| © 2026 NOVAVAX. All rights reserved. 1 Novavax Corporate Presentation John C. Jacobs, President and Chief Executive Officer J.P. Morgan Healthcare Conference © 2026 NOVAVAX. All rights reserved. 1 |

| © 2026 NOVAVAX. All rights reserved. 2 We envision a world where our technology is amplified to touch the lives of billions, sparking transformation in global health. This is Novavax © 2026 NOVAVAX. All rights reserved. 2 |

| © 2026 NOVAVAX. All rights reserved. 3 Cautionary Note Regarding Forward-Looking Statements This presentation includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including Novavax’s corporate strategy and operating plans, objectives and prospects; its value drivers and near-term priorities; its partnerships, including expectations with respect to potential royalties, milestones, and cost reimbursement, and plans for additional potential partnering activities; its expectations regarding manufacturing capacity, timing, production and delivery for its COVID-19 vaccine; the transition of the lead responsibility for commercialization of Novavax’s COVID-19 vaccine to Sanofi beginning with the 2025-2026 vaccination season the development of Novavax’s clinical and preclinical product candidates and pipeline advancement; the conduct, timing and potential results from clinical trials and other preclinical and postmarketing studies; scope, timing and outcome of future and pending regulatory filings and actions; potential future market sizes and demand for its COVID-19 vaccine and product candidates; the conduct of our post marketing commitment (“PMC”) study requested by the U.S. FDA following the U.S. FDA’s approval of the BLA for our COVID-19 Vaccine and the expected costs and timing associated with the PMC study; full year 2025 financial guidance and revenue framework; expected combined annual R&D and SG&A expenses for 2025, 2026 and 2027; the amount and impact of Novavax’s cost reduction plans; Novavax’s future financial or business performance; and plans and negotiations with respect to Novavax’s existing advanced purchase agreements. Novavax cautions that these forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These risks and uncertainties include, without limitation, Novavax’s ability to successfully and timely obtain and maintain full U.S. FDA licensure or foreign regulatory approvals necessary to manufacture, market, distribute, or deliver its COVID-19 vaccine; the impact of delays in obtaining regulatory approval, including regulatory decisions impacting labeling, approval or authorization, including the scope of the indicated population, product dosage, manufacturing processes, shelf life, safety, for Novavax’s product candidates; challenges in conducting the PMC study, Novavax’s ability to obtain adequate additional funding to maintain its current level of operations and fund the further development of its vaccine candidates; challenges related to Novavax’s partnership with Sanofi, including collaboration on the PMC, and in pursuing additional partnership opportunities; challenges satisfying, alone or together with partners, various safety, efficacy, and product characterization requirements, including those related to process qualification, assay validation, and stability testing, necessary to satisfy applicable regulatory authorities; challenges or delays in conducting clinical trials or studies for Novavax’s product candidates; manufacturing, distribution or export delays or challenges; Novavax’s substantial dependence on Serum Institute of India Pvt. Ltd. and Serum Life Sciences Limited for co-formulation and filling Novavax’s COVID-19 vaccine and the impact of any delays or disruptions in their operations; the impact of potential legislative, regulatory, or policy changes under the current presidential administration, including any adverse impact funding for vaccine research and development, reimbursement for vaccines and their administration, vaccine mandates and recommendations, and public perception of vaccine importance; uncertainty with respect to pricing, third-party reimbursement and healthcare reform; uncertainty in the regulatory pathway for our COVID -19 vaccine; the impact of any new or changes in interpretations of existing trade measures, including tariffs, embargoes, sanctions, import restrictions, and export licensing requirements; difficulty obtaining scarce raw materials and supplies, including for Novavax’s proprietary adjuvant; resource constraints, including human capital and manufacturing capacity, constraints on Novavax’s ability to pursue planned regulatory pathways, alone or with partners, in multiple jurisdictions simultaneously, leading to staggering of regulatory filings, and potential regulatory actions; Novavax’s ability to timely deliver doses; challenges in obtaining commercial adoption and market acceptance of Novavax’s COVID-19 vaccine or any COVID-19 variant strain containing formulation, or Novavax’s CIC vaccine candidates, stand-alone influenza vaccine candidates or other candidates; challenges meeting contractual requirements under agreements with multiple commercial, governmental, and other entities, including requirements to deliver doses that may require Novavax to refund portions of upfront and other payments previously received or result in reduced future payments pursuant to such agreements and challenges in negotiating, amending or terminating such agreements; challenges related to the seasonality of vaccinations against COVID-19 or influenza; challenges related to the demand for vaccinations against COVID-19 or influenza; challenges in identifying and successfully pursuing innovation expansion opportunities; Novavax’s expectation as to expenses and cash needs may prove not to be correct for reasons such as changes in plans or actual events being different than Novavax’s assumptions, and other risks and uncertainties identified the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections of Novavax's Annual Report on Form 10-K for the year ended December 31, 2024, and subsequent Quarterly Reports on Form 10-Q, as filed with the Securities and Exchange Commission (SEC). Novavax cautions investors not to place considerable reliance on forward-looking statements contained in this presentation. Investors are encouraged to read Novavax’s filings with the SEC, available at www.sec.gov and www.novavax.com, for a discussion of these and other risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of this presentation, and we undertake no obligation to update or revise any of these statements. Our business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. NovavaxTM (and all associated logos) is a trademark of Novavax, Inc. Matrix-M is a trademark of Novavax AB. |

| © 2026 NOVAVAX. All rights reserved. 4 Non-GAAP Financial Measures The Company presents the following non-GAAP financial measures in this presentation: Combined R&D and SG&A expenses (net of partner reimbursements) and Non-GAAP profitability. Non-GAAP financial measures refer to financial information adjusted from financial measures prepared in accordance with accounting principles generally accepted in the United States (GAAP). The Company believes that the presentation of these adjusted financial measures is useful to investors as they provide additional information on comparisons between periods by including certain items that affect overall comparability. The Company uses these non-GAAP financial measures for business planning purposes and to consider underlying trends of its business. Non-GAAP financial measures should be considered in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with GAAP. Our use of non-GAAP financial measures may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. The Company is unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable GAAP measures without unreasonable effort because the Company is reliant on Sanofi sales forecasts for certain revenue categories, which are not available. |

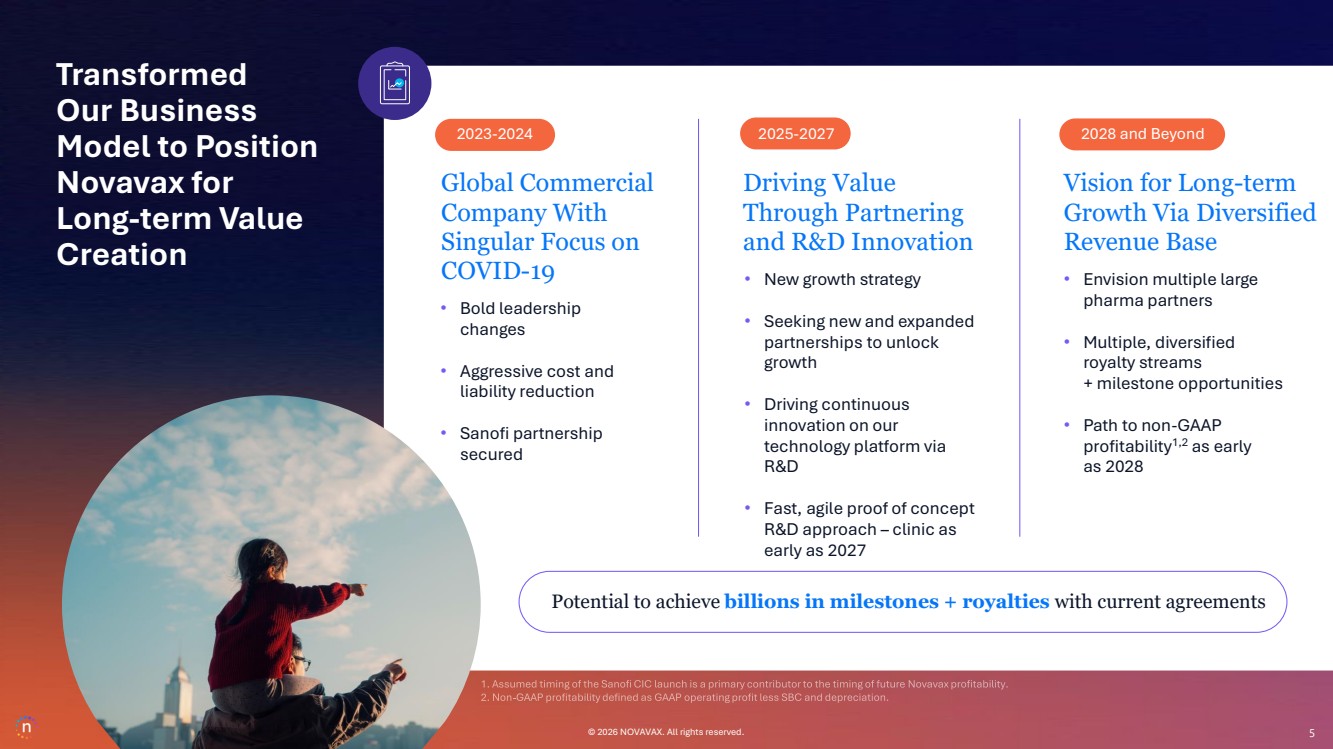

| © 2026 NOVAVAX. All rights reserved. 5 Global Commercial Company With Singular Focus on COVID-19 Vision for Long-term Growth Via Diversified Revenue Base Driving Value Through Partnering and R&D Innovation • Bold leadership changes • Aggressive cost and liability reduction • Sanofi partnership secured • New growth strategy • Seeking new and expanded partnerships to unlock growth • Driving continuous innovation on our technology platform via R&D • Fast, agile proof of concept R&D approach – clinic as early as 2027 • Envision multiple large pharma partners • Multiple, diversified royalty streams + milestone opportunities • Path to non-GAAP profitability1,2 as early as 2028 2025-2027 2028 and Beyond Potential to achieve billions in milestones + royalties with current agreements 2023-2024 © 2026 NOVAVAX. All rights reserved. 5 Transformed Our Business Model to Position Novavax for Long-term Value Creation |

| © 2026 NOVAVAX. All rights reserved. 6 Actual Novavax scientist • Strong existing partnerships drive current value and have the potential to deliver significant additional value over time • Actively seeking new partnerships to further amplify the value of our technology • Lean and focused R&D and BD operating model Partnerships R&D Lean Operating In-house early-stage R&D to: Model • Drive further proof points on value of our technology • Expand utility of our technology • Build, create additional assets that can further facilitate partnering Corporate Growth Strategy Designed to Deliver Value Through Partnering and R&D Innovation 6 6 |

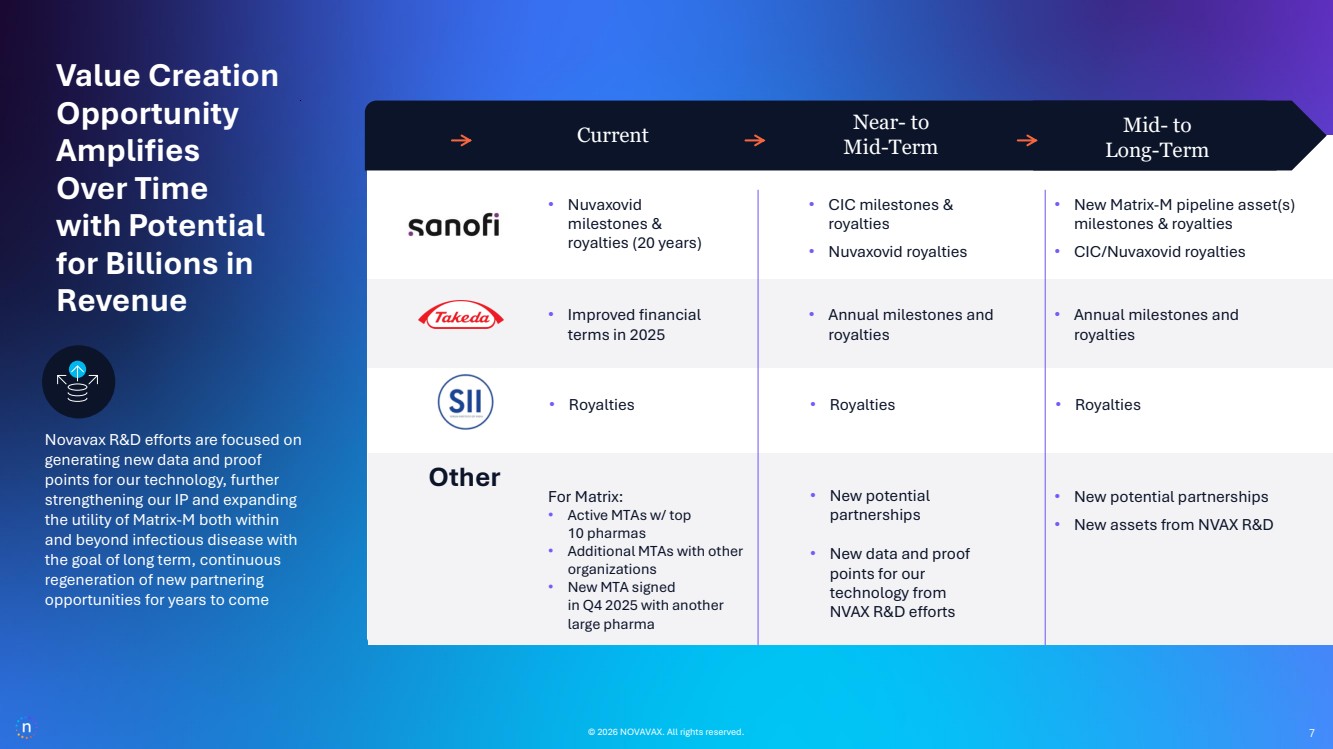

| © 2026 NOVAVAX. All rights reserved. 7 • New Matrix-M pipeline asset(s) milestones & royalties • CIC/Nuvaxovid royalties • CIC milestones & royalties • Nuvaxovid royalties • Improved financial terms in 2025 • Nuvaxovid milestones & royalties (20 years) • Annual milestones and royalties • Annual milestones and royalties Novavax R&D efforts are focused on generating new data and proof points for our technology, further strengthening our IP and expanding the utility of Matrix-M both within and beyond infectious disease with the goal of long term, continuous regeneration of new partnering opportunities for years to come © 2026 NOVAVAX. All rights reserved. Current Near- to Mid-Term Mid- to Long-Term For Matrix: • Active MTAs w/ top 10 pharmas • Additional MTAs with other organizations • New MTA signed in Q4 2025 with another large pharma • New potential partnerships • New data and proof points for our technology from NVAX R&D efforts • New potential partnerships • New assets from NVAX R&D Value Creation Opportunity Amplifies Over Time with Potential for Billions in Revenue • Royalties • Royalties • Royalties Other 7 7 |

| © 2026 NOVAVAX. All rights reserved. 8 2025: A Year of Achievements Potential for Value Creation: 2026-2028 and beyond Ongoing receipt of milestones and royalties from existing partnerships Nuvaxovid U.S. BLA approved + commercial transition to Sanofi $225 million in Sanofi milestones achieved Sanofi flu / COVID-19 combination clinical programs that include Nuvaxovid achieved positive preliminary results R21/Matrix-M malaria vaccine via partners achieved 85% share in growing market2 Developed and advanced new pipeline programs Optimized existing partnerships Multiple MTAs signed Advance early-stage assets into the clinic Preclinical data and select product candidates for clinical work, expansion beyond ID Additional licensing agreements with Matrix and new partnerships for pipeline assets >12% market share1 for Nuvaxovid in Japan in 2025 via Takeda partnership © 2026 NOVAVAX. All rights reserved. 1. Encise cluster daily data. 2. Novavax internal data. |

| © 2026 NOVAVAX. All rights reserved. 9 Novavax technology has the potential to target high-value/ high unmet need vaccine opportunities Potential for cancer immunotherapies, vaccine and adjuvant innovations ~$12B2 2024 2032 Over $42B2 Combined total of projection of the infectious disease and oncology immunotherapeutics categories globally © 2026 NOVAVAX. All rights reserved. ~$57B1 2024 Over $75B1 Market Projected to Grow Key Markets: • Pneumococcal • HPV • Shingles • Flu • COVID-19 • Flu/COVID-19 Combo • DTaP • Meningococcal • RSV Novavax Growth Strategy is Focused on Tapping Into a Global Market Opportunity That is Projected to Grow to >$100B by the 2030s 9 1. McKinsey Report, March 2025. 2. Fortune Business Insights, November 2025. |

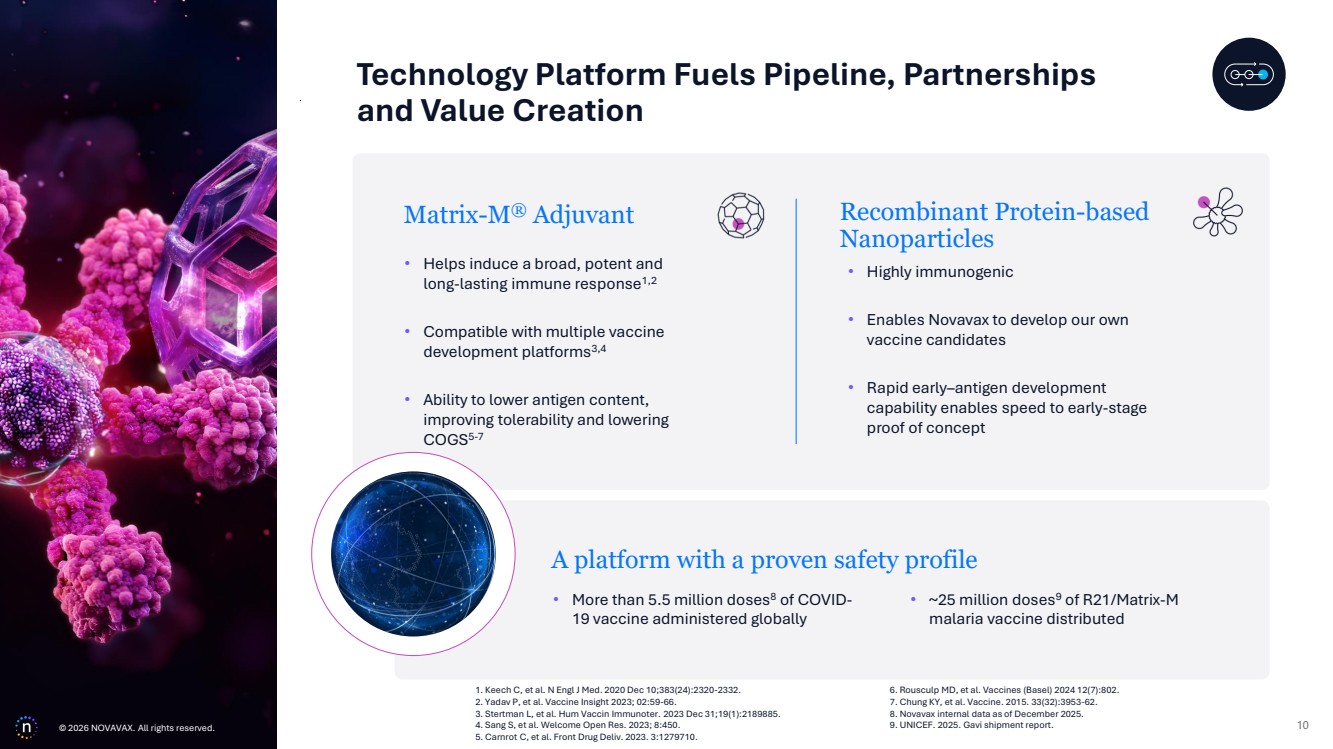

| © 2026 NOVAVAX. All rights reserved. 10 Matrix-M® Adjuvant • Helps induce a broad, potent and long-lasting immune response1,2 • Compatible with multiple vaccine development platforms3,4 • Ability to lower antigen content, improving tolerability and lowering COGS5-7 • ~25 million doses9 of R21/Matrix-M malaria vaccine distributed A platform with a proven safety profile • More than 5.5 million doses8 of COVID-19 vaccine administered globally Recombinant Protein-based Nanoparticles • Highly immunogenic • Enables Novavax to develop our own vaccine candidates • Rapid early–antigen development capability enables speed to early-stage proof of concept Technology Platform Fuels Pipeline, Partnerships and Value Creation 1. Keech C, et al. N Engl J Med. 2020 Dec 10;383(24):2320-2332. 2. Yadav P, et al. Vaccine Insight 2023; 02:59-66. 3. Stertman L, et al. Hum Vaccin Immunoter. 2023 Dec 31;19(1):2189885. 4. Sang S, et al. Welcome Open Res. 2023; 8:450. 5. Carnrot C, et al. Front Drug Deliv. 2023. 3:1279710. 6. Rousculp MD, et al. Vaccines (Basel) 2024 12(7):802. 7. Chung KY, et al. Vaccine. 2015. 33(32):3953-62. 8. Novavax internal data as of December 2025. © 9. UNICEF. 2025. Gavi shipment report. 2026 NOVAVAX. All rights reserved. |

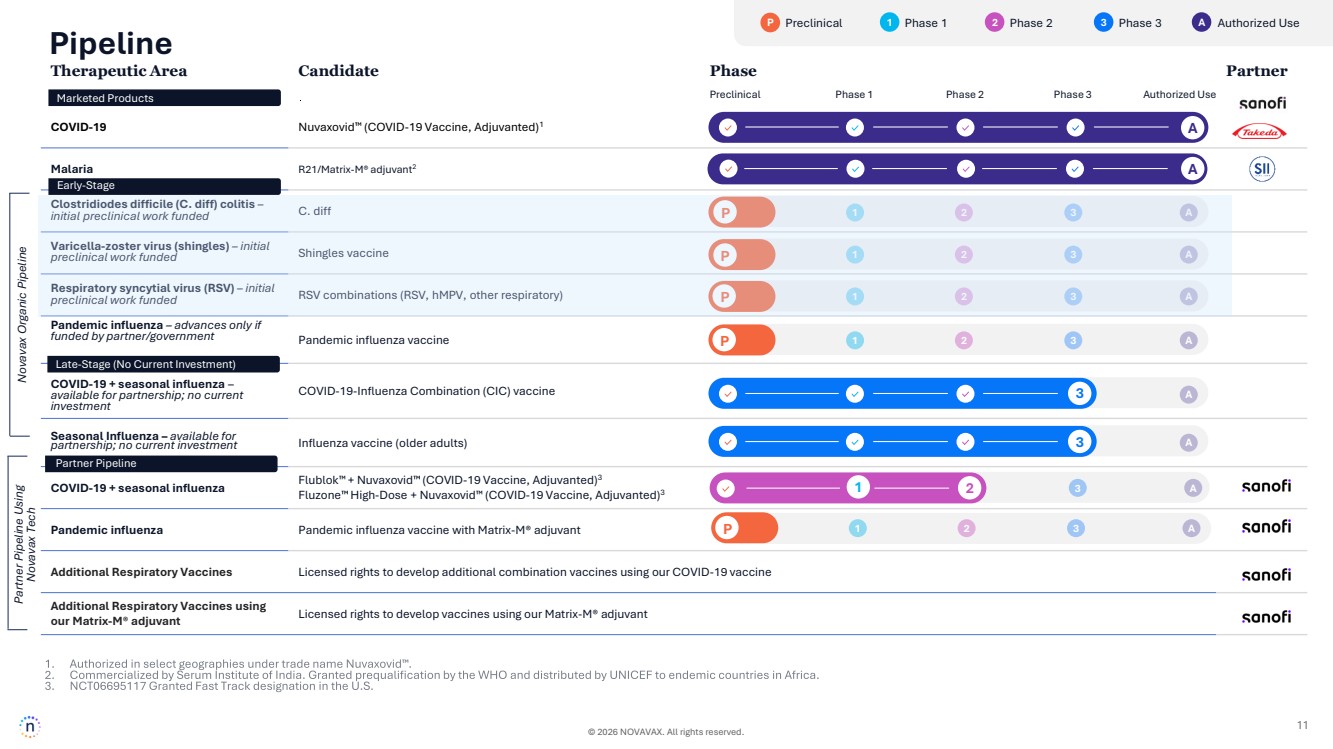

| © 2026 NOVAVAX. All rights reserved. 11 P Preclinical 1 Phase 1 2 Phase 2 3 Phase 3 A Authorized Use Therapeutic Area Candidate Phase Partner COVID-19 Nuvaxovid (COVID-19 Vaccine, Adjuvanted)1 Malaria R21/Matrix-M® adjuvant2 Clostridiodes difficile (C. diff) colitis – initial preclinical work funded C. diff Varicella-zoster virus (shingles) – initial preclinical work funded Shingles vaccine Respiratory syncytial virus (RSV) – initial preclinical work funded RSV combinations (RSV, hMPV, other respiratory) Pandemic influenza – advances only if funded by partner/government Pandemic influenza vaccine COVID-19 + seasonal influenza – available for partnership; no current investment COVID-19-Influenza Combination (CIC) vaccine Seasonal Influenza – available for partnership; no current investment Influenza vaccine (older adults) COVID-19 + seasonal influenza Flublok + Nuvaxovid (COVID-19 Vaccine, Adjuvanted)3 Fluzone High-Dose + Nuvaxovid (COVID-19 Vaccine, Adjuvanted)3 Pandemic influenza Pandemic influenza vaccine with Matrix-M® adjuvant Additional Respiratory Vaccines Licensed rights to develop additional combination vaccines using our COVID-19 vaccine Additional Respiratory Vaccines using our Matrix-M® adjuvant Licensed rights to develop vaccines using our Matrix-M® adjuvant Preclinical Phase 1 Phase 2 Phase 3 Authorized Use A Pipeline Partner Pipeline Using Novavax Tech A Marketed Products Early-Stage Late-Stage (No Current Investment) Partner Pipeline P 1 2 3 A P 1 2 3 A P 1 2 3 A P 1 2 3 A 1 2 3 A 3 A P 1 2 3 A 3 A Novavax Organic Pipeline |

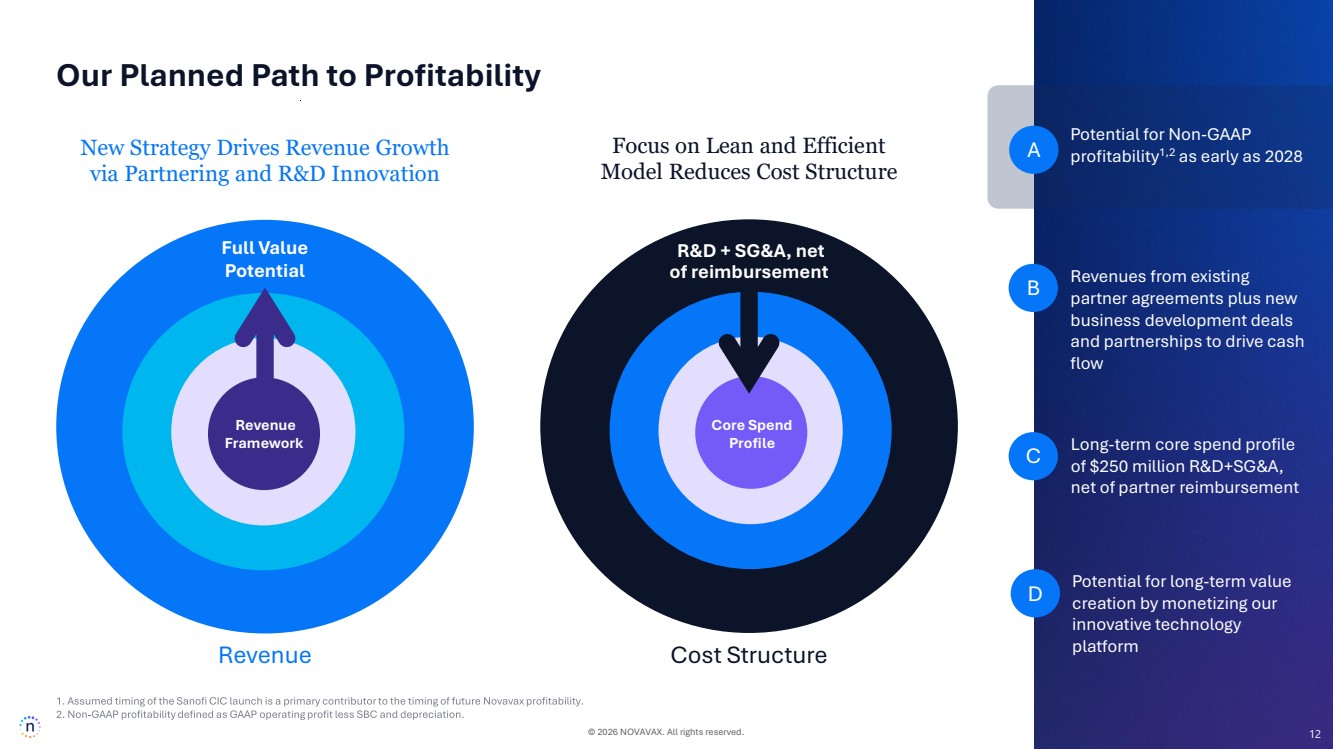

| © 2026 NOVAVAX. All rights reserved. 12 Revenue Framework New Strategy Drives Revenue Growth via Partnering and R&D Innovation Core Spend Profile Focus on Lean and Efficient Model Reduces Cost Structure Full Value Potential Revenue Cost Structure Long-term core spend profile of $250 million R&D+SG&A, net of partner reimbursement Potential for Non-GAAP profitability1,2 A as early as 2028 Revenues from existing partner agreements plus new business development deals and partnerships to drive cash flow B Potential for long-term value creation by monetizing our innovative technology platform C D R&D + SG&A, net of reimbursement Our Planned Path to Profitability 12 |

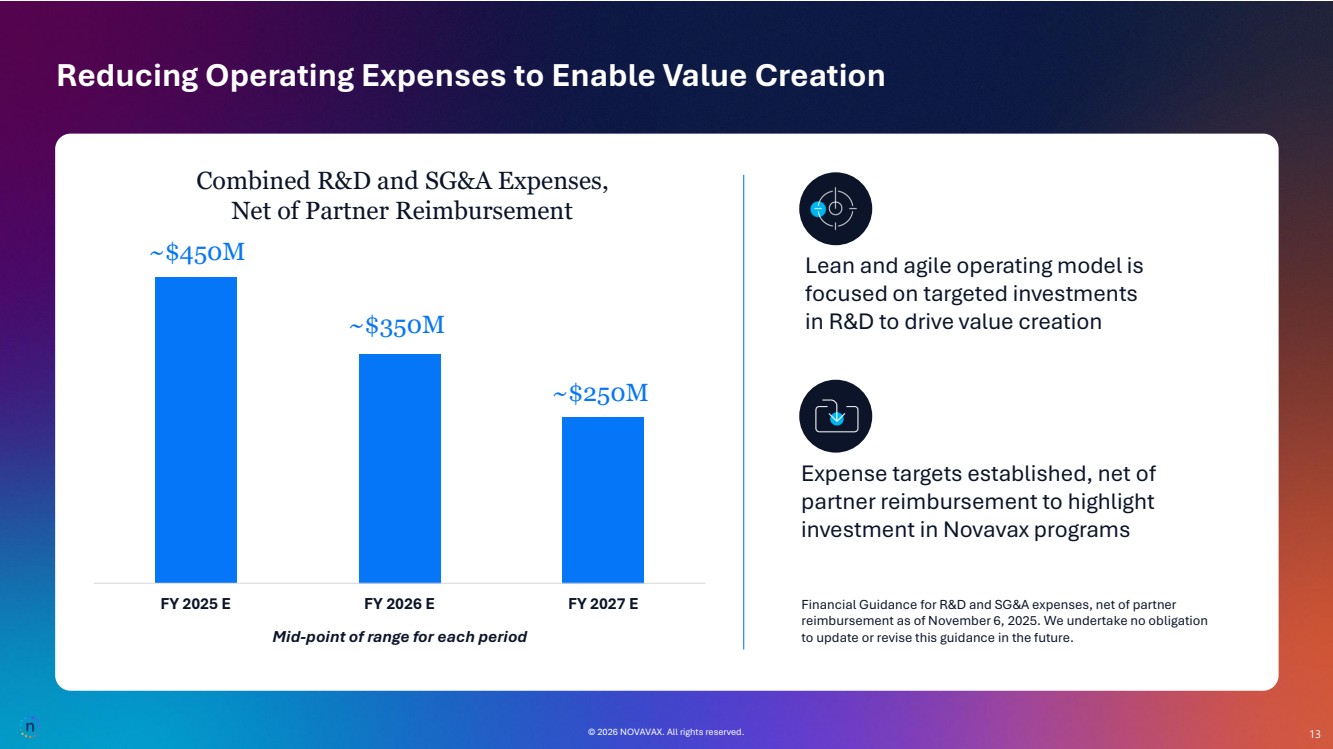

| © 2026 NOVAVAX. All rights reserved. 13 Lean and agile operating model is focused on targeted investments in R&D to drive value creation FY 2025 E FY 2026 E FY 2027 E ~$250M ~$350M ~$450M Combined R&D and SG&A Expenses, Net of Partner Reimbursement Financial Guidance for R&D and SG&A expenses, net of partner reimbursement as of November 6, 2025. We undertake no obligation to update or revise this guidance in the future. Expense targets established, net of partner reimbursement to highlight investment in Novavax programs © 2026 NOVAVAX. All rights reserved. Mid-point of range for each period Reducing Operating Expenses to Enable Value Creation 13 |

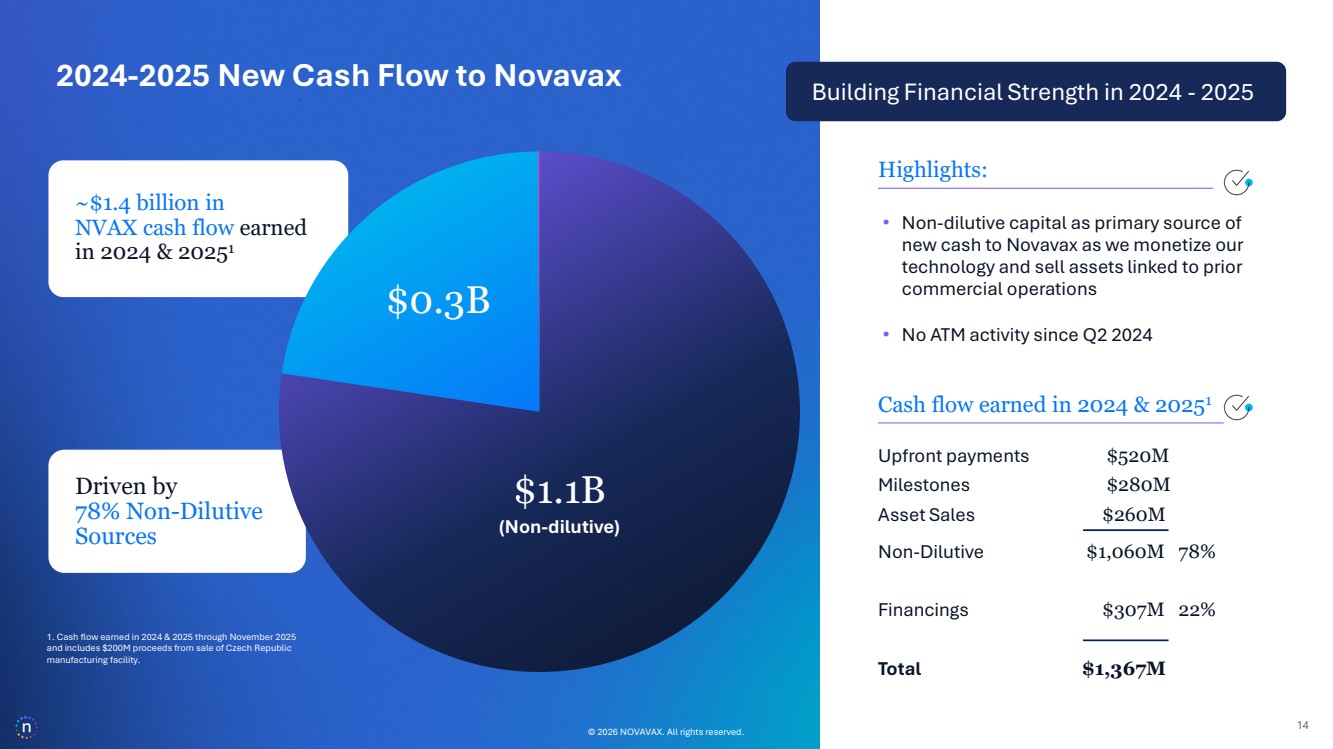

| © 2026 NOVAVAX. All rights reserved. 14 Building Financial Strength in 2024 - 2025 Cash flow earned in 2024 & 20251 Upfront payments $520M Milestones $280M Asset Sales $260M Non-Dilutive $1,060M 78% Financings $307M 22% Total $1,367M Highlights: 1. Cash flow earned in 2024 & 2025 through November 2025 and includes $200M proceeds from sale of Czech Republic manufacturing facility. • Non-dilutive capital as primary source of new cash to Novavax as we monetize our technology and sell assets linked to prior commercial operations • No ATM activity since Q2 2024 © 2026 NOVAVAX. All rights reserved. 2024-2025 New Cash Flow to Novavax $1.1B $0.3B (Non-dilutive) ~$1.4 billion in NVAX cash flow earned in 2024 & 20251 Driven by 78% Non-Dilutive Sources |

| © 2026 NOVAVAX. All rights reserved. 15 We look forward to the year ahead where our efforts will be focused on unlocking new opportunities to create shareholder value and deliver lasting impact on global health. Thank you! © 2026 NOVAVAX. All rights reserved. 15 |