. . . OceanFirst Financial Corp. Fixed Income Investor Presentation October 2025

. . .Legal Disclaimer REGISTRATION STATEMENT; NO OFFER OR SOLICITATION. This presentation is neither an offer to sell nor a solicitation of an offer to purchase any securities of OceanFirst Financial Corp. (the “Company”). If the Company were to conduct an offering of securities in the future, such offering would be made under the Company’s automatic shelf registration statement (including a prospectus) filed with the Securities and Exchange Commission and only by means of a prospectus supplement relating to the offering and the accompanying prospectus forming part of that registration statement. In such an event, a copy of the prospectus and the applicable prospectus supplement relating to such offering may be obtained from the Securities and Exchange Commission's website at www.sec.gov, by contacting the Company or the underwriters for such offering. If the Company conducts such an offering, you are advised to obtain a copy of such documents and to carefully review the information contained or incorporated by reference therein before making any investment decision. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third-party sources. While we believe these third-party sources to be reliable, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. Except as otherwise indicated, this presentation speaks as of the date hereof. FORWARD LOOKING STATEMENTS. In addition to historical information, this presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on certain assumptions and describe future plans, financial results, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, inflation, general economic conditions, including potential recessionary conditions, levels of unemployment in the Company’s lending area, real estate market values in the Company’s lending area, potential goodwill impairment, natural disasters, potential increases to flood insurance premiums, the effects of the federal government shutdown; the current or anticipated impact of military conflict, terrorism or other geopolitical events, the imposition of tariffs or other domestic or international governmental policies and retaliatory responses, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, the availability of low-cost funding, changes in liquidity, including the size and composition of the Company’s deposit portfolio and the percentage of uninsured deposits in the portfolio, changes in capital management and balance sheet strategies and the ability to successfully implement such strategies, competition, demand for financial services in the Company’s market area, changes in investor sentiment and consumer spending, borrowing and saving habits, changes in accounting principles, a failure in or breach of the Company’s operational or security systems or infrastructure, including cyberattacks, the failure to maintain current technologies, failure to retain or attract employees, the impact of pandemics on our operations and financial results and those of our customers and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

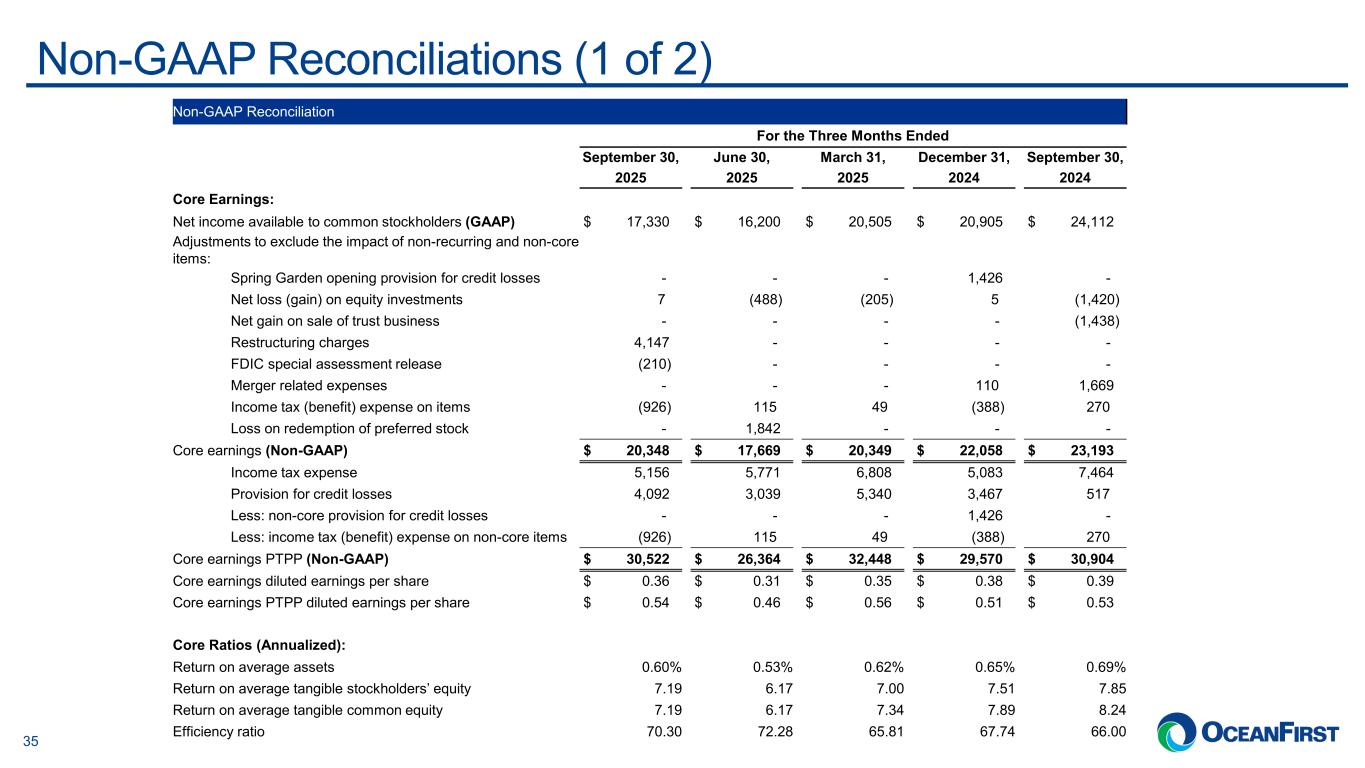

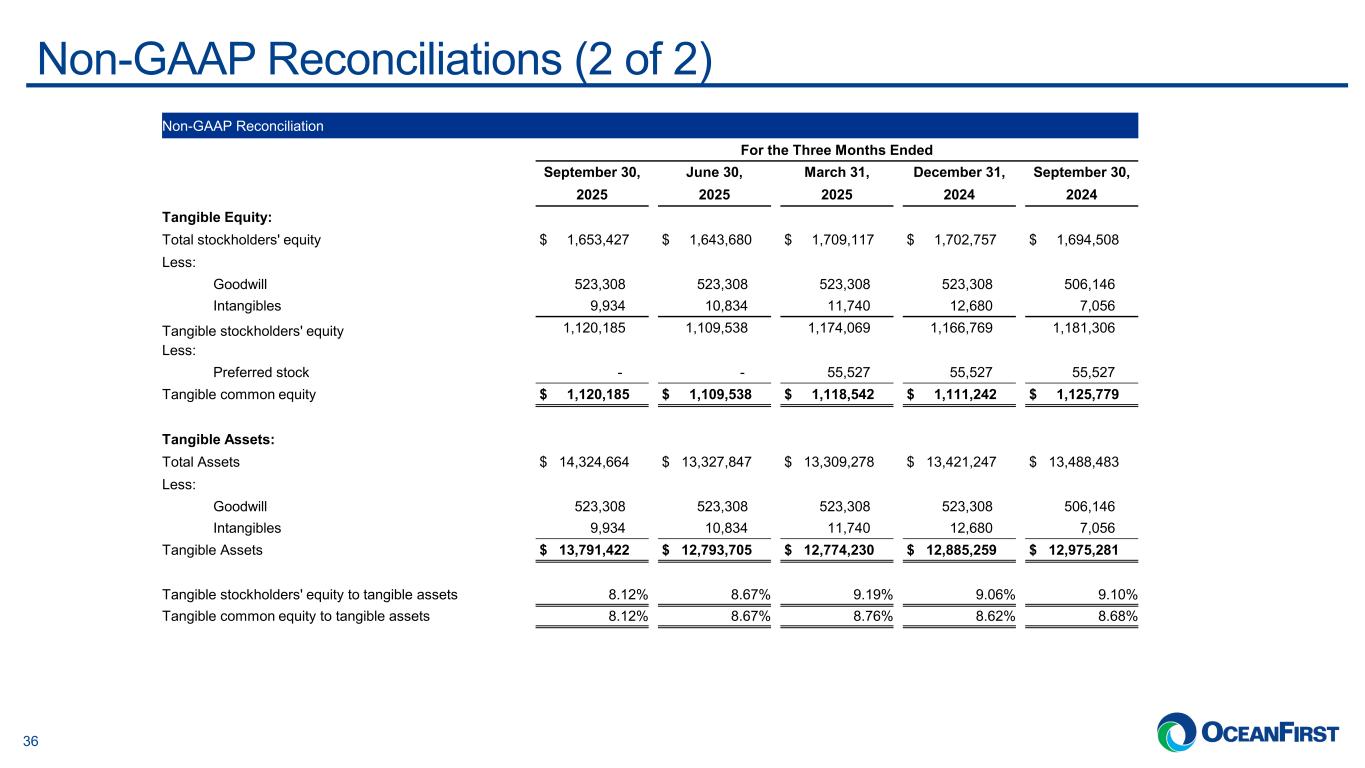

. . .Legal Disclaimer (Continued) NON-GAAP FINANCIAL INFORMATION. This presentation contains certain non-GAAP (generally accepted accounting principles) measures. These non-GAAP measures, as calculated by the Company, are not necessarily comparable to similarly titled measures reported by other companies. Additionally, these non-GAAP measures are not measures of financial performance or liquidity under GAAP and should not be considered alternatives to the Company's other financial information determined under GAAP. See reconciliations of certain non-GAAP measures included at the end of this presentation and in the Company’s Earnings Release furnished as to the Form 8-K as filed with the SEC on October 22, 2025. MARKET AND INDUSTRY DATA. This presentation references certain market, industry and demographic data, forecasts and other statistical information. We have obtained this data, forecasts and information from various independent, third-party industry sources and publications. Nothing in the data, forecasts or information used or derived from third-party sources should be construed as advice. Some data and other information are also based on our good faith estimates, which are derived from our review of industry publications and surveys and independent sources. We believe that these sources and estimates are reliable but have not independently verified them. Statements as to our market position are based on market data currently available to us. These estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. 3

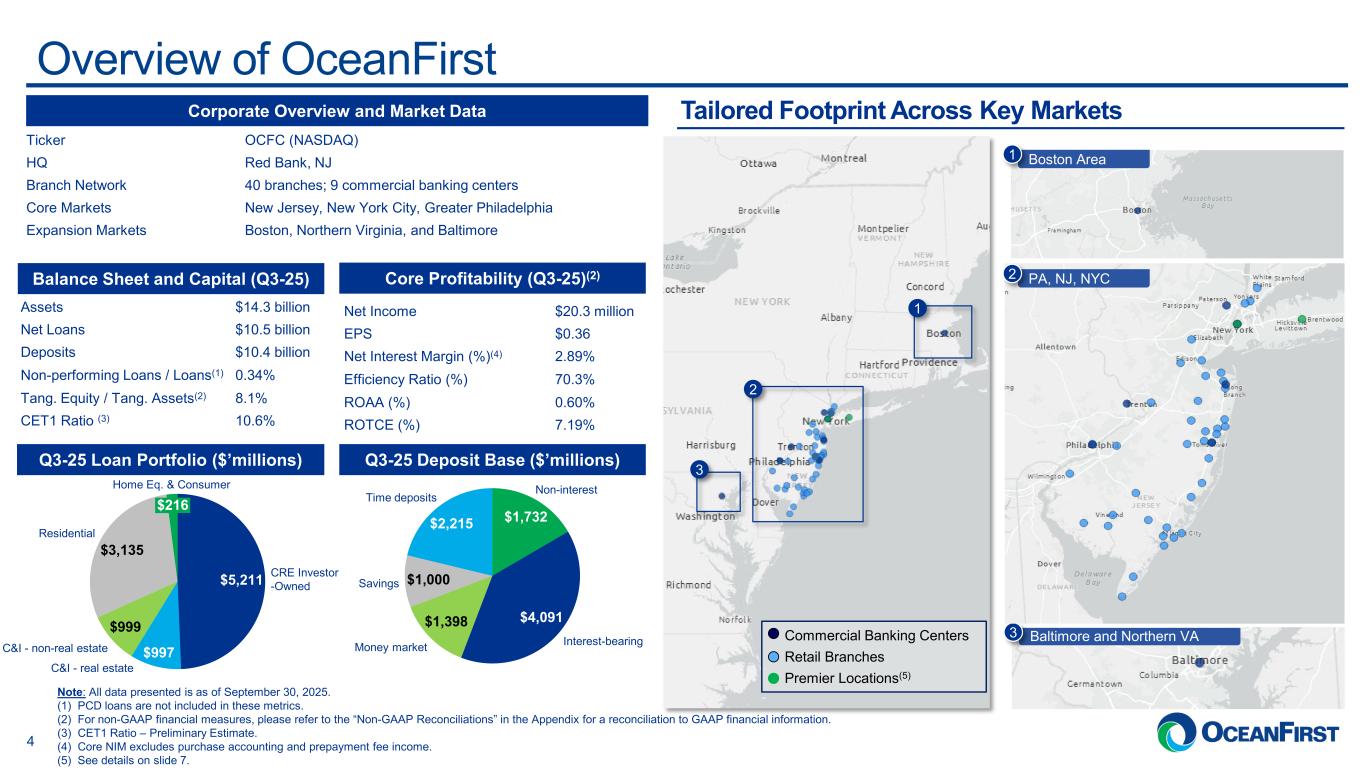

. . . Tailored Footprint Across Key Markets Overview of OceanFirst Corporate Overview & Market Data Ticker OCFC (NASDAQ) HQ Red Bank, NJ Branch Network 40 branches; 9 commercial banking centers Core Markets New Jersey, New York City, Greater Philadelphia Expansion Markets Boston, Northern Virginia, and Baltimore Balance Sheet and Capital (Q1-23) Assets $14.3 billion Net Loans $10.5 billion Deposits $10.4 billion Non-performing Loans / Loans(1) 0.34% Tang. Equity / Tang. Assets(2) 8.1% CET1 Ratio (3) 10.6% Q3-25 Loan Portfolio ($’millions) Q3-25 Deposit Base ($’millions) Core Profitability (Q1-23)2 Net Income $20.3 million EPS $0.36 Net Interest Margin (%)(4) 2.89% Efficiency Ratio (%) 70.3% ROAA (%) 0.60% ROTCE (%) 7.19% Corporate Overview and Market Data Balance Sheet and ital (Q3-25) Core Profitability (Q3-25)(2) $5,211 CRE Investor -Owned $997 C&I - real estate $999 C&I - non-real estate $3,135 Residential $216 Home Eq. & Consumer Note: All data presented is as of September 30, 2025. (1) PCD loans are not included in these metrics. (2) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. (3) CET1 Ratio – Preliminary Estimate. (4) Core NIM excludes purchase accounting and prepayment fee income. (5) See details on slide 7. $1,732 Non-interest $4,091 Interest-bearing $1,398 Money market $1,000Savings $2,215 Time deposits 4 3 Baltimore and Northern VA Boston Area PA, NJ, NYC 1 2 Commercial Banking Centers Retail Branches Premier Locations 2 3 1 Commercial Banking Centers Retail Branches Premier Locations(5)

. . .Key Investor Highlights Positioned in high-growth markets with opportunities for retail expansion Consistent profitability through various economic cycles Growth plan focused on obtaining stable low-cost deposits to fund future commercial lending opportunities Experienced commercial lender with strong credit quality and disciplined underwriting Robust capital position with a total risk- based capital ratio of 13.1% Best-in-class management team with deep banking, regulatory, M&A and integration experience Demonstrated commitment to local communities with an “Outstanding” CRA rating 5

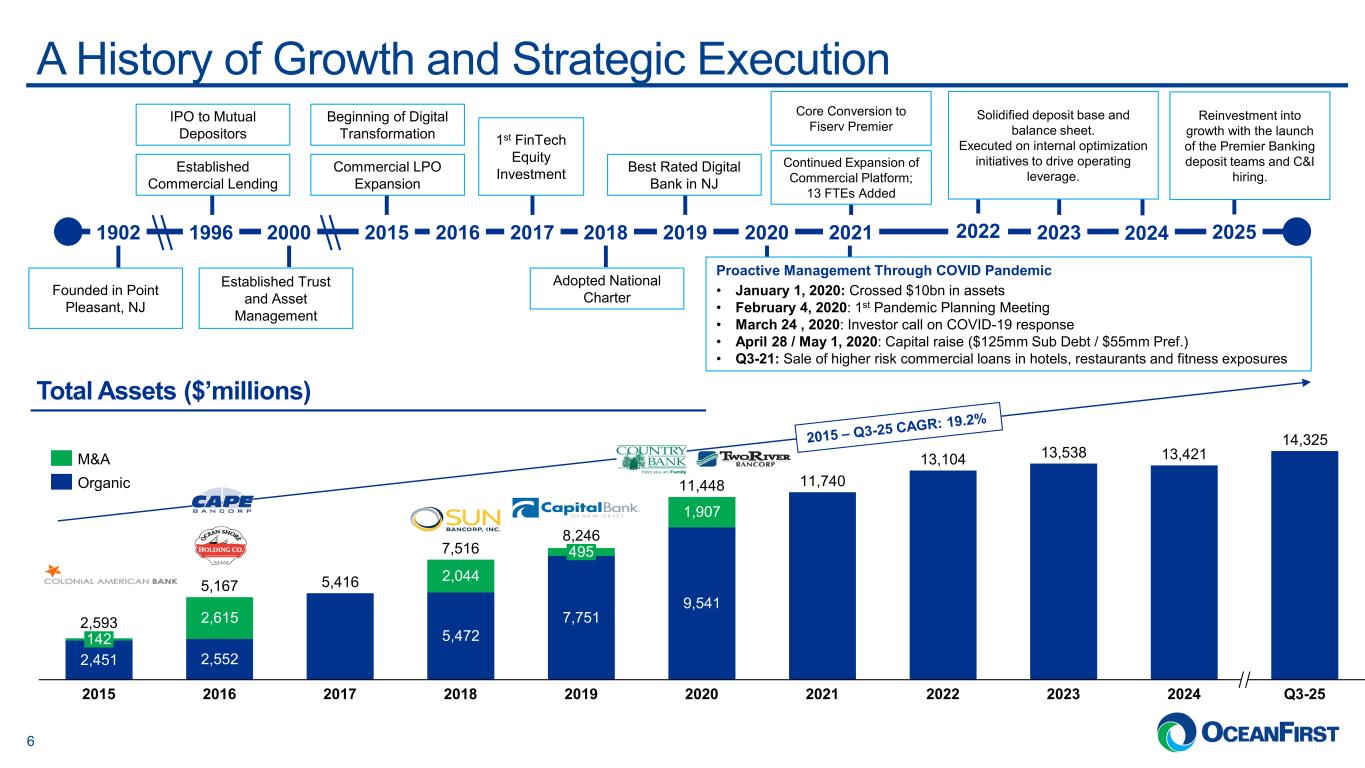

. . . 2,451 2,552 5,416 5,472 7,751 9,541 11,740 13,104 13,538 13,421 14,325 2,615 2,044 1,907 142 2015 2016 2017 2018 495 2019 2020 2021 2022 2023 2024 Q3-25 2,593 5,167 7,516 8,246 11,448 Founded in Point Pleasant, NJ Established Trust and Asset Management IPO to Mutual Depositors Established Commercial Lending Commercial LPO Expansion Adopted National Charter Proactive Management Through COVID Pandemic • January 1, 2020: Crossed $10bn in assets • February 4, 2020: 1st Pandemic Planning Meeting • March 24 , 2020: Investor call on COVID-19 response • April 28 / May 1, 2020: Capital raise ($125mm Sub Debt / $55mm Pref.) • Q3-21: Sale of higher risk commercial loans in hotels, restaurants and fitness exposures Beginning of Digital Transformation 1st FinTech Equity Investment Best Rated Digital Bank in NJ 2018 20191996 2015 20161902 20202000 2017 2021 Continued Expansion of Commercial Platform; 13 FTEs Added A History of Growth and Strategic Execution 2023 Core Conversion to Fiserv Premier 2022 Solidified deposit base and balance sheet. Executed on internal optimization initiatives to drive operating leverage. 2024 M&A Organic 2025 Reinvestment into growth with the launch of the Premier Banking deposit teams and C&I hiring. Total Assets ($’millions) 6

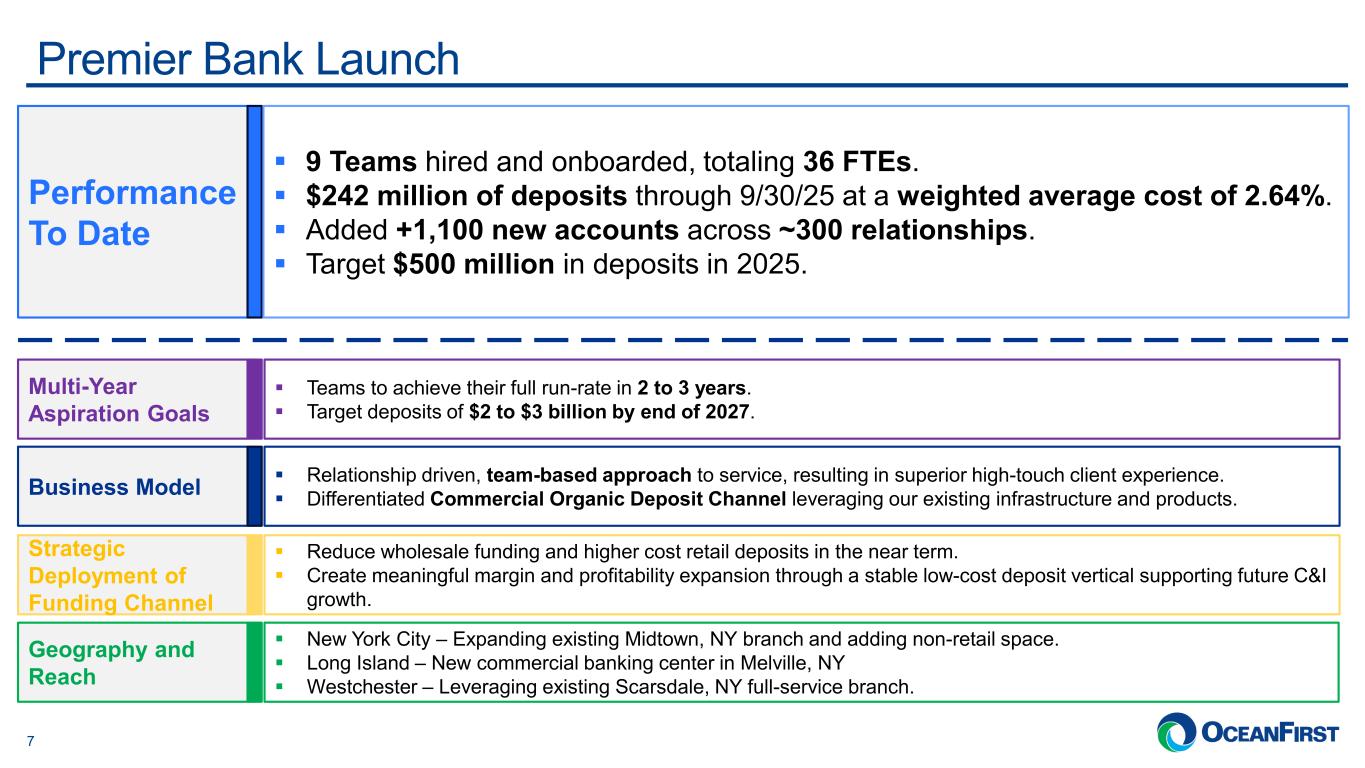

. . .Premier Bank Launch Multi-Year Aspiration Goals Performance To Date Teams to achieve their full run-rate in 2 to 3 years. Target deposits of $2 to $3 billion by end of 2027. 9 Teams hired and onboarded, totaling 36 FTEs. $242 million of deposits through 9/30/25 at a weighted average cost of 2.64%. Added +1,100 new accounts across ~300 relationships. Target $500 million in deposits in 2025. Strategic Deployment of Funding Channel Reduce wholesale funding and higher cost retail deposits in the near term. Create meaningful margin and profitability expansion through a stable low-cost deposit vertical supporting future C&I growth. Geography and Reach New York City – Expanding existing Midtown, NY branch and adding non-retail space. Long Island – New commercial banking center in Melville, NY Westchester – Leveraging existing Scarsdale, NY full-service branch. 7 Business Model Relationship driven, team-based approach to service, resulting in superior high-touch client experience. Differentiated Commercial Organic Deposit Channel leveraging our existing infrastructure and products.

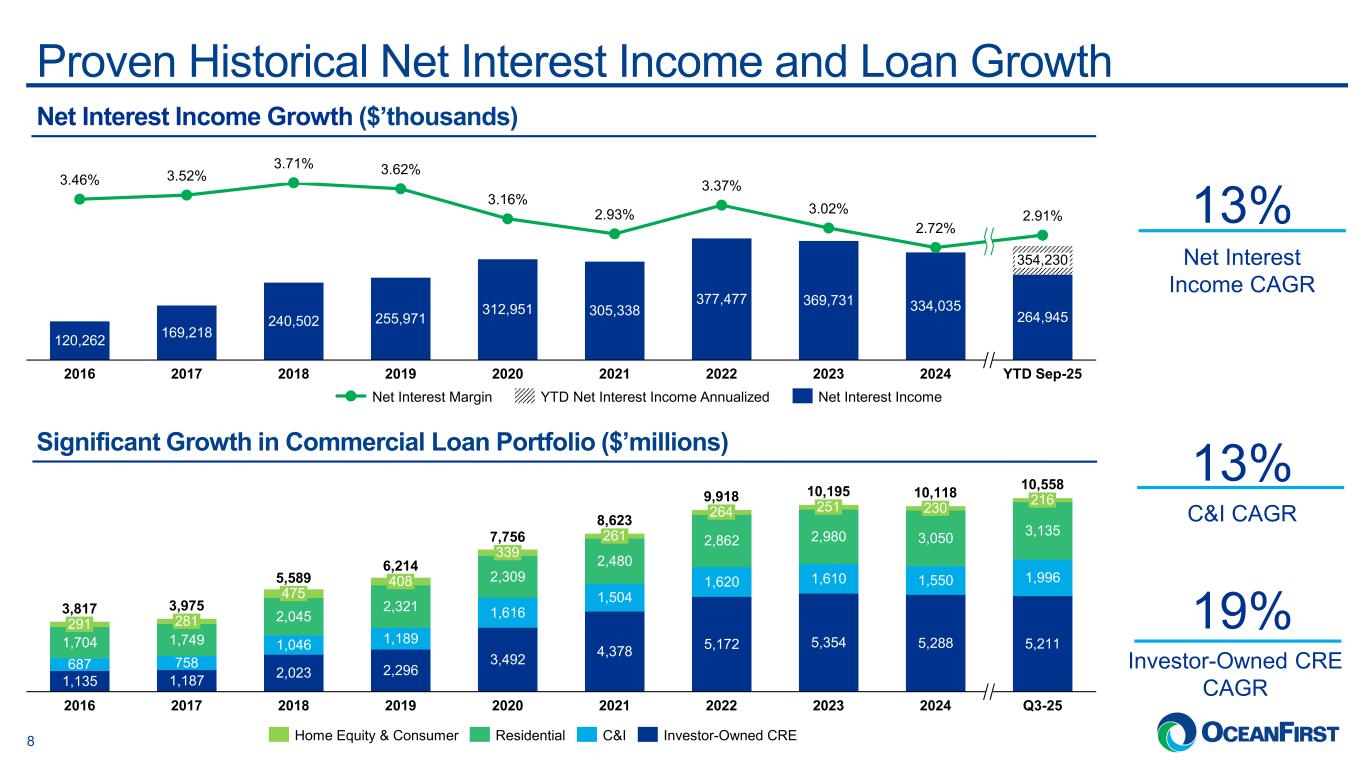

. . .Proven Historical Net Interest Income and Loan Growth 120,262 169,218 240,502 255,971 312,951 305,338 377,477 369,731 334,035 264,945 3.46% 2016 3.52% 2017 3.71% 2018 3.62% 2019 3.16% 2020 2.93% 2021 3.37% 2022 3.02% 2023 2.72% 2024 2.91% 354,230 YTD Sep-25 Net Interest Margin YTD Net Interest Income Annualized Net Interest Income Net Interest Income Growth ($’thousands) Net Interest Income CAGR 13% 1,135 1,187 2,023 2,296 3,492 4,378 5,172 5,354 5,288 5,211 687 758 1,046 1,189 1,616 1,504 1,620 1,610 1,550 1,996 1,704 1,749 2,045 2,321 2,309 2,480 2,862 2,980 3,050 3,135 475 2018 408 2019 339 2020 261 2021 264 2022 251 2023 230 291 216 Q3-25 3,817 3,975 5,589 6,214 7,756 8,623 9,918 10,195 2016 281 2017 10,118 10,558 2024 Home Equity & Consumer Residential C&I Investor-Owned CRE Significant Growth in Commercial Loan Portfolio ($’millions) Investor-Owned CRE CAGR 19% C&I CAGR 13% 8

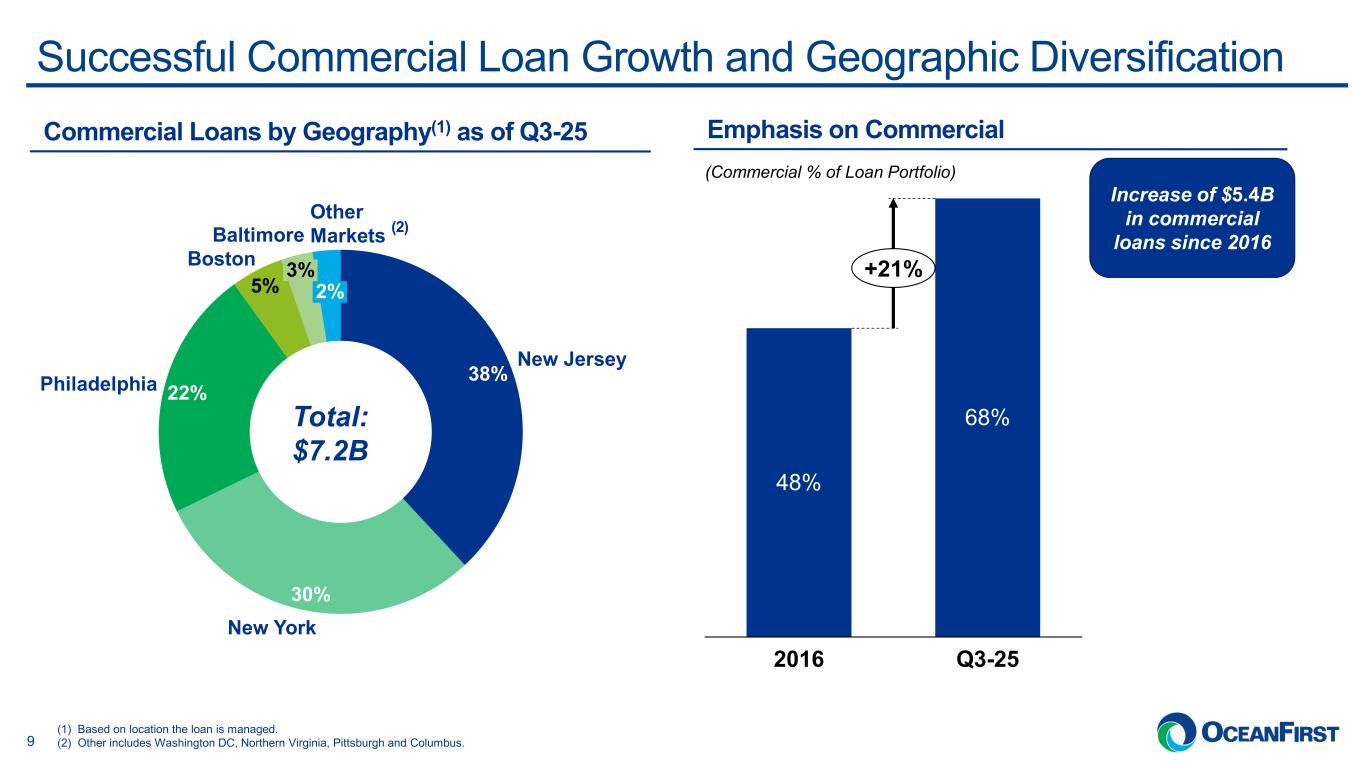

. . .Successful Commercial Loan Growth and Geographic Diversification 48% 68% 2016 Q3-25 +21% (Commercial % of Loan Portfolio) Commercial Loans by Geography(1) as of Q3-25 Emphasis on Commercial Increase of $5.4B in commercial loans since 2016 Total: $7.2B 38% 30% 22% 5% New Jersey New York Philadelphia Boston 3% Baltimore 2% Other Markets (2) 9 (1) Based on location the loan is managed. (2) Other includes Washington DC, Northern Virginia, Pittsburgh and Columbus.

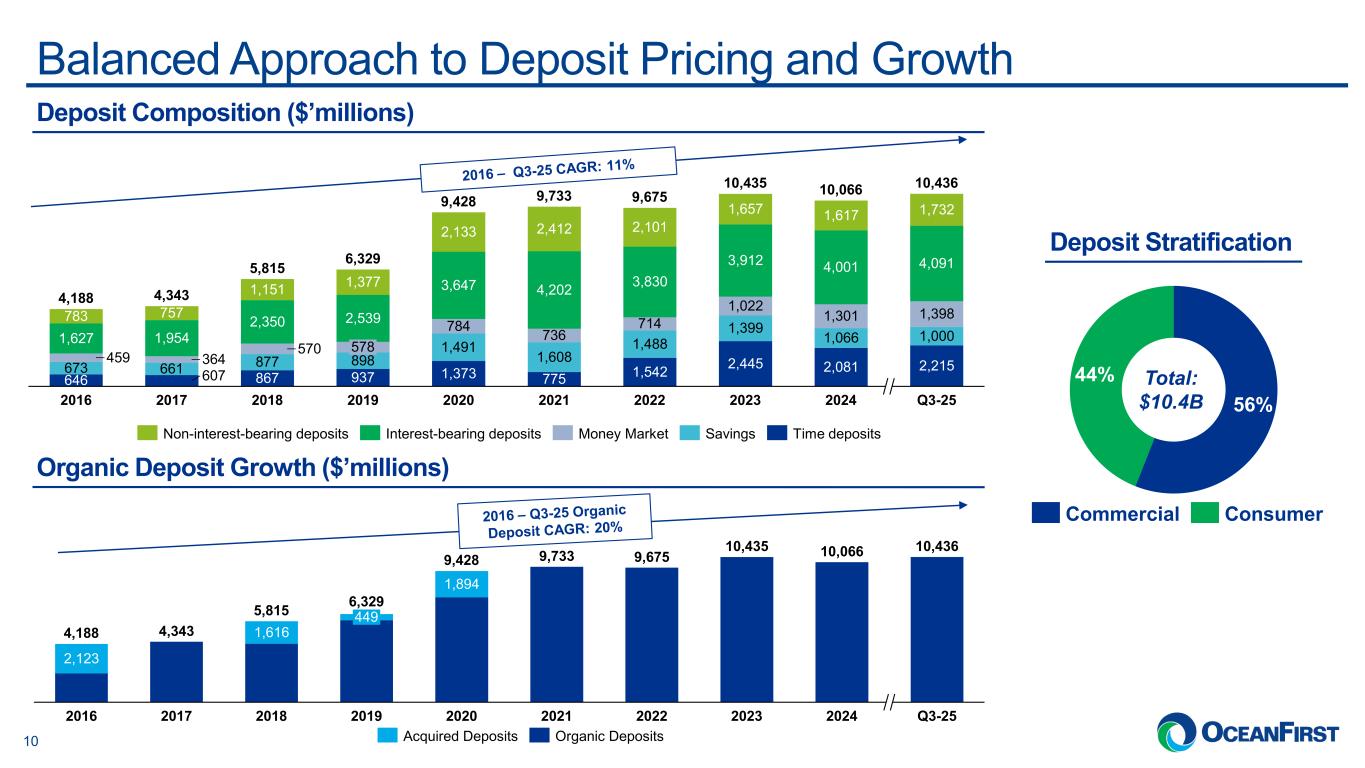

. . .Balanced Approach to Deposit Pricing and Growth Deposit Composition ($’millions) 646 607 867 937 1,373 775 1,542 2,445 2,081 2,215673 661 877 898 1,491 1,608 1,488 1,399 1,066 1,000 459 364 570 784 736 714 1,022 1,301 1,398 1,627 1,954 2,350 2,539 3,647 4,202 3,830 3,912 4,001 4,091 783 757 1,151 1,377 2,133 2,412 2,101 1,657 1,617 1,732 2016 2017 2018 578 2019 2020 2021 2022 2023 2024 Q3-25 4,188 4,343 5,815 6,329 9,428 9,733 9,675 10,435 10,066 10,436 Non-interest-bearing deposits Interest-bearing deposits Money Market Savings Time deposits Organic Deposit Growth ($’millions) 4,343 9,733 9,675 10,435 10,066 10,436 2,123 1,616 1,894 2016 2017 2018 449 2019 2020 2021 2022 2023 2024 Q3-25 4,188 5,815 6,329 9,428 Acquired Deposits Organic Deposits 56% 44% Commercial Consumer Total: $10.4B Deposit Stratification 10

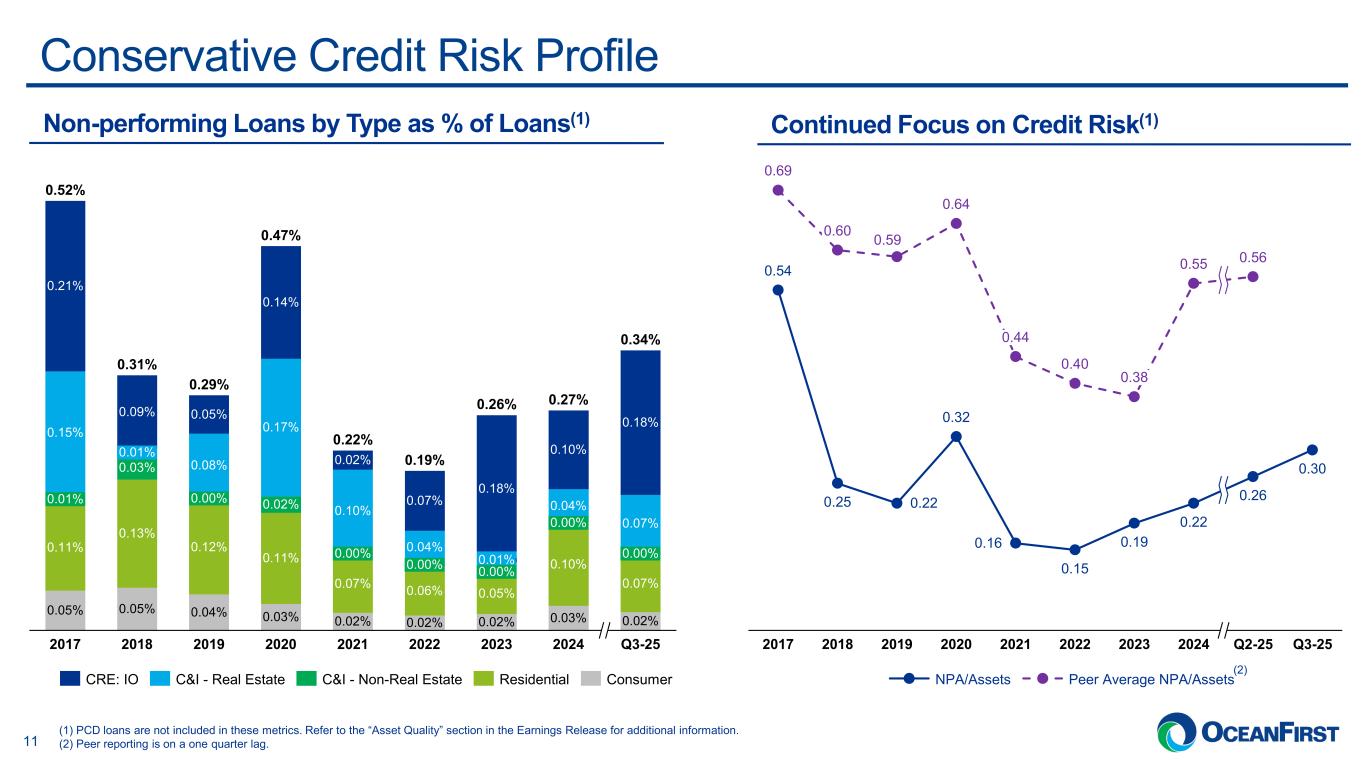

. . .Conservative Credit Risk Profile 0.05% 2017 0.09% 0.01% 0.03% 0.13% 0.05% 2018 0.05% 0.08% 0.00% 0.12% 0.04% 2019 0.14% 0.17% 0.02% 0.11% 0.03% 2020 0.02% 0.10% 0.00% 0.07% 0.02% 2021 0.07% 0.04% 0.00% 0.06% 0.02% 2022 0.18% 0.00% 0.05% 0.02% 2023 0.10% 0.04% 0.00% 0.10% 0.03% 2024 0.18% 0.07% 0.21% 0.07% 0.02% Q3-25 0.52% 0.31% 0.29% 0.47% 0.00% 0.19% 0.26% 0.27% 0.34% 0.15% 0.01% 0.11% 0.22% CRE: IO C&I - Real Estate C&I - Non-Real Estate Residential Consumer (1) PCD loans are not included in these metrics. Refer to the “Asset Quality” section in the Earnings Release for additional information. (2) Peer reporting is on a one quarter lag. 0.54 0.69 2017 0.25 0.60 2018 0.22 2022 0.19 0.38 2023 0.22 0.55 2024 0.26 0.56 0.64 0.30 Q3-25 0.16 0.44 0.32 2020 20212019 0.15 0.40 0.59 Q2-25 NPA/Assets Peer Average NPA/Assets Continued Focus on Credit Risk(1)Non-performing Loans by Type as % of Loans(1) 0.01% 11 (2)

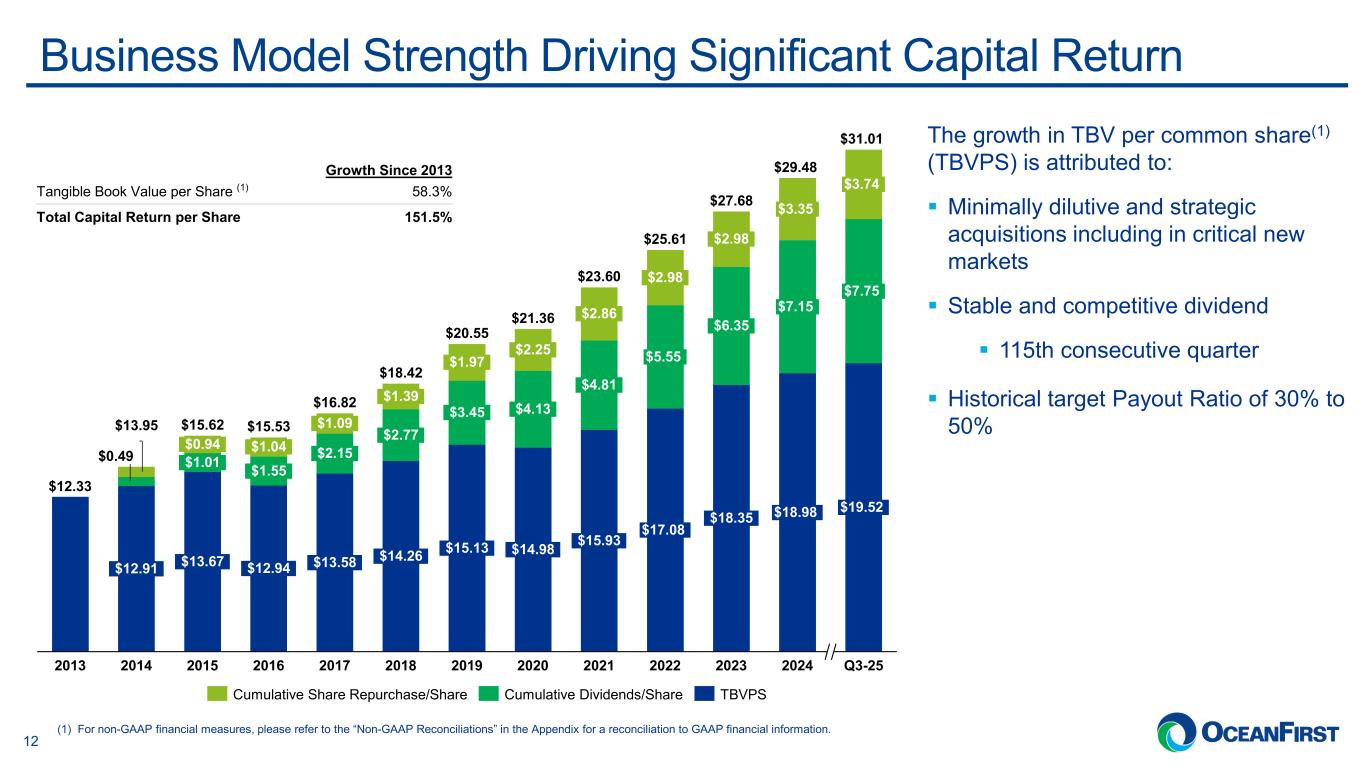

. . .Business Model Strength Driving Significant Capital Return $12.33 $0.49 $0.55 $1.01 $13.67 2015 $1.04 $1.55 $12.94 2016 $1.09 $2.15 $13.58 2017 $1.39 $2.77 $14.26 2018 $1.97 $3.45 $15.13 2019 $2.25 $4.13 $14.98 2020 $2.86 $4.81 $15.93 2021 $2.98 $5.55 $17.08 2022 $2.98 $6.35 $18.35 2023 $3.35 $7.15 $18.98 2024 $3.74 $7.75 $19.52 2013 $13.95 $15.62 $15.53 $16.82 $18.42 $20.55 $21.36 Q3-25 $25.61 $27.68 $29.48 $31.01 $12.91 2014 $0.94 $23.60 The growth in TBV per common share(1) (TBVPS) is attributed to: Minimally dilutive and strategic acquisitions including in critical new markets Stable and competitive dividend 115th consecutive quarter Historical target Payout Ratio of 30% to 50% (1) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. Growth Since 2013 Tangible Book Value per Share (1) 58.3% Total Capital Return per Share 151.5% Cumulative Share Repurchase/Share Cumulative Dividends/Share TBVPS 12

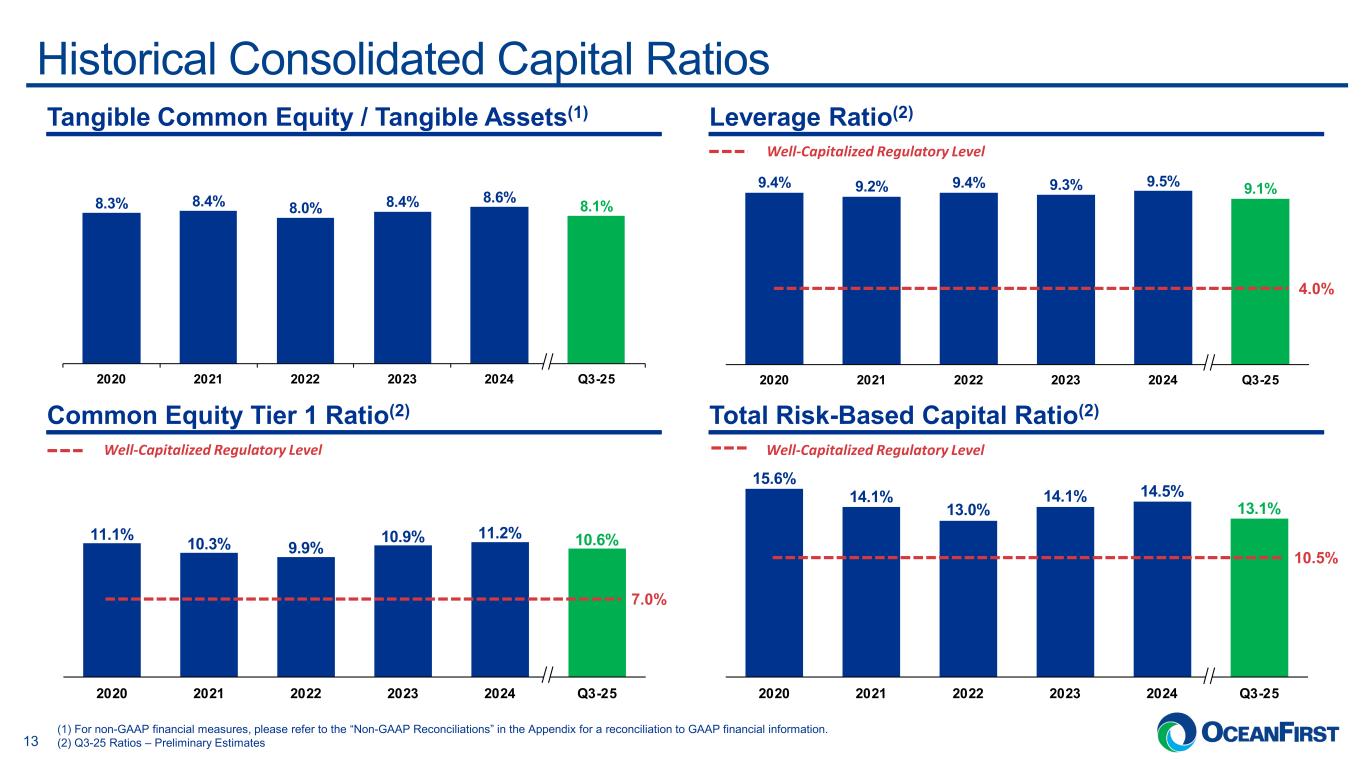

. . . 9.4% 9.2% 9.4% 9.3% 9.5% 9.1% 2020 2021 2022 2023 2024 Q3-25 Historical Consolidated Capital Ratios Leverage Ratio(2) 8.3% 8.4% 8.0% 8.4% 8.6% 8.1% 2020 2021 2022 2023 2024 Q3-25 Tangible Common Equity / Tangible Assets(1) Common Equity Tier 1 Ratio(2) Total Risk-Based Capital Ratio(2) 13 (1) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. (2) Q3-25 Ratios – Preliminary Estimates 11.1% 10.3% 9.9% 10.9% 11.2% 10.6% 2020 2021 2022 2023 2024 Q3-25 7.0% Well-Capitalized Regulatory Level 4.0% Well-Capitalized Regulatory Level 15.6% 14.1% 13.0% 14.1% 14.5% 13.1% 2020 2021 2022 2023 2024 Q3-25 10.5% Well-Capitalized Regulatory Level

. . . Quarterly Earnings Update 14

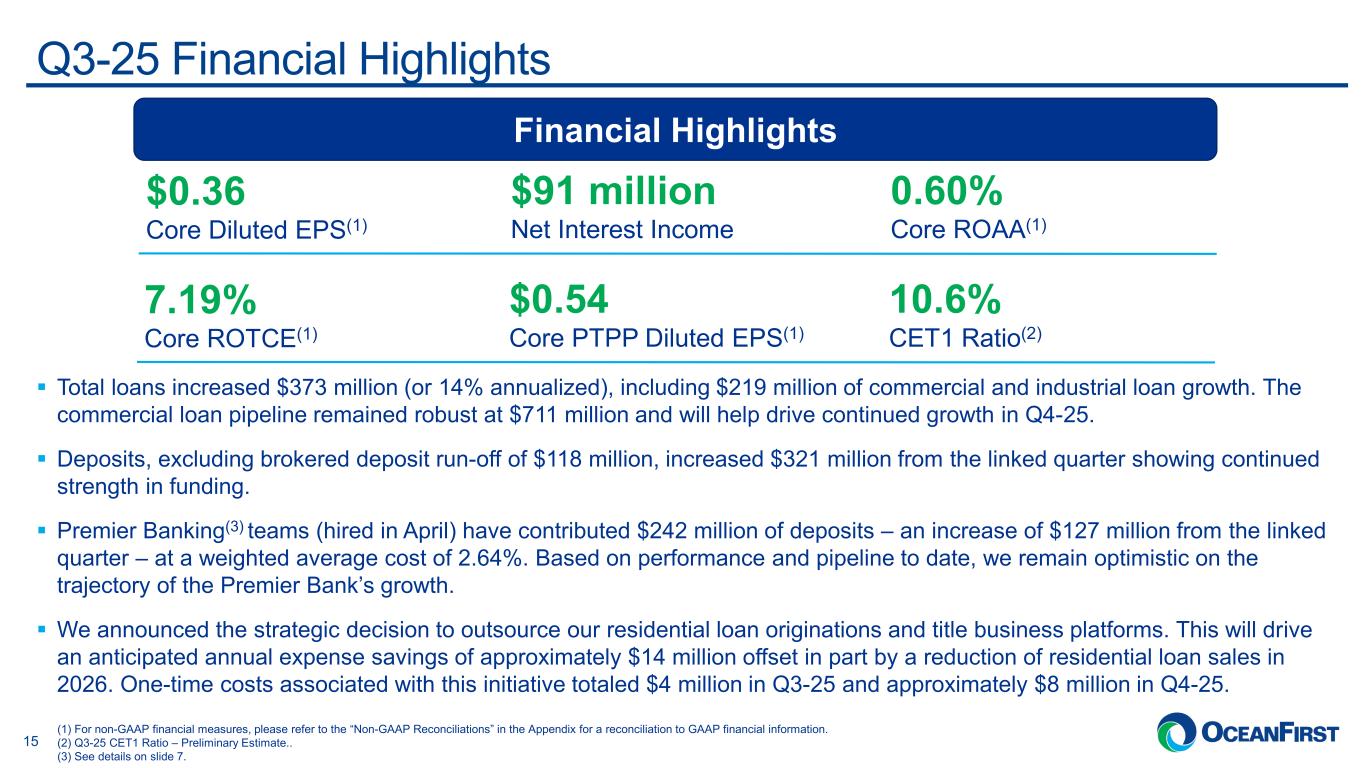

. . .Q3-25 Financial Highlights Financial Highlights $0.36 Core Diluted EPS(1) $91 million Net Interest Income 0.60% Core ROAA(1) 7.19% Core ROTCE(1) $0.54 Core PTPP Diluted EPS(1) 10.6% CET1 Ratio(2) Total loans increased $373 million (or 14% annualized), including $219 million of commercial and industrial loan growth. The commercial loan pipeline remained robust at $711 million and will help drive continued growth in Q4-25. Deposits, excluding brokered deposit run-off of $118 million, increased $321 million from the linked quarter showing continued strength in funding. Premier Banking(3) teams (hired in April) have contributed $242 million of deposits – an increase of $127 million from the linked quarter – at a weighted average cost of 2.64%. Based on performance and pipeline to date, we remain optimistic on the trajectory of the Premier Bank’s growth. We announced the strategic decision to outsource our residential loan originations and title business platforms. This will drive an anticipated annual expense savings of approximately $14 million offset in part by a reduction of residential loan sales in 2026. One-time costs associated with this initiative totaled $4 million in Q3-25 and approximately $8 million in Q4-25. 15 (1) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. (2) Q3-25 CET1 Ratio – Preliminary Estimate.. (3) See details on slide 7.

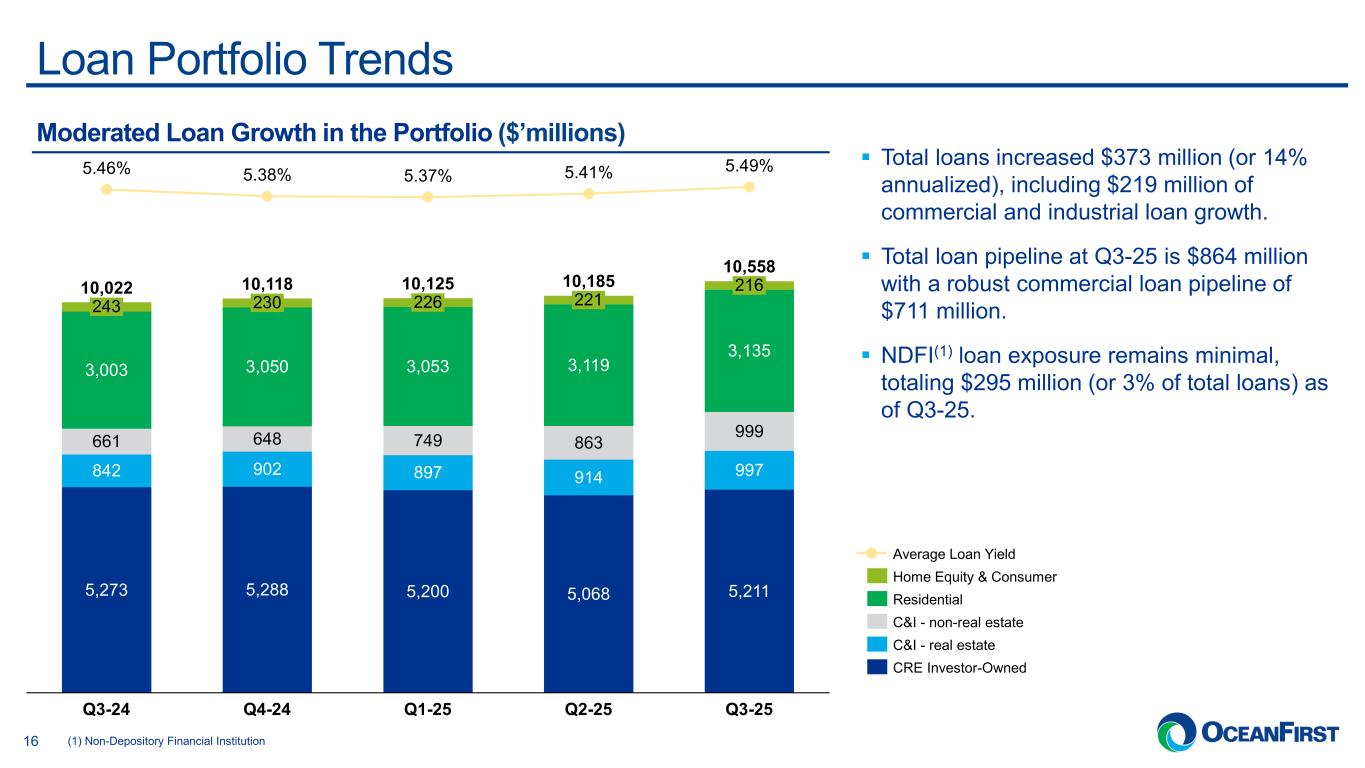

. . .Loan Portfolio Trends Moderated Loan Growth in the Portfolio ($’millions) Total loans increased $373 million (or 14% annualized), including $219 million of commercial and industrial loan growth. Total loan pipeline at Q3-25 is $864 million with a robust commercial loan pipeline of $711 million. NDFI(1) loan exposure remains minimal, totaling $295 million (or 3% of total loans) as of Q3-25. 5,273 5,288 5,200 5,068 5,211 842 902 897 914 997 661 648 749 863 999 3,003 3,050 3,053 3,119 3,135 5.46% 243 Q3-24 5.38% 230 Q4-24 5.37% 226 Q1-25 5.41% 221 Q2-25 5.49% 216 Q3-25 10,022 10,118 10,125 10,185 10,558 Average Loan Yield Home Equity & Consumer Residential C&I - non-real estate C&I - real estate CRE Investor-Owned 16 (1) Non-Depository Financial Institution

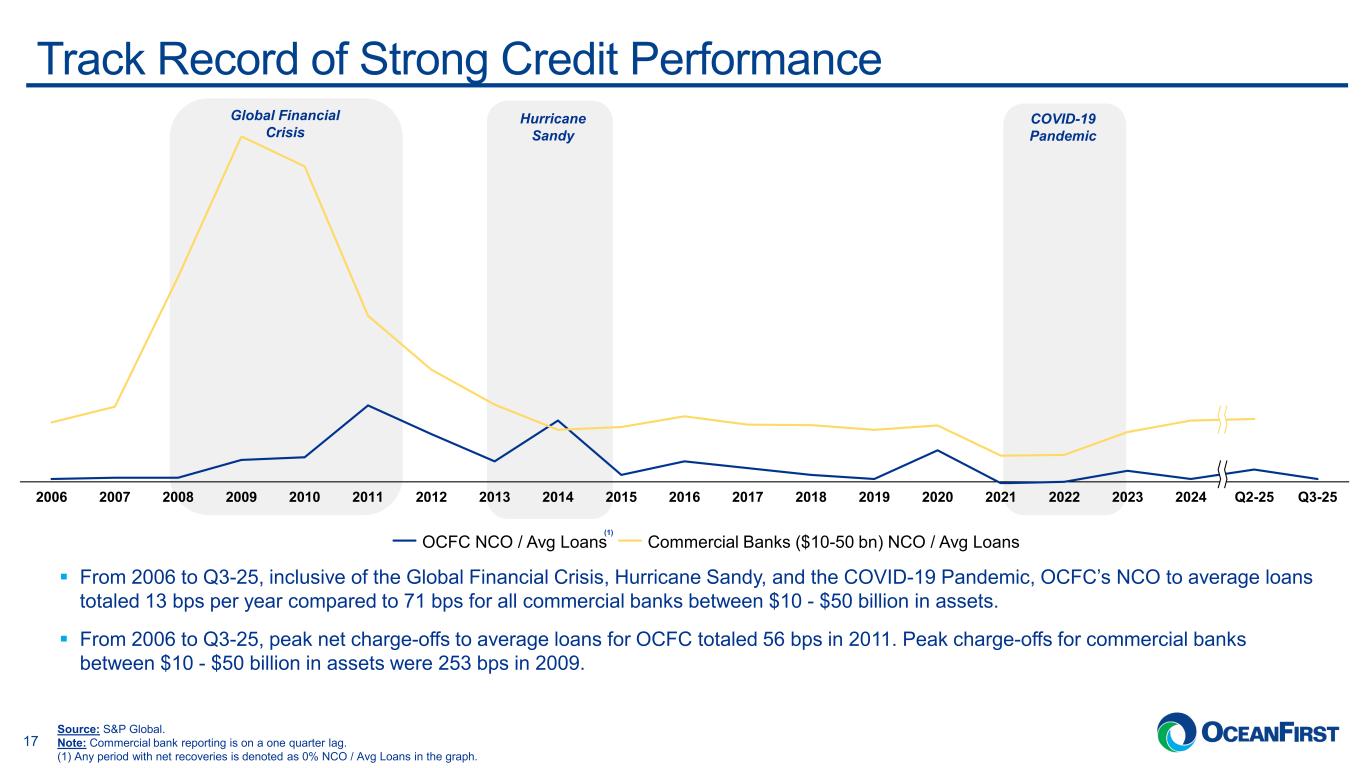

. . . COVID-19 Pandemic Track Record of Strong Credit Performance From 2006 to Q3-25, inclusive of the Global Financial Crisis, Hurricane Sandy, and the COVID-19 Pandemic, OCFC’s NCO to average loans totaled 13 bps per year compared to 71 bps for all commercial banks between $10 - $50 billion in assets. From 2006 to Q3-25, peak net charge-offs to average loans for OCFC totaled 56 bps in 2011. Peak charge-offs for commercial banks between $10 - $50 billion in assets were 253 bps in 2009. Global Financial Crisis Hurricane Sandy 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Q2-25 Q3-25 OCFC NCO / Avg Loans Commercial Banks ($10-50 bn) NCO / Avg Loans (1) 17 Source: S&P Global. Note: Commercial bank reporting is on a one quarter lag. (1) Any period with net recoveries is denoted as 0% NCO / Avg Loans in the graph.

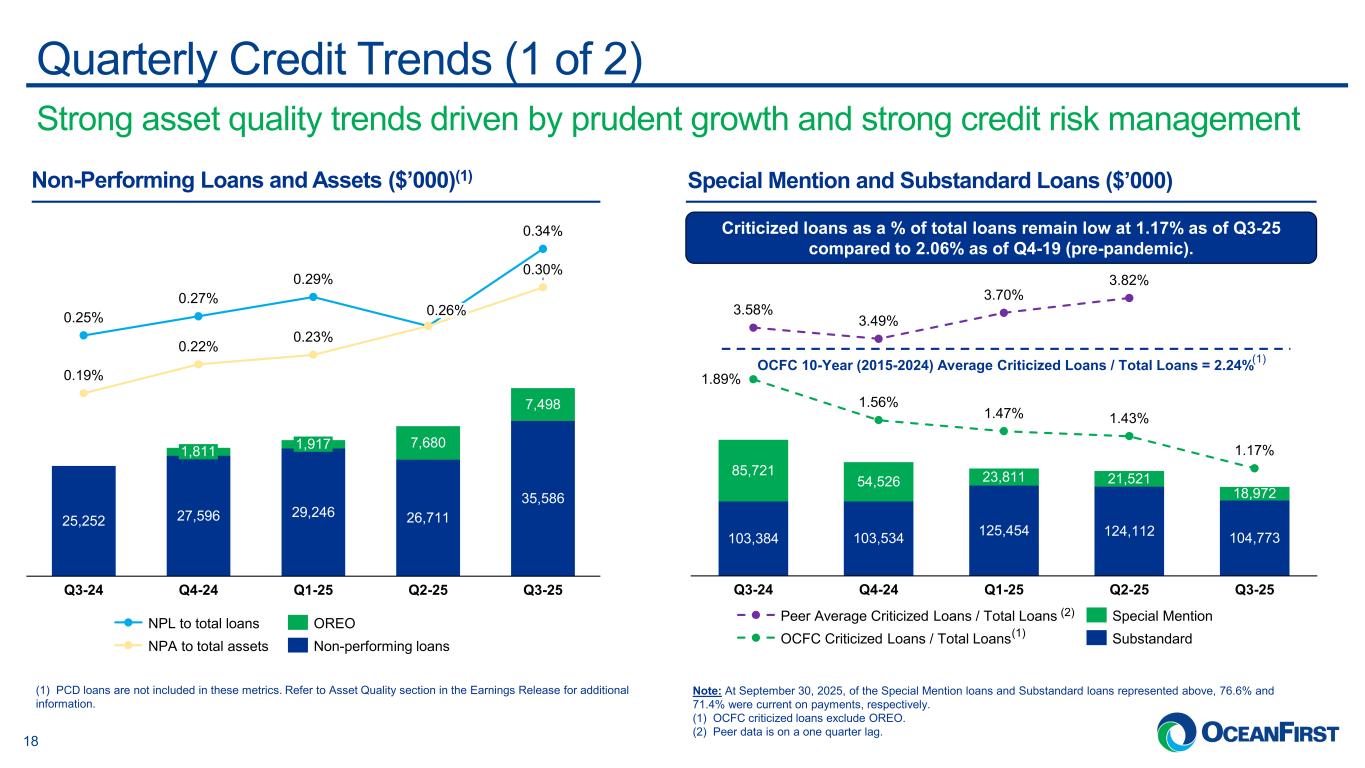

. . . 103,384 103,534 125,454 124,112 104,773 85,721 54,526 23,811 21,521 18,972 3.58% 1.89% Q3-24 3.49% 1.56% Q4-24 3.70% 1.47% Q1-25 3.82% 1.43% Q2-25 1.17% Q3-25 Strong asset quality trends driven by prudent growth and strong credit risk management Quarterly Credit Trends (1 of 2) Note: At September 30, 2025, of the Special Mention loans and Substandard loans represented above, 76.6% and 71.4% were current on payments, respectively. (1) OCFC criticized loans exclude OREO. (2) Peer data is on a one quarter lag. Non-Performing Loans and Assets ($’000)(1) Special Mention and Substandard Loans ($’000) (1) PCD loans are not included in these metrics. Refer to Asset Quality section in the Earnings Release for additional information. Criticized loans as a % of total loans remain low at 1.17% as of Q3-25 compared to 2.06% as of Q4-19 (pre-pandemic). 0.20% 25,252 27,596 29,246 26,711 35,586 7,680 7,498 0.25% 0.19% Q3-24 0.27% 0.22% 1,811 Q4-24 0.29% 0.23% 1,917 Q1-25 0.26% Q2-25 0.34% 0.30% Q3-25 NPL to total loans NPA to total assets OREO Non-performing loans Peer Average Criticized Loans / Total Loans OCFC Criticized Loans / Total Loans Special Mention Substandard 18 OCFC 10-Year (2015-2024) Average Criticized Loans / Total Loans = 2.24% (2) (1) (1)

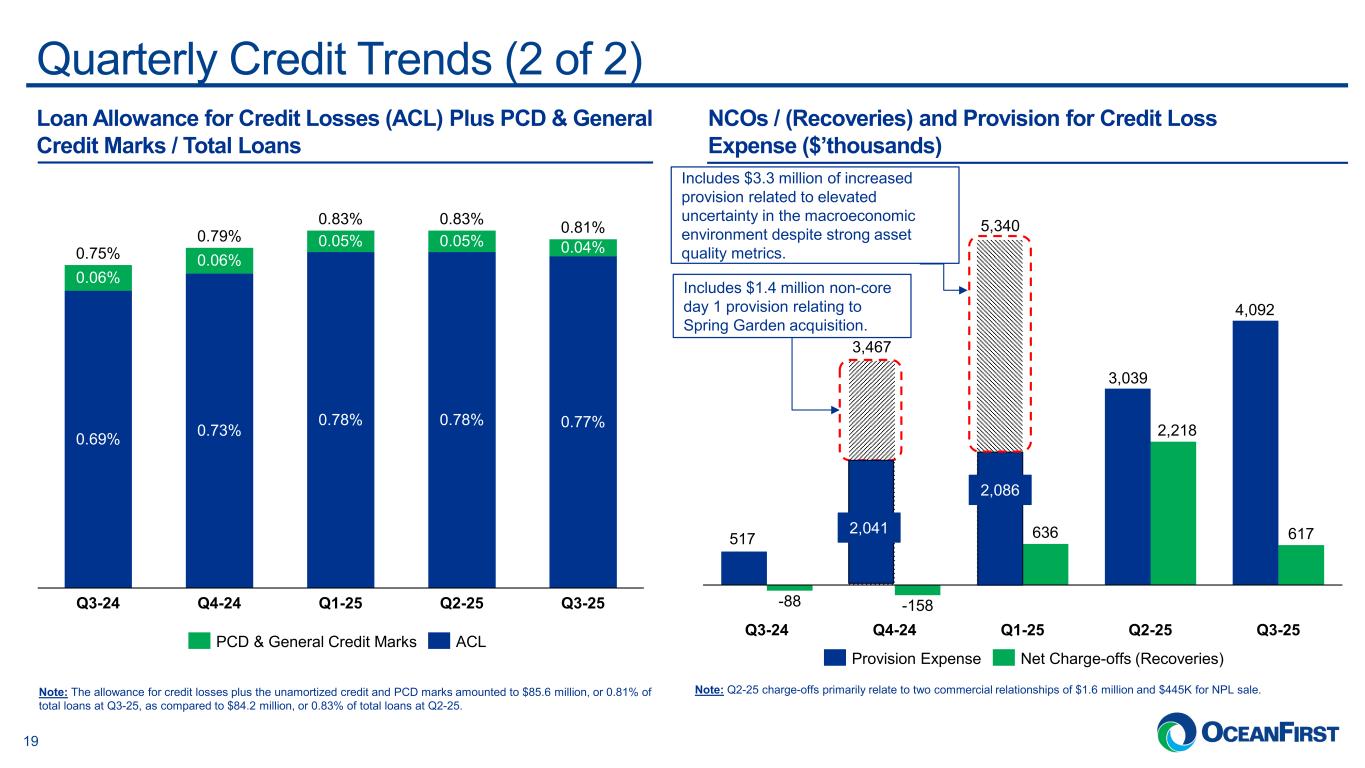

. . .Quarterly Credit Trends (2 of 2) Loan Allowance for Credit Losses (ACL) Plus PCD & General Credit Marks / Total Loans NCOs / (Recoveries) and Provision for Credit Loss Expense ($’thousands) 0.06% 0.69% Q3-24 0.06% 0.73% Q4-24 0.05% 0.78% Q1-25 0.05% 0.78% Q2-25 0.04% 0.77% Q3-25 0.75% 0.79% 0.83% 0.83% 0.81% PCD & General Credit Marks ACL -88 -158 636 2,218 617 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Provision Expense Net Charge-offs (Recoveries) 517 3,467 Includes $1.4 million non-core day 1 provision relating to Spring Garden acquisition. Note: The allowance for credit losses plus the unamortized credit and PCD marks amounted to $85.6 million, or 0.81% of total loans at Q3-25, as compared to $84.2 million, or 0.83% of total loans at Q2-25. 2,041 Includes $3.3 million of increased provision related to elevated uncertainty in the macroeconomic environment despite strong asset quality metrics. 5,340 2,086 19 3,039 Note: Q2-25 charge-offs primarily relate to two commercial relationships of $1.6 million and $445K for NPL sale. 4,092

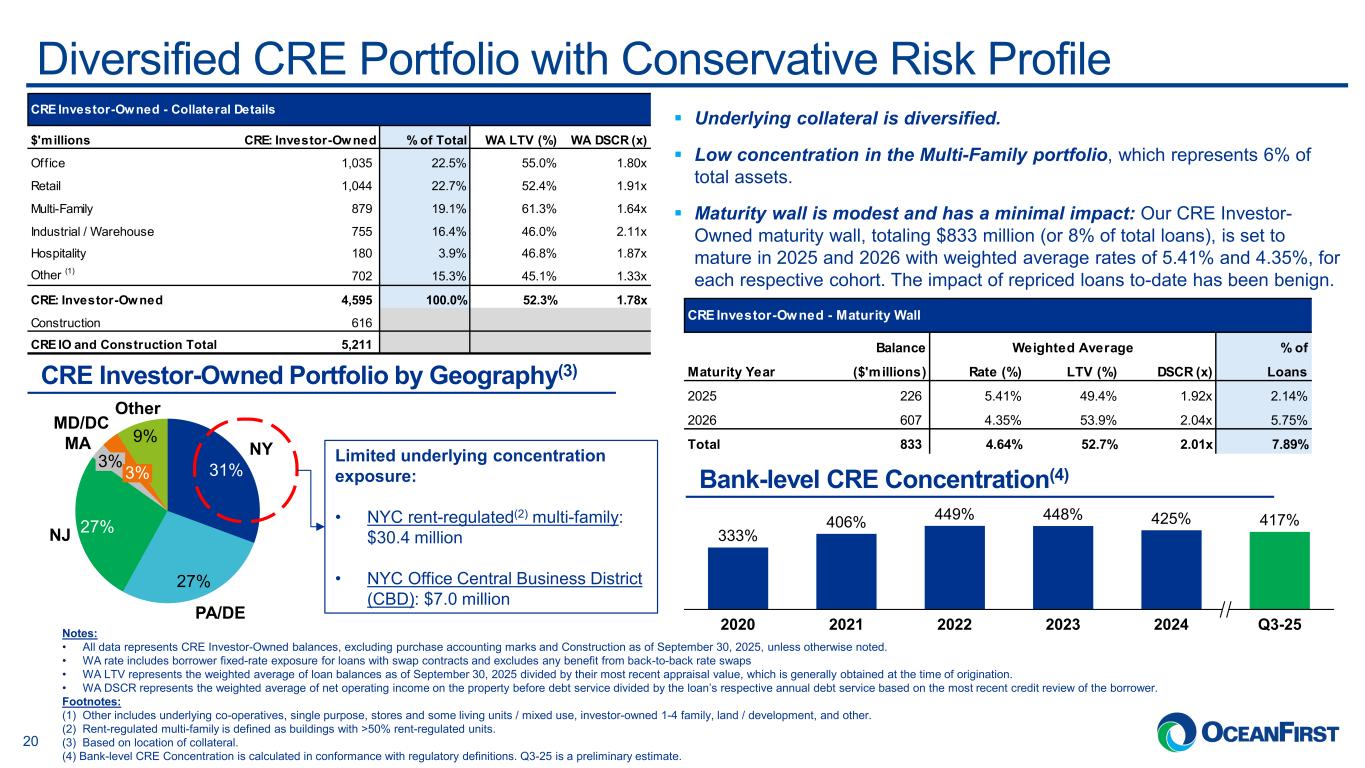

. . .Diversified CRE Portfolio with Conservative Risk Profile Underlying collateral is diversified. Low concentration in the Multi-Family portfolio, which represents 6% of total assets. Maturity wall is modest and has a minimal impact: Our CRE Investor- Owned maturity wall, totaling $833 million (or 8% of total loans), is set to mature in 2025 and 2026 with weighted average rates of 5.41% and 4.35%, for each respective cohort. The impact of repriced loans to-date has been benign. CRE Investor-Owned Portfolio by Geography(3) Notes: • All data represents CRE Investor-Owned balances, excluding purchase accounting marks and Construction as of September 30, 2025, unless otherwise noted. • WA rate includes borrower fixed-rate exposure for loans with swap contracts and excludes any benefit from back-to-back rate swaps • WA LTV represents the weighted average of loan balances as of September 30, 2025 divided by their most recent appraisal value, which is generally obtained at the time of origination. • WA DSCR represents the weighted average of net operating income on the property before debt service divided by the loan’s respective annual debt service based on the most recent credit review of the borrower. Footnotes: (1) Other includes underlying co-operatives, single purpose, stores and some living units / mixed use, investor-owned 1-4 family, land / development, and other. (2) Rent-regulated multi-family is defined as buildings with >50% rent-regulated units. (3) Based on location of collateral. (4) Bank-level CRE Concentration is calculated in conformance with regulatory definitions. Q3-25 is a preliminary estimate. 31% 27% 27% 9% NY PA/DE NJ 3% MA 3% MD/DC Other Limited underlying concentration exposure: • NYC rent-regulated(2) multi-family: $30.4 million • NYC Office Central Business District (CBD): $7.0 million 20 Bank-level CRE Concentration(4) 2020 2021 2022 2023 2024 Q3-25 333% 406% 449% 448% 425% 417% CRE Investor-Owned - Collateral Details $'millions CRE: Investor-Owned % of Total WA LTV (%) WA DSCR (x) Office 1,035 22.5% 55.0% 1.80x Retail 1,044 22.7% 52.4% 1.91x Multi-Family 879 19.1% 61.3% 1.64x Industrial / Warehouse 755 16.4% 46.0% 2.11x Hospitality 180 3.9% 46.8% 1.87x Other (1) 702 15.3% 45.1% 1.33x CRE: Investor-Owned 4,595 100.0% 52.3% 1.78x Construction 616 CRE IO and Construction Total 5,211 CRE Investor-Owned - Maturity Wall Balance Weighted Average % of Maturity Year ($'millions) Rate (%) LTV (%) DSCR (x) Loans 2025 226 5.41% 49.4% 1.92x 2.14% 2026 607 4.35% 53.9% 2.04x 5.75% Total 833 4.64% 52.7% 2.01x 7.89%

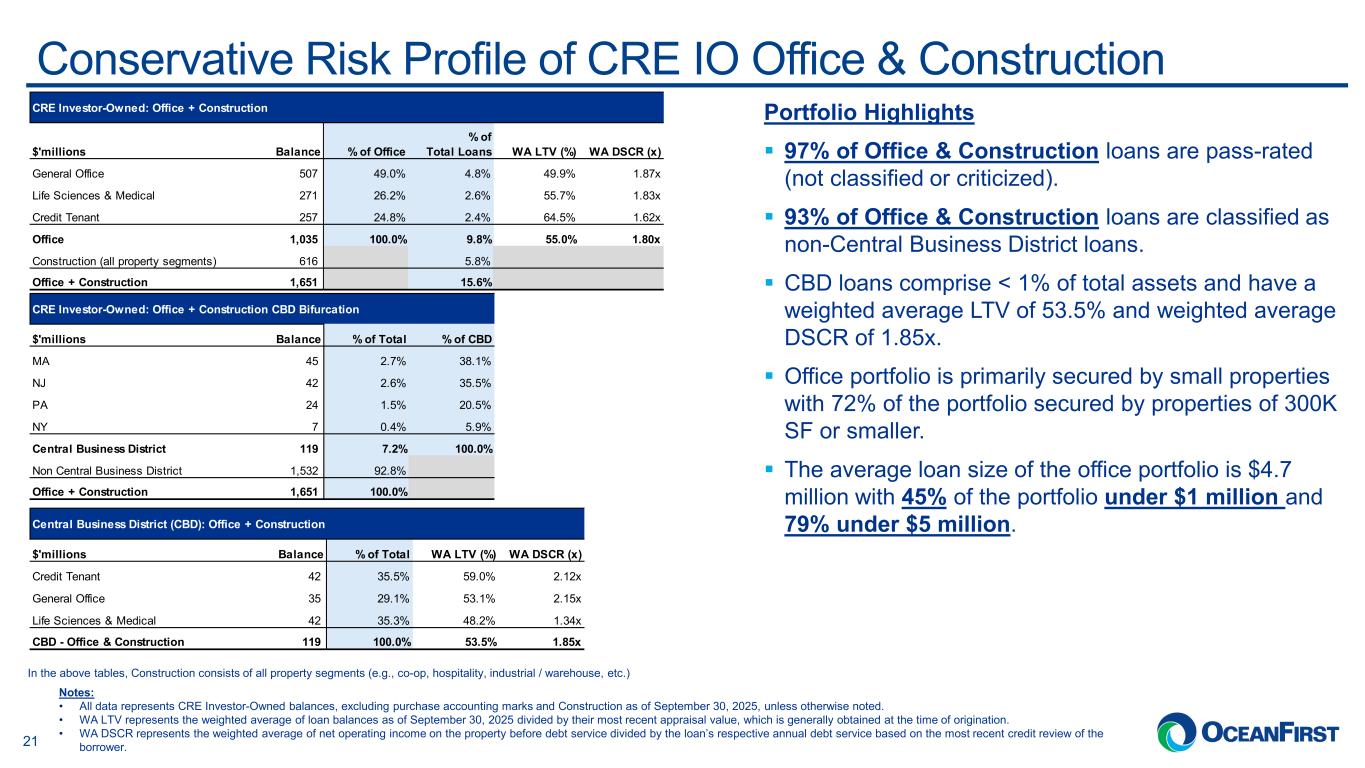

. . .Conservative Risk Profile of CRE IO Office & Construction Portfolio Highlights 97% of Office & Construction loans are pass-rated (not classified or criticized). 93% of Office & Construction loans are classified as non-Central Business District loans. CBD loans comprise < 1% of total assets and have a weighted average LTV of 53.5% and weighted average DSCR of 1.85x. Office portfolio is primarily secured by small properties with 72% of the portfolio secured by properties of 300K SF or smaller. The average loan size of the office portfolio is $4.7 million with 45% of the portfolio under $1 million and 79% under $5 million. In the above tables, Construction consists of all property segments (e.g., co-op, hospitality, industrial / warehouse, etc.) 21 Notes: • All data represents CRE Investor-Owned balances, excluding purchase accounting marks and Construction as of September 30, 2025, unless otherwise noted. • WA LTV represents the weighted average of loan balances as of September 30, 2025 divided by their most recent appraisal value, which is generally obtained at the time of origination. • WA DSCR represents the weighted average of net operating income on the property before debt service divided by the loan’s respective annual debt service based on the most recent credit review of the borrower. CRE Investor-Owned: Office + Construction $'millions Balance % of Office % of Total Loans WA LTV (%) WA DSCR (x) General Office 507 49.0% 4.8% 49.9% 1.87x Life Sciences & Medical 271 26.2% 2.6% 55.7% 1.83x Credit Tenant 257 24.8% 2.4% 64.5% 1.62x Office 1,035 100.0% 9.8% 55.0% 1.80x Construction (all property segments) 616 5.8% Office + Construction 1,651 15.6% CRE Investor-Owned: Office + Construction CBD Bifurcation $'millions Balance % of Total % of CBD MA 45 2.7% 38.1% NJ 42 2.6% 35.5% PA 24 1.5% 20.5% NY 7 0.4% 5.9% Central Business District 119 7.2% 100.0% Non Central Business District 1,532 92.8% Office + Construction 1,651 100.0% Central Business District (CBD): Office + Construction $'millions Balance % of Total WA LTV (%) WA DSCR (x) Credit Tenant 42 35.5% 59.0% 2.12x General Office 35 29.1% 53.1% 2.15x Life Sciences & Medical 42 35.3% 48.2% 1.34x CBD - Office & Construction 119 100.0% 53.5% 1.85x

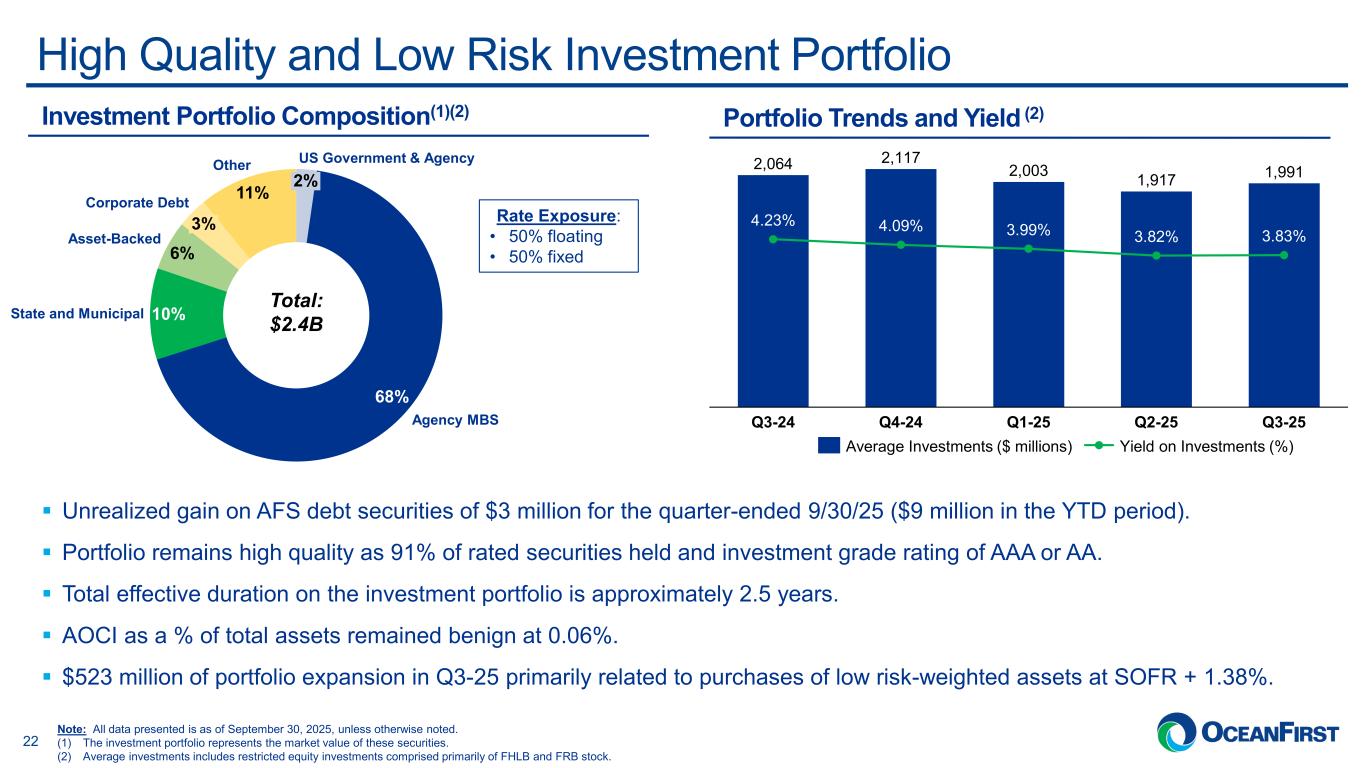

. . .High Quality and Low Risk Investment Portfolio Unrealized gain on AFS debt securities of $3 million for the quarter-ended 9/30/25 ($9 million in the YTD period). Portfolio remains high quality as 91% of rated securities held and investment grade rating of AAA or AA. Total effective duration on the investment portfolio is approximately 2.5 years. AOCI as a % of total assets remained benign at 0.06%. $523 million of portfolio expansion in Q3-25 primarily related to purchases of low risk-weighted assets at SOFR + 1.38%. Investment Portfolio Composition(1)(2) 68% 10% 6% 11% 2% US Government & Agency Agency MBS State and Municipal Asset-Backed 3% Corporate Debt Other Total: $2.4B 2,064 2,117 2,003 1,917 1,991 4.23% Q3-24 4.09% Q4-24 3.99% Q1-25 3.82% Q2-25 3.83% Q3-25 Portfolio Trends and Yield (2) Rate Exposure: • 50% floating • 50% fixed Average Investments ($ millions) Yield on Investments (%) 22 Note: All data presented is as of September 30, 2025, unless otherwise noted. (1) The investment portfolio represents the market value of these securities. (2) Average investments includes restricted equity investments comprised primarily of FHLB and FRB stock.

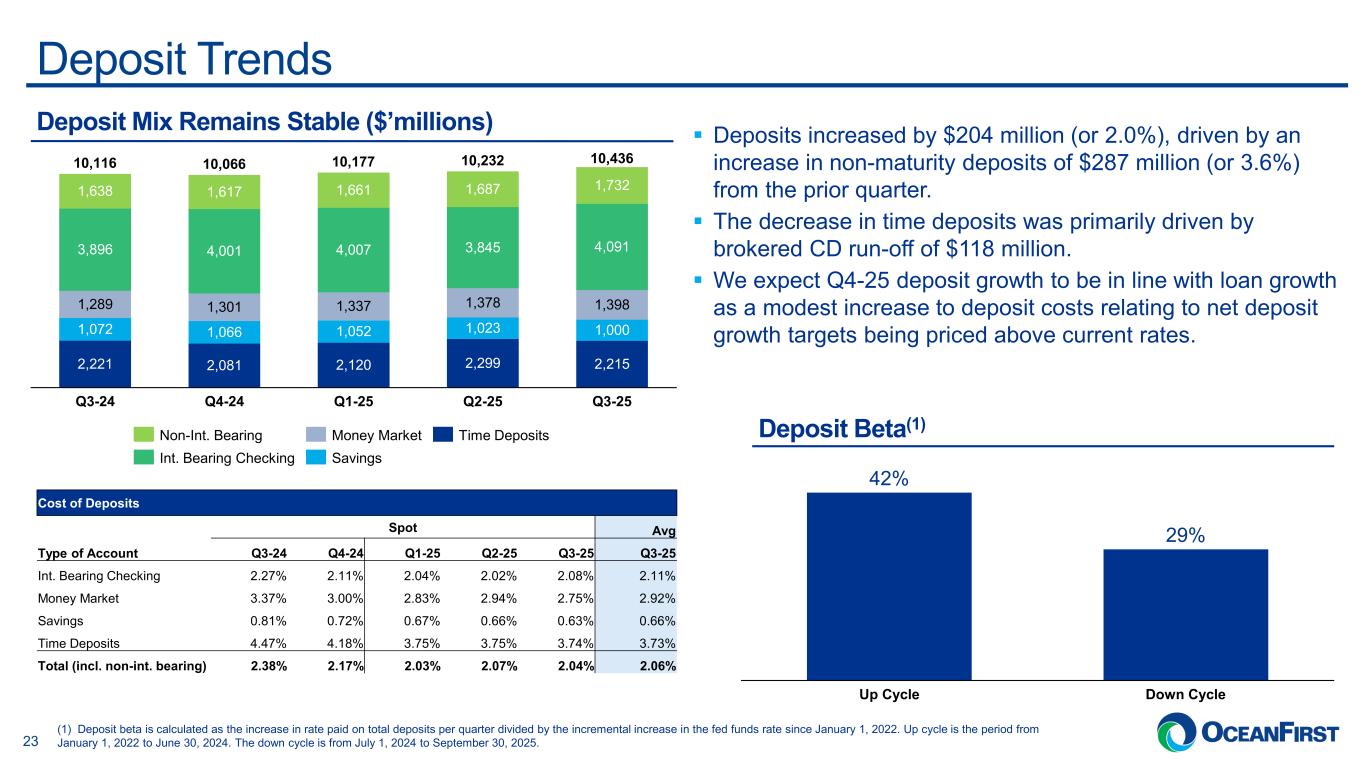

. . .Deposit Trends Deposits increased by $204 million (or 2.0%), driven by an increase in non-maturity deposits of $287 million (or 3.6%) from the prior quarter. The decrease in time deposits was primarily driven by brokered CD run-off of $118 million. We expect Q4-25 deposit growth to be in line with loan growth as a modest increase to deposit costs relating to net deposit growth targets being priced above current rates. Deposit Mix Remains Stable ($’millions) 2,221 2,081 2,120 2,299 2,215 1,072 1,066 1,052 1,023 1,000 1,289 1,301 1,337 1,378 1,398 3,896 4,001 4,007 3,845 4,091 1,638 1,617 1,661 1,687 1,732 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 10,116 10,066 10,177 10,232 10,436 Non-Int. Bearing Int. Bearing Checking Money Market Savings Time Deposits Deposit Beta(1) 23 Cost of Deposits Spot Avg Type of Account Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Q3-25 Int. Bearing Checking 2.27% 2.11% 2.04% 2.02% 2.08% 2.11% Money Market 3.37% 3.00% 2.83% 2.94% 2.75% 2.92% Savings 0.81% 0.72% 0.67% 0.66% 0.63% 0.66% Time Deposits 4.47% 4.18% 3.75% 3.75% 3.74% 3.73% Total (incl. non-int. bearing) 2.38% 2.17% 2.03% 2.07% 2.04% 2.06% (1) Deposit beta is calculated as the increase in rate paid on total deposits per quarter divided by the incremental increase in the fed funds rate since January 1, 2022. Up cycle is the period from January 1, 2022 to June 30, 2024. The down cycle is from July 1, 2024 to September 30, 2025. Up Cycle Down Cycle 42% 29%

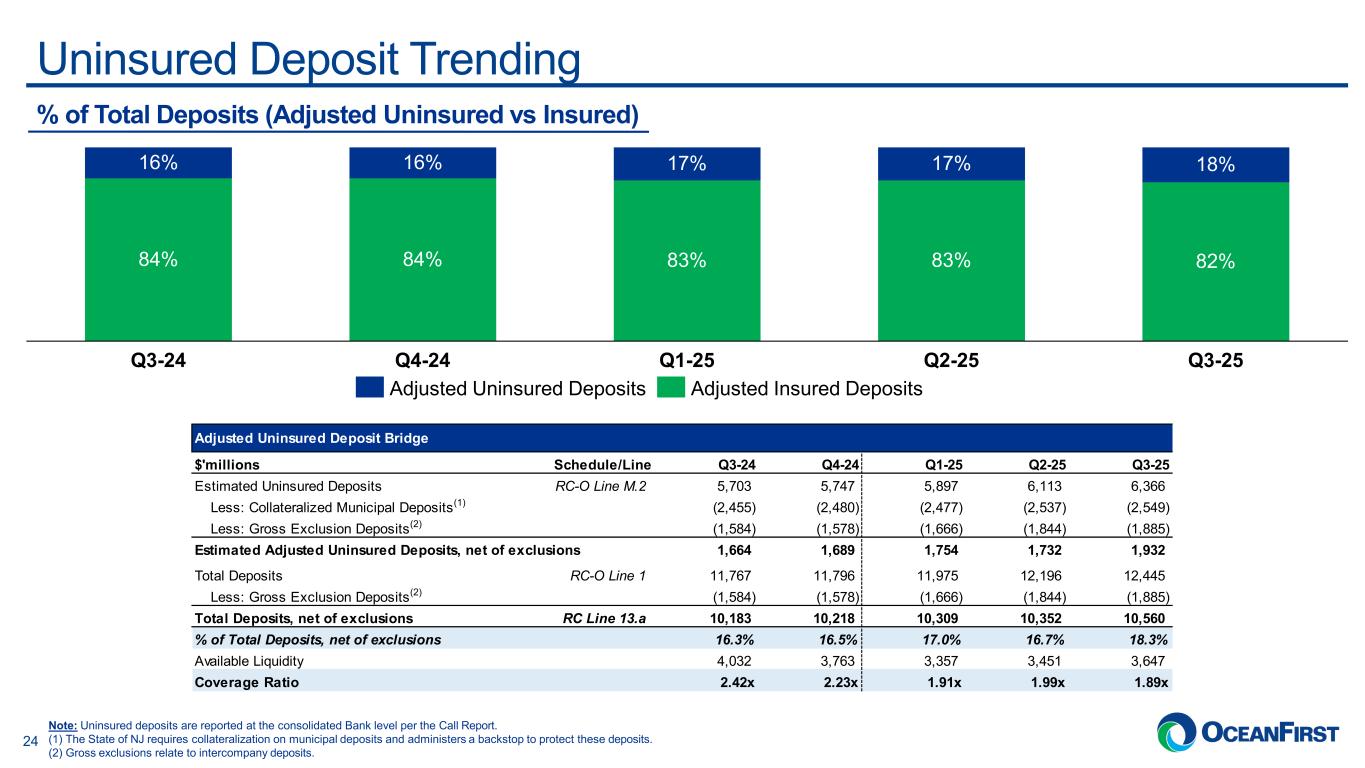

. . .Uninsured Deposit Trending 16% 84% Q3-24 16% 84% Q4-24 17% 83% Q1-25 17% 83% Q2-25 18% 82% Q3-25 Adjusted Uninsured Deposits Adjusted Insured Deposits % of Total Deposits (Adjusted Uninsured vs Insured) Note: Uninsured deposits are reported at the consolidated Bank level per the Call Report. (1) The State of NJ requires collateralization on municipal deposits and administers a backstop to protect these deposits. (2) Gross exclusions relate to intercompany deposits. 24 Adjusted Uninsured Deposit Bridge $'millions Schedule/Line Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Estimated Uninsured Deposits RC-O Line M.2 5,703 5,747 5,897 6,113 6,366 Less: Collateralized Municipal Deposits(1) (2,455) (2,480) (2,477) (2,537) (2,549) Less: Gross Exclusion Deposits(2) (1,584) (1,578) (1,666) (1,844) (1,885) Estimated Adjusted Uninsured Deposits, net of exclusions 1,664 1,689 1,754 1,732 1,932 Total Deposits RC-O Line 1 11,767 11,796 11,975 12,196 12,445 Less: Gross Exclusion Deposits(2) (1,584) (1,578) (1,666) (1,844) (1,885) Total Deposits, net of exclusions RC Line 13.a 10,183 10,218 10,309 10,352 10,560 % of Total Deposits, net of exclusions 16.3% 16.5% 17.0% 16.7% 18.3% Available Liquidity 4,032 3,763 3,357 3,451 3,647 Coverage Ratio 2.42x 2.23x 1.91x 1.99x 1.89x

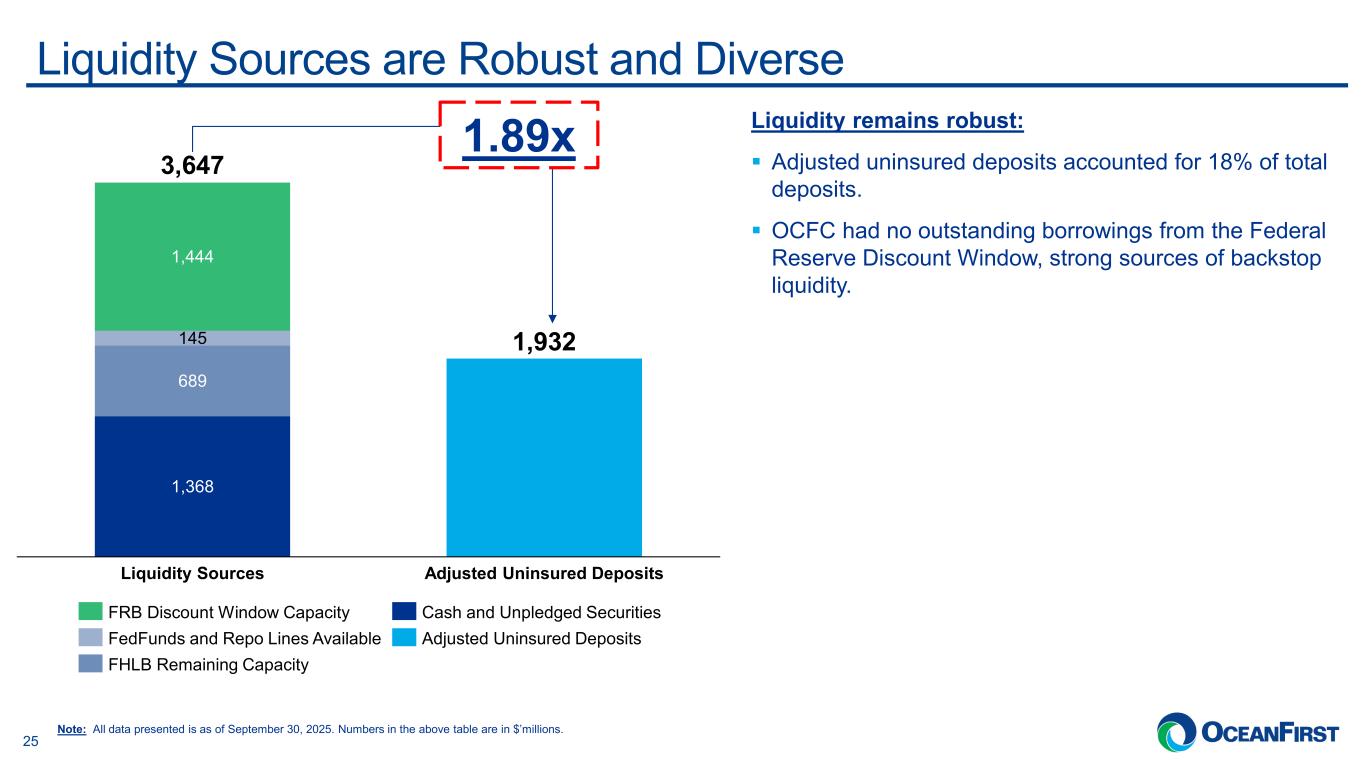

. . .Liquidity Sources are Robust and Diverse Liquidity remains robust: Adjusted uninsured deposits accounted for 18% of total deposits. OCFC had no outstanding borrowings from the Federal Reserve Discount Window, strong sources of backstop liquidity. 1,368 1,932 689 145 1,444 Liquidity Sources Adjusted Uninsured Deposits 3,647 FRB Discount Window Capacity FedFunds and Repo Lines Available FHLB Remaining Capacity Cash and Unpledged Securities Adjusted Uninsured Deposits 1.89x 25 Note: All data presented is as of September 30, 2025. Numbers in the above table are in $’millions.

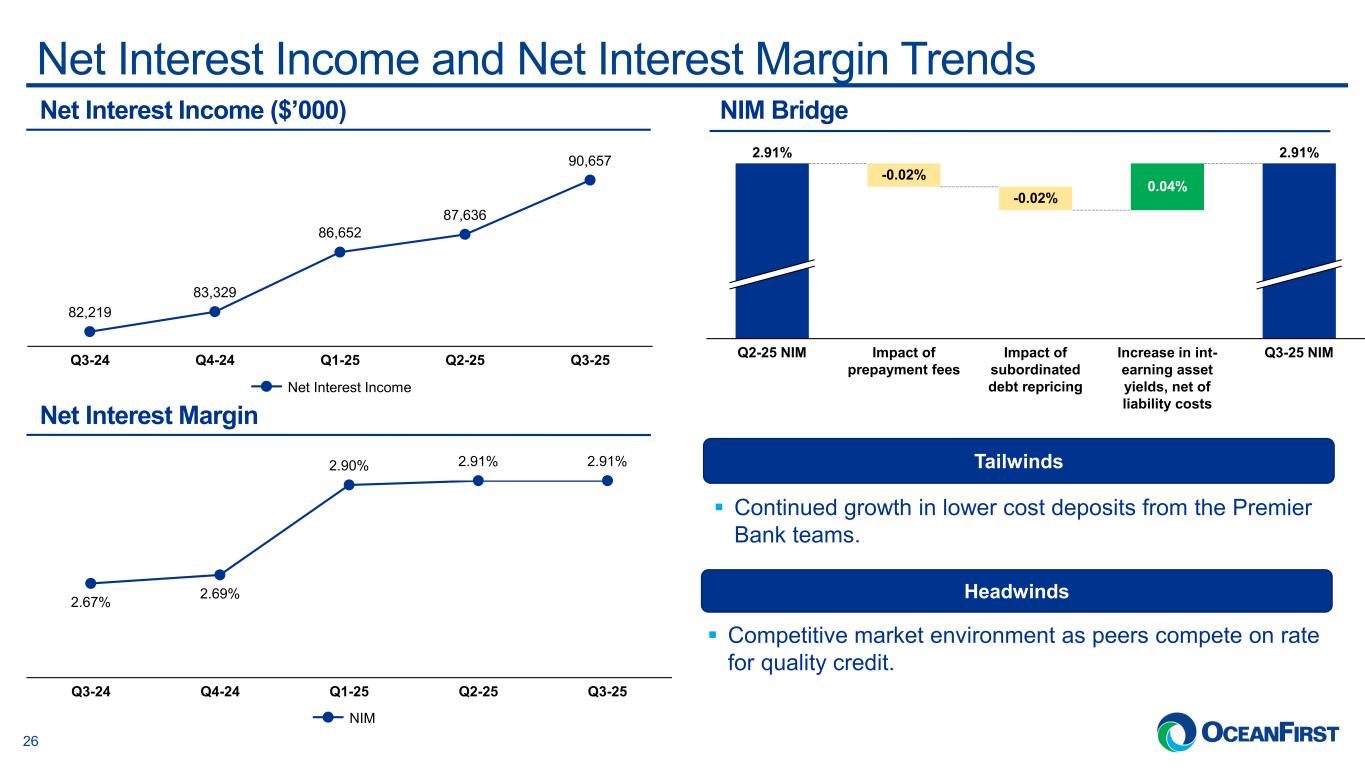

. . .Net Interest Income and Net Interest Margin Trends Net Interest Margin NIM Bridge 2.67% Q3-24 2.69% Q4-24 2.90% Q1-25 2.91% Q2-25 2.91% Q3-25 NIM Net Interest Income ($’000) 82,219 Q3-24 83,329 Q4-24 86,652 Q1-25 87,636 Q2-25 90,657 Q3-25 Net Interest Income Headwinds Competitive market environment as peers compete on rate for quality credit. Tailwinds Continued growth in lower cost deposits from the Premier Bank teams. 26 Q2-25 NIM -0.02% Impact of prepayment fees -0.02% Impact of subordinated debt repricing 0.04% Increase in int- earning asset yields, net of liability costs Q3-25 NIM 2.91% 2.91%

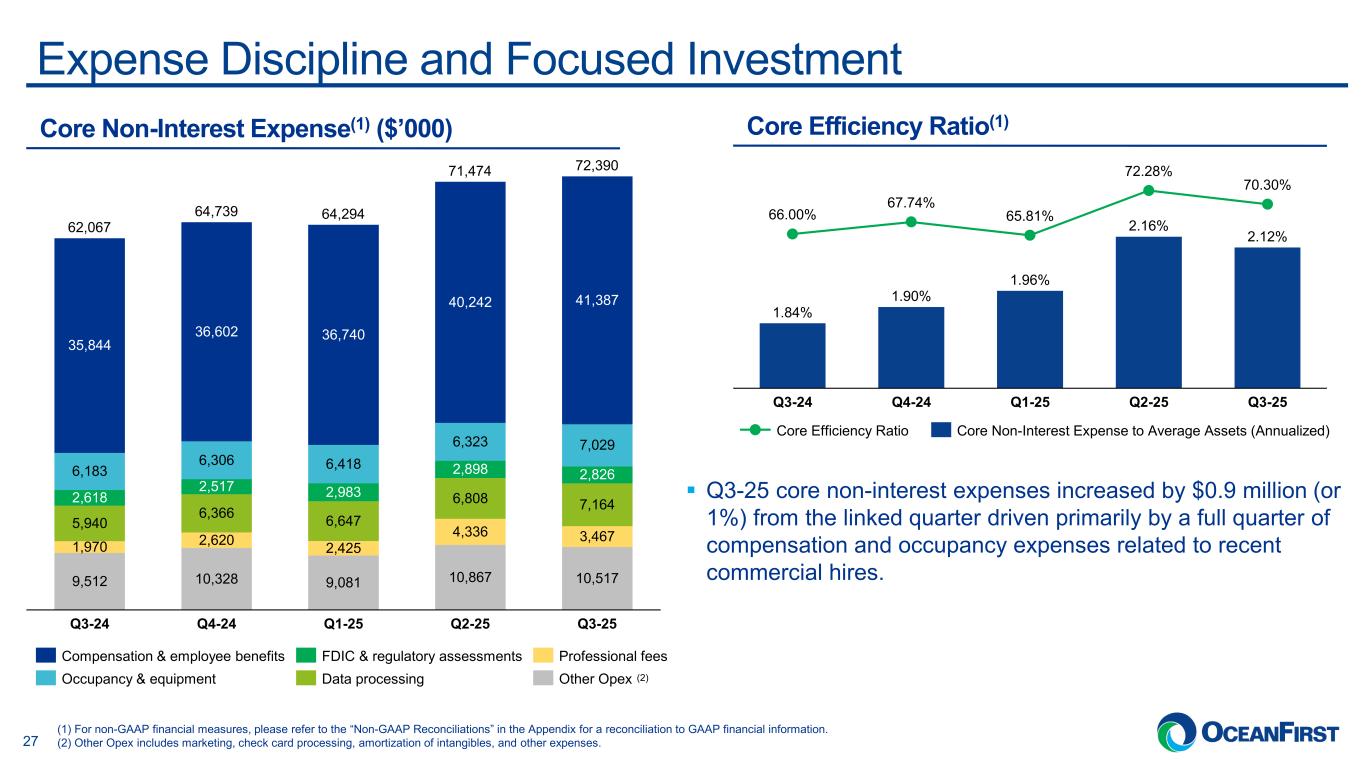

. . . Core Efficiency Ratio(1) Expense Discipline and Focused Investment Core Non-Interest Expense(1) ($’000) 9,512 10,328 9,081 10,867 10,517 1,970 2,620 2,425 4,336 3,467 5,940 6,366 6,647 6,808 7,1642,618 2,517 2,983 2,898 2,8266,183 6,306 6,418 6,323 7,029 35,844 36,602 36,740 40,242 41,387 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 62,067 64,739 64,294 71,474 72,390 Compensation & employee benefits Occupancy & equipment FDIC & regulatory assessments Data processing Professional fees Other Opex (1) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. (2) Other Opex includes marketing, check card processing, amortization of intangibles, and other expenses. Q3-25 core non-interest expenses increased by $0.9 million (or 1%) from the linked quarter driven primarily by a full quarter of compensation and occupancy expenses related to recent commercial hires. (2) 27 66.00% Q3-24 67.74% Q4-24 65.81% Q1-25 72.28% Q2-25 70.30% Q3-25 1.84% 1.90% 1.96% 2.16% 2.12% Core Efficiency Ratio Core Non-Interest Expense to Average Assets (Annualized)

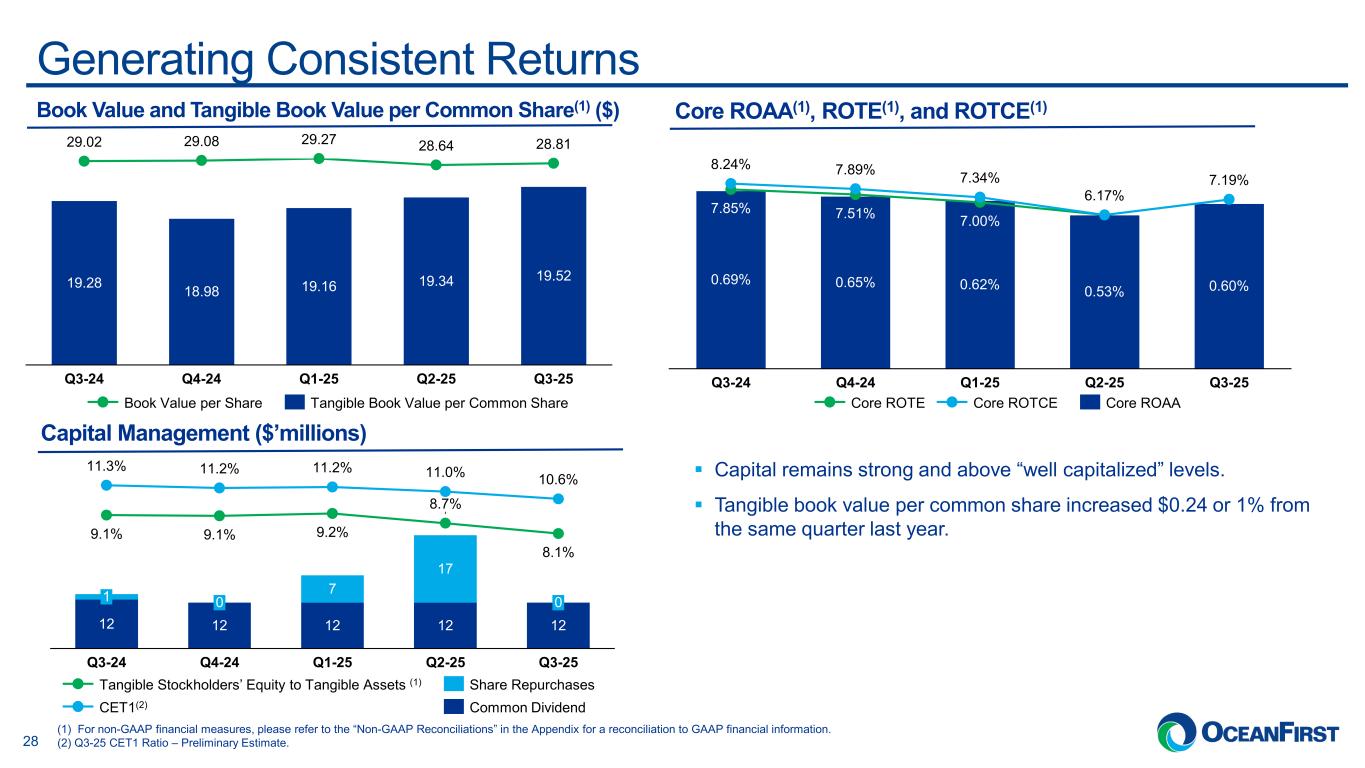

. . .Generating Consistent Returns Book Value and Tangible Book Value per Common Share(1) ($) Core ROAA(1), ROTE(1), and ROTCE(1) Capital remains strong and above “well capitalized” levels. Tangible book value per common share increased $0.24 or 1% from the same quarter last year. Capital Management ($’millions) 19.28 18.98 19.16 19.34 19.52 29.02 29.08 29.27 28.64 28.81 Q3-24 Q4-24 Q1-25 Q2-25 Q3-25 Book Value per Share Tangible Book Value per Common Share 7.85% 8.24% 0.69% Q3-24 7.51% 7.89% 0.65% Q4-24 7.00% 7.34% 0.62% Q1-25 6.17% 0.53% Q2-25 7.19% 0.60% Q3-25 Core ROTE Core ROTCE Core ROAA 12 12 12 12 12 7 17 9.1% 11.3% 1 Q3-24 9.1% 11.2% 0 Q4-24 9.2% 11.2% Q1-25 8.7% 11.0% Q2-25 8.1% 10.6% 0 Q3-25 Tangible Stockholders’ Equity to Tangible Assets (1) CET1(2) Share Repurchases Common Dividend 28 (1) For non-GAAP financial measures, please refer to the “Non-GAAP Reconciliations” in the Appendix for a reconciliation to GAAP financial information. (2) Q3-25 CET1 Ratio – Preliminary Estimate.

. . . Appendix 29

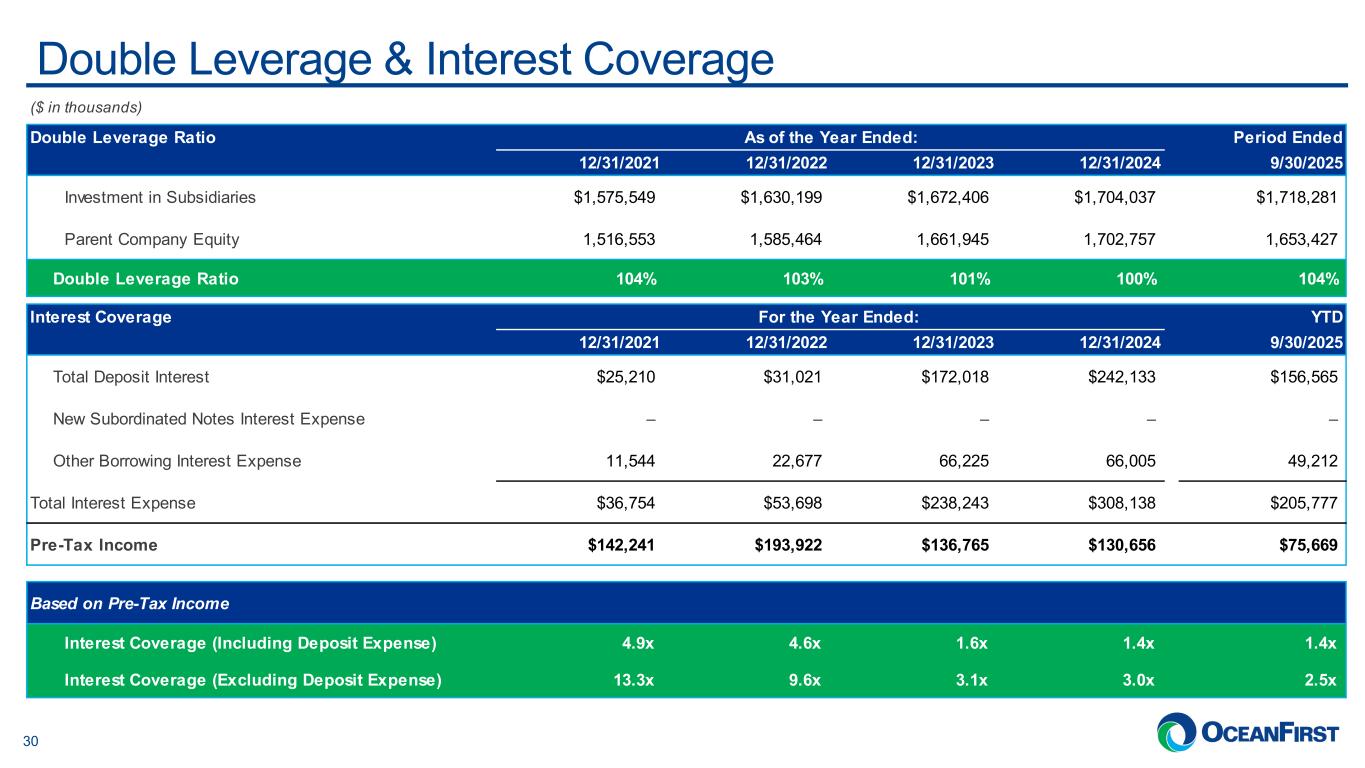

. . .Double Leverage & Interest Coverage 30 ($ in thousands) Double Leverage Ratio As of the Year Ended: Period Ended 12/31/2021 12/31/2022 12/31/2023 12/31/2024 9/30/2025 Investment in Subsidiaries $1,575,549 $1,630,199 $1,672,406 $1,704,037 $1,718,281 Parent Company Equity 1,516,553 1,585,464 1,661,945 1,702,757 1,653,427 Double Leverage Ratio 104% 103% 101% 100% 104% Interest Coverage For the Year Ended: YTD 12/31/2021 12/31/2022 12/31/2023 12/31/2024 9/30/2025 Total Deposit Interest $25,210 $31,021 $172,018 $242,133 $156,565 New Subordinated Notes Interest Expense – – – – – Other Borrowing Interest Expense 11,544 22,677 66,225 66,005 49,212 Total Interest Expense $36,754 $53,698 $238,243 $308,138 $205,777 Pre-Tax Income $142,241 $193,922 $136,765 $130,656 $75,669 Based on Pre-Tax Income Interest Coverage (Including Deposit Expense) 4.9x 4.6x 1.6x 1.4x 1.4x Interest Coverage (Excluding Deposit Expense) 13.3x 9.6x 3.1x 3.0x 2.5x

. . .Deep and Experienced Management with Large Bank Experience Steven Tsimbinos Senior Executive Vice President, General Counsel & Corporate Secretary Joined in 2010 Michele Estep Senior Executive Vice President & Chief Administrative Officer Joined in 2018 David Berninger Senior Executive Vice President & Chief Risk Officer Joined in 2023 Brian Schaeffer Senior Executive Vice President & Chief Information Officer Joined in 2018 Chris Maher Chairman & Chief Executive Officer Joined in 2013 Joseph J. Lebel III President & Chief Operating Officer Joined in 2006 Patrick S. Barrett Senior Executive Vice President & Chief Financial Officer Joined in 2022 31

. . .Highly Qualified Board Chris Maher Chairman & CEO of OCFC Director since 2014 Tony Coscia Partner at Windels Marx; Chairman of the Board of Directors of Amtrak Lead Indep. Director since 2022, Director since 2018 John Barros Managing Principal of Civitas Builder Director since 2023 Grace Torres Former CFO, Treasurer and Principal Financial Officer of Prudential Mutual Funds Director since 2018 Dr. Patricia Turner CEO at American College of Surgeons Director since 2020 Bob Garrett CEO at Hackensack Meridian Health Director since 2023 Joseph Lebel III President & COO of OCFC Director since 2022 Joseph Murphy Jr. EVP at ValuExpress Director since 2020 Dalila Wilson-Scott EVP and Chief Diversity Officer at Comcast; President of the Comcast NBCUniversal Foundation Director since 2023 Jack Farris Vice President and Deputy General Counsel, InfoSec & Cybersecurity at Verizon Director since 2015 Independent Board Members Non-independent Board Members Nicos Katsoulis Investor at Vendavel Energy SA Director since 2019 Steve Scopellite Former Global Chief Information Officer at Goldman Sachs; Director at Ionic Security Director since 2019 10 of 11 (91%) Independent Directors have been added in the last 7 years Kimberly Guadagno Partner at Connell Foley; Former Lt. Governor / Sec. for State for NJ Director since 2018 32

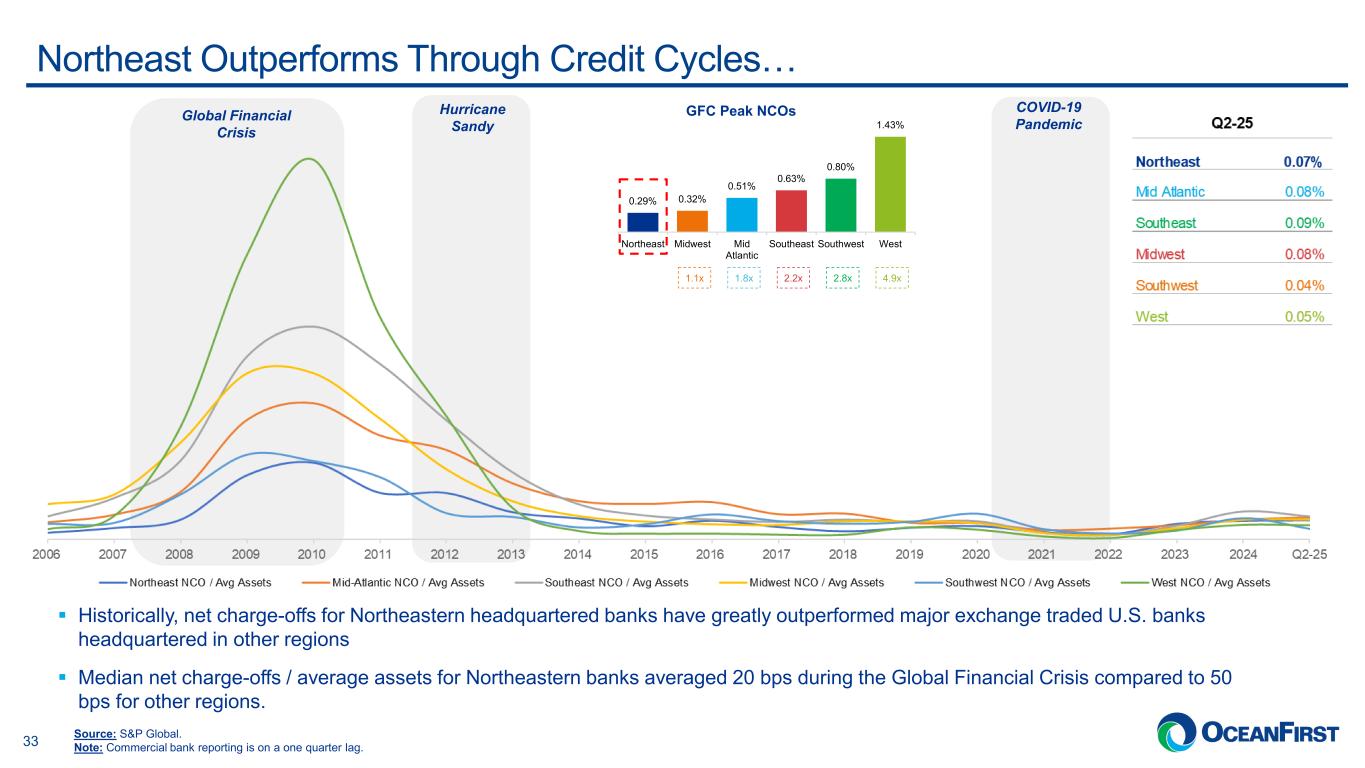

. . . 0.29% 0.32% 0.51% 0.63% 0.80% 1.43% Northeast Midwest Mid Atlantic Southeast Southwest West COVID-19 Pandemic Hurricane Sandy Global Financial Crisis Northeast Outperforms Through Credit Cycles… Historically, net charge-offs for Northeastern headquartered banks have greatly outperformed major exchange traded U.S. banks headquartered in other regions Median net charge-offs / average assets for Northeastern banks averaged 20 bps during the Global Financial Crisis compared to 50 bps for other regions. GFC Peak NCOs 1.1x 1.8x 2.2x 4.9x2.8x Source: S&P Global. Note: Commercial bank reporting is on a one quarter lag.33

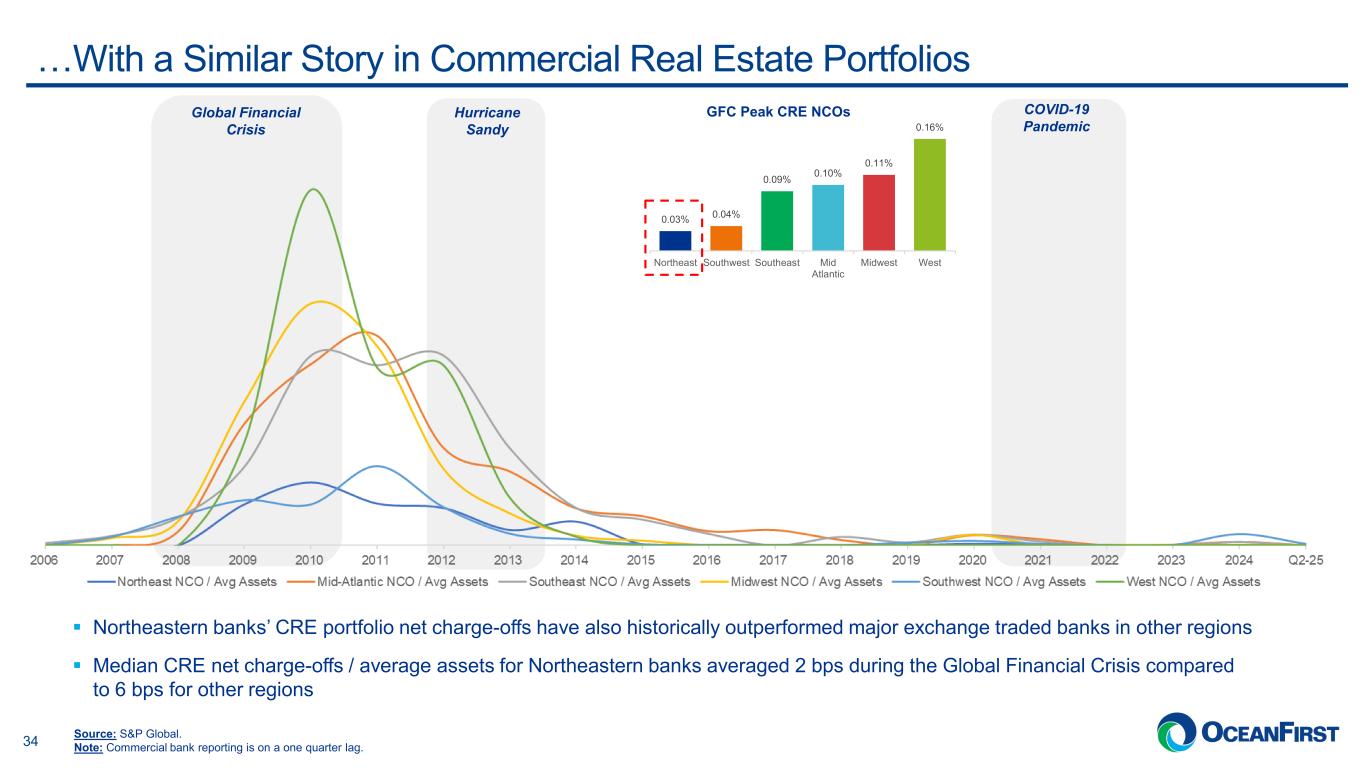

. . . Hurricane Sandy Global Financial Crisis COVID-19 Pandemic …With a Similar Story in Commercial Real Estate Portfolios 0.03% 0.04% 0.09% 0.10% 0.11% 0.16% Northeast Southwest Southeast Mid Atlantic Midwest West GFC Peak CRE NCOs Northeastern banks’ CRE portfolio net charge-offs have also historically outperformed major exchange traded banks in other regions Median CRE net charge-offs / average assets for Northeastern banks averaged 2 bps during the Global Financial Crisis compared to 6 bps for other regions Source: S&P Global. Note: Commercial bank reporting is on a one quarter lag.34

. . .Non-GAAP Reconciliations (1 of 2) 35 Non-GAAP Reconciliation For the Three Months Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Core Earnings: Net income available to common stockholders (GAAP) $ 17,330 $ 16,200 $ 20,505 $ 20,905 $ 24,112 Adjustments to exclude the impact of non-recurring and non-core items: Spring Garden opening provision for credit losses - - - 1,426 - Net loss (gain) on equity investments 7 (488) (205) 5 (1,420) Net gain on sale of trust business - - - - (1,438) Restructuring charges 4,147 - - - - FDIC special assessment release (210) - - - - Merger related expenses - - - 110 1,669 Income tax (benefit) expense on items (926) 115 49 (388) 270 Loss on redemption of preferred stock - 1,842 - - - Core earnings (Non-GAAP) $ 20,348 $ 17,669 $ 20,349 $ 22,058 $ 23,193 Income tax expense 5,156 5,771 6,808 5,083 7,464 Provision for credit losses 4,092 3,039 5,340 3,467 517 Less: non-core provision for credit losses - - - 1,426 - Less: income tax (benefit) expense on non-core items (926) 115 49 (388) 270 Core earnings PTPP (Non-GAAP) $ 30,522 $ 26,364 $ 32,448 $ 29,570 $ 30,904 Core earnings diluted earnings per share $ 0.36 $ 0.31 $ 0.35 $ 0.38 $ 0.39 Core earnings PTPP diluted earnings per share $ 0.54 $ 0.46 $ 0.56 $ 0.51 $ 0.53 Core Ratios (Annualized): Return on average assets 0.60% 0.53% 0.62% 0.65% 0.69% Return on average tangible stockholders’ equity 7.19 6.17 7.00 7.51 7.85 Return on average tangible common equity 7.19 6.17 7.34 7.89 8.24 Efficiency ratio 70.30 72.28 65.81 67.74 66.00

. . .Non-GAAP Reconciliations (2 of 2) 36 Non-GAAP Reconciliation For the Three Months Ended September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 Tangible Equity: Total stockholders' equity $ 1,653,427 $ 1,643,680 $ 1,709,117 $ 1,702,757 $ 1,694,508 Less: Goodwill 523,308 523,308 523,308 523,308 506,146 Intangibles 9,934 10,834 11,740 12,680 7,056 Tangible stockholders' equity 1,120,185 1,109,538 1,174,069 1,166,769 1,181,306 Less: Preferred stock - - 55,527 55,527 55,527 Tangible common equity $ 1,120,185 $ 1,109,538 $ 1,118,542 $ 1,111,242 $ 1,125,779 Tangible Assets: Total Assets $ 14,324,664 $ 13,327,847 $ 13,309,278 $ 13,421,247 $ 13,488,483 Less: Goodwill 523,308 523,308 523,308 523,308 506,146 Intangibles 9,934 10,834 11,740 12,680 7,056 Tangible Assets $ 13,791,422 $ 12,793,705 $ 12,774,230 $ 12,885,259 $ 12,975,281 Tangible stockholders' equity to tangible assets 8.12% 8.67% 9.19% 9.06% 9.10% Tangible common equity to tangible assets 8.12% 8.67% 8.76% 8.62% 8.68%