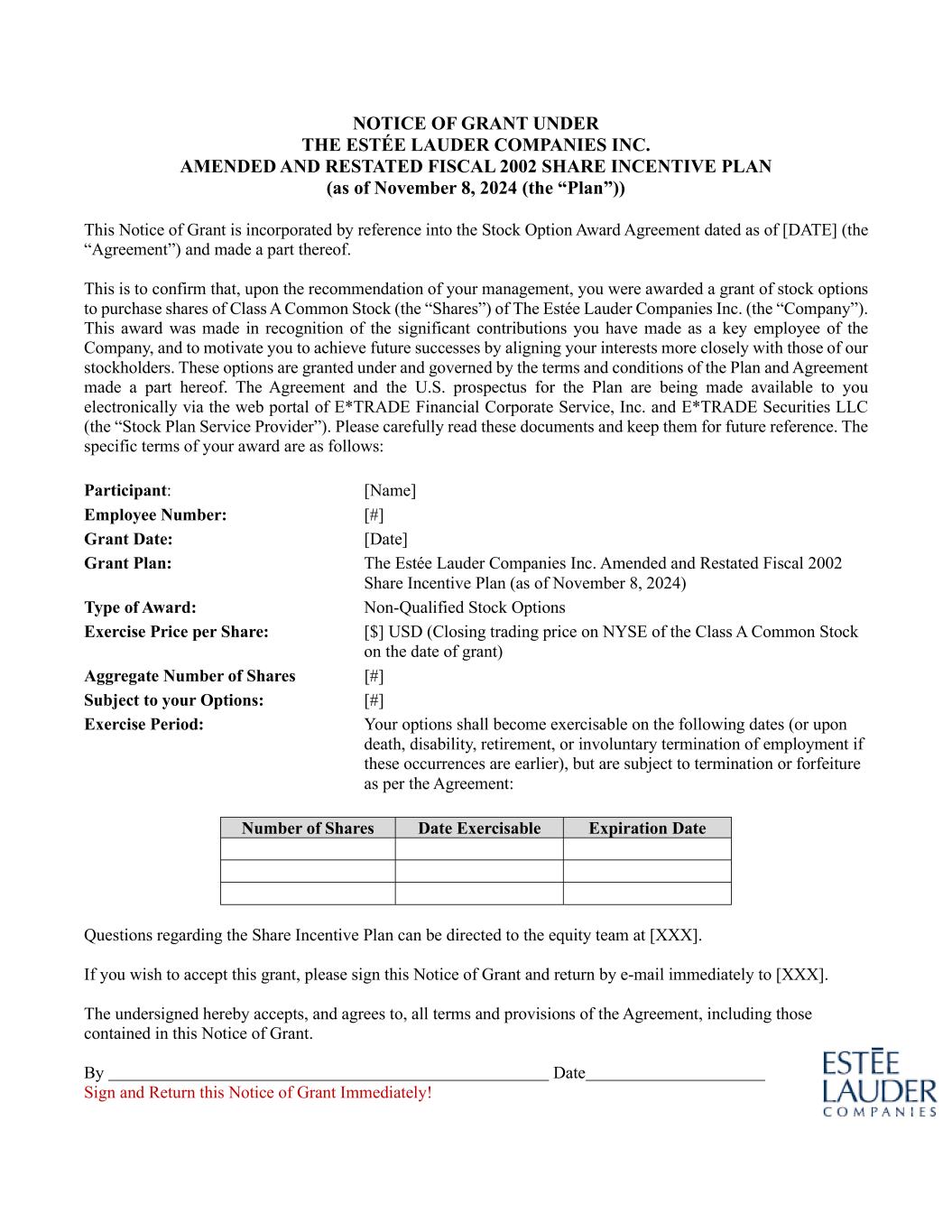

EXHIBIT 10.1 Stock Option Award Agreement for Employees Under The Estée Lauder Companies Inc. Amended and Restated Fiscal 2002 Share Incentive Plan (as of November 8, 2024) (the “Plan”) This STOCK OPTION AWARD AGREEMENT (the “Agreement”) provides for the granting of stock options by The Estée Lauder Companies Inc., a Delaware corporation (the “Company”), to the participant, an employee of the Company or one of its subsidiaries (the “Participant”), to purchase shares of the Company’s Class A Common Stock, par value $0.01 (the “Shares”), subject to the terms below (the “Stock Options” or “Options”). The name of the “Participant,” “Grant Date” (or “Award Date”), the aggregate number of Shares that may be purchased pursuant to this Agreement, and the “Award Price” (which is the “Exercise Price”) per Share are stated in the “Notice of Grant,” as applicable, attached or posted electronically together with this Agreement and are incorporated by reference. The other terms of the Options are stated in this Agreement and in the Plan. Terms not defined in this Agreement are defined in the Plan, as amended. The Plan is referred to as the “Grant Plan” in the electronic Notice of Grant. For purposes of this Agreement, to the extent the Participant is not employed by the Company, “Employer means the subsidiary of the Company that employs the Participant. The “Company Group” means the Company and/or any of its subsidiaries and affiliates. The Stock Options described in this Agreement are granted pursuant to the Plan and are subject in all respects to the provisions of the Plan. The Stock Options granted under this Agreement are not Incentive Stock Options (as defined in Section 422(b) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”)). 1. Payment of Exercise Price. The Company will provide and communicate to the Participant various methods of exercise. In all cases, upon exercise, the Participant must deliver or cause to be delivered to the Company (or its agent designated for the purpose) upon settlement of the exercise sufficient cash or sufficient number of Shares with value equal to or exceeding the Exercise Price per Share. The Participant is also required to deliver or cause to be delivered sufficient cash to cover the applicable tax withholding in accordance with Section 5 of this Agreement and fees in connection with the exercise. To facilitate exercise, the Company may enter into agreements for coordinated procedures with one or more brokerage firms or financial institutions. 2. Exercise Period. (a) General. Subject to other provisions contained in this Agreement and in the Plan, Stock Options granted under this Agreement will be exercisable in installments as specified under “Exercise Period” in the “Notice of Grant”. Stock Options awarded under this Agreement are exercisable until the close of business on the tenth (10th) anniversary of the Award Date; after this date, the Stock Options expire. (b) Death or Disability. If the Participant dies or becomes totally and permanently

disabled (as determined under the Company’s long term disability program, or an affiliate or a successor plan or program of similar purpose (“permanently disabled”)) and is not at least age fifty-five (55) and has completed ten (10) years of service or at least age sixty-five (65) and has completed five (5) years of service (“Retirement Eligible”, which is subject to Section 2(c) below), each Stock Option awarded but not yet exercisable as of the date of determination of the Participant’s death or disability will become immediately exercisable. The period during which the Stock Option may be exercised will commence on the day after the date of determination of the Participant’s death or disability and end on the earlier of the close of business on the date of (i) the first (1st) anniversary of the determination of the Participant’s death or disability or (ii) the tenth (10th) anniversary of the Award Date. (c) Retirement. Subject to Section 3 of this Agreement and the six (6) month limitation set forth herein, if the Participant voluntarily terminates employment and is Retirement Eligible, and is not otherwise terminated for cause under Section 2(g) below, each Stock Option awarded but not yet exercisable as of the date of retirement will become immediately exercisable. Each Stock Option awarded may thereafter be exercised until the close of business on the date of the tenth (10th) anniversary of the Award Date. If the Participant dies or becomes permanently disabled during active employment while Retirement Eligible, or after formally retiring, the Participant will be deemed to be retired as of the date of death or permanent disability and this Section 2(c) will apply rather than Section 2(b) above. However, if the Award Date occurred within the six (6) months immediately preceding the last day of active employment (last day worked) due to retirement, except for termination due to death or disability, the Stock Options shall become null and void on the last date of active employment (last day worked). (d) Resignation. Subject to Section 3 of this Agreement, if the Participant voluntarily terminates the Participant's employment (e.g., by resigning), other than by retirement or disability, which is subject to Section 2(b) and 2(c) above, each Stock Option exercisable but unexercised as of the effective date of such termination may be exercised until the close of business on the date first to occur of (i) one (1) year after the effective date of such termination and (ii) the tenth (10th) anniversary of the Award Date. Each Stock Option awarded but unexercisable as of the date of such termination will be forfeited. (e) Termination of Employment Without Cause. Subject to Section 3 of this Agreement and the six (6) month limitation herein, if the Participant’s employment is terminated by the Company Group without Cause (as defined in Section 2(g) below), unless Retirement Eligible, which is subject to Section 2(c) above, and subject to the Participant’s execution of a binding and effective waiver and release agreement in favor of the Company Group, if applicable and as permitted by applicable law, each Stock Option awarded but unexercisable as of the date of such termination will become vested and exercisable on a pro rata basis though the Participant’s last day paid. All remaining unvested Stock Options will

be forfeited. Each Stock Option granted may be exercised until the close of business on the date first to occur of (i) (1) year after the effective date of such termination and (ii) the tenth (10th) anniversary of the Grant Date. However, if the Grant Date occurred within the six (6) months immediately preceding the last day of active employment (last day worked) the Stock Options shall become null and void on the last date of active employment (last day worked). (f) Termination for Good Reason on or After a Change in Control. Subject to Section 3 of this Agreement, if the Participant terminates for Good Reason (as defined below) on or following a Change in Control, each Stock Option awarded but unexercisable as of the date of termination will become immediately exercisable. Each Stock Option awarded may be exercised until the close of business on the date first to occur of (i) one (1) year after the effective date of such termination and (ii) the tenth (10th) anniversary of the Award Date. “Good Reason” means the occurrence of any of the following, without the express written consent of the Participant within two (2) years after the occurrence of a Change in Control: i) the assignment to the Participant of any duties inconsistent in any material adverse respect with the Participant’s position, authority or responsibilities immediately prior to the Change in Control, or any other material adverse change in such position, including title, authority or responsibilities; ii) any failure by the Company to pay any amounts for compensation or benefits owed to the Participant or a material reduction of the overall amounts of compensation and benefits in effect prior to the Change in Control, other than an insubstantial or inadvertent failure remedied by the Company promptly after receipt of notice thereof given by the Participant; iii) the Company’s requiring the Participant to be based at any office or location more than fifty (50) miles (eighty (80) kilometers) from that location at which the Participant performed the Participant's services for the Company Group immediately prior to the Change in Control, except for travel reasonably required in the performance of the Participant’s responsibilities; or iv) any failure by the Company to obtain the assumption and agreement to perform this Agreement by a successor, unless such assumption occurs by operation of law. (g) Termination of Employment with Cause. If the Participant’s employment is terminated for Cause (as defined herein), irrespective of being Retirement Eligible, all outstanding Stock Options held by the Participant will be forfeited. For this purpose, “Cause” means any breach by the Participant of any of the Participant's material obligations under any Company policy or procedure, including, without limitation, the Code of Conduct. Notwithstanding the foregoing, in the case of a Participant who has an employment agreement that includes a definition of “Cause,” “Cause” for purposes of this Section 2(g) shall

have the same meaning as defined in such employment agreement in effect between the Participant and the Company or its U.S. subsidiary, including an employment agreement entered into after the Grant Date. (h) Age Discrimination Rules. If the Participant is a non-U.S. national and employed outside of the United States, the grant of the Stock Option and the terms and conditions governing the Stock Option are intended to comply with the age discrimination laws, rules and regulations of the Participant's country of employment (and country of residence, if different) (the “Age Discrimination Rules”). To the extent that a court or tribunal of competent jurisdiction determines that any provision of this Agreement is invalid or unenforceable, in whole or in part, under the Age Discrimination Rules, the Company, in its sole discretion, shall have the power and authority to revise or strike such provision to the minimum extent necessary to make it valid and enforceable to the full extent permitted under local law. (i) Compliance with Personal Covenants; Forfeiture and Clawback Upon Violation of Personal Covenants. As a condition to the grant of the Stock Options, the Participant expressly acknowledges Shares acquired pursuant to such Stock Options and/or any amount received with respect to any sale of such Shares are subject to the Participant’s current and ongoing compliance with any personal covenants to which the Participant is a party with the Company Group, including (but not limited to) the Restrictive Covenants set forth in Exhibit A and any other non-disclosure, non-competition, non-solicitation, non-interference, non- disparagement or other similar restrictions (collectively, the “Personal Covenants”). To the extent the Participant violates any Personal Covenant, the Participant expressly acknowledges and agrees to the immediate forfeiture of any outstanding Stock Options, the clawback of any Shares or other amounts that Participant may have previously acquired pursuant to such Stock Options. For purposes of the foregoing, the Participant expressly and explicitly authorizes the Company to issue instructions, on the Participant’s behalf, to the Stock Plan Service Provider and any other brokerage firm and/or third party administrator engaged by the Company to hold the Participant’s Shares and other amounts acquired under the Plan to re-convey, transfer or otherwise return such Shares and/or other amounts to the Company in the enforcement of the Personal Covenants. 3. Employment and Post-Employment Exercises. Except as provided in Section 2(b) through 2(f) of this Agreement, no Stock Option represented by this Agreement may be exercised after termination of the Participant’s employment with the Company Group. The exercise of any Stock Option after termination of the Participant’s employment by reason of retirement in accordance with Section 2(c) or due to termination by the Participant or termination by the Company Group without Cause in accordance with Section 2(d) through 2(f), is subject to satisfaction of the conditions precedent that the Participant fully complies with the provisions of Section 2(i) above. All unexercisable Stock Options held by the Participant after the Participant’s employment is terminated will be forfeited. The monitoring of unexercised Stock Options held by the Participant during and after the Participant’s employment is terminated that are eligible

for exercise is solely the responsibility of the Participant, including the expiration date to exercise each Stock Option, The Company has no obligation to proactively notify the Participant of the exercise expiration date of such Stock Options nor the eligibility to exercise any such Stock Options. 4. Change in Control. Upon a Change in Control during the Exercise Period, each unexercisable Stock Option will vest and become exercisable by the Participant in accordance with the Plan and this Agreement, unless the unexercisable Stock Option is assumed by an acquirer in which case the provisions of Section 2 shall continue to apply. If an unexercisable Stock Option is not assumed by the acquirer and the Shares cease to be outstanding immediately after the Change in Control (e.g., due to a merger with and into another entity), then the consideration to be received per Share upon exercise of the Stock Option will equal the consideration paid to each shareholder per Share generally upon the Change in Control. If the Exercise Price of the Stock Option is equal to or greater than the consideration paid to each Participant shareholder per Share generally upon the Change in Control and the Stock Option is not assumed, then the Stock Options shall expire upon the Change in Control. 5. Withholding Taxes. Regardless of any action the Company or the Employer takes with respect to any or all income tax, social security (or social insurance), payroll tax, fringe benefits tax, payment on account or other tax- related items related to the Participant’s participation in the Plan and this Agreement and legally applicable to the Participant (“Tax-Related Items”), the Participant acknowledges that the ultimate liability for all Tax-Related Items legally due by the Participant is and remains the Participant's responsibility and may exceed the amount actually withheld by the Company or the Employer. Furthermore, the Participant acknowledges that the Company and/or the Employer (i) make no representations or undertakings regarding the treatment of any Tax- Related Items in connection with any aspect of the Stock Options, including, but not limited to, the grant and the exercise of the Stock Options, the subsequent sale of Shares acquired under the Plan and the receipt of any dividends, and (ii) do not commit to and are under no obligation to structure the terms of the grant of the Stock Options or any aspect of the Participant’s participation in the Plan to reduce or eliminate the Participant's liability for Tax- Related Items or achieve any particular tax result. If the Participant is or becomes subject to Tax- Related Items in more than one jurisdiction, the Participant acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax-Related Items in more than one jurisdiction. Prior to any relevant taxable event, or tax withholding event, as applicable, the Participant agrees to pay or make adequate arrangements satisfactory to the Company and/or the Employer to satisfy all withholding obligations of the Company and/or the Employer. In this regard, the Participant authorizes the Company and/or the Employer, or the Participant's respective agents, at the Company’s discretion, to satisfy any applicable withholding obligations with regard to all Tax-Related Items by one or a combination of the following: (i) withholding from the Participant’s wages or other cash compensation paid by the Company and/or the Employer; (ii) withholding from proceeds of the sale of the Shares acquired upon settlement of the Stock Options either through a voluntary sale or through a mandatory sale arranged by the Company (on the Participant’s behalf pursuant to this authorization); and/or (iii) withholding in whole Shares to be issued upon settlement of the Stock Options, provided the Company only withholds the amount of whole Shares necessary to satisfy the statutory withholding requirements, not to

exceed the maximum withholding tax rate in the Participant’s applicable jurisdiction. If the Company satisfies the withholding obligation for the Tax-Related Item by withholding a number of Shares as described herein, the Participant will be deemed to have been issued the full number of Shares due to the Participant at exercise, notwithstanding that a number of the Shares is held back solely for purposes of such Tax-Related Items. Finally, the Participant further agrees to pay to the Company or the Employer any amount of Tax-Related Items that the Company or the Employer may be required to withhold or account for as a result of the Participant's participation in the Plan that cannot be satisfied by the means previously described. The Company may refuse to issue or deliver the Shares or the proceeds of the sale of Shares, if the Participant fails to comply with the Participant's obligations in connection with the Tax-Related Items. 6. Transferability. Only those Stock Options granted under this Agreement to the Participants who are employed by the Company Group at the time of Stock Option grant may be transferred under laws of descent and distribution or, during the Participant’s lifetime, solely to such Participant’s spouse, siblings, parents, children and grandchildren or trusts for the benefits of such persons, or partnerships, corporations, limited liability companies, or other entities owned solely by such persons, including trusts for such persons. Any such transfer of Stock Options will have no effect until written notice (providing sufficient details relating to the proposed transfer, as required by the Company at that time) is received and confirmed by the Company. Such Participant will remain liable for all obligations of the Participant and the Participant's transferee or transferees. Each transferee will also be subject to such Participant’s obligations under this Agreement relating to the Stock Option transferred to him or her. 7. Effect Upon Employment. The Participant’s right to continue to serve the Company Group as an officer, employee, or otherwise, is not enlarged or otherwise affected by an award under this Agreement. Nothing in this Agreement or the Plan gives the Participant any right to continue in the employ of the Company Group or interfere in any way with the right of the Company Group to terminate the Participant's employment at any time. Stock Options are not secured by a trust, insurance contract or other funding medium, and the Participant does not have any interest in any fund or specific asset of the Company by reason of this award or the account established on the Participant's behalf. An award of Stock Options confers no rights as a shareholder of the Company until Shares are actually delivered to the Participant. 8. Specific Restrictions Upon Receipt of Stock Option Shares. The Participant and the Company agree to each of the following: (a) The Participant will acquire Shares hereunder for investment purposes only and not with a view to reselling or otherwise distributing the Shares to the public in violation of the U.S. Securities Act of 1933, as amended (the “1933 Act”), and will not dispose of any such Shares in transactions which, in the opinion of counsel to the Company, violate the 1933 Act or the rules and regulations thereunder, or any applicable state or national securities or “blue sky” laws. (b) If any Shares are registered under the 1933 Act, no public offering (other than on a national securities exchange, as defined in the U.S. Securities Exchange Act of

1934, as amended) of any Shares acquired under this Agreement will be made by the Participant (or any other person) under circumstances where he or she (or such person) may be deemed an underwriter, as defined in the 1933 Act. (c) The Participant agrees that the Company has the authority to endorse upon the certificate or certificates representing the Shares acquired under this Agreement any legends referring to the restrictions described under this Section 8 and any other application restrictions, as the Company may deem appropriate. 9. Electronic Notice, Delivery and Acceptance. The Company may, in its sole discretion, decide to deliver any documents related to Stock Options awarded under the Plan or future Stock Options that may be awarded under the Plan by email or other electronic means. The Participant hereby consents to receive such documents by email or other electronic delivery and agrees to access information concerning the Plan through an on-line or electronic system established and maintained by the Company or by another third party designated by the Company. 10. Data Privacy. The Company is located at 767 Fifth Avenue, New York, New York 10153, United States of America and grants Performance Share Units under the Plan to employees of the Company Group in its sole discretion. In conjunction with the Company’s grant of the Performance Share Units under the Plan and its ongoing administration of such awards, the Company is providing the following information about its data collection, processing and transfer practices (“Personal Data Activities”). In accepting the grant of the Performance Share Units, the Participant expressly and explicitly consents to the Personal Data Activities as described herein. (a) Data Collection, Processing and Usage. The Company collects, processes and uses the Participant’s personal data, including the Participant’s name, home address, email address, and telephone number, date of birth, social insurance/passport number or other identification number (e.g. resident registration number), salary, citizenship, job title, any Shares or directorships held in the Company, and details of all Performance Share Units or any other equity compensation awards granted, canceled, exercised, vested, or outstanding in the Participant’s favor, which the Company receives from the Participant or the Employer (“Personal Information”). In granting the Performance Share Units under the Plan, the Company will collect the Participant’s Personal Information for purposes of allocating Shares and implementing, administering and managing the Plan. The Company’s legal basis for the collection, processing and usage of the Participant’s Personal Information is the Participant’s consent. (b) Stock Plan Service Provider. The Company transfers the Participant’s Personal Information to E*TRADE Financial Corporate Services, Inc. and E*TRADE Securities LLC, an independent service provider based in the United States, which assists the Company with the implementation, administration and management of the Plan (the “Stock Plan Service Provider”). In the future, the Company may select a different Stock Plan Service Provider and share the Participant’s Personal Information with another company that serves in a similar manner. The Stock Plan Service Provider will open an account for the Participant to receive

and trade Shares acquired under the Plan. The Participant will be asked to agree on separate terms and data processing practices with the Stock Plan Service Provider, which is a condition to the Participant’s ability to participate in the Plan. (c) International Data Transfers. The Company and the Stock Plan Service Provider are based in the United States. The Participant should note that the Participant’s country of residence may have enacted data privacy laws that are different from the United States. The Company’s legal basis for the transfer of the Participant’s Personal Information to the United States is the Participant’s separate consent as provided herein. (d) Data Retention. The Company will use the Participant’s Personal Information only as long as is necessary to implement, administer and manage the Participant’s participation in the Plan or as required to comply with legal or regulatory obligations, including under tax and securities laws. When the Company no longer needs the Participant’s Personal Information, the Company will remove it from its systems. If the Company keeps the Participant’s Personal Information longer, it would be to satisfy legal or regulatory obligations and the Company’s legal basis would be for compliance with relevant laws or regulations. (e) Voluntariness and Consequences of Consent Denial or Withdrawal. The Participant’s participation in the Plan and the Participant’s grant of consent is purely voluntary. The Participant may deny or withdraw the Participant’s consent at any time. If the Participant does not consent, or if the Participant later withdraws the Participant’s consent, the Participant may be unable to participate in the Plan. This would not affect the Participant’s existing employment or salary; instead, the Participant merely may forfeit the opportunities associated with the Plan. (f) Data Subject Rights. The Participant may have a number of rights under data privacy laws in the Participant’s country of employment (and country of residence, if different). For example, the Participant’s rights may include the right to (i) request access or copies of Personal Information the Company processes pursuant to the Agreement, (ii) request rectification of incorrect Personal Information, (iii) request deletion of Personal Information, (iv) request restrictions on or object to the processing of Personal Information, (v) withdraw the Participant’s consent, and/or (vi) lodge complaints with competent authorities in the Participant’s country of employment (and country of residence, if different. To receive clarification regarding the Participant’s rights or to exercise the Participant’s privacy rights, the Participant should refer to their local ELC HR Privacy Policy, located on MYELC.

11. Nature of Award; Participant Acknowledgements. The Participant agrees to be bound by the terms of this Agreement and acknowledges, understands and agrees that: (a) The Plan is established voluntarily by the Company, it is discretionary in nature, and it may be modified, amended, suspended, or terminated by the Company at any time, unless otherwise provided in the Plan and this Agreement; (b) The Plan is operated and the Stock Options are granted solely by the Company and only the Company is a party to this Agreement; accordingly, any rights the Participant may have under this Agreement may be raised only against the Company but not any subsidiary of the Company (including but not limited to the Employer); (c) The award of the Stock Options is exceptional, voluntary and occasional, and does not create any contractual or other right to receive future grants, or benefits in lieu of Stock Options, even if Stock Options have been granted in the past; (d) All decisions with respect to future Stock Option grants, if any, will be at the sole discretion of the Company; (e) The Participant’s participation in the Plan is voluntary; (f) The Stock Options and any Shares acquired under the Plan, and the income and value of the same, are not intended to replace any pension rights or compensation; (g) The Participant’s participation in the Plan shall not create a right to further employment with the Employer and shall not interfere with the ability of the Company or the Employer to terminate Participant’s employment at any time; (h) The award of the Stock Option is an extraordinary item that does not constitute compensation of any kind for services of any kind rendered to the Company Group, and which is outside the scope of the Participant’s employment or service contract, if any; (i) The Stock Options and any Shares acquired under the Plan, and the income value of the same, are not part of the Participant’s normal or expected compensation or salary for any purposes, including, but not limited to, calculating any severance, resignation, termination, redundancy, dismissal end of service payments, bonuses, holiday pay, long-service awards, pension or retirement or welfare benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Employer or the Company Group; (j) In the event the Participant is not an employee of the Company, the Stock Options and the Participant’s participation in the Plan will not be interpreted to form an employment or service contract or relationship with the Company Group; (k) The future value of the Shares is unknown, indeterminable and cannot be predicted with certainty;

(l) If the Shares decrease in value, the Stock Options will have no value; (m) If the Participant exercises the Stock Options and acquires Shares, the value of the Shares acquired upon exercise may increase or decrease, even below the Exercise Price; (n) In consideration of the award of the Stock Options, no claim or entitlement to compensation or damages shall arise from forfeiture of any of the Stock Options or diminution in value of the Stock Options, or Shares purchased through exercise of the Stock Options, resulting from termination of the Participant’s employment (for any reason whatsoever and whether or not later found to be invalid or in breach of employment laws in the jurisdiction where the Participant is employed, or the terms of the Participant’s employment), and in consideration of the grant of the Stock Options, the Participant irrevocably releases the Employer and the Company Group from any such claim that may arise; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by acknowledging and agreeing to or signing the Notice of Grant, the Participant shall be deemed to have irrevocably waived the Participant's right to pursue or seek remedy for any such claim or entitlement against the Employer or the Company Group; (o) For purposes of the award of the Stock Options, the Participant’s employment or service relationship will be considered terminated as of the date the Participant is no longer actively providing services to the Employer or the Company Group as determined by the Company in its sole discretion (regardless of the reason for such termination and whether or not later found to be invalid or in breach of employment laws in the jurisdiction where the Participant is employed or the terms of the Participant’s employment agreements, if any; (p) The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant’s participation in the Plan or Participant’s acquisition or sale of the underlying Shares; and (q) The Participant is hereby advised to consult with the Participant’s own personal tax, legal and financial advisors regarding the Participant’s participation in the Plan before taking any action related to the Plan. 12. Failure to Enforce Not a Waiver. The Company’s failure to enforce at any time any provision of this Agreement does not constitute a waiver of that provision or of any other provision of this Agreement. 13. Governing Law. The Agreement is governed by and is to be construed according to the laws of the State of New York that apply to agreements made and performed in that state, without regard to its choice of law provisions. For purposes of litigating any dispute that arises under the Stock Options or this Agreement, the parties hereby submit to and consent to the jurisdiction of the State of New York, and agree that such litigation will be conducted in the courts of New York County, New York, or the federal courts for the United States for the Southern District of New

York, and no other courts, where the Stock Options are made and/or to be performed. 14. Partial Invalidity. The invalidity or illegality of any provision of this Agreement will be deemed not to affect the validity of any other provision. Furthermore, it is the parties’ intent that any order striking any portion of this Agreement and/or the Plan should modify the stricken terms as narrowly as possible to give as much effect as possible to the intentions of the parties hereunder. 15. Entire Agreement. This Agreement, the Country Addendum (defined below) and the Plan constitute the entire agreement between the Participant and the Company regarding the award and supersede all prior and contemporaneous agreements and understandings, oral or written, between the parties regarding the award. Except as expressly set forth herein, this Agreement (and any provision of this Agreement) may not be modified, changed, clarified, or interpreted by the parties, except in a writing specifying the modification, change, clarification, or interpretation, and signed by a duly authorized Company officer. 16. Section 409A. The Stock Options are intended to be exempt from Section 409A of the Code. The Company reserves the unilateral right to amend this Agreement upon written notice to the Participant to prevent taxation under Section 409A of the Code. 17. Recoupment. Notwithstanding any other provision of this Agreement to the contrary, the Participant acknowledges and agrees that the Stock Options, any Shares acquired pursuant thereto and/or any amount received with respect to any sale of such Shares are subject to potential cancellation, recoupment, rescission, payback or other action in accordance with the terms of the Company’s recoupment policy as in effect on the Grant Date and as such policy may be amended from time to time in order to comply with changes in laws, rules or regulations that are applicable to the Stock Options and Shares. The Participant agrees and consents to the Company’s application, implementation and enforcement of (a) the recoupment policy, and (b) any provision of applicable law relating to cancellation, recoupment, rescission or payback of compensation and expressly agrees that the Company may take such actions as are necessary to effectuate the recoupment policy (as applicable to the Participant) or applicable law without further consent or action being required by the Participant. For purposes of the foregoing, the Participant expressly and explicitly authorizes the Company to issue instructions, on the Participant's behalf, to the Stock Plan Service Provider and any other brokerage firm and/or third party administrator engaged by the Company to hold the Participant's Shares and other amounts acquired under the Plan to re-convey, transfer or otherwise return such Shares and/or other amounts to the Company upon enforcement of the provisions contained in this Section 17. To the extent that the terms of this Agreement and the recoupment policy conflict, the terms of the recoupment policy shall prevail. 18. Insider Trading/Market Abuse Laws. By accepting the award of Stock Options, the Participant acknowledges that the Participant is bound by all the terms and conditions of any Company insider trading policy as may be in effect from time to time. The Participant further acknowledges that, depending on the Participant’s country of residence (and country of employment, if different), the Participant may be or may become subject to insider trading restrictions and/or market abuse laws, which may affect the Participant’s ability to accept, acquire, sell or otherwise dispose of Shares, rights to Shares (e.g., Stock Options) or rights linked

to the value of Shares under the Plan during such times as the Participant is considered to have “inside information” regarding the Company (as defined by the laws in the applicable jurisdictions). The Participant acknowledges that it is the Participant’s personal responsibility to comply with any applicable restrictions, and the Participant should consult with the Participant’s personal advisor on this matter. 19. Private Placement. The grant of the Stock Options is not intended to be a public offering of securities in the Participant’s country of employment (and country of residence, if different). The Company has not submitted any registration statement, prospectus or other filings with the local securities authorities (unless otherwise required under law), and this grant of Stock Options is not subject to the supervision of the local authorities. 20. Exchange Control, Tax and/or Foreign Asset/Account Reporting. The Participant acknowledges that there may be exchange control, tax, foreign asset, and/or account reporting requirements that may affect the Participant’s ability to acquire or hold Shares acquired under the Plan or cash received from participating in the Plan (including from any paid with respect to the Stock Options or dividends paid on Shares acquired under the Plan) in a brokerage/bank account or legal entity outside the Participant’s country of employment (and country of residence, if different). The Participant may be required to report such accounts, assets, the balances therein, the value thereof and/or the transactions related thereto to the tax or other authorities in the Participant’s country of employment (and country of residence, if different). The Participant also may be required to repatriate sale proceeds or other funds received as a result of the Participant’s participation in the Plan to the Participant’s country of employment (and country of residence, if different) through a designated bank or broker within a certain time after receipt. The Participant acknowledges that it is the Participant’s responsibility to be compliant with such regulations, and the Participant should consult the Participant's personal legal advisor for any details. 21. Language. If the Participant has received this Agreement or any other document related to the Plan translated into a language other than English and if the translated version is different than the English version, the English version will control, unless otherwise prescribed by local law. 22. Hedging Policy and Pledging Policy. The Participants is subject to the Company’s Hedging Policy and Pledging Policy that, among other things, each prohibit hedging (e.g., purchasing financial instruments designed to hedge or offset any decrease in the market value of the Company’s securities) or pledging (e.g., using Company securities as collateral for indebtedness) outstanding equity grants during or after termination of employment. This means the Participant may not hedge or pledge the equity award represented by this Agreement or any outstanding equity awards represented by previous agreements. 23. Imposition of Other Requirements. The Company reserves the right to impose other requirements on the Participant’s participation in the Plan, on the Stock Options and on any Shares acquired under the Plan, to the extent the Company determines, in its sole discretion, it is necessary or advisable for legal or administrative reasons, and to require the Participant to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing.

24. Country Addendum. The award of the Stock Options shall be subject to any terms and conditions for the Participant’s country of employment (and country of residence, if different) set forth in an addendum attached hereto as Exhibit B (“Country Addendum”). Moreover, if the Participant transfers residence and/or employment to another country reflected in the Country Addendum to this Agreement, the terms and conditions for such country will apply to the Participant to the extent the Company determines, in its sole discretion, that the application of such terms and conditions is necessary or advisable in order to comply with local law, rules and regulations or to facilitate the operation and administration of the Stock Options and the Plan (or the Company may establish alternative terms and conditions as may be necessary or advisable to accommodate the Participant’s transfer). 25. Legal and Tax Compliance; Cooperation. If the Participant resides or is employed outside of the United States, the Participant agrees, as a condition of the grant of the Stock Options, to repatriate all payments attributable to the Shares and/or cash acquired under the Plan (including, but not limited to, dividends and any proceeds derived from the sale of Shares acquired pursuant to the Stock Options) if required by and in accordance with local foreign exchange rules and regulations in the Participant‘s country of residence (and country of employment, if different). In addition, the Participant also agrees to take any and all actions, and consent to any and all actions taken by the Company Group, as may be required to allow the Company Group to comply with local laws, rules and regulations in the Participant’s country of residence (and country of employment, if different). Finally, the Participant agrees to take any and all actions as may be required to comply with the Participant’s personal legal and tax obligations under local laws, rules and regulations in the Participant ‘s country of residence (and country of employment, if different). 26. Deemed Acceptance and Acknowledgement. The Participant shall be deemed to have accepted the award of Stock Options unless the Participant objects to the award by notifying the Company at ELCEquity@estee.com no later than fifteen (15) days from the Grant Date. By accepting the award of Stock Options, the Participant affirmatively and expressly acknowledges that: (a) the Company has provided the Participant with a copy of the Plan and the U.S. prospectus for the Plan; (b) the Participant has reviewed the Plan and the U.S. prospectus for the Plan and is familiar with the terms and provisions contained therein; and (c) the Participant has carefully read this Agreement and the Country Addendum, and specifically accept and agree to the terms and conditions governing the Stock Options as reflected herein. The Participant also affirmatively and expressly acknowledges that the Company, in its sole discretion, may amend the terms and conditions reflected in this Agreement and the Country Addendum without the Participant's consent, either prospectively or retroactively: (a) to comply with applicable laws, rules and regulations; or (b) to the extent that such amendment does not materially impair the Participant's rights under this award of Stock Options, and the Participant expressly agrees to be bound by such amendment regardless of whether notice is given to the Participant of such change.

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized officer as of the Grant Date set forth in the Notice of Grant. The Estée Lauder Companies Inc. By: Executive Vice President, Chief People Officer

Exhibit A Restrictive Covenants (a) Legitimate Business Interests. By accepting the grant of the Stock Options, the Participant understands and acknowledges that the nature of the Participant’s position gives the Participant access to and knowledge of Protected Information and relationships with clients and business partners, and places the Participant in a position of trust and confidence with the Company Group; (i) the Participant will obtain knowledge and skills relevant to the Company's industry, methods of doing business, and marketing strategies by virtue of the Participant’s employment; (ii) the intellectual skill set and services the Participant provides to the Company Group are unique, special, or extraordinary; (iii) the Company Group’s ability to reserve these for the exclusive knowledge and use of the Company Group is of great competitive importance and commercial value to the Company, and that improper use or disclosure by the Participant is likely to result in unfair or unlawful competitive activity; (iv) the Company Group’s Protected Information and client and business partner relationships are invaluable to the Company Group, and the protection and maintenance of such Protected Information and client relationships constitute legitimate business interests of the Company; (v) the Company has expended and continues to expend significant time and expense in recruiting and training its employees and that the loss of employees would cause significant and irreparable harm to the Company Group. (vi) it would cause severe and irreparable harm to the Company if the Participant were to improperly utilize or disclose any Protected Information or client or business partner relationships, or if the Company were to otherwise lose its customer or business partner relationships or goodwill; (vii) the restrictions set forth herein, including the definition of a competitive activity, as well as the time, geographic, customer and employee-based restrictions, are reasonable and necessary to protect the trade secrets, other Protected Information, goodwill, client and business partner relationships and other legitimate business interests of the Company in light of the relationship between the Participant and the Company Group, and such restrictions do not impose undue hardship or burdens on the Participant; and (viii) the Participant has entered into the restrictions contained in this Exhibit A in exchange for good and valuable consideration, including, but not limited to, the Participant’s employment with the Company Group, the training, experience and expertise provided to the Participant by the Company Group, and the grant of the Stock Options. (b) Non-Competition. During the Restricted Period, the Participant shall not, directly or indirectly, unless approved by the Company in advance in writing, in any capacity, alone or in association or in connection with or on behalf of any Person (including through any existing or future affiliate): (1) engage in any Competitive Activity in the Restricted Area; (2) invest in, finance, own, manage, operate, control, enable (whether by license, sublicense, assignment or otherwise) or otherwise engage or participate in, or be connected as a securityholder, director, officer, employee, partner, member, lender, guarantor or advisor of, or consultant or contractor to, any Person that, directly or indirectly, engages in the Business; or (3) market, distribute or sell any products or services through intermediaries or otherwise in the Restricted

Area that are Competitive with the Business’ products or services or any products or services marketed, sold or distributed, or planned to be marketed, sold or distributed, by the Company Group. Notwithstanding anything to the contrary set forth herein, the Participant may own (solely as a passive investor) securities of a publicly-held Person that may be engaged in the Business, but only to the extent the Participant (or other interest holder) do not own, directly or indirectly, of record or beneficially, more than an aggregate of 3% of the outstanding securities of any such Person engaged in the Business that represent (either directly or upon conversion or exchange of any other securities) equity ownership thereof. (c) Non-Solicitation of Employees. During the Restricted Period, the Participant shall not, either on the Participant’s own account or for any Person (including through any existing or future affiliate), directly or indirectly, (i) solicit for employment or engagement, or hire any employee or any independent contractor or consultant who provided services to the Company Group at any time during the then immediately preceding two (2) year period but ending on the last day of the Participant’s employment with the Company Group, or (ii) induce or attempt to induce any such employee or independent contractor or consultant to terminate or breach their employment agreement or engagement agreement with the Company Group. (d) Non-Solicitation of Clients and Business Partners. During the Restricted Period, the Participant shall not, either on the Participant’s own account or for any Person (including, without limitation, through any existing or future affiliate), directly or indirectly, (i) solicit or attempt to solicit any Client or Business Partner or Prospective Client or Business Partner, or (ii) induce or encourage any Client or Business Partner to cease doing business, in whole or in part, with or otherwise adversely modify their or its business relationship with the Company Group, (e) Non-Interference with Vendors and Suppliers. During the Restricted Period, the Participant shall not, either on the Participant’s own account or for any Person (including, without limitation, through any existing or future affiliate), directly or indirectly, interfere with the Company Group’s relationships with its vendors or suppliers in any way that would impair the Company Group’s relationship with such vendors or suppliers, including by reducing, diminishing, or otherwise restricting the flow of supplies, services or goods from the vendors or suppliers to the Company Group. (f) No Disparaging or Defamatory Statements. During the Restricted Period, the Participant shall not make, publish, or otherwise transmit any disparaging or defamatory statements about the Company Group or any employee, director, or manager thereof, whether written or oral. Unless authorized by the Company in advance in writing, during the Restricted Period, the Participant shall not give interviews or provide comment, information, or opinions, positive or negative, to any publicly available media resource, regardless of the format and intent of that media. Nothing in the section shall prohibit or restrict the Participant from (i) voluntarily communicating with an attorney retained by the Participant, (ii) voluntarily communicating with any law enforcement, government agency, including the U.S. Securities and Exchange Commission or public body regarding possible violations of law, in each case without advance notice to the Company, (iii) discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or (iv) engaging in any other legally protected conduct. (g) No Adverse Conduct. During the Restricted Period, the Participant shall not engage in any conduct that adversely affects the business of the Company Group. (h) Definitions. For purposes of this Exhibit A, (i) “Business” shall mean principally engaged in the business of manufacturing, marketing and/or selling skin care, makeup, fragrance, home, bath and body, and hair care products and related

services. (ii) “Client or Business Partner” shall mean any client or business partner of the Company Group, and in each case with whom the Participant had material or substantial contact or about which the Participant had access to Protected Information in the then immediately preceding two (2) year period but ending on the last day of the Participant’s employment with the Company. (iii) “Company” shall mean The Estée Lauder Companies Inc., a Delaware corporation. (iv) “Company Group” shall mean the Company and/or any of its subsidiaries and affiliates. (v) “Competitive Activity” shall mean (1) becoming, or taking actions to become, an employee, advisor, officer, director, consultant, contractor, partner, principal, manager, or executive of any Person which is engaged or preparing to engage, directly or indirectly, in competition with the Business and/or any business of the Company Group as conducted or any business proposed to be conducted in the then immediately preceding two (2) year period but ending on the last day of the Participant’s employment with the Company Group. (vi) “Covenants” shall mean all covenants contained in this Exhibit A. (vii) “Person” means any individual, corporation, limited or general partnership, limited liability company, limited liability partnership, trust, association, joint venture, governmental entity, or other legal entity. (viii) “Prospective Client or Business Partner” shall mean any Person to which the Company Group provided, or from which the Company Group received, a proposal, bid, written inquiry or similar (not including general advertising or promotional materials and mass mailings) for the Company Group to provide services or products or to have a business relationship with, and in each case with whom the Participant had material or substantial contact or about which the Participant had access to Protected Information in the then immediately preceding two (2) year period but ending on the last day of the Participant’s employment with the Company Group. (ix) “Protected Information” shall mean trade secrets, confidential or proprietary information and all other knowledge, know-how, information, documents or materials owned, developed or possessed by the Company Group, whether in tangible or intangible form, pertaining to the Business or any other business or proposed business of the Company Group, including, but not limited to, research and development, operations, systems, data bases, computer programs and software, designs, models, operating procedures, knowledge of the organization, products (including prices, costs, sales or content), processes, formulas, techniques, machinery, contracts, financial information or measures, business methods, business plans, details of consultant contracts, new personnel hiring plans, business acquisition or divestiture plans, customer lists, business relationships and other information owned, developed or possessed by the Company Group; provided that Protected Information shall not include information that becomes generally known to the public or the trade without violation of the Agreement. (x) “Restricted Area” shall mean anywhere in the world where the Participant worked or had material oversight for the Company Group during the then immediately preceding two (2) year period but ending on the last day of the Participant’s employment with the Company Group. (xi) “Restricted Period” shall mean the period commencing on the Grant Date and concluding on the later of (i) the last date on which the Participant’s becomes eligible to exercise a Stock Option

pursuant to the terms of the Agreement or (ii) the second (2nd) anniversary of the date on which the Participant’s employment with the Company Group ceases for any reason. To the extent any Covenants are determined by a competent court or tribunal to be unlawful under applicable law, the Restricted Period for the specific restriction shall be modified to comply with applicable law. (i) Separate Covenants. This Exhibit A shall be deemed to consist of a series of separate covenants, one for each line of business included within the Business as it may be conducted by the Company Group, and each city, county, state, country or other region included within the Restricted Area. The parties expressly agree that the character, duration, and geographical scope of the Covenants are reasonable in light of the circumstances as they exist on the date upon which the Agreement has been executed. However, should a determination be made by a court of competent jurisdiction that the character, duration, or geographical scope of the Covenants exceeds the limitations permitted by applicable law, then it is the intention and the agreement of the parties hereto that the Covenants shall be reformed or severed in such a manner as to impose only those restrictions that are permitted by applicable law. If, in any proceeding, a court shall refuse to enforce all of the separate covenants deemed included herein, it is expressly understood and agreed among the parties hereto that such unenforceable covenant(s) shall be deemed eliminated from the provisions hereof.

Exhibit B Country Addendum to Stock Option Award Agreement The Estée Lauder Companies Inc. Amended and Restated Fiscal 2002 Share Incentive Plan (as of November 8, 2024) (the “Plan”) This Country Addendum includes additional terms and conditions that govern the Stock Options granted to the Participant if the Participant works and/or resides in one of the countries listed herein. Capitalized terms used but not defined herein shall have the same meanings ascribed to them in the Notice of Grant, the Agreement or the Plan. This Country Addendum also includes information regarding securities, exchange control, tax and certain other issues of which the Participant should be aware with respect to the Participant’s participation in the Plan. The information is based on the securities, exchange control, tax and other laws in effect as of January 2025. Such laws are often complex and change frequently. As a result, the Company strongly recommends that the Participant not rely on the information contained herein as the only source of information relating to the consequences of the Participant’s participation in the Plan because the information may be out of date at the time the Participant vests in the Stock Options or sells Shares acquired under the Plan. In addition, this Country Addendum is general in nature and may not apply to the Participant’s particular situation, and the Company is not in a position to assure the Participant of any particular result. Accordingly, the Participant should seek appropriate professional advice as to how the relevant laws in the Participant’s country apply to the Participant’s specific situation. If the Participant is a citizen or resident (or is considered as such for local tax purposes) of a country other than the one in which the Participant is currently residing and/or working, or if the Participant transfers employment and/or residency to another country after the grant of the Performance Share Units, the information contained herein may not be applicable to the Participant in the same manner. EUROPEAN UNION (“EU”) / EUROPEAN ECONOMIC AREA (“EEA”) / SWITZERLAND / THE UNITED KINGDOM Data Privacy. If the Participant resides and/or is employed in the EU / EEA, Switzerland or the United Kingdom, the following provision replaces Section 10 of the Agreement: The Company is located at 767 Fifth Avenue, New York, New York 10153, United States of America and grants Stock Options under the Plan to employees of the Company and its subsidiaries in its sole discretion. The Participant should review the following information about the Company’s data processing Practices. (a) Data Collection, Processing and Usage. Pursuant to applicable data protection laws, the Participant is hereby notified that the Company collects, processes, and uses certain personally-identifiable information about the Participant; specifically, including the Participant’s name, home address, email address and telephone number, date of birth, social insurance/passport or other identification number (e.g., resident registration number), salary, citizenship, job title, any Shares or directorships held in the Company,

and details of all Stock Options or any other equity compensation awards granted, cancelled, exercised, vested, or outstanding in the Participant’s favor, which the Company receives from the Participant or the Employer (“Personal Information”). In granting the Stock Options under the Plan, the Company will collect the Participant’s Personal Information for purposes of allocating Shares and implementing, administering and managing the Plan. The Company’s legal basis for collecting, processing and using the Participant’s Personal Information will be the Company’s legitimate interest of managing the Plan and generally administering employee equity awards, the Company’s necessity to execute its contractual obligations under the Agreement and to comply with its legal obligations. The Participant’s refusal to provide Personal Information may affect the Participant’s ability to participate in the Plan. As such, by participating in the Plan, the Participant voluntarily acknowledges the collection, processing and use, of the Participant’s Personal Information as described herein. (b) Stock Plan Service Provider. The Company transfers Participant’s Personal Information to E*TRADE Financial Corporate Services, Inc. and E*TRADE Securities LLC, an independent service provider based in the United States, which assists the Company with the implementation, administration and management of the Plan (the “Stock Plan Service Provider”). In the future, the Company may select a different Stock Plan Service Provider and share the Participant’s Personal Information with another company that serves in a similar manner. The Stock Plan Service Provider will open an account for the Participant to receive and trade Shares acquired under the Plan. The Participant will be asked to agree on separate terms and data processing practices with the Stock Plan Service Provider, which is a condition to the Participant’s ability to participate in the Plan. (c) International Data Transfers. The Company and the Stock Plan Service Provider are based in the United States. The Company can only meet its contractual obligations to the Participant if the Participant’s Personal Information is transferred to the United States. The Company’s legal basis for the transfer of the Participant’s Personal Information to the United States is the performance of the Agreement. (d) Data Retention. The Company will use the Participant’s Personal Information only as long as is necessary to implement, administer and manage the Participant’s participation in the Plan or as required to comply with legal or regulatory obligations, including under tax and securities laws. When the Company no longer needs the Participant’s Personal Information, the Company will remove it from its systems. If the Company keeps the Participant’s Personal Information longer, it would be to satisfy legal or regulatory obligations and the Company’s legal basis would be for compliance with relevant laws or regulations. (e) Data Subjects Rights. The Participant may have a number of rights under data privacy laws in the Participant’s country of employment (and country of residence, if different). For example, the Participant’s rights may include the right to (i) request access or copies of Personal Information the Company processes pursuant to the Agreement, (ii) request rectification of incorrect Personal Information, (iii) request deletion of Personal Information, (iv) request restrictions on or object to the processing of Personal Information, (v) withdraw the Participant’s consent, and/or (vi) lodge complaints with

competent authorities in the Participant’s country of employment (and country of residence, if different. To receive clarification regarding the Participant’s rights or to exercise the Participant’s privacy rights, the Participant should refer to their local ELC HR Privacy Policy, located on MYELC. CANADA Terms and Conditions Non-Qualified Securities. All or a portion of the Shares subject to the Stock Options may be "non- qualified securities" within the meaning of the Income Tax Act (Canada). The Company shall provide the Participant with additional information and/or appropriate notification regarding the characterization of the Stock Option for Canadian income tax purposes as may be required by the Income Tax Act (Canada) and the regulations thereunder. Payment of Exercise Price. Notwithstanding anything to the contrary in the Agreement or the Plan, if the Participant resides in Canada, the Participant may not tender Shares that the Participant already owns to pay the Exercise Price or any Tax-Related Items in connection with the Stock Options. Forfeiture Upon Termination of Employment. The following provision supplements Section 2 of the Agreement: For the avoidance of doubt, unless explicitly required by applicable legislation, the date on which any termination of employment occurs shall not be extended by any notice period or period for which pay in lieu of notice or related damages or payments are provided or mandated under local law (including, but not limited to, statute, contract, regulatory law and/or common or civil law), and the Participant shall have no right to full or pro-rated vesting or compensation for lost vesting related to such periods. Further, unless otherwise expressly provided in the Agreement or determined by the Company, the Participant’s right to exercise the vested portion of the Stock Options will not be extended by any notice period. For greater clarity, the date on which a termination of employment occurs shall not be extended by any period of “garden leave”, paid administrative leave or similar period under local law. The Company shall have the exclusive discretion to determine when the Participant ceased to actively provide services to the Employer for the purposes of the Stock Options (including, subject to statutory protections, whether the Participant may still be considered to be providing services while on an approved leave of absence). Unless the Company provides otherwise (1) termination of employment shall include instances in which the Participant is terminated and immediately rehired as an independent contractor, and (2) the spin-off, sale, or disposition of the Employer from the Company or a subsidiary (whether by transfer of shares, assets or otherwise) such that the Employer no longer constitutes a subsidiary shall constitute a termination of employment. If, notwithstanding the foregoing, applicable employment legislation explicitly requires continued vesting and/or exercisability of the Stock Options during a statutory notice period, the Participant’s right to vest in and/or exercise the Stock Options, if any, will terminate effective as of the last day of the minimum statutory notice period, but the Participant will not earn or be entitled to pro-rated vesting if the vesting date falls after the end of the Participant’s statutory notice period, nor will the Participant be entitled to any compensation for the lost vesting. The following provisions apply if the Participant is a resident of Quebec:

French Language Documents. A French translation of this Agreement, the Plan and certain other documents related to the offer will be made available to the Participant as soon as reasonably practicable following the Participant’s written request. Notwithstanding the Language provision included in Section 21 of the Agreement, to the extent required by applicable law and unless the Participant indicates otherwise, the French translation of such documents will govern the Participant’s participation in the Plan. Documents en Langue Française Une traduction française du présent Contrat, du Plan et de certains autres documents liés à l’offre sera mise à la disposition du Participant dès que cela sera raisonnablement possible suite à la demande écrite du Participant. Nonobstant la disposition reprise ci-dessus dans la Section 21 du Contrat relative à la Langue, dans la mesure où la loi applicable l’exige et à moins que le Participant n’indique le contraire, la traduction française de ces documents régira la participation au Plan du Participant. Data Privacy. The following provision supplements Section 10 of the Agreement: The Participant hereby authorizes the Company and the Company’s representatives to discuss with and obtain all relevant information from all personnel, professional or not, involved in the administration and operation of the Participant’s awards under the Plan. The Participant further authorizes the Company, its subsidiaries and the Stock Plan Service Provider to disclose and discuss the Participant’s participation in the Plan with their respective advisors. The Participant further authorizes the Company and its subsidiaries to record such information and to keep such information in the Participant’s employee file. The Participant acknowledges that the Participant’s personal information, including any sensitive personal information, may be transferred or disclosed outside the province of Quebec, including to the U.S. If applicable, the Participant also acknowledges that the Company, its subsidiaries and the Stock Plan Service Provider may use technology for profiling purposes and to make automated decisions that may have an impact on the Participant or the administration of the Plan. Notifications Securities Law Information. The Participant is permitted to sell Shares acquired under the Plan through the Stock Plan Service Provider (or any other broker acceptable to the Company), provided the resale of Shares acquired under the Plan takes place outside of Canada through the facilities of a stock exchange on which the Shares are listed. The Shares are currently listed on the New York Stock Exchange under the trading symbol “EL”. Foreign Asset/Account Reporting Information. Specified foreign property, including the Stock Options, Shares acquired under the Plan, and other rights to receive shares of a non-Canadian company held by a Canadian resident must generally be reported annually on a Form T1135 (Foreign Income Verification Statement) if the total cost of the foreign property exceeds C$100,000 at any time during the year. Thus, unvested Stock Options must be reported – generally at a nil cost – if the C$100,000 cost threshold is exceeded because the Participant holds other specified foreign property. When Shares are acquired, their cost generally is the adjusted cost base (“ACB”) of the Shares. The ACB would ordinarily equal the fair market value of the Shares at the time of acquisition, but if the Participant owns other shares of the Company, this ACB may need to be averaged with the ACB of the other shares. The Participant should consult with the Participant’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations the Participant may have in connection with the Participant’s

participation in the Plan. CHINA Terms and Conditions The following provision applies if the Participant is subject to exchange control restrictions and regulations in the People’s Republic of China (“PRC”), including the requirements imposed by the PRC State Administration of Foreign Exchange (“SAFE”), as determined by the Company in its sole discretion: Mandatory Full Cashless Exercise. Notwithstanding any provision in the Agreement to the contrary, the Stock Options may be exercised only by using the cashless method, except as otherwise determined by the Company. Only full cashless exercise (net proceeds remitted to the Participant in cash) will be permitted. Cash, cashless sell-to-cover, or stock swap methods of exercise are prohibited. Settlement Notice. Notwithstanding anything to the contrary in the Plan or the Agreement, the Participant may not exercise the Stock Options unless and until all necessary exchange control or other approvals with respect to the Stock Options under the Plan have been obtained from the SAFE or its local counterpart (“SAFE Approval”). In the event that SAFE Approval has not been obtained prior to any date(s) on which the Stock Options are exercised, any cash payment which is contemplated to be issued in settlement of such exercised Stock Options shall be held by the Company in escrow on behalf of the Participant until SAFE Approval is obtained. Post-Termination Exercise Period. Notwithstanding any provision of the Plan or the Agreement to the contrary, the Stock Options will expire no later than the six (6) month anniversary of the date that the Participant terminates employment. Any portion of the vested Stock Options that are not exercised prior to expiration of such Stock Options will be forfeited. Notifications Exchange Control Information. By accepting the Stock Options, the Participant understands and agrees that the Participant will be required to immediately repatriate to the PRC all proceeds due to the Participant under the Plan, including any Share sale proceeds from the cashless exercise of the Participant’s Stock Options. The Participant understands that such repatriation will need to be effected through a special exchange control account established by the Company or one of the Company's subsidiaries in the PRC, and the Participant hereby consents and agrees that the proceeds may be transferred to such special account prior to being delivered to the Participant. The proceeds may be paid to the Participant in U.S. dollars or in local currency, at the Company’s discretion. If the proceeds are paid in U.S. dollars, the Participant understands that the Participant will be required to set up a U.S. dollar bank account in the PRC so that the proceeds may be deposited into this account. If the proceeds are paid in local currency, the Participant acknowledges that neither the Company nor any subsidiary of the Company is under an obligation to secure any particular currency conversion rate and that the Company (or any subsidiary of the Company) may face delays in converting the proceeds to local currency due to exchange control requirements in the PRC. The Participant agrees to bear any currency fluctuation risk between the time the Shares are sold and the time the proceeds are converted into local currency and distributed to the Participant. The Participant further agrees to comply with any other requirements that may be imposed by the Company in the future to facilitate compliance with PRC exchange control

requirements. The Participant should consult with the Participant’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations the Participant may have in connection with the Participant’s participation in the Plan. Foreign Asset/Account Reporting Information. PRC residents are required to report to SAFE details of their foreign financial assets and liabilities, as well as details of any economic transactions conducted with non-PRC residents, either directly or through financial institutions. The Participant may be subject to reporting obligations for the Shares or awards acquired under the Plan and Plan-related transactions. The Participant should consult with the Participant’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations the Participant may have in connection with the Participant’s participation in the Plan. FRANCE Terms and Conditions Consent to Receive Information in English. By accepting the Stock Options, the Participant confirms having read and understood the Plan, the Notice of Grant, the Agreement and this Country Addendum, including all terms and conditions included therein, which were provided in the English language. The Participant accepts the terms of those documents accordingly. Consentement à recevoir des informations en anglais. En acceptant les unités d'actions de performance, le participant confirme avoir lu et compris le plan, l'avis d'attribution, l'accord et le présent addenda pays, y compris tous les termes et conditions qui y sont inclus, qui ont été fournis en anglais. Le Participant accepte en conséquence les termes de ces documents. Notifications Non-Qualified Nature of Stock Options. The Stock Options granted under this Agreement are not intended to be “French-qualified” and are ineligible for specific tax and/or social security treatment in France under Sections L. 225-197-1 to L. 225-197-5 and Sections L. 22-10-59 to L. 22-10-60 of the French Commercial Code, as amended. Exchange Control Information. The value of any cash or securities imported to or exported from France without the use of a financial institution must be reported to the customs and excise authorities when the value of such cash or securities is equal to or greater than a certain amount (currently €10,000). The Participant should consult with the Participant’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations the Participant may have in connection with participation in the Plan. Foreign Asset/Account Reporting Information. French residents must report annually any shares and bank accounts held outside France, including the accounts that were opened, used and/or closed during the tax year, to the French tax authorities, on an annual basis on a special Form N° 3916, together with the Participant’s personal income tax return. Failure to report triggers a significant penalty. The Participant should consult with the Participant’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations the Participant may have in connection with participation in the Plan.