Please wait

Driving Sustainable Growth, Delivering Long-term Value

Jim Davis

Chairman, CEO, and President

J.P. Morgan Healthcare Conference

January 12, 2026

Quest Diagnostics

Safe harbor disclosure

The statements in this presentation that are not historical facts may be forward-looking statements. Readers and listeners are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date that they are made and which reflect management's current estimates, projections, expectations, or beliefs and which involve risks and uncertainties that could cause actual results and outcomes to be materially different. Risks and uncertainties that may affect the future results of the company include, but are not limited to, uncertain and volatile economic conditions, adverse results from pending or future government investigations, lawsuits or private actions, the competitive environment, the complexity of billing, reimbursement and revenue recognition for clinical laboratory testing, changes in government policies, including related to trade, and regulations, changing relationships with customers, payers, suppliers, or strategic partners, acquisitions, and other factors discussed in the company's most recently filed Annual Report on Form 10-K and in any of the company's subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including those discussed in the "Business," "Risk Factors," "Cautionary Factors that May Affect Future Results," and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of those reports.

In the following presentation, references to adjusted EPS refer to adjusted diluted EPS. Any references to operating margin(s) refer to adjusted operating income as a percentage of net revenues. Any references to free cash flow refer to cash flow from operations less capital expenditures.

WHY WE EXIST

PURPOSE

The Quest Way

STRATEGY

HOW WE GROW

CULTURE

HOW WE WORK

PURPOSE WHY WE EXIST

Working together to create a healthier world, one life at a time

STRATEGY HOW WE GROW

We are connecting consumers and clinicians to innovative, affordable, and actionable insights that illuminate every person's path to better health, at every stage of life.

CULTURE HOW WE WORK

The 5Cs

Customer first

Care

Collaboration

Continuous improvement

Curiosity

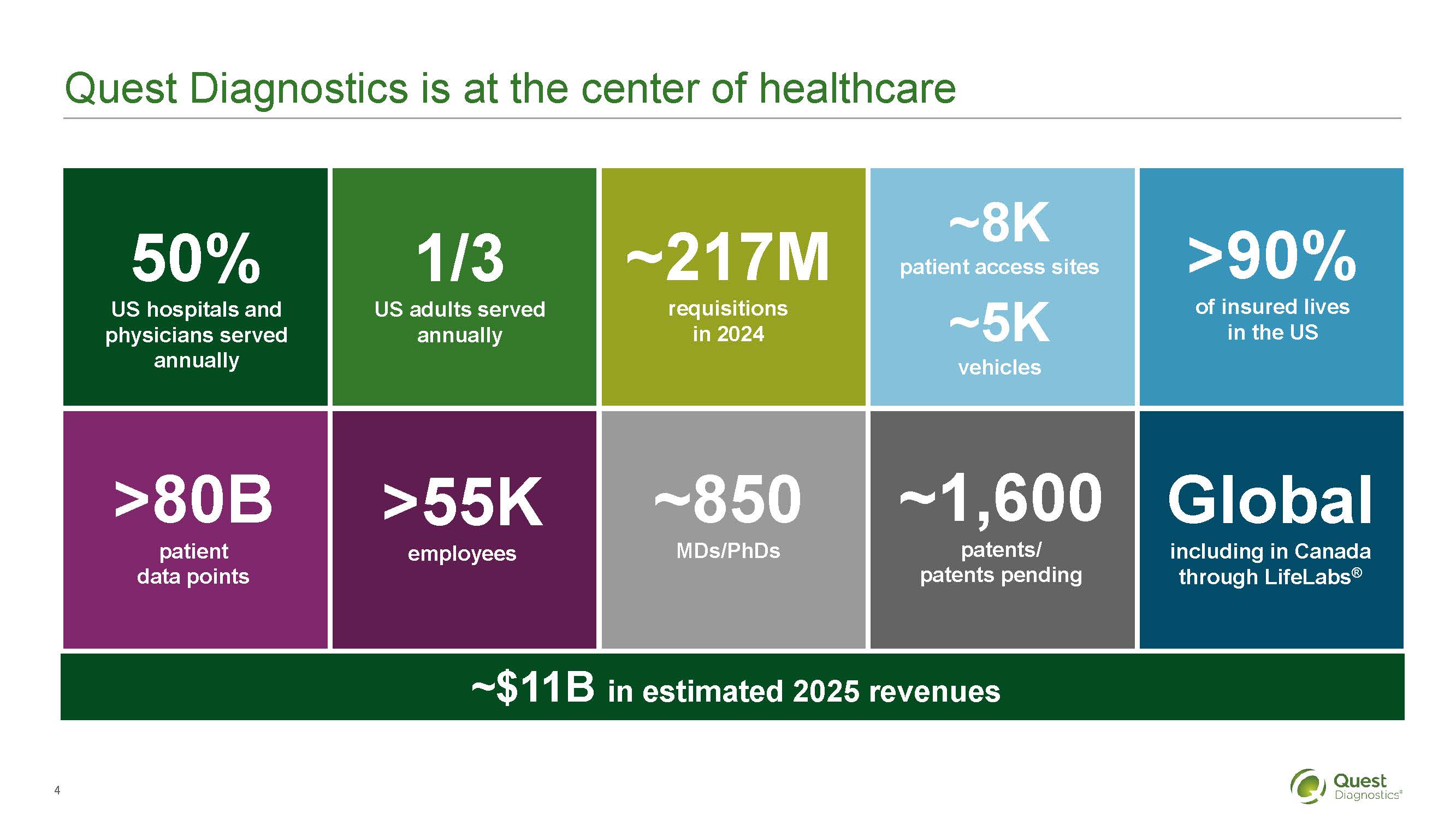

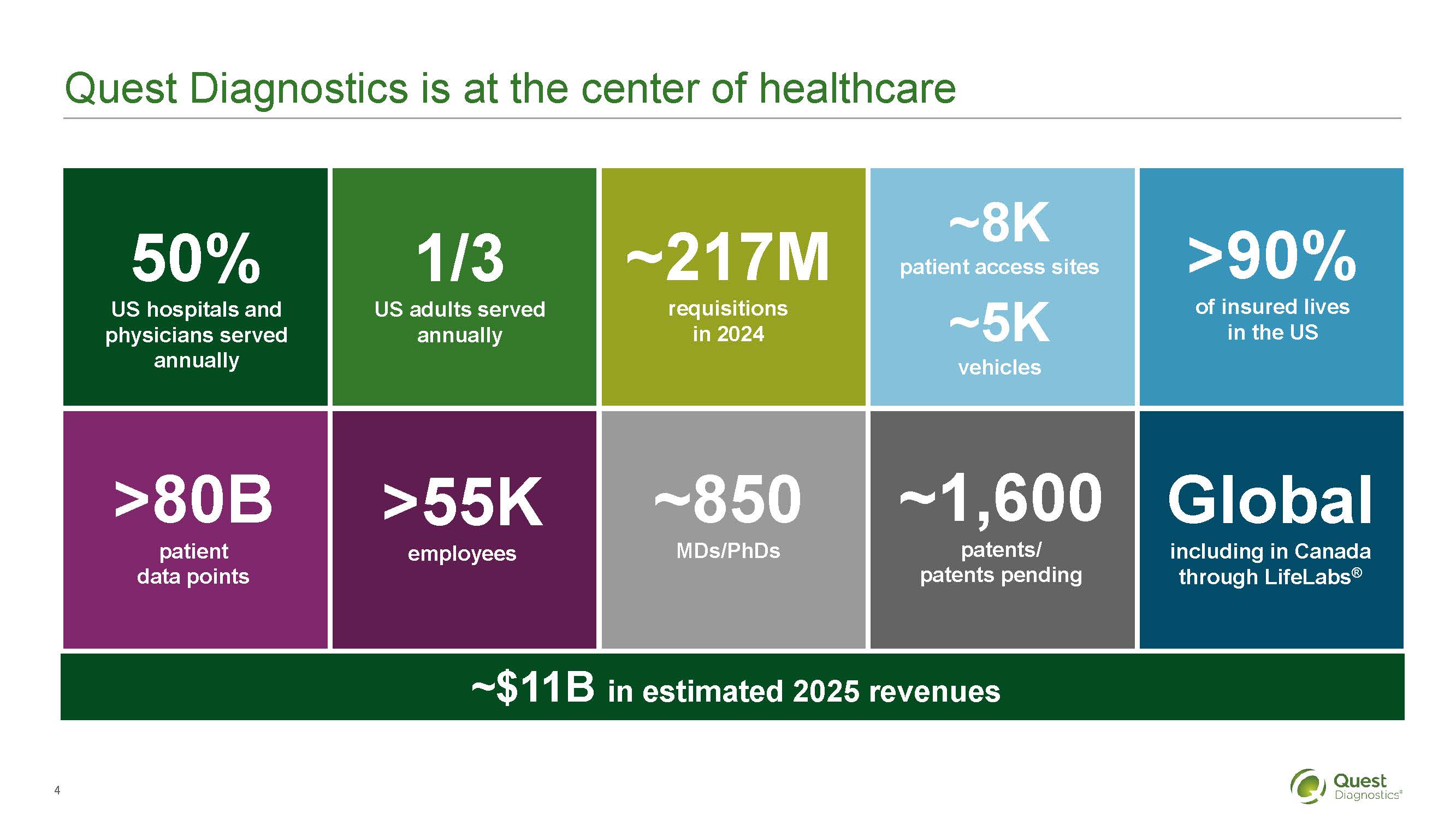

Quest Diagnostics is at the center of healthcare

50% US hospitals and physicians served annually

1/3 US adults served annually

~217M requisitions in 2024

~8K patient access sites

~5K vehicles

>90% of insured lives in the US

>>80B patient data points

>55K employees

~850 MDs/PhDs

~1,600 patents/patents pending

Global including in Canada through LifeLabs

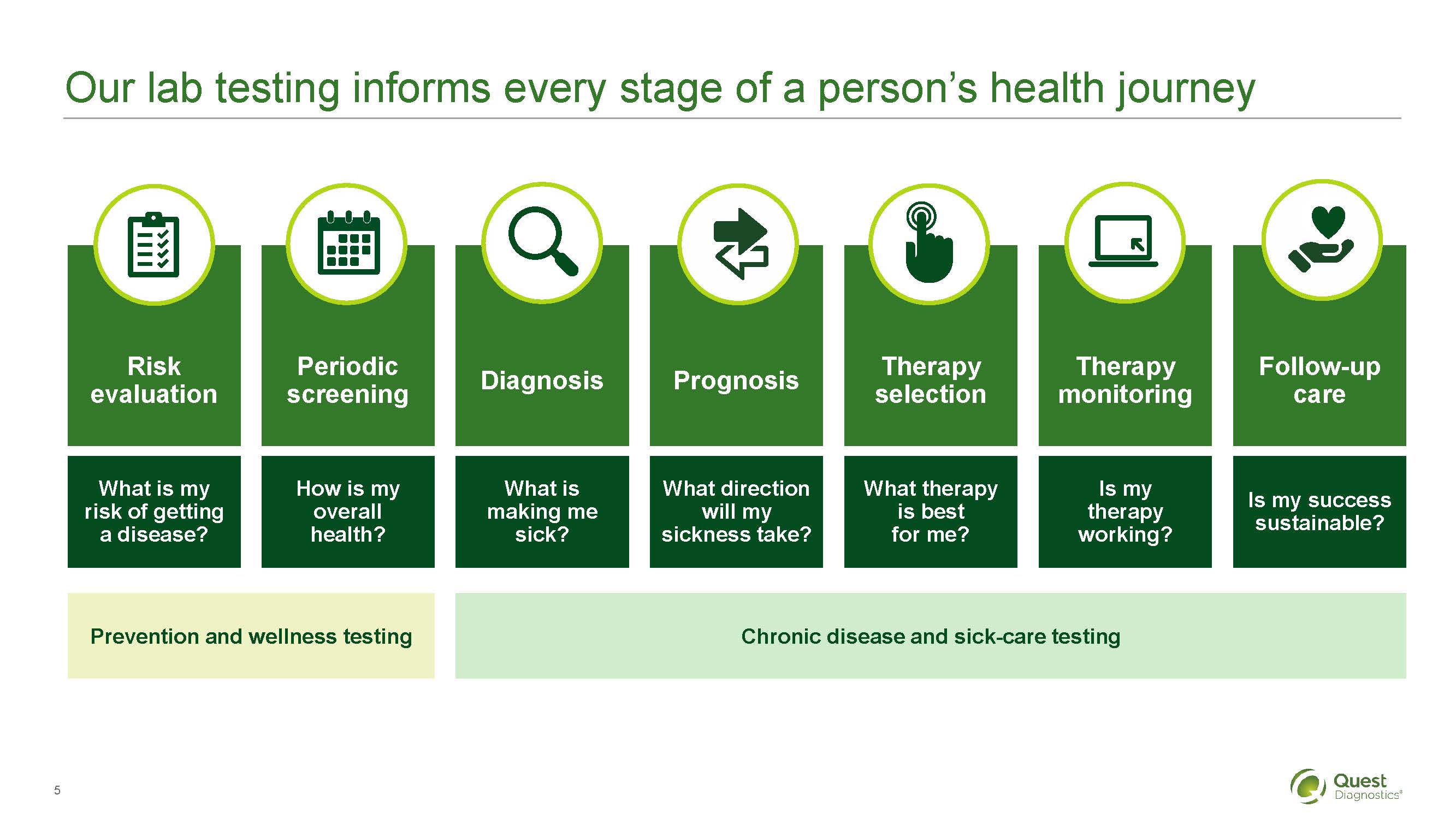

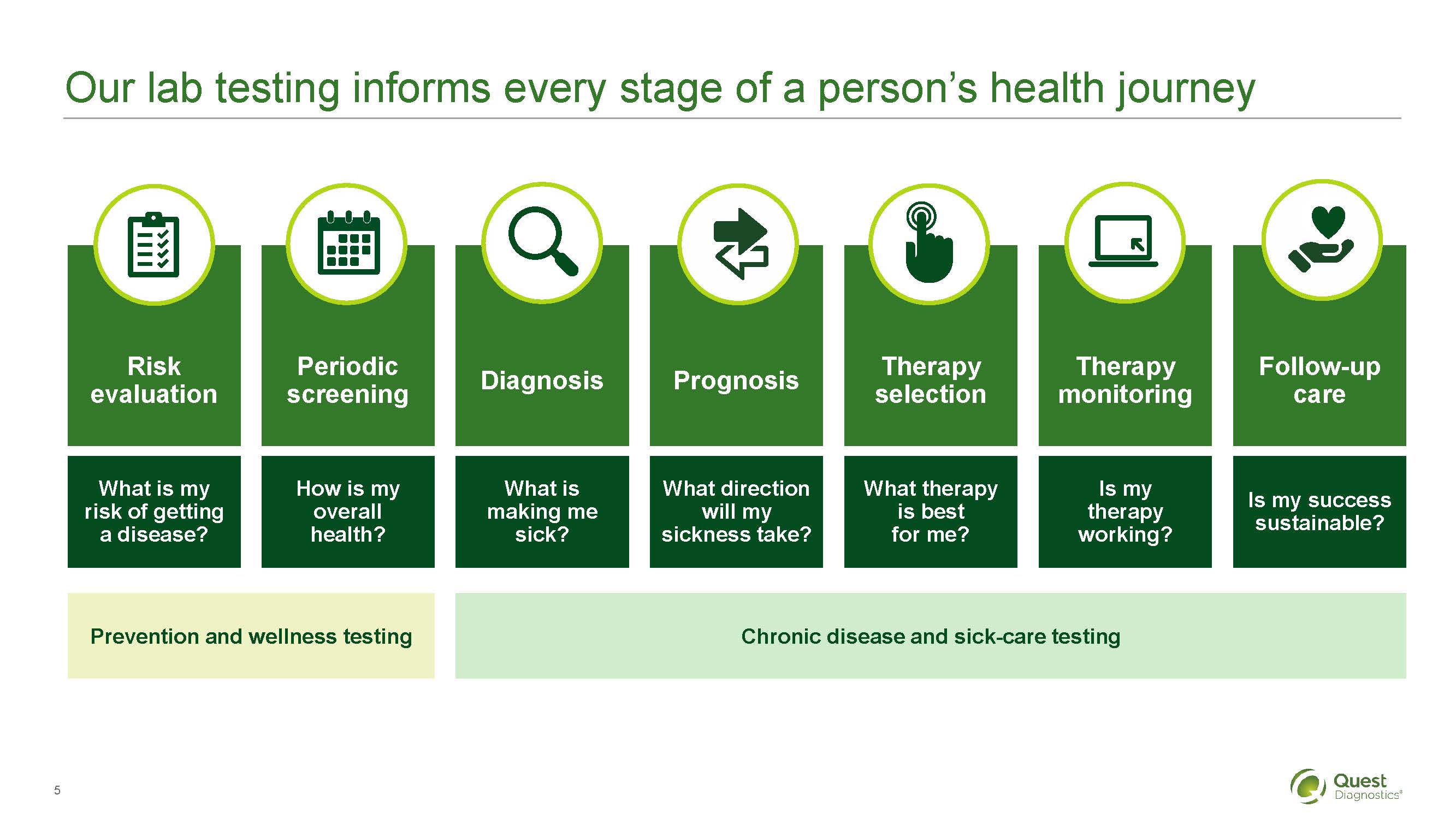

Our lab testing informs every stage of a person's health journey

Risk evaluation

What is my risk of getting a disease?

Periodic screening

How is my overall health?

Diagnosis

What is making me sick?

Prognosis

What direction wil my sickness take?

Therapy selection

What therapy is best for me?

Therapy monitoring

Is my therapy working?

Follow-up care

Is my success sustainable?

Prevention and wellness testing

Chronic disease and sick-care testing

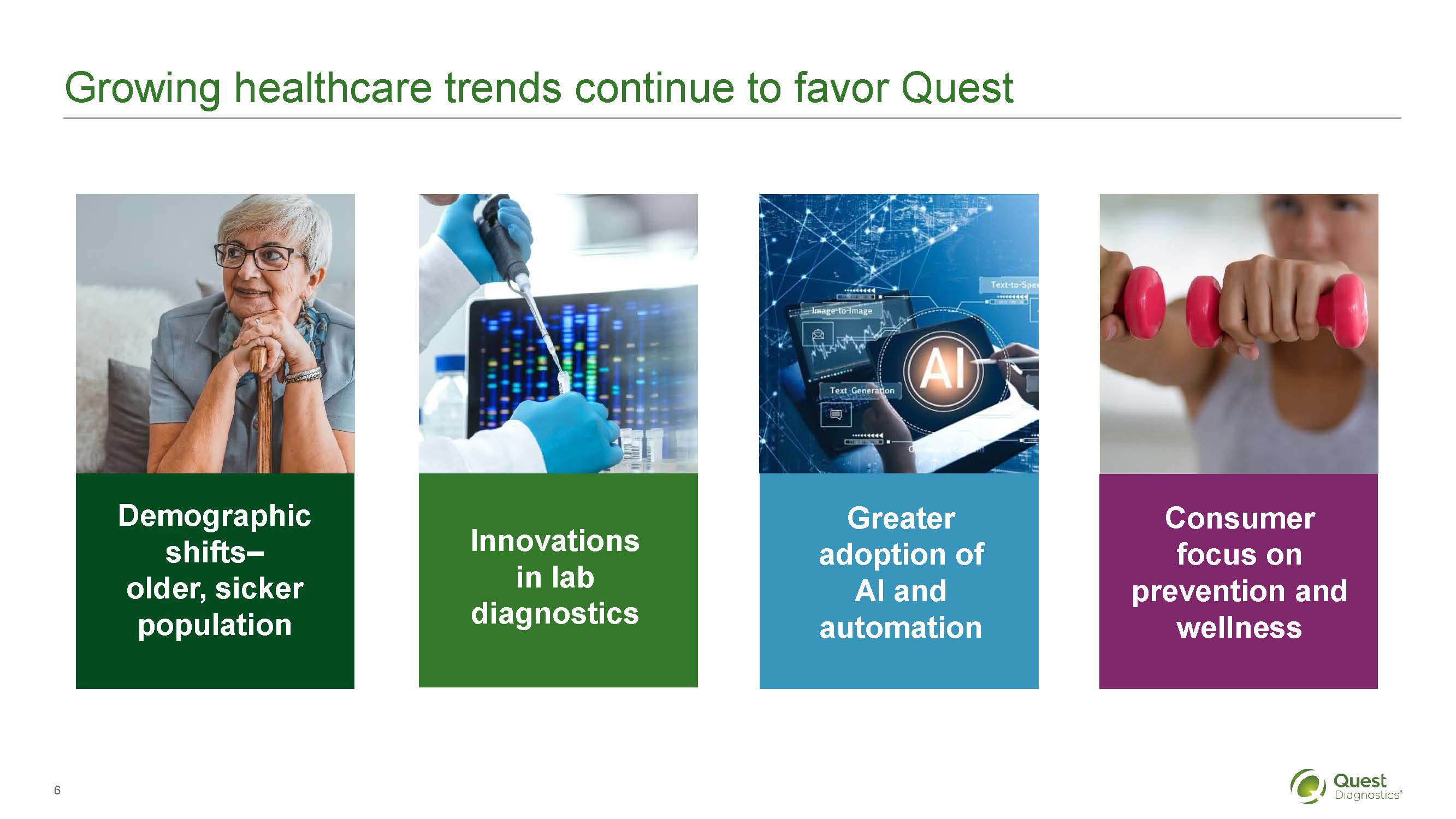

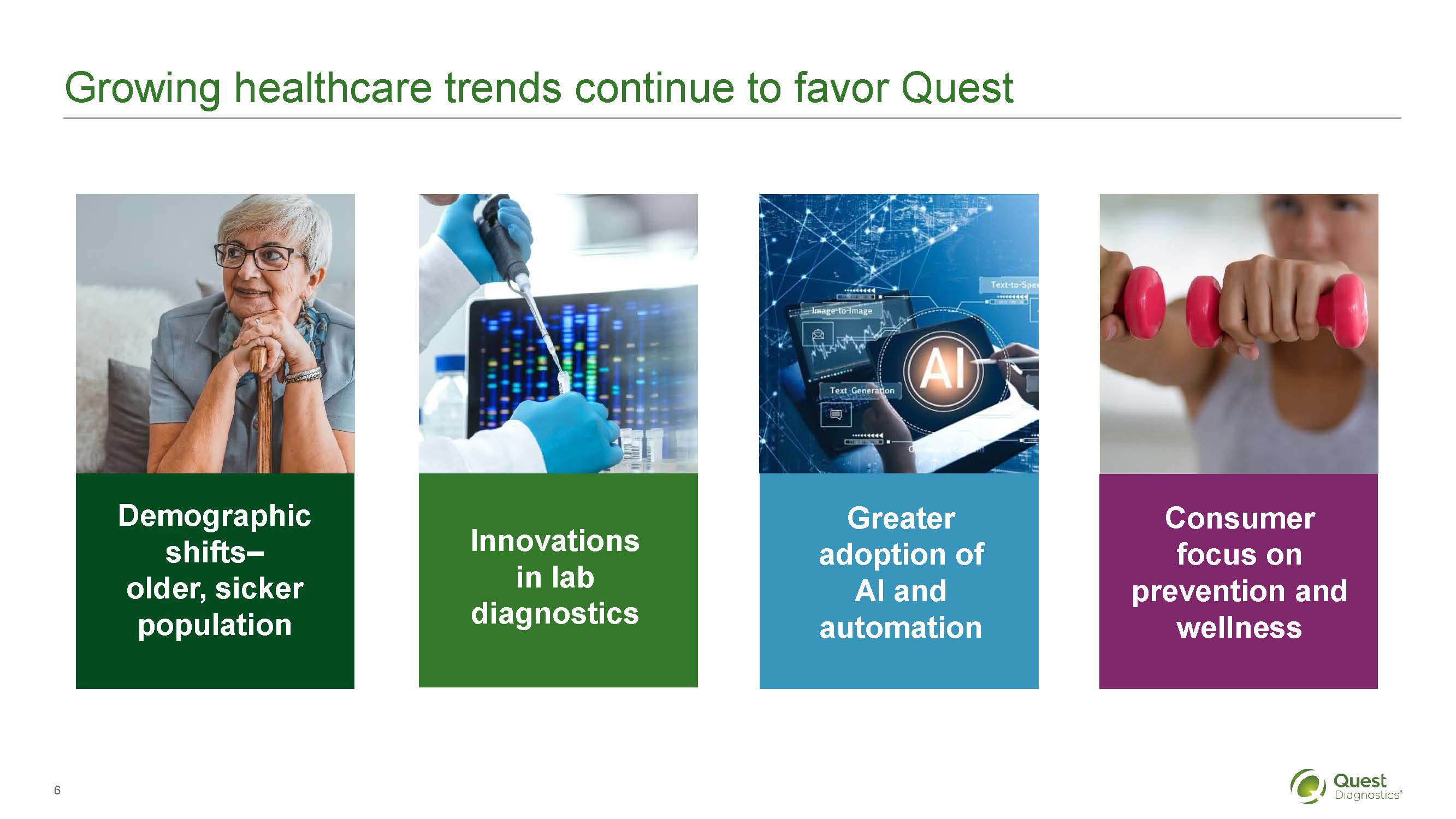

Growing healthcare trends continue to favor Quest

Demographic shifts- older, sicker population

Innovations in lab diagnostics

Greater adoption of AI and automation

Consumer focus on prevention and wellness

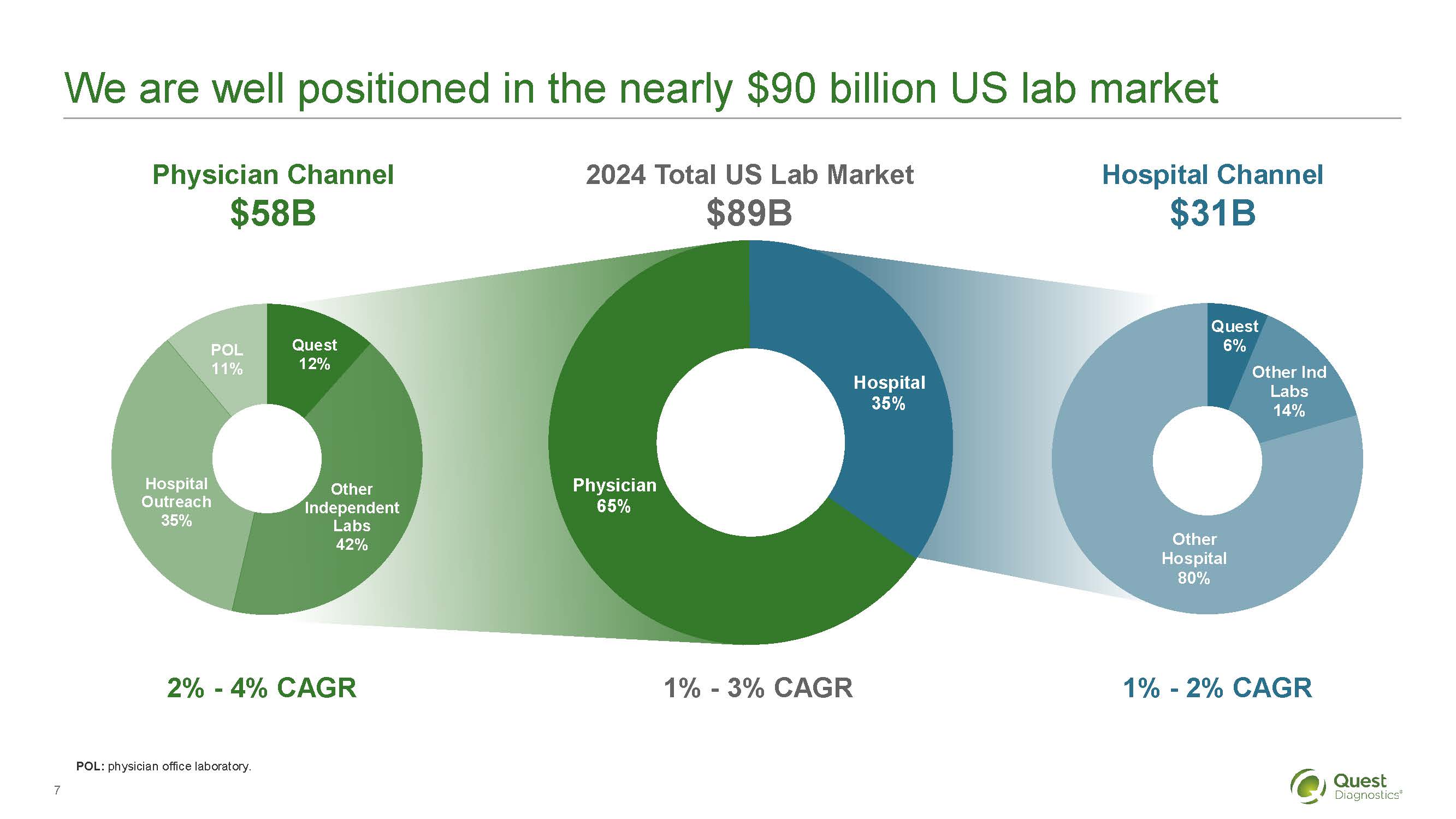

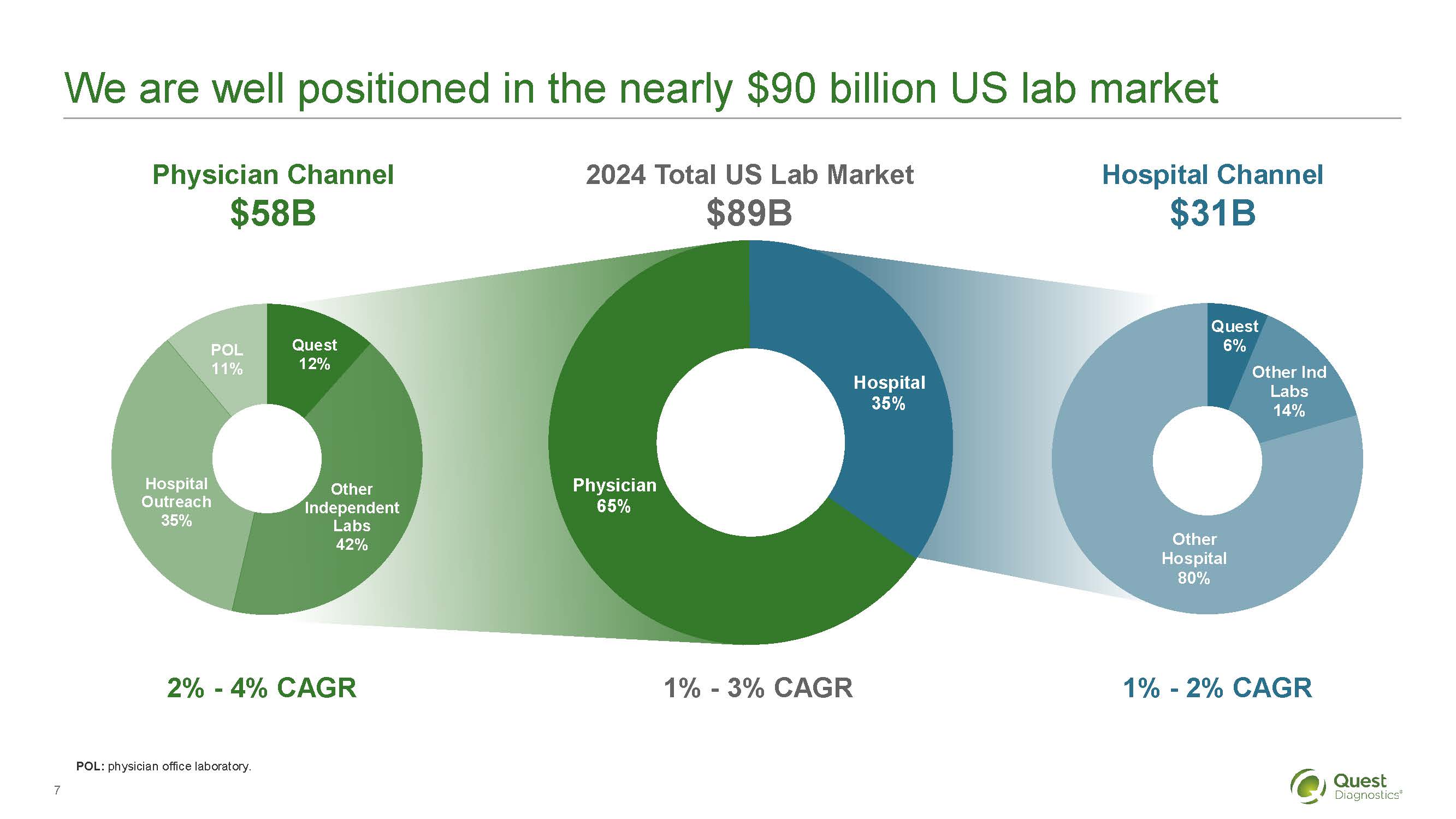

We are well positioned in the nearly $90 billion US lab market

Physician Channel $58B

POL 11%

Quest 12%

Hospital Outreach 35%

Other independent Labs 42%

2% - 4% CAGR

2024 Total US Lab Market $89B

Physician 65%

Hospital 35%

1% - 3% CAGR

Hospital Channel $31B

Quest 6%

Other Ind Labs 14%

Other Hospital 80%

1% - 2% CAGR

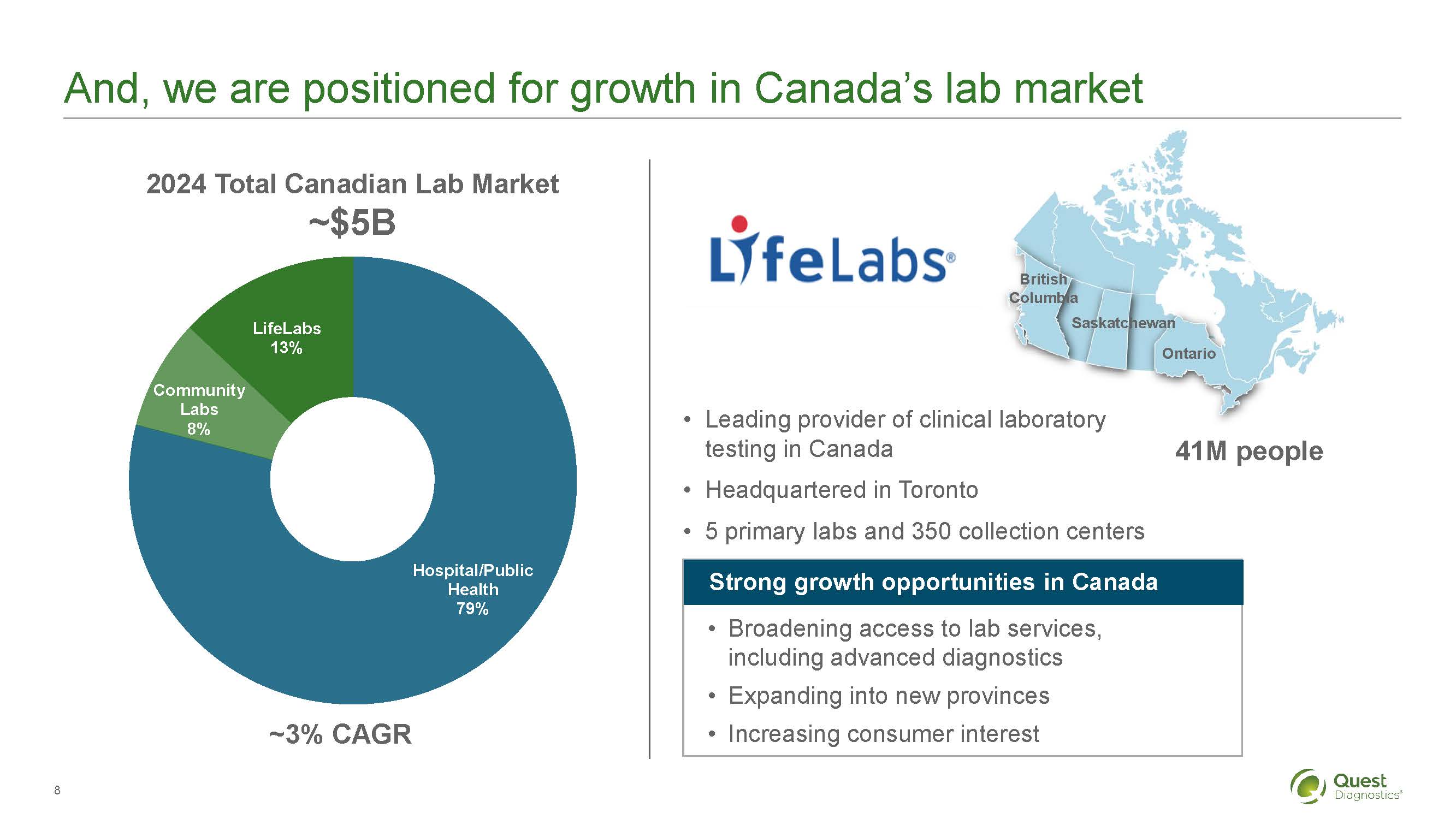

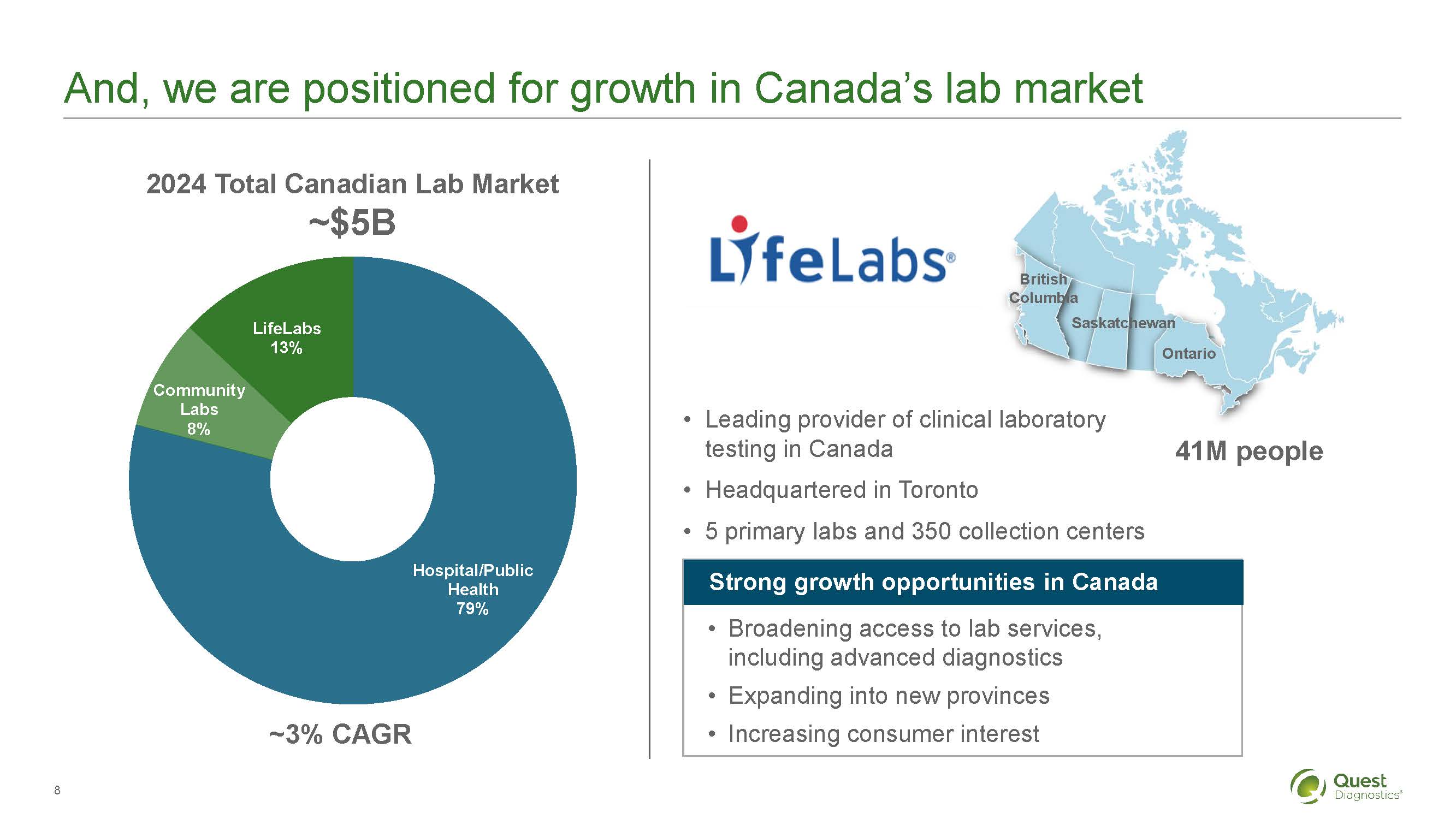

2024 Total Canadian Lab Market ~$5B

LifeLabs 13%

Community Labs 8%

Hospital/Public Health 79%

~3%CAGR

LifeLabs

British Columbia

Saskatchewan

Ontario

41M people

Leading provider of clinical laboratory testing in Canada

Headquartered in Toronto

5 primary labs and 350 collection centers

Strong growth opportunities in Canada

Broadening access to lab services, including advanced diagnostics

Expanding into new provinces

Increasing consumer interest

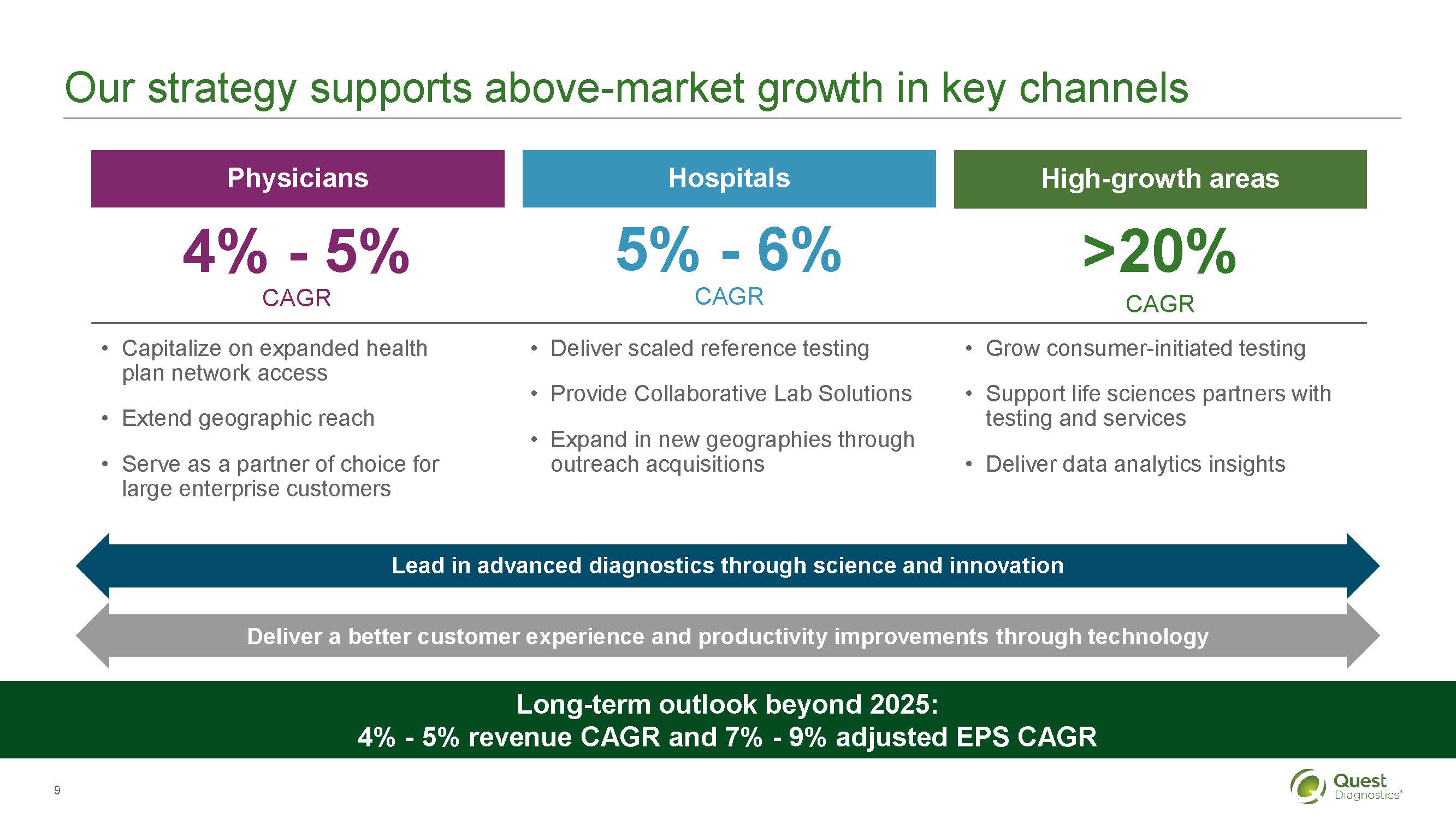

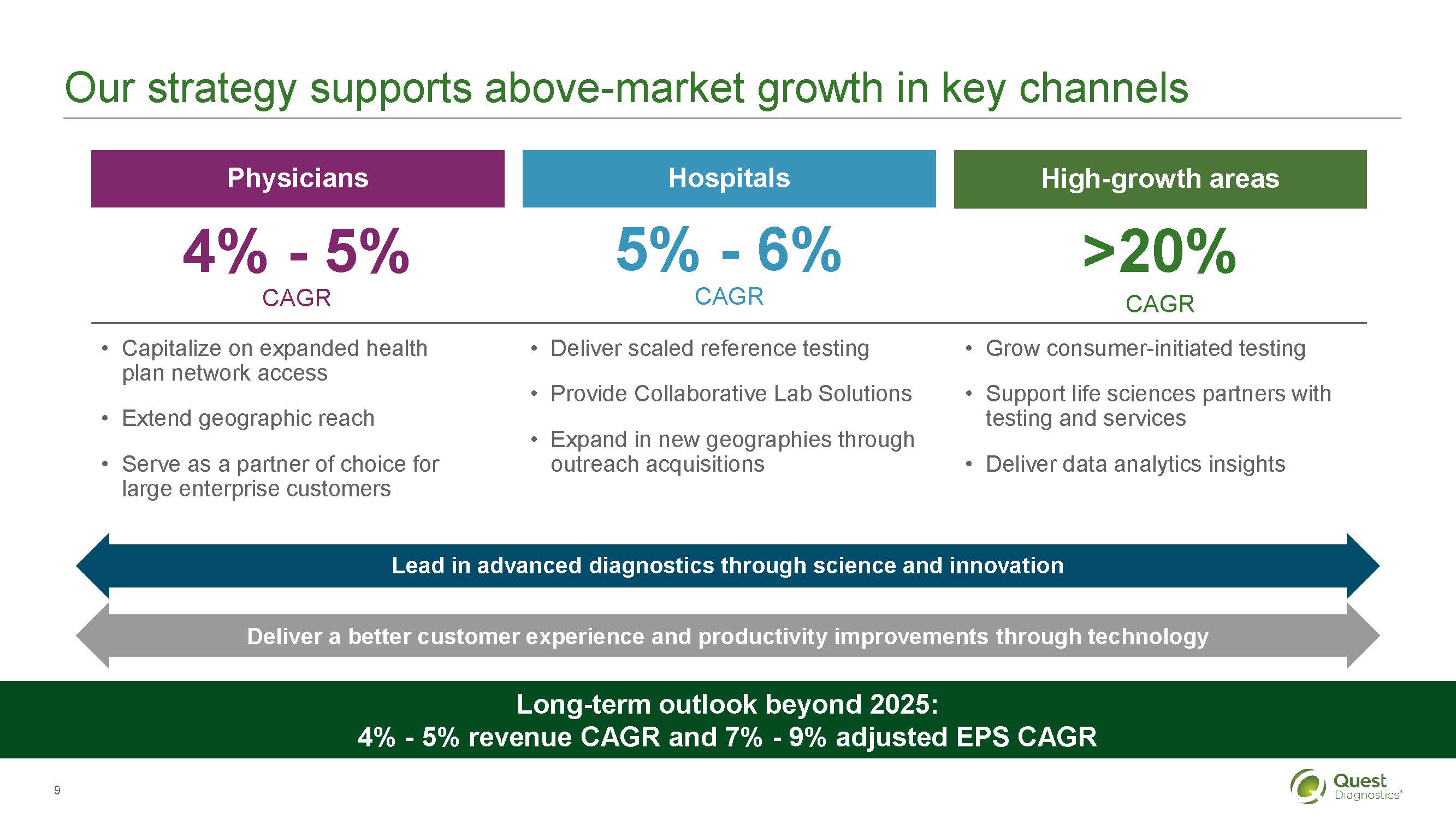

Our strategy supports above-market growth in key channels

Physicians

4% - 5% CAGR

Capitalize on expanded health

plan network access

Extend geographic reach

Serve as a partner of choice for large enterprise customers

Hospitals

5% - 6% CAGR

Deliver scaled reference testing

Provide Collaborative Lab Solutions

Expand in new geographies through outreach acquisitions

High-growth areas

>20% CAGR

Grow consumer-initiated testing

Support life sciences partners with testing and services

Deliver data analytics insights

Lead in advanced diagnostics through science and innovationDeliver a better customer experience and productivity improvements through technology

Long-term outlook beyond 2025: 4% - 5% revenue CAGR and 7% - 9% adjusted EPS CAGR

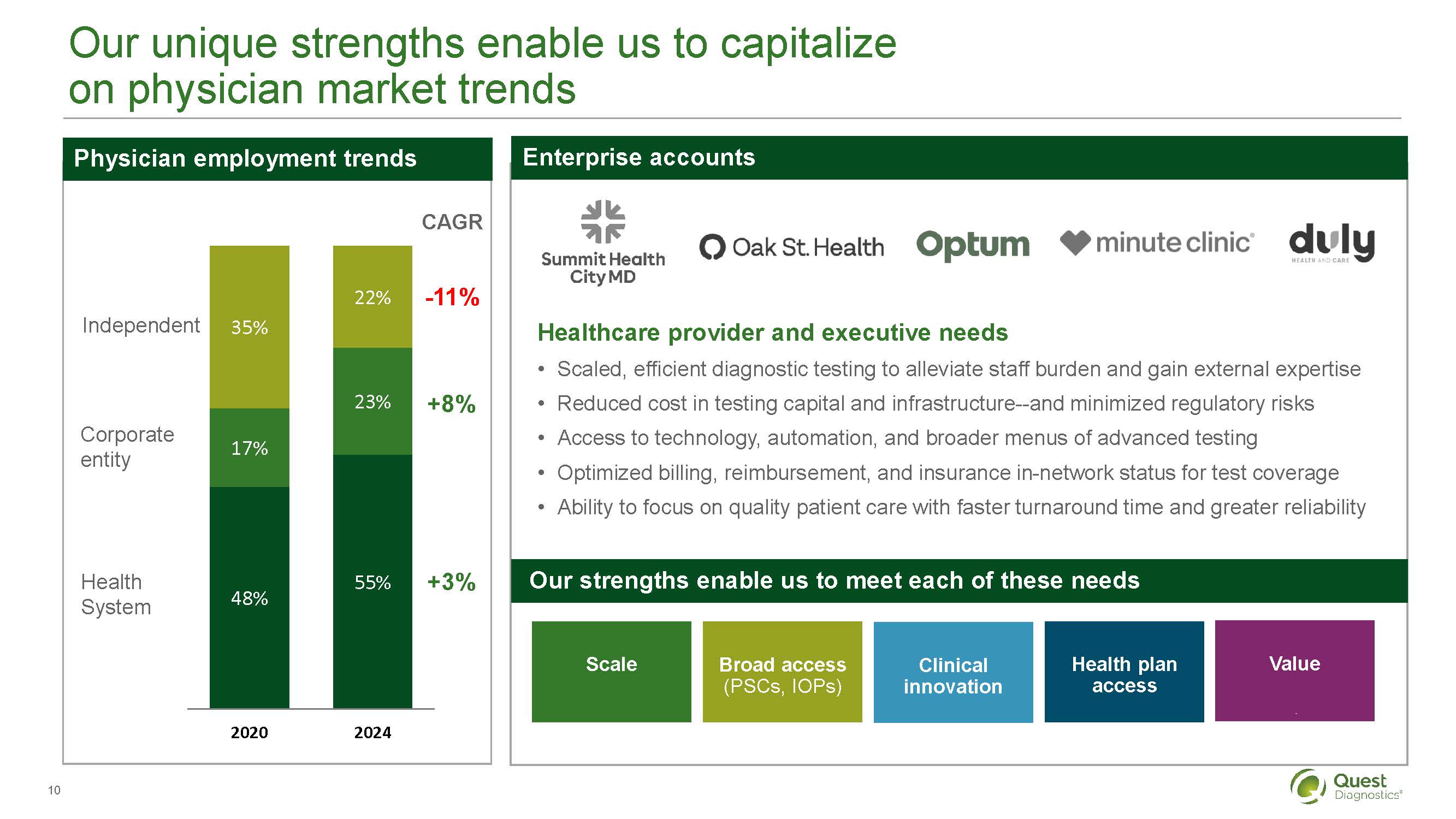

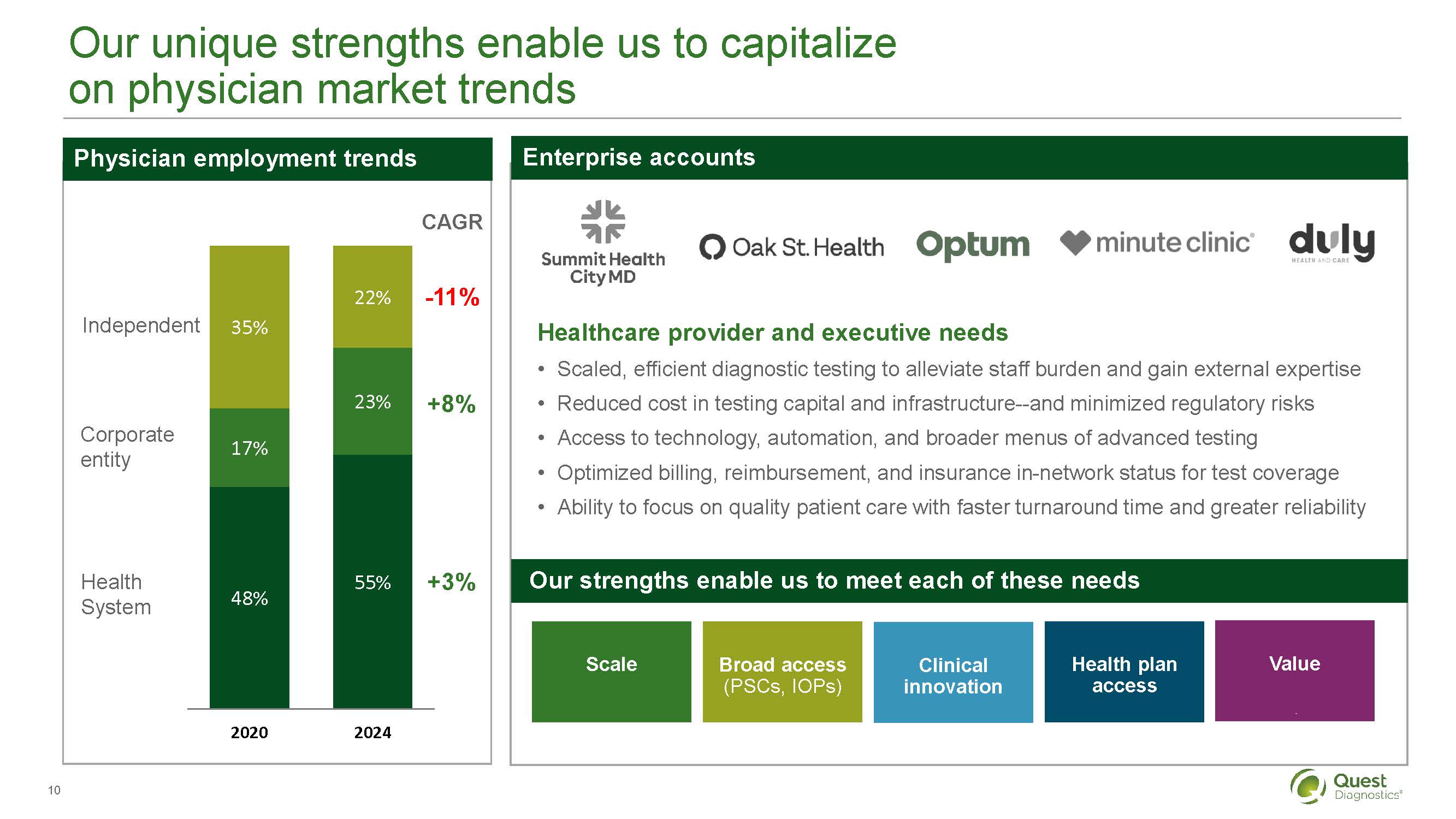

Our unique strengths enable us to capitalize on physician market trends

Physician employment trends

CAGR

Independent

35%

22%

-11%

Corporate entity

17%

23%

+8%

Health System

48%

55%

+3%

2020

2024

Enterprise accounts

Summit Health City MD

Oak St. Health

Optum

Minute clinic

duly

Healthcare provider and executive needs

Scaled, efficient diagnostic testing to alleviate staff burden and gain external expertise

Reduced cost in testing capital and infrastructure--and minimized regulatory risks

Access to technology, automation, and broader menus of advanced testing

Optimized billing, reimbursement, and insurance in-network status for test coverage

Ability to focus on quality patient care with faster turnaround time and greater reliability

Our strengths enable us to meet each of these needs

Scale

Board access (PSCs, IOPs)

Clinical Innovation

Health plan access

Value

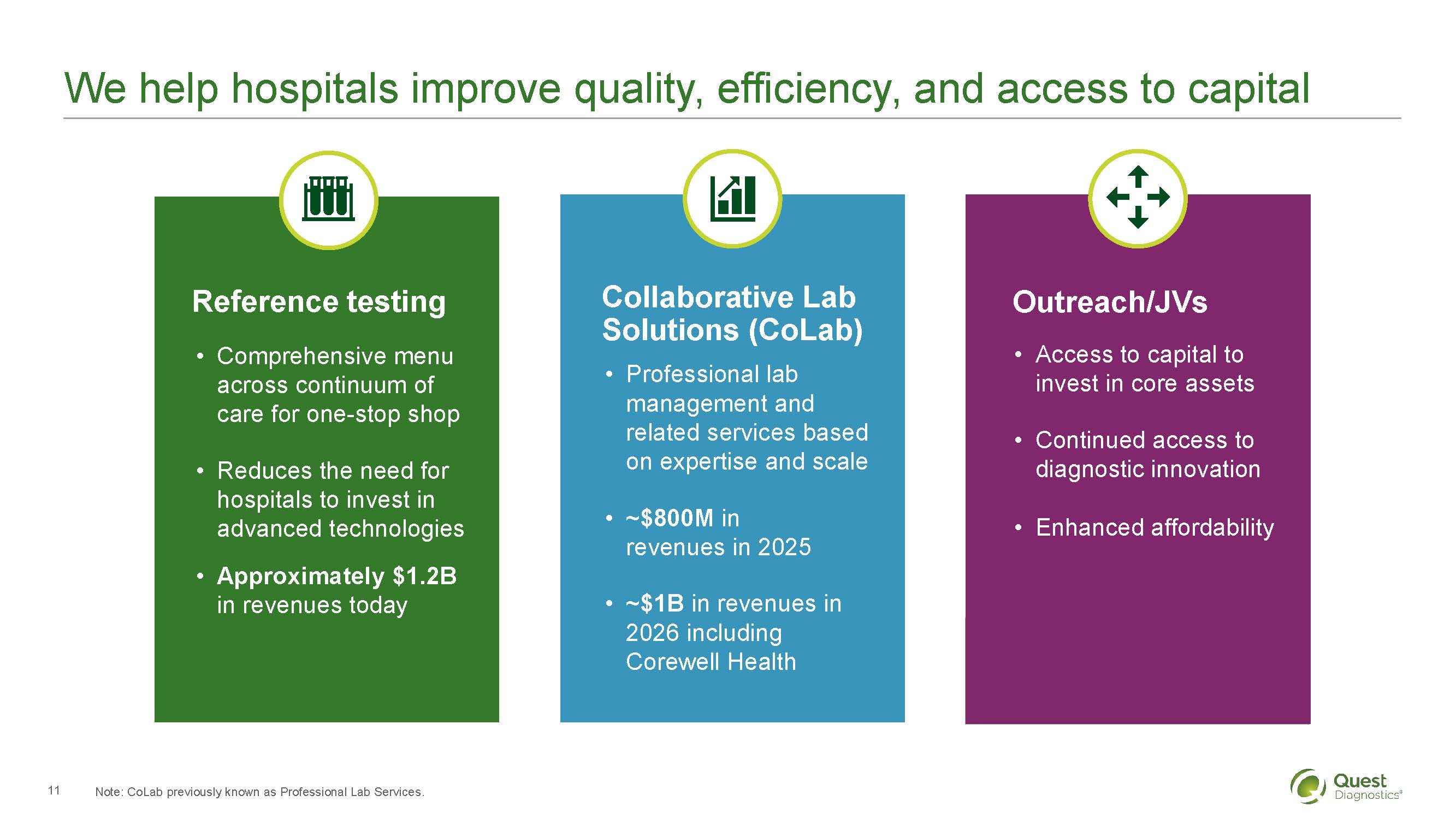

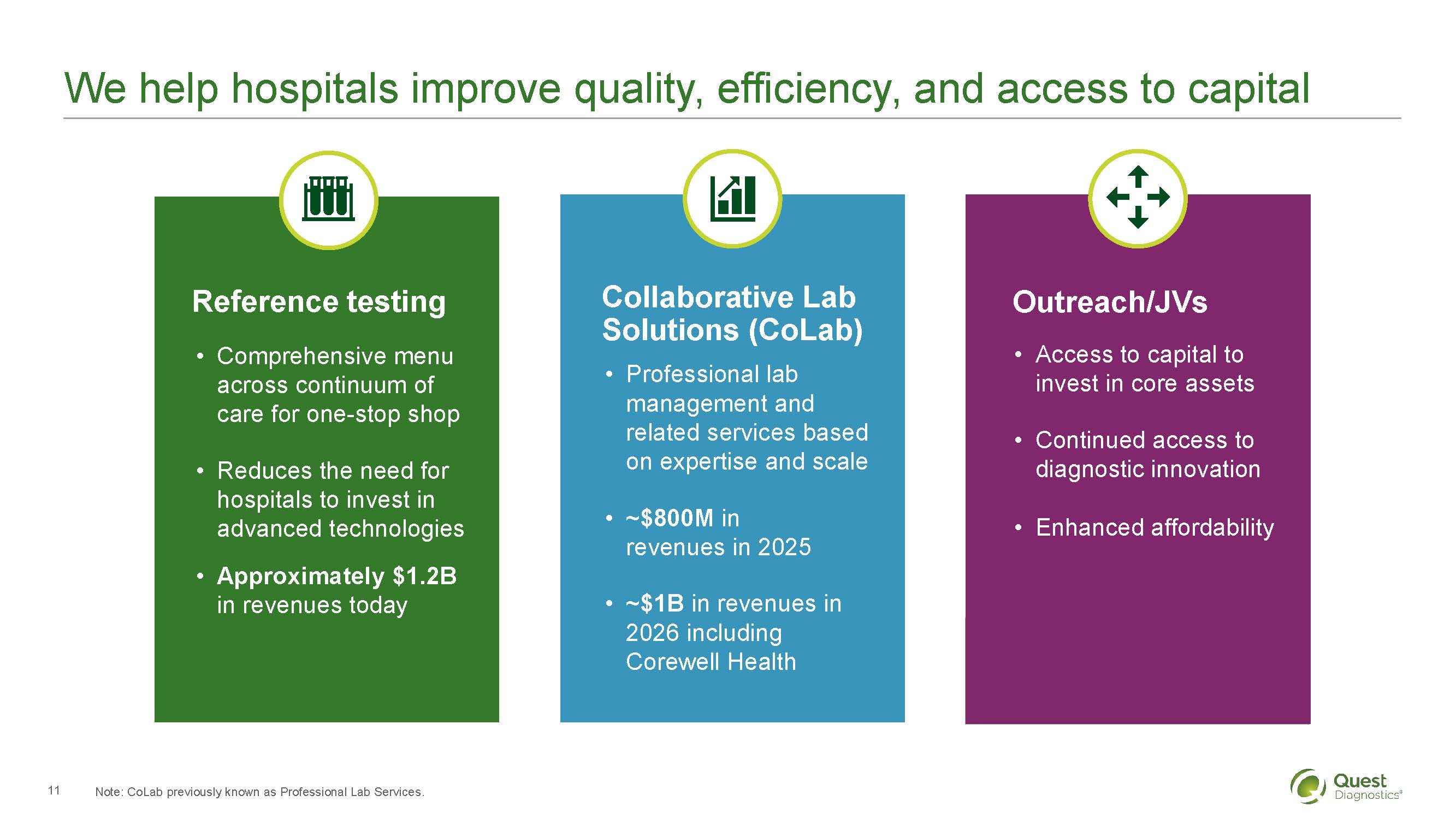

We help hospitals improve quality, efficiency, and access to capital

Reference testing

Comprehensive menu across continuum of care for one-stop shop

Reduces the need for hospitals to invest in advanced technologies

Approximately $1.2B in revenues today

Collaborative Lab Solutions (CoLab)

Professional lab management and related services based on expertise and scale

~$800M in revenues in 2025

~$1B in revenues in 2026 including Corewell Health

Outreach / JVs

Access to capital to invest in core assets

Continued access to diagnostic innovation

Enhanced affordability

Quest is the lab engine for the growing wellness industry

~$100M direct

Quest

~250M annual revenue

~150M partners

Function

WHOOP

Hims&hers

OURA

Behavioral Change

Biometric data from device

Biomarker data from lab

Provider direction

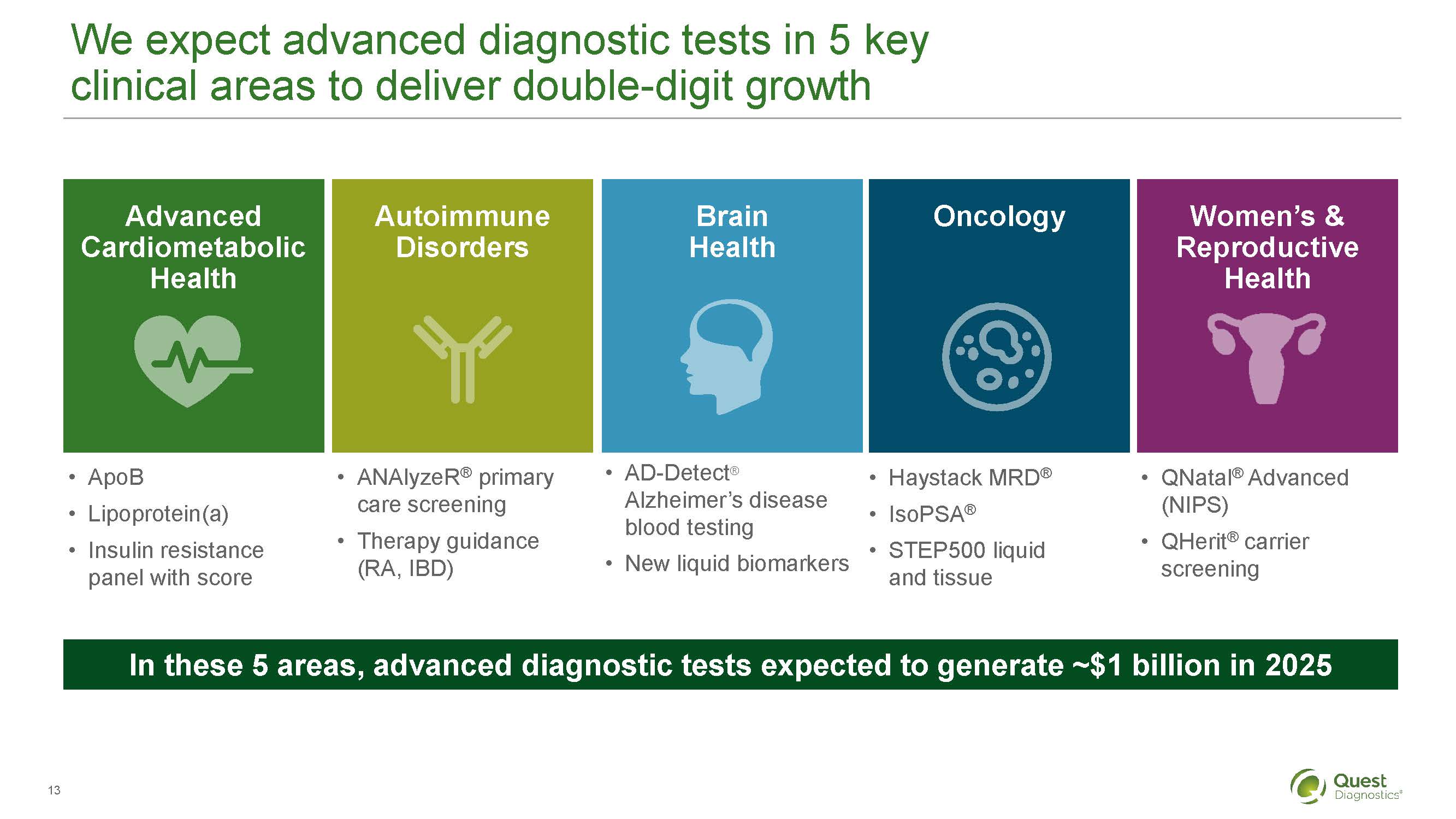

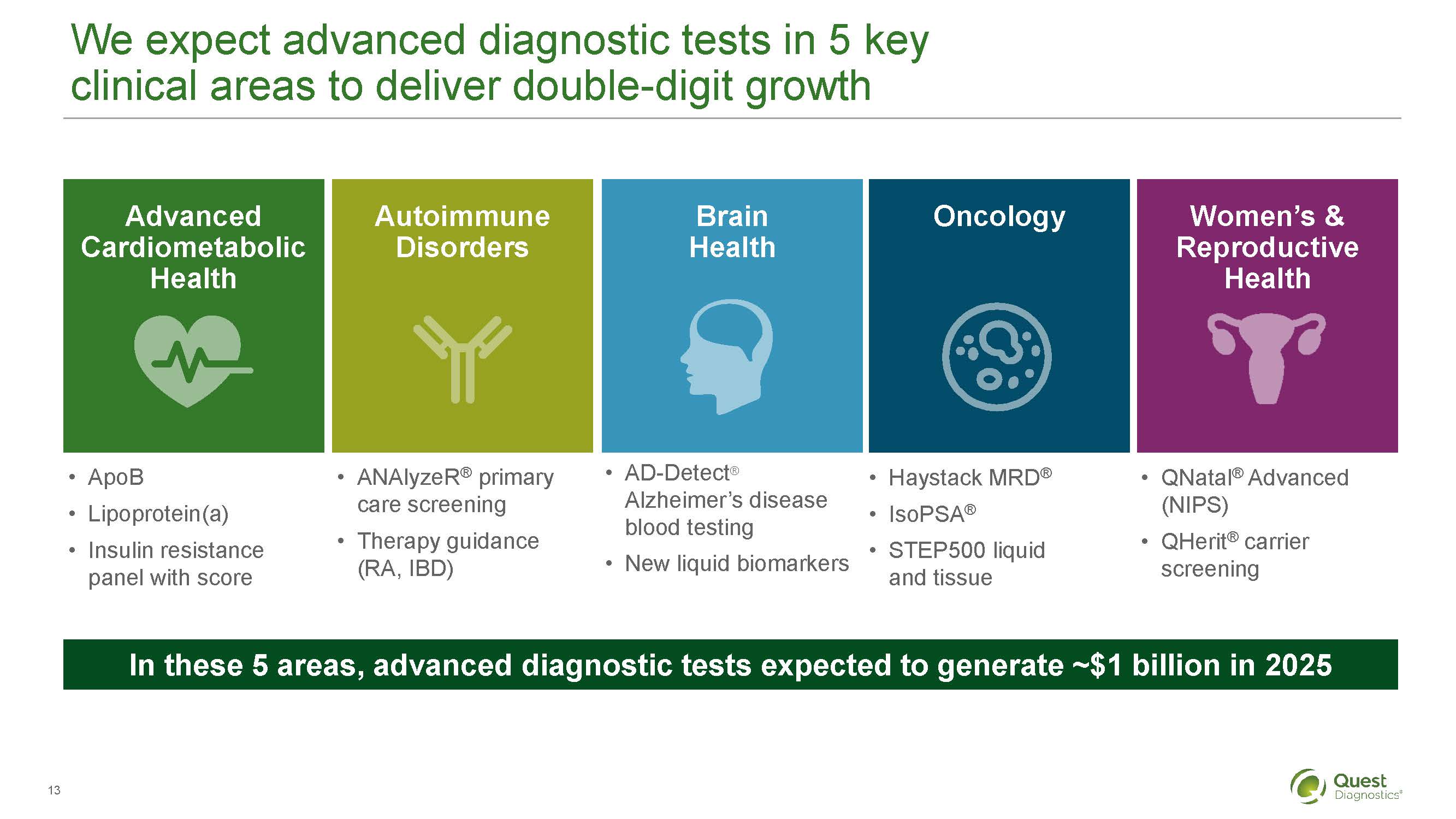

We expect advanced diagnostic tests in 5 key clinical areas to deliver double-digit growth

Advanced Cardiometabolic Health

ApoB

Lipoprotein(a)

Insulin resistance panel with score

Autoimmune Disorders

ANAlyzeR® primary care screening

Therapy guidance

(RA, IBD)

Brain Health

AD-Detect® Alzheimer's disease blood testing

New liquid biomarkers

Oncology

Haystack MRD®

IsoPSA®

STEP500 liquid and tissue

Women's & Reproductive Health

QNatal® Advanced (NIPS)

QHerit® carrier screening

In these 5 areas, advanced diagnostic tests expected to generate ~$1 billion in 2025

We continue to improve quality, productivity, and customer experience

3% annual productivity and cost savings target through Invigorate

Onboard

Order

Collect

Transport

Test

Result

Bill

Service

People Customer-centric and highly engaged employees driving performance and innovation

Process Lean, standardized, and digital processes powering experience and productivity

Technology Automation, AI, and new software tools enabling operational excellence

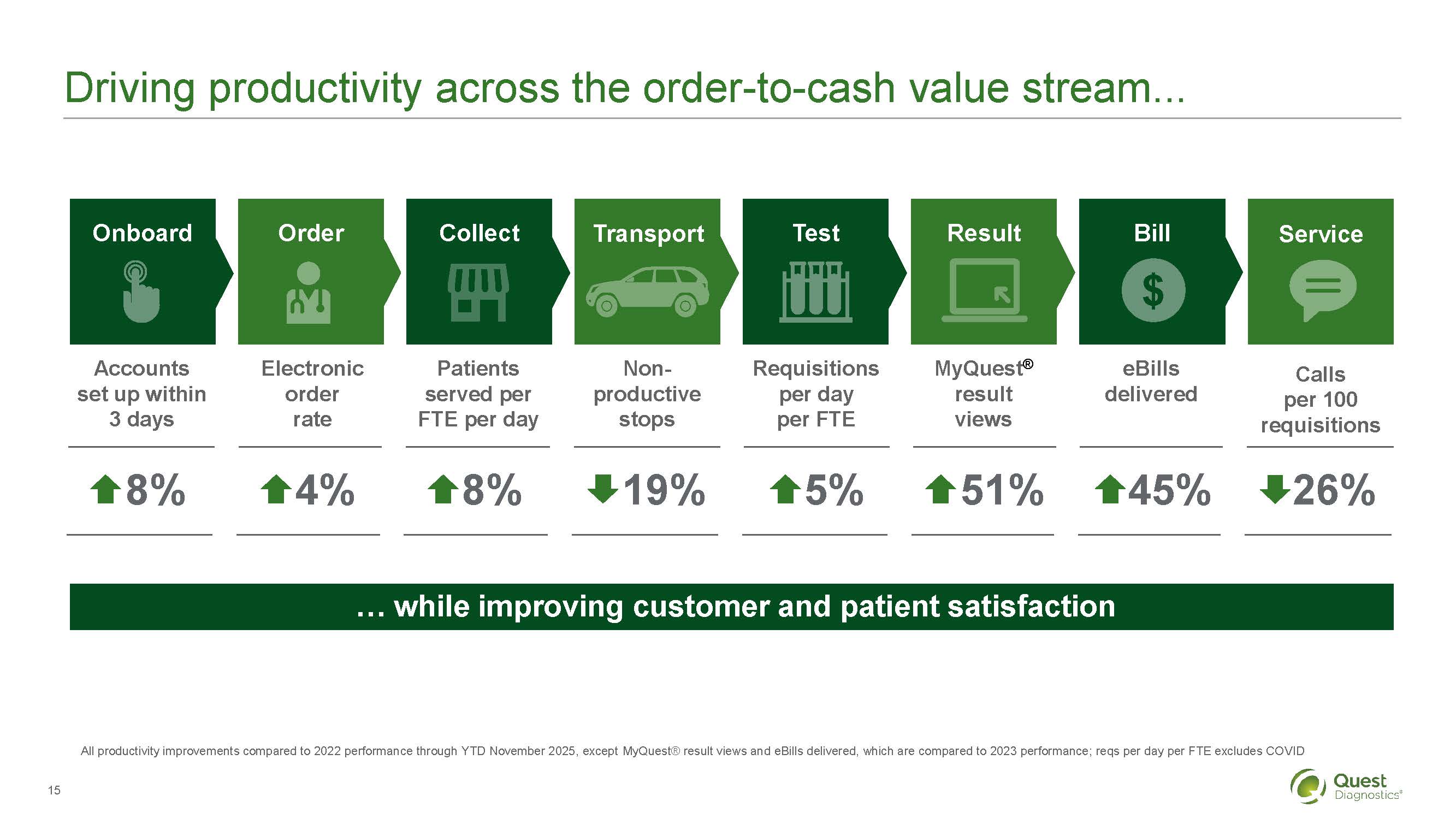

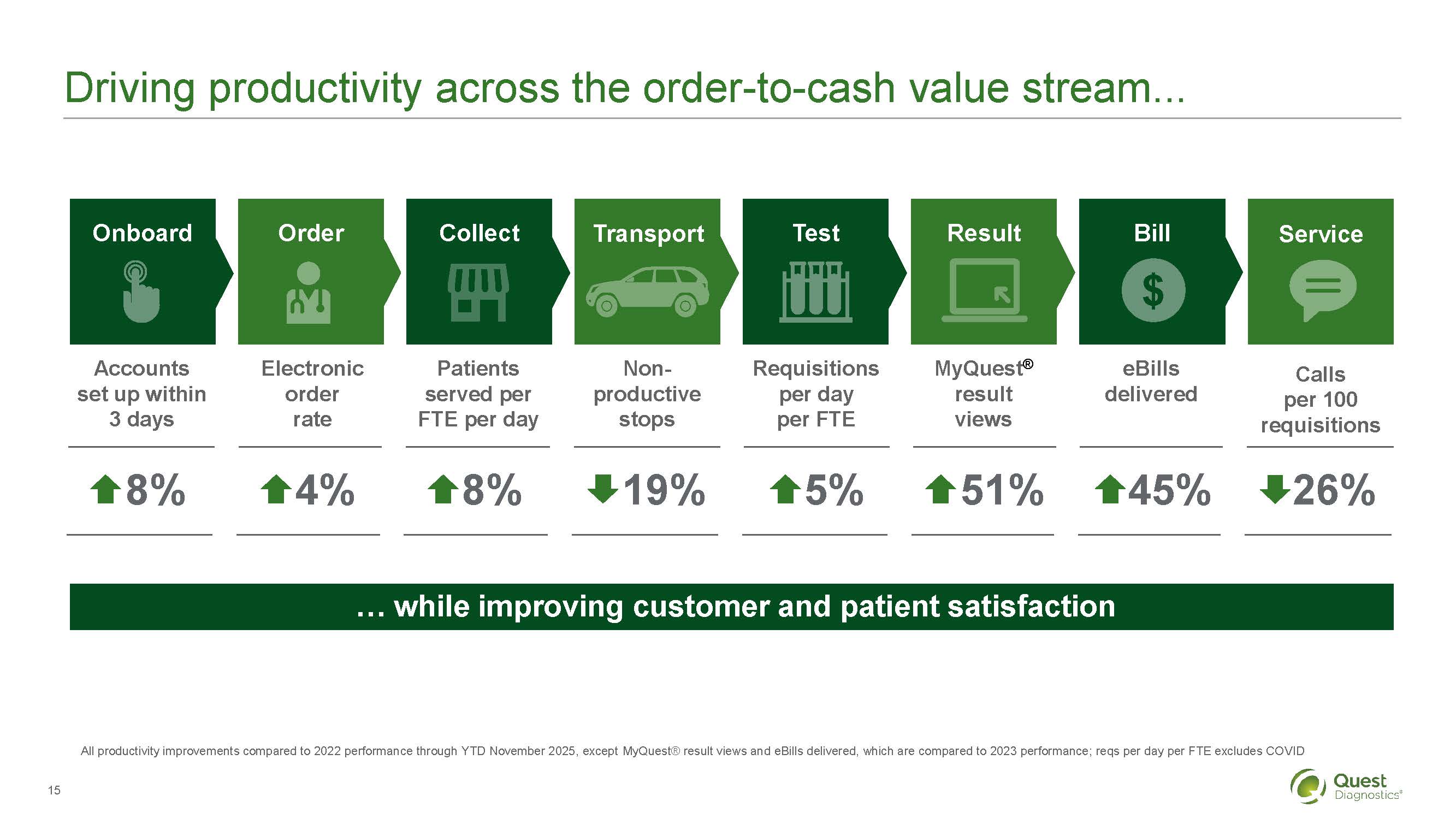

Driving productivity across the order-to-cash value stream...

Onboard

Order

Collect

Transport

Test

Result

Bill

Service

Accounts set up within 3 days

Electronic order rate

Patients served per FTE per day

Non-productive stops

Requisitions per day per FTE

MyQuest® result views

eBills delivered

Calls per 100 requisitions

8%

4%

8%

19%

5%

51%

45%

26%

… while improving customer and patient satisfaction

All productivity improvements compared to 2022 performance through YTD November 2025, except MyQuest®result views and eBills delivered, which are compared to 2023 performance; reqs per day per FTE excludes COVID

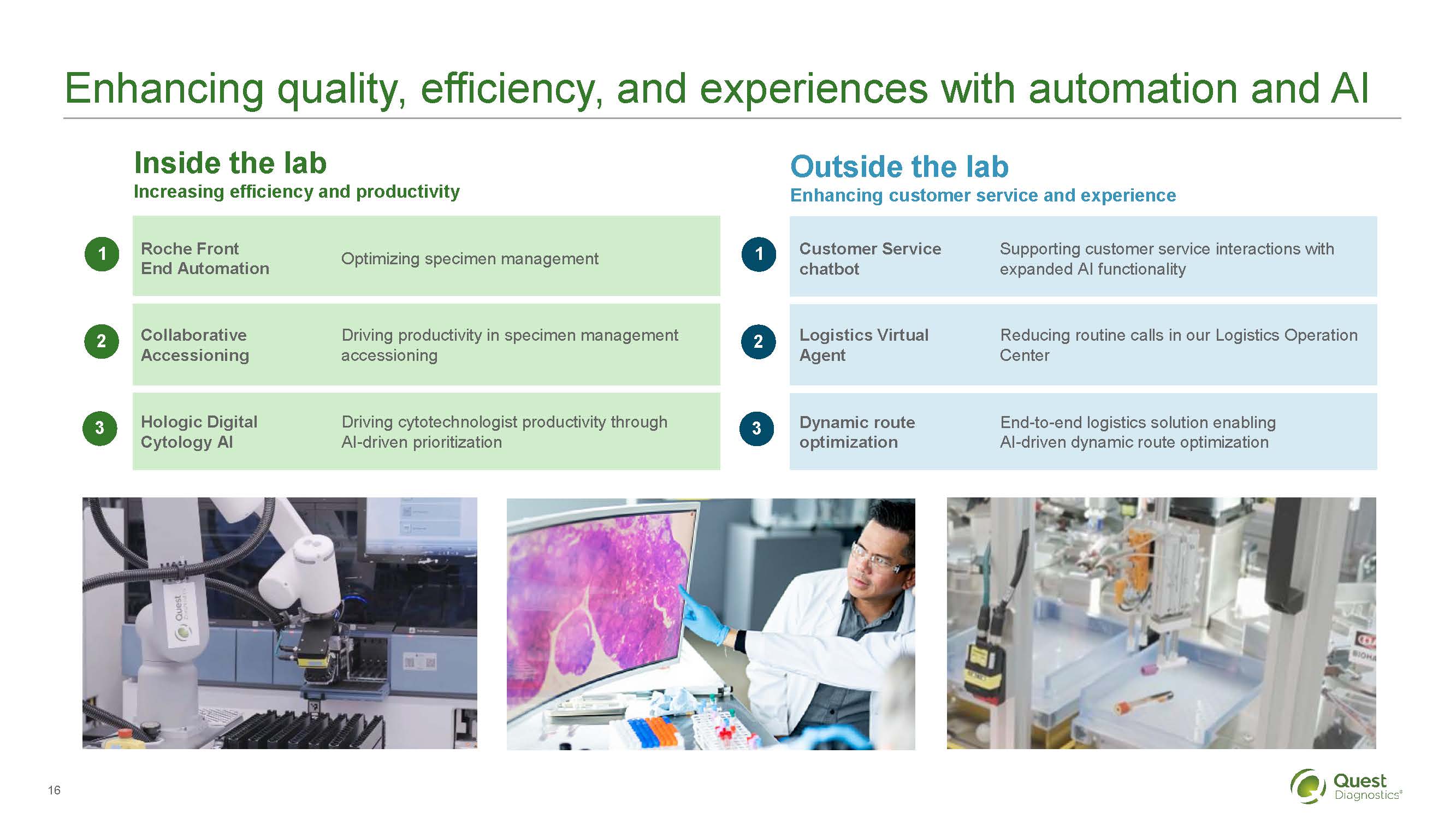

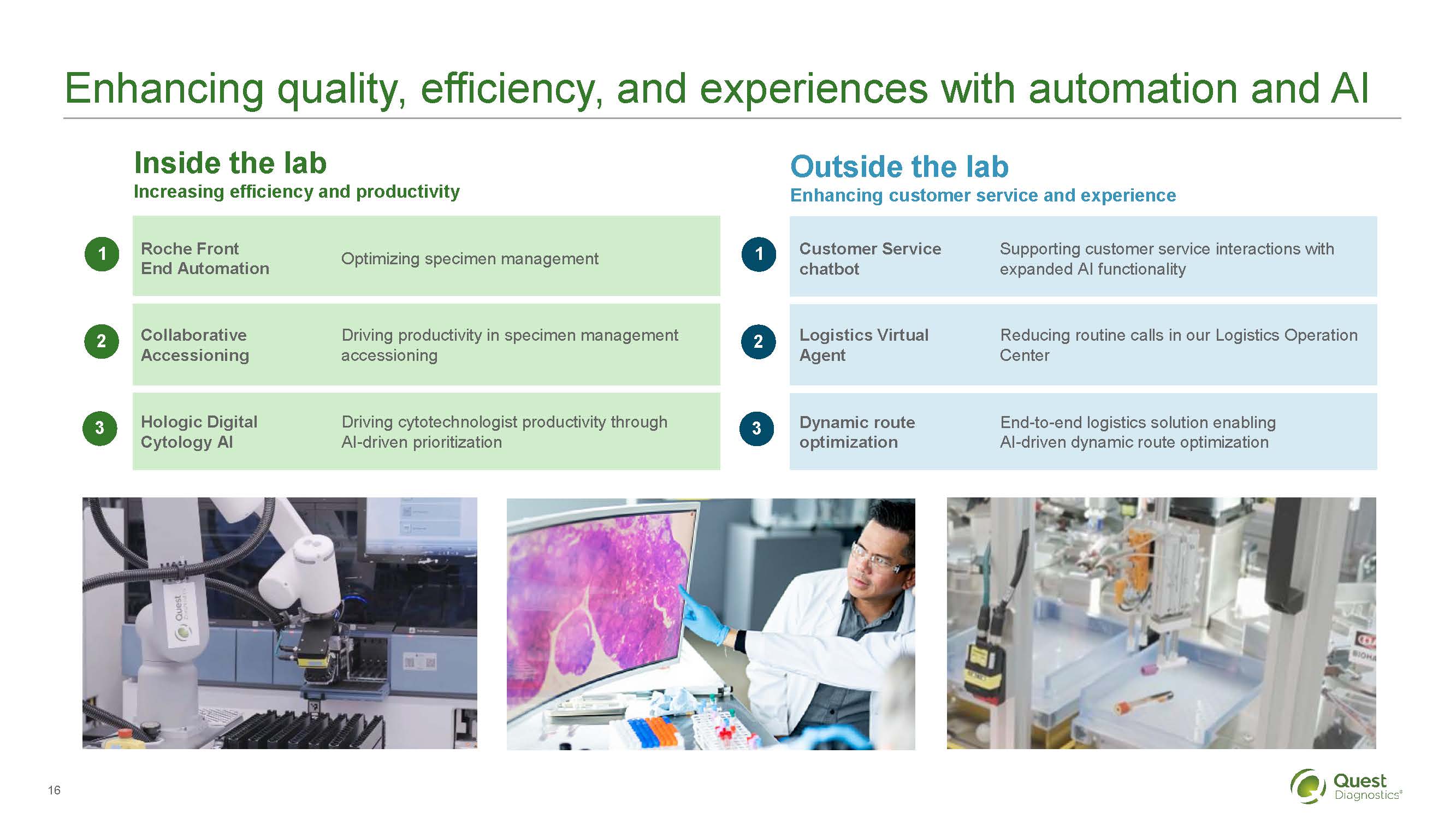

Enhancing quality, efficiency, and experiences with automation and AI

Inside the lab

Increasing efficiency and productivity

1 Roche Front End Automation

Optimizing specimen management

2 Driving productivity in specimen management accessioning

Driving productivity in specimen management accessioning

3 Hologic Digital Cytology AI

Driving cytotechnologist productivity through AI-driven prioritization

Outside the lab

Enhancing customer service and experience

1 Customer Service chatbot

Supporting customer service interactions with expanded AI functionality

2 Logistics Virtual Agent

Reducing routine calls in our Logistics Operation Center

3 Dynamic route optimization

End-to-end logistics solution enabling AI-driven dynamic route optimization

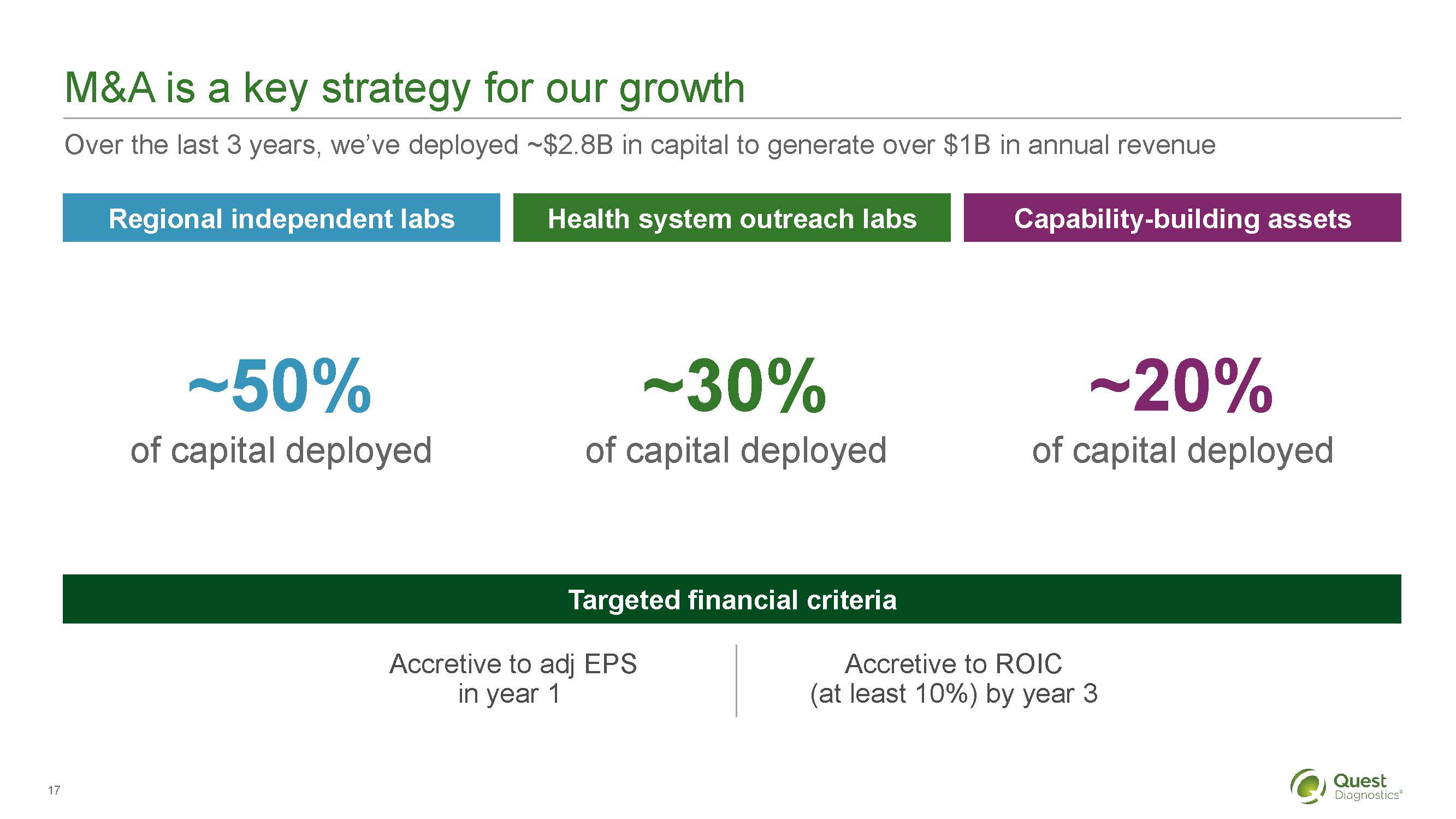

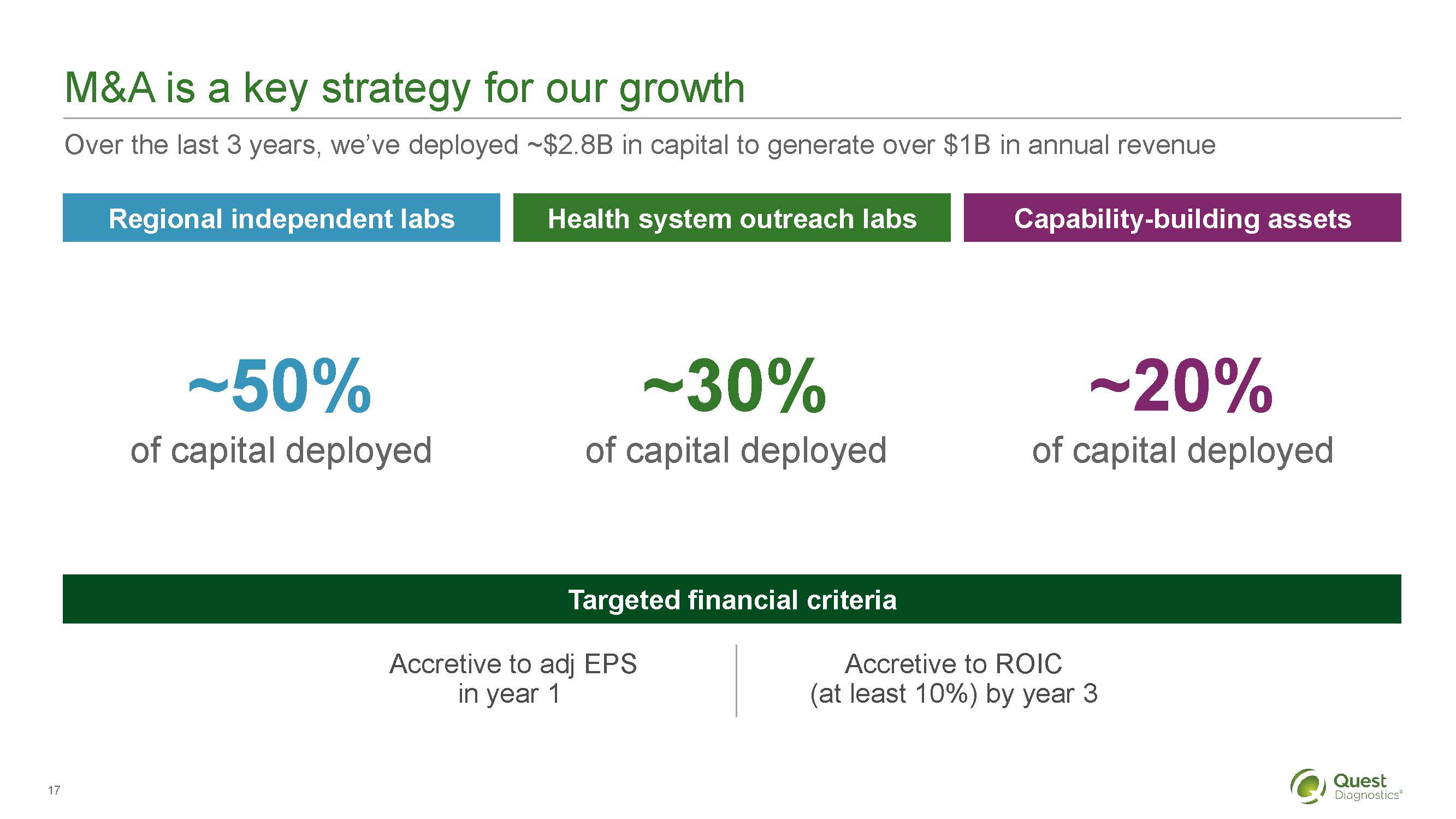

M&A is a key strategy for our growth

Over the last 3 years, we've deployed ~$2.8B in capital to generate over $1B in annual revenue

Regional independent labs

Health system outreach labs

Capability-building assets

~50% of capital deployed

~30% of capital deployed

~20% of capital deployed

Targeted financial criteria

Accretive to adj EPS in year 1

Accretive to ROIC (at least 10%) by year 3

Building new capabilities through strategic partnerships

FRESENIUS MEDICAL CARE

Provides end-stage renal disease (ESRD) dialysis testing for over 2,600 dialysis centers serving 200,000+ US patients

Built dialysis-related water testing capabilities

Leverages Quest's national network to enable near-access services

Daytime testing optimizes lab utilization

Faster results for some dialysis-related testing for patients

Greater value for Fresenius

Medical Care

Improved access to the dialysis market

for Quest

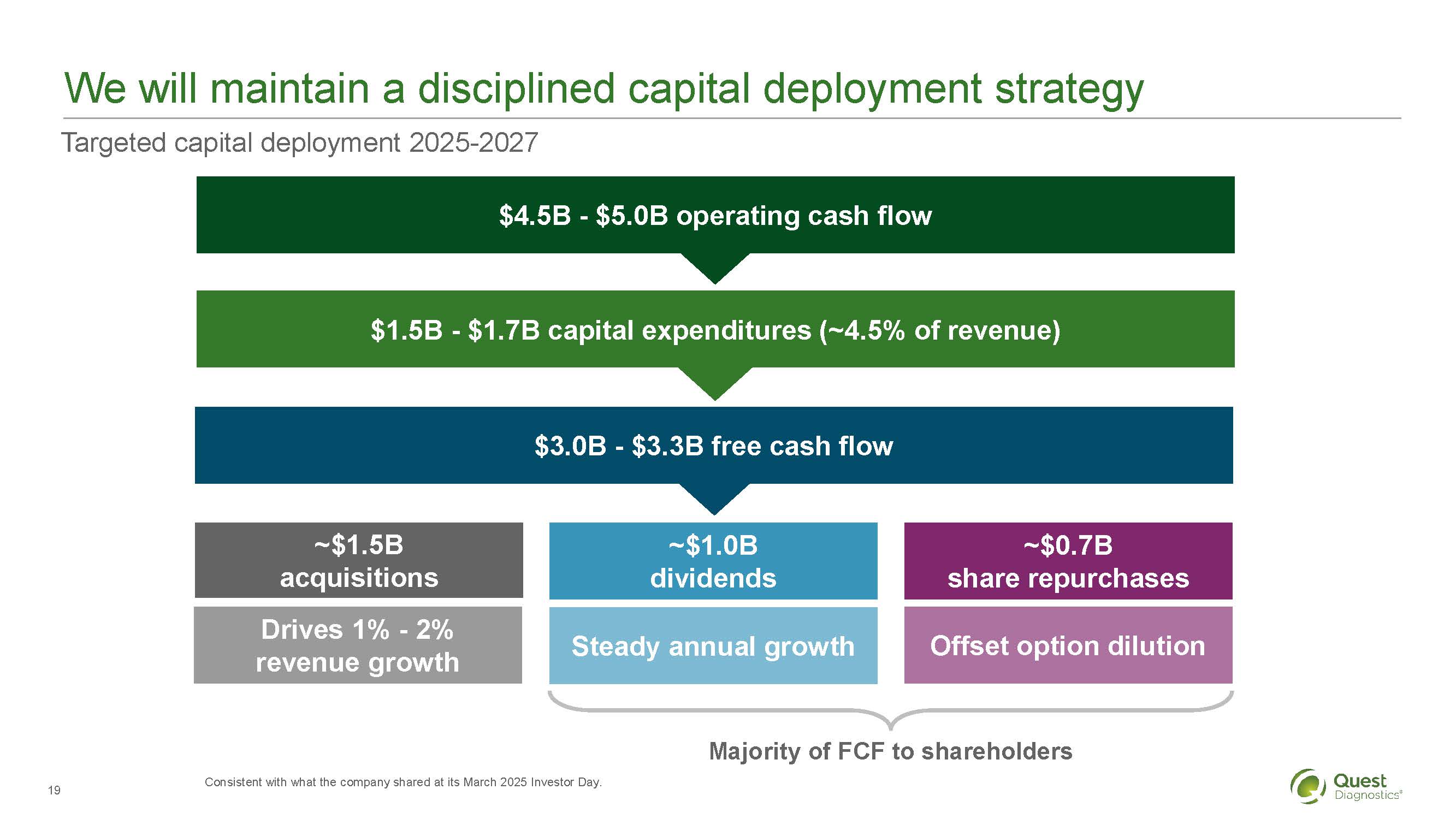

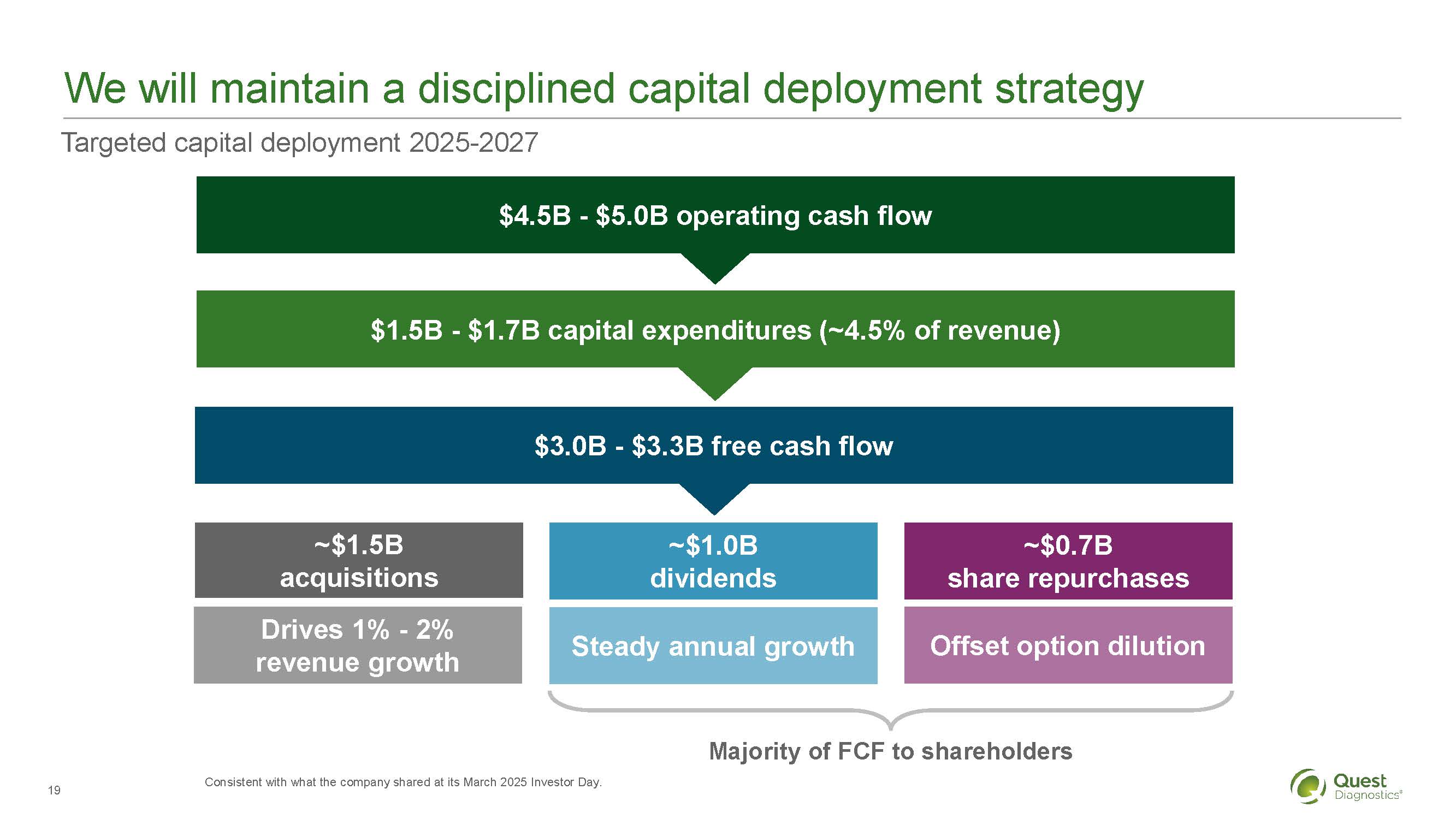

We will maintain a disciplined capital deployment strategy

Targeted capital deployment 2025-2027

$4.5B - $5.0B operating cash flow

$1.5B - $1.7B capital expenditures (~4.5% of revenue)

$3.0B - $3.3B free cash flow

~$1.5B

acquisitions

Drives 1% - 2%

revenue growth

~$1.0B

dividends

Steady annual growth

~$0.7B

share repurchases

Offset option dilution

Majority of FCF to shareholders

Consistent with what the company shared at its March 2025 Investor Day.

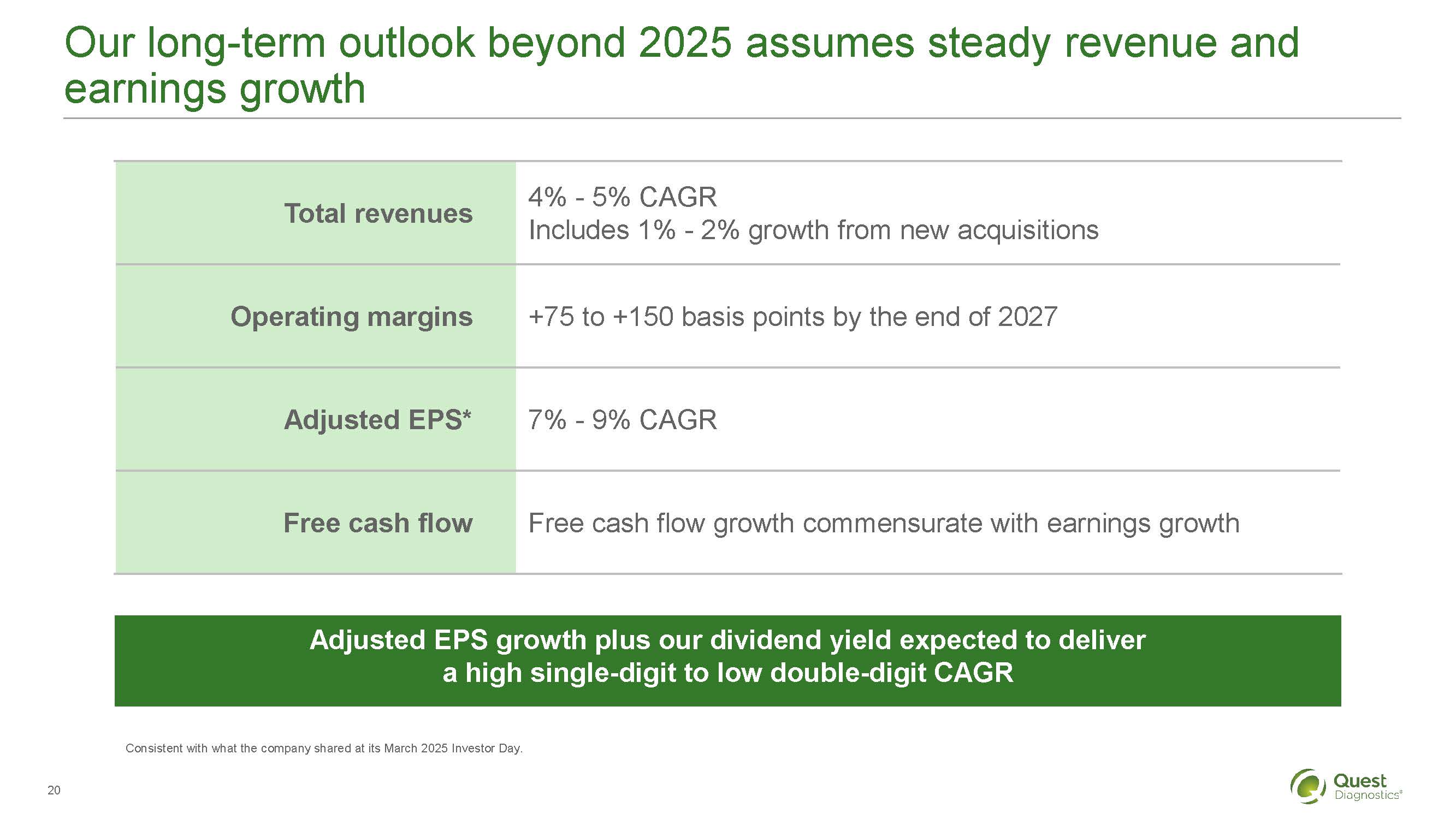

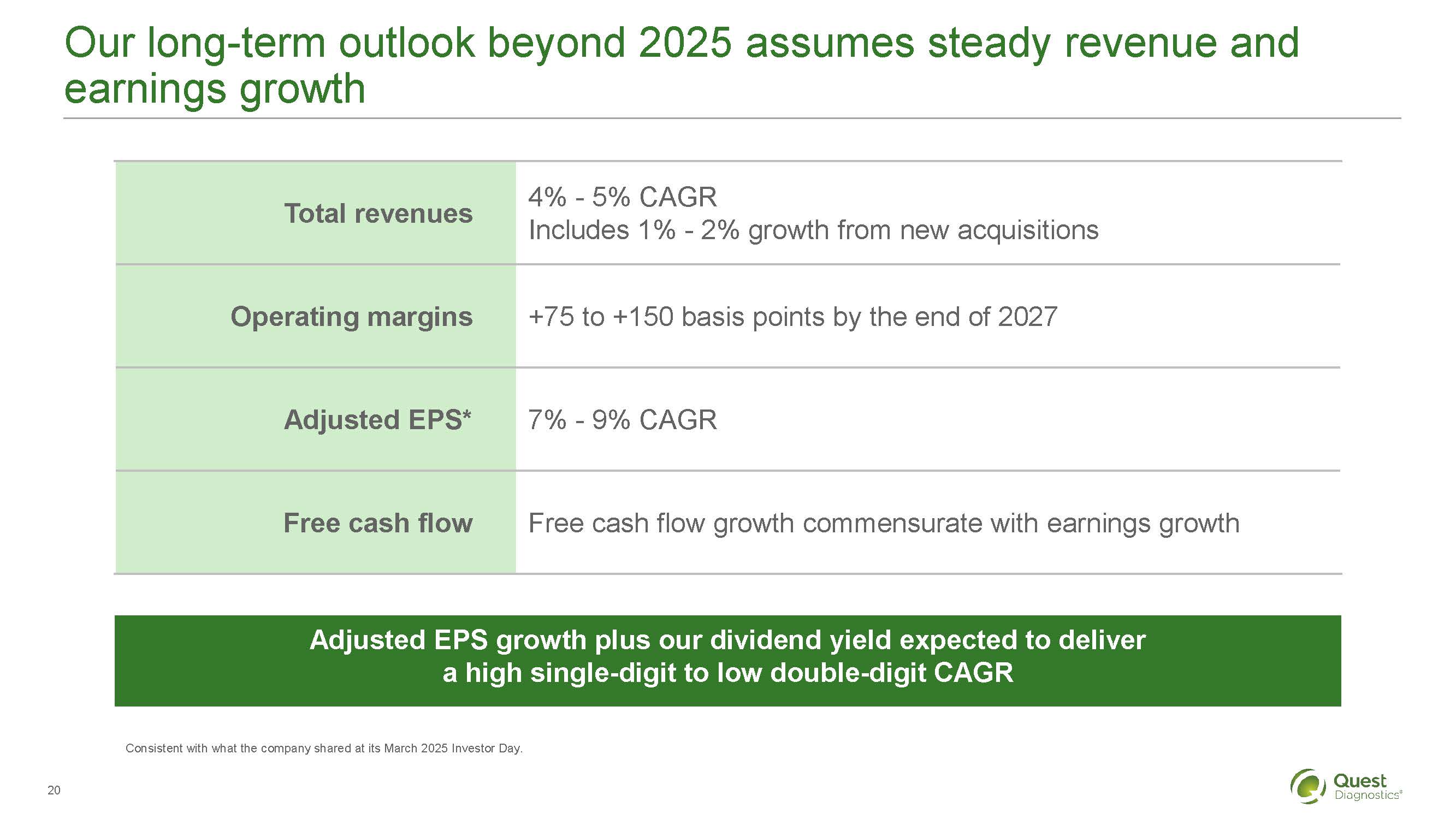

Our long-term outlook beyond 2025 assumes steady revenue and earnings growth

Total revenues

4% - 5% CAGR

Includes 1% - 2% growth from new acquisitions

Operating margins

+75 to +150 basis points by the end of 2027

Adjusted EPS*

7% - 9% CAGR

Free cash flow

Free cash flow growth commensurate with earnings growth

Adjusted EPS growth plus our dividend yield expected to deliver a high single-digit to low double-digit CAGR

The lab market is expected to remain strong driven by health trends and diagnostic innovation

Key takeaways

The lab market is expected to remain strong driven by health trends and diagnostic innovation

Our proven strategy, innovation, and scale position us to generate above-market growth

Our operational strategy is designed to enhance quality, customer experiences, and productivity

M&A is a key strategy for growth, and we will maintain a disciplined capital deployment strategy

Long-term outlook beyond 2025: 4% - 5% revenue CAGR and 7% - 9% adjusted EPS CAGR

Note on Non-GAAP Financial Measures

As used in this presentation, the term "reported" refers to measures under accounting principles generally accepted in the United States ("GAAP"). The term "adjusted" refers to non-GAAP operating performance measures that exclude special items such as restructuring and integration charges, amortization expense, gains and losses on investments, and excess tax benefits ("ETB") associated with stock-based compensation.

The company has provided discussion of projected operating margin, which is adjusted operating income as a percentage of net revenues, and a compound annual growth rate projection beyond 2025 of 7% - 9% for adjusted diluted earnings per share ("EPS"), which are non-GAAP measures. The company is unable to present a reconciliation of adjusted operating income as a percentage of net revenues to operating income as a percentage of net revenues and adjusted diluted EPS to reported diluted EPS, the most comparable GAAP measure, due to the inherent uncertainty and variability in the nature and amount of special items referenced above, and the amount of these items could be significant in any of the associated periods.

Non-GAAP measures are presented because management believes those measures are useful adjuncts to GAAP results. Non-GAAP adjusted measures should not be considered as an alternative to the corresponding measures determined under GAAP. Management may use these non-GAAP measures to evaluate our performance period over period and relative to competitors, to analyze the underlying trends in our business, to establish operational budgets and forecasts, and for incentive compensation purposes. We believe that these non-GAAP measures are useful to investors and analysts to evaluate our performance period over period and relative to competitors as well as to analyze the underlying trends in our business and to assess our performance.