| CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS CAL MICROTURBINE, INC. REVIEWED FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 FOR THE THREE MONTHS ENDED MARCH 31, 2024 (NO ASSURANCE PROVIDED) AND FINANCIAL STATEMENTS |

| Scott M. Biehl, CPA Andy R. Jones, CPA Graham S. Applebaum, CPA CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS 1067 PARK VIEW DRIVE • COVINA, CA 91724-3748 • (626) 858-5100 • W W W.ROGERSCLEM.COM To the Board of Directors Cal Microturbine, Inc. Costa Mesa, CA Other Matter - Prior-Period Financial Statements Management's Responsibility for the Financial Statements Accountant's Responsibility We are required to be independent of Cal Microturbine, Inc. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our review. Independent Accountant's Review Report We have reviewed the accompanying interim financial statements of Cal Microturbine, Inc. (a California corporation), which comprise the balance sheets as of March 31, 2025, and the related statements of income, stockholders' equity, and cash flows for the three months then ended, and the related notes to the financial statements. A review includes primarily applying analytical procedures to management's financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the interim financial statements as a whole. Accordingly, we do not express such an opinion. Management is responsible for the preparation and fair presentation of these interim financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of interim financial statements that are free from material misstatement whether due to fraud or error. The financial statements as of and for the three months ended March 31, 2024 are presented for comparative purposes. We were not engaged to audit, review, or compile those financial statements and, accordingly, we do not express an opinion, a conclusion, nor provide any assurance on them. Our responsibility is to conduct the review engagement in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the interim financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion. |

| Scott M. Biehl, CPA Andy R. Jones, CPA Graham S. Applebaum, CPA CERTIFIED PUBLIC ACCOUNTANTS & CONSULTANTS 1067 PARK VIEW DRIVE • COVINA, CA 91724-3748 • (626) 858-5100 • W W W.ROGERSCLEM.COM Accountant's Conclusion Based on our review, we are not aware of any material modifications that should be made to the accompanying interim financial statements in order for them to be in accordance with accounting principles generally accepted in the United States of America. Supplementary Information The supplementary information included in Schedule I and II is presented for purposes of additional analysis and is not a required part of the basic financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the financial statements. The supplementary information has been subjected to the review procedures applied in our review of the basic financial statements. We are not aware of any material modifications that should be made to the supplementary information. We have not audited the supplementary information and do not express an opinion on such information. ROGERS, CLEM & COMPANY Covina, California September 26, 2025 |

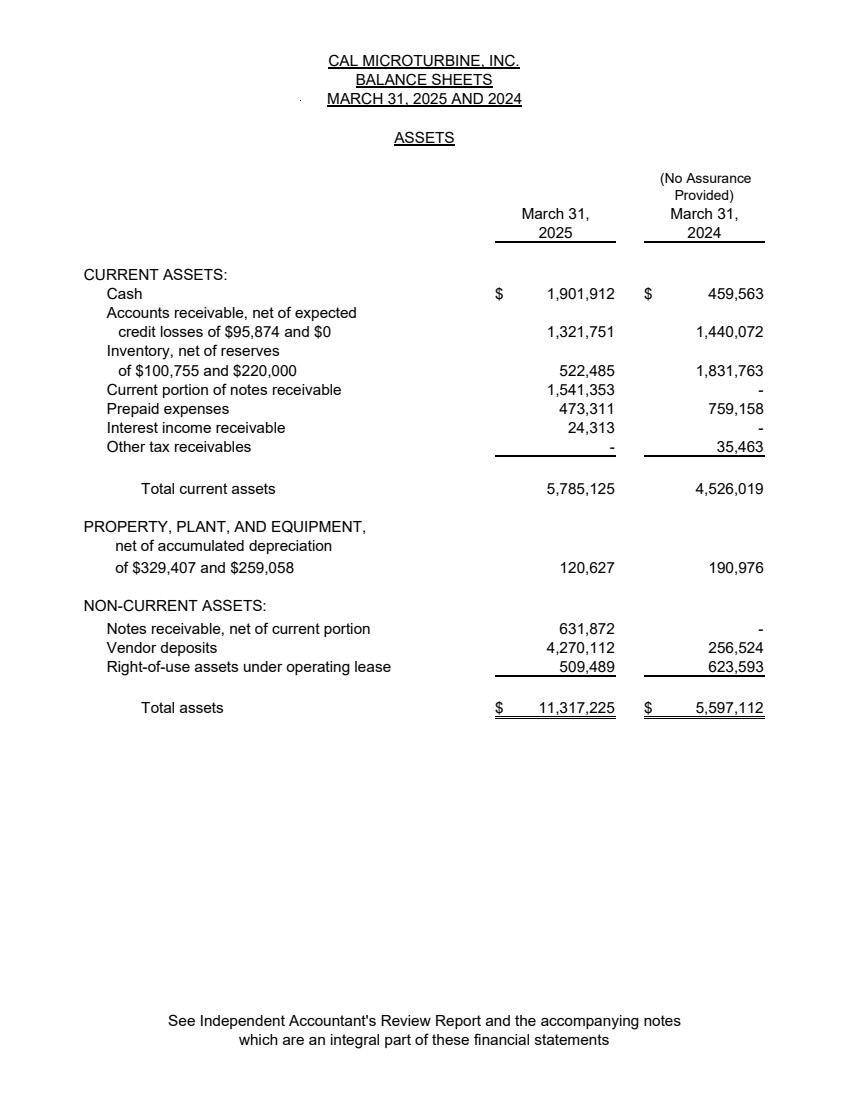

| March 31, March 31, 2025 2024 CURRENT ASSETS: Cash 1,901,912 $ 459,563 $ Accounts receivable, net of expected credit losses of $95,874 and $0 1,321,751 1,440,072 Inventory, net of reserves of $100,755 and $220,000 522,485 1,831,763 Current portion of notes receivable 1,541,353 - Prepaid expenses 473,311 759,158 Interest income receivable 24,313 - Other tax receivables - 35,463 Total current assets 4,526,019 5,785,125 PROPERTY, PLANT, AND EQUIPMENT, net of accumulated depreciation of $329,407 and $259,058 120,627 190,976 NON-CURRENT ASSETS: Notes receivable, net of current portion 631,872 - Vendor deposits 4,270,112 256,524 Right-of-use assets under operating lease 623,593 509,489 Total assets $ 11,317,225 5,597,112 $ ASSETS CAL MICROTURBINE, INC. BALANCE SHEETS MARCH 31, 2025 AND 2024 (No Assurance Provided) See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

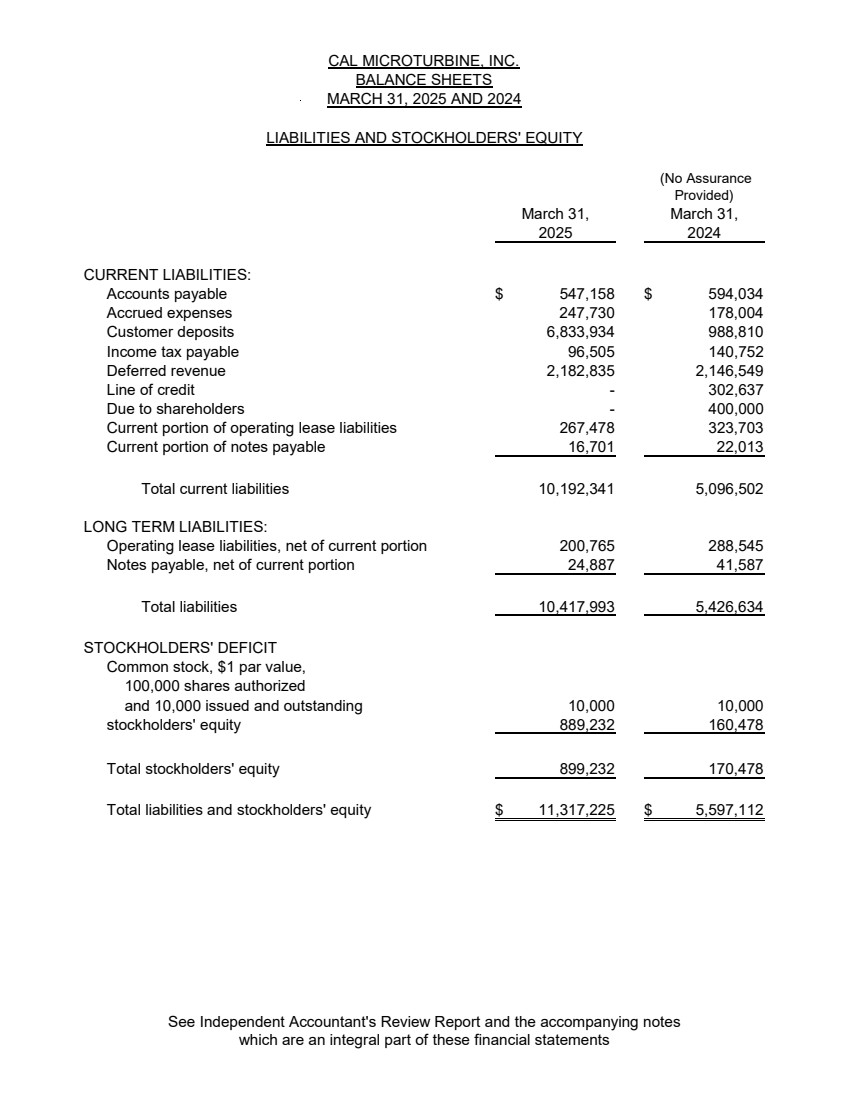

| March 31, March 31, 2025 2024 CURRENT LIABILITIES: Accounts payable $ 547,158 $ 594,034 Accrued expenses 247,730 178,004 Customer deposits 6,833,934 988,810 Income tax payable 96,505 140,752 Deferred revenue 2,182,835 2,146,549 Line of credit - 302,637 Due to shareholders - 400,000 Current portion of operating lease liabilities 267,478 323,703 Current portion of notes payable 22,013 16,701 Total current liabilities 10,192,341 5,096,502 LONG TERM LIABILITIES: Operating lease liabilities, net of current portion 200,765 288,545 Notes payable, net of current portion 41,587 24,887 Total liabilities 10,417,993 5,426,634 STOCKHOLDERS' DEFICIT Common stock, $1 par value, 100,000 shares authorized and 10,000 issued and outstanding 10,000 10,000 stockholders' equity 160,478 889,232 Total stockholders' equity 899,232 170,478 Total liabilities and stockholders' equity $ 5,597,112 11,317,225 $ LIABILITIES AND STOCKHOLDERS' EQUITY CAL MICROTURBINE, INC. BALANCE SHEETS (No Assurance Provided) MARCH 31, 2025 AND 2024 See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

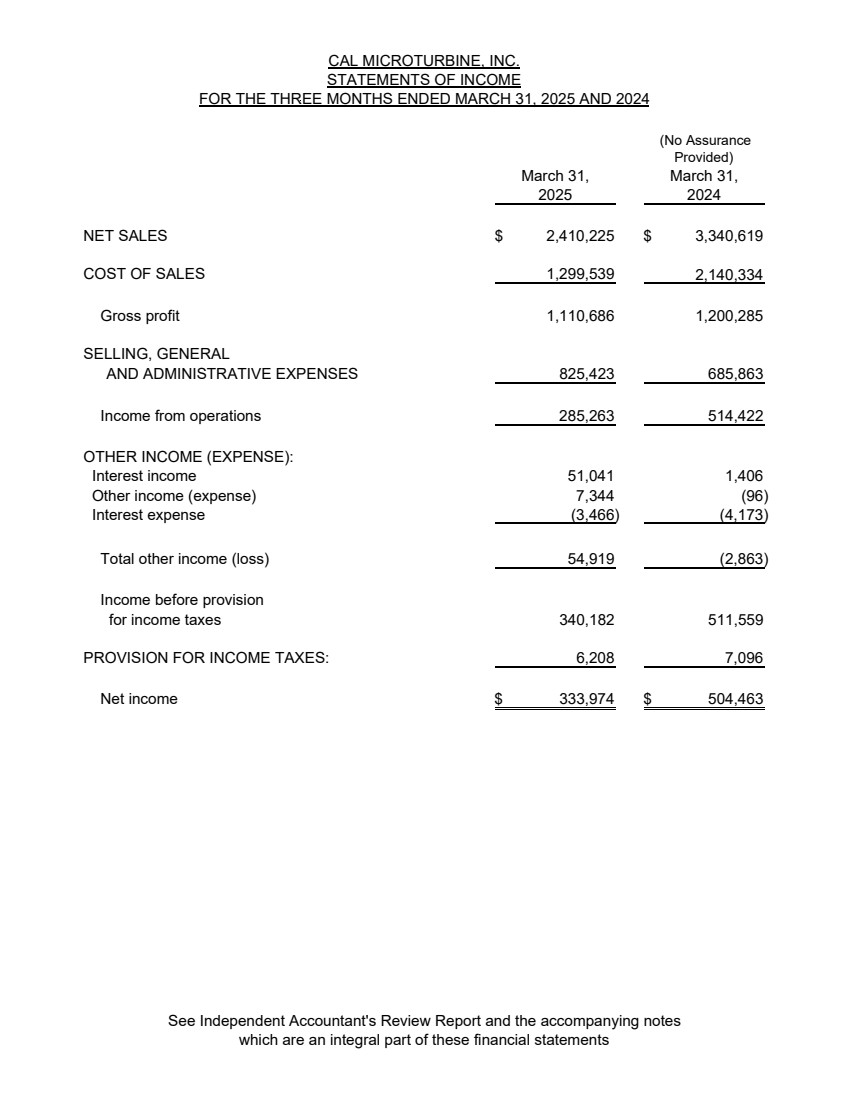

| March 31, March 31, 2025 2024 NET SALES $ 3,340,619 2,410,225 $ COST OF SALES 1,299,539 2,140,334 Gross profit 1,110,686 1,200,285 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES 825,423 685,863 Income from operations 514,422 285,263 OTHER INCOME (EXPENSE): Interest income 51,041 1,406 Other income (expense) 7,344 (96) Interest expense (3,466) (4,173) Total other income (loss) 54,919 (2,863) Income before provision for income taxes 340,182 511,559 PROVISION FOR INCOME TAXES: 6,208 7,096 Net income $ 333,974 504,463 $ STATEMENTS OF INCOME CAL MICROTURBINE, INC. FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 (No Assurance Provided) See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

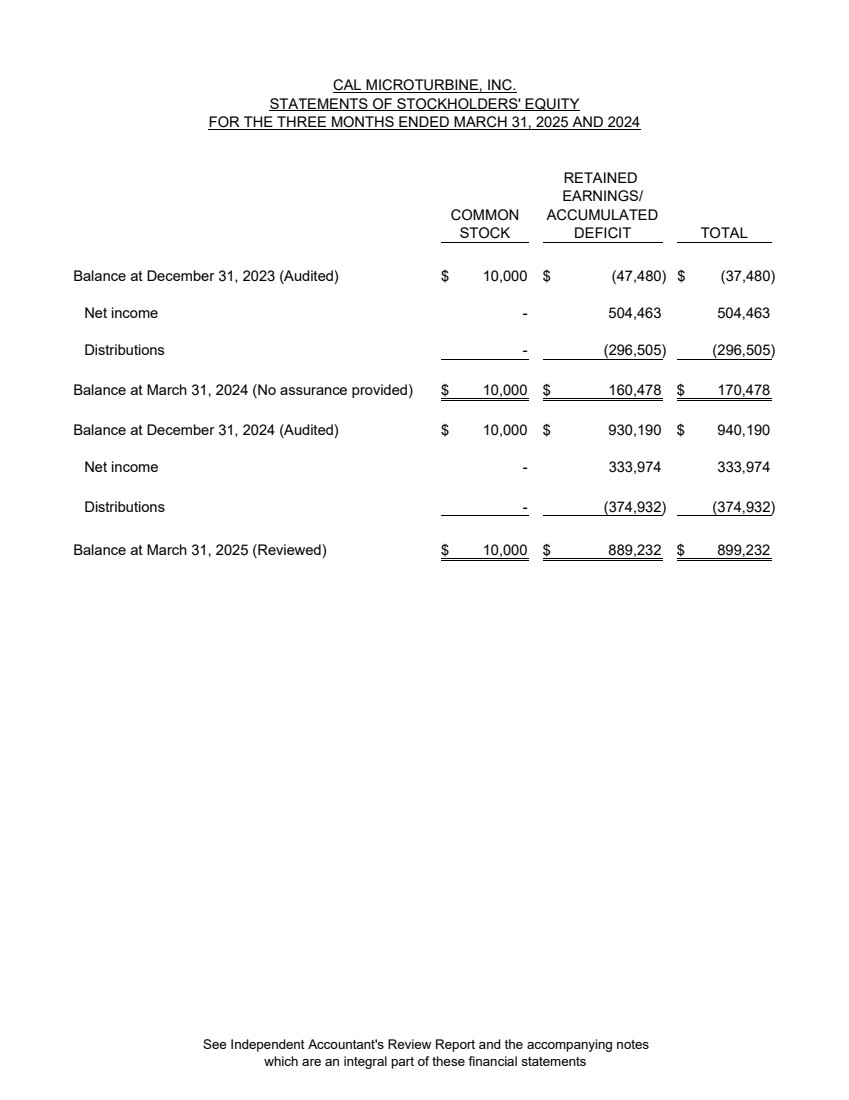

| RETAINED EARNINGS/ COMMON ACCUMULATED STOCK DEFICIT TOTAL Balance at December 31, 2023 (Audited) $ 10,000 $ (47,480) $ (37,480) Net income - 504,463 504,463 Distributions (296,505) - (296,505) Balance at March 31, 2024 (No assurance provided) 10,000 $ 160,478 $ 170,478 $ Balance at December 31, 2024 (Audited) 10,000 $ 930,190 $ 940,190 $ Net income - 333,974 333,974 Distributions - (374,932) (374,932) Balance at March 31, 2025 (Reviewed) 10,000 $ 889,232 $ 899,232 $ CAL MICROTURBINE, INC. STATEMENTS OF STOCKHOLDERS' EQUITY FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

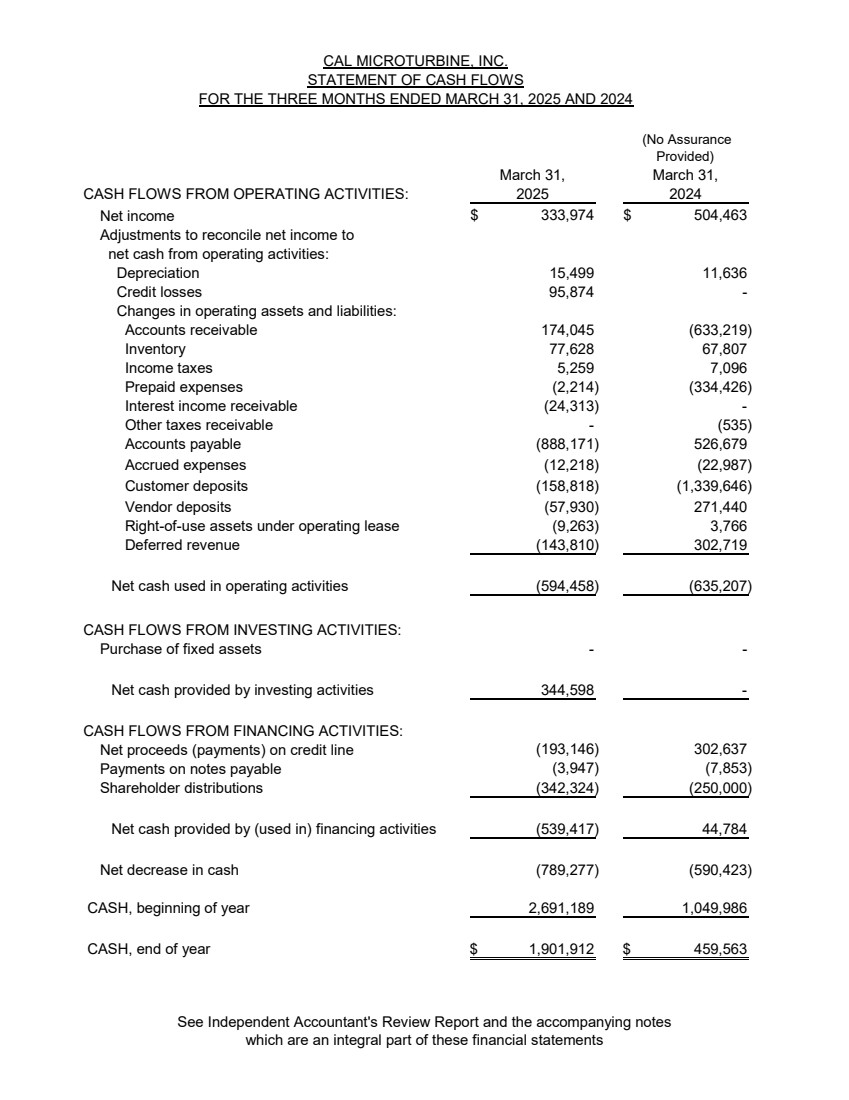

| March 31, March 31, CASH FLOWS FROM OPERATING ACTIVITIES: 2025 2024 Net income $ 504,463 333,974 $ Adjustments to reconcile net income to net cash from operating activities: Depreciation 15,499 11,636 Credit losses 95,874 - Changes in operating assets and liabilities: Accounts receivable 174,045 (633,219) Inventory 77,628 67,807 Income taxes 5,259 7,096 Prepaid expenses (2,214) (334,426) Interest income receivable (24,313) - Other taxes receivable - (535) Accounts payable (888,171) 526,679 Accrued expenses (12,218) (22,987) Customer deposits (158,818) (1,339,646) Vendor deposits (57,930) 271,440 Right-of-use assets under operating lease (9,263) 3,766 Deferred revenue (143,810) 302,719 Net cash used in operating activities (594,458) (635,207) CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of fixed assets - - Net cash provided by investing activities 344,598 - CASH FLOWS FROM FINANCING ACTIVITIES: Net proceeds (payments) on credit line 302,637 (193,146) Payments on notes payable (7,853) (3,947) Shareholder distributions (342,324) (250,000) Net cash provided by (used in) financing activities (539,417) 44,784 Net decrease in cash (789,277) (590,423) CASH, beginning of year 2,691,189 1,049,986 CASH, end of year $ 459,563 1,901,912 $ CAL MICROTURBINE, INC. STATEMENT OF CASH FLOWS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 (No Assurance Provided) See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

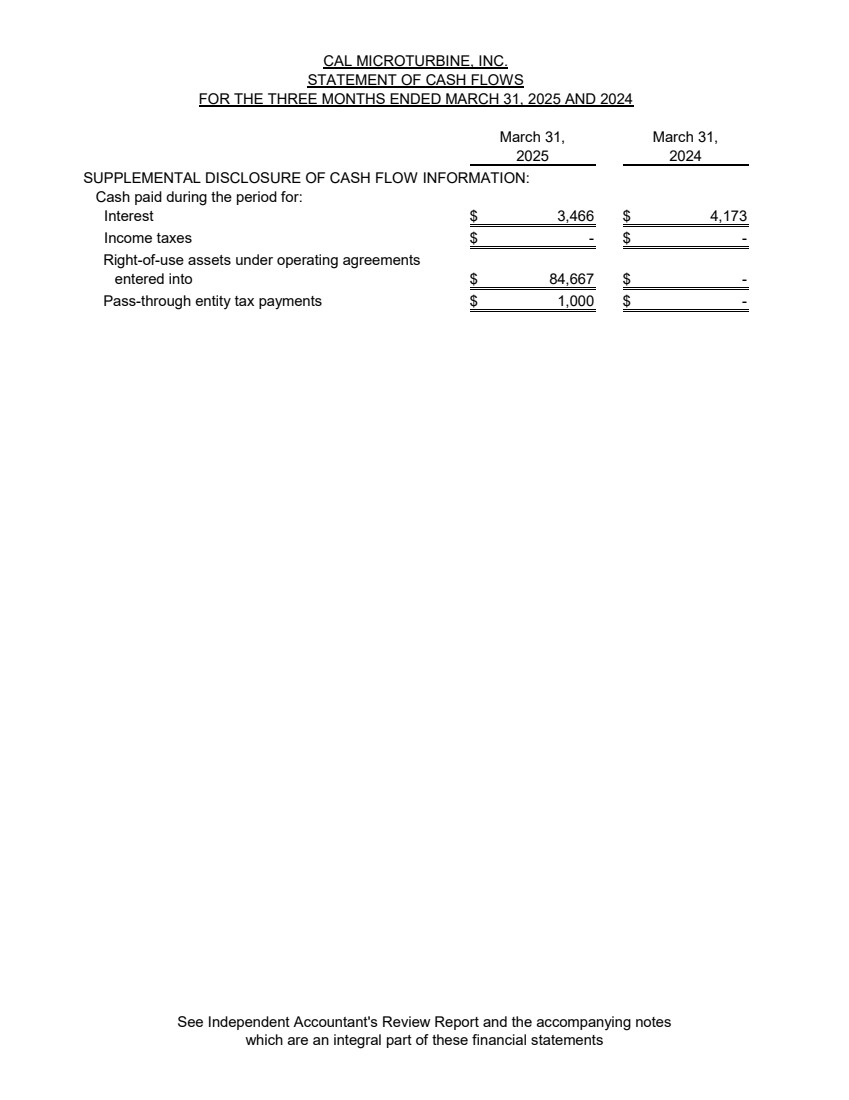

| CAL MICROTURBINE, INC. STATEMENT OF CASH FLOWS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 March 31, March 31, 2025 2024 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the period for: Interest 3,466 $ 4,173 $ Income taxes $ - - $ Right-of-use assets under operating agreements entered into 84,667 $ - $ Pass-through entity tax payments 1,000 $ - $ See Independent Accountant's Review Report and the accompanying notes which are an integral part of these financial statements |

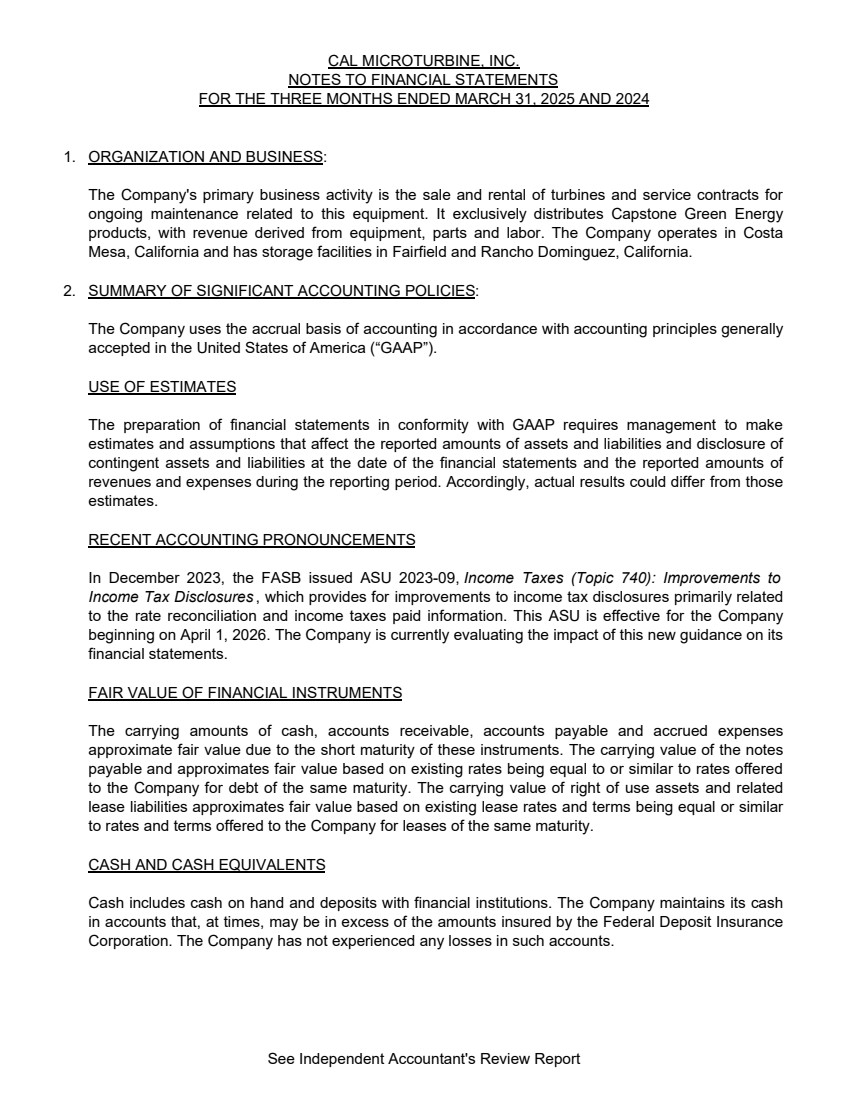

| 1. ORGANIZATION AND BUSINESS: 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: USE OF ESTIMATES RECENT ACCOUNTING PRONOUNCEMENTS FAIR VALUE OF FINANCIAL INSTRUMENTS CASH AND CASH EQUIVALENTS The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from those estimates. In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures , which provides for improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. This ASU is effective for the Company beginning on April 1, 2026. The Company is currently evaluating the impact of this new guidance on its financial statements. The carrying amounts of cash, accounts receivable, accounts payable and accrued expenses approximate fair value due to the short maturity of these instruments. The carrying value of the notes payable and approximates fair value based on existing rates being equal to or similar to rates offered to the Company for debt of the same maturity. The carrying value of right of use assets and related lease liabilities approximates fair value based on existing lease rates and terms being equal or similar to rates and terms offered to the Company for leases of the same maturity. Cash includes cash on hand and deposits with financial institutions. The Company maintains its cash in accounts that, at times, may be in excess of the amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in such accounts. The Company's primary business activity is the sale and rental of turbines and service contracts for ongoing maintenance related to this equipment. It exclusively distributes Capstone Green Energy products, with revenue derived from equipment, parts and labor. The Company operates in Costa Mesa, California and has storage facilities in Fairfield and Rancho Dominguez, California. CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 The Company uses the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (“GAAP”). See Independent Accountant's Review Report |

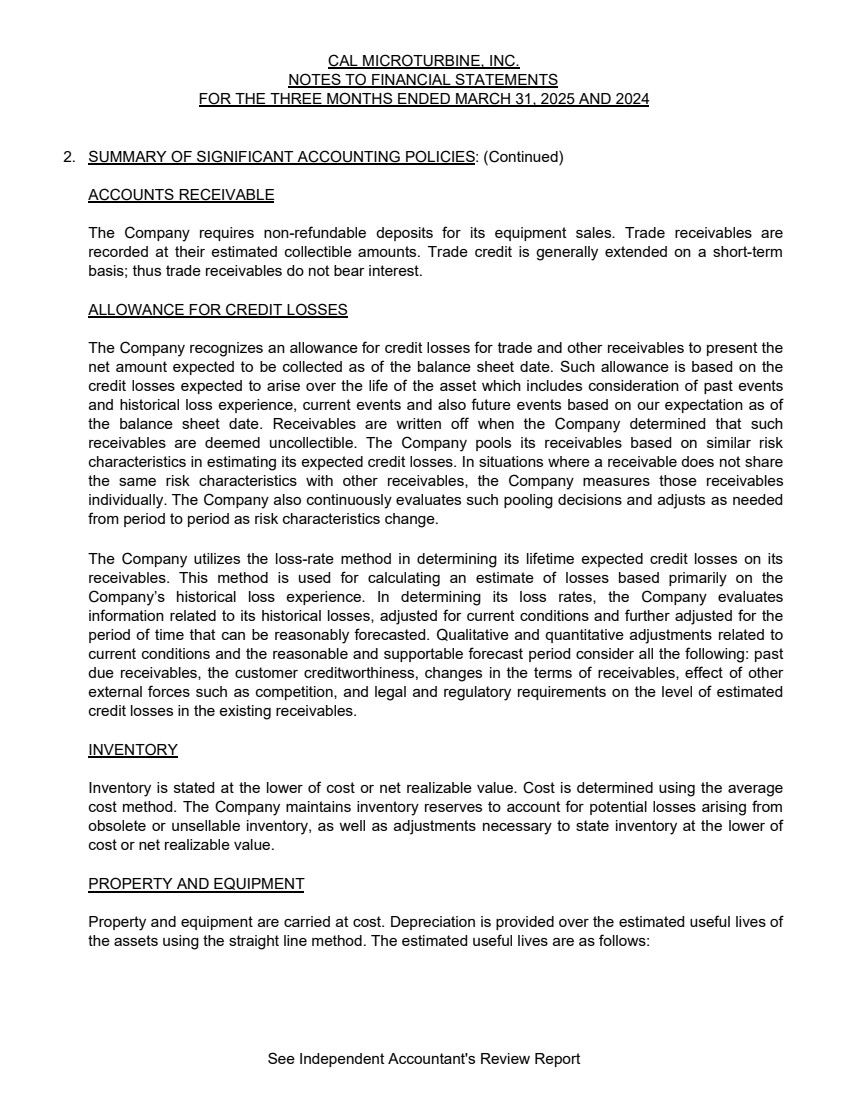

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) ACCOUNTS RECEIVABLE ALLOWANCE FOR CREDIT LOSSES INVENTORY PROPERTY AND EQUIPMENT The Company utilizes the loss-rate method in determining its lifetime expected credit losses on its receivables. This method is used for calculating an estimate of losses based primarily on the Company’s historical loss experience. In determining its loss rates, the Company evaluates information related to its historical losses, adjusted for current conditions and further adjusted for the period of time that can be reasonably forecasted. Qualitative and quantitative adjustments related to current conditions and the reasonable and supportable forecast period consider all the following: past due receivables, the customer creditworthiness, changes in the terms of receivables, effect of other external forces such as competition, and legal and regulatory requirements on the level of estimated credit losses in the existing receivables. The Company recognizes an allowance for credit losses for trade and other receivables to present the net amount expected to be collected as of the balance sheet date. Such allowance is based on the credit losses expected to arise over the life of the asset which includes consideration of past events and historical loss experience, current events and also future events based on our expectation as of the balance sheet date. Receivables are written off when the Company determined that such receivables are deemed uncollectible. The Company pools its receivables based on similar risk characteristics in estimating its expected credit losses. In situations where a receivable does not share the same risk characteristics with other receivables, the Company measures those receivables individually. The Company also continuously evaluates such pooling decisions and adjusts as needed from period to period as risk characteristics change. The Company requires non-refundable deposits for its equipment sales. Trade receivables are recorded at their estimated collectible amounts. Trade credit is generally extended on a short-term basis; thus trade receivables do not bear interest. Inventory is stated at the lower of cost or net realizable value. Cost is determined using the average cost method. The Company maintains inventory reserves to account for potential losses arising from obsolete or unsellable inventory, as well as adjustments necessary to state inventory at the lower of cost or net realizable value. Property and equipment are carried at cost. Depreciation is provided over the estimated useful lives of the assets using the straight line method. The estimated useful lives are as follows: See Independent Accountant's Review Report |

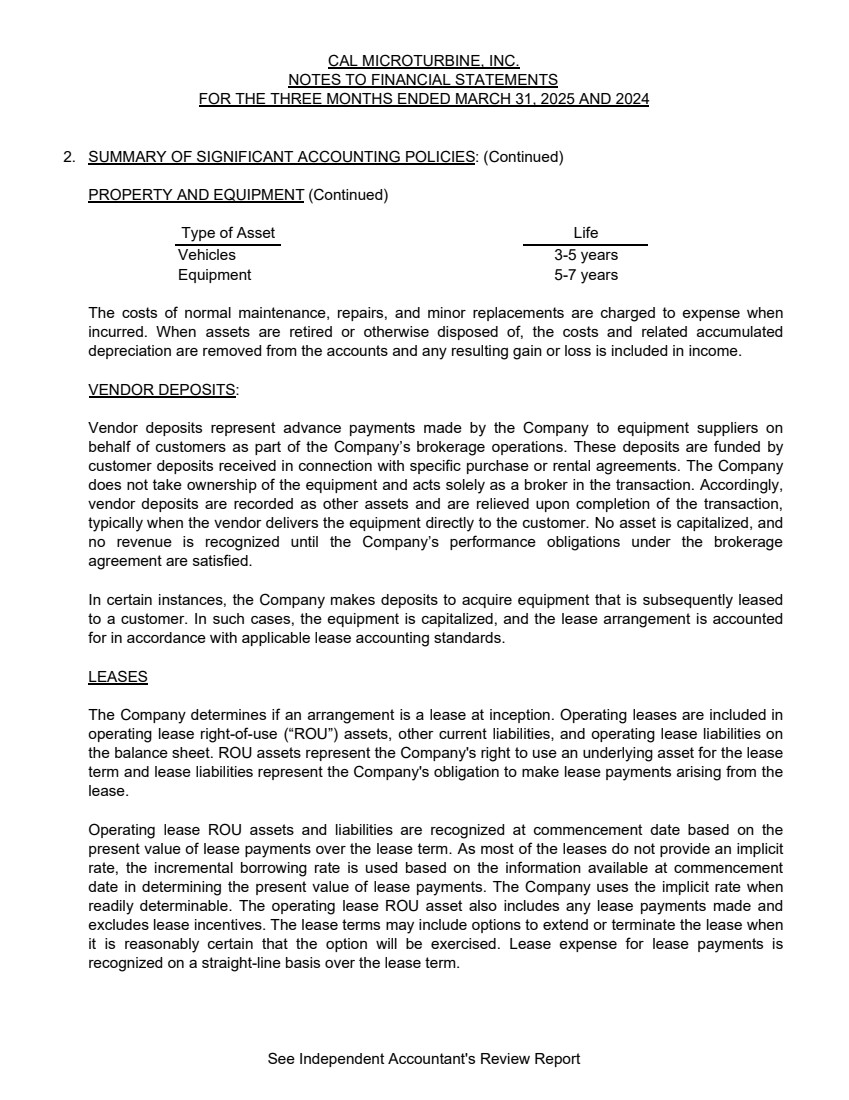

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) PROPERTY AND EQUIPMENT (Continued) Life 3-5 years Equipment 5-7 years VENDOR DEPOSITS: LEASES The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets, other current liabilities, and operating lease liabilities on the balance sheet. ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the leases do not provide an implicit rate, the incremental borrowing rate is used based on the information available at commencement date in determining the present value of lease payments. The Company uses the implicit rate when readily determinable. The operating lease ROU asset also includes any lease payments made and excludes lease incentives. The lease terms may include options to extend or terminate the lease when it is reasonably certain that the option will be exercised. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The costs of normal maintenance, repairs, and minor replacements are charged to expense when incurred. When assets are retired or otherwise disposed of, the costs and related accumulated depreciation are removed from the accounts and any resulting gain or loss is included in income. In certain instances, the Company makes deposits to acquire equipment that is subsequently leased to a customer. In such cases, the equipment is capitalized, and the lease arrangement is accounted for in accordance with applicable lease accounting standards. Vendor deposits represent advance payments made by the Company to equipment suppliers on behalf of customers as part of the Company’s brokerage operations. These deposits are funded by customer deposits received in connection with specific purchase or rental agreements. The Company does not take ownership of the equipment and acts solely as a broker in the transaction. Accordingly, vendor deposits are recorded as other assets and are relieved upon completion of the transaction, typically when the vendor delivers the equipment directly to the customer. No asset is capitalized, and no revenue is recognized until the Company’s performance obligations under the brokerage agreement are satisfied. Type of Asset Vehicles See Independent Accountant's Review Report |

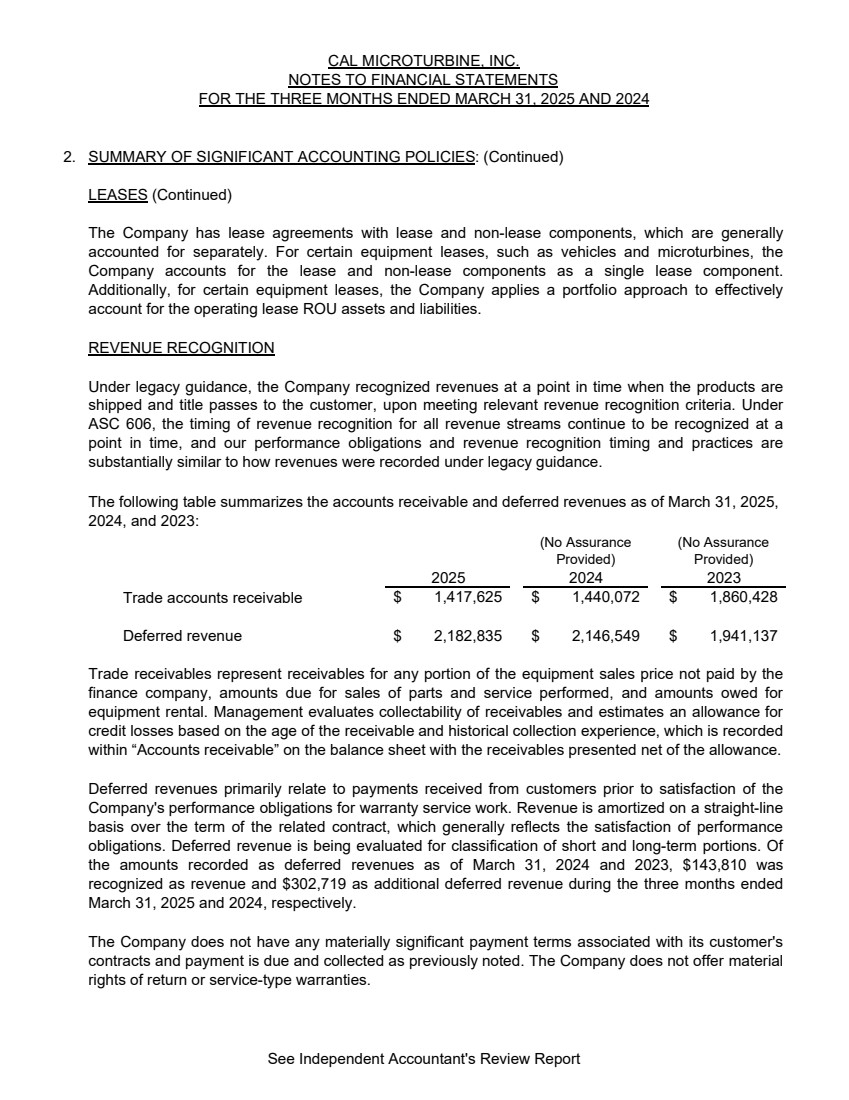

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) LEASES (Continued) REVENUE RECOGNITION 2025 2024 2023 Trade accounts receivable $ 1,417,625 $ 1,440,072 $ 1,860,428 Deferred revenue $ 2,182,835 $ 2,146,549 $ 1,941,137 Trade receivables represent receivables for any portion of the equipment sales price not paid by the finance company, amounts due for sales of parts and service performed, and amounts owed for equipment rental. Management evaluates collectability of receivables and estimates an allowance for credit losses based on the age of the receivable and historical collection experience, which is recorded within “Accounts receivable” on the balance sheet with the receivables presented net of the allowance. (No Assurance Provided) (No Assurance Provided) The Company does not have any materially significant payment terms associated with its customer's contracts and payment is due and collected as previously noted. The Company does not offer material rights of return or service-type warranties. Under legacy guidance, the Company recognized revenues at a point in time when the products are shipped and title passes to the customer, upon meeting relevant revenue recognition criteria. Under ASC 606, the timing of revenue recognition for all revenue streams continue to be recognized at a point in time, and our performance obligations and revenue recognition timing and practices are substantially similar to how revenues were recorded under legacy guidance. The Company has lease agreements with lease and non-lease components, which are generally accounted for separately. For certain equipment leases, such as vehicles and microturbines, the Company accounts for the lease and non-lease components as a single lease component. Additionally, for certain equipment leases, the Company applies a portfolio approach to effectively account for the operating lease ROU assets and liabilities. The following table summarizes the accounts receivable and deferred revenues as of March 31, 2025, 2024, and 2023: Deferred revenues primarily relate to payments received from customers prior to satisfaction of the Company's performance obligations for warranty service work. Revenue is amortized on a straight-line basis over the term of the related contract, which generally reflects the satisfaction of performance obligations. Deferred revenue is being evaluated for classification of short and long-term portions. Of the amounts recorded as deferred revenues as of March 31, 2024 and 2023, $143,810 was recognized as revenue and $302,719 as additional deferred revenue during the three months ended March 31, 2025 and 2024, respectively. See Independent Accountant's Review Report |

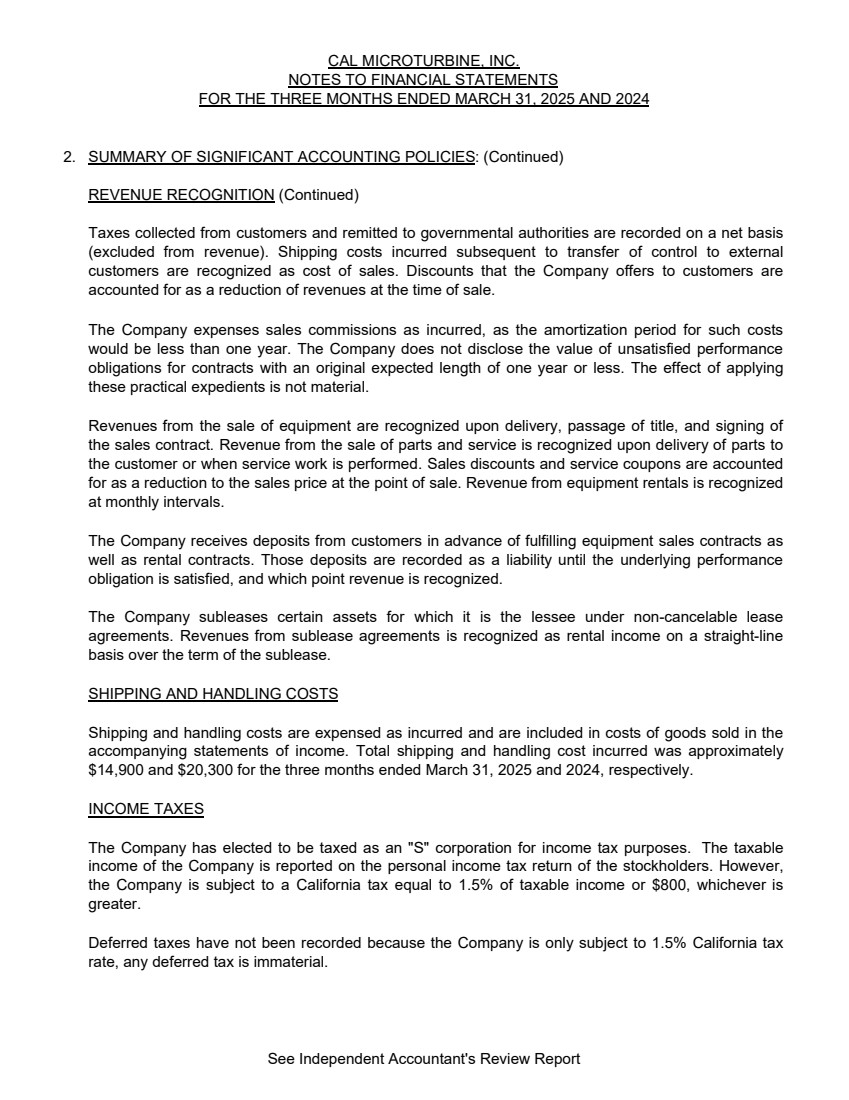

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (Continued) REVENUE RECOGNITION (Continued) SHIPPING AND HANDLING COSTS INCOME TAXES The Company receives deposits from customers in advance of fulfilling equipment sales contracts as well as rental contracts. Those deposits are recorded as a liability until the underlying performance obligation is satisfied, and which point revenue is recognized. Deferred taxes have not been recorded because the Company is only subject to 1.5% California tax rate, any deferred tax is immaterial. Revenues from the sale of equipment are recognized upon delivery, passage of title, and signing of the sales contract. Revenue from the sale of parts and service is recognized upon delivery of parts to the customer or when service work is performed. Sales discounts and service coupons are accounted for as a reduction to the sales price at the point of sale. Revenue from equipment rentals is recognized at monthly intervals. Shipping and handling costs are expensed as incurred and are included in costs of goods sold in the accompanying statements of income. Total shipping and handling cost incurred was approximately $14,900 and $20,300 for the three months ended March 31, 2025 and 2024, respectively. The Company has elected to be taxed as an "S" corporation for income tax purposes. The taxable income of the Company is reported on the personal income tax return of the stockholders. However, the Company is subject to a California tax equal to 1.5% of taxable income or $800, whichever is greater. Taxes collected from customers and remitted to governmental authorities are recorded on a net basis (excluded from revenue). Shipping costs incurred subsequent to transfer of control to external customers are recognized as cost of sales. Discounts that the Company offers to customers are accounted for as a reduction of revenues at the time of sale. The Company subleases certain assets for which it is the lessee under non-cancelable lease agreements. Revenues from sublease agreements is recognized as rental income on a straight-line basis over the term of the sublease. The Company expenses sales commissions as incurred, as the amortization period for such costs would be less than one year. The Company does not disclose the value of unsatisfied performance obligations for contracts with an original expected length of one year or less. The effect of applying these practical expedients is not material. See Independent Accountant's Review Report |

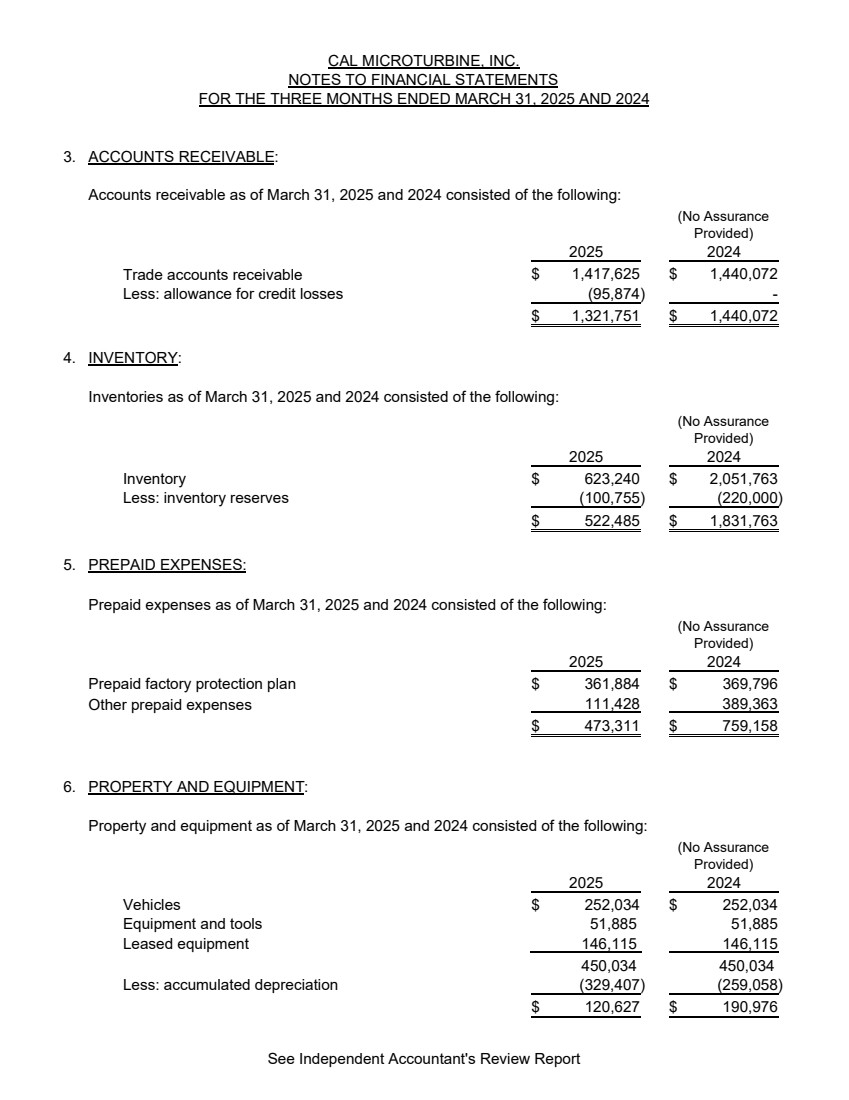

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 3. ACCOUNTS RECEIVABLE: Accounts receivable as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Trade accounts receivable $ 1,440,072 1,417,625 $ Less: allowance for credit losses (95,874) - $ 1,440,072 1,321,751 $ 4. INVENTORY: Inventories as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Inventory $ 2,051,763 623,240 $ Less: inventory reserves (100,755) (220,000) $ 1,831,763 522,485 $ 5. PREPAID EXPENSES: Prepaid expenses as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Prepaid factory protection plan $ 361,884 $ 369,796 Other prepaid expenses 389,363 111,428 $ 759,158 473,311 $ 6. PROPERTY AND EQUIPMENT: Property and equipment as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Vehicles $ 252,034 $ 252,034 Equipment and tools 51,885 51,885 Leased equipment 146,115 146,115 450,034 450,034 Less: accumulated depreciation (329,407) (259,058) $ 190,976 120,627 $ (No Assurance Provided) (No Assurance Provided) (No Assurance Provided) (No Assurance Provided) See Independent Accountant's Review Report |

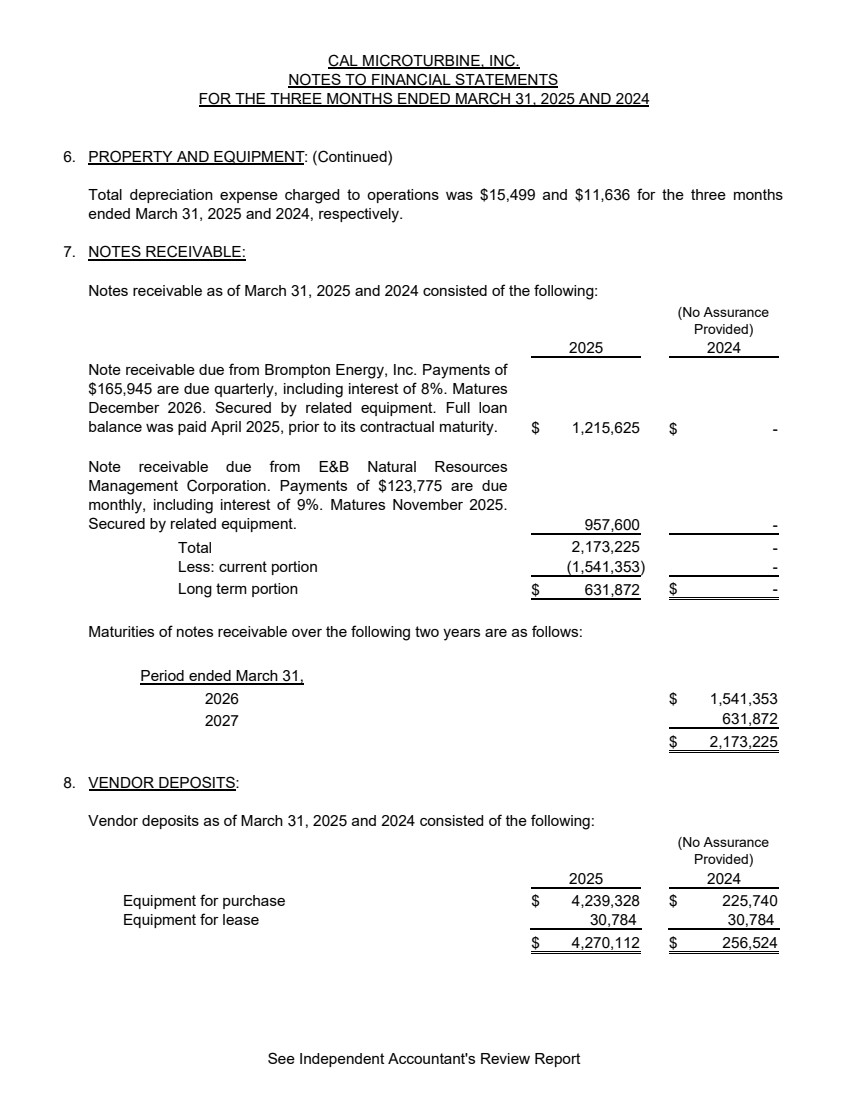

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 6. PROPERTY AND EQUIPMENT: (Continued) 7. NOTES RECEIVABLE: Notes receivable as of March 31, 2025 and 2024 consisted of the following: 2025 2024 $ 1,215,625 $ - - 957,600 Total 2,173,225 - Less: current portion (1,541,353) - Long term portion $ 631,872 $ - Maturities of notes receivable over the following two years are as follows: Period ended March 31, 2026 $ 1,541,353 2027 631,872 $ 2,173,225 8. VENDOR DEPOSITS: Vendor deposits as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Equipment for purchase $ 225,740 4,239,328 $ Equipment for lease 30,784 30,784 $ 256,524 4,270,112 $ (No Assurance Provided) (No Assurance Provided) Total depreciation expense charged to operations was $15,499 and $11,636 for the three months ended March 31, 2025 and 2024, respectively. Note receivable due from Brompton Energy, Inc. Payments of $165,945 are due quarterly, including interest of 8%. Matures December 2026. Secured by related equipment. Full loan balance was paid April 2025, prior to its contractual maturity. Note receivable due from E&B Natural Resources Management Corporation. Payments of $123,775 are due monthly, including interest of 9%. Matures November 2025. Secured by related equipment. See Independent Accountant's Review Report |

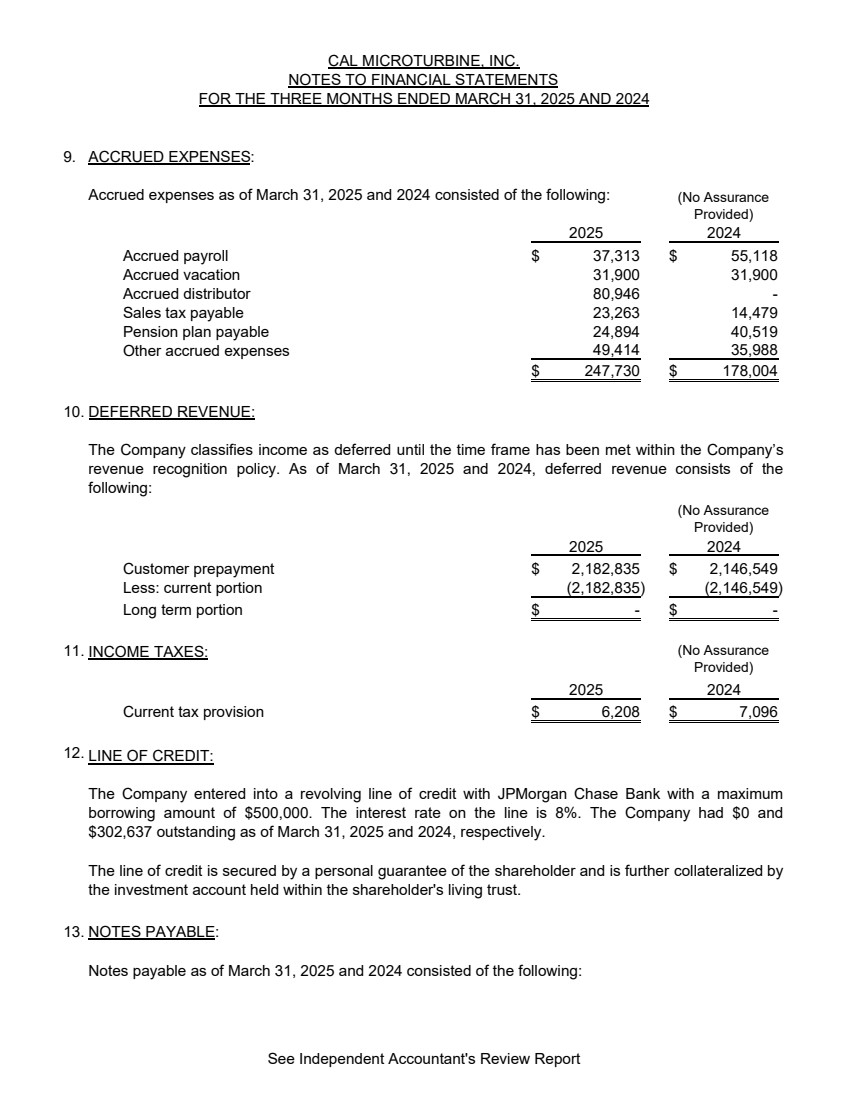

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 9. ACCRUED EXPENSES: Accrued expenses as of March 31, 2025 and 2024 consisted of the following: 2025 2024 Accrued payroll $ 37,313 $ 55,118 Accrued vacation 31,900 31,900 Accrued distributor 80,946 - Sales tax payable 23,263 14,479 Pension plan payable 24,894 40,519 Other accrued expenses 35,988 49,414 $ 178,004 247,730 $ 10. DEFERRED REVENUE: 2025 2024 Customer prepayment $ 2,182,835 $ 2,146,549 Less: current portion (2,146,549) (2,182,835) Long term portion - $ - $ 11. INCOME TAXES: 2025 2024 Current tax provision $ 6,208 $ 7,096 12. LINE OF CREDIT: 13. NOTES PAYABLE: Notes payable as of March 31, 2025 and 2024 consisted of the following: (No Assurance Provided) (No Assurance Provided) (No Assurance Provided) The Company classifies income as deferred until the time frame has been met within the Company’s revenue recognition policy. As of March 31, 2025 and 2024, deferred revenue consists of the following: The Company entered into a revolving line of credit with JPMorgan Chase Bank with a maximum borrowing amount of $500,000. The interest rate on the line is 8%. The Company had $0 and $302,637 outstanding as of March 31, 2025 and 2024, respectively. The line of credit is secured by a personal guarantee of the shareholder and is further collateralized by the investment account held within the shareholder's living trust. See Independent Accountant's Review Report |

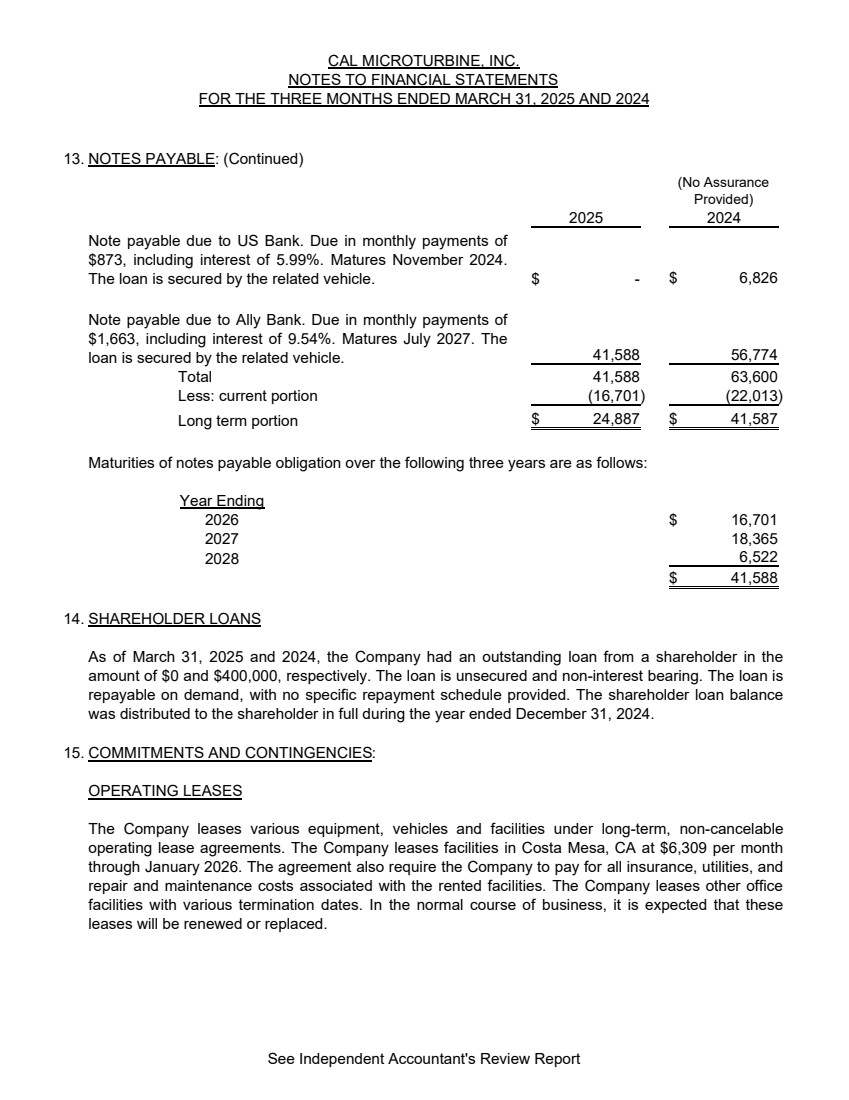

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 13. NOTES PAYABLE: (Continued) 2025 2024 $ - $ 6,826 56,774 41,588 Total 63,600 41,588 Less: current portion (16,701) (22,013) Long term portion $ 41,587 24,887 $ Maturities of notes payable obligation over the following three years are as follows: Year Ending 2026 $ 16,701 2027 18,365 2028 6,522 $ 41,588 14. SHAREHOLDER LOANS 15. COMMITMENTS AND CONTINGENCIES: OPERATING LEASES (No Assurance Provided) Note payable due to US Bank. Due in monthly payments of $873, including interest of 5.99%. Matures November 2024. The loan is secured by the related vehicle. As of March 31, 2025 and 2024, the Company had an outstanding loan from a shareholder in the amount of $0 and $400,000, respectively. The loan is unsecured and non-interest bearing. The loan is repayable on demand, with no specific repayment schedule provided. The shareholder loan balance was distributed to the shareholder in full during the year ended December 31, 2024. Note payable due to Ally Bank. Due in monthly payments of $1,663, including interest of 9.54%. Matures July 2027. The loan is secured by the related vehicle. The Company leases various equipment, vehicles and facilities under long-term, non-cancelable operating lease agreements. The Company leases facilities in Costa Mesa, CA at $6,309 per month through January 2026. The agreement also require the Company to pay for all insurance, utilities, and repair and maintenance costs associated with the rented facilities. The Company leases other office facilities with various termination dates. In the normal course of business, it is expected that these leases will be renewed or replaced. See Independent Accountant's Review Report |

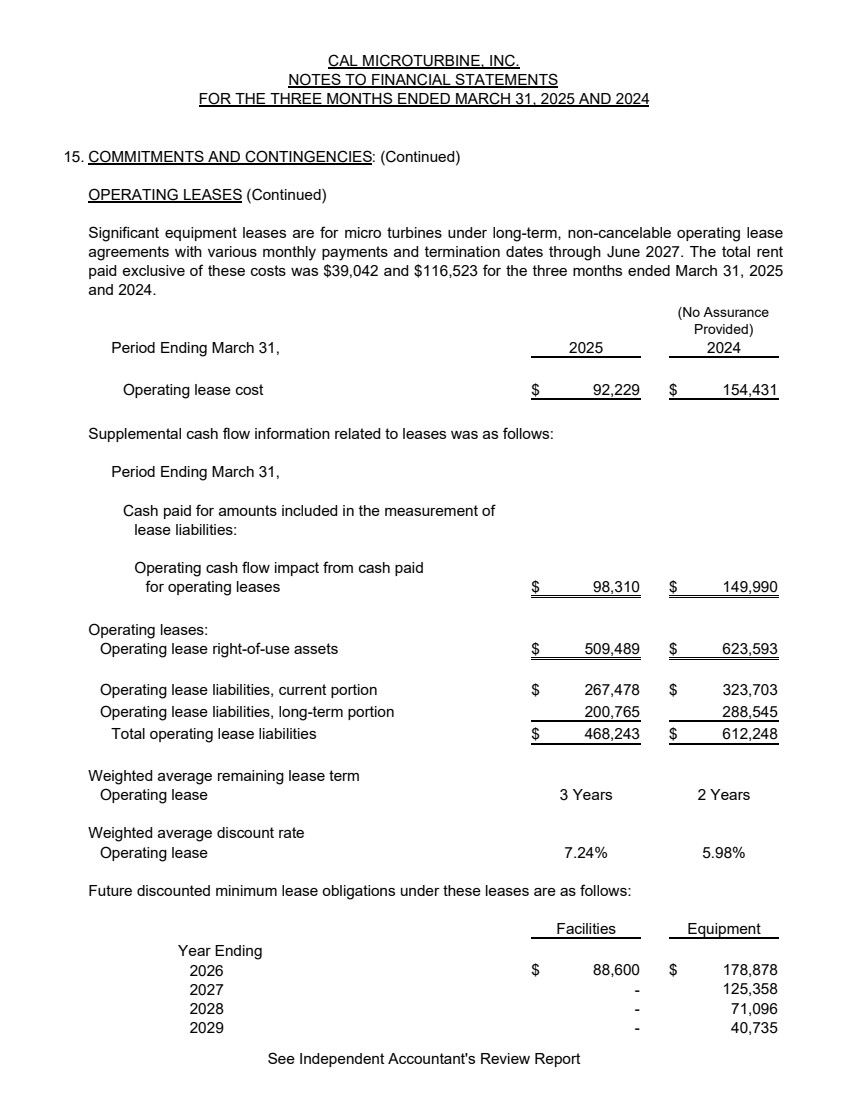

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 15. COMMITMENTS AND CONTINGENCIES: (Continued) OPERATING LEASES (Continued) Period Ending March 31, 2025 2024 Operating lease cost $ 154,431 92,229 $ Supplemental cash flow information related to leases was as follows: Period Ending March 31, Cash paid for amounts included in the measurement of lease liabilities: Operating cash flow impact from cash paid for operating leases 98,310 $ 149,990 $ Operating leases: Operating lease right-of-use assets 509,489 $ 623,593 $ Operating lease liabilities, current portion $ 267,478 $ 323,703 Operating lease liabilities, long-term portion 288,545 200,765 Total operating lease liabilities 468,243 $ 612,248 $ Weighted average remaining lease term Operating lease 3 Years 2 Years Weighted average discount rate Operating lease 7.24% 5.98% Future discounted minimum lease obligations under these leases are as follows: Facilities Equipment Year Ending 2026 $ 178,878 88,600 $ 2027 - 125,358 2028 - 71,096 2029 - 40,735 (No Assurance Provided) Significant equipment leases are for micro turbines under long-term, non-cancelable operating lease agreements with various monthly payments and termination dates through June 2027. The total rent paid exclusive of these costs was $39,042 and $116,523 for the three months ended March 31, 2025 and 2024. See Independent Accountant's Review Report |

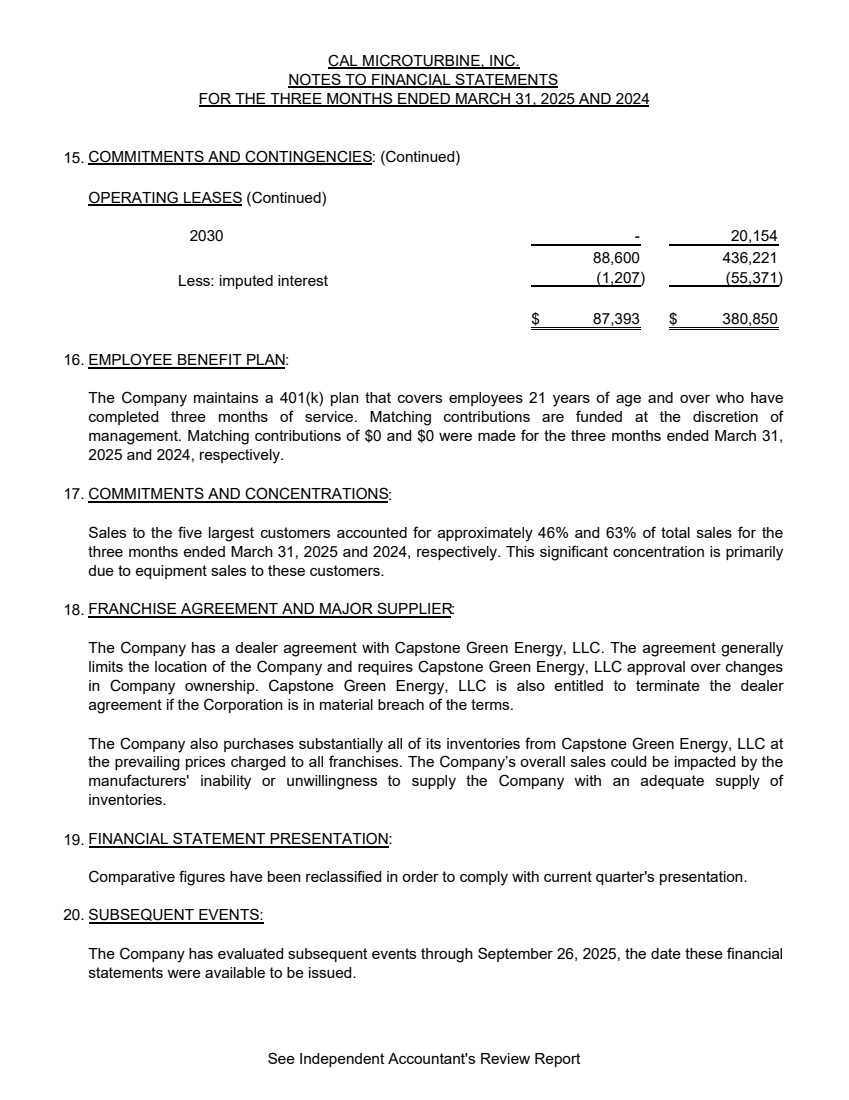

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 15. COMMITMENTS AND CONTINGENCIES: (Continued) OPERATING LEASES (Continued) 2030 - 20,154 436,221 88,600 Less: imputed interest (55,371) (1,207) $ 380,850 87,393 $ 16. EMPLOYEE BENEFIT PLAN: 17. COMMITMENTS AND CONCENTRATIONS: 18. FRANCHISE AGREEMENT AND MAJOR SUPPLIER: 19. FINANCIAL STATEMENT PRESENTATION: 20. SUBSEQUENT EVENTS: The Company also purchases substantially all of its inventories from Capstone Green Energy, LLC at the prevailing prices charged to all franchises. The Company’s overall sales could be impacted by the manufacturers' inability or unwillingness to supply the Company with an adequate supply of inventories. The Company has a dealer agreement with Capstone Green Energy, LLC. The agreement generally limits the location of the Company and requires Capstone Green Energy, LLC approval over changes in Company ownership. Capstone Green Energy, LLC is also entitled to terminate the dealer agreement if the Corporation is in material breach of the terms. Sales to the five largest customers accounted for approximately 46% and 63% of total sales for the three months ended March 31, 2025 and 2024, respectively. This significant concentration is primarily due to equipment sales to these customers. The Company has evaluated subsequent events through September 26, 2025, the date these financial statements were available to be issued. The Company maintains a 401(k) plan that covers employees 21 years of age and over who have completed three months of service. Matching contributions are funded at the discretion of management. Matching contributions of $0 and $0 were made for the three months ended March 31, 2025 and 2024, respectively. Comparative figures have been reclassified in order to comply with current quarter's presentation. See Independent Accountant's Review Report |

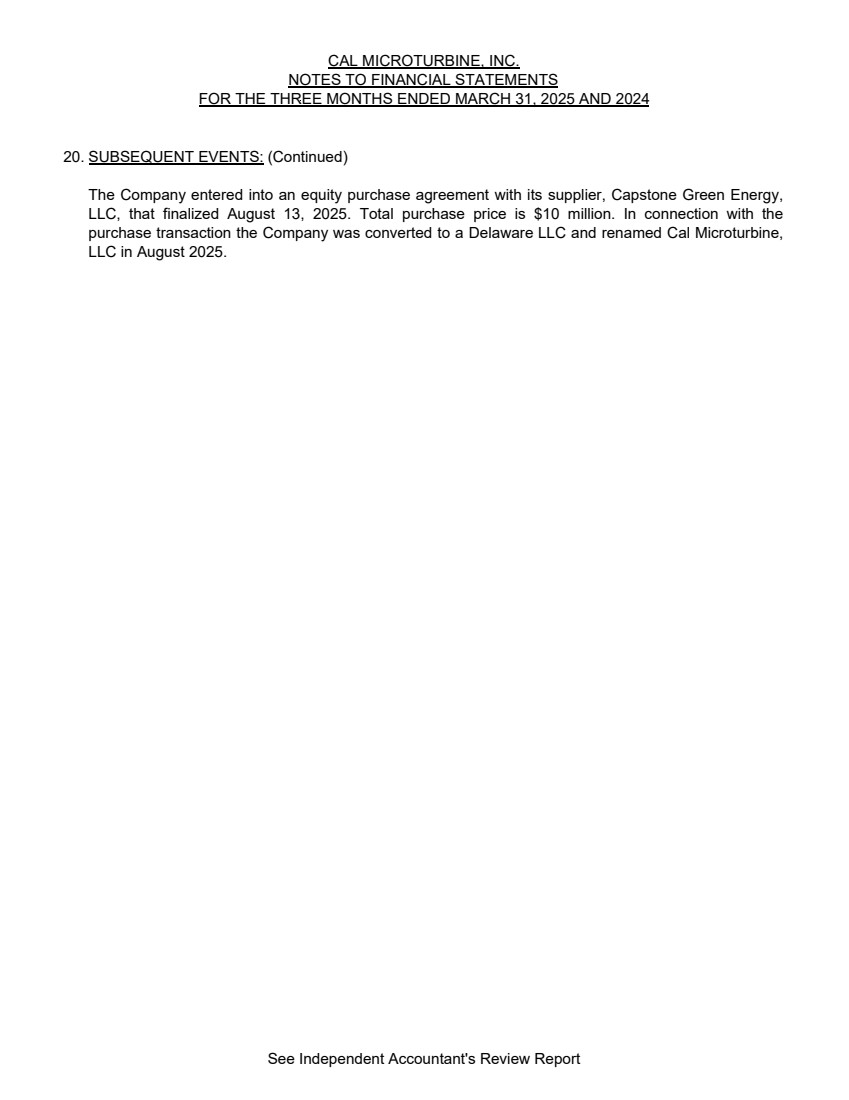

| CAL MICROTURBINE, INC. NOTES TO FINANCIAL STATEMENTS FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 20. SUBSEQUENT EVENTS: (Continued) The Company entered into an equity purchase agreement with its supplier, Capstone Green Energy, LLC, that finalized August 13, 2025. Total purchase price is $10 million. In connection with the purchase transaction the Company was converted to a Delaware LLC and renamed Cal Microturbine, LLC in August 2025. See Independent Accountant's Review Report |

| SUPPLEMENTAL INFORMATION |

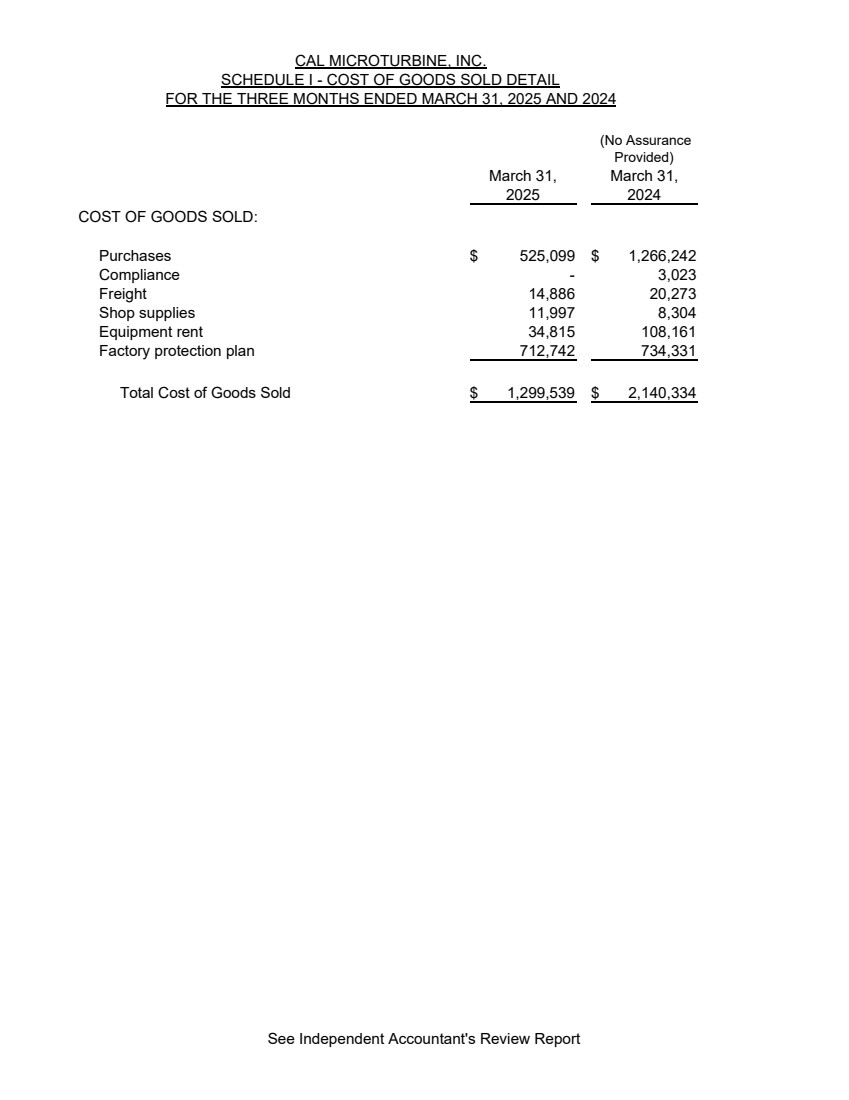

| March 31, March 31, 2025 2024 COST OF GOODS SOLD: Purchases 525,099 $ 1,266,242 $ Compliance - 3,023 Freight 14,886 20,273 Shop supplies 11,997 8,304 Equipment rent 34,815 108,161 Factory protection plan 712,742 734,331 Total Cost of Goods Sold $ 2,140,334 1,299,539 $ CAL MICROTURBINE, INC. SCHEDULE I - COST OF GOODS SOLD DETAIL FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 (No Assurance Provided) See Independent Accountant's Review Report |

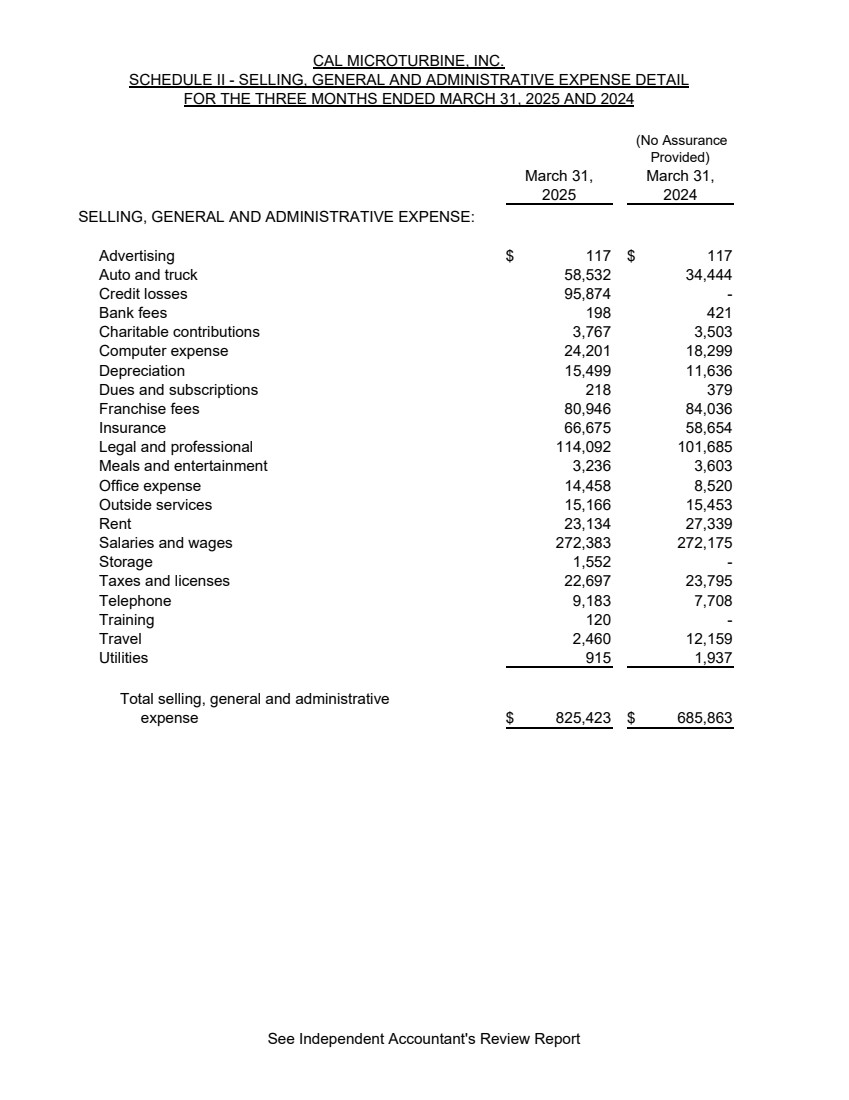

| March 31, March 31, 2025 2024 SELLING, GENERAL AND ADMINISTRATIVE EXPENSE: Advertising 117 $ 117 $ Auto and truck 58,532 34,444 Credit losses 95,874 - Bank fees 198 421 Charitable contributions 3,767 3,503 Computer expense 24,201 18,299 Depreciation 15,499 11,636 Dues and subscriptions 218 379 Franchise fees 80,946 84,036 Insurance 66,675 58,654 Legal and professional 114,092 101,685 Meals and entertainment 3,236 3,603 Office expense 14,458 8,520 Outside services 15,166 15,453 Rent 23,134 27,339 Salaries and wages 272,383 272,175 Storage 1,552 - Taxes and licenses 22,697 23,795 Telephone 9,183 7,708 Training 120 - Travel 2,460 12,159 Utilities 915 1,937 Total selling, general and administrative expense 825,423 $ 685,863 $ CAL MICROTURBINE, INC. SCHEDULE II - SELLING, GENERAL AND ADMINISTRATIVE EXPENSE DETAIL FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024 (No Assurance Provided) See Independent Accountant's Review Report |