PROSPECTUS |

Filed Pursuant |

2,500,000 shares

Common Stock

We are offering 2,500,000 shares of our common stock, par value

$0.01 per share. Our common stock is quoted on the Nasdaq National Market under

the symbol “RSTI.” On March 23, 2004, the last reported sale

price of our

common stock on the Nasdaq National Market was $29.40 per share.

Investing in our common stock involves a

high degree of risk. Before buying any shares, you should carefully read the discussion

of material risks of investing in our common stock under the heading “Risk

Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total |

|||

| Public offering price | $ |

28.00 |

$ |

70,000,000 |

| Underwriting discounts and commissions | $ |

1.40 |

$ |

3,500,000 |

| Proceeds, before expenses, to us | $ |

26.60 |

$ |

66,500,000 |

The underwriters may also purchase from us an amount of shares of common stock

up to an additional 15% of the shares of common stock sold in the United States

as part of this offering at the public offering price, less the underwriting

discounts

and

commissions, to cover over-allotments, if any, within 30 days from the date

of this prospectus.

The underwriters are offering the shares of common stock as

set

forth under “Underwriting.” Delivery of the shares of common stock

will

be made in New York, New York on or about March 29, 2004.

UBS Investment Bank

Jesup and Lamont Securities Corporation

The date of this prospectus is March 23, 2004.

You

should rely only on information contained or incorporated by reference in this prospectus.

We have not and the underwriters have not authorized anyone to provide you with

information that is different. We are offering to sell and seeking offers to buy

shares of common stock only in jurisdictions where offers and sales are permitted.

These documents do not constitute an offer to sell or the solicitation of an offer

to buy these shares of common stock in any circumstance under which the offer or

solicitation is unlawful. The information contained in this prospectus is accurate

only as of the date of this prospectus, regardless of the time of delivery of this

prospectus or of any sale of our common stock.

TABLE OF CONTENTS

Prospectus summary |

1 |

| Risk factors | 5 |

| Forward-looking statements | 11 |

| Use of proceeds | 12 |

| Price range of common stock | 13 |

| Dividend policy | 13 |

| Capitalization | 14 |

| Selected consolidated financial data | 15 |

| Management’s discussion and analysis | |

| of financial condition and results | |

| of operations | 16 |

| Business | 26 |

| Description of capital stock | 43 |

| Management | 48 |

| Underwriting | 50 |

| Legal matters | 53 |

| Experts | 53 |

| Information incorporated by reference | 53 |

| Where you can find more information | 54 |

| Index to consolidated financial statements | F-1 |

The following product or technology designations are trademarks of Rofin-Sinar Technologies Inc.: rofin, StarWeld, StarCut, PerfoLas Systems, StarShape Systems, Visual Laser Marker, LaserCAD, PowerLine, StarMark, CombiLine, MultiScan and VectorScan.

i

(This page has been left blank intentionally.)

Prospectus summary

This summary highlights information contained

elsewhere in this prospectus. This summary does not contain all of the information

that you should consider before buying our common stock in this offering. You should

read the entire prospectus carefully, including the information under the heading

“Risk Factors” beginning on page 5 and the information incorporated by

reference in this prospectus.

Unless the context otherwise requires, all references to “Rofin,” the “Company,” “we” and “our” include Rofin-Sinar Technologies Inc. and its subsidiaries as a consolidated entity.

OUR COMPANY

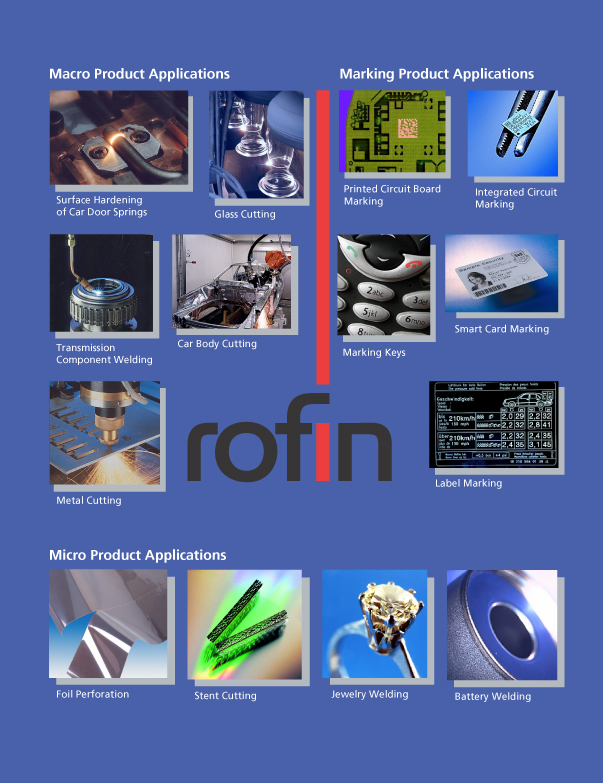

We are a global leader in the design, development, engineering, manufacture and marketing of laser-based products used for material processing, including cutting, welding and marking of a wide range of materials. Lasers are a non-contact technology for material processing which have several advantages compared to conventional manufacturing tools used in industrial applications. Our lasers deliver a high-quality beam at guaranteed power outputs and feature compact design, high processing speed, flexibility, low operating and maintenance costs and easy integration into a customer’s production process.

Through our global manufacturing, distribution and service network, we provide a comprehensive range of laser sources and laser-based system solutions to our principal target markets: the machine tool, automotive, and semiconductor and electronics industries. We sell principally to end-users and to original equipment manufacturers (“OEMs”) that integrate our laser sources with other system components. Many of our customers are among the largest global participants in their respective industries. During fiscal 2003, 21% of our sales were in North America, 65% were in Europe and 14% were in Asia.

THE INDUSTRIAL LASER MARKET FOR MATERIAL PROCESSING

Over the past 30 years, lasers have revolutionized

industrial manufacturing and have been used increasingly to provide reliable, flexible,

non-contact and high-speed alternatives to conventional technologies for processing

a wide range of metal and non-metal materials used in advanced manufacturing applications.

According to the January 2004 Optoelectronics Report, the global market for non-diode lasers was approximately $1.8 billion in 2003. We operate primarily in the materials processing segment of the non-diode market, which had total revenues in 2003 of $1.2 billion.

COMPETITIVE STRENGTHS

We attribute our strong market position and long-standing customer relationships to several competitive strengths:

| • | Laser technology expertise and product innovation; | ||

| • | Sophisticated applications development; | ||

| • | Broad product range; | ||

| • | Product quality; | ||

| • | Global platform; | ||

| • | Diverse customer and end-market mix; and | ||

| • | Comprehensive customer service. |

1

OUR STRATEGY

Our business objective is to maximize shareholder value through growth in revenues and profitability. We intend to capitalize on the opportunities in our industry and achieve our objectives by executing the following strategy:

| • | Develop new laser products through technological innovation; | ||

| • | Focus on new markets and applications; | ||

| • | Capitalize on our global presence to attract new customers; | ||

| • | Offer customized solutions based on standard platforms; and | ||

| • | Acquire complementary business operations or products. |

OUR CORPORATE INFORMATION

Our corporate office is located at 40984 Concept Drive, Plymouth, MI 48170 and our telephone number is (734) 455-5400. Our fiscal year ends on September 30.

2

The offering

| Common stock offered by us | 2,500,000 shares | ||

| Common stock to be outstanding after this offering | 14,538,650 shares | ||

| Use of proceeds | Assuming the underwriters do not exercise their over-allotment option, we estimate that the net proceeds to us from this offering will be approximately $65.6 million, after expenses. We intend to use the net proceeds for working capital and other general corporate purposes, and to acquire complementary products, technologies or businesses as opportunities arise. See “Use of Proceeds.” | ||

| Nasdaq National Market symbol | RSTI | ||

| Risk factors | See “Risk factors” beginning on page 5 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | ||

The number of shares of our common stock to be outstanding after this offering is based on the number of shares outstanding as of December 31, 2003 and does not include:

| • | 275,300 shares issuable upon the exercise of outstanding options, as of December 31, 2003; | ||

| • | 965,000 additional shares authorized and reserved for issuance upon the exercise of options that may be issued in the future pursuant to our stock option plans, as of December 31, 2003; and | ||

| • | the shares of common stock issuable upon exercise of the underwriters’ over-allotment option. | ||

We have agreed to sell an amount of shares of common

stock up to an additional 15%

of

the shares of common stock sold in the United States as part of this offering

if

the

underwriters

exercise

in full their over-allotment option.

Unless otherwise stated, all information contained in this prospectus assumes that the underwriters do not exercise their over-allotment option. All currency amounts in this prospectus are in US dollars, except where otherwise clearly stated.

Our common stock is also listed on the Geregelter Markt

Segment (Prime Standard) of the Frankfurt Stock Exchange under the symbol “RSI.”

3

Summary consolidated financial data

The following summary of our consolidated financial

data should be read in conjunction with, and is qualified in its entirety by reference

to, “Selected Consolidated Financial Data,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our audited

and unaudited historical consolidated financial statements, including the introductory

paragraphs and related notes to these financial statements appearing elsewhere or

incorporated by reference in this prospectus. Historical results are not necessarily

indicative of results to be expected in the future and the interim results for the

three months ended December 31, 2003 are not necessarily indicative of results to

be expected for fiscal 2004 or any future quarter.

| Year ended September 30, | Three months

ended December 31, |

|||||||||||||||||||||||||||||||||||||||||||

| Consolidated

statement of operations data |

1999 |

2000 |

2001 |

2002 |

2003 |

2002 |

2003 | |||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | (unaudited) |

|||||||||||||||||||||||||||||||||||||||||||

| Net sales | $ 124,024 | $ 171,187 | $ 220,557 | $ 221,948 | $ 257,746 | $ 58,144 | $ 71,058 | |||||||||||||||||||||||||||||||||||||

| Cost of goods sold | 82,230 | 109,702 | 138,408 | 143,128 | 161,465 | 35,701 | 43,224 | |||||||||||||||||||||||||||||||||||||

| Gross profit | 41,794 | 61,485 | 82,149 | 78,820 | 96,281 | 22,443 | 27,834 | |||||||||||||||||||||||||||||||||||||

| Selling, general, and administrative expenses |

23,706 | 29,593 | 41,841 | 46,401 | 51,282 | 11,855 | 13,978 | |||||||||||||||||||||||||||||||||||||

| Research and

development expenses |

11,808 | 12,953 | 14,798 | 13,249 | 18,060 | 3,906 | 5,027 | |||||||||||||||||||||||||||||||||||||

| Goodwill and intangibles amortization |

341 | 1,701 | 3,653 | 3,762 | 1,654 | 367 | 449 | |||||||||||||||||||||||||||||||||||||

| Special charge | — | — | 700 | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Income from operations | 5,939 | 17,238 | 21,157 | 15,408 | 25,285 | 6,315 | 8,380 | |||||||||||||||||||||||||||||||||||||

| Net other expense (income) | (936) | 1,159 | 2,980 | 3,023 | 558 | 633 | (210) | |||||||||||||||||||||||||||||||||||||

| Income tax expense | 3,242 | 8,202 | 10,962 | 7,384 | 9,422 | 2,224 | 3,385 | |||||||||||||||||||||||||||||||||||||

| Net income | $ 3,633 | $ 7,877 | $ 7,215 | $ 5,001 | $ 15,305 | $ 3,458 | $ 5,205 | |||||||||||||||||||||||||||||||||||||

| Net

income per common share — |

||||||||||||||||||||||||||||||||||||||||||||

| Basic | $ 0.32 | $ 0.68 | $ 0.62 | $ 0.43 | $ 1.31 | $ 0.30 | $ 0.43 | |||||||||||||||||||||||||||||||||||||

| Net income per common share — |

||||||||||||||||||||||||||||||||||||||||||||

| Diluted | $ 0.32 | $ 0.68 | $ 0.62 | $ 0.43 | $ 1.29 | $ 0.30 | $ 0.41 | |||||||||||||||||||||||||||||||||||||

At December 31, 2003 |

||||||||||||||||||||||

| Consolidated balance sheet data | Actual |

As Adjusted(1) |

||||||||||||||||||||

(unaudited, in thousands) |

||||||||||||||||||||||

| Cash and cash equivalents | $ 43,393 | $ 108,993 | ||||||||||||||||||||

| Current assets | 208,618 | 274,218 | ||||||||||||||||||||

| Current liabilities | 107,756 | 107,756 | ||||||||||||||||||||

| Total assets | 299,882 | 365,482 | ||||||||||||||||||||

| Line of credit and short-term borrowings | 33,252 | 33,252 | ||||||||||||||||||||

| Long-term debt | 24,699 | 24,699 | ||||||||||||||||||||

| Stockholders’ equity | 153,980 | 219,580 | ||||||||||||||||||||

| (1) | Adjusted to give effect to the sale of our common stock in this offering and the use of proceeds as described under “Use of Proceeds.” |

4

Risk factors

Before making an investment decision, you should carefully consider the following risks. The risks described below are not the only ones that we face. Any of the following risks could have a material adverse effect on our business, financial condition and operating results. Additional risks and uncertainties of which we are unaware or currently believe are immaterial may also impair our business operations. The trading price of our common stock could decline due to any of these risks, and you could lose all or part of your investment in our common stock. Before making an investment decision, you should also read the other information included or incorporated by reference in this prospectus and our financial statements and the related notes incorporated by reference in this prospectus.

RISKS RELATED TO OUR BUSINESS

Future downturns in the economy, particularly in the machine tool, automotive or semiconductor and electronics industries, may have a material adverse effect on our sales and profitability.

Our business depends substantially upon capital expenditures particularly by manufacturers in the machine tool, automotive and semiconductor and electronics industries. We estimate that approximately 60% of our laser sales during fiscal 2003 were to these three industry markets. These industries are cyclical and have historically experienced periods of oversupply, resulting in significantly reduced demand for capital equipment, including the products manufactured and marketed by us. For the foreseeable future, our operations will continue to depend upon capital expenditures in these industries, which, in turn, depend upon the market demand for their products. Decreased demand from manufacturers in these industries during a downturn, for example, may lead to decreased demand for our products, which would reduce our sales. If that were to occur, we may not be able to reduce our expenses to maintain our profitability, due in part to the need for continual investment in research and development and the need to maintain extensive ongoing customer service and support capability. Furthermore, although we order materials for assembly in response to firm orders, the lead time for assembly and delivery of some of our products creates a risk that we may incur expenditures or purchase inventories for products that we cannot sell.

Accordingly, any downturn or slowdown in the machine tool, automotive or semiconductor and electronics industries could have a material adverse effect on our financial condition and results of operations.

A high percentage of our sales are overseas and our results are subject to the impact of foreign currency exchange rate fluctuations.

Although we report our results in US dollars,

approximately 75% of our current sales are denominated in other currencies, including

the Euro, British pound, Singapore dollar, Japanese yen, Korean won and Taiwanese

NT dollar. The fluctuation of the Euro and other currencies against the US dollar

has had the effect of increasing and decreasing (as applicable) our reported net

sales as well as our cost of goods sold, gross margin and selling, general and administrative

expenses denominated in such foreign currencies when translated into US dollars

as compared to prior periods. Our subsidiaries will, from time to time, pay dividends

in their respective local currencies, thus presenting another area of potential

currency exposure in the future.

We also face transaction risk from fluctuations in exchange rates between the various currencies in which we do business. We believe that a certain portion of the transaction risk of our operations in multiple currencies is mitigated by our hedging activities, utilizing forward exchange contracts and forward exchange options. We also continue to borrow in each operating subsidiary’s local currency to reduce exposure to exchange gains and losses. However, changes in currency exchange rates may have a material adverse effect on our business, financial condition and results of operations.

5

Our inability to

manage risks associated with our international operations could adversely affect

our business.

Our products are currently marketed in approximately 35 countries,

with Germany, the rest of Europe, the United States and the Asia/Pacific region

being our principal markets. Our operations and sales in our principal markets are

subject to risks inherent in international business activities, including:

| • | general political and economic conditions in each such country or region; | ||

| • | overlap of differing tax structures; | ||

| • | management of an organization spread over various jurisdictions; and | ||

| • | unexpected changes in regulatory requirements and compliance with a variety of foreign laws and regulations, such as import and export licensing requirements and trade restrictions. |

Our failure to manage the risks associated with our international business operations could have a material adverse effect on our sales and profitability.

Our profitability may be adversely affected

by economic slowdowns in the United States, Europe, or the Asia/Pacific region.

A recession in these economies could trigger a decline in laser sales to the machine

tool, automotive, or semiconductor and electronics industries, and any related weaknesses

in their respective currencies could adversely affect consumer demand for our products,

the US dollar value of our foreign currency-denominated sales, and ultimately our

consolidated results of operations.

We depend on the ability of our OEM-customers to incorporate our laser products into their systems.

Our net sales depend in part upon the ability of our OEM-customers to develop and sell systems that incorporate our laser products. Adverse economic conditions, large inventory positions, limited marketing resources and other factors affecting these OEM-customers could have a substantial impact upon our financial results. If our OEM-customers experience financial or other difficulties that adversely affect their operations, our financial condition or results of operations may also be adversely affected.

We experienced in the past, and expect to experience in the future, fluctuations in our quarterly results. These fluctuations may increase the volatility of our stock price.

We have experienced and expect to continue to experience

some fluctuations in our quarterly results. We believe that fluctuations in quarterly

results may cause the market prices of our common stock, on the Nasdaq National

Market and the Frankfurt Stock Exchange, to fluctuate, perhaps substantially. Factors

which may have an influence on our operating results in a particular quarter include:

| • | the timing of the receipt of orders from major customers; | ||

| • | product mix; | ||

| • | competitive pricing pressures; | ||

| • | the relative proportions of domestic and international sales; | ||

| • | our ability to design, manufacture and introduce new products on a cost-effective and timely basis; | ||

| • | the delayed effect of incurring expenses to develop and improve marketing and service capabilities; | ||

| • | foreign currency fluctuations; | ||

| • | the ability of our suppliers to produce and deliver components and parts, including sole or limited source components, in a timely manner, in the quantity desired and at the prices we have budgeted; | ||

| • | our ability to control expenses; and | ||

| • | costs related to acquisitions of businesses. |

These and other factors make it difficult for us to make precise predictions regarding the results and the development of our business.

6

In addition, our backlog at any given time is not necessarily indicative of actual sales for any succeeding period. As our delivery schedule typically ranges from one week to six months, our sales will often reflect orders shipped in the same quarter that they are received. Moreover, customers may cancel or reschedule shipments, and production difficulties could delay shipments. Accordingly, our results of operations are subject to significant fluctuations from quarter to quarter. See also “Business—Order Backlog.”

Other factors that we believe may cause the market price of our common stock to fluctuate, perhaps substantially, include announcements of new products or technologies by us or our competitors, developments with respect to intellectual property and shortfalls in our operations relative to analysts’ expectations. In addition, in recent years, the stock market in general, and the shares of technology companies in particular, have experienced wide price fluctuations. These broad market and industry fluctuations, particularly in the semiconductor and electronics and automotive industries, may adversely affect the market prices of our common stock on the Nasdaq National Market and the Frankfurt Stock Exchange.

The markets for our products are highly competitive and increased competition could increase our costs, reduce our sales or cause us to lose market share.

The laser industry is characterized by significant price and technical competition. Our current and proposed laser products for macro and marking and micro applications compete with those of several well-established companies, some of which are larger and have substantially greater financial, managerial and technical resources, more extensive distribution and service networks and larger installed customer bases than ours.

We believe that competition will be particularly

intense in the carbon dioxide (“CO2”), diode laser and solid-state

laser markets, as many companies have committed significant research and development

resources to pursue opportunities in these markets. We may not be able to successfully

differentiate our current and proposed products from the products of our competitors

and the market place may not consider our products to be superior to competing products.

Because many of the components required to develop and produce a laser-based marking

system are commercially available, barriers to entry into this market are relatively

low, and we expect new competitive product entries in this market. To maintain our

competitive position in these markets, we believe that we will be required to continue

a high level of investment in engineering, research and development, marketing and

customer service and support. We may not have sufficient resources to continue to

make these investments, we may not be able to make the technological advances necessary

to maintain our competitive position, and our products may not receive market acceptance.

See also “Business—Competition.”

Our future growth and competitiveness depend upon our ability to develop new, enhanced products and new applications to meet market demand and to increase our market share for laser marking and micro products.

If we are to increase our laser sales in the near term,

these sales will have to come through increases in market share for our existing

products or through the development of new products and new applications

of our core

technologies, or through the acquisition of competitors or their products. To

date, a substantial portion of our revenues has been derived from sales

of high-powered

CO2 laser sources, solid-state laser sources and diode lasers. In

order to increase market demand for these products, we will need to devote substantial

resources to:

| • | broadening our CO2 laser product range; | ||

| • | increasing the output power of our CO2 laser sources, diode lasers and diode pumped, solid-state laser products; and | ||

| • | continuing to reduce the manufacturing costs of our product range to achieve more attractive pricing. |

A large part of our growth strategy depends upon being able to increase substantially our worldwide market share for laser marking and micro products.

Our future success depends on our ability to anticipate our customers’ needs and develop products that address those needs. Our ability to control costs is limited by our need to invest in research and development. If we are unable to implement our strategy to develop new and enhanced products, our business,

7

operating results and financial condition could be adversely affected. We cannot assure you that we will successfully implement our business strategy or that any of the newly developed or enhanced products or any of the new applications will achieve market acceptance or not be rendered obsolete or uncompetitive by products of other companies. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business—Our Laser Products.”

If we lose our key management personnel, we may not be able to successfully manage our business or achieve our objectives.

Our future success depends in a large part upon the leadership

and performance of our executive management team, including our Chief Executive

Officer and Chief Financial Officer, and key employees at the operating

level. These

key employees include technical, sales and support personnel for our operations

on a worldwide basis. If we lose the services of one or more of our executive

officers

or key employees, or if one or more of them decides to join a competitor or otherwise

compete directly or indirectly with us, we may not be able to successfully

manage

our business or achieve our business objectives. If we lose the services of any

of our key employees at the operating or regional level, we may not be

able to replace

them with similarly qualified personnel, which could harm our business.

We may not be able to successfully acquire new operations or integrate future acquisitions, which could cause our business to suffer.

One of the ways in which we seek to grow our company is through strategic acquisitions of companies with complementary operations or products. We may be unable to successfully complete potential strategic acquisitions if we cannot reach agreement on acceptable terms or for other reasons. Future acquisitions may require us to obtain additional debt or equity financing, which may not be available on terms acceptable to us, if at all. In connection with future acquisitions, we may assume the liabilities of the companies we acquire. Any debt that we incur to pay for future acquisitions could contain covenants that restrict the manner in which we operate our business. Any new equity securities that we issue for this purpose would be dilutive to our existing stockholders. If we buy a company or a division of a company, we may experience difficulty integrating that company or division’s personnel and operations, which could negatively affect our operating results.

In addition:

| • | the key personnel of the acquired company may decide not to work for us; | ||

| • | we may experience additional financial and accounting challenges and complexities in areas such as tax planning, treasury management and financial reporting; | ||

| • | we may be held liable for risks and liabilities (including for environmental-related costs) as a result of our acquisitions, some of which we may not discover during our due diligence; | ||

| • | our ongoing business may be disrupted or receive insufficient management attention; and | ||

| • | we may not be able to realize the cost savings or other financial benefits we anticipated. |

We depend on limited source suppliers that could cause substantial manufacturing delays and increase our costs if a disruption in supply occurs.

We estimate that 22% of our revenues are derived from sales of products that require specialized components only currently available from single sources. We also rely on a limited number of independent contractors to manufacture subassemblies for some of our products. In the future, our current or alternative sources may not be able to meet all of our demands on a timely basis. If one or more of our suppliers or subcontractors experiences difficulties that result in a reduction or interruption in supply to us, or if they fail to meet any of our manufacturing requirements, our business could be harmed until we are able to secure alternative sources, if any. If we are unable to find necessary parts or components on commercially reasonable terms, we could be required to reengineer our products to accommodate available substitutions which would increase our costs and/or have a material adverse effect on manufacturing schedules, product performance and market acceptance.

8

Our failure to protect our proprietary technology or to avoid litigation for infringement or misappropriation of proprietary rights of third parties could result in a loss of revenues and profits.

From time to time, we receive notices from third parties alleging infringement of such parties’ patent or other proprietary rights by our products. While these notices are common in the laser industry and we have in the past been able to develop non-infringing technology or license necessary patents or technology on commercially reasonable terms, we may not in the future prevail in any litigation seeking damages or expenses from us or to enjoin us from selling our products on the basis of such alleged infringement, and we may not be able to develop any non-infringing technology or license any valid and non-infringing patents on commercially reasonable terms. In the event any third party made a valid claim against us or our customers and a license was not made available to us on commercially reasonable terms, we would be adversely affected.

Our future success depends in part upon our intellectual property rights, including trade secrets, know-how and continuing technological innovation. The steps taken by us to protect our intellectual property rights may not be adequate to prevent misappropriation and we cannot assure you that others will not develop competitive technologies or products.

We currently hold 99 United States and foreign

patents on our laser sources, with expiration dates ranging from 2004 to

2022. We

have

also obtained licenses under certain patents covering lasers and related

technology incorporated

into our products. Of particular importance is the license of two patents related

to the sales of our Slab Series CO2 lasers, which we estimate to account

for approximately 22% of our revenue in fiscal 2003. In addition, 36

patent

applications

have been filed and are under review by the patent authorities. Other companies

may be investigating or developing other technologies that are similar to ours.

Patents may not issue from any application filed by us and, if patents do issue,

the claims allowed may not be sufficiently broad to deter or prohibit others

from

marketing similar products. In addition, any patents issued to us may be challenged,

invalidated or circumvented, and the rights thereunder may not provide a competitive

advantage to us. See also “Business—Intellectual Property.”

We have been and are likely to be involved from time to time in litigation involving our intellectual property and ordinary routine litigation arising in the ordinary course of business.

We are currently engaged in discussions with the licensor of patents covering the technology used in certain of our CO2 lasers concerning the amount of royalty due in respect to certain past sales and future sales of such laser products. We believe that we will achieve a resolution of this matter that will not have a material adverse impact on our financial condition or results of operations.

Any defects in our products or customer problems arising from the use of our products may seriously harm our business and reputation.

Our laser products are technologically complex

and may contain unknown and undetected errors or performance problems. In addition,

performance problems can also be caused by the improper installation of our products

by a customer. These errors or performance problems could result in customer dissatisfaction,

which could harm our sales or customer relationships. In addition, these problems

may cause us to incur significant warranty and repair costs and divert the attention

of our engineering personnel from our product development efforts.

RISKS RELATED TO INVESTING IN OUR STOCK

Our stock is subject to substantial price and volume fluctuations due to a number of factors, many of which are beyond our control, and those fluctuations may prevent our stockholders from reselling our common stock at a profit.

The trading price of our common stock has in the past been

and could in the future be subject to significant fluctuations in response to:

| • | quarterly variations in our results of operations; |

9

| • | international political instability, including, for example, instability associated with military action in Afghanistan and Iraq, strained relations with North Korea and other conflicts; | ||

| • | announcements of technological innovations or new products by us, our customers or competitors; | ||

| • | our failure to achieve the operating results anticipated by analysts or investors; | ||

| • | sales or the perception in the market of possible sales of a large number of shares of our common stock by our directors, officers, employees or principal stockholders; | ||

| • | releases or reports by or changes in security analysts’ recommendations; and | ||

| • | developments or disputes concerning our intellectual property or other proprietary rights. |

For example, since the start of fiscal 2003, the trading price

of our common stock on the Nasdaq National Market has ranged from a high of $38.99

to a low of $5.18. If our revenue and results of operations are below the expectations

of public market securities analysts or investors, significant fluctuations in the

market price of our common stock could occur. In addition, the securities markets

have, from time to time, experienced significant price and volume fluctuations,

which have particularly affected the market prices for high technology companies

and often are unrelated and disproportionate to the operating performance of particular

companies. These broad market fluctuations, as well as general economic, political

and market conditions, may negatively affect the market price of our common stock.

In the past, following periods of volatility in the market price of a company’s

stock, securities class action litigation has occurred against that company. The

litigation could result in substantial costs and would at a minimum divert management’s

attention and resources, which could have a material adverse effect on our business,

which could further reduce our stock price. Any adverse decision in the litigation

could also subject us to significant liabilities.

Our charter documents, Delaware law and our stockholder rights plan contain provisions that may inhibit potential acquisition bids, which may adversely affect the market price of our common stock, discourage merger offers or prevent changes in our management.

Our board of directors has the authority to issue up to 5,000,000 shares of preferred stock and to determine the rights, preferences, privileges and restrictions, including voting rights, of the shares without any further vote or action by our stockholders. If we issue any of these shares of preferred stock in the future, the rights of holders of our common stock may be negatively affected. See “Description of Capital Stock—Preferred Stock.” If we issue preferred stock, a change of control of our company could be delayed, deferred or prevented. We have no current plans to issue shares of preferred stock.

Section 203 of the Delaware General Corporation Law restricts

certain business combinations with any “interested stockholder” as defined

by that statute. In addition, our certificate of incorporation and bylaws contain

certain other provisions that may have the effect of delaying, deferring or preventing

a change of control. These provisions include:

| • | the division of our board into three groups that serve staggered terms; | ||

| • | the elimination of actions by written consent of stockholders; and | ||

| • | the limitation of liability and indemnification of our directors and officers. |

Our board of directors adopted a stockholder rights agreement on September 30, 1996 and amended the agreement on July 12, 2001. Under this agreement, we issued a dividend of one right for each share of our common stock. Each right initially entitles stockholders to purchase one common share at a purchase price of $28.50. If a person or group acquires, or announces a tender or exchange offer that would result in the acquisition of, a certain percentage of our assets or earning power, unless the rights are redeemed by us for $0.01 per right subject to adjustment as provided in the rights agreement, the rights will become exercisable by all rights holders, except the acquiring person or group, for the number of shares of such acquiring entity (or of the Company if we are the surviving entity) equal to the book value of twice the purchase price.

10

These provisions are designed to encourage potential acquirers to

negotiate with our board of directors and give our board of directors an opportunity

to consider various alternatives to increase stockholder value. These provisions

are also intended to discourage certain tactics that may be used in proxy contests.

However, the potential issuance of preferred stock, our charter and bylaw provisions,

the restrictions in Section 203 of the Delaware General Corporation Law and our

stockholder rights plan could discourage potential acquisition proposals and could

delay or prevent a change in control, which may adversely affect the market price

of our stock. These provisions and plans may also have the effect of preventing

changes in our management. See “Description of Capital Stock—Certain Provisions

of Our Certificate of Incorporation and By-Laws”; “—Section 203 of

the Delaware General Corporation Law”; and “—Rights Agreement.”

Forward-looking statements

Certain statements in this prospectus and in the documents we have incorporated by reference constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “may,” “believe,” “will,” “expect,” “project,” “anticipate,” “estimate,” “plan” or “continue.” These forward-looking statements are based on the current plans and expectations of our management and are subject to a number of uncertainties and risks that could significantly affect our current plans and expectations, as well as future results of operations and financial condition.

These factors include:

| • | downturns in the machine tool, automotive, semiconductor and electronics industries which may have, in the future, a material adverse effect on our sales and profitability; | ||

| • | the ability of our OEM-customers to incorporate our laser products into their systems; | ||

| • | the impact of exchange rate fluctuations, which may be significant because a substantial portion of our operations are located overseas; | ||

| • | the level of competition and our ability to compete in the markets for our products; | ||

| • | our ability to develop new and enhanced products to meet market demand or to adequately utilize our existing technology; | ||

| • | third party infringement of our proprietary technology or third party claims against us for the infringement or misappropriation of their proprietary rights; | ||

| • | competing technologies that are similar to or that serve the same uses as our technology; | ||

| • | the scope of patent protection that we are able to obtain or maintain; | ||

| • | our ability to efficiently manage the risks associated with our international operations; and | ||

| • | the other risks described under “Risk Factors” beginning on page 5. |

In making these forward-looking statements, we claim the protection of the safe-harbor for forward-looking statements contained in the Reform Act. You are cautioned not to place undue reliance on these forward-looking statements, which are speaking only as of the date that they were made. We do not assume any obligation to update these forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting such forward-looking statements.

11

Use of proceeds

We estimate that the gross proceeds from the sale of the

2,500,000 shares of common stock that we are selling in this offering will

be approximately $70.0 million. We estimate that the net proceeds

from our sale of the shares will be

approximately $65.6 million after deducting the underwriting

discounts and commissions of $3.5 million

and estimated offering expenses payable by us of $0.9 million. Solely in order

to estimate the maximum amount of net proceeds to us if the underwriters

exercise their over-allotment option in full, we assume that all 2,500,000

shares of common stock are sold in the United States as part of this offering.

Under these circumstances, the underwriters may purchase from us a maximum

of 375,000 additional shares of common stock pursuant to their over-allotment

option

and the estimated maximum net proceeds to us would be $75.6 million if the

underwriters exercised their over-allotment option in full.

The principal reason for this offering is to make available to us funds for working capital and other general corporate purposes. We may use a portion of the net proceeds to acquire complementary products, technologies or businesses as opportunities arise. Pending these uses, we intend to invest the net proceeds in short-term, interest bearing, investment grade securities.

12

Price range of common stock

Our common stock is quoted on the Nasdaq National Market

under the symbol “RSTI” and is also listed on the Geregelter Markt Segment

(Prime Standard) of the Frankfurt Stock Exchange under the symbol “RSI”.

The table below sets forth for the periods indicated the range of quarterly high

and low sales prices for our common stock as reported on the Nasdaq National Market:

| Fiscal year ending September 30, 2002 | High |

Low |

|||||

| First Quarter | $10.44 | $ 7.00 | |||||

| Second Quarter | $11.01 | $ 7.55 | |||||

| Third Quarter | $10.70 | $ 8.15 | |||||

| Fourth Quarter | $ 9.99 | $ 6.25 | |||||

| Fiscal year ending September 30, 2003 | |||||||

| First Quarter | $ 9.05 | $ 4.95 | |||||

| Second Quarter | $11.72 | $ 7.17 | |||||

| Third Quarter | $17.70 | $10.05 | |||||

| Fourth Quarter | $27.95 | $12.55 | |||||

| Fiscal year ending September 30, 2004 | |||||||

| First Quarter | $36.62 | $20.45 | |||||

| Second Quarter (through March 23, 2004) | $38.99 | $27.77 | |||||

On March 23, 2004 the last reported sale price of our common

stock

on the Nasdaq National Market was $29.40 per share.

At December 31, 2003, we had 13 holders of record of our

common stock and 12,038,650 shares outstanding.

Dividend policy

We have not paid dividends on our common stock and do not anticipate paying dividends in the foreseeable future.

13

Capitalization

The following table sets forth our capitalization as of

December 31, 2003:

| • | on an actual basis; and | ||

| • | as adjusted to give effect to the issuance and sale of the 2,500,000 shares of our common stock offered by this prospectus and the receipt by us of estimated net proceeds to us of $65.6 million, after expenses. See “Use of Proceeds.” | ||

The information in the table below is qualified in its entirety

by, and should be read in conjunction with, “Selected Consolidated Financial

Data,” “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and our audited and unaudited consolidated financial

statements, including the introductory paragraphs and related notes to these financial

statements, included elsewhere or incorporated by reference in this prospectus.

| As of December 31, 2003 | |||||||

Actual |

As Adjusted |

||||||

(unaudited, in

thousands) |

|||||||

| Cash and cash equivalents | $ 43,393 | $ 108,993 | |||||

| Long-term debt | $ 24,699 | $ 24,699 | |||||

| Stockholders’ equity: | |||||||

|

Preferred

Stock, par value $0.01 per share, 5,000,000 shares authorized; no shares issued or outstanding |

0 | 0 | |||||

|

Common

Stock, par value $0.01 per share, 50,000,000 shares authorized; 12,038,650 shares issued and outstanding as of December 31, 2003; and 14,538,650 shares issued and outstanding, as adjusted |

120 | 145 | |||||

| Additional paid-in capital | 81,343 | 146,918 | |||||

| Retained earnings | 59,871 | 59,871 | |||||

| Accumulated other comprehensive income | 12,646 | 12,646 | |||||

| Total stockholders’ equity | 153,980 | 219,580 | |||||

| Total capitalization | $178,679 | $ 244,279 | |||||

The table above does not include:

| • | 275,300 shares of common stock issuable upon exercise of options outstanding under our option plans at December 31, 2003, at a weighted average exercise price of $11.75 per share; | ||

| • | 965,000 additional shares of common stock reserved for future grant or issuance under our stock option plans at December 31, 2003; and | ||

| • | the shares of common stock issuable upon exercise of the underwriters’ over-allotment option. |

14

Selected consolidated financial data

The selected historical consolidated financial

data set forth below should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and

the consolidated financial statements and notes thereto included elsewhere or incorporated

by reference in this prospectus. The consolidated statement of operations data for

the fiscal years ended September 30, 2003, 2002 and 2001 and the consolidated balance

sheet data as of September 30, 2003 and 2002 are derived from the audited consolidated

financial statements and are included elsewhere or incorporated by reference in

this prospectus. The consolidated statement of operations data for the fiscal years

ended September 30, 2000 and 1999 are derived from the audited consolidated financial

statements which are not included in this prospectus. The selected historical consolidated

financial data as of December 31, 2003 and for the three months ended December 31,

2003 and 2002 are derived from unaudited consolidated financial statements included

elsewhere or incorporated by reference in this prospectus. These unaudited consolidated

financial statements have been prepared on the same basis as the audited consolidated

financial statements and, in our management’s opinion, contain all adjustments,

consisting only of normal recurring adjustments, necessary for a fair presentation

of our financial position and results of operations. Historical results are not

necessarily indicative of results to be expected in the future and the interim results

for the three months ended December 31, 2003 are not necessarily indicative of results

to be expected for fiscal 2004 or any future quarter.

Year ended September 30, |

Three

months ended December 31, |

|||||||||||||||||||||||||

| Consolidated

statement of operations data: |

1999 |

2000 |

2001 |

2002 |

2003 |

2002 |

2003 |

|||||||||||||||||||

| (in thousands, except per share data) | (unaudited) | |||||||||||||||||||||||||

| Net sales | $ 124,024 | $ 171,187 | $ 220,557 | $221,948 | $ 257,746 | $ 58,144 | $ 71,058 | |||||||||||||||||||

| Cost of goods sold | 82,230 | 109,702 | 138,408 | 143,128 | 161,465 | 35,701 | 43,224 | |||||||||||||||||||

| Gross profit | 41,794 | 61,485 | 82,149 | 78,820 | 96,281 | 22,443 | 27,834 | |||||||||||||||||||

| Selling, general, and administrative expenses |

23,706 | 29,593 | 41,841 | 46,401 | 51,282 | 11,855 | 13,978 | |||||||||||||||||||

| Research and

development expenses |

11,808 | 12,953 | 14,798 | 13,249 | 18,060 | 3,906 | 5,027 | |||||||||||||||||||

| Goodwill and intangibles amortization |

341 | 1,701 | 3,653 | 3,762 | 1,654 | 367 | 449 | |||||||||||||||||||

| Special charge | — | — | 700 | — | — | — | — | |||||||||||||||||||

| Income from operations | 5,939 | 17,238 | 21,157 | 15,408 | 25,285 | 6,315 | 8,380 | |||||||||||||||||||

| Net other expense (income) | (936) | 1,159 | 2,980 | 3,023 | 558 | 633 | (210) | |||||||||||||||||||

| Income tax expense | 3,242 | 8,202 | 10,962 | 7,384 | 9,422 | 2,224 | 3,385 | |||||||||||||||||||

| Net income | $ 3,633 | $ 7,877 | $ 7,215 | $ 5,001 | $ 15,305 | $ 3,458 | $ 5,205 | |||||||||||||||||||

| Net

income per common share—Basic |

$ 0.32 | $ 0.68 | $ 0.62 | $ 0.43 | $ 1.31 | $ 0.30 | $ 0.43 | |||||||||||||||||||

| Net income

per common share—Diluted |

$ 0.32 | $ 0.68 | $ 0.62 | $ 0.43 | $ 1.29 | $ 0.30 | $ 0.41 | |||||||||||||||||||

| Shares used in computing net income per common share—Basic |

11,527 | 11,538 | 11,547 | 11,552 | 11,640 | 11,557 | 11,978 | |||||||||||||||||||

| Shares used

in computing net income per common share—Diluted |

11,527 | 11,622 | 11,601 | 11,592 | 11,863 | 11,557 | 12,545 | |||||||||||||||||||

| At September 30, | At December 31, |

|||||||||||||||||||

| Consolidated balance | ||||||||||||||||||||

| sheet data: | 2002 | 2003 | 2003 | |||||||||||||||||

(in thousands)

|

(unaudited) |

|||||||||||||||||||

| Cash and cash equivalents | $ 20,312 | $ 44,487 | $ 43,393 | |||||||||||||||||

| Current assets | 163,892 | 204,509 | 208,618 | |||||||||||||||||

| Current liabilities | 82,231 | 105,750 | 107,756 | |||||||||||||||||

| Total assets | 240,815 | 291,486 | 299,882 | |||||||||||||||||

| Line of credit and short-term borrowings | 22,544 | 35,781 | 33,252 | |||||||||||||||||

| Long-term debt | 40,591 | 33,052 | 24,699 | |||||||||||||||||

| Stockholders’ equity | 108,418 | 140,586 | 153,980 | |||||||||||||||||

|

|

||||||||||||||||||||

15

Management’s discussion and analysis of financial condition and results of operations

The following discussion should be read

in conjunction with the consolidated financial statements and accompanying notes,

which appear elsewhere in this prospectus. This discussion contains forward-looking

statements that involve risks and uncertainties. Our actual results could differ

materially from those anticipated in these forward-looking statements as a result

of various factors, including those discussed below and elsewhere in this prospectus,

particularly under the heading “Risk Factors.”

OVERVIEW

We are a global leader in the design, development, engineering, manufacture and marketing of laser-based products used for material processing, including cutting, welding and marking of a wide range of materials. Lasers are a non-contact technology for material processing which have several advantages compared to conventional manufacturing tools used in industrial applications. Our lasers deliver a high-quality beam at guaranteed power outputs and feature compact design, high processing speed, flexibility, low operating and maintenance costs and easy integration into a customer’s production process.

Through our global manufacturing, distribution and service network, we provide a comprehensive range of laser sources and laser-based system solutions to our principal target markets: the machine tool, automotive, and semiconductor and electronics industries. We sell principally to end-users and to original equipment manufacturers (“OEMs”) that integrate our laser sources with other system components. Many of our customers are among the largest global participants in their respective industries. During fiscal 2003, 21% of our sales were in North America, 65% were in Europe and 14% were in Asia. For the three months ended December 31, 2003, 20% of our sales were in North America, 59% were in Europe and 21% were in Asia.

During fiscal 2003, 53% of revenues related

to sales of laser products for macro applications and approximately 47% related

to sales of laser products for marking and micro applications. For the three months

ended December 31, 2003, 51% of our revenues related to sales of laser products

for macro applications and approximately 49% related to sales of laser products

for marking and micro applications.

The consolidated financial statements included in this

prospectus present the historical financial information of Rofin-Sinar Technologies

Inc. and its wholly owned subsidiaries. These financial statements include the consolidated

accounts of Rofin-Sinar Inc. (“RS Inc.”) and Rofin-Sinar Technologies

Europe S.L. (“RSTE”). RSTE is a European holding company formed in 1999

which owns 100% of Rofin-Sinar Laser GmbH (“RSL”), 80% of Dilas Diodenlaser

GmbH (“Dilas”), 100% of Rofin-Baasel Italiana S.r.l., 100% of Rofin-Baasel

France S.A., 71% of Rofin-Sinar UK Ltd., 100% of Rofin-Baasel UK Ltd., 100% of Rofin-Baasel

Benelux B.V., 100% of Rofin-Baasel Singapore Pte. Ltd., 100% of Rofin-Baasel Taiwan

Ltd. (formed on July 1, 2002), 100% of Rofin-Baasel Korea Co. Ltd. (formed on July

22, 2002), and 83% of Rofin-Baasel Espana S.L. (“RBE”).

The financial statements of RSL include the consolidated accounts of its 88% owned subsidiary, Rofin-Baasel Japan Corporation (a Japanese corporation), its 100% owned subsidiary, Rasant-Alcotec Beschichtungstechnik GmbH (“Rasant”), its 100% owned subsidiary, Carl Baasel Lasertechnik GmbH & Co. KG (“CBL”), and its 100% owned subsidiary, CBL Verwaltungsgesellschaft mbH.

The financial statements of CBL include the

consolidated accounts of its wholly owned subsidiaries, Rofin-Baasel Inc. (“RB

Inc.”), Wegmann-Baasel Laser und elektrooptische Geraete GmbH (“WBL”),

and PMB Elektronik GmbH.

On May 10, 2000, we acquired 90.01% of the share capital

of Carl Baasel Lasertechnik GmbH (“Baasel Lasertech”) through our wholly

owned subsidiary RSL. In September 2001 Baasel Lasertech was transformed into Carl

Baasel Lasertechnik GmbH & Co. KG (“CBL”), a limited partnership.

We and the minority shareholder of CBL were party to an option agreement for the

remaining capital held by the minority shareholder for a fixed price of Euro 6.3

million, which, along with accumulated interest

16

of $0.4 million, was accrued for in accounts payable to the related party as of September 30, 2002. Accordingly, the accompanying financial statements present CBL as if it were 100% owned. Effective December 31, 2002, the minority shareholder resigned from the limited partnership and the remaining shares of CBL were purchased by RSL during fiscal 2003 for the fixed price of Euro 6.3 million ($6.2 million at the December 31, 2002 exchange rate).

On February 28, 2001, we acquired 80% of the share capital of Z-Laser S.A. through our wholly owned subsidiary Rofin-Baasel Espana, S.A., Barcelona, Spain for $3.3 million in cash. At the end of June 2001, Z-Laser S.A. was merged into RBE. As a result of this merger, the minority shareholder owns 17% of the total stock of the new Spanish subsidiary.

On October 5, 2001, we sold the assets of our medical laser

business resulting in a gain of $0.7 million. As part of the proceeds from the sale,

we received marketable equity securities, which have been classified as trading

securities under “other current assets and prepaid expenses” in the accompanying

balance sheet. During the twelve-month period ended September 30, 2003 we sold the

above mentioned securities for a total amount of $1.2 million. For the fiscal years

ended September 30, 2003 and 2002, we recorded a realized gain of $0.3 million and

an unrealized loss of $0.2 million, respectively.

On March 31, 2003, we acquired an additional 37% of the

share capital of Rofin-Marubeni Laser Corporation, Atsugi-shi, Japan, through RSL

for $0.1 million in cash. We subsequently hold 88% of the share capital. As of May

1, 2003, Rofin-Marubeni Laser Corporation, Japan was renamed Rofin-Baasel Japan

Corporation.

OUTLOOK

Management believes that the near-term growth

in our macro business is limited and depends, especially in North America and Europe,

on the general investment cycle for capital goods. Revenues from a recently finalized

technical license agreement are expected to contribute approximately $7 million

to sales in the current fiscal year. In our marking and micro business, management

sees positive developments from the semiconductor and electronics market which management

believes should lead to increased sales in this sector in the coming quarters.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are more fully described in Note 1 to our consolidated financial statements. Certain of the accounting policies require the application of significant judgment by management in selecting appropriate assumptions for calculating financial estimates. By their nature, these judgments are subject to an inherent degree of uncertainty.

Allowance for Doubtful Accounts

We record allowances for uncollectible customer accounts receivable based on historical experience. Additionally, an allowance is made based on an assessment of specific customers’ financial condition and liquidity. If the financial condition of our customers were to deteriorate, additional allowances may be required. No individual customer represents more than 10% of total accounts receivable.

Inventory Valuation

Inventories are stated at the lower of cost

or market, after provisions for excess and obsolete inventory salable at prices

below cost. The valuation of slow moving and obsolete inventories are provided based

on current assessments about historical experience, future product demand and production

requirements for the next twelve months. These factors are impacted by market conditions,

technology changes, and changes in strategic direction that are uncertain, require

estimates and management judgment. Although we strive to achieve a balance between

market demands and risk of inventory excess or obsolescence, it is possible that,

should conditions change, additional adjustments to inventory valuation may be needed.

Warranty Reserves

We provide reserves for the estimated costs of product warranties when revenue is recognized. We rely upon historical experience, expectation of future conditions, and our service data to estimate our warranty reserve. We continuously monitor these data to ensure that the reserve is sufficient. To the extent

17

we experience increased warranty claim activity or increased costs associated with servicing those claims (such costs may include material, labor and travel costs), revisions to the estimated warranty liability would be required. While such expenses have historically been within our expectations, we cannot guarantee this will continue in the future.

Our high-power diode pumped solid-state laser

products, which are sold primarily in our macro business, have experienced quality

issues in the past that have affected the performance of certain units in the field.

For this reason, based on available information and our estimation of what would

be required to resolve the quality issues in the affected diode laser products,

we established a reserve of $0.3 million in fiscal 2000. In fiscal 2001 and 2002,

we added $2.9 million to this reserve, of which $1.2 million in total was utilized.

In fiscal 2003, we utilized $1.8 million of this reserve and added $2.2 million

to increase the reserve to $2.4 million. We believe this reserve is adequate to

address the associated costs (including an estimate of the related material, labor

and transportation costs) estimated to be incurred related to these products that

have been sold prior to September 30, 2003. We also believe that future profitability

will not be materially affected by this issue due to the low business volume (5%

of total sales) attributable to these products in fiscal 2003.

Pension

The determination of our obligation and expense for pension is dependent on the selection of certain assumptions used by actuaries in calculating those amounts. Assumptions are made about interest rates, expected investment return on plan assets, total turnover rates, and rates of future compensation increases. In addition, our actuarial consultants use subjective factors such as withdrawal rates and mortality rates to develop our valuations. We generally review these assumptions at the beginning of each fiscal year. We are required to consider current market conditions, including changes in interest rates, in making these assumptions. The actuarial assumptions that we may use may differ materially from actual results due to changing market and economic conditions, higher or lower withdrawal rates or longer or shorter life spans of participants. These differences may result in a significant impact on the amount of pension benefits expense we have recorded or may record.

The discount rate enables us to state expected future cash flows at a present value on the measurement date. We have little latitude in selecting this rate, and we must represent the market rate of high-quality fixed income investments. A lower discount rate increases the present value of benefit obligations and increases pension expense.

To determine the expected long-term rate of return on plan assets, we consider the current and expected asset allocations, as well as historical and expected returns on various categories of plan assets.

RESULTS OF OPERATIONS

For the periods indicated, the following table sets forth

the unaudited percentage of net sales represented by the respective line items in

our consolidated statements of operations:

Year ended September 30, |

Three

months ended December 31, |

||||||||||||||||||

2001 |

2002 |

2003 |

2002 |

2003 |

|||||||||||||||

| Net sales | 100% | 100% | 100% | 100% | 100% | ||||||||||||||

| Cost of goods sold | 63% | 64% | 63% | 61% | 61% | ||||||||||||||

| Gross profit | 37% | 36% | 37% | 39% | 39% | ||||||||||||||

| Selling, general

and administrative expenses |

19% | 21% | 20% | 20% | 20% | ||||||||||||||

| Research and development expenses |

7% | 6% | 7% | 7% | 7% | ||||||||||||||

| Goodwill and

intangibles amortization |

1% | 2% | 0% | 1% | 0% | ||||||||||||||

| Income from operations | 10% | 7% | 10% | 11% | 12% | ||||||||||||||

| Income before income taxes | 8% | 6% | 10% | 10% | 12% | ||||||||||||||

| Net income | 3% | 2% | 6% | 6% | 7% | ||||||||||||||

18

Three months ended December

31, 2003 compared to three months ended

December 31, 2002

Net Sales

Net sales of $71.1 million represent an increase

of $13.0 million, or 22%, for the three months ended December 31, 2003, as compared

to the corresponding period in fiscal 2003. The increase resulted from a net

sales

increase of $10.8 million, or 23%, in Europe/Asia and an increase of $2.2 million,

or 18%, in the United States, compared to the corresponding period in fiscal

2003.

Continued weakening of the US dollar against foreign currencies, primarily against

the Euro, had a favorable effect on net sales of $8.8 million for the three-month

period ended December 31, 2003. Net sales of laser products for macro applications

for the three-month period increased by 16% to $36.1 as compared to the corresponding

period in fiscal 2003. 14% of this increase represents the revenue recognized

on the recently finalized technical license agreement and the remaining increase

was

primarily due to higher demand for our lasers for macro applications from the

automotive industry including sub-suppliers. Net sales of lasers for marking

and micro applications

increased by 30% to $35.0 million for the three months ended December 31, 2003

as compared to the corresponding period in fiscal 2003. The increase in sales

of lasers

for marking applications can be attributed primarily to the continuing recovery

in demand from the semiconductor and electronics industries during the period.

The

increase in sales of lasers for marking and micro applications can be attributed

primarily to demand for our Starweld product series and our perforating laser

series from

various

industries.

Gross Profit

Our gross profit of $27.8 million for the three

months ended December 31, 2003 represents an increase of $5.4 million, or 24%, from

the corresponding period in fiscal year 2003. As a percentage of sales compared

to the corresponding three-month period in fiscal year 2003, gross profit remained

unchanged at 39%. The high percentage margin was primarily a result of the favorable

product mix, which included higher laser sales for marking and micro applications

to the semiconductor and electronics industry. Gross profit was favorably affected

by $2.3 million for the three-month period ended December 31, 2003 due to the continued

weakening of the US dollar against foreign currencies, primarily against the Euro.

Selling, General and Administrative Expenses

Selling, general and administrative expenses

of $14.0 million increased $2.1 million, or 18%, for the three-month period ended

December 31, 2003, compared to the corresponding period in fiscal 2003, primarily

due to increased sales activities world wide. Selling, general and administrative

expenses, a significant portion of which are incurred in foreign currencies, were

unfavorably affected by $1.6 million for the three-month period ended December 31,

2003 due to the continued weakening of the US dollar against foreign currencies,

primarily the Euro.

Research and Development

We spent $5.0 million on research and development

during the three-month period ended December 31, 2003. This represents an increase

of 28% for the three-month period ended December 31, 2003, compared to the corresponding

period in fiscal 2003 and is mainly attributed to the ongoing research and development

work in the field of diode pumped solid-state lasers and CO2 lasers.

Gross research and development expenses for the three-month period ended December

31, 2003 and December 31, 2002 were $5.3 million and $4.2 million, respectively,

and were reduced by $0.3 million of government grants during each respective period.

Research and development, a significant portion of which is conducted in Europe,

and therefore incurred in foreign currencies, was unfavorably affected by $0.8 million

for the three-month period in fiscal 2003, due to the continued weakening of the

US dollar against foreign currencies.

19

Other Expense (Income)

Net other expense (income) of $(0.5 million) for the three-month period ended December 31, 2003 represents a change of $1.1 million compared to net other expense of $0.6 million in the corresponding period in fiscal 2003. The change in the three-month period is primarily attributable to higher unrealized exchange gains ($0.9 million) resulting from certain intercompany indebtedness and reduced ($0.3 million) net interest expense.

Income Tax Expense

Income tax expense of $3.4 million for the three-month

period ended December 31, 2003 represents an effective tax rate of 39%, equivalent

to the tax rate for the corresponding period in fiscal 2003. Income tax expense,

a significant portion of which is incurred in foreign currencies, was unfavorably

affected by $0.5 million for the three-month period ended December 31, 2003 due

to the continued weakening of the US dollar against foreign currencies, primarily

the Euro.

Net Income

As a result of the foregoing factors, the Company

realized consolidated net income of $5.2 million for the three months ended

December 31, 2003, which represents an increase of $1.7 million from the corresponding

period

in fiscal 2003. For the three months ended December 31, 2003, basic and diluted

earnings per share equaled $0.43 and $0.41, respectively, based upon a weighted

average of 12.0 million and 12.5 million common shares outstanding, as compared

to basic and diluted earnings per share of $0.30, based on 11.6 million common

shares

outstanding for the same period in fiscal 2003.

Fiscal year ended 2003 compared to fiscal year ended 2002

Net Sales

Net sales of $257.7 million represents an increase

of $35.8 million, or 16%, over the prior year. Net sales increased $41.4 million,

or 25%, in Europe/Asia and decreased $5.6 million, or 10%, in the United States,

as compared to the prior year. The US dollar weakened against foreign currencies,

which had a favorable effect on net sales of $28.2 million. Net sales of laser products

for macro applications increased by 17% over the prior year to $136.7 million, primarily

due to a result of higher macro laser shipments to the machine tool industry. Net

sales of lasers for marking and micro applications increased by 16% to $121.0 million

compared to fiscal 2002, mainly as a result of slightly higher marking laser shipments

to the semiconductor and electronics industry and higher micro laser shipments to

the dental and jewelry industries.

Gross Profit

Our gross profit of $96.3 million increased

by $17.5 million, or 22%, over the prior year. As a percentage of sales, gross profit

increased from 36% to 37%. The higher percentage margin in fiscal 2003 was primarily

a result of the overall change in the product mix and lower cost in relation to

our high powered solid-state laser products. Gross profit was favorably affected

by $7.7 million in fiscal 2003 due to the weakening of the US dollar.

Selling, General and Administrative Expenses

Selling, general and administrative expenses

increased $4.9 million, or 11%, to $51.3 million, compared to fiscal 2002 primarily

due to the implementation of a new computer system within the German operations

($1.2 million) and severance expenses ($0.5 million). As a percentage of net sales,

selling, general and administrative expenses decreased from 21% to 20%. Selling,

general and administrative expenses were unfavorably affected by $5.3 million in

fiscal 2003 due to the weakening of the US dollar.

Research and Development

We spent net $18.1 million on research and development, which represents an increase of $4.9 million, or 37%, over fiscal 2002 primarily due to ongoing research and development work mainly in the area of diode pumped solid-state lasers. Gross research and development expenses for fiscal 2003 and 2002 were $19.0 million and $14.3 million, respectively, and were reduced by $0.9 million and $1.1 million of government grants during the respective periods. We will continue to apply for, and expect to con-

20

tinue receiving government

grants towards research and development, especially in Europe. Research and development

expenses were unfavorably affected by $2.5 million in fiscal 2003 due to the weakening

of the US dollar.

Income Tax Expense

Income tax expense of $9.4 million in fiscal 2003 and $7.4 million in fiscal 2002 represent effective tax rates of 38.1% and 59.6%, respectively. The lower effective tax rate in 2003 is mainly due to a higher earnings basis, the elimination of non-deductible goodwill amortization, and the utilization of foreign tax credits.

Net Income

As a result of the foregoing factors, our net income of $15.3 million ($1.29 per diluted share) in fiscal 2003 increased by $10.3 million over the prior year’s net income of $5.0 million ($0.43 per diluted share). Currency translation decreased net income by $1.2 million, or 7%, of fiscal 2003 net income.

Fiscal year ended 2002 compared to fiscal year ended 2001

Net Sales

Net sales of $221.9 million represents an increase

of $1.4 million, or 0.6%, over the prior year. Net sales decreased $11.8 million,

or 7%, in Europe/Asia and increased $13.2 million, or 29%, in the United States,

as compared to the prior year. The US dollar weakened against foreign currencies,

which had a favorable effect on net sales of $4.3 million. Net sales of laser products

for macro applications increased by 10% to $117.3 million, over the prior year,

primarily due to higher macro laser shipments to the machine tool industry. Net

sales of lasers for marking and micro applications decreased by 8% to $104.6 million

compared to fiscal 2001, mainly as a result of lower marking laser shipments to

the semiconductor and electronics industry.

Gross Profit

Our gross profit of $78.8 million decreased

by $3.3 million, or 4%, over the prior year. As a percentage of sales gross profit

decreased from 37% to 36%. The lower percentage margin in fiscal 2002 was primarily

a result of the overall change in product mix and higher than anticipated costs

in our laser diode related high-power laser products. Gross profit was favorably

affected by $0.4 million in fiscal 2002 due to the weakening of the US dollar.

Selling, General and Administrative Expenses

Selling, general and administrative expenses

increased $4.6 million, or 11%, to $46.4 million, compared to fiscal 2001 primarily

due to additional legal expenses to settle the outstanding patent infringement case

($2.3 million) and a write-off and an increase in the allowance for bad debts ($1.1

million), as a result of some large customers declaring bankruptcy in the current

year. As a percentage of net sales, selling, general and administrative expenses

increased from 19% to 21%. Selling, general and administrative expenses were unfavorably

affected by $0.9 million in fiscal 2002 due to the weakening of the US dollar.

Research and Development

We spent net $13.2 million on research and

development, a decrease of 10%, or $1.5 million, over fiscal 2001 primarily due

to lower material costs and more man-power spent on cost of goods sold. Research

and development spending is dependent on the latest technology changes and product

life cycles, which can significantly impact spending volumes. Gross research and

development expenses for fiscal 2002 and 2001 were $14.3 million and $16.0 million,

respectively, and were reduced by $1.1 million and $1.2 million of government grants

during the respective periods. Research and development expenses were unfavorably

affected by $0.4 million in fiscal 2002 due to the weakening of the US dollar.

21

Income Tax Expense

Income tax expense of $7.4 million in fiscal 2002 and $11.0

million in fiscal 2001 represent effective tax rates of 59.6% and 60.3%, respectively.

The effective tax rate exceeds the actual statutory rate (which ranges from 30%

to 46%) principally due to minority interest and other permanent differences, non-deductible

goodwill amortization and increases in the deferred tax asset valuation allowance,