Earnings Release Presentation Q4 2025 Wintrust Financial Corporation

22 This document contains forward-looking statements within the meaning of federal securities laws. Forward-looking information can be identified through the use of words such as “intend,” “plan,” “project,” “expect,” “anticipate,” “believe,” “estimate,” “contemplate,” “possible,” “will,” “may,” “should,” “would” and “could.” Forward-looking statements and information are not historical facts, are premised on many factors and assumptions, and represent only management’s expectations, estimates and projections regarding future events. Similarly, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict, and which may include, but are not limited to, those listed below and the Risk Factors discussed under Item 1A of the Company’s 2024 Annual Report on Form 10-K and in any of the Company’s subsequent SEC filings. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and is including this statement for purposes of invoking these safe harbor provisions. Such forward-looking statements may be deemed to include, among other things, statements relating to the Company’s future financial performance, the performance of its loan portfolio, the expected amount of future credit reserves and charge-offs, delinquency trends, growth plans, regulatory developments, securities that the Company may offer from time to time,the Company’s business and growth strategies, including future acquisitions of banks, specialty finance or wealth management businesses, internal growth and plans to form additional de novo banks or branch offices, and management’s long-term performance goals, as well as statements relating to the anticipated effects on the Company's financial condition and results of operations from expected developments or events. Actual results could differ materially from those addressed in the forward- looking statements as a result of numerous factors, including the following: • economic conditions and events that affect the economy, housing prices, the job market and other factors that may adversely affect the Company’s liquidity and the performance of its loan portfolios, including an actual or threatened U.S. government shutdown, debt default or rating downgrade, particularly in the markets in which it operates; • negative effects suffered by us or our customers resulting from changes in U.S. or international trade policies; • the extent of defaults and losses on the Company’s loan portfolio, which may require further increases in its allowance for credit losses; • estimates of fair value of certain of the Company’s assets and liabilities, which could change in value significantly from period to period; • the financial success and economic viability of the borrowers of our commercial loans; • commercial real estate market conditions in the Chicago metropolitan area and southern Wisconsin; • the extent of commercial and consumer delinquencies and declines in real estate values, which may require further increases in the Company’s allowance for credit losses; • inaccurate assumptions in our analytical and forecasting models used to manage our loan portfolio; • changes in the level and volatility of interest rates, the capital markets and other market indices that may affect, among other things, the Company’s liquidity and the value of its assets and liabilities; • the interest rate environment, including a prolonged period of low interest rates or rising interest rates, either broadly or for some types of instruments, which may affect the Company’s net interest income and net interest margin, and which could materially adversely affect the Company’s profitability; • competitive pressures in the financial services business which may affect the pricing of the Company’s loan and deposit products as well as its services (including wealth management services), which may result in loss of market share and reduced income from deposits, loans, advisory fees and income from other products; • failure to identify and complete favorable acquisitions in the future or unexpected losses, difficulties or developments related to the Company’s recent or future acquisitions; • unexpected difficulties and losses related to FDIC-assisted acquisitions; • harm to the Company’s reputation; • any negative perception of the Company’s financial strength; • ability of the Company to raise additional capital on acceptable terms when needed; • disruption in capital markets, which may lower fair values for the Company’s investment portfolio; • ability of the Company to use technology to provide products and services that will satisfy customer demands and create efficiencies in operations and to manage risks associated therewith; • failure or breaches of our security systems or infrastructure, or those of third parties; • security breaches, including denial of service attacks, hacking, social engineering attacks, malware intrusion and similar events or data corruption attempts and identity theft; • adverse effects on our information technology systems, or those of third parties, resulting from failures, human error or cyberattacks (including ransomware); Forward Looking Statements

33 • adverse effects of failures by our vendors to provide agreed upon services in the manner and at the cost agreed, particularly our information technology vendors; • increased costs as a result of protecting our customers from the impact of stolen debit card information; • accuracy and completeness of information the Company receives about customers and counterparties to make credit decisions; • ability of the Company to attract and retain senior management experienced in the banking and financial services industries; • environmental liability risk associated with lending activities; • the impact of any claims or legal actions to which the Company is subject, including any effect on our reputation; • losses incurred in connection with repurchases and indemnification payments related to mortgages and increases in reserves associated therewith; • the loss of customers as a result of technological changes allowing consumers to complete their financial transactions without the use of a bank; • the soundness of other financial institutions and the impact of recent failures of financial institutions, including broader financial institution liquidity risk and concerns; • the expenses and delayed returns inherent in opening new branches and de novo banks; • liabilities, potential customer loss or reputational harm related to closings of existing branches; • examinations and challenges by tax authorities, and any unanticipated impact of tax legislation; • changes in accounting standards, rules and interpretations, and the impact on the Company’s financial statements; • the ability of the Company to receive dividends from its subsidiaries; • the impact of the Company's transition from LIBOR to an alternative benchmark rate for current and future transactions; • a decrease in the Company’s capital ratios, including as a result of declines in the value of its loan portfolios, or otherwise; • legislative or regulatory changes, particularly changes in regulation of financial services companies and/or the products and services offered by financial services companies; • changes in laws, regulations, rules, standards and contractual obligations regarding data privacy and cybersecurity; • a lowering of our credit rating; • changes in U.S. monetary policy and changes to the Federal Reserve’s balance sheet, including changes in response to persistent inflation or otherwise; • regulatory restrictions upon our ability to market our products to consumers and limitations on our ability to profitably operate our mortgage business; • increased costs of compliance, heightened regulatory capital requirements and other risks associated with changes in regulation and the regulatory environment; • the impact of heightened capital requirements; • increases in the Company’s FDIC insurance premiums, or the collection of special assessments by the FDIC; • delinquencies or fraud with respect to the Company’s premium finance business; • credit downgrades among commercial and life insurance providers that could negatively affect the value of collateral securing the Company’s premium finance loans; • the Company’s ability to comply with covenants under its credit facility; • fluctuations in the stock market, which may have an adverse impact on the Company’s wealth management business and brokerage operation; and • widespread outages of operational, communication, or other systems, whether internal or provided by third parties, natural or other disasters (including acts of terrorism, armed hostilities and pandemics), and the effects of climate change could have an adverse effect on the Company’s financial condition and results of operations, lead to material disruption of the Company’s operations or the ability or willingness of clients to access the Company’s products and services. Therefore, there can be no assurances that future actual results will correspond to these forward-looking statements. The reader is cautioned not to place undue reliance on any forward- looking statement made by the Company. Any such statement speaks only as of the date the statement was made or as of such date that may be referenced within the statement. The Company undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events after the date of the press release and this presentation. Persons are advised, however, to consult further disclosures management makes on related subjects in its reports filed with the Securities and Exchange Commission and in its press releases and presentations. Forward Looking Statements

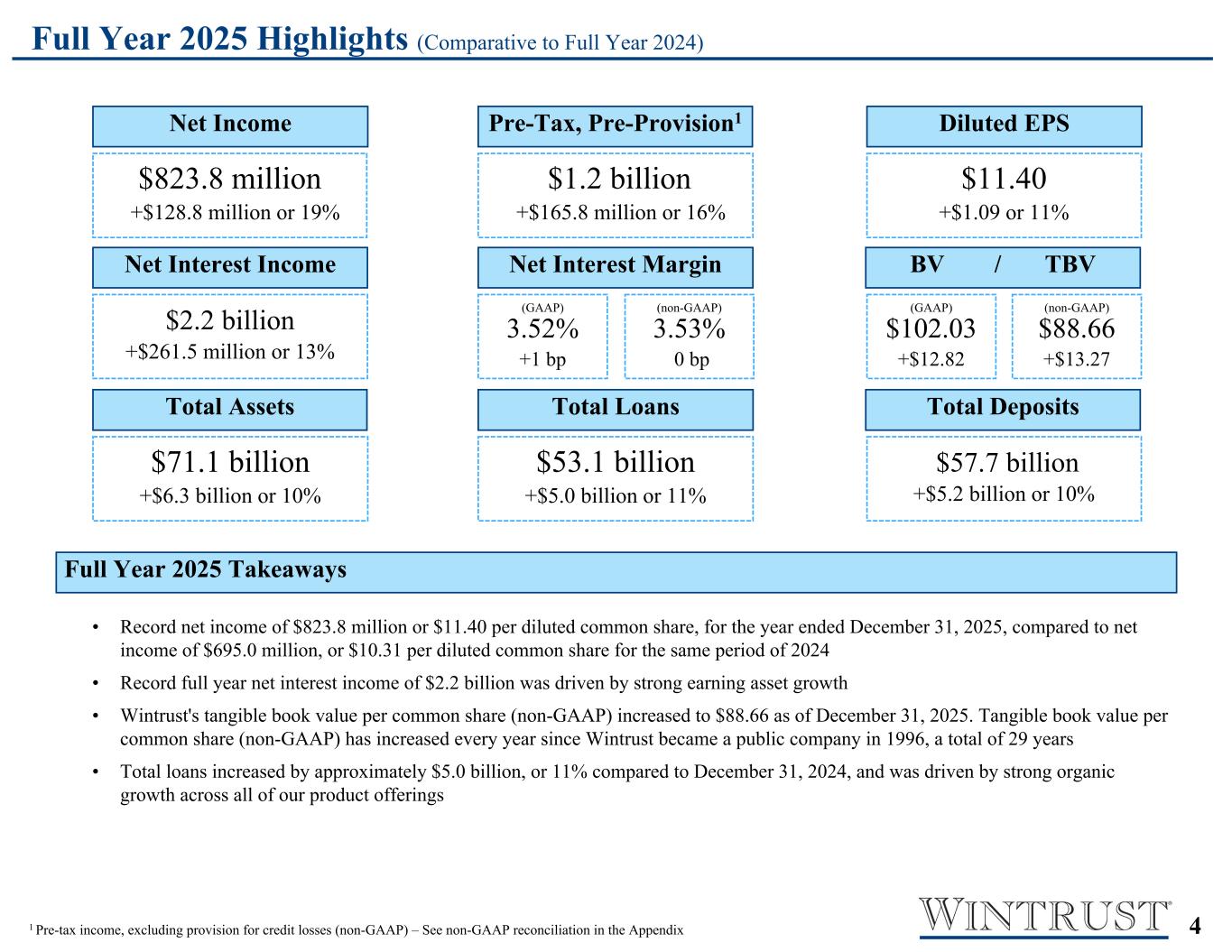

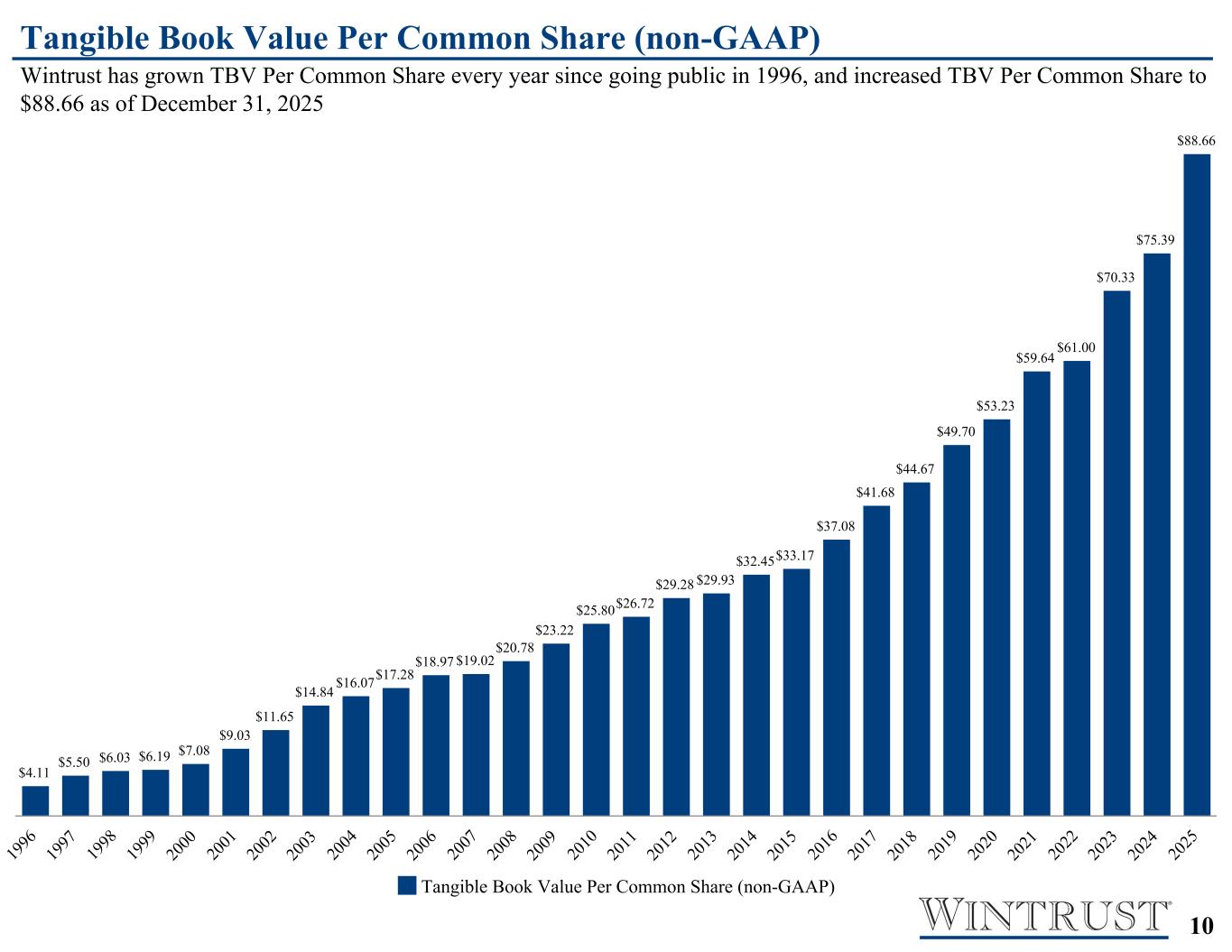

44 • Record net income of $823.8 million or $11.40 per diluted common share, for the year ended December 31, 2025, compared to net income of $695.0 million, or $10.31 per diluted common share for the same period of 2024 • Record full year net interest income of $2.2 billion was driven by strong earning asset growth • Wintrust's tangible book value per common share (non-GAAP) increased to $88.66 as of December 31, 2025. Tangible book value per common share (non-GAAP) has increased every year since Wintrust became a public company in 1996, a total of 29 years • Total loans increased by approximately $5.0 billion, or 11% compared to December 31, 2024, and was driven by strong organic growth across all of our product offerings Pre-Tax, Pre-Provision1 Full Year 2025 Highlights (Comparative to Full Year 2024) Total DepositsTotal Assets Total Loans Net Income $71.1 billion +$6.3 billion or 10% $53.1 billion +$5.0 billion or 11% $57.7 billion +$5.2 billion or 10% $823.8 million +$128.8 million or 19% Update Format second box BV / TBV Net Interest Income Net Interest Margin $2.2 billion +$261.5 million or 13% (non-GAAP) $88.66 +$13.27 $1.2 billion +$165.8 million or 16% Diluted EPS $11.40 +$1.09 or 11% Current EPS Prior EPS $ 3.15 2.78 $ 0.37 PPNI Prior PPNI $ 329.8 317.8 $12.00 12000000 329,811 317,809 3 Bps: Basis Points 4 See Non-GAAP reconciliation in the Appendix 5 NPLs: Non-Performing Loans Metric DEC 2025 YTD DEC 2024 YTD Difference % Change Net Income $ 823,844 $ 695,045 $ 128,799 19 % Pre-Tax, Pre- Provision 1,213,960 1,048,136 $ 165,824 16 % Diluted EPS $ 11.40 $ 10.31 $ 1.09 11 % Net Interest Income 2,224,052 1,962,535 $ 261,517 13 % NIM 3.52 % 3.51 % 0.0100 % 58 TBV 88.66 75.39 $ 13.27 18 % Total Assets 71,142,046 64,879,668 $ 6,262,378 10 % Rounding support Total Loans 53,105,101 48,055,037 $ 5,050,064 11 % $ 5,030,064 Total Deposits 57,717,191 52,512,349 $ 5,204,842 10 % Full Year 2025 Takeaways 1 Pre-tax income, excluding provision for credit losses (non-GAAP) – See non-GAAP reconciliation in the Appendix (GAAP) $102.03 +$12.82 (non-GAAP) 3.53% 0 bp (GAAP) 3.52% +1 bp NIM FY GAAP NIM PY GAAP Change 3.52% 3.51% 1.00 NIM FY Non- GAAP NIM PY Non- GAAP Change 3.53% 3.53% 0.00 BV FY BV PY Change $ 102.03 $ 89.21 $ 12.82 TBV TBV PY Change 88.66 75.39 13.27

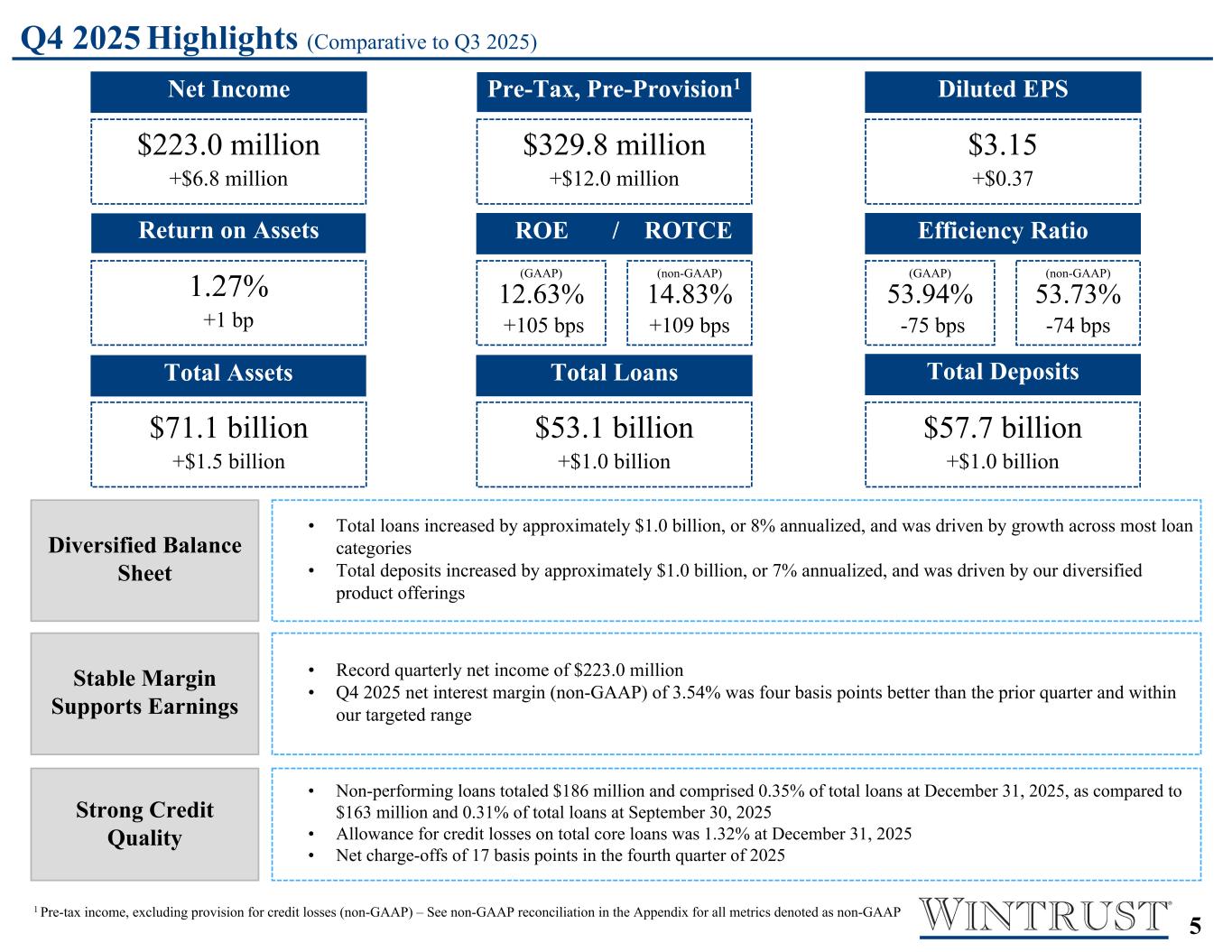

55 • Record quarterly net income of $223.0 million • Q4 2025 net interest margin (non-GAAP) of 3.54% was four basis points better than the prior quarter and within our targeted range Q4 2025 Highlights (Comparative to Q3 2025) • Total loans increased by approximately $1.0 billion, or 8% annualized, and was driven by growth across most loan categories • Total deposits increased by approximately $1.0 billion, or 7% annualized, and was driven by our diversified product offerings Pre-Tax, Pre-Provision1 Diversified Balance Sheet Total DepositsTotal Assets Total Loans Net Income $71.1 billion +$1.5 billion $53.1 billion +$1.0 billion $57.7 billion +$1.0 billion $223.0 million +$6.8 million Strong Credit Quality • Non-performing loans totaled $186 million and comprised 0.35% of total loans at December 31, 2025, as compared to $163 million and 0.31% of total loans at September 30, 2025 • Allowance for credit losses on total core loans was 1.32% at December 31, 2025 • Net charge-offs of 17 basis points in the fourth quarter of 2025 Efficiency RatioReturn on Assets ROE / ROTCE 1.27% +1 bp (GAAP) 53.94% -75 bps $329.8 million +$12.0 million 1 Pre-tax income, excluding provision for credit losses (non-GAAP) – See non-GAAP reconciliation in the Appendix for all metrics denoted as non-GAAP Diluted EPS $3.15 +$0.37 Current EPS Prior EPS $ 3.15 2.78 $ 0.37 PPNI Prior PPNI $ 329.8 317.8 $12.00 12000000 329,811 317,809 Stable Margin Supports Earnings (non-GAAP) 53.73% -74 bps Efficiency Ratio (GAAP) Current Q Efficiency Ratio (GAAP) Prior Q Efficiency Ratio (Non- GAAP) Current Q Efficiency Ratio (Non- GAAP) Prior Q 53.94 % 54.69 % 53.73 % 54.47 % % Change File does not have calc for GAAP numbers (73.9999999999996) Check -75.00 -74.00 (GAAP) 12.63% +105 bps (non-GAAP) 14.83% +109 bps Current ROE Prior ROE Current ROTCE Prior ROTCE 12.63 % 11.58 % 14.83 % 13.74 % 105 109 PENDING 2 Shares issued for the acquisition of Macatawa increased average dilutive shares by 3,118,000 shares

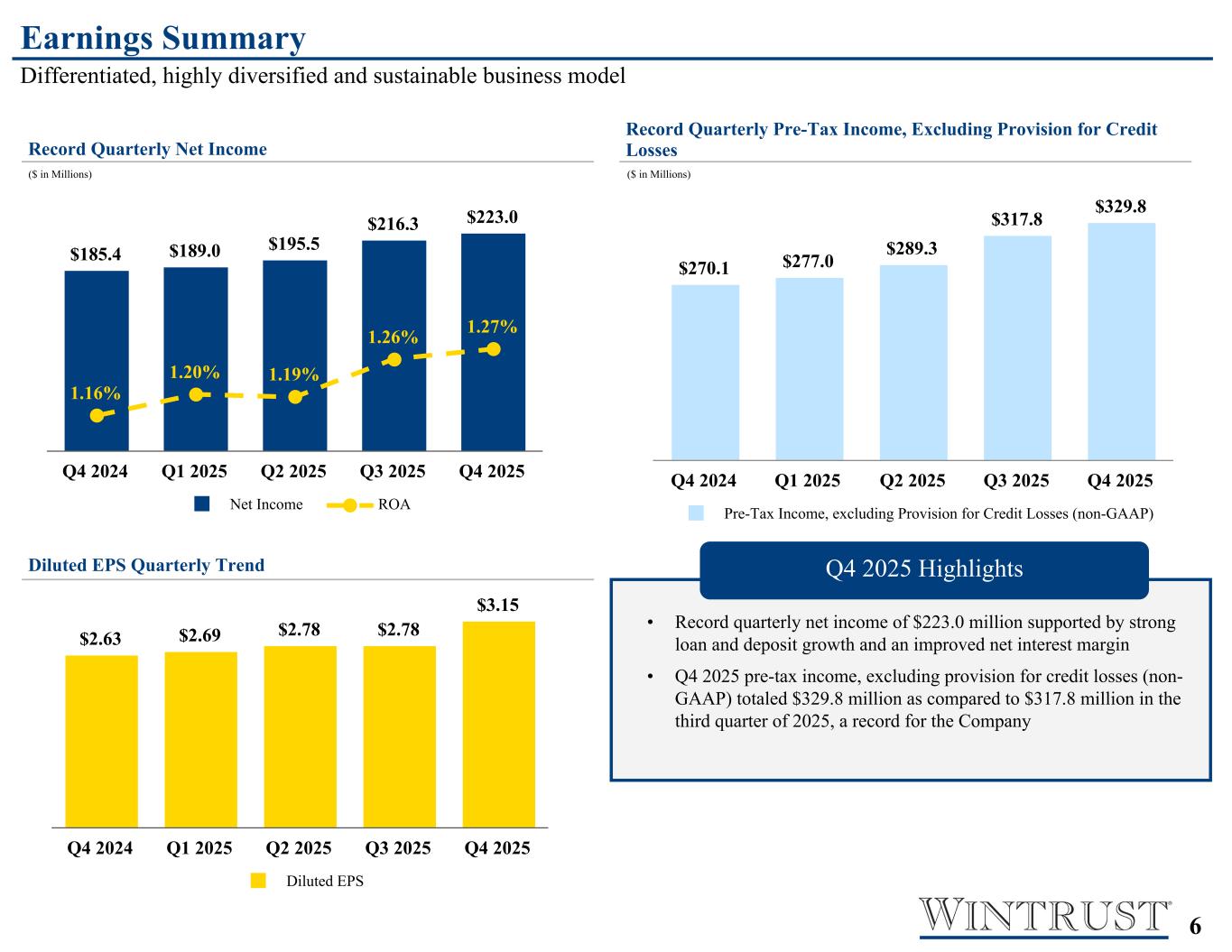

66 Diluted EPS Quarterly Trend Record Quarterly Pre-Tax Income, Excluding Provision for Credit Losses Record Quarterly Net Income $185.4 $189.0 $195.5 $216.3 $223.0 1.16% 1.20% 1.19% 1.26% 1.27% Net Income ROA Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $2.63 $2.69 $2.78 $2.78 $3.15 Diluted EPS Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $270.1 $277.0 $289.3 $317.8 $329.8 Pre-Tax Income, excluding Provision for Credit Losses (non-GAAP) Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in Millions) ($ in Millions) 1 See non-GAAP reconciliation in Appendix Q4 2025 Highlights Earnings Summary Differentiated, highly diversified and sustainable business model Manual Input - Highlights May Change QoQ • Record quarterly net income of $223.0 million supported by strong loan and deposit growth and an improved net interest margin • Q4 2025 pre-tax income, excluding provision for credit losses (non- GAAP) totaled $329.8 million as compared to $317.8 million in the third quarter of 2025, a record for the Company 1The first quarter of 2024 includes FDIC special assessment of $5.2 million and net gain on sale of RBA of $19.3 million 1 1 1

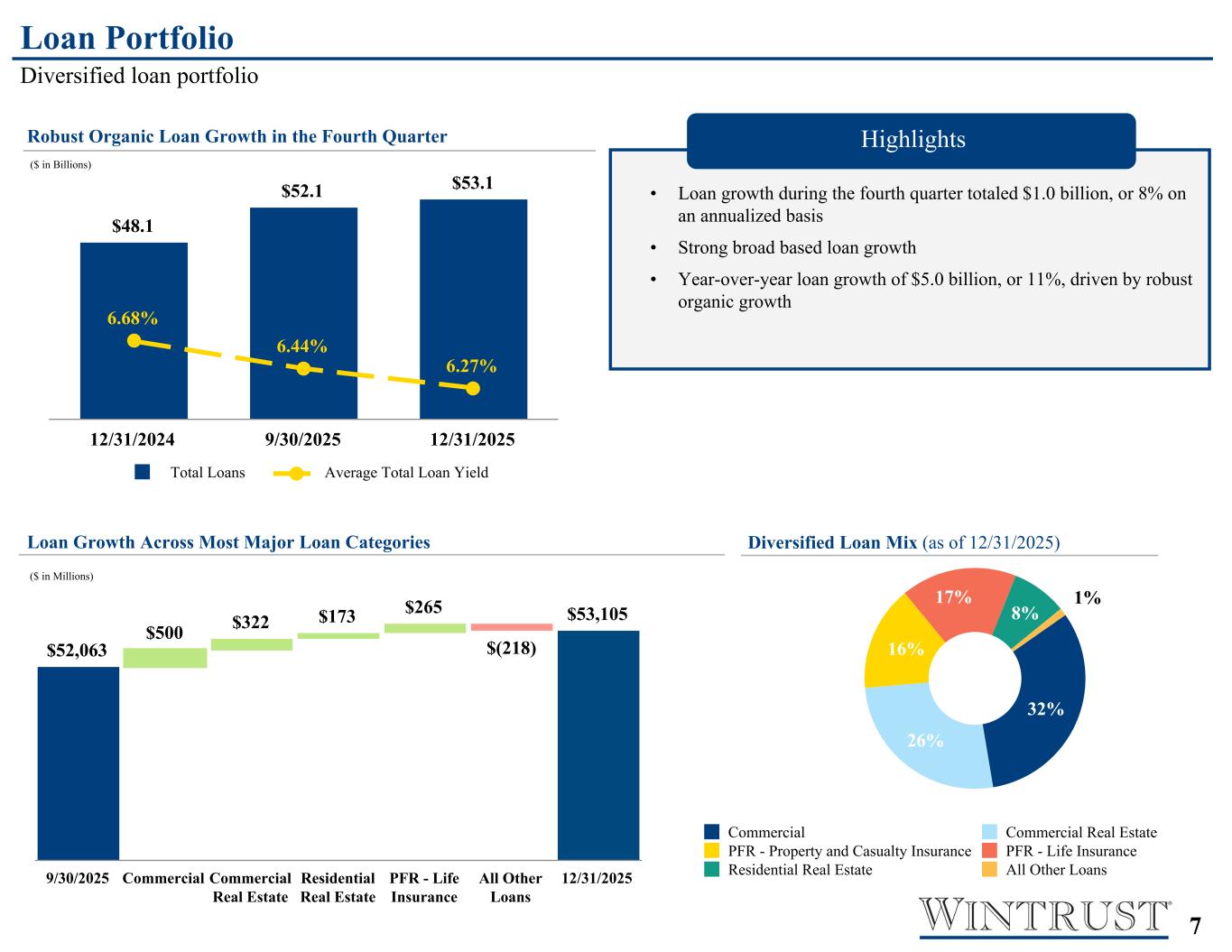

77 32% 26% 16% 17% 8% 1% Commercial Commercial Real Estate PFR - Property and Casualty Insurance PFR - Life Insurance Residential Real Estate All Other Loans $52,063 $500 $322 $173 $265 $(218) $53,105 9/30/2025 Commercial Commercial Real Estate Residential Real Estate PFR - Life Insurance All Other Loans 12/31/2025 $48.1 $52.1 $53.1 6.68% 6.44% 6.27% Total Loans Average Total Loan Yield 12/31/2024 9/30/2025 12/31/2025 Year-over-Year Change $5.6B or 11% in Total Loans Loan Portfolio Diversified loan portfolio Loan Growth Across Most Major Loan Categories ($ in Millions) Diversified Loan Mix (as of 12/31/2025) Robust Organic Loan Growth in the Fourth Quarter ($ in Billions) • Loan growth during the fourth quarter totaled $1.0 billion, or 8% on an annualized basis • Strong broad based loan growth • Year-over-year loan growth of $5.0 billion, or 11%, driven by robust organic growth Highlights

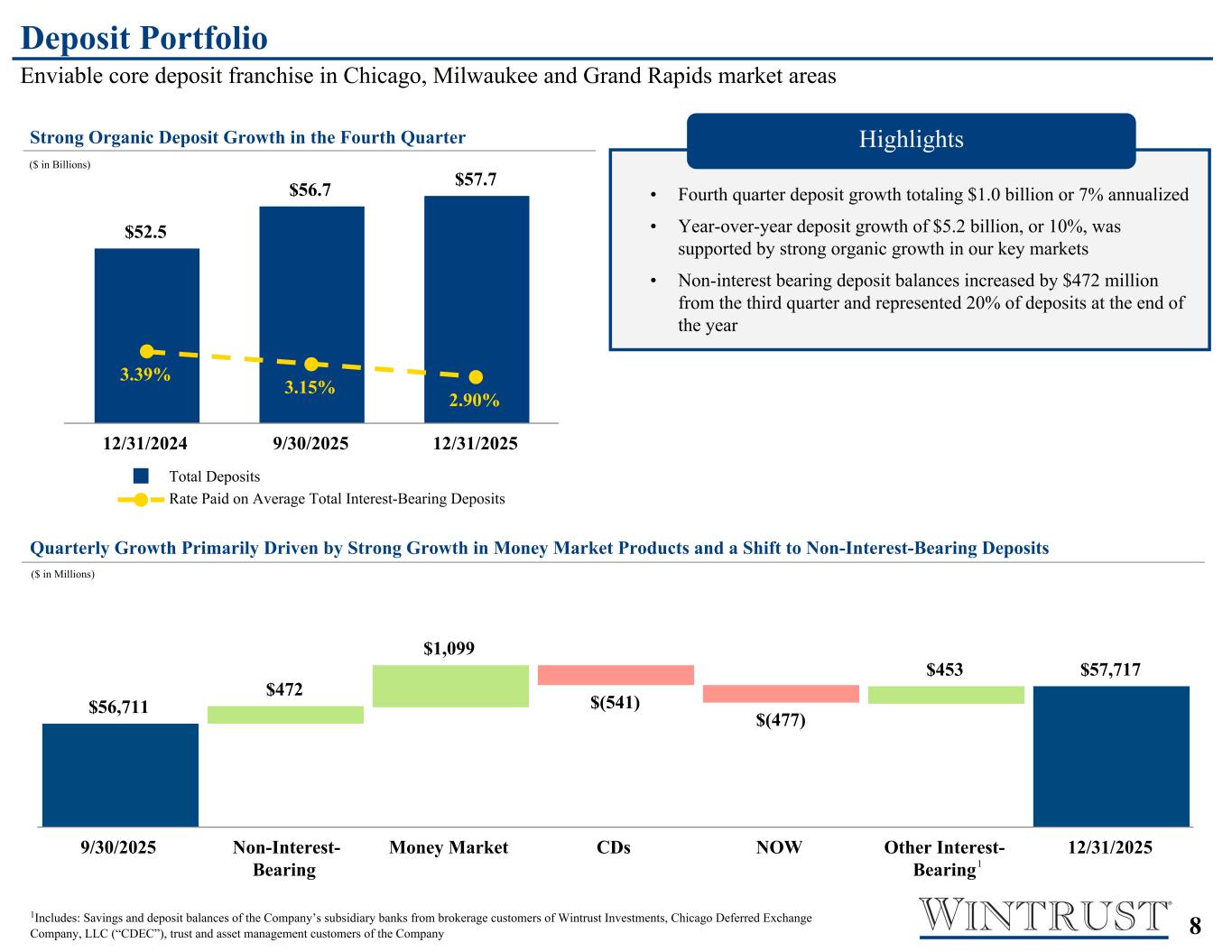

88 • Fourth quarter deposit growth totaling $1.0 billion or 7% annualized • Year-over-year deposit growth of $5.2 billion, or 10%, was supported by strong organic growth in our key markets • Non-interest bearing deposit balances increased by $472 million from the third quarter and represented 20% of deposits at the end of the year $56,711 $472 $1,099 $(541) $(477) $453 $57,717 9/30/2025 Non-Interest- Bearing Money Market CDs NOW Other Interest- Bearing 12/31/2025 $52.5 $56.7 $57.7 3.39% 3.15% 2.90% Total Deposits Rate Paid on Average Total Interest-Bearing Deposits 12/31/2024 9/30/2025 12/31/2025 1 1Includes: Savings and deposit balances of the Company’s subsidiary banks from brokerage customers of Wintrust Investments, Chicago Deferred Exchange Company, LLC (“CDEC”), trust and asset management customers of the Company Deposit Portfolio Enviable core deposit franchise in Chicago, Milwaukee and Grand Rapids market areas Quarterly Growth Primarily Driven by Strong Growth in Money Market Products and a Shift to Non-Interest-Bearing Deposits ($ in Millions) Strong Organic Deposit Growth in the Fourth Quarter ($ in Billions) Highlights 1 Manual Input - Highlights May Change QoQ

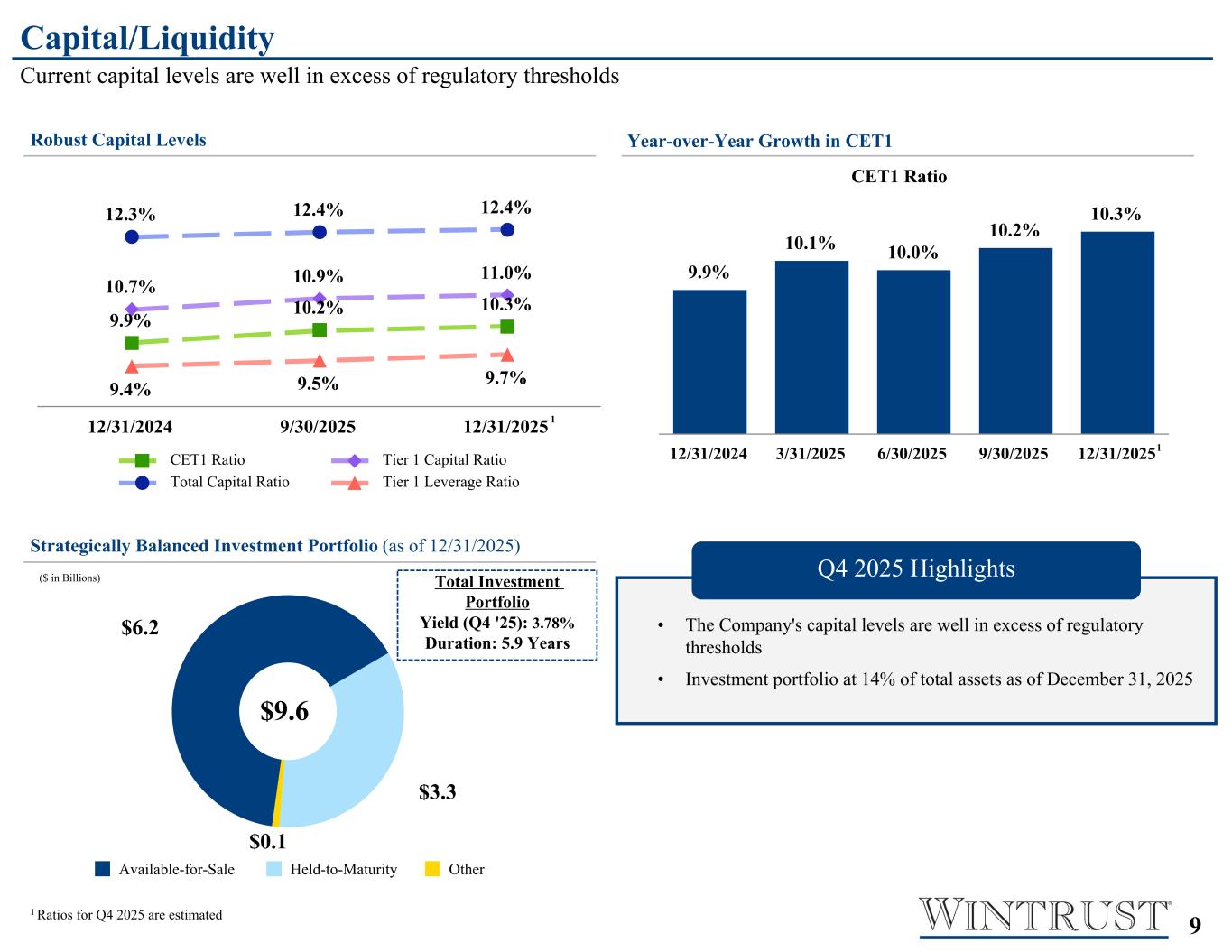

99 9.9% 10.1% 10.0% 10.2% 10.3% 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 Manual Input- Investment Duration comes from Scott Capital/Liquidity Current capital levels are well in excess of regulatory thresholds $6.2 $3.3 $0.1 Available-for-Sale Held-to-Maturity Other 1 Ratios for Q4 2025 are estimated 9.9% 10.2% 10.3% 10.7% 10.9% 11.0% 12.3% 12.4% 12.4% 9.4% 9.5% 9.7% CET1 Ratio Tier 1 Capital Ratio Total Capital Ratio Tier 1 Leverage Ratio 12/31/2024 9/30/2025 12/31/2025 CET1 Ratio 1 Year-over-Year Growth in CET1Robust Capital Levels Strategically Balanced Investment Portfolio (as of 12/31/2025) ($ in Billions) • The Company's capital levels are well in excess of regulatory thresholds • Investment portfolio at 14% of total assets as of December 31, 2025 Q4 2025 Highlights 1 Total Investment Portfolio Yield (Q4 '25): 3.78% Duration: 5.9 Years $9.6 Manual Input - Highlights May Change QoQ Manual Input - CET1 calculation comes from Mark Expect Q4 2025 CET1 +10.0% Pending Capital Ratios Decline Driven by Return of Prior Preferred Issuance in the Third Quarter

1010 $4.11 $5.50 $6.03 $6.19 $7.08 $9.03 $11.65 $14.84 $16.07$17.28 $18.97 $19.02 $20.78 $23.22 $25.80$26.72 $29.28 $29.93 $32.45$33.17 $37.08 $41.68 $44.67 $49.70 $53.23 $59.64 $61.00 $70.33 $75.39 $88.66 Tangible Book Value Per Common Share (non-GAAP) 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 Tangible Book Value Per Common Share (non-GAAP) Wintrust has grown TBV Per Common Share every year since going public in 1996, and increased TBV Per Common Share to $88.66 as of December 31, 2025 1 1Q2 2024 is a Preliminary Number Manual Input - S&P File

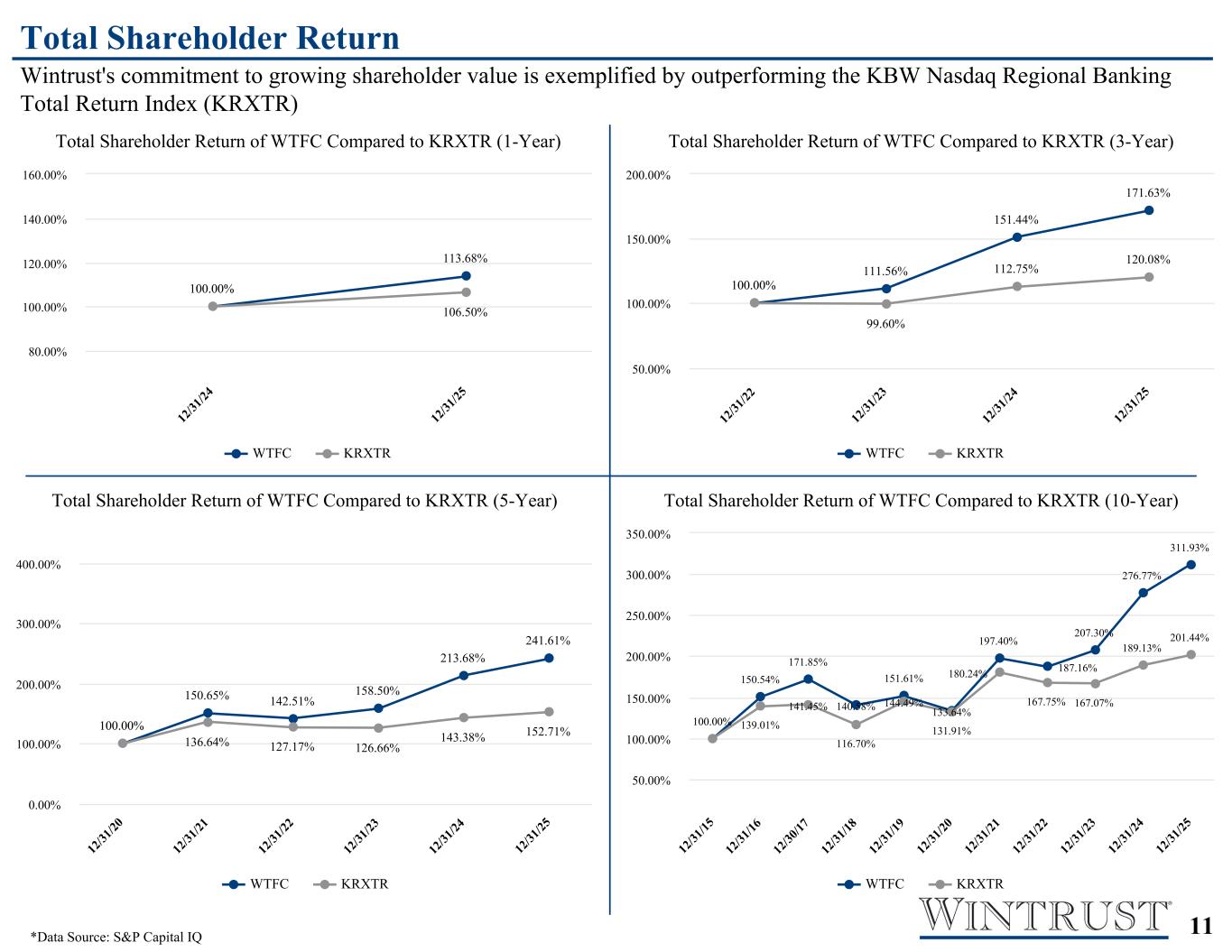

1111 Total Shareholder Return Wintrust's commitment to growing shareholder value is exemplified by outperforming the KBW Nasdaq Regional Banking Total Return Index (KRXTR) Total Shareholder Return of WTFC Compared to KRXTR (1-Year) 100.00% 113.68% 106.50% WTFC KRXTR 12 /31 /24 12 /31 /25 80.00% 100.00% 120.00% 140.00% 160.00% Total Shareholder Return of WTFC Compared to KRXTR (3-Year) 100.00% 111.56% 151.44% 171.63% 99.60% 112.75% 120.08% WTFC KRXTR 12 /31 /22 12 /31 /23 12 /31 /24 12 /31 /25 50.00% 100.00% 150.00% 200.00% Total Shareholder Return of WTFC Compared to KRXTR (5-Year) 100.00% 150.65% 142.51% 158.50% 213.68% 241.61% 136.64% 127.17% 126.66% 143.38% 152.71% WTFC KRXTR 12 /31 /20 12 /31 /21 12 /31 /22 12 /31 /23 12 /31 /24 12 /31 /25 0.00% 100.00% 200.00% 300.00% 400.00% Total Shareholder Return of WTFC Compared to KRXTR (10-Year) 100.00% 150.54% 171.85% 140.58% 151.61% 133.64% 197.40% 187.16% 207.30% 276.77% 311.93% 139.01% 141.45% 116.70% 144.49% 131.91% 180.24% 167.75% 167.07% 189.13% 201.44% WTFC KRXTR 12 /31 /15 12 /31 /16 12 /30 /17 12 /31 /18 12 /31 /19 12 /31 /20 12 /31 /21 12 /31 /22 12 /31 /23 12 /31 /24 12 /31 /25 50.00% 100.00% 150.00% 200.00% 250.00% 300.00% 350.00% Manual Input - S&P File *Data Source: S&P Capital IQ

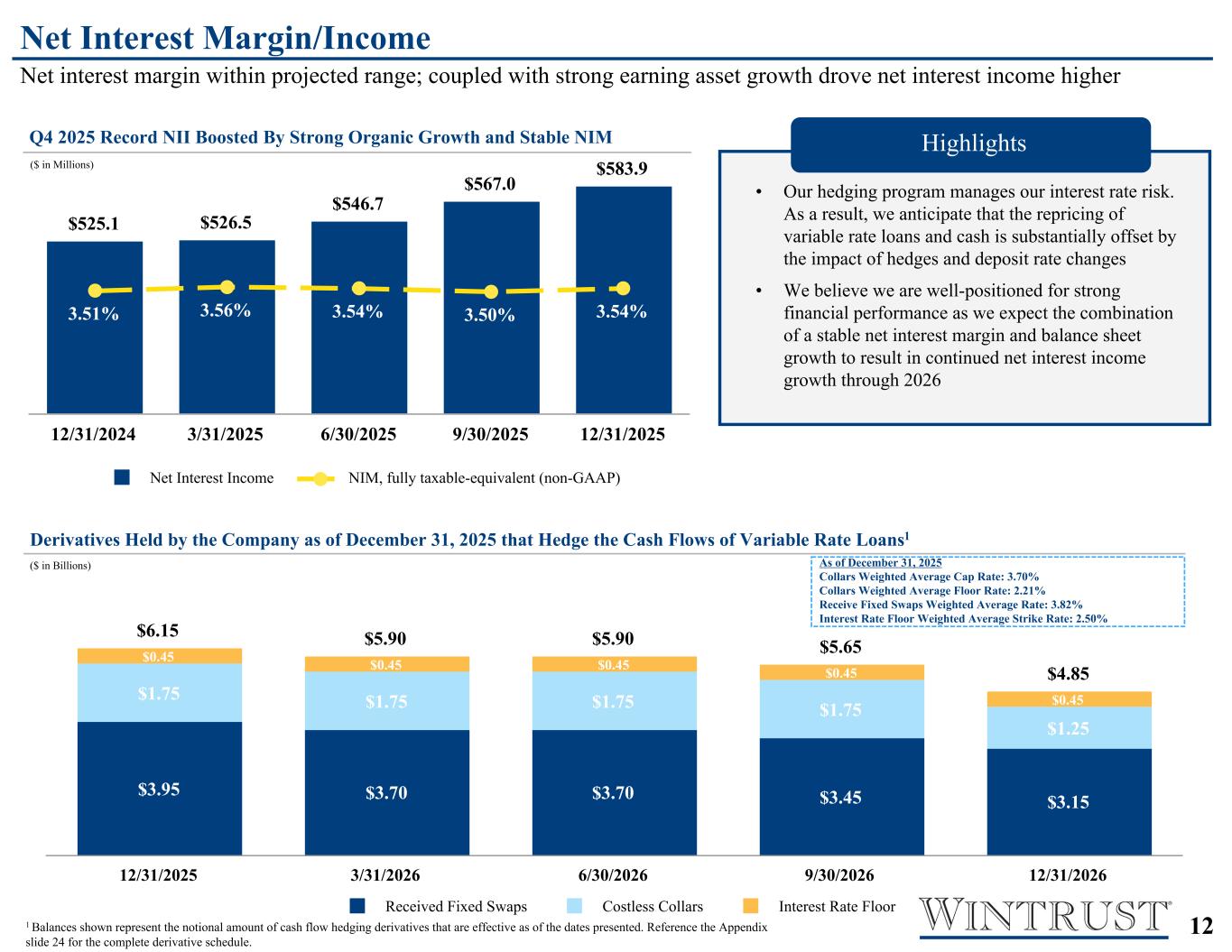

1212 • Our hedging program manages our interest rate risk. As a result, we anticipate that the repricing of variable rate loans and cash is substantially offset by the impact of hedges and deposit rate changes • We believe we are well-positioned for strong financial performance as we expect the combination of a stable net interest margin and balance sheet growth to result in continued net interest income growth through 2026 • Well-positioned for strong financial performance as we continue our momentum into the remainder of the year and 2025 • Expect the combination of a stable net interest margin and balance sheet growth to result in continued net interest income growth over the next few quarters • Hedging program to protect both net interest margin and capital during the new lower rate fed cycle $6.15 $5.90 $5.90 $5.65 $4.85 $3.95 $3.70 $3.70 $3.45 $3.15 $1.75 $1.75 $1.75 $1.75 $1.25 $0.45 $0.45 $0.45 $0.45 $0.45 Received Fixed Swaps Costless Collars Interest Rate Floor 12/31/2025 3/31/2026 6/30/2026 9/30/2026 12/31/2026 $525.1 $526.5 $546.7 $567.0 $583.9 3.51% 3.56% 3.54% 3.50% 3.54% Net Interest Income NIM, fully taxable-equivalent (non-GAAP) 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 3.5% (0.14)% 0.24% (0.06)% 3.54% NIM (non-GAAP) Q1 2024 Earning Asset Yield Interest-Bearing Liability Rate Net Free Funds NIM (non-GAAP) Q2 2024 Net Interest Margin/Income Net interest margin within projected range; coupled with strong earning asset growth drove net interest income higher Derivatives Held by the Company as of December 31, 2025 that Hedge the Cash Flows of Variable Rate Loans1 2.9% 1.0% 1.8% 1.0% Static Ramp 6/30/2023 6/30/2024 Percentage Change in Net Interest Income Over a One-Year Time Horizon Rising Rates Scenario + 100 Basis Points (2.9)% 0.6% (0.9)% 0.9% Static Ramp 6/30/2023 6/30/2024 1 2 Percentage Change in Net Interest Income Over a One-Year Time Horizon Falling Rates Scenario - 100 Basis Points 1 Static Shock Scenario results incorporate actual cash flows and repricing characteristics for balance sheet instruments following an instantaneous, parallel change in market rates based upon a static (i.e. no growth or constant) balance sheet 2 Ramp Scenario results incorporate management’s projections of future volume and pricing of each of the product lines following a gradual, parallel change in market rates over twelve months Q1 '24 NII $567.0MM Q2 '24 NII $583.9MMNIM Linking Chart 12/31/2025 9/30/2025 Variance Total earning assets (7) 5.79 % 5.93 % (0.14) % Total interest-bearing liabilities 2.97 % 3.21 0.24 % Net free funds/contribution (6)/ Net interest income/Net interest margin 0.72 % 0.78 -0.06 NIM 3.54 % 3.5 Manual Input - Data Comes from Joel Pending Expect sustained NII growth and Stable NIM through 2025 Q4 2025 Record NII Boosted By Strong Organic Growth and Stable NIM Q4 2025 Highlights As of December 31, 2025 Collars Weighted Average Cap Rate: 3.70% Collars Weighted Average Floor Rate: 2.21% Receive Fixed Swaps Weighted Average Rate: 3.82% Interest Rate Floor Weighted Average Strike Rate: 2.50% 1 Balances shown exclude cash flow hedges with future effective starting dates and those that have matured as of 12/31/2025. Reference the Appendix slide 24 for the complete derivative schedule. ($ in Billions) ($ in Millions) • Expect sustained NII growth and Stable NIM through 2025 Highlights Q4 2025 1 Balances shown represent the notional amount of cash flow hedging derivatives that are effective as of the dates presented. Reference the Appendix slide 24 for the complete derivative schedule.

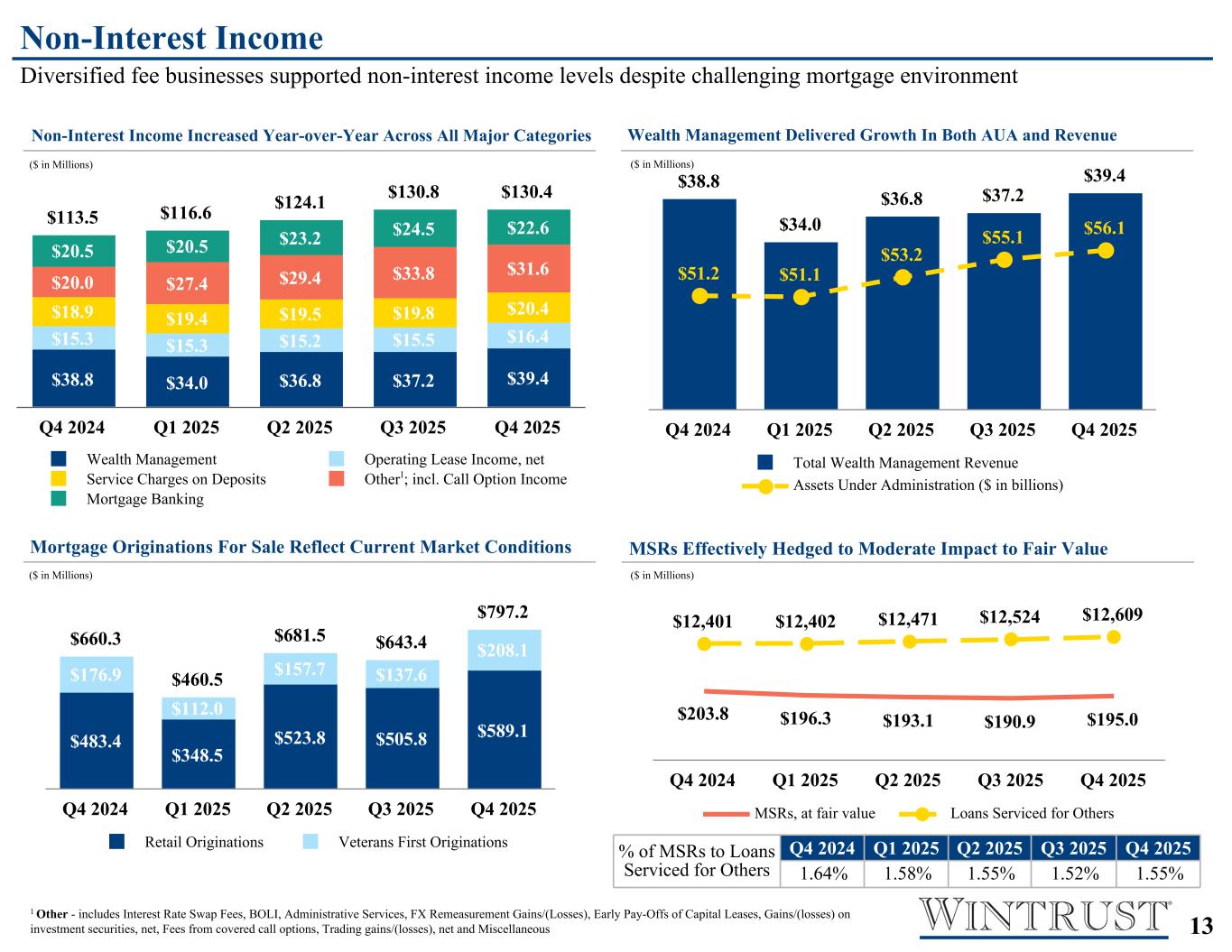

1313 Wealth Management Delivered Growth In Both AUA and Revenue $113.5 $116.6 $124.1 $130.8 $130.4 $38.8 $34.0 $36.8 $37.2 $39.4 $15.3 $15.3 $15.2 $15.5 $16.4 $18.9 $19.4 $19.5 $19.8 $20.4 $20.0 $27.4 $29.4 $33.8 $31.6 $20.5 $20.5 $23.2 $24.5 $22.6 Wealth Management Operating Lease Income, net Service Charges on Deposits Other ; incl. Call Option Income Mortgage Banking Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $660.3 $460.5 $681.5 $643.4 $797.2 $483.4 $348.5 $523.8 $505.8 $589.1 $176.9 $112.0 $157.7 $137.6 $208.1 Retail Originations Veterans First Originations Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Mortgage Originations For Sale Reflect Current Market Conditions MSRs Effectively Hedged to Moderate Impact to Fair Value Non-Interest Income Increased Year-over-Year Across All Major Categories 1 Other - includes Interest Rate Swap Fees, BOLI, Administrative Services, FX Remeasurement Gains/(Losses), Early Pay-Offs of Capital Leases, Gains/(losses) on investment securities, net, Fees from covered call options, Trading gains/(losses), net and Miscellaneous 1 $38.8 $34.0 $36.8 $37.2 $39.4 $51.2 $51.1 $53.2 $55.1 $56.1 Total Wealth Management Revenue Assets Under Administration ($ in billions) Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in Millions) ($ in Millions) % of MSRs to Loans Serviced for Others Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 1.64% 1.58% 1.55% 1.52% 1.55% $203.8 $196.3 $193.1 $190.9 $195.0 $12,401 $12,402 $12,471 $12,524 $12,609 MSRs, at fair value Loans Serviced for Others Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in Millions) ($ in Millions) Non-Interest Income Diversified fee businesses supported non-interest income levels despite challenging mortgage environment Manual Input - Data Comes from Mortgage Team Pending Pending

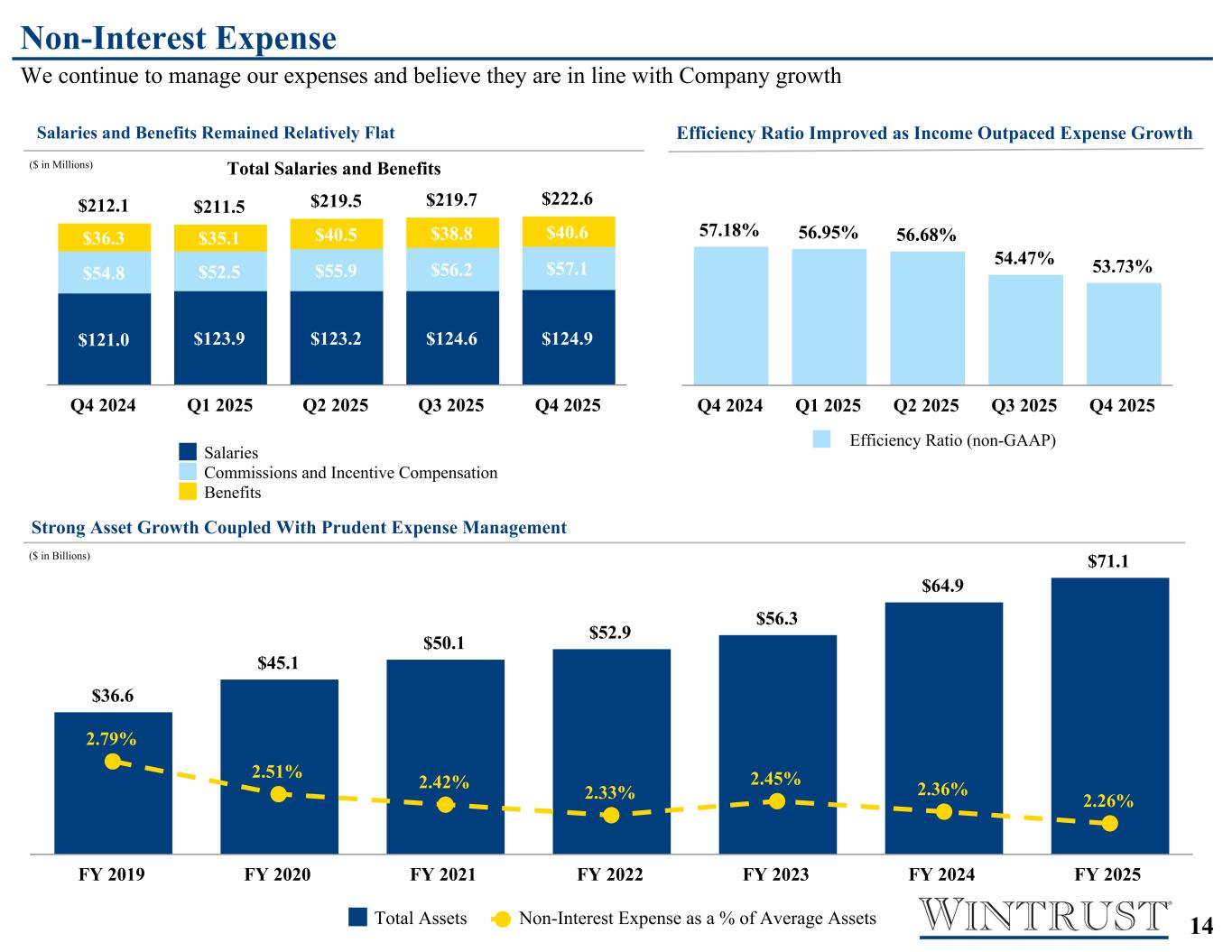

1414 57.18% 56.95% 56.68% 54.47% 53.73% Efficiency Ratio (non-GAAP) Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $212.1 $211.5 $219.5 $219.7 $222.6 $121.0 $123.9 $123.2 $124.6 $124.9 $54.8 $52.5 $55.9 $56.2 $57.1 $36.3 $35.1 $40.5 $38.8 $40.6 Salaries Commissions and Incentive Compensation Benefits Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $36.6 $45.1 $50.1 $52.9 $56.3 $64.9 $71.1 2.79% 2.51% 2.42% 2.33% 2.45% 2.36% 2.26% Total Assets Non-Interest Expense as a % of Average Assets FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 Efficiency Ratio Improved as Income Outpaced Expense Growth Q1 2024 Non-Interest Expense Advertising and Marketing FDIC Special Assessment Salaries and Benefits Occupancy Expense All Other Expenses Q2 2024 Non-Interest Expense Non-Interest Expense We continue to manage our expenses and believe they are in line with Company growth ($ in Millions) Strong Asset Growth Coupled With Prudent Expense Management ($ in Billions) 1 Q1 2024 Includes FDIC Special Assessment of $5.2 million and Net Gain on Sale of RBA of $19.3 million 1 Total Salaries and Benefits Salaries and Benefits Remained Relatively Flat Total Salaries and Benefits Expense Relatively Stable Quarter over Quarter as Q1 2025 Impacted

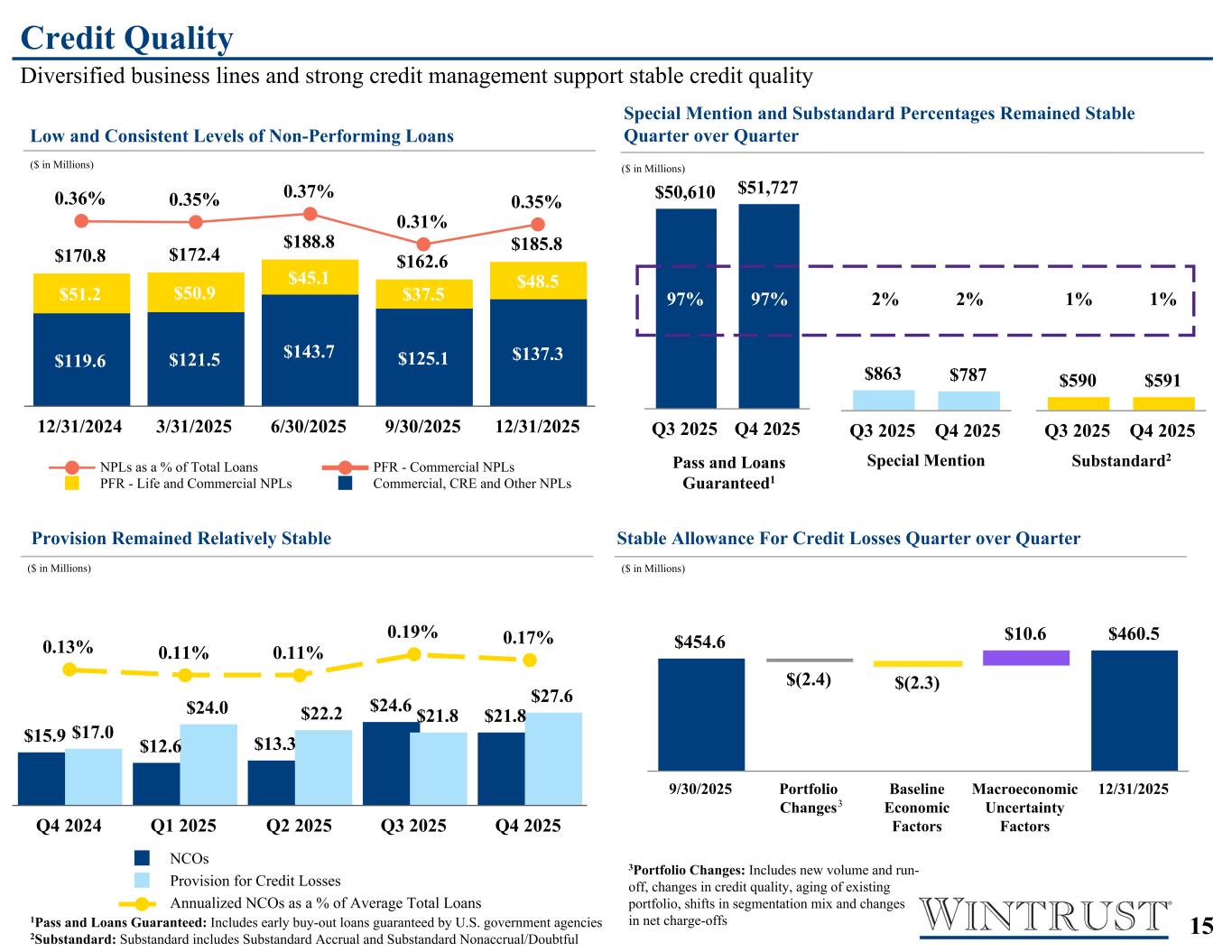

1515 $454.6 $(2.4) $(2.3) $10.6 $460.5 9/30/2025 Portfolio Changes Baseline Economic Factors Macroeconomic Uncertainty Factors 12/31/2025 $15.9 $12.6 $13.3 $24.6 $21.8 $17.0 $24.0 $22.2 $21.8 $27.6 0.13% 0.11% 0.11% 0.19% 0.17% NCOs Provision for Credit Losses Annualized NCOs as a % of Average Total Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $170.8 $172.4 $188.8 $162.6 $185.8 $119.6 $121.5 $143.7 $125.1 $137.3 $51.2 $50.9 $45.1 $37.5 $48.5 0.36% 0.35% 0.37% 0.31% 0.35% NPLs as a % of Total Loans PFR - Commercial NPLs PFR - Life and Commercial NPLs Commercial, CRE and Other NPLs 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $(33) $(15) $(42) $(41) $2 (0.01)% 0.00% (0.01)% (0.01)% 0.00% NCOs Annualized NCOs as a % of Average Total Loans Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $50,610 $51,727 Q3 2025 Q4 2025 $863 $787 Q3 2025 Q4 2025 $590 $591 Q3 2025 Q4 2025 Pass and Loans Guaranteed1 Special Mention Substandard2 1Pass and Loans Guaranteed: Includes early buy-out loans guaranteed by U.S. government agencies 2Substandard: Substandard includes Substandard Accrual and Substandard Nonaccrual/Doubtful 97% 97% 2% 2% 1% 1% Credit Quality Diversified business lines and strong credit management support stable credit quality Low and Consistent Levels of Non-Performing Loans ($ in Millions) ($ in Millions) Special Mention and Substandard Percentages Remained Stable Quarter over Quarter $15.9 $12.6 $13.3 $24.6 $21.8 $17.0 $24.0 $22.2 $21.8 $27.6 0.13% 0.11% 0.11% 0.19% 0.17% NCOs Total Provision for Credit Losses Annualized NCOs as a % of Average Total Loans Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ($ in Millions) $75 $72 $1 $1 $1 0.01% 0.01% 0.00% 0.00% 0.00% NPLs Annualized NPLs as a % of Average Total Loans Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 $15.5 Day 1 Macatawa Provision for Credit Losses $6.8 Stable Allowance For Credit Losses Quarter over Quarter ($ in Millions) 3Portfolio Changes: Includes new volume and run- off, changes in credit quality, aging of existing portfolio, shifts in segmentation mix and changes in net charge-offs 3 Manual Input - All Data comes from Mike Reiser Manual Input - All Data comes from Mike Reiser $15.5 Provision Remained Relatively Stable

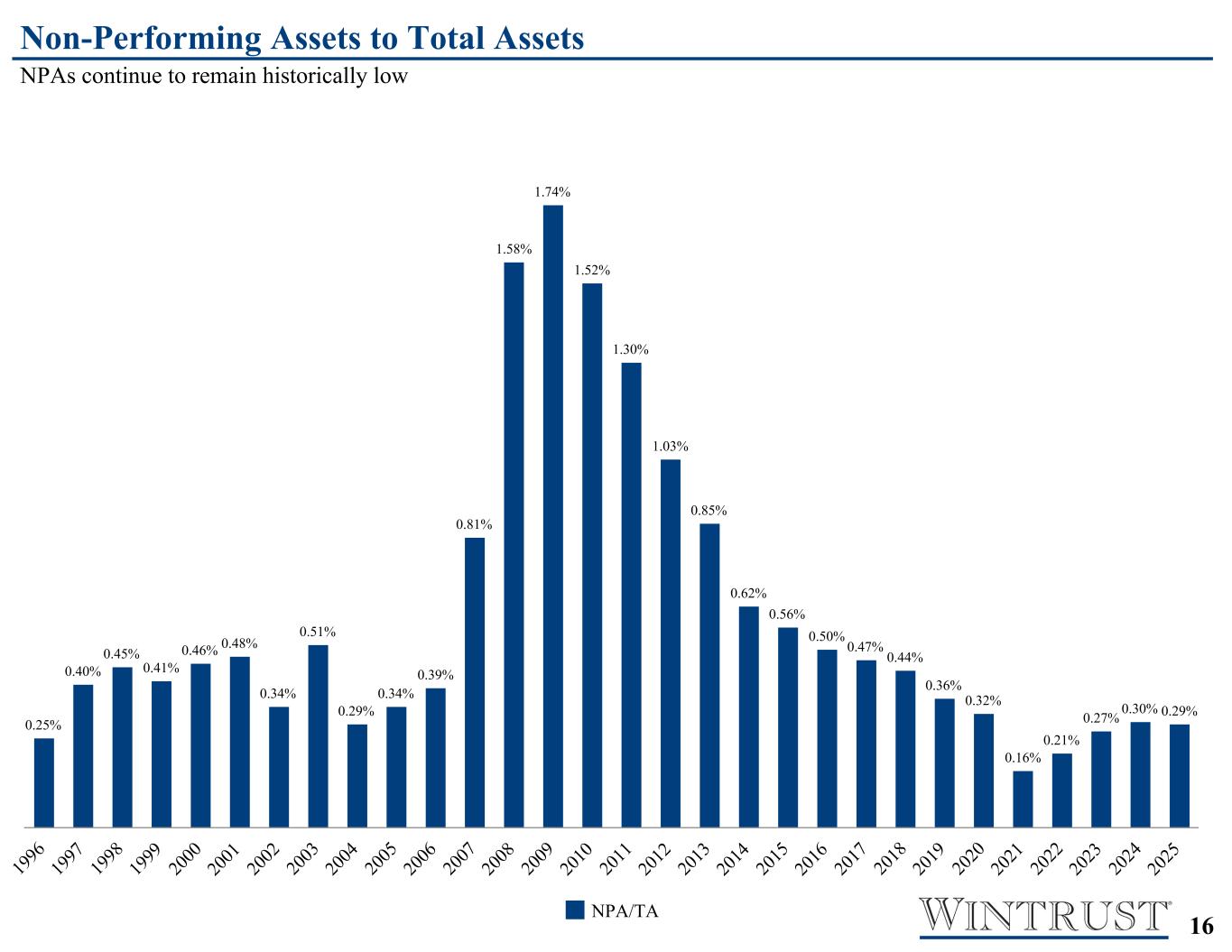

1616 0.25% 0.40% 0.45% 0.41% 0.46% 0.48% 0.34% 0.51% 0.29% 0.34% 0.39% 0.81% 1.58% 1.74% 1.52% 1.30% 1.03% 0.85% 0.62% 0.56% 0.50% 0.47% 0.44% 0.36% 0.32% 0.16% 0.21% 0.27% 0.30% 0.29% NPA/TA 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 1Q2 2024 is a Preliminary Number Non-Performing Assets to Total Assets NPAs continue to remain historically low Historical Data are manual input from S&P File. Current quarter is linked

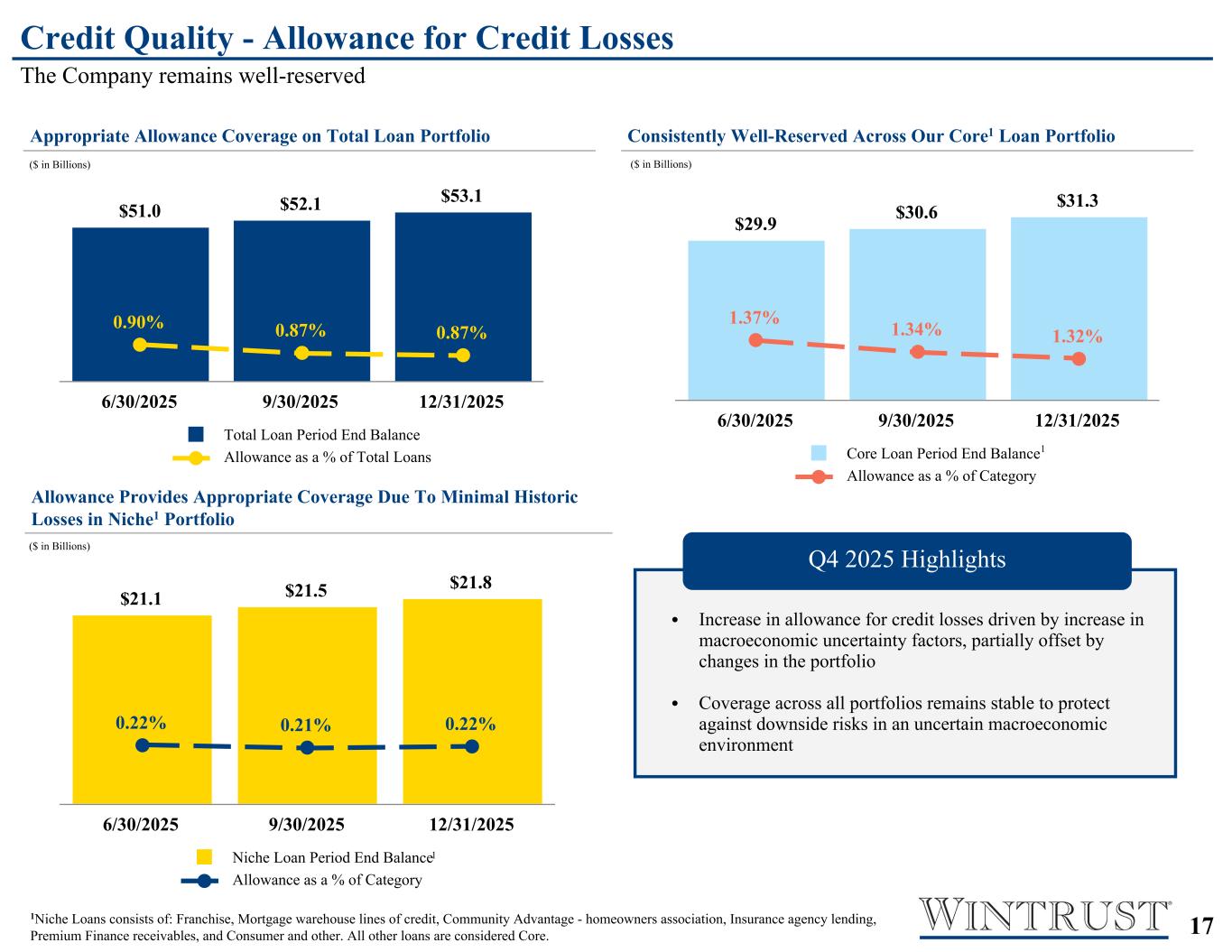

1717 • Increase in allowance for credit losses driven by increase in macroeconomic uncertainty factors, partially offset by changes in the portfolio • Coverage across all portfolios remains stable to protect against downside risks in an uncertain macroeconomic environment • Increase in allowance driven by net loan growth across most segments coupled with changes in credit quality within specific products of the portfolio • Strong coverage across all portfolios designed to protect against potential future economic downturn $51.0 $52.1 $53.1 0.90% 0.87% 0.87% Total Loan Period End Balance Allowance as a % of Total Loans 6/30/2025 9/30/2025 12/31/2025 $29.9 $30.6 $31.3 1.37% 1.34% 1.32% Core Loan Period End Balance Allowance as a % of Category 6/30/2025 9/30/2025 12/31/2025 $21.1 $21.5 $21.8 0.22% 0.21% 0.22% Niche Loan Period End Balance Allowance as a % of Category 6/30/2025 9/30/2025 12/31/2025 Credit Quality - Allowance for Credit Losses The Company remains well-reserved Consistently Well-Reserved Across Our Core1 Loan PortfolioAppropriate Allowance Coverage on Total Loan Portfolio ($ in Billions) ($ in Billions) Allowance Provides Appropriate Coverage Due To Minimal Historic Losses in Niche1 Portfolio ($ in Billions) Q4 2025 Highlights Manual Input - All Data comes from Mike Reiser 1Niche Loans consists of: Franchise, Mortgage warehouse lines of credit, Community Advantage - homeowners association, Insurance agency lending, Premium Finance receivables, and Consumer and other. All other loans are considered Core. 1 1

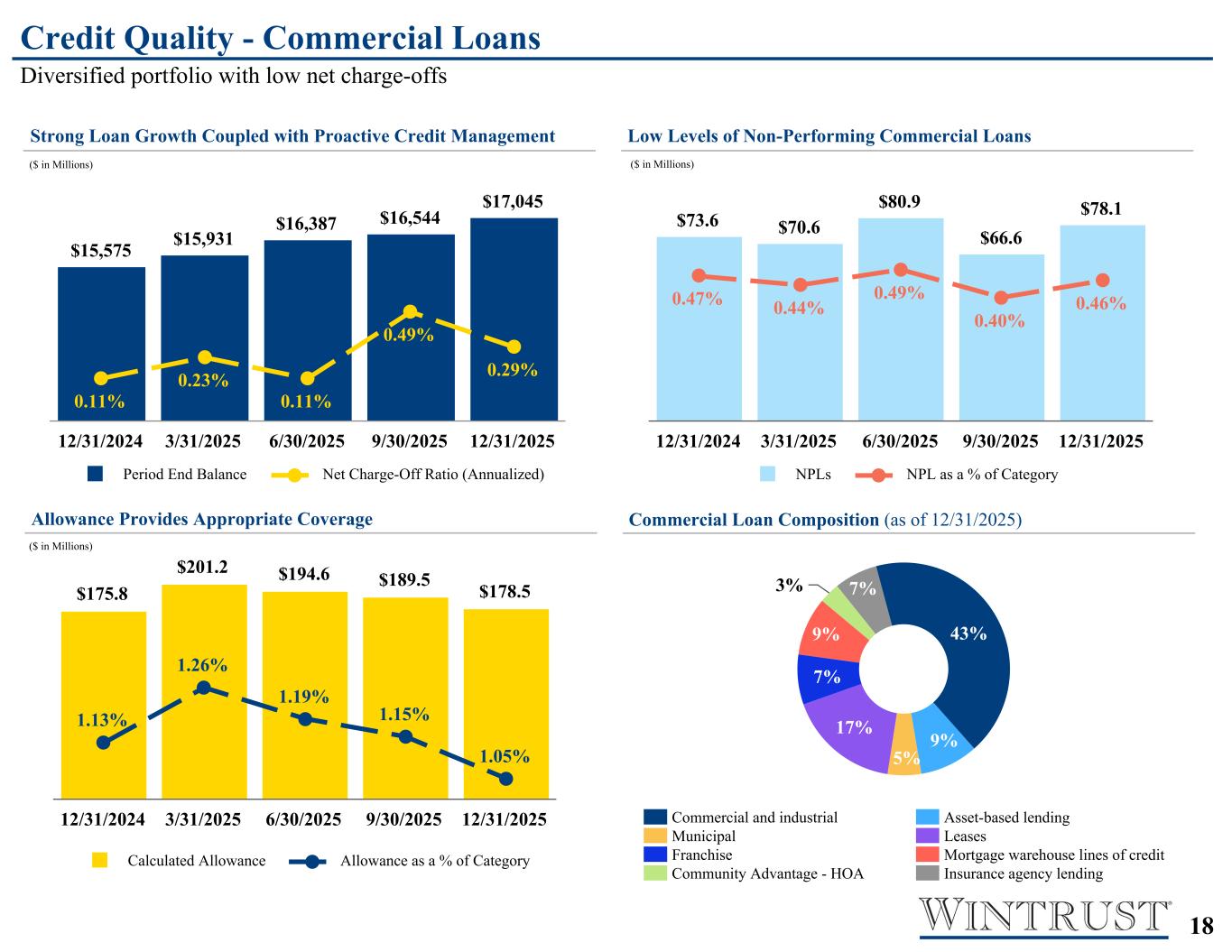

1818 $175.8 $201.2 $194.6 $189.5 $178.5 1.13% 1.26% 1.19% 1.15% 1.05% Calculated Allowance Allowance as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $73.6 $70.6 $80.9 $66.6 $78.1 0.47% 0.44% 0.49% 0.40% 0.46% NPLs NPL as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $15,575 $15,931 $16,387 $16,544 $17,045 0.11% 0.23% 0.11% 0.49% 0.29% Period End Balance Net Charge-Off Ratio (Annualized) 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 43% 9% 5% 17% 7% 9% 3% 7% Commercial and industrial Asset-based lending Municipal Leases Franchise Mortgage warehouse lines of credit Community Advantage - HOA Insurance agency lending Credit Quality - Commercial Loans Diversified portfolio with low net charge-offs Low Levels of Non-Performing Commercial LoansStrong Loan Growth Coupled with Proactive Credit Management ($ in Millions) ($ in Millions) Allowance Provides Appropriate Coverage Commercial Loan Composition (as of 12/31/2025) ($ in Millions)

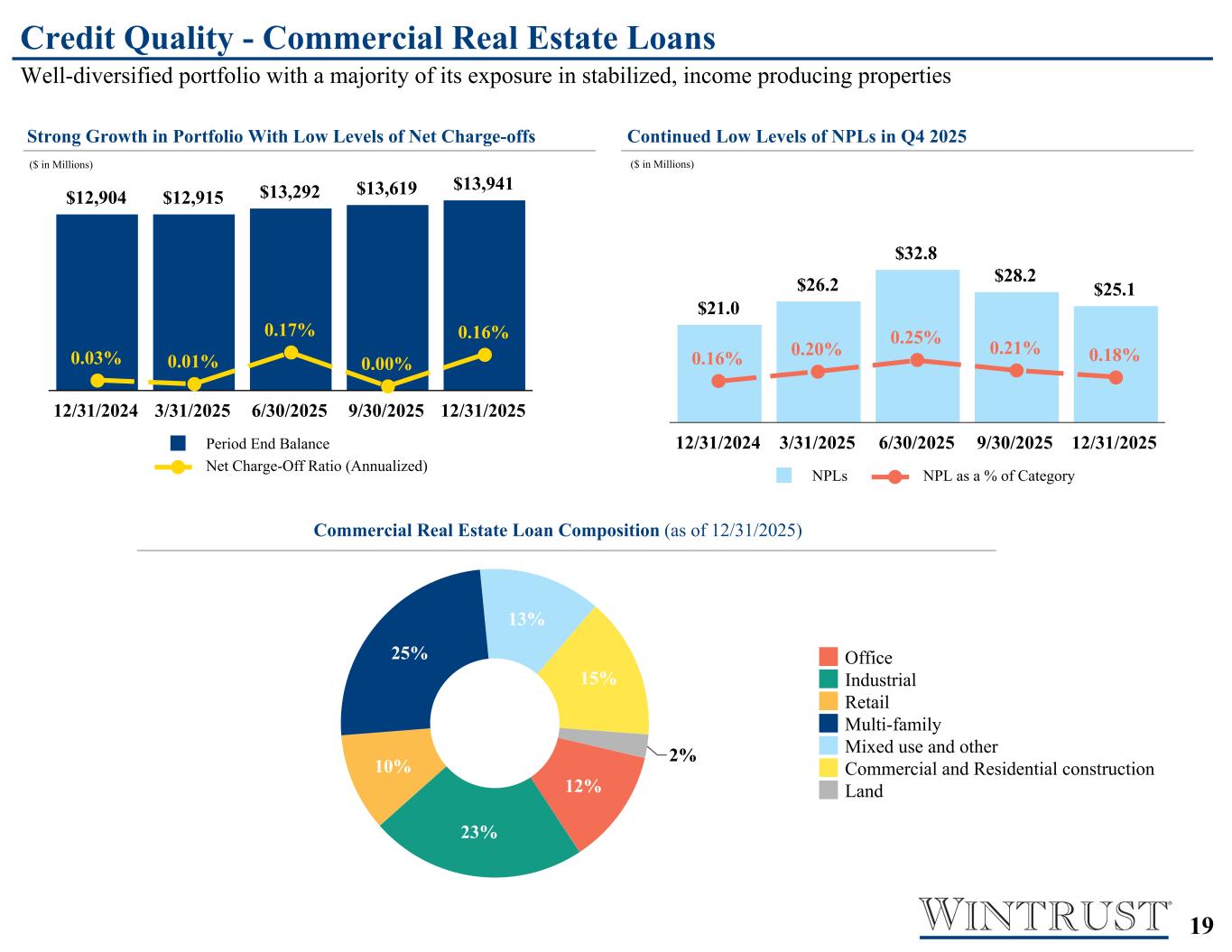

1919 $12,904 $12,915 $13,292 $13,619 $13,941 0.03% 0.01% 0.17% 0.00% 0.16% Period End Balance Net Charge-Off Ratio (Annualized) 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $21.0 $26.2 $32.8 $28.2 $25.1 0.16% 0.20% 0.25% 0.21% 0.18% NPLs NPL as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 215.7 215.7 224.4 230.5 246.9 1.67% 1.67% 1.69% 1.69% 1.77% Calculated Allowance Allowance as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 12% 23% 10% 25% 13% 15% 2% Office Industrial Retail Multi-family Mixed use and other Commercial and Residential construction Land Credit Quality - Commercial Real Estate Loans Well-diversified portfolio with a majority of its exposure in stabilized, income producing properties Continued Low Levels of NPLs in Q4 2025 Strong Growth in Portfolio With Low Levels of Net Charge-offs ($ in Millions) ($ in Millions) Ample Allowance Levels to Protect Against Potential Future Market Pressure Commercial Real Estate Loan Composition (as of 12/31/2025) ($ in Millions)

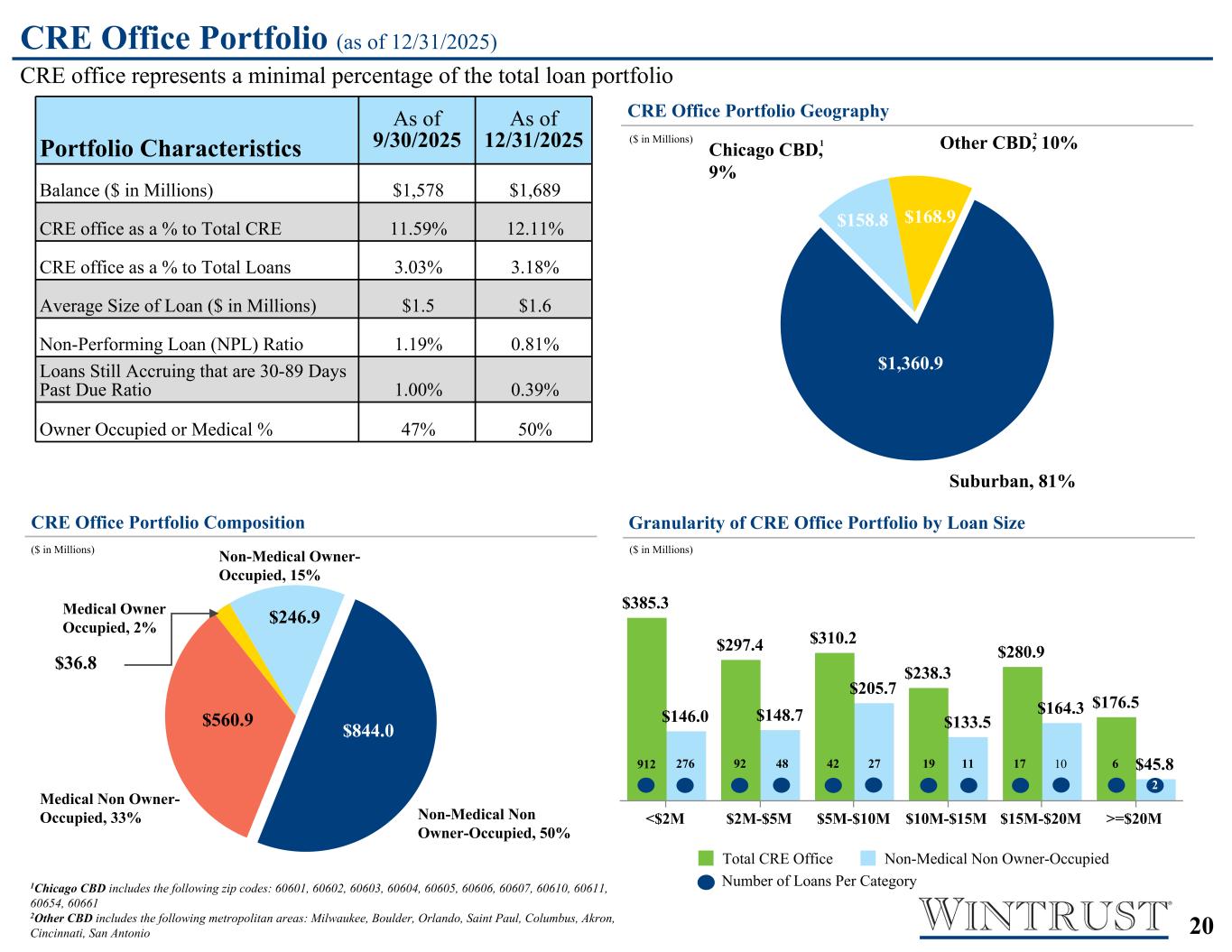

2020 Chicago CBD, 9% Other CBD, 10% Suburban, 81% $385.3 $297.4 $310.2 $238.3 $280.9 $176.5 $146.0 $148.7 $205.7 $133.5 $164.3 $45.8 Total CRE Office Non-Medical Non Owner-Occupied <$2M $2M-$5M $5M-$10M $10M-$15M $15M-$20M >=$20M Medical Non Owner- Occupied, 33% Medical Owner Occupied, 2% Non-Medical Owner- Occupied, 15% Non-Medical Non Owner-Occupied, 50% 1Chicago CBD includes the following zip codes: 60601, 60602, 60603, 60604, 60605, 60606, 60607, 60610, 60611, 60654, 60661 2Other CBD includes the following metropolitan areas: Milwaukee, Boulder, Orlando, Saint Paul, Columbus, Akron, Cincinnati, San Antonio 1 2 $1,360.9 $168.9$158.8 $844.0 $246.9 $560.9 276912 92 48 42 27 19 11 17 10 6 2 Number of Loans Per Category CRE Office Portfolio (as of 12/31/2025) CRE office represents a minimal percentage of the total loan portfolio CRE Office Portfolio Geography ($ in Millions) CRE Office Portfolio Composition Granularity of CRE Office Portfolio by Loan Size ($ in Millions) ($ in Millions) <$2M $2M-$5M $5M-$10M $10M-$15M $15M-$20M >=$20M # of Loans CRE 912 92 42 19 17 6 Non Med 276 48 27 11 10 2 Portfolio Characteristics As of 9/30/2025 As of 12/31/2025 Balance ($ in Millions) $1,578 $1,689 CRE office as a % to Total CRE 11.59% 12.11% CRE office as a % to Total Loans 3.03% 3.18% Average Size of Loan ($ in Millions) $1.5 $1.6 Non-Performing Loan (NPL) Ratio 1.19% 0.81% Loans Still Accruing that are 30-89 Days Past Due Ratio 1.00% 0.39% Owner Occupied or Medical % 47% 50% $36.8 Manual Input - Data Comes from Mario's Team Medical $ 560.9 Medical Owner Occupied $ 36.8 Non-Medical Owner-Occupied $ 246.9 Non-Medical Non Owner- Occupied $ 844.0 Chicago CBD $ 158.8 Other CBD $ 168.9 Suburban $ 1,360.9 Total $ 1,688.6 PENDING

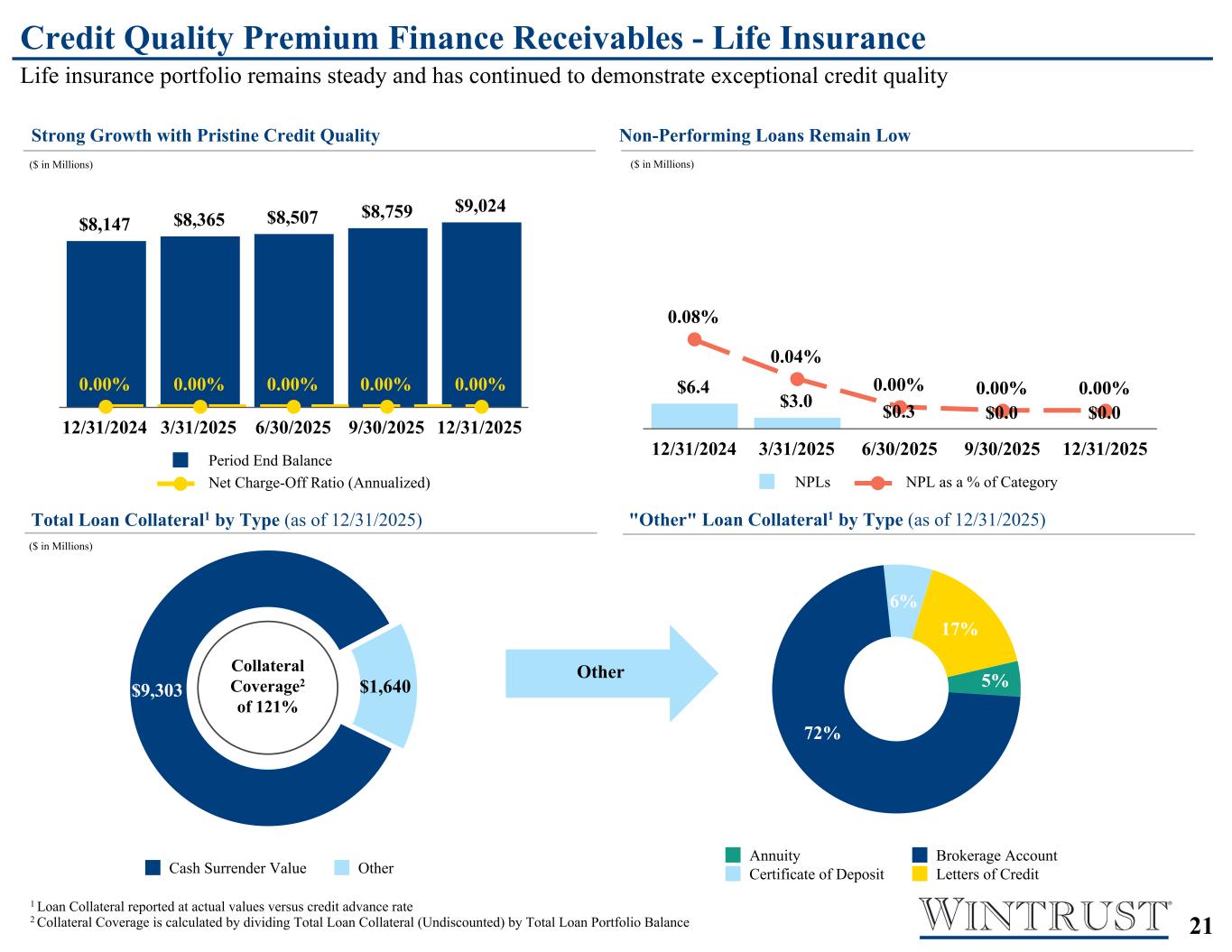

2121 Manual Input - Data comes from Dominic Sarro $6.4 $3.0 $0.3 $0.0 $0.0 0.08% 0.04% 0.00% 0.00% 0.00% NPLs NPL as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $9,303 $1,640 Cash Surrender Value Other $8,147 $8,365 $8,507 $8,759 $9,024 0.00% 0.00% 0.00% 0.00% 0.00% Period End Balance Net Charge-Off Ratio (Annualized) 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 1 Loan Collateral reported at actual values versus credit advance rate 2 Collateral Coverage is calculated by dividing Total Loan Collateral (Undiscounted) by Total Loan Portfolio Balance 5% 72% 6% 17% Annuity Brokerage Account Certificate of Deposit Letters of Credit OtherCollateral Coverage2 of 121% Credit Quality Premium Finance Receivables - Life Insurance Life insurance portfolio remains steady and has continued to demonstrate exceptional credit quality Non-Performing Loans Remain LowStrong Growth with Pristine Credit Quality ($ in Millions) ($ in Millions) Total Loan Collateral1 by Type (as of 12/31/2025) "Other" Loan Collateral1 by Type (as of 12/31/2025) ($ in Millions) Pending

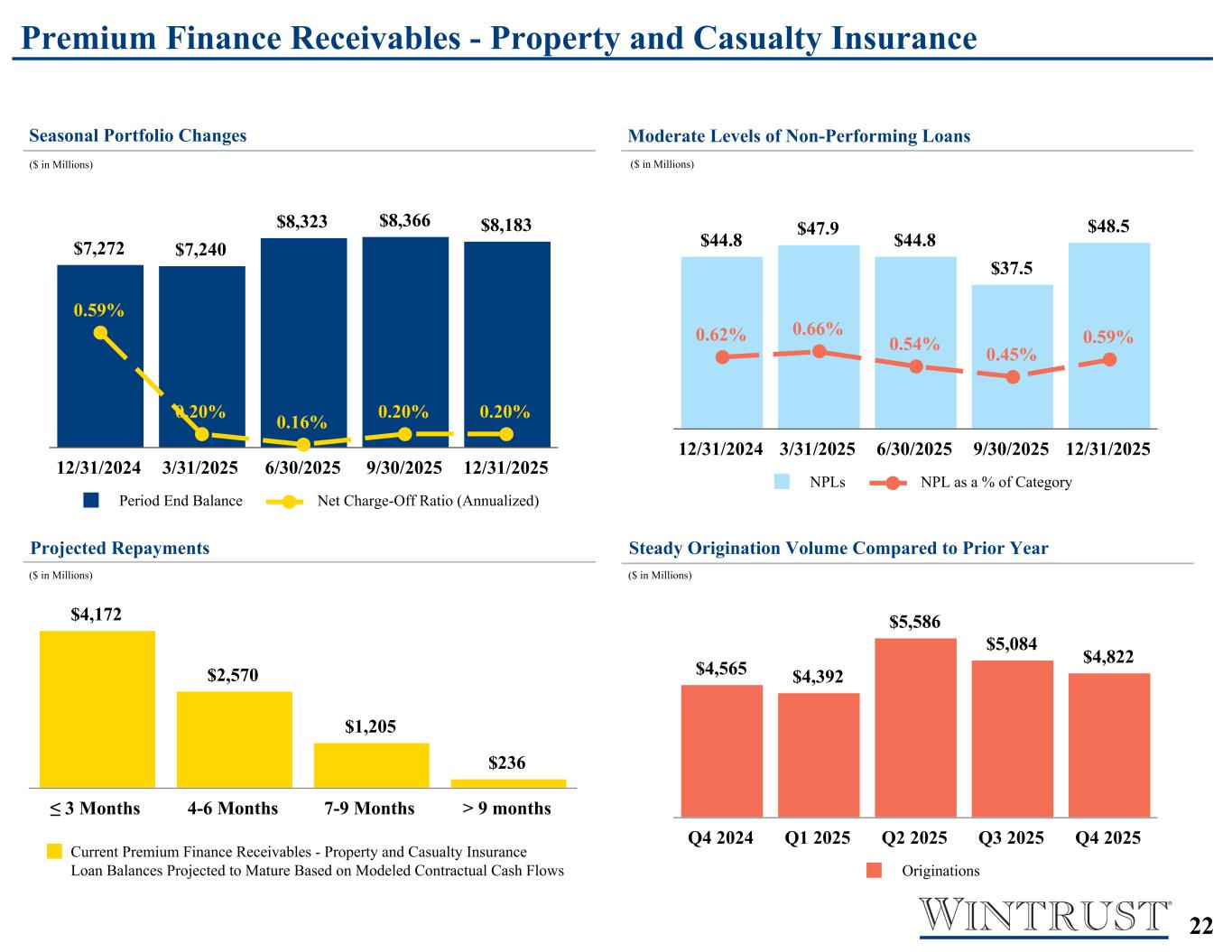

2222 Moderate Levels of Non-Performing LoansSeasonal Portfolio Changes $7,272 $7,240 $8,323 $8,366 $8,183 0.59% 0.20% 0.16% 0.20% 0.20% Period End Balance Net Charge-Off Ratio (Annualized) 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $4,565 $4,392 $5,586 $5,084 $4,822 Originations Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 $44.8 $47.9 $44.8 $37.5 $48.5 0.62% 0.66% 0.54% 0.45% 0.59% NPLs NPL as a % of Category 12/31/2024 3/31/2025 6/30/2025 9/30/2025 12/31/2025 $4,172 $2,570 $1,205 $236 Current Premium Finance Receivables - Property and Casualty Insurance Loan Balances Projected to Mature Based on Modeled Contractual Cash Flows ≤ 3 Months 4-6 Months 7-9 Months > 9 months Premium Finance Receivables - Property and Casualty Insurance ($ in Millions) ($ in Millions) Projected Repayments Steady Origination Volume Compared to Prior Year ($ in Millions) ($ in Millions) Manual Input - Data comes from Mark B Manual Input - Data comes from Thanos Polyzois and Matt for Canada Pending Pending 1 16/30/2024 Balances are net of approximately $698MM loan sale

2323 Appendix

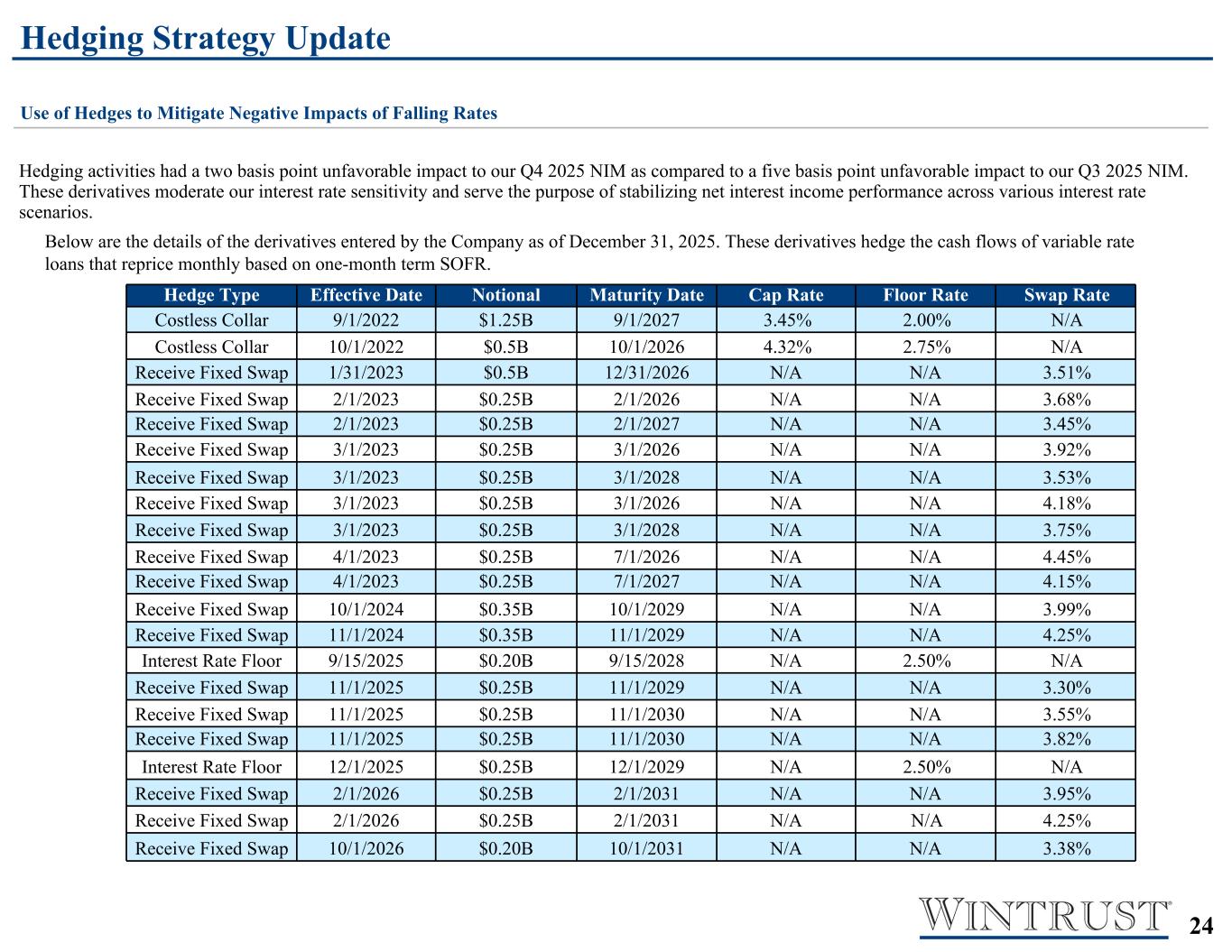

2424 Hedging activities had a two basis point unfavorable impact to our Q4 2025 NIM as compared to a five basis point unfavorable impact to our Q3 2025 NIM. These derivatives moderate our interest rate sensitivity and serve the purpose of stabilizing net interest income performance across various interest rate scenarios. Hedge Type Effective Date Notional Maturity Date Cap Rate Floor Rate Swap Rate Costless Collar 9/1/2022 $1.25B 9/1/2027 3.45% 2.00% N/A Costless Collar 10/1/2022 $0.5B 10/1/2026 4.32% 2.75% N/A Receive Fixed Swap 1/31/2023 $0.5B 12/31/2026 N/A N/A 3.51% Receive Fixed Swap 2/1/2023 $0.25B 2/1/2026 N/A N/A 3.68% Receive Fixed Swap 2/1/2023 $0.25B 2/1/2027 N/A N/A 3.45% Receive Fixed Swap 3/1/2023 $0.25B 3/1/2026 N/A N/A 3.92% Receive Fixed Swap 3/1/2023 $0.25B 3/1/2028 N/A N/A 3.53% Receive Fixed Swap 3/1/2023 $0.25B 3/1/2026 N/A N/A 4.18% Receive Fixed Swap 3/1/2023 $0.25B 3/1/2028 N/A N/A 3.75% Receive Fixed Swap 4/1/2023 $0.25B 7/1/2026 N/A N/A 4.45% Receive Fixed Swap 4/1/2023 $0.25B 7/1/2027 N/A N/A 4.15% Receive Fixed Swap 10/1/2024 $0.35B 10/1/2029 N/A N/A 3.99% Receive Fixed Swap 11/1/2024 $0.35B 11/1/2029 N/A N/A 4.25% Interest Rate Floor 9/15/2025 $0.20B 9/15/2028 N/A 2.50% N/A Receive Fixed Swap 11/1/2025 $0.25B 11/1/2029 N/A N/A 3.30% Receive Fixed Swap 11/1/2025 $0.25B 11/1/2030 N/A N/A 3.55% Receive Fixed Swap 11/1/2025 $0.25B 11/1/2030 N/A N/A 3.82% Interest Rate Floor 12/1/2025 $0.25B 12/1/2029 N/A 2.50% N/A Receive Fixed Swap 2/1/2026 $0.25B 2/1/2031 N/A N/A 3.95% Receive Fixed Swap 2/1/2026 $0.25B 2/1/2031 N/A N/A 4.25% Receive Fixed Swap 10/1/2026 $0.20B 10/1/2031 N/A N/A 3.38% Below are the details of the derivatives entered by the Company as of December 31, 2025. These derivatives hedge the cash flows of variable rate loans that reprice monthly based on one-month term SOFR. Hedging Strategy Update Use of Hedges to Mitigate Negative Impacts of Falling Rates Manual Input - To Confirm with Joel

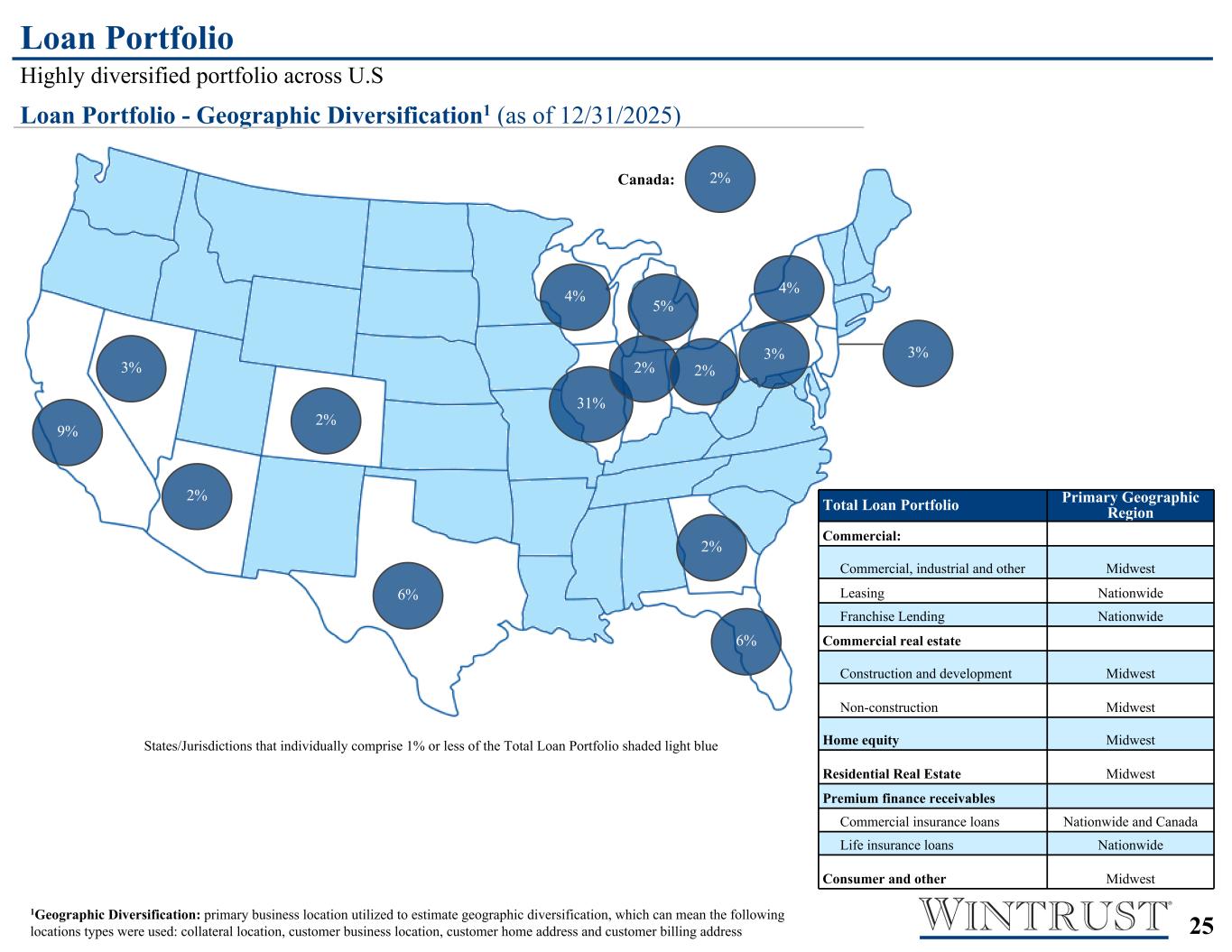

2525 1Geographic Diversification: primary business location utilized to estimate geographic diversification, which can mean the following locations types were used: collateral location, customer business location, customer home address and customer billing address States/Jurisdictions that individually comprise 1% or less of the Total Loan Portfolio shaded light blue Loan Portfolio Highly diversified portfolio across U.S Loan Portfolio - Geographic Diversification1 (as of 12/31/2025) 31% 9% 6% 6% 4% 4% 3% 2% 2% 2% 3% 2%Canada: Total Loan Portfolio Primary Geographic Region Commercial: Commercial, industrial and other Midwest Leasing Nationwide Franchise Lending Nationwide Commercial real estate Construction and development Midwest Non-construction Midwest Home equity Midwest Residential Real Estate Midwest Premium finance receivables Commercial insurance loans Nationwide and Canada Life insurance loans Nationwide Consumer and other Midwest 2% 1.4% 1.5% 5% 3% Pending 2%

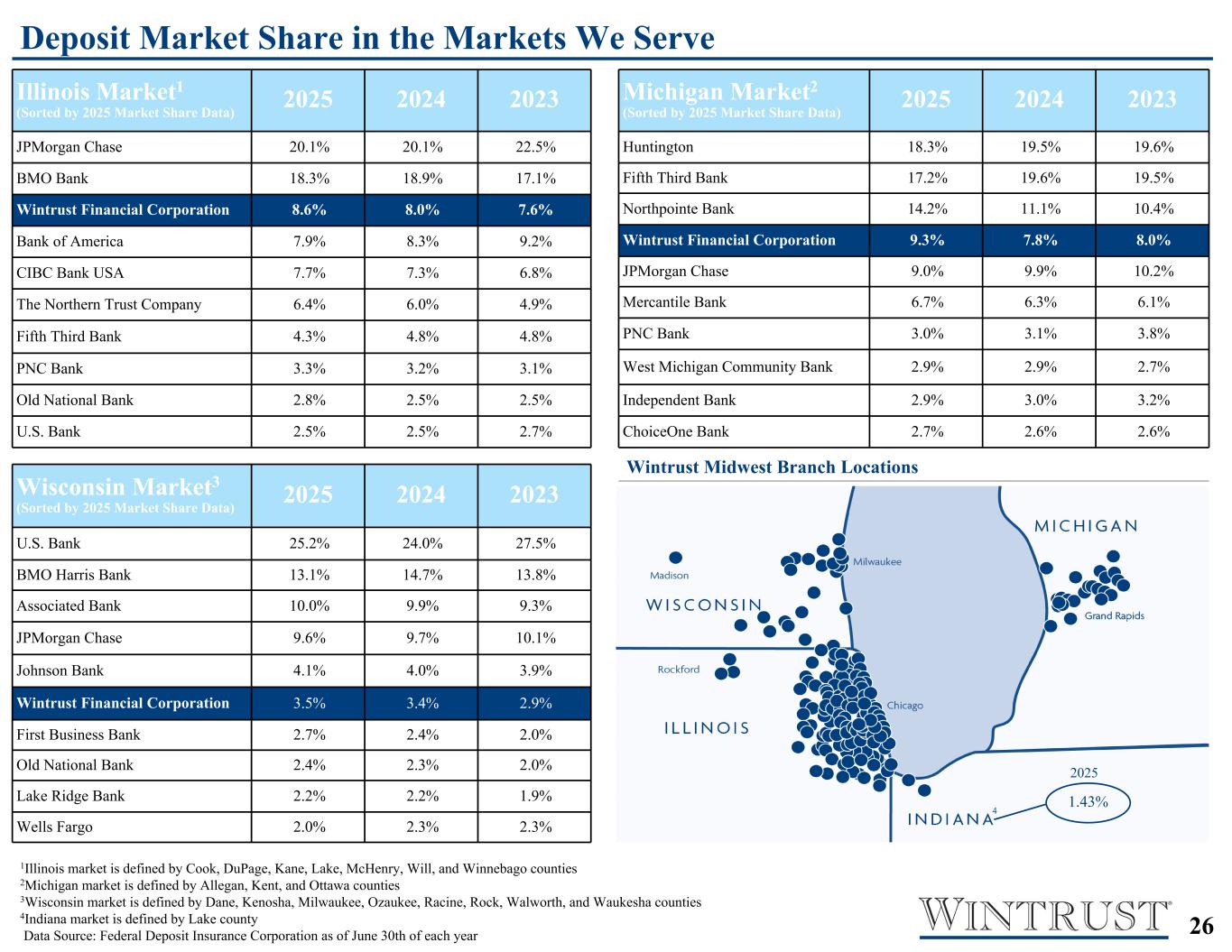

2626 Illinois Market1 (Sorted by 2025 Market Share Data) 2025 2024 2023 JPMorgan Chase 20.1% 20.1% 22.5% BMO Bank 18.3% 18.9% 17.1% Wintrust Financial Corporation 8.6% 8.0% 7.6% Bank of America 7.9% 8.3% 9.2% CIBC Bank USA 7.7% 7.3% 6.8% The Northern Trust Company 6.4% 6.0% 4.9% Fifth Third Bank 4.3% 4.8% 4.8% PNC Bank 3.3% 3.2% 3.1% Old National Bank 2.8% 2.5% 2.5% U.S. Bank 2.5% 2.5% 2.7% Data Source: Federal Deposit Insurance Corporation as of June 30th of each year Deposit Market Share in the Markets We Serve Wisconsin Market3 (Sorted by 2025 Market Share Data) 2025 2024 2023 U.S. Bank 25.2% 24.0% 27.5% BMO Harris Bank 13.1% 14.7% 13.8% Associated Bank 10.0% 9.9% 9.3% JPMorgan Chase 9.6% 9.7% 10.1% Johnson Bank 4.1% 4.0% 3.9% Wintrust Financial Corporation 3.5% 3.4% 2.9% First Business Bank 2.7% 2.4% 2.0% Old National Bank 2.4% 2.3% 2.0% Lake Ridge Bank 2.2% 2.2% 1.9% Wells Fargo 2.0% 2.3% 2.3% Michigan Market2 (Sorted by 2025 Market Share Data) 2025 2024 2023 Huntington 18.3% 19.5% 19.6% Fifth Third Bank 17.2% 19.6% 19.5% Northpointe Bank 14.2% 11.1% 10.4% Wintrust Financial Corporation 9.3% 7.8% 8.0% JPMorgan Chase 9.0% 9.9% 10.2% Mercantile Bank 6.7% 6.3% 6.1% PNC Bank 3.0% 3.1% 3.8% West Michigan Community Bank 2.9% 2.9% 2.7% Independent Bank 2.9% 3.0% 3.2% ChoiceOne Bank 2.7% 2.6% 2.6% *Map Source: S&P Capital IQ 1Illinois market is defined by Cook, DuPage, Kane, Lake, McHenry, Will, and Winnebago counties 2Michigan market is defined by Allegan, Kent, and Ottawa counties 3Wisconsin market is defined by Dane, Kenosha, Milwaukee, Ozaukee, Racine, Rock, Walworth, and Waukesha counties 4Indiana market is defined by Lake county Data Source: Federal Deposit Insurance Corporation as of June 30th of each year Wintrust Midwest Branch Locations 1.43% 1.43% 2025 4

2727 Selected Wintrust Awards Q4 2025 - Wintrust Awards Year-to-Date Wintrust continues to be recognized for its Different Approach to banking. J.D. Power ranked Wintrust Community Banks #1 in Illinois for Retail banking Customer Satisfaction • Scored highest by customers as Most trusted Retail Bank in Illinois for four straight years • Customers also rated Wintrust Community Banks #1 for convenience, value, and account offerings 14 Coalition Greenwich Best Bank Awards for Middle Market • 10th consecutive year of recognition • Wintrust also received the Best Bank - Overall Satisfaction Award in National and Regional markets • These awards demonstrate Wintrust's strong client relationships and commitment to excellence For J.D. Power 2025 award information, visit jdpower.com/awards American Banker for 2025 Top Banks by Reputation • Ranked 6th as Wintrust enters the 2025 ranking for the first time with a score of 82.9, reflecting its growing regional presence Pending

2828 Abbreviation Definition AUA Assets Under Administration BOLI Bank Owned Life Insurance BP Basis Point BV Book Value per Common Share CBD Central Business District CET1 Ratio Common Equity Tier 1 Capital Ratio CRE Commercial Real Estate Diluted EPS Net Income per Common Share - Diluted FDIC Federal Deposit Insurance Corporation GAAP Generally Accepted Accounting Principles HOA Homeowners Association Interest Bearing Cash Total Interest-Bearing Deposits with Banks, Securities Purchased under Resale Agreements and Cash Equivalents MSA Metropolitan Statistical Area MSR Mortgage Servicing Right NCO Net Charge Off NII Net Interest Income NIM Net Interest Margin Non-GAAP For non-GAAP metrics, see the reconciliation in the Appendix NPA Non-Performing Asset NPL Non-Performing Loan PFR Premium Finance Receivables PTPP Pre-Tax, Pre-Provision Income RBA Retirement Benefits Advisors ROA Return on Assets ROE Return on Average Common Equity ROTCE Return on Average Tangible Common Equity RWA Risk-Weighted Asset SOFR Secured Overnight Financing Rate TA Total Assets TBV Tangible Book Value TBVPCS Tangible Book Value Per Common Share Glossary

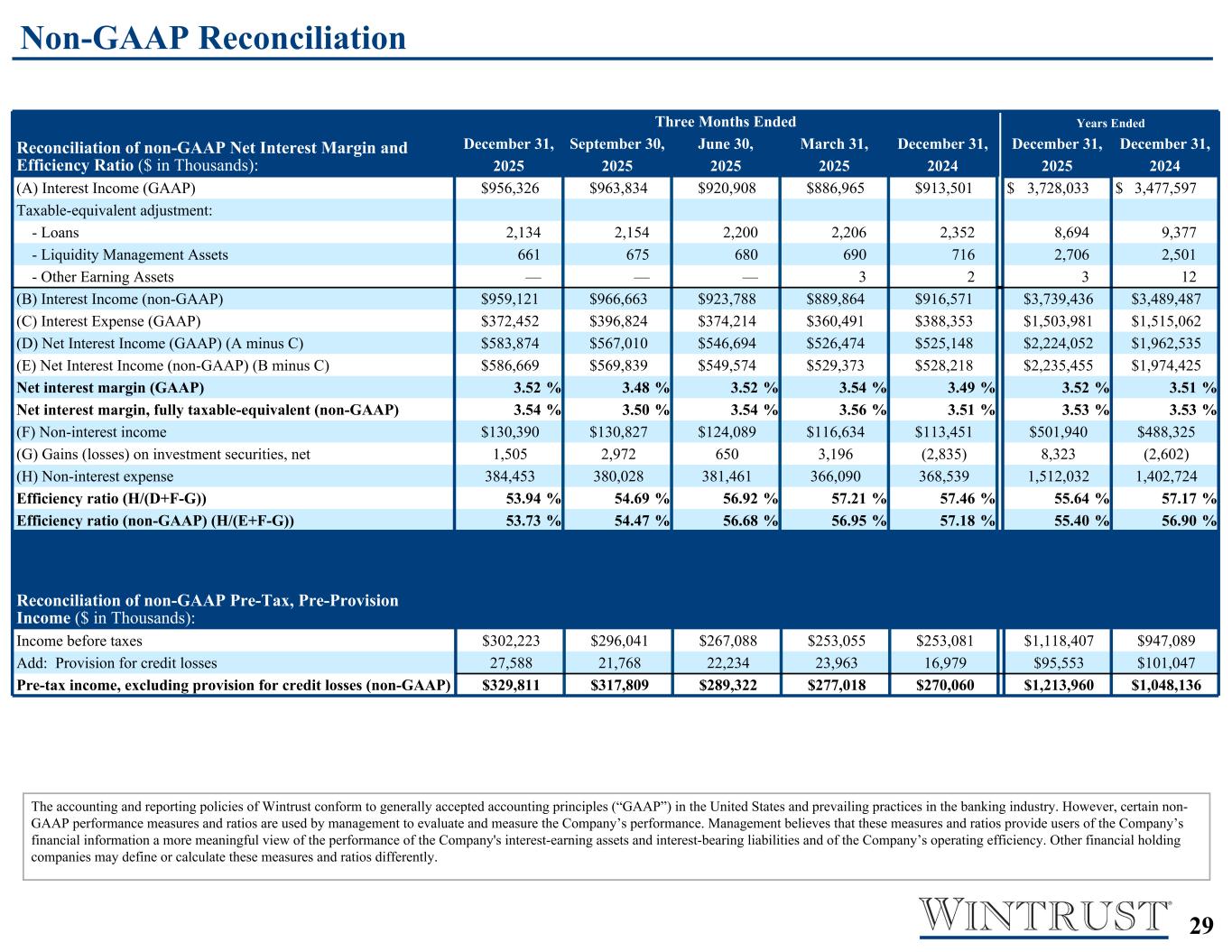

2929 Three Months Ended Years Ended Reconciliation of non-GAAP Net Interest Margin and Efficiency Ratio ($ in Thousands): December 31, September 30, June 30, March 31, December 31, December 31, December 31, 2025 2025 2025 2025 2024 2025 2024 (A) Interest Income (GAAP) $956,326 $963,834 $920,908 $886,965 $913,501 $ 3,728,033 $ 3,477,597 Taxable-equivalent adjustment: - Loans 2,134 2,154 2,200 2,206 2,352 8,694 9,377 - Liquidity Management Assets 661 675 680 690 716 2,706 2,501 - Other Earning Assets — — — 3 2 3 12 (B) Interest Income (non-GAAP) $959,121 $966,663 $923,788 $889,864 $916,571 $3,739,436 $3,489,487 (C) Interest Expense (GAAP) $372,452 $396,824 $374,214 $360,491 $388,353 $1,503,981 $1,515,062 (D) Net Interest Income (GAAP) (A minus C) $583,874 $567,010 $546,694 $526,474 $525,148 $2,224,052 $1,962,535 (E) Net Interest Income (non-GAAP) (B minus C) $586,669 $569,839 $549,574 $529,373 $528,218 $2,235,455 $1,974,425 Net interest margin (GAAP) 3.52 % 3.48 % 3.52 % 3.54 % 3.49 % 3.52 % 3.51 % Net interest margin, fully taxable-equivalent (non-GAAP) 3.54 % 3.50 % 3.54 % 3.56 % 3.51 % 3.53 % 3.53 % (F) Non-interest income $130,390 $130,827 $124,089 $116,634 $113,451 $501,940 $488,325 (G) Gains (losses) on investment securities, net 1,505 2,972 650 3,196 (2,835) 8,323 (2,602) (H) Non-interest expense 384,453 380,028 381,461 366,090 368,539 1,512,032 1,402,724 Efficiency ratio (H/(D+F-G)) 53.94 % 54.69 % 56.92 % 57.21 % 57.46 % 55.64 % 57.17 % Efficiency ratio (non-GAAP) (H/(E+F-G)) 53.73 % 54.47 % 56.68 % 56.95 % 57.18 % 55.40 % 56.90 % The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently. Reconciliation of non-GAAP Pre-Tax, Pre-Provision Income ($ in Thousands): Income before taxes $302,223 $296,041 $267,088 $253,055 $253,081 $1,118,407 $947,089 Add: Provision for credit losses 27,588 21,768 22,234 23,963 16,979 $95,553 $101,047 Pre-tax income, excluding provision for credit losses (non-GAAP) $329,811 $317,809 $289,322 $277,018 $270,060 $1,213,960 $1,048,136 Non-GAAP Reconciliation

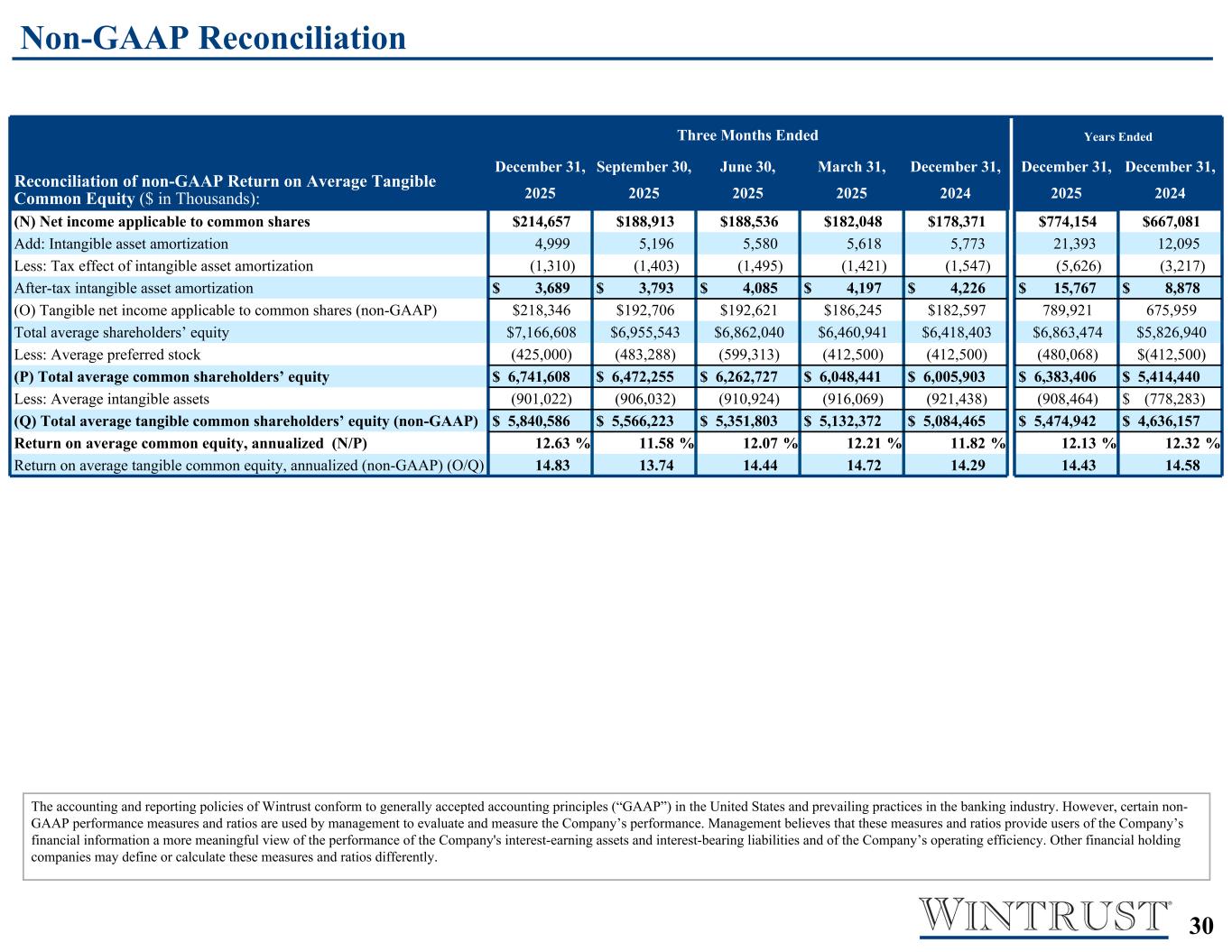

3030 Reconciliation of Non-GAAP Pre-Tax, Pre-Provision Income ($ in Thousands): Income before taxes $ 302,223 $ 296,041 $ 267,088 $ 253,055 $ 253,081 $ 1,118,407 $ 947,089 Add: Provision for credit losses 27,588 21,768 22,234 23,963 16,979 95,553 101,047 Pre-tax income, excluding provision for credit losses (non-GAAP) $ 329,811 $ 317,809 $ 289,322 $ 277,018 $ 270,060 $ 1,213,960 $ 1,048,136 Three Months Ended Years Ended Reconciliation of non-GAAP Return on Average Tangible Common Equity ($ in Thousands): December 31, September 30, June 30, March 31, December 31, December 31, December 31, 2025 2025 2025 2025 2024 2025 2024 (N) Net income applicable to common shares $214,657 $188,913 $188,536 $182,048 $178,371 $774,154 $667,081 Add: Intangible asset amortization 4,999 5,196 5,580 5,618 5,773 21,393 12,095 Less: Tax effect of intangible asset amortization (1,310) (1,403) (1,495) (1,421) (1,547) (5,626) (3,217) After-tax intangible asset amortization $ 3,689 $ 3,793 $ 4,085 $ 4,197 $ 4,226 $ 15,767 $ 8,878 (O) Tangible net income applicable to common shares (non-GAAP) $218,346 $192,706 $192,621 $186,245 $182,597 789,921 675,959 Total average shareholders’ equity $7,166,608 $6,955,543 $6,862,040 $6,460,941 $6,418,403 $6,863,474 $5,826,940 Less: Average preferred stock (425,000) (483,288) (599,313) (412,500) (412,500) (480,068) $(412,500) (P) Total average common shareholders’ equity $ 6,741,608 $ 6,472,255 $ 6,262,727 $ 6,048,441 $ 6,005,903 $ 6,383,406 $ 5,414,440 Less: Average intangible assets (901,022) (906,032) (910,924) (916,069) (921,438) (908,464) $ (778,283) (Q) Total average tangible common shareholders’ equity (non-GAAP) $ 5,840,586 $ 5,566,223 $ 5,351,803 $ 5,132,372 $ 5,084,465 $ 5,474,942 $ 4,636,157 Return on average common equity, annualized (N/P) 12.63 % 11.58 % 12.07 % 12.21 % 11.82 % 12.13 % 12.32 % Return on average tangible common equity, annualized (non-GAAP) (O/Q) 14.83 13.74 14.44 14.72 14.29 14.43 14.58 The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently. Non-GAAP Reconciliation

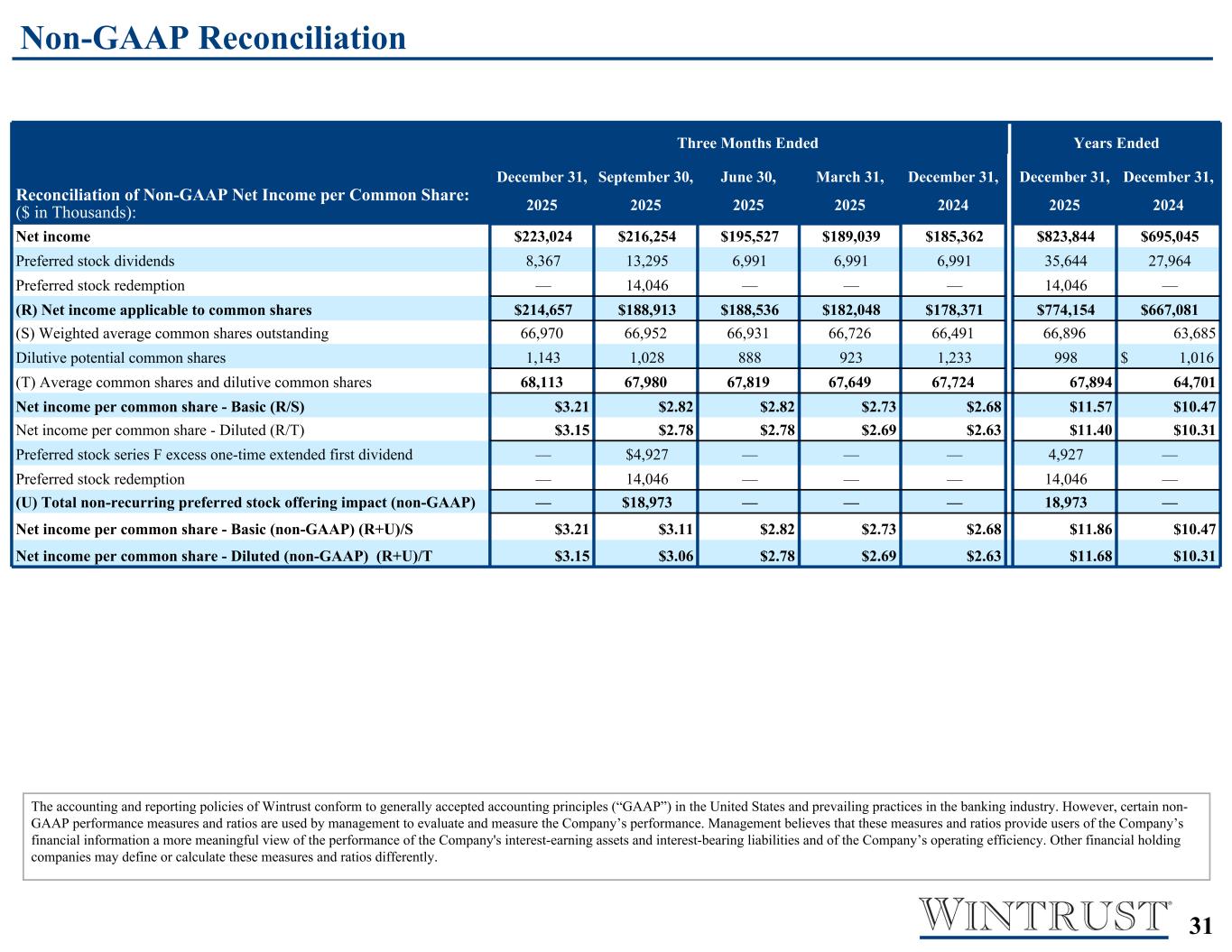

3131 Reconciliation of Non-GAAP Pre-Tax, Pre-Provision Income ($ in Thousands): Income before taxes $ 302,223 $ 296,041 $ 267,088 $ 253,055 $ 253,081 $ 1,118,407 $ 947,089 Add: Provision for credit losses 27,588 21,768 22,234 23,963 16,979 95,553 101,047 Pre-tax income, excluding provision for credit losses (non-GAAP) $ 329,811 $ 317,809 $ 289,322 $ 277,018 $ 270,060 $ 1,213,960 $ 1,048,136 Three Months Ended Years Ended Reconciliation of Non-GAAP Net Income per Common Share: ($ in Thousands): December 31, September 30, June 30, March 31, December 31, December 31, December 31, 2025 2025 2025 2025 2024 2025 2024 Net income $223,024 $216,254 $195,527 $189,039 $185,362 $823,844 $695,045 Preferred stock dividends 8,367 13,295 6,991 6,991 6,991 35,644 27,964 Preferred stock redemption — 14,046 — — — 14,046 — (R) Net income applicable to common shares $214,657 $188,913 $188,536 $182,048 $178,371 $774,154 $667,081 (S) Weighted average common shares outstanding 66,970 66,952 66,931 66,726 66,491 66,896 63,685 Dilutive potential common shares 1,143 1,028 888 923 1,233 998 $ 1,016 (T) Average common shares and dilutive common shares 68,113 67,980 67,819 67,649 67,724 67,894 64,701 Net income per common share - Basic (R/S) $3.21 $2.82 $2.82 $2.73 $2.68 $11.57 $10.47 Net income per common share - Diluted (R/T) $3.15 $2.78 $2.78 $2.69 $2.63 $11.40 $10.31 Preferred stock series F excess one-time extended first dividend — $4,927 — — — 4,927 — Preferred stock redemption — 14,046 — — — 14,046 — (U) Total non-recurring preferred stock offering impact (non-GAAP) — $18,973 — — — 18,973 — Net income per common share - Basic (non-GAAP) (R+U)/S $3.21 $3.11 $2.82 $2.73 $2.68 $11.86 $10.47 Net income per common share - Diluted (non-GAAP) (R+U)/T $3.15 $3.06 $2.78 $2.69 $2.63 $11.68 $10.31 The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently. Non-GAAP Reconciliation

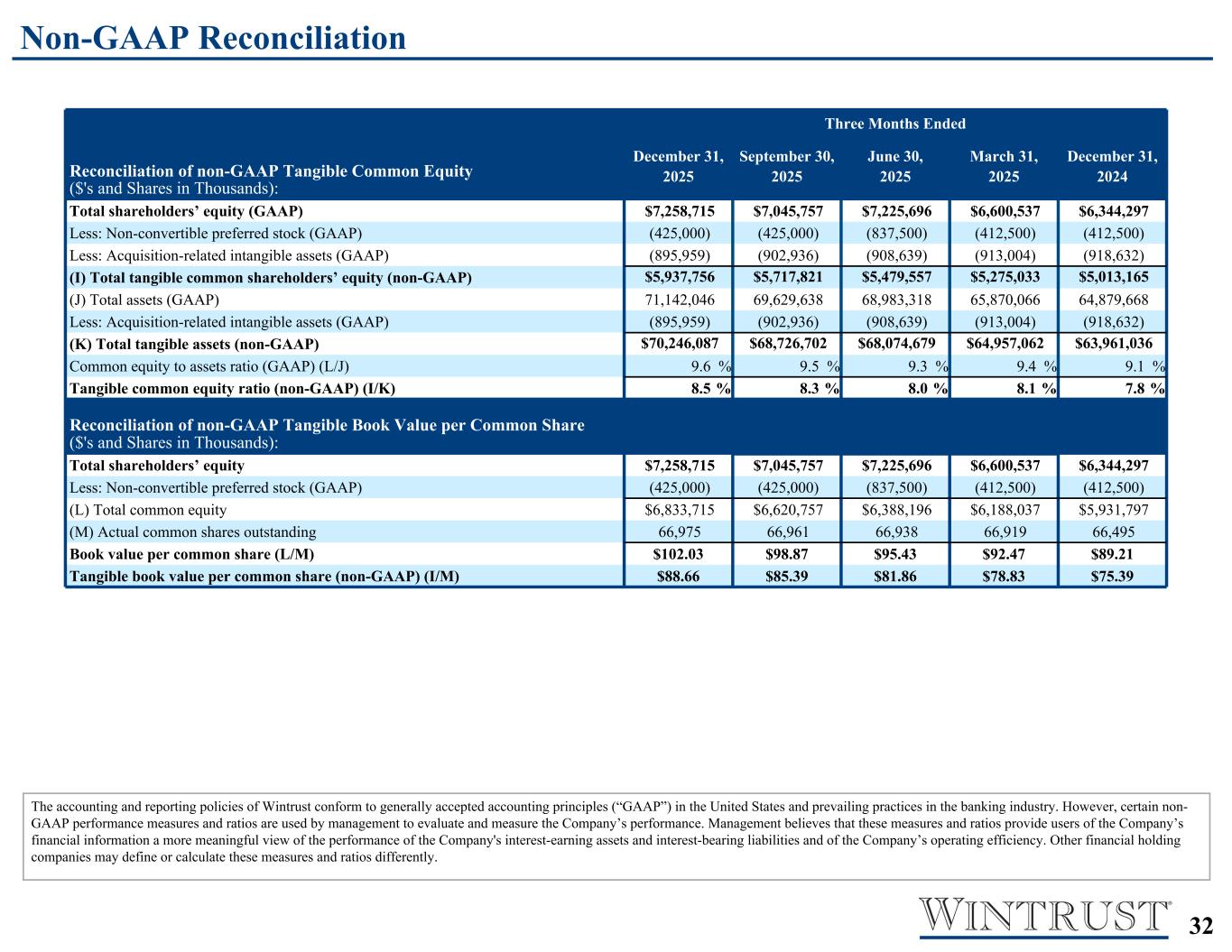

3232 Three Months Ended Reconciliation of non-GAAP Tangible Common Equity ($'s and Shares in Thousands): December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 Total shareholders’ equity (GAAP) $7,258,715 $7,045,757 $7,225,696 $6,600,537 $6,344,297 Less: Non-convertible preferred stock (GAAP) (425,000) (425,000) (837,500) (412,500) (412,500) Less: Acquisition-related intangible assets (GAAP) (895,959) (902,936) (908,639) (913,004) (918,632) (I) Total tangible common shareholders’ equity (non-GAAP) $5,937,756 $5,717,821 $5,479,557 $5,275,033 $5,013,165 (J) Total assets (GAAP) 71,142,046 69,629,638 68,983,318 65,870,066 64,879,668 Less: Acquisition-related intangible assets (GAAP) (895,959) (902,936) (908,639) (913,004) (918,632) (K) Total tangible assets (non-GAAP) $70,246,087 $68,726,702 $68,074,679 $64,957,062 $63,961,036 Common equity to assets ratio (GAAP) (L/J) 9.6 % 9.5 % 9.3 % 9.4 % 9.1 % Tangible common equity ratio (non-GAAP) (I/K) 8.5 % 8.3 % 8.0 % 8.1 % 7.8 % Reconciliation of non-GAAP Tangible Book Value per Common Share ($'s and Shares in Thousands): Total shareholders’ equity $7,258,715 $7,045,757 $7,225,696 $6,600,537 $6,344,297 Less: Non-convertible preferred stock (GAAP) (425,000) (425,000) (837,500) (412,500) (412,500) (L) Total common equity $6,833,715 $6,620,757 $6,388,196 $6,188,037 $5,931,797 (M) Actual common shares outstanding 66,975 66,961 66,938 66,919 66,495 Book value per common share (L/M) $102.03 $98.87 $95.43 $92.47 $89.21 Tangible book value per common share (non-GAAP) (I/M) $88.66 $85.39 $81.86 $78.83 $75.39 Reconciliation of Non-GAAP Return on Average Tangible Common Equity: ($'s and Shares in Thousands): December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 (N) Net income applicable to common shares $ 173,207 $ 137,826 $ 1,492 $ 1,579 $ 120,400 Add: Acquisition-related intangible asset amortization 1,235 1,436 $ (425) $ (445) 1,609 Less: Tax effect of acquisition-related intangible asset amortization (321) (370) 1067000 1,134 (430) After-tax Acquisition-related intangible asset amortization $ 914 $ 1,066 137,037 88,656 $ 1,179 (O) Tangible net income applicable to common shares (non-GAAP) $ 174,121 $ 138,892 $ 4,795,387 $ 4,526,110 $ 121,579 Total average shareholders’ equity $ 4,895,271 $ 4,710,856 $ (412,500) $ (412,500) $ 4,500,460 Less: Average preferred stock (412,500) (412,500) 4,382,887 4,113,610 (412,500) (P) Total average common shareholders’ equity $ 4,482,771 $ 4,298,356 $ (678,953) $ (681,091) $ 4,087,960 Less: Average acquisition-related intangible assets (675,247) (676,371) 3,703,934 3,432,519 (682,603) (Q) Total average tangible common shareholders’ equity (non-GAAP) $ 3,807,524 $ 3,621,985 $0.12 $0.09 $ 3,405,357 Return on average common equity, annualized (N/P) 15.67 % 12.72 % 11.94 % Return on average tangible common equity, annualized (non-GAAP) (O/Q) 0.1854636737388 63 Three Months Ended Reconciliation of non-GAAP Return on Average Tangible Common Equity ($ in Thousands): December 31, September 30, June 30, March 31, December 31, 2025 2025 2025 2025 2024 (N) Net income applicable to common shares $ 214,657 $ 188,913 $ 188,536 $ 182,048 $ 178,371 Add: Intangible asset amortization $ 4,999 $ 5,196 $ 5,580 $ 5,618 5773000 Less: Tax effect of intangible asset amortization $ (1,310) $ (1,403) $ (1,495) $ (1,421) (1,547) After-tax intangible asset amortization $ 3,689 $ 3,793 $ 4,085 $ 4,197 4,226 (O) Tangible net income applicable to common shares (non-GAAP) $ 218,346 $ 192,706 $ 192,621 $ 186,245 182,597 Total average shareholders’ equity $ 7,166,608 $ 6,955,543 $ 6,862,040 $ 6,460,941 $ 6,418,403 Less: Average preferred stock $ (425,000) $ (483,288) $ (599,313) $ (412,500) $ (412,500) (P) Total average common shareholders’ equity $ 6,741,608 $ 6,472,255 $ 6,262,727 $ 6,048,441 $ 6,005,903 Less: Average intangible assets $ (901,022) $ (906,032) $ (910,924) $ (916,069) $ (921,438) (Q) Total average tangible common shareholders’ equity (non-GAAP) $5,840,586 $5,566,223 $5,351,803 $5,132,372 $5,084,465 Return on average common equity, annualized (N/P) 12.63% 11.58% 12.07% 12.21% 11.82% Return on average tangible common equity, annualized (non-GAAP) (O/Q) 14.83 13.74 14.44 14.72 14.29 Non-GAAP Reconciliation The accounting and reporting policies of Wintrust conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non- GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. Management believes that these measures and ratios provide users of the Company’s financial information a more meaningful view of the performance of the Company's interest-earning assets and interest-bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures and ratios differently.