2025 THIRD QUARTER EARNINGS October 23, 2025 Delivering For Customers AND Investors 1

2 This presentation and the oral remarks made in connection with it contain statements regarding PG&E Corporation’s and Pacific Gas and Electric Company’s (the “Utility”) future performance, including expectations, objectives, and forecasts about operating results (including 2025 and 2026 non-GAAP core earnings), debt and equity issuances, refinancing activity, rate base growth, capital expenditures, cash flow, cost savings, customer bills, inflation, wildfire risk mitigation, wildfire-related cost recovery, dividends, load growth, operating and maintenance costs, financing efficiency, capital to expense ratio, technology (including AI) and regulatory developments. These statements and other statements that are not purely historical constitute forward-looking statements that are necessarily subject to various risks and uncertainties. Actual results may differ materially from those described in forward-looking statements. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Factors that could cause actual results to differ materially include, but are not limited to, risks and uncertainties associated with: • wildfires that have occurred or may occur in the Utility’s service area, including the extent of the Utility’s liability in connection with the 2019 Kincade fire, the 2021 Dixie fire, the 2022 Mosquito fire, and future wildfires; • the Utility’s ability to recover wildfire-related costs, including costs for the 2021 Dixie fire, from the Wildfire Fund and Continuation Account (including the Utility’s maintenance of a valid safety certificate and whether the Wildfire Fund or Continuation Account has sufficient remaining funds), and through the WEMA and FERC TO rate cases; • the Utility’s implementation of its wildfire mitigation programs, including PSPS, EPSS, situational awareness and response, undergrounding, and the programs’ effectiveness; • the Utility’s ability to safely and reliably operate, maintain, construct, and decommission its facilities; • changes in the electric power and natural gas industries driven by technological advancements and a decarbonized economy; • a cyber incident, cybersecurity breach, or physical attack; • severe weather events, extended drought, and climate change, particularly their impact on the likelihood and severity of wildfires; • the impact of legislative and regulatory developments, including those regarding the Wildfire Fund, wildfires, the environment, California’s clean energy goals, the nuclear industry, extended operations at Diablo Canyon nuclear power plant, utilities’ transactions with their affiliates, municipalization, privacy, import tariffs, and taxes; • the timing and outcome of FERC and CPUC proceedings, including regarding ratemaking, cost recovery, and other matters; • the outcome of self-reports, agency compliance reports, investigations, or other enforcement actions; • PG&E Corporation and the Utility’s substantial indebtedness, which may adversely affect their financial health and limit their operating flexibility; • the timing and outcome of PG&E Corporation’s and the Utility’s litigation, including securities class action claims, and wildfire-related litigation; • the Utility’s ability to manage its costs effectively, timely recover costs through rates, and achieve projected savings and the extent of excess unrecoverable costs; • the tax treatment of certain assets and liabilities, including whether PG&E Corporation or the Utility undergoes an “ownership change” that limits certain tax attributes; • the impact of growing distributed and renewable generation resources, and changing customer demand for natural gas and electric services; • the Utility’s ability and cost to construct necessary infrastructure and the extent of customer demand for new load; and • the other factors disclosed in PG&E Corporation’s and the Utility’s joint Annual Report on Form 10-K for the year ended December 31, 2024, their joint Quarterly Form 10-Q for the quarter ended September 30, 2025 (the “Form 10-Q”), and other reports filed with the SEC, which are available on PG&E Corporation’s website at www.pgecorp.com and on the SEC’s website at www.sec.gov. Undefined, capitalized terms have the meanings set forth in the Form 10-Q. Unless otherwise indicated, the statements in this presentation are made as of October 23, 2025. PG&E Corporation and the Utility undertake no obligation to update information contained herein. This presentation was attached to PG&E Corporation’s and the Utility’s joint Current Report on Form 8-K that was furnished to the SEC on October 23, 2025, and is also available on PG&E Corporation’s website at www.pgecorp.com. Forward-Looking Statements

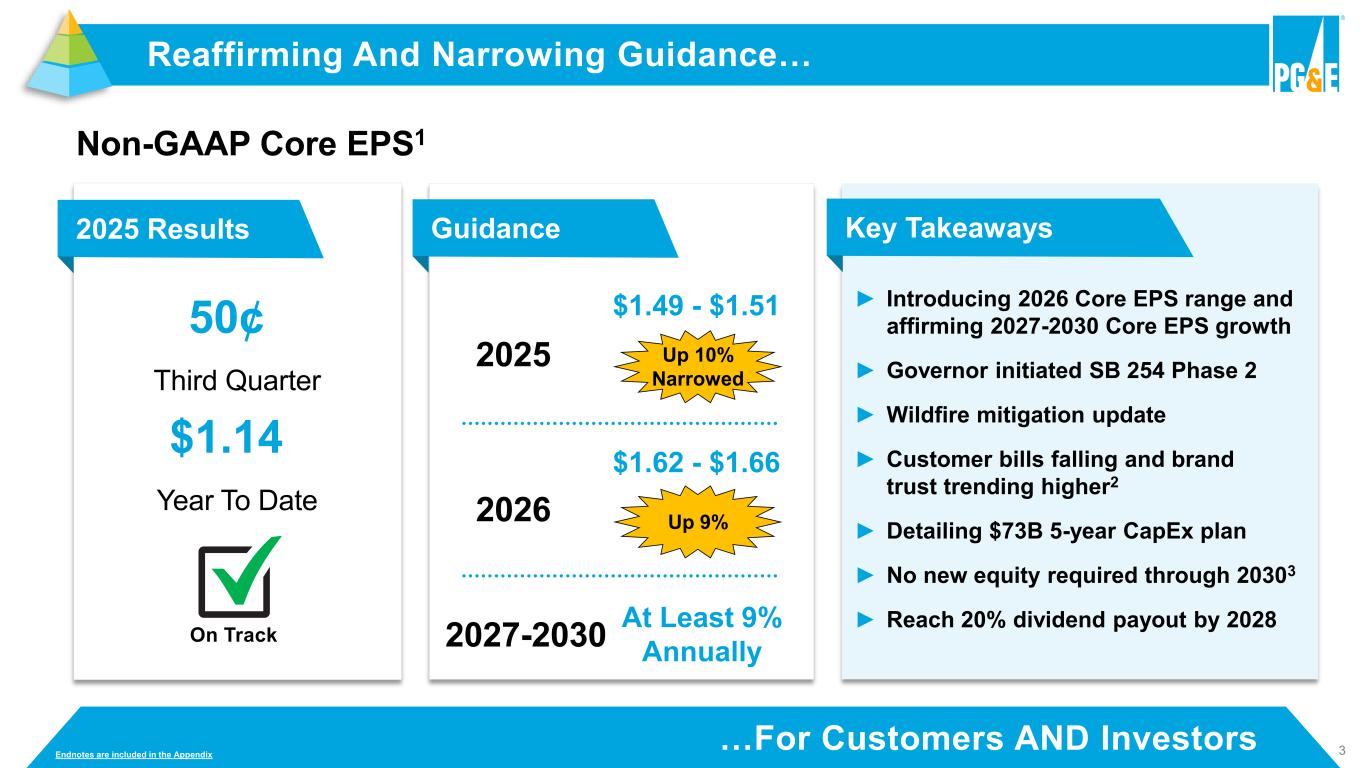

3 Non-GAAP Core EPS1 50¢ Third Quarter 2025 Results …For Customers AND Investors Reaffirming And Narrowing Guidance… Endnotes are included in the Appendix Guidance On Track ► Introducing 2026 Core EPS range and affirming 2027-2030 Core EPS growth ► Governor initiated SB 254 Phase 2 ► Wildfire mitigation update ► Customer bills falling and brand trust trending higher2 ► Detailing $73B 5-year CapEx plan ► No new equity required through 20303 ► Reach 20% dividend payout by 2028 Key Takeaways $1.14 Year To Date 2025 At Least 9% Annually 2027-2030 $1.62 - $1.66 2026 $1.49 - $1.51 Up 10% Narrowed Up 9%

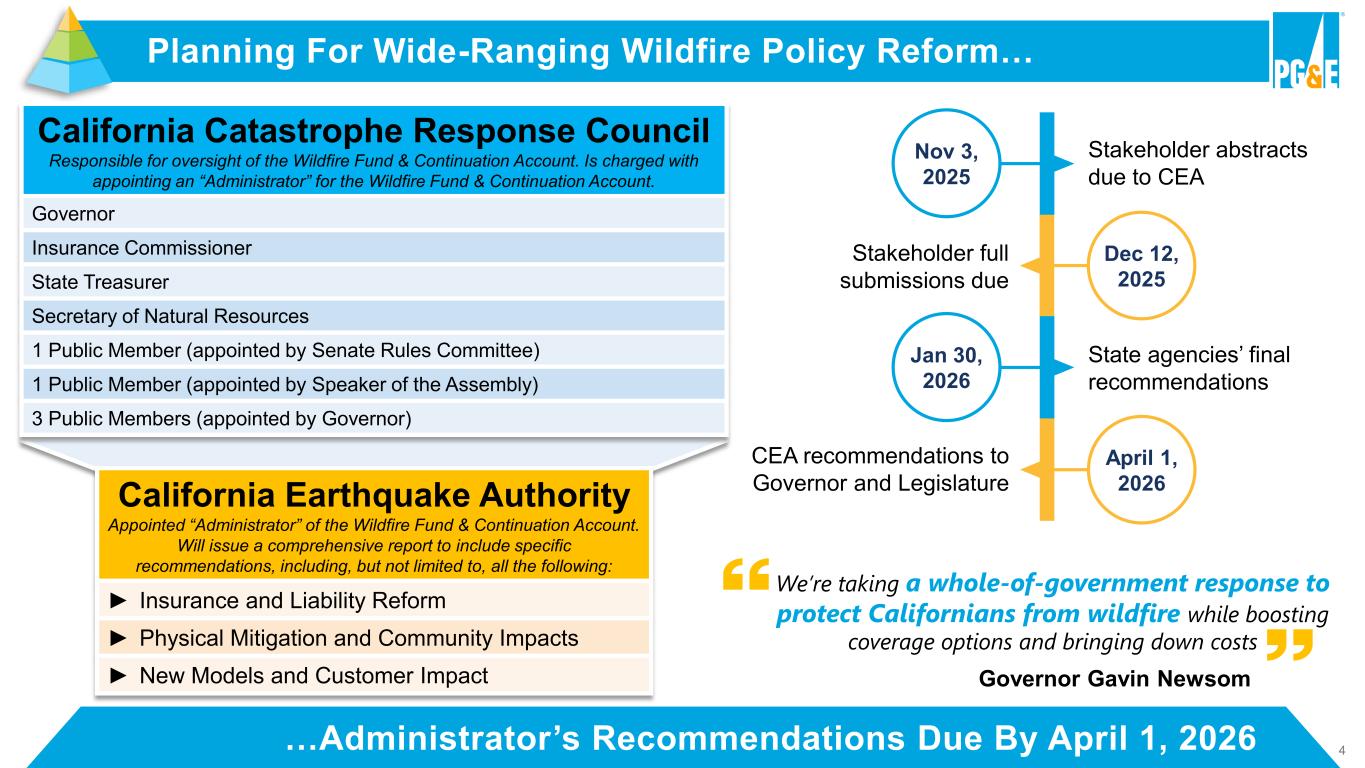

4 Planning For Wide-Ranging Wildfire Policy Reform… …Administrator’s Recommendations Due By April 1, 2026 California Catastrophe Response Council Responsible for oversight of the Wildfire Fund & Continuation Account. Is charged with appointing an “Administrator” for the Wildfire Fund & Continuation Account. Governor Insurance Commissioner State Treasurer Secretary of Natural Resources 1 Public Member (appointed by Senate Rules Committee) 1 Public Member (appointed by Speaker of the Assembly) 3 Public Members (appointed by Governor) California Earthquake Authority Appointed “Administrator” of the Wildfire Fund & Continuation Account. Will issue a comprehensive report to include specific recommendations, including, but not limited to, all the following: ► Insurance and Liability Reform ► Physical Mitigation and Community Impacts ► New Models and Customer Impact Dec 12, 2025 Stakeholder full submissions due Nov 3, 2025 Stakeholder abstracts due to CEA Jan 30, 2026 State agencies’ final recommendations April 1, 2026 CEA recommendations to Governor and Legislature We’re taking a whole-of-government response to protect Californians from wildfire while boosting coverage options and bringing down costs Governor Gavin Newsom

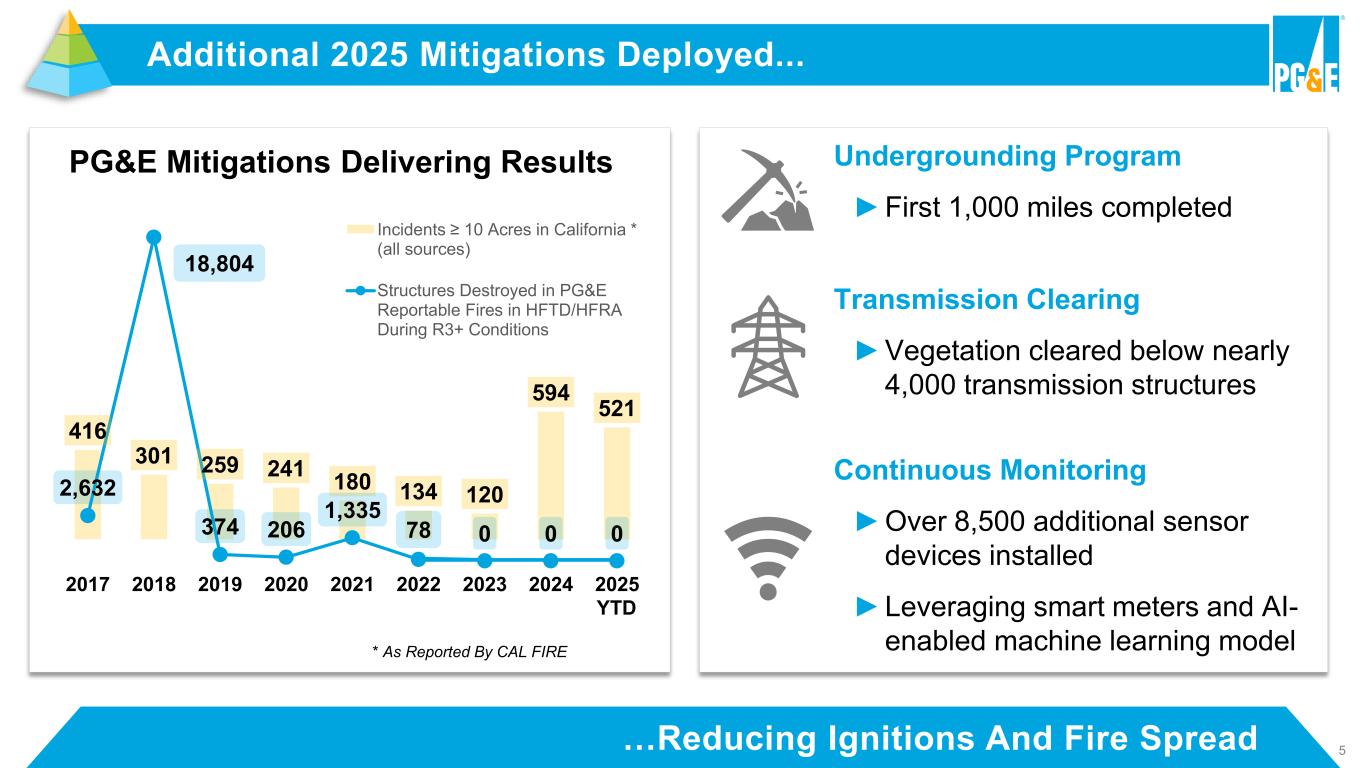

5…Reducing Ignitions And Fire Spread Additional 2025 Mitigations Deployed... Undergrounding Program ►First 1,000 miles completed Transmission Clearing ►Vegetation cleared below nearly 4,000 transmission structures Continuous Monitoring ►Over 8,500 additional sensor devices installed ►Leveraging smart meters and AI- enabled machine learning model PG&E Mitigations Delivering Results * As Reported By CAL FIRE 416 301 259 241 180 134 120 594 521 2,632 18,804 374 206 1,335 78 0 0 0 0 2000 4000 6000 8000 10000 12000 14000 16000 18000 20000 -100 100 300 500 700 900 1100 1300 1500 2017 2018 2019 2020 2021 2022 2023 2024 2025 Incidents ≥ 10 Acres in California * (all sources) Structures Destroyed in PG&E Reportable Fires in HFTD/HFRA During R3+ Conditions YTD

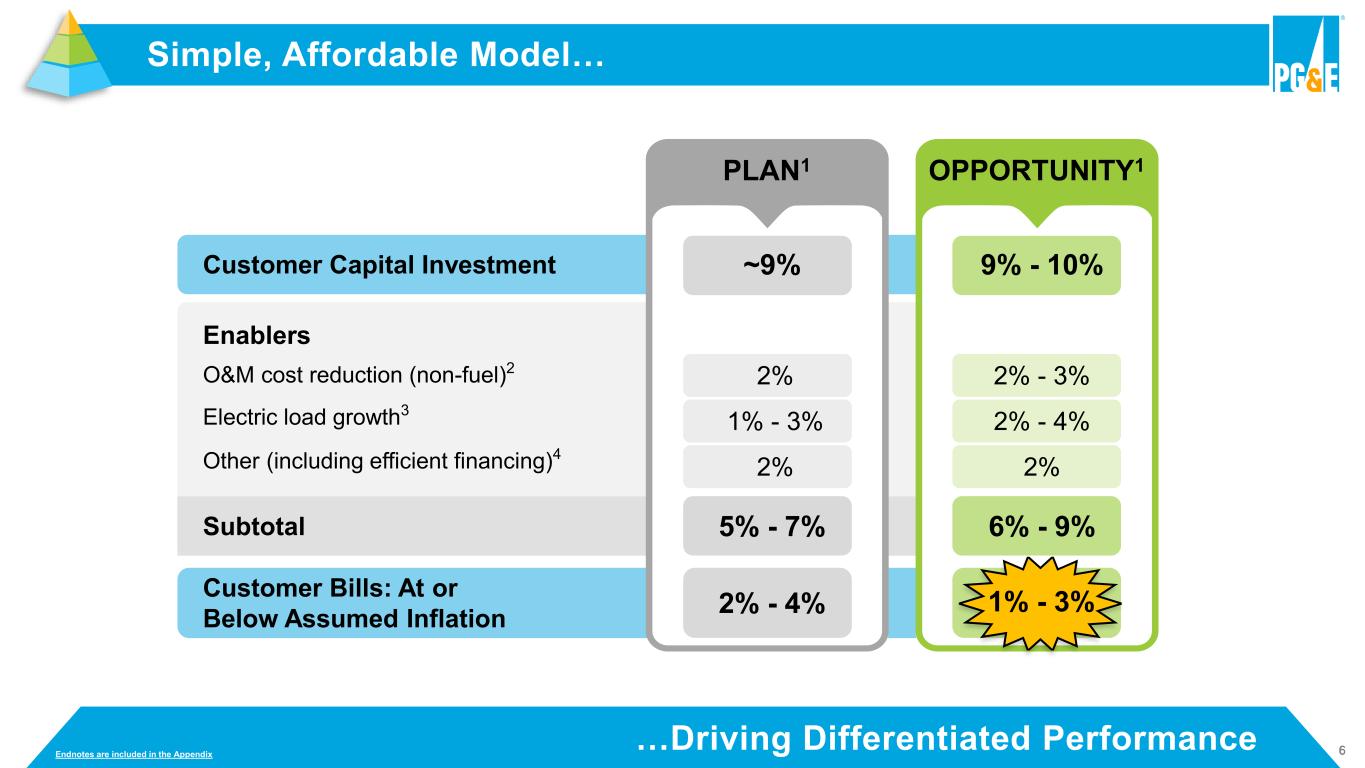

6…Driving Differentiated Performance Simple, Affordable Model… Endnotes are included in the Appendix Subtotal Enablers O&M cost reduction (non-fuel)2 Electric load growth3 Other (including efficient financing)4 Customer Capital Investment Customer Bills: At or Below Assumed Inflation 2% 1% - 3% 2% ~9% 5% - 7% 2% - 4% PLAN1 2% - 3% 2% - 4% 2% 9% - 10% 6% - 9% 1% - 3% - - OPPORTUNITY1

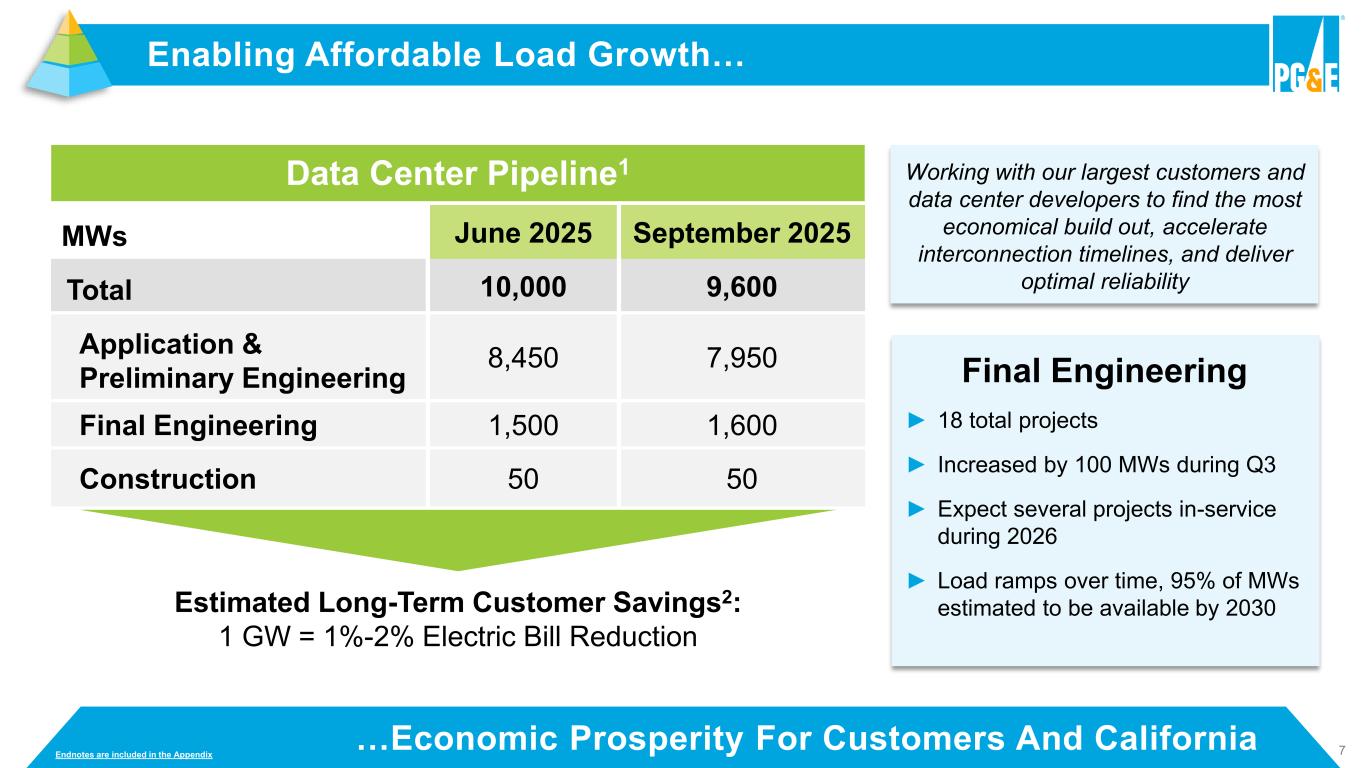

7…Economic Prosperity For Customers And California Enabling Affordable Load Growth… Data Center Pipeline1 Estimated Long-Term Customer Savings2: 1 GW = 1%-2% Electric Bill Reduction MWs June 2025 September 2025 Total 10,000 9,600 Application & Preliminary Engineering 8,450 7,950 Final Engineering 1,500 1,600 Construction 50 50 Endnotes are included in the Appendix Final Engineering ► 18 total projects ► Increased by 100 MWs during Q3 ► Expect several projects in-service during 2026 ► Load ramps over time, 95% of MWs estimated to be available by 2030 Working with our largest customers and data center developers to find the most economical build out, accelerate interconnection timelines, and deliver optimal reliability

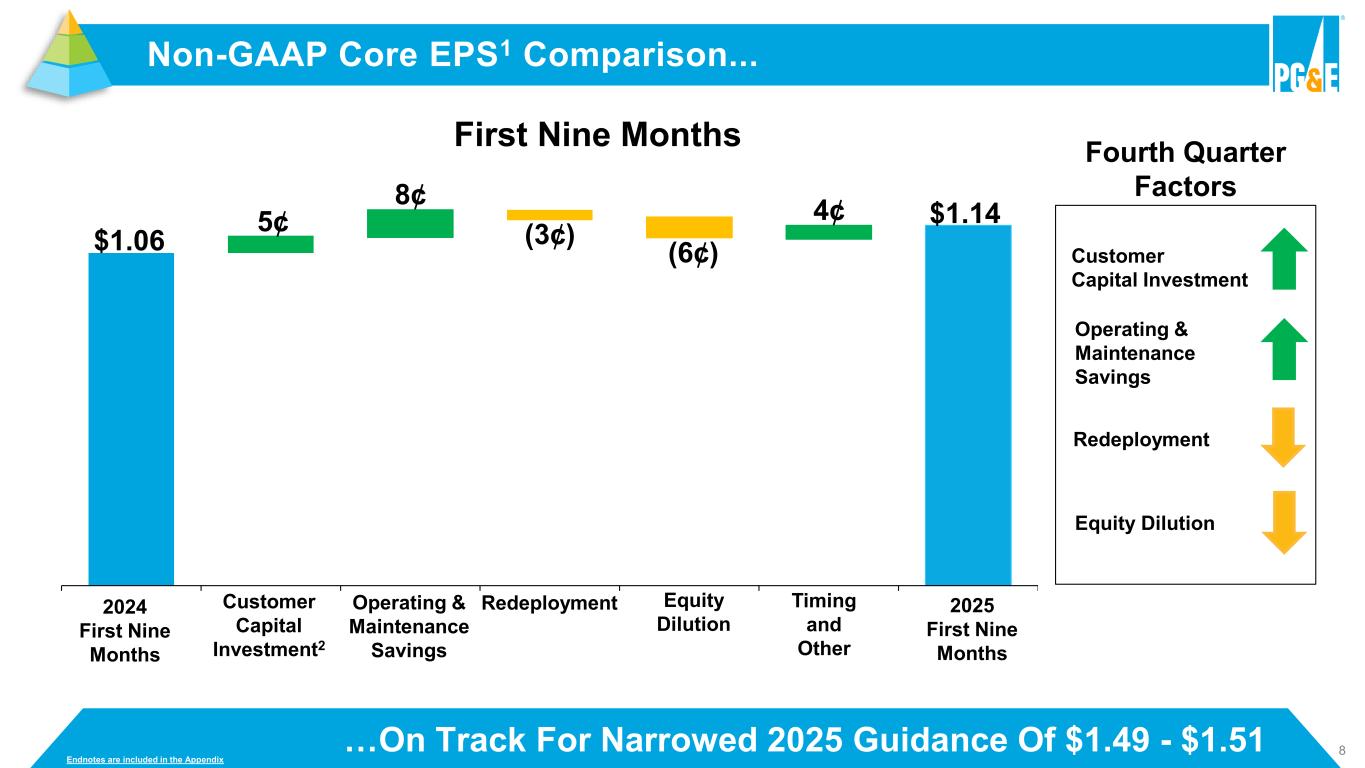

8 Non-GAAP Core EPS1 Comparison... Endnotes are included in the Appendix Fourth Quarter Factors $1.14 8¢ 4¢ First Nine Months Equity Dilution 2025 First Nine Months 2024 First Nine Months Customer Capital Investment2 Redeployment 5¢ $1.06 Operating & Maintenance Savings (3¢) …On Track For Narrowed 2025 Guidance Of $1.49 - $1.51 Endnotes are included in the Appendix Operating & Maintenance Savings Customer Capital Investment Redeployment Equity Dilution (6¢) Timing and Other

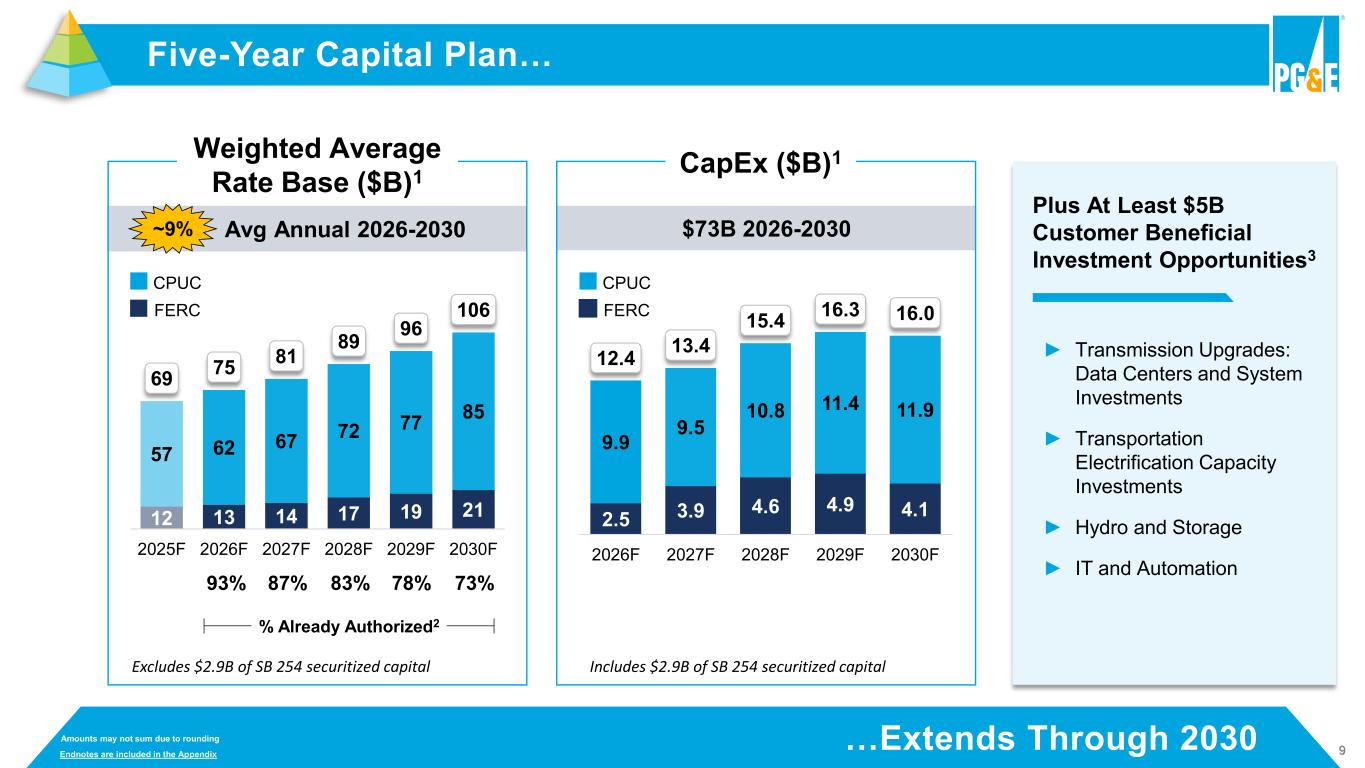

9…Extends Through 2030 Five-Year Capital Plan… Plus At Least $5B Customer Beneficial Investment Opportunities3 CPUC FERC XX% Avg Annual 2026-2030 % Already Authorized2 87% 83% 78% 73% Weighted Average Rate Base ($B)1 $73B 2026-2030 CPUC FERC CapEx ($B)1 Endnotes are included in the Appendix ~9% 12 13 14 17 19 21 57 62 67 72 77 85 69 75 81 89 96 106 2025F 2026F 2027F 2028F 2029F 2030F 2.5 3.9 4.6 4.9 4.1 9.9 9.5 10.8 11.4 11.9 12.4 13.4 15.4 16.3 16.0 2026F 2027F 2028F 2029F 2030F ► Transmission Upgrades: Data Centers and System Investments ► Transportation Electrification Capacity Investments ► Hydro and Storage ► IT and Automation 93% Includes $2.9B of SB 254 securitized capitalExcludes $2.9B of SB 254 securitized capital Amounts may not sum due to rounding

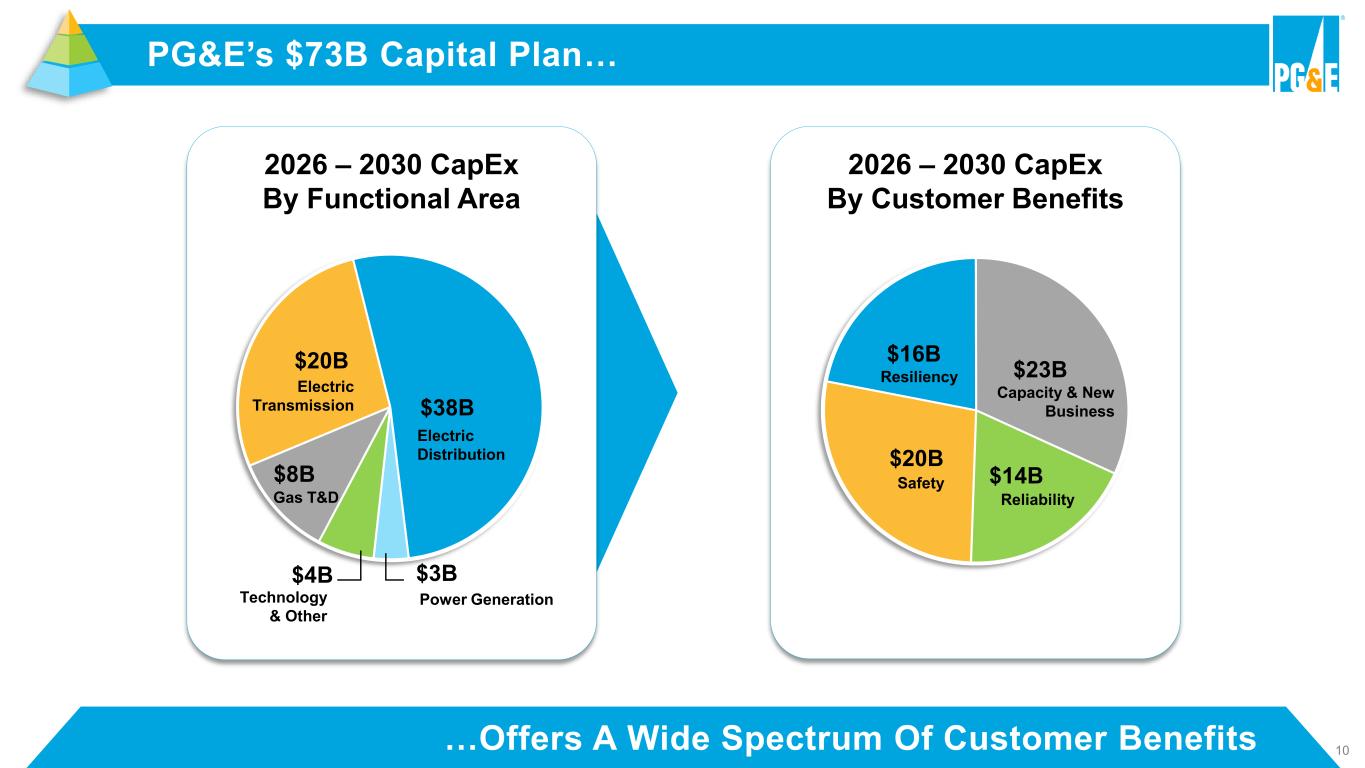

Internal 10 PG&E’s $73B Capital Plan… …Offers A Wide Spectrum Of Customer Benefits $3B$4B $8B $20B $38B Electric Distribution Electric Transmission Technology & Other Gas T&D Power Generation 2026 – 2030 CapEx By Functional Area $20B $16B $23B $14BSafety Capacity & New Business Reliability 2026 – 2030 CapEx By Customer Benefits Resiliency

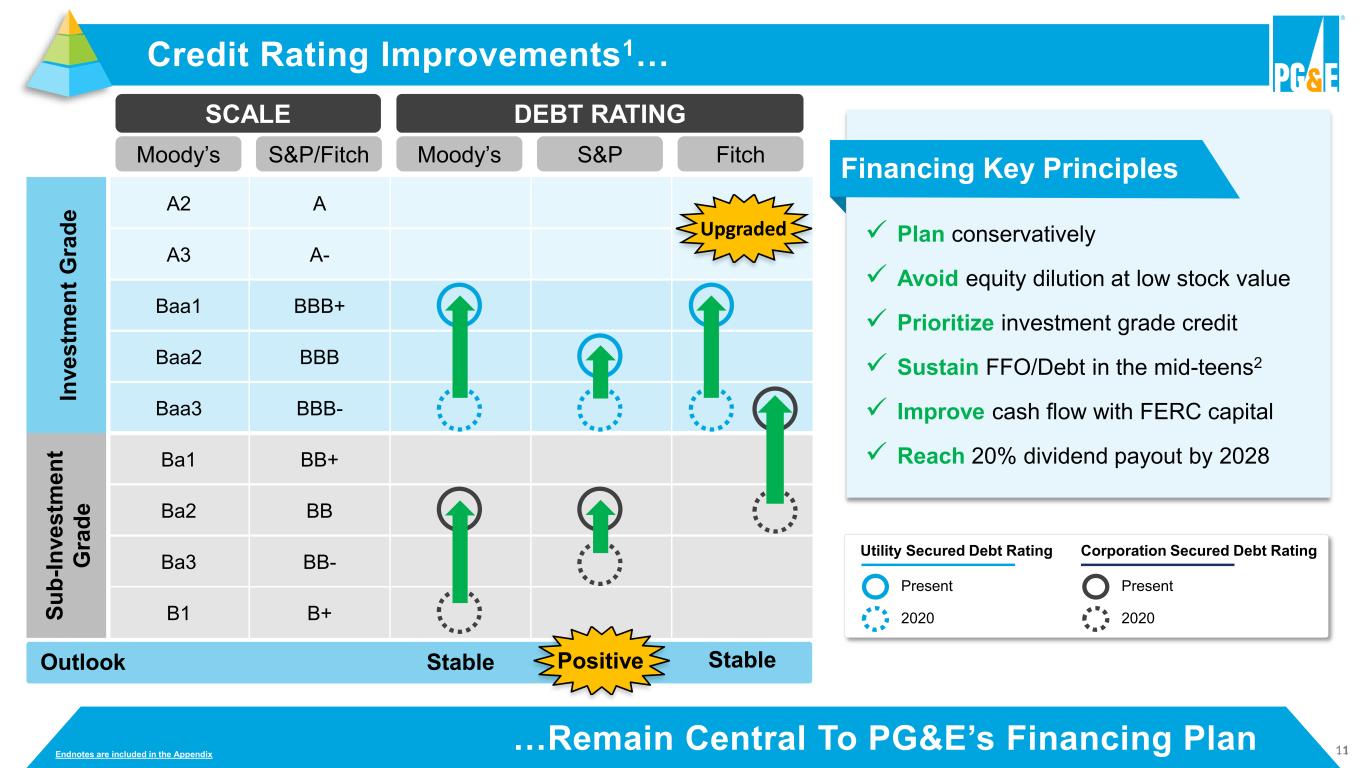

11…Remain Central To PG&E’s Financing Plan SCALE RATING In v e s tm e n t G ra d e A2 A A3 A- Baa1 BBB+ Baa2 BBB Baa3 BBB- S u b -I n v e s tm e n t G ra d e Ba1 BB+ Ba2 BB Ba3 BB- B1 B+ Outlook Stable Credit Rating Improvements1… Positive Stable SCALE DEBT RATING Moody’s S&P/Fitch Moody’s S&P Fitch Present 2020 Corporation Secured Debt Rating Present 2020 Utility Secured Debt Rating Endnotes are included in the Appendix Financing Key Principles ✓ Plan conservatively ✓ Avoid equity dilution at low stock value ✓ Prioritize investment grade credit ✓ Sustain FFO/Debt in the mid-teens2 ✓ Improve cash flow with FERC capital ✓ Reach 20% dividend payout by 2028 Upgraded

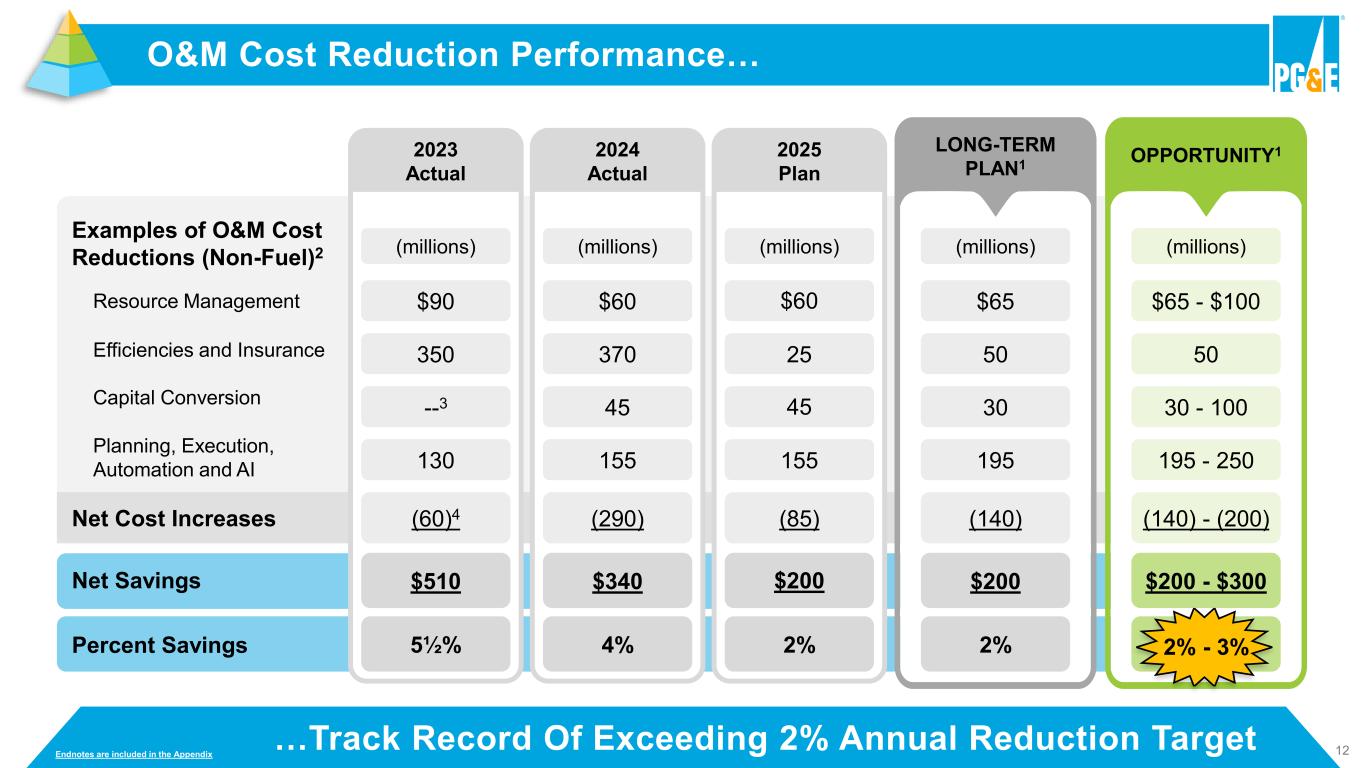

12 O&M Cost Reduction Performance… Examples of O&M Cost Reductions (Non-Fuel)2 Resource Management Efficiencies and Insurance Capital Conversion Planning, Execution, Automation and AI Net Cost Increases Net Savings Percent Savings $510 5½% (60)4 130 --3 350 $90 (millions) 2023 Actual $340 4% (290) 155 45 370 $60 (millions) 2024 Actual $200 2% (85) 155 45 25 $60 (millions) 2025 Plan $200 2% (140) 195 30 50 $65 (millions) LONG-TERM PLAN1 …Track Record Of Exceeding 2% Annual Reduction Target $200 - $300 2% - 3% (140) - (200) 195 - 250 30 - 100 50 $65 - $100 (millions) OPPORTUNITY1 Endnotes are included in the Appendix

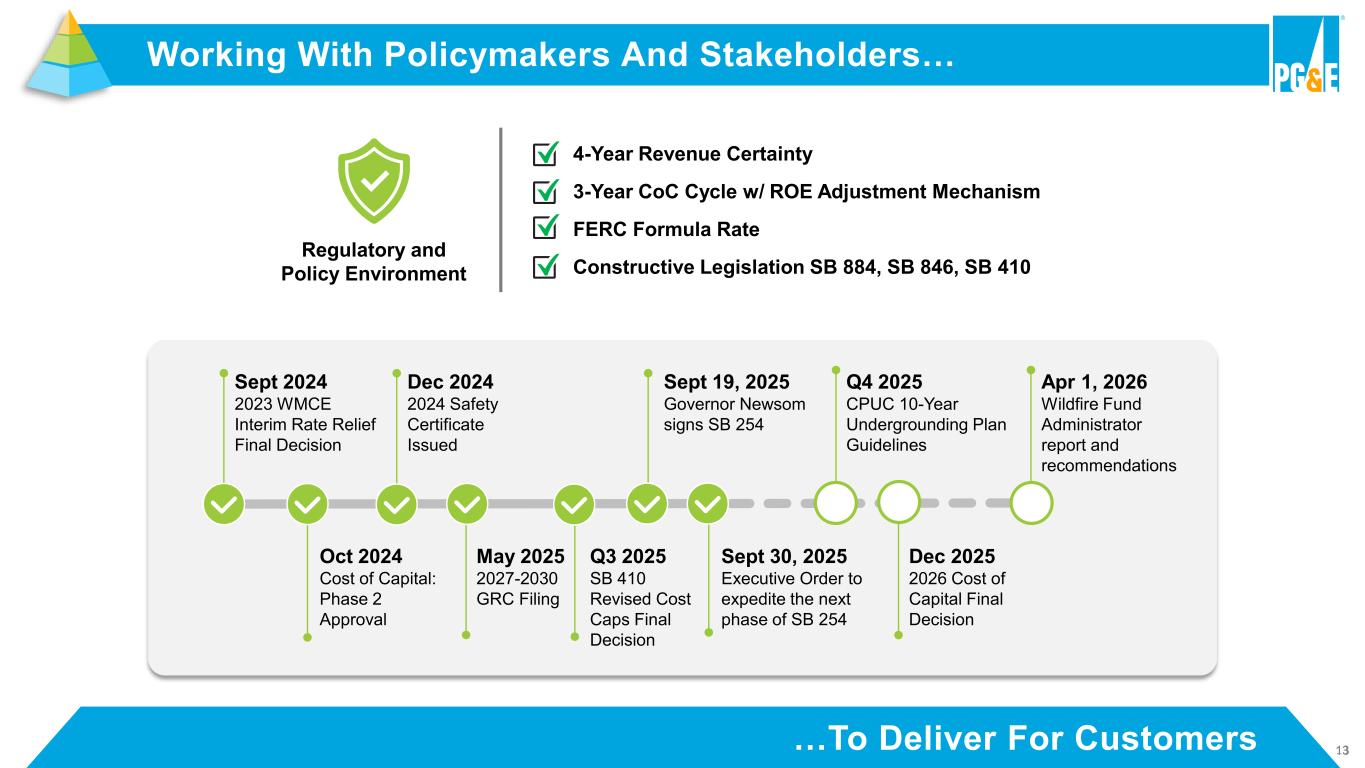

13…To Deliver For Customers Working With Policymakers And Stakeholders… Constructive Legislation SB 884, SB 846, SB 410 4-Year Revenue Certainty 3-Year CoC Cycle w/ ROE Adjustment Mechanism FERC Formula Rate Regulatory and Policy Environment Q4 2025 CPUC 10-Year Undergrounding Plan Guidelines Oct 2024 Cost of Capital: Phase 2 Approval Dec 2025 2026 Cost of Capital Final Decision Sept 2024 2023 WMCE Interim Rate Relief Final Decision Dec 2024 2024 Safety Certificate Issued Sept 19, 2025 Governor Newsom signs SB 254 May 2025 2027-2030 GRC Filing Q3 2025 SB 410 Revised Cost Caps Final Decision Sept 30, 2025 Executive Order to expedite the next phase of SB 254 Apr 1, 2026 Wildfire Fund Administrator report and recommendations

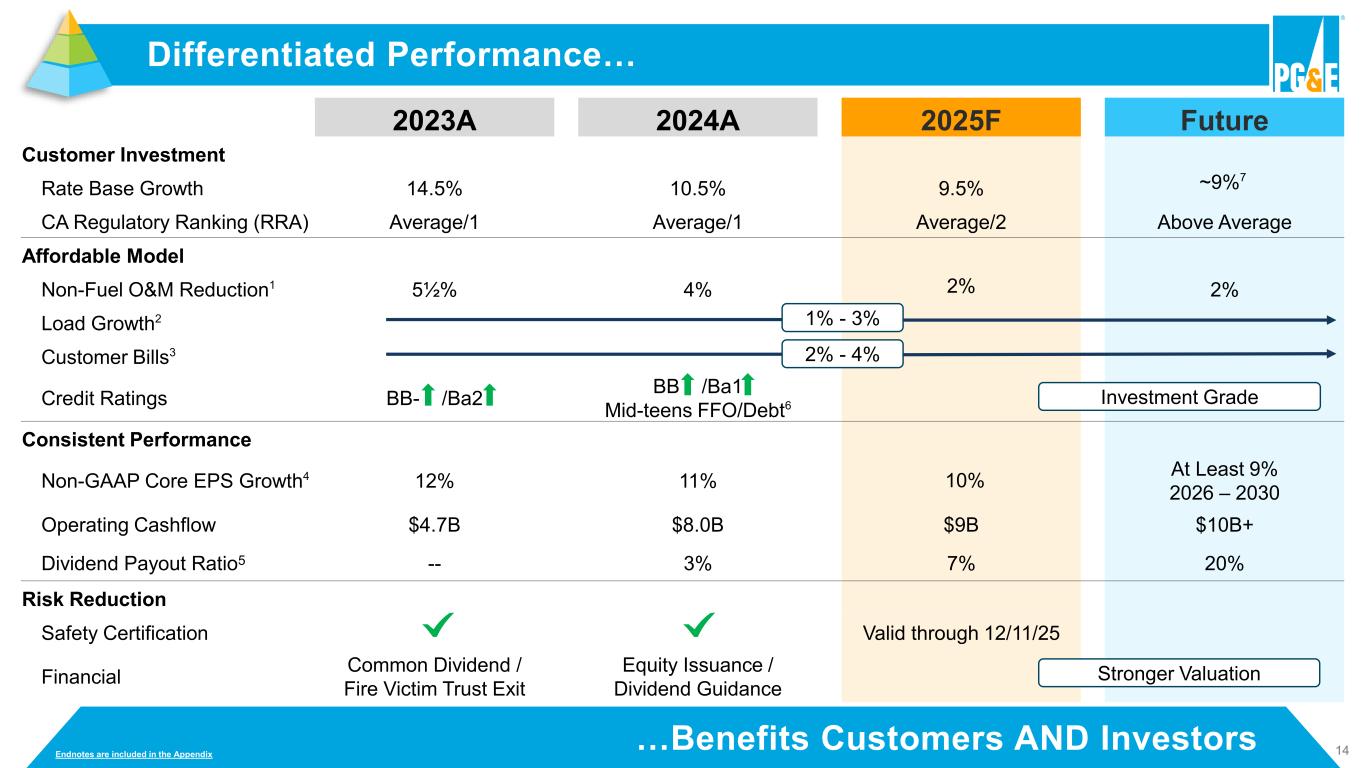

14…Benefits Customers AND Investors 2023A 2024A 2025F Future Customer Investment Rate Base Growth 14.5% 10.5% 9.5% CA Regulatory Ranking (RRA) Average/1 Average/1 Average/2 Above Average Affordable Model Non-Fuel O&M Reduction1 5½% 4% 2% 2% Load Growth2 Customer Bills3 Credit Ratings BB- /Ba2 BB /Ba1 Mid-teens FFO/Debt6 Consistent Performance Non-GAAP Core EPS Growth4 12% 11% 10% At Least 9% 2026 – 2030 Operating Cashflow $4.7B $8.0B $9B $10B+ Dividend Payout Ratio5 -- 3% 7% 20% Risk Reduction Safety Certification Valid through 12/11/25 Financial Common Dividend / Fire Victim Trust Exit Equity Issuance / Dividend Guidance Differentiated Performance… 1% - 3% 2% - 4% Stronger Valuation 2 ~9%7 Investment Grade 10 Endnotes are included in the Appendix

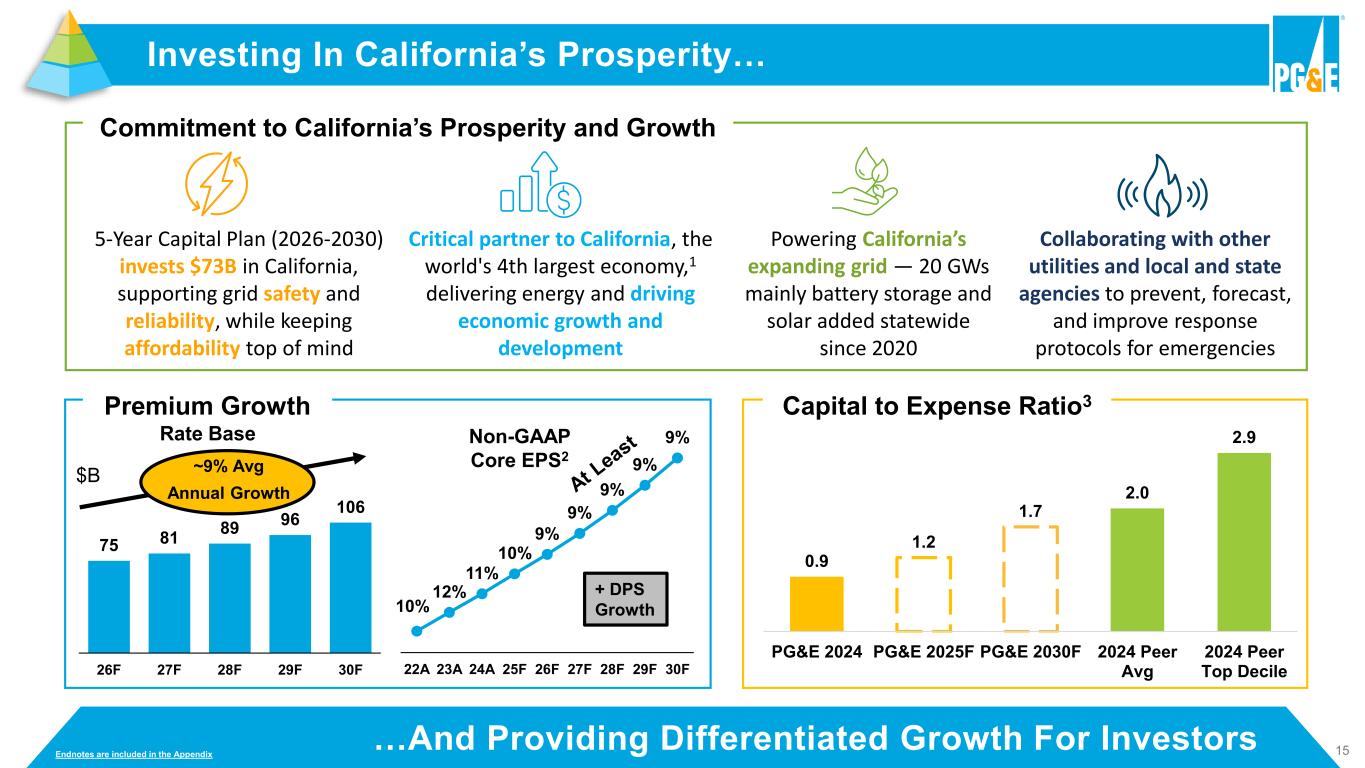

15…And Providing Differentiated Growth For Investors Investing In California’s Prosperity… Commitment to California’s Prosperity and Growth 10% 12% 11% 10% 9% 9% 9% 9% 9% 22A 23A 24A 25F 26F 27F 28F 29F 30F $B 0.9 1.2 1.7 2.0 2.9 PG&E 2024 PG&E 2025F PG&E 2030F 2024 Peer Avg 2024 Peer Top Decile Premium Growth Capital to Expense Ratio3 ~9% Avg Annual Growth Rate Base Non-GAAP Core EPS2 + DPS Growth 75 81 89 96 106 26F 27F 28F 29F 30F Endnotes are included in the Appendix 5-Year Capital Plan (2026-2030) invests $73B in California, supporting grid safety and reliability, while keeping affordability top of mind Critical partner to California, the world's 4th largest economy,1 delivering energy and driving economic growth and development Powering California’s expanding grid — 20 GWs mainly battery storage and solar added statewide since 2020 Collaborating with other utilities and local and state agencies to prevent, forecast, and improve response protocols for emergencies

16 Physical and Financial Safety Decarbonized Energy System Affordable and Resilient Energy Q&A

Appendix 1 Presentation Endnotes 17

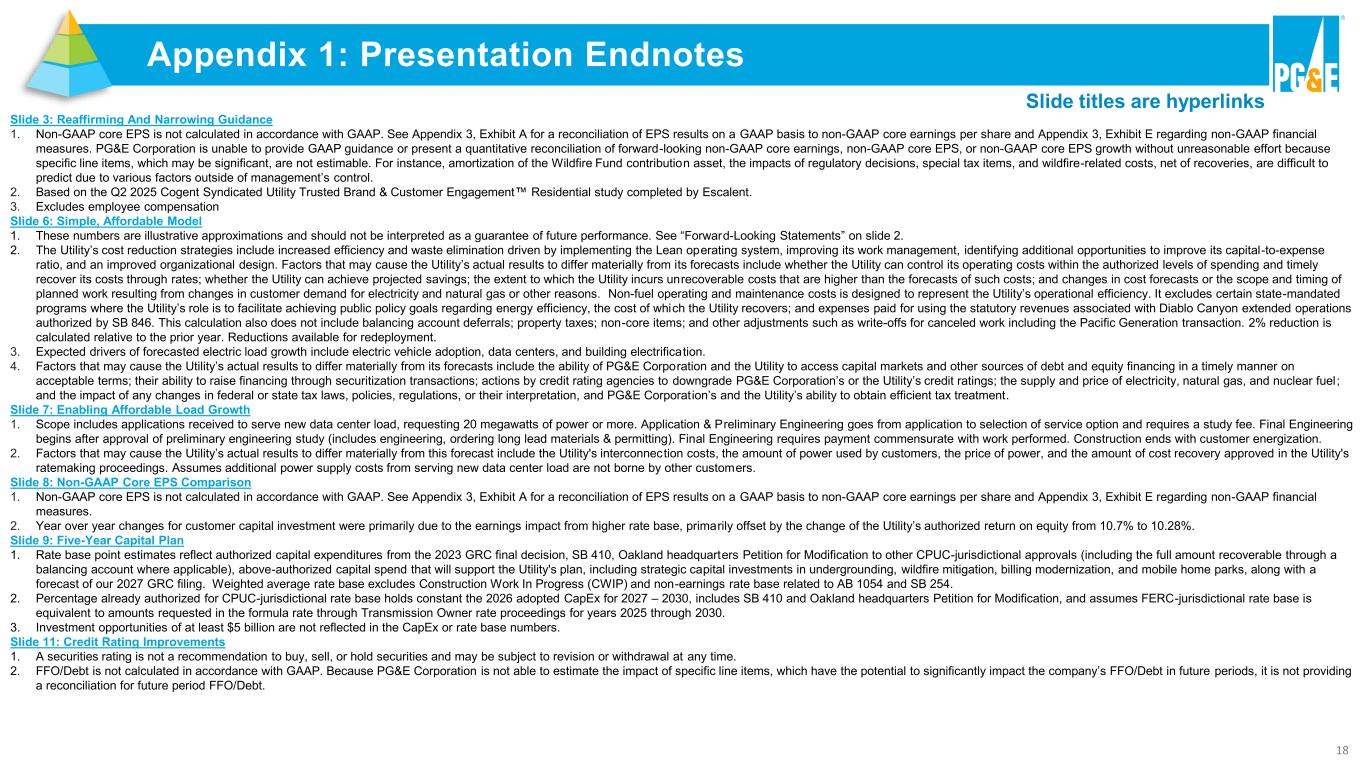

18 Appendix 1: Presentation Endnotes Slide 3: Reaffirming And Narrowing Guidance 1. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit A for a reconciliation of EPS results on a GAAP basis to non-GAAP core earnings per share and Appendix 3, Exhibit E regarding non-GAAP financial measures. PG&E Corporation is unable to provide GAAP guidance or present a quantitative reconciliation of forward-looking non-GAAP core earnings, non-GAAP core EPS, or non-GAAP core EPS growth without unreasonable effort because specific line items, which may be significant, are not estimable. For instance, amortization of the Wildfire Fund contribution asset, the impacts of regulatory decisions, special tax items, and wildfire-related costs, net of recoveries, are difficult to predict due to various factors outside of management’s control. 2. Based on the Q2 2025 Cogent Syndicated Utility Trusted Brand & Customer Engagement Residential study completed by Escalent. 3. Excludes employee compensation Slide 6: Simple, Affordable Model 1. These numbers are illustrative approximations and should not be interpreted as a guarantee of future performance. See “Forward-Looking Statements” on slide 2. 2. The Utility’s cost reduction strategies include increased efficiency and waste elimination driven by implementing the Lean operating system, improving its work management, identifying additional opportunities to improve its capital-to-expense ratio, and an improved organizational design. Factors that may cause the Utility’s actual results to differ materially from its forecasts include whether the Utility can control its operating costs within the authorized levels of spending and timely recover its costs through rates; whether the Utility can achieve projected savings; the extent to which the Utility incurs unrecoverable costs that are higher than the forecasts of such costs; and changes in cost forecasts or the scope and timing of planned work resulting from changes in customer demand for electricity and natural gas or other reasons. Non-fuel operating and maintenance costs is designed to represent the Utility’s operational efficiency. It excludes certain state-mandated programs where the Utility’s role is to facilitate achieving public policy goals regarding energy efficiency, the cost of which the Utility recovers; and expenses paid for using the statutory revenues associated with Diablo Canyon extended operations authorized by SB 846. This calculation also does not include balancing account deferrals; property taxes; non-core items; and other adjustments such as write-offs for canceled work including the Pacific Generation transaction. 2% reduction is calculated relative to the prior year. Reductions available for redeployment. 3. Expected drivers of forecasted electric load growth include electric vehicle adoption, data centers, and building electrification. 4. Factors that may cause the Utility’s actual results to differ materially from its forecasts include the ability of PG&E Corporation and the Utility to access capital markets and other sources of debt and equity financing in a timely manner on acceptable terms; their ability to raise financing through securitization transactions; actions by credit rating agencies to downgrade PG&E Corporation’s or the Utility’s credit ratings; the supply and price of electricity, natural gas, and nuclear fuel ; and the impact of any changes in federal or state tax laws, policies, regulations, or their interpretation, and PG&E Corporation’s and the Utility’s ability to obtain efficient tax treatment. Slide 7: Enabling Affordable Load Growth 1. Scope includes applications received to serve new data center load, requesting 20 megawatts of power or more. Application & Preliminary Engineering goes from application to selection of service option and requires a study fee. Final Engineering begins after approval of preliminary engineering study (includes engineering, ordering long lead materials & permitting). Final Engineering requires payment commensurate with work performed. Construction ends with customer energization. 2. Factors that may cause the Utility’s actual results to differ materially from this forecast include the Utility's interconnec tion costs, the amount of power used by customers, the price of power, and the amount of cost recovery approved in the Utility's ratemaking proceedings. Assumes additional power supply costs from serving new data center load are not borne by other customers. Slide 8: Non-GAAP Core EPS Comparison 1. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit A for a reconciliation of EPS results on a GAAP basis to non-GAAP core earnings per share and Appendix 3, Exhibit E regarding non-GAAP financial measures. 2. Year over year changes for customer capital investment were primarily due to the earnings impact from higher rate base, primarily offset by the change of the Utility’s authorized return on equity from 10.7% to 10.28%. Slide 9: Five-Year Capital Plan 1. Rate base point estimates reflect authorized capital expenditures from the 2023 GRC final decision, SB 410, Oakland headquarters Petition for Modification to other CPUC-jurisdictional approvals (including the full amount recoverable through a balancing account where applicable), above-authorized capital spend that will support the Utility's plan, including strategic capital investments in undergrounding, wildfire mitigation, billing modernization, and mobile home parks, along with a forecast of our 2027 GRC filing. Weighted average rate base excludes Construction Work In Progress (CWIP) and non-earnings rate base related to AB 1054 and SB 254. 2. Percentage already authorized for CPUC-jurisdictional rate base holds constant the 2026 adopted CapEx for 2027 – 2030, includes SB 410 and Oakland headquarters Petition for Modification, and assumes FERC-jurisdictional rate base is equivalent to amounts requested in the formula rate through Transmission Owner rate proceedings for years 2025 through 2030. 3. Investment opportunities of at least $5 billion are not reflected in the CapEx or rate base numbers. Slide 11: Credit Rating Improvements 1. A securities rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any time. 2. FFO/Debt is not calculated in accordance with GAAP. Because PG&E Corporation is not able to estimate the impact of specific line items, which have the potential to significantly impact the company’s FFO/Debt in future periods, it is not providing a reconciliation for future period FFO/Debt. Slide titles are hyperlinks

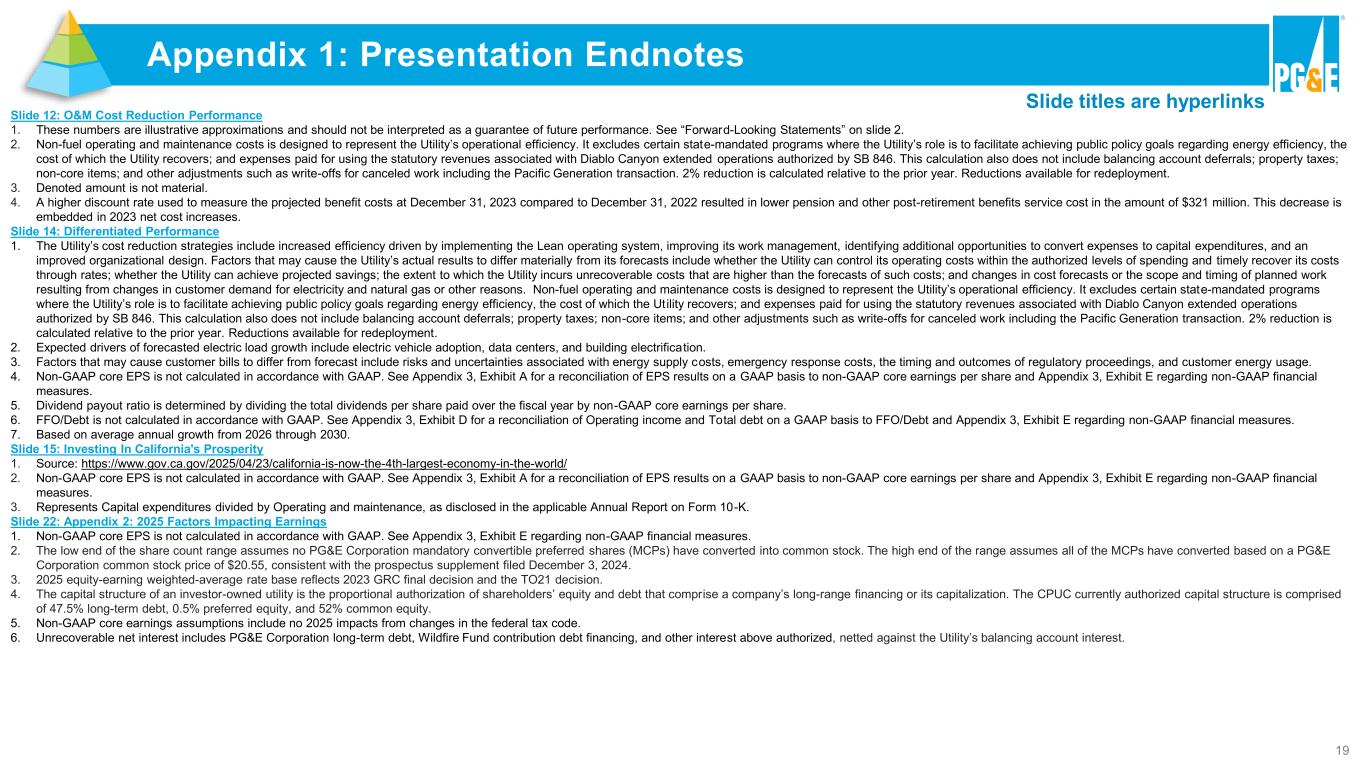

19 Appendix 1: Presentation Endnotes Slide titles are hyperlinks Slide 12: O&M Cost Reduction Performance 1. These numbers are illustrative approximations and should not be interpreted as a guarantee of future performance. See “Forward-Looking Statements” on slide 2. 2. Non-fuel operating and maintenance costs is designed to represent the Utility’s operational efficiency. It excludes certain state-mandated programs where the Utility’s role is to facilitate achieving public policy goals regarding energy efficiency, the cost of which the Utility recovers; and expenses paid for using the statutory revenues associated with Diablo Canyon extended operations authorized by SB 846. This calculation also does not include balancing account deferrals; property taxes; non-core items; and other adjustments such as write-offs for canceled work including the Pacific Generation transaction. 2% reduction is calculated relative to the prior year. Reductions available for redeployment. 3. Denoted amount is not material. 4. A higher discount rate used to measure the projected benefit costs at December 31, 2023 compared to December 31, 2022 resulted in lower pension and other post-retirement benefits service cost in the amount of $321 million. This decrease is embedded in 2023 net cost increases. Slide 14: Differentiated Performance 1. The Utility’s cost reduction strategies include increased efficiency driven by implementing the Lean operating system, improving its work management, identifying additional opportunities to convert expenses to capital expenditures, and an improved organizational design. Factors that may cause the Utility’s actual results to differ materially from its forecasts include whether the Utility can control its operating costs within the authorized levels of spending and timely recover its costs through rates; whether the Utility can achieve projected savings; the extent to which the Utility incurs unrecoverable costs that are higher than the forecasts of such costs; and changes in cost forecasts or the scope and timing of planned work resulting from changes in customer demand for electricity and natural gas or other reasons. Non-fuel operating and maintenance costs is designed to represent the Utility’s operational efficiency. It excludes certain state-mandated programs where the Utility’s role is to facilitate achieving public policy goals regarding energy efficiency, the cost of which the Ut ility recovers; and expenses paid for using the statutory revenues associated with Diablo Canyon extended operations authorized by SB 846. This calculation also does not include balancing account deferrals; property taxes; non-core items; and other adjustments such as write-offs for canceled work including the Pacific Generation transaction. 2% reduction is calculated relative to the prior year. Reductions available for redeployment. 2. Expected drivers of forecasted electric load growth include electric vehicle adoption, data centers, and building electrification. 3. Factors that may cause customer bills to differ from forecast include risks and uncertainties associated with energy supply costs, emergency response costs, the timing and outcomes of regulatory proceedings, and customer energy usage. 4. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit A for a reconciliation of EPS results on a GAAP basis to non-GAAP core earnings per share and Appendix 3, Exhibit E regarding non-GAAP financial measures. 5. Dividend payout ratio is determined by dividing the total dividends per share paid over the fiscal year by non-GAAP core earnings per share. 6. FFO/Debt is not calculated in accordance with GAAP. See Appendix 3, Exhibit D for a reconciliation of Operating income and Total debt on a GAAP basis to FFO/Debt and Appendix 3, Exhibit E regarding non-GAAP financial measures. 7. Based on average annual growth from 2026 through 2030. Slide 15: Investing In California's Prosperity 1. Source: https://www.gov.ca.gov/2025/04/23/california-is-now-the-4th-largest-economy-in-the-world/ 2. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit A for a reconciliation of EPS results on a GAAP basis to non-GAAP core earnings per share and Appendix 3, Exhibit E regarding non-GAAP financial measures. 3. Represents Capital expenditures divided by Operating and maintenance, as disclosed in the applicable Annual Report on Form 10-K. Slide 22: Appendix 2: 2025 Factors Impacting Earnings 1. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit E regarding non-GAAP financial measures. 2. The low end of the share count range assumes no PG&E Corporation mandatory convertible preferred shares (MCPs) have converted into common stock. The high end of the range assumes all of the MCPs have converted based on a PG&E Corporation common stock price of $20.55, consistent with the prospectus supplement filed December 3, 2024. 3. 2025 equity-earning weighted-average rate base reflects 2023 GRC final decision and the TO21 decision. 4. The capital structure of an investor-owned utility is the proportional authorization of shareholders’ equity and debt that comprise a company’s long-range financing or its capitalization. The CPUC currently authorized capital structure is comprised of 47.5% long-term debt, 0.5% preferred equity, and 52% common equity. 5. Non-GAAP core earnings assumptions include no 2025 impacts from changes in the federal tax code. 6. Unrecoverable net interest includes PG&E Corporation long-term debt, Wildfire Fund contribution debt financing, and other interest above authorized, netted against the Utility’s balancing account interest.

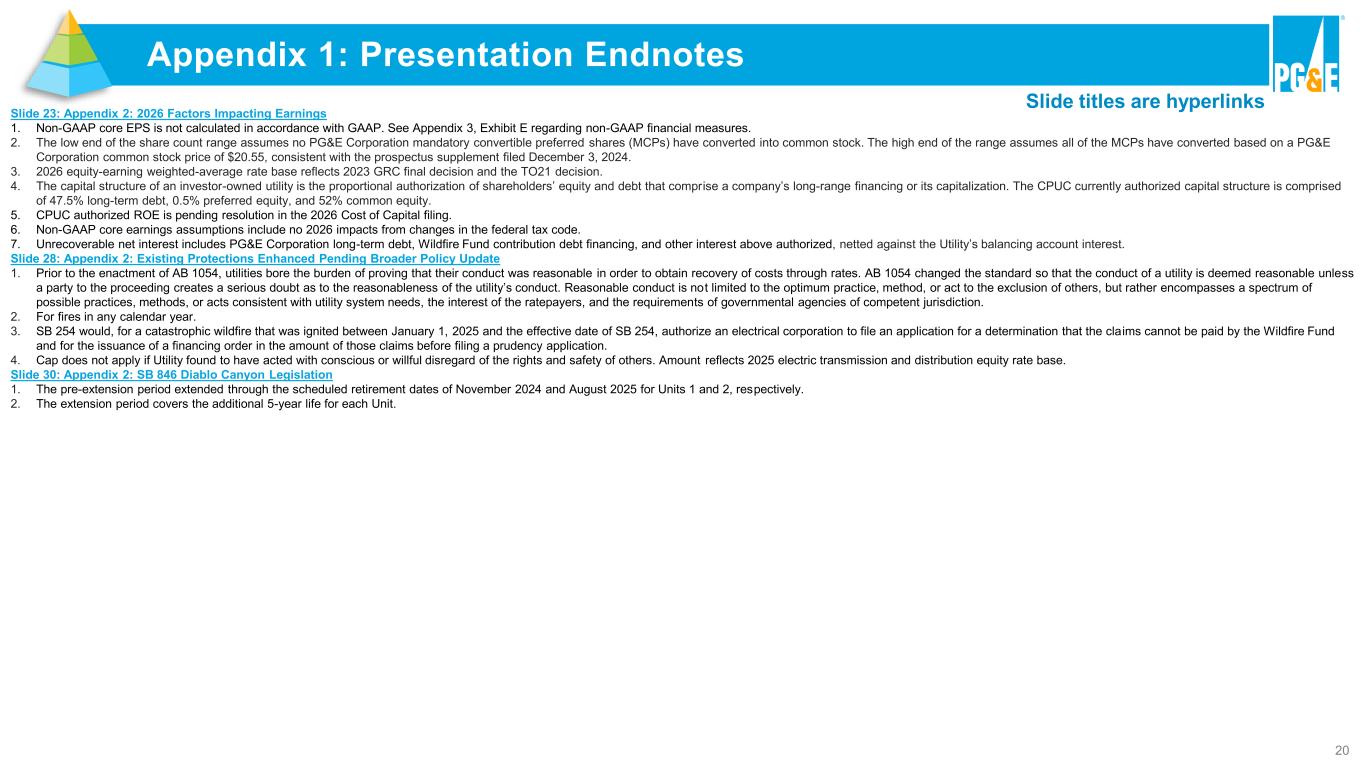

20 Appendix 1: Presentation Endnotes Slide titles are hyperlinks Slide 23: Appendix 2: 2026 Factors Impacting Earnings 1. Non-GAAP core EPS is not calculated in accordance with GAAP. See Appendix 3, Exhibit E regarding non-GAAP financial measures. 2. The low end of the share count range assumes no PG&E Corporation mandatory convertible preferred shares (MCPs) have converted into common stock. The high end of the range assumes all of the MCPs have converted based on a PG&E Corporation common stock price of $20.55, consistent with the prospectus supplement filed December 3, 2024. 3. 2026 equity-earning weighted-average rate base reflects 2023 GRC final decision and the TO21 decision. 4. The capital structure of an investor-owned utility is the proportional authorization of shareholders’ equity and debt that comprise a company’s long-range financing or its capitalization. The CPUC currently authorized capital structure is comprised of 47.5% long-term debt, 0.5% preferred equity, and 52% common equity. 5. CPUC authorized ROE is pending resolution in the 2026 Cost of Capital filing. 6. Non-GAAP core earnings assumptions include no 2026 impacts from changes in the federal tax code. 7. Unrecoverable net interest includes PG&E Corporation long-term debt, Wildfire Fund contribution debt financing, and other interest above authorized, netted against the Utility’s balancing account interest. Slide 28: Appendix 2: Existing Protections Enhanced Pending Broader Policy Update 1. Prior to the enactment of AB 1054, utilities bore the burden of proving that their conduct was reasonable in order to obtain recovery of costs through rates. AB 1054 changed the standard so that the conduct of a utility is deemed reasonable unless a party to the proceeding creates a serious doubt as to the reasonableness of the utility’s conduct. Reasonable conduct is not limited to the optimum practice, method, or act to the exclusion of others, but rather encompasses a spectrum of possible practices, methods, or acts consistent with utility system needs, the interest of the ratepayers, and the requirements of governmental agencies of competent jurisdiction. 2. For fires in any calendar year. 3. SB 254 would, for a catastrophic wildfire that was ignited between January 1, 2025 and the effective date of SB 254, authorize an electrical corporation to file an application for a determination that the claims cannot be paid by the Wildfire Fund and for the issuance of a financing order in the amount of those claims before filing a prudency application. 4. Cap does not apply if Utility found to have acted with conscious or willful disregard of the rights and safety of others. Amount reflects 2025 electric transmission and distribution equity rate base. Slide 30: Appendix 2: SB 846 Diablo Canyon Legislation 1. The pre-extension period extended through the scheduled retirement dates of November 2024 and August 2025 for Units 1 and 2, respectively. 2. The extension period covers the additional 5-year life for each Unit.

Appendix 2 Supplemental Earnings Materials 21

22 2025 Factors Impacting Earnings Endnotes are included in the Appendix $1.49 - $1.51 Non-GAAP Core EPS1 Diluted Shares 20252 2,195M - 2,285M Key Ranges Weighted Average Rate Base3 CPUC $57B FERC $12B Total Rate Base $69B Equity Ratio:4 52% Return on Equity: 10.28% Key Factors Affecting Non-GAAP Core Earnings5 ($ millions after tax) Unrecoverable net interest6 $350 - $400 Other earnings factors including AFUDC equity, incentive revenues, tax benefits, and cost savings, net of below-the-line costs Changes from prior quarter noted in blue text

23 2026 Factors Impacting Earnings Endnotes are included in the Appendix $1.62 - $1.66 Non-GAAP Core EPS1 Diluted Shares 20262 2,210M - 2,295M Key Ranges Weighted Average Rate Base3 CPUC $62B FERC $13B Total Rate Base $75B Equity Ratio:4 52% Return on Equity: TBD5 Key Factors Affecting Non-GAAP Core Earnings6 ($ millions after tax) Unrecoverable net interest7 $350 - $400 Other earnings factors including AFUDC equity, incentive revenues, tax benefits, and cost savings, net of below-the-line costs

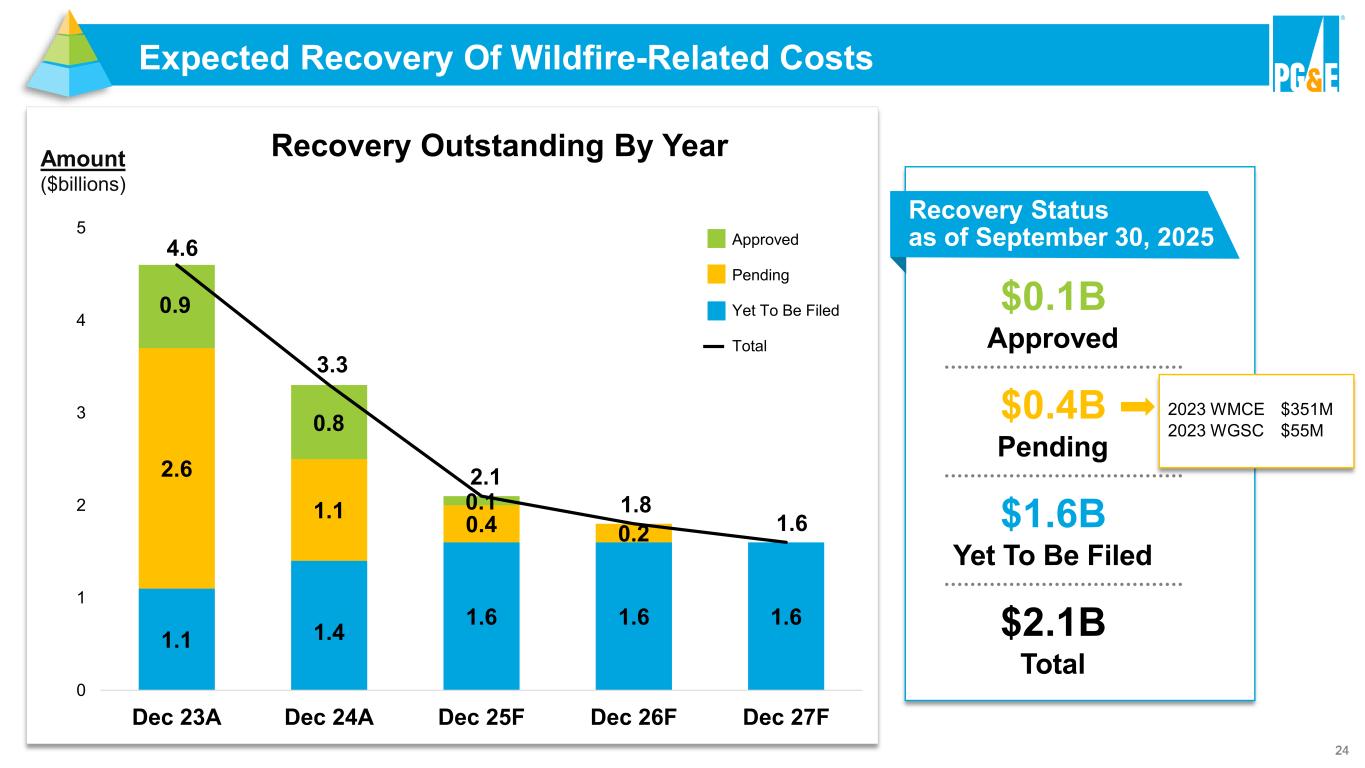

24 Expected Recovery Of Wildfire-Related Costs Recovery Outstanding By Year 1.1 1.4 1.6 1.6 1.6 2.6 1.1 0.4 0.2 0.9 0.8 0.1 4.6 3.3 2.1 1.8 1.6 0 1 2 3 4 5 Dec 23A Dec 24A Dec 25F Dec 26F Dec 27F Approved Pending Yet To Be Filed Total Amount ($billions) $0.1B Approved Recovery Status as of September 30, 2025 $0.4B Pending $1.6B Yet To Be Filed $2.1B Total 2023 WMCE $351M 2023 WGSC $55M

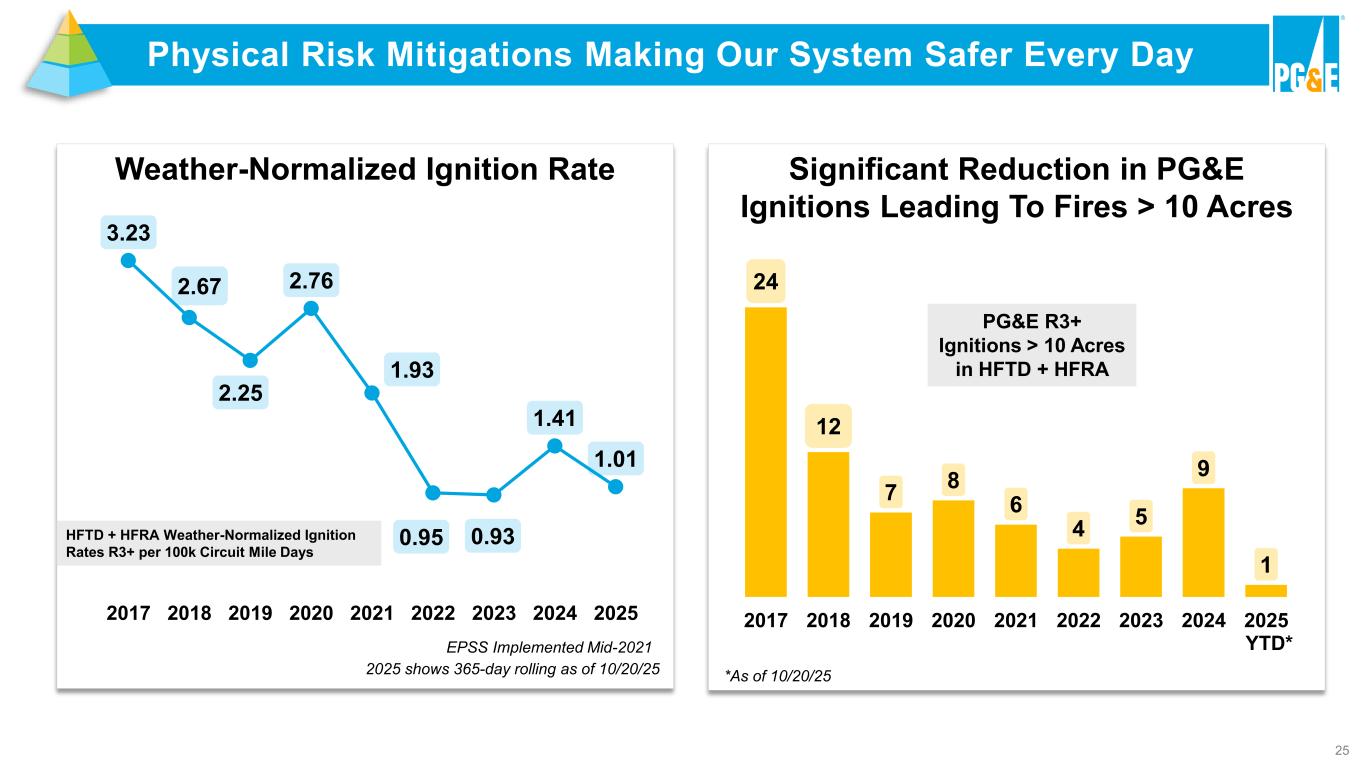

25 Physical Risk Mitigations Making Our System Safer Every Day HFTD + HFRA Weather-Normalized Ignition Rates R3+ per 100k Circuit Mile Days 2025 shows 365-day rolling as of 10/20/25 Weather-Normalized Ignition Rate 3.23 2.67 2.25 2.76 1.93 0.95 0.93 1.41 1.01 2017 2018 2019 2020 2021 2022 2023 2024 2025 EPSS Implemented Mid-2021 24 12 7 8 6 4 5 9 1 2017 2018 2019 2020 2021 2022 2023 2024 2025 Significant Reduction in PG&E Ignitions Leading To Fires > 10 Acres PG&E R3+ Ignitions > 10 Acres in HFTD + HFRA YTD* *As of 10/20/25

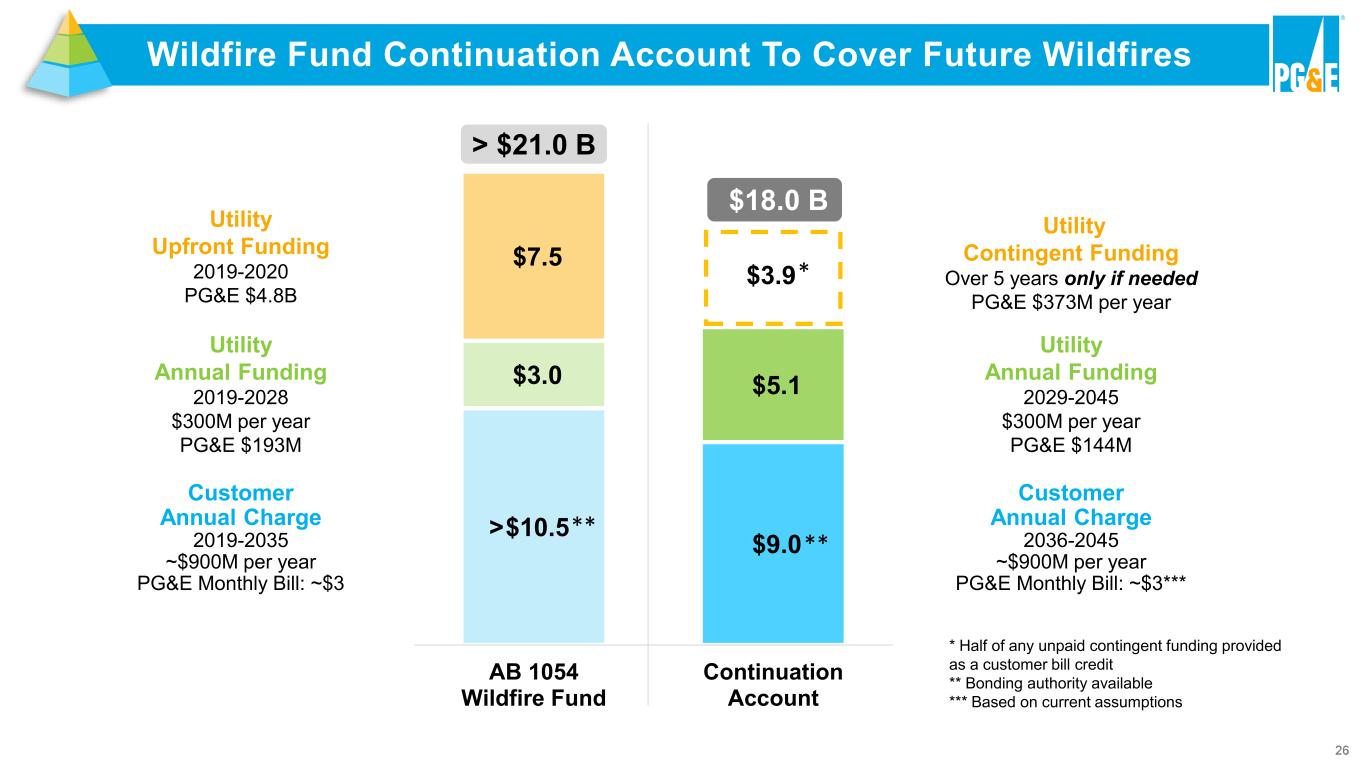

26 Wildfire Fund Continuation Account To Cover Future Wildfires Customer Annual Charge 2036-2045 ~$900M per year PG&E Monthly Bill: ~$3*** Utility Contingent Funding Over 5 years only if needed PG&E $373M per year Utility Annual Funding 2029-2045 $300M per year PG&E $144M $10.5 $9.0 $3.0 $5.1 $3.9 $7.5 > $21.0 B $18.0 B AB 1054 Wildfire Fund Continuation Account ** * Half of any unpaid contingent funding provided as a customer bill credit ** Bonding authority available *** Based on current assumptions Utility Upfront Funding 2019-2020 PG&E $4.8B Utility Annual Funding 2019-2028 $300M per year PG&E $193M Customer Annual Charge 2019-2035 ~$900M per year PG&E Monthly Bill: ~$3 * > **

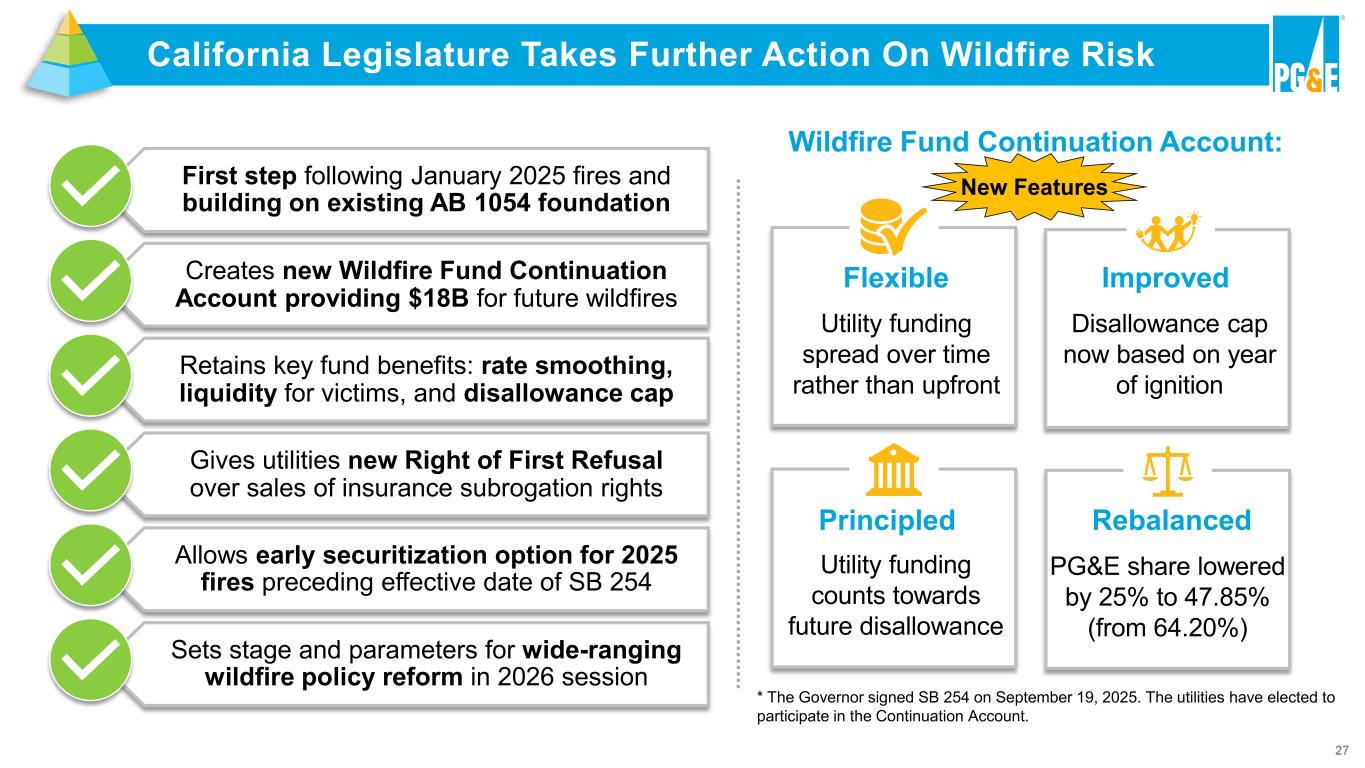

27 California Legislature Takes Further Action On Wildfire Risk First step following January 2025 fires and building on existing AB 1054 foundation Creates new Wildfire Fund Continuation Account providing $18B for future wildfires Retains key fund benefits: rate smoothing, liquidity for victims, and disallowance cap Gives utilities new Right of First Refusal over sales of insurance subrogation rights Allows early securitization option for 2025 fires preceding effective date of SB 254 Wildfire Fund Continuation Account: Sets stage and parameters for wide-ranging wildfire policy reform in 2026 session Rebalanced PG&E share lowered by 25% to 47.85% (from 64.20%) Principled Utility funding counts towards future disallowance Flexible Improved Disallowance cap now based on year of ignition Utility funding spread over time rather than upfront * The Governor signed SB 254 on September 19, 2025. The utilities have elected to participate in the Continuation Account. New Features

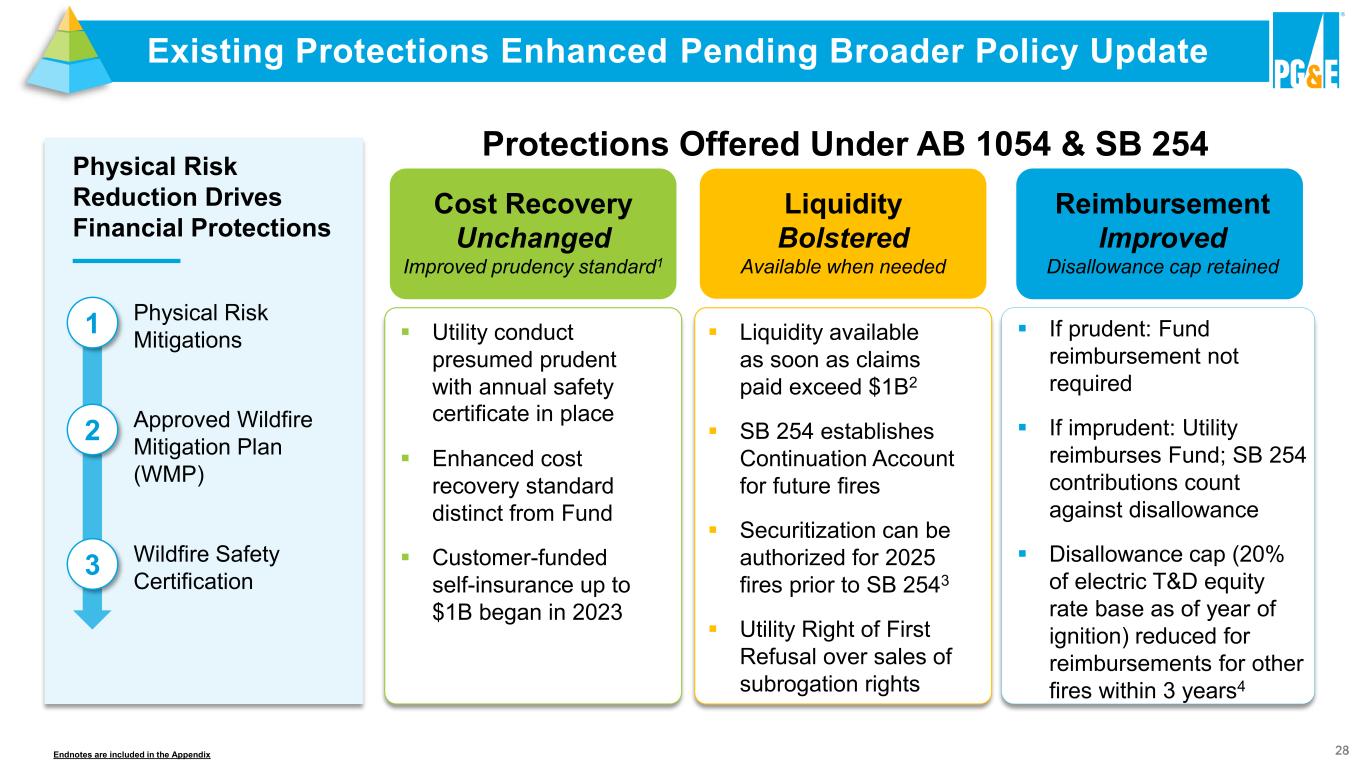

28 Existing Protections Enhanced Pending Broader Policy Update Protections Offered Under AB 1054 & SB 254 ▪ Liquidity available as soon as claims paid exceed $1B2 ▪ SB 254 establishes Continuation Account for future fires ▪ Securitization can be authorized for 2025 fires prior to SB 2543 ▪ Utility Right of First Refusal over sales of subrogation rights Liquidity Bolstered Available when needed ▪ Utility conduct presumed prudent with annual safety certificate in place ▪ Enhanced cost recovery standard distinct from Fund ▪ Customer-funded self-insurance up to $1B began in 2023 Cost Recovery Unchanged Improved prudency standard1 Reimbursement Improved Disallowance cap retained ▪ If prudent: Fund reimbursement not required ▪ If imprudent: Utility reimburses Fund; SB 254 contributions count against disallowance ▪ Disallowance cap (20% of electric T&D equity rate base as of year of ignition) reduced for reimbursements for other fires within 3 years4 Physical Risk Reduction Drives Financial Protections 1 Physical Risk Mitigations 2 Approved Wildfire Mitigation Plan (WMP) 3 Wildfire Safety Certification Endnotes are included in the AppendixEndnotes are included in the ppendix

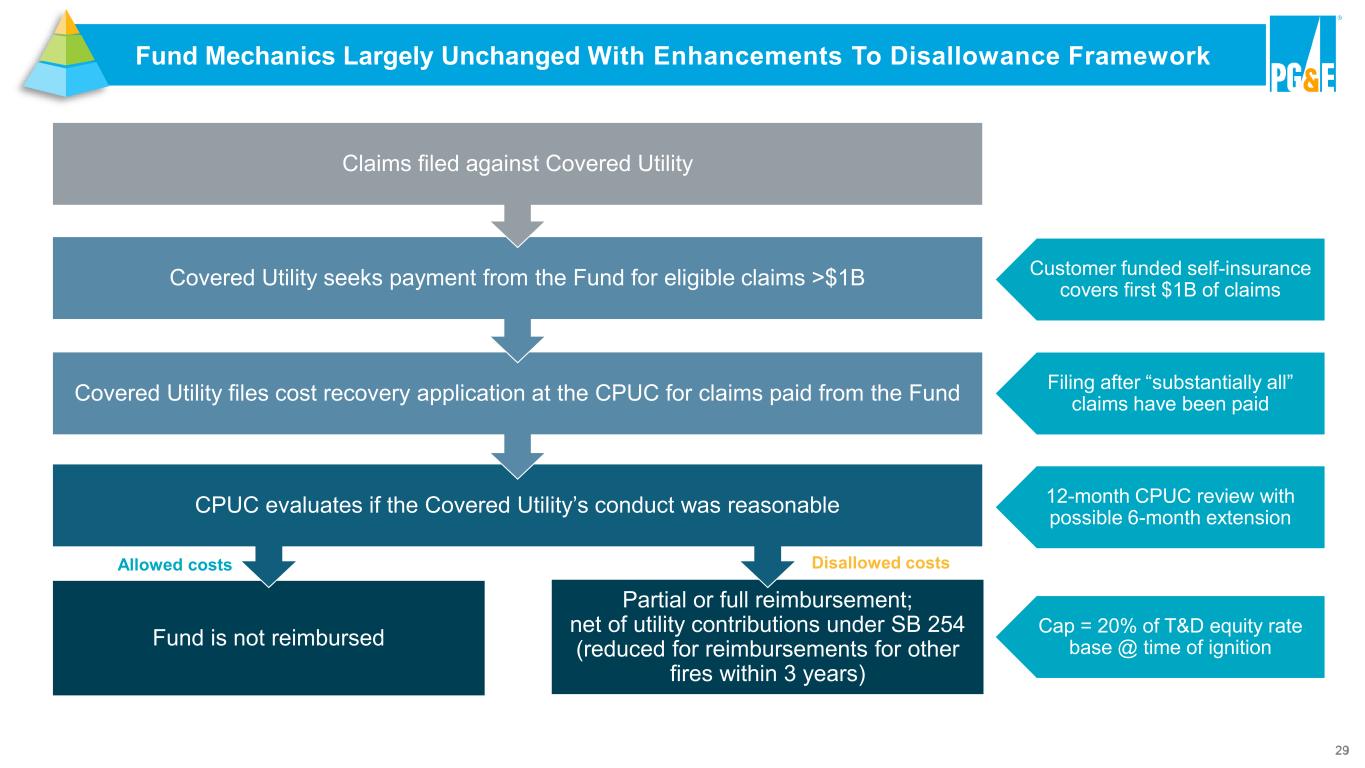

29 Fund Mechanics Largely Unchanged With Enhancements To Disallowance Framework Fund is not reimbursed Partial or full reimbursement; net of utility contributions under SB 254 (reduced for reimbursements for other fires within 3 years) CPUC evaluates if the Covered Utility’s conduct was reasonable Covered Utility files cost recovery application at the CPUC for claims paid from the Fund Covered Utility seeks payment from the Fund for eligible claims >$1B Disallowed costsAllowed costs Claims filed against Covered Utility Filing after “substantially all” claims have been paid 12-month CPUC review with possible 6-month extension Customer funded self-insurance covers first $1B of claims Cap = 20% of T&D equity rate base @ time of ignition

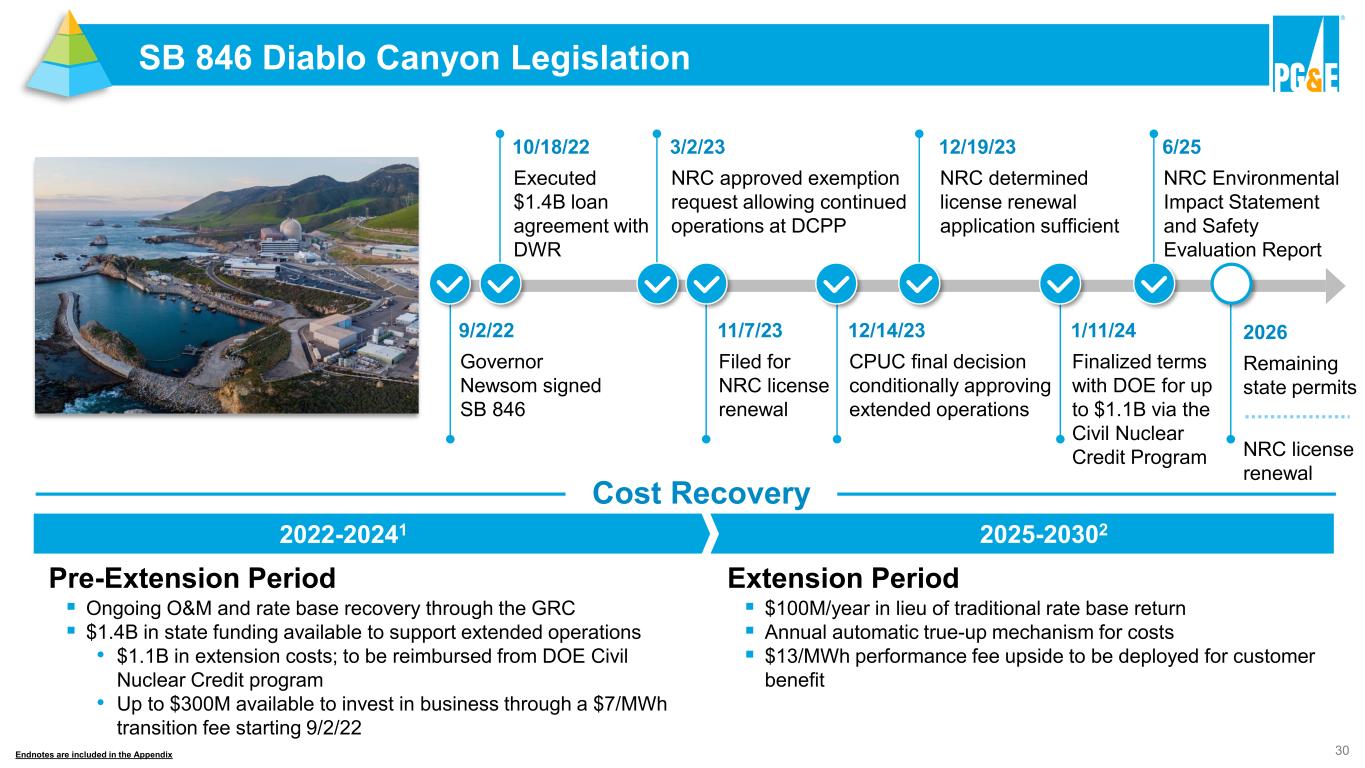

30 SB 846 Diablo Canyon Legislation Cost Recovery 2022-20241 2025-20302 ▪ Ongoing O&M and rate base recovery through the GRC ▪ $1.4B in state funding available to support extended operations • $1.1B in extension costs; to be reimbursed from DOE Civil Nuclear Credit program • Up to $300M available to invest in business through a $7/MWh transition fee starting 9/2/22 ▪ $100M/year in lieu of traditional rate base return ▪ Annual automatic true-up mechanism for costs ▪ $13/MWh performance fee upside to be deployed for customer benefit Pre-Extension Period Extension Period 9/2/22 Governor Newsom signed SB 846 1/11/24 Finalized terms with DOE for up to $1.1B via the Civil Nuclear Credit Program 10/18/22 Executed $1.4B loan agreement with DWR 3/2/23 NRC approved exemption request allowing continued operations at DCPP 11/7/23 Filed for NRC license renewal 12/14/23 CPUC final decision conditionally approving extended operations 12/19/23 NRC determined license renewal application sufficient 6/25 NRC Environmental Impact Statement and Safety Evaluation Report Endnotes are included in the Appendix 2026 Remaining state permits NRC license renewal

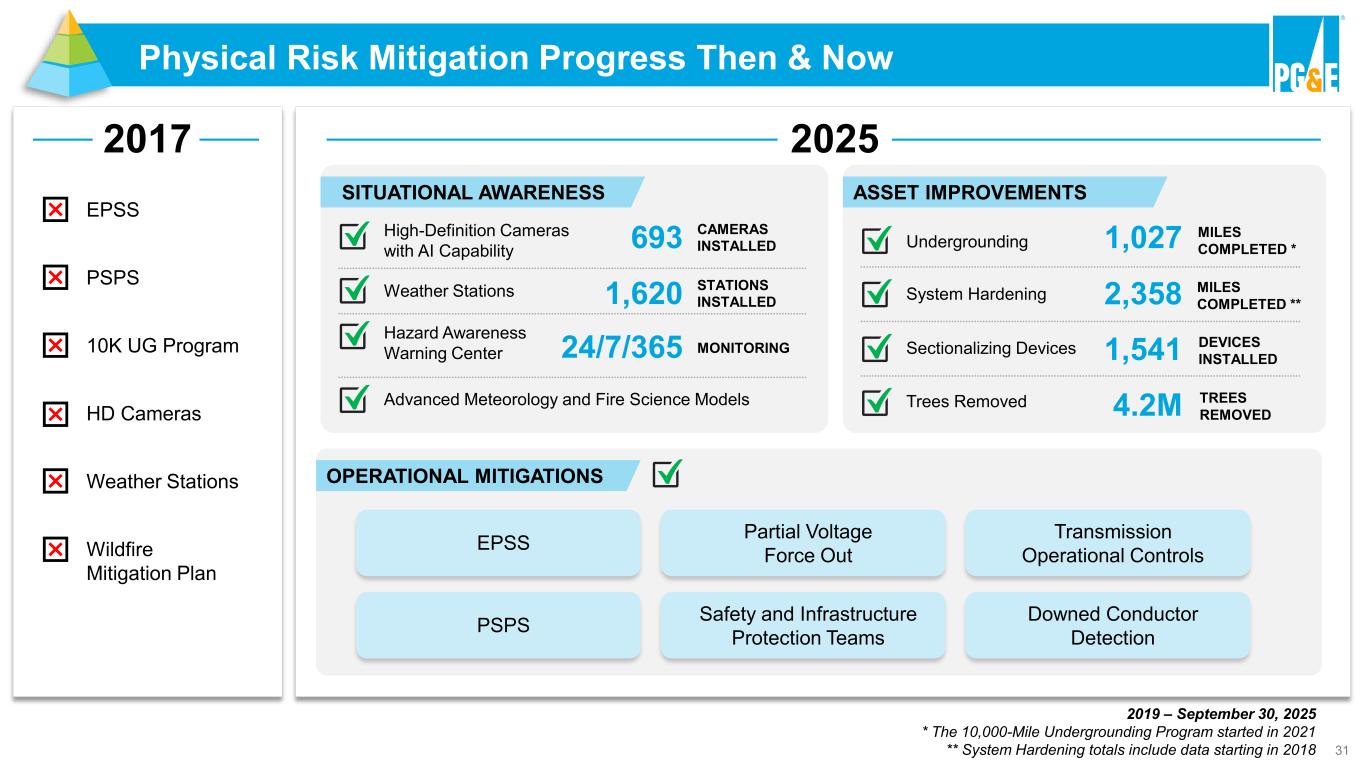

31 Physical Risk Mitigation Progress Then & Now 2017 EPSS PSPS 10K UG Program HD Cameras Weather Stations Wildfire Mitigation Plan SITUATIONAL AWARENESS High-Definition Cameras with AI Capability Weather Stations Hazard Awareness Warning Center Advanced Meteorology and Fire Science Models 693 CAMERAS INSTALLED 1,620 STATIONS INSTALLED 24/7/365 MONITORING ASSET IMPROVEMENTS Undergrounding System Hardening Sectionalizing Devices Trees Removed 1,027 MILES COMPLETED * 2,358 MILES COMPLETED ** 1,541 DEVICES INSTALLED 4.2M TREES REMOVED OPERATIONAL MITIGATIONS EPSS PSPS Partial Voltage Force Out Safety and Infrastructure Protection Teams Transmission Operational Controls Downed Conductor Detection 2019 – September 30, 2025 * The 10,000-Mile Undergrounding Program started in 2021 ** System Hardening totals include data starting in 2018 2025

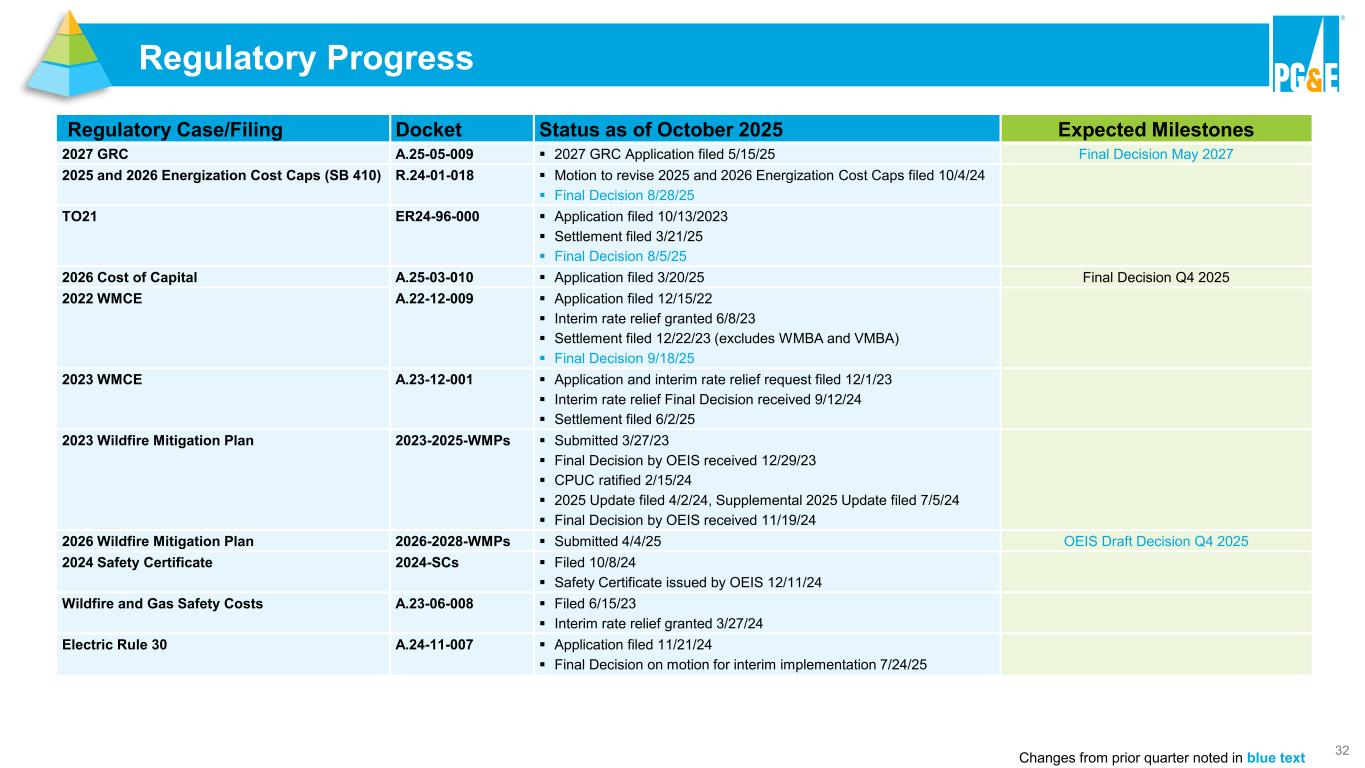

32 Regulatory Case/Filing Docket Status as of October 2025 Expected Milestones 2027 GRC A.25-05-009 ▪ 2027 GRC Application filed 5/15/25 Final Decision May 2027 2025 and 2026 Energization Cost Caps (SB 410) R.24-01-018 ▪ Motion to revise 2025 and 2026 Energization Cost Caps filed 10/4/24 ▪ Final Decision 8/28/25 TO21 ER24-96-000 ▪ Application filed 10/13/2023 ▪ Settlement filed 3/21/25 ▪ Final Decision 8/5/25 2026 Cost of Capital A.25-03-010 ▪ Application filed 3/20/25 Final Decision Q4 2025 2022 WMCE A.22-12-009 ▪ Application filed 12/15/22 ▪ Interim rate relief granted 6/8/23 ▪ Settlement filed 12/22/23 (excludes WMBA and VMBA) ▪ Final Decision 9/18/25 2023 WMCE A.23-12-001 ▪ Application and interim rate relief request filed 12/1/23 ▪ Interim rate relief Final Decision received 9/12/24 ▪ Settlement filed 6/2/25 2023 Wildfire Mitigation Plan 2023-2025-WMPs ▪ Submitted 3/27/23 ▪ Final Decision by OEIS received 12/29/23 ▪ CPUC ratified 2/15/24 ▪ 2025 Update filed 4/2/24, Supplemental 2025 Update filed 7/5/24 ▪ Final Decision by OEIS received 11/19/24 2026 Wildfire Mitigation Plan 2026-2028-WMPs ▪ Submitted 4/4/25 OEIS Draft Decision Q4 2025 2024 Safety Certificate 2024-SCs ▪ Filed 10/8/24 ▪ Safety Certificate issued by OEIS 12/11/24 Wildfire and Gas Safety Costs A.23-06-008 ▪ Filed 6/15/23 ▪ Interim rate relief granted 3/27/24 Electric Rule 30 A.24-11-007 ▪ Application filed 11/21/24 ▪ Final Decision on motion for interim implementation 7/24/25 Changes from prior quarter noted in blue text Regulatory Progress

Appendix 3 Supplemental Non-GAAP Information 33

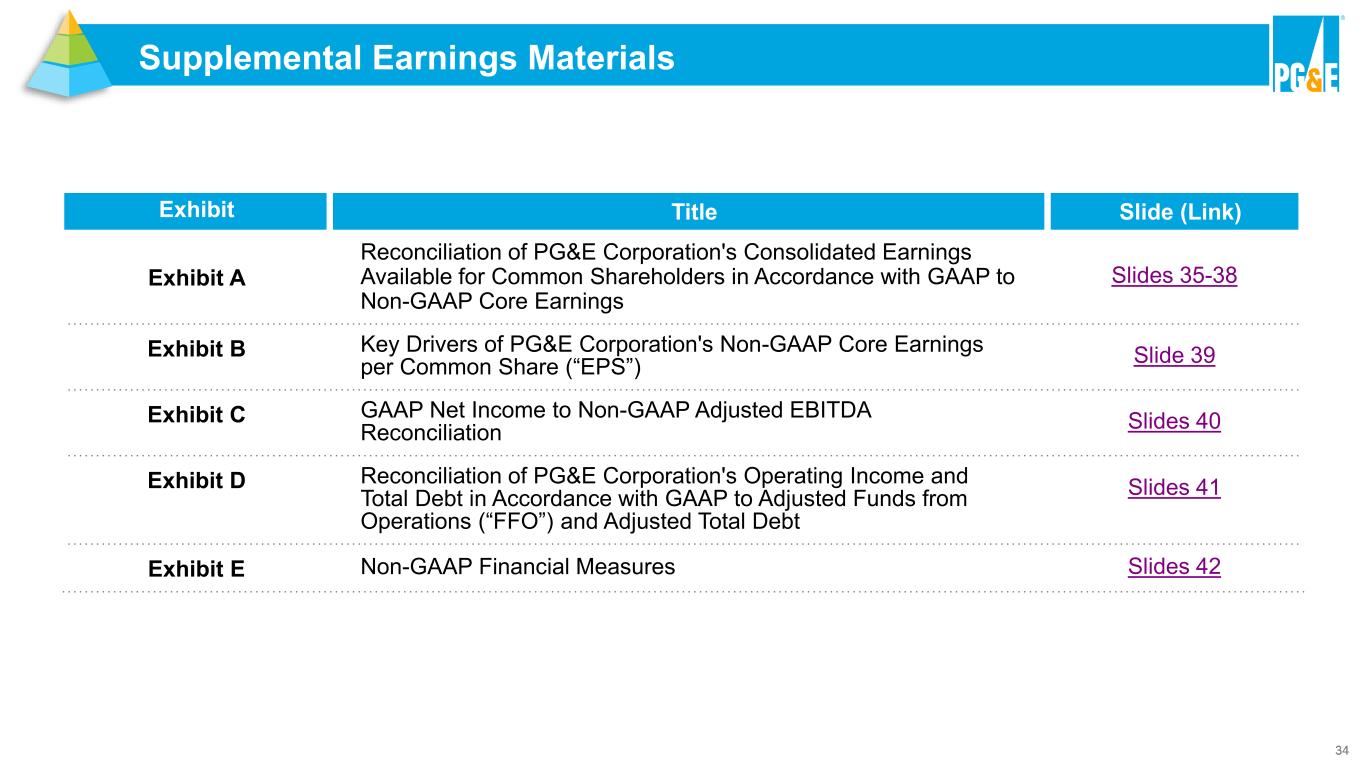

34 Supplemental Earnings Materials Exhibit Title Slide (Link) Exhibit A Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with GAAP to Non-GAAP Core Earnings Slides 35-38 Exhibit B Key Drivers of PG&E Corporation's Non-GAAP Core Earnings per Common Share (“EPS”) Slide 39 Exhibit C GAAP Net Income to Non-GAAP Adjusted EBITDA Reconciliation Slides 40 Exhibit D Reconciliation of PG&E Corporation's Operating Income and Total Debt in Accordance with GAAP to Adjusted Funds from Operations (“FFO”) and Adjusted Total Debt Slides 41 Exhibit E Non-GAAP Financial Measures Slides 42

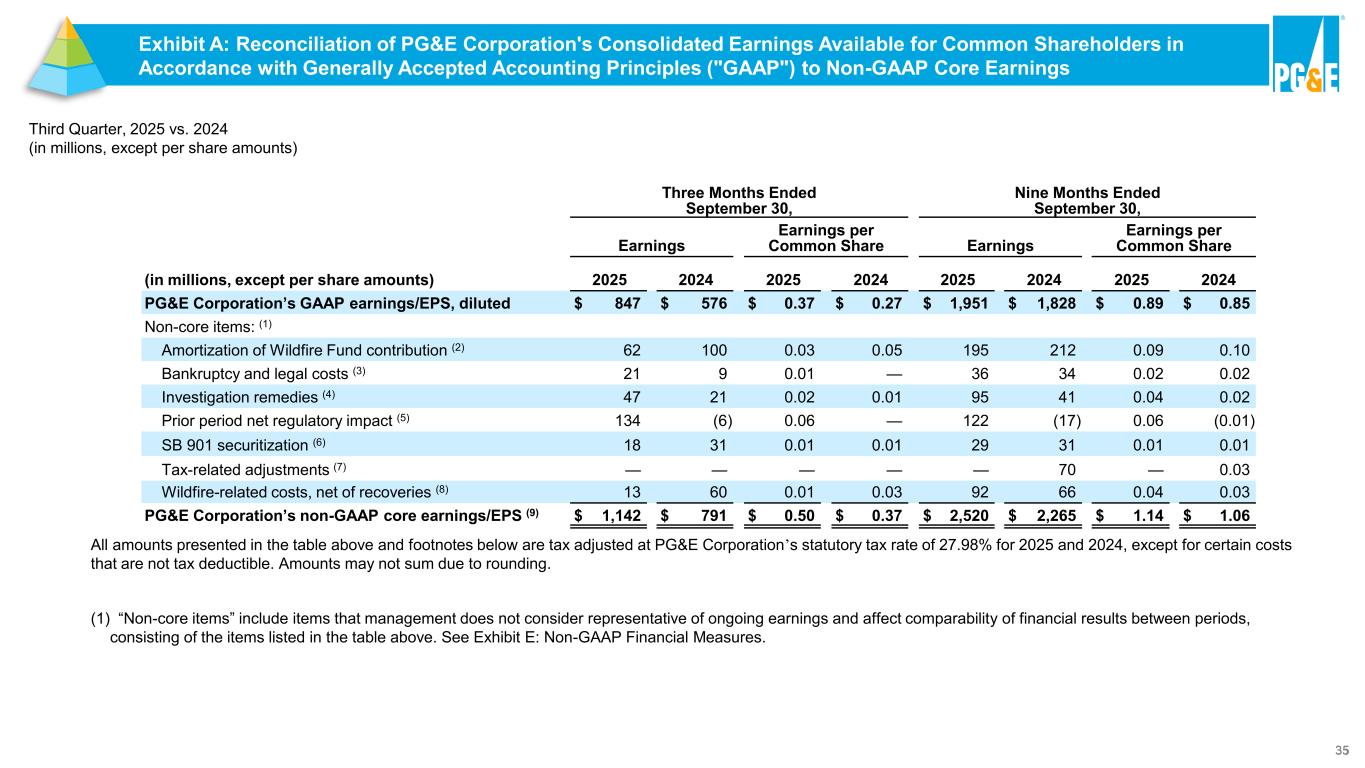

35 Three Months Ended September 30, Nine Months Ended September 30, Earnings Earnings per Common Share Earnings Earnings per Common Share (in millions, except per share amounts) 2025 2024 2025 2024 2025 2024 2025 2024 PG&E Corporation’s GAAP earnings/EPS, diluted $ 847 $ 576 $ 0.37 $ 0.27 $ 1,951 $ 1,828 $ 0.89 $ 0.85 Non-core items: (1) Amortization of Wildfire Fund contribution (2) 62 100 0.03 0.05 195 212 0.09 0.10 Bankruptcy and legal costs (3) 21 9 0.01 — 36 34 0.02 0.02 Investigation remedies (4) 47 21 0.02 0.01 95 41 0.04 0.02 Prior period net regulatory impact (5) 134 (6) 0.06 — 122 (17) 0.06 (0.01) SB 901 securitization (6) 18 31 0.01 0.01 29 31 0.01 0.01 Tax-related adjustments (7) — — — — — 70 — 0.03 Wildfire-related costs, net of recoveries (8) 13 60 0.01 0.03 92 66 0.04 0.03 PG&E Corporation’s non-GAAP core earnings/EPS (9) $ 1,142 $ 791 $ 0.50 $ 0.37 $ 2,520 $ 2,265 $ 1.14 $ 1.06 All amounts presented in the table above and footnotes below are tax adjusted at PG&E Corporation’s statutory tax rate of 27.98% for 2025 and 2024, except for certain costs that are not tax deductible. Amounts may not sum due to rounding. Third Quarter, 2025 vs. 2024 (in millions, except per share amounts) (1) “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods, consisting of the items listed in the table above. See Exhibit E: Non-GAAP Financial Measures. Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings

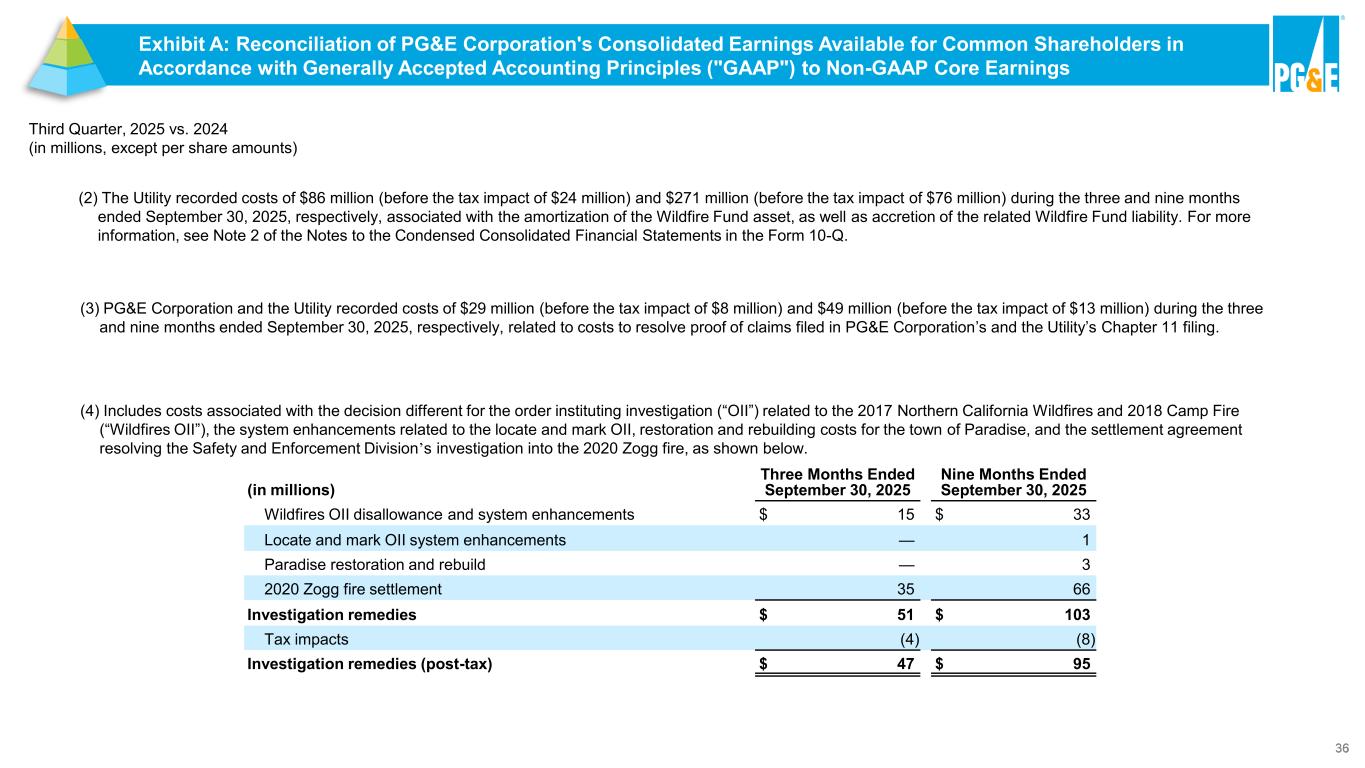

36 Third Quarter, 2025 vs. 2024 (in millions, except per share amounts) (3) PG&E Corporation and the Utility recorded costs of $29 million (before the tax impact of $8 million) and $49 million (before the tax impact of $13 million) during the three and nine months ended September 30, 2025, respectively, related to costs to resolve proof of claims filed in PG&E Corporation’s and the Utility’s Chapter 11 filing. (2) The Utility recorded costs of $86 million (before the tax impact of $24 million) and $271 million (before the tax impact of $76 million) during the three and nine months ended September 30, 2025, respectively, associated with the amortization of the Wildfire Fund asset, as well as accretion of the related Wildfire Fund liability. For more information, see Note 2 of the Notes to the Condensed Consolidated Financial Statements in the Form 10-Q. Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings (4) Includes costs associated with the decision different for the order instituting investigation (“OII”) related to the 2017 Northern California Wildfires and 2018 Camp Fire (“Wildfires OII”), the system enhancements related to the locate and mark OII, restoration and rebuilding costs for the town of Paradise, and the settlement agreement resolving the Safety and Enforcement Division’s investigation into the 2020 Zogg fire, as shown below. (in millions) Three Months Ended September 30, 2025 Nine Months Ended September 30, 2025 Wildfires OII disallowance and system enhancements $ 15 $ 33 Locate and mark OII system enhancements — 1 Paradise restoration and rebuild — 3 2020 Zogg fire settlement 35 66 Investigation remedies $ 51 $ 103 Tax impacts (4) (8) Investigation remedies (post-tax) $ 47 $ 95

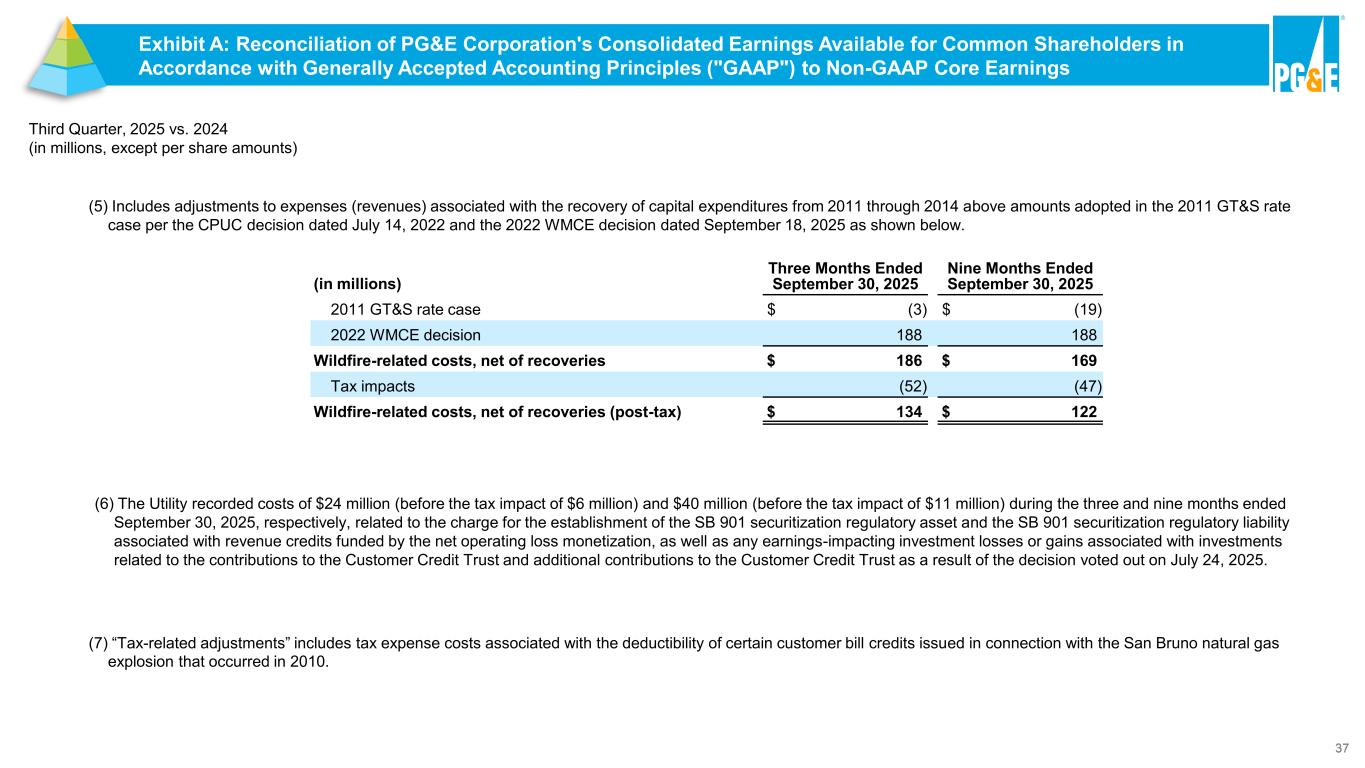

37 Third Quarter, 2025 vs. 2024 (in millions, except per share amounts) (in millions) Three Months Ended September 30, 2025 Nine Months Ended September 30, 2025 2011 GT&S rate case $ (3) $ (19) 2022 WMCE decision 188 188 Wildfire-related costs, net of recoveries $ 186 $ 169 Tax impacts (52) (47) Wildfire-related costs, net of recoveries (post-tax) $ 134 $ 122 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings (6) The Utility recorded costs of $24 million (before the tax impact of $6 million) and $40 million (before the tax impact of $11 million) during the three and nine months ended September 30, 2025, respectively, related to the charge for the establishment of the SB 901 securitization regulatory asset and the SB 901 securitization regulatory liability associated with revenue credits funded by the net operating loss monetization, as well as any earnings-impacting investment losses or gains associated with investments related to the contributions to the Customer Credit Trust and additional contributions to the Customer Credit Trust as a result of the decision voted out on July 24, 2025. (7) “Tax-related adjustments” includes tax expense costs associated with the deductibility of certain customer bill credits issued in connection with the San Bruno natural gas explosion that occurred in 2010. (5) Includes adjustments to expenses (revenues) associated with the recovery of capital expenditures from 2011 through 2014 above amounts adopted in the 2011 GT&S rate case per the CPUC decision dated July 14, 2022 and the 2022 WMCE decision dated September 18, 2025 as shown below.

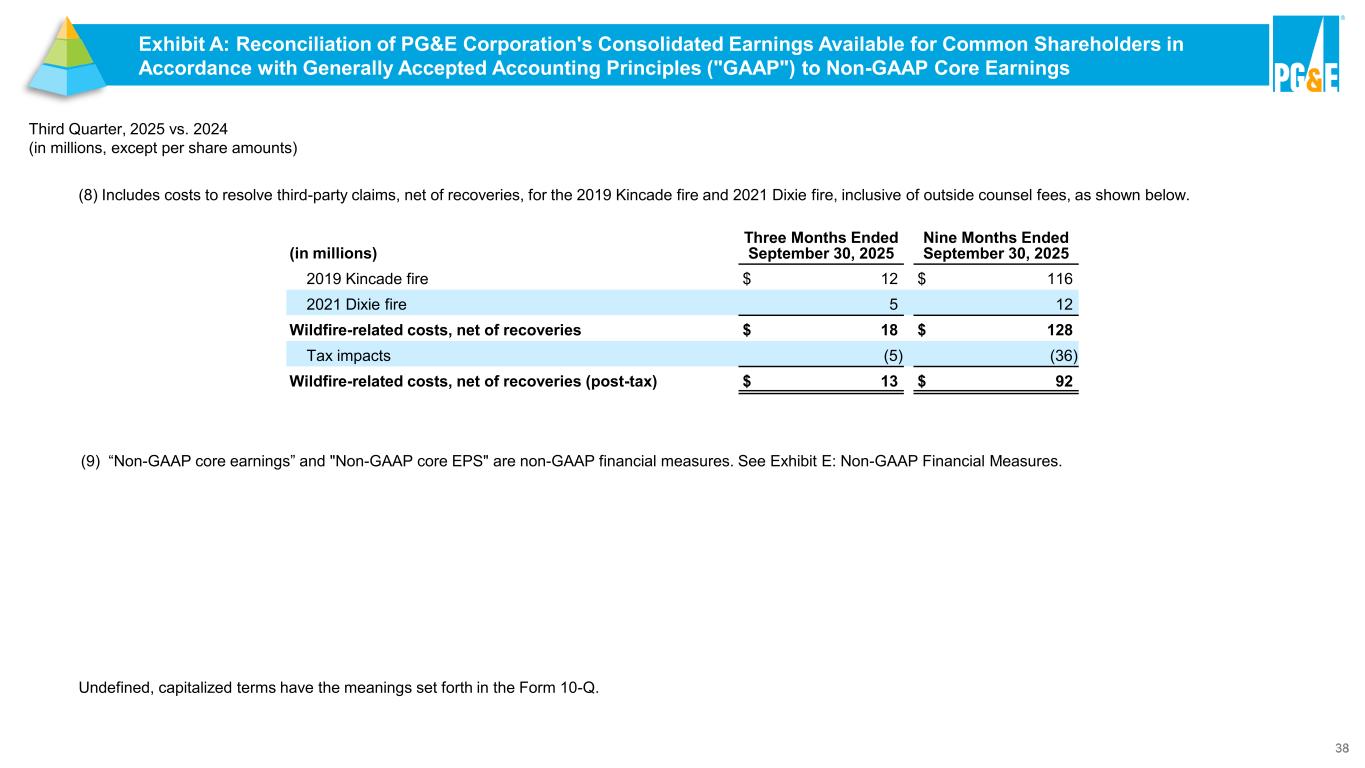

38 Third Quarter, 2025 vs. 2024 (in millions, except per share amounts) (9) “Non-GAAP core earnings” and "Non-GAAP core EPS" are non-GAAP financial measures. See Exhibit E: Non-GAAP Financial Measures. Undefined, capitalized terms have the meanings set forth in the Form 10-Q. (8) Includes costs to resolve third-party claims, net of recoveries, for the 2019 Kincade fire and 2021 Dixie fire, inclusive of outside counsel fees, as shown below. (in millions) Three Months Ended September 30, 2025 Nine Months Ended September 30, 2025 2019 Kincade fire $ 12 $ 116 2021 Dixie fire 5 12 Wildfire-related costs, net of recoveries $ 18 $ 128 Tax impacts (5) (36) Wildfire-related costs, net of recoveries (post-tax) $ 13 $ 92 Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings Exhibit A: Reconciliation of PG&E Corporation's Consolidated Earnings Available for Common Shareholders in Accordance with Generally Accepted Accounting Principles ("GAAP") to Non-GAAP Core Earnings

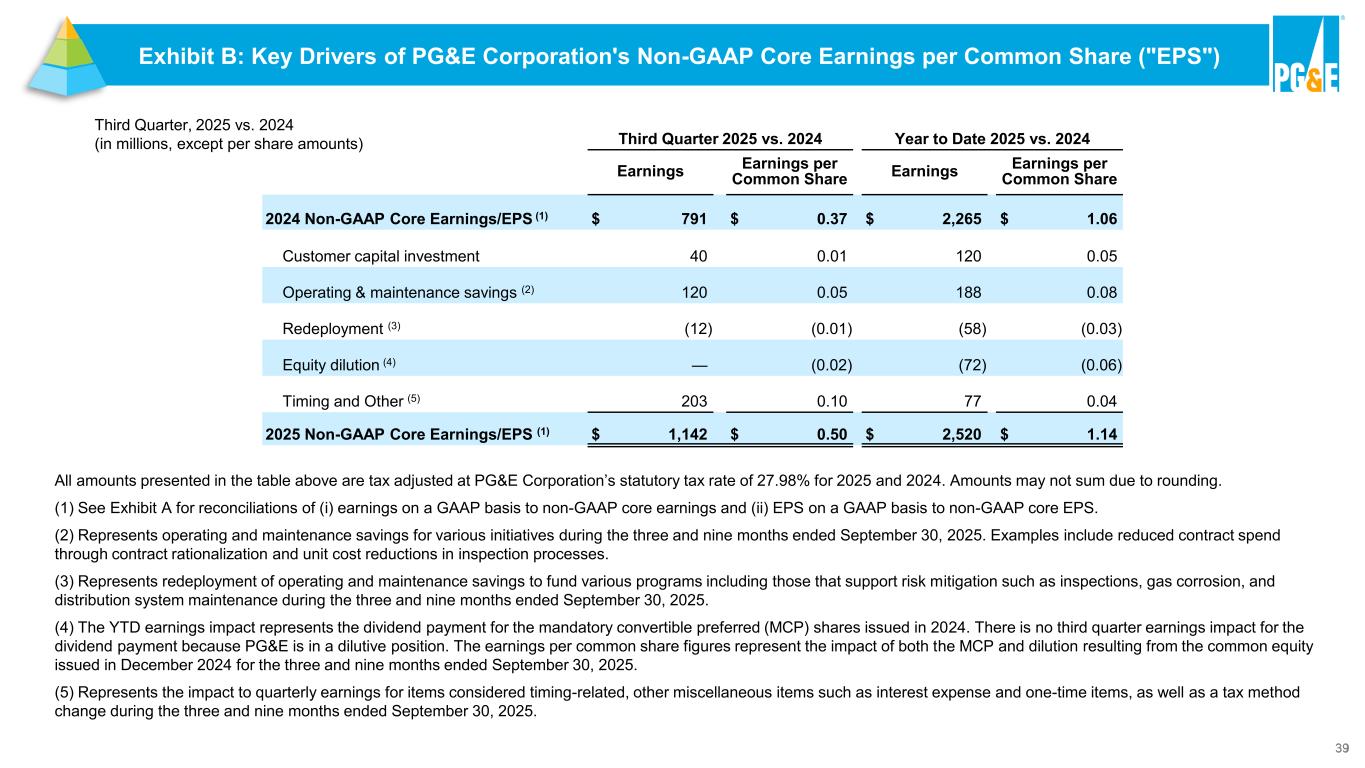

39 All amounts presented in the table above are tax adjusted at PG&E Corporation’s statutory tax rate of 27.98% for 2025 and 2024. Amounts may not sum due to rounding. (1) See Exhibit A for reconciliations of (i) earnings on a GAAP basis to non-GAAP core earnings and (ii) EPS on a GAAP basis to non-GAAP core EPS. (2) Represents operating and maintenance savings for various initiatives during the three and nine months ended September 30, 2025. Examples include reduced contract spend through contract rationalization and unit cost reductions in inspection processes. (3) Represents redeployment of operating and maintenance savings to fund various programs including those that support risk mitigation such as inspections, gas corrosion, and distribution system maintenance during the three and nine months ended September 30, 2025. (4) The YTD earnings impact represents the dividend payment for the mandatory convertible preferred (MCP) shares issued in 2024. There is no third quarter earnings impact for the dividend payment because PG&E is in a dilutive position. The earnings per common share figures represent the impact of both the MCP and dilution resulting from the common equity issued in December 2024 for the three and nine months ended September 30, 2025. (5) Represents the impact to quarterly earnings for items considered timing-related, other miscellaneous items such as interest expense and one-time items, as well as a tax method change during the three and nine months ended September 30, 2025. Third Quarter 2025 vs. 2024 Year to Date 2025 vs. 2024 Earnings Earnings per Common Share Earnings Earnings per Common Share 2024 Non-GAAP Core Earnings/EPS (1) $ 791 $ 0.37 $ 2,265 $ 1.06 Customer capital investment 40 0.01 120 0.05 Operating & maintenance savings (2) 120 0.05 188 0.08 Redeployment (3) (12) (0.01) (58) (0.03) Equity dilution (4) — (0.02) (72) (0.06) Timing and Other (5) 203 0.10 77 0.04 2025 Non-GAAP Core Earnings/EPS (1) $ 1,142 $ 0.50 $ 2,520 $ 1.14 Third Quarter, 2025 vs. 2024 (in millions, except per share amounts) Exhibit B: Key Drivers of PG&E Corporation's Non-GAAP Core Earnings per Common Share ("EPS") Exhibit B: Key Drivers of PG&E Corporation's Non-GAAP Core Earnings per Common Share ("EPS")

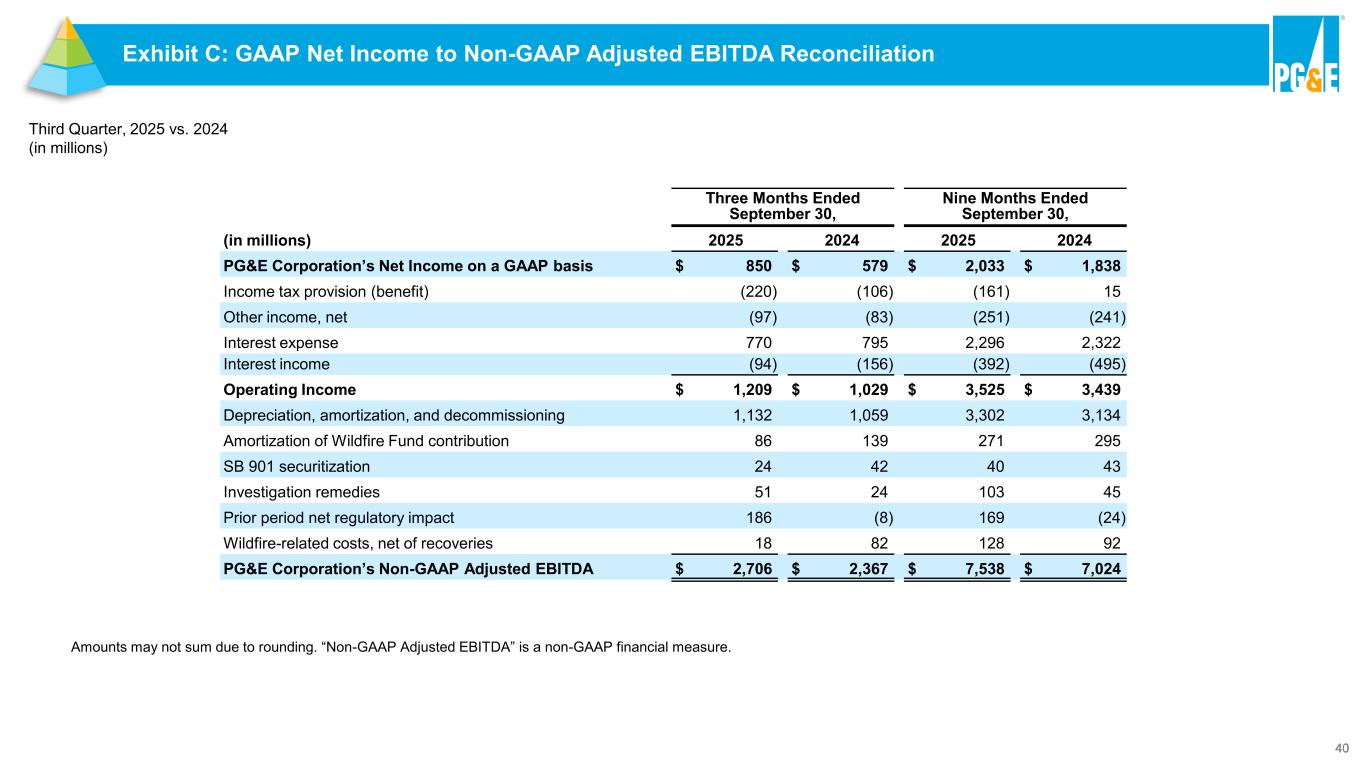

40 Three Months Ended September 30, Nine Months Ended September 30, (in millions) 2025 2024 2025 2024 PG&E Corporation’s Net Income on a GAAP basis $ 850 $ 579 $ 2,033 $ 1,838 Income tax provision (benefit) (220) (106) (161) 15 Other income, net (97) (83) (251) (241) Interest expense 770 795 2,296 2,322 Interest income (94) (156) (392) (495) Operating Income $ 1,209 $ 1,029 $ 3,525 $ 3,439 Depreciation, amortization, and decommissioning 1,132 1,059 3,302 3,134 Amortization of Wildfire Fund contribution 86 139 271 295 SB 901 securitization 24 42 40 43 Investigation remedies 51 24 103 45 Prior period net regulatory impact 186 (8) 169 (24) Wildfire-related costs, net of recoveries 18 82 128 92 PG&E Corporation’s Non-GAAP Adjusted EBITDA $ 2,706 $ 2,367 $ 7,538 $ 7,024 Third Quarter, 2025 vs. 2024 (in millions) Amounts may not sum due to rounding. “Non-GAAP Adjusted EBITDA” is a non-GAAP financial measure. Exhibit C: GAAP Net Income to Non-GAAP Adjusted EBITDA Reconciliation

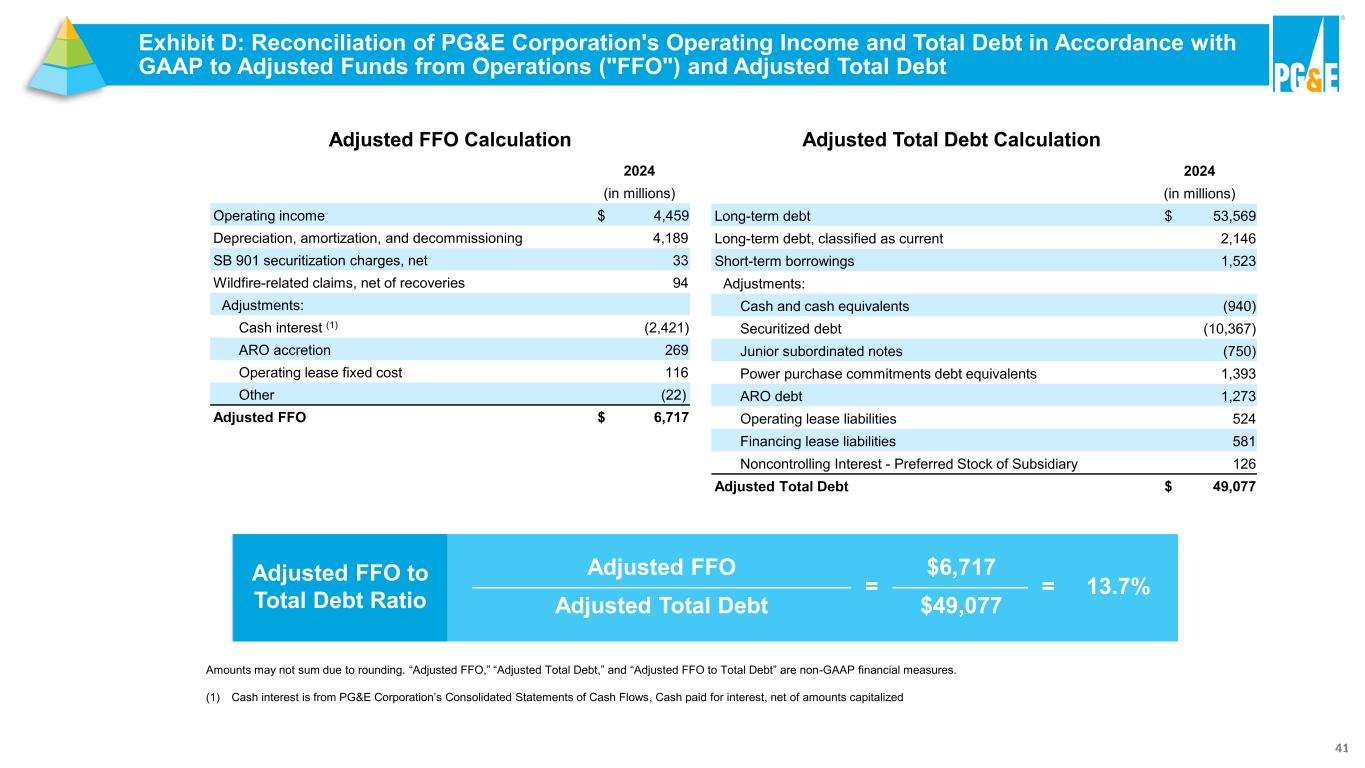

41 Exhibit D: Reconciliation of PG&E Corporation's Operating Income and Total Debt in Accordance with GAAP to Adjusted Funds from Operations ("FFO") and Adjusted Total Debt 2024 (in millions) Operating income $ 4,459 Depreciation, amortization, and decommissioning 4,189 SB 901 securitization charges, net 33 Wildfire-related claims, net of recoveries 94 Adjustments: Cash interest (1) (2,421) ARO accretion 269 Operating lease fixed cost 116 Other (22) Adjusted FFO $ 6,717 2024 (in millions) Long-term debt $ 53,569 Long-term debt, classified as current 2,146 Short-term borrowings 1,523 Adjustments: Cash and cash equivalents (940) Securitized debt (10,367) Junior subordinated notes (750) Power purchase commitments debt equivalents 1,393 ARO debt 1,273 Operating lease liabilities 524 Financing lease liabilities 581 Noncontrolling Interest - Preferred Stock of Subsidiary 126 Adjusted Total Debt $ 49,077 Adjusted FFO Calculation Adjusted Total Debt Calculation Adjusted FFO = $6,717 = 13.7% Adjusted Total Debt $49,077 Adjusted FFO to Total Debt Ratio Amounts may not sum due to rounding. “Adjusted FFO,” “Adjusted Total Debt,” and “Adjusted FFO to Total Debt” are non-GAAP financial measures. (1) Cash interest is from PG&E Corporation’s Consolidated Statements of Cash Flows, Cash paid for interest, net of amounts capitalized

42 Non-GAAP Core Earnings and Non-GAAP Core EPS “Non-GAAP core earnings” and “Non-GAAP core EPS,” also referred to as “non-GAAP core earnings per share,” are non-GAAP financial measures. Non-GAAP core earnings is calculated as income available for common shareholders, diluted, less non-core items. “Non-core items” include items that management does not consider representative of ongoing earnings and affect comparability of financial results between periods, consisting of the items listed in Exhibit A. Non-GAAP core EPS is calculated as non-GAAP core earnings divided by common shares outstanding on a diluted basis. PG&E Corporation discloses historical financial results and provides guidance based on “non-GAAP core earnings” and “non-GAAP core EPS” in order to provide measures that allow investors to compare the underlying financial performance of the business from one period to another, exclusive of non-core items. PG&E Corporation and the Utility use non-GAAP core earnings and non-GAAP core EPS to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and long-term operating planning, and employee incentive compensation. PG&E Corporation and the Utility believe that non-GAAP core earnings and non-GAAP core EPS provide additional insight into the underlying trends of the business, allowing for a better comparison against historical results and expectations for future performance. PG&E Corporation is unable to provide GAAP guidance or present a quantitative reconciliation of forward-looking non-GAAP core earnings, non-GAAP core EPS, or non-GAAP core EPS growth without unreasonable effort because specific line items, which may be significant, are not estimable. For instance, amortization of the Wildfire Fund contribution asset, the impacts of regulatory decisions, special tax items, and wildfire-related costs, net of recoveries, are difficult to predict due to various factors outside of management’s control. Non-GAAP core earnings and non-GAAP core EPS are not substitutes or alternatives for GAAP measures such as consolidated income available for common shareholders and may not be comparable to similarly titled measures used by other companies. Exhibit E: Non-GAAP Financial Measures