Q3 Fiscal 2026 Financial Results Conference Call February 9, 2026 Kristine MoserGregory RustowiczDavid Wilson President & Chief Executive Officer Executive Vice President Finance & Chief Financial Officer Vice President, Investor Relations & Treasurer

Safe Harbor Statement 2 This presentation and the accompanying oral discussion contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward looking statements are generally identified by the use of forward-looking terminology, including the terms "anticipate," “believe,” “continue,” “could,” “estimate,” “expect,” “illustrative,” “intend,” “likely,” “may,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “shall,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. Such forward-looking statements include, among others, statements regarding: (1) our strategy, outlook and growth prospects, including our fiscal year 2026 guidance and the impact of certain transaction-related expenses, purchase accounting adjustments, early integration costs and higher interests expense on GAAP earnings per shares for the fourth quarter and for the full fiscal year of 2026; (2) our ability to de-leverage the Company to a Net Leverage Ratio to below 4.0x by the end of fiscal 2028; (3) our operational and financial targets and capital allocation priorities including our ability to generate significant free cash flow to fund these capital allocation priorities and our ability to advance our Intelligent Motion strategy; (4) general economic trends and trends in our industry and markets; (5) expected timing for the closing of the divestiture; (6) the benefits expected to be achieved from the Kito Crosby acquisition and the Company's ability to realize expected synergies; and (7) the competitive environment in which we operate. Forward-looking statements are not based on historical facts, but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions, and involve known and unknown risks, uncertainties and other factors that could cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. It is not possible to predict or identify all such risks. These risks include, but are not limited to, (1) risks relating to the competitive environment in which we operate; (2) the risk that the integration of Kito Crosby's business and operations into the Company will be materially delayed or will be more costly or difficult than expected, or that the Company is otherwise unable to successfully integrate Kito Crosby's business into its own, including as a result of unexpected factors or events; (3) risks related to the general competitive, economic, political and market conditions and other factors that may affect future results of the Company; and (4) the other risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2025 as well as in our other filings with the Securities and Exchange Commission, which are available on its website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward looking statements speak only as of the date they are made. Columbus McKinnon undertakes no duty to update publicly any such forward- looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority. Non-GAAP Financial Measures and Forward-looking Non-GAAP Financial Measures This presentation will discuss some non-GAAP (“adjusted”) financial measures which we believe are useful in evaluating Columbus McKinnon’s performance. You should not consider the presentation of this additional information in isolation or as a substitute for results prepared in accordance with GAAP. The non-GAAP financial measures are noted and reconciliations of comparable historical GAAP measures with historical non-GAAP financial measures can be found in tables either included in the Supplemental Information portion of this presentation or our filings with the Securities and Exchange Commission.

Q3 FY26 Highlights 3 1 Non-GAAP financial measure; see definition and reconciliation at the end of this Presentation 2 In connection with the preparation of this presentation, the Company has used its updated definition of Adjusted EBITDA, which includes an addback of Company's stock-based compensation expense. This revised definition of Adjusted EBITDA was used to calculate Adjusted EBITDA set forth above and will be used by the Company on a go-forward basis for purposes of all future Adjusted EBITDA disclosures. This definitional change was driven by the Company's belief that adding back the expense associated with stock-based compensation for purposes of the computation of Adjusted EBITDA will provide the Company's investors with a better understanding of our underlying performance from period to period and enable them to better compare our performance against that of our peer companies, many of which also include an addback of stock-based compensation expense in computing Adjusted EBITDA. Double-digit growth in orders and backlog Y/Y Net sales of $259M increased 10% from prior year Net income of $6M, or $0.21 per diluted share was up 50% Y/Y Adjusted Net Income1 of $18 million, or $0.62 per diluted share1 was up 11% Y/Y Adjusted EBITDA1,2 of $40 million with Adjusted EBITDA Margin1,2 of 15.4% YTD cash provided by operations of $21M increased 106% as strong cash generation more than offset acquisitions-related cash outflows of $13M Completed closing of the Kito Crosby acquisition and announced go-forward leadership team Delivered Double-Digit Sales, Order and Adjusted EPS Growth; Strong Cash Flow Provided by Operations YTD

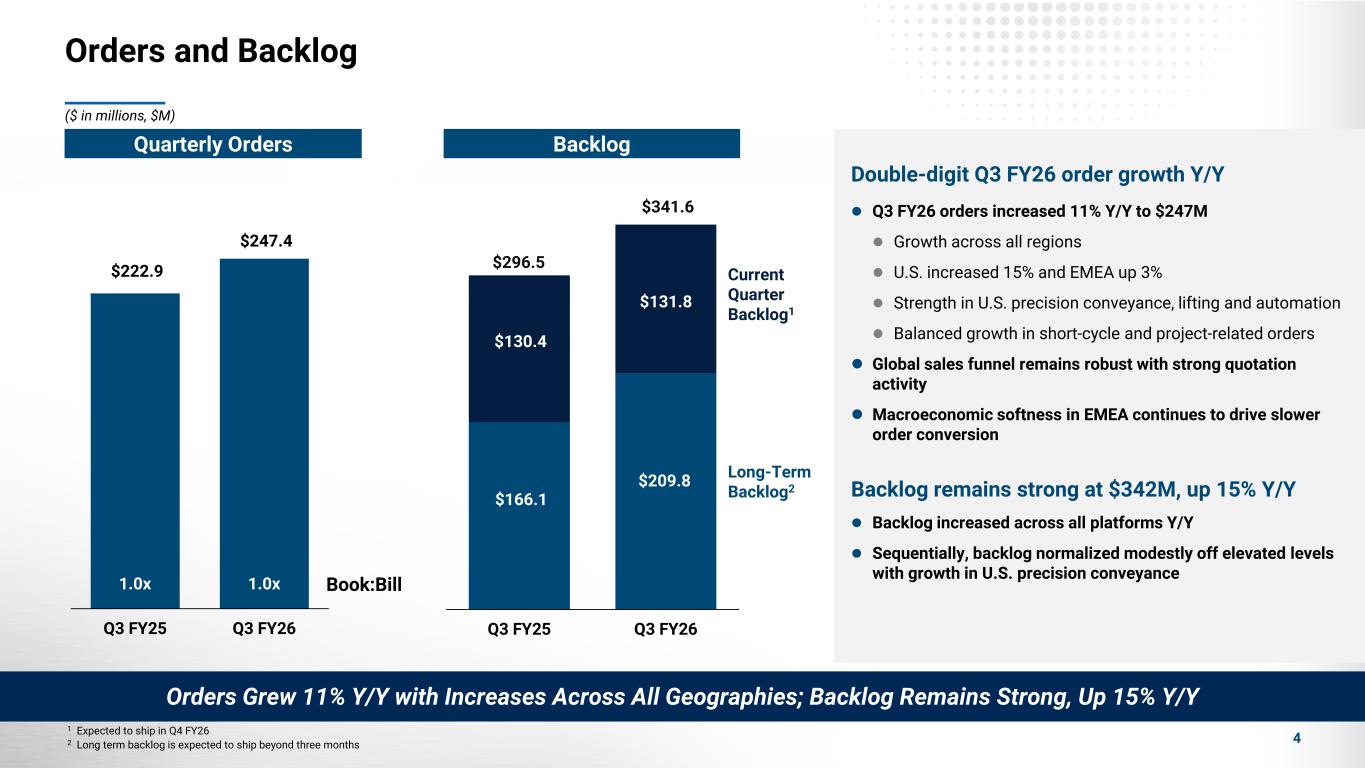

Orders and Backlog 4 $166.1 $209.8 $130.4 $131.8 $296.5 $341.6 Q3 FY25 Q3 FY26 Book:Bill $222.9 $247.4 1.0x 1.0x 0.0x 0.2x 0.4x 0.6x 0.8x 1.0x 1.2x 1.4x 1.6x 1.8x 2.0x $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 Q3 FY25 Q3 FY26 Current Quarter Backlog1 Long-Term Backlog2 1 Expected to ship in Q4 FY26 2 Long term backlog is expected to ship beyond three months Orders Grew 11% Y/Y with Increases Across All Geographies; Backlog Remains Strong, Up 15% Y/Y Double-digit Q3 FY26 order growth Y/Y Q3 FY26 orders increased 11% Y/Y to $247M Growth across all regions U.S. increased 15% and EMEA up 3% Strength in U.S. precision conveyance, lifting and automation Balanced growth in short-cycle and project-related orders Global sales funnel remains robust with strong quotation activity Macroeconomic softness in EMEA continues to drive slower order conversion Backlog remains strong at $342M, up 15% Y/Y Backlog increased across all platforms Y/Y Sequentially, backlog normalized modestly off elevated levels with growth in U.S. precision conveyance ($ in millions, $M) BacklogQuarterly Orders

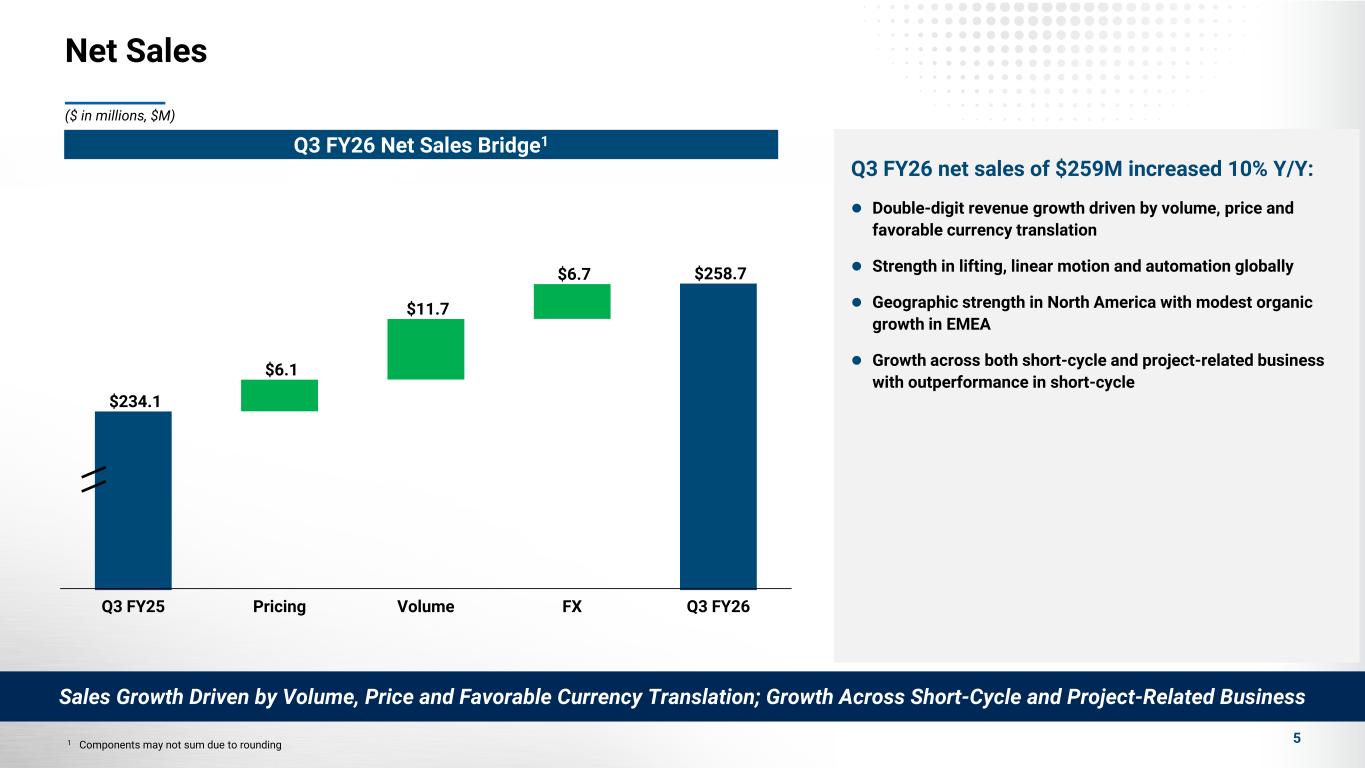

$234.1 $6.1 $11.7 $6.7 $258.7 Q3 FY25 Pricing Volume FX Q3 FY26 Q3 FY26 Net Sales Bridge1 Net Sales 5 Q3 FY26 net sales of $259M increased 10% Y/Y: Double-digit revenue growth driven by volume, price and favorable currency translation Strength in lifting, linear motion and automation globally Geographic strength in North America with modest organic growth in EMEA Growth across both short-cycle and project-related business with outperformance in short-cycle Sales Growth Driven by Volume, Price and Favorable Currency Translation; Growth Across Short-Cycle and Project-Related Business ($ in millions, $M) 1 Components may not sum due to rounding

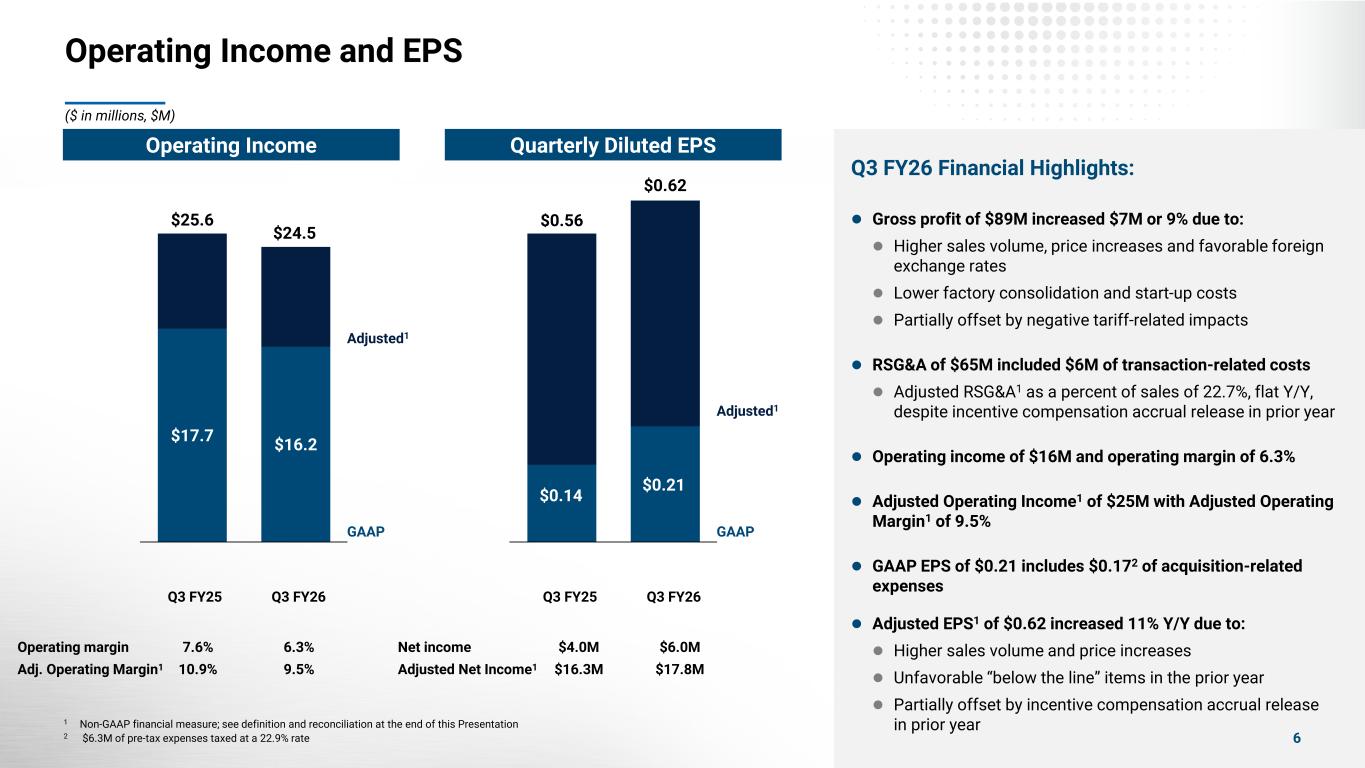

Operating Income and EPS ($ in millions, $M) Quarterly Diluted EPSOperating Income Net income $4.0M $6.0M Adjusted Net Income1 $16.3M $17.8M $0.14 $0.21 $0.56 $0.62 Adjusted1 GAAP $17.7 $16.2 $25.6 $24.5 Adjusted1 GAAP Operating margin 7.6% 6.3% Adj. Operating Margin1 10.9% 9.5% Q3 FY25 Q3 FY26 Q3 FY26 Financial Highlights: Gross profit of $89M increased $7M or 9% due to: Higher sales volume, price increases and favorable foreign exchange rates Lower factory consolidation and start-up costs Partially offset by negative tariff-related impacts RSG&A of $65M included $6M of transaction-related costs Adjusted RSG&A1 as a percent of sales of 22.7%, flat Y/Y, despite incentive compensation accrual release in prior year Operating income of $16M and operating margin of 6.3% Adjusted Operating Income1 of $25M with Adjusted Operating Margin1 of 9.5% GAAP EPS of $0.21 includes $0.172 of acquisition-related expenses Adjusted EPS1 of $0.62 increased 11% Y/Y due to: Higher sales volume and price increases Unfavorable “below the line” items in the prior year Partially offset by incentive compensation accrual release in prior year Q3 FY25 Q3 FY26 6 1 Non-GAAP financial measure; see definition and reconciliation at the end of this Presentation 2 $6.3M of pre-tax expenses taxed at a 22.9% rate

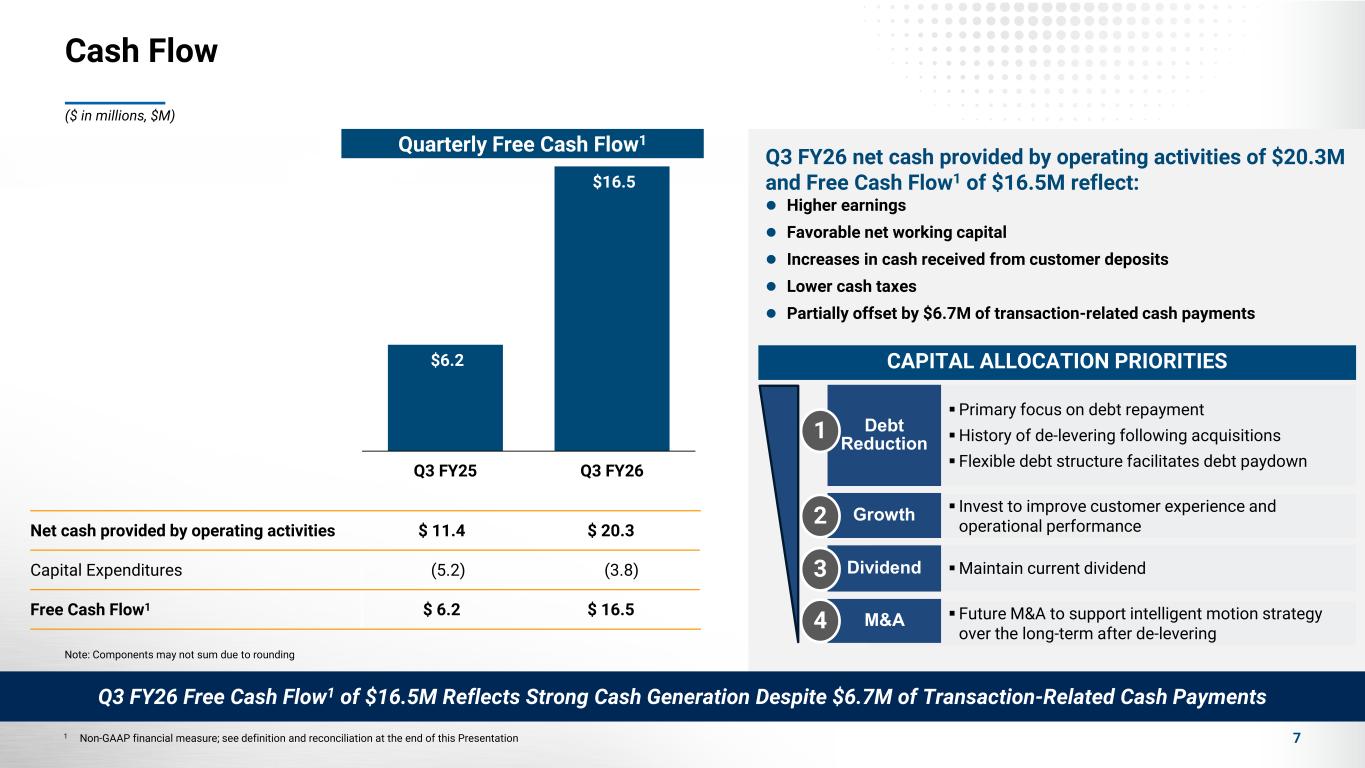

Cash Flow 7 Net cash provided by operating activities $ 11.4 $ 20.3 Capital Expenditures (5.2) (3.8) Free Cash Flow1 $ 6.2 $ 16.5 Note: Components may not sum due to rounding Q3 FY26 net cash provided by operating activities of $20.3M and Free Cash Flow1 of $16.5M reflect: Higher earnings Favorable net working capital Increases in cash received from customer deposits Lower cash taxes Partially offset by $6.7M of transaction-related cash payments Primary focus on debt repayment History of de-levering following acquisitions Flexible debt structure facilitates debt paydown CAPITAL ALLOCATION PRIORITIES Debt Reduction Invest to improve customer experience and operational performance Growth Maintain current dividend Future M&A to support intelligent motion strategy over the long-term after de-levering Dividend M&A 1 2 3 4 Q3 FY26 Free Cash Flow1 of $16.5M Reflects Strong Cash Generation Despite $6.7M of Transaction-Related Cash Payments 1 Non-GAAP financial measure; see definition and reconciliation at the end of this Presentation ($ in millions, $M) Quarterly Free Cash Flow1 $6.2 $16.5 Q3 FY25 Q3 FY26

FY2026 Guidance 8 Given the recently completed Kito Crosby acquisition and the pending divestiture of our U.S. power chain hoist and chain operations, the Company is withdrawing FY26 guidance due to: Uncertainty around the timing of the divestiture Regulatory limitations on information sharing with or from Kito Crosby prior to closing The integration of our financial processes within Kito Crosby Consistent with prior years' convention, we will provide an updated financial outlook and issue financial guidance for fiscal 2027 in conjunction with our fourth quarter fiscal 2026 earnings release in late May of 2026. Certain transaction-related expenses, purchase accounting adjustments and early integration costs will be incurred in Q4 FY26. The impact of these costs as well as higher interest expense is expected to be dilutive to GAAP earnings per share in Q4 FY26.

Supplement

Non-GAAP Measures 10 The following information provides definitions and reconciliations of the non-GAAP financial measures presented in this presentation to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). The Company has provided this non-GAAP financial information, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in this presentation that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this presentation. The non-GAAP financial measures in this presentation may differ from similarly titled measures used by other companies. Adjusted Gross Profit and Adjusted Gross Margin Adjusted RSG&A and Adjusted RSG&A as a Percentage of Sales Adjusted Operating Income and Adjusted Operating Margin Adjusted Net Income and Adjusted EPS Adjusted EBITDA and Adjusted EBITDA Margin Free Cash Flow

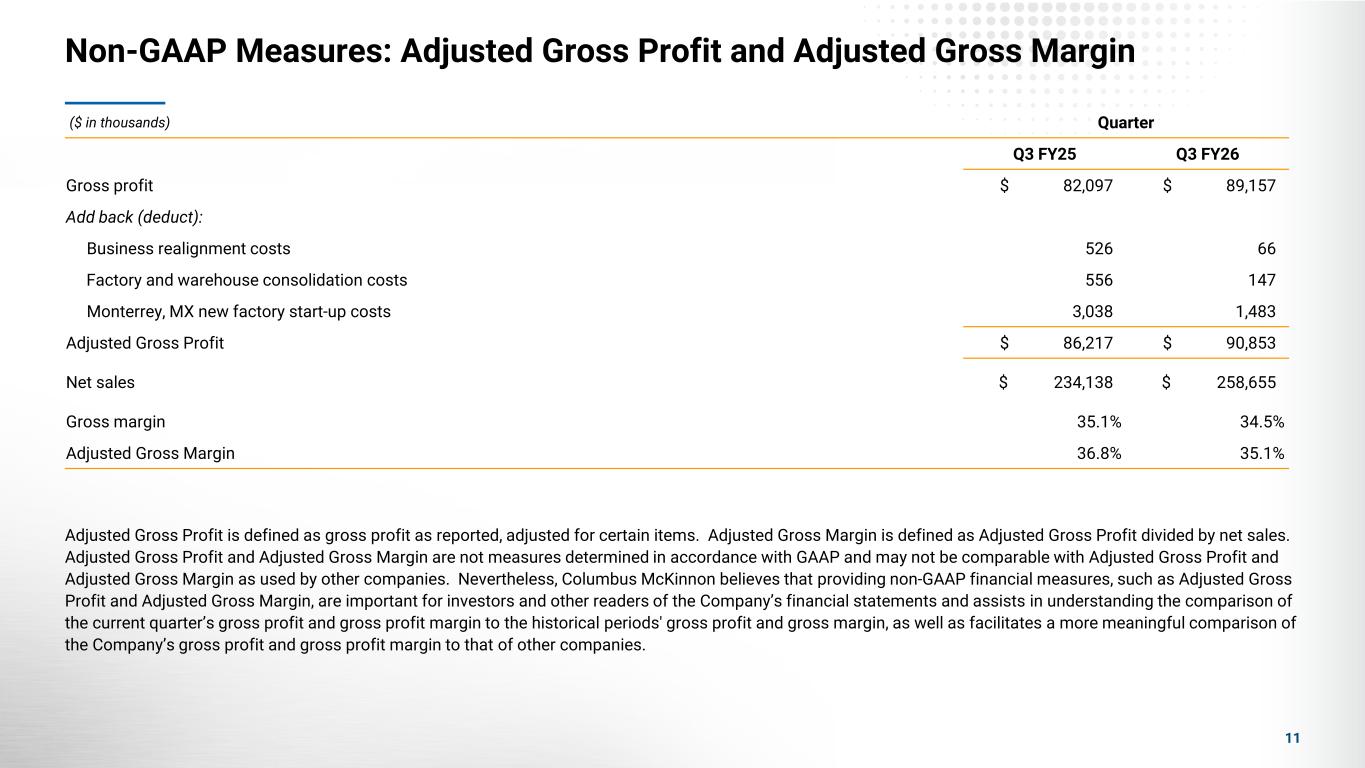

Non-GAAP Measures: Adjusted Gross Profit and Adjusted Gross Margin 11 Adjusted Gross Profit is defined as gross profit as reported, adjusted for certain items. Adjusted Gross Margin is defined as Adjusted Gross Profit divided by net sales. Adjusted Gross Profit and Adjusted Gross Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Gross Profit and Adjusted Gross Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Gross Profit and Adjusted Gross Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s gross profit and gross profit margin to the historical periods' gross profit and gross margin, as well as facilitates a more meaningful comparison of the Company’s gross profit and gross profit margin to that of other companies. ($ in thousands) Quarter Q3 FY25 Q3 FY26 Gross profit $ 82,097 $ 89,157 Add back (deduct): Business realignment costs 526 66 Factory and warehouse consolidation costs 556 147 Monterrey, MX new factory start-up costs 3,038 1,483 Adjusted Gross Profit $ 86,217 $ 90,853 Net sales $ 234,138 $ 258,655 Gross margin 35.1% 34.5% Adjusted Gross Margin 36.8% 35.1%

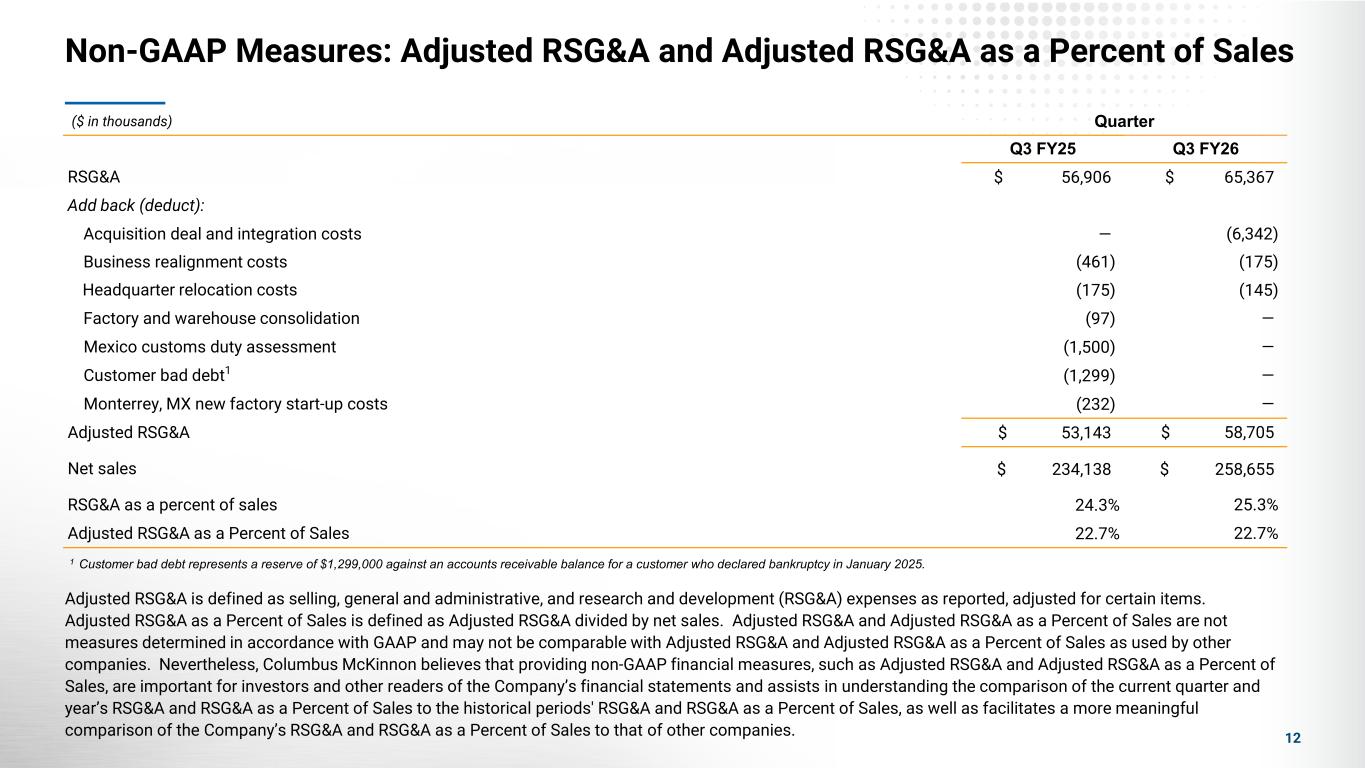

Non-GAAP Measures: Adjusted RSG&A and Adjusted RSG&A as a Percent of Sales 12 ($ in thousands) Quarter Q3 FY25 Q3 FY26 RSG&A $ 56,906 $ 65,367 Add back (deduct): Acquisition deal and integration costs — (6,342) Business realignment costs (461) (175) Headquarter relocation costs (175) (145) Factory and warehouse consolidation (97) — Mexico customs duty assessment (1,500) — Customer bad debt1 (1,299) — Monterrey, MX new factory start-up costs (232) — Adjusted RSG&A $ 53,143 $ 58,705 Net sales $ 234,138 $ 258,655 RSG&A as a percent of sales 24.3% 25.3% Adjusted RSG&A as a Percent of Sales 22.7% 22.7% Adjusted RSG&A is defined as selling, general and administrative, and research and development (RSG&A) expenses as reported, adjusted for certain items. Adjusted RSG&A as a Percent of Sales is defined as Adjusted RSG&A divided by net sales. Adjusted RSG&A and Adjusted RSG&A as a Percent of Sales are not measures determined in accordance with GAAP and may not be comparable with Adjusted RSG&A and Adjusted RSG&A as a Percent of Sales as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted RSG&A and Adjusted RSG&A as a Percent of Sales, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter and year’s RSG&A and RSG&A as a Percent of Sales to the historical periods' RSG&A and RSG&A as a Percent of Sales, as well as facilitates a more meaningful comparison of the Company’s RSG&A and RSG&A as a Percent of Sales to that of other companies. 1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January 2025.

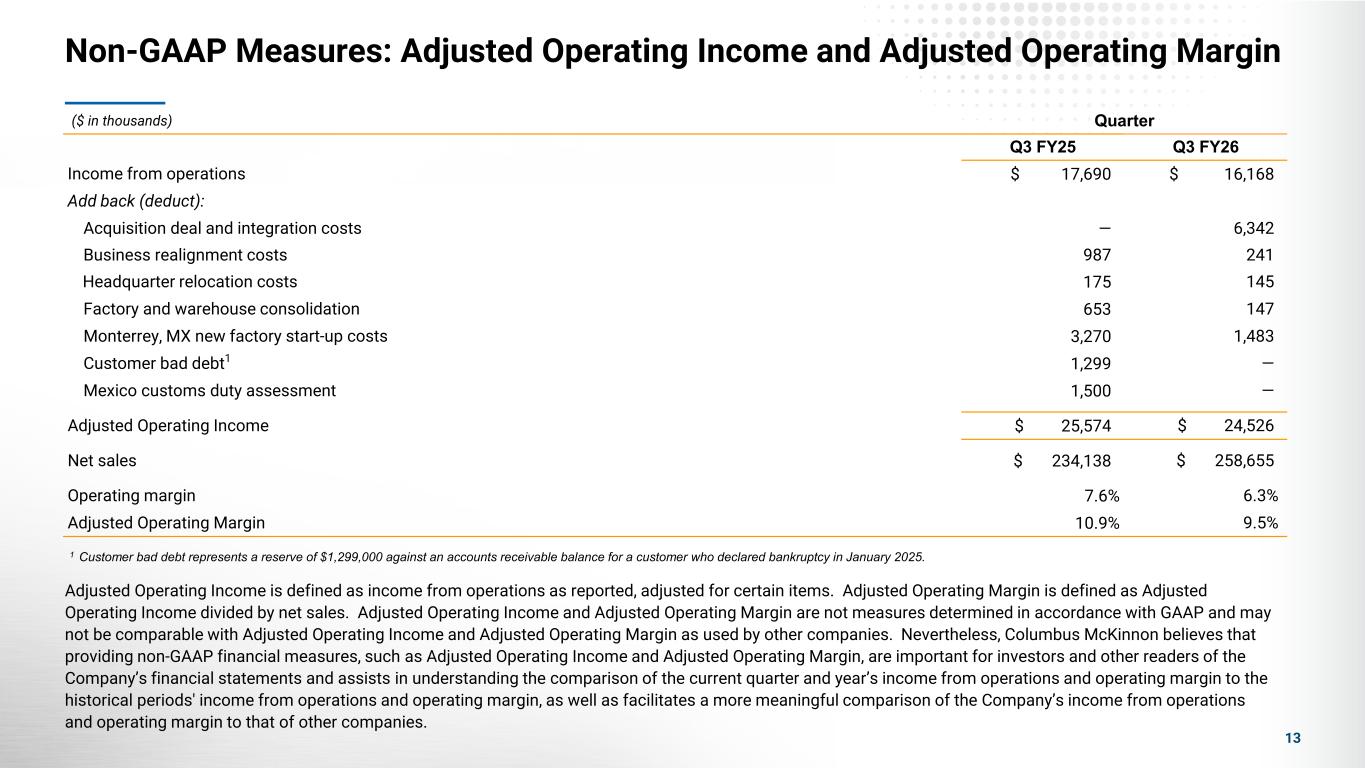

Non-GAAP Measures: Adjusted Operating Income and Adjusted Operating Margin 13 ($ in thousands) Quarter Q3 FY25 Q3 FY26 Income from operations $ 17,690 $ 16,168 Add back (deduct): Acquisition deal and integration costs — 6,342 Business realignment costs 987 241 Headquarter relocation costs 175 145 Factory and warehouse consolidation 653 147 Monterrey, MX new factory start-up costs 3,270 1,483 Customer bad debt1 1,299 — Mexico customs duty assessment 1,500 — Adjusted Operating Income $ 25,574 $ 24,526 Net sales $ 234,138 $ 258,655 Operating margin 7.6% 6.3% Adjusted Operating Margin 10.9% 9.5% Adjusted Operating Income is defined as income from operations as reported, adjusted for certain items. Adjusted Operating Margin is defined as Adjusted Operating Income divided by net sales. Adjusted Operating Income and Adjusted Operating Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Operating Income and Adjusted Operating Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Operating Income and Adjusted Operating Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter and year’s income from operations and operating margin to the historical periods' income from operations and operating margin, as well as facilitates a more meaningful comparison of the Company’s income from operations and operating margin to that of other companies. 1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January 2025.

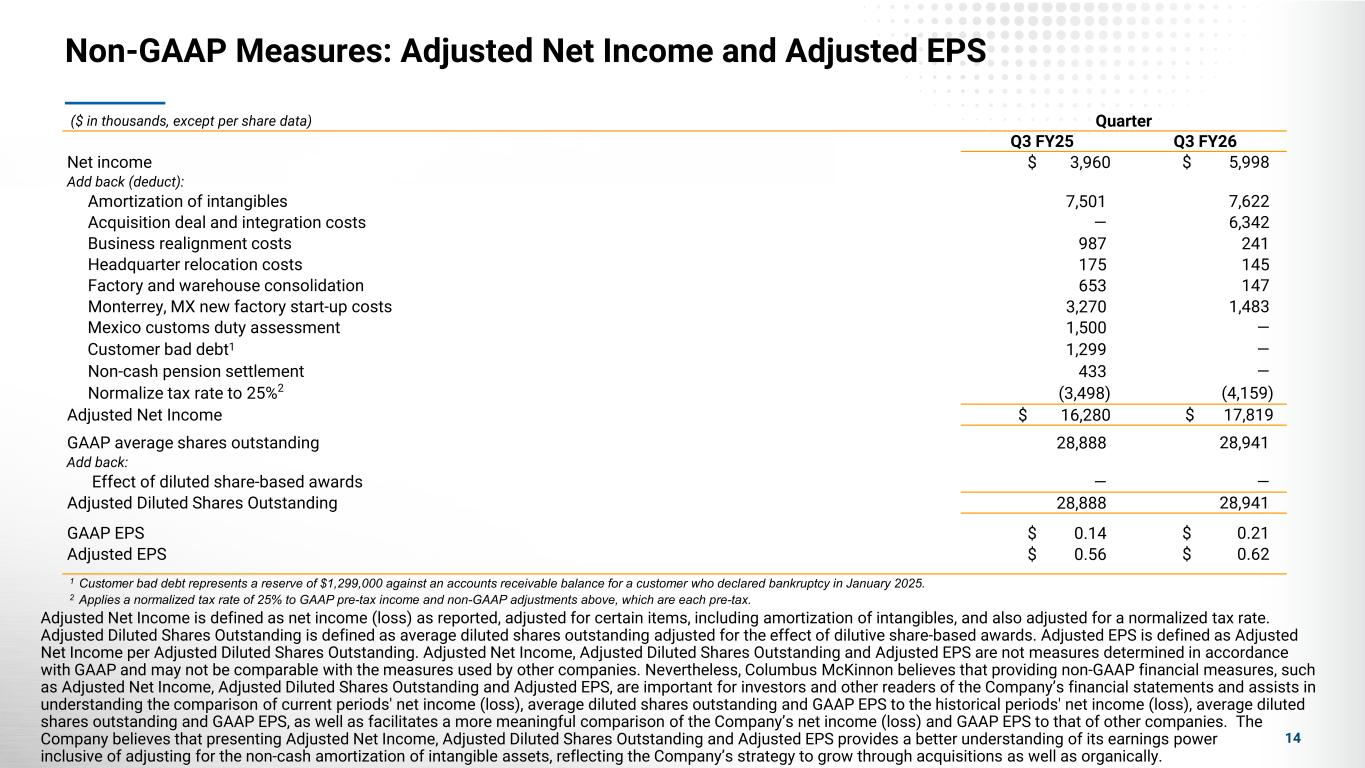

Adjusted Net Income is defined as net income (loss) as reported, adjusted for certain items, including amortization of intangibles, and also adjusted for a normalized tax rate. Adjusted Diluted Shares Outstanding is defined as average diluted shares outstanding adjusted for the effect of dilutive share-based awards. Adjusted EPS is defined as Adjusted Net Income per Adjusted Diluted Shares Outstanding. Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS are not measures determined in accordance with GAAP and may not be comparable with the measures used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of current periods' net income (loss), average diluted shares outstanding and GAAP EPS to the historical periods' net income (loss), average diluted shares outstanding and GAAP EPS, as well as facilitates a more meaningful comparison of the Company’s net income (loss) and GAAP EPS to that of other companies. The Company believes that presenting Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically. Non-GAAP Measures: Adjusted Net Income and Adjusted EPS ($ in thousands, except per share data) Quarter Q3 FY25 Q3 FY26 Net income $ 3,960 $ 5,998 Add back (deduct): Amortization of intangibles 7,501 7,622 Acquisition deal and integration costs — 6,342 Business realignment costs 987 241 Headquarter relocation costs 175 145 Factory and warehouse consolidation 653 147 Monterrey, MX new factory start-up costs 3,270 1,483 Mexico customs duty assessment 1,500 — Customer bad debt1 1,299 — Non-cash pension settlement 433 — Normalize tax rate to 25%2 (3,498) (4,159) Adjusted Net Income $ 16,280 $ 17,819 GAAP average shares outstanding 28,888 28,941 Add back: Effect of diluted share-based awards — — Adjusted Diluted Shares Outstanding 28,888 28,941 GAAP EPS $ 0.14 $ 0.21 Adjusted EPS $ 0.56 $ 0.62 14 1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January 2025. 2 Applies a normalized tax rate of 25% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax.

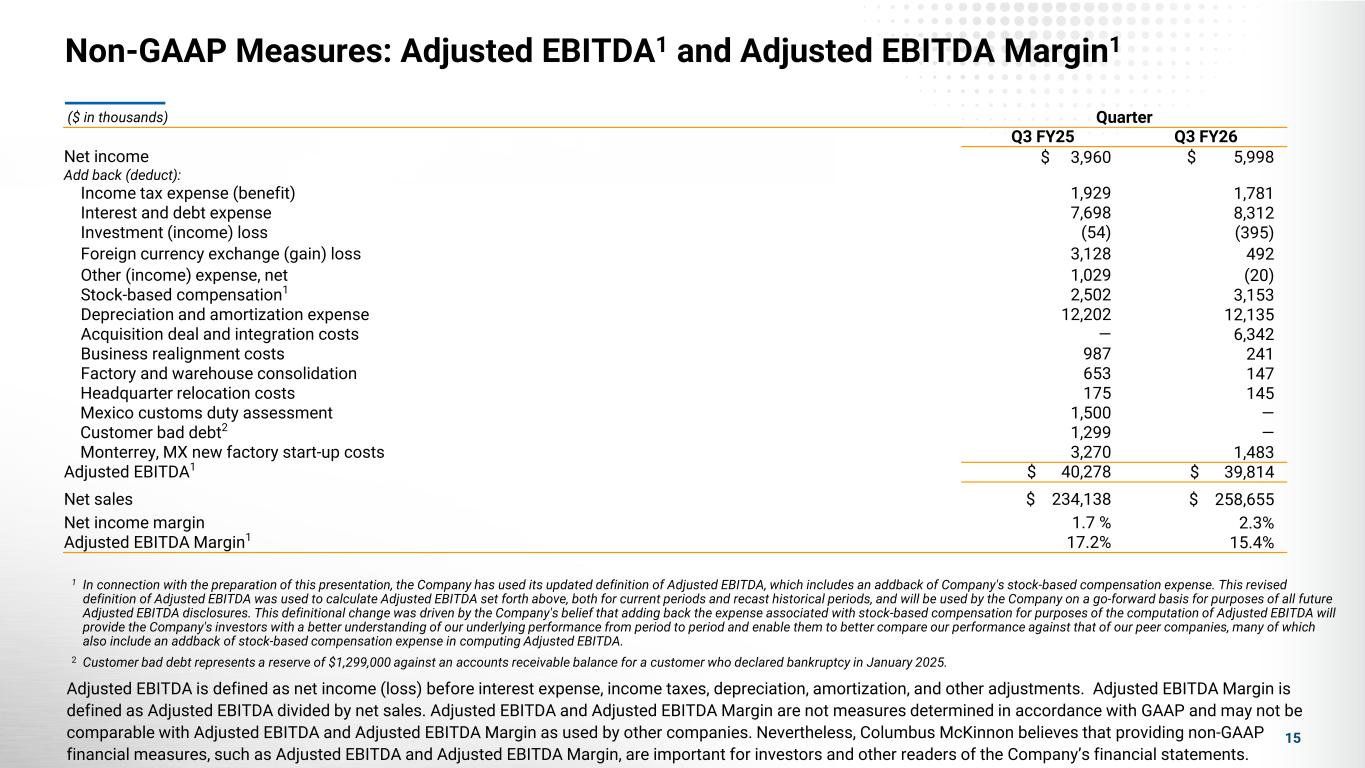

Non-GAAP Measures: Adjusted EBITDA1 and Adjusted EBITDA Margin1 15 Adjusted EBITDA is defined as net income (loss) before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales. Adjusted EBITDA and Adjusted EBITDA Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted EBITDA and Adjusted EBITDA Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, are important for investors and other readers of the Company’s financial statements. ($ in thousands) Quarter Q3 FY25 Q3 FY26 Net income $ 3,960 $ 5,998 Add back (deduct): Income tax expense (benefit) 1,929 1,781 Interest and debt expense 7,698 8,312 Investment (income) loss (54) (395) Foreign currency exchange (gain) loss 3,128 492 Other (income) expense, net 1,029 (20) Stock-based compensation1 2,502 3,153 Depreciation and amortization expense 12,202 12,135 Acquisition deal and integration costs — 6,342 Business realignment costs 987 241 Factory and warehouse consolidation 653 147 Headquarter relocation costs 175 145 Mexico customs duty assessment 1,500 — Customer bad debt2 1,299 — Monterrey, MX new factory start-up costs 3,270 1,483 Adjusted EBITDA1 $ 40,278 $ 39,814 Net sales $ 234,138 $ 258,655 Net income margin 1.7 % 2.3% Adjusted EBITDA Margin1 17.2% 15.4% 1 In connection with the preparation of this presentation, the Company has used its updated definition of Adjusted EBITDA, which includes an addback of Company's stock-based compensation expense. This revised definition of Adjusted EBITDA was used to calculate Adjusted EBITDA set forth above, both for current periods and recast historical periods, and will be used by the Company on a go-forward basis for purposes of all future Adjusted EBITDA disclosures. This definitional change was driven by the Company's belief that adding back the expense associated with stock-based compensation for purposes of the computation of Adjusted EBITDA will provide the Company's investors with a better understanding of our underlying performance from period to period and enable them to better compare our performance against that of our peer companies, many of which also include an addback of stock-based compensation expense in computing Adjusted EBITDA. 2 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January 2025.

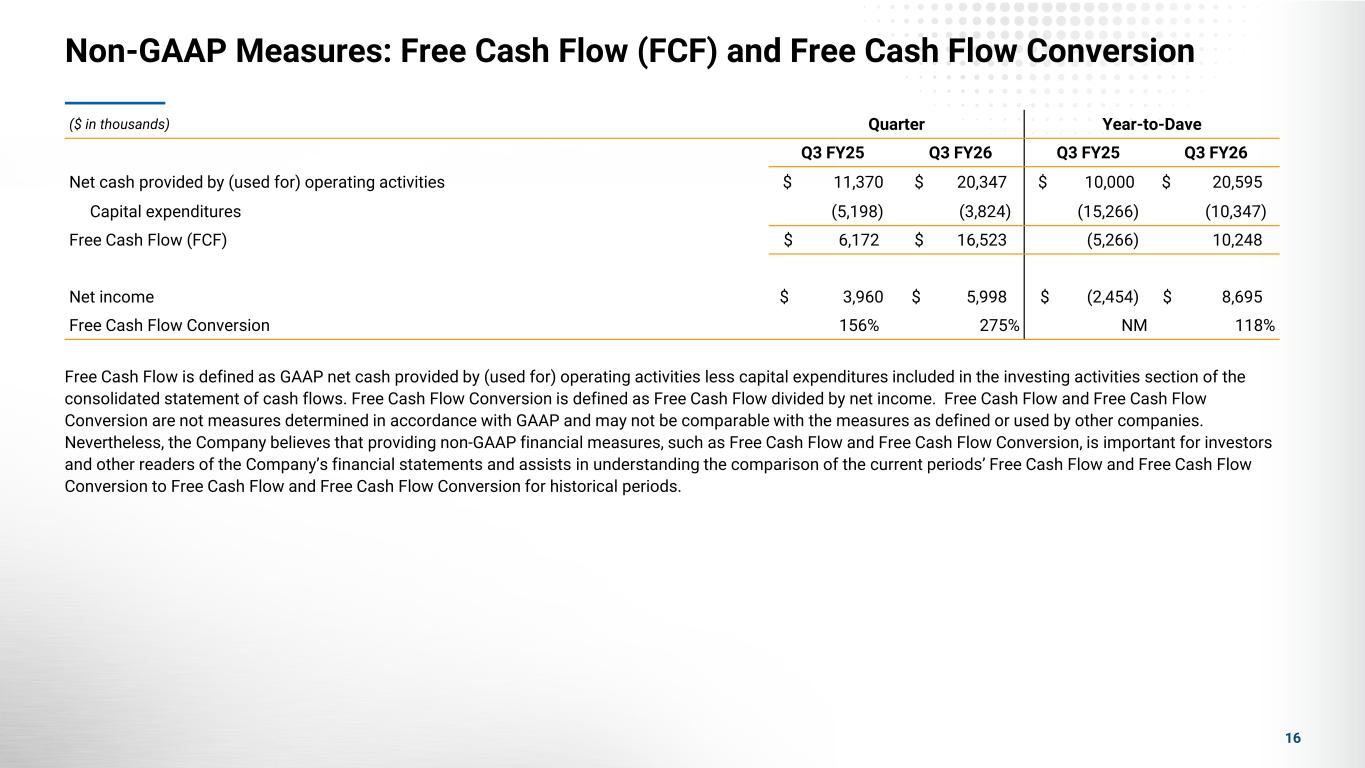

Non-GAAP Measures: Free Cash Flow (FCF) and Free Cash Flow Conversion 16 Free Cash Flow is defined as GAAP net cash provided by (used for) operating activities less capital expenditures included in the investing activities section of the consolidated statement of cash flows. Free Cash Flow Conversion is defined as Free Cash Flow divided by net income. Free Cash Flow and Free Cash Flow Conversion are not measures determined in accordance with GAAP and may not be comparable with the measures as defined or used by other companies. Nevertheless, the Company believes that providing non-GAAP financial measures, such as Free Cash Flow and Free Cash Flow Conversion, is important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current periods’ Free Cash Flow and Free Cash Flow Conversion to Free Cash Flow and Free Cash Flow Conversion for historical periods. ($ in thousands) Quarter Year-to-Dave Q3 FY25 Q3 FY26 Q3 FY25 Q3 FY26 Net cash provided by (used for) operating activities $ 11,370 $ 20,347 $ 10,000 $ 20,595 Capital expenditures (5,198) (3,824) (15,266) (10,347) Free Cash Flow (FCF) $ 6,172 $ 16,523 (5,266) 10,248 Net income $ 3,960 $ 5,998 $ (2,454) $ 8,695 Free Cash Flow Conversion 156% 275% NM 118%