| CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS CAL MICROTURBINE, INC. AUDITED FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 |

| Scott M. Biehl, CPA Andy R. Jones, CPA Graham S. Applebaum, CPA CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS 1067 PARK VIEW DRIVE • COVINA, CA 91724-3748 • (626) 858-5100 • W W W.ROGERSCLEM.COM To the Board of Directors Cal Microturbine, Inc. Costa Mesa, CA Opinion Basis for Opinion Responsibilities of Management for the Financial Statements Independent Auditor's Report We have audited the accompanying financial statements of Cal Microturbine, Inc. (a California corporation), which comprise the balance sheets as of December 31, 2024 and 2023, and the related statements of income, stockholders' equity, and cash flows for the years then ended, and the related notes to the financial statements. In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Cal Microturbine, Inc. as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Cal Microturbine, Inc. and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about Cal Microturbine, Inc.’s ability to continue as a going concern within one year after the date that the financial statements are available to be issued. |

| Scott M. Biehl, CPA Andy R. Jones, CPA Graham S. Applebaum, CPA CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS 1067 PARK VIEW DRIVE • COVINA, CA 91724-3748 • (626) 858-5100 • W W W.ROGERSCLEM.COM Auditor’s Responsibilities for the Audit of the Financial Statements In performing an audit in accordance with generally accepted auditing standards, we: • • • • • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about Cal Microturbine, Inc.’s ability to continue as a going concern for a reasonable period of time. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of Cal Microturbine, Inc.’s internal control. Accordingly, no such opinion is expressed. Exercise professional judgment and maintain professional skepticism throughout the audit. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. |

| Scott M. Biehl, CPA Andy R. Jones, CPA Graham S. Applebaum, CPA CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS 1067 PARK VIEW DRIVE • COVINA, CA 91724-3748 • (626) 858-5100 • W W W.ROGERSCLEM.COM Report on Supplementary Information ROGERS, CLEM & COMPANY Covina, California August 8, 2025 Our audit was conducted for the purpose of forming an opinion on the financial statements as a whole. The supplementary information included in Schedule I and II is presented for purposes of additional analysis and is not a required part of the financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. The information has been subjected to the auditing procedures applied in the audit of the financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the financial statements or to the financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the information is fairly stated in all material respects in relation to the financial statements as a whole. |

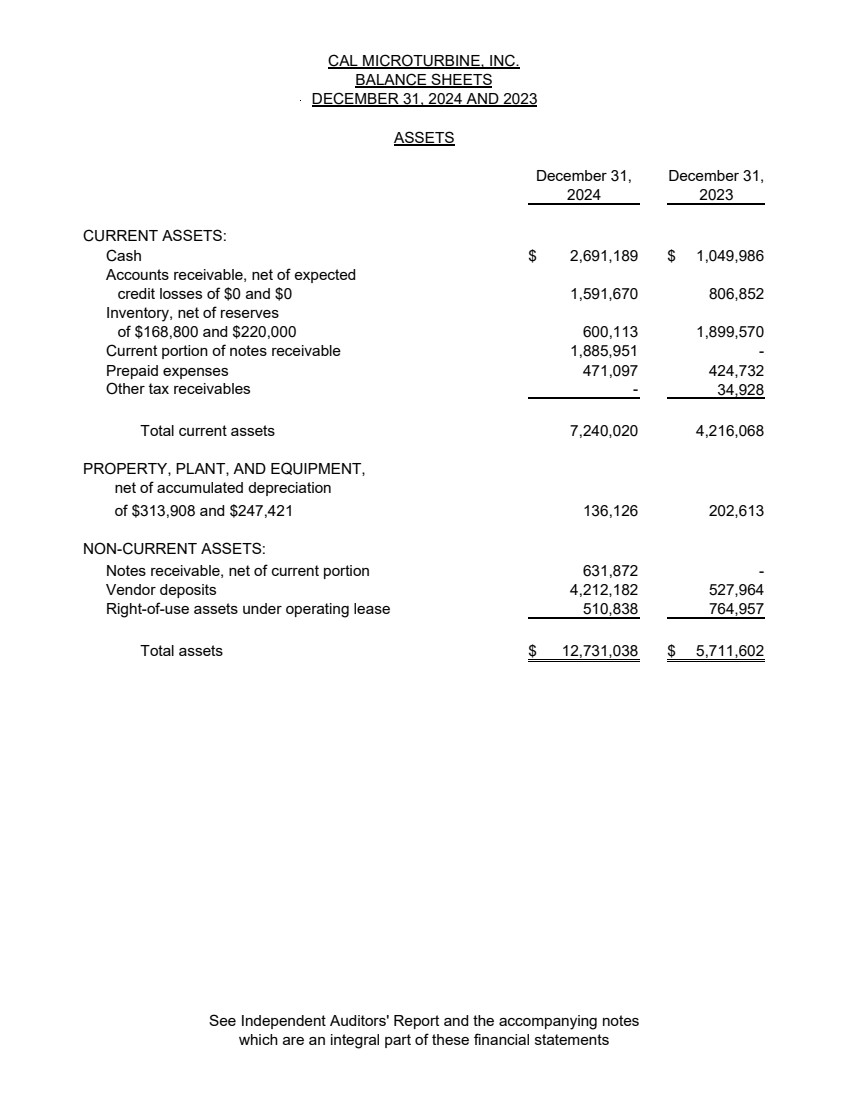

| December 31, December 31, 2024 2023 CURRENT ASSETS: Cash 2,691,189 $ 1,049,986 $ Accounts receivable, net of expected credit losses of $0 and $0 1,591,670 806,852 Inventory, net of reserves of $168,800 and $220,000 600,113 1,899,570 Current portion of notes receivable 1,885,951 - Prepaid expenses 471,097 424,732 Other tax receivables - 34,928 Total current assets 7,240,020 4,216,068 PROPERTY, PLANT, AND EQUIPMENT, net of accumulated depreciation of $313,908 and $247,421 136,126 202,613 NON-CURRENT ASSETS: Notes receivable, net of current portion 631,872 - Vendor deposits 4,212,182 527,964 Right-of-use assets under operating lease 764,957 510,838 Total assets 12,731,038 $ 5,711,602 $ ASSETS CAL MICROTURBINE, INC. BALANCE SHEETS DECEMBER 31, 2024 AND 2023 See Independent Auditors' Report and the accompanying notes which are an integral part of these financial statements |

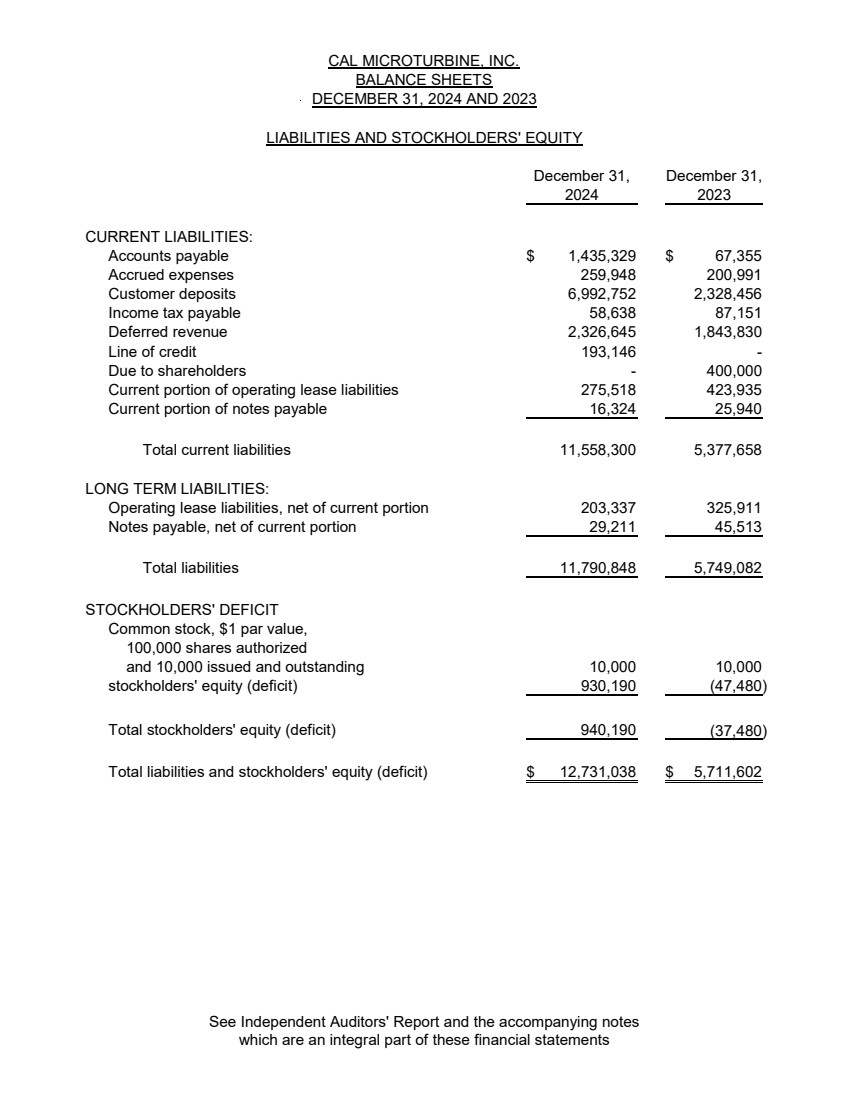

| December 31, December 31, 2024 2023 CURRENT LIABILITIES: Accounts payable 1,435,329 $ 67,355 $ Accrued expenses 259,948 200,991 Customer deposits 6,992,752 2,328,456 Income tax payable 58,638 87,151 Deferred revenue 2,326,645 1,843,830 Line of credit 193,146 - Due to shareholders - 400,000 Current portion of operating lease liabilities 275,518 423,935 Current portion of notes payable 25,940 16,324 Total current liabilities 11,558,300 5,377,658 LONG TERM LIABILITIES: Operating lease liabilities, net of current portion 203,337 325,911 Notes payable, net of current portion 29,211 45,513 Total liabilities 11,790,848 5,749,082 STOCKHOLDERS' DEFICIT Common stock, $1 par value, 100,000 shares authorized and 10,000 issued and outstanding 10,000 10,000 stockholders' equity (deficit) (47,480) 930,190 Total stockholders' equity (deficit) 940,190 (37,480) Total liabilities and stockholders' equity (deficit) 12,731,038 $ 5,711,602 $ DECEMBER 31, 2024 AND 2023 LIABILITIES AND STOCKHOLDERS' EQUITY CAL MICROTURBINE, INC. BALANCE SHEETS See Independent Auditors' Report and the accompanying notes which are an integral part of these financial statements |

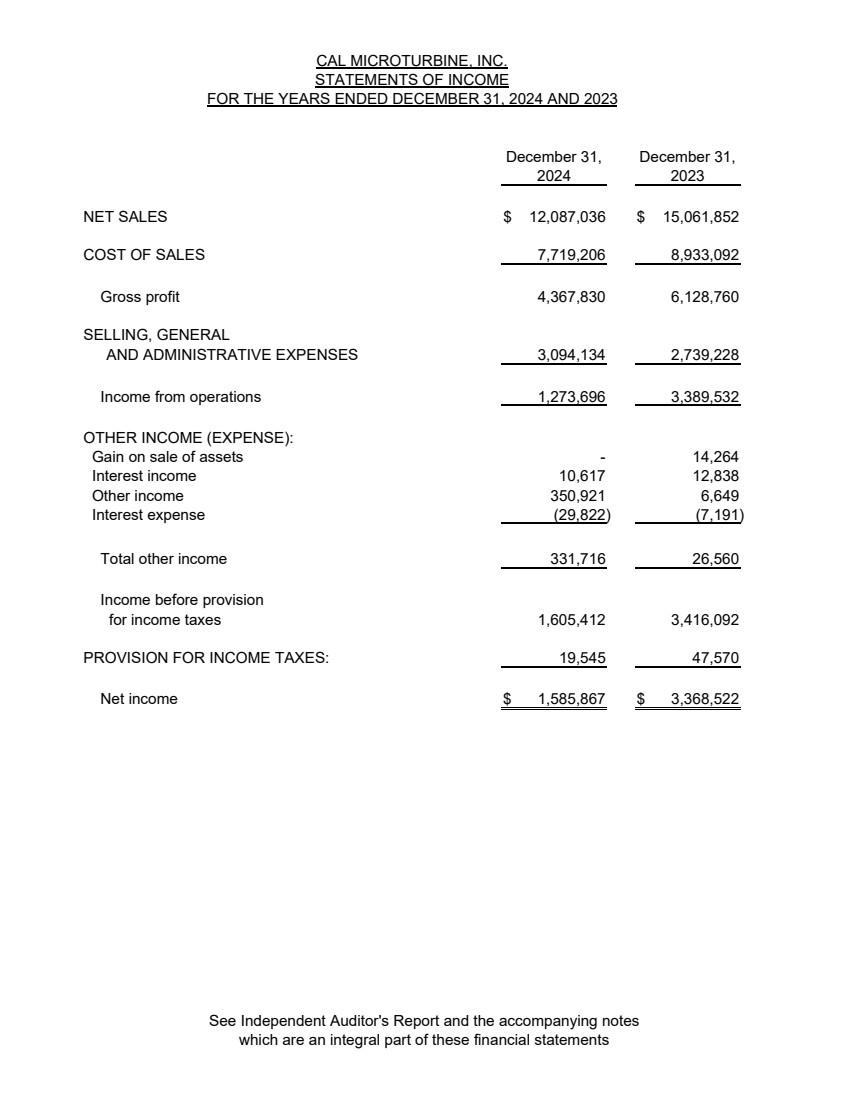

| December 31, December 31, 2024 2023 NET SALES $ 15,061,852 12,087,036 $ COST OF SALES 7,719,206 8,933,092 Gross profit 4,367,830 6,128,760 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES 3,094,134 2,739,228 Income from operations 1,273,696 3,389,532 OTHER INCOME (EXPENSE): Gain on sale of assets - 14,264 Interest income 10,617 12,838 Other income 350,921 6,649 Interest expense (7,191) (29,822) Total other income 331,716 26,560 Income before provision for income taxes 1,605,412 3,416,092 PROVISION FOR INCOME TAXES: 19,545 47,570 Net income 1,585,867 $ 3,368,522 $ STATEMENTS OF INCOME CAL MICROTURBINE, INC. FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 See Independent Auditor's Report and the accompanying notes which are an integral part of these financial statements |

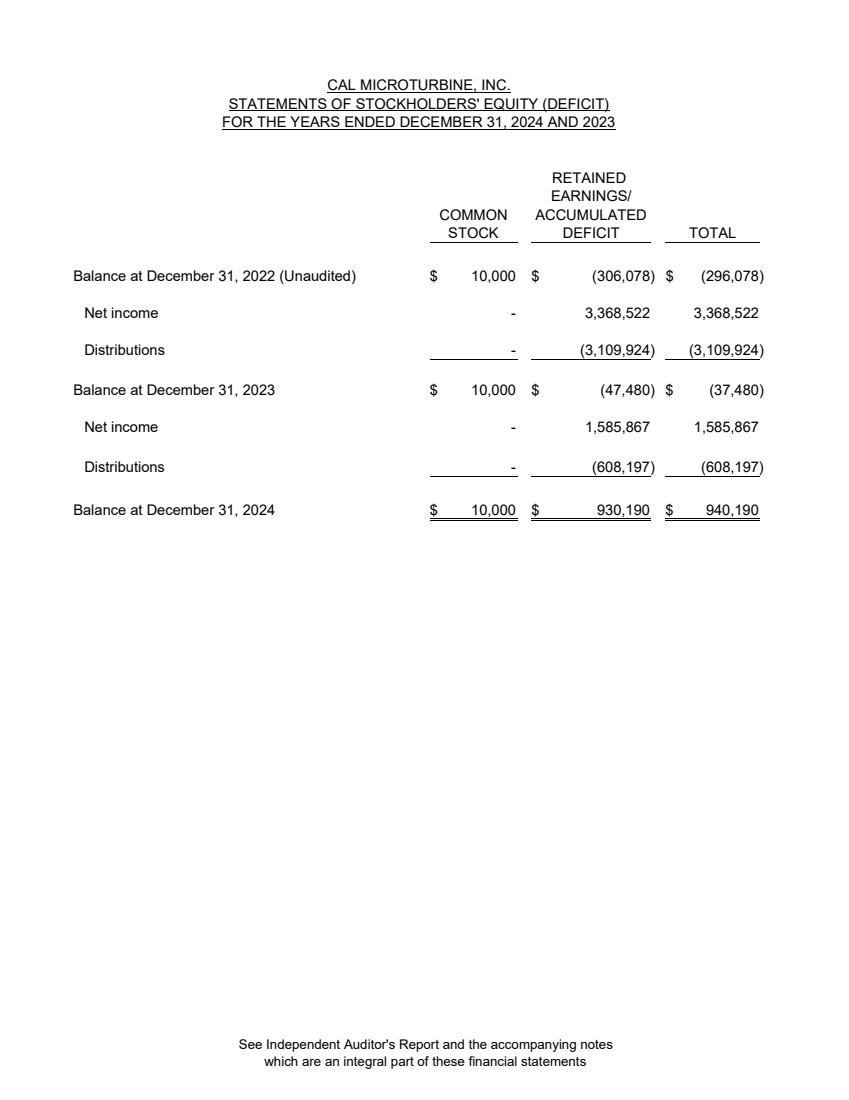

| RETAINED EARNINGS/ COMMON ACCUMULATED STOCK DEFICIT TOTAL Balance at December 31, 2022 (Unaudited) $ 10,000 $ (306,078) $ (296,078) Net income - 3,368,522 3,368,522 Distributions - (3,109,924) (3,109,924) Balance at December 31, 2023 10,000 $ (47,480) $ $ (37,480) Net income - 1,585,867 1,585,867 Distributions - (608,197) (608,197) Balance at December 31, 2024 10,000 $ 930,190 $ 940,190 $ CAL MICROTURBINE, INC. STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 See Independent Auditor's Report and the accompanying notes which are an integral part of these financial statements |

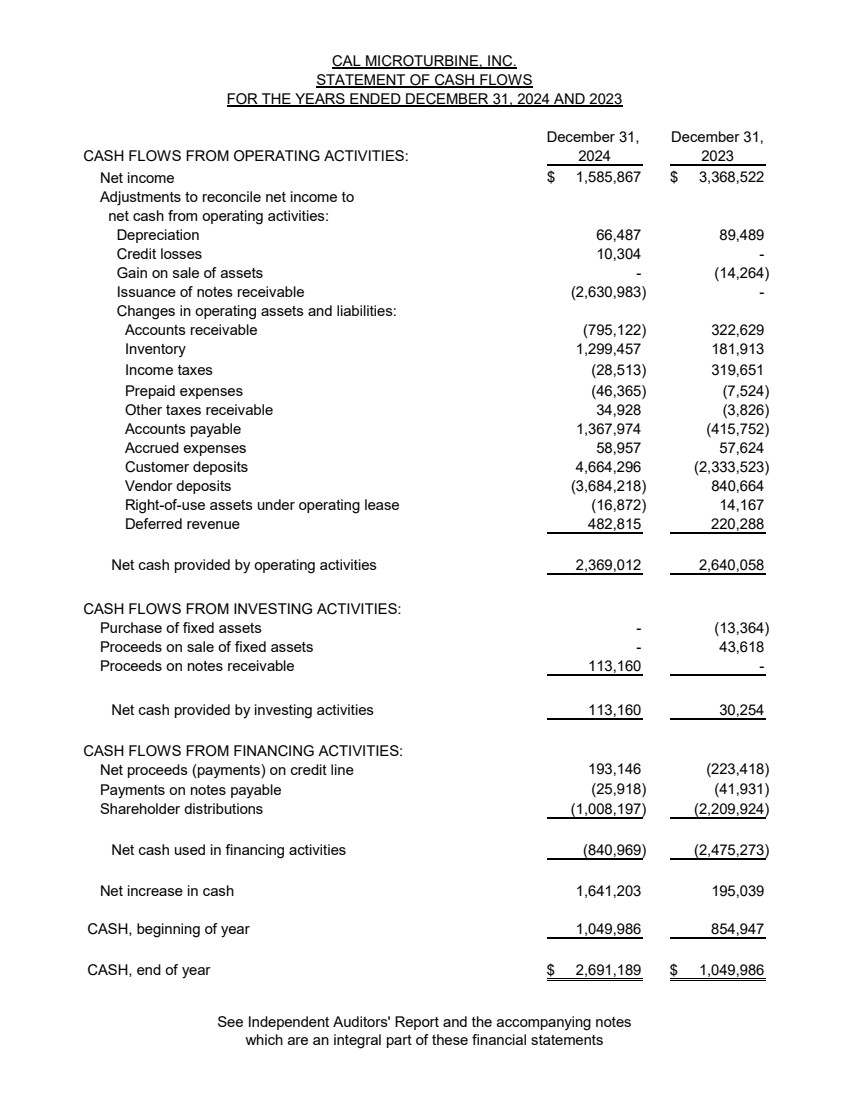

| December 31, December 31, CASH FLOWS FROM OPERATING ACTIVITIES: 2024 2023 Net income $ 3,368,522 1,585,867 $ Adjustments to reconcile net income to net cash from operating activities: Depreciation 66,487 89,489 Credit losses 10,304 - Gain on sale of assets - (14,264) Issuance of notes receivable (2,630,983) - Changes in operating assets and liabilities: Accounts receivable (795,122) 322,629 Inventory 1,299,457 181,913 Income taxes (28,513) 319,651 Prepaid expenses (46,365) (7,524) Other taxes receivable 34,928 (3,826) Accounts payable 1,367,974 (415,752) Accrued expenses 58,957 57,624 Customer deposits 4,664,296 (2,333,523) Vendor deposits (3,684,218) 840,664 Right-of-use assets under operating lease (16,872) 14,167 Deferred revenue 482,815 220,288 Net cash provided by operating activities 2,369,012 2,640,058 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of fixed assets - (13,364) Proceeds on sale of fixed assets - 43,618 Proceeds on notes receivable 113,160 - Net cash provided by investing activities 113,160 30,254 CASH FLOWS FROM FINANCING ACTIVITIES: Net proceeds (payments) on credit line (223,418) 193,146 Payments on notes payable (41,931) (25,918) Shareholder distributions (1,008,197) (2,209,924) Net cash used in financing activities (2,475,273) (840,969) Net increase in cash 1,641,203 195,039 CASH, beginning of year 1,049,986 854,947 CASH, end of year $ 1,049,986 2,691,189 $ CAL MICROTURBINE, INC. STATEMENT OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 See Independent Auditors' Report and the accompanying notes which are an integral part of these financial statements |

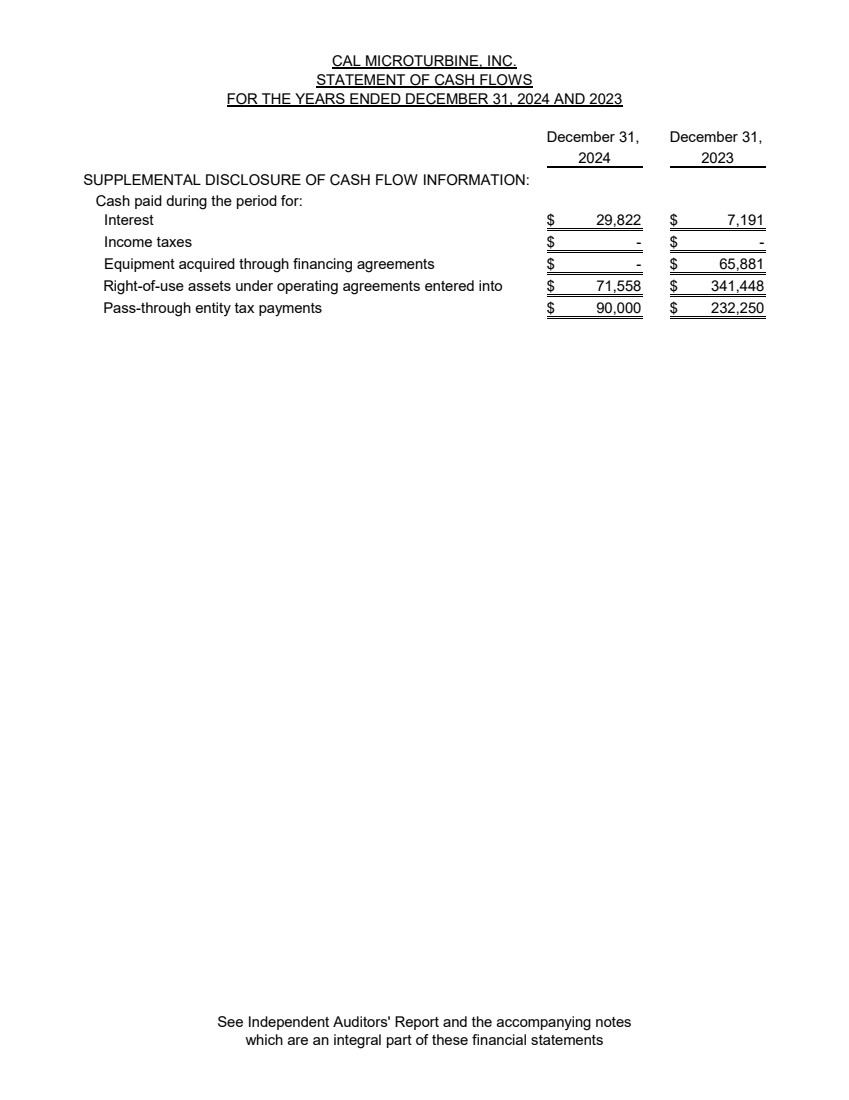

| CAL MICROTURBINE, INC. STATEMENT OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 December 31, December 31, 2024 2023 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest 29,822 $ 7,191 $ Income taxes $ - $ - Equipment acquired through financing agreements $ 65,881 - $ Right-of-use assets under operating agreements entered into 71,558 $ 341,448 $ Pass-through entity tax payments $ 90,000 232,250 $ See Independent Auditors' Report and the accompanying notes which are an integral part of these financial statements |

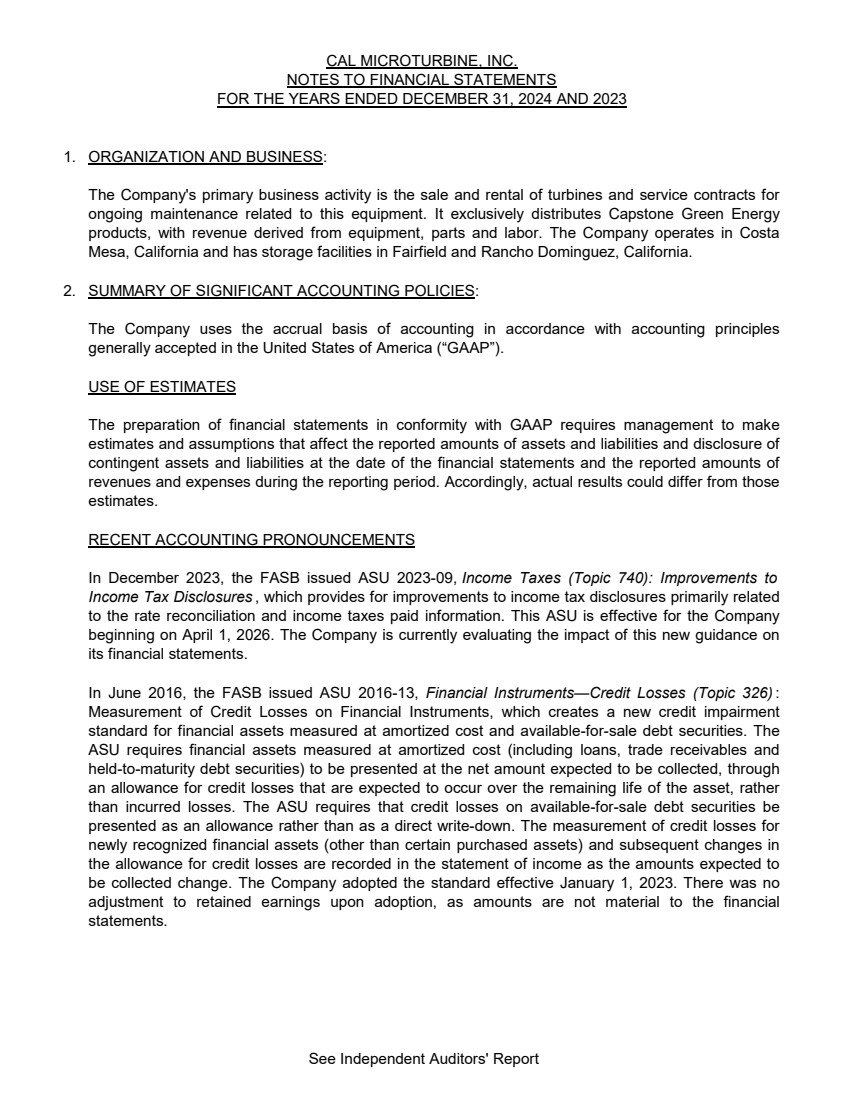

| 1. ORGANIZATION AND BUSINESS: 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: USE OF ESTIMATES RECENT ACCOUNTING PRONOUNCEMENTS CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 The Company uses the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company's primary business activity is the sale and rental of turbines and service contracts for ongoing maintenance related to this equipment. It exclusively distributes Capstone Green Energy products, with revenue derived from equipment, parts and labor. The Company operates in Costa Mesa, California and has storage facilities in Fairfield and Rancho Dominguez, California. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from those estimates. In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures , which provides for improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. This ASU is effective for the Company beginning on April 1, 2026. The Company is currently evaluating the impact of this new guidance on its financial statements. In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326) : Measurement of Credit Losses on Financial Instruments, which creates a new credit impairment standard for financial assets measured at amortized cost and available-for-sale debt securities. The ASU requires financial assets measured at amortized cost (including loans, trade receivables and held-to-maturity debt securities) to be presented at the net amount expected to be collected, through an allowance for credit losses that are expected to occur over the remaining life of the asset, rather than incurred losses. The ASU requires that credit losses on available-for-sale debt securities be presented as an allowance rather than as a direct write-down. The measurement of credit losses for newly recognized financial assets (other than certain purchased assets) and subsequent changes in the allowance for credit losses are recorded in the statement of income as the amounts expected to be collected change. The Company adopted the standard effective January 1, 2023. There was no adjustment to retained earnings upon adoption, as amounts are not material to the financial statements. See Independent Auditors' Report |

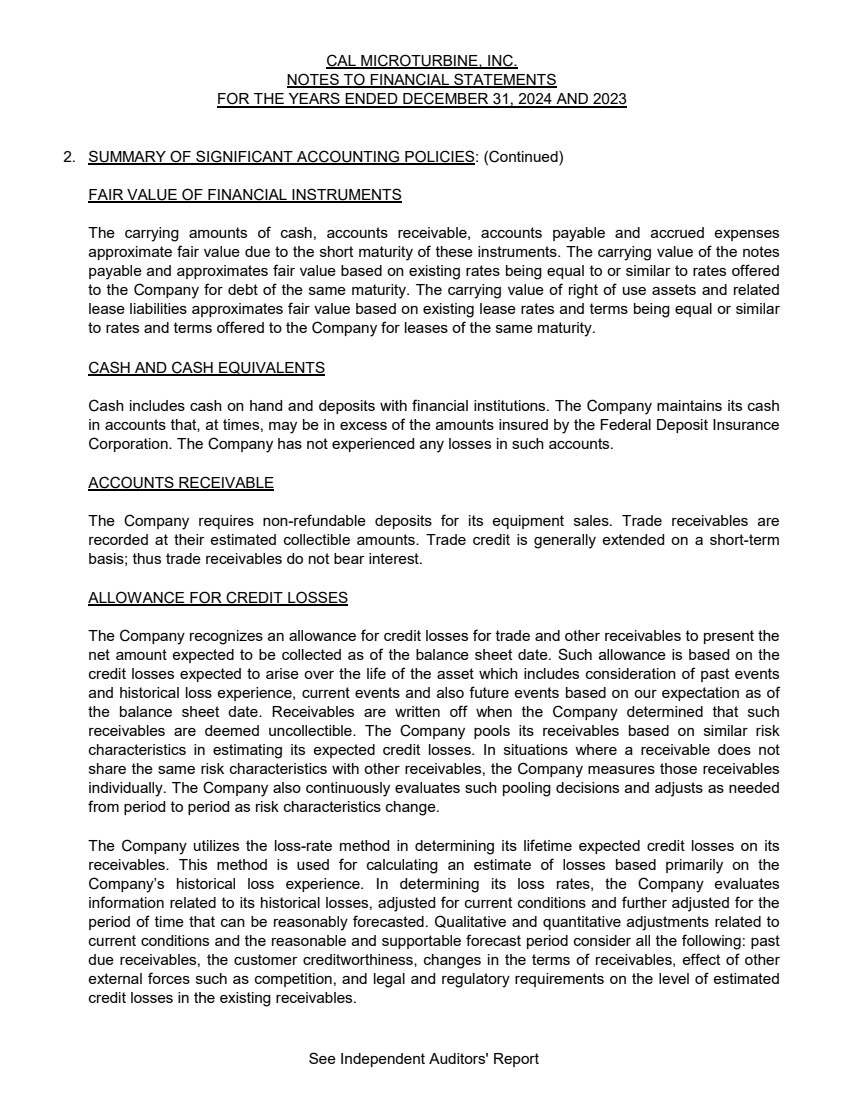

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) FAIR VALUE OF FINANCIAL INSTRUMENTS CASH AND CASH EQUIVALENTS ACCOUNTS RECEIVABLE ALLOWANCE FOR CREDIT LOSSES Cash includes cash on hand and deposits with financial institutions. The Company maintains its cash in accounts that, at times, may be in excess of the amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in such accounts. The Company requires non-refundable deposits for its equipment sales. Trade receivables are recorded at their estimated collectible amounts. Trade credit is generally extended on a short-term basis; thus trade receivables do not bear interest. The carrying amounts of cash, accounts receivable, accounts payable and accrued expenses approximate fair value due to the short maturity of these instruments. The carrying value of the notes payable and approximates fair value based on existing rates being equal to or similar to rates offered to the Company for debt of the same maturity. The carrying value of right of use assets and related lease liabilities approximates fair value based on existing lease rates and terms being equal or similar to rates and terms offered to the Company for leases of the same maturity. The Company utilizes the loss-rate method in determining its lifetime expected credit losses on its receivables. This method is used for calculating an estimate of losses based primarily on the Company’s historical loss experience. In determining its loss rates, the Company evaluates information related to its historical losses, adjusted for current conditions and further adjusted for the period of time that can be reasonably forecasted. Qualitative and quantitative adjustments related to current conditions and the reasonable and supportable forecast period consider all the following: past due receivables, the customer creditworthiness, changes in the terms of receivables, effect of other external forces such as competition, and legal and regulatory requirements on the level of estimated credit losses in the existing receivables. The Company recognizes an allowance for credit losses for trade and other receivables to present the net amount expected to be collected as of the balance sheet date. Such allowance is based on the credit losses expected to arise over the life of the asset which includes consideration of past events and historical loss experience, current events and also future events based on our expectation as of the balance sheet date. Receivables are written off when the Company determined that such receivables are deemed uncollectible. The Company pools its receivables based on similar risk characteristics in estimating its expected credit losses. In situations where a receivable does not share the same risk characteristics with other receivables, the Company measures those receivables individually. The Company also continuously evaluates such pooling decisions and adjusts as needed from period to period as risk characteristics change. See Independent Auditors' Report |

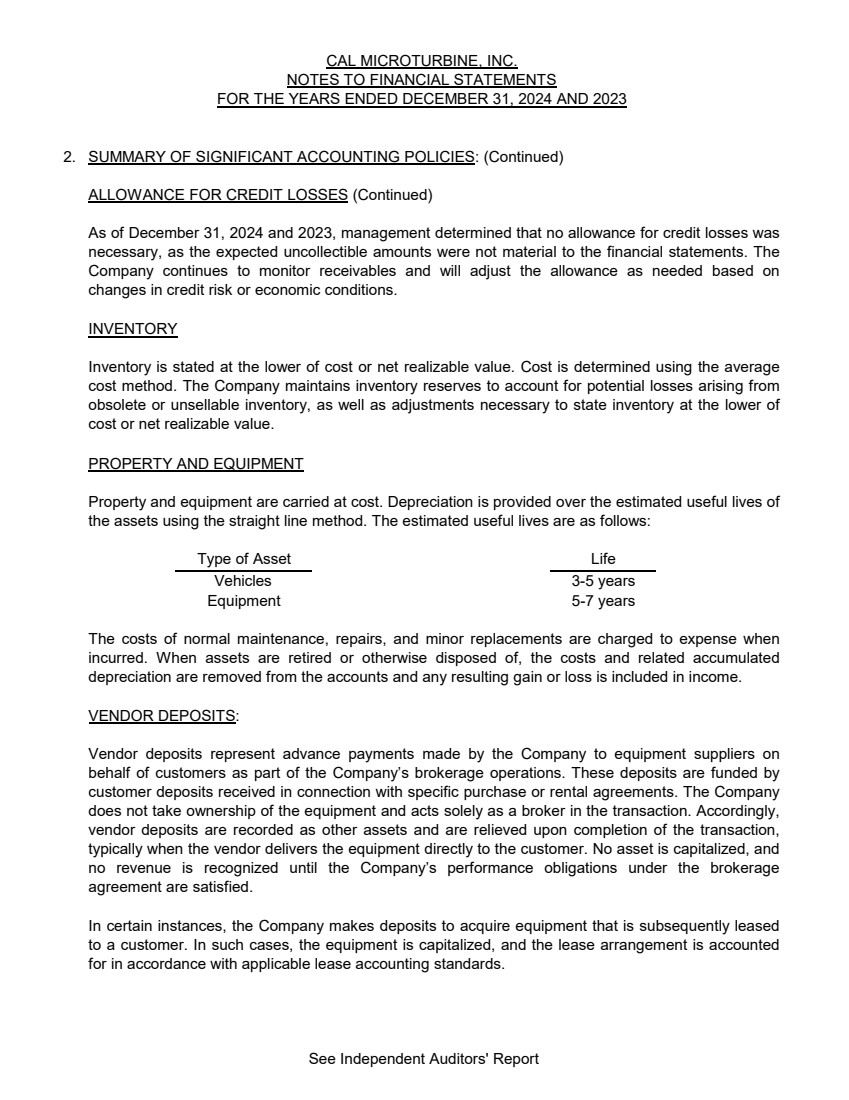

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) ALLOWANCE FOR CREDIT LOSSES (Continued) INVENTORY PROPERTY AND EQUIPMENT Life 3-5 years Equipment 5-7 years VENDOR DEPOSITS: Property and equipment are carried at cost. Depreciation is provided over the estimated useful lives of the assets using the straight line method. The estimated useful lives are as follows: Type of Asset Vehicles In certain instances, the Company makes deposits to acquire equipment that is subsequently leased to a customer. In such cases, the equipment is capitalized, and the lease arrangement is accounted for in accordance with applicable lease accounting standards. Inventory is stated at the lower of cost or net realizable value. Cost is determined using the average cost method. The Company maintains inventory reserves to account for potential losses arising from obsolete or unsellable inventory, as well as adjustments necessary to state inventory at the lower of cost or net realizable value. As of December 31, 2024 and 2023, management determined that no allowance for credit losses was necessary, as the expected uncollectible amounts were not material to the financial statements. The Company continues to monitor receivables and will adjust the allowance as needed based on changes in credit risk or economic conditions. The costs of normal maintenance, repairs, and minor replacements are charged to expense when incurred. When assets are retired or otherwise disposed of, the costs and related accumulated depreciation are removed from the accounts and any resulting gain or loss is included in income. Vendor deposits represent advance payments made by the Company to equipment suppliers on behalf of customers as part of the Company’s brokerage operations. These deposits are funded by customer deposits received in connection with specific purchase or rental agreements. The Company does not take ownership of the equipment and acts solely as a broker in the transaction. Accordingly, vendor deposits are recorded as other assets and are relieved upon completion of the transaction, typically when the vendor delivers the equipment directly to the customer. No asset is capitalized, and no revenue is recognized until the Company’s performance obligations under the brokerage agreement are satisfied. See Independent Auditors' Report |

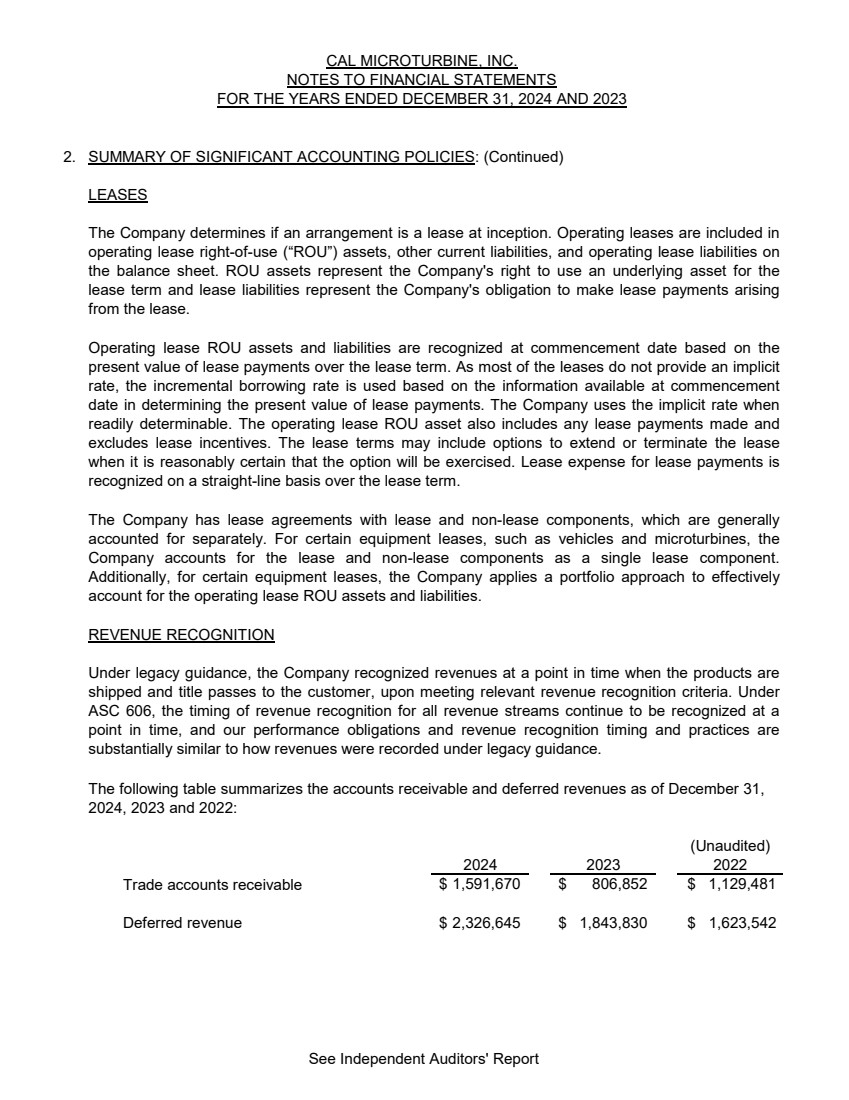

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) LEASES REVENUE RECOGNITION (Unaudited) 2024 2023 2022 Trade accounts receivable $ 1,591,670 $ 806,852 Deferred revenue $ 2,326,645 $ 1,843,830 $ 1,129,481 $ 1,623,542 Under legacy guidance, the Company recognized revenues at a point in time when the products are shipped and title passes to the customer, upon meeting relevant revenue recognition criteria. Under ASC 606, the timing of revenue recognition for all revenue streams continue to be recognized at a point in time, and our performance obligations and revenue recognition timing and practices are substantially similar to how revenues were recorded under legacy guidance. The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets, other current liabilities, and operating lease liabilities on the balance sheet. ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. The Company has lease agreements with lease and non-lease components, which are generally accounted for separately. For certain equipment leases, such as vehicles and microturbines, the Company accounts for the lease and non-lease components as a single lease component. Additionally, for certain equipment leases, the Company applies a portfolio approach to effectively account for the operating lease ROU assets and liabilities. The following table summarizes the accounts receivable and deferred revenues as of December 31, 2024, 2023 and 2022: Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the leases do not provide an implicit rate, the incremental borrowing rate is used based on the information available at commencement date in determining the present value of lease payments. The Company uses the implicit rate when readily determinable. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. The lease terms may include options to extend or terminate the lease when it is reasonably certain that the option will be exercised. Lease expense for lease payments is recognized on a straight-line basis over the lease term. See Independent Auditors' Report |

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) REVENUE RECOGNITION (Continued) Taxes collected from customers and remitted to governmental authorities are recorded on a net basis (excluded from revenue). Shipping costs incurred subsequent to transfer of control to external customers are recognized as cost of sales. Discounts that the Company offers to customers are accounted for as a reduction of revenues at the time of sale. The Company expenses sales commissions as incurred, as the amortization period for such costs would be less than one year. The Company does not disclose the value of unsatisfied performance obligations for contracts with an original expected length of one year or less. The effect of applying these practical expedients is not material. Revenues from the sale of equipment are recognized upon delivery, passage of title, and signing of the sales contract. Revenue from the sale of parts and service is recognized upon delivery of parts to the customer or when service work is performed. Sales discounts and service coupons are accounted for as a reduction to the sales price at the point of sale. Revenue from equipment rentals is recognized at monthly intervals. The Company subleases certain assets for which it is the lessee under non-cancelable lease agreements. Revenues from sublease agreements is recognized as rental income on a straight-line basis over the term of the sublease. Deferred revenues primarily relate to payments received from customers prior to satisfaction of the Company's performance obligations for warranty service work. Revenue is amortized on a straight-line basis over the term of the related contract, which generally reflects the satisfaction of performance obligations. Deferred revenue is being evaluated for classification of short and long-term portions. Of the amounts recorded as deferred revenues as of December 31, 2023 and 2022, $1,843,830 and $1,623,542 was recognized as revenue during the year ended December 31, 2024 and 2023, respectively. The Company receives deposits from customers in advance of fulfilling equipment sales contracts as well as rental contracts. Those deposits are recorded as a liability until the underlying performance obligation is satisfied, and which point revenue is recognized. The Company does not have any materially significant payment terms associated with its customer's contracts and payment is due and collected as previously noted. The Company does not offer material rights of return or service-type warranties. Trade receivables represent receivables for any portion of the equipment sales price not paid by the finance company, amounts due for sales of parts and service performed, and amounts owed for equipment rental. Management evaluates collectability of receivables and estimates an allowance for credit losses based on the age of the receivable and historical collection experience, which is recorded within “Accounts receivable” on the balance sheet with the receivables presented net of the allowance. See Independent Auditors' Report |

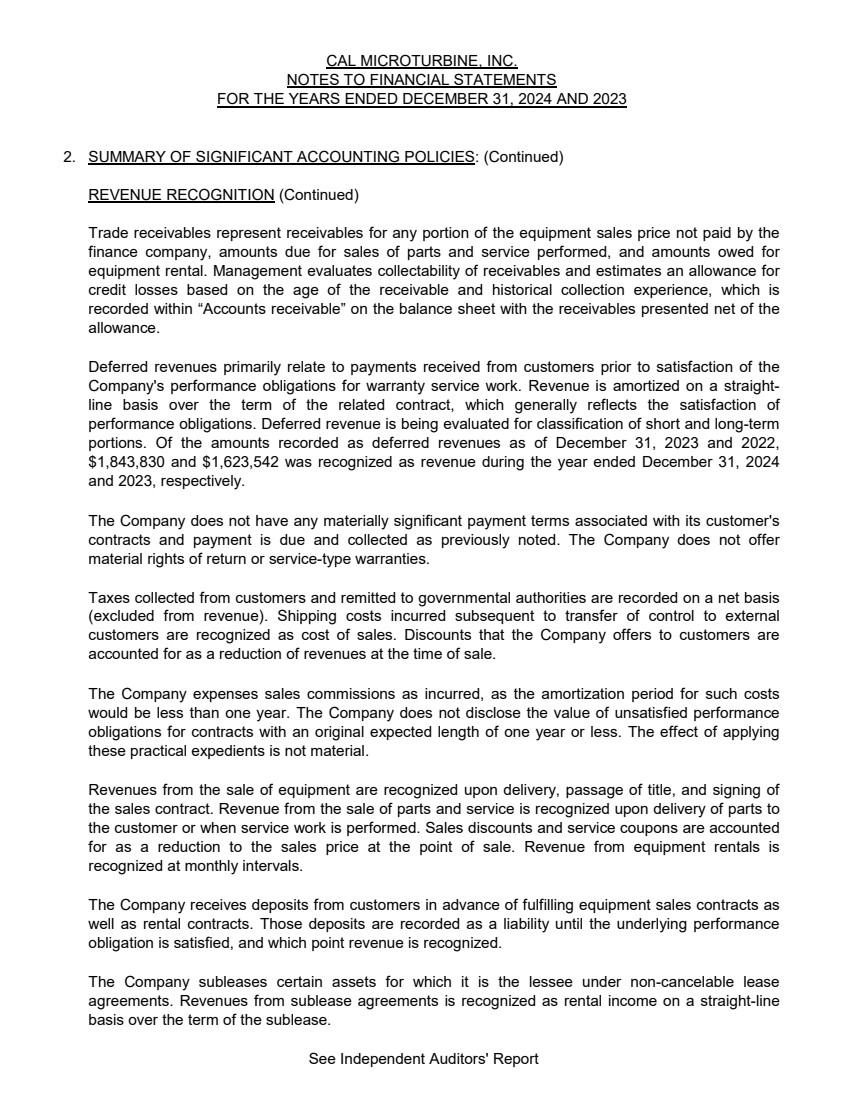

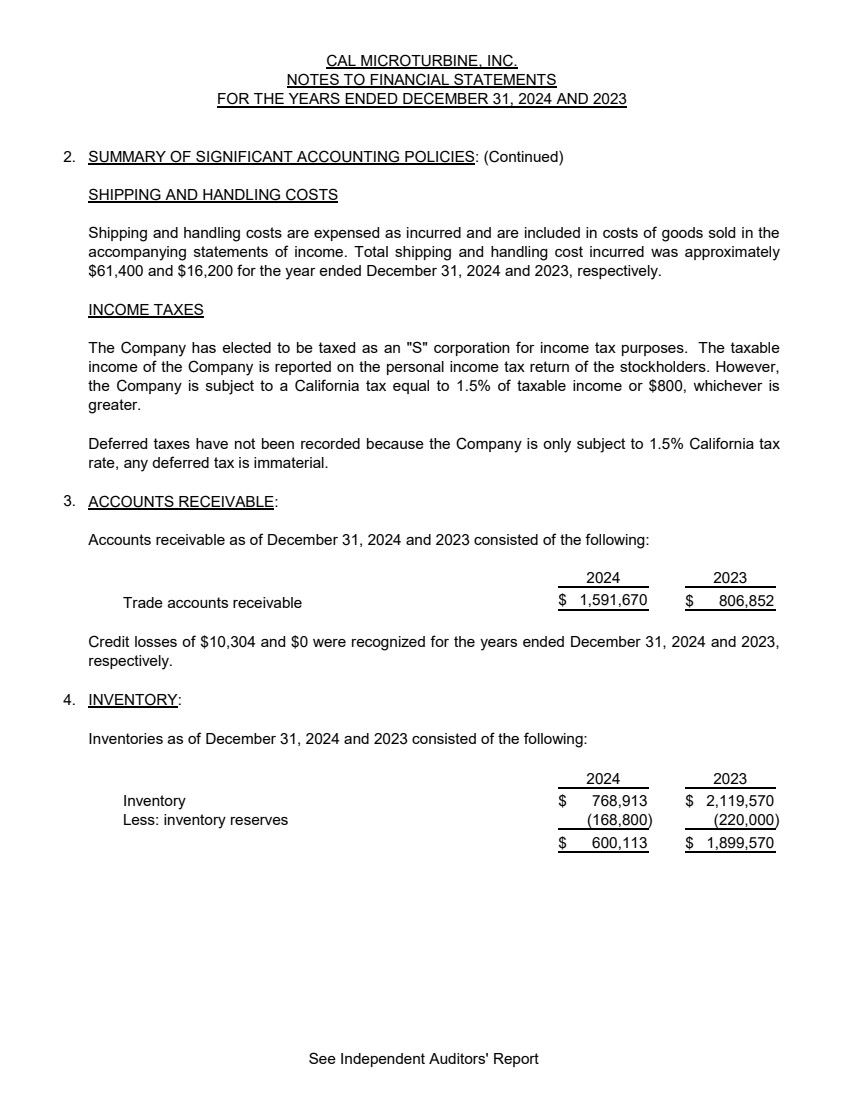

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) SHIPPING AND HANDLING COSTS INCOME TAXES 3. ACCOUNTS RECEIVABLE: Accounts receivable as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Trade accounts receivable $ 806,852 1,591,670 $ 4. INVENTORY: Inventories as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Inventory $ 2,119,570 768,913 $ Less: inventory reserves (168,800) (220,000) $ 1,899,570 600,113 $ Credit losses of $10,304 and $0 were recognized for the years ended December 31, 2024 and 2023, respectively. The Company has elected to be taxed as an "S" corporation for income tax purposes. The taxable income of the Company is reported on the personal income tax return of the stockholders. However, the Company is subject to a California tax equal to 1.5% of taxable income or $800, whichever is greater. Shipping and handling costs are expensed as incurred and are included in costs of goods sold in the accompanying statements of income. Total shipping and handling cost incurred was approximately $61,400 and $16,200 for the year ended December 31, 2024 and 2023, respectively. Deferred taxes have not been recorded because the Company is only subject to 1.5% California tax rate, any deferred tax is immaterial. See Independent Auditors' Report |

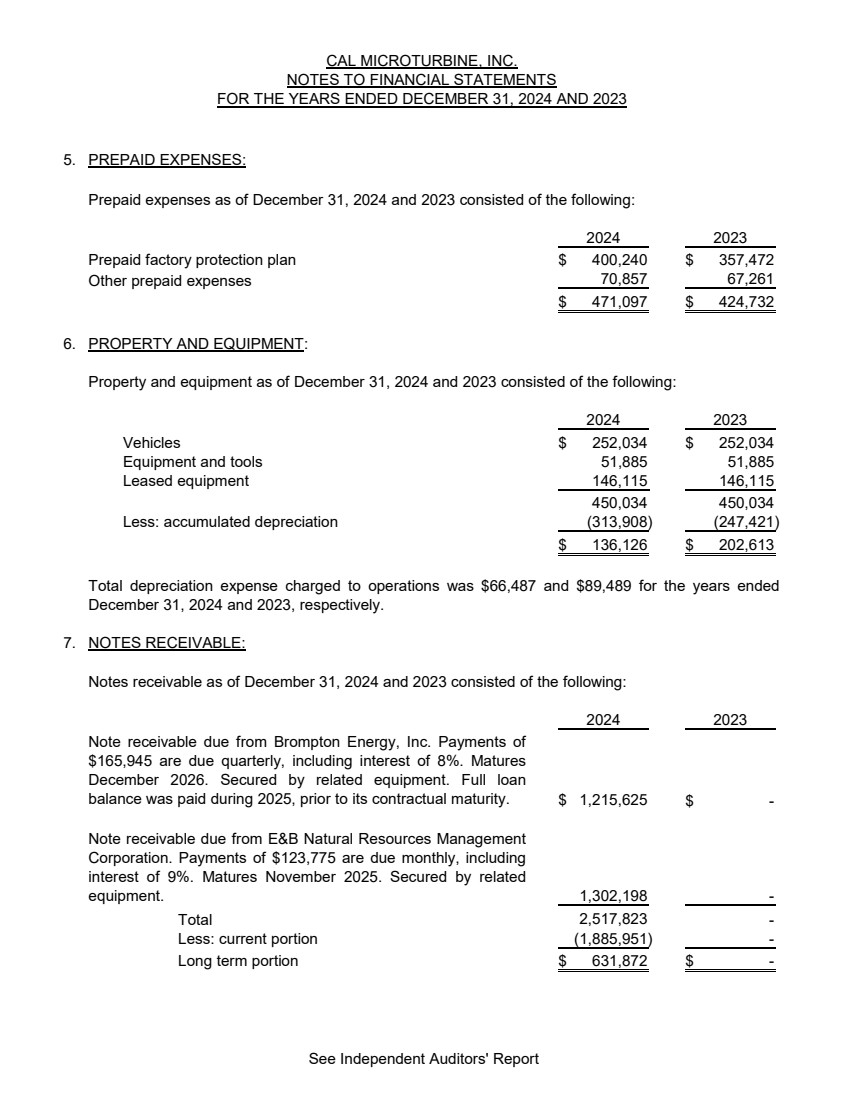

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 5. PREPAID EXPENSES: Prepaid expenses as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Prepaid factory protection plan $ 400,240 $ 357,472 Other prepaid expenses 67,261 70,857 $ 424,732 471,097 $ 6. PROPERTY AND EQUIPMENT: Property and equipment as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Vehicles $ 252,034 $ 252,034 Equipment and tools 51,885 51,885 Leased equipment 146,115 146,115 450,034 450,034 Less: accumulated depreciation (313,908) (247,421) $ 202,613 136,126 $ 7. NOTES RECEIVABLE: Notes receivable as of December 31, 2024 and 2023 consisted of the following: 2024 2023 $ 1,215,625 $ - - 1,302,198 Total 2,517,823 - Less: current portion - (1,885,951) Long term portion $ 631,872 $ - Note receivable due from Brompton Energy, Inc. Payments of $165,945 are due quarterly, including interest of 8%. Matures December 2026. Secured by related equipment. Full loan balance was paid during 2025, prior to its contractual maturity. Note receivable due from E&B Natural Resources Management Corporation. Payments of $123,775 are due monthly, including interest of 9%. Matures November 2025. Secured by related equipment. Total depreciation expense charged to operations was $66,487 and $89,489 for the years ended December 31, 2024 and 2023, respectively. See Independent Auditors' Report |

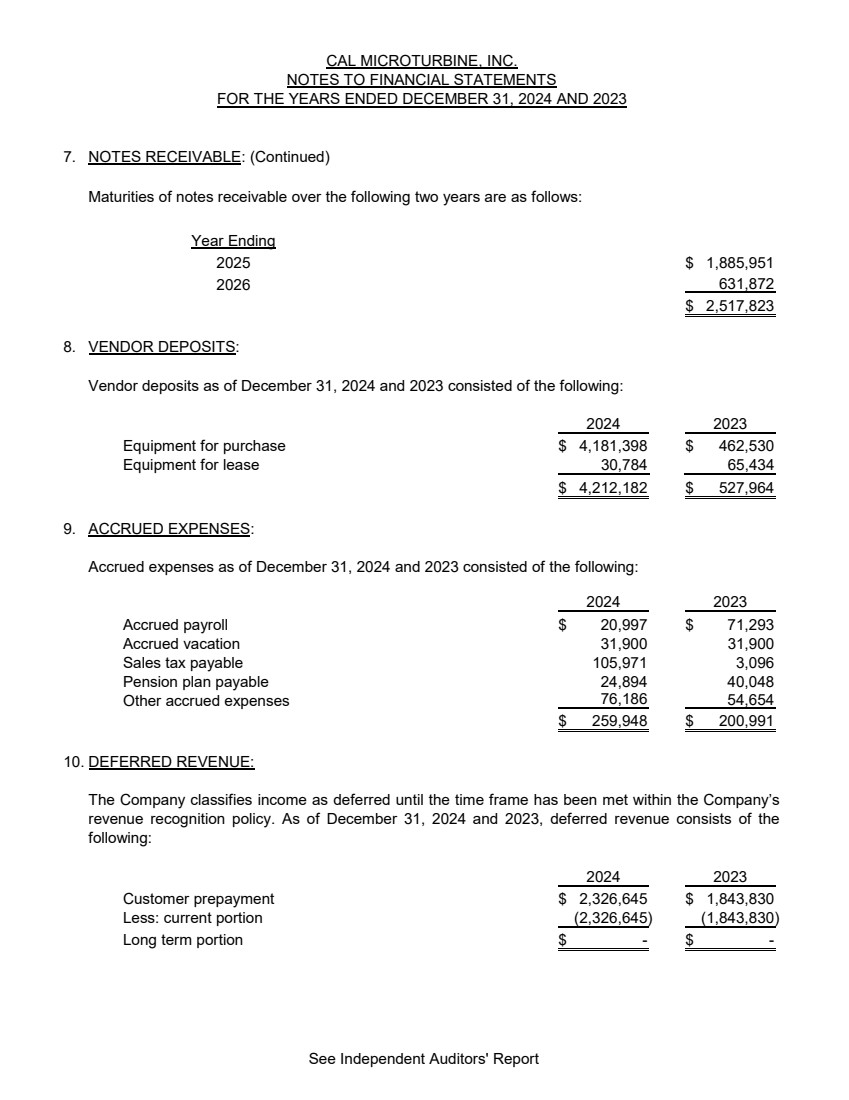

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 7. NOTES RECEIVABLE: (Continued) Maturities of notes receivable over the following two years are as follows: Year Ending 2025 $ 1,885,951 2026 631,872 $ 2,517,823 8. VENDOR DEPOSITS: Vendor deposits as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Equipment for purchase $ 4,181,398 $ 462,530 Equipment for lease 30,784 65,434 $ 527,964 4,212,182 $ 9. ACCRUED EXPENSES: Accrued expenses as of December 31, 2024 and 2023 consisted of the following: 2024 2023 Accrued payroll $ 20,997 $ 71,293 Accrued vacation 31,900 31,900 Sales tax payable 105,971 3,096 Pension plan payable 24,894 40,048 Other accrued expenses 54,654 76,186 $ 200,991 259,948 $ 10. DEFERRED REVENUE: 2024 2023 Customer prepayment $ 2,326,645 $ 1,843,830 Less: current portion (1,843,830) (2,326,645) Long term portion - $ - $ The Company classifies income as deferred until the time frame has been met within the Company’s revenue recognition policy. As of December 31, 2024 and 2023, deferred revenue consists of the following: See Independent Auditors' Report |

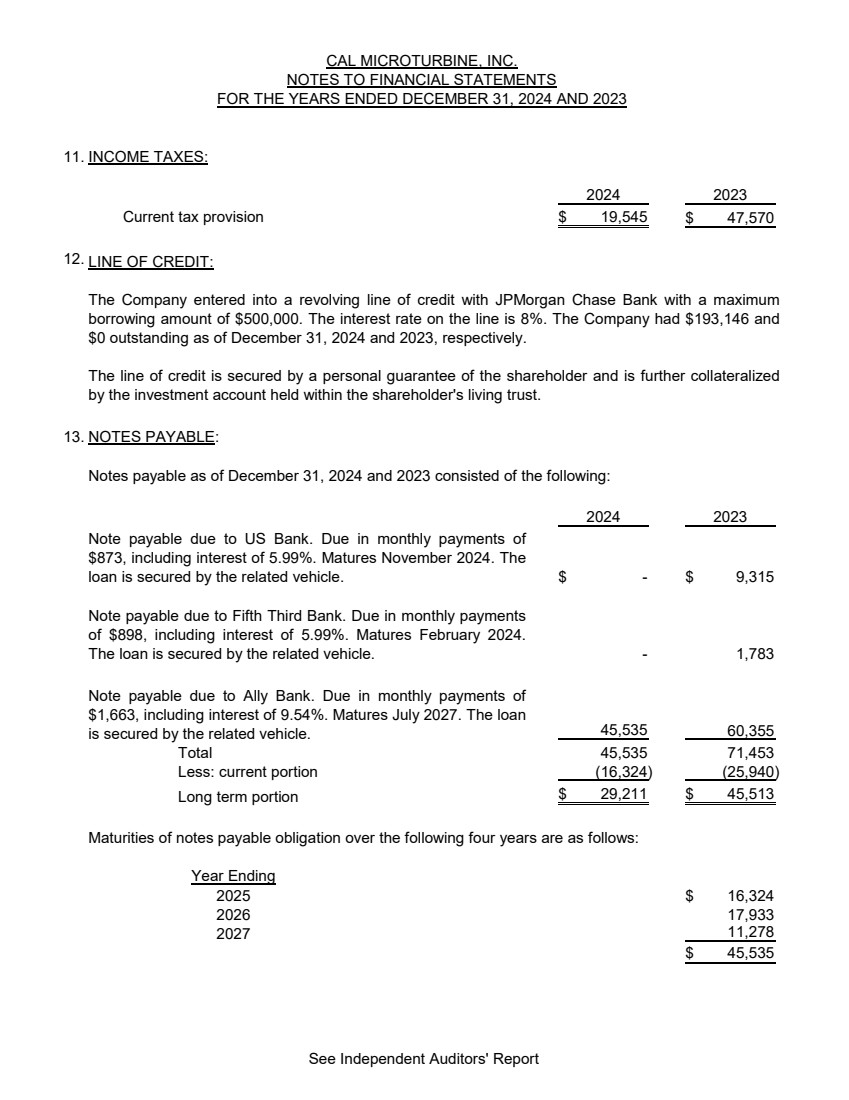

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 11. INCOME TAXES: 2024 2023 Current tax provision $ 19,545 $ 47,570 12. LINE OF CREDIT: 13. NOTES PAYABLE: Notes payable as of December 31, 2024 and 2023 consisted of the following: 2024 2023 $ - $ 9,315 - 1,783 60,355 45,535 Total 71,453 45,535 Less: current portion (16,324) (25,940) Long term portion $ 45,513 29,211 $ Maturities of notes payable obligation over the following four years are as follows: Year Ending 2025 $ 16,324 2026 17,933 2027 11,278 $ 45,535 Note payable due to Ally Bank. Due in monthly payments of $1,663, including interest of 9.54%. Matures July 2027. The loan is secured by the related vehicle. Note payable due to US Bank. Due in monthly payments of $873, including interest of 5.99%. Matures November 2024. The loan is secured by the related vehicle. Note payable due to Fifth Third Bank. Due in monthly payments of $898, including interest of 5.99%. Matures February 2024. The loan is secured by the related vehicle. The Company entered into a revolving line of credit with JPMorgan Chase Bank with a maximum borrowing amount of $500,000. The interest rate on the line is 8%. The Company had $193,146 and $0 outstanding as of December 31, 2024 and 2023, respectively. The line of credit is secured by a personal guarantee of the shareholder and is further collateralized by the investment account held within the shareholder's living trust. See Independent Auditors' Report |

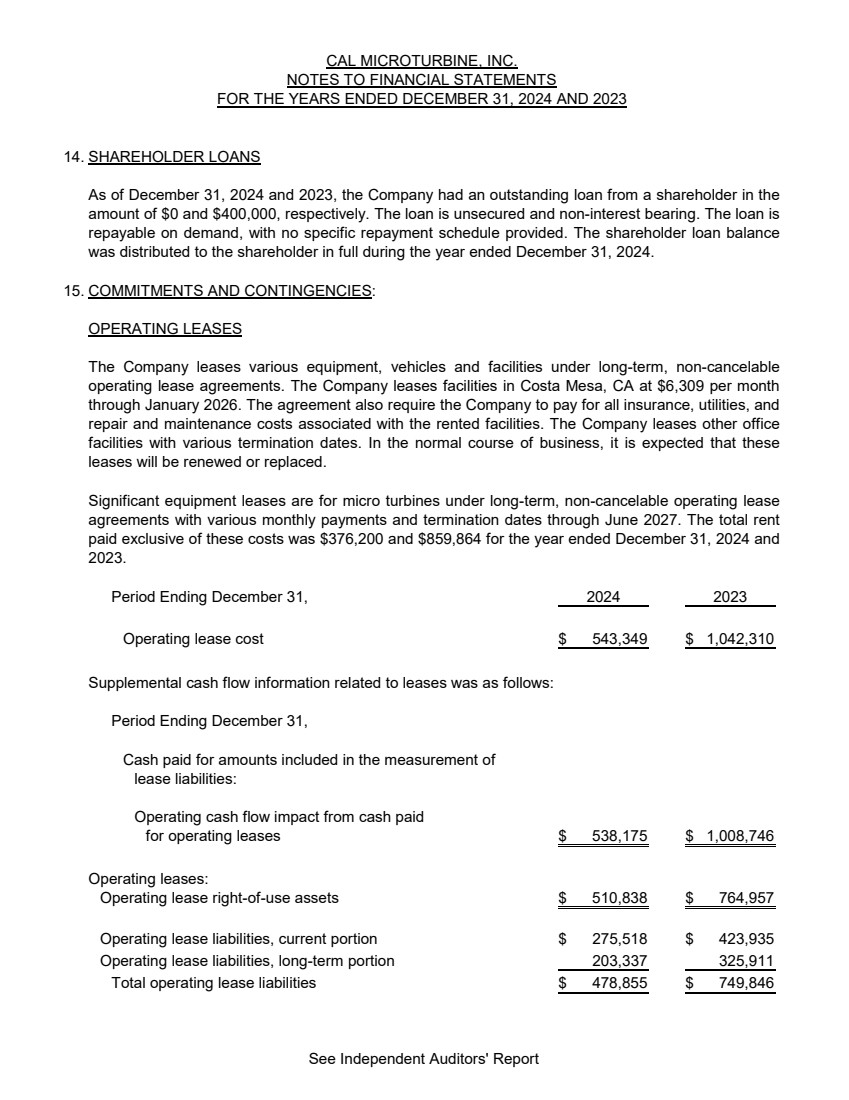

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 14. SHAREHOLDER LOANS 15. COMMITMENTS AND CONTINGENCIES: OPERATING LEASES Period Ending December 31, 2024 2023 Operating lease cost $ 1,042,310 543,349 $ Supplemental cash flow information related to leases was as follows: Period Ending December 31, Cash paid for amounts included in the measurement of lease liabilities: Operating cash flow impact from cash paid for operating leases 538,175 $ 1,008,746 $ Operating leases: Operating lease right-of-use assets 510,838 $ 764,957 $ Operating lease liabilities, current portion 275,518 $ 423,935 $ Operating lease liabilities, long-term portion 203,337 325,911 Total operating lease liabilities 478,855 $ 749,846 $ The Company leases various equipment, vehicles and facilities under long-term, non-cancelable operating lease agreements. The Company leases facilities in Costa Mesa, CA at $6,309 per month through January 2026. The agreement also require the Company to pay for all insurance, utilities, and repair and maintenance costs associated with the rented facilities. The Company leases other office facilities with various termination dates. In the normal course of business, it is expected that these leases will be renewed or replaced. Significant equipment leases are for micro turbines under long-term, non-cancelable operating lease agreements with various monthly payments and termination dates through June 2027. The total rent paid exclusive of these costs was $376,200 and $859,864 for the year ended December 31, 2024 and 2023. As of December 31, 2024 and 2023, the Company had an outstanding loan from a shareholder in the amount of $0 and $400,000, respectively. The loan is unsecured and non-interest bearing. The loan is repayable on demand, with no specific repayment schedule provided. The shareholder loan balance was distributed to the shareholder in full during the year ended December 31, 2024. See Independent Auditors' Report |

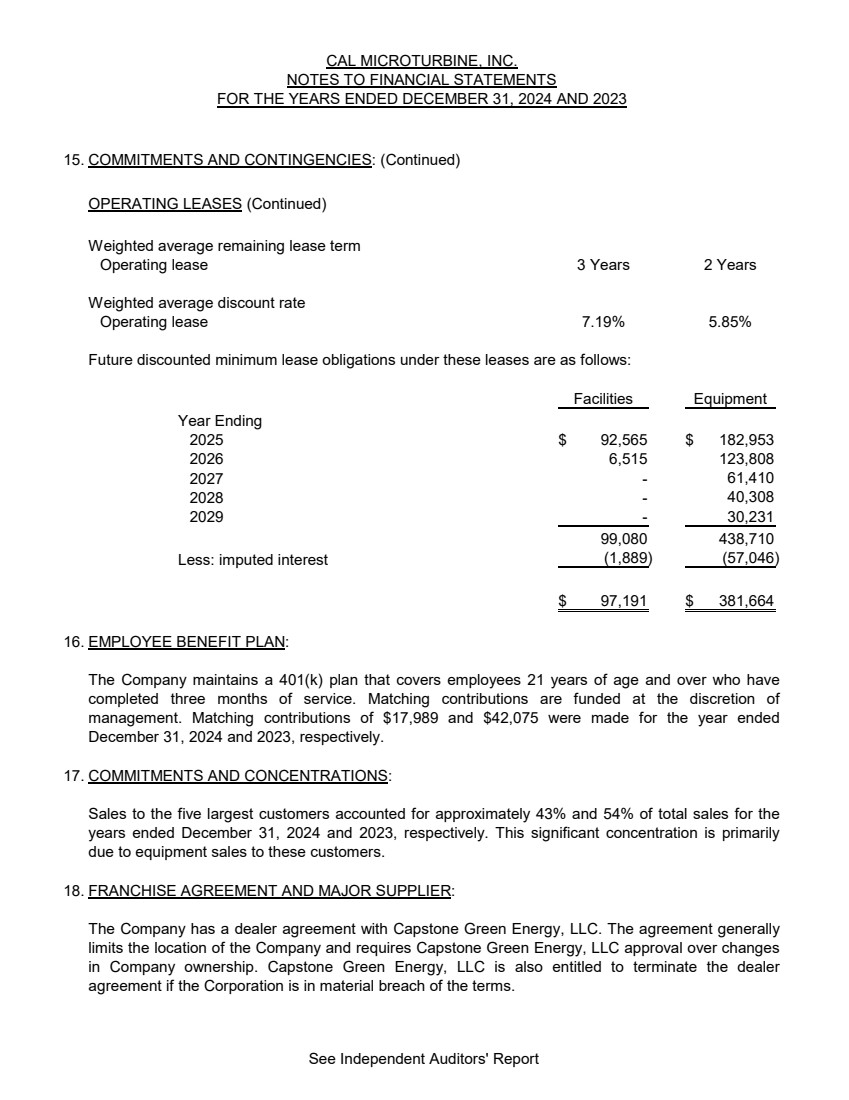

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 15. COMMITMENTS AND CONTINGENCIES: (Continued) OPERATING LEASES (Continued) Weighted average remaining lease term Operating lease 3 Years 2 Years Weighted average discount rate Operating lease 7.19% 5.85% Future discounted minimum lease obligations under these leases are as follows: Facilities Equipment Year Ending 2025 $ 182,953 92,565 $ 2026 123,808 6,515 2027 - 61,410 2028 - 40,308 2029 - 30,231 99,080 438,710 Less: imputed interest (57,046) (1,889) $ 381,664 97,191 $ 16. EMPLOYEE BENEFIT PLAN: 17. COMMITMENTS AND CONCENTRATIONS: 18. FRANCHISE AGREEMENT AND MAJOR SUPPLIER: The Company maintains a 401(k) plan that covers employees 21 years of age and over who have completed three months of service. Matching contributions are funded at the discretion of management. Matching contributions of $17,989 and $42,075 were made for the year ended December 31, 2024 and 2023, respectively. Sales to the five largest customers accounted for approximately 43% and 54% of total sales for the years ended December 31, 2024 and 2023, respectively. This significant concentration is primarily due to equipment sales to these customers. The Company has a dealer agreement with Capstone Green Energy, LLC. The agreement generally limits the location of the Company and requires Capstone Green Energy, LLC approval over changes in Company ownership. Capstone Green Energy, LLC is also entitled to terminate the dealer agreement if the Corporation is in material breach of the terms. See Independent Auditors' Report |

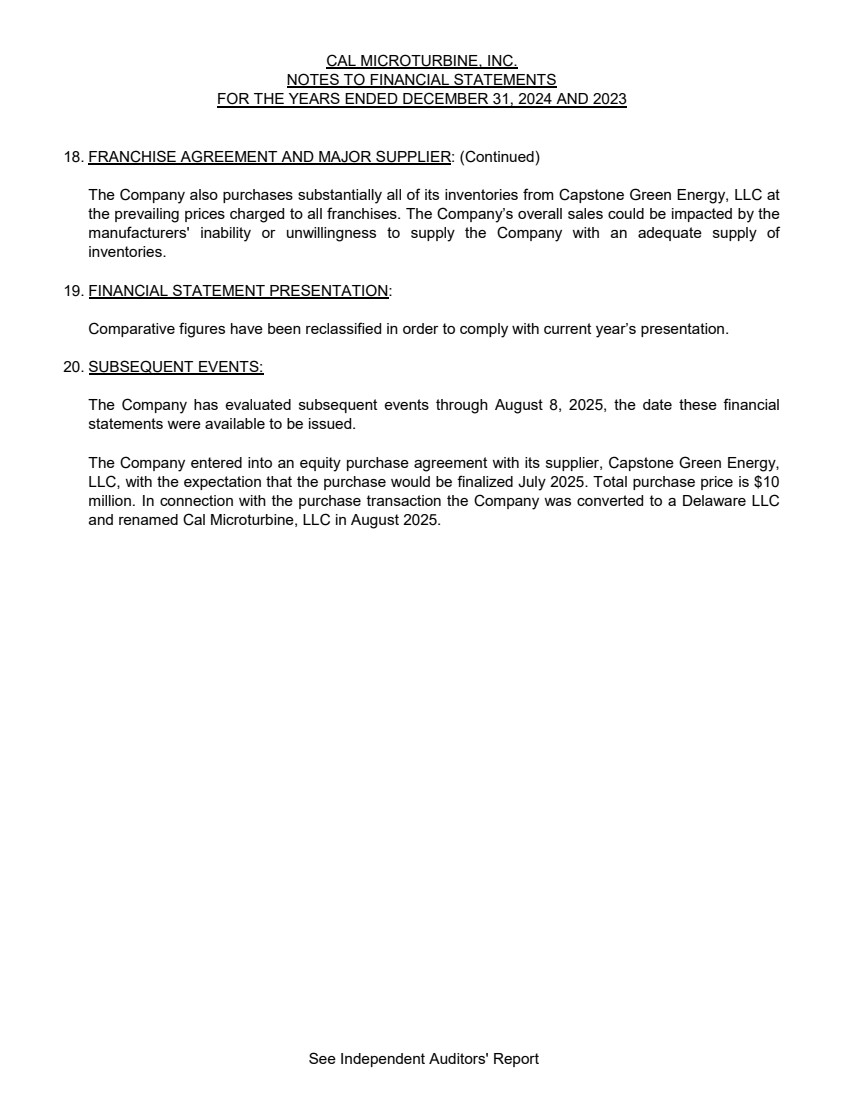

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 18. FRANCHISE AGREEMENT AND MAJOR SUPPLIER: (Continued) 19. FINANCIAL STATEMENT PRESENTATION: 20. SUBSEQUENT EVENTS: The Company entered into an equity purchase agreement with its supplier, Capstone Green Energy, LLC, with the expectation that the purchase would be finalized July 2025. Total purchase price is $10 million. In connection with the purchase transaction the Company was converted to a Delaware LLC and renamed Cal Microturbine, LLC in August 2025. The Company has evaluated subsequent events through August 8, 2025, the date these financial statements were available to be issued. Comparative figures have been reclassified in order to comply with current year’s presentation. The Company also purchases substantially all of its inventories from Capstone Green Energy, LLC at the prevailing prices charged to all franchises. The Company’s overall sales could be impacted by the manufacturers' inability or unwillingness to supply the Company with an adequate supply of inventories. See Independent Auditors' Report |

| SUPPLEMENTAL INFORMATION |

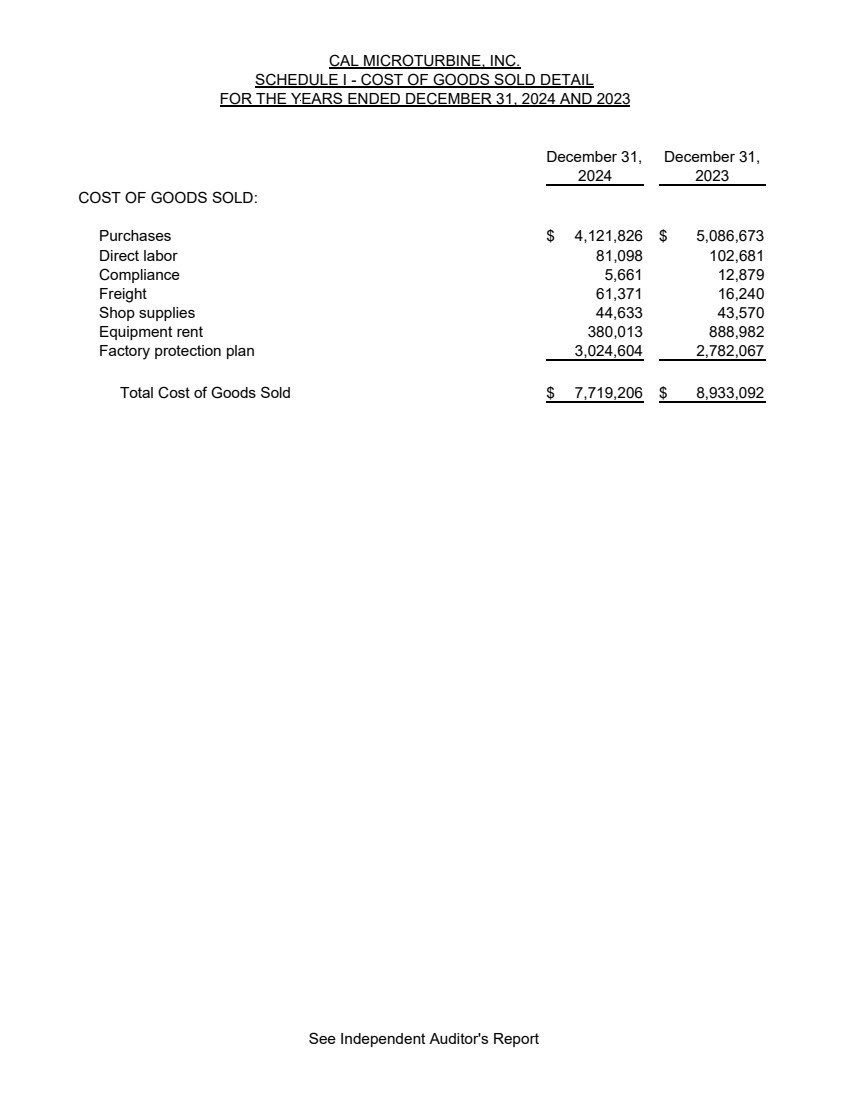

| December 31, December 31, 2024 2023 COST OF GOODS SOLD: Purchases 4,121,826 $ 5,086,673 $ Direct labor 81,098 102,681 Compliance 5,661 12,879 Freight 61,371 16,240 Shop supplies 44,633 43,570 Equipment rent 380,013 888,982 Factory protection plan 2,782,067 3,024,604 Total Cost of Goods Sold 7,719,206 $ 8,933,092 $ CAL MICROTURBINE, INC. SCHEDULE I - COST OF GOODS SOLD DETAIL FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 See Independent Auditor's Report |

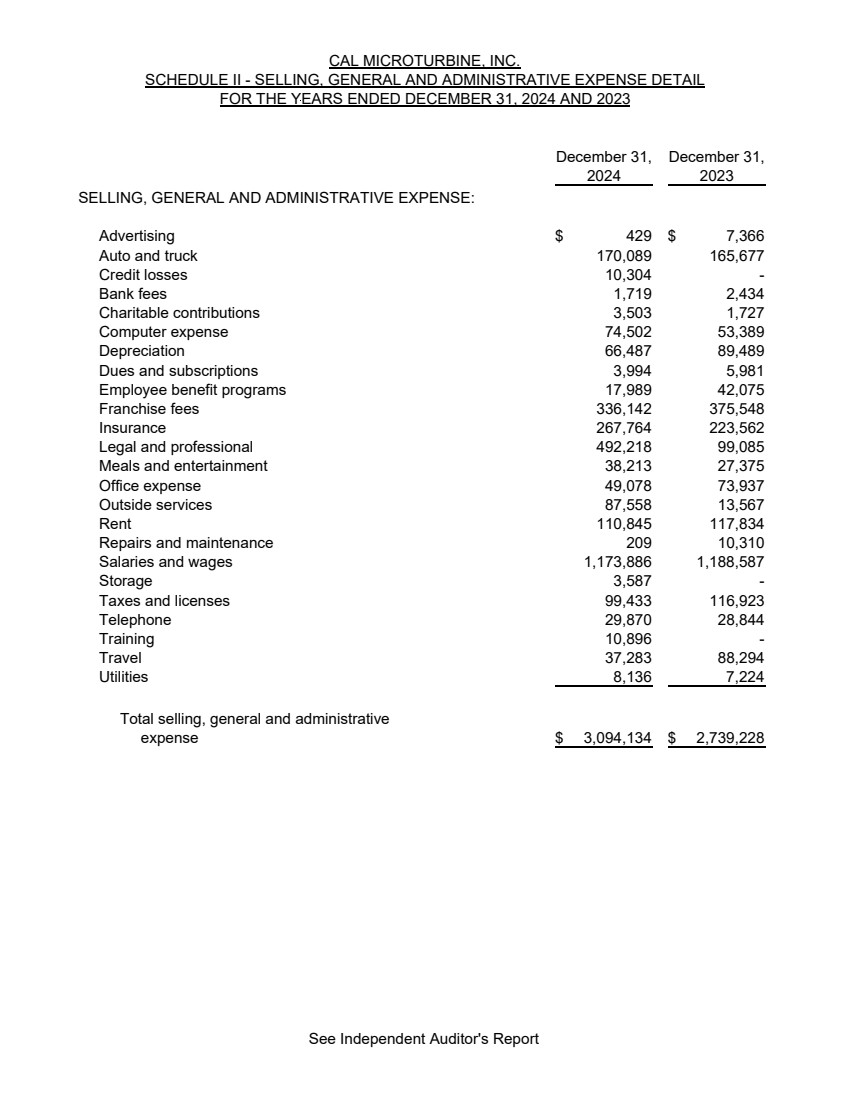

| December 31, December 31, 2024 2023 SELLING, GENERAL AND ADMINISTRATIVE EXPENSE: Advertising 429 $ $ 7,366 Auto and truck 170,089 165,677 Credit losses 10,304 - Bank fees 1,719 2,434 Charitable contributions 3,503 1,727 Computer expense 74,502 53,389 Depreciation 66,487 89,489 Dues and subscriptions 3,994 5,981 Employee benefit programs 17,989 42,075 Franchise fees 336,142 375,548 Insurance 267,764 223,562 Legal and professional 492,218 99,085 Meals and entertainment 38,213 27,375 Office expense 49,078 73,937 Outside services 87,558 13,567 Rent 110,845 117,834 Repairs and maintenance 209 10,310 Salaries and wages 1,173,886 1,188,587 Storage 3,587 - Taxes and licenses 99,433 116,923 Telephone 29,870 28,844 Training 10,896 - Travel 37,283 88,294 Utilities 7,224 8,136 Total selling, general and administrative expense 3,094,134 $ 2,739,228 $ CAL MICROTURBINE, INC. SCHEDULE II - SELLING, GENERAL AND ADMINISTRATIVE EXPENSE DETAIL FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023 See Independent Auditor's Report |