the Notes may trade at a discount from the initial offering price of the Notes depending on the prevailing interest rates, the market for similar securities, our performance and other factors,

many of which are beyond our control.

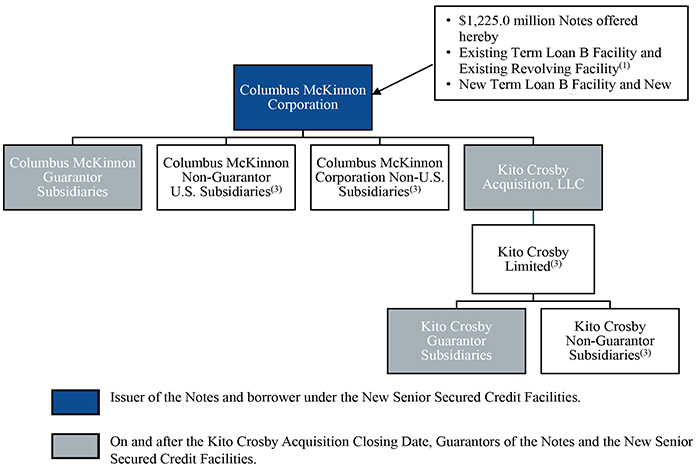

If we and, following the Kito Crosby Acquisition Closing Date, the Guarantors do not fulfill our obligations

to you under the Notes or the guarantees, you will not have any recourse against our equity holders.

None of our indirect equity

holders, investors, directors, officers, employees or affiliates, including, without limitation, certain entities affiliated with the CD&R Investors, will be an obligor or guarantor under the Notes. If we do not fulfill our obligations to you

under the Notes, you will have no recourse against any of our indirect equity holders, directors, officers, employees or affiliates (who are non-guarantors), including, without limitation, the entities or

persons listed above.

The Indenture will not be qualified under the Trust Indenture Act and we will not be required to comply with the provisions

of the Trust Indenture Act.

The Indenture will not be qualified under the Trust Indenture Act of 1939, as amended (the

“Trust Indenture Act”), and we will not be required to comply with the provisions of the Trust Indenture Act. Therefore, holders of the Notes will not be entitled to the benefit of the provisions and protection of the Trust Indenture Act

except to the extent there are similar provisions in the Indenture.

On and after the Kito Crosby Acquisition Closing Date, there may not be

sufficient Collateral to pay all or any of the Notes.

No appraisal of the value of the Collateral has been made in connection with

this offering and the value of the Collateral in the event of liquidation will depend on market and economic conditions, the availability of buyers and other factors. Consequently, liquidating the Collateral securing the Notes may not produce

proceeds in an amount sufficient to pay any amounts due on the Notes.

On and after the Kito Crosby Acquisition Closing Date, our

obligations under the New Senior Secured Credit Facilities will be secured by the Collateral ratably with our obligations under the Notes. As a result, upon any distribution to our creditors, foreclosure, liquidation, reorganization, bankruptcy or

other insolvency proceedings, or following acceleration of our indebtedness or an event of default under our indebtedness, the lenders under the New Senior Secured Credit Facilities will be entitled to be repaid from the proceeds of the Collateral

ratably with any payment made to holders of the Notes from such proceeds. In addition, the terms of the Indenture will permit, subject to certain limitations, the incurrence of additional debt that may be secured on a pari passu priority basis with

the Notes and the New Senior Secured Credit Facilities with respect to the Collateral.

The fair market value of the Collateral securing

the Notes is subject to fluctuations based on factors that include, among others, the condition of our industry, the real estate markets and the markets for other forms of collateral, the ability to sell the Collateral in an orderly sale, general

economic conditions, the availability of buyers and other factors. The amount to be received upon a sale of the Collateral would be dependent on numerous factors, including, but not limited to, the actual fair market value of the Collateral at such

time and the timing and the manner of the sale. By its nature, portions of the Collateral may be illiquid and may have no readily ascertainable market value. Accordingly, there can be no assurance that the Collateral can be sold in a short period of

time or in an orderly manner. In the event of a foreclosure, liquidation, reorganization, bankruptcy or other insolvency proceeding, we cannot assure you that the proceeds from any sale or liquidation of the Collateral will be sufficient to pay our

obligations under the Notes. In addition, in the event of any such proceeding, the ability of the holders of the Notes to realize upon any of the Collateral would generally be subject to applicable bankruptcy and insolvency law limitations. See

“—Bankruptcy laws may limit the ability of holders of the Notes to realize value from the Collateral following the Kito Crosby Acquisition Closing Date.”

64