by the affirmative vote of a majority of shares virtually present in person or represented by proxy and entitled to vote on the subject matter at the Annual Meeting.

What Happens if I Do Not Vote My Shares?

We encourage you to vote. Voting is an important stockholder right and helps to establish a quorum for the conduct of business. Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. In tabulating the voting result for any particular proposal, abstentions and, if applicable, broker non-votes are not counted as votes “FOR” or “AGAINST” (or “WITHHOLD” for) the proposals. Accordingly, abstentions will have no effect on Proposal One, because only votes “FOR” the director nominee will be considered in determining the outcome. Because they are considered to be present and entitled to vote for purposes of determining voting results, abstentions will have the effect of a vote “AGAINST” Proposals Two, Three and Four.

Under the New York Stock Exchange (“NYSE”) rules, if your shares are held in “street name” and you do not indicate how you wish to vote, your broker is permitted to exercise its discretion to vote your shares only on certain “routine” matters. Proposal Two is a “routine” matter under NYSE rules and, as such, your broker is permitted to exercise discretionary voting authority to vote your shares “FOR” or “AGAINST” the proposal in the absence of your instruction. The other proposals are not considered “routine” matters. Accordingly, if you do not direct your broker how to vote on such proposals, your broker may not exercise discretionary voting authority and may not vote your shares. This is called a “broker non-vote,” and although your shares will be considered to be represented by proxy at the Annual Meeting and counted for quorum purposes as discussed above, they are not considered to be shares “entitled to vote” on those proposals and will not be counted as having been voted on the applicable proposals. Therefore, they will not have the effect of a vote for or against (or withheld from) such proposals.

3

How Can I Revoke My Proxy or Change My Vote?

At any time before it is voted, any proxy may be revoked by the stockholder who granted it by (i) delivering to the Company’s Corporate Secretary at the Company’s principal executive office another signed proxy card or a signed document revoking the earlier proxy or (ii) voting online during the virtual Annual Meeting. You may also change your previously submitted vote by submitting a subsequent vote over the Internet prior to the Annual Meeting. The last vote received prior to the Annual Meeting will be the one counted.

If your shares are held in “street name” (i.e., if they are held through a broker, bank or other nominee), you may submit new voting instructions by contacting your broker, bank or other nominee. At any time before your previously submitted vote or previously granted proxy is voted, you may change such vote or revoke such proxy online during the Annual Meeting if you obtain a legal proxy from the record holder (the broker, bank or other nominee) giving you the right to vote the shares and have followed the instructions to participate in the meeting provided above under “How May I Participate in the Virtual Annual Meeting?”.

Who Pays for the Proxy Solicitation?

The Company has engaged Georgeson LLC, to assist in distributing and soliciting proxies for a fee of approximately $15,500, plus reasonable out-of-pocket expenses. However, the proxy solicitor fee is only a small fraction of the total cost of the proxy process. A significant expense in the proxy process is printing and mailing the proxy materials. The Company will reimburse brokers, fiduciaries and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners. In addition to solicitation by mail, directors, officers and employees of the Company may solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees of the Company will not receive any additional compensation in connection with such solicitation. The Company will pay the entire cost of the proxy solicitation.

Who Will Count the Vote?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged to tabulate stockholder votes and act as our independent inspector of election for the Annual Meeting.

Who Can Help Answer Any Other Questions I Might Have?

If you have any questions concerning the virtual Annual Meeting or need help voting your shares of Common Stock, please contact Broadridge at 1-800-690-6903 with your 16-digit control number found on your proxy materials. If you would like to request a copy of the material(s) for the Annual Meeting, you may (1) visit www.ProxyVote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com.

Hedging and Pledging Policy

The Company’s insider trading policy prohibits directors and key executives (including all Named Executive Officers) from directly or indirectly hedging or pledging any of the Company’s equity securities.

Hedging is defined in the policy to include any instrument or transaction, including put options and forward-sale contracts, through which such director or key executive would offset or reduce exposure to the risk of price fluctuations in the Company’s stock. In addition, the Company strongly discourages all other employees from engaging in similar arrangements with respect to Company stock, and any employee who wishes to enter into such an arrangement must seek prior approval from our Chief Legal Officer.

The policy also generally prohibits all officers, directors and employees of the Company (and its subsidiaries, independent contractors or consultants) from, among other things, engaging in short sales or transactions in publicly traded options, puts, calls or other derivative securities based on the Company’s equity securities on an exchange or any other organized market.

4

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities to file reports with the SEC regarding beneficial ownership of Common Stock and other equity securities of the Company. Directors, executive officers and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all forms they file pursuant to Section 16(a).

Based solely on a review of copies of such reports filed with the SEC and written representations from the Company’s directors and executives that no other reports were required, the Company believes that all of its directors, executive officers and greater than 10% stockholders complied with the reporting requirements of Section 16(a) applicable to them since January 1, 2024, other than due to administrative error, a late Form 4 filing on behalf of Ms. Schertell and Mr. Weitzel to report RSU vesting on January 26, 2024; late Form 4 filings on behalf of former director Jeffrey Keenan to report acquisitions of Common Stock on February 28 and March 1, and March 7 and 8, 2024; a late Form 3 and Form 4 filing on behalf of Messrs. Downard and Stenzel to report acquisitions of RSUs on January 30, 2024 and cash settlement of RSUs on February 16, 2024; a late Form 3 and Form 4 filing on behalf of Mr. Stenzel; and a late Form 4 on behalf of Ms. Allegri to report the acquisition of RSUs on April 26, 2024.

5

ELECTION OF DIRECTORS

The Company’s By-Laws provide that the number of directors on its Board shall be fixed by resolution of the Board from time to time.

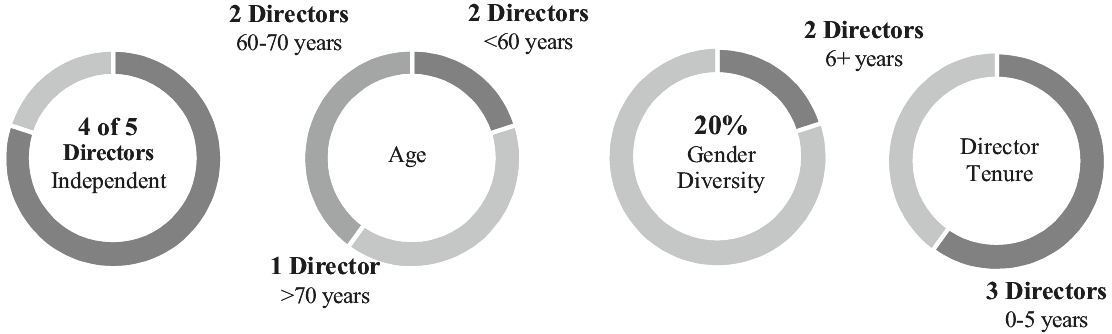

The Board is divided into three classes of directors of the same or nearly the same number. The table below shows the allocation of our directors and nominee across the three classes. John D. Rogers, PhD, who is currently a Class III director, will not stand for re-election at the Annual Meeting. Accordingly, as of the date of this proxy statement, there are six directors serving on the Board. The Board has agreed that the number of directors constituting the entire Board immediately following the Annual Meeting shall be five:

Class I - Current Term Ending at 2026 Annual Meeting | Class II - Current Term Ending at 2027 Annual Meeting | Class III - Nominee for Election at 2025 Annual Meeting | ||||

Marco Levi | Shruti Singhal | Kimberly E. Ritrievi, ScD | ||||

William M. Cook | John K. Stipancich | |||||

The Board, through its Nominating & Governance Committee, regularly reviews the particular skill sets required by the Board based on the nature of the Company’s business, strategic plans and regulatory challenges as well as the current performance of the incumbent directors. The Nominating & Governance Committee expects to continue to seek director candidates to replace current directors as they retire.

The By-Laws of the Company provide that a director is not eligible for election or re-election after his or her 72nd birthday but allows the Board to make an exception to this policy when it believes that nomination is in the best interests of the Company’s stockholders.

Upon recommendation of the Nominating & Governance Committee, the Board has nominated Kimberly E. Ritrievi, ScD for election to the Board as a Class III director to serve a three-year term ending at the 2028 Annual Meeting of Stockholders. If elected by our stockholders, Dr. Ritrievi will hold office until her successor has been elected and qualified or until her earlier resignation or removal. Dr. Ritrievi is a current member of the Board.

The Board has determined that Dr. Ritrievi is independent pursuant to the independence standards of the SEC, the NYSE and the Company. Dr. Ritrievi has consented to serve if elected. Should the nominee become unable to serve, proxies may be voted for another person designated by the Board. Proxies can only be voted for the number of persons named as nominees in this Proxy Statement (one).

The Board of Directors unanimously recommends a vote FOR the election to the Board of our nominee, Kimberly E. Ritrievi, ScD.

6

The name of the nominee and the directors continuing in office, their ages as of the date of the Annual Meeting, their principal occupations and public company directorships during at least the past five years and certain other biographical information are set forth on the following pages.

Kimberly E. Ritrievi, ScD Age: 66 Director Since: 2018  | Business Experience: | ||

• President, The Ritrievi Group, LLC, since 2005 • Various leadership roles at Goldman Sachs & Co., 1997 – 2004 | |||

Public Company Directorship: | |||

• Director of Tetra Tech, Inc., since 2013 | |||

Director Qualifications: | |||

• Dr. Ritrievi has over thirty years of collective experience in the capital markets and specialty chemicals industries. Dr. Ritrievi’s financial markets career has given her significant experience in identifying and creating stockholder value by applying short- and long-term time horizons and assessing strategy, capital allocation, business mix, competitive position and execution capabilities. In addition, Dr. Ritrievi has experience in the specialty chemical industry that provides her with insight into the Company’s key products and customers. | |||

7

William M. Cook Age: 71 Director Since: 2022  | Business Experience: | ||

• President and Chief Executive Officer, Donaldson Company, Inc., 2004 – 2015 • Various leadership roles at Donaldson Company, Inc., 1994 – 2004 | |||

Public Company Directorships: | |||

• Director, IDEX Corporation, 2008 – 2022 • Director, AXALTA Coating Systems, Ltd., since 2019 • Director, Neenah Inc., 2016 – 2022 • Director, Valspar Corporation, 2010 – 2017 | |||

Director Qualifications: | |||

• Mr. Cook brings to the Mativ Board his 35 years of filtration industry experience and his operations experience and financial expertise at Donaldson where he held a wide range of financial and business positions with global responsibilities. Mr. Cook is an experienced public company board member having served on the board of Donaldson Company, Inc. from 2004 - 2016 and as an independent Director for IDEX Corporation, Neenah, AXALTA Coating Systems, Ltd., and Valspar Corporation. Mr. Cook also has valuable board experience from his past board service for various private company and charitable organizations. | |||

8

Marco Levi Age: 67 Director Since: 2016  | Business Experience: | ||

• Chief Executive Officer, Ferroglobe PLC, a mining and metals company, since January 2020 • Chief Executive Officer, Thermission AG, a metals finisher, June 2018 – December 2019 • President and Chief Executive Officer, Ahlstrom Corporation, 2014 – 2016 • Senior Vice President and Business President of Emulsion Polymers, Styron Corporation, 2010 – 2014 | |||

Public Company Directorships: | |||

• Director of Ferroglobe PLC, since 2020 | |||

Director Qualifications: | |||

• Mr. Levi has over thirty years of experience in the Mine & Metals, chemicals, plastics and specialty paper and composites industries. His record of successfully running global materials technology businesses brings proven leadership experience to the Board. He is currently chief executive officer and Board Director of Ferroglobe PLC, a world leader in mines and minerals and recently served as the chief executive officer of Thermission AG, a pioneer in the field of zinc thermal diffusion to coat and finish industrial commercial materials. As the former president and chief executive officer of Ahlstrom Corporation, a global high-performance fiber company, Mr. Levi understands the principles that create stockholder value and has successfully navigated many of the strategic challenges facing a publicly traded company. Prior to his service with Ahlstrom Corporation, Mr. Levi was the senior vice president and business president of Emulsion Polymers, Styron Corporation, a global chemical materials solutions provider. There, he led the Emulsion Polymers business through a successful initial public offering and was integral in overseeing core business functions including manufacturing, supply chain marketing, sales and research and development. | |||

9

Shruti Singhal Age: 55 Director Since: 2022  | Business Experience: | ||

• President and Chief Executive Officer of the Company, since March 2025 • President and Chief Executive Officer, Chroma Color Corporation, a leading formulator, and specialty color and additive concentrates supplier, 2021 – March 2025 • President, DSM’s Engineering Materials Business, 2019 – 2021 | |||

Public Company Directorships: | |||

• Director, Neenah Inc., 2021 – 2022 | |||

Director Qualifications: | |||

• Mr. Singhal brings significant business and engineering experience in the specialty materials industry gained from his roles as President and Chief Executive Officer of Chroma Color Corporation, a leading formulator, and specialty color and additive concentrates supplier, and as President of DSM’s Engineering Materials Business. Mr. Singhal also extensive experience with international corporate operations as he has worked in North America and Europe with companies like Henkel, Cognis (now BASF), Rohm & Haas, The Dow Chemical Company, Ashland, Solenis, General Cable, DSM and others throughout his career. | |||

John K. Stipancich Age: 56 Director Since: 2024  | Business Experience: | ||

• Executive Vice President, General Counsel and Secretary of Roper Technologies, Inc., an operator of market-leading businesses that design and develop vertical software and technology-enabled products for a variety of niche markets, since 2016 • Chief Financial Officer of Newell Brands Inc., 2014 – 2016 • General Counsel of Newell Brands Inc., 2009 – 2014 | |||

Director Qualifications: | |||

• Mr. Stipancich has extensive business and legal experience, having worked as both chief financial officer and general counsel of Fortune 500 companies. He has a wealth of M&A experience, including acquisitions, divestitures, joint ventures, and tax restructurings. Mr. Stipancich also bring significant special materials global operations experience, as he served as the General Counsel and Corporate Secretary, and Executive Leader of Newell Brand Inc.’s operations in the Europe, Middle East, and Africa region. | |||

10

Summary of Skills, Experience, and Attributes of Director Nominee and Continuing Directors

Our director nominee and continuing directors and bring a diversity of expertise, experience, skills, and attributes to the Board. The following director skills matrix highlights the balanced mix of skills, experience and attributes that are most relevant to our Company.

Skills and Experience | W. Cook | M. Levi | K. Ritrievi | S. Singhal | J. Stipancich | ||||||||||

Current/Former CEO | X | X | X | ||||||||||||

Public Company Board Experience | X | X | X | X | |||||||||||

Strategic Leadership | X | X | X | X | X | ||||||||||

Audit/Accounting/ Financial Statements | X | X | X | X | X | ||||||||||

M&A/Integration/ Transformation | X | X | X | X | X | ||||||||||

Industrial/ Manufacturing Sector Experience | X | X | X | X | |||||||||||

International Experience | X | X | X | X | X | ||||||||||

Investor Relations | X | X | X | X | X | ||||||||||

Innovation/R&D | X | X | X | X | |||||||||||

Human Capital | X | X | X | X | X | ||||||||||

Executive Compensation | X | X | X | X | X | ||||||||||

Advertising/ Marketing/Sales | X | X | |||||||||||||

Communications | X | X | |||||||||||||

Enterprise Risk Management | X | X | X | ||||||||||||

Legal/Regulatory | X | X | |||||||||||||

ESG/Sustainability | X | X | X | X | |||||||||||

Attributes | W. Cook | M. Levi | K. Ritrievi | S. Singhal | J. Stipancich | ||||||||||

Gender Diversity | |||||||||||||||

Male | X | X | X | X | |||||||||||

Female | X | ||||||||||||||

Racial Diversity | |||||||||||||||

Asian/Pacific Islander | X | ||||||||||||||

White/Caucasian | X | X | X | X | |||||||||||

Directors may be nominated by the Board or by stockholders in accordance with the By-Laws of the Company. The Nominating & Governance Committee, which is composed of independent directors, identifies potential candidates and reviews all proposed nominees for the Board, including those proposed by stockholders. The Nominating & Governance Committee selects individuals as director nominees who have the highest personal and professional integrity and whose background and skills will enhance the Board’s ability to serve the long-term interests of the Company’s stockholders. The candidate review process includes an assessment of the person’s judgment, experience, financial expertise, independence, understanding of the Company’s business or other related industries, commitment and availability to prepare for and attend Board and Standing Committee meetings and such other factors as the Nominating & Governance Committee determines are relevant in light of the needs of the Board and the Company. In seeking director candidates, the Nominating & Governance Committee uses a director candidate qualification matrix that compares the skills, experience, and competencies of existing directors, directors that are expected to retire in the near-term and the anticipated future strategic and operational strategies and development needs of the Company in order to identify skills, experience and/or competencies that may otherwise be absent from the Board’s future composition. It also uses its and the Board’s professional contact networks and/or director search firms to identify and recommend to the Board suitable director candidates.

The Nominating & Governance Committee selects qualified candidates consistent with criteria approved by the Board and presents them to the full Board, which decides whether to nominate the candidate for election to the Board. The Nominating & Governance Committee Charter authorizes the Nominating & Governance Committee

11

to retain such outside experts, at the Company’s expense, as it deems necessary and appropriate to assist it in the execution of its duties. The Nominating & Governance Committee evaluates candidates recommended by stockholders in the same manner as it evaluates other candidates. A further discussion of the process for stockholder nominations and recommendations of director candidates is found under the caption “How Stockholders May Nominate or Recommend Director Candidates.”

The Nominating & Governance Committee, with input from the Board, considers a wide range of factors in determining the desired experiences and qualifications for director candidates and then seeks candidates that best meet those criteria. The Company does not have a formal policy concerning the diversity of its directors, however, the diversity of the Board is a consideration in evaluating candidates for the Board.

The Board is committed to including candidates with diverse personal and professional backgrounds in the pool of candidates when conducting a search for qualified candidates.

Any stockholder of record entitled to vote generally in the election of directors may nominate one or more persons for election as directors by complying with the procedures set forth in the Company’s By-Laws, a copy of which may be obtained from the Company’s Corporate Secretary. The notice of intent to nominate a candidate for the Board must satisfy the requirements described in the By-Laws and be received by the Company not less than 90 calendar days nor more than 120 calendar days before the first anniversary date of the preceding year’s annual meeting. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company.

Stockholders may recommend a director candidate for consideration by the Nominating & Governance Committee by notifying the Company’s Corporate Secretary in writing at Mativ Holdings, Inc., 100 Kimball Place, Suite 600, Alpharetta, Georgia 30009. The information that must be included in the notice and the procedures that must be followed (including the timeframe for submission) by a stockholder wishing to recommend a director candidate for the Nominating & Governance Committee’s consideration are the same as would be required under the By-Laws if the stockholder wished to nominate that candidate directly.

12

Compensation Discussion & Analysis

Overview

In 2024, we continued to make progress on strategic initiatives to drive long-term growth, with a focus on profit growth, cash flow generation and reducing our debt and leverage.

As part of the organizational realignment initiative implemented during the first quarter of 2024, we reorganized into two new reportable segments: Filtration & Advanced Materials (FAM), focused primarily on filtration & netting, and advanced films categories, and Sustainable & Adhesive Solutions (SAS), focused primarily on tapes, labels & liners, paper & packaging, and healthcare categories. We believe this structure enables us to streamline organizational size and complexity, and leverage business critical resources to enhance customer support. In connection with this realignment, the Company engaged in a significant workforce reduction, which resulted in an overhead cost reduction of $20 million in 2024, and announced a second wave of savings to be unlocked by system integrations, further restructuring, and transactional efficiencies and which we expect will result in an additional $20 million savings by the end of 2026, effectively reducing overhead costs by approximately 15% over that timeframe.

Looking ahead to 2025, we have a clear portfolio strategy with identified growth platforms and investments for the future, aligned with our strongest markets and customers. This includes investments in capacity and capabilities in filtration, release liners, specialty tapes, optical films and health care. From an execution approach, as we enter 2025, we are laser focused on profit growth, cash flow generation and reducing our debt and leverage.

As such, in 2025, we expect to reduce overall capital spending while still investing for growth, be even more aggressive on our footprint efforts, continue to streamline the organization by reducing complexity in how we go to market and further reduce supply chain and manufacturing costs. These actions are targeted at reducing costs while simultaneously supporting and improving customer relationships. We are optimistic about what we can accomplish as we leverage our teams and commercial excellence best practices across the Company.

Named Executive Officers

For 2024, the Company’s Named Executive Officers (“NEOs”) were:

• | Julie Schertell, Former President and Chief Executive Officer |

• | Greg Weitzel, Chief Financial Officer |

• | Mark W. Johnson, Chief Legal and Administrative Officer and Corporate Secretary |

• | Michael W. Rickheim, Chief Human Resources and Communications Officer |

• | Ryan Elwart, Group President, Sustainable & Adhesive Solutions (commenced employment on January 30, 2024) |

As previously disclosed, effective March 11, 2025, Shruti Singhal was appointed President and Chief Executive Officer, and Ms. Schertell departed the Company and stepped down from her role as a member of the Board. Please see “2025 CEO Transition” below for additional information regarding this transition.

13

Executive Compensation Philosophy

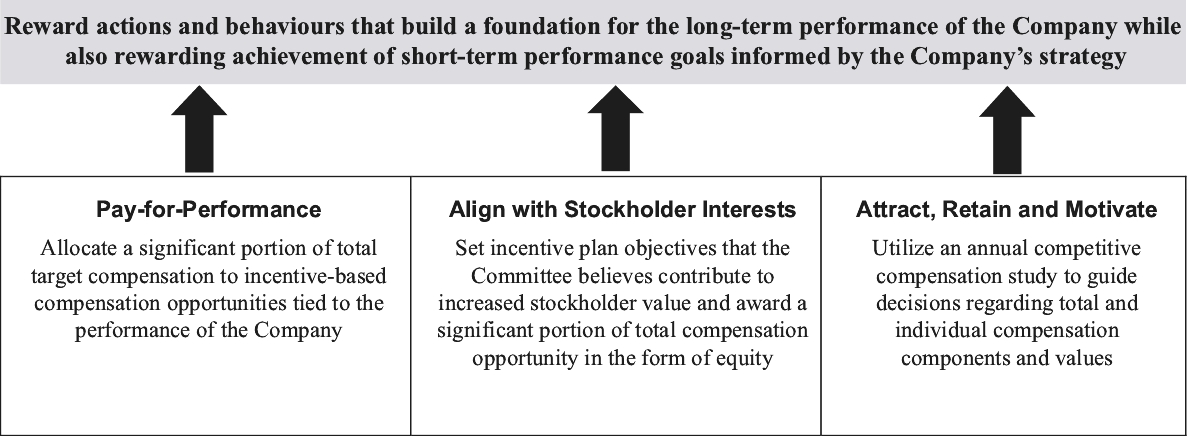

The Compensation Committee of the Board (the “Committee”) which is responsible for overseeing the Company’s executive compensation program, believes that the Company’s executive compensation program should reward actions and behaviors that build a foundation for the long-term performance of the Company, while also rewarding achievement of short-term performance goals informed by the Company’s strategy. To align the Company’s executive compensation program with the Committee’s compensation philosophy, the Committee has adopted the following objectives and guiding principles:

2024 “Say on Pay”: Advisory Votes on Executive Compensation and Stockholder Engagement

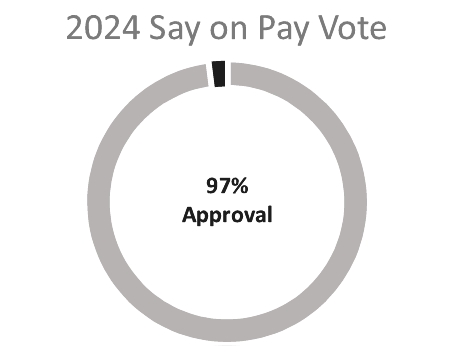

In 2024, in a non-binding advisory vote, the Board asked the Company’s stockholders to indicate whether they approved the Company’s compensation program for its NEOs, as disclosed in the 2024 proxy statement (“say on pay”). At its 2024 Annual Meeting of Stockholders, the Company’s stockholders approved the compensation program for its NEOs, with approximately 97% of the votes cast in favor of the say on pay proposal, which was consistent with the support we received on average for the five previous say on pay proposals of 97%. |  | ||

The Committee’s review of the Company’s executive compensation program considers whether the program serves the interests of stockholders. The Committee values continuing and constructive feedback from our stockholders on compensation and management and the Committee make themselves available to have a continuing dialogue with our stockholders in order to better understand their opinions regarding our executive compensation program. The Committee will continue to monitor our executive compensation program and, as it deems appropriate, engage with our stockholders and take into account stockholder input. Stockholders are invited to express their views or concerns directly to the Committee or the Board in the manner described below under “Communicating with the Board.”

14

Key Compensation Policies and Practices

We are committed to having strong governance standards with respect to our executive compensation program, policies and practices. Consistent with this focus, our 2024 executive compensation program was based on the following policies and practices that we believe demonstrate our commitment to executive compensation best practices.

What We Do: | |||||||||||

✔ | A significant portion of the NEOs’ total target compensation is delivered in the form of variable compensation that is connected to actual performance. | ✔ | Annual compensation risk assessment. | ||||||||

✔ | Maximum payout caps for annual and long-term incentive compensation. | ✔ | Annual peer group review. | ||||||||

✔ | Linkage between quantitative performance measures for incentive compensation and operating objectives. | ✔ | TSR modifier applicable to 2024 performance-based equity awards. | ||||||||

✔ | Independent compensation consultant reporting directly to the Committee and providing no other services to the Company. | ✔ | Clawback policies. | ||||||||

✔ | Robust stock ownership guidelines for NEOs. | ||||||||||

What We Don’t Do: | |||||

✘ | Change-in-control tax gross-ups. | ||||

✘ | “Single trigger” vesting of equity awards in the event of a change-in-control. | ||||

✘ | Re-price stock options or buy out underwater option awards. | ||||

✘ | Allow directors and key executives (including the NEOs) to hedge or pledge their Company securities. | ||||

✘ | Executive employment contracts unless required by local law. | ||||

✘ | Excessive perquisites. | ||||

15

Elements of the 2024 Executive Compensation Program

The graphic below summarizes the material elements of the Company’s 2024 executive compensation program for the NEOs. The Committee believes that this design balances fixed and variable compensation elements, provides alignment with the Company’s short and long-term financial and strategic priorities through the short-term and long-term incentive programs, and provides alignment with stockholder interests.

2024 Annual Pay Elements* | ||||||||||||||

Salary | Short-Term Incentive Plan | Service-Based Restricted Stock Units (“RSUs”) | Performance-Based Restricted Stock Units (“PSUs”) | |||||||||||

Who Receives |  | |||||||||||||

When Granted |  | |||||||||||||

Form of Delivery |  | |||||||||||||

Why We Pay | Establish a pay foundation at competitive levels to attract and retain talented executives | Motivate and reward executives for performance related to key financial performance metrics Hold executives accountable, with payouts varying from target based on actual performance against pre-established and communicated performance goals | Align the interests of executives with those of the Company’s stockholders by subjecting payout to fluctuations in the Company’s stock price performance Competitive with market practices in order to attract and retain top executive talent | Align the interests of executives with those of the Company’s stockholders by focusing the executives on the Company’s financial performance over the performance period and further subjecting payout to fluctuations in the Company’s stock price performance Competitive with market practices in order to attract and retain top executive talent | ||||||||||

Vesting/Performance Period | N/A | 1 year | 3 years pro-rata | 3 years cliff | ||||||||||

16

2024 Annual Pay Elements* | ||||||||||||||

Salary | Short-Term Incentive Plan | Service-Based Restricted Stock Units (“RSUs”) | Performance-Based Restricted Stock Units (“PSUs”) | |||||||||||

How Target and Payout Are Determined | Committee determines amounts and considers Chief Executive Officer recommendations for other NEOs Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant | Committee determines target amounts and considers Chief Executive Officer recommendations for other NEOs Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant Committee determines performance objectives and evaluates performance against objectives | Committee determines target amounts and considers Chief Executive Officer recommendations for other NEOs Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant | Committee determines target amounts and considers Chief Executive Officer recommendations for other NEOs Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant Committee determines performance objectives and evaluates performance against objectives | ||||||||||

Performance Measures | Individual | EBITDA, Revenue, Safety Scorecard | Change in Company stock price | Free Cash Flow as a Percent of Net Sales, Return on Invested Capital, Relative TSR | ||||||||||

* | Excludes sign-on compensation awarded to Mr. Elwart in connection with the commencement of his employment, as described below under “New Hire Compensation.” |

17

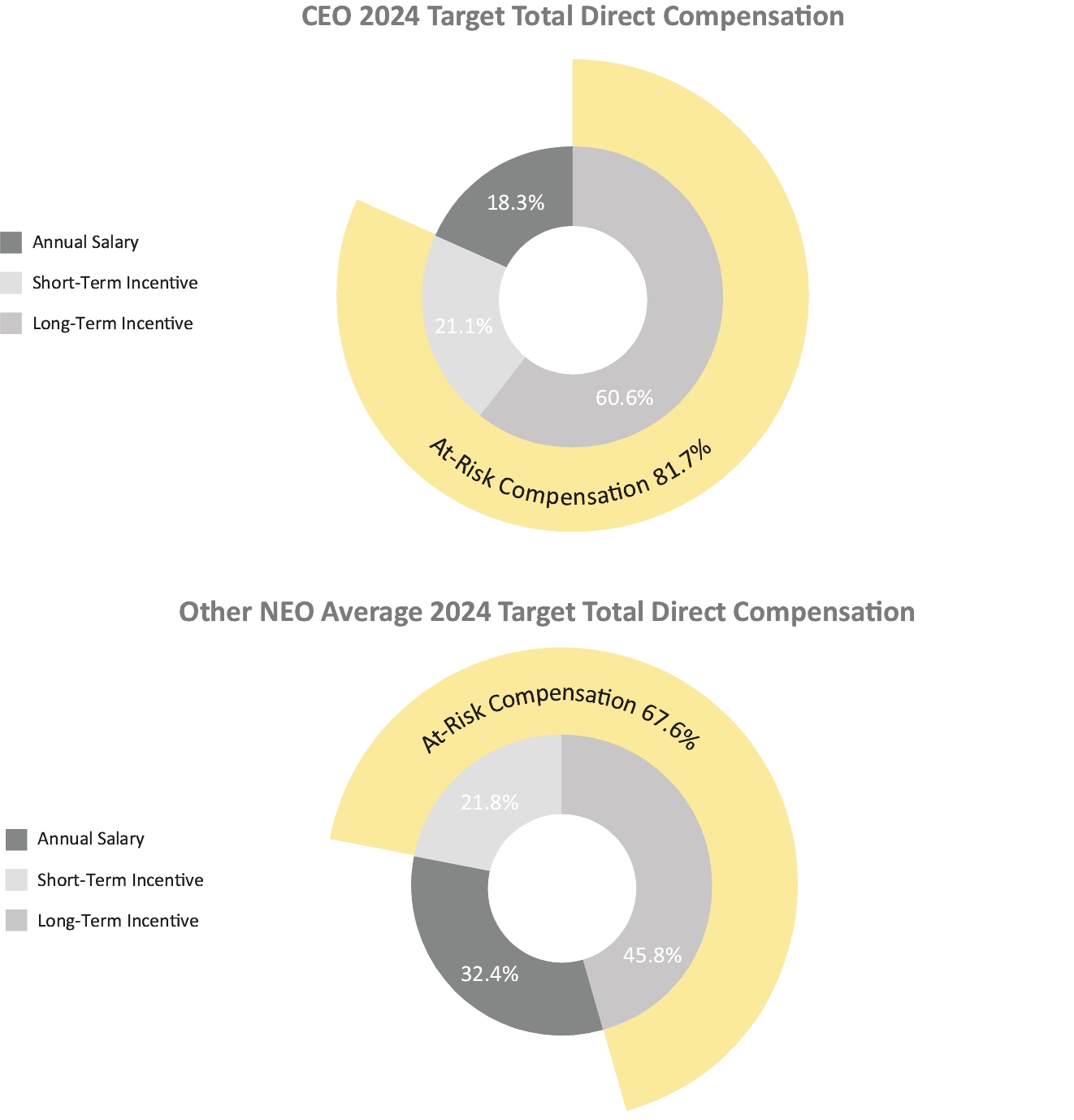

The following charts illustrates the mix of the targeted 2024 annual direct compensation for the Chief Executive Officer and the average mix of the targeted 2024 annual direct compensation for our other NEOs (excluding sign-on compensation awarded to Mr. Elwart in connection with the commencement of his employment) and the portion of that compensation that is at-risk.

18

Base Salary

In February 2024, in consultation with Meridian Compensation Partners, LLC (“Meridian”), the Committee’s independent compensation consultant, and based on Meridian’s review of materials prepared by Aon plc (“Aon”) as well as individual performance, the Committee increased the base salaries for all of the NEOs other than Mr. Elwart, with the increases made in order to more closely align the NEO salary levels with the competitive market. In connection with his commencement of employment in January 2024, Mr. Elwart’s base salary was established after consulting with Meridian and considering internal pay equity and a review of competitive market practices.

Name | 2023 Annual Base Salary | 2024 Annual Base Salary | ||||

Julie Schertell | $925,000 | $975,000 | ||||

Greg Weitzel | $425,000 | $475,000 | ||||

Mark W. Johnson | $470,000 | $500,000 | ||||

Michael W. Rickheim | $425,000 | $450,000 | ||||

Ryan Elwart(1) | N/A | $500,000 | ||||

(1) | Mr. Elwart’s 2024 annual base salary represents his annual base salary, effective January 30, 2024. |

2024 Short-Term Incentive Plan

In February 2024, after consulting with Meridian, the Committee approved cash-based award opportunities for the NEOs under our 2024 Short-Term Incentive Plan (“STIP”) as set forth in the table below in order to further align their compensation with the Company’s performance. The performance objectives for 2024 were EBITDA Delivered, revenue and Safety Scorecard. The Committee determined to replace the Synergies Achieved metric that had been originally approved for the 2023 STIP with revenue due to the amount of time that has elapsed since the consummation of the July 2022 merger between Schweitzer-Mauduit International, Inc. (“SWM”) and Neenah, Inc. (“Neenah”), resulting in the combined company, Mativ Holdings, Inc. (the ‘‘Merger”), and to focus instead on metrics that were viewed by the Committee to be core drivers of the Company’s performance and stockholder value creation.

The following table summarizes the 2024 target annual incentive opportunity for each NEO (expressed as a percentage of 2024 base salary). The target award opportunities for Messrs. Weitzel and Johnson were increased based on a review of the competitive market data as well as their individual performance since assuming their respective roles. The target award opportunity for Mr. Elwart was determined after considering market data and the Company’s historical compensation practices.

Name | 2023 Target Bonus (% of Base Salary) | 2024 Target Bonus (% of Base Salary) | ||||

Julie Schertell | 115% | 115% | ||||

Greg Weitzel | 65% | 70% | ||||

Mark W. Johnson | 65% | 70% | ||||

Michael W. Rickheim | 65% | 65% | ||||

Ryan Elwart | N/A | 65% | ||||

19

The following table sets forth the financial performance metrics applicable to the determination of 2024 STIP payouts for the NEOs. The target achievement levels for the EBITDA Delivered and revenue metrics were based our 2024 budget, factoring in anticipated growth rates for such metrics. The Committee believed at the time that the performance targets set for the 2024 STIP were rigorous yet achievable, and therefore established the targets so that they would be achieved, at the target performance level, if the Company successfully executed against its operating plan for 2024.

2024 Objectives(1) | Results | ||||||||||||||

MEASUREMENT METRICS | Threshold (50%) | Target (100%) | Maximum (200%)(2) | Actual Performance | Attainment Percentage | ||||||||||

70% EBITDA Delivered(3) ($ in millions) | $213 | $235 | $272 | $221 | 67% | ||||||||||

20% Revenue(4) ($ in millions) | $2,026 | $2,168 | $2,261 | Below Threshold | 0% | ||||||||||

10% Safety Scorecard(5) | 80% | 90% | 100% | 96% | 115% | ||||||||||

(1) | For any actual performance which falls between two defined payout thresholds, the payout with respect to such performance criteria is determined using straight-line interpolation. |

(2) | Achievement of the maximum performance level would result in a payout of 200% of target for the EBITDA Delivered and Revenue metrics and 125% of target for the Safety Scorecard metric. |

(3) | EBITDA Delivered is determined on a consolidated basis for continuing operations and consists of the sum of (a) Net Income, (b) interest expense, (c) depreciation and amortization expense, and (d) taxes. For these purposes, “Net Income” does not include (a) extraordinary gains or losses, (b) nonrecurring gains or losses, (c) gains or losses from asset sales, or (d) facility/asset closure or restructuring costs. |

(4) | Revenue represents total revenues as reported in the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2024. |

(5) | Safety Scorecard is intended to focus the NEOs on the leading indicators of proactive risk reduction and is measured based on achievement with respect to certain goals relating to ergonomic risk assessments, job safety analysis, leader learning engagement and pre-task risk assessments. |

The following table summarizes the target STIP opportunities for each NEO (expressed as a percentage of 2024 base salary and in dollars) for 2024 and the STIP payouts received by each NEO for 2024:

Name | 2024 Target Bonus (% of Base Salary) | 2024 Target Bonus Award Opportunity ($) | Final 2024 Bonus ($) | Final 2024 Bonus as a % of Target | ||||||||

Julie Schertell | 115% | $1,121,250 | $661,538 | 59.0% | ||||||||

Greg Weitzel | 70% | $332,500 | $196,175 | 59.0% | ||||||||

Mark W. Johnson | 70% | $350,000 | $206,500 | 59.0% | ||||||||

Michael W. Rickheim | 65% | $292,500 | $172,575 | 59.0% | ||||||||

Ryan Elwart | 65% | $299,250(1) | $176,558 | 59.0% | ||||||||

(1) | Mr. Elwart’s target bonus award opportunity was pro-rated based on his start date of January 30, 2024. |

20

2024 Long-Term Incentive Compensation

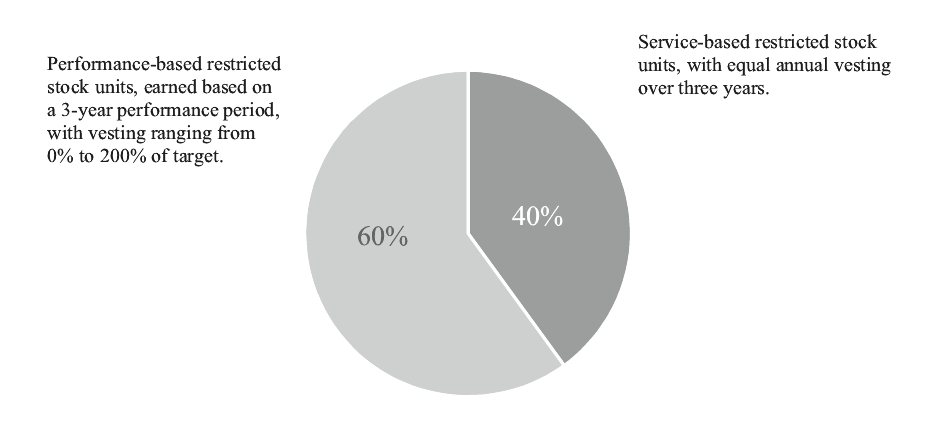

In April 2024, the Committee granted our NEOs long-term incentive award opportunities for the 2024-2026 performance period under the Company’s 2024 Equity and Incentive Plan (the “2024 Plan”), with the 2024 long-term incentive opportunity for each NEO allocated as follows:

The Committee believed that this design supported the Company’s pay-for-performance philosophy by tying a majority of the long-term incentive award opportunity to the achievement of a pre-established performance goal that supported the Company’s operating and strategic plan.

After consulting with Meridian and considering internal pay equity and a review of competitive market practices, the Committee established the following 2024-2026 performance period target long-term incentive award opportunities for our NEOs. The target long-term incentive opportunities for each of the continuing NEOs increased as compared to 2023 (or, in the case of Mr. Johnson, from the target opportunity set forth in his offer letter) in recognition of their performance since assuming each of their respective roles and based on the competitive market data. The target long-term incentive award opportunity for Mr. Elwart was determined after considering market data and the Company’s compensation practices with respect to its other executive officers.

Name | 2023 Target LTIP (% of 2023 Base Salary) | 2024 Target LTIP (% of 2024 Base Salary) | ||||

Julie Schertell | 324% | 331% | ||||

Greg Weitzel | 125% | 150% | ||||

Mark W. Johnson | N/A(1) | 140% | ||||

Michael W. Rickheim | 100% | 125% | ||||

Ryan Elwart | N/A | 150% | ||||

(1) | As previously disclosed, Mr. Johnson commenced employment with the Company in September 2023 and did not participate in the Company’s 2023 long-term incentive program. |

The table below sets forth the target award value, as of the date of grant, of the long-term incentive award received by each of the Company’s NEOs under its 2024 long-term incentive program, expressed (i) as a percentage of 2024 base salary and (ii) in dollars.

Name | Target LTIP (% of 2024 Base Salary) | Target LTIP Award Opportunity ($) | 2024 PSUs (# at Target) | 2024 Service- Based RSUs (#) | ||||||||

Julie Schertell | 331% | $3,227,244 | 142,904 | 95,269 | ||||||||

Greg Weitzel | 150% | $712,500 | 31,550 | 21,033 | ||||||||

Mark W. Johnson | 140% | $700,000 | 30,996 | 20,664 | ||||||||

Michael W. Rickheim | 125% | $562,500 | 24,906 | 16,605 | ||||||||

Ryan Elwart | 150% | $750,000 | 33,210 | 22,140 | ||||||||

21

2023 and 2024 Performance-Based Restricted Stock Unit Awards

In 2023 and 2024, the Company granted PSU awards that are subject to a three-year performance period, with vesting based 50% on each of the Company’s Free Cash Flow as a Percent of Net Sales and Return on Invested Capital (“ROIC”) performance, subject to a TSR modifier based on performance relative to the S&P 600 Materials Index, which may be applied by the Committee at its discretion. These goals were selected because they were viewed as core indicators of the Company’s success in executing its long-term operating plan and delivering value to its stockholders.

The Free Cash Flow as a Percent of Net Sales and ROIC targets are established annually, and payout percentages will be calculated based on the straight average of the payout percentages for each of the three individual calendar years in the performance period. The Free Cash Flow as a Percent of Net Sales and ROIC targets for 2023 (with respect to the PSUs granted in 2023) and 2024 (with respect to the PSUs granted in 2023 and 2024) are set forth in the table below and were each established based on the Company’s prior year performance and the Company’s internal operating and strategic plan. The number of PSUs earned based on the Company’s Free Cash Flow as a Percent of Net Sales and ROIC performance may be modified by the Committee at its discretion by applying a TSR modifier based on the Company’s performance relative to the S&P 600 Materials Index.

The tables below set forth the performance goals applicable to the PSU awards for the 2023-2025 and 2024-2026 performance periods:

2023 | 2024 | 2025 | ||||||||||||||||||||||||||||||||||

Threshold (50%) | Target (100%) | Maximum (200%) | Actual | Threshold (50%) | Target (100%) | Maximum (200%) | Actual | Threshold (50%) | Target (100%) | Maximum (200%) | Actual | |||||||||||||||||||||||||

Free Cash Flow as a Percent of Net Sales | 3.0% | 5.0% | 7.0% | Below Threshold | 0.7% | 1.6% | 3.7% | 2.0% | * | * | * | * | ||||||||||||||||||||||||

ROIC | 6.0% | 7.5% | 9.0% | Below Threshold | 3.5% | 4.5% | 7.0% | 4.5% | * | * | * | * | ||||||||||||||||||||||||

Payout Result | 0% | 105% | * | |||||||||||||||||||||||||||||||||

Relative TSR Result |  | |||||||||||||||||||||||||||||||||||

2024 | 2025 | 2026 | ||||||||||||||||||||||||||||||||||

Threshold (50%) | Target (100%) | Maximum (200%) | Actual | Threshold (50%) | Target (100%) | Maximum (200%) | Actual | Threshold (50%) | Target (100%) | Maximum (200%) | Actual | |||||||||||||||||||||||||

Free Cash Flow as a Percent of Net Sales | 0.7% | 1.6% | 3.7% | 2.0% | * | * | * | * | * | * | * | * | ||||||||||||||||||||||||

ROIC | 3.5% | 4.5% | 7.0% | 4.5% | * | * | * | * | * | * | * | * | ||||||||||||||||||||||||

Payout Result | 105% | * | * | |||||||||||||||||||||||||||||||||

Relative TSR Result |  | |||||||||||||||||||||||||||||||||||

* | Performance goals for the 2025 performance year was established at the beginning of 2025 and will be disclosed in next year’s proxy statements. Performance goals for the 2026 performance year are expected to be established at the beginning of 2026 and will be disclosed in the Company’s 2026 proxy statement. |

2024 Service-Based Restricted Stock Unit Awards

Pursuant to the service-based component of the Company’s 2024 long-term incentive award opportunity, in April 2024, the NEOs were granted RSU awards, which are scheduled to vest in equal installments in February 2025, 2026 and 2027, subject to continued employment through each applicable vesting date.

Cash Settlement of Outstanding 2015 Plan Awards

As permitted under the Schweitzer-Mauduit International, Inc. 2015 Long-Term Incentive Plan (the “2015 Plan”), the full value awards granted under the 2015 Plan were amended in 2024 to provide for cash-settlement in order to preserve the Company’s available shares under the 2015 Plan.

2025 CEO Transition

As previously disclosed, Ms. Schertell departed the Company and stepped down from her role as a member of the Board on March 11, 2025. For purposes of the Mativ Holdings, Inc. Executive Severance Plan (the

22

“Executive Severance Plan”), Ms. Schertell’s departure was treated as an involuntary termination without “cause”, and she became entitled to receive the severance benefits provided under the plan for such a termination. In connection with her departure, the Company and Ms. Schertell entered into a Separation Agreement and General Waiver and Release (the “Separation Agreement”) confirming the severance benefits and post-termination obligations pursuant to the Executive Severance Plan and the awards governing her outstanding equity awards, which includes a customary release of claims.

In connection with his appointment as President and Chief Executive Officer, Mr. Singhal and the Company entered into an offer letter pursuant to which Mr. Singhal will receive a monthly cash stipend of $110,000. Mr. Singhal will also receive an equity award under the Mativ Holdings, Inc. 2024 Equity Incentive Plan with a grant date value equal to $2,100,000, subject to a one-year cliff vesting requirement. The offer letter also contains customary employment terms and conditions.

New Hire Compensation

In connection with Mr. Elwart’s appointment as Group President, Sustainable and Adhesive Solutions, Mr. Elwart and the Company entered into an offer letter setting forth the initial terms of his employment, with the principal compensation elements as described above. In addition, Mr. Elwart was granted service-based RSUs, with a grant date fair value equal to $300,000 and which are scheduled to vest in equal installments on each of the first two anniversaries of the grant date, subject to his continued employment through each vesting date. Pursuant to the terms of his offer letter, Mr. Elwart was also awarded a sign-on bonus of $450,000, which Mr. Elwart must repay in full in the event that he voluntarily terminates his employment for any reason within 24 months of the payment date. The sign-on bonus and sign-on RSUs were awarded to induce Mr. Elwart to accept employment with the Company and were intended to replace compensation from his prior employer that he would forfeit upon accepting employment with the Company.

Severance Plans

In June 2024, the Company adopted the Executive Severance Plan, which superseded and replaced the Amended and Restated Neenah Executive Severance Plan. The Committee approved the Executive Severance Plan in order to, among other things, attract and retain key talent and ensure continuity of the business in the event of a change in control of the Company. The Executive Severance Plan was modeled on the Amended and Restated Neenah Executive Severance Plan and the terms of the Executive Severance Plan were determined after considering market practices and the input of Meridian. Based on such review, the Executive Severance Plan was modified to (i) increase the pre-change in control severance multiples from one-and-a-half for the Chief Executive Officer and one for the other NEOs to two and one-and-a-half, respectively, (ii) increase the post-change in control severance multiples from two times for the Chief Executive Officer and one and half times for the other NEOs to three times and two times, respectively, (iii) enhance the pre-change in control severance benefits to include pro-rated bonus payouts, COBRA continuation and equity vesting and (iv) add outplacement benefits for both pre-and post-change in control terminations, each as described further below.

In the event of an involuntary termination by the Company without “cause” that is not within two years following a change of control (each, a “Qualifying Termination”), the NEO is entitled to (i) a lump sum severance payment equal to the sum of (a) the NEO’s annual base salary and (b) the NEO’s target bonus, multiplied by two (in the case of Ms. Schertell) or one and a half (in the case of the NEOs other than Ms. Schertell), (ii) any earned but unpaid annual bonus amount and a prorated bonus payment for the year of termination, (iii) a lump sum payment equal to the NEO’s COBRA continuation premium for medical and dental coverage, multiplied by 24 (in the case of Ms. Schertell) or 18 (in the case of the NEOs other than Ms. Schertell), (iv) a lump sum payment in the amount of $25,000 for professional outplacement services, and (v) except as otherwise described below, prorated vesting of outstanding equity-based awards, based on service during the applicable vesting period, with performance based on target if the first annual performance period has not concluded as of the Qualifying Termination and averaged actual performance for any then-completed performance periods. With respect to any one-time equity-based awards, time-based awards will fully vest and performance-based awards will vest based on target performance.

In the event of (a) an involuntary termination by the Company without “cause” or (b) resignation for “good reason” by the NEO, in either case, within two years following a change of control (each, a “CIC Qualifying Transaction”), the NEO is entitled to (i) a lump sum severance payment equal to the sum of (a) the NEO’s annual base salary and

23

(b) the NEO’s target bonus, multiplied by three (in the case of Ms. Schertell) or two (in the case of the NEOs other than Ms. Schertell), (ii) any earned but unpaid annual bonus amount and a prorated bonus payment for the year of termination, (iii) a lump sum payment equal to the NEO’s monthly COBRA continuation premium for medical and dental coverage, multiplied by 36 (in the case of Ms. Schertell) or 24 (in the case of the NEOs other than Ms. Schertell), (iv) a lump sum payment in the amount of $25,000 for professional outplacement services, and (v) the vesting of outstanding equity-based awards, based on target performance with respect to performance-based awards.

Payments and other benefits provided under the Executive Severance Plan are contingent upon the NEO’s execution and non-revocation of an agreement providing for a general release of all claims against the Company and, as permitted by law, restrictive covenants relating to non-competition, non-disclosure, non-solicitation and non-disparagement.

See “Potential Payments Upon Termination or Change in Control” below for further information regarding the Executive Severance Plan.

Deferred Compensation Plans

Prior to the Merger, all of SWM’s U.S.-based NEOs were eligible to participate in a deferred compensation plan maintained by SWM (the “Legacy SWM Deferred Compensation Plan”). Mr. Rickheim is the only NEO who currently participates in the Legacy SWM Deferred Compensation Plan. Eligible employees may elect to defer up to 25% of their annual salary and up to 50% of their incentive bonus to the Legacy SWM Deferred Compensation Plan and the Company may, with Committee approval, make cash contributions to a participant’s account in the Legacy SWM Deferred Compensation Plan.

Prior to the Merger, Neenah maintained a supplemental retirement contribution plan (the “Supplemental RCP”), which is a non-qualified defined contribution plan which is intended to provide a tax-deferred retirement savings alternative for amounts exceeding Internal Revenue Code limitations on qualified plans. Ms. Schertell and Mr. Weitzel currently participate in the Supplemental RCP.

Please see the “2024 Non-Qualified Deferred Compensation” table for further information regarding the Company’s deferred compensation arrangements.

Stock Ownership Guidelines

The Company has adopted stock ownership guidelines (the “Guidelines”), which require the Company’s executive officers, including the NEOs, to own shares of Company common stock with a fair market value equal to a multiple of base salary. The Guidelines are designed to align the interests of the Company’s executive officers with the long-term interests of the Company’s stockholders and to promote commitment to sound corporate governance. Under the Guidelines, the NEOs must retain at least 50% of vested shares of Company common stock and shares acquired pursuant to the exercise of an option (except for shares sold to pay required tax withholding and the exercise price for options) until the required ownership guideline levels have been achieved (and thereafter if required to maintain the required ownership levels). Our NEOs must satisfy the Guidelines within five years after becoming subject to the Guidelines. Under the Guidelines, the Company’s Chief Executive Officer is required to hold stock equal to a multiple of five times her base salary and the other NEOs are each required to hold stock equal to a multiple of three times his base salary. As of the record date, each of our NEOs either meets the Guidelines or is within the five-year period to become in compliance with the Guidelines.

What Counts Toward the Guidelines | What Does Not Count Toward the Guidelines | ||||||||

✔ | Shares owned outright (including through vesting of equity awards) | ✘ | Performance shares and PSUs | ||||||

✔ | Shares owned directly by a spouse, domestic partner, or minor child | ✘ | Service-based restricted stock and RSUs | ||||||

✔ | Shares owned indirectly through beneficial trust ownership | ✘ | Stock options (whether vested or unvested) | ||||||

✔ | Vested shares or stock units held in any Company equity plan, employee stock purchase plan, deferred compensation plan, retirement plan or similar Company plan | ||||||||

24

Clawback Policies

During fiscal year 2024, the Company adopted a Dodd-Frank Clawback Policy to comply with SEC and NYSE listing rules. Under that policy, the Company is required in certain situations to recoup incentive compensation paid or payable to certain current or former executive officers of the Company, including the NEOs, in the event of an accounting restatement.

In addition, the Company continues to maintain the SWM International, Inc. Executive Compensation Adjustment and Recovery Policy, pursuant to which the Compensation Committee has the discretion to seek to recover any annual or long-term incentive compensation (including time-based equity awards) awarded or paid to a covered officer (including each NEO) during the previous three years if the result of a performance measure upon which the award was based or paid is subsequently restated or otherwise adjusted in a manner that would reduce the size of the award or payment.

How We Make Compensation Decisions

As illustrated in the table below, our Chief Executive Officer reviews annually the performance and pay level of each of our other executive officers, develops recommendations concerning the compensation of each of our other executive officers and presents those recommendations to the Committee. The Chief Executive Officer does not make any recommendation concerning her own compensation.

While the Committee considers the input of our Chief Executive Officer and management in the compensation decision-making process, the Committee is responsible for overseeing our executive compensation program, which includes the STIP and long-term incentive awards as well as our retirement and other benefit programs and practices. The Committee considers all elements of the program in total, as well as individual performance, Company-wide performance and internal equity and market compensation considerations, when making executive compensation-related decisions.

Market Review | Internal Review | Pay Decisions | ||||

• Performed by independent compensation consultant • Considers peer pay practices • Influences program design | • Chief Executive Officer evaluates performance • Chief Executive Officer and management review market data and internal comparable roles • Chief Executive Officer recommends to the Committee program changes and any pay adjustments | • Chief Executive Officer and management recommend to the Committee any program changes • Chief Executive Officer recommends pay adjustments • Committee carefully considers: ○ Historical and current market practices, ○ Internal pay equity, and ○ Established market trends • Committee approves any program and pay changes | ||||

Independent Compensation Consultant

The Committee engaged Meridian as its independent compensation consultant. In 2024, Meridian provided executive compensation and governance-related services including review of 2024 compensation adjustments, review of competitive market data provided by Aon, awards under our long-term incentive program, the setting of performance goals in our incentive plans including the payout leverage for results above and below the target performance levels, a review of the analysis of the relationship between the Company’s total direct pay relative to the competitive market, a review of trends and regulatory developments with respect to executive compensation, a review of our compensation peer group, based on materials prepared by Aon plc, and assistance with this Compensation Discussion & Analysis. Meridian is retained by and reports to the Committee and, at the request of the Committee, participates in committee meetings. Meridian did not provide any other services to the Company in 2024. The Committee reviewed the independence of Meridian under the New York Stock Exchange and SEC rules and concluded that the work of Meridian has not raised any conflict of interest.

Market-Based Competitive Compensation Levels

With respect to 2024, the Committee continued its philosophy of setting compensation within a range of the market median for each position, which experience has shown is the level at which the Company has been able

25

to recruit and retain highly talented executives. Compensation paid to our Chief Executive Officer is determined and approved by the Committee using competitive market data analyzed annually by Meridian, based on data provided by Aon. The Committee annually reviews, in consultation with Meridian, and approves the compensation for the Company’s other NEOs in consultation with the Chief Executive Officer using competitive market data, based on data provided by Aon. In establishing 2024 executive compensation, the Committee relied on proxy statement data from the same peer group of 16 companies that was established in August 2022 for purposes of evaluating the Company’s post-Merger compensation decisions. The Committee believes that the Company’s peer group should reflect the industries in which the Company potentially competes for business, executive talent and capital, as well as the Company’s significant international operations. The component companies of the peer group were selected from Aon’s Radford Global Compensation database for manufacturing companies with revenues between one-third and three times the Company’s revenue.

Peer Companies | |||

AptarGroup, Inc. | Greif, Inc. | ||

Ashland Global Holdings, Inc. | H.B. Fuller Company | ||

Avient Corporation (f/k/a PolyOne Corporation) | Ingevity Corporation | ||

Axalta Coating Systems Ltd. | Innospec Inc. | ||

Cabot Corporation | Mercer International Inc. | ||

Clearwater Paper Corporation | Minerals Technologies Inc. | ||

Donaldson Company, Inc. | Rayonier Advanced Materials Inc. | ||

Glatfelter Corporation | Trinseo PLC | ||

The Committee considers 2024 target total direct compensation to be competitive if it falls with +/-15% of the market median. The analysis evaluates the following components:

• | base salary; |

• | annual incentive bonus (assuming attainment of the target objective level, as a percentage of base salary); |

• | target total cash compensation (base salary plus target level annual incentive); |

• | long-term incentive compensation (assuming attainment of the target objective level); and |

• | target total direct compensation, which is the sum of base salary plus annual incentive plus long-term incentive compensation at the target levels. |

In September 2024, the Committee reviewed the compensation peer group and determined not to make any changes to the peer group used for purposes of evaluating 2025 compensation decisions.

Equity Grant Timing Practices

It is the Committee’s practice to generally approve ordinary course annual equity grants at the February Committee meeting each year for the NEOs, with the Committee’s regular meeting schedule determined in the prior fiscal year. In 2024, the Committee delayed granting annual equity awards to our NEOs until the 2024 LTIP was approved by our stockholders at the 2024 Annual Meeting of Stockholders. If NEOs are hired or promoted during the year, they generally receive a grant at the first scheduled Committee meeting following their hire date or promotion date for an aggregate number of RSUs and PSUs based on position.

On an annual basis, the Committee reviews the risks associated with the Company’s executive compensation program and whether the program was reasonably likely to have a material adverse effect on the Company. The Committee concluded that the program design, metrics and objectives, taken as a whole and considered within the other financial control and approval processes in place at the Company, were not reasonably likely to have a material adverse effect on the Company.

26

The Committee has reviewed and discussed the “Compensation Discussion & Analysis” with management.

Based on the review and discussions, the Committee recommended to the Board that the “Compensation Discussion & Analysis” be included in the Company’s 2024 Proxy Statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS | |||

Kimberly E. Ritrievi, ScD (Chair) William M. Cook Marco Levi | |||

27

2024 SUMMARY COMPENSATION TABLE