NOV Inc. Fourth Quarter 2025 Earnings Presentation February 5, 2026 .2

Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. This document contains, or has incorporated by reference, statements that are not historical facts, including estimates, projections, and statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often contain words such as “may,” “can,” “likely,” “believe,” “plan,” “predict,” “potential,” “will,” “intend,” “think,” “should,” “expect,” “anticipate,” “estimate,” “forecast,” “expectation,” “goal,” “outlook,” “projected,” “projections,” “target,” and other similar words, although some such statements are expressed differently. Other oral or written statements we release to the public may also contain forward-looking statements. Forward-looking statements involve risk and uncertainties and reflect our best judgment based on current information. You should be aware that our actual results could differ materially from results anticipated in such forward-looking statements due to a number of factors, including but not limited to changes in oil and gas prices, customer demand for our products, potential catastrophic events related to our operations, protection of intellectual property rights, compliance with laws, and worldwide economic activity, including matters related to recent Russian sanctions and changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs and their related impacts on the economy. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements. We undertake no obligation to update any such factors or forward-looking statements to reflect future events or developments. You should also consider carefully the statements under “Risk Factors,” as disclosed in our most recent Annual Report on Form 10-K, as updated in Part II, Item 1A of our most recent Quarterly Report on Form 10-Q, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our most recent Annual Report on Form 10-K, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements, as well as additional disclosures we make in our press releases and other securities filings. We also suggest that you listen to our quarterly earnings release conference calls with financial analysts. This presentation contains certain forward-looking non-GAAP financial measures, including Adjusted EBITDA. The Company has not provided a reconciliation of projected Adjusted EBITDA. Management cannot predict with a reasonable degree of accuracy certain of the necessary components of net income, such as other income (expense), which includes fluctuations in foreign currencies. As such, a reconciliation of projected Adjusted EBITDA to projected net income is not available without unreasonable effort. The actual amount of other income (expense), provision (benefit) for income taxes, equity income (loss) in unconsolidated affiliates, depreciation and amortization, and other amounts excluded from Adjusted EBITDA could have a significant impact on net income. Safe Harbor / Forward Looking Statements / Non-GAAP Financial Measures

Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. NOV delivers technology-driven solutions to empower the global energy industry. For more than 150 years, NOV has pioneered innovations that enable its customers to safely produce abundant energy while minimizing environmental impact. The energy industry depends on NOV’s deep expertise and technology to continually improve oilfield operations and assist in efforts to advance the energy transition towards a more sustainable future. NOV powers the industry that powers the world.

1 Working capital intensity defined as working capital less cash, debt, and lease liabilities as a percentage of annualized fourth quarter revenue. 2 Free Cash Flow and Adjusted EBITDA are non-GAAP financial measures. See appendix for a reconciliation to the nearest GAAP measures. $2.3B Revenue +5% Sequentially Working Capital Intensity1 -340 basis point improvement YOY Free Cash Flow2 ~177% conversion of Adjusted EBITDA 21.9% $472MM Fourth Quarter 2025 Highlights Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved.

Significant Achievements Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. Downhole Broadband Solutions™ technology powered by wired drill pipe used to drill record annual footage in 2025 NOV’s Downhole Broadband Solutions technology was used to drill record annual footage of more than 750,000 ft in 2025, up 74% year-over-year, reflecting growing demand for real-time downhole data to improve execution, reservoir exposure, and decision-making. Awarded the drilling equipment package for the Kingdom 4 jack-up rig to be built in Saudi Arabia NOV was awarded the drilling equipment package for the Kingdom 4 jack-up rig to be built in Saudi Arabia at International Maritime Industries. The package includes complete topside equipment, structures, drilling equipment, pipe handling, mud processing, and drilling controls, as well as blowout preventer (BOP) equipment and BOP control system. NOV’s surface automation package with AI-enabled solutions delivered strong results in the Middle East The surface automation package featured our NOVOS™ reflexive drilling system, Kaizen™ intelligent drilling application, and SoftSpeed™ stick-slip mitigation system. The technologies increased rate of penetration and reduced the number of drilling runs in a complex drilling environment, contributing to a 68% reduction in total drilling days compared with offset wells.

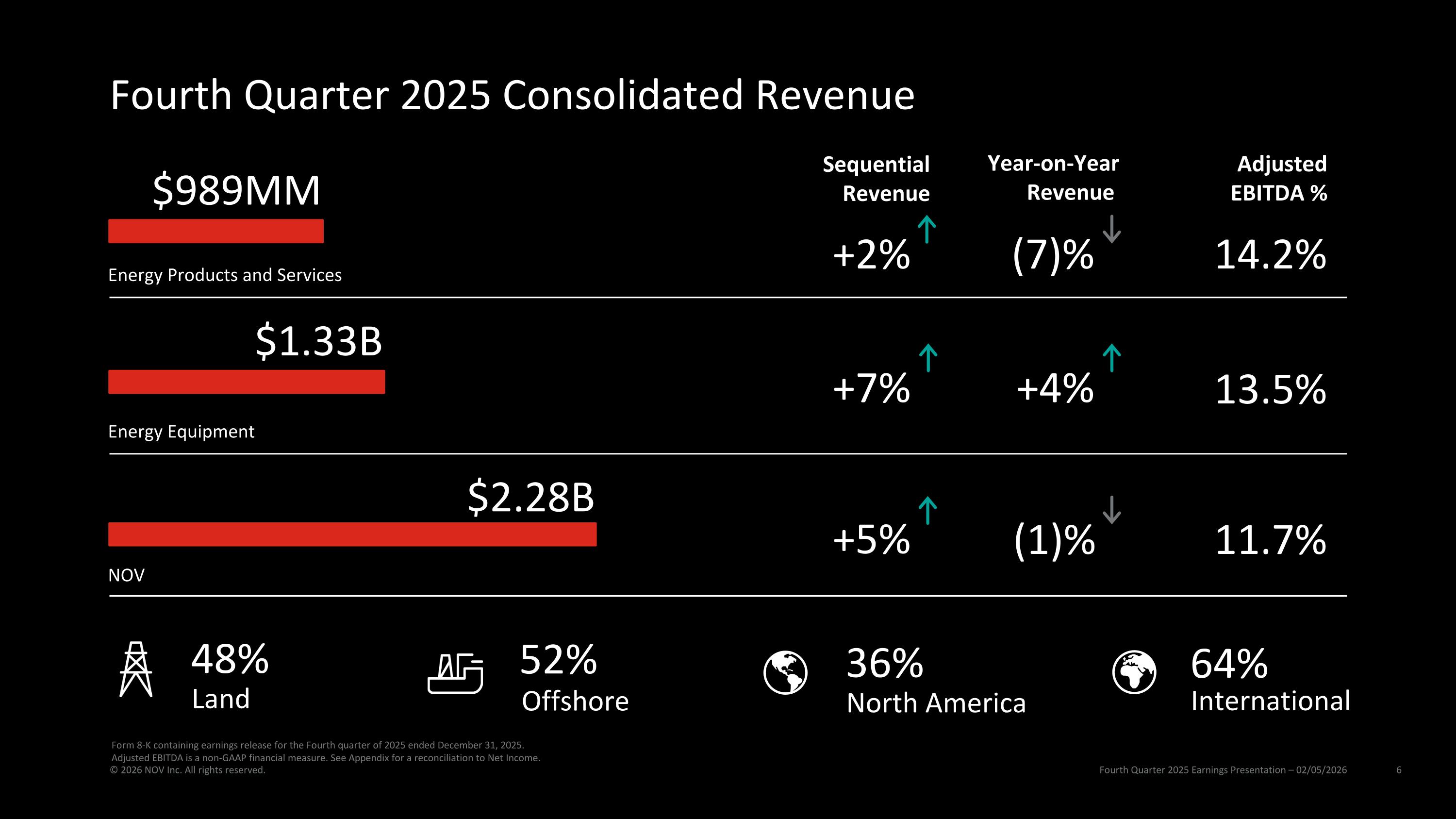

Fourth Quarter 2025 Consolidated Revenue Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. $1.33B $989MM Energy Products and Services Energy Equipment (7)% 14.2% +4% 13.5% 36% North America 64% International 48% Land 52% Offshore $2.28B NOV 11.7% (1)% Form 8-K containing earnings release for the Fourth quarter of 2025 ended December 31, 2025. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to Net Income. +2% +7% +5% Year-on-Year Revenue Adjusted EBITDA % Sequential Revenue

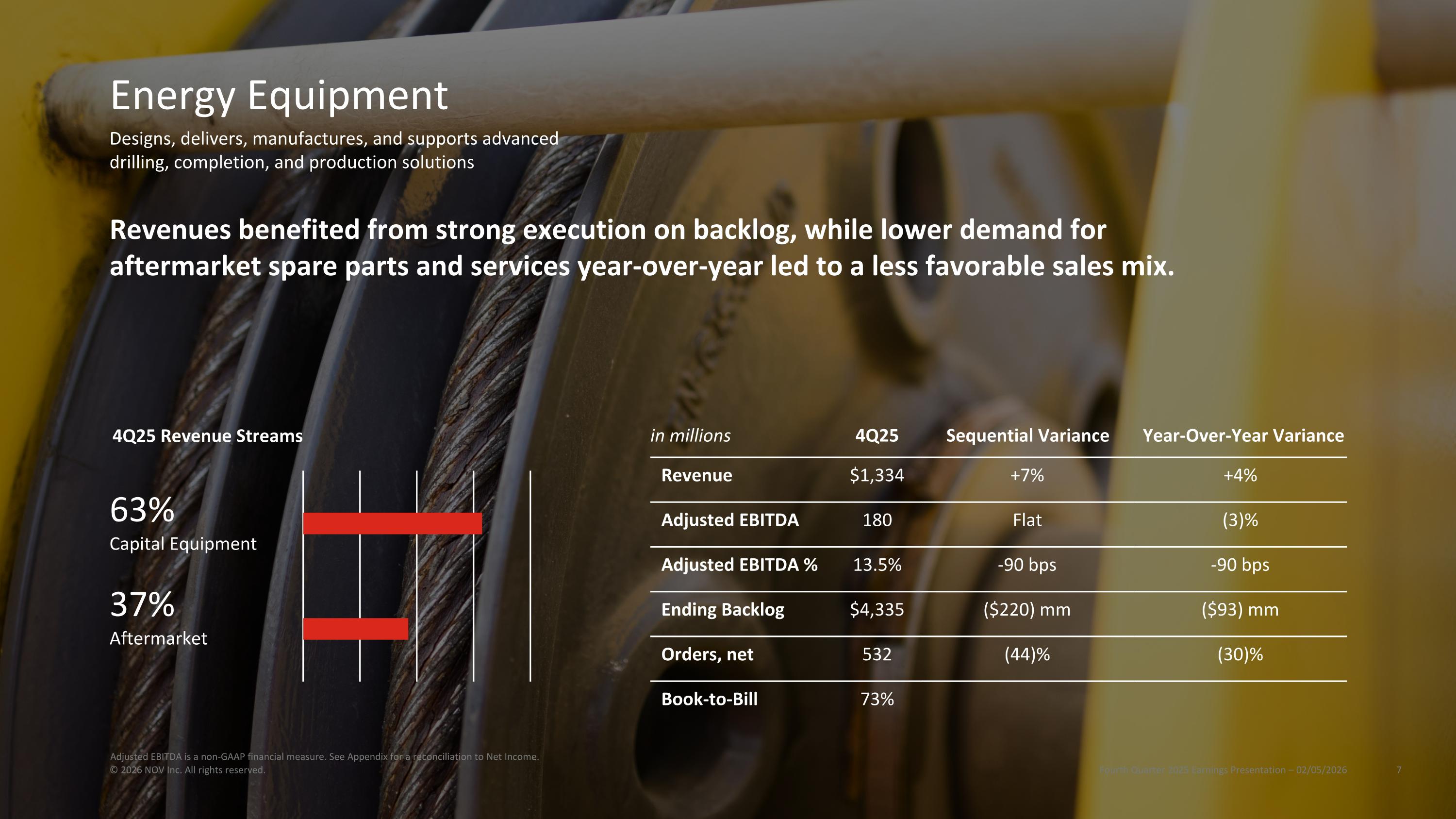

in millions 4Q25 Sequential Variance Year-Over-Year Variance Revenue $1,334 +7% +4% Adjusted EBITDA 180 Flat (3)% Adjusted EBITDA % 13.5% -90 bps -90 bps Ending Backlog $4,335 ($220) mm ($93) mm Orders, net 532 (44)% (30)% Book-to-Bill 73% Revenues benefited from strong execution on backlog, while lower demand for aftermarket spare parts and services year-over-year led to a less favorable sales mix. 4Q25 Revenue Streams 37% Aftermarket 63% Capital Equipment Energy Equipment Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. Designs, delivers, manufactures, and supports advanced drilling, completion, and production solutions Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to Net Income.

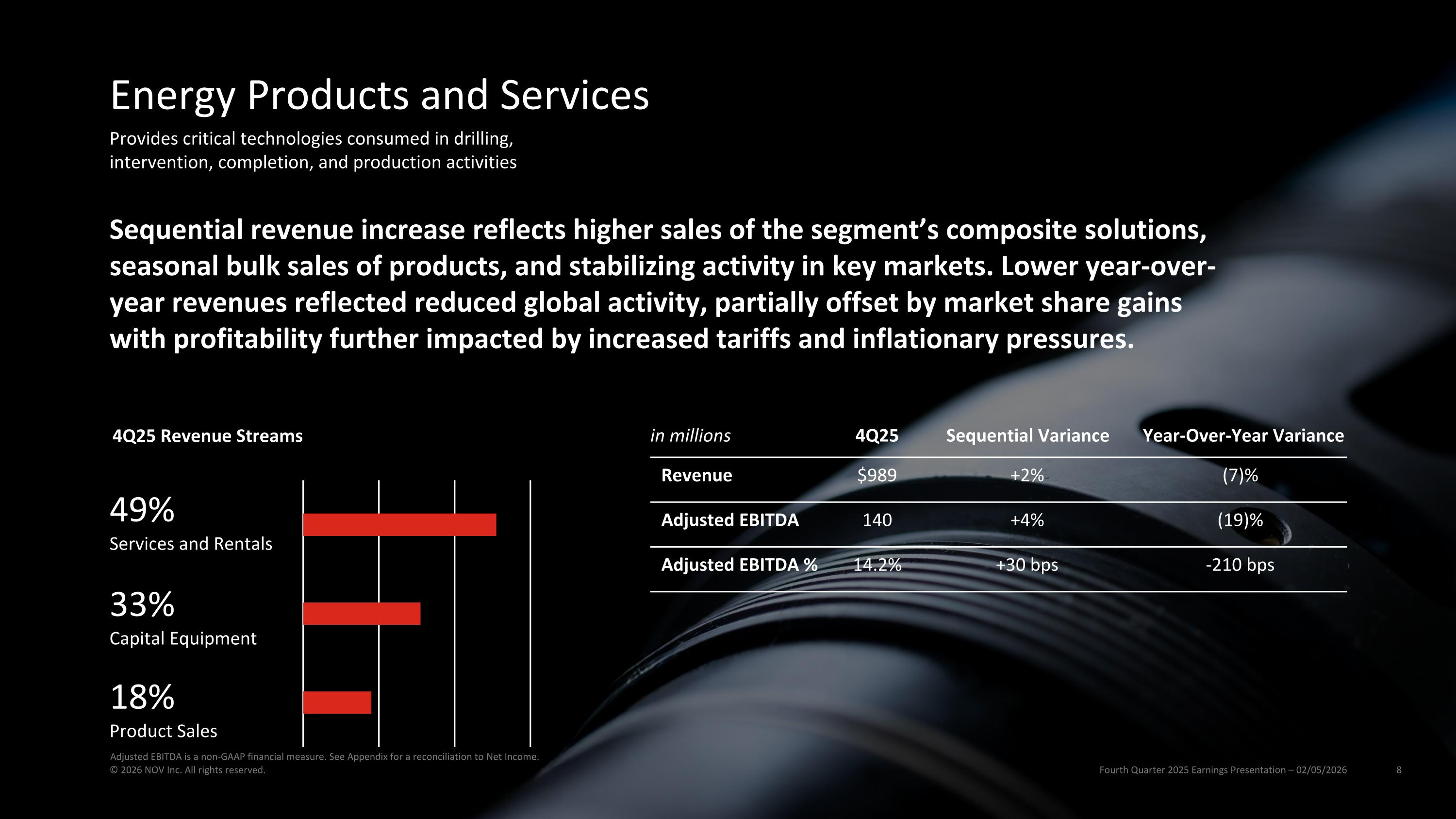

in millions 4Q25 Sequential Variance Year-Over-Year Variance Revenue $989 +2% (7)% Adjusted EBITDA 140 +4% (19)% Adjusted EBITDA % 14.2% +30 bps -210 bps Sequential revenue increase reflects higher sales of the segment’s composite solutions, seasonal bulk sales of products, and stabilizing activity in key markets. Lower year-over-year revenues reflected reduced global activity, partially offset by market share gains with profitability further impacted by increased tariffs and inflationary pressures. 4Q25 Revenue Streams 33% Capital Equipment 49% Services and Rentals 18% Product Sales Energy Products and Services Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. Provides critical technologies consumed in drilling, intervention, completion, and production activities Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation to Net Income.

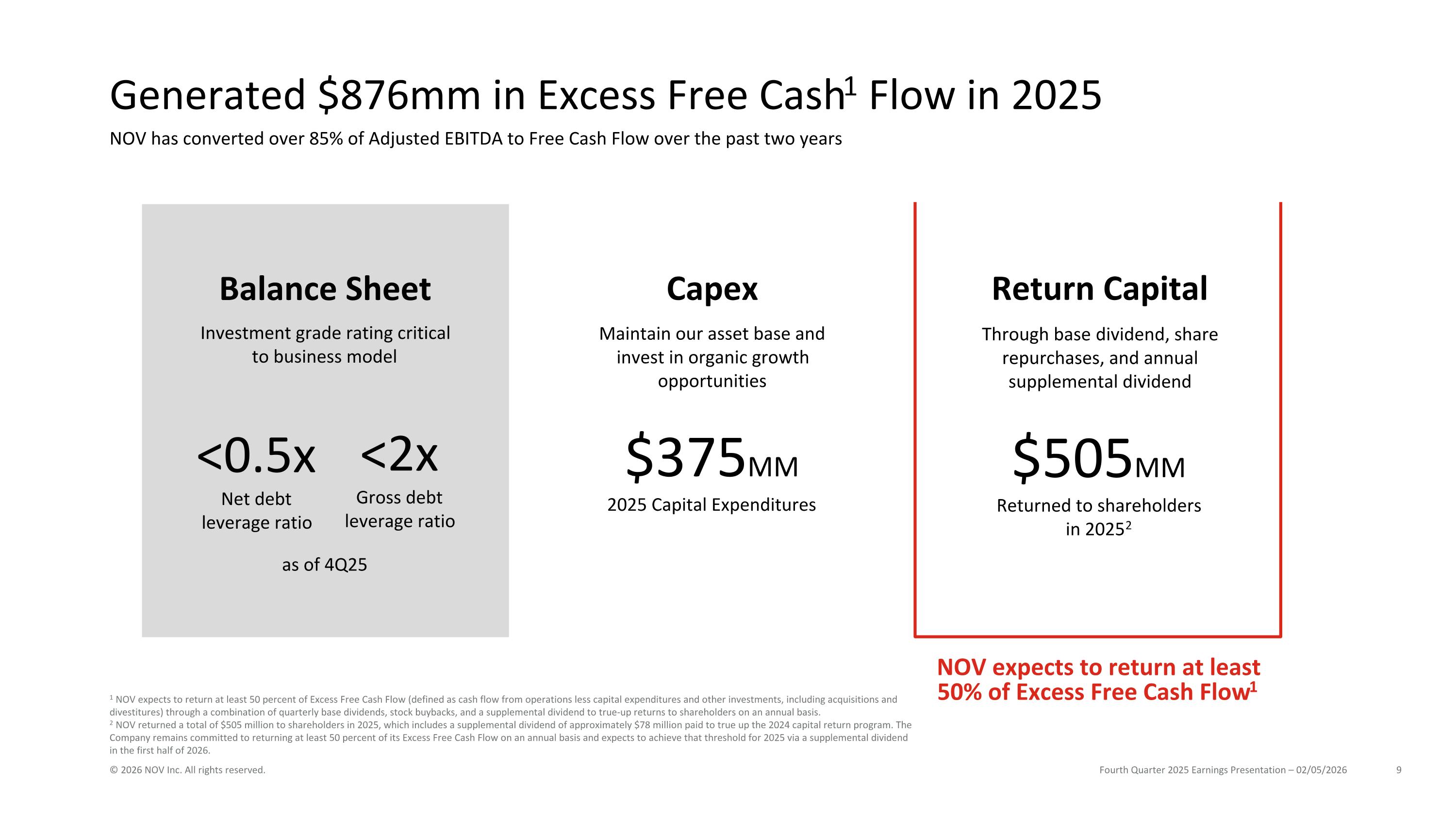

Generated $876mm in Excess Free Cash1 Flow in 2025 Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. NOV expects to return at least 50% of Excess Free Cash Flow1 1 NOV expects to return at least 50 percent of Excess Free Cash Flow (defined as cash flow from operations less capital expenditures and other investments, including acquisitions and divestitures) through a combination of quarterly base dividends, stock buybacks, and a supplemental dividend to true-up returns to shareholders on an annual basis. 2 NOV returned a total of $505 million to shareholders in 2025, which includes a supplemental dividend of approximately $78 million paid to true up the 2024 capital return program. The Company remains committed to returning at least 50 percent of its Excess Free Cash Flow on an annual basis and expects to achieve that threshold for 2025 via a supplemental dividend in the first half of 2026. Maintain our asset base and invest in organic growth opportunities Through base dividend, share repurchases, and annual supplemental dividend Balance Sheet Capex Return Capital Investment grade rating critical to business model $375MM 2025 Capital Expenditures <0.5x Net debt leverage ratio <2x Gross debt leverage ratio as of 4Q25 $505MM Returned to shareholders in 20252 NOV has converted over 85% of Adjusted EBITDA to Free Cash Flow over the past two years

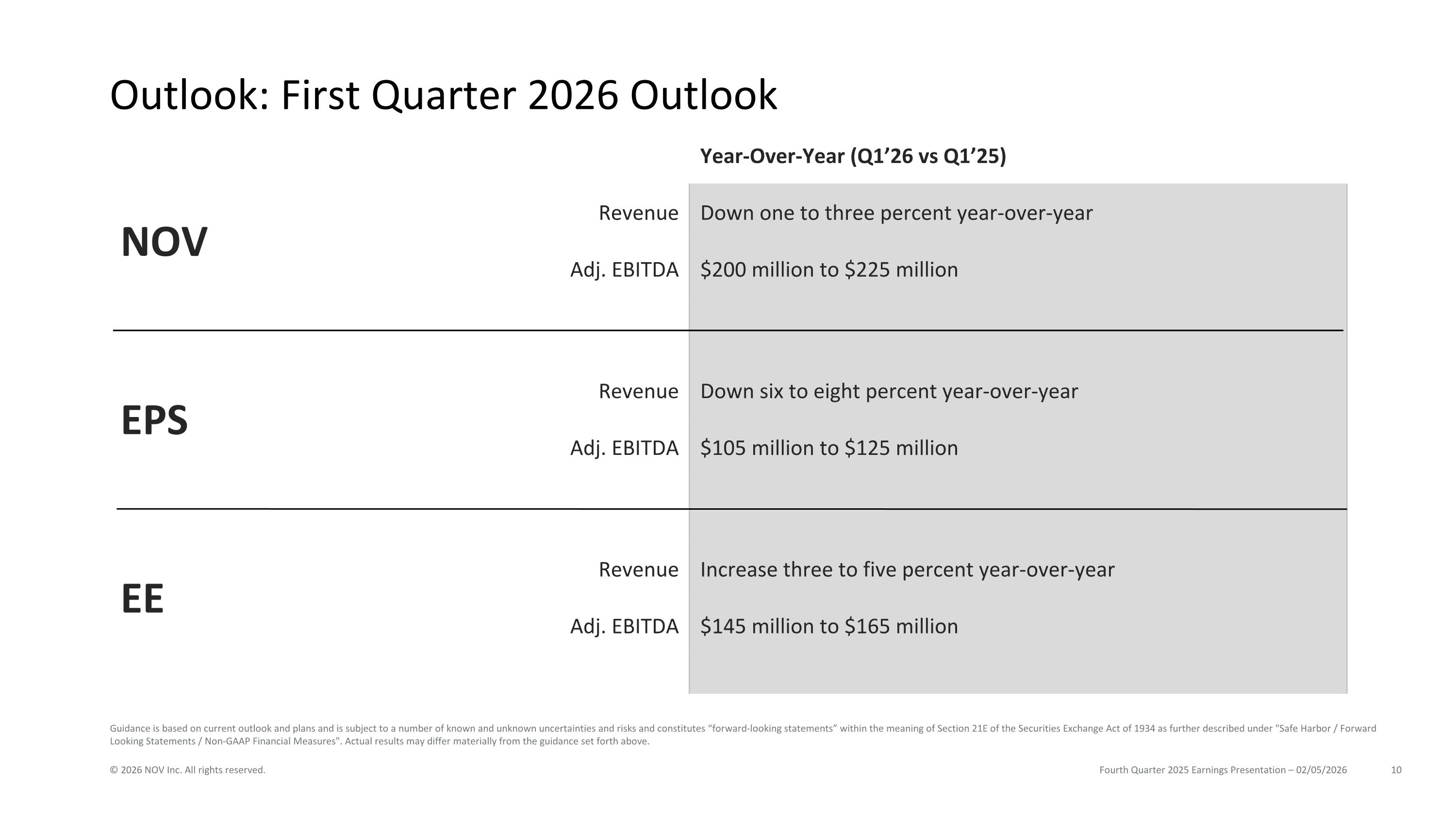

Outlook: First Quarter 2026 Outlook Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. Year-Over-Year (Q1’26 vs Q1’25) NOV Revenue Down one to three percent year-over-year Adj. EBITDA $200 million to $225 million EPS Revenue Down six to eight percent year-over-year Adj. EBITDA $105 million to $125 million EE Revenue Increase three to five percent year-over-year Adj. EBITDA $145 million to $165 million Guidance is based on current outlook and plans and is subject to a number of known and unknown uncertainties and risks and constitutes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 as further described under "Safe Harbor / Forward Looking Statements / Non-GAAP Financial Measures". Actual results may differ materially from the guidance set forth above.

Appendix Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved.

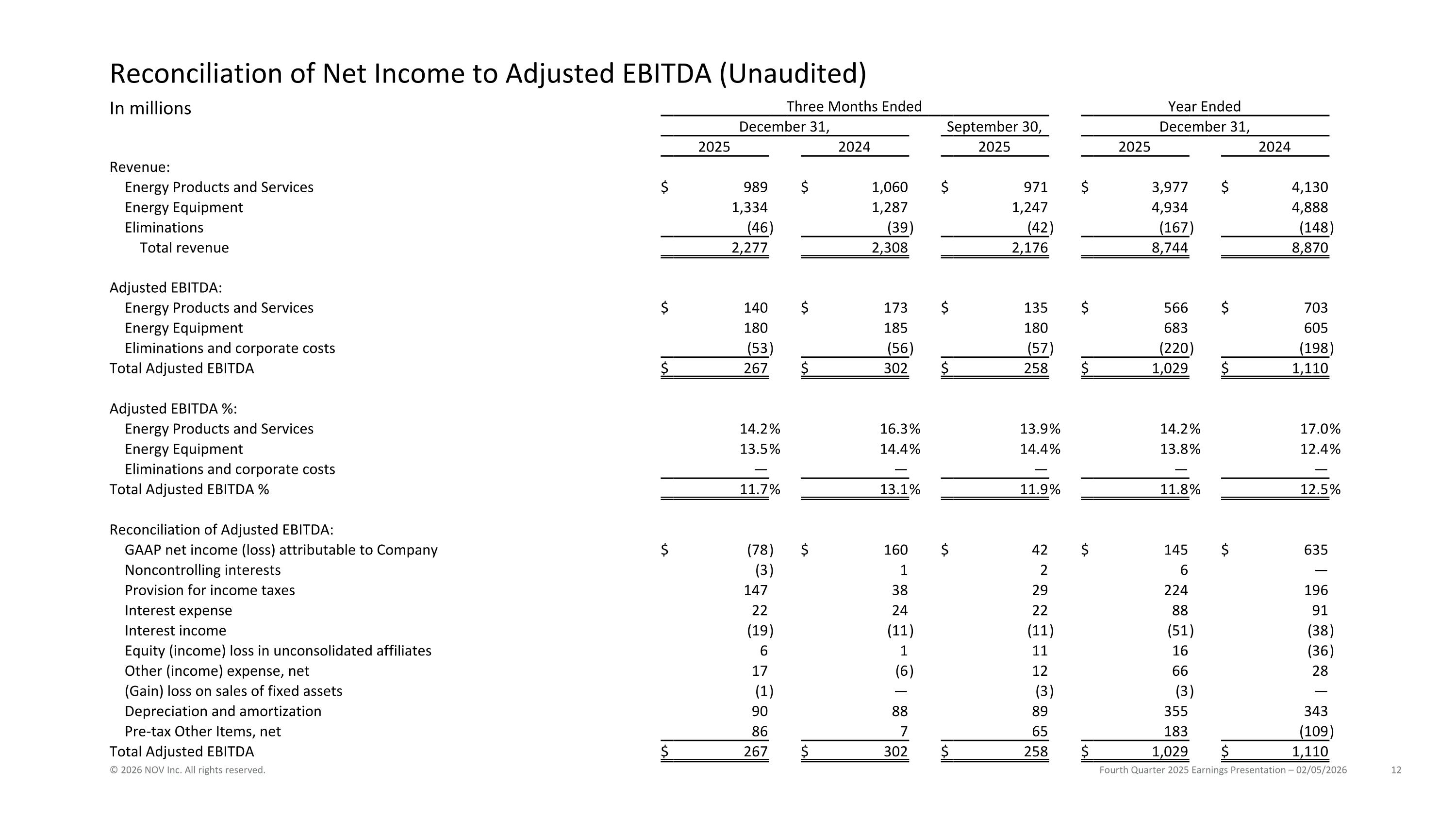

Three Months Ended Year Ended December 31, September 30, December 31, 2025 2024 2025 2025 2024 Revenue: Energy Products and Services $ 989 $ 1,060 $ 971 $ 3,977 $ 4,130 Energy Equipment 1,334 1,287 1,247 4,934 4,888 Eliminations (46 ) (39 ) (42 ) (167 ) (148 ) Total revenue 2,277 2,308 2,176 8,744 8,870 Adjusted EBITDA: Energy Products and Services $ 140 $ 173 $ 135 $ 566 $ 703 Energy Equipment 180 185 180 683 605 Eliminations and corporate costs (53 ) (56 ) (57 ) (220 ) (198 ) Total Adjusted EBITDA $ 267 $ 302 $ 258 $ 1,029 $ 1,110 Adjusted EBITDA %: Energy Products and Services 14.2 % 16.3 % 13.9 % 14.2 % 17.0 % Energy Equipment 13.5 % 14.4 % 14.4 % 13.8 % 12.4 % Eliminations and corporate costs — — — — — Total Adjusted EBITDA % 11.7 % 13.1 % 11.9 % 11.8 % 12.5 % Reconciliation of Adjusted EBITDA: GAAP net income (loss) attributable to Company $ (78 ) $ 160 $ 42 $ 145 $ 635 Noncontrolling interests (3 ) 1 2 6 — Provision for income taxes 147 38 29 224 196 Interest expense 22 24 22 88 91 Interest income (19 ) (11 ) (11 ) (51 ) (38 ) Equity (income) loss in unconsolidated affiliates 6 1 11 16 (36 ) Other (income) expense, net 17 (6 ) 12 66 28 (Gain) loss on sales of fixed assets (1 ) — (3 ) (3 ) — Depreciation and amortization 90 88 89 355 343 Pre-tax Other Items, net 86 7 65 183 (109 ) Total Adjusted EBITDA $ 267 $ 302 $ 258 $ 1,029 $ 1,110 Reconciliation of Net Income to Adjusted EBITDA (Unaudited) Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. In millions

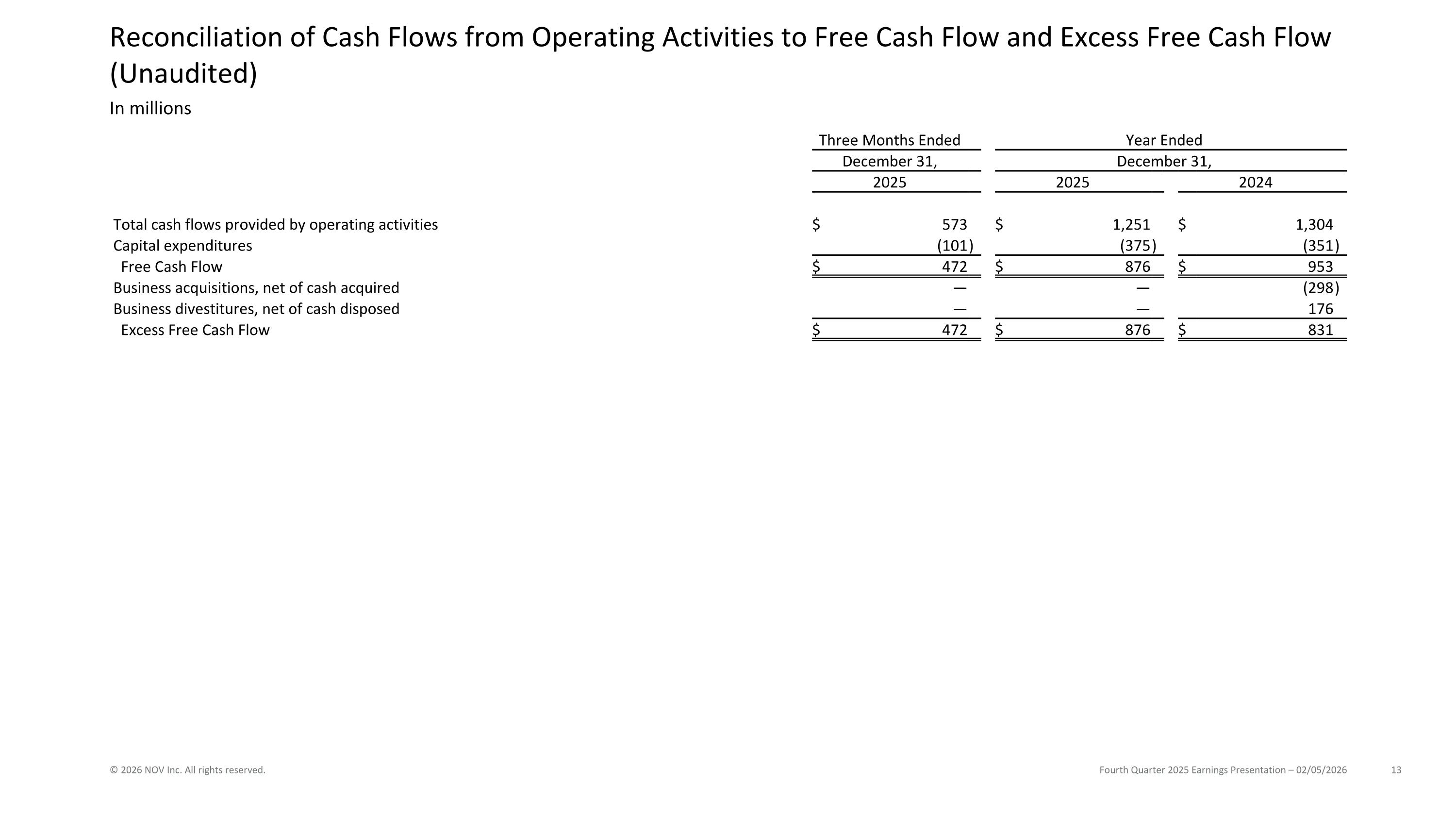

Reconciliation of Cash Flows from Operating Activities to Free Cash Flow and Excess Free Cash Flow (Unaudited) Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved. In millions Three Months Ended Year Ended December 31, December 31, 2025 2025 2024 Total cash flows provided by operating activities $ 573 $ 1,251 $ 1,304 Capital expenditures (101 ) (375 ) (351 ) Free Cash Flow $ 472 $ 876 $ 953 Business acquisitions, net of cash acquired — — (298 ) Business divestitures, net of cash disposed — — 176 Excess Free Cash Flow $ 472 $ 876 $ 831

Fourth Quarter 2025 Earnings Presentation – 02/05/2026 © 2026 NOV Inc. All rights reserved.