Shaping our future: QIAGEN to join forces with Thermo Fisher QLT/QSM/QM call March 3, 2020 .3

QIAGEN agrees to be acquired by Thermo Fisher You can be proud of our achievements QIAGEN has built a global leader in molecular testing with our differentiated Sample to Insight solutions We have accomplished a lot – and we continue to solve pressing needs for our customers Together with Thermo Fisher, we can achieve even more to make improvements in life possible Promising new era with broader opportunities for us

employees 75,000 invested in R&D $1B revenue $25B We are the world leader in serving science Unmatched depth of capabilities Leading innovative technologies Deep applications expertise Premier productivity partner Comprehensive services offering Industry-leading scale Unparalleled commercial reach Unique customer access Expanding global footprint

We work to fulfill our Mission every day We enable our customers to make the world healthier, cleaner and safer Healthier Safer Cleaner Enabling hospitals and clinics to diagnose infection Responding to the Novel Coronavirus outbreak Detecting foodborne pathogens and chemical contamination

Our 4i Values are the foundation of our culture Our 4i Values guide all of our interactions with customers, suppliers, partners, and with each other Integrity Intensity Innovation Involvement Our strong culture is a key competitive advantage

The unrivaled leader in serving science, with revenues of $50 billion One of the world’s most admired companies An incredibly talented global team that brings diverse perspectives, collaborative energy and a passion to excel every day Our customer-centric culture delivers a unique value proposition and sustained competitive advantage Our unwavering commitment to innovation and to leadership in digital science enables our customers to make the world healthier, cleaner and safer An exceptional track record of consistently delivering strong financial performance Our Vision for 2030 is our future aspiration

This transaction is mutually beneficial Creates significant value for customers and employees Expands our specialty diagnostics portfolio by significantly enhancing our presence in the attractive molecular diagnostics market Complements our leading life sciences offering with innovative sample preparation, assay and bioinformatics technologies Shares our commitment to cutting-edge scientific innovation and close partnership with our customers Leverages Thermo Fisher’s industry-leading global presence and commercial reach to access a broader customer base Creates new opportunities to accelerate innovation to advance precision medicine and address emerging healthcare needs Benefits employees by creating new opportunities for career growth and development as part of the industry leader

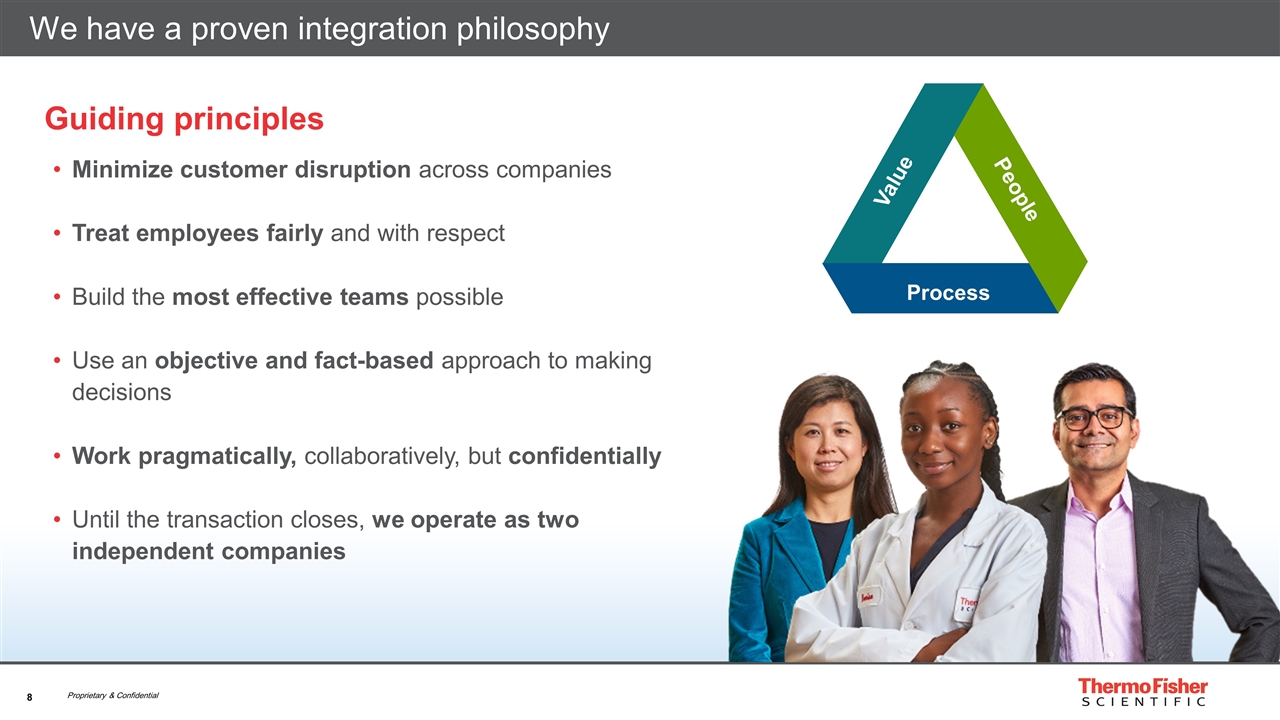

We have a proven integration philosophy Guiding principles Minimize customer disruption across companies Treat employees fairly and with respect Build the most effective teams possible Use an objective and fact-based approach to making decisions Work pragmatically, collaboratively, but confidentially Until the transaction closes, we operate as two independent companies Value People Process

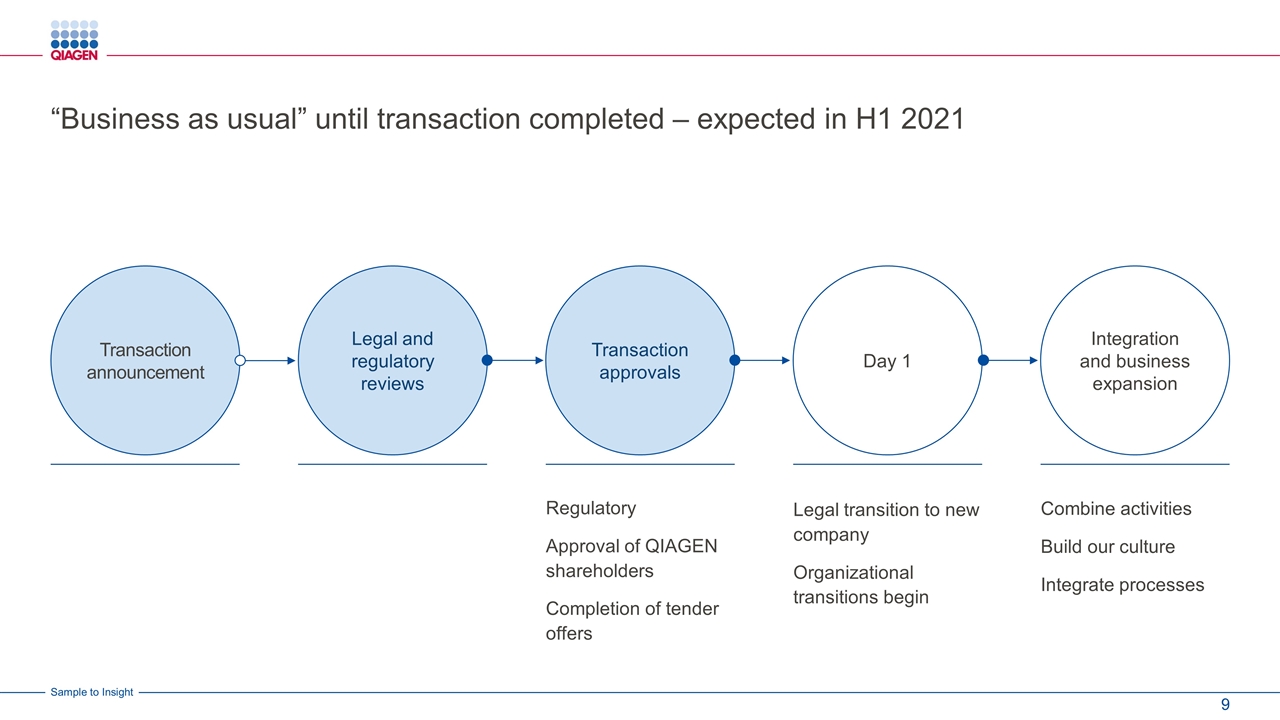

“Business as usual” until transaction completed – expected in H1 2021 Transaction announcement Legal and regulatory reviews Transaction approvals Day 1 Integration and business expansion Regulatory Approval of QIAGEN shareholders Completion of tender offers Legal transition to new company Organizational transitions begin Combine activities Build our culture Integrate processes

We will keep you updated on the process and address your questions Questions about your job and what this means for each of you are top of mind We will strive to answer your questions while also complying with disclosure regulations A lot of questions can only be answered in time Ways to access information: Talk to your line managers Get more information and feedback on your questions via Yammer, townhall meetings and conference calls

Ground rules for all employees QIAGEN and Thermo Fisher remain separate companies and must operate their businesses independently until closing, avoiding any coordinated activity or information sharing that could violate applicable competition laws This means that QIAGEN must continue operating “business as usual“ until the closing We will inform customers, commercial partners and suppliers shortly through letters and personal calls Customers of each company continue to deal with established channels at the respective companies Employees should not communicate or coordinate activities with Thermo Fisher until after the transaction closes Inquiries and ideas about the transaction should be communicated within QIAGEN’s internal organization This especially applies to the companies’ commercial activities and business operations, which must not be discussed with Thermo Fisher Competitively sensitive information includes, among others: current or future pricing; customer contract terms; contract pipeline or future business opportunities; marketing, business, and strategic plans; and most on-public information which the business considers sensitive Employees should not discuss the acquisition with media, investors / analysts and external business stakeholders unless their job description explicitly defines that role Employees should refrain from posting about the acquisition on social media Continue to comply with QIAGEN’s Insider Trading Policy during the pendency of the transaction Media inquiries should be directed to Thomas Theuringer, questions on financials and other inquiries to John Gilardi Our Legal Team will provide further guidelines concerning appropriate interaction between the companies before closing If you have any questions regarding the foregoing, please contact Philipp von Hugo, Head of Global Legal Affairs, at philipp.hugo@qiagen.com

QIAGEN will continue to enable scientific and clinical breakthroughs for our customers …

… making improvements in life possible

Our messages for you: 1 2 3 4 QIAGEN has agreed to be acquired and join forces with Thermo Fisher We are entering an exciting new era in QIAGEN’s journey to make improvements in life A committed team will lead QIAGEN through the transition Let’s stay focused on our daily work – and deliver on our commitments for 2020

QIAGEN has a great future in joining with Thermo Fisher

Disclaimer Forward-looking Statements This communication contains forward-looking statements that involve a number of risks and uncertainties. Words such as “believes,” “anticipates,” “plans,” “expects,” “seeks,” “estimates,” and similar expressions are intended to identify forward-looking statements, but other statements that are not historical facts may also be deemed to be forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by forward-looking statements include risks and uncertainties relating to: the need to develop new products and adapt to significant technological change; implementation of strategies for improving growth; general economic conditions and related uncertainties, including the impact of public health epidemics; dependence on customers’ capital spending policies and government funding policies; the effect of economic and political conditions and exchange rate fluctuations; use and protection of intellectual property; the effect of changes in governmental regulations; and the effect of laws and regulations governing government contracts, as well as the possibility that expected benefits related to recent or pending acquisitions, including the proposed transaction, may not materialize as expected; the proposed transaction not being timely completed, if completed at all; prior to the completion of the transaction, QIAGEN’s business experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, licensees, other business partners or governmental entities; difficulty retaining key employees; the outcome of any legal proceedings related to the proposed transaction; and the parties being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all. Additional important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Thermo Fisher’s Annual Report on Form 10-K for the year ended December 31, 2019, which is on file with the U.S. Securities and Exchange Commission (“SEC”) and available in the “Investors” section of Thermo Fisher’s website, ir.thermofisher.com, under the heading “SEC Filings,” and in any subsequent Quarterly Reports on Form 10-Q and other documents Thermo Fisher files with the SEC, and in QIAGEN’s Annual Report on Form 20-F for the year ended December 31, 2019, which is on file with the SEC and available in the “Investor Relations” section of the website corporate.QIAGEN.com/investor-relations, under the heading “Financial Reports,” and in any subsequent Quarterly Reports on Form 6-K and other documents QIAGEN files or furnishes with the SEC. While Thermo Fisher or QIAGEN may elect to update forward-looking statements at some point in the future, Thermo Fisher and QIAGEN specifically disclaim any obligation to do so, even if estimates change and, therefore, you should not rely on these forward-looking statements as representing either Thermo Fisher’s or QIAGEN’s views as of any date subsequent to today. Additional Information and Where to Find it The tender offer referenced herein has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of QIAGEN or any other securities, nor is it a substitute for the tender offer materials that Thermo Fisher or its acquisition subsidiary will file with the SEC and publish in Germany. The terms and conditions of the tender offer will be published in, and the offer to purchase ordinary shares of QIAGEN will be made only pursuant to, the offer document and related offer materials prepared by Thermo Fisher and as approved by the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, “BaFin”). Once the necessary permission from BaFin has been obtained, the offer document and related offer materials will be published in Germany and also filed with the SEC in a tender offer statement on Schedule TO at the time the tender offer is commenced. QIAGEN intends to file a solicitation / recommendation statement on Schedule 14D-9 with the SEC with respect to the tender offer; in addition, QIAGEN will publish a document combining the recommendation statement pursuant to Sec. 27 of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz, WpÜG) and the position statement (gemotiveerde standpuntbepaling) pursuant to Section 18 and appendix G of the Dutch Decree on Public Takeovers (Besluit Openbare Biedingen). The offer document for the tender offer (German and English) containing the detailed terms and conditions of, and other information relating to, the tender offer will, among other things, be published on the internet at www.thermofisher.com. Acceptance of the tender offer by shareholders that are resident outside Germany and the United States may be subject to further legal requirements. With respect to the acceptance of the tender offer outside Germany and the United States, no responsibility is assumed for the compliance with such legal requirements applicable in the respective jurisdiction. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION / RECOMMENDATION STATEMENT ON SCHEDULE 14D-9, AS THEY MAY BE AMENDED FROM TIME TO TIME, AS WELL AS QIAGEN’S RECOMMENDATION STATEMENT PURSUANT TO SEC. 27 WPÜG AND position statement (gemotiveerde standpuntbepaling) pursuant to Section 18 and appendix G of the Dutch Decree on Public Takeovers (Besluit Openbare Biedingen) WILL CONTAIN IMPORTANT INFORMATION. INVESTORS AND SHAREHOLDERS OF QIAGEN ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY, AND NOT THIS DOCUMENT, WILL GOVERN THE TERMS AND CONDITIONS OF THE TENDER OFFER, AND BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SUCH PERSONS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR ORDINARY SHARES. The tender offer materials, including the offer to purchase and the related letter of transmittal and certain other tender offer documents, and the solicitation/recommendation statement (when they become available) and other documents filed with the SEC by Thermo Fisher or QIAGEN, may be obtained free of charge at the SEC’s website at www.sec.gov or at QIAGEN’s website at www.QIAGEN.com or by contacting QIAGEN’s investor relations department at +1-240-686-2222 or at Thermo Fisher’s website at www.thermofisher.com or by contacting Thermo Fisher’s investor relations department at +1-781-622-1111. In addition, Thermo Fisher’s tender offer statement and other documents it will file with the SEC will be available at www.thermofisher.com. Furthermore, copies of the offer document will also be available free of charge at the information agent to be identified in the offer document.