| 1 PROTALIX BIOTHERAPEUTICS C O R P O R A T E P R E S E N T A T I O N J u n e 2024 PROTALIX BIOTHERAPEUTICS Pioneering solutions to transform the treatment of rare diseases C O R P O R A T E P R E S E N T A T I O N F e b r u a r y 2026 |

| 2 Forward-Looking Statements This presentation contains forward-looking statements that involve risks and uncertainties within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on management’s current expectations or plans projections for future operating and financial performance based on assumptions currently believed to be valid. Forward-looking statements can be identified by the use of words such as “anticipate,” “believe,” “estimate,” “expect,” “can,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and other words or phrases of similar import, as they relate to Protalix, its subsidiaries or its management, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements in this presentation include, among other things, statements regarding our cash runway and the commercialization of our products. Forward-looking statements are subject to many risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements, including, but not limited to, the risk that the European Commission will not approve the positive opinion of the Committee for Medicinal Products for Human Use recommending approval of the 2mg/kg every-4-weeks (E4W) dosing regimen for Elfabrio in adults with Fabry disease; risks related to the commercialization of Elfabrio®; Elfabrio’s revenue, expenses and costs may not be as expected; Elfabrio’s market acceptance, competition, reimbursement and regulatory actions, including as a result of the boxed warning contained in the U.S. Food and Drug Administration, or FDA, approval received for the product; the regulatory approval and commercial success of our other product and product candidates, if approved; risks related to our expectations with respect to the potential commercial value of our other product and product candidates; failure or delay in the commencement or completion of our preclinical studies and clinical trials, which may be caused by several factors, including: slower than expected rates of patient recruitment; unforeseen safety issues; determination of dosing issues; lack of effectiveness during clinical trials; inability to satisfactorily demonstrate non-inferiority to approved therapies; inability or unwillingness of medical investigators and institutional review boards to follow our clinical protocols; inability to monitor patients adequately during or after treatment; and/or lack of sufficient funding to finance our clinical trials; delays in the approval or potential rejection of any applications we file with the FDA, European Medicines Agency or other health regulatory authorities for our other product candidates, and other risks relating to the review process; our ability to manage our relationship with our collaborators, distributors or partners, including, but not limited to, Pfizer Inc., and Chiesi Global Rare Diseases; and other factors described in our filings with the U.S. Securities and Exchange Commission. In addition, new risk factors and uncertainties may emerge from time to time, and it is not possible to predict all risk factors and uncertainties. Given these uncertainties, investors should not place undue reliance on these forward-looking statements. Except as required by law, Protalix undertakes no obligation to update or revise the information contained in this presentation whether as a result of new information, future events or circumstances or otherwise. 2 This presentation also contains estimates and other data made by independent parties and Protalix relating to market size and growth and other data related to the industry in which Protalix operates. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither Protalix nor any other person makes any representation as to the accuracy or completeness of such data. In light of the foregoing, you are urged not to rely on any forward-looking statement or third-party data in reaching any conclusion or making any investment decision about any securities of the Company. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. We recommend that investors independently evaluate specific investments and strategies. Third-Party Information |

| 3 Experienced leadership team ORI KALID, PH.D. VP of R&D Dr. Kalid brings >20 years of leadership experience in pharmaceutical R&D. Previously he was co-founder and CEO of Silverskate Bio, as well as co-founder and CEO of Pi Therapeutics. He also served at Hotaru Innovation Partners, PREDIX/EPIX Pharmaceuticals and Karyopharm Therapeutics. Dror Bashan President and CEO Mr. Bashan has over 20 years of experience in the pharmaceutical industry with roles ranging from business development, marketing, sales and finance, providing him with both cross regional and cross discipline experience and a deep knowledge of the global pharmaceutical and health industries. SHOSHI TESSLER, PH.D. VP, Clinical Dev & Regulatory Affairs Dr. Tessler has >20yrs experience in the pharma, leading innovative drug development projects, from discovery to market. Previously, she served as VP, R&D of Biosight and of Enzymotec. (currently part of International Flavors & Fragrances Inc.) and as a Project Champion at Innovative R&D, Teva. YARON NAOS SVP of Operations Mr. Naos has been with Protalix for >20 years. He has a wealth of hands-on experience and knowledge in the field of pharmaceutical development. Previously, he was R&D Product Manager at Dexxon Pharmaceutical Co., one of Israel's largest pharmaceutical companies, where he was responsible for technology transfer from R&D to production GILAD MAMLOK SVP & CFO Mr. Mamlok brings 30 yrs experience in healthcare/ technology companies. His has extensive experience in capital markets transactions, mergers and acquisitions and BD. Previously, he served as the CFO of TytoCare and CFO of Sol-Gel Technologies. Earlier, he served in other medical device and technology companies, including Given Imaging for 10 years (acquired by Covidien) and Nice. Fernando Sallés, PH.D., CLP Chief Business Officer Dr. Salles has spent >25 years in senior strategic/BD roles. Most recently as CBO at Kallyope. Previously at IMAB, Teva, Merck, Schering-Plough and Organon. Notable transactions: Acquired phase 2b ready asset, novel obesity target to Novo Nordisk, BioCentury/Bay Helix deal of the year award for IMab - AbbVie >$2B |

| 4 Accomplished Board of Directors AMOS BAR SHALEV Director POL F. BOUDES, M.D. Director GWEN A. MELINCOFF Director AHARON SCHWARTZ, PH.D. Director ELIOT FORSTER, PH.D. Chairman DROR BASHAN President & CEO, Director SHMUEL “MULI” BEN ZVI, PH.D. Director Christian Else Director BATM logo |

| 5 CHMP Endorsement Could Unlock Meaningful Differentiation for Elfabrio® • Positive CHMP opinion supports expanded dosing flexibility in the European Union (EU) • 2 mg/kg every four weeks (E4W) for adult Fabry patients stable on enzyme replacement therapy • Final decision of European Commission (EC) is expected by end of March 2026 • First and only enzyme replacement therapy positioned for E4W dosing in Fabry (EU) • Material reduction in treatment burden without compromising efficacy • CHMP’s opinion supported by the BRIGHT study and long-term extension data, demonstrating maintained clinical and renal outcomes in stable patients while cutting infusion frequency by 50%, a key quality-of-life driver in lifelong therapy; further support provided by an updated Population Pharmacokinetics (PopPK) model and exposure–response analysis, which leverage data from multiple clinical studies • Strengthens Elfabrio’s competitive positioning and potential market share expansion in the EU • E4W dosing directly addresses infusion burden, one of the more common unmet needs in Fabry disease, by supporting improved adherence, persistence, and patient choice in the EU • Protalix eligible to receive regulatory milestone of $25 million from Chiesi if the EC approves the CHMP opinion Elfabrio would become the only ERT in Europe Union offering an every-four-week option, differentiating it from standard bi-weekly regimens 5 |

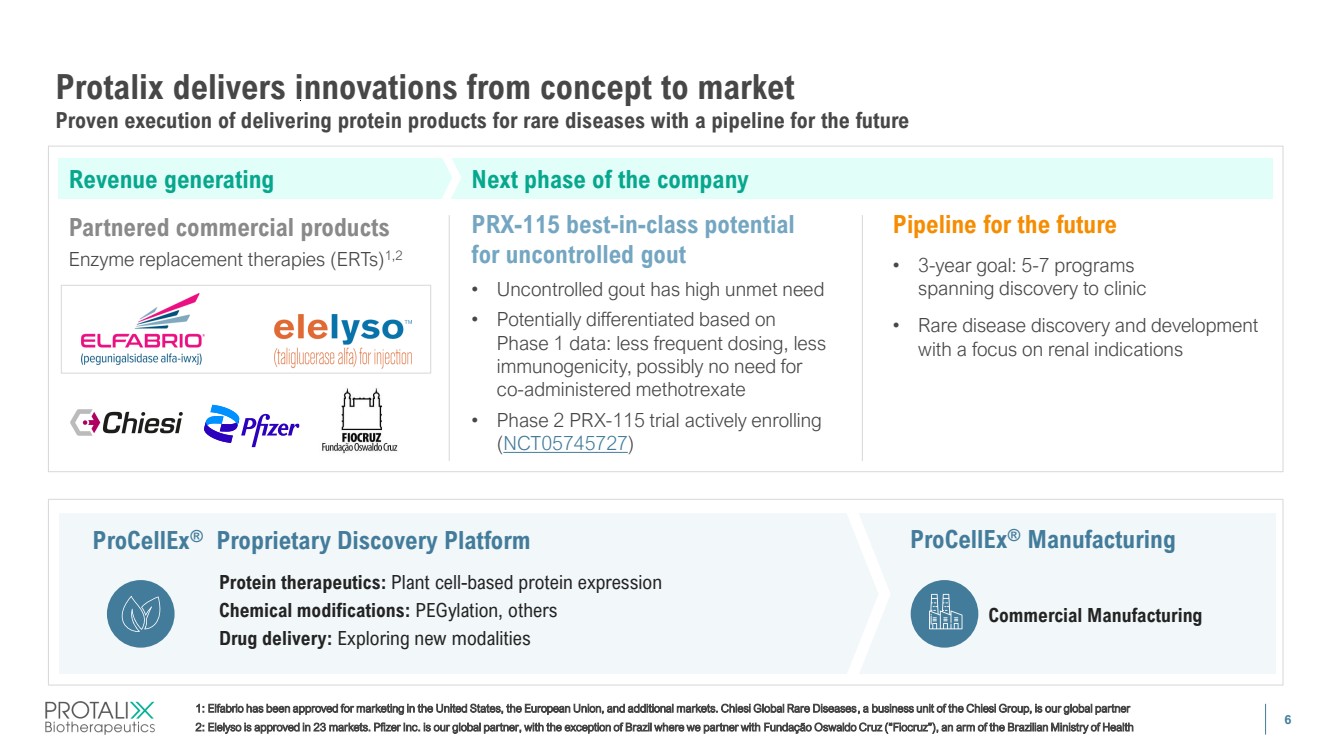

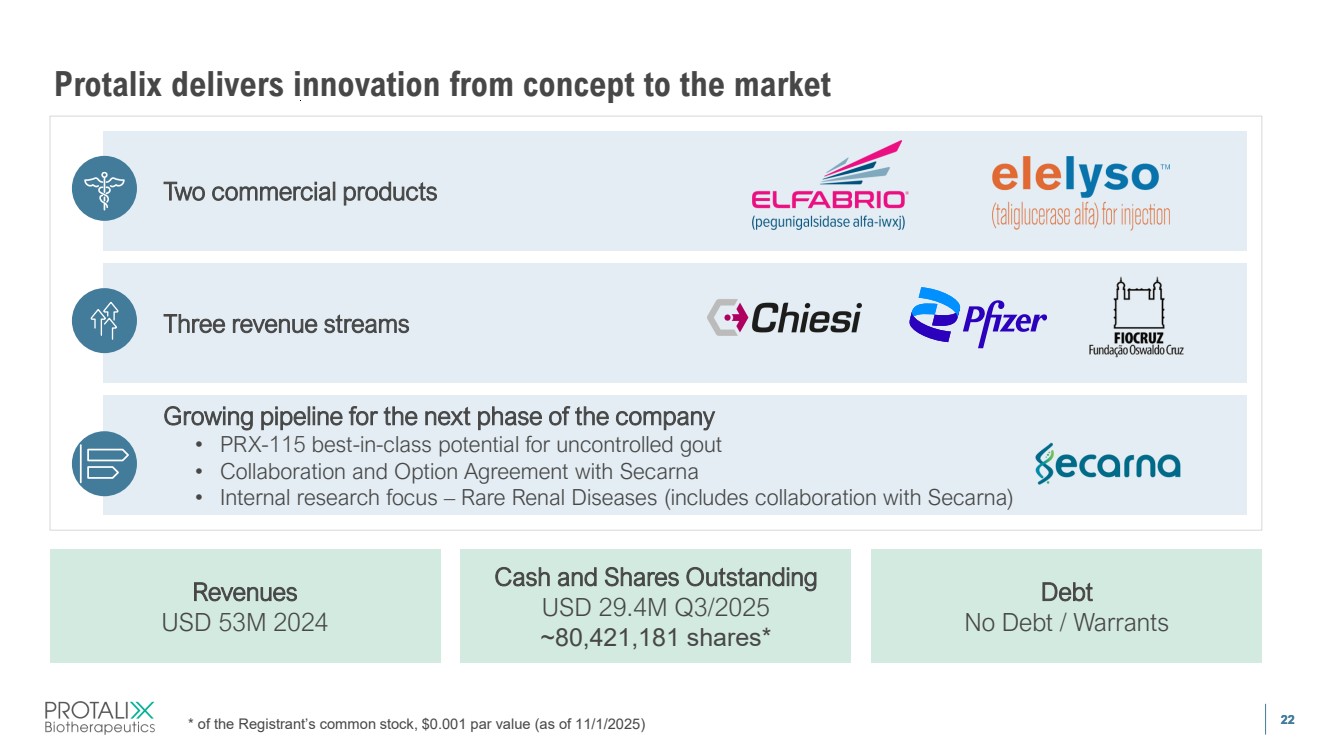

| 6 Protalix delivers innovations from concept to market Proven execution of delivering protein products for rare diseases with a pipeline for the future 1: Elfabrio has been approved for marketing in the United States, the European Union, and additional markets. Chiesi Global Rare Diseases, a business unit of the Chiesi Group, is our global partner 2: Elelyso is approved in 23 markets. Pfizer Inc. is our global partner, with the exception of Brazil where we partner with Fundação Oswaldo Cruz (“Fiocruz”), an arm of the Brazilian Ministry of Health Partnered commercial products Enzyme replacement therapies (ERTs)1,2 Pipeline for the future • 3-year goal: 5-7 programs spanning discovery to clinic • Rare disease discovery and development with a focus on renal indications PRX-115 best-in-class potential for uncontrolled gout • Uncontrolled gout has high unmet need • Potentially differentiated based on Phase 1 data: less frequent dosing, less immunogenicity, possibly no need for co-administered methotrexate • Phase 2 PRX-115 trial actively enrolling (NCT05745727) ProCellEx® Proprietary Discovery Platform Protein therapeutics: Plant cell-based protein expression Chemical modifications: PEGylation, others Drug delivery: Exploring new modalities Commercial Manufacturing ProCellEx® Manufacturing Revenue generating Next phase of the company |

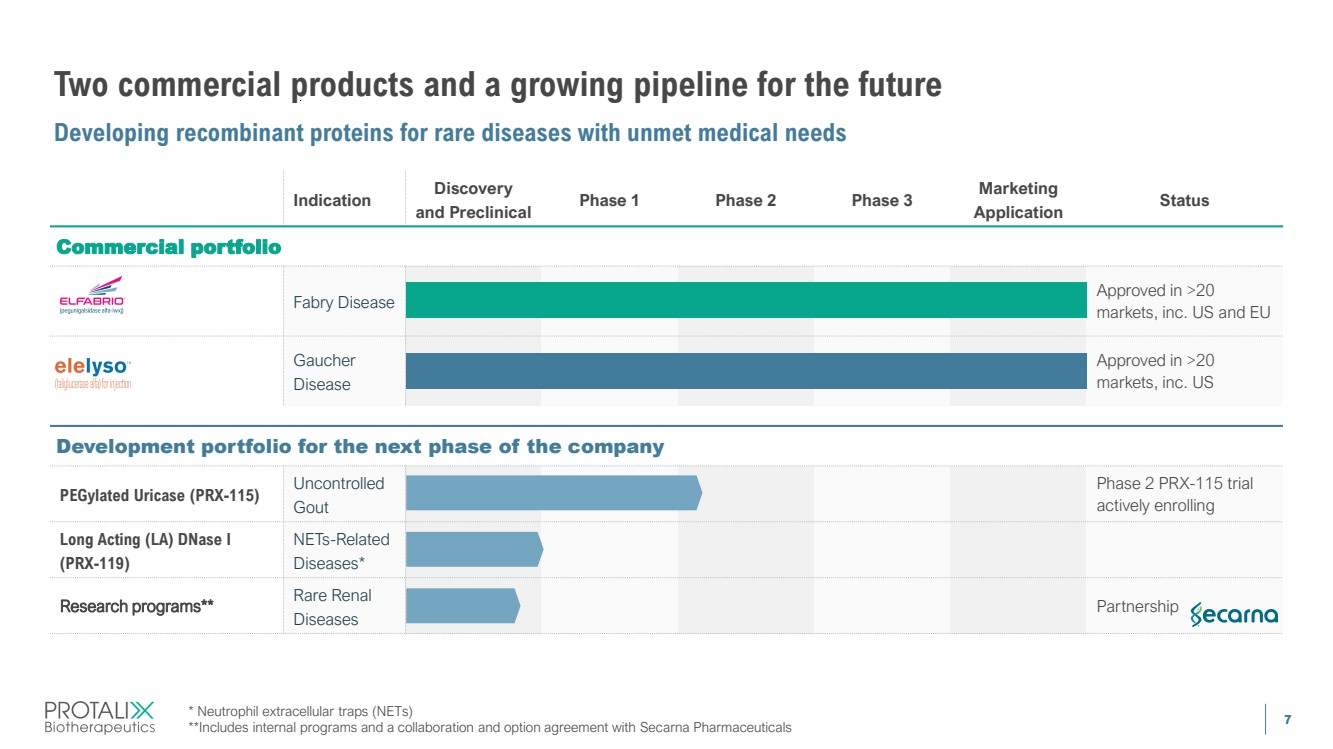

| 7 Indication Discovery and Preclinical Phase 1 Phase 2 Phase 3 Marketing Application Status Fabry Disease Approved in >20 markets, inc. US and EU Gaucher Disease Approved in >20 markets, inc. US PEGylated Uricase (PRX-115) Uncontrolled Gout Phase 2 PRX-115 trial actively enrolling Long Acting (LA) DNase I (PRX-119) NETs-Related Diseases* Research programs** Rare Renal Diseases Partnership Two commercial products and a growing pipeline for the future Developing recombinant proteins for rare diseases with unmet medical needs 7 * Neutrophil extracellular traps (NETs) **Includes internal programs and a collaboration and option agreement with Secarna Pharmaceuticals Development portfolio for the next phase of the company Commercial portfolio |

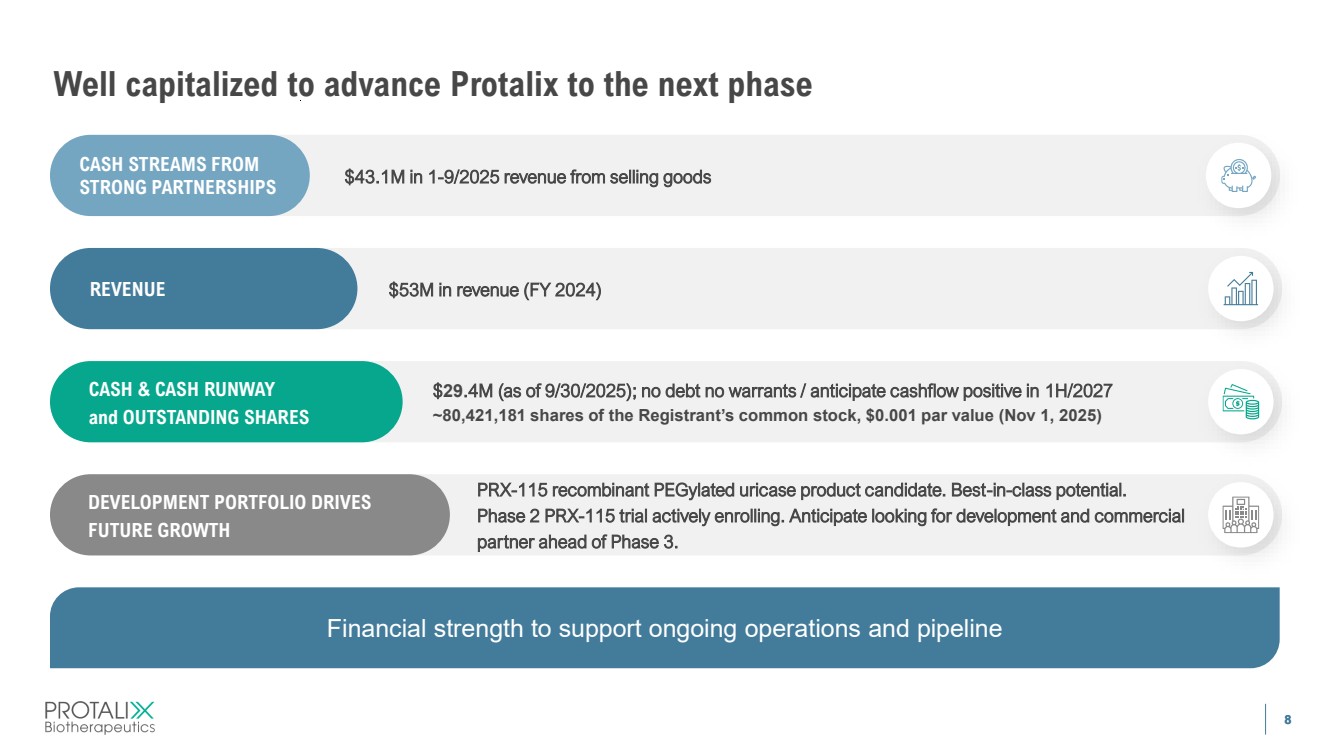

| 8 Well capitalized to advance Protalix to the next phase CASH STREAMS FROM STRONG PARTNERSHIPS REVENUE CASH & CASH RUNWAY and OUTSTANDING SHARES $43.1M in 1-9/2025 revenue from selling goods $53M in revenue (FY 2024) $29.4M (as of 9/30/2025); no debt no warrants / anticipate cashflow positive in 1H/2027 ~80,421,181 shares of the Registrant’s common stock, $0.001 par value (Nov 1, 2025) PRX-115 recombinant PEGylated uricase product candidate. Best-in-class potential. Phase 2 PRX-115 trial actively enrolling. Anticipate looking for development and commercial partner ahead of Phase 3. DEVELOPMENT PORTFOLIO DRIVES FUTURE GROWTH Financial strength to support ongoing operations and pipeline |

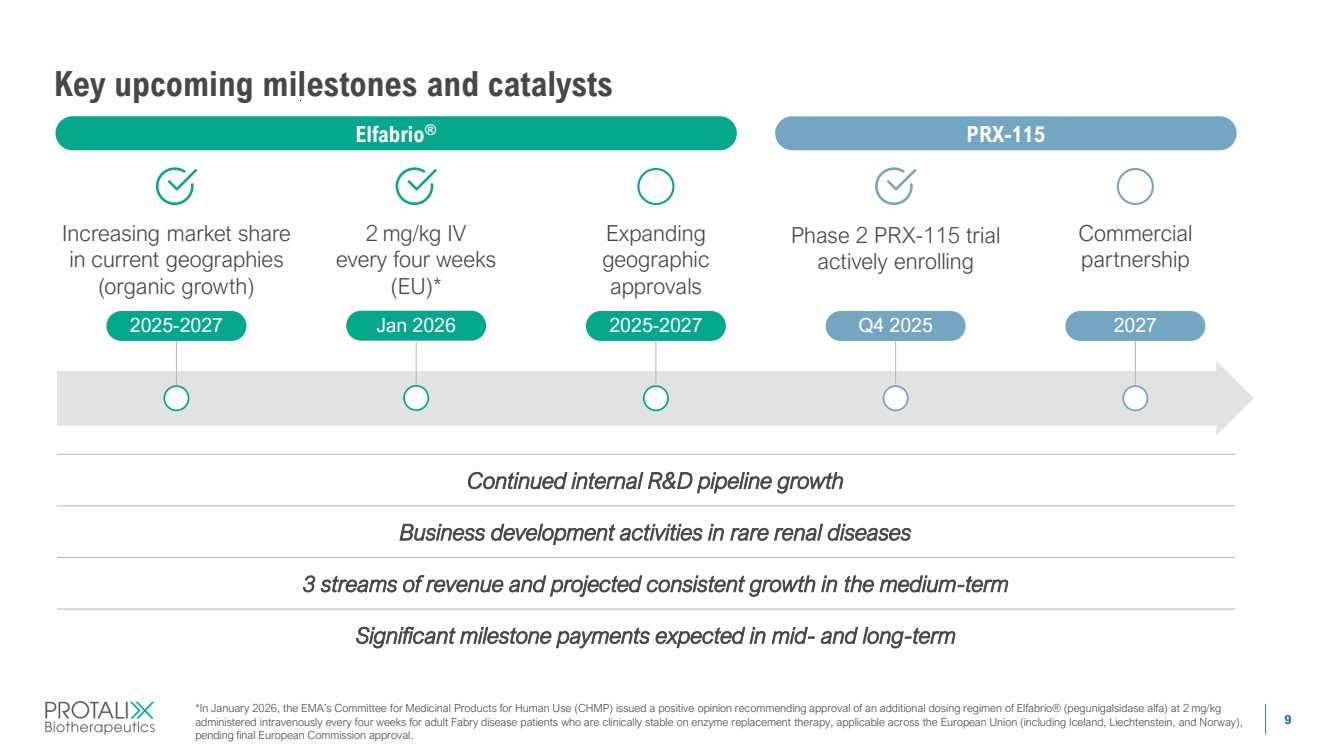

| 9 Key upcoming milestones and catalysts Business development activities in rare renal diseases 3 streams of revenue and projected consistent growth in the medium-term Significant milestone payments expected in mid- and long-term Continued internal R&D pipeline growth Elfabrio® Commercial partnership 2027 PRX-115 Expanding geographic approvals Jan 2026 2025-2027 2 mg/kg IV every four weeks (EU)* *In January 2026, the EMA’s Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion recommending approval of an additional dosing regimen of Elfabrio® (pegunigalsidase alfa) at 2 mg/kg administered intravenously every four weeks for adult Fabry disease patients who are clinically stable on enzyme replacement therapy, applicable across the European Union (including Iceland, Liechtenstein, and Norway), pending final European Commission approval. Phase 2 PRX-115 trial actively enrolling 2025-2027 Q4 2025 Increasing market share in current geographies (organic growth) |

| 10 Phase 2 Actively enrolling PRX-115 in development for uncontrolled gout |

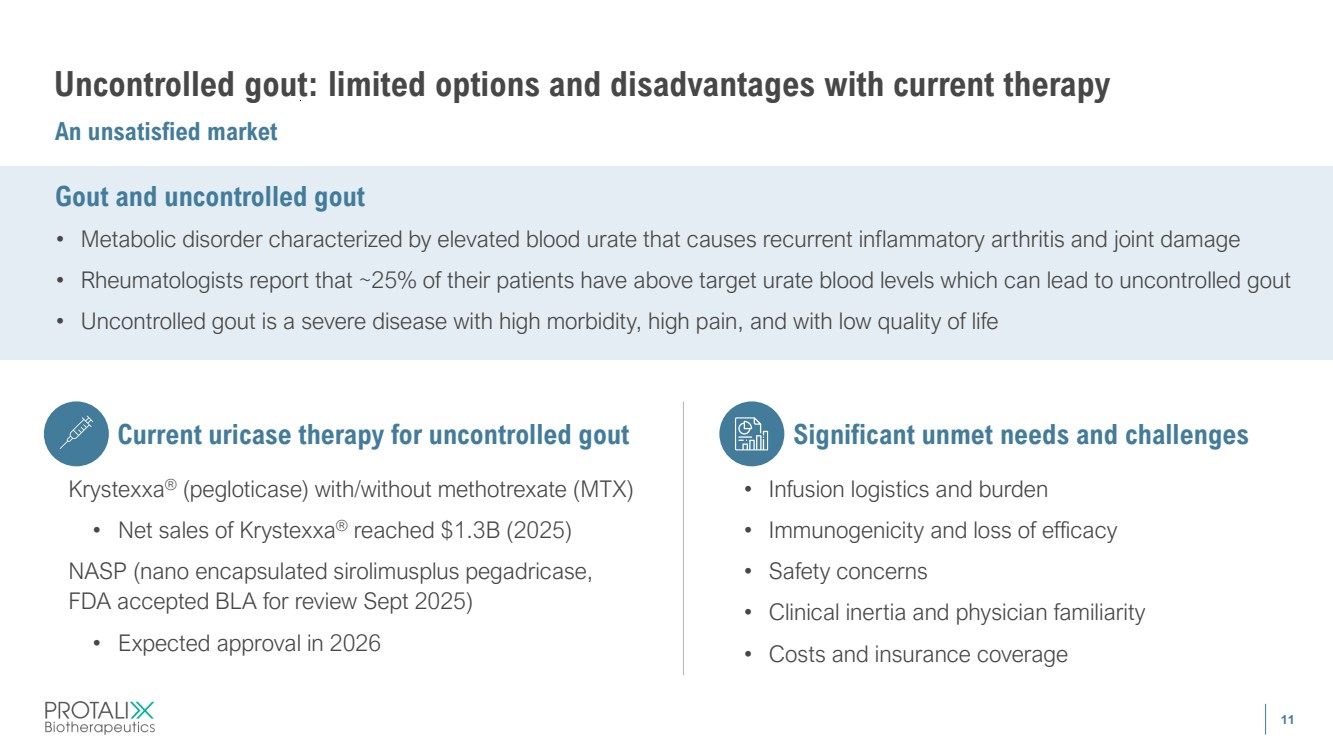

| 11 Uncontrolled gout: limited options and disadvantages with current therapy An unsatisfied market Gout and uncontrolled gout • Metabolic disorder characterized by elevated blood urate that causes recurrent inflammatory arthritis and joint damage • Rheumatologists report that ~25% of their patients have above target urate blood levels which can lead to uncontrolled gout • Uncontrolled gout is a severe disease with high morbidity, high pain, and with low quality of life Current uricase therapy for uncontrolled gout Krystexxa® (pegloticase) with/without methotrexate (MTX) • Net sales of Krystexxa® reached $1.3B (2025) NASP (nano encapsulated sirolimusplus pegadricase, FDA accepted BLA for review Sept 2025) • Expected approval in 2026 Significant unmet needs and challenges • Infusion logistics and burden • Immunogenicity and loss of efficacy • Safety concerns • Clinical inertia and physician familiarity • Costs and insurance coverage |

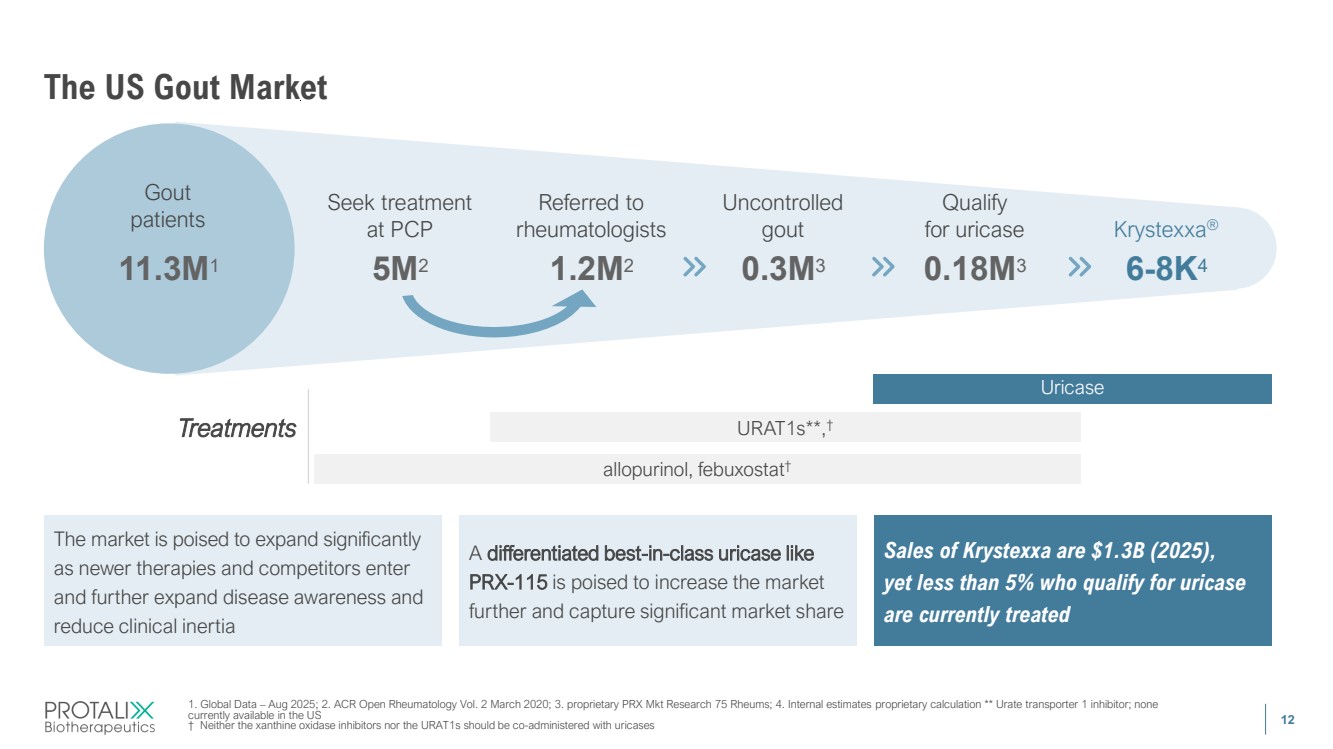

| 12 11.3M1 5M2 1.2M2 0.3M3 0.18M3 6-8K4 The US Gout Market Treatments The market is poised to expand significantly as newer therapies and competitors enter and further expand disease awareness and reduce clinical inertia A differentiated best-in-class uricase like PRX-115 is poised to increase the market further and capture significant market share Sales of Krystexxa are $1.3B (2025), yet less than 5% who qualify for uricase are currently treated Gout patients Uncontrolled gout Referred to rheumatologists Seek treatment at PCP Qualify for uricase Krystexxa® allopurinol, febuxostat† URAT1s**,† Uricase 1. Global Data – Aug 2025; 2. ACR Open Rheumatology Vol. 2 March 2020; 3. proprietary PRX Mkt Research 75 Rheums; 4. Internal estimates proprietary calculation ** Urate transporter 1 inhibitor; none currently available in the US † Neither the xanthine oxidase inhibitors nor the URAT1s should be co-administered with uricases |

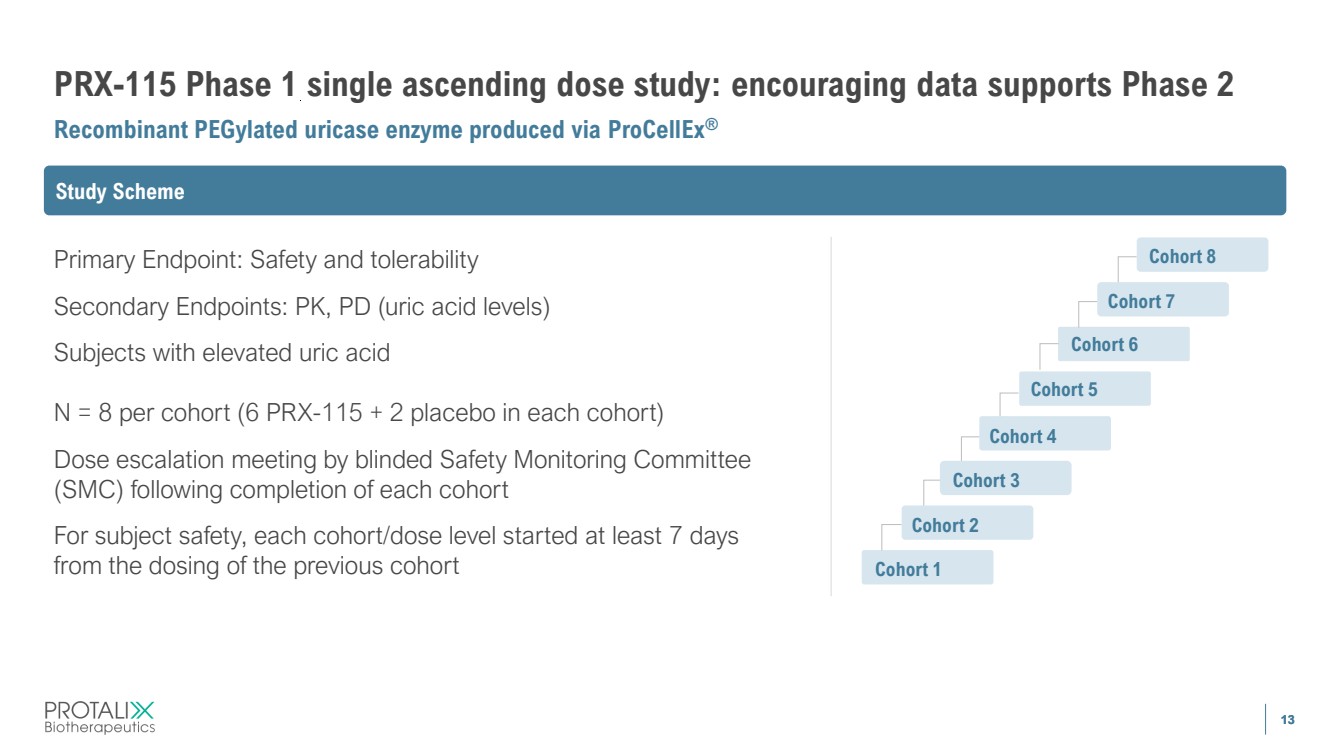

| 13 PRX-115 Phase 1 single ascending dose study: encouraging data supports Phase 2 Recombinant PEGylated uricase enzyme produced via ProCellEx® 13 Study Scheme Primary Endpoint: Safety and tolerability Secondary Endpoints: PK, PD (uric acid levels) Subjects with elevated uric acid N = 8 per cohort (6 PRX-115 + 2 placebo in each cohort) Dose escalation meeting by blinded Safety Monitoring Committee (SMC) following completion of each cohort For subject safety, each cohort/dose level started at least 7 days from the dosing of the previous cohort Cohort 1 Cohort 2 Cohort 3 Cohort 4 Cohort 5 Cohort 6 Cohort 7 Cohort 8 |

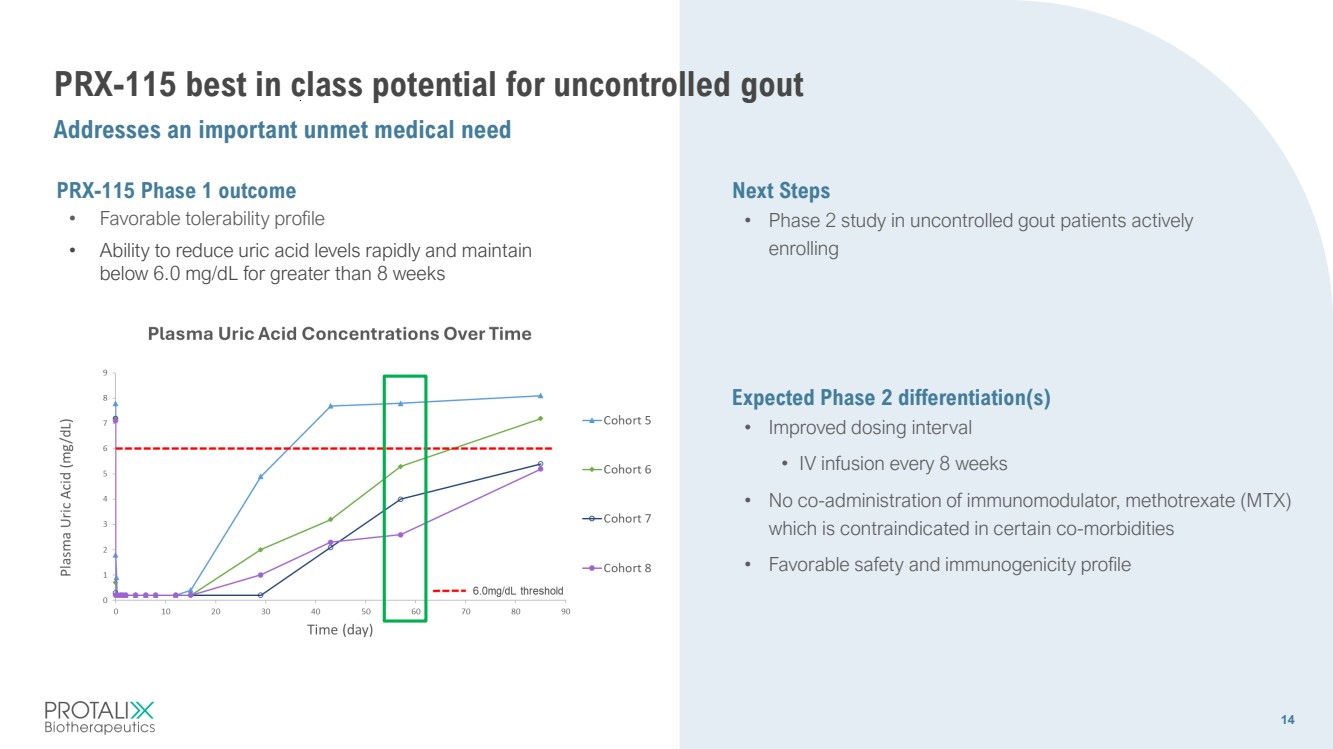

| 14 PRX-115 best in class potential for uncontrolled gout Addresses an important unmet medical need 14 Next Steps • Phase 2 study in uncontrolled gout patients actively enrolling PRX-115 Phase 1 outcome • Favorable tolerability profile • Ability to reduce uric acid levels rapidly and maintain below 6.0 mg/dL for greater than 8 weeks Expected Phase 2 differentiation(s) • Improved dosing interval • IV infusion every 8 weeks • No co-administration of immunomodulator, methotrexate (MTX) which is contraindicated in certain co-morbidities • Favorable safety and immunogenicity profile |

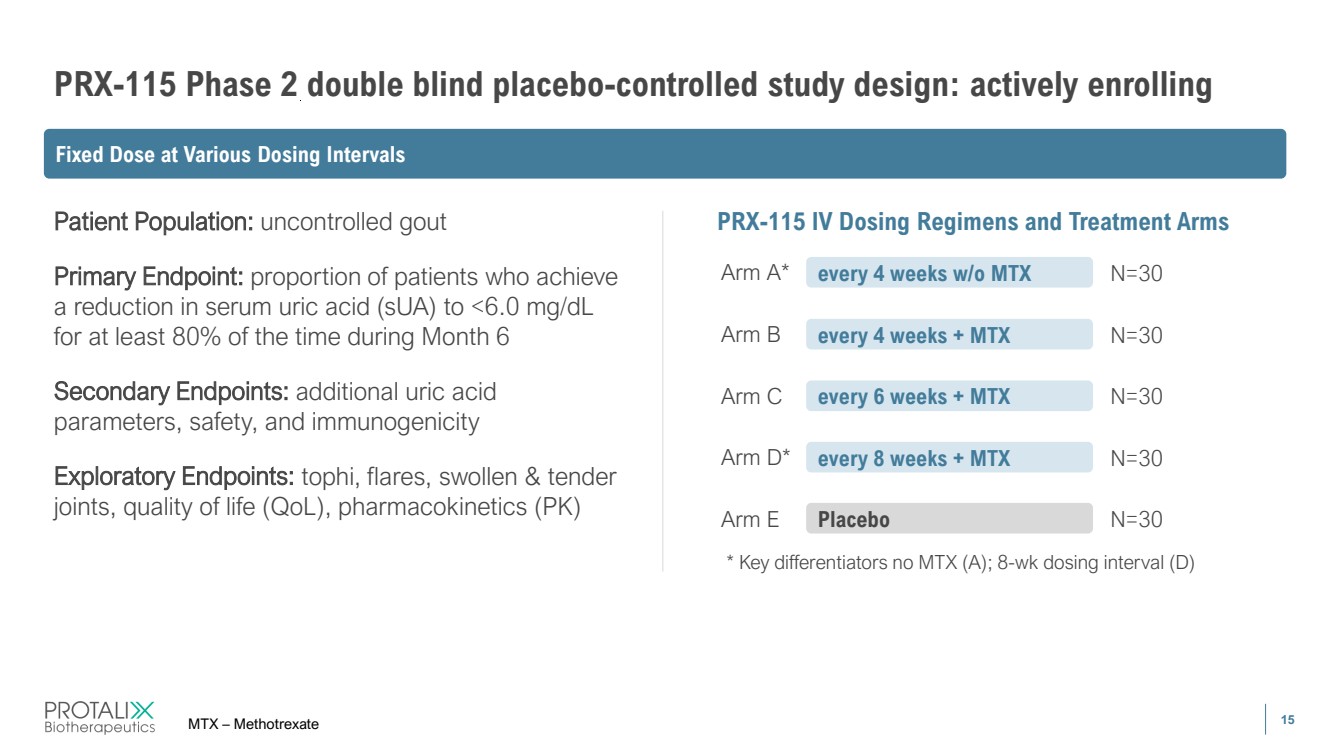

| 15 PRX-115 Phase 2 double blind placebo-controlled study design: actively enrolling MTX – Methotrexate Patient Population: uncontrolled gout Primary Endpoint: proportion of patients who achieve a reduction in serum uric acid (sUA) to <6.0 mg/dL for at least 80% of the time during Month 6 Secondary Endpoints: additional uric acid parameters, safety, and immunogenicity Exploratory Endpoints: tophi, flares, swollen & tender joints, quality of life (QoL), pharmacokinetics (PK) PRX-115 IV Dosing Regimens and Treatment Arms Arm A* every 4 weeks w/o MTX N=30 Arm B every 4 weeks + MTX N=30 Arm C every 6 weeks + MTX N=30 Arm D* every 8 weeks + MTX N=30 Arm E Placebo N=30 * Key differentiators no MTX (A); 8-wk dosing interval (D) Fixed Dose at Various Dosing Intervals |

| 16 Commercial products Reliably partnered and delivering revenue |

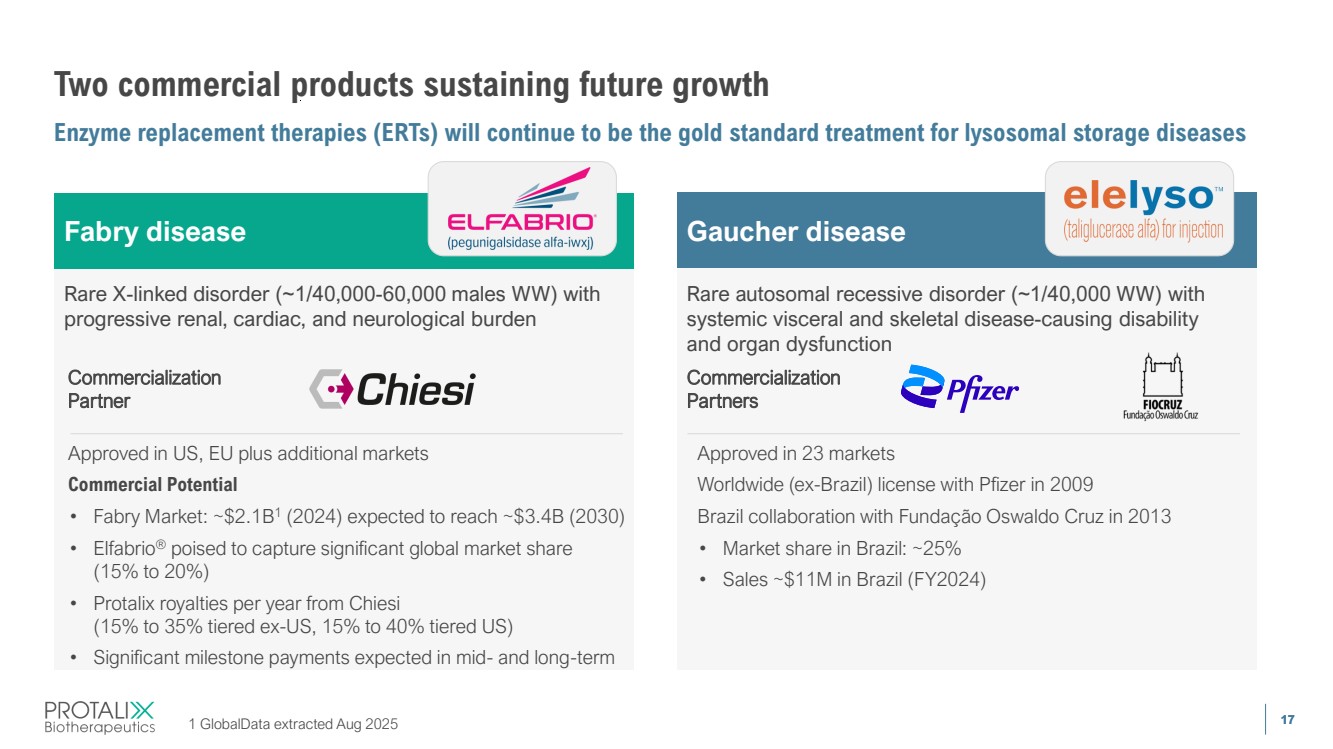

| 17 Rare autosomal recessive disorder (~1/40,000 WW) with systemic visceral and skeletal disease-causing disability and organ dysfunction Rare X-linked disorder (~1/40,000-60,000 males WW) with progressive renal, cardiac, and neurological burden Fabry disease Two commercial products sustaining future growth Enzyme replacement therapies (ERTs) will continue to be the gold standard treatment for lysosomal storage diseases 17 1 GlobalData extracted Aug 2025 Approved in 23 markets Worldwide (ex-Brazil) license with Pfizer in 2009 Brazil collaboration with Fundação Oswaldo Cruz in 2013 • Market share in Brazil: ~25% • Sales ~$11M in Brazil (FY2024) Gaucher disease Approved in US, EU plus additional markets Commercial Potential • Fabry Market: ~$2.1B1 (2024) expected to reach ~$3.4B (2030) • Elfabrio® poised to capture significant global market share (15% to 20%) • Protalix royalties per year from Chiesi (15% to 35% tiered ex-US, 15% to 40% tiered US) • Significant milestone payments expected in mid- and long-term Commercialization Partners Commercialization Partner |

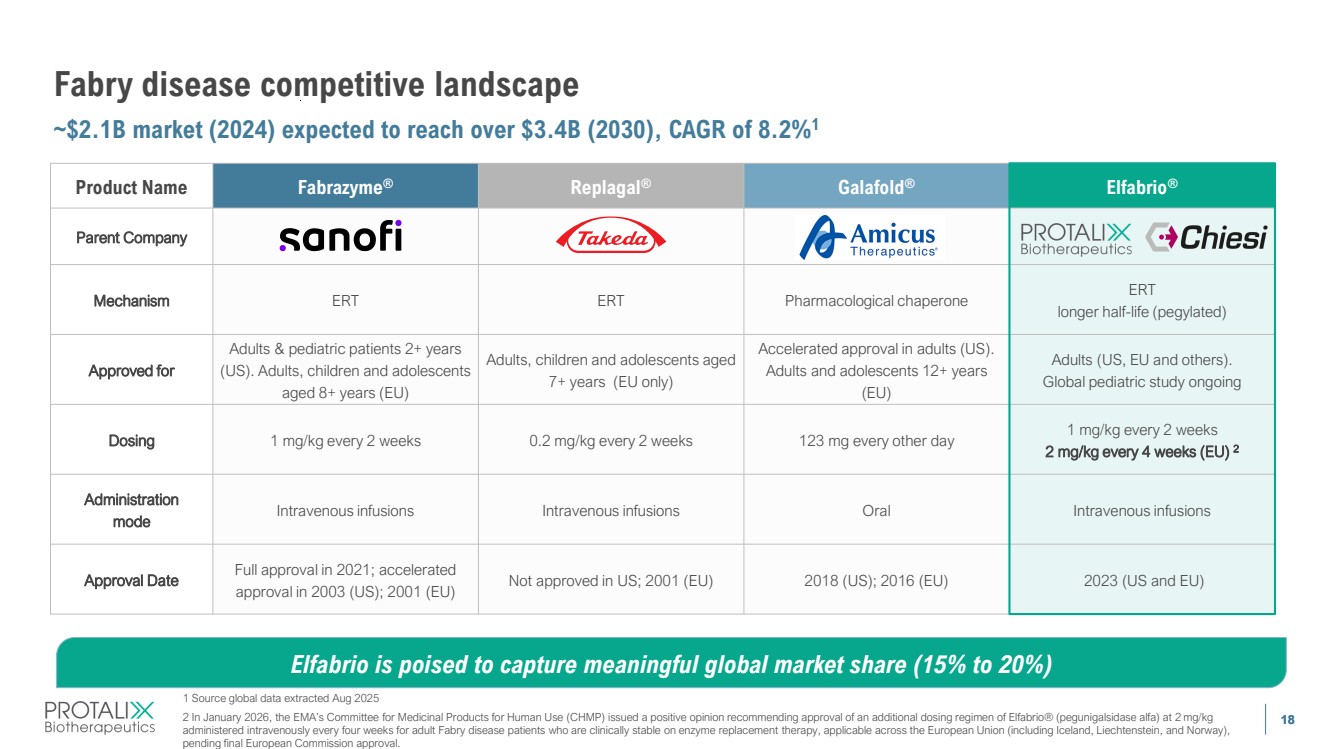

| 18 Fabry disease competitive landscape ~$2.1B market (2024) expected to reach over $3.4B (2030), CAGR of 8.2%1 18 Product Name Fabrazyme® Replagal® Galafold® Elfabrio® Parent Company Mechanism ERT ERT Pharmacological chaperone ERT longer half-life (pegylated) Approved for Adults & pediatric patients 2+ years (US). Adults, children and adolescents aged 8+ years (EU) Adults, children and adolescents aged 7+ years (EU only) Accelerated approval in adults (US). Adults and adolescents 12+ years (EU) Adults (US, EU and others). Global pediatric study ongoing Dosing 1 mg/kg every 2 weeks 0.2 mg/kg every 2 weeks 123 mg every other day 1 mg/kg every 2 weeks 2 mg/kg every 4 weeks (EU) 2 Administration mode Intravenous infusions Intravenous infusions Oral Intravenous infusions Approval Date Full approval in 2021; accelerated approval in 2003 (US); 2001 (EU) Not approved in US; 2001 (EU) 2018 (US); 2016 (EU) 2023 (US and EU) Elfabrio is poised to capture meaningful global market share (15% to 20%) 1 Source global data extracted Aug 2025 2 In January 2026, the EMA’s Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion recommending approval of an additional dosing regimen of Elfabrio® (pegunigalsidase alfa) at 2 mg/kg administered intravenously every four weeks for adult Fabry disease patients who are clinically stable on enzyme replacement therapy, applicable across the European Union (including Iceland, Liechtenstein, and Norway), pending final European Commission approval. |

| 19 Commitment and execution from global partnership with Chiesi Committed Global Partner • International research-focused biopharmaceutical group with sales in excess of €3.4B in 2024 (reflecting 13% growth year-on-year) • Operating in close to 30 countries with over 7,500 employees; invested over 24% of 2024 revenue in research and development • Strong sales and marketing partner poised to maximize the market potential of pegunigalsidase alfa as the centerpiece of their new strategic US-based Rare Disease division • Elfabrio® launched in US, throughout EU and additional markets • Experience with data generation/ongoing post-marketing studies to support further uptake Chiesi Farmaceutici S.p.A. • Experienced sales team • Strategic focus on rare diseases • Specific expertise in Fabry disease • Ideally suited to bring Elfabrio to patients with Fabry disease |

| 20 Growth strategy Next phase of the company |

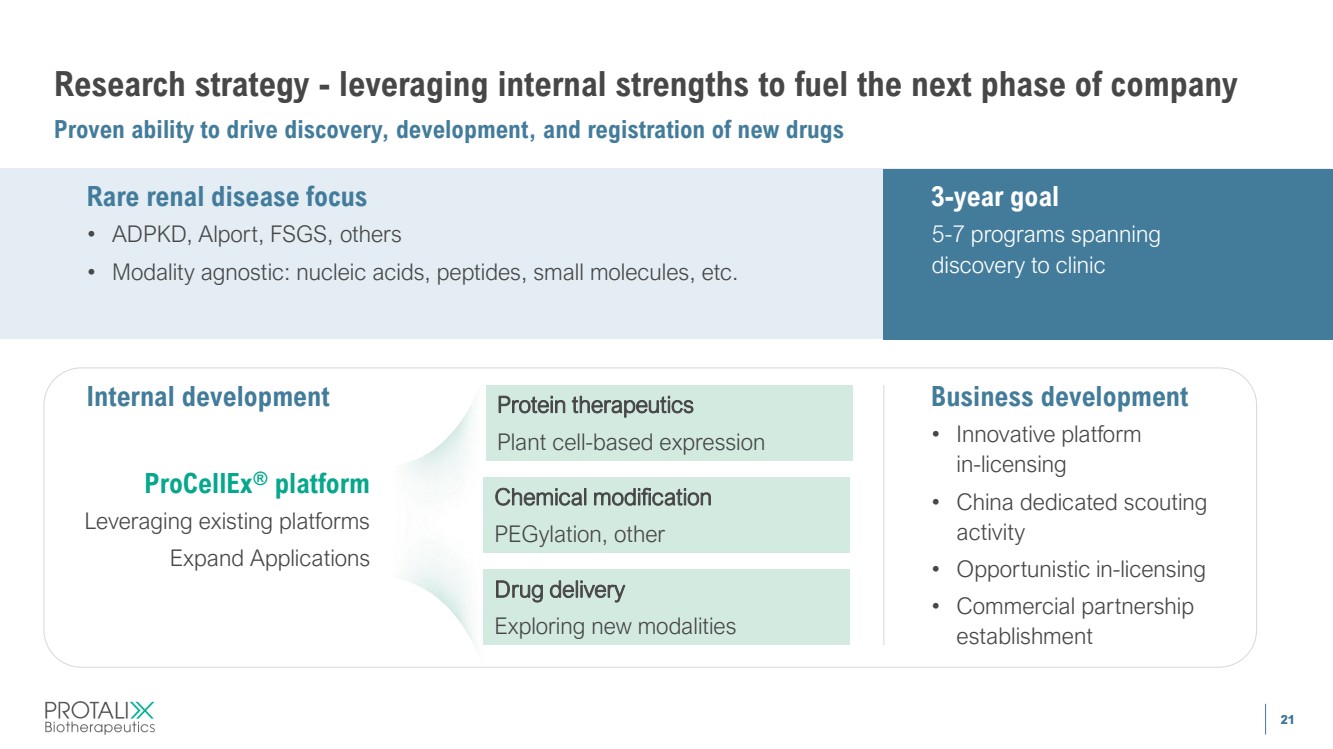

| 21 Research strategy - leveraging internal strengths to fuel the next phase of company Proven ability to drive discovery, development, and registration of new drugs 21 Internal development Protein therapeutics Plant cell-based expression Chemical modification PEGylation, other Drug delivery Exploring new modalities Business development • Innovative platform in-licensing • China dedicated scouting activity • Opportunistic in-licensing • Commercial partnership establishment Rare renal disease focus • ADPKD, Alport, FSGS, others • Modality agnostic: nucleic acids, peptides, small molecules, etc. 3-year goal 5-7 programs spanning discovery to clinic ProCellEx® platform Leveraging existing platforms Expand Applications |

| 22 Protalix delivers innovation from concept to the market * of the Registrant’s common stock, $0.001 par value (as of 11/1/2025) Revenues USD 53M 2024 Cash and Shares Outstanding USD 29.4M Q3/2025 ~80,421,181 shares* Debt No Debt / Warrants Growing pipeline for the next phase of the company • PRX-115 best-in-class potential for uncontrolled gout • Collaboration and Option Agreement with Secarna • Internal research focus – Rare Renal Diseases (includes collaboration with Secarna) Three revenue streams Two commercial products |

| 23 PROTALIX BIOTHERAPEUTICS C O R P O R A T E P R E S E N T A T I O N J u n e 2024 PROTALIX BIOTHERAPEUTICS Pioneering solutions to transform the treatment of rare diseases C O R P O R A T E P R E S E N T A T I O N F e b r u a r y 2026 |